Natural Gas - A Tale of Two Markets

Posted by nate hagens on September 26, 2006 - 11:28am

This post will provide a graphical update on what has been a roller coaster ride in the natural gas market over the past 12 months, and a steep plummet of late. Natural gas prices have dropped by 50% in the last month, and over 70% from their highs earlier in the year. The warmest winter on record and not a single rig-damaging hurricane have combined to create record gas in storage, thereby reducing price demand for the marginal unit. Yet, production is flat with last year despite significant more drilling and rigs allocated to the commodity. The current situation is thus one of short term plenty and long term supply concern. If longer term predictions of reduced supply and accelerated well depletion are correct, we should be seeing some of the major producers reduce rig counts at these levels, or shut-in their production with intent to sell it higher in the future. This post examines the supply/demand equation for natural gas in the US, the NG futures strip, and the implications going forward of higher price volatility in this important commodity.

(For those unfamiliar with how the energy futures markets work, here is some background info.)

Natural gas. It does everything from heat our homes to fertilize and cook our food. And unless you've lived in a climate that doesn't require air conditioning or heat, you've probably heard of the wild swings in the gas market in the past year. The price drop has caused fits, threats and lost bets. Each day the natural gas market goes up or down. This year, its pretty much gone down.

The two markets I refer to in the title are supply and demand. But I could just as easily be referring to the dichotomy between near term prices and long term. The above chart (and most news services (CNBC, etc) quote what the 'front' or near month for oil and gas futures is doing. However, these commodities can be traded for expiration each of the next 60 months. A 'futures strip' is comprised of the entire forward market for a commodity. The complexity of the short and long term supply/demand situation can be better understood by looking at the entire curve. Below is a graphic of the futures strip from NYMEX.com of last fridays close for natural gas. (it was down again on Monday). As can be seen, prices are very low for October and November 2006 then form a sine wave pattern for the next 60 months, with peak prices expected in winter months, when heating demand is high. (Note, the above chart shows historical prices over 10 years, the below chart are todays prices for delivery the next 5 years in the future)

We will return to the futures strip at the end of this post but first give a review of the current dynamics of the natural gas market.

NATURAL GAS SUPPLY

The Peak Oil (and Natural Gas) crowd typically focus their worries on the supply side of the market equation. The supply story for natural gas, at least domestically, does not look promising. The United States has roughly 400,000 natural gas wells operating currently, near an all time high. First of all, lets look at total production in the United States. (The difference in the two lines is the top one includes 'wet gas' or non-gas liquids which are added into the petroleum supplies.) (Source EIA)

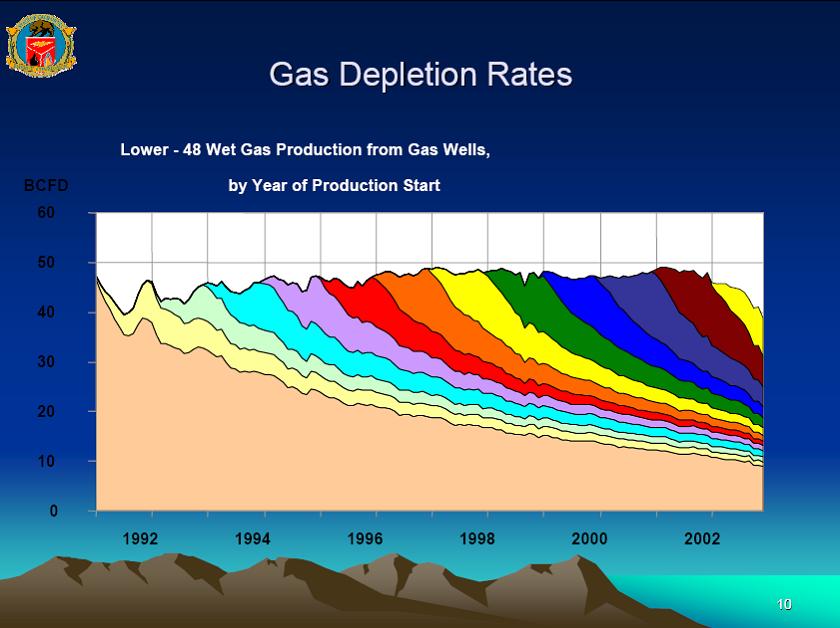

The following is a graphic showing how quickly the average new gas well is depleted. (this is for wet wells but dry wells appear to be depleting slightly faster) As can be seen, a decade ago, it took 10-15 years for a new well to deplete. Now they are going dry in less than 18 months.

In addition to quicker depletion, wells are smaller and hence less productive: (Source EIA)

We are drilling more wells and smaller wells. Equity research house Johnson Rice recently put out a report showing that from Q2 2005 to Q2 2006, the top 20 NG production firms were down 2.4% in production yet had increased rig count by 22%. (this doesnt include shut-in production).

HELP FROM THE NORTH?

Canada produces about 6.2 TCF per year and exports 3.6 TCF to the United States. However, they too are declining in production with a large increase in wells - a similar pattern to the US. The graph below shows Canada producing about the same amount of NG as in 1998, but needing to drill more than twice the wells annually to do this. (Don't get me started on net energy)

This is a broad sketch of the supply picture - of course there are coal bed methane and liquefied natural gas, but the impact of both is uncertain, and with natural gas currently with a $4 handle, those sources may be uneconomical or not come to market in a timely fashion. To me, the North American natural gas supply situation can best be likened to the Red Queen in Alice in Wonderland, who kept running very fast just to stay in place - if she slowed down, she might go backwards rapidly.

NOT SO FAST MY FRIEND!

Natural gas demand is the other half of the story. The US (in 2005) used just under 22 trillion cubic feet of natural gas. Believe it or not, this is less than we used 10 years ago (compared to a 13% increase in crude oil).

The 22 TCF roughly breaks down as follows: 24% for residential heating, 14% for commercial use, 35% for industrial use, and 27% for electric and combined cycle power.

Though many say that closure of industrial and chemical plants domestically due to high NG prices is responsible for the drop in industrial demand, as can be seen from the chart, this trend has been in place since the late 1990s, when gas was still cheap. If I was a manufacturer in Toledo paying $17/hr why wouldnt I move my plant to Mexico and pay $4/hr for wages? It is unclear how much more demand destruction can come from the manufacturing sector. However, electricity demand and its use of natural gas has surely been growing.

THE NEW GODZILLA MOVIE - "GLOBAL WARMING VS GAS DEPLETION"

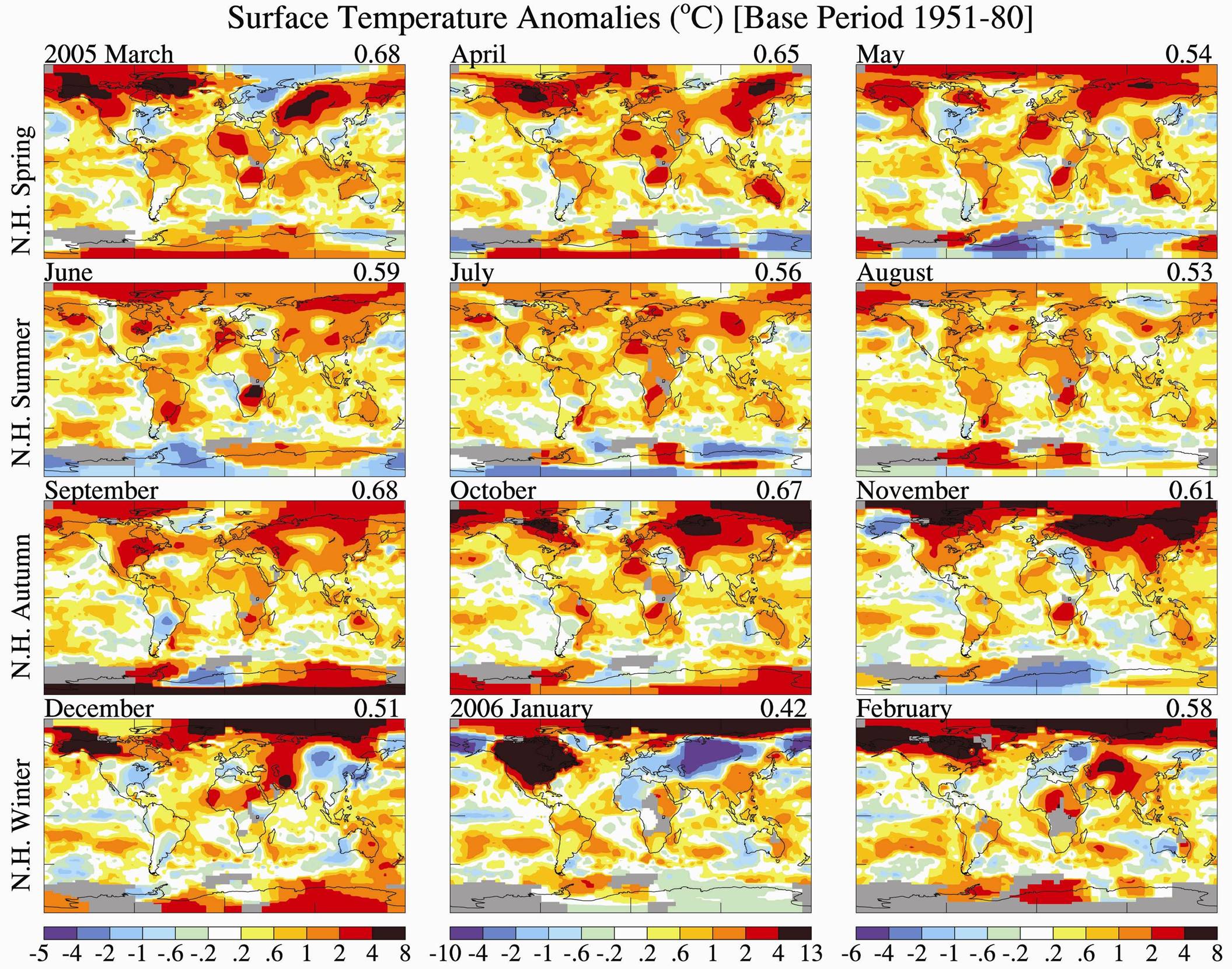

The past winter was the warmest on record. But just how warm is not commonly known. The dark red patches in North America in the below graph are 4-13 Degrees C above the historical average - needless to say, less people needed natural gas for heat (except in Russia - where they had the opposite trend in January)

Click to enlarge.

(Source - James Hansen NASA 2006)

The warm temperatures contributed to much less demand for heating not only in the dead of winter, but in the spring as well. April, May and Jun 2006 each saw less natural gas usage than any equivalent month for the last 33 years. So far through 2 quarters in 2006, residential customers have used 12% less natural gas than 2005.

BACK TO THE FUTURE(S) - WHAT A DIFFERENCE A YEAR MAKES

The pink line represents what the futures strip looked like in September 2005. The blue line represents the futures strip on Friday. (Notice, we are missing 12 months of pink line at the end because last year 60 months only brought us to 2010 and we are missing 12 months of blue line at the front because fridays futures are only looking forward, not backward)

What we see here is that the front month, which at one time was over $15 is now at around $4.50, an historic drop. However, a year or so out there has been a much smaller drop and at the end of the futures strip (2011) prices are actually slightly higher than they were a year ago. We also can see that winter months command higher prices, due to higher chances of shortages when natural gas usage is highest. Also, the shape of the winter 'hump', though at lower levels, is similar to a year ago. We also notice that currently all winters in the future are roughly priced the same, whereas a year ago, the nearer the winter, the higher the price.

WHAT A DIFFERENCE A MONTH MAKES

What does this graph tell us? First of all, near month futures have dropped like a stone since August - from near $8 to $4.50ish. Also, the winter-summer premium has declined, not only in this coming winter (where supposedly Amaranth had their calendar spreads), but in all subsequent winters. Either there was some major hedge fund activity, or some energy traders talked to Al Gore. Curiously, in the face of this steep decline, back dated futures actually went up (the blue is higher than the brown in 2011)

WHAT A DIFFERENCE A WEEK MAKES

Here we can see that in all years except for 2006, the majority of the winter-summer premium collapse of the last month came in the last week. (compare the brown-blue vs red-blue in the two graphs). However, this winters price differential had already collapsed, presumably earlier in the month, from about a $2.50 premium over spring to about $1.

If we believe the media reports of Amaranth losing $6 billion, how could they do that in natural gas calendar spreads? First of all, each natural gas futures contract is 10,000 million BTUs or 10 million cubic feet of gas - this means for each 1 point movement in price, the contract value changes by $10,000. So to lose $6B, one would have to have on 400,000 contracts if there was a $1.50 loss. However, the entire open interest of all the 2006-7 winter months is about 260,000 contracts and the entire open interest of every contract thru 2011 is 960,000 contracts. So either Amaranth had off balance sheet exposure (derivatives), they had things other than calendar spreads on (the actual front month contract declined almost $4), or something else was afoot.

Incidentally, if they did have 400,000 contracts, that would represent 4 trillion cubic feet, or about 20% of US annual natural gas consumption. Boy do energy and dollars make strange bedfellows...

AND FOR SOME PERSPECTIVE

Keep in mind that despite the dramatic fall in natural gas prices in the past year, when we compare the current futures strip to what it looked like 5 years ago, we see a) current prices are still much higher that they used to be and b) the winter 'humps', though still existent 5 years ago, were much smaller.

CONCLUSIONS

We currently have a glut of natural gas. As scary as the future supply situation is, the fact is that even with a cold winter supplies will be adequate. Could another warm winter (it is an el Nino year) combined with no increase in storage capacity result in actual flaring of gas? Producers wouldn't allow this to happen of course, as at SOME price they will shut-in production and stop drilling new wells. In fact, today Baker Hughes announced their new weekly rig count, and the Canadians, always quick to reduce drilling on commodity price drops, had a 22% drop in rigs from last week. High prices gave us demand destruction. Low prices give us supply destruction.

Low prices, while currently pleasant, send the wrong long term signal to the alternative energy markets (like wind, tidal, solar, etc). Energy price volatility (in both directions) interrupts progress being made replacing fossil fuels with renewables. Low natural gas prices remove the motivation of utility providers to invest in alternatives. Low prices also prevent wind and solar entrepreneurs from being cost competitive, until the signal is too late. Furthermore, continued volatility will hamstring policymakers. A warm winter and everything is fine and a cold winter and people freeze in Michigan. As James Schlesinger, our nations first energy secretary said about energy "We have only two modes--complacency and panic." I can think of a third mode -schizophrenia due to alternating years of complacency and panic.

Towards this end, and this applies to crude oil as well, the ease with which the wall street crowd can impact the price of a commodity that is so ubiquitous in making our system work, combined with growing knowledge that fossil fuels are a one time subsidy given to humanity and are depleting rapidly, should alert policymakers to the importance of making immediate changes to current energy policy. In addition to position limits for non-users or hedgers of energy, we should create a floor price for oil and gas, so that financial market-led volatility or intermittent gluts of product do not derail the development of alternative forms of electricity and liquid fuels. The achilles heel of the big two fossil fuels in their use in our world, is the time it takes to replace them. The natural gas market, in its current price dichotomy, is a prime example of the high standard deviation potential in our current system. Heads everything is rosy. Tails there are power outages.

I have no idea whether it will be cold this winter.

*Note - Thanks to Art Smith of John S Herold and Co., Joann Arena at the New York Mercantile Exchange, Neal Elliot at ACEEE, and John Rowan at Johnson Rice for data that was used in this post.

Can the extraction rate of natural gas be regulated on a new well?

The reason i ask is that if it can be regulated, then it can be reduced substantially or even stopped so as to keep it stored in the ground. Then there would be no need to flare it off.

Why flare? because raw gas contains valuable non gas liquids, and these liquids can be separated and sold for at least a little revenue even as the gas is flared. Flaring used to be a widespread practice... maybe we'll see this again if a few procuders get desperate enough.

Flaring ended as a normal practice in the 1960'sn the US, but some producers flare gas overseas because no market exists and they lack the wells and equipment for reinjection.

Lots of the new gas wells are unconventional gas from shale and coal bed methane. They produce a lot of water because of the huge frac jobs. Does anybody know whether the watre will cause formation damage on a shut-in well?

Yes, natural gas wells are very easy to control, and that is why production figures do not tell the complete story. Also, gas drillers can take option on tracts and then just wait to drill it (this is happening out west right now) so you can't assume that just because the gas is not being drilled, it is not there.

The idea of "flaring" natural gas in this day and age is absolutely barbaric.

Roger Conner known to you as ThatsItImout

In Oil and Gas Lease contracts the mineral owners can prevent flaring by requiring the producer to pay for all flared gas at the market price.

Thanks for this post! I'm printing it out now to show to a couple friends at work who don't seem to understand the idea of fossil fuel depletion.

Amaranth is a god study in how to lose (other people's) money quickly. (The twenty-something Calgary based Amaranth trader was gambling with other people's pension funds and such.) As I am less leveraged, and speculating in far future contracts, my (percentage) losses were much more manageable. Commodity trading risk can be reduced by controlling one's greed and mastering one's fears.

These guys roll the dice (with other people's money)and if they win they get rich. If they lose, they may need to find a new job (although after his $50mn payment last year, that may not be so urgent for the Amaranth guy).

Actually, technically, in finance the term risk applies equally to upside and downside - it is essentially volitility (or deviation from expected result). Your claim is that you can limit exposure to downside risk, while maintaining exposure to upside risk. I won't argue that it is not possible, but it is not an investment strategy for everyone.

Any money that you are going to need to spend should be in a fairly safe investment class such as bonds or cash equiv.

It's OK to take risks with a portion of your equity, or if you are young and have time to earn it back.

Can not open them for a better detail

look. ;-)

Note that accroding to the above 35% of demand is industrial, and maybe 2/3 of this is in the process of moving offshore. So, and notwithstanding the vagaries of weather, supply will have to decline around 25% before we will see a return of high prices.

i tried to find info on the industrial side but couldnt - do you have any source for the 2/3 might move offshore?

And by the way, I have been traveling in NA for 5 months and have stayed at many hotels housing pipeline workers in towns where they are installing new natural gas home heating - so there will be increases as well

So, if 20% of us demand is lost over the next four years, say 5%/year, we can expect low ng prices even as production declines. I suspect it will be difficult to find investors to put up the money required for a lng industry/long term contracts in such an environment... As usual, we can expect to wait for the crisis to be here before any action is taken.

I predict serious demand destruction:

- chemical plants moving to countries with cheap feedstock

- (some) home heating switching to heat pumps (electricity)

- more efficient home boilers (a modern condensing boiler can get 90% thermal efficiency)

- gas fired electricity switching to coal fired (easy to do and well under way)

There is a 'cap' on gas prices, which is the price at which LNG can be economically imported into the US if that infrastructure gets built (eg the Canaport in New Brunswick, which will ship to New England http://www.canaportlng.com/).In a world where LNG is more important, I suspect that price is over $6/mcf (Europeans can afford to pay those prices, so can the Japanese and South Koreans).

Long run, there are the Alaskan and Canadian gas pipelines

http://www.foe.org/powerpolitics/10.1.pdf

http://www.carc.org/2005/draws_stark.php

http://www.carc.org/oil_and_gas/Mackenzie_Pipeline_Backgrounder.pdf (purpose of the pipeline to supply gas to Canada's tar sands)

one or both will, I am sure, eventually get built.

I dont know how many people can afford new home boilers. I know in Europe - pellet stoves are huge - Im in British Columbia now and its big business to take the trees killed by the pine beetle and make them into pellets for these stoves and export them in giant grain containers.

Is the demand destruction you predict due to higher prices? or due to price volatility (uncertainty)?

That is USD $2200 or so. Against an old gas fired boiler it would pay for itself in about 7-10 years.

http://cgi.ebay.com/Baxi-Luna-310Fi-Gas-Fired-Direct-Vent-Boiler_W0QQitemZ290032168971QQihZ019QQcate goryZ41987QQrdZ1QQcmdZViewItem?hash=item290032168971

$3700 on Ebay.

So I would think that a fair few people could afford to make that kind of investment (less than the difference between the middle and top of a car range for a single model?).

Whether they will or not is another question.

I would imagine that calculation of US home energy use doesn't include wood?

Obviously heat pumps are an obvious alternative, but my suspicion is they don't pay off for Americans connected to mains gas. They do if you have time to recoup the boring/ laying costs, but they are really best deployed if there is an air conditioning requirement as well. (in a Canadian context, a relation invested in the mid 90s with a 10 year payback, but since then fuel and electricity prices have doubled, so the payback has been much quicker).

So my sense is the demand destruction will simply be it is more expensive to heat, so people will resort to more fuel efficient solutions.

I am not sure uncertainty, in and of itself, causes demand destruction (except in industrial businesses, where they might simply choose not to invest).

At least some of those plans are being changed.BP just dropped a plan to import gas to Galveston, which is near their huge gasoline refinery at Texas City. Natural gas is used as a source of hydrogen in refining for lightening the gravity of oil, plus as energy for refinining and sulfur removal.

But on the other hand LNG can be burned in automobiles as a substitute for gasoline at a reasonably priced conversion (under $2,000 in the Houston area) and can be used to manufacture diesel. That's why I think Exxon is focusing on the Qatar gas. I believe that is the real plan of the Iron Triangle to replace gasoline. And massive amounts of gas are needed to manufacture syncrude from tar and shale oil. So the long term prospects for gas look fairly bright to me.

The G-to-L project is having technical difficulties, and the Qataris have scaled back further developments.

Interestingly, Pakistan is a world leader in Compressed Natural Gas (CNG) for transport. So in the long run, the world may go that way, rather than burning lots of gas to make expensive fuel oil substitutes.

A note on growing electricity demand. This will be met by coal-fired power plants. Gas-based electrical power generation is dead for the time being. It will only be revived by rising LNG imports but that is years away. And if prices remain low, these will become uneconomical, as you note. Without higher prices, our supply fate is sealed. When it comes to cooking or heating, there just isn't that much demand elasticity, is there?

The inability of myopia in the markets to solve longer term supply & demand problems should get more attention than it typically does. For natural gas in North America, the problem is manifest now. I do normally work the supply side of the fence but the view from either side is the same.

On the other hand, due to climate change, maybe winter is a thing of the past!

But assuming that we still live in a temperate climate and that harsh winters are still possible, the three modes, as you note, are complacency, panic and freeze to death.

-- Dave

I predict we will all be in for a surprise with Global Warming. A warmer Global Climate results in only one outcome for temperate regions; More Instability. I don't trust any long term predictions about temperatures for seasons. Notice what Russia went through last year during a "warm winter" globally.

Heating and Cooling degree days are based on 68 degrees F. Departures from that require heating or cooling and the old assumption is that we spent the greatest amount of time near 68 F. Check your heating and cooling degree days on your utility bills to see what has happened over the last decade.

I predict that in the future we will almost never be at 68 F. We will either be much above requiring AC or well below, say 40 & 50's F, requiring heat. A well built solar home would not see much change, but modern homes are going to be cooling one week and heating the next all Spring and Fall. Even wild swings in summer and winter will become more probable.

My prediction is that we will get no net reduction in energy usage, merely fewer winters with super cold January/February spells lasting for 6 weeks or more.

Yes, we can expect more extreme weather events (pdf) like last summer's heat wave throughout much of the Northern Hemisphere. The Big One was in Europe in 2003.

I wrote about degree-days in Climate Change and Electricity From Biomass.

By the way, front month natural gas (Henry Hub) prices went over $8.00/Mcf a few times during last summer's heat wave. Today is $4.63.

These assumptions of when we need to run AC are just wrong. Honestly stated they are periods when people want to run AC, not when they have to. No doubt on the cold side we do need to have heat in the 40s and 50s, but the reverse is not so dire. Humankind did come "out of Africa" after all, home to some of the hotter areas of the globe.

Europe gets as hot as much of the USA but very little of it gets as humid as the US east of the Mississippi.

Hence, I think, a major reason for the much greater prevalence of air conditioning.

A well insulated home doesn't need much external HVAC however very few homes, even new ones, are well insulated.

The Germans have a programme of houses that function without any additional heating system (just lights and the activities of inhabitants, passive solar, cooking etc.).

or by wind. Wind is a much bigger part of new generation construction than popular press indicates. See the NEI report, page 8:

http://www.nei.org/documents/Energy%20Markets%20Report.pdf

You'll see that in 2007 wind is 44% of new generation, adjusted for capacity factor (please note that 2008 and beyond is beyond the planning window for wind, so it doesn't tell us much). Note that coal doesn't become a big part of the mix until 2009, and that many of these plants are tentative and subject to change, should a national commitment to renewables become stronger.

New entrant natural gas projects were planned years ago. They peak in 2008 and then fall off rapidly. Coal projects ramp up big time in 2009. That's the bad news.

The wind generating capacity (in megawatts) is encouraging. There's no obvious reason why it shouldn't continue to grow.

Utilities are very conservative. That means that some haven't warmed up to wind, with it's relatively unpredictable production. OTOH, those that have gotten used to wind are very happy with the price stability that it provides: no fuel, no worries about price increases.

I saw a study recently that quantified the cost of fuel price volatility alone (regardless of level or direction of trend): it was higher than you'd expect.

http://www.renewableenergyaccess.com/rea/news/reinsider/story?id=46045

So, if you're a conservative power utility, living with the easy money, do you want to make that bet? Given the volatility in the prices that you yourself pointed out?

Concerning future natural gas-fired power plants, here's my take on it:

Feeling Lucky?

Have a good one

Was this what you were thinking of?

That programme is renewed sporadically by Congress, so you get a big surge in orders (contributing to a worldwide shortage of generation kit right now) and then a big drop off.

The potential for wind in the US is huge. President Bush mentioned 20% of all power. It could be bigger than that if the inherent conservatism of the grid managers were to be overcome and there was more pumped storage and long distance DC power transmission from the Midwest to the East Coast were put in place.

If you look at the 21st century, the US might look blessed, not because of its coal or oil or gas resources, but because of its wind, and the existing hydro electric capacity.

The key term is capacity factor. If you read into this that wind will be 44% of new generation, then you don't understand the terminology. You're off by a factor of at least 10, and probably much more.

In 2004, the US used 1,974 B KWh of electricity. The past year, wind has contributed 17 B KWh.

Let's say the average US turbine gets 2500 hours per year. There is some 7000 MW installed, which produces 17.5 B KWh.

The DOE wants 6% by 2020. Suppose no growth. That is 6% of 2000 B KWh, or 120 B KWh. Over 100 B KWh, or 100,000 M KWh, needs to be added, 6 times more than present capacity of 7000 MW. If a turbine produces 1 MW, 42.000 turbines are needed, just to get 6% of electricity demand.

Want 20%? Do the math.

You don't have the steel, you don't have the personnel, you don't have the facilities to produce the turbines, and you don't have the locations to place the turbines.

http://www.er.doe.gov/sbir/awards_abstracts/sbirsttr/cycle20/phase1/100.htm

Offshore perhaps, but at that height you're talikng waaay offshore. And that is a problem with cables, transmission, etc.

There are lots of theoretical possibilities, but practical requirements need attention too.

Coal mining, uranium mining, oil sands, oil shales, biofuels, oil rigs, solar panels...

They're ALL big gaping wounds in the 'beauty of nature.' NIMBYism is not an immutable law.

They're ALL big gaping wounds in the 'beauty of nature.' :

Actually, solar panels could all go on roofs, be pretty inconspicuous, and completely away from natural settings. There's more than enough roof space for all the PV capacity we might need.

In Ireland, a wind power station, unsubsidised, is competitive with a new gas fired station.

Ireland has expensive gas, but that is a measure of how close wind power is to competitive with fossil fuels.

See this article for Sharp's (the biggest PV producer) viewpoint on falling PV costs:

"Sharp sees solar power costs halving by 2010"

http://today.reuters.com/news/articlenews.aspx?type=reutersEdge&storyID=2006-08-31T164803Z_01_L3 1438550_RTRUKOC_0_US-FAIR-SHARP-SOLAR.xml

Also, see nanosolar.com

The only limiting factor is that residences/commercial structures cannot be with the "fall zone" of said wind turbines. As I understand it, Tower height + radius of blades + safety margin (10 m ?) around each wind turbine has to be devoid of human occupation. But with residences 1.6 km apart, not a major issue.

Aviation clearances might be a problem in some few areas.

Yes, you can build one 500 foot turbine, and make it work, and a 1000 foot one as well in all likelihood. But it is not at all the same as building 8000, or 15000 of them.

I'm totally sympathetic to wind energy, and I like optimism, but I cannot figure beyond these issues.

We need solutions that work now, and can be implemented fast. Things that will be feasible 30 years from now, or will take 30 years to build, are not good enough. If it takes 10 years to overcome public protests, you have a problem right there. 1 MW turbines have issues with noise, dead birds and bats, visibility etc. 5 MW turbines will have those quadrupled, and add some new ones.

The Pentagon has vetoed most new wind development projects in the US for now. All issues need attention, not just one.

Twenty years ago, where were the chip fabs and support facilities to make our computer IC chips ? New technology and new factories were required and built.

Problems with supply chain, siting, aviation clearance that you see are quite surmountable. And without major difficulty.

Even if it takes 30 years for a complete solution, every day new WTs would come on-line and society would get the benefit of another incremental part of the solution.

The numbers you are intimidated by are quite simply "not that big a deal" over a couple of decades.

It's that windpower is transient on the order of days and the scale of entire timezones. This can be worked around a bit with pumped storage (dam-limited), hydrogen production (water/filtration limited, low efficiency), hydrocarbons, and a commitment to thrash our river ecosystems by handing the Hoover Dam's flow dial to a 2 year old, but we still cannot build a grid based on a majority of windpower.

We need something else for that - or we need to design energy storage systems whose footprint on the landscape + whose cost is in all liklihood bigger than the windmills themselves.

Solar presents an even bigger problem than wind with regards to forming a baseline, though it is environmentally by far the best choice.

A HV DC grid around North America could link the different wind, hydro and pumped storage (air & water) facilities.

Getting 2/3rds of our electrical energy from wind creates another layer of issues (potentially soluble), but 51% is quite doable IMO.

You are talking decades, and your concerns are valid if talking about 2 or 3 years. Personnel training is a non-issue. New steel mills (if needed) can be built and existing ones expanded in a decade. New laws & regulations to speed installation and ignoring environmental impacts (probably not needed) can be passed. New WT designs can, and will be, made, tested and installed in quantity. New transmission lines built. And all the rest.

How many billion tons of concrete are in the highway system? How many iron and steel rail road bridges?

I would think wind would be the easiest to mass manufacture. The turbines themselves are not very large, so you can site the factory in an urban area with lots of labor. The complexity of the device is fairly low (less parts than a standard automobile) which will make the factory simpler.

I think a lot of your arguments are frankly nonsense. It's not like wind turbines are the only thing that require resources to build.

Now the MOD has worse flying problems than the US DOD-- much smaller country. So the problem can be solved, technically.

Whether we need 5MW wind turbines (my guess is offshore only) 1MW turbines are certainly enough to be getting on with.

Spain has built 12000MW of wind capacity, Germany a bit more. That would be the equivalent of the US building 100k MW of capacity (6 times the population, twice the GDP per capita). Spain is the least crowded country in Europe, but it is not less crowded than the US of A.

There are grid issues, but the grid exists, its the connections that need to be built.

Wind is the 'quick win' in energy. New nuclear plants will take 8-12 years. Carbon Sequestration doesn't exist yet (although we should force the electric utilities to provision for it). The US could easily have 60GW of wind capacity (from 10GW now) in 8 years time, and more than 100 in 14 years time.

http://www.carbontrust.co.uk/Publications/publicationdetail.htm?productid=CT-2004-03&metaNoCache =1

Renewables Network Impact Study - looks at the issues for the UK.

On intermittency, the problem hasn't been fully tested yet. Horror stories aside, most of the time, the wind is blowing somewhere, and there is enough power. The cost, such as it is, will be keeping a number of gas fired stations around as backup given they can start and run in minutes (seconds?). But since they won't be spinning much, they won't wear out very fast (low depreciation).

A couple of other grid management points:

- Ontario Hydro now has a tariff where they can turn off your air con at peak times (for up to 60 minutes I think). Universally applied, that would have a huge impact on peak demand, and therefore the problem of the wind not blowing at 4.30pm on a Thursday in the summer. (it's literally that specific a problem-- even intra-day, peak loads are 3X minimum loads)

- in the UK emergency generators can be turned on remotely by the Grid co. Companies participate in that programme because it turns out you can't run a emergency power unit reliably without regular testing.

Obviously in the long term the solution is pumped storage. What you need then are mountains and lowlands-- a problem for the UK, but less so for the USA.Or compressed air storage, or flow batteries, or V2G (see latest on Vehicle-to-Grid development here).

Also, maybe even hybrid houses (houses with several kWh of local storage - batteries and/or ultracaps).

My own preference is to go for technologies we know we have, now. In a sense, the problem of global warming is so pressing that we have to move now with what we have now.

The analogy I make is WWII. The British were basically taking prototypes into full production, they needed new kit so fast after losing it all at Dunkirk. Ditto the Russians after the Germans invaded. In the case of the Manhattan Project, the US ran 2 parallel tracks (the Fat Boy uranium bomb at Almogorado and Hiroshima, and the Plutonium bomb they dropped on Nagasaki) because they didn't know which one would work.

It's grab what you can and get to the front line.

That's a little funny math, 10 percent over one year, powered by 28 years ... but it still seems like a straightforward enough move.

more here:

http://odograph.com/?p=676

I put a link up yesterday to the 800 watt hour house. It would be great if we all did that, but would more power be lost transmitting to the house than it uses? I don't know.

That's a solar array panel plus a room full of storage batteries, and a small diesel for backup.

don't know if the standard you are refering to has been established nation wide, but the company where I was employed until retirement, has made it their standard.

For the record; what we are talking about is distribution transformers. When I first bought this property there was no electricity within 2000 ft. The local Coop, informed me that they would put in 1000 feet free, but I would have to pay $7.50 for any distance beyond that. At the time I didn't have the $7500, so I looked into solar, (this was 12 years ago) and discovered it would cost me somewhere near $15,000 for a constant 1.5kw. Well beyond my means. What I wound up doing was telling the Coop to put in their 1000ft, and I would take it from there. What I did was purchase a couple of used underground transformers and enough 15kv cable and conduit to finish the run up to the house. The 980 ft cost me just over $3000 dollars installed, bottom line. Everything was fine until a couple of years later I decided to take the summer off and go up to the Pacific Northwest, to get out of this heat. I had my power bill on automatic pay,along with the other bills that would normally come due. The first month I was gone I checked my bank account over the internet and noticed that my power bill seemed a little high, so I called my neighbor and explained how to do it and go up to the house and turn off the main breaker in the electrical panal outside, and go inside and take what was in the freezer and refrigerator home with him as a gift for the favor. The following month I checked the bill again, and there it was a 300kwh usage. I called the neighbor and asked if he had done what I asked. I asked if he had seen anyone fooling around up at the house, he said to his knowledge no one had even been up there. I scratched my head and wondered where the power was going. When I got home I ran some tests on the system and found that the two transformers were the culprit. It takes 410watts to heat the transformers up, before you take any power from them. The math says that's approx. 30kwh per month, if it's a 30 day month. That's like having two 200watt light bulbs burning 24/7/365.

Knowing this, think of the thousands and thousands of transformers out there that have been in service for over ? years. The figures I listed were for small one house transformers, think of what it must take for those multihouse ones, let alone the big suckers that are behind all those shopping malls. I have no Idea what it would be but, it's going to be one BIG number.

The main problems here are turbine parts shortages and building new transmission lines. The best areas for generation are the mountains of West Texas, the Gulf/South Texas areas and the Panhandle, none of which are close to the population centers.

Only this time, the oil and gas has (mostly) run out, it is wind.

What I find fascinating (and a tribute to Texans) is that they adapt so easily from 'dirty' power, to 'green' power. A very pragmatic attitude.

http://www.charlotte.com/mld/charlotte/news/nation/15375243.htm

For struggling West Texans, giant turbines bring winds of change

By Alyson Ward

McClatchy Newspapers

(MCT)

2020 is long enough to build new steel plants (or, more likely, design WTs that use less steel/MWh), train personnel, and new WT factories.

Like Germany, the average load factor may decline. OTOH, larger WTs tend to have higher load factors (taller is better for WTs). But it is clear that the US has enough locations to produce 20% of their electricity from wind.

I see 20% by 2020 as aggressive but doable.

capacity (1000MW = 1 GW) X capacity factor x hours in a year = GWhr

A terrawatt hr is 1000 GW hr. UK electricity demand is 350Terrawatt hr pa. So I would guess US demand is around 3000TWhr but would have to check (twice the GDP per capita, 4.5 times the population).

Capacity factor is how much of the year you run at rated capacity. However it is probabilistic. A nuclear plant can run at nearly 100% capacity, but in practice the long run average is in the mid 70s (higher more recently).

For this reason, the grid uses a 'Capacity Value' or 'Capacity Credit' which is lower than what an individual plant will achieve. It reflects the risk of maintenance outages and/or the time it takes to bring a unit on line which varies by type of fuel.

The rule of thumb reserve margin is 20% ie for 400 GW of peak demand you need 480GW of capacity. Peak demand on a hot summer's day, for most utility companies, is 3 times the demand low (typically about 3.30am). You need less reserve margin if everything is gas fired, more if it is nuclear (you can turn gas on and off very quickly).

Generation units range in size. Nuclear about 1000MW (although they also burn power running their pumps) but ranging 650MW to about 1100MW I think. Coal fired units around 600MW (but you usually build more than one at once in a station). Gas fired about 650MW. There is an optimal size for each unit (a station is one or more units) depending on current energy and pollution control technology.

So 12,000 MW (12 GW) of wind fired capacity is quite small in that context.

To get the contribution to total energy production, you need to multiply by number of hours in a year, and multiply that by your capacity factor.

Wind Turbines cost $500,000 to $1,000,000 each for the big 'uns, and from $5,000 to $30,000 for a home model. They begin to pay out a whole lot more quickly than a big power plant because they have so much less lead time and engineering costs. Because of these factors and the tax advantages the tax shelter promoters in Dallas are having a field day.

I'm guessing that the big utilities are permitting coal plants because they have Rick "Good Hair" Perry in office until January, and they anticipate that it will be much harder to permit them after any of the other three candidates in Texas gets elected governor. Whether they actually get built depends on several factors, including competing fuel costs..

Vote for Kinky! At least he has a sense of humor, and supports alternatives, and sings great country western songs.

I will be attending his campaign speech tomorrow at College Station, should be a hoot!

The nuclear power subsidies are huge. The UK radioactive waste liability has a present value of £70bn (about $120bn). We have 20 years of nuclear power left, more or less, and will be left with that bill. Similarly both governments provide an insurance policy indemnifying the industry against accidents-- that policy would not be purchasable in a private market. And of course the entire technology was developed at government expense. And then there is the problem of long term waste disposal (Yucca is in the wrong place, and has already consumed $17bn I think?).

Another way to look at it is what is the cost of a tonne of carbon emissions (1 tonne carbon = 3.667 tonnes CO2)? A guess is that it is $100 (this is the place economists start when they talk about serious carbon taxation). I believe that is the price the world will move to within the next 10 years-- the political and scientific pressure to do something about global warming is just becoming too great. The UK government has a 'social cost' figure of about euros 100.

There is a portfolio value to a utility of adding another fuel source, which is uncorrelated in cost with its existing fuel sources. This is the old Markowitz financial diversification logic: the same thing that drives investment into hedge funds. I don't remember the paper exactly, but it is on the order of 10% of total input cost.

Whatever the local tax economics of wind power, the fact is that a completely clean (the CO2 cost of building the unit is paid back in c. 9 months) energy source with no long tail environmental liabilities and no fuel price uncertainty has to be worth a lot.

The National Grid Co. (the UK grid company also owns Niagara Mohawk) applies a 25% Capacity Value (Capacity Credit) to wind. For every 1000MW of wind, it needs 250MW less of capacity from other stations.

Comparable Capacity Values for nuclear are 70% and for CCGT about 90%.

Capacity Factor is the actual MWhrs you get divided by rated capacity. Whilst a wind turbine may only power at rated CF of 25% (probably 30% in the UK and 60-70% for offshore wind) it actually generates some power even when not at rated capacity.

p23 ' in the UK, a wind turbine will be producing useful power for 70-85% of the year'

The NGC have stated that 25000MW of capacity would displace the need for 5000MW of other plant

http://www.sd-commission.org.uk/publications/downloads/Wind_Energy-NovRev2005.pdf

The calculation in the report (p32) is that if UK demand for electricity is 400TWhr (ie 400,000 GWhr) in 2020, 26GW of wind capacity can displace 5GW of conventional capacity. With an average capacity factor of 35% (mix of onshore and offshore wind), production would be

26GW X 8760hrs pa X 35% = 79.8 GWhr or 20%.

This is about (I think) the size of the current California power market.

As to your other objections:

- steel is a cyclical industry. China has increased capacity massively and is now a small exporter (I am not sure if that is net of imports). Steel prices will fall. Structural steel is not automotive steel, it's not an inherently difficult product (and in worst case, you can use reinforced concrete, and rebar is the most basic steel there is).

- there has been a c. 30% rise in the cost of windpower generation kit. However there is nothing inherently complex or difficult about wind generation kit: the technology is well proven. Already the Chinese are starting to build units (jv with Vestas I think). In 2 to 3 years time, there will be the capacity.

There is a learning curve effect in wind turbine production. Every doubling of the sector (total capacity installed) has led to a 8-15% decline in per unit cost. No reason to think that won't continue (consistent with other large industrial products).- locations - difficult, and not difficult. In Texas, the farmers love these things. Getting paid for just owning the land. This is also true in the Midwest I suspect.

In Cape Cod, Nimbyism rules-- but the Democratic Gubernatorial nominee, and a number of environmental groups, have lined up in favour of CapeWind (the Republican nominee is opposed). In North Carolina, a number of lobby groups, pro coal, have suddenly 'discovered' a great love of birds and mountaintop views. To a very large extent, this scenario will be played out all over the world in the next few years. Much depends on national priorities.

world steel production 103.6m tonnes in July (up 14% YonY).

100GW of US wind power = 100,000 MW

100,000 wind turbines at 1MW per. Say 70/30 onshore/offshore.

I don't know how much an onshore turbine is in steel, I am guessing 5 tonnes? So 70,000X5 = 350,000 tonnes of steel.

Offshore say 15 tonnes. So 30,000 X 15 = 450,000 tonnes of steel.

800,000 tonnes. Assume I am off by 10 fold. So 8 million tonnes of steel.

less than 8% of one month's world steel production. Over 15 years, say. 0.04% of world steel production in that time if there is no increase in steel making capacity.

Structural steel is not automotive steel. There aren't the same supply constraints.

Well, here are the figures for 2007:

Natural Gas 9,111

Coal 1,450

Wind 11,754

Hydro 160

Wood/Wood Waste 249

Solar-PV 97

Geothermal 155

Biomass 215

Petroleum 0

Landfill Gas 44

Waste 20

23,255

Here are the capacity factors:

Cap Factor

Natural Gas 0.376

Coal 0.71

Wind 0.32

Hydro 0.296

Wood/Wood Waste 0.224

Solar-PV 0.5

Geothermal 0.5

Biomass 0.5

Petroleum 0.262

Landfill Gas 0.5

Waste 0.5

Here are the figures adjusted for capacity factor:

Natural Gas 3,426

Coal 1,030

Wind 3,761

Hydro 47

Wood/Wood Waste 56

Solar-PV 49

Geothermal 78

Biomass 108

Petroleum 0

Landfill Gas 22

Waste 10

8,585

And here are the percentages:

Natural Gas 39.9%

Coal 12.0%

Wind 43.8%

Hydro 0.6%

Wood/Wood Waste 0.6%

Solar-PV 0.6%

Geothermal 0.9%

Biomass 1.3%

Petroleum 0.0%

Landfill Gas 0.3%

Waste 0.1%

100.0%

You can see that wind is the largest contributor.

The normal capacity credit for a combined cycle gas turbine is 90% (awarded by the Network Operator). In terms of rated capacity, I would reckon the factor must be 75-80%

unless high gas prices mean they are only being used for peak power.

http://www.nei.org/documents/U.S._Capacity_Factors_by_Fuel_Type.pdf

Please note that I understand these to be actual % of rated capacity used in 2005. These will be pretty different from "capacity credit" which I understand to provide the average utilization at peak (the difference will be greatest for solar, I suspect). Also we should note that this figure will be too low for wind, because these kinds of figures typically use the average production over the year divided by capacity at the end of the year, which is misleading where capacity has risen sharply during the year.

I used an earlier version, which had higher capacity factors for nat gas - I assumed 90% combined cycle, and adjusted accordingly.

I believe even CC NG is mostly used for peak power.

Load or capacity factor is actual production as a % of nameplate MW x 365 (or 366) x 24.

Capacity credit is the accounting to determine if a utility has enough capacity to meet summer and winter peak.

ERCOT (Texas grid) recently (last year ?) cut the capacity credit for wind turbines. This did not reduce actually production by one MWh.

Solar-PV 0.5

Geothermal 0.5

Biomass 0.5

Landfill Gas 0.5

Waste 0.5

look like default numbers.

NO WAY does solar PV have a 50% load factor. OTOH, geothermal I know in Iceland has 97%-99% load factor, landfill gas in an open landfill typically near or at 99% load factor (once closed gas production declines slowly).

Best Hopes,

Alan

Yes, they are.

The load factors I see for solar range from 15% to 25%, with the latest NEI figure at 18.8%. It seems to me that doesn't capture the peak loading of solar, but there you are.

The other info is helpful, thanks.

Geographically and meteorologically, why would the US have more wind capacity than other places? Or is it due to our relatively large area per capita - but that would suggest Russia and Canada have enormously more wind potential...?

The problem is a lot of US coal plant is coming up for renewal and the capital costs are 40% higher than conventional pulverised bed. If the government were to move now then the US could have a spanking new IGCC plant fleet by 2025, ready to be retrofitted with sequestration technology.

I would say that people often underestimate the actual degree of elasticity which exists in most things. There's more elasticity in NG use, energy use and automobile use than most give credit for. It would not surprise me if it were possible for most people to cut back on their use of all those things by upwards of 30% without that much hardship. If the prices get high enough that it starts to impact the pocket book of many, then I expect they will make adjustments.

However WalMart is trying to change that: they are targetting 100 million bulb sales in 2007 (which is something like a 10-fold market expansion over 3 years ago).

I can see the ad campaign

'Changing the world. One lightbulb at a time'.

quite an interesting tale of the Chicago Heat Wave. A few key lessons learned:

- it's the social that matters. In bad neighbourhoods in Chicago, and in France, the informal networks were what kept people alive (or failed to). Just having someone to look in on the elderly, the un-airconditioned. So in Hispanic neighbourhoods, the dying was much less. Whereas in France, 15,000 people died, because the French go on holiday in August, leaving no one to look after the isolated elderly (there was a national scandal about this, the government announced they would remove one national holiday to pay for amelioration measures, the French staged civil resistance, the national holiday is still de facto a day off)

- apparently irrelevant government decisions (the efficiency of air conditioners standard) can have big impacts during climatic extremes

It's Jared Diamond all over again. Societies and in particular the decisions of their elites determine their own success or failure, not lack of technology per se.The exceptions are:

- driving - people need to drive to work (but they could drive more fuel efficient vehicles or car pool perhaps)

- utilities

- shelter

- food - although given how much the middle class Brit or American eats out, there are certainly savings here

Other little examined areas of expense are cable bills, subscriptions etc.The exceptions are:

- driving - people need to drive to work (but they could drive more fuel efficient vehicles or car pool perhaps)

- utilities

- shelter

- food - although given how much the middle class Brit or American eats out, there are certainly savings here

Other little examined areas of expense are cable bills, subscriptions etc.Heat was a 1,500 watt electric heater (at night blowing on my face as I snuggled under blankets) at first, then electric blanket till I got a window heat pump in late February. Showers were scheduled by 7 day weather forecast (I would rather stick than take a 40 F/5 C shower).

Saved on utilities though ;-)

is the offshoring of a lot of chemical industries. NG is

the basic feedstock for most plastics, for example. It is the primary source of hydrogen and hydrogen-rich materials

for other industrial uses. It's not that total demand for

industrial uses of NG is declining, it's just that a lot

of that industry is finding it cheaper to operate in other

countries than the US.

And I like the observation, "alternating years of complacency and panic."

and that was really the point of the post - that various conditions suggest continued volatility in our energy markets and that high prices give us one kind of problem - but the uncertainty brought on by huge yearly volatility quite another.

Side note: regarding your president/3 decade comment - its impossible to test of course (I think) but I wonder how peoples discount rates have changed over time - say the last 3 decades? Have we come to value the present with small regard for the future more than we used to? I know we are genetically biased towards the present but I wonder if culture has exaggerated this tendency, especially during the 2-3 decades of ubiquitous media coverage of the 'market'? theme for another day..

Google also David Laibson 'Hyperbolic Discounting'.

For short periods, people have a very high discount rate. You value today over tomorrow by about 10% I think.

Yet you value a day 10 years from now, vs. a day 10 years +1 day from now, by a much smaller difference (fraction of a per cent.).

It is hypothesised this is what leads to excessive volatility in the stock market, and all kinds of other 'short term' behaviour.

Thanks for that very informative essay. That map of North America in January is amazing. If that trend continues, I will plant some banana trees in Montana.

I have a question. You suggested "we should create a floor price for oil and gas." Vinod Khosla has suggested the same thing, and I agree that this would be a good idea. The effect would be very similar to a fossil fuels tax in curbing demand, and it would help alternative fuels out.

But how would you implement this in practice? If oil goes below $50/bbl, for instance, do you envision a per barrel tax that brings it back up to $50? I could see something like that working, but wondered if that's what you had in mind.

Yes thats what I was thinking - the difficulties arise in who is taxing whom and where do the revenues come from and go to - ultimately all these ideas work out to subsidies going to flow-based energy from stock-based. A price-floor would be a tough nut to crack but would buy back some of the time that Robert Hirsch says we need for mitigation. They do it on milk...;)

However, for it to actually gain traction as an idea, unfortunately we would need a few more periods of price schizophrenia for people to connect the dots. Because market interference of this magnitude would be tanatamount to admitting that the invisible hand needs guidance from time to time (for basic goods for example...), which would have other implications.

In addition to complaceny and panic, I'd prefer the third category be called foresight?

I will think on further details how it might work. Others thoughts welcomed.

Another possibility is to require 100% payment on future's contracts. With no leverage the volatility would be minimized because very few people or institutions have much money for that kind of speculation. Once again the speculators would squeal like hogs in the process of donating a fresh ham steak.

I have to wonder if the oil companies efforts to fight global warming and deny peak oil are based on a fear of returning to $10.00 oil. Just a fraction lower demand seems to drop prices by tens of dollars.

So following on from that, I wonder if those doing the denying could be "brought into the fold" and stop fighting the changes our society needs by allowing them to fix the prices, should they drop into the $20.00 area again. (or fix them higher if we want to encourage demand destruction).

A texas railroad commission revival.

That's what Hugo Chavez proposed earlier this year: a long-term guaranteed contract for Venezuela oil at $50 a barrel. He implied that would make it more feasible to seriously start digging up the Orinoco.

Not-so-minor correction: if I read the legend right, it's the range from 4 to 13 degrees C above average. Still, that's a major warm-up. Anybody know where the US was in that range? And who's to say we won't one of these years get what Russia got last winter? Other questions of interest: how much NG storage space is there in NA, as compared with demand? I.e., starting with full storage, can a really cold winter eat up all the stocks? Finally, how does the increased NG demand in the summer (for the electricity for AC) balance against the decrease in the winter?

All good questions. I know that storage right now is 3.2TCF or so and residential alone uses 5 TCF in winter - however, we are continuing to produce gas in the winter as well.

Regarding US last winter:

looks like midwest was about 10-20 degrees warmer (F)

And your last question will require some more analysis.

Thanks to celebrity activist Tod Brilliant for passing along this news: Texas "stealth company" EEStor has patented a new ceramic electrical storage device (which we can't call a battery because it has no chemicals) that can power a car for 500 miles on a $9 charge of electricity. Even more exciting is their claim that fully charging the system will take all of five minutes. And even more exciting: we're not talking about cars that drive like golf carts. According to Business 2.0:

"A four-passenger sedan will drive like a Ferrari," [Toronto-based Feel Good Cars CEO] Clifford predicts. In contrast, first electric car, the Zenn, which debuted in August and is powered by a more conventional battery, can't go much faster than a moped and takes hours to charge. (note: Feel Good Cars plans to incorporate the EEStor into cars by 2008)

The cost of the engine itself depends on how much energy it can store; an EEStor-powered engine with a range roughly equivalent to that of a gasoline-powered car would cost about $5,200. That's a slight premium over the cost of the gas engine and the other parts the device would replace -- the gas tank, exhaust system, and drivetrain. But getting rid of the need to buy gas should more than make up for the extra cost of an EEStor-powered car.

EEStor is tight-lipped about its device and how it manages to pack such a punch. According to a patent issued in April, the device is made of a ceramic powder coated with aluminum oxide and glass. A bank of these ceramic batteries could be used at "electrical energy stations" where people on the road could charge up.

EEStor is backed by VC firm Kleiner Perkins Caufield & Byers, and the company's founders are engineers Richard Weir and Carl Nelson. CEO Weir, a former IBM-er, won't comment, but his son, Tom, an EEStor VP, acknowledges, "That is pretty much why we are here today, to compete with the internal combustion engine." He also hints that his engine technology is not just for the small passenger vehicles that Clifford is aiming at, but could easily replace the 300-horsepower brutes in today's SUVs.

Not being an engineer, I have no idea how this might work. But I'm very impressed to see Kleiner Perkins on board, and, obviously, very intrigued by the concept. If this turns out to be the real deal, it's hard to imagine how the internal combustion engine, or even gas-electric hybrids, could survive the competition, as the EEStor claims to have all of the qualities potential buyers would want: price, power and efficiency. At the same time, I remember the old saying about "If it seems too good to be true...." Others that are much more knowledgeable about such things, such as J.C. Winnie, Mike Milliken, and TH compadre John Laumer, seem cautiously optimistic...

http://sustainablog.blogspot.com/

Second, this company has been around for at least 5 years, trying to get this to work. It's a very tall order, as they have to attain voltages that have never been seen before in ultracapacitors, apparently through unprecedented purity of traditional UC materials. They seem to be making progress: they have KPCB backing, and they have a contract with Feelgood electric automaker and the automaker has been making progress payments, so apparently something is happening.

They are being secret: my best guess is that this is because the key purification process isn't patented yet.

It's a long shot, but if it works it changes everything.

Now, of course, they've lost control. They know that at these prices alternatives are coming. They're just holding their breath, and hoping that they take as long as possible to arrive.

Of course, when they do the royal family will just pack their bags and go to Europe, to become part of the free floating european wealthy.

For example consider building a building today vs in 1960.

Lets say we do it twice as fast today as we did then.

Sounds good until you start running number for widescale deployment. How long for example to deploy light rail ?

Your talking decades to make a serious dent in oil usage.

And this is considering a lot of key work is not only not in production now but in the labs your start realizing that we may be in serious trouble.

Basically we need 10-15 years or reasonable oil supplies to convert from a oil based economy we don't have the time.

I'm not saying we won't convert but since we have waited well past the last minute it will ugly.

Every year we go without a concerted effort to get off oil from now on out probably double's the pain.

With primitive technology (coal, mules & sweat), ~90 million people, 3% of today's GNP, the US built subways in it's major cities and streetcars in 500 of it's cities & towns (most of 25,000 people & larger) in twenty years (1897-1916).

The approach today is delay and slow building as much as possible.

Alan, your point is well taken. It amazes me how it is now impossible to build anything in less than a century!

We did subways and streetcars in 2 decades with far inferior technology.

We converted the avaition industry from prop plans to pressurized jets in less than a couple of decades.

We went from steam to Diesel on locomotives in not much over a decade.

We went from manual transmissions in cars to predominately automatic in barely that, while adding air conditioning and power everything.

We went from a nation with a few thousand homebuilt computers to the internet age in something like a decade and a half.

When I was a child, a home with air conditioning in my area was still considered a luxury item and even my school was not air conditioned.

Such a situation would be unthinkable only a decade later.

America, rapidly becoming the "can't do" nation.

Roger Conner known to you as ThatsItImout

Electrostatic motors make a comeback ?

90/805=11,18kWh/100km

11,18kWh*3,6=40,25MJ

assuming 90% efficiency of the electric motor that's 40,25*0,90=36,23 MJ of work put into the transmission. A gasoline engine with a 20% efficiency would have to spend 36,23*5=181,13 MJ of gasoline to do the same work.

assuming 32MJ/liter of gasoline that's 181,13/32=5,66L/100km, a bit more than what you would expect from a small new car today, so the claim of $9/500 miles sounds reasonable if we further assume the car this motor will be powering isn't an SUV or similar. that would be 42mpg if a US gallon is 3,8 liters.

A ferrari, driven like a ferrari, probably wouldn't need 500 miles to use those 90kWh with a 4-500kW motor, I don't think the acceleration, deceleration and speed of a ferrari would compare to the fuel efficiency of a Peugeot 307/VW Golf type of car driven sensibly.

The charging would be tricky ofcourse, 90 kWh would take 23,5 hours of max load through a standard 240Volt 16Amp circuit, so it wouldn't be wise run the "tank" dry, but rather to top it off at every opportunity. I imagine a way to swap the battery/capacitator in the car with one that has been charging overnight, or to have a capacitator sitting in your garage soaking up power (off-peak preferably), then unloading it quickly through some very thick cables when you need a charge would be more convenient.

Disclaimer: I am very tired at the moment, so the calculations, assumptions and facts could therefore be very wrong, but the numbers look plausible enough to me in my current state.

but they claim the system "fully charges" in "five minutes". is that possible?

Electric motors become more efficient with size, which is a good part of the reason they started with a muscle car.

Its good to hear about the dynamics of the gas market rather than just oil - very different dynamics! I agree that quite a few producers were banking on prices higher than $4/mmbtu to make their wells attractive - current prices might wipe out virtually all their profits. Wouldn't be surprised at all to see drilling activity falling significantly. Given the depletion rates shown, this will put the squeeze on supply again within a year or two. Then only imports will be able to cover the gap (too late to start drilling again). The UK is going through the same process now - even with record high gas prices domestic production is not increasing but just slowing the decline. Imports from Norway and continental europe are covering the gap (mostly Russian gas coming through new pipelines).

This brings me to my main question - will imports cover the gap for the US when decline starts in earnest?

- Although Canada does have a lot of gas production, is much more likely to be heading south. The oil sands projects are incredibly energy intensive and the Canadians are largely using gas to power the processing. Given how these developments are ramping up prodution all over I would doubt there is a lot of slack in gas supply the medium term.

- LNG ! There was no real mention in the note yet oil co's and utilities have been planning a hell of a lot of new LNG regas capacity recently. Is all that still going to be built - the economics for a big increase in LNG don't look great at $4/mmbtu. I could imagine a lot of projects go on hold at this price level as the upstream investments suddenly look a lot more risky with no guaranteed market.

Any comments on this out there ?Canada has an LNG port under construction in New Brunswick (to supply New England). I believe the Mexicans are also building one to supply San Diego.

Predictably, there is massive local opposition from movie stars, etc. to building an Australian one in Malibu.

Sea birds are washing up dead on the west coast of Scotland and wild salmon are retruning emaciated - a sign that the sand eel population has moved on with cooler currents probably to the N. It seems like we must have a great tongue of warm water sitting in the NW Atlantic right now.

Looking at your maps I can hardly believe what I'm seeing - It seems that whole of N America was 13 C warmer on average this January - if this is correct then this is seriously worrying. I note that at the same time Siberia and Europe had anomalous cold - and I know that is correct. But that anomalous cold in Siberia in January was matched by warm spells in November, December and February.

I would tend to extrapolate all this anomalous behavior to last year's Hurricane season and El Nino. Have these maps been published in Nature or Science? That January map is seriously worrying.

CW

More worrying is the latest data on methane release from permafrost-- much higher than expected. In the Permian meltdown, the world temperature shifted up enough to kill 90% of animal species, due to methane release (why is open to debate, but possibly kicked off by volcanism).

http://environment.guardian.co.uk/climatechange/story/0,,1869133,00.html

* for example, the UK had a particularly cold January and February last year. But in other evidence of climate shift, we in London have had the driest 18 month period since records have been kept (1720). And of course we had almost the hottest summer ever recorded.

What is striking is that the peaks, when they come, seem to be getting higher each time.

On Katrina and its ilk, the average surface temperature of the water is the key driver of hurricane intensity. Again, that has been rising progressively across the whole planet.

It's especially interesting to see the one-week change. In the past week, the market's opinion about the price differential from Winter 2010 to Summer 2010 has been cut by a third, from over $2 to under $1.50. What information came in last week that caused us to drastically change our opinion about how natural gas conditions would change from January-April 2010? I don't see it.

The other explanation would be a dramatic change in long term weather forecasts but I checked the farmers almanac and they are calling for a cold winter. So it must be the first reason...;)

I thought canada and america behaved like one market. Why is canadian storage down 5% from last years levels while we are up over 12%?

Storing NG costs money, both in compression and transmission costs and the time value of money. The only reason it is stored at all is to guarantee a sure source of supply

Nate, first, great post, and for a longer term view of what you are talking about, I would suggest going to the NPC (National Petroleum Coucil) website at http://www.npc.org and getting what are essentially free reference books in the form of their "Balanced Options" report on future natural gas supply/demand and the longer term problems in this area.

But it all depends on the weather in the short term, doesn't it? Your closing paragraph, and closing sentence were especially astute:

"The natural gas market, in its current price dichotomy, is a prime example of the high standard deviation potential in our current system. Heads everything is rosy. Tails there are power outages."

"I have no idea whether it will be cold this winter."

This relates also to a poster on this string who said that Matt Simmons had advised "locking in" nat gas prices, and they were glad they didn't do it, and my repeated mantra (I know, your sick of hearing it) that everyone ignores, that being that we are running completely in the blind on future energy prices, supply, consumption and how to invest our money.

PLAY IT SAFE: If you must or think you should contract natural gas, crude oil or propane, "dollar cost average" it, and ladder the contracts. That way, you may not get the cheapest possible price, but you will protect yourself from what are completely unpredictable price swings, and at least know where you stand on risk, whichever direction or amount the price moves.

DO NOT assume that wild price swings are not entirely possible, and in EITHER DIRECTION, on a moments notice.

Roger Conner known to you as ThatsItImout

If there is a cold snap demand goes up, if there is a heat wave demand for electricity goes up. Either pushes up the demand for gas. Only in the long run can consumers make significant economies eg by more efficient appliances or more insulation.

Most big industrial users will at least partly hedge their price exposure, making them less likely to shut down in a price spike.

Gas is also not physically mobile in the way oil is: it's a segmented market around supply areas linked by pipeline to demand areas, not a single global market in the way oil is. Not a lot of gas is traded in LNG tankerload form, so it's not meaningful to speak of a 'spot' market in LNG (yet! it's coming).

The result will therefore almost inevitably be significant price volatility.

I can't see Alberta choosing to give Ontario energy over the US.

Canada would die, politically, before NAFTA did.

near term you are correct. but long term it raises the spectre of regional energy/natural resource blocks that may fall outside current political boundaries. seems farfetched but i remember reading about the 1970s where some US politicians from TX and LA(senators even?) stated that they were not 'obligated' to sell oil to other states.

In Alberta the bumper sticker was 'let those Eastern bastards freeze in the dark'. The legacy of the National Energy Policy, imposed by Ottawa in 1980, is one of enormous bitterness (actually the NEP never really took effect, but that is not how it is remembered).

Under NAFTA it's share and share alike with the USA. If the US can pay more for oil, it gets the oil. Those Ontario b-stards can go freeze in the dark ;-).

Excellent post as always. I agree with your assessment of short term prices not properly bridging to the long term trend of depletion. If the North American countries agreed by cartel to a certain pricing floor whereby the natgas would be converted to fertilizers--would this help bridge the short-to-long trend? Stockpiling of fertilizers on farms across the continent would help insure future food supplies because it reduces the chances of postPeak JIT delivery failures.

A farmer is not going to waste fertilizer because any excessive amounts applied stunts or burns plant growth. Thus the natgas is converted to a long-term product-- a pricing bridge is created.

A city slicker just wastes the cheap natgas by cranking the thermostat and unthinkingly flipping electric switches. Is insulation made from natgas? This would be another way to convert short burn-rates to a better long-term burn-rate. I am no expert, but throwing this out for consideration.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

interesting.

given that our long term needs for NG are heat and nitrogen it actually makes sense. they would never put a floor on something unless there were a way to store/use the product.

actually a crazy idea. crazy like a fox...;)

on the idea of fertilizer as natural gas storage system....

I do have one reservation: I am not sure that in a security conscious world, our police and anti-terror brigades would welcome the idea of every barn and shed sitting full of ammonia nitrate, the "bang" maker of choice among home made bomb builders!

RC known to you as ThatsItImout

Anhydrous liquid Ammonia (NH3) is a dense storage medium for hydrogen. It can be burnt in ICEs and there are working fuel cells using it. Physical properties similar to Propane.

Its nasty stuff, but millions of tons are made every year and moved around in tankers, and it is spread directly onto fields off the back of tractors.

And of course, created from wind-generated electricity, it offers the potential for us to get off carbon completely !

But the point is, so what ?

There are already millions of tons of the material being producted every year, and the place is otherwise awash with chemicals which could be used to cause mayhem. Indeed, ten gallons of gasoline poured where it should not be and ignited will make a nasty mess.

By large I mean a city block and up.