US Natural Gas: Lessons from BP's Tight Gas Facility in Wamsutter WY

Posted by Gail the Actuary on June 3, 2008 - 10:00am

I recently visited BP America's tight gas facility in Wamsutter, Wyoming on a trip paid for by the American Petroleum Institute. I was the only representative of internet media on the trip. The other reporters on the trip were from AP-Cheyenne, Casper Star-Tribune, and Natural Gas Weekly. On the trip, we spent a day and a half listening to presentations and touring facilities. We also stayed overnight at the facility BP built for visiting workers.

In this post, I will tell a little about what I learned. I will also look at prospects for the future -- both in terms of being able to expand operations and threats to maintaining current production levels.

BP America's Wamsutter Operation - Early Years

The Wamsutter gas field is located in southwestern Wyoming. It is about 55 miles long and 35 miles wide. BP America has had operations there since the mid 1970s. BP is not the only operator in this field, but it is the largest one.

Wamsutter's gas is tight gas -- It has low permeability (.01 md) and low porosity (< 12%). Hydraulic fracturing ("fracing") is needed to get the natural gas out. Compared to conventional gas, wells need to be spaced closer together because gas does not travel far in such a tight formation. The initial internal pressure of a well can be high, but drops off quickly. Natural gas production also start off high, but quickly drops. Wamsutter gas is sweet gas--without H2S (hydrogen sulfide).

The produced natural gas has water with it. Once the pressure of a well declines, external energy inputs are required to separate the gas from the water. The energy source BP and other companies in the Wamsutter gas field have been using for many years is electricity from solar panels. BP is now considering adding windmills as an additional source of external energy.

The reservoir depth is about 10,000 feet. At this depth, there is a layer 500 feet thick, about 20% of which is pay. The productive portion is found in strata as thin as 10 feet thick. The productive strata (the "net pay") together add up to about 60 to 100 feet of the 500 foot layer.

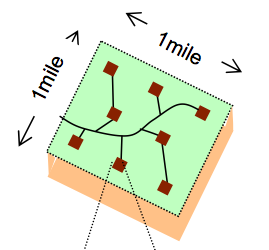

In the early years, BP's approach to extracting natural gas was similar to that used for conventional gas. Individual vertical wells were drilled, with 8 wells per square mile (80 acre spacing). From the air, the arrangement looked like this:

This arrangement was very costly to service and maintain, in part because BP was responsible for building the roads to the wells. In addition, service people needed to visit each well individually. Pipelines were needed to each well. Separate tanks and other infrastructure were also needed for each well.

Besides well arrangements, BP followed industry practice in other respects. When prices were relatively high, it would rent more drilling rigs and increase the number of wells drilled. When prices decreased, it would lay off workers, stop renting rigs, and let production level off or fall.

BP America's 2005 Wamsutter Investment Program

In 2005, BP made a decision to change the way it managed the Wamsutter gas field. Instead of simply following the conventional gas drilling model, it would put together its own model, one more in line with maximizing productivity as a tight gas facility. BP announced that it was planning to invest $2.2 billion in the field, to raise production from 125 million to 250 million cubic feet a day, before 2010. Of this, $120 million was investment in improving technology.

One of the major things BP decided to change was well spacing. Instead of drilling eight separate wells on individual pads within an area one mile square, it would consolidate up to eight wells onto a single pad, and arrange the pipes so they still drained the same area one mile square. This way, much less land would be disturbed and many fewer roads would be needed. Other infrastructure could also be consolidated and servicing costs would go down.

In order to make this change, BP needed drilling rigs that would drill "deviated" wells - that is, wells that angled off, then down, so that the surface portion of the wells could be placed on a single pad, while the wells themselves were spaced out, like the legs of a daddy long legs spider. The drilling rigs also needed to be capable of drilling one well, and then moving to the next, without being taken apart, transported a few feet, and put back together again. Since rigs are rented by the day, the several days that rigs are out of service during the take-down and set-up would add greatly to the cost.

In order to get rigs of the proper specifications, BP found it was necessary to work with manufacturers to produce rigs suited to its needs and then sign long-term leases on the rigs. BP decided to lease seven rigs--three from Helmerich & Payne, and four from Nabors, at rates averaging approximately $30,000 a day.

Besides having the proper specifications, the new drilling rigs are much more automated. The "dog houses" are air conditioned and relatively quiet. Operators need to be highly trained individuals, instead of traditional "roughnecks".

As part of the 2005 initiative, BP made a decision to staff at a fixed level--the level of operations that the seven drilling rigs on long-term contracts could support. With this approach, there would be no more lay-offs, even if the price of natural gas declined. Besides fitting with the long-term contracts on the rigs, this approach had the benefit of providing a more stable working environment for employees.

Prior to the 2005 initiative, the community of Wamsutter had a population of 261, and had few amenities. The homes were mobile homes, each with its own well. BP decided that this needed to change, if Wamsutter was to be an inviting place for educated workers to live. Starting in 2005, BP began helping Wamsutter add services. Some of the projects BP has helped fund include water and sewer systems, road improvements, a day care, and a park.

In order to have educated workers, BP has also contributed $500,000 to Western Wyoming Community College, to enhance the college's oil and gas technology program and $5 million to University of Wyoming's School of Energy Resources.

Other Technology Enhancements

Besides shifting from individual wells to grouped wells, BP has been pursuing other types of research:

• Remote monitoring. Years back, service people needed to drive around in a truck to check each well individually. Now most of the relevant information is transmitted electronically, so that a visit is required only if there is a problem.

• Electrification of wells. Electricity is needed at the well site to separate natural gas from the water produced with it and to transmit monitoring information to the office. The original approach, used by BP and others, was to use a single solar panel and battery for each well. Now that BP is grouping wells on a pad, BP uses a larger grouping of solar panels together with several batteries, to provide longer backup. BP is considering adding a windmill to some pads, as an additional source of energy.

• Cordless seismic imaging. BP has worked with outside contractors on what it calls Firefly(R) land seismic imaging system. With the old technology, seismic imaging systems needed to be plugged into electric power at a proposed well site. This was a problem, since there are no electric power lines in most areas being tested. The new system uses battery operated units which transmit signals to the office.

• Horizontal wells. BP's current wells are basically vertical wells, adjusted for the need to have the surface units located on a single pad. BP is planning to test horizontal wells, to see how the economics of these wells compare with the current approach.

Well Productivity

The written material we were provided indicates that with BP's new technology, hydrocarbon recovery has been increased by up to 40% and drilling costs have been reduced by up to 50%. I do not know to what base this comparison is being made, but I can believe that costs have been brought down substantially.

We were not provided with an estimate of the expected recovery per well, but I tried to compute one from various information given at the presentation. I came up with a range of about 900 million to 2 billion cubic feet of natural gas per well. This seems like a fairly respectable level, compared to estimates for other natural gas producers.

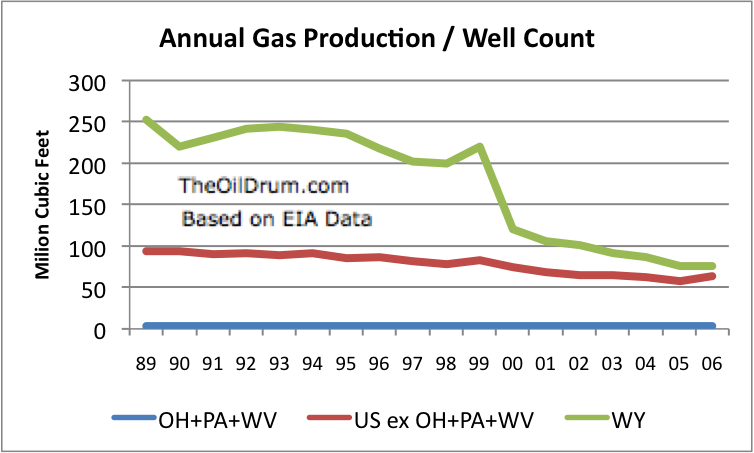

One figure that is fairly easy to calculate is average annual gas production per operating well, including wells that were drilled years ago. In this calculation, only natural gas "not associated" with petroleum production is used. One can compare this statistic to statewide averages, using EIA statistics for natural gas production and number of wells.

For BP Wamsutter, the information provided suggests the average annual production per operating well is currently about 68 million cubic feet per well ((240 million x 365 days)/1,282 wells). If wells have an average life of 30 years, and this average continues to hold, this would suggest ultimate recovery averaging just over 2.0 billion (=30 x 68 million) cubic feet per well. One could get a similar number with a 40 year life and a lower annual average.

One thing I noticed when looking at EIA data is how much average production per well varies from state to state (Figure 6). Ohio, Pennsylvania, and West Virginia all have very low averages--about 3 or 4 million cubic feet per year. I expect this production is coal bed methane. If these wells have a 40 year life span, one might expect ultimate recovery of 140 million cubic feet per well (=40 x 3.5). I find it hard to believe that wells with this low level of productivity could be profitable. Yet developers seem to view these wells as at least marginally profitable--the number of wells in these states has been increasing in recent years.

In contrast, Figure 6 shows Wyoming's average annual production per well is above the US average (excluding these states with very low average production rates). BPs Wamsutter's average of 68 million cubic feet is in line with both the Wyoming average and the US average excluding Ohio, Pennsylvania, and West Virginia.

Production Costs

We were not given an accounting of costs that go into producing BP's tight gas, but it appears that drilling costs are a smaller percentage of the total than for conventional gas. Items which would contribute to BPs costs include the following:

• Drilling costs. We were told that the individual wells costs in excess of $2 million. I am not certain which costs are rolled into this calculation. The seven drilling rigs are rented at rates averaging $30,000 a day, and these seven drilling rigs in total drill 150 to 170 wells a year.

• Seismic imaging. Imaging is needed at each proposed well site.

• "Fracing" of wells. BP uses two portable rigs for this operation. I would presume these rigs are considerably less expensive than the seven drilling rigs on long-term lease.

• Long term lease for the large amount of land held. Costs may be low, since the same land can be used for agricultural purposes (grazing cattle, etc.)

• Roads to service the wells. Roads are gravel and need to be regraded when affected by washing.

• Travel of service people to wells. We were told that while this amounted to 1,000,000 miles per month in the past, it has been reduced to 800,000 miles per month through greater use of long distance monitoring.

• Technology research. BP has allocated $120 million for research, over a five year period.

• Well infrastructure and replacements. Each well or group of wells contains equipment for separating the extracted material into its components, holding tanks, monitoring equipment, solar panels, and battery back-ups. If wells have a 40 year life, replacements will be needed for many reasons--corrosion, solar panel theft, battery life, etc.

• Pipelines and compressors. Pipelines are needed for natural gas transmission. Compressors use natural gas for power, since electricity is rarely available in Wyoming.

• Office. Building for people overseeing natural gas production. Also warehouse for supplies.

• Residence facility. Since nearby living facilities are very limited, BP built a residence facility for workers who desire to stay there. It provides meals, recreation and laundry for up to 200 workers. The cost is at least partly offset by charges to workers using the facility.

• Assistance to Wamsutter. BP has been active in setting up a city a water system, building a day care, and finding a person to coordinate town development. Part of this is funded by BP; part is funded by Wyoming state agencies.

• Funding for University Training Programs. Noted previously.

• Taxes. Material provided indicates that in Wyoming (not just Wamsutter), these were $60 million in 2005, plus $170 million in federal royalties.

• Cost of money. Most of the expenses are front end expenses. Either funds need to be borrowed, or there is an opportunity cost in using funds that might be invested elsewhere.

We were told that in total, there are 750 to 900 workers at the BP site in a typical month. Of these, only 150 are actually BP employees. The rest are contractors of various types.

Future Prospects for BP Wamsutter

The company generally seems to be well situated. It is taking an approach of trying to learn as it goes, and incorporating new technology to hold down costs.

The company says that it has produced about 3 trillion cubic feet of natural gas since 1977. This represents less than 20% of the resource available in BP's portion of Wamsutter field. We were told that gas wells from the 1970s are still flowing.

To date, the spacing of the wells has been one well per 80 acres. BP has filed for approval to change the spacing to one well for 40 acres, and is in the process of getting necessary approvals. With this spacing, BP can put up to 16 wells on a pad, instead on 8. It can also add infill wells to previously drilled areas. BP's research indicates that in some portions of the field, flow rates will be adequate with the closer spacing.

Based on what BP has done to date, BP seems to be in a good position to increase production in the future, if it chooses to. For example, it could decide to increase the number of drilling rigs it operates by one or two in say, 2011. If it were to make such a decision, it would need to order new rigs sufficiently in advance, and sign additional long term leases. It might need to make increases in other areas as well--more employees, more support for the Wamsutter community, greater office space, and perhaps a larger residence for visiting workers.

I don't know whether BP would choose to make such an increase in production, however. With its current "level load" philosophy, BP could choose not to add capacity. Instead, it might extend the number of years over which it can produce gas further into the future.

I think issues which would tend to hold back BPs Wamsutter production are peak oil issues and possibility water shortages.

Wamsutter is in a remote location. At present, it has a population of about 600. It does not have a grocery store, any medical services, or a hotel. Many of the workers live as far as 70 miles away, in order to have basic services. Even those who live nearby make many long car trips to purchase necessities. All of this is very oil dependent.

BP Wamsutter's natural gas operations are also quite petroleum dependent. The service people visit the wells in trucks; the drilling rigs are powered by diesel fuel. Grading of roads requires diesel. All of the supplies are brought by truck from distant locations. Visitors generally fly into Rock Springs, a tiny airport 70 miles away. Cutbacks in the availability of oil could affect all of these oil uses.

Regarding water scarcity, Wamsutter is in the Red Desert. It gets 8 inches of rain a year. The Rock Springs newspaper was full of stories about water issues when I visited. For example, it talked about well levels for existing homeowners dropping when new wells are added. Clearly, Wamsutter cannot be self-sufficient in growing its own food. It will need to have nearly everything brought in by truck. If residents try to pump more than the aquifer can handle, there could be a serious problem. Increasing the number of resident is likely to make the water problems worse, sooner.

Possibility of Others Ramping Up Production

What is the possibility of others jumping in and ramping up production in another tight stands location?

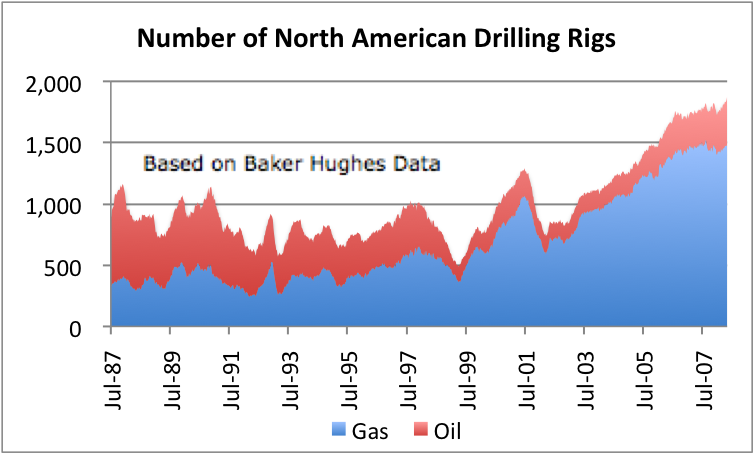

Shale gas is different, but I don't know how different. I suspect that some of the issues might be similar with Hayneville shale, which now seems to have the possibility of increased production.

My guess would be that if anyone wants to ramp up production quickly, it will not be easy. The number of rotary drilling rigs in use for natural gas in North America has stagnated in the last year. One reason for this may be the competition from oil, since the higher price is drawing rigs toward oil. Another reason may be that the more popular rig types are already close to full utilization. If this is the case, a company wishing to ramp up production quickly might need to make do with whatever happens to be available, even if it is not optimal for the particular application.

Three of the rigs used by BP are manufactured by Helmerich & Payne. A check of its website indicates that in the past year, its land rigs were 97% utilized.

Clearly trained workers are another issue, especially with unconventional gas. Unconventional gas is expanding so rapidly that there are not enough workers to go around.

I have listed some other costs that BP has encountered, such as building roads, getting pipelines laid, and doing seismic testing. Depending on the location, a new company would need to deal with many of these issues. These are likely to take time and money, and may delay production.

I would expect that much of the research would be skipped, so as to start production quickly. Because of the important role technology plays, this could easily mean the difference between a profitable operation and an unprofitable one.

Putting these things together, it seems like ramping up production of tight gas will be a challenge. There is likely to be a delay of at least three years just to get all of the basics covered. Skipping research puts the new producer at risk of a much lower profitability level. And of course, the new producer will have to deal with the impacts of peak oil, just as BP will.

Previous Post

An earlier post I wrote, giving background information, can be found here:

US Natural Gas: The Role of Unconventional Gas

BP Presentation

BP provided a press version of one of the presentations that I saw. I have permission to post it:

1 acre = 0.0015625 sq mile

So 8 wells/sq mile

or

8 wells/acre ?

Which is it? Otherwise a nice article.

It is 8 wells per section. A section is 640 acres.

A BP presentation I found on the internet had the 1 mile by 1 mile graphic. I presume 640 acres is equivalent to 1 mile by 1 mile, but haven't checked.

I found the place I said "per acre" instead of "per square mile" and fixed it.

Correct, in terms of area, 640 Acres = 1 square mile = 1 Section

http://www.metric-conversions.org/area/acres-to-square-miles.htm

Land survey Jargon (In US and Canada):

A square mile, or an acre, can be any shape, but a Section (as in a Section of a Township) must be a square with a side length of 1 mile.

A Township is a square shape with a side length of 6 miles i.e. contains 36 Sections.

Thanks again for all you do Gail. Your efforts have enhanced the TOD experience greatly.

Could they not design the facility to be self sustaining through NG use,Electricity generation, NG powered transportation, etc?

I suppose they could use the natural gas to be sustainable, but they haven't started yet.

BP mentioned that some types of drilling rigs run on natural gas rather than diesel. I am not sure if they could get the type of drilling rig they needed on this basis. Perhaps their current rigs could be adapted to run on natural gas.

When I visited Shell's offshore drilling platform, it had a big electrical power plant built in that ran off produced natural gas. It powered all of the operations on the platform. The same thing could be done in Wamsutter, if someone got to work and did it.

I think there is a possibility on the NG transportation, but one has to get started on it in advance. Part of the problem is all of the workers need to be housed and fed, and the food has to come from somewhere. There are a lot of necessary chains that could break down. Lieblig's law of the minimum is what may come into play rather quickly. If by any chance there is rationing, some part of the chain is likely to get left out.

If a gas field's energy inputs could be suddenly and miraculously switched over to natural gas, the EROEI calculation could be replaced by a simpler figure for net gas "exported" to the world from this field.

If a time were to arrive when much or all of the field's gas output would be consumed for its own operation, there would clearly be no further benefit to keeping the field in production.

I'm curious as to whether transportation of equipment, personnel and energy products themselves is actually a significant factor in EROEI and/or profitability. If so, then the geography of production and consumption is likely to play an increasingly important role in energy economics.

Maybe it will emerge after a sufficiently detailed analysis that local solar and wind installations are more competitive than expected when compared with distant sources of fossil energy. One can hope.

I guess there is a gas plant hanging around out there.

A green one, that grows gas?

" Two natural gas wells plus solar panel"

well that's something to think about.

I was surprised to see solar panels everywhere I went. It wasn't just BP gas wells with them. Gas wells operated by other folks had them also. I believe they said they had been doing this since the late 1970s.

These solar panels are sitting on the ground, unguarded, in an area where there are very few people. It would be very easy to walk off with them, and I understand that this has happened from time to time. As people have more need for solar panels, I expect this will be more of a problem. This may be why BP is looking at windmills.

do the solar panels provide ALL the electricity needed to run the pumps, etc? I assume that it is also grid connected? or not....?

What grid? We are in the middle of nowhere.

I think there may be some natural gas burned for some portion of the energy in the separation process. I am not entirely clear on this. I could probably get a clarification.

There are some waste gasses that are burned. I know that there was mention of the possibility of using these for energy, but there seems to be a problem with regulators not liking this approach so far.

Like Gail said, these are not grid connected. As such, they require unusually large batteries to maintain reserves during the winter months. In fact, they typically mount the solar panels vertically, since that way they shed snow, and the only important months to consider angle of incidence is December/January. Until recently photovoltaic panels on oil and gas wells were the #1 source of demand in Canada.

I suspect the interest in windmills is to try and get more winter energy, and hence scale back the battery packs.

"do the solar panels provide ALL the electricity needed to run the pumps?"

gas wells are not usually equiped with pumps.

if you are refering to compressors, no these are fueled with ng(hundreds or thousands of hp).

it would appear that the solar panels are for monitoring and control equipment.

What you say sounds right. I received a copy of one of the presentations this afternoon, and was trying to understand what it says about electrification.

According to the presentation, electricity is used for monitoring and for what BP calls "automation". Automation may be monitoring, translated to some action when the monitored results are out of a specified range--perhaps what you call "control equipment".

In the description of electrical use, I also found reference to something saying "power for gas lift pilots". BP has a pilot program in which it is temporarily pumping some of the gas back in (I think) in an attempt to raise production. This is related to deliquification. See slide 14 of the presentation. This may be another use of the electricity.

You mention natural gas being used to run compressors. One use of the compressors would be to make gas move through the pipes. Would compression also provide power for the separation process (into condensate, natural gas, water, and waste gasses), or does this happen some other way? I was originally under the impression that electricity was somehow used in the separation process, but I could be wrong on that. Perhaps it was only the pilot gas lift problem that was being referred to.

In other installations that I've seen, the solar cells provide power for two purposes...

This requires very little power. You could put a small genset at the wellpad, but that would be equally expensive, less reliable (more moving parts), more polluting (noise as well as CO2), it would cut into your revenue stream, and (important!) it would have problems providing cold start service (no gas => no power).

The solar cells and microwave save you from having to run power and C&I cabling to every wellpad - a considerable cost (and theft risk!) in such a geographically spread-out operation. Solar couldn't provide anything like enough power for any serious process or lift energy input, though you might be able to do something along those lines with windmills.

"Pilots" in Gail's context probably refers to pilot valves (small valves which allow the main valves to be opened by flow or process pressure).

thanks. very interesting.

I wonder what % of our gas (conv/unconv) is off the grid like that and requires ecosystem services (solar flows) to harvest fossil fuels....?

Clearly everything offshore is off grid. I think they pretty much burn natural gas for power, though.

I am not sure how one would go about quantifying the rest. Most of the Colorado/Wyoming/Utah/Montana natural gas production would be off grid, and much of Canada that is not in major cities.

Natural gas wells are so spread out that it probably does not make sense to string electricity to them, unless it is already there (Barnett Shale in Dallas?). I would wonder if some of the shale gas production from Eastern states will end up being off grid. It is very expensive and time-consuming to get electrical grid wires put up, if wires are not there already.

Pennsylvania is so heavily populated and has such extensive infrastructure (from power to phones to water to gas to taverns for the workers) that you can handle things pretty well. The gas in Pennsylvania has the advantage that it is very close to markets and does not have to depend on a pipeline to move it.

They sometimes don't even bring the gas to market, they just power a diesel generator with the power on site for factories, schools, etc. The waste heat comes in handy during winters.

You seem to be talking about building electric power plants (often with cogeneration, to share waste heat) at the location of the gas. I knew that this was done with coal; I hadn't thought about it with gas.

The thing that then needs to be built is electric transmission lines. I have seen comments that when new gas power plants are built, the plants can be up in 18 months but the transmission lines can take 5 to 10 years. Hopefully the problem is not that bad, but lagging transmission lines can be a problem.

i think your questions were pretty well answered by the posters upthread.

bp is using gas lift, meaning that some of the wells are producing liquids, either free water or condensate. in a gas lift operation, dry gas is injected into the tubing casing anulus to lighten and accelerate the flow stream, allowing the well to flow. this would require a compressor on site or nearby.

dehydration would require electrical imputs as well. dehydration is probably accomplished either by cooling the gas stream or by desiccation(glycol absorption). in a desiccation cycle, heating would also be required. the heat cycle would be fired by ng. another means of dehydration uses a "molecular seive". at the very least electricity would be used for operating the process and control equipment.

those are probably dehydrators shown in the photo.

that kind of flips things a bit. we rely on solar for our natural gas and maybe soon wind. any geothermal prospects for these wells?

Geothermal I think is a way of making electricity. You need transmission wires for electricity, and that would get very expensive. That is the reason for local generation-solar or wind.

I'm talking on-site geothermal like they do with some oil wells I've seen.

I was not aware that on-site geothermal is used with some oil wells. It would seem like there would have to be "hot rocks" fairly close below the wells. One would have to have a drilling rig that could dig the well of the appropriate depth. Where is geothermal used with oil wells?

Where is geothermal used with oil wells?

AFAIK, nowhere. Anyone care to quote a counterexample? Anyone care to quote several counterexamples?

Edited after posting - OK, john15 below quotes two (his first link seems dead), but the scale is tiny

Geothermal wells produce large volumes of dry steam, wet steam or at least boiling water from hot, fractured igneous rock. Lots of heat. There isn't enough thermal energy in oil well or gas well effuent to make it anywhere near economic to harness it - even if the price of electrical power goes up by an order of magnitude.

IIRC the really hot petroleum basins are on failed rift axes (e.g. North Sea) or hotspots like the South China Sea. Offshore operators aren't going faff around retrofitting heat exchangers, turbogenerators and condensers to production platforms.

Scale is tiny because demand is tiny. Only enough power for one oil or gas well. At this level you consider thermoelectric or solar. The thermoelectric power of condensing the steam from the gas stream is enough to pump the water out of the condenser and into a nearby stream or sump. Solar and a battery seems to be cheaper at this time.

Also, please keep in mind that in this Wyoming case, the area is a literal desert. Any water used for goethermal or other steam cycle processes would likely have to be transported to the site. Solar or wind are being used as Gail noted in the main article. One reason for this is the lack of water. Another is that the use of an outside energy source is small during ordinary production and only on demand for safety shut-off.

I had a video of geothermal coupled with an oil well but I can't find it.

here are some links.

http://peswiki.com/index.php/Directory:Geothermal_Oil_Wells

http://www.renewableenergyworld.com/rea/news/story?id=49161

http://www.hydrogencarsnow.com/blog2/index.php/hydrogen-production/geoth...

the youtube vid is no more.

I find it highly unlikely that they are looking at windmills. Import grain to export flour? Use wind power to directly pump ... water? natural gas mebbe?

Like I say, I find windmills unlikely.

Perhaps wind turbines?

It is quite windy there. I think there are talking about little windmills, that would help keep the bank of batteries for each natural gas well grouping charged. They may be more like the windmills we used to expect on each farm for pumping water for animals.

If they are turbines generating electricity, they are not called windmills ... windmills translate wind power into direct mechanical energy for a device, like a water pump or, as in the source of the term, grain mill.

You are talking about wind turbines.

Windmill is still a useful term ,as without using it it is difficult to differentiate between the nacelle on a wind tower and the complete structure.

A wind turbine, strictly speaking, excludes this.

Words do change in their application, you know, and no-one seriously imagines that any corn is ground in a modern array.

Gail,

Thanks very much for this, this has allowed me to better understand tight gas.

Do you or anybody know what's happening to me in the following picture?

I went to the link you posted for spreadsheet data on Nat Gas from the EIA. I copied column A (1967-2006) and B (U.S. Natural Gas Gross Withdrawals from Gas Wells (MMcf).

But when I pasted them into a new excel sheet, what was supposed to start at 1967, instead started at 1971. The production column pasted in ok.

Also, the 2 EIA data columns only go to 2006, I selected and copied only the 1967 -2006 info, but my new spreadsheet pasted-in info up to 2010. WTF?

Please help anyone, do I have some preference selected that I shouldn't? This has happened before.

I had some similar problems when I tried copying from Baker Hughes data.

In that case, the Excel date data seemed to be in a different format between the two spreadsheets. (I don't know if this had to do with MacIntosh vs PC, or new version of Excel vs old version of Excel). When I looked closely at the data, I realized that the copied number were skipping groups of dates, so the numbers were not lining up properly. It was as if the dates were recorded as a formula, and the new spreadsheet was interpreting the formula incorrectly.

For what it is worth, I was also using information from Table 6.4 found here. One thing I found annoying was changing definitions between sources regarding where the offshore gas is. This is one reason I did not try to look at Texas and Louisiana.

Thanks Gail. What I did was just use the downloaded EIA sheet for pasting additional data into. When pasting between EIA sheets all went well. Although I wish I could figure this problem out.

Again, nice work.

Great article, thanks!

An interesting calculation is that by clustering the wellheads in the center of the section, you only increase the bore length by ~ 1%. (hypotenuse of triangle with sides 0.33 mile and 2 miles). Admittedly 1% of 10,000 feet is not zero, but is easy to believe the advantage of not having to move a lot of equipment, build roads, etc.

Minor typo: (?)

I assume that "I came up with a range of about 900,000 million to 2 billion cubic feet of natural gas per well" should have read "...900 million..."?

-Dave

Thanks. I will fix it. I depend on readers to do my proofreading.

Of course the other thing that needs to be looked at is the potential rate of increase of gas consumption. This could shoot way up with the heating oil problem + new plant conversions. In a couple of years that 11 year supply could quickly become 3 years, assuming the worst. From what I have read, importation of LNG could well become very difficult as ROW starts to switch to gas.

While reserve numbers look good, we've been down that road before!

Thanks for your work.

Exactly. We currently use less natural gas than oil, so even a small percentage change from oil can have a big impact on natural gas. Also, the switch to electricity is often in effect a switch to natural gas, since all of the new plans have been electrical.

Thanks Gail; this is fascinating stuff.

When BP began making these investments in 2005 is about the same period that the Rockies Express pipeline was planned. Is there a connection?

I expect you are right--there is a connection. Without a pipeline to take the new gas production away, increasing production doesn't make much sense. Once it is in place, about all BP can produce is the capacity of the pipeline.

everybody been hitting "share this"? :)

Excellent report.

With all the attention to oil at TOD, North American gas seems a bit less quantified. But is something strange going on here?

The percentage of NG produced from unconventional sources is rising quickly (is it 20% now?) But as I understand it, CBM and tight gas wells produce for about 5 years and are then exhausted, whereas a normal oil/gas well produce for 15? years. If the US produces 19 Tcf of gas, then maybe 4 Tcf will have to be replaced every five years with new wells?

This sounds like a queueing process with the service time reduced to 1/3. To get the same system queue you'd have to increase the arrival rate(new wells put into service)

by 3 times and that assumes that an unconventional gas well is on average as productive as a normal gas well. Does that mean the life cost of unconventional

gas is 3 times regular natural gas?

So today, x times (3 times .2 + .8)= $5 per Mscf

or x, the cost of normal gas=$3.57 per Mscf

In 2015, when maybe 50% of gas comes from unconventional

we would see $3.57 times (3 times .5 +.5)=$7.14.

By 2030 what would we see maybe 100% unconventional gas? Costs at over $10 per Mscf?

I don't know much about unconventional gas costs of production but since about 5.8 million btus is equal to a barrel of oil and a million btus of natural gas prices at about $10 in some places, then doubling of the price of natural gas would make natural gas just as expensive as crude oil per btu, and natural gas is used to make petroleum products. In just a decade or so.

Oil and gas at the same price per btu!

Now I can see why the money men are especially interested in natural gas!

I hope I'm wrong here!

Regarding the proportion of US natural gas that is unconventional, the latest year we have figures for is 2005. In that year 43.8% was unconventional (7.98 Tcf / 18.2 Tcf), and the percentage rises each year. I posted this graph in my earlier post:

The proportion is rising rapidly, so I would not be surprised if we are already at 50% in 2008.

Regarding how long the wells last, and what the shape of curve is, that is not as clear. BP claims to have tight gas wells still producing that were drilled in the late 1970s. I am sure that they are not pumping much.

The figures I showed regarding average annual production per well (Figure 6, above) are interesting. The averages for Ohio, Pennsylvania, and West Virginia are incredibly low. These seem to be coal bed methane states. The numbers I was looking at for Wyoming tight gas seem to be much better.

I stand corrected.

I wanted to get some idea about what the price of gas would look like when we get are getting most of our gas from unconventional supplies. The notion that natural gas could be as expensive as oil is very troubling.

One reason we don't have oil fired electric plants in the US is the fact that oil is twice as expensive as natural gas.

What happens to peaking electricity from natural gas when gas costs as much as oil per BTU?

Peaking plants are plants to cover demand in excess of baseload nuclear and coal plants. Increasing baseload capacity won't help because baseload plants

can't ramp up for morning startup loads or afternoon airconditioning loads. If the gas isn't there then expect brownouts and load shedding.

(Another reason I support IGCC-CCS which can produce synthetic natural gas as a by-product as well as electricity.)

If costs rise to level equal on a BTU basis with natural gas, I think we are likely talking costs over $20 a Msfc. This is a chart I posted in my earlier post, which uses natural gas at its historical relativity to oil. If it were twice as high, the costs would be a lot higher.

Today I received a copy of a presentation I heard during my visit. I posted a link at the end of the article. This is a comparative graph of the shape of the downslope for conventional gas production vs. tight gas from that presentation. Note that the scale is a log scale, and the author is comparing two wells with the same total production.

Hehe, you're RIGHT about that!

A quick curve fitting exercise (mainly compluter plus eyeballing) gave me y=-100*ln(x)+677 over 500 months for tight gas well. Integrating that I get 76000 Mcf for the tight gas well.

For the conventional well, I got y=-800*ln(x)+3600 over just 75 months and integrating I get 64000 Mcf.

So the conventional well will extract almost the same amount of natural gas in 75 months as the tight gas well does in 500 months! Interesting!

I interpret this to mean you need 5 tight gas well for each conventional well.

LOL, I wonder if the tax man depreciates them at the same rate?

You also have all of the monitoring activity for 40+ years, and have to make sure that corrosion is not a problem for 40+ years. These are non-trivial costs. If you built a well so it was difficult to monitor 40 years ago, you are stuck with that, unless you can do some retrofitting.

Also, with the fast drop off, I was surprised I was getting as good annual average production as I was in Wyoming, and for BP. It may be partly because BP has recently ramped up production. It didn't sound like the production had been going up all that quickly - it sounded like it had been up and down, and now was up again.

Here's what the EIA gave for US natural gas in 2002.

http://www.eia.doe.gov/oiaf/presentation/ng/ngoutlook.html

They give a total 1289 Tcf including 169 Tcf unproven plus 269 Tcf undiscovered. There are also 29 Tcf of oil-associated natural gas.

EIA has 445 Tcf comes from low productivity unconventional gas and 183 Tcf proven convention plus 222 Tcf inferred conventional=391 Tcf. So it's roughly 400 Tcf conventional, 400 Tcf unconventional and 400 Tcf of hope(lies?).

The US domestic production is 24 Tcf gross(18 Tcf net). Today 10 Tcf gross of the 24 Tcf gross comes from unconventional gas.

http://tonto.eia.doe.gov/dnav/ng/ng_prod_sum_dcu_NUS_a.htm

I really like your gas chart.

Your 2007 chart showed conventional gas peaked before 1990

and is declining at a very steady 400 bcf net per year with the difference being made up by unconventional gas, so by ~2032 100% would be unconventional gas. We should start seriously looking at geopressured gas.

The trend shows that contrary to EIA, we have (10+0)/2*25years or 125 Tcf of conventional gas left instead of the 405 Tcf EIA claims.

Another problem is that unconventional gas reserves would be nearly exhausted at the same time that conventional gas is completely exhausted; roughly

(2+18)/2*40years(1990-2030) minus (2+6.8)/2*12years(1990-2002)=347 Tcf, already running thru 78% of the unconventional reserve.

This assumes that they are able to keep up with demand by extracting unconventional gas faster, i.e. drilling more wells. Your well curve, (which I approximated as 677-100*ln(month)=mscf) indicates that by year 15 of a 40 year life 60% of the unconventional gas in the well would be gone.

Just when you got Peak Oil half-way down your throat, here comes Peak Gas for the US.

I think the unconventional gas reserves are less clear. There is a huge amount of the resource available, which has not been well explored. To produce it, we need a lot of things, and one of them may be petroleum. We also need new pipelines (or transmission wires, if it is burned on site for electricity).

It may not be able to scale up unconventional gas as much as we like, but production may continue for a while on a plateau, assuming peak oil and water problems don't get in the way.

Hey majorian,

How many wells per year do you calculate we'll be drilling as NG winds down?

On the subject of taking up slack, I was pleased to notice that AWEA's figures for current wind projects under construction is up to 5736.3 MW nameplate. But on the other hand the EB has a new packet of dire stories about this year's situation in the US for electricity.

They'll try to maintain 18 Tcf forever. The point of peak oil as you know is peak production, which is 18

Tcf per year. Since a tight gas well(700 mscf?) initially produces 1/6th or less of a conventional well(4000 mscf) according to Gail's graph, that means we need to drill 5 or 6 new unconventional wells to make up for each new one that drains( with a 6 year lifetime). I don't know how many new sucessful gas wells we drill per year now, but it seems that a huge number of new ones must be drilled to keep running in place.

I think with respect to new wind, we have mostly maxed out our electricity transmission capability for such a variable resource. For example, see this article:

Lines lacking to transmit wind energy

I wonder if the tax man depreciates them at the same rate?

Of course not! The two assets have drastically different economic lifespans.

Oilfield depreciation traditionally works on a "unit of production" basis. If you spend 1 million dollars to develop 100,000 barrels of reserves (as defined by the SEC), you get to write off 10 dollars of capital for every barrel you actually produce. If you have produced 50,000 barrels and then (on the basis of field performance, or a new reservoir model, or something else) reduce your estimate of remaining reserves to 25,000 barrels, you would increase the depreciation rate of the remaining capital accordingly. This would reduce your per-barrel profit, and hence tax, for the remaining reserves. I think it's similar for gas. Of course production accounting (and taxation) is much more complex than this, but the fundamental rule is that every dollar of capital must be matched with a certain volume of reserves.

Thanks plucky underdog.

So an agonizingly slow producer like a tight gas well with a 40 year life (based on Gail's graph) would have to depreciate the $10 of capital over say 24 year period(most of the production) instead of a 6 year period with the typical conventional gas well, right? That would be around 1/4th the write-off and if inflation hits basically zero.

It seems that unconventional oil/gas will be produced much slower than conventional, so tax incentives like depreciation won't help much. High prices won't last forever (as everyone will be broke). What's the incentive for free enterprise for develop oil/gas?

Perhaps the US government should look at nationalizing the energy business.

You are confusing financial accounting with tax accounting. The numbers reported in the financial statements will match the method you describe. For taxes, drilling costs are split between tangible nd intangible costs. Tangible costs are those for things like pipe, pumps, control equip ect. Intangibles are the costs to rent the rig, the frac job, ect... Usually you will see a 75% intangible, 25% tangible split, but of course it depends on the well depth, and numerous other variables. For tax purposes, the intangibles are written off as expense in the year incurred, while tangible expenses are depreciated using the asset life provided determined by the IRS(certainly less than 40 years, probably 5-10 max). I could be mistaken, but this is probably one of the "tax breaks" that are always being griped about. In a very real way, it reduces the risk of drilling, making it more likely that risky wells will be drilled. Of course, $135 oil prices have the same effect.

Interesting! I know something about insurance accounting, but not about oil and gas accounting.

What makes it more interesting is that we do not do a well by well depreciation. Instead, all of the capital for an area is put into one "bucket" called a depletion unit, and then divided by the total reserves for the field. After you drill a well, you add the capital, and the reserves into the depletion unit, and calculate a new depletion rate for the field. Of course in a big field, with hundreds of millions of capital, your rate may only change by a few pennies. In a small field, drilling one new well close to a well drilled 10 years ago could double or triple the rate. At the end of the month, you multiply the rate, by your net production to calculate your depletion expense. You subtract the capital, and the reserves from their respective base, and move on to the next month with the same process. If there is no activity, or course the rate does not change. Reserves are typicaly re-evaluated annually, according to SEC guidlines. Higher prices will typically increase the economically recoverable oil, pushing down the rate, all else equal.

I just asked a question!

I said depreciation where I should have said depletion, which is depreciation of reserves.

At any rate, does it make a difference whether a well

has to operate 30 or 40 years or only 6 years to the tax situation of a project?

It seems obvious that it does!

For more confusion, there are two methods of accounting for oil/gas.

http://www.investopedia.com/articles/fundamental-analysis/08/oil-gas.asp...

Gail,

A quick question.

From the previous article on the tight sand gas I printed out the map showing the "Tight Sand Basins". I find that my farm is sitting right smack dab in the middle of the Midcontinent Rift!

Do you know anywhere that I might be able to go to find out if anyone has done any significant seismic imaging or drilling in this basin and if so what they might have found?

Thanks

Sorry, I don't know. Maybe some other reader would.

Do you ever get the idea that trying to predict the future is a fool's game? I think I could spend the rest of my life researching the energy situation and at the end only end up more confused than ever. Human behavior for good or ill is simply unfathomable.

Jon: Midcontinent Rift Gas home page should be enlightening. They've found oil in the Great Lakes region, too.

amoco (now bp) drilled a deep well in harlan co, in '84, i believe. that data is all available at the iowa state geological library. they dont have much of their data online, afaict.

there was a lease play back in the '80's with some of the majors jumping in. the idea was that the mid-continent rift was analogous to the north sea and mid east rift system. if i recall correctly, amoco determined that the rocks had at one time contained oil, but the oil was cooked out.

this unconventional play in tight gas is a new one on me. there must be something published by the usgs, i will see what i can find out.

as a side note, the manson meteor impact was at one time a candidate for the big one that whacked the dinosaurs. i dont buy that theory (dinosaur whacking) at all.

Hello Gail,

Thxs for this keypost on the massive effort that natgas producers are now undertaking to extract remaining flowrates wherever they can find them.

IMO, Haber-Bosch natgas-generated nitrogen fertilizer products and their rising price give strong leading indicators of future natgas pricing trends. The rapidly scaling price of natural nitrates is another indicator:

http://www.marketwire.com/mw/release.do?id=863347

------------------------------

Atacama Major Expansion Into Nitrate Production

...Nitrate fertilizers from Chile are considered a specialty fertilizer and have been experiencing strong demand and price increases in recent years, especially during 2007 (recent potassium nitrate contracts have been priced at in excess of US $1,000 per tonne). This demand, part of a long term trend, is a result of global agricultural growth estimated at more than 5% per year, stimulated more recently by the implementation of government policies to replace gasoline with bio-fuels (bio-diesel and ethanol) produced from crops such as corn, soybeans and sugar cane. These crops are grown with significant amounts of nitrate-based fertilizers.

-------------------------------

Recall the recent NYT's weblink posting on guano demand too. Once the very long and complex supply chains for I-NPK & O-NPK start breaking down due to postPeak FF shortages, I expect things to get ugly. As posted before: we are evolved to sit in the nightly darkness, but starvation is a real problem.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

There is a lot more than oil involved in the peak oil story - natural gas and NPK are important too. Liebig's law of the minimum can become a problem very quickly. I believe his law was originally stated in the context of fertilizer.

Hello Gail,

Thxs for responding. Yep, a Liebig Minimum originally was used in an agricultural context, but I have posted much before on how we could see postPeak Liebig Minimums in many kinds of equipment that would effectively rapidly curtail or totally disable their use.

Imagine a Govt. decree that the only tires made henceforth would be bicycle, wheelbarrow, scooter, farm tractor, big mining tires, and tires for the semi-rigs and buses. This induced Liebig Minimum for the normal personal vehicle would rapidly take millions of cars and SUVs off the roads.

It could be any critical component of the thousands of parts required to make a vehicle run safely. Imagine if you can't buy a replacement gastank, cpu/ignition system, air or oil filter, radiator or hoses, sparkplugs, brake pads, etc, etc, for your vehicle....pretty soon it is up on concrete blocks in the front yard as a chicken coop.

"For want of a nail....a kingdom was lost."

This would also happen if we couldn't buy imports. Ouch!

and if we don't use oil in the "very long and complex supply chains" anymore?

Hello John15,

IMO, the best partial solution is my non-FF proposal for SpiderWebRiding to keep NPK moving [far preferable than to fallback to Nauhtl Tlameme backpacking]. Picks, shovels, and wheelbarrows, as required, in the mines and wherever else these tools are needed. This is how it was done originally, recall my earlier Florida phosphate weblink: a modern dragline would extract 15 acres/month vs hand-mining 15 acres/year.

Recall that hand labor and sailing ships brought over 300,000 tons of guano per year into Britain during the Guano glory days.

9 photos of modern day tlamemes mining sulfur:

http://www.nytimes.com/slideshow/2008/06/03/science/earth/20080603SCI_in...

Hopefully we humans can do better than this worldwide as we go postPeak. At current sulfur spot prices near $1,000/ton: these poor workers are not getting a fair wage for their efforts IMO. :(

I find the thoughts on the community - the externalities - most interesting. On the one hand I found myself thinking that BP has to pay for schools because the free-market mentality has so destroyed the commonwealth that if corporations want trained workers, they have to pay directly. On the other, one might call that "giving back". But it is not giving back. Because one cannot use money to repair environmental devastation - it only causes more devastation elsewhere. And is a trained worker - one that is trained for a specific company and task - really anything more than a company flack/whore/stooge/sucker? That's a bit rude, but if such a worker has no place other than with the company that paid to train him, he is captive labor. Maybe I take it to an extreme, but I don't want business paying for schools because there will be no graduates willing to challenge business.

It does seem that once the decision has been made to tap a resource, this sounds like - technically - a better approach. But I wonder how much those high-tech control rooms depend on business-as-usual. When people start walking off with the solar collectors, when parts are not available, how well will it work? That is the resiliency angle. I suspect there are a lot of projects going into production that will not be able to stay in production when FedEx stops flying and parts are unavailable.

And there is always the who-gets-to-make-the-decision part.

In my usual understated way, "good work Gail".

cfm in Gray, ME

I think there is a little more flexibility in choosing employers than you might think. Wyoming is filled with a variety of companies in the natural gas business. Even the Wamsutter field has several companies operating there. The bigger companies probably bear a bigger share of the burden in trying to get appropriate programs set up. When the material is highly technical, employers probably have to be involved, to see that the students are studying the right things.

I agree, though, that with everything being so high tech, there is more chance of things falling apart. I just had an e-mail conversation with the woman from BP who flew up from Denver for the meeting and acted as our tour guide. Going home, the plane she and the API representatives were going to fly on was grounded because of a mechanical problem. They could not get another plane out of Rock Springs within 24 hours. (Tiny airport, few planes, all booked.) There were no hotel rooms in Rock Springs whatsoever. She and the API representatives ended up renting a car (there were only two left), and headed for Denver, leaving at 11:00pm. They then ran into rain, hail, sleet, snow and fog. Conditions were so bad that they had to stop and get a hotel room in Cheyenne at 4:00am.

The system is so tightly stretched that it doesn't take much to make things fall apart. I had decided when the trip was planned that it was too risky counting on connecting flights with the first one at 7:30pm, and instead booked a room in Rock Springs, with flights the next day, so I missed out on the problems.

wind-turbine v windmill

Windmill can be just propeller + DC motor. No turbine necessary. The prop-driven DC motor output can be used directly [e.g. 18 V to run DC loads w or wo going thru a battery-charging intermediate] or thru an inverter for 120V AC loads.

Maybe suitable for low-order instrumentation loads, mostly signals and pilot-valves.

DC motors? Lots available, especially for modest loads

edit above...using DC motor as the generator.