Tech Talk - A Second Look at Natural Gas in the Bakken

Posted by Heading Out on November 27, 2011 - 6:28am

The comments on the recent post on natural gas flaring at The Oil Drum drew a few comments that I would like to discuss before moving on to start reviewing the situation in Russia.

Most particularly I want to discuss the change in the regulations that are now imposed in the Bakken, and then go on to review the alternate ways in which that stranded gas might be used. I would like to thank those who commented, particularly benamery21, who pointed me to the set of presentations in a Webinar that covers the change. There was also a comment by aws-classifieds that led to a Wood Mackenzie view of the current situation.

The Wood Mackenzie view mirrored to some extent what Sid Green and Rockman have both been noting about the current economics of the shale gas drilling bonanza. Harry Flashman also commented. The point is that much of the growth in drilling for the natural gas in shales such as the Marcellus is coming from Joint Ventures, and

the pool of potential shale gas investors has expanded beyond experienced onshore North American operators to include companies willing to commit up to several billion dollars to enter and develop plays. It can be argued that they have neither the skills nor experience to efficiently exploit the resource and evaluate selling gas into the most liquid, dynamic natural gas market, alien to their own typically regulated natural gas markets.

The continued waves of new investors have committed around US$90 billion to exploiting the shale gas plays in North America, throwing a lifeline to the established players who have been able to continue to hold and exploit their lease holdings using their new investors’ money.

The article goes on to note that the service companies have been making the most out of the current efforts, and as a result companies are beginning to move more of the well servicing in house (including hydraulic fracturing). The article notes, as has been highlighted particularly in comments on earlier posts on the topic, that the majority of shale gas plays are failing to break even at current prices. In consequence it anticipates a market correction, following which only the very best shale gas plays (and that will include those with high liquid content) will survive.

On that note, it is worth looking at the prediction by the North Dakota Department of Mineral Resources at that recent Webinar, which Ben pointed to.

Note that this anticipates that production will only rise by perhaps 150 kbd over current levels. This is perhaps a cautionary tale for those who are looking to see sustained production from these fields of up to 1 mbd through the rest of the decade. DMR sees production declining around 2015, though only at around 1% per year, under a sustained drilling program.

The State, however, notes that 7.6% of the energy value coming from the wells, and 4.3% of the economic value is currently going up in smoke as over 30% of the gas coming from those wells continues to be flared. Regulations do, however, limit the amount of such gas that is flared, through a control on the amount of oil that can be pumped from the well before it is connected into a gas-gathering network.

Typically, wells are allowed to produce at a maximum efficient rate or MER for a period of time (generally 30-60 days) in order to evaluate the potential of the well and stabilize the production. After such time, the well production is then restricted to 200 bopd (barrels of oil per day) for another 30-60 days, then 150 bopd for an additional 30-60 days, and finally 100 bopd until the well is connected to a gas-gathering system. Further extensions may be granted provided certain conditions are met. But whatever the reason, until that connection is made, the only alternative is to burn the gas.

There is a small catch if the well continues to be flared. If the company applies for an exemption, it can be relieved of paying taxes and royalties on the natural gas flared for a year, but after that taxes and royalties can be imposed – even if the gas continues to be flared.

However one “out” is to use the natural gas to produce electric power – provided that the generator consumes at least 75% of the natural gas from the well. At the same time new gas plants are being constructed, so that, by the end of next year capacity should be up to around 1,000 MMcf/day. The use of on-site generators was also mentioned in the Webinar, though all the presentations are sequenced so this appears lower down the site.

Two ways are proposed for effectively using the gas that is currently flared. The first is a modification to the requirement for electrical generators, with a project by Blaise Energy. There is a case study of an existing operation available, where the company installed a 300-kw generator near one well, and a 340-kw generator by another, in North Dakota. The power is then sold to a local electrical co-operative and the company now claims agreements to generate 4 MW, with another 15 MW in view.

The alternate approach, which is being developed by Bakken Express, is to capture and condense the natural gas at the well head and then transport it either to a pipeline or an end user. The initial proposal is looking at five wells, and will generate both Compressed Natural Gas (CNG) and Natural Gas Liquids (NGL) at the well, which can then be delivered.

The company uses specialized tube containers to hold the CNG, and to move it to the customer.

Should the fields be larger and further from a reliable pipeline (Yamal for some reason pops back into mind, and we’ll get there) then it might be possible, as Sid Green has suggested, that the process might be carried one step further and the gas liquefied.

For the present, however, with the growth of CNG-powered vehicles, it is perhaps enough to envisage that before too long the carriers shown above might become a more familiar sight while pulling into the local filling station.

And with that thought, I wish you all a Happy Thanksgiving.

Very interesting post, Dave.

That DMR forecast will be a bit of a shocker, one would think.

My impression was that just about everyone was expecting significant, sustained increases from the Bakken shale oil.

Please explain what you think is going on here....

I believe the DMR is pretty conservative, and previous DMR forecasts have been rather lower.

Nick,

But surely the DMR forecast would not be well received by investors... in fact, I'm surprised that it isn't front-page news in ND, with industry roundly criticizing such pessimism.

Do you think that people simply are not aware?

Meanwhile, I found those BakkenWatch videos to be quite compelling and entirely consistent with what PA farmers are reporting.

I, for one, find these people to be highly credible... it's pretty hard to fake cats which are spastic, stuffed up with snot, cattle losing hair, and human skin rashes. Given what such publicity can do to their property values, I simply cannot believe that people are making this stuff up.

If even half of this is true, we surely have a problem.

But that's the real puzzler: when ND state officials seem so dismissive of the alleged effects of shale gas production (ie. appear so supportive of industry) why would they then release a forecast which is so unhelpful to industry and its investors?

I don't get it.....

Rick:

you may be striving too hard to find hidden motivations for state officials who are merely doing the job that they are supposed to.

Please say more, Dave

There are several aspects that I'd like to learn more about.

1. Bakken decline

Is the DMR forecast something new (it's certainly news to me) or more like a confirmation of what's been widely anticipated?

Without having followed the Bakken story all that closely, my sense was that its development has only now really started to take off, and that just about everyone was expecting 1 mbpd, maybe more.

Could someone please explain on what grounds these expectations would change so markedly (and so suddenly).

2. Market response

Has there been any fall-out with investors, stock values, etc because of this article or the earlier DMR study?

One would think that this news (whether accurate or inaccurate) would have some people furious.

3. State officials

If DMR analysts are doing the job that they're supposed to do (ie. safeguard the public interest and provide the most honest assessment that they can) then hats off to them.

But on the environmental/human & animal health front, state officials (according to testimonies on BakkenWatch) seem to be incompetent, uncaring, or both.

Of course we are dealing with different departments, but when a government has a clear position on industrial development, etc, there seems to be a good deal of consistency across the various sectors.

Does the Keystone XL pipeline fit the bill as a "reliable pipeline"?

jal

http://www.youtube.com/user/BakkenWatch#p/u/4/jN_YwQp4pzY

http://www.youtube.com/user/BakkenWatch#p/u/3/6N8-dXMLjNg

http://www.youtube.com/user/BakkenWatch#p/u

http://www.bakkenwatch.org/

They are activist videos describing detrimental effects from a fracking rig in North Dakota. I could not summon the interest at this time to completely explore the site, but what I saw seemed to focus on a single drilling site. Maybe the poster could put up a description of the videos. They might be worth seeing.

JJ,

They may be activist videos, but the language and the images seem pretty credible to me.

I watched the Trip to the Farm video (7 min or so) and this is what it shows:

- 40 seconds of annoying music (but please don't let that deter viewers)

1:00 - sick cattle

2:00 - bull losing fur

2:11 - congested cats

3:29 - kitten with bad eye

4:30 - report of chemical concentration in buildings

4:50 - contaminated well water

5:20 - skin rashes

6:00 - white stuff on basement walls & floor

I don't think I'd live there if you paid me.

I like the idea of truck delivery of CNG. It's an extension of the familiar idea of LPG or propane tank delivery except I think propane-butane is liquid at 15 bar compression (hence plastic lighters) but methane is still gaseous at 220 bars and room temperature. When diesel is prohibitively expensive then re-usable CNG bottles could be sold at garages in farming towns. Using a CNG powered pickup truck the farmer calls into town to get CNG bottles to take back to the homestead. There it runs the kitchen stove and the farm tractors. The empty bottles are taken back and swapped for full bottles, just like propane. Depending on size the CNG cylinders may need a hoist if they are too heavy for manual lifting. Methane leakage when disconnecting couplings may also need to be reduced.

What a joke ! Only 4.3 % of the economic value of ND's oil and gas is flared.

That amounts to about $16 billion per year and they need a corporate welfare carrot ?

There is no need for cng transport by truck, a pipeline will do and gas pipelines are all over the Missouri River Badlands, this is not the arctic. Trouble is the so called engineers working for the so called operators are too busy creating flashy power point presentations for their next quarterly report to figure that one out, so it seems.

The truth is the NDIC has a tiger by the tail. They were so eager to encourage development, they forgot about the prevent waste and protect correlative rights part of the deal.

Proactive self regualation ? Ha ha ha ha ah.... yer killin me.... ha ha ha ah ha!

Iraq clinches $17 bln flared gas deal with Shell

http://finance.yahoo.com/news/Iraq-clinches-17-bln-flared-rb-4276990216....

Dave

What a shame that this gas is being flared. Diesel fuel is being sold at a premium in ND as it is in shortage there. Only refinery in the region (Tesoro in Mandan) does not even have enough capacity to supply ND with deisel fuel to keep western ND supplied. My friend in ND that owns a fuel distributorship is making an extra $ million a year profit just on the price difference between east and west ND fuel.

So the market cries out for nat. gas vehicles to use this flared gas. I should move to ND and open up a nat gas vehicle conversion business selling "do it yourself kits".

Using the stranded gas to run gen sets is ok, but using it for vehicles would be much better, especially since the entire agricultural economy is dependent on diesel fuel.

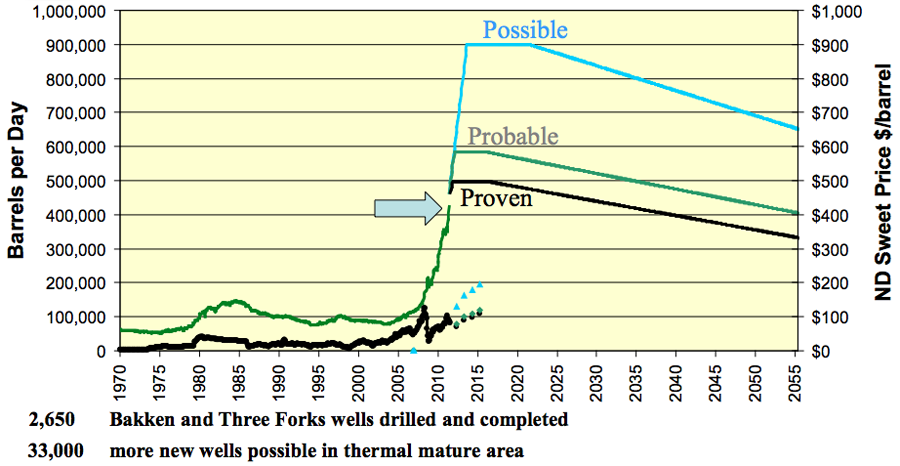

Predicted future oil production from the Bakken shale in North Dakota (ND DMR)

WRT the Predicted future oil production from the Bakken shale in North Dakota (ND DMR) graph, note that we have two data sets on the one graph.

The forecast production curves, Proven (black), Proven + Probable (green) which actually overlies the Proven production curve, are IMHO plausible, peaking at 100,000+ BOPD in 2012, declining to ~80,000 BOPD in 2013, and peaking again at 100,000+ BOPD in 2016.

Where it stops.

There is no Proved or Proved + Probable forecast production curve beyond this. Alarum bells should be going off, loudly. This is 4 years out, and the North Dakota DMR doesn’t have a handle? Maybe they just don't officailly know.

The 3P curve implies a doubling of production in 4 years. Evidently there are sweet spots out there that are confidential. (Release Sarcasm Button). Again, the ND-DMR doesn’t care to forecast beyond this date.

The other set of curves is the historical and actual price curves. There must be a misprint on the legend on the right hand side of the graph, as it shows a current price of $400/bbl and a future price of up to $900/bbl. Either price would but ND into a deeper recession than winter in Tuktoyuktuk in the Late Pleistocene.

WRT to the comments about (1) flaring the gas, (2) using the gas for CNG, and (3) tying the gas in to gathering systems.

Building G&P systems costs time and money. My estimate would be 12 to 24 months to get a handle on the associated gas reserves and the forecast production profiles (and the gas production profiles will be a part function of the oil production decline curves), 12 to 18 months to contract the flared gas, 12 months to plan and get regulatory approval, and another 12 months to permit and build.

I suspect that these Bakken associated gas wells will have fizzled close to being out in 5 years, low production volumes at low pressure. ND will have a dead cat by the tail. Still we could make $ off 50 Mcf/d in southern Alberta – at prices above ~~$3-4/Mcf. The reservoir pressure will have dropped, so compressor stations will be required; it very probably isn’t that great even now.

I would not point a finger at anybody over the perceived failure to build a gas gathering and processing system to support an oil boom, not a gas boom.

I think the best analogy for a G&P system would be the old (but still running hard) low pressure SEAGGS (South East Alberta Gas Gathering System) built by Ocelot (?) around the Hat for the Med Hat / Milk River shallow low pressure gas play, with little compressors hither and yon. Now that really does have a high density G&P system (lots of low pressure gathering lines), unlike (I strongly suspect) much of ND.

I could make this work (being ex ANG, TCPL and Westcoast), but I’m not telling outsiders how. RockyMtnGuy will probably guess right.

I'm seeing three curves for future price (separate curves from production), rising from a current price just over $100/bbl, with the 'possible' curve corresponding to rise in prices to ~$200?

OK, you're right, I'm wrong ...

How not to right a Stephi Graff

The graph is poorly labelled and difficult to discern... But, what I am seeing is production shown in green (up to the big arrow), scale on the left. Then 3 forecasts extend it beyond the arrow: black=proven, green=probable, blue=possible. The black line on the bottom shows the price, scale on the right. There is only a tenuous forecast for future price going out 4 years, shown in dots or deltas, from just over $100 to just under $200.

Gas can be sold for money.

That time line would mysteriously collapse if the operators weren't allowed to flare. Note that Parshall was discovered in 2006, the bakken was first produced from hz wells in 1987, and first produced from vertical wells in 1953.

The bakken oil is a volatile oil at reservoir temperatures above 240 deg. F. Gas oil ratio will continue to rise, and yes low pressure is a problem. Why is it a good idea to flare instead of re-inject or sell ?

Have a look at the first bakken hz boom 'n bust cycle. The quintessential bakken hz well, the MOI-Elkhorn 33-11H is still producing with a gas/oil ratio of 28,000.

You are half right, the bakken gas has a heating content of up to 1800 btu/mcf. Bakken gas is being sold for $7 to $8/mcf.

How does Alberta deal with flared gas ? They don't(allow it).

My estimate on the schedule to put a G&P system together is based on my experience doing just that for TCPL in the WCSB in Alberta W5M,W6M and in BC.

1. Nobody will put a system together until they have a handle on P90 and P50 in the proposed gathering area.

2. They you have to plan the specifications for the physical system (dry gas, wet gas, sweet gas, sour gas, lots/little water production), run and rerun the capex and opex, and finally put a proposal to the operators.

3. You then have to sign up the operators to commit their gas to your G&P system and your contract, beating out the competition. Canada uses the Jumpingpound Formula, named after the Jumpingpound gas plant (surprise) which relates fees to capex and opex recovery. This is regulated. So a G&P operator cannot screw the producers (too much).

4. Once you have everybody signed up, then ... you have to order the pipe and the facilities.

5. Then you build it, test it, get it approved to operate, and start it up.

Building G&P systems is not a low cost 1-week job.

However, the economic parameters are like those of a utility, which is what they are to the producers.

Flaring is discouraged across the WCSB by the provinces. It's not nil, and it never will be nil for economic and operating reasons, but it is being very significantly nil.

This has never been done before ? There is no need to re-invent the wheel or the space shuttle, either.

I knew a guy one time who could never get anything done, he couldn't make a decision, worrying the problem to death.

Flaring is not the solution to anything. Flaring an important finite resource like natural gas only demonstrates a lack of competence, a lack of sanity.

"This has never been done before ? There is no need to re-invent the wheel or the space shuttle, either".

When I was in Exploration, and when I was in Development (which are two closely related subjects, but with different mindsets and risk profiles), I had no idea how my wells were to be tied in and then how they were to be produced.

Building G&P systems takes time, money, producer approval, regulatory and environmental approval, even within established producing areas.

AND THEN THE G&P SYSTEM HAS TO MAKE A PROFIT FOR THE BUILDERS/OWNERS, GIVEN THE FORECAST ECONOMIC PARAMETERS

The O&G industry is not a registered charity.

At least the Williston Basin has a transmission line or two running through it to established markets.

I'm wondering why the sales gas prices in the Williston are so high, as there are gas discoveries in neighbouring basins even in the Montana Territories that are not being brought on stream because of the low prices.

Present low gas prices caused by the shale gas bubble are an investment risk, at present and until the bubble deflates.

Sorry about going CAPITAL in the middle, but my text about start caps and end caps for emphasis was deleted.

Marvelous thing, technology.

My point is this: if a project is not profitable, then the industry will not do it - unless there's a guaranteed long-term government subsidy or tax break to make it profitable, i.e. ~10% Return On Investment or better.

How about a gas/condensate reservoir in the deepest part of the Williston Basin at, lets say 300 deg F, would that be a too costly and time consuming to hook up too ? Would that be a charity case in need of injection of corporate welfare ?

ban - Doesn't matter the depth or temp. It's all about reserves vs. costs. During the 80's I drilled 23 shallow NG wells and sold profitably even though prices were around $1.20/mcf. In your example a company could afford to spend $10 million for the pipeline hook up. But only if there's enough NG to make an acceptable return.

Trust me: every company flaring NG has studied the problem to death trying to figure a way to sell the NG at a profit. As a career production geologist I can tell you there are few sights more depressing to me than a flare stack burning away. While working offshore Africa I could nightly watch $1 million+ per day being flared from platforms off Nigeria...very depressing.

You fail the test. It is no wonder you are a geologist and not a reservoir engineer.

Doesn't matter the depth or temp ! ha ha ha ha ha......yer killin me.........ha ha ah ha !

Ever hear of retrograde condensation ? Ever hear of gas injection ? Ever hear of rule of capture ? Ever hear of Spindletop ?

Did ExxonMobil study every possible way to make money on Point Thomson, Alaska ?

Maybe they did, but until the State of Alaska revolked their leases, they couldn't find a way to make money. Then a consultant studied the field on behalf of the State of Alaska and demonstrated the feasibility:

Summary of findings Alaska oil gas commission

http://gasline.alaska.gov/Findings/Appendix%20O%20-%20Findings%20for%20R...

And suddenly, Exxon thought it was a grrrrrreat idea:

Point Thomson Project Update

http://www.akrdc.org/membership/events/breakfast/0809/haymes2.pdf

That'll put a tiger in your tank.

ban - I was completely right: doesn't matter if it's at 300' (I've completed well at 260') or at 24,000' (at 300 degrees plus...completed one of those). I've completed many retrograde reservoirs. And it didn't make any difference how shallow or deep or thin or thick or hot or cold or whether I could flare or not. Those wells were all drilled/completed for one reason and one reason only: it was economic to do so. No one drills/completes a well if they don't think it will be profitable. It really is that simple.

As far as the Exxon situation did you miss my BIG POINT about the flared NG in ND? Again, very simple: they won't capture the flared gas because it isn't economical to do so. Now if the state required operators to capture the NG or they couldn't produce the oil then...TA DA!!!...it's economical to do it. They'll still not make a profit selling that NG but the profit from the oil production will supplement the loss from gathering the NG. That's how it’s always been in the oil patch: regardless of the regs operators will drill and produce if it's economical to do so. I've seen an operator pay 50% royalty (1/6 to 1/4 the norm) to acquire leases. And they didn't do so because the reservoir was/wasn’t deep or was/wasn't at 300 degrees or because they could/couldn't flare NG. They did so for a very simple reason: it was profitable to do so and they didn't have a choice if they wanted to drill the well.

Again: very, very simple: if ND doesn't want the NG flared then they simply modify the regs. It would slow up development (not necessarily a bad thing IMHO) but if it was still profitable (though not as much as it had been) the companies would still drill. And even the very marginally profitable wells would still be drilled by the public oils. And again: they have no choice...either drill or go extinct.

I know the technology and hype can make it confusing sometimes. But it really is that simple: every well I've seen drilled in the last 36 years was done so for the same reason: expectation of profit. The details were unimportant compared to that simple metric.

I was completely right. Congratulations, if you have been completing retrograde condensate reservoir and flaring the gas, you have probably pi$$ed away 3/4 of the recoverable hydrocarbons. Good job Rockman, you have done your part to insure the collapse of civilization, starvation, pestilence - whatever the doomers forecast.

Try this one. The NDIC has a provision in their regulations that allows the operator to flare permanently in cases where it is not economic to connect to gas sales. Guess what, no one has done so. The NDIC has made the determination that the operators can flare because the value of the gas is much less than the value of the oil, that is all, not that it is uneconomic to connect associated gas.

How does Marathon manage to connect nearly all their wells to sales from day one? XTO and Burlington Resources are doing similar. Are they loosing money on that? I had no idea Marathon was so incompetent.

With 900 or so rigs drilling for gas, how can those operators selling $3-$4/mcf gas possibly make money if the economics of selling $7 or $8/mcf associated gas is such a looser? Show me the economics.

You are just assuming that the reason the operators are not connecting gas to sales is because it is not economical. Show me the economics.

I'm not the least bit confused on this, are you ? All the projects i have been involved in were based on maximizing profits. If you have been drilling wells based on the expectation of profits, you have just been trading dollars.

Rock talks about quite a few topics in a general way, and the economics of wells happens to be one of them. When particulars are mentioned, particularly the language from those who do reserves, reserve audits, reservoir engineering particulars, stochastic analysis of production rates or declines, or many other of the minutia involved, he sometimes whiffs on them. For example, have you ever heard Rockman talk about defending his reserve estimates in front of Ryder Scott auditors? His knowledge on the economics of production is very..conversational.

Those who live or die by NPV, shepard their own reserve estimates past either the auditors or IRS or partners, defend them later when they are changed to investors, are more familiar with some of these types of details.

Banned, you appear more than familiar with a few Alaskan details which might be specific to people who are working there, or have. I don't suppose you were around Anchorage on October 25th, near the Alaska Pacific University during certain presentations?

Also, might you stop in to the occasional Williston Basin petroleum conference? Certainly some of the details you have mentioned related to the NDIC are the types of things only those completely familiar with the process might have bumped into. Visiting fields offices is about the only way I am able to acquire some of the information you seem to already have.

Bruce - A couple of items. First, I've snookered more non-existent reserves out of R-S then anyone I know. I've been contracted more than once for that very reason. And if you know R-S then you know that's no small boost. Second I keep my messages as conversational as possible. I don't post on TOD for the benefit of any oil patch hands here. I’m trying to give all the non-industry folks here a sense of how the oil patch works. So no, I’m not here to impress anyone with my resume.

As far as flaring NG I have never seen an operator do so when he could market it at an acceptable profit. Have you? As far as some operators not flaring NG in ND…well Da! Have you ever drilled for NG when the pipeline connect was too far away to tie the well in profitably? It’s very easy to drill a Bakken well and sell the NG at a profit: drill you wells close to a gathering system. That’s essential how NG development has been done for many, many decades.

As far as conversation argument that’s all I’ve heard from ban. Marathon sells all their associated NG. Great: now show me map indicting they are drilling where there’s no immediate pipeline to sell the gas into. As I keep saying: it stupidly simple. If a company can tie the flare gas into a pipeline system at a profit they’ll do it. If Marathon is selling all their gas then it must be profitable. If a company isn’t then it’s not worth it to them to do so. And I’ll keep pounding out the fact that not one cubic foot of NG has to be fared in ND. All the state has to do is ban it. The play will still go forward but more slowly. Only wells close enough to be commercially connected will be drilled. As the pipeline system spreads outward more wells become economical to drill. This is a simple fact that the entire history of NG development has followed for over 100 years. It’s not going to change for me, ban or you.

Sure. For matters of convenience, temporary expediency, lack of available equipment, lazy field hands, for all sorts of reasons.

You are describing some interpretation of the white elephant effect, and it applies to fields as well. Prudhoe Bay, for example. And while your concentration (lets say it is all for the benefit of internet denizens who don't know a kelly hose from a traveling block) on economics is quite reasonable, it is just as reasonable to mention that all wells don't come in economical. And they still get produced anyway, generally assuming that their revenue is greater than OpEx.

As far as the history of natural gas development, you aren't seriously suggesting that the same white elephant effect which happens with oil field development doesn't drive the same sort of infrastructure development with natural gas development? They build a pipeline to nowhere, and then pipeline companies stand around waiting for someone to drill only those economic gas wells everyone is hopeful are out there?

Bruce,

Looks like GTL is starting to be looked as a way handling stranded gas.

http://www.oxfordcatalysts.com/financial/fa/ocgfa20110614.php

Small scale GTL plants now look feasible, and they would kill two birds with the one stone. Reduce / eliminate flaring and help solve NDs recurrent diesel shortages. It is even possible to fit the plants on an FPSO for offshore applications.

Thank you for expressing your opinion.

The fact you cite is not a fact at all. This may be a fact in some cases. Show me how the fact you cite applies in every case.

Here try another one: The average ND producer flares 4.6% of the economic value of oil and gas produced. That, according to the ND DMR link to the Webinar in the lead story.

Read that link. The DMR claims that most of the wells will be hooked up eventually. And indeed, that is true, within limits. So how do these companies eventually find it economical to connect ?

The companies that are flaring gas are, in esscence, paying a 4.6% premium for the privilage of flaring gas. Some are pi$$ing away even more.

That is real economical and so are pay-day loans.

How are companies decieving themselves, their 'investors' and many geologists with this ? Out of sight, out of mind.

A dirty little secret: Women can buy expensive label jeans with a tag that shows a smaller size than actual. A size 10 butt can be converted to a size 6 with the wave of a credit card. Out of sight, out of mind.

My knowledge of Point Thomson is limited to what has been posted on the internet, not the least of which is here on TOD. I have first hand experience with volatile oil and gas/condensate reservoirs.

With respect to the Williston Basin, I was assigned that area in 1984. I've worked the area, off and on ever since and aquired a mineral interest in the 'thermally mature' area in 1994. Thus, my keen interest in the Bakken hz play.

I have had subscriptions to the NDIC site which allowed me access to all the commission's case files, rulings, exhibits presented at the hearings and well files and production data.

A lot of data is available free on the NDIC site also.

Got it.

"You fail the test."

So you weren't asking Rockman a legit question?

Please explain. I am not a reservoir engineer either.

OK - I see now the considerable edit at 5:50PM. I'll look at the cites later.

Gen sets may have the advantage of nearby grid connections thus reducing overheads. Using the gas for other things adds an overhead for distribution.

NAOM

How about compressing the NG but instead of transporting it by truck burn it in an onsite generator when wind isn't blowing or grid regulation is needed or when the local storage bottles are full? So, combine NG with near or onsite wind to create a hybrid powerplant with a much better capacity factor...

Too difficult?

Styno - None of the possibilites lack decades of experience dealing with such situations in many places around the globe. It's strickly a matter of economics. The oil patch makes its profits by selling oil/NG. If there's a way to profit from the NG production we would be doing it now. Basic common sense, eh?

But they haven't because there's no profit motive. But change the regs so the oil can't be produced if the NG is flared it will immediately become profitable to capture the NG: the profit from the oil sales will make it so. Not as profitable as just flaring the NG but still profitable. But no one (oil companies, state politicians, mineral owners) wants to delay the cash flow while gathering systems are put in place.

In the end it's up to the states to make the rules. The oil patch will always figure out how to make a profit regardless of the rules.

Basic common sense, eh if you interpret profit to mean profit shown on the next quarterly report.

Companies are profiting from NG sales. Marathon is an example, Marathon flares very little NG.

Show me a single ND bakken well that is not economical to connect to gas sales, and i will show you a dozen that are.

Welcome to Spindletop of the Missouri River Badlands.

There are lots of ways to add value to NG, flaring isn't among them.

You know very well why so much gas is being flared: 1) It doesn't materially impacts public companies next quarterly report. 2) Pausing to connect wells to gas sales slows down drilling of wells - to tie up acerage. 3) Salivating Analysts(except for Ben Dell) and their 'Investors' are buying it, obsessed with IP rates.

b - And exactly as I said: if it were profitable the companies would do it. If it increases market cap for a pubic company to flare instead of spending their capex on pipelines then drilling then it is more profitable to do so. Might not be they way you or I would chose to add value but they aren't companies so our opinions are worth cr*p. LOL.

There are no emotions involved in the process: if there's a gain in value for management/shareholders to flare the NG they'll do it. Unless the regs are changed. Perhaps you missed my main point: every mcf of currently flared NG in ND would become economical to recover if the state banned flaring. It would slow up development...but that might not be a bad thing right now.

The NG is being wasted because that is what the state's political leadership has decided. The oil companies can lobby all they want but in the end it's the state regulatory group that makes the final call. It would slow up the drilling rate but not one company in the play would walk away.

The NDIC certainly has the authority to conclude what constitutes waste, but the NDIC is regulatory in name only. The NDIC is the referee, the players make up the rules, here's how: The NDIC makes rulings based on the evidence presented, and only the evidence presented. Its as if they wake up in a new world everyday.

banned - I'm not familiar with the power of the NDIC. The Texas Rail Road Commission could require every operator in the state to stand on their heads and pee into their ears...or have their wells shut in 100%. We still have proration rules in effect. Every month the TRRC sets the level of oil production for every well in the state. They've set it at 100% since the 70's. But next month they can set it at 1% if they vote to do so. In Texas you do exactly as the TRRC dictates or you don't get to drill here. No company can drill or produce a well in the state without explicit written permission of the state. If the politicians in ND aren't smart enough to control the oil patch then their citizens deserve what they elect...incompetent govt.

And we have a boat load of oil patch lobbyists here.

I'm not so sure Rock,do traditional FF players regularly mix with the renewables bunch? Is there much of a synergy between them? I don't think so, which (if true) means that these options aren't well tested or even exploited. I wouldn't be surprised if exploitation companies rather burn NG then having to bring in those hippie renewable guys and play even or perhaps pocket a small profit. You are an insider, does it work like that?

But you are right about the State governments and their role: I think they should require the best (which doesn't always mean: most profitable) use of their valuable non-renewable resources. They can only give it away once...

Styno – Any corporation can own any number of other businesses. My owner has dozens including a steel salvage company that cuts up a lot of oil patch infrastructure and ships it to China. But my company has nothing to do with this one. When I was working with Mobil Oil they bought Montgomery Ward department store. And we didn’t even get a discount for shopping there.

ExxonMobil could build wind turbines or solar panels. But so could Starbucks or Microsoft. I’ve never seen any significant synergy between an exploration/production company and any alt company. A utility company, like a NG-fired power plants, might have some leverage. But even that may be a bit of a push.

Allow me to speak for the entire oil patch (or at least all the folks I know): we couldn’t care less about the alts. They are no completion to us today or anytime in the near future IMHO. If an operator could sell flared NG for any profit to the devil they would do it. As I keep reminding folks: we ain’t your momma. We’re in business to make a profit…not save flared NG. If we can sell the flare gas at a profit we will. If ND required the flare gas to be collected by the producers they’ll do it even though it would cut into the profits. Better some profit than no profit. And remember: the public companies have to drill something or disappear like the dinosaurs. If there’s a profit to be made producing/selling Bakken oil AND the flare gas the oil patch will drill. Like I said…it’s just business…nothing personal. LOL.

And no...I own nothing in the Bakken. So it won't be my butt nailed to the barn door. I ain't momma to ND operators either. LOLLLLLLLLLLLL.

Thanks Rock, it's all for one, one for one and none for all. As usual. Shame that state government isn't thinking long term when the give away one-time resources.

Styno - I suppose I've gotten so use to oil/NG regs in Texas and La. I've assumed other states were similar. Folks in PA were complaining about the need to fund expanded oil/NG regs due to the surge in Marcellus drilling. I was shocked to find out that PA has never imposed a production tax on the oil patch. Texas and La. have collected $trillions in production taxes/royalties. At one time the entire Texas university system was funded by this source. And the feds have collected $trillions from offshore production.

The new R gov of PA has a problem: he ran on a no-new-tax pledge. Now the state would like to impose a production tax. I ran the model: tax producers at less than half the going rate in Texas and PA would collect $50 – 100 million per year.

As the great Texan comedian Ron White says: You can’t fix stupid.

And California (the #3 oil state) doesn't have a severance tax!

Styno,

While this may seem a logical approach from a grid point of view, it is not an economical one from the well operators POV.

The first question is what are the differences in electricity rates they will get paid for producing during low wind/ peak consumption periods? As a rough guide, it needs to be at least 50% higher -when you are paying for your fuel- to make it worthwhile.

Secondly, lets assume that the peak pricing would apply for 50% of the time. So, to build a generating system that would burn all the gas, only operating 50% of the time, it has to be twice the size - a significant expense, for no increase in production, only selling price.

Even worse, to do this, a gas storage compression and storage system is needed. Either re-injection or onsite pressure vessels. Either one is a significant additional expense.

Add to this, that as the well gas production declines, all these facilities become even more oversized with time!

So, the best thing the operator could do is start out with a genset that matches the gas production, and run it 24/7. As gas production declines, they can then lower the output of the genset, or maybe go to peak/off peak, but additional expense is incurred, while production is declining - would you do that?

If the currently flared, stranded, gas gets used for generating electricity back to the grid, that is a good win. Aiming for perfection likely akes it uneconomic - as is often the case.

Might this then be a better approach for a power company to do? Set up a microgenerator at a well head or cluster of well heads and hook in. Perhaps a private company that does not have to pay out to shareholders.

NAOM

The PrivateCo still wants to make a profit ....

And Privateco's pay dividends to their shareholders, they just don't share them with the public.

(Or they are in the business to build value and get a ten-bagger before they bail out or do an IPO).

Very true, though I am thinking that they do not have to dance to another piper's tune so can look at sites that are more marginal that can still return a profit. Investment costs may be the issue, putting the plant on the ground needs money and how long can they stand to pay that off. Even so, they are better off than having to feed the street at the same time.

NAOM

But PrivateCo's are not interested in marginal sites, unless the company is being run as a hobby farm, which I assure you is not.

PrivateCo's want as big a gain on their investment as possible.

Got to get this across, the oil patch is not a charity.