The depletion of Abqaiq

Posted by Heading Out on August 20, 2006 - 11:52pm

To begin, Abqaiq, like most giant fields, has been around for a long time, and when it was first developed, by a relatively small group during the Second World War, there were many other things going on that limited development so that it took 4 years to go from drilling the first well to the fifth. Technology was not nearly as advanced as it is now, and the wells were spaced considerably further apart than the spacing I placed mine at in the model. Further while I had estimated the OIP as being some 62 billion barrels, based on porosity, in reality the number was half that. I am grateful that both westexas and plucky underdog had the reasons for this.

There are several possible reasons, but the most likely is what is known as Oil Formation Volume Factor (FVF for short, mathematical symbol capital B subscript little O). Basically, oil takes up more space in the reservoir than it does on the surface. The main reason for this is that oil in the reservoir contains large amounts of dissolved gas - possibly 1000 or 2000 cubic feet of gas per barrel of oil (say up to 300 cubic metres of gas per cubic metre of oil).The gas content at Abqaiq was 860 cf/barrel. As I mentioned yesterday this was initially re-injected, but more recently has been collected and sold. (The GOSP - gas oil separation plants that are located in or near the oil fields are used for this and at one time Abqaig had eleven of these).The gas molecules are small and fit in between the oil molecules, but oil with gas in solution is less dense and the oil simply takes up more space. Add to that the fact that the oil is up to 100 degrees Kelvin hotter at depth, so bigger, and then take off a little volume to allow for the high pressure downstairs, and you end up with Bo = 1.4; so for every barrel of oil you produce at surface you need to inject 1.4 barrels to replace what you are taking out.

1.4 is a very typical oil FVF - it can vary from 1.15 or so up to maybe 1.6 or 1.7, depending on a number of factors, principally the quantity of dissolved gas.

In regard to the spacing, I don't have access to the actual numbers but can do the following: If the surface area is 7 x 37= 259 sq miles and the maximum number of producing wells was 72, then each well was draining, on average some 3.6 sq. miles, or the wells, were about 1.9 miles apart. Making a SWAG on this being the number of wells at peak would indicate that the individual well production rate, at the time, was 1,092,064/72 = 15,000 bd. This seems somewhat consistent with production in later years. At peak, Abqaig produced about 0.4 billion barrels a year. (Incidentally in Ghawar the initial spacing was 2 km, with individual well drainage areas of up to 5 sq. miles, and subsequently this was changed to 1 km, so that these initial numbers may not be that far out.

The real size of the volume that can be recovered from the field is a matter of some debate, and it is not completely clear how much has been extracted so far. If the IHS numbers from the past are used, then the field has produced a total of some 8.2 billion barrels and if we accept the Aramco view (given at the CSIS meeting) that some 78% of the oil that it is possible to recover has been, then this suggests that Jean Laherrere's view that it has a total available of 12 billion is highly optimistic. Roughly, it means that it can potentially recover another 2.3 billion barrels of oil. It is currently producing at a rate of around 434,000 bd, or 0.16 billion barrels a year, which means that, without an annual decline in production rate, it would last for another 14 years. In this regard however, it is worth noting that the IHS analysis changed from 2004 to 2005 in downrating the overall recovery factor for Abqaiq from an anticipated 72% to 60%. Of the oilfields listed it was the closest to being emptied, and is the only one for which the overall recovery factor has been dropped.

Matt Simmons in "Twilight" quotes Greg Croft in that the productivity index at Abqaiq is 110 barrels/day per psi differential across the well. Thus if they were retaining 1,000 psi at the well then to produce 15,000 bd they would need to hold 26,500 psi pressure in the formation. While I don't have data from Abqaiq, we can, again look at nearby Ghawar both for the pressure, and to see what happened to it as the field began to deplete.

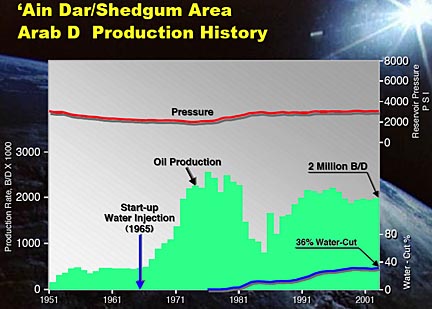

Note that they began water injection in 1965, and that oil production here peaked in the late 1970's. (For those who don't know Ain Dar/Shedgum is one of the older, and most produced, parts of the Ghawar oil field.) The slide, which also comes from the Aramco presentation as CSIS in refutation of Matt Simmons, also shows that about the time that production was peaking, so water started to appear in significant quantities in the wells, and has grown to a greater percentage of the take, since that time.

The arrival of water at the production wells is where it becomes increasingly a technical challenge to maintain production from the field. Much of the reason for this has to do with permeability and more specifically relative permeability. As I pointed out in that post, a very narrow crack in a rock can take all the flow, stranding the fluid on either side of it. For those who never saw it, here is the picture I showed.

The arrows point to the thin fracture in the sandstone. And as I commented back then

I have been on a site where the ground was supposed to be as evenly sized and permeable as this sandstone, if not more. A test was being run in which my hosts had pumped some fluid into the rock. Since they did not get the result they wanted, they dyed the next batch of water a bright color and pumped it into the ground. They then dug a hole over the site, and looked down the side to see the thick colored layer that they expected to find. They needed a magnifying glass, all the fluid (hundreds of gallons) had gone into a single flaw, about the size of the one shown in the two pictures, and none anywhere else.This is relevant since the rock formation known as Arab D zone 2-B, in which Abqaiq is located has zones of high permeability within it. So that, if water is being injected below the oil:water interface, to increase pressure, if that interface rises to meet one of these highly permeable zones, the water can preferentially flow under the pressure head, to the well.

As water is injected (at greater that production volumes as PUD pointed out) and production increases. The water level also rises with time (as I pointed out in the first post) reducing the length of well that is available for oil production. Now in the example I first gave, to make the point, I had assumed that the oilwell was drawing oil from the entire length of the well in the oil bearing rock. This makes it easier to illustrate oilfield depletion with time. However Aramco would, more likely, use one of their workover rigs and since they had cased the well they would seal the water producing levels and reperforate the well higher up. But before I explsin why that didn/t solve the problem, let me continue with that assumption for just one more paragraph, while I explain "water cut".

In the slide from Aramco above, you can see that the water cut ends up at about 36%. In our 300 ft example when we pressurized the well back, we had 180 ft of oil and 120 ft of water in the well. If they both flowed at an equivalent rate then we would get 60% of the fluid coming out as oil, and 40% as water, i.e. we would have a water cut of 40%.

Now unfortunately water flows more easily that oil and so if the hole were left open almost all the fluid would be water, and the well would not produce much oil. Hence the need to seal and reperforate. But this does not, as I said, solve the problem.

If I can make an analogy for the water flow issue, consider that you have a sponge full of lemonade, and you are sucking over the surface to get the lemonade out. Now someone pops a straw through the sponge and leads it down into some cold sour milk that is in the glass under the lemonade.. You don't want to drink the milk, but you do want the lemonade. However if you continue to suck very hard then you will find that the milk flows more easily up through the straw, than the lemonade comes out of the sponge, and so you quit in disgust. There are, however, some controls that can be maintained that don't get as much milk into your mouth. You can, for example, reduce the amount of suction (differential pressure) with which you are sucking on the sponge. One of the problems with doing that is that the amount of suction (or differential pressure) is one of the controls on how far from the well that you can draw oil. So if you drop the pressure differential then you won't get all the oil.

So to reach that oil you can drill more and shallower holes, using computer maps of the fields to work out where, that only go down into the oil layer, and locating them between the wells of the original pattern. Of course, with a relatively uniform water layer rising under the field, and the highly permeable layers being quite common, in most cases you will still find straws sticking up through the sponge, and so you will have to learn to deal, as Aramco has, with a water cut of 35% or more.

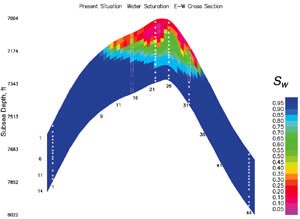

However, let me go back to the picture that I ended with last time

which came from a paper in the Journal of Petroleum Technology and where, by using suitable istrumentation, they had found where the water (deep blue), oil (green) and gas (red) layers were in a relatively depleted section across the reservoir. Now you should be able to see why, by putting long horizontal wells across the field, in its latter days, that one could run the horizontal section through the green zone, and thus continue to get more oil out of the area. Unfortunately, in this zone, because of vertical scale exaggeration, the oil looks thicker than it was - less than 40 ft. (Which anywhere else would be a lot).

(UPDATE: The source paper for the figure above is given here. It is worth a read because it has on-site photos and a lot more detail about the field than I can get into a post such as this. It also has the results of a horizontal well - which failed shortly after insertion because of water penetration - although it went on to produce 3,000 bd when pumped using multiphase pumping, and accepting the water cut. Note that wells in that region were closed when they reached 70% water cut).

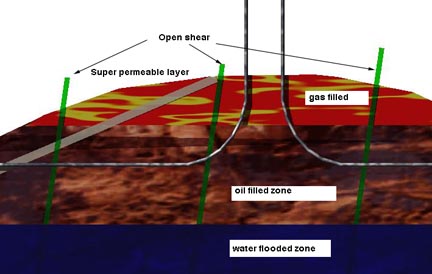

Unfortunately also the highly permeable zones and fractures that run through the rock will also run into the horizontal wells, so that some gas and water will continue to be drawn in, but one can, nevertheless, get more production from the zone than one could before. I can, perhaps illustrate this with a very simplified version of a sketch that Matt Simmons first drew of the geology of the Arabian oil fields.

I have added some of the open shear zones that exist in the field, and one of a number of inclined "super permeable" zones that lie in the field. You can see that as the suction is applied to the horizontal wells, that these provide passage ways to the well from the gas and water filled regions. I have neglected to add the relatively vertical fractures that are also very common within these fields.

In addition (and one of the reasons that the original paper was written) there is another way to go. By drawing the water and oil combination from some of the original wells where the water cut had risen above 75% it was possible to separate as much as 1,000 barrels per well per day of oil from the multiphase flow that came from them. However this is a considerable short-fall from the early production of 15,000 bd/well that the field enjoyed.

At present, as I mentioned, the field is producing at just over 400,000 bd. Wells continue to be drilled to extract the remaining oil, and it is likely that, for a while longer, production may be sustained at around that level. The second last picture in the last post showed that the drop in production at Abqaiq (ABQQ) was running at 2.8%, despite the drilling of more wells, in 2004, which gives a reduction, per year of some 12,000 bd. However that depends on how well water ingress to the horizontal wells can be controlled in the future. Unfortunately I am not that optimistic.

Incidentally I have tried giving this sort of technical explanation in the past, and since it takes a fair amount of words to try and explain the posts are spread over a number of weeks. The posts are as follows, with topic:

Previous posts can be found at::

the drill

using mud

the derrick

the casing

pressure control

completing the well

flow to the well

working with carbonates

spacing your well

directional drilling 1

directional drilling 2

types of offshore drilling rigs

coalbed methane

workover rigs

As ever, if this is not clear, or if there is disagreement then please feel free to post, and I will try and respond.

Clear and concise! Who can't understand this.

The implications!!!. An example; I was (for business reasons) in Sun Valley Idaho early this year. Driving in I noticed there are no trees(enough?) to heat with, it gets very cold in winter, and thousands of people! I looked very hard to find old homesteads - they were few and far between located in small valleys maybe 10 -12 miles apart, near water. I assume they raised cattle. There is no way this area is sustainable with out the rich folks(not me, I was working) who go there. Without oil/gas/electricity this is no-mans-land- in winter at least for this kind of population. I bet we can replay this situation over and over again accross the US.

To many of those here on TOD who think that we can return to a simpler life style I have a few words of caution. Where I live in western oregon the really choice raw materials are gone. Specifically old growth western red cedar. What is the big deal? Old growth cedar made shingles for houses all over the US. Locals used them for fence posts because of thier rot resistance. I use a piece to prop up my laptop- to allow the fan more room to move air. It is 5/8's of an inch thick has 28 yearly growth rings. You will never, ever find this stuff (alive)except in protected forests. We hord it like gold and use it for kindling of all things. The blocks that I can find are too short to do much with. The hundreds of years it took to grow this stuff will not be repeated with the current humans present. Yes it's just a tree but if we don't have asphalt for shingles, or steel for roofing then what are we going to cover our houses with? Dried grass? I suppose if we don't use it for motor fuel...:(

The implications of PO are truely mind blowing.

We might well reach total peak rescouces, not just oil.

You're giving TOD a bad name.

Your posting rights should be repealed.

Hmmm...

I think that there have been a few oil proffesionals that have been just as blunt. Jeffee's I believe was quoted in the local paper "war, famine, pestilence, and death". and you are pissed about resorts and shingles?

My gut feeling is that the people who post here in the oil industry are all too aware of the implications of PO as we move forward. It is not an "uplifting" conversation which is why the politicians really have thier hands tied in trying to fix it, is because of people like you. Oil is everywhere you just don't see it. If you dare, look around you and ask yourself this question "how does oil enter into what I'm looking at right now?." Paint-shingles-electricity-food-clothes-irrigation, etc. Move to the next question - "What will replace it?." When it starts to look ugly don't look away because whether you or I like it doesn't really matter. This kind of conversation will

become more common in the future. I guess I get to drag you by the ear to take a look from my limited obsevations.

The "worlds first oil shortage". 2 weeks ago I drove to a newly restored lighthouse at cape foul weather and took a tour. It was built in the late 1800's during the "worlds first oil shortage" - whale oil, we humans had hunted the whales to near extinction so there was a shortage of whale oil to light the lamps. They used "pig oil" for 12 years rendered from pig fat. Then they found a new oil called "kerosene" which they used until the 50's when they switched to electric lamps. Which they still use today. The point being- whales like oil are not unlimited.

Electricity in Oregon is from: 42%coal, 7%nat gas, 3% nuclear, <5% bio-gas/wind, and the balance hydro, according the "The Oregonian". My clean-fish killing-hydro myth was busted. So lets replace fuel cars with battery ones and plug in...to more fossil fuel! How many enviromentalists think plug in cars are the answer? Quite a few I bet.

The future has to be very diferent than it is today. I tried to point out some obsevations that are to me relative to what we face in an oil limited world. Is it about wells and extraction rates- no. But I think that we need to come to grips with how pervasive oil is in our society, so that we realize just what we are up against. I believe that the oil professionals here understand it very well and let us draw the conclusions and get called names.;-)

Unlike the post below you offer no(0)solutions. Perhaps you should think of some and reply. Spare me the "nasty doomer" unless you have good suggestions that are not so full of holes that a sieve looks like a good way to carry water. I would love that debate....your turn.

Sorry you did not get the sarcasm, may be you never read my comments because I am "banned"?

What about heat pumps?

Best, ( will look up comments later)

Light, low moisture, no haven for insects, high resistance to warp and rot. Looks very good too. Not splotchy like pine.

For those who might be interested I am going to sell my log house and 20 acres that go with it. It has a full poured concrete basement. A very good deep well that will never go dry. Extremely good soil and near 5 major rivers plus close to two of the biggest manmade lakes in the USA.

Deer have to be shooed out of your way. Turkeys are plentiful as well as squirrels. Much fish in the rivers.

For someone looking for a place to ride out the upcoming events this appears to be the best part of the US to do it in. Water,wildlife,forests,live springs and so on. I live 4 miles from the Mississippi and Ohio rivers. Once there were enormous numbers of native american indians living on these lands and in the bottoms nearby as well as mound builders all around the area.

Reason: Divorce but I intend to stay on part of the land in another residence in another tract I have surveyed off.

The loghouse sports a geothermal heatpump and has a Buck stove in the great room that I have heated the whole house with. There are some woods as part of the acreage.

Apologies if this sounds like spam. If so you have my permission to delete it.

airdale

Thank you, oilaholic, for putting the question in such a concise way.

This is exactly the argument that I have been trying to make and somehow not been able to clearly convey, Despite my crude efforts at wordsmithing, I seem to have managed to make people annoyed or downright angry, when I say the biggest danger may not be immediate peak (again, it MAY be, we simply cannot know), but that we are running completely and totally in the blind.

The changes in technology and the changes in the exact definition of what is:

OIP

URR

production

production capability

oil

all liquids

are now occurring so fast as to make the HL (Hubbert Linearization) model more and more difficult to use as a predictive tool in the old way, that predicting peak becomes a complete crapshoot, and runs the risk of undermining credibility of those trying to do so based on the old models.

There is possible good news in this, if one thinks a delayed peak is good news, in that it "may" give us more time to attempt the "Hirsch Report(s)" type mitigation plans to reduce the chaos and suffering when peak does come.

There is bad news though, in that when, as you point out, and Simmons and Hirsch himself and others try to point out, the "peak" itself may come with virtually no warning whatsoever, and the post peak drop in production may be much more severe than expected (the "cliff" instead of the "slow squeeze")

We cannot even be sure of the above however, because the changing definition of "oil" per se, and "all liquids" further cloud the picture. We simply cannot dismiss the effect of NGL (Naturual Gas Liquids or Condensates), "GTL" (Gas to Liquids) different than GTL, although the two are often confused in the popular press, and the introduction of heavy and sour crude in a much bigger way (notice I am leaving out tar sand and ultra heavy oils, simply because they are too speculative to even think about, but many popular commentators gaining widespread press do not leave them out (Yergin and Lynch comes to mind, and I am not discussing the ethanol issue, which I see as a giant fuel switching operation, from natural gas to liquids, but again, many commentators now throw this in, thus making the statistical picture murky beyond all comprehension even to the people who spend hours studying these issues....to the average citizen, it must appear more esoteric and complex than subatomic physics! We cannot, repeat, CANNOT fault the man or woman on the street for being unable to separate the wheat from the chaff!)

What's it all mean? I have insisted that it means that someone should be getting the message to the public that they should be laying contigency plans for sudden and massive changes, some of them less than pleasant, possibly outright catastrophic to them and their organizations. Interruptions of energy supply and massive price moves in any direction are possible. The long held faith in the stability of energy sources and supply should now be viewed as a dangerous myth. The complexity of the fuel delivery system means that you and your organization can no longer rely on the simplicities of a "mono fuel" crude oil based world....there may be energy available but it may be the wrong kind, and you may not be able to make use of it.

And for the "peak aware", it should be given as a caution: Sudden disruption/interrruption/price movement and chaos may NOT in and of itself be proof of "peak" per se, depending on how "peak" is defined (peak oil, peak all liquids, peak light sweet crude, peak usable liquids, etc)

Even being aware of the threat above gives us some slight advantage in vision over the general public, but, and I don't say this to be in any way rude, and let me say again that the work here is extremely valuable, useful and informative, I cannot say enough about how highly I regard what I have learned from folks like Standiford, Robert R., and Westexas, and the others, and have NEVER disparaged in any way the efforts and sheer clever and perceptive knowledge of this group), but....we are running, due to the definitional problems cited above, with only slightly more vision than the public at large.

Humility, caution, is the order of the day.....but we can take comfort in the old proverb, "in the kingdom of the blind, the one eyed man is king!" :-)

Caution. Strategic and Contigency Planning. Energy Diversity. Conservation and reduction of waste. Transport alternatives. The acceptance of workable and usable alternatives and renewables, and the acceptance of something close to "Mitigation options" of the type that Hirsch and others who see the enormous challenge in front of us. Perhaps not all of the options. But use the best first, and work outward.

This is the concise, coherent planning that I am accepting, and I am encouraging folks to spread to others and to their organizations.

"I cannot do a lot, but I will do the little I can do." Helen Keller

Thank you.

Roger Conner known to you as ThatsItImout

Bear in mind, however, that as the oilfield production drops, it is not going to be how much, in absolute terms, we get out that is the main concern. It is the rate of production, since demand is going up, and we are looking to see where we can meet that demand. There is no question that the field is declining, and I have tried to explain why that is irreversible. It has implications for the future of Ghawar, which is close, and the Northern parts of which are close behind Abqaiq in relative amounts of oil produced.

Controlling the pressure, to control water movement, also controls the amount of oil that is drawn from an individual well, and the rate at which it is produced.

As far as reservoir management is concerned, the ONLY purpose of water injection is to maintain reservoir pressure by replacing the volume of produced fluids. Some folk will say that water injection is "designed" to sweep oil towards production wells, but that is as much a matter of hope as it is of engineering. You try to inject the water in such a manner (i.e. in such a place) that it doesn't immediately channel through to your producers - this is mainly common sense, e.g. you don't normally want to put a water injector immediately updip of a producer.

Yes, water cones can collapse given enough time and the right rock and fluid properties. This sometimes makes a difference to how wells are managed. Another approach is to produce below the critical rate at which the cone will reach the production well. As always, it depends.

Could you expand on this remark a bit, plucky? When, where applicable? does it extend production into the future at lower flow rates? Etc.

Really hard to interpret diagram here http://www.glossary.oilfield.slb.com/search.cfm and search for "coning"

Coning is promoted by:

High production rates

Narrow interval between contact and bottom of well

High oil viscosity (=> high drawdown & adverse mobility ratio)

Low horizontal permeability (ditto)

High vertical permeability (gas moves faster)

High net:gross (no shale stringers to stop water moving vertically)

If you know enough about the rock and fluid properties then you can estimate the "coning critical rate", i.e. the rate at which the cone will have grown to the point where it just reaches the bottom of the producing well. You can then choose to limit your production rate to just below this level to avoid water production. It certainly extends DRY production into the future at lower flowrates, but if you are willing to cycle enough water through the reservoir then you'll eventually get all the moveable oil out anyway, up to the economic limit. And sometimes the coning critical rate is so low that you just have to shrug and accept that it will happen at any economically realistic well production rate, and manage the water on the surface.

Remember that if you are injecting water below the oil, or if an aquifer is influxing into the reservoir, then the contact will be moving upwards anyway so the coning critical rate will change with time as the contact gets nearer to the wells and eventually breaks through independent of production rate.

Coning can happen with gas as well, this time coming from above not below - think Cantarell (but unlikely there due to very high horizontal permeability).

Horizontal wells spread production out through a larger volume of reservoir (hand wave) and so reduce drawdown and the propensity for coning. Again this delays water breakthrough but once it happens, it happens. See "cresting" in the Schlumberger glossary linked above.

This seems to be constant confusion at TOD but I think it is due to many others (eg. IHS/CERA) spreading it publicly, which I'll call "the appeal to URR" argument. Field F has a URR of 10 Gb. You have recovered 4 Gb. If you have a recovery efficiency (factor, rate) of 50% instead of 45%, you can extract 1 Gb over time instead of 0.5 Gb. At what flow (production) rate will you do so?

In other words, what is the shape of the tail? How are you managing it? You might maximize flow rates now and near-term followed by a steep decline (this is the strategy I have called Extreme Production Measures). You still get your extra 5% of URR but then you are hosed--to use a technical term :) The proximate cause for this strategy is economic but there is a deeper reason: a system built on continuous growth must deploy such a strategy and it is always seen as necessary and good.

Or you can manage the tail differently, reduce flow rates from the field by delaying in-field drilling and try to maximize yields over a longer time--again assuming that the recovery efficiency remains unchanged, you will still get your 50%. This strategy assumes that you have a finite resource, better to live a bit more humbly now and longer than burn the candle at both ends. You will meet demand by demanding less and implement other strategies for living.

OK, as David Byrne once said, I will stop making sense now.

best --

Dave, whatever about the ethical dimensions of accelerated versus protracted extraction, I don't really see how speedy oil recovery affects the overall depletion curve except that it might bring on the peak a few years sooner than otherwise. How can rapid extraction of individual fields impact the overall decline rate? Not all oilfields were discovered at the same time.

If there are lots of oilfields, all of which matured at a different date, and presuming their individual nose-diving decline is staggered over time (say, 20 years), won't the cumulative decline rate be much the same as if all had declined gradually?

In other words the 'slow food' as opposed to the 'fast food' extraction approach will only postpone the hour of reckoning by a couple of years at best. And it won't change the shape of the decline curve to any notable extent.

I am not an oil guy but I disagree with this logic for the following reasons.

- I have experience with water wells for irrigation in Texas and New Mexico. They also have shown decline over time from pumping. In many places the aquifer recharges so this is not applicable to oil fields which don't recharge.

- However there are some aquifers in West Texas near Lubbuck and in much of New Mexico that are not recharging, at least not in the last 50 years, this is water from 10,000 years ago or more in underground lakes.

- A lot of places near Lubbuck used to have one well per quarter section that used to pump say 750 gallons per minute out of a lobe of the Ogallala aquifer. These wells were drilled in the 1940's and 1950's mostly, and for 30 years supplied all the water to grow crops on that quarter section.

- Irrigation pivot equipment is often sized for 400 gpm in many of these locations. Over time the well declined until it was pumping below 400 gpm and wouldn't feed the pivot. Might only produce 350 gpm by the 1970's.

- So they "infield" drilled another well between pivots some years ago that also initially delivered 350 gpm. They were back to 700 gpm (very slight decline) but out of two wells now, not one.

- In about another 10 years both of these wells declined rapidly until the net was again below 400 gpm. So now there is often 4 wells pumping 125 gpm or a total of 500 gpm for the quarter section. They didn't get back to the original 750 gpm and they have 4 wells now not the original single well.

- What is scary is that no matter when the original wells were drilled, or farms developed in those 1000's of square miles, everybody has drilled lots and lots of new wells in the last 20 years.

- So at present everybody is still farming using lots of water. Some farms have more or less water under them but all wells have declined very rapidly in the last 20 years compared to the first 20 years of operation.

So in summary these water wells have maintained a near constant production via lots of new wells. But they are reaching a point when doubling the number of wells isn't really going to help that much. And the cost is going through the roof. So even though these individual pockets of water were developed at different times they are all going to collapse at about the same time. The reason for this is that new water wells always needed to be pumped at the maximum rate to make up for declining original wells. People moved more of their high water requiring crops to where the most water could be pumped. No spare capacity like the original wells had.Very late in the day people have come to realize that using irrigation equipment that only uses 250 gpm or less, instead of 400, can work just as well if applied efficiently. But now wells are dropping below 100 gpm and there just isn't very much water left. If the same efficient systems had been put in place 30 years ago there may not have been the need to drill more wells and there would still be a lot of water left to use. But in aggregate all the water has been found and all the aquifers depleted to the same low level because the easiest water is always removed fastest.

NC,

Thank you for your highly instructive reply. Until now I had always believed that the US still had a long way to go before groundwater shortage became a problem.

You've certainly given me food for thought -- so I've put my thinking cap on.

Groundwater depletion is even scarier than `peak oil'.

BTW has anybody ever constructed a Hubbert curve for `peak groundwater'?

Many people on this site at the moment seem to think it self evident that if individual fields all show sharp declines, then the sum total of those fields must show a sharp decline also.

This is not the case.

If this seems counter-intuitive to you, please dwell on it.

I think this idea has become popular mainly because it supports the general doomeristic framework.

Hubbert didn't use a symmetrical curve to model oil production because he thought production from individual fields was symmetrical! This isn't typically the case, and as far as I know, never was. Rather, he knew he could use a symmetrical curve because summing large amounts of skewed distributions will likely produce a more or less symmetrical curve.

It is possible that world oil production will have a significant skew post peak. If so, this would likely be caused by such things as political events. The fact that individual production wells are getting more skewed is unlikely to be a candidate.

If you (ie. anyone) think the post peak production curve will show a skew, you should be able to explain why you think this will be the case without appealing to the fact that individual fields show a skew.

You are right. But see my remarks below. Look at the graph for North America from the Hirsch article cited there. I am interested in production curves. Look at Stuart's Extrapolating World Production. Consider this.

I am trying to explain generally the "big spike" (1st graph) and consider the plausibility of Stuart's guess (2nd graph) which does not display a "bell curve" shape. My theory is that it has to do with advanced EOR/IOR applied to old giant existing fields and also the spike in deepwater production. I've called these strategies extreme production measures. I think that yellow line, which shows a sharp decline, may be our future. I've tried to explain why. I've called for production slowdowns because there's no other good explanation for what's happened in the last few years. It's not because we are swamped with new production but we have encountered a demand shock. The world is pumping like crazy to meet it.

It's not because I'm some doomer.

But we must ask ourselves why individual fields are being squeezed so hard. Globally, the answer seems to be a lack of replacement fields coming on stream to take up the slack. So, individual field profiles will show, instead of a bell-curve decline, a plateau followed by a steep decay.

If it turns out that a high proportion of existing producing fields are past their peak, and are in this artificial post-peak plateau phase (big and small fields alike), then it seems likely that the aggregate production numbers will also be deformed in the same way.

If it turns out, over the next couple of years, that world production numbers are indeed in a plateau, whereas we know that large numbers individual fields are being squeezed, then that would seem to indicate to me, a strong likelihood of a steeper downward slope once the plateau ends. Given that the area under the curve is constant, you can't have your cake and eat it.

There are lots of oil fields but not lots of giant oil fields (like Abqaiq) and these produce somewhere between 40% and 50% of the world's oil daily depending on you how define "giant". If you define it as a field with a URR of greater than 0.5 Gb, then the percentage is closer to 50%. Most of these fields are old (pre-dating 1980 at least, most are much older). See Giant Oil Fields of the World (pdf file).

If a significant number of these fields go into rapid decline close to each other in time--say, within a decade--then due to the large percentage of the world's oil we get from them we will alter the shape of the global decline curve--it will be sharper. Even a few percentage points makes a difference here. Abaqaiq is producing 400/kbd and peaked some time ago. If you manage the tail end production of this field (and others) to promote longevity and not rush to suck them dry, you are partially managing the global decline also. These really big fields are in some sense "priceless" -- they can not be replaced. The discoveries trend shows this clearly. See Hirsch's Shaping the peak of world oil production. Do we want to see a global peak that looks like North America?

Indeed, the trend is toward a greater share of world production from smaller fields in countries like Chad, Mauritania, Malaysia, offshore Brazil, et. al. What you say would be true if all oil fields were created equal. But they are not. If you lose 200/kbd within a few years at Abaqaiq because of the way you produced it, you need to put 20 10/kbd fields onstream just to replace that. At Cantarell, the situation is much worse. Ghawar could go that way.

I might have to post on this again. Concerning the ethical implications of my position, my answer is:

No to #1, Yes to #2. Why can't humans make reasonable extrapolations about the future and act accordingly? Unfortunately, that's just the way it is.

Should read

these produce somewhere between 40% and 50% of the world's daily oil flows depending on how you define "giant"

Still, there might be enough relatively immature 'rhino-sized' and 'water buffalo-sized' oilfields (in Chad, Brazil etc.) to compensate and stave off the grand finale just a little bit longer.

Though it takes an awful lot of rhinos and water-buffalos to outweigh half a dozen elephant.

I am far more fatalistic than you are, I suppose -- it's the irreversibility of the oil crisis, not the date of its eruption or even the shape of the downward curve, that is the most depressing. What are ten or twenty years reprieve for the automobile compared with an eternity of the horse and cart?

Well, you and I are not running blind anyway, the problem is everyone else is running blind because they are wearing blinders. It is like we were part of a huge herd of buffalo running full steam toward a cliff. Now you and I can see the cliff ahead. We both know we are about to run over the cliff. But everyone else seems totally oblivious to our predicament. And there is not one damn thing we can do about it. The vast majority do not wish to see the cliff so therefore they do not see it.

And by the way Roger, I must emphatically disagree with you as to how much we can know about the future of oil resources. When you say "we simply cannot know", you are simply dead wrong. What an insult that is to the hundreds who have studied the problem without their blinders on. What an insult that is to the good people who run this list who have gone to great lengths to try to describe the problem and to explain why we do know! Now I do not mean to say we know the exact day of the peak, but we do know it is imminent. To say that "we simply cannot know" is, in effect, to say it could be thirty years from now. If that is all we know then we might as well quit worrying and join the herd in running headlong toward the cliff. All the data we have gathered concerning the nature oil reserves, the nature of water injection and other methods to enhance recovery is not for nothing. If we simply cannot know then what the hell are we doing here. If we simply cannot know then Heading Out's thesis on the life of a large oilfield was a useless exercise. He, and all the other good folks who help run this site, are simply wasting their time because we simply cannot know. The hell you say, we do know.

One more point. There is nothing you can do to turn the herd. They are running toward the cliff and are destined to run off it. What you can possibly do is somehow keep yourself, and perhaps a few others, from running off the cliff. But if your dream is to spread the word and save the whole damn herd, forget it, it is already way too late.

Ron Patterson

Darwinian,

You say,

"Now I do not mean to say we know the exact day of the peak, but we do know it is imminent. To say that "we simply cannot know" is, in effect, to say it could be thirty years from now. If that is all we know then we might as well quit worrying and join the herd in running headlong toward the cliff."

Well, I am about to get in deep trouble, but it is not fair not to be honest and straight up.....sorry, but I do believe it could possibly be 30 years or more away, if you are referring to what I call "geological peak" of the true Hubbert type. I do not dismiss that this whole current situation is purely logistical/geopolitical/economic in nature, and has very little to do with geological peak. The peak could indeed be 30 years away, or it could have occured yesterday. I am sorry, and I intend to be insulting to no one, and I have great respect for the work they do, and consider it useful to inform us of possible danger, but....I simply feel that the graphers and the stats makers have no good and valid imput information to work with.

Why are we here? Because even if peak happens to be further away than we think, nothing changes the fact that oil and gas consumption has gone to mad and wasteful levels, and the even if we don't reach peak oil soon, we are running the risk of hitting peak money and logistical rescources very soon, in other words, we are hemorrhaging money, effort and resources with or without peak, and must attempt to regain control of out of control waste and consumption before it bankrupts us. I am going to say something a bit odd, but I think true: some who dismiss "peak oil" say, "oh, don't worry the oil is 'out there'....."

out where? The fact is the one thing that may be worse for America than the oil not being 'out there' is if it really is 'out there', and I do see that as a real potential danger. I repeat, I cannot KNOW that peak is not already behind us, but I cannot KNOW that is not decades away, and with technical advances, may go by essentially unnoticed.

So my goals stay the same. Strategic planning, Case harden America through reserve planning, fuel diversity, acceptance of conservation and workable renewables, transportation alternatives. The biggest enemy is bing single sourced, get loose from the "mono-fuel" past.

There is plenty to do. :-)

Roger Conner known to you as ThatsItImout

I came to the same conclusion, as you have just reached, about a year and a half ago. I visuallize it this way:

We are not going to see a nice bell shaped curve of production. All the advanced drilling and extraction cause the production to be maintained as a plateau for a very long time. But then we are literally going to drop off a vertical cliff face of depletion.

All these water cuts and pressurized fields and horizontal wells allow for faster extraction on a daily basis. But faster extraction today must logically mean less oil to extract in the future if the total oil amount in the field is kept constant.

As we all agree (with very few exceptions) oil is not being created in these field to replace the extracted oil in a human lifespan. So if we force production to stay plateaued we can't rely on a gradual downslope. New field extraction is not going to behave like the old Pennsylvania or Texas fields developed in the early 1900's. The area under the extraction curve is fixed. The "curve" from these new fields is more likely to look like a stove pipe hat instead of a normal distribution bell curve.

The problem with all of this is it doesn't give society any warning on peak oil. Or any gradual decline that we can adjust to. Most people are not going to get the message that we have a supply issue because we work so hard at maintaining a high rate of extration. We are likely to have all the oil we want, until we don't. And then we might not have any at all from many wells, just a lot of water.

1. CERA is wrong for two reasons:

a. they over-estimate new production coming on stream, using "best case" estimates for everything, and

b. they fail to account for the "cliff" effect that will occur at various elephant fields over the next, say, ten years.

2. Peak Pessimists are wrong, because they fail to understand two things:

a. that supply and demand are enormously powerful in providing unforseen alternative sources of both traditional and non-conventional oil, and

b. the ability of new technologies to radically re-shape the theoretical Hubbertian curve of depletion, keeping fields producing for much longer at much higher rates.

3. Westexas is right in pointing out that a combination of increased domestic demand and supply management by oil exporters will have a major impact in limiting supply to importing countries and that in the foreseeable future the western democracies will be competing with China, India, and other affluent developing countries for imports, not with Guatemala, as currently is the case.

So where I am coming out is that

1. there will be a gradual peak in the availability of oil to satisfy the needs of importing countries,

2. that peak will not be a direct result of traditional Hubbertian analysis, and

3. while the timing is not predictible in any sense that I've read, it is probably more likely to come within the next five years than not.

Finally, we will know when we have a true oil problem when the MSM begin to discuss the issue in terms of an inability of exporters to supply demand rather than in terms of the risks of hurricanes and wars.

Meanwhile, I've never found a source of more thoughtful and informed discussion on a matter of more importance than here at TOD. Thanks to all.

It occurs to me, and I think I've commented on this before, that we are seeing in part a difference between the levels of certainty between data having to do with projected decline of existing producing oil fields:

http://www.theoildrum.com/story/2006/8/11/114030/450

and projected production of projects coming on line:

http://www.theoildrum.com/story/2006/8/10/14547/4499

Someone correct me if I'm wrong, but it seems that the figures for the projected production are probably (statistically speaking) better known or more certain than are the figures for projected decline. This can lead to a CERA-type view of the future that simply discounts data less certain than some standard thus giving an optimistic picture.

This is not at all to say that projected production figures for new projects are known with certainty. I remember a Glenn Morton post going down a list of the GOM sites with projections and actual, the actual in almost every case being somewhat below the projected.

This is also a good reason why much of the number-crunching here has more to do with trying to nail down the decline rates with more certainty.

Also, I believe somebody posted something about the EIA expecting Saudi to be producing 20+ mbd by 2025. CERA's estimates/projections/whatever make that look kind of silly. No?

Yes, I have seen that. What is most interesting to me is the sentence:

"If needed, the Khurais field will be brought back onstream at up to 1.2 mbd by 2010. However, CERA believes that this latter addition will be ramped up slowly or delayed."

First, we can request the statistic keepers here who know so much more than I do (and most people do) about Saudi oil fields to tell us what they know about Khurais oil field. (??) 1.2 mbd is a nice chunk of change as oil goes, is it just sitting idle right now?

Think of it this way...Energy Bulletin reported in July, 2004, by way of DMD Publishing...

"There are four oil fields in the world which produce over one million barrels per day. Ghawar, which produces 4.5 million barrels per day, Cantarell in Mexico, which produces nearly 2 million barrels per day, Burgan in Kuwait which produces 1 million barrels per day and Da Qing in China which produces 1 million barrels per day."

http://www.energybulletin.net/1269.html

Thus, 1.2 mbd would put Khurais in the top four, displacing Burgan (which we now know is peaked, per the Kuwaiti's) and Da Qing IF a field could get to 1.2 mbd. We are assuming that Khurais could not do that all in one swoop, but is it concievable it could by 2010?

Later in this same story from 2004 linked above we get one mention of Khurais:

"The Centre for Global Energy Studies hinted at the beginning of the year that the kingdom appeared to be heading for difficulties. Now one of its analysts has said that having reserves does not equate to production capacity. Citing the Haradh field, he said it required 500,000 barrels per day of water injection to get out 300,000 bpd of oil. Moreover the problem is even more serious in the Khurais field."

But by 2005 at the same Energy Bulletin, hopes had grown much brighter:

"Production from the Khurais Field is to be increased to 1.2 million barrels per day in 2009. Khurais is located on a large structural trend to the west of, and parallel to, the Ghawar trend. Because of this superficial resemblance to Ghawar, there were very high hopes that Khurais would be comparably large. It turned out that the reservoir at Khurais was much smaller and not as high quality as Ghawar, though it is still the largest of the proposed projects. Variable reservoir quality has also been a problem at Khurais. Pilot-scale production at Khurais began in 1963, but the field has never been fully developed. It produces Arab light crude.

http://www.energybulletin.net/4785.html

Now folks, there is just all kinds of news in there, and some of odd to the extreme...here we have a field that was pilot drilled in 1963, and layed aside??!! And ARAB LIGHT SWEET TO BOOT!!

If we accept the Energy Bulleting story, it means that the myth that "Saudi Arabia has been producing "flal out" through the recent "oil crisis" is just that, a myth. But, there are some caveats, aren't there? What about the 2004 story of water cut problems? This would mean that Khurais was pretty watery right from day one (and as Simmons points out in "Twilight" this is not unheard of...despite the popular belief that ALL fields start out with almost no water cut, that is not the case...Ghawar itself began with an 11% water saturation, and that's actually a damm good number as the world goes)

The story linked above written in 2005, closes,

"The next meaningful production increment does not arrive until 2007."

Well, of course, we will be in 2007 when the next meaningful demand season (summer driving) starts. Who has the balls to sell oil short on the above stats? ;-)

By the way, unless you think the writer of the story, Greg Croft, is not aware of "Peak", please check out his fascinating website, this page in particular:

http://www.gregcroft.com/peakoil.ivnu

So much wisdom in his sentence, it is almost becoming my motto:

"The greatest danger from peak oil is that we will do something foolish in response to it."

Heading Out, here at TOD, however, gives a later date than 2007, and lists

Khurais - 1,200,000 bd, due in 2009.

This given in August, 2006

http://www.theoildrum.com/story/2006/8/13/232547/321

Heading out quotes in this story...

The contract to start the Khurais development, due on stream in 2009, has just been given to Foster Wheeler Energy Ltd. (That link to the OGJ is no longer valid, but merely said

Saudi Aramco let a front-end engineering and project-management services contract to Foster Wheeler Energy Ltd. for full development of supergiant Khurais oil and gas field in Saudi Arabia.

The field is to produce 1.2 million b/d of Arabian light crude by 2009 as part of Aramco's program to raise production capacity from 10.5 million b/d at present to 12 million b/d by 2009 .

So, do we have a supergiant on the way, that will drawf the decline of, say for example, Canterell? Who kiows. But if the Saudi's have been basically able to hold a 1.2 mbd light sweet crude oil field in reserve, and we have gotten through the cluster** of the last 5 years

(5th anniversary of 9/11, coming up :-(

without oil blowing past $100 a barrell (much less $120), and gasoline yesterday in central Kentucky at $2.63 per gallon.....

yeah.....tell me there ain's some bigtime fudgin' around going on in this world, peak tomorrow or peak 2050....sheer BLINDNESS. (my favorite theme....:-)....

Folks we should be getting off oil if for no other reason than to regaim some DAMM DIGNITY!!

Roger Conner known to you as ThatsItImout

Yes, most folks don't seem to know that despite the current hysteria about "plateau", Saudi Arabian production essentially sat at a "plateau" for two decades! (1982-2002)

Most people still do not accept 1982 as a geological peak given recent production numbers, but in fact it is very hard to know how oil Saudi Arabia has produced in recent years...it is possible to swap around from tank farms, and even resell purchased oil....and the seasonal issues cloud things.

"good supply management", despite the Americans recent childish belief that the Saudi's run "flat out" on our command and purely for our benefit all the time, is still, TODAY very much a factor. And it is indeed a factor in all the number's Croft and everyone else gives, whether they know it or not when they give the numbers.

Roger Conner known to you as ThatsItImout

peakearl,

Let us take your exact position as correct (I don't, but for the sake of discussion, let's),

Then why would we assume that a Saudi peak now is anything but what you call trying to "reign in supplies to support prices"?

As our thred on the Khurais oil field discusses, here we have a field that could have the productive capacity anywhere from essentially zero up to 1.2 mbd, for a period anywhere between essentially none, and or decades.

Yet we insist with absolute certainty, having so wrong so many times before that we know what Saudi Arabia can produce, and bless their sweet little hearts, they are running flat out, all the time, just for our benefit. It is astounding beyond belief that the Americans can choose to belief such shiit and causes me to deeply question the fitness of the modern American nation to survive in the modern world. How did we get to such a point?

Roger Conner known to you as ThatsItImout

First, we haven't "been wrong so many times before" about SA production. No one claimed they were having a capacity peak before. If we are speculating about it now, it's because of a combination of factors, not just simple production data: the technical state of their fields as discussed by Simmons, the billions they are pouring into their fields recently without production increases (I don't believe they would spend these billions just to sit on fields and not produce), the rigs they are having to hire and contract for, the personnel they keep searching for - all while production drifts down. Khurais doesn't impress me. If it could have been reasonably produced, they would have as their early efforts show, certainly before spending billions on advanced EOR methods on the other fields. If it's so hard to produce, I seriously doubt it will get to much in the way of volume at any cost in the near future.

Anyone can believe anything, and I know I can't convince you, but I don't think your position is at all tenable in light of all the various factors taken together.

"Anyone can believe anything, and I know I can't convince you, but I don't think your position is at all tenable in light of all the various factors taken together."

Perhaps not, but I do want to make sure my position is clearly represented:

We are still running completely and totally blind, but there are many who refuse to see it.

The Saudi's word is useless to me, and the contention that they are producing flat out is not a usable statement given that it may or may not be true. The same is true of the rest of the world's oil producers.

On Khurais we can be certain that it will produce somewhere between three farts in the wind, or 1.2 mbd, and it's anybodies guess where between that bottom and top range. The one thing we can certain of, one more time, is that we can only guess. The same is true of the rest of Saudi and OPEC production.

Surprise to the upside/downside on price and or production are about equally as possible. Given the lack of useful information, betting either way is about equally as risky. The view ahead is very purposely murky.

There is only one group that can be called with absolute certainty, wrong. That is the group that believes with absolute certainty they cannot be wrong.

And that folks is the kind of clear information you can take to the bank, :-), and it is about as useful as anything else your hearing from the "experts".

Roger Conner known to you as ThatsItImout

Sorry. Uncertainty is a horrible thing.

But if I rattle someone's faith in this blind certainty that I see as SO damaging on all sides, my job is done. And nice to get to visit with ya' :-)

Roger Conner known to you as ThatsItImout

As for Roger. You better slow down. You are about to become the smartest voice on peak. You better be prepared. I hope you are ready. I'm serious. This stuff sneaks up on you. I believe you said it yourself. It may well be behind us. No?

As for peakearl. I dunno. He kinda snuck up on me. I guess he's always struck me as sane. The voice of reason.

To Oil CEO,

Thank you for the kind words, but I assure I am not and am in no danger of becoming anywhere near as informed and very clever and observant of the details as the best here....I repeat, I have learned huge amounts from the contributers and editors here, and have never said a word to in anyway deny this.

My discussion is not about their very expert methods and statistical observations, which I admire and hold in high respect, but about the absolute lack of valid information and a trustworthy statistical base from which everyone is forced to start.

As for Peakearl and everyone else I have discussed things with, I have NEVER been disappointed in the quality of the discourse. This is one thing that keeps me coming back, beside the interesting debate and depth of interest and knowledge in the subject of energy....that the discourse even when somewhat "assertive" very seldom has descended to the personal attack, and to repeat, my regard for all the folks here has remained very high.

In my personal dealings, I have taken a path in discussion with friends and family, and even began to try to lobby local firms and organizations toward nothing more than what I have called "case hardening" their energy usage.

This involves strategic planning by way of contract, and even strategic storage if that is possible, diversification of fuel sources (for example, a utility should have some of it's service trucks on gas, some on Diesel, and some on LPG or CNG....the cut of off gasoline or Diesel should NOT leave them without any functioning service trucks, for example), introduction of solar hot water, passive solar heating and daylighting, ground coupled heat pumps (very conservative, and able to provide heat and cooling as long as the grid stays up, etc.

There should be a variety of transportation options (bus, cabs, train, whatever can be afforded), and it goes without saying that conservation should be a top priority to reduce strain on the systems of energy provision and distribution. These are things that can hopefully be done and will be of benefit no matter what happens. I simply wish we all had more information to plan with. We do know one thing...if we frequent TOD, we are at least alert and have our antenna up. We won't be completely blindsided by surprise when the energy situation shifts in whatever direction (many people will be) and we will know that the shifts could be in completely unexpected directions.

That is really about the most we can know or do, but that is much more than nothing...."In the kingdom of the blind, the one eyed man is king." :-)

I wish I could learn more faster. I have a feeling that we will all wish we could have known more over the next few years, but we will, in the end, have to go with what we know! I think, and I know this may not be a popular view, but I thing we could just surprise to the upside! :-) But that is only an opinion, but it is more fun to believe it than to believe the worst...:-)

Roger Conner known to you as ThatsItImout

Croft also says

You can take that to the bank.

Laid aside! Yes it was laid aside, but not because they did not need the oil, but because of their frustration in trying to get enough production from the field to make it worth the massive efforts to extract and deliver the oil. Every effort was made to make Khurais a productive field, and every effort, after some initial success, failed.

Matt Simmons in Khurais:

Simmons goes on for two more pages on the production potential of Khurais:

Saudi Aramco has recently let contracts to ShawCor Ltd. And Halliburton to lay oil and seawater pipelines to the Khurais field. This, in my estimation, should be viewed as a desperate attempt by Aramco to bring an old unproductive field back on line to boost production. It is not as you suggest Roger, simply bringing a field on line that was earlier mothballed simply because they did not need the oil.

And yes, I have seen Simmons remarks on Khurais, and that's the point I am getting at....what do we really know?

This field is now more than being "touted" if the pronouncements are that 1.2 mbd can be gotten out of it are even halfway correct, (let's say 600,000 can be, that would have still made it worth developing. Many smaller fields than that are developed and worked over.

So we have a field that has gone from so hopeless as to be virtually ignored, to going to a projected 1.2 mbd per day in only a couple of years. Again, think about that number....1.2 mbd per day! One has to say that if Aramco has chosen to attempt to make liars and asses of themselves, they intend to do it in the biggest possible way! :-)

Or are there other possibilities? I have read and reread the paragraphs you quote from "Twilight in The Desert" by Simmons. To me, that are among the most mysterious and hard to understand in the book.

First given reason for mothballing, remoteness. (??) Now by todays standards, 100 miles is just not that remote. The remoteness problem, if one reads the paragraph, seems to a remoteness from water issue, in that water will have to be piped to the field for water injection. Then of course, the oil will have to be piped some distance for distribution. But the oil does indeed seem to be there, as Simmons himself does not dispute this is the second largest oil bearing structure in Saudi Arabia. But, the field essentially sat fallow through the 1980's and 1990's, as oil prices dipped to postwar inflation adjusted lows.

Wait, back up there, rerun that sentence?

The Khurais field essentially sat fallow through the 1980's and 1990's, as oil prices dipped to postwar inflation adjusted lows.

AHHHHHH, now we're getting somewhere....What kind of idiots would lay expensive water pipelines, expensive oil pipelines, build large expensive water separation plants, all to pour more oil onto a market that was already in price collapse? The Saudi's are a lot of things perhaps, but I am becoming more and more and convinced they are NOT stupid. They are not going to make that kind of expensive capital outlay to essentially give the oil away.

The price does matter.

Simmons said, as you quote,

"It must have been terribly frustrating for Khurais' production managers and engineers to realize that the second-largest onshore structure in Saudi Arabia, lying just 70 miles west of Ghawar, gave no indication of output potential comparable to its size. Page 213

Let's turn that around. I am willing to bet they were anything but frustrated. They were learning the field, learning what would be needed, and learning at what price it could be done. And one thing they knew for sure...it was NOT worth messing with at $18 or $28 bucks a barrel. And if they had developed at (at great expense mind you) crude oil could not have held at $12 dollars a barrel, as a world already flooded by cheap oil from the North Sea and Mexico would have been hit with more.

Frustrated? More like walking around with their tongue in their cheek and grinning like the cat that ate the canary.....hehehe, let Britian and Norway and Mexico give theirs away at $20 and $30 dollars a barrel....while we sit with the aces still in the hole....

Quoting Simmons,

"At the very least, this information reaffirmed that the entire Khurais complex bore only the most superficial resemblance to Saudi Arabia's giant oilfields."

How much oil is now given in place at Khurais? What is now given as the URR? What's a Hubbert Linearization look like on it? If it walks like a duck, and quacks like a duck, it may be a duck, and this little doll could be Ghawar's very pretty little sister....and the Saudi's may have known it all along.....as I have said over and over and over again, WE ARE RUNNING SO COMPLETELY BLIND, we could have no way of knowing, and in fact no way of knowing there are not two or three more of these....do you think Aramco EVER gave honest and full accounting?

Or on the other side of the coin, Khurais may all be a mythical field, full of nothing, (despite even Simmons and others calling it "the second largest oil bearing structure" in Saudia Arabia, (a true geological oddity that, by the way, an oil bearing structure from which it is impossible to get oil?)

Darwinian, in closing, you say,

"Saudi Aramco has recently let contracts to ShawCor Ltd. And Halliburton to lay oil and seawater pipelines to the Khurais field. This, in my estimation, should be viewed as a desperate attempt by Aramco to bring an old unproductive field back on line to boost production. It is not as you suggest Roger, simply bringing a field on line that was earlier mothballed simply because they did not need the oil."

Frankly, only time will tell, but I have tried to turn the news around and look from every angle I can come up with, and to see development of a potential 1.2 mbd barrels a day light sweet oil field that can potentially deliver for years into the future, an onshore field at that, and to do this into the face of $70 dollar a barrell oil prices strikes me as ANYTHING but an act of desperation, and to see it as such would make me concerned that I was desperate to see Saudi desperation in any news story, no matter what it said.

But, to repeat an important point, I do not for one moment dismiss the possibility that the whole Khurais field is simply a myth, and can produce virtually nothing. Such is the ABSOLUTE BLINDNESS we operate in when we do not have third party confirmation and outside auditing in the most crucial industry in the world. Sheer blindness and guesswork.

Roger Conner known to you as ThatsItImout

The Elephant of All Elephants (Ghawar)

That's a little disturbing, don't you think? Only reduced to 30%?Understanding water contact.

Glenn Morton talks about Ghawar.

Greg Croft talks about Ghawar

Question: what about fracturing induced by water injection in these fields?

Can anyone supply pressures required and energy required?

I know the maintainence on high pressure water pumps on water jet cutters is often and expensive.

And the Saudi's are injecting sea water - ie corrosive. The filtration system for the water before entering the pumps must be pretty big and expensive to maintain too. Even a single grain of sand in a high pressure pump is asking for disaster.

At least the mechanics that work on those things must be pretty certain of having a long term job <BG>.

The fluid column in a production well is a lot lighter (oil, entrained gas etc.) than in a water injector (100% water), so producer wellhead pressure will be higher by the corresponding amount. In some fields, the water injectors take water on vacuum, i.e. zero wellhead pressure - it's just the gravity head (over a mile or two of depth) powering the injection process.

But let's say 3000 psi injection pressure as an example. So for a million barrels a day at 3000 psi WHP you're talking about 42 megawatts of prime mover output - say a couple of big gas turbines - and at 30% thermal efficiency they would burn about 3 litres per second of gasoil, say 1600 barrels per day.

http://www.defra.gov.uk/environment/ccl/pdf/na(00)59.pdf#search=%22calorific%20value%22

So at a watercut of 30% (Ghawar) and an FVF of 1.5, you get about 300 barrels of oil for every barrel of fuel you burn to inject water. Sounds like a pretty good deal to me. And in practice you power your water injection pumps and gas compressors with produced gas, which in dollar (not energy) terms costs a lot less than refined liquid fuel.

One thing that always bothers me on production of wells with a water cut that is exemplified by the graphic of 'Ain Dar/Shedgum Area in your post.

The green production in B/d looks like a plateau around 2 million b/d. I think that is a very misleading way to represent oil extration. Pre 1975 all the green is oil or gas production. Currently the green level looks the same but 40% of the volume is water.

Or am I misinterpreting the graph? Is the volume of oil being kept constant by extracting a much larger volume of total liquids, of which 40% is water?

You see how easy it is to misinterpret what is being produced with that type of graph. I think it would be much clearer if the oil rate (in B/d) was shown to be decreasing as the water amount was shown to be increasing. With total liquids extracted remaining the same. Have a line for total liquids extraced like the pressure line.

I just heard something that sounded very strange on CNBC. Oil closed up $1.31 at $72.45 for the September contract which expires tomorrow. But the reason the NYMEX correspondent said was Iraq which will continue to enrich uranium, and news from BP that its Texas City Refinery will not meet its expected import quota.

Now what the hell does that mean? Anyone? Anyone? Bhuler? Anyone? At any rate I thinks this BP news came in about five minutes before the close. Because that's when the price of oil suddenly jumped by about sixty cents.

Now we've really got problems!!

-- warmer homes and offices in summer (won't kill anyone but the shirt won't be as crisp)

-- colder homes and offices in winter (keep the jacket on indoors)

-- much smaller and lighter vehicles (go from 20 mpg avg 60 mpg average)

-- less waste in retailing (e.g. a grocery store buys tomatoes at 0.20 c/lb, retails for $2.50 per pound but usually a large amount is wasted so they are not really making that much money)

-- As I look at our society I realize that a lot of resources that we use are discretionary, rather than essential. Discretionary items can always be cut.

-- There will be economic dislocations for workers caught in the wrong profession, but that happens here all the time. Ultimately I feel that the United States will bear the advent of Peak Oil relatively well.

If you avoid dry-cleaners and make wearing cotton polo shirts in the summer a habit, you don't even have to think about the crisp-ness factor. Most of humanity understood this concept thousands of years ago. Then again, they had the advantage of not having air-conditioning. We appreciate your optimism. Stick around.

If one is a believer in Malthusian theory then in a perverse way profligacy in resource use is good in the long run since it should result in a lower peak world population than would otherwise have been - implying less collective human misery on the inevitable decline from the peak :-)