Oil Prices and the €uro

Posted by Luis de Sousa on September 16, 2009 - 10:14am in The Oil Drum: Europe

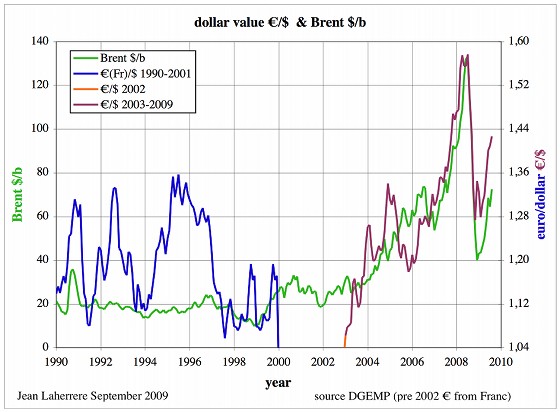

À propos the post Euan put up last July on Oil prices, Jean Laherrère sent The Oil Drum two interesting graphs on the relationship between the common currency and Oil. These charts show very similar patterns in the rise of both Oil and the €uro against the Dollar, a clear sign that the record 147 $/barrel had much to do with the weakness of the greenback. Even after the economic crisis, this relationship seems to hold.

|

While the Oil price has definitely risen against the €uro these past few years, it has done so in a much less volatile fashion.

It is also interesting to note that since 2007 the correlation is stronger and since then the €uro seems to precede Oil by a month or so in its movements against the Dollar.

|

Interesting and unsurprising. Keep in mind, that if more euros are sought to purchase crude, the euro itself will demonstrate more volatility. When a currency is bought, one gains a proxy for what the currency can buy.

Euros = cookoo clocks and Glock handguns, Tintin comics and futbol.

Yen = Toyotas, sushi and manga.

Dollars = whiskey, Hollywood and cocaine (and Credit Default Swaps).

Yuan = poisonous dog and cat food, hammers that fall apart in your hand, unapproachably bizarre government statistics.

Right now the oil producers are Catholic about what they will accept so the dollar/oil metric is stable.

One reason for increased euro volatility would be simply keeping up with the demand for them if and when producing countries start demanding more euros. Remember, 'volatility' doesn't mean the item will fluctuate up and down, it really means the value will plummet. A volatile euro is basically one that is worthless. Or, worth less ... go figure!

Another issue is whether the euro would be considered a proxy for the dollar should the dollar rapidly depreciate. The answer would be ? and no. The dollar won't rapidly depreciate because there are no savings - no dollars squirreled away to flood the marketplace in an instant emergency. The dollars would have to printed one at a time in the basement of the Federal Reserve building ... (just kidding).

As for the euro being a proxy for the dollar; this would only happen if there is a dollar panic - a default or repudiation - that would cause dollar revulsion among sellers of any good. The dollar holders would race to sell dollars in exchange for any currency ... which would be repudiated in turn as a dollar proxy. This scenario is not in the immediate future ... maybe next month. (Just kidding.)

Under ordinary cirumstances, the euro would be measured in the currency marketplace ... hey! That's a three- way marketplace now with oil as the third player. A 'pick and choose' currency environment would get is back to that euro volatility thing again.

The It's all circumstances which change how the players react to them ... before the circumstances take place; another positive feedback loop.

Excuse me, it's late and I'm tired.

Ok you are up and active, S-f-V. Some speedy thoughts you have there!

I was thinking what the author up in post said: "140 $ oil had much to do with weakness of greenback".

I dont see that "much". Oil goes from about 20 to 140 $/barrel but € increases "only" about 40%. The

axis are not the same scale... that must mean something else than "much".

There are other explanations the rise in price - not this one single that explains "much"?

I find the chart a little confusing. It would make more sense imo to have only three graphs in there. One is the €/$ rate, the other two are the price in $ of a bbl and the price in € of a bbl. (Just take the $-price and divide it by the €/$ rate.) That would clearly show that the price spike of July 2008 was not nearly as dramatic to the Europeans as to the USAians

Given that the European fuel prices are mostly made up of taxes, the actual price at the pump only rose about 25% due to the price spike (instead of about 100% in the US).

Somehow I have the impression that Americans are more aware of peak-oil than Europeans, due to the massive price rises at the pump last year in the US, while most Europeans hardly noticed it. Just my € 0.02 (or $ 0.03).

This is not true.

It is the scales on the axes of the charts in the post which have been chosen deliberately or by accident which give that impression. The euro is just as bad (or good) a currency as the dollar and the RELATIVE strength or weakness of the euro versus the dollar explains a trivial amount of the change in the value of oil.

January 17, 2006 = X

Brent crude in Euro = 39.20

Brent crude in US$ = 50.75

July 3, 2008 = Y

Brent crude high in Euro = 93.45 (238% increase from X)

Brent crude high in US$ = 147.50 (291% increase from X)

December 24, 2008

Brent crude low in Euro = 25.91 (72% decrease from Y)

Brent crude low in US$ = 36.20 (75% decrease from Y)

The weakness and strength of the US$ RELATIVE to other currencies explains a minor amount of the change in oil prices in US$ (you would see this even more clearly if you looked at an analysis of daily currency returns). Relative currency exchange rates are not a major factor.

Weakness and strength in ALL government issued currencies (including the Euro) explains much more than RELATIVE exchange rates between currencies.

In other words, the change in purchasing power of dollars and euros together explains more than the relative exchange rate of the dollar to the euro.

Precisement. (said w french accent)

You hit the nail on the head.

It doens't matter much about the currency, the values are fluid between currencies (and are manipulated). Check the BIS website and look for statistics and check the 'interest rate swaps' stat. Most of that is to hedge overseas currency trades.

I agree the different charts are confusing but it really doesn't matter. What matters is what foreign buyers had to pay to buy dollars ... to buy crude. The dollar/euro trade was pretty favorable for the euro as I recall.

A big prob was in producer countries flooded w/ dollars and dollar inflation.

I think (and the person to ask is Chris Cook) that tight supply/demand and a very strongly bullish US/UK futures market combined to push oil from a 'normal' price of $90 to $147. I think there was a lot of 'spot trading' (after delivery or in transit).

My opinion, thanks.

SFV,

One of your best! Over the last few months anyway,since I 've been reading them.

The Europeans tax the Hell out of their fuel made from oil, so their euros seem buffered against oil price swings, or at least that's what I've learned reading here on TOD. The US does not tax nearly as much, but perhaps that's because there is no pressing need, other than a few highway maintenance funds.

Non-PC warning: the US military seems poised to maintain dollar pricing of oil from the Middle East, at the least, if not globally. Lots of ships patrolling the Persian Gulf, aircraft flying around, troops on the ground defending freedom in Iraq and now Afganipakistan, looking for terrorists, etc., with no pressing plans to leave. Nothing too overt, just hanging around, waiting for orders, if necessary.

well, those warships etc. are also there to keep the straits of Hormuz open when the Iranians try to mine them, when the Israelis bomb their alleged nuclear weapons program.

There is an argument that there is a huge crisis about to spring in that respect :

Obama having foolishly promised to force the Iranians to negotiate, Ahmedinnerjacket, encouraged by the Russians, will not negotiate, so Netanyahu will feel free to negotiate via air strikes...

The Russians are delighted with anything that annoys the US, and would profit hugely from $200 oil.

http://www.stratfor.com/weekly/20090915_misreading_iranian_nuclear_situa...

alistair, yes, that's a plausible cover story, certainly, and it makes the US look like the good cops to the Israeli bad cops, with the Iranians playing the bad guys. Quite an arrangement, actually, but in the end, wow, what a coincidence that the world is (soon to be if not already) running short on oil, most by far of that oil is in the Persian Gulf states, and just by chance (??), the US and its closest allies are there in all military and intelligence capacities, looking for "insurgents" (our definition) and "terrorists" (ditto), with no obvious plan to vacate the premises any time soon. Why, that's almost as good a cover story as 911 (a criminal mass murder, least we forget).

Luis, I would be very wary about the implication that oil prices are about to rise a lot, based on the decline of the dollar ($1.47 will buy you a euro this morning).

Oversupply is still lurking, waiting to pounce; and if the American regulators grow gonads, the flight of speculative money out of oil futures could halve the price of a barrel.

AC,

I just can't see it.

If Oil is overpriced and there IS a spot market then why don't the producers just sell more on the spot directly to independent refiners and capture all this revenue supposedly goig into speculators hands?

If most of the oil is sold by contract between the producers and major refiners then how does the speculator horn in there?

And if there is a huge overhang of speculative oil in storage then when it IS eventually sold and burnt at that time it will DEPRESS prices ,right?So over a year or so it looks like a wash on the speculative thing ANYWAY.

Oil has held pretty steady for several months at a price that seems to be supported by a fundamental to me-between what is shut in by OPEC and what is leaving the market never to return due to decling production in old fields and rising comsumption domestically in the producing countries the price has settled at a point matching demand and supply.

I can see this speculation thing holding up for as long as there is someplace to store actual physical oil brought to market by a high "speculative" price but it seems that inventories are bulging the tanks these days.

Now if somebody could make the case that some of these "speculators" re either major producers or major refiners /distributors I could see the case for speculation a little more clearly.

Just why the heck should the producers -countries with very sophisticated business pros on thier payrolls-allow these speculators to take a huge bite out of thier revenues?

Of course I am but a babe in the woods when it comes to oil but the picture TO ME looks like a Dali painting interpreted with speculation included.

Apply Occam's razor, give it a nice shave and a haircut, and a very clear image of the supply and demand equilibrium villian emerges imo.The nationals and multinationals are supplying a certain number of barrels and the world is buying them.The price will rise-has risen- until the world looses its appetite for more oil at which point supply and demand are matched.

What is so hard to understand about that?

Of course the folks who for one reason or another don't want to see this will continue to insist that the guy in the picture doesn't look anything like the guy who robbed the nationals and the multinationals off all that loot with a cap gun and a bandanna.

(Poor old oil companies-a helpless lot obviously in need of a court appointed gaurdian to look after thier money for them-they are after all getting sorta old and undoubtedly well into thier dotage.)

The people who just simply deny peak oil altogether WILL NOT look directly at the face of the Devil of supply and demand for fear of recognizing him and facing up to a final reckoning on a day of his choosing-which is probably not that far off if the world economy struggles back to its feet.

But the producers are getting the market price, Mac! They are not missing out. In fact, they are the main beneficiaries of the speculatively inflated price. And quite likely, instrumental in its functioning.

Others have set out the case, much more persuasively than I could, for a speculative component in the oil price -- I'm thinking of Chris Vernon's articles about Gold-in-Sacks etc.

It's precisely because I was convinced that the price of oil was determined by supply and demand, that I finally understood. Oil has been in oversupply since the beginning of the year; so why did the oil price recover so quickly to its fairly stable level of $65-70? Why are oil futures so high for the remainder of 2009, when nobody anywhere has ever predicted that demand would recover to 2008 levels? Think about it. Doesn't fit.

Fundamentally I'm happy with the oil price, I don't want a collapse, and relative stability in price is a good thing. Without a doubt, when demand really recovers in a year or two, then it'll go through the ceiling again. But what I'm saying is that it ain't no Invisible Hand determining the price... or if it is, that invisible hand is pulling some fancy strings.

It does fit.

Why? Although demand is down 2 million barrels per day year/year, supply, due to OPEC cuts, has fallen by close to 3 million barrels per day.

If more oil is coming out of the ground than can be sold to end users-the simplest defintion of oversupply I can think of-then it has to be going into storage ,right?

Now just maybe those who are betting on higher prices are betting on a recovering economy and declining exports from the non OPEC producers and therefore a very tight supply situation-that would make storing physical oil a very good thing for the owner of it.

Now I don't doubt that there is a COMPONENT part of the price that is due to speculation ,or that players such as Gold in Sacks can't temporarily manipulate the market.They probably are able to correctly anticipate a lot of price moves due to having access to so much information.They probably can CAUSE a price move-but not one that can LAST for very long.Still long enough for them to bag up some more gold of course.

But I believe that others have made the case that any oil in storage has to come out eventually and at that time DEPRESS THE PRICE of currrent production.That's a wash over any extended period.Period.

And of course the major sellers ARE getting the market price-most of the time anyway.

What I'm saying is that all this talk about speculation is totally unnecessary to modeling the actual history of the market and may well be cotton candy sold by the guys who make a living fleecing the carnival customers.If you have ever tried cotton candy you will get the metaphor.

Very enticing stuff-until you actually try it.Then it has the highest eye candy to substance ratio of any food product I ever heard of.

What your graph suggests is systemic risk increasing in tertiary assets (financial markers of real things). On one recent project, I took daily closes of all major commodity classes, SP500 and currency crosses (EUR/JPY, etc) for last decade. The daily cross correlations from Sep 2008 to Feb of 2009 on virtually all asset classes (other than treasuries) were the highest they'd ever been. (using rolling 30 day R^2s). When I get time I'll try to organize this data, (though that may never happen-as Im not sure what it gains us) - but to me it suggests, as some have pointed out, that confidence in financial system itself provides liquidity and search for diversification, but fear of entire system rule changes, debtload vs real energy budget, etc. causes all risky (debt based) assets to become more correlated.

I expect this will continue, with periods of confidence alternating with periods of increasing systemic risk, with amplitude increasing over time, until a new monetary system/ debt devaluation, more closely linked to underlying assets, is introduced. I've no idea whether that is 1 year or 10, though I expect sooner, given the existing constraints on the old system.

You have to remember that at the time, there was a tremendous emptying out of the shadow banking system and a run on hedge funds. There were a lot of dollars looking for a place to hide.

I remember this quite well, particularly the yield/appreciation spreads between bonds/equities - why hold stocks when you got the same yield on safe Treasuries?

Speculators had had enough of abstract nonsense such as MBS (mortgage backed securities) and wanted something that could be held in the hand - don't forget the correlated bull market in gold, silver, copper, coal and iron.

Another thing is that while a lot of securities cannot find buyers in a bear market, commodities are completely symmetrical; for every buyer there is a seller and vice- versa. Traders could 'go long' and hold physical oil (in storage) and make their money on the way up ... and sell their contracts and make just as much money on the way down.

Can't do that with a Credit Default Swap, particularly in a market stress period where there is nobody to take the other side of a trade. See 'portfolio insurance'.

Interestingly, it's China desperately hunting around for a hard currency in its death throes ... I recall an editorial in the Wall Street Journal calling for a dual currency system which I thought was quite radical (for WSJ). Hard and fiat, with fiat distilling into a set of 'local' and inflationary mini- currencies. Put another way, it is likely that some kind of hard system (trading gold internationally on sailing ships?) is in the future. Bernanke thinks (along with all the rest of the stooges) that the current situation is a garden variety liquidity crisis and BAU will fire right up in a few more months. Bernanke is wrong. It's always been an energy crisis ... it all began w/ the hated Jimmy Carter..

The risk issue is all about moral hazard at this point, it may as well not exist. How can anyone price nothing?

I suspect that the US economy is more oil intensive than the European economy. Hence, for every Dollar of GDP the US will need more oil than Europe because of its highly oil dependant infrastructure.

Hence a rise in the price of oil makes Europe more competitive and strengthens the Euro.

The Euro zone net imports larger volumes of oil and natural gas on a net import basis than the US. So every time oil and gas prices increase, Euro zone citizens have to send more cash overseas than the US does. The per person number may be smaller, but the absolute amounts of cash leaving the Euro zone as a whole (to pay for imported oil and gas) is greater than the US.

But I would suspect that they are using the energy more efficiently rather than wasting it in SUVs. Wouldn't this mean that they are probably getting a better return on their investment than we are? At least for oil, if not nat gas, it would seem likely. I would think it doesn't matter that we spend a little less (by the way... can you provide figures for that statement?) if we are doing the economic equivelant of dumping most of it onto the ground.

Data sources are the EIA, CIA and IEA. Data are on their web sites. You need to select net import data for individual Euro zone countries (rather than use OECD Europe, EU, and other European groupings) and then add them in a spreadsheet.

Do Europeans generate a higher return on investment by consuming less oil? That depends on how the "return" is measured. Measuring return by GDP, Europeans generate similar and not greater returns. Excluding government taxation on oil (which is key when comparing Europe and the US), spending on oil before government taxation accounts for a similar percentage of total GDP in the US as it does in the big Euro zone economies of Germany, France and Italy.

Given that GDP is coming under a lot of pressure as a measure of "return", one could use an alternative return basis - such as happiness. Maybe people in SUVs are more comfortable and perceive themselves to be safer. They act rationally to increase wellbeing and happiness and are willing to spend (not waste) a reasonable amount for this benefit. On this basis, perhaps US oil consumers are generating a greater return for their oil spending than small car driving, dangerous motorcycle riding Europeans. ;)

OK: So you're talking about the sum of the net import data of the individual euro zone countries.

The analogy would be the sum of the net import data of the individual states of the US. Right?

Here's the reddit links for this post (we appreciate your helping us spread our work around, both in this post and any of our other work--if you want to submit something yourself to another site, etc., that isn't already here--feel free, just leave it as a reply to this comment, please so folks can find it.):

Find us on twitter:

http://twitter.com/theoildrum

http://friendfeed.com/theoildrum

Find us on facebook and linkedin as well:

http://www.facebook.com/group.php?gid=14778313964

http://www.linkedin.com/groups?gid=138274&trk=hb_side_g

Thanks again. Feel free to submit things yourself using the share this button on our articles as well to places like stumbleupon, metafilter, or other link farms yourself--we appreciate it!

OK, I didn't read the text. I just looked at the charts, in particular the second one.

To me that chart shows that (1) prior to 2003 there was no correlation between exchange rates and oil price, and (2) since 2003 there has been a correlation between movements in the dollar and movements in the oil price. The correlation looks to have grown stronger in '08 and '09.

That suggests a progressive move of "trader" money (speculation) into the oil futures market. It's quite a good "smoking gun", another piece of evidence about the role speculation plays in the world economy.

This would be consistent with monetary inflation, not speculation. A part of price change is fundamentals, then you have to multiply it by new money in circulation.

To get the clearer picture about influence of the inflation to price of oil, imagine that you own a business that spend 10 $ on oil for every unit produced you sell for 100$. Inflating the money supply by 10% could easily increase your selling price to 110$. If you are on top of the food chain, you could easily pay 20$ and still stay profitable. However, it's inevitable that higher price of oil will feed through the system, increasing your other costs. Especially if supply/demand balance for oil is tight, relative to other supplies.

If it was speculation that rises price of oil then it would not be possible for you to raise the price and sell the same amount of your product. Something has to give, there is not enough money to buy all the goods produced.