Tech Talk - Production from Abqaiq, an Aging Queen

Posted by Heading Out on April 9, 2012 - 2:57pm

The topic of rising gas prices is pervasive, and at a breakfast meeting last Monday, Richard Williams, a friend, commented that he had seen some cores from Saudi Arabia, and that they looked so weak, he felt he could put his fist through them. It reminded me of a passage that Glenn Morton had also caught in Ken Deffeyes book “Hubbert’s Peak”:

Most massive and nonporous limestones contain textures made by invertebrate animals that ingest sediment and turn out fecal pellets. Usually, the pellets get squished into the mud. Rarely do the fecal pellets themselves form a porous sedimentary rock. In the 1970s, the first native-born Saudi to earn a doctorate in petroleum geology arrived for a year of work at Princeton. I used the occasion to twist Aramco’s collective arm for samples from the super-giant Ghawar field. As soon as the samples were ready, I made an appointment with our Saudi visitor to examine together the samples using petrographic microscopes. That morning, I was really excited. Examining the reservoir rock of the world’s biggest oil field was for me a thrill bigger than climbing Mount Everest. A small part of the reservoir was dolomite, but most of it turned out to be a fecal-pellet limestone. I had to go home that evening and explain to my family that the reservoir rock in the world’s biggest oil field was made of shit.

Such it may be, but it has supplied a form of liquid gold to the world for the past fifty years. Ali Naimi, the Minister for Petroleum and Mineral Resources in Saudi Arabia, had an article in the Financial Times in which he re-iterated that the Kingdom can produce some 12.5 mbd, and that it thus has more than enough in reserve to meet any supply shock that might be reasonably foreseeable at present. (Texas was in the same position and proved its capacity on occasion, before it lost it). There are times when the true size of the Saudi reserve is not fully recognized, as the late Matt Simmons noted in his early presentations on the subject.

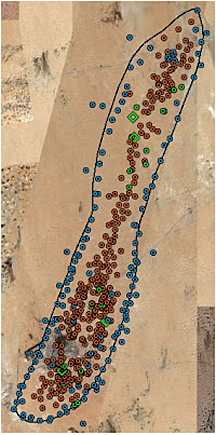

In writing about the oil production from the most active drilling sites in the United States, the last post noted that there are thousands of wells being drilled in the Bakken and Eagle Ford regions, and that they average less than 100 bd of production. Consider that there are about 100 rigs in Saudi Arabia, and that in 2010 they drilled some 386 wells in a country that had a total of 2,880 producing wells in 2010, not counting the 527 wells in the Saudi:Kuwait Neutral Zone. (In perspective, there are roughly a million producing wells around the world). Those wells produced roughly 8.1 mbd on average in 2010, or an average of 2,800 barrels a day. (OPEC Annual Statistical Review 2010:2011).

However, even the most massive of reservoirs must begin to run out of crude over time, and that has been an area of concern, particularly in the older fields perhaps best exemplified by the adjacent fields of Abqaiq and Ghawar. The first well at Abqaiq was spudded in August 1940, not that much later than the first oil wells at Dammam. At that time, the company now known as Aramco had 3,229 Saudi employees, 363 Americans, and 121 other nationalities working to produce some 15 kbd.

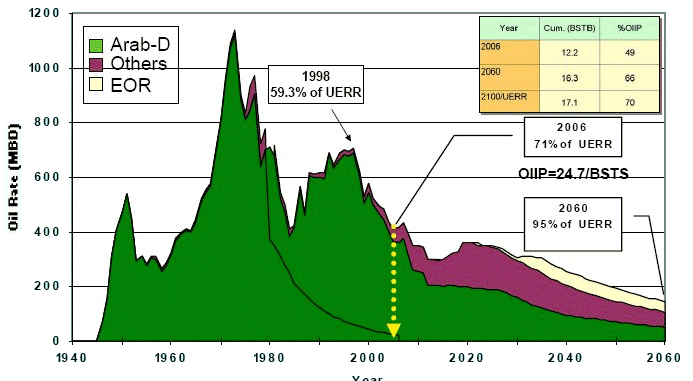

The EIA reported in their last Country Analysis brief that in 2010, Abqaiq was still producing at 400,000 bd, but that the available reserves for the field had been depleted by 74%. Times have changed from those early days, however, and (as the late Matt Simmons noted in 2008) all the 40,000 to 60,000 bd wells that existed in Abqaiq have long stopped producing at that rate, and the average has fallen by an order of magnitude.

I am going to append an abbreviated and slightly modified description that I gave in an earlier post at this point, because in the next couple of posts, understanding a little of the technology is going to be helpful. It begins with a simple model, and does not get very complicated.

. . . . . . .

Assume that there is a layer of rock that is 300 ft thick, five miles wide and thirty miles long. This has, over time, been folded in the middle, so that it now has trapped oil within all the pores of the rock. And, for the sake of discussion, let's assume that it has a porosity of 20%. This gives a very rough initial approximation to the conditions of the Arab D horizons at Abqaiq.

Doing the arithmetic - 300 x 5 x 5280 x 30 x 5280 = 1,254,528,000,000 cu.ft. At 20% porosity, this means that some 250,905,600,000 cu. ft. are not rock, and in this case are going to be full of fluid. This is equivalent to 1,876,773,888,000 gallons or 44,685,092,571 barrels of oil. This is, roughly 45 billion barrels of oil. That's how much is there, or the oil initially in place. (We're neglecting for now any water that is also in the rock).

This is a relatively light oil (API gravity 37 deg) that flows through the cracks in the rock quite easily. There are a lot of these fractures, and it doesn't stick to the rock that tightly, so the assumption is made that production can get out some 50% of the original oil in place. So, at this point we can say that the ultimate resource recovery (URR) is going to be 22.5 billion barrels.

When production began, vertical wells were drilled a quarter of a mile apart. Consider, therefore, a one-quarter-mile section of the reservoir, taken along the length. If the slice is five miles long, then it has 20 wells set along the section, so that each well will pull the oil out of a box that extends out one-eighth of a mile laterally from the well, out toward the next. The total recoverable oil for each well is roughly 10 million barrels, or 30,000 barrels per foot of the oil well in the reservoir.

The rate at which the oil flows into the well is related to the difference in pressure between the oil in the rock and the fluid in the well, the frictional resistance of the rock to the oil flow through it, and the length of the well that is exposed to the rock. Let us assume that the rock resistance remains the same, and that production varies directly with changes in the pressure difference and the length of the exposure. And let us start by assuming that the well produces 3,000 barrels of oil a day (i.e. 10 barrels per foot of well exposed to the rock). Then, in the course of a year, the well will produce one million barrels of oil.

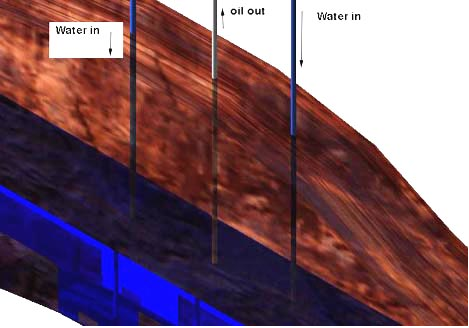

After production begins, however, the volume coming out of the well will, if nothing else is done, begin to decline. This is because as the oil leaves the reservoir, so the pressure on the oil reduces, and with a lower driving force, the flow slows down. To counteract the loss in pressure through the fluid loss, water can be added to the reservoir. This was initially achieved by adding water wells around individual production wells, but this was later changed so that the water is, instead, fed to wells around the perimeter of the field. Joules Burn showed how these were laid out at Abqaiq in an earlier post.

If the water enters the reservoir beneath the oil, then it will fill holes left as the oil leaves and maintain pressure in the oil. The oil flow will not drop as fast, and production rates will increase (note that when this was done at Berri, it took a field that was producing at 155 kbd in 1971 and raised production to 800 kbd in 1976 when production peaked).

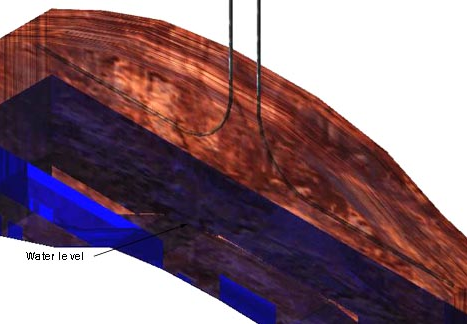

Production per well will not return to peak values, however, and it will continue to decline with time. To explain why, return to the model calculation. If four million barrels have been removed from the well, then as the water fills the void left beneath the oil and compresses the fluid back to the original pressure (we're neglecting the gas issue for now), it will now only occupy 60% of the original space, or the top 180 ft of the reservoir. With the same driving pressure, we will now only get 60% of our original flow, because the length of the well exposed to the rock has been reduced (and flow is related to length and pressure).

This decline in production will continue each year since the flow will decline as the length of exposed well in the rock gets smaller, with the water rising up behind the oil. For example, assume that in the next year the well will produce at 1,800 bd (10 barrels/day/ft), then at the end of that year it will have delivered (simplifying) 650,000 bd of oil, and so the volume of oil will be reduced by (roughly) 11% of the 6 million barrels that were left, and so the following year, the production will come from only 160 ft of the reservoir, and at the same reservoir pressure, the flow will be reduced because of the shorter exposed length. And the flow will accordingly also be reduced by 11%, assuming that the overall area remains the same. (Some folks might call this depletion, and it is the decline in production with time).

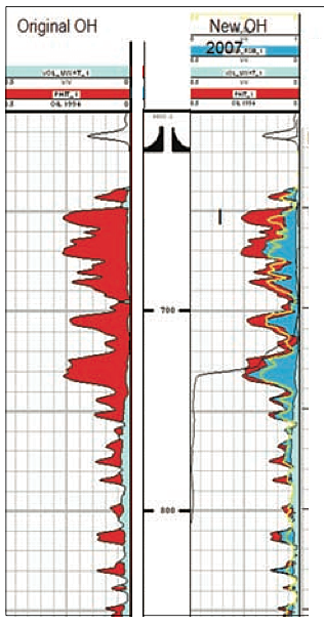

One of the reasons that this is a simplified explanation is that the water does not fully displace the oil, but only some of it, and thus there will be some oil left that can be recovered later in the process. This can be illustrated by looking at open hole (OH) well logs from a survey done in the region which shows the relative quantities of oil, (red) and water (blue) over the reservoir column before and after the water flood - the well was shut-in prior to 2007.

There are ways in which the relative penetration of the water through the formation can be controlled, so that more of the oil is initially moved and less is left in place. This requires detailed knowledge of the reservoir, and knowing where zones of high permeability exist that can otherwise allow water to bypass oil. (These are the Super K layers shown below, as well as the fractures).

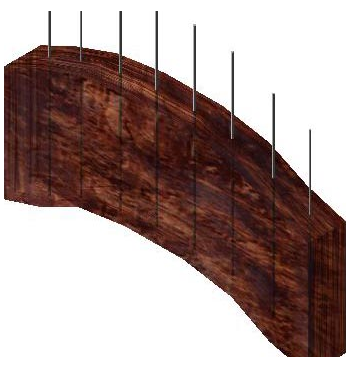

In order to overcome the problem of declining production over time, and as the water flood rises up the well, the alternative (which has not been around that long) is to drill the wells horizontally. These wells can be drilled over the full two-and-a-quarter miles from the center out to the edge of the reservoir, and just two would have the same exposed length in the reservoir as forty of the original wells. Now the exposed length to the oil stays the same, and at a constant pressure (held through water injection) production from the horizontal wells may reach 18,000 barrels of oil a day.

When horizontal wells were introduced (1992), the field had already been in production for decades. Thus, while horizontal well technology allowed some gain in daily production, the rate of oil removal still had to be controlled in order to maximize overall total recovery. And thus, from time to time, the field was “rested.” In addition, over the years, smart well technology has been introduced, with isolating valves located along the horizontal section of the well, so that should water break through at one section, this can be shut off from the rest of the well, which can then continue to produce.

As the technology improved over the life of the field, oil was found in an additional mile of rock to either side of the zone that had been initially identified and the field extended about seven miles longer than originally anticipated. However, with the new additions, and as the field finally began to play out, it turned out that the average thickness of the carbonate grainstone was only 240 ft. Repeating the calculation changes the estimate of the original oil in place to be some 62 billion barrels. This change in reserves as the field is developed is not uncommon in oil fields, and is one of the ways in which reserves grow, often quite significantly, after the field has started to be developed.

(The above exemplary numbers, other than the geometric size of the field and its porosity and depth, were invented to illustrate the developments of the technology that have been applied to that field). The oil has a 36deg API, with a gas/oil ratio of 860 cf/barrel. (It is also sour). The rock permeability is 400 millidarcies in the Arab D formation (this info is from "Twilight").

The first well at Abqaiq was spudded in August 1940. It began production at 9,720 bd in October 1940, but had to be temporarily shut-in the following February because of the adjacent war. Early development was slow, but began to pick up as the conflict moved further away.

If the expansion of 1936 had struck some of them as a period of hectic confusion, this 1944 expansion struck them as bedlam. Their goal by the end of 1945, they were told from San Francisco, was 550,000 barrels a day, nearly 25 times what they were turning out now in their standby operation, and much more than the capacity of their existing wells. There would have to be a massive drilling program involving perhaps 20 strings of tools, and drilling that many oil wells meant developing adequate water supplies both at Abqaiq and at Qatif, where they had been instructed to put down a wildcat. . . . . . . . By 13 June, too, Phil McConnell had entirely shut down the Abqaiq field after completing No. 5, and had diverted his entire Drilling Department to Ras Tanura.

By 1962, only 72 wells had been drilled in the field. At the same time the gas was being extracted with the oil, and 50% of it was being used. Most of it was pumped back underground to maintain pressure and in some cases it was mixed with LPG (liquefied petroleum gas), and this helped dilute and increase the flow of oil from the reservoir. (But sometimes it did not work). It was used in the Ain Dar part of the Ghawar field and right next door to Abqaiq. But in 1982 the gas was collected for sale abroad.

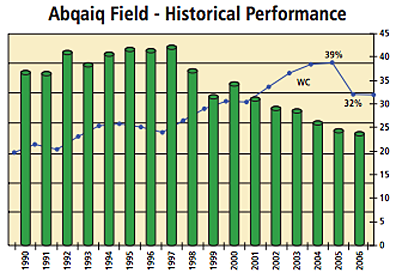

By 1972, Aramco was drilling a well at the rate of 1 every 2.1 days. Shortly thereafter, Abqaiq peaked at 1,094,062 bd. In the area of Abqaiq, there were four drilling rigs and five workover rigs in the period around 1977, as the field fell back to a production of less than 800,000 bd. By 1981, production was down to 652,000 bd. In the mid-80's it was partially shut-in, and flow was reduced to 200,000 bd as demand declined.

And while the rest of Saudi production continued to grow, in 1988 it had 550 wells in production; by 1990 Abqaig had only 47 flowing wells, and by 2002 had dropped to 500,000 bd. It is currently 73% depleted, according to Aramco in 2004 and 74% according to the EIA . Horizontal wells were introduced in 1992, and maximum reservoir contact (MRC) wells with 15,000 ft of contact have been extensively used. Since 2004, Aramco has also gone back into “dead” wells with perhaps 10 ft of remaining oil and run short laterals (up to 1,000 ft long) across the top of the reservoir to gain that additional production. These typically produced around 1,000 bd for six months before water breakthrough. By combining those into MRC layouts, production could be increased to 4-5,000 bd and held for a year before watering out.

Now, beyond this point there are some conflicting numbers. Let me just list some of the information that is out there.

In the 50 years since discovery, it yielded 7.5 billion barrels of oil.

The EIA considers that Abqaiq has 17 billion barrels of proven reserves. This is in contrast with the recent "World Energy Outlook 2005", which projected - through 2004 - that Abqaiq had 5.5 billion barrels remaining, and had produced some 13 billion. It uses IHS data for its projections.

(But it got the start date wrong as well).

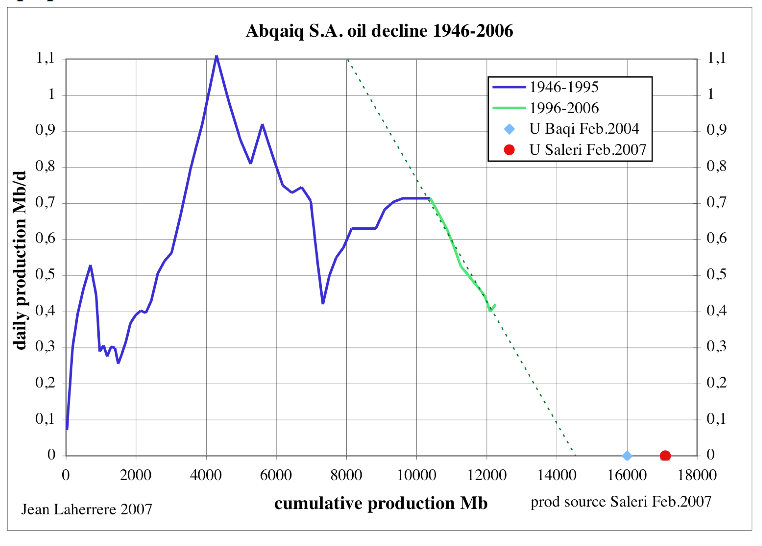

From that data, quoted by Jean Laherrere, one can estimate the total oil contained in the field. Using their anticipated total of 19 billion barrels, and that this is considered to have a recovery factor of 60%, indicates that the overall oil in place is about 31 billion barrels. This is about half of the theoretical prediction I had made, using total volume and porosity, but given the variations in geology over the region, that the field has about 50% of the oil that the general assumption predicted is not bad.

However, using the Aramco statement that the field is 73% depleted implies that the total oil that can be recovered from the field is around 11 - 12 billion barrels, which is in line with an HL projection created by Jean Laherrere.

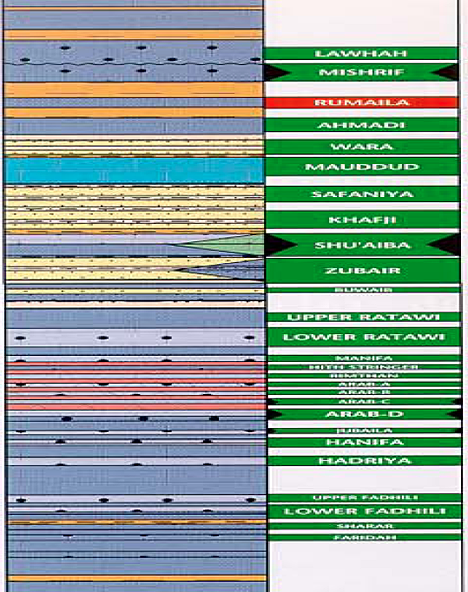

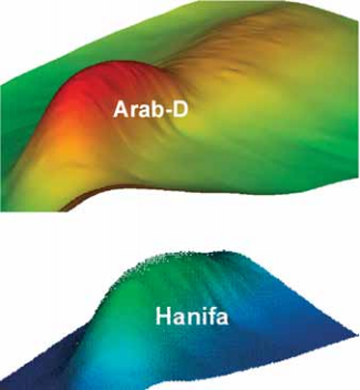

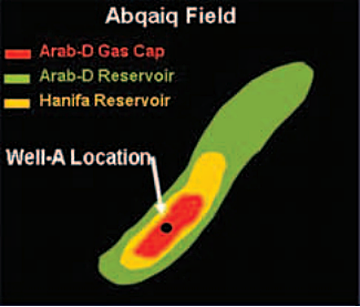

The above presentation also assumes only production from the upper (Arab D) reservoirs available at Abqaiq. Joules Burn has, however, carried out a detailed analysis looking at additional production that can be achieved from the underlying Hanifa reservoir, which is 450 ft lower, is some 300 ft thick, and has a higher porosity (perhaps 30%). Unfortunately, as he points out, the permeability of the rock is much poorer than that of the Arab D, and thus production has not been as easy from the reservoir, nor can as high an overall yield be anticipated.

Nevertheless, this explains why production levels of up to 434,000 bd can be achieved. However, while there is a considerable oil resource in the lower reservoir, it is not as extensive as the Arab D.

Production from the Hanifa reservoir began in 1954 and was limited, since with a matrix permeability of only 1-2 millidarcies, much of the flow relies on fractures in the rock for production. (The Arab D has a permeability of some 400 millidarcies). Fractures do extend between the two reservoirs and so there has also been some migration of oil up into the overlying reservoir.

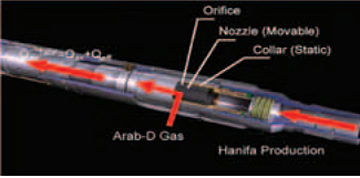

As the field has aged, there is some problem in achieving enough pressure in the center (crest) of the field when the water is being injected only at the perimeter. Thus, as the field now enters the latter stages of production, a novel solution to extracting the oil has been tested. It is referred to as a SmartWell technology, and simplistically uses the gas in the gas cap as it enters the well through a choked valve, to create enough suction in the well as to draw the underlying oil into the lower section of the well, and thence be taken with the gas to the surface.

The gas enters the well through side vents and a constriction in the well (the collar) which generates the suction needed.

While the idea is ingenious, the use of the gas cap to draw out the remaining oil from the field does suggest that the age of Abqaiq is coming to a close. Aramco has recently stated that, using EOR they anticipated that they may get up to 80% of the recoverable oil, although they are now running at 40% water cut. By 2006, some 60% of the oil initially in place (OIIP) had been produced. Joules’ post goes into more detail on the field with a greater discussion of the well patterns and what they mean.

Thanks for this detailed post and solid explanation with graphics of how the water flood props up production (but only so much). I had read Matt Simmons "Twilight In The Desert" but I don't remember seeing a decent graphic of how water injection altered the reservoir pressure, and had to mentally imagine it. Good to see graphical confirmation.

Heading Out- a very interesting post. What is actually happening underground is fascinating and seems more mysterious than the deep sea to me. I have a few technical questions, if you don’t mind:

1. Does anyone really know how much oil is really in a field? I suppose some sensors could listen for readings from sound waves etc. But there seems to be such a variety of rock formation and type that seems very challenging for anyone to actually understand how much is really there.

2. When a field is said to have been 73% depleted, does this mean that it is depleted 73% from the total amount of oil in the entire field or 73% depleted from the amount of oil that can be recovered with current technology?

3. Could you explain how resting a field helps oil production a little more? I am having a hard time understanding or visualizing the mechanics of this. I know oil is lighter than water but I’m not sure why waiting would make it come out better. Doesn’t the presence of stone and rock and gravel interfere as the movement of oil? How does this work exactly?

4. Does every oilfield benefit from resting? Most? If so, this would seem to guarantee that world oil will decline in a very gentle fashion as fields are brought in an out of resting states.

5. Does it matter what kind of water is injected into an oilfield: freshwater or saltwater? If salt water is used, could it escape the oilfield and damage freshwater aquifers?

6. Finally, and most importantly, I have read that in many places that only 1/3 of all the oil already discovered in the ground has been extracted due to technical limits. If true, this obviously leaves a great deal of oil left to be extracted using better technologies in the future. In your opinion is this 1/3rd figure true?

Even if you have the time to answer only a few of these questions I would appreciate it. I thank you for your contribution- C8

The question of resting fields is also going round in my head. Now, I have absolutely no oil industry background and am only going on what I've learnt from this site, but I have the following scenario in mind:

1. Just taking out the oil leaves a large proportion of the original Oil In Place underground, since eventually there isn't enough pressure to get the oil out.

2. Injecting water enables more oil to come up, because pressure is maintained. This still, however, leaves a substantial amount of water underground, since the water only imperfectly pushes the oil upwards through the reservoir.

3. Over time, oil that had been bypassed by injected water will make its way upwards, exchanging its place with water. The effect is that of an oil/water mix gradually separating out into its constituent components, with the lighter one on top. The rate at which it does this depends on the porosity of the reservoir.

4. Resting the field would allow more time for the oil/water mix to separate into its constituent components, following which water injection could be resumed to induce oil production once more. The length of the needed rest would have to be a substantial fraction of the length of time that water has been being injected. The size of the fraction will depend on the porosity of the reservoir. When the water cut gets too high, the field could be given another rest.

5. Conceivably, with repeated rests and periods of injection, and provided that complex geology doesn't produce trapped pools of oil, the strategy could eventually lead to 99% recovery of OIP. After about 1,000 years.

Have I got it right?

No, you haven't got that quite right. A water to oil mix is a serious problem but that is not why most of the oil is unrecoverable. One could technically recover oil that only 1 percent oil and 99 percent water. It is unrecoverable because it is soaked into the carbonate rock in fields such as Abqaiq or Ghawar, or it clings to the sandstone in sandstone reservoirs.

Slow pumping can eventually recover a much higher percentage of OOIP from sandstone reservoirs than from carbonate or limestone reservoirs but they can never recover 99%. I think some of the sandstone fields in East Texas have yielded over 60% of the OOIP but I doubt you could ever get more than 35% from a carbonate reservoir like Abqaiq or Ghawar.

I am not an oilman but from the books and articles I have read in the last ten to twelve years, I think that is pretty close. If not I am sure someone will correct me.

Ron P.

I think you're underestimating the amount of oil that can be recovered from a carbonate reservoir. For instance, around 80% of the OOIP has been recovered from the Redwater field in Alberta, which is a carbonate reef structure, and companies are still producing it at a 99% water cut and reinjecting the produced water. It's kind of a water cycling process with a little bit of oil coming back on top of the water every time it goes through the reef. It just goes on and on and on, and it's a nice cash flow for the companies doing it.

It depends on the type of carbonate reservoir, and Devonian reefs like Redwater are nearly ideal. Ghawar ultimately recovery will probably be pretty high, too, but it might take a long, long time (centuries) to get those last few billion barrels out.

Rocky - Yep...carbonate reservoirs can seem magical at times. And often equally confusing. I had planned to be a carbonate petrologist when I went to grad school but I didn't care for the prof I would have had to work under. The little exposure I've had to carbonate reservoirs involved production acquisition. So difficult to map...especially porosity/permeability distribution. Have one well recover 5 milion bbls of oil with three offsets producing a total of just a few hundred thousands. Or vice versa. Once saw a 600 bopd Smackover well offset by 5 dry holes. Updip wells that were non-commercial with down dip wells making 10X your money.

And even when you have some decent control the reservoir dynamics are still tough. I've seen wells with 200' oil columns perf'd in the top 20' and then start seeing beaucoup water in just a few months thanks to fractures. And for variety there's the H2S issues/corrosion to deal with. By comprison sandstone reservoirs can be down right boring some times. LOL.

Well, yes, carbonate reservoirs do test your wits. The ones in Alberta are particularly difficult to deal with. They are just like the girl with the curl right, in the middle of her forehead: when they are good, they are very good, but when they are bad, they are horrid.

A classic was the Rumsey Reef, which they found not too far from where I grew up.

The Rumsey Reef is an oil field about the size and shape of a New York skyscraper, just full of oil waiting to be sucked out. Based on the geological history of the area, there must be thousands of similar reefs out there, but they just don't show up on seismic.

The Redwater field was a similar reef formation, but rather than being measured in feet, its diameter was measured in miles. It was 58 square miles in area, 800 feet high and it contained over a billion barrels of oil. It did show up on seismic, but that was the only way to find it because there was no other indication of its existence.

@ C8,

Your first question,

is what petroleum geologists and petroleum engineers work to answer all the time. I'm a geologist, and a lot of what I do is look at rock samples from core (conventional and sidewall) in thin section, which is a 30 micron thick slice of the rock that is glued to a microscope slide and is then analyzed with a polarizing microscope.

A key part of this analysis, where the actual sample of rock from the stratum that is a possible or known hydrocarbon reservoir, is the determination of percent porosity in the thin section, because that number can be extrapolated out to a larger volume of rock. Of course, sedimentary rocks are heterogeneous, so the distance that this extrapolation is valid is always a point of discussion among the geologists and engineers.

I've commented on this aspect of the search for oil before here, and you might find some information that will be helpful in some of those comments:

http://www.theoildrum.com/node/5403/502648

http://www.theoildrum.com/node/5757/537469

http://www.theoildrum.com/node/6383/612033

plus, I expect that others on TOD will add their comments and thoughts to your questions soon enough.

C8 - Actually in many cases estimating the amount of oil/NG INPLACE in the reservoir isn't too difficult. Never 100% accurate but often close enough. What's much more difficult is estimating recoverable reserves. And not just the volume but the time frame. I can show you dozens of fields in an area I'm working now that have averaged 50% recovery of the in place oil. Not a bad recovery rate in general. But it took 25+ years to recover much of that oil. And it also required billions of bbls of water produced with the oil that had to be disposed. Typically 75% of the billions of bbl of oil were recovered from these fields with 80% of the flow being water...80% "water cut". But I can also point to other water drive reservoirs that had similar recovery rates and recovered half of the oil in place in less than 6 or 7 years. There are numerous complex engineering models for recovery but in the end most just look at comparable fields if they are available. As a wise man once said: data trumps theory every time.

Typically X% depleted means X% of the original oil in place (OOIP). As far as "resting a field" that's a rather ambiguous term I've seldom seen anyone use in the oil patch. I think a better way to put it is that not producing a field too fast increase ultimate recovery. And this aspect deals primarily with water drive reservoirs...not pressure depletion. To understand why you need to understand that the permeability of a reservoir rock is proportional to the saturation of the fluid you're referring top. We actually call it "relative permeability". In the best oil reservoirs you may still originally have the 20% of the pore space field with water. But at that saturation the permeability (flow capability) to water is zero and the permeability to oil is high. Thus you produce 100% oil. As the oil water level rises as the wells are produced you are not pushing all the oil to the top of the reservoir. It varies quite a bit but as the oil saturation declines its permeability declines. Once the oil saturation gets down to the 20-30% range the permeability of the reservoir to oil can become zero and the well flows only water.

Now if one produces the oil too fast it can cause the oil saturations in some areas to drop faster than the oil can be produced from those areas. If the oil saturation drops too low between those areas and the structurally higher areas the oil will stop flowing to those updip areas. This is often referred to "by passed oil". And once those areas develop it can be nearly impossible (at least on an economic basis) to ever recover that stranded oil. You can let that reservoir "rest" a 100 years and that oil still won't move...zero relative permiability is still zero. Resting a field does very little to correct the problems caused by producing a field too fast IMHO. There are some techniques that can be applied with water injection in to those areas but seldom does much good. The key to any "pressure maintenance" program is that it be started very early in the life of a field and thus minimize the amount of stranded oil. Horizontal wells into those areas might work...I'm about to start such a project in Texas. And even though such wells might recover a lot of that stranded oil in many cases the cost of those wells are too great even when oil is selling above $100/bbl. This is where you have to be careful when you hear of "technically recoverable oil". I can show you an area in Texas where there is at least 1 billion bbls of technically recoverable oil that will never be produced ever if oil reached $200/bbl IMHO.

Yes: injection water compatibility is very critical. Inject the wrong water and you can completely kill the ability of a reservoir to flow. As far as the 1/3 number it's just as good as any other inaccurate number. I've seen 70% recovery and I've seen 10% recovery. Unless someone does a weight based average analysis such generalized numbers as "1/3" are useless IMHO. Again, there can be enhance oil recovery (EOR) techniques used in many reservoirs. But what the cornucopians fail to offer when they throw such possibilities out is that EOR methods have been employed in most US fields for over 50 years. And as I said earlier the best methods are employed early in a field's life. Think about it: with the exception of horizontal drilling most EOR methods have been known for half a century. Why would the oil patch not employ economic methods of EOR over the last 50 years? There is no reason: they have been doing it since the 50's. There is no big reserve of stranded oil that can be produced via EOR...that process has been ongoing for decades. And even though hz drilling is "new" it's been applied in appropriate cases in the US for almost 20 years. Even with oil selling over $100/bbl I have to do a pilot program with my horizontal EOR project to convince my owner it's worth doing on a major scale.

I appreciate all who commented to help me. Rockman, I had no idea that water could change rock permeability for all liquids underground- I had to read that four times before I understood the concept since it seems so alien to my understanding of rocks. Oil extraction seems to be as much an art as it is a science. Thanks, again.

One fluid flows more or less well depending on the rock permeability. Two fluids have a surface between them, and the surface tension gets in the way of one or the other or both of them flowing in all sorts of ways.

Rockman:

Thanks for the help in explaining. I was thinking of the Saudi habit of stopping production from different wells at times, which I always thought of as a way of ensuring that individual wells didn't cone out, when I talked about "resting" the field. There have also been times, when demand was lower, when production was reduced, extending the impact over larger areas. As I'm starting to put together a post or two on Ghawar I note that the descriptive term might instead be "pampered".

Cheers

Dave

dave - I look forward to that post. All my experience has been with sandstone reservoirs. Carbonate rocks have their own unique reservoir dynamics I've had little involvement with.

Rockman, I have problems with the idea of "resting" an oil field, too. What the Saudis really need to do is slow down production rates so the water doesn't bypass and strand oil pockets in the process of producing the field. The fact that they are varying the rates up and down probably means they are stranding a lot of oil while they are producing it at high rates. When the water hits the producing wells, then they decide to slow it down to give the oil a chance to catch up, but ultimately they are going to lose a lot of oil regardless.

It's driven by political considerations more than geological considerations. At the end of it all, it is going to cost them a lot of long term production, but in the short term they are trying to maintain the illusion they can crank up production rates as high as they want without any consequences to them. I think the time they can maintain this illusion is coming to an end.

Do we have any good posts on GTL? It seems like an obvious response to the oil:gas price discrepancy.

If not, are any planned?

Robert Rapier posted this back in 2010:

Inside Shell's Bintulu Gas-to-Liquids Plant

Shell has a summary of the Pearl (qatar) GTL plant:

Pearl GTL

Thanks.

We might need an update for the US's current situation.

Sasol has announced a GTL facility for Louisiana:

http://www.worldoil.com/Sasol_chooses_southwestern_Louisiana_for_GTL_fac...

Shell is also considering a U.S.-based GTL plant. At the current ratio of natural gas to oil prices, the economics should be attractive. But that ratio would need to hold up over a long period of time; spiking natural gas prices or fallen oil prices would kill the economics.

The article talks about a 2 or 4M ton facility. That would be about 75k bpd.

That's pretty big as these things go, but we'd need 5 or ten to start making a really noticable difference to US supply. I wonder what the chances are.

I wonder how much hedging would help the price stability question - is counter-party risk too high?

Hey Bud,

Can you give any comments on smaller scale GTL plants? From my understanding there are is a lot work being done on sub 1000 bbl plant designs.

P.s. any petrochemical marketing experts out there?

Cheers,

Moric

I didn't realize you were asking me. I don't know that much about GTL, except what is on the Internet.

Small scale GTL seems questionable based on what I have read - the process depends on the economy of scale.

What is considered economic? I have seen projects with 70,000 flowing barrel capex with 25 $ bbl operating margin. The rest is gas cost and diesel price related. Think they use roughly 12:1 ratio of gas per bbl.

Likewise I have heard mention in previous TOD posts that shells GTL facility makes the majority of its money on wax products? Can you comment on this?

Robert Rapier commented on that.

What I have read on Pearl GTL is that the products are mid distillates, miscellaneous naptha, greese and ethane.

That is a HUGH project as big as phase one of Pearl. Pearl also produces a significant quantity of condensate, NGL and sulfur through this plant from North Dome field.

Great article. Thanks for correcting the "Greg" mistake on my name, although I didn't tell you. The eventual collapse of the Saudi fields will impact the world in a horrendous way. Products will not be moved to market (the physics law that work/energy = force x distance is useful when thinking about manufactured products being moved around the economy). When energy becomes expensive, product won't move. This may be one reason for the drop in the Baltic Dry Index (not to mention the surplus of ships available now). With less product moving to market, there will be less taxes available to debt-ridden governments--rhymes with flea-ridden. If government revenues go down, they can't pay off their bonds, and huge quantities of wealth will be destroyed when the governments default (and we are starting to see that happening). I pretty much have withdrawn from anything other than getting my ranch ready for my family who still don't believe that they will eventually need to live there and grown their own food and catch their own fish. Humans are incredibly horrible at dealing with and coming to grips with long term cycles.

The world black crude production has been flat for 7 years. My suspicion is that we have at most another 3 years before the decline actually starts. Having cancer, I am praying that I will live long enough to pass the ranch on to my kids, cause if I die too early, they will sell it and they will die. We can not solve this problem with solar or wind energy--we are headed back to a 19th century life style in which there will be many fewer people on earth. Without cheap oil, one can not plant 30,000 corn plants per acre or 1.5 million wheat plants per acre on a 20 square mile Kansas farm. If we cant do that, people will starve.

People have a recentcy bias. They think because things have always been this way, they always will be this way. Abqaiq, and Ghawar, being rather extensively depleted put the lie to that concept.

Glenn R. Morton aka Seismobob

Products will not be moved to market (the physics law that work/energy = force x distance is useful when thinking about manufactured products being moved around the economy). When energy becomes expensive, product won't move.

The cost of oil used to ship goods and raw materials around the world is only small part of the cost products. Slowing down ship speeds greatly reduces oil consumption. The cost of diesel used to truck goods within countries such as US is more significant but can be replaced by rail. The big cost in US is the low fuel economy of cars and light trucks and the high VMT. This can and will change with oil prices >$200 /barrel. Doubling fuel economy and halving VMT wont really be that dramatic and certainly is unlikely to cause your children to die or cause a return to a 19th century life style.

Without cheap oil, one can not plant 30,000 corn plants per acre or 1.5 million wheat plants per acre on a 20 square mile Kansas farm.

Of course mechanized agriculture can still occur with expensive oil, the price of maize and wheat will have to be a little higher, but these foods are very very inexpensive( a few hundred dollars of wheat or maize will feed a family for one year). A lot more energy is used to process grains into foods and also to cook, but these activities can be powered by electricity generated from wind and solar energy.

Neil is quite right. Energy use in the world today is quite profligate. In the US, it is particularly so. There is vast capacity to increase efficiency of energy use, particularly that of oil. If an increase in efficiency is being driven by price, Jeavon's Paradox will not apply, but instead living standards can be kept up with a lesser energy consumption.

In the long run, of course, the oil will be gone, but increases in efficiency (both at the individual level and the social level) will give us a lot more time to shift to a sustainable society, one with 100% renewable energy. The remaining fossil fuels should be seen as an energy bank to facilitate the transition to that society.

And on the topic of agriculture, I can spot two things that can save masses of energy in the US, as well as provide social improvements:

1. Switch from grain fed beef to grass fed. This would be a great improvement to the US diet, since the meat would be less fatty and more of the fats would be polyunsaturated. Raising beef on grass only would probably cut production a fair bit, too, but that wouldn't do any harm, either, since it would do people good to cut down on meat consumption.

2. Get rid of the sugar from processed food. This would greatly cut the need for corn, since the sugar is mostly in the form of high-fructose corn syrup.

George W Bush said that "the American way of life is not negotiable". He was wrong. The laws of physics are not negotiable. The people of the US will modify their way of life when the laws of physics make the current way of life unaffordable. It's already starting and you'd be surprised how fast most people can move when they pull their finger out.

Neil 1947, the idea BAU can continue via conservation and other techniques ignores the idea of a net energy decline. Sure, some mitigation can take place as we dance along a plateau of oil production, but the bigger problem once world oil production starts to decline is how to employ 7 billion people and feed them while their numbers increase. As energy gets much more expensive this complex civilization simply will not operate as it has in the past. It's already creaking, heavy in debt just trying to stay afloat. It's all about flow and as that flow reduces so will everything else. It's geologic but the implications are economic.

After past recessions growth has always rebounded to 5-7%, but after 08's Great Recession it has rebounded to about 2%. Something's wrong, and that's the price of oil. The higher it gets the less profit available, the less it is possible to keep infrastructure updated and replaced. In spite of all the stimulus so far the US still cannot get off the money printing press monetization bandwagon. Why? Because we are getting squeezed by high energy costs, oil, transportation of goods. And if you take away over a trillion in added debt per year that 2% growth disappears into negative territory. If someone can't see something's wrong then they aren't looking very hard.

Agreed, Earl. I think most folks understand that oil is a necessary input of virtually everything modern society does, but haven't fully grasped what happens when competition for declining production meets our attempts to mitigate the many other conundrums we face; a problem of syncronicity and scale. Even substition strategies will require continued high levels of oil consumption/demand. We've seen how even small supply/demand imbalances affect economies and the price of energy, and there simply aren't viable substitutes for so many of the benefits that oil provides; not yet for some; never for many.

These arguments also tend to ignore the major portion of the global economy that relies on discretionary uses of oil and other resources. Do they suppose all of the folks who make their living in these sectors will just be "put on hold" as existing oil production is diverted to more critical sectors? Do they assume these folks will be paying taxes, not need to eat, not need healthcare, etc.?

While energy use is only a small part of many business sectors, oil is indeed the most critical; the achilles heel of modern society. The question isn't whether or not humans will adjust to declining oil production; it's what this period of adjustment will look like. We don't have a history of handling these things very well, and there are few strategies being posited that don't create problems of their own. In the mean time, folks will keep burning stuff as fast as they can afford to. It's what we do....

We can reduce the work week to reduce unemployment. Amazing, it hasn't been reduced in 50 years, through the entire computer internet thingy. In the industrial revolution it was reduced from 12 hours 7 days a week to what we now have. The reason is because we are economic slaves forced to build our Owners' empire larger and larger. Zero growth implies reduced work week / full employment OR 40 hour work week with high unemployment. Exponential growth implies 40 hour work week / full employment.

Wages have been dropping for over 40 years. People will regress in their living "standards" if they work less. The average American family doesn't think it can survive without two wage earners working full time. In addition the constant barrage of advertising demands that people keep buyng the latest junk. It really is effective, particularly on the young. I know, I have two daughters in their late 20s. They want everything that they see.

All else being equal, hourly wages would go up in a reduced work week to compensate. "All else being equal", meaning that the wealth of the middle class is no longer stolen by the elites via the banking system, which of course isn't going to happen until there's nothing left to steal and the bankers own the world.

The widespread misunderstanding out there is that labour "produces" goods, and therefore if we need to produce more "stuff" because we are getting poorer as our wealth is being stolen, we need to work longer hours. Unfortunately this is entirely false -- the laws of conservation of matter and energy explicitly state this, because labour doesn't "produce" anything. All we do is "take and transform" resources from the natural world. Therefore, if the natural world is running out of resources, and technology greatly increases our per-person taking power over what it did 50 years ago, then it follows that the only way to maintain full employment in a modern technological society that can no longer grow due to resource limitations is to work less than 40 hours a week.

All we do is "take and transform" resources from the natural world.

Think renewable energy and recycled metals/minerals.

We can reduce the work week to reduce unemployment.

That's the lump of labor fallacy. Reducing the number of work hours doesn't work to reduce unemployment. Sorry.

Since almost all economists hold as the core foundation on which the rest of their theory is developed the notion that labour has "productivity", which is completely false, it therefore follows that almost all conventional economic theory is invalid. These "straw man" arguments against reducing the work week are based on false premises.

The amount of work available to workers is indeed fixed in an economy that can no longer grow due to resource limitations, and one whose markets operate on the principle of competition. Any company that decides to hire two workers to do a task that modern technology says should only require one worker will quickly go out of business, leaving those people unemployed. With no more resources available for those unemployed to go "produce" more, they will remain unemployed.

You've dragged a straw man into the argument yourself, because economists do not believe what you say. They have determined that cutting the work week does not cut unemployment, and that is based on considerable study.

If you don't believe me, feel free to wade through the huge amounts of literature on the subject by yourself. I'm not going to debate it because it's just too tedious to do it over and over again for each new person who doesn't believe it.

And economists believe that human innovation will be able to power economic growth in perpetuity. They believe that energy use in society will decrease to an infinitesimally small proportion of GDP as scientists develop perpetual motion machines. I'll do as you say and investigate it further but honestly, I have very little respect for any conclusions made by conventional economists. How can they say that cutting the work week will not result in lowered unemployment? It hasn't been done in 50 years so I don't know what they "studied", therefore any of their conclusions are dependent on imaginary thought experiments derived from their flawed understanding of how economies work. Par for the course for the "science" (an oxymoronic statement if there ever was one) of economics.

economists believe that human innovation will be able to power economic growth in perpetuity. They believe that energy use in society will decrease to an infinitesimally small proportion of GDP as scientists develop perpetual motion machines.

I'd be curious to see a source showing that any reputable mainstream economist has argued for either of these ideas.

Okay the "perpetual motion machines" was just hyperbole. However...

The Ultimate Resource II: People, Materials, and Environment by Julian Simon.

And when you are finished with that one I could give you the URL for Bjorn Borg and the Skeptical Environmentalist.

Ron P.

Bjorn Borg. This guy?

;-)

I think if you look closely you'll see that he's not discussing economic growth, he's discussing resource consumption. That's different.

My point: the idea that "economists argue for unlimited exponential growth" is a "strawman", that is, not something economists really argue. I'd say it's perfectly well understood by mainstream economics that at some point in the foreseeable future everyone will have all the goods and services they need or want (especially quantities - quality is a bit squishy), and economic growth of the sort we're most concerned with presently will cease.

I also don't see an argument that " energy use in society will decrease to an infinitesimally small proportion of GDP" (which would indeed seem to follow from the first argument, if it existed).

It's not that simple. From your source:

"This common argument against the use of restricted working hours to reduce unemployment has recently been questioned, with one scholar arguing that "substituting a dubious fallacy claim for an authentic economic theory may have obstructed fruitful dialogue about working time and the appropriate policies for regulating it".[3] Tom Walker holds that the lump of labour idea is a straw man, arguing that most proponents of restriction on working hours do not hold the simplistic view. He argues that a reduction of working hours can have similar labour-saving impacts as the introduction of technology into the production process.[4]

...Martin Ford, founder of a software development firm and author of The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future,[6] argues that the lump of labour fallacy is merely an historical observation, rather than a rule that applies indefinitely into the future. Ford suggests that as information technology advances, robots and other forms of automation will ultimately result in significant unemployment as machines and software begin to match and exceed the capability of workers to perform most routine jobs."

Glenn,

Sorry to hear about the cancer. I think that I previously sent you some stuff on Vitamin D, e.g, from the Vitamin D Council: "Those with higher vitamin D blood levels at time of cancer diagnosis had nearly twice the survival rate of those with the lowest levels."

Based on the BP data base, the Saudi's ratio of their consumption to production of total petroleum liquids (C/P) has risen from 18% in 2005 to (I estimate) between 27% and 28.5% in 2011. Using the most optimistic C/P number for 2011 (27%), and if we extrapolate the rate of increase in the C/P ratio, the Saudis would approach zero net oil exports around 2030, and I estimate that by the end of next year, 2013, they would have shipped about half of their post-2005 Cumulative Net Exports (CNE).

I'm modeling net export decline curves as showing a roughly triangular shape, so, one can get a reasonable approximation for post-peak CNE by estimating the area under the triangle. Using that approach, a range of post-2005 CNE estimates for Saudi Arabia:

Assuming 100% C/P ratio in the respective year:

2030: 41 Gb (2013*)

2040: 58 Gb (2017)

2050: 74 Gb (2020)

*Year that estimated post-2005 CNE would be about 50% depleted

Note that the post-2005 Saudi CNE for 2006 to 2011 inclusive are about 18 Gb. So, even if we use the 2040 number of 58 GB for post-2005 CNE, the Saudi's post-2005 CNE would already be about 31% depleted. Sam Foucher's most optimistic projection (circa 2007) for Saudi Arabia approaching zero net oil exports is around 2034.

There is always some discussion about how unrealistic it is for Saudi Arabia to hit zero net oil exports. My point is that the tail end of a net export decline period is pretty much irrelevant. The biggest percentage depletion in post-peak CNE occurs early in the decline period. For example, using the ELM, which went from peak exports to zero net exports in nine years, in Year One of the decline period, they shipped 23% of post-peak CNE, but in Year Eight of the decline period they only shipped 3% of post-peak CNE.

Incidentally, my thoughts on what might be a way to make things not as bad as they would otherwise have been:

http://www.theoildrum.com/node/9104#comment-885998

Jeffrey Brown

The giant East Texas oil field still produces over 1 million barrels/day. Unfortunately, it is about 99% water. None-the-less, it is not completely depleted and the oil produced since water cuts >95% and will be produced in the future decades is several percentage of the URR.

Does anyone have any idea what percentage of claimed URR at Abaiq and Ghawar is from "oil stained water" ?

Thanks for the Good Work !

Alan

How much "oil stained water" is being produced from Ghawar ? Not much.

Do you see any indication Saudi Aramco is installing 100 million bpd pumping and water handling equipment for Ghawar ?

Last time I heard, Ghawar was at a 35% water cut, but that was because they were shutting in all the high water cut wells and drilling new horizontals above the water line. They would be reinjecting all the produced water, plus they are injecting substantial amounts of seawater to maintain reservoir pressures.

If the water cut is 35% and the oil production is 5 million bpd, the water being produced and reinjected would be around 2.7 million bpd. In total they must be injecting over 3 million bpd of water into Ghawar, which is an awful lot of water to handle.

They are also going to put Ghawar on CO2 flood next year to maintain production rates.

Saudi Aramco to use CO2 to boost Ghawar oil field output by 2013

It's starting to sound more and more like West Texas, just trying to keep those old oil fields producing.

This is a demonstration project, not at the scale to contribute anything substantial.

As long as Aramco can maintain production - at ever lower volumes - with a water cut @ 33-36%, they will.

Little, if any new water injection wells will be needed when they switch to "oil stained water". The daily volume of "oil stained water" will likely be close to peak oil production at Ghawar - 6 million b/day, just as East Texas "oil stained water" production is close to peak oil production from the East Texas oil field. Unlike today, they will just reinject 97+% of what they pump out.

A reasonable guess for Ghawar, after the northern 2/3rds have watered out (likely by 2017 or earlier IMHO) is the 900,000 b/day from Southern Ghawar will continue as before (they only started producing S. Ghawar @ 2000) and "oil stained water" from Northern Ghawar will produce slightly more than 100,000 b/day at first. This will decline over time to the 60,000 b/day range.

Not such great hopes for sustained Saudi oil production,

Alan

I'm confident the Saudi Aramco Engineers, busy modeling Ghawar with a giga-cell model and 60 years of history to calibrate the model, can figure it out.

Why all the fretting ? Previous forecasts of Ghawar's imminent demise have been consistant and consistantly wrong.

I'm confident the Saudi Aramco Engineers, busy modeling Ghawar with a giga-cell model and 60 years of history to calibrate the model, can figure it out.

Why all the fretting ? Previous forecasts of Ghawar's imminent demise have been consistant and consistantly wrong.

Your post is nonsensical. It makes zero logical sense.

All the supercomputer time in the world will not add one barrel to the oil in place. All it will do is maximize the recovery percentage.

There was a finite amount of oil in Ghawar when the first well was spudded. There is much less oil today.

Today, we are still within the window predicted by Matthew Simmons. However, I prefer the work of Stuart Staniford in projected the future of Ghawar. And for Northern Ghawar, I see a catastrophic production decline due to watering out by 2017 at current production rates - whatever they are (Aramco desperately tries to keep such data secret).

However, we do know that Saudi Arabia is trying to displace Iranian oil exports - which means near capacity or at capacity production. And we alos know that Saudi does not have enough non-Ghawar production to meet current production without heavily pumping Ghawar.

And the fretting is because when Northern Ghawar production declines - as it is already doing - the slope of the decline curve will soon be quite steep - and there is no replacement production anywhere in the world for a field the size of Ghawar.

Not Much Hope for Sustained Saudi Oil Production,

Alan

Obviously not, however modeling 'realizations' can result in an expansion of what is interpreted as 'net pay'. Saudi Aramco is now using 210 Gb -vs- Aramco's 170 Gb of ooip. Some of that increase may be the result of additional drilling.

Here is what Jeremy Gilbert had to say in 2007:

In other words, without performance history by which to calibrate the model, there are infinite solutions - i.e. a guessing game. Sixty years of performance history is probably sufficient to get in the ball park.

And this sums up what you seem to have so much difficulty making sense of:

It should be remembered that unknowns don't have to "add" to the recoverable oil. They could just as easily "remove". There is also no reason why they won't start applying technology to get oil out faster to the detriment of the sustainability. I can think of a few scenarios where that could happen.

Figure what out? We are talking about the long term depletion of an oil field. All your "infinite solutions" are simply points on a graph with a generally downward slope. Plot as many points as you want, the final shape of the graph will be the same.

Figure out how to recover the maximum oil from Ghawar, how much will be recovered and at what rate.

Not really what I said, but as far as anyone on here knows, Ghawar is producing 5 million bpd. Are we to conclude this will continue into the future ?

We are indeed! Not only are the gloom-and-doom assertions of most liberal elitists here wrong (as Paul Ehrlich was wrong in his famous bet with the late Julian Simon), but we can also assume that Saudi production rates are likley to *increase* once sustained prayer brings all that abiotic oil from the mantle to the crust and, henceforth, into American gas tanks! Everyone knows the center of the earth is a creamy nugat-filled bolus of abiotic oil, being constantly replenished by the prayers of conservative Americans who practice Prosperity Gospel and consistently vote Republican. Jeebus would never let His Chosen People run out of the cheap black stuff --not gonna happen doomers!

Optimism and technology will win again, like it always does!

Better to tell the truth from purposefully limited data, then to lie about the truth they know.

And you almost NEVER hear a technical person @ Saudi Aramco say anything. One little gem that did fall out (by accident) was "Overall, our annual depletion rate is -8% without new wells. With new drilling we can limit annual depletion to 3% to 4%"

One breakthrough in Stuart's analysis was when a 3D oil/water contact map in an advertisement was found to be from a section of Ghawar. The complex shape "fit" precisely on one side of Ghawar. Data that leaked out by accident.

And TOD was getting "hints"on places to look from inside Aramco (or from retirees) during that time.

Alan

Ahh, memories. For fun I dug down into the archives to find out where I first pointed out that 3D maps could anchor 2D cross sections of the oil left in place. 5 years ago, almost to the day. Images from Stuart's posts are missing, and the article got rewritten during the day, but much is still there.

You can almost sense the excitement through this and subsequent work, digging out hidden Aramco docs to pull apart each field of Ghawar. Upshot was Ain Dar was basically watered out, Shedgum had major issues with waterfront incursion via faults, and Uthmaniyah was much further along in depletion than most had given credit for.

To me, the other major finding trawling the Aramco docs was the change in focus ~2001 from research into techniques to improve oil extraction, towards gas. Almost as if some decision point had been reached and long term plans made. Nothing in the subsequent 5 years has changed my view.

Bud - I am asking this respectfully. Do you represent Aramco in any way?

Just curious because I have noticed that you consistently react so strongly when there are any posts that questions Aramco's ability to keep things going. I don't have any problem with defending them but it seems all out of proportion.

No, I don't represent Saudi Aramco, I have never set foot in Saudi Arabia.

I came across TOD in '06 absolutely convinced that Saudi's production was about to collapse. I read what others had to say and did my own research and applied my own experience.

I came to the conclusion that most 'Twilight in the Desert' is fiction, misinterpretation and misrepresentation. Sold a lot of Books.

It seems that many posters on TOD swallowed 'Twilight in the Desert' hook line and sinker.

Yet, I see repeated references here to 'Twilight'. Many of Simmon's bogus claims have been discussed on TOD, but they just keep coming back. Dogma in the first degree.

I am not defending Saudi Aramco, I am defending petroleum reservoir engineering and good sense.

Does 'they are lying' amount to anything other than ad hominem attacks on Saudi Aramco's engineers, geologists and technicians ?

You will never get a straight answer out of a SA oil minister or Aramco representative. Their oil reserve data are state secrets. Their stated reserves are clearly political, because they follow no known discovery or reporting pattern for any nation outside of OPEC. SA ministers repeatedly make sweeping generalisations of their intention to 'support the market' and 'cover for shortfalls from Iraq/Libya/Iran' etc., which are rarely reflected in actual oil exported as reported by Western agencies.

I am 100% sure that Saudi Aramco's engineers, geologists and technicians are extremely professional and among the best in the world. You will never hear them tell a lie because they are very well paid never to say ANYTHING without official sanction, and the SA sanctions for speaking out of line are very painful.

This is quite specific:

http://csis.org/files/attachments/040224_baqiandsaleri.pdf

Saudi Aramco made significant production increases in each of the examples you cited Iraq/Libya/Iran. SA increased production by 0.6 million bpd in '91, 1.1 million bpd in '11 and 0.3 million bpd this year, Iran hasn't happened yet (OPEC - crude oil only).

Your referenced link is dated 2004, which more or less predates Iraq/Libya/Iran, so is not at all relevant to my statement you quoted. (except the first Iraq war, which predates SA did indeed cover for. Nobody is suggesting they had no spare capacity in 91).

I would question a lot of the statistics and predictions in that report, in particular the estimated future 'reserves growth' figure, which is little more than an accounting trick based on a flawed model of reserves reporting.

Who says SA increased production by 1.1Mbpd in 2011 about from SA and people quoting SA sources? They certainly didn't increase exports by that quantity, and a lot of the stated increase occurred before Libyan production was shut in, and the increase was from SA production which had been 'rested' following the price collapse in 2008.

The reported figures I saw for SA exports were that they rose only by a few hundred thousand bpd in response to Libyan shut in.

Sorry, the 0.6 million bpd is from '03.

Here is a chart showing Libya,SA and OPEC production for 2011:

However, much of that extra production was not exported. It was either burned to run air conditioning or stored.

So Saudi Arabia did NOT replace Libyan oil exports from the data I remember.

Alan

I didnt make that claim. The rest of OPEC made up the difference, about 0.5 million bpd in 08'11 by the above chart.

Who's fretting? I'm eagerly looking forward to the collapse of Ghawar. It would have two greatly beneficial consequences:

1. It would cut through to popular consciousness and pull the rug from under the cornucopians like nothing else could. The world would be able to start discussing the transition to a post-carbon economy in a way that isn't possible at present.

2. It would lead to the fall of the House of Saud. The baleful influence of this extended family is not restricted to Arabia, but extends to half the world. Discussing this further would take us too far off topic, but rest assured that it would be a positive development.

I spent some time there designing royal palaces, it's kind of amazing to see the extent to which the royal family wastes wealth. They all try to outdo each other with their next palace. Then when they die the palace just remains there, maintained but unoccupied, as an homage to the family. No one buys it and moves in like would happen in the west. Imagine building your own personal Disneyland. That's what it's like, the stereotypes you get about the extravagant palaces are all true. I would look around in amazement. Where does all this wealth come from? It comes from you, me and every other westerner who buys their oil.

And then outside the gates you have regular and poor people just trying to get by. How close you are to the top determines how much of the welfare gravy train you are given to build your own little empire. Of course many Saudi's don't get anything, but they inherit the national lack of work ethic (it's all foreigners that work, beyond the high level positions, seems to be the attitude of Saudi's), so they can't support a family because they get no welfare and they also refuse to work like foreigners, then they turn to fanaticism (I can see where they are coming from) and go train in Pakistan's camps.

I don't see any forward planning. They just build new clogged freeways with everyone in a single occupant car. Eventually their oil will end, I really can't say when beyond what I read here, but it will, and they seem to be doing very little to transition. Of course, the same holds true for the US... and most of the world for that matter too.

I have been helping the Saudi national science lab design a program for centers of research excellence since 2008. I have been to Saudi Arabia 6 times, the most recent being from March 30-April 3, 2012. I have seen at the national level an urgency to move past an oil economy to a knowledge based economy. One of the proposals we reviewed recently has to do with solid state lighting. It was evident that the top planners are acutely aware that simply by going from incandescent bulbs to LEDs they can reduce their own dependence on oil in lighting, which accounts for 20% of all oil used in KSA. In my personal experience, I see sufficient forward planning. Perhaps more so than the Luddite right wingers in USA.

Doomer's we cant, we wont and there is nothing we can do mantra isn't an obstacle ?

2) Why do you hate Saudi Arabia so much ?

1. I'm not a doomer. I support the Peak Oil theory, but believe that it will be possible to adapt to decreasing oil production and have a manageable transition to a 100% renewable energy economy. Certain aspects of the American Way of Life will have to go, but that will be mostly for the good. A much bigger obstacle to discussion about the transition away from oil is the domination of the mainstream media by cornucopians.

2. I don't hate the people of "Saudi" Arabia* and still less do I hate 2.25m sq km of mostly desert geography. Rather, I hate the House of Saud. I hate it because it is an absolute monarchy, which lives in luxury while rules its subjects with barbarity and exports extremely reactionary social and political doctrines to half the world. Forget about votes for women - they don't even allow driver's licences for women! It was only recently that they achieved the major advance of allowing women to work in shops that sell women's underwear. Calling these boys mediaeval is an insult to the Middle Ages.

The House of Saud is worse than the House of Bourbon, whose Louis XVI lost his head late in the 18th Century, and worse than the House of Stuart, whose Charles I lost his head in the middle of the 17th Century. The United States established itself as a democratic republic by revolting against a far more limited monarchy of George III of Great Britain. That the House of Saud survives into the 21st Century is an abomination which brings shame onto all who support it and would have the founding fathers of the United States turning in their graves.

* And what other country do we describe by the name of its ruling family? Even the Hashemite Kingdom of Jordan is mostly referred to as simply Jordan.

HARDLY !!!

No one in power, and few in popular culture, listen to them.

As for myself, I am working quite hard on oil free transportation.

My immediate goal is to expand and electrify our freight railroads - and shift much of today's truck freight over to electrified rail.

About as anti-Doomer "give up" as one can get - while still realizing the gravity of the situation.

The REAL threat is people like you. Those that think that Ghawar will always (or "for the indefinite future") produce 5 million b/day so there is no need to prepare for a future without.

Maximum reservoir contact horizontal wells have quite steep decline curves.

-------

What is the harm if we miss the ultimate decline of Ghawar, and other major Saudi oil fields, by a few years sooner than the actual decline ?

We start preparing "too soon" ? (Given the task required - "too soon" was during Jimmy Carter's second term)

OTOH, believing the Saudi Oil Minister - as you apparently do - if he is lying (as he has good reason to do) has a catastrophic impact !

Best Hopes for Realistic Preparations for the Inevitable,

Alan

BTW, in 2011 UK oil production fell -17% and natural gas production fell -20%. On the bright side, wind generation was up by more than 50% (58% from memory) to 4% of national electrical generation and national energy consumption, weather adjusted, fell -2%.

Double digit declines ARE possible

Alan,

Just a thank you for a breath of fresh air. You represent a sect of the "doomer" wing that isn't quite ready to hole-up on the back 40 armed to the teeth. I suspect it is unlikely we will avoid the catastrophic die-off associated with our current overshoot, but one thing that is uniquely human is the hope (delusion?) that we have some say over our future. Keep inspiring us, leading by example--not only your lifestyle but your sane, measured, responses.

Thank You for your kind, and inspiring words.

I have little hope that we can get through the coming "transition" without major pain, suffering and disruption. But as with almost all things, there are degrees of pain, suffering and disruption. The time to start solving the upcoming crisis was during Jimmy Carter's second term. At this point, we can still mitigate. And substantially so.

And I am making some headway - enough to hear that Speaker Boehner spiked my idea to finance rail electrification with the $1.4 trillion in un-repatriated profits till after the 2012 elections. At least it got to Rep. Mica and got some serious consideration.

There is *TOO* much to do - and too few hands to do it - but one can work as well as one can.

And them, on rare occasions, one is in the right place at the right time, and "things happen". !

Best Hopes,

Alan

What are 'people like (me)' ?

Oh, I get it - but those are not 'people like (me)', and I don't know where you got that idea. Are you reading something into my posts that aint there ? Please enlighten me ?

What 'good reason' does al-Naimi have to lie about production capacity ? That part has never been explained.

Here is what al-Husseini has said relative to Saudi production capacity:

In other words - lots of up the wrong tree barking, perpetuated by people like Matthew Simmons.

No point in arguing with liberal elitists, bud. Ann Coulter already proved that. All these people care about are "facts" and "empirical evidence", whatever leftist hippie nonsense that is. You and I know that a certain Higher Power would never let His Chosen People run out of Stuff We Need, and so is quietly replenishing previously depleted fields with abiotic oil from the mantle. They'll be proven wrong like Doomers and secular Club-of-Rome types always are. All we need is FAITH and OPTIMISM that the technology genie will continue to come through for us and she will! I know it --my gut tells me so.

All additions and no subtractions. Per the middle manager that "spoke out of school", their fields decline by -3% to -4% each year even with more drilling, etc. A very believable number BTW.

So =270,000 to -360,000 b/day each year subtracted from above.

Suddenly the additions above are much less impressive. They are mainly replacing depletion.

And after Manifa, the cupboard is bare.

The reason they lie is easy to understand. Internally, an end to the myth of endless oil may make some people wonder "Why are we squandering the resource we need to survive on the princes, this life style, etc. ?"

Externally, saying "We are. at our sustainable limits of production at 10 million b/day, and that limit will drop to 9.7 million this time nest year. And once northern Ghawar waters out in 2017 or so, we will not be able to produce 7 million b/day." would have a number of effects.

Iran would breathe a sigh of relief - "We suspected this, but good to know we are right".

The value of Saudi diplomacy would shrink - and the world (outside the USA I am afraid) would get more serious about getting off oil. Etc.

And if I am wrong, and Ghawar, and the other major Saudi oil fields do not deplete AT ALL till, say 2025. That is still only 13 years away. Time to start preparing *NOW* !! Because by 2030, we will have an even bigger problem. Horizontal Maximum Reservior Contact wells deplete *FAST* once they start.

BTW, you said you have been reading since 2006, yet your ID is 5 weeks and 5 days old.

Not Much Hope for Sustained Saudi Oil Production,

Alan

Alan, a question for you and others.

Something that has often confused me about depletion rates.

Is it the fields that are depleting 3-4% per year, or is it the wells that are depleting at that rate? Clearly (or maybe not!), it is possible (especially in the early to mid life of an oil field) that the wells are depleting but enough new wells are being drilled and are producing, that there is no net "subtraction" for a number of years.

The middle manager of Aramco quote was that individual wells were averaging an -8% annual decline, but additional drilling and other measures was limiting the field decline to -3% to -4% "overall".

Saudi Aramco has largely moved to horizontal, maximum reservoir contact wells in it's older fields. These wells, just a few feet below the cap rock, can sustain production for quite some time. So, an -8% annual decline from these type wells is indicative that the fields are nearing their "end of life".

I am concerned that superb petroleum engineering, in an effort to balance production at a more or less constant 8.5-10 million b.day, will cause several major Saudi fields, not just Ghawar, to crash more or less simultaneously. This will be the sign for the Princes to move to their London et al homes.

When Ghawar maximum production drops by double digit %, or even large single digit %, for a few years running, that will be very bad. But if Abaiq, Safinaya, Shaybah and Berri also go into terminal decline at the same time (perhaps offset by a couple of years), then Saudi Arabia will have difficulty producing enough oil and natural gas for domestic demand.

Not Much Hope for Sustained Saudi Oil Production,

Alan

You have made that claim before without citation. Do you have a source ?

A simple model shows that decline could not be as much as 4%.

I read it in a TOD Drumbeat several years a ago. Not too long after the Stuart Staniford series. Sorry, but I did not save the link.

Elsewhere in the world, outside of the "special" Aramco oil fields, those numbers would be typical, or at least unremarkable, for giant oil fields pumped lightly at first, for 40+ years and finally starting to decline.

And if Saudi Aramco once could pump 12.5 million b/day, it would take a while for 12.5 million to decline to the observed 10.x million b/day at 3% and 4% annual declines - what with new fields coming on-line as you listed.

Manifa is almost the last "new" oil field to come on-line though. They have decided to re-enter Damman, their very first oil field, after abandoning it 30 years ago - and pump 100,000 b/day of low quality oil. It looks like scraping the bottom of the barrel to me.

BTW, we known Saudi Aramco routinely lies. Every year they pump oil, and almost every year they find, or redefine existing fields, "EXACTLY" the same amount of oil as they pumped - and their reserves don't grow or shrink.

*VERY* special oil fields !

Not Much Hope for Sustained Saudi Oil Production,

Alan