Linearize this...

Posted by Stuart Staniford on July 7, 2006 - 4:15am

It shows a Hubbert linearization of oil production for the entire Middle East. The total URR from this plot is 828Gb, and the implied data of peak to make cumulative production to date match up is in 2017. A number of people suggested that this is inconsistent with the idea that the world is at plateau production now (though as we'll see, that's not actually true).

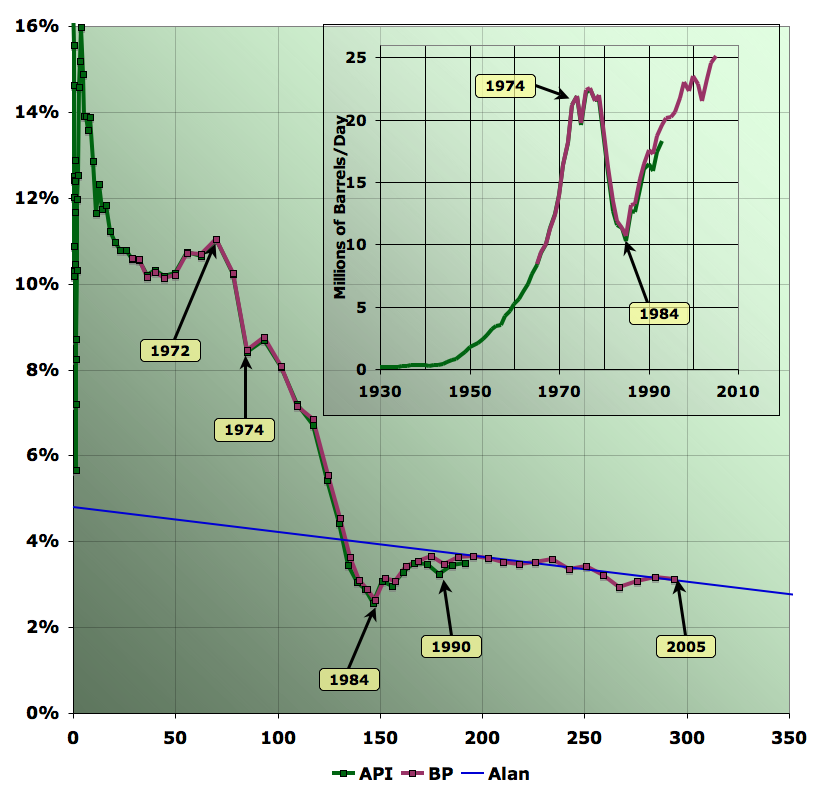

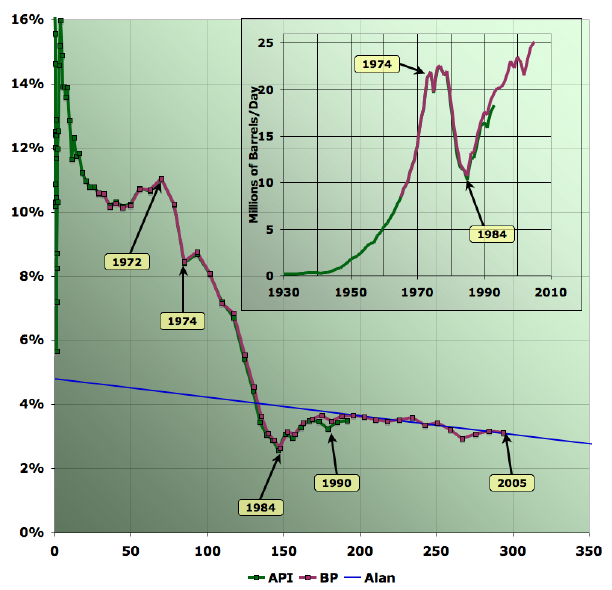

Anyway, let's take a closer look. Here I've reproduced Alan's linearization, but have focussed in on the area where most of the data is, and labeled various years that represent particular features of the graph. Also, I've inset the production versus time graph for comparison.

As you can see, especially in the inset, the history is marred by massive shut-ins for various reasons (wars, revolutions, and OPEC's role as a monopolist maintainer of prices). It seems to me that this makes extrapolating this series a little problematic and I have less faith in linearization in the Middle East than elsewhere (recall the poor stability of the Kuwait linearization, for example, which I subjectively estimated might need an error bar of a factor of 2 on the URR).

For another view of the situation, here's the linearization with the vertical scale blown up some more, and with a kind of "stacked" linearization. I've plotted what each country's production adds to the y axis (P/Q recall - but all of them are divided by the same total Q for the entire Middle East). I've also marked some historical incidents that affected oil production so you can see how they play out.

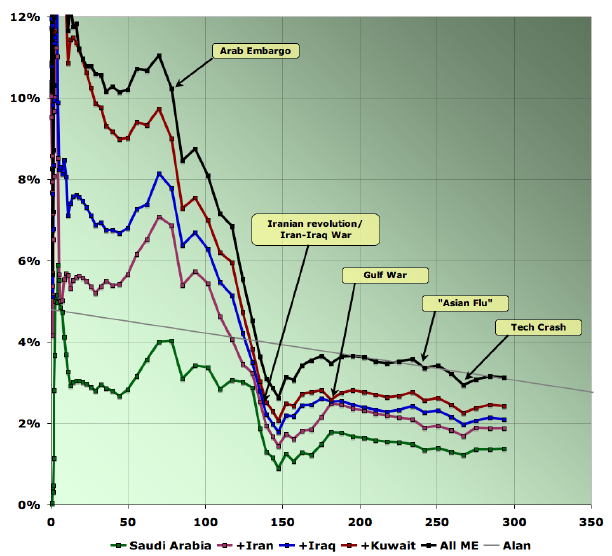

Finally, here's what two Hubbert peaks would look like in production versus time:

The blue curve is Alan's 828 Gb, K=4.8% line peaking in 2017. As you can see, it fits the recent history (from about 1992 on) fairly well, but does a terrible job earlier. The gray line is an eyeball fit to the front of the curve. It has K=12% and URR of 500 Gb. The idea is maybe if production had continued unconstrained by oil shocks and price increases, it would have followed that path (peaking in 1988 and we'd be well on the downside by now). Presumably if that is what would have happened in an alternative universe with enthusiastically free-market Middle Eastern governments, then in this world we'd get to go for a little longer based on not having used the area between the gray curve and the actual data. We'd have about 200 Gb of Middle Eastern oil left.

What should we believe? I don't have a clue, to be honest. If I had to speculate, I'd guess somewhere in between.

One last thing worth noting: Alan's curve only rises by a couple of million barrels per day between now and its peak in 2017. It takes until 2009 to get another 1mbpd over 2005. So if non-OPEC production was peaking now, even in Alan's scenario, we might well be at the global plateau already (that is if non-OPEC production declines at least 1mbpd by 2009, and at least a couple of mbpd by 2017).

It shifts production under the curve to the left a bit, and distorts the curve, but when one aggregates all of the fields together the effect may be lost in the noise. Or it may shift peak from Qt = 50% to Qt = 51%.

The reason is that for any specific year near the middle, some younger fields will produce more due to this effect and some older fields will produce less.

If the ME fields diverge from a Hubbert linearization, it is more likely to be because the bulk of production comes from such a small number of fields.

I still think that the whole data set may be distorted by the fact that production over the past 50 odd years has not captured the whole resource base but is heavily biased towards the biggest fields.

Frantic developement of a vast number of smaller fields now (some discovered some not) may lead to yet a third peak in ME production on the down curve.

Cry Wolf, to quote you...

"I still think that the whole data set may be distorted by the fact that production over the past 50 odd years has not captured the whole resource base but is heavily biased towards the biggest fields."

I think that's a pretty darn good read, and then of course we have to confront the "all liquids" issue again (for what, the 400th time this year?! :-), because NGL, GTL and the "dash to gas" are sure to accelerate as light crude oil gets harder to find, to get, and to afford. This must also be combined with the various logistical issues (my old distinction about "geological peak vs. logistical peak."

The problem is, we still have a problem. I am amazed at how groups like CERA and other "bright and sunny types" can use the facts above, which indicate, even if not immediate peak, an obvious sense of chasing the treadmill on the part of oil and "liquids" fuel producers, as somehow an indication that "all's well". This is not a comfortable situation no matter how you can piece together a "Rube Goldberg" technical/logistical house of cards to keep "official peak" at bay for one more, two more, three more, whatever (?), years. IF let us say, peak is in 2017 and not yesterday, ALL IS STILL NOT WELL. Given where the oil comes from in the international community, and the CO2 issues, all is MOST CERTAINLY NOT WELL.

As a nation and a world economy, it has the feel of slipping down an icy slope to the edge of a cliff....one inch, one foot....and then you don't slide for an hour or two and call it victory, even though there you are still on the edge of the icy slope....then, one inch, one foot more.....but you rejoice, your still several feet from the edge! How long do we want to go on that way without turning our heads about, and looking for a way off the slope, or at least, a way back up it?

One last concern: in this seemingly eternal "death by a thousand cuts" inch by inch slide, there will be price and supply crisis, followed by relief, followed by deeper and more varied crisis. After awhile, in one of the "relief" periods, and in sheer weariness of hearing that the "end is nigh", people will just wander off the topic, and the hope of gaining real momentum on energy conservation/efficiency/alternatives begins to wane....until it is too late.

Despite prejections by some "doom" peakers saying that TWSWHTF (the whatcha' stuff would hit the fan) by the first third or half of this year, and we would already be well in the full meltdown....it may be tomorrow, but wasn't yesterday....and we just crossed out of the sixth month.

I am more and more opposed to predicting a date for peak oil, which I have stated before is a very vague term, and would be all but impossible to prove until years or decades after it occured. It becomes an argument about how many angels can dance on the head of a pin, and pulls us aways from real, big scale change, which is what we really need, peak yesterday, or peak 20 years from now.

Roger Conner known to you as ThatsItImout

As I understand it, that's the kind of the point of Hubbert linearization. The biggest fields are found first, and when you've found the biggest, you can project the rest.

Very interesting analysis, thank you.

Now linearize this.....

Imagine about early '70s as M. King Hubbert's original '56 thesis was becoming confirmed for the first time and some really astute observers decided to use King's ideas to graph the burn rate and Hubbert curve for the MiddleEast. They would be looking at your grey bell curve with the peak in 1988 and probably deciding, "Hell no, not on my watch!"

Kinda of boggles one's political mind--does it not?

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Perhaps another round of speculation is called for...? ;-)

Thxs for responding. I am grateful for this potential 20 year shift of the ME production profile peak from 1988 to 2006? 2008? 2010? by whomever, but it saddens one to think of those that have paid with their lives. The turmoil, conflict, and wars as historically highlighted arrows in Stuart's graph clearly indicate that millions in the MiddleEast were sacrificed towards this peakshift program extending through to the present Iraqi War. But billions & billions of barrels of crude can do strange things.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

P/Q ? Mind your P's and Q's...

Reading the Oil Drum generally makes me feel smart (ahead of the curve?)

Today I feel dumb.

The X axis is Q (not time as I first thought) and the y-axis is P/Q, or in other words, the percentage that the Production rate is of the Cumulative Production.

Take an example:

By the end of the first year of production from your oil well, you are producing at a rate of 1 million barrels a year and have cumulatively produced half a million barrels (you started with no production at the beginning of the year). Thus, Q=0.5 and P=1, so P/Q=2 (or 200%), and a point at (0.5, 2) is plotted to mark the end of the first year.

By the end of the second year, you are producing at a rate of 1.5 million barrels a year and have produced a cumulative total of (say) 1.7 million barrels. Thus, the P/Q value would be about 0.88 or 88%, and another point at (1.7, 0.88) is plotted.

This carries on and each point defined as (Q, P/Q) is plotted for each year.

It has been found that if production follows the usual Hubbert curve, then the Hubbert Linearisation graph tends to become linear after a certain period of production, and the linear extrapolation projects down to the x-axis to give the URR.

Of course, if the production curve does not fit a Hubbert curve exactly, then the linearisation also doesn't work very well either (as can be seen from Stuart's graphs above)

I've played around with fictional production curves and their linearisations and I've found that you can make graphs that look like the field has a higher URR. For example if the production keeps ramping up and up and then suddenly collapses, then the linearisation essentially 'drops off'.

I believe a lot of the current production is like that, and even areas like the North Sea will decline faster than the linearisation currently predicts.

In any case, that's an excellent nutshell.

You seem to understand the calculus. Now, can you give it a try and explain the physical meaning of the equation in the context of oil depletion? So far no one has been able to do this without punting on the question and then relying on the heuristics of the fit as a rationale.

For all intents and purposes, the consensus here on TOD seems to be that we are at the cusp of an age of discontinuity.

Thus I question the relevance of calculous, which was, after all, first invented by Newton to help describe and understand gravity and the motion of the planets.

Solar system astronomy is an atrocious model for trying to figure out petroleum geology, IMO.

Then we have stochastic calculus and strochastic differential equations which applies basically the same formulations to solve problems in probabalistic terms. In simple terms this approach applies basic laws to aggregated sets of particles using mean values for rate determining factors. I don't think anyone studying the oil depletion problem seriously is trying to apply deterministic calculus to generate a solution.

And I think that is a huge problem in our greater understanding. For one, I think we have a much better chance of creating simple formulations for oil depletion (and NG depletion, etc) than we do for other econometrics areas of study, which apply some of the same stochastic principles.

However, if the proverbial "we" do give up, I will keep plugging away on this problem because it is certainly an interesting hobby and I have a tin-foil-free niche market to toil away in.

Anyway, the Hubble formula says when production begins, it grows exponentially (compound interest): growth is proportional to the amount produced. I could make up a story about why that might be true, but it would just be a story. Of course, this part doesn't fit the very early data, which show oscillations before P/Q settles down.

The model also says that the production rate is proportional to the amount remaining (URR-Q). Makes sense, I guess, when you're nearly out of unproduced oil. That's the whole model: rate= aQ(*URR-Q)

It's a very simple pair of assumptions, and it's surprising to me that it fits so well so many situations. (The Fermi function of describing the energy of electrons in metals at finite temperatures is a form of this function.) I hope this helps.

Just eye-balling the production curves - the area under the grey curve looks to be a lot less than the area under the blue curve.

It seems that finding the URR by the HL method is unlikely to work for the Middle East at this stage. So I wondered if there is a formula to deduce the area under the curves from the parameters you have drawn and so give estimates for the URR? Maybe this would give us the upper and lower estimates of the URR for this region.

Thanks for your great work!

So a substatial difference.

A key point is that the ME has the best remaining oil reserves in the world, and it looks like all of the key countries are showing strong HL behavior. Iraq probably has the best remaining exploratory potential, and oddly enough that is where we have 135,000 troops stationed.

Note that the two largest producing oil fields in the region, Ghawar and Burgan, are both almost certainly declining.

An interesting exercise would be to try to model the Yibal Field in Oman, which was redeveloped--like Ghawar--using horizontal wells, and which had a severe, and unexpected, production crash when the water hit the horizontal wells.

But my key point is that the world is at the 50% of Qt mark, and world crude + condensate production is down 1% since December. Based on these HL plots and based on the fact that the two largest oil fields--accounting for about one-fourth of total production--are almost certainly declining, I don't expect the Middle East to do much to reverse the decline.

Another factor: in the past couple of years, oil consumption in the Arab countries in the ME has been going up at the rate of close to 6% per year. And many countries in the ME have huge populations of young people.

For example, using HL on the only OPEC member that is clearly beyond peak, Indonesia, shows that it went into decline when it was close to 50% of URR. Unfortunately the only data that fits the linearization well is from after it went into decline. If you try to force a fit of the data shortly before peak ( the 80's ) it looks like it was beyond 70% of URR when production peaked.

For models, my personal "rule" is that a region should have been producing about 2 mbpd for about 20 years.

Khebab and/or I have several HL themed articles on the Energy Bulletin: http://www.energybulletin.net/news.php?author=jeffrey+brown&keywords=&cat=0&action=searc h

At my request, Khebab took only the Lower 48 production through 1970, and used it to predict future Lower 48 production. Actual post-1970 cumulative production was 99% of what the HL method predicted that it would be. IMO, the world is now where the Lower 48 was at in 1970.

In short, Hubbert Linearization is likely to be better than astrology, but needs to be applied with great caution and only as one part of an overall evaluation of the situation. You can't just linearize and treat the answers as gospel.

Light Crude Oil - High - 75.78

http://futures.fxstreet.com/Futures/quotes/futuresource/quotes.asp?iFSQgroup=energy&iFSQtitle=En ergy Futures&iFSQfields=desc,month,last,netchg,open,high,low,exchg,time

I predict that we will see the following pattern over and over again (sort of like my posts on net export capacity):

(1) Net exports drop;

(2) Oil prices go up, and the remaining net export capacity is allocated to the high bidders and the low bidders do without (generally developing countries at this point);

(3) We have a period of stability, and then the cycle starts all over again.

I think that we had one complete cycle earlier this year, and I think that we are at the start of another cycle right now. We will proceed through progressive cycles of demand destruction. The irony of Americans complaining about high gasoline prices is that high prices are the only thing keeping the gas stations supplied.

UPDATE 4-Oil hits record $75.78 on strong demand

http://futures.fxstreet.com/Futures/news/afx/singleNew.asp?menu=economicnews&pv_noticia=MTFH7182 5_2006-07-07_12-55-10_SP136390

Basically, they are saying it's due to higher demand in the US and supply worries.

This pretty much fits what we discuss here at TOD.

Here's what the MSM are saying about it.

Excellent analysis. I still remain skeptical of the predictive value of these linearization plots. It appears from your eyeball curve fit that an HL prediction would fail using pre-1974 data. What if it were 1984, and we used the 1972-1984 data for our fit?

What convincing evidence is there that the past 15 years are predictive of the future, whereas all of the years prior that are not?

For example, do we need to account for the effect of Iraqi production shut in by the Gulf Wars?

You say this deep in some comments and it doesn't raise any eyebrows. When I say essentially the same thing regarding why the logistic curve should theoretically map to any oil depletion model at all, I just about get my head taken off.

It might come down to the way I say it. At work, my boss describes me as edgy. I have set off fireworks by simply calling someone's work "ornate". Some would call it a skill.

ciao

The temporal dynamics are what I am interested in, and neither the gaussian or logistics curve effectively address this shortcoming, i.e. how does everthing kick in.

The quadratic growth is a "gold-rush" behavior often observed. The 4th-order gamma is determined by the fallow/construction/maturity/extraction behavior that gives a lag between discoveries and full scale production.

So it's one parameter with supporting data, but like I said, I am not into some simple empirical formula that would give me a solution without any physical understanding.

In contrast, if you look at how a Gaussian could be generated off a rate equation, it means solving the following partial differential equation:

dP/P = K(T1 - t)

where P is production, t is time, T1 is the peak time, and K is the width of the Gaussian. I suppose I can read that as exponentially growing production with the throttle linearly pulled back through to where it switches sign at the peak. However, the T1 number looks suspiciously preordained as opposed to coming out of some intuitive process.

On the other hand, I could look at the gaussian from the law of large numbers approach, which would mean for me to give up and punt, while waving my hands wildly.

However, IMO, the HL plots are more likely to be too optimistic.

Let me illustrate this with an example of a fictional oil producing country called "Sudia".

In this example, Sudia is blessed with a fair amount of oil in a small number of super giant and giant, shallow oil fields. The initial estimates of these fields predicts a URR of about 170Gb.

Here is the complete graph of the 30 year history of Sudia Oil Production:

Here's what happened:

Initially, production was ramped up fairly quickly due to the shallow wells and initial high pressure in the fields.

By year 8 production has reached almost 6Gb/yr, but pressures are dropping and by year 10 production appears to be plateauing.

At this point the Sudians discover water injecion and the pressure in the fields is maintained. Production from smaller fields is added in the following years allowing production to grow to over 11Gb/yr in year 22.

All this time the oil columns in their super giant fields are getting smaller and smaller, but by managing the water injection carefully, the Sudians keep the production at what appear to be indestructible levels.

But in the 22nd year of production (when they are at their Peak), disaster strikes as most of the largest Sudian fields completely water out as their oil columns disappear.

Sudian oil production then collapses as only the very small fields are left, and by year 30 it's all over.

Now the HL plot of this entire production would look like this:

But let's assume we are only looking at the graph up to their peak in the 22nd year (Q=140Gb). The line I added to the graph would appear to fit the HL plot up to that point, and seems to predict a URR of 400Gb (which the Sudians themselves believe and publicly announce that their reserves have actually 'grown' to this new figure).

However, the sudden collapse of these fields means that the actual URR ends up being only 180Gb.

The trouble I have is that most of the 'mature' HL plots (ones that plot fields that have gone to completion) are based on production that has had only very late help from advanced EOR techniques. I believe that these techniques produce non-symmetrical production curves with sudden collapses. This is essentially what Matt Simmons in predicting.

If the bulk of the world oil supply is coming from fields that will exhibit this behaviour, then the world HL plot could be misleading us into thinking that we've still got a fair amount of oil to extract.

Anyway, I'd be interested in peoples thoughts on this. I'm going to bed now (3am), so I'll check back tomorrow.

The HL result can be biased if the production curve is asymmetric. In the case of your virtual country, peak production is at 140/200= 70% of the URR. The HL works well when the production is symmetric (peak at 50% of the URR) which means that the growth and decline rates before and after the peak are similar (in your case you have K= 14% and K around 50% before and after peak respectively).

That's a possibility, Cantarell is maybe a good example. In that case, you need to go down the Parabolic Fractal ladder and develop a lot of smaller fields to soften the blow from the big fields' decline.The question that is really bugging me is this: How much of the daily global supply of oil comes from fields that could behave like Yibal? If there is a significant proportion of the major fields that have had extensibe EOR techniques applied to them to maintain their production?

I guess we would need to expand our 'top 20' field list to include details of what EOR methods have been used on the fields and for how long.

Unfortunately, I wouldn't even know where to start looking for such data.

Still, I'm glad if my post has provoked some thought.

I did some quick Google searches but I have been unable to locate annual production data about Yibal. Does anyone else have such data or know where we can get it?

From Matt Simmons:

Retired Aramco Executive's best case for Ghawar: 70 Gb--now at 86% of URR

World best case history for similar reservoirs: 77 Gb--now at 78% of URR

Anyone have a production graph for Ghawar?

Note that the Saudis are raising oil prices for light, sweet--which is what Ghawar produces.

Trouble in the World's Largest Oil Field-Ghawar

Copyright 2004 G.R. Morton This can be freely distributed so long as no changes are made and no charges are made.

http://home.entouch.net/dmd/ghawar.htm

Excerpt:

One of the things to keep in mind as you look at the model below is that the original oil column was 1300 feet thick. Today, the green layer is less than 150 feet thick. One must draw the necessary conclusions that most of the oil has been removed from Ghawar.

You can see for yourself, that the area occupied by oil is not very large compared with where the initial injectors were placed. One friend, a reservoir engineer, to whom I showed this picture said "It's over! Kiss your life-style goodbye!"

It's exactly like my Sudia fictional country. Half their production comes from this one field which has been very carefully managed to keep the oil flowing, but the oil column is down to 1/10th of the original size.

As that engineer said (in 2004!) "It's over! Kiss your life-style goodbye!"

And yeah, Khebab... that graph is a gigantic "OH CRAP!" moment, isn't it?

See also my reply to Khebab above.

You have a copy of that 'top 20' field list, don't you?

How can we expand that list with information about how aggressively EOR techniques have been used on these fields.

Thanks also for the heads up about the cross-posting to PeakOil.com. I'll keep watching the comments there, too.

Your main point as I see it, that EOR may change the linearization analysis, is well taken. Cantarell (nitrogen injection) would appear to be the best test case. But we're basically all waiting around to see what happens. IMHO, we will know within a few years. Until then, we'll just have to wait it out.

Throw in a few oil shocks just for realism and now you're talking.

best, Dave

It is difficult to deduce where this remaining "60%" could be hiding.

Thanks for the posting.

As an aside, even if SA has multitudes of smaller fields that could be developed, they won't have the hundreds of rigs/crews necessary to exploit them any time soon. Going from 4000b/d/well to 2000b/d not so bad, just double the number of rigs from 50 to 100, but dropping down to 100b/d means a lot more holes if you want to maintain production. In the US, 10b/d is no longer considered a 'dry' hole, but a useful investment; four of these produce $1mm/year.

Stuart, I really hope that this is true.

As I said above in response to Khebab, it would be nice to know how many of the top 20 or top 50 fields have had aggressive EOR activities, and for how long. Since Canterell was the last super giant found and it starting to decline after EOR has already been used, then what chance do the other major fields have that were discovered before it?

Is there a way we can quantify how many of these big fields could fit this collapse profile?

The essential problem is NOT with the models. The root of the problem is lack of data, and there is no mathematics than can elegantly get around this problem.

IMO the least bad way is to use the techniques propounded by L.J. Savage (and others) more than fifty years ago to use subjective probability.

GIGO.

Peak oil in the near future and the middle east peak more than a deacade away is the last thing I would want to see. 25 years from now most of the world would be far beyond peak while the miile east would still be producing at near 90% of its peak. If alternative energy sources were not developed quickly we could end up with the middle east countries, or whoever was able to occupy and control them, essentially owning the world.

- Shut-ins disrupt the typical HL so there is likely more oil the ground than would otherwise be predicted.

- Dependence on a few large fields and advanced recovery techniques argue that we have gotten more of it out than HL would otherwise predict.

What are the arguments for why one factor is more important than the other?Big fields have been developped first in the middle east for obvious economic reasons. The first production peak in 1975 is probably 90% based on a small group of 15-20 giant and super-giant fields that constitutes 50% of the total URR. In 1984, there is a cumulative production at 150Gb. Assuming that the reserves are 387 Gb (ASPO) which gives an URR at 700 Gb for the Middle East. Following Norway example, half of the 700 Gb is coming from the big fields (i.e. 350 Gb).

That could mean that the big fields may have reached 150/350= 43% of their URR already in 1984!

I've been hoping you might explore this issue ever since I posted that link to Drollas's analysis here where he also compares two production peaks as you have done.

Thxs for this link to Drollas's analysis. I found it to be a fascinating alternative discussion to much of what Stuart and others have posted. As to it's validity regarding his Hubbert Curves and where he thinks we currently are on his Peakoil path-- I think he may be too optimistic, but I am no expert. Hopefully Stuart & other TOD data freaks will analyze this more.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?