Questions About the World's Biggest Natural Gas Field

Posted by Dave Cohen on June 9, 2006 - 6:41pm

Update [2006-6-11 15:33:22 by Dave]: The SCI report I used for this story is now available there. Simmons Oil Monthly - Qatar (large pdf warning).

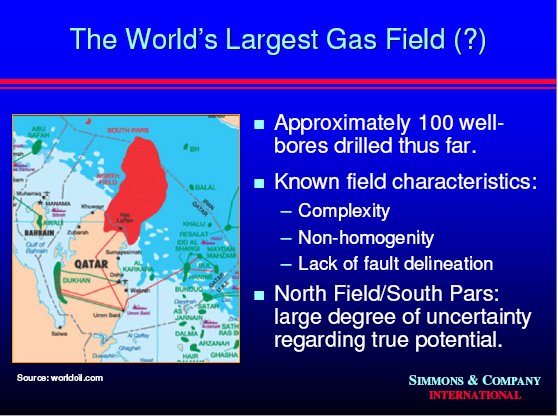

Without much fanfare, Qatar announced a moratorium on new development of the natural gas North Field basin, a decision that had actually been taken in 2005. At the same time, in a recent presentation by Matt Simmons entitled Tight Oil Supplies, we run into this intriguing slide (#44, big pdf warning).

The North Field/South Pars Natural Gas Complex

Figure 1 -- Click to Enlarge

This report will go into considerable detail about the future role of the North Field/South Pars natural gas field, it's size and importance, the reasons for the moratorium and finally important questions about both the geology and proven reserves of the field. As Simmons notes in his slide, there is a "large degree of uncertainty regarding [the] true potential [of this field]". The topic is important regarding the uncommon phrase "peak natural gas" on a global scale. As we know, natural gas production has already peaked in North America.

The Size and Role of North Field

Not only is North Field, which lies in Qatar and it's eastern extention, South Pars, which lies in Iran, the biggest natural gas field in the world, it also contains a lot of non-associated natural gas. From the EIA's excellent article Natural Gas Processing: The Crucial Link Between Natural Gas Production and Its Transportation to Market, we learn that

Natural gas processing begins at the wellhead. The composition of the raw natural gas extracted from producing wells depends on the type, depth, and location of the underground deposit and the geology of the area. Oil and natural gas are often found together in the same reservoir. The natural gas produced from oil wells is generally classified as “associated-dissolved,” meaning that the natural gas is associated with or dissolved in crude oil. Natural gas production absent any association with crude oil is classified as“non-associated.” In 2004, 75 percent of U.S. wellhead production of natural gas was non-associated.And as we learn from this IHS report Middle East Outlook by Stuart Lewis published on March 8th of 2006, that non-associated gas reserves are rare, at least in the Middle East.Most natural gas production contains, to varying degrees, small (two to eight carbons) hydrocarbon molecules in addition to methane. Although they exist in a gaseous state at underground pressures, these molecules will become liquid (condense) at normal atmospheric pressure. Collectively, they are called condensates....

Middle Eastern Gas Fields

Figure 2 -- Click to Enlarge

You can easily discern that North Field outpaces all the other fields in the Middle East as regards to natural gas. Here's what the SCI Qatar report has to say about the size of the field.

The North field is currently assumed to contain approximately 900 tcf of recoverable natural gas reserves, accounting for 14% of the 6,337 tcf of worldwide natural gas reserves according to the BP statistical review of world energy. In addition, Iran’s South Pars field (a geological extension of Qatar’s North field) is estimated to contain 280 tcf of reserves. Taken together, the North field and South Pars are assumed to hold 1,180 tcf of reserves, or roughly 19% of the world total. The North Field covers an area of over 6,000 sq.km, almost half of the surface area of Qatar. Reservoir depth is up to 11,000 feet. Pressure is up to 5,200 psi (350 Barg). The field is a carbonate reservoir with approximate thickness of 1,500 feet (this varies considerably throughout the reservoir).That's a lot of natural gas. Obviously, the importance of any gas field of this size can not be understated. To put this in perspective, Russia holds the largest percentage of proven gas reserves with 25% of the world's total. This single field alone accounts for 19% of global reserves. And what is to become of all this natural gas? Qatar is ramping up to become the largest LNG (liquified natural gas) exporter in the world. Much of this imported gas will be exported to the United States. At this time, Qatar's liquefaction capacity is 3.4/bcfd, 14% of the world's total. However, the current plan is to ramp this production up to 10.3/bcfd by 2011. Qatar's intention is to achieve 100 years of production. The SCI report states that "This would not seem to be much of a challenge on current reserve assumptions and production rates. However, the 320% increase in production capacity planned over the next five to six years will bring Qatar’s expected production to 25 bcfed [billion cubic feet equivalent per day] and the North field’s reserve life to 97 years (slightly below the minister's target of 100 years). This leaves little room for error if what is believed to be the world's largest gas field turns out to be anything under 900 tcf". This brings us to the moratorium.

So Why the Moratorium?

Citing the link at the top,Qatar has put a moratorium on future projects utilizing natural gas from the massive North Field and the freeze is to apparently give Qatar Petroleum (QP) time to conduct field tests on the reserves.The re-evaluation of the fields should be completed in the 2007/2008 time frame. Another reason for the decision comes from Ahmed Al Klulaifi, the chief operating officer of QatarGas. He notes the fact that there is already a huge effort underway at Ras Laffen to build up Qatar's liquefaction and GTL (gas to liquids) capability. This massive effort leaves little in the way of spare resources and manpower for major operations in untouched parts of the fields. While this explanation seems quite reasonable on the face of it, it would appear that the re-evaluation of the fields is necessary because there are serious questions about the geology of the field and what precisely its proven reserves are. Here's a quote from an interview with Matt Simmons that succinctly summarizes the situation."A decision had been taken sometime ago to freeze any further development in the North Field," Ali Al Hammadi, marketing manager of QP, told the 2nd Middle East liquefied natural gas (LNG) shipping conference here yesterday.

Well, in 2004, if the reports were correct—and I haven’t seen any denials—ExxonMobil booked 94% of its reported proven reserve additions as a result of contracts they signed in Qatar for gas from the North Field. Now, the North Field has basically two producing platforms, Alpha and Bravo. And, while ConocoPhillips last summer was drilling the wells for the Charlie platform, they hit dry holes. What’s more, the quality of the gas is already sufficiently different, between Alpha and Bravo, that it would appear that the geology of the whole North Field is compartmentalized. In any event, the sheer audacity of the idea that you could have only two producing platforms in such a huge area, and know enough to book 30 years of supply is breathtaking. And we are not talking about some tiny wildcatter here. We are talking about the largest, and theoretically the most conservative, of all the oil companies in the world.This is in answer to a question about oil & natural gas field reserves accounting practices. Besides from the question of ExxonMobil's dubious bookkeeping, the pertinent information concerns the geology of North Field/South Pars. This brings us to the geology of the field.

The Geology of North Field/South Pars

Recall from Figure 1 that Simmons characterized the North Field/South Pars geology as complex, non-homogeneous and containing a lack of fault delineation. Before citing some specific details from the Simmons report, I had asked one of TOD's resident petroleum geologists, Jeffrey Brown, aka westexas who has also done some nice work over with Khebab over at Graphoilogy, to explain what these terms meant. Here was his response.An ideal field would be one with a very high porosity and permeability reservoir with great continuity, i.e., a pay zone in a well on one side of the field looks like a pay zone in a well on the other side of the field, and there is one continuous, high porosity and high permeability reservoir. Our ideal field could be developed with a minimum number of wellbores, with low decline rates per well.Apparently, as we see from Jeffrey's description and Simmons' brief remarks quoted above, North Field/South Pars does not seem to be an "ideal" natural gas field. We get more information from the SCI report but not all the details are known.A less than ideal field would be a series of discrete reservoirs, with little or no continuity between the discrete reservoirs. To fully develop our less than ideal field would require far more wells than the ideal field. Also, given the limited volume in each reservoir, the decline rate per well would be fairly high.

In regard to fault delineation I assume that he means that there is no definite fault trap, but I am not sure.

In summary, I assume that he is saying that the play consists of a bunch of small ("small" in Middle Eastern terms) discrete reservoirs, but I am certainly no expert on Iran [or Qatar].

Regarding complexity and non-homogeneity (lack of uniformity in the producing underground formations), SCI's best source of information comes from talks with the IOC's (ExxonMobil, ConocoPhillips) working in the area and some SPE papers.

For instance, the IOCs who have booked reserves for the North field don’t generally provide precise information on the reserves that have been recorded. This leaves our analysis heavily dependent on conversations with various IOC executives. Still, these conversations have been illuminating. For instance, we find no support for the myth that the North field is a single, large, homogenous structure. To the contrary, several industry representatives, including CEOs of two of the five largest IOCs in the world have represented that the field is complex and non-homogenous. Meanwhile, conversations with other industry representatives indicate that new assumptions have emerged about the North field structure over the past two to three years and that those assumptions imply a more complex reservoir than what was previously assumed to be the case. Non-uniformity applies to the different Khuff formations. It is generally assumed that developments to date have favored the highly productive and liquids-rich zone 4 from the Khuff formation. This leaves a higher degree of uncertainty with regard to production capabilities from the shallower three zones.Regarding the "disappointing drilling results", the report confirms Simmons' remark saying "that ConocoPhillips drilled an unexpected dry hole in the North Field and that this event was at least a partial catalyst for a revamped perspective on the North field structure and potential [ie. the moratorium and re-evaluation]". This raises questions about the actual proven reserves.

Meanwhile, in 2005, COP [ConocoPhillips] recorded 1,212 bcf of natural gas reserves and 21 mmboe of NGLs in this business segment, noting that these additions were primarily attributable to Qatar. These amounts equate to 33% of COP’s 2005 organic reserve additions, without which COP would have reported a 67% RRR [Reserves Replacement Ratio] for 2005. A 93% expense rate on exploration costs incurred would imply that the company is basically taking it on faith that these reserves are proven. The obvious unknown offset is what well specific information the Qataris might have provided COP in order to book these reserves. Such information is required by the SEC in order to book reserves as proven. Meanwhile, other IOC operators in Qatar have referred to the North field as one of the least delineated natural gas fields in their portfolio of proven reserves.[editor's note, by Dave] RRR Reserves change during the year, before the deduction of production, divided by production during the year. An annual RRR of 100% indicates full replacement of production by reserve additions for that year. Source.

The SCI report goes on to discuss well productivity for the three main rigs Alpha, Bravo and Charlie but reliable information is hard to pin down. Concluding this section, we find that there are serious questions about the geology and proven reserves of the world's largest natural gas field. Naturally, difficult geology will make for much higher production costs going forward, requires more resources (wells) and slows the rate of production.

A Final Note on Ghawar and Iranian Gas Production

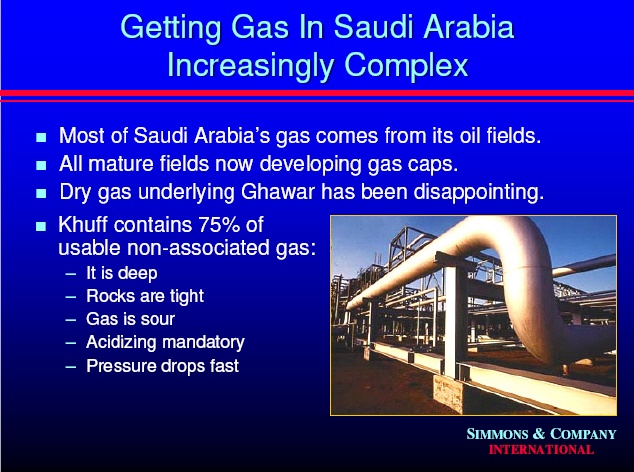

Meanwhile, Simmons is also concerned about natural gas production in Saudi Arabia.

Gas Production in Saudi Arabia

Figure 3 -- Click to Enlarge

And generally, his presentation mentions "peak natural gas" more prominently than I've seen in previous talks based on his analysis of resources in the Middle East.

Finally, as regards South Pars in Iran, the EIA notes in their Persian Gulf Fact Sheet that

Development of South Pars is Iran's largest energy project, already having attracted around $15 billion in investment. Natural gas from South Pars largely is slated to be shipped north via the planned 56-inch, 300-mile, $500 million, IGAT-3 pipeline, as well as planned IGAT-4 and IGAT-5 lines....However, more recent news notes that

GdF [Gaz de France] will invest in the project alongside French oil major Total SA (TOT) and Malaysian oil and gas company Petronas Gas Bhd. (6033.KU), which will be operator on the field once exploration starts, Bayle told reporters during a lunch at the World Gas Conference in Amsterdam.So, it's not clear what the status of development is in South Pars and as usual the Iranians are mum on the subject. Finally, we see these disturbing quotes from the Lewis IHS report presentation cited above: "Iran needs some 1 bcm/d of gas for its own domestic use, which means there is no surplus gas for export gas in the next twenty years" - Kamal Daneshyar, Chair of Energy Commission of Majlis (07/05) and "Gas export is one of the objectives to be pursued within the frame of ‘Iran’s 20-year prospect plan’" - Roknoddin Javadi, MD of National Iranian Gas Export Company (07/05)". So the status of Iran's natural gas exports and the development of the South Pars extenstion to North Field is up in the air as things currently stand.Iran owns the world's second-largest natural gas reserves, thanks to the South Pars field, which is shared with Qatar. But while Qatar is exploiting its part of the field, Iran hasn't yet decided to launch the exploration phase.

"We've been told Iran will make its so-called final investment decision by the end of the year, but this may be delayed," Bayle said.

If you've gotten this far, congratulations. It is just these kinds of issues that the world will confront as we face the inevitable peaking of natural gas. But when that will happen is unknown and hard to predict.

On top of that Louisiana is planning to block new offshore leaeing till we get a %.

Extra tidbits to note on one record cold February morning. Or sweltering hot late August afternoon.

http://edition.cnn.com/2006/BUSINESS/06/05/australia.lng.reut/index.html The thinking is that it might be easier to build a 3000km pipeline to domestic customers on the other side of the country.

EPA want them to build the LNG terminal on the mainland. There is also some interest from politicians in possible encouraging gas-to-liquids down the track and there may ultimately be a pipeline for domestic consumption in the east but this is not likely in the short term. Coal-bed methane in the eastern states is more likely to be developed first, and the price for gas in the eastern states (currently cheap) doesn't offer muchy incentive for a pipeline from WA.

Either way a pipeline from WA seems highly unlikely - I would expect (and hope) that they just put an LNG plant on the mainland and leave Barrow island alone...

However, something has happened in the last 2 weeks with back month NG prices

All winter and spring, when front month 2006 prices were crashing from $15 to under $6 due to incredibly mild winter, the back month stuff stayed very tight on all time highs - it has plummeted in recent weeks while front month has rallied a skootch. This is consistent across months starting in 2007. So there is definitely another side to this story - some big players chose last 2 weeks to have confidence in nat gas being more plentiful in 2008, 2009, 2010 than they previously had.

IMO, North America is one long hot summer or one colder than average winter away from a real gas crisis. The LNG imports will not be ready in time to avert this.

The big issue to me is that natural gas must be, "not too hot, not too cold, but juuust right...."

If the natural gas price is too high, it destroys demand in the U.S. as people will try to "fuel switch" to electricity from cheaper coal even if that means more CO2 release (logic: I don't have to pay the "full price" of global warming, but I sure have to pay the full price, and NOW, to heat my home), and as companies "outsource" to places in the world with cheaper natural gas, and damage employment in the process.

But, if the natural gas price goes too low, the pipelines and LNG projects cannot possibly be done at a profit. This means that, as one other poster said, "one bad winter" could be catastrophic, because the lead time needed to have the gas pipeline and LNG plants up and providing gas is years. By the time we realized we needed the gas, we could not possibly build the infrastrure fast enough (go to TOD UK and look at exactly this situation in Britain) to save the U.S. from a very serious (and in New England/upper midwest states, a possibly deadly) supply problem. The LNG and Alaska gas pipeline are two perfect examples of projects that even thier backers admit must have a "sustainably high" price for natural gas to find investors/backing.

Right now, though, the price is bearish, as back to back to back to back mild winter/summer/winter/summer has led to an astounding amount of spare gas (and propane likewise, the great under utilized fuel is easily stored and in the summer, cheap and in surplus).

The best thing we could do is try to build faciliteis to store even more gas and propane, so that when we have these mild spells, we have somewhere to save the fuel for a rainy day!

Roger Conner known to you as ThatsItImout

OTOH, storing a moderate amount of propane as a liquid in a pressurized tank in a vehicle seems to me as a better way to go than pressurized (but still gaseous) methane. Why is that not done as often? Perhaps because methane has a price advantage over gasoline, while propane does not.

Talking about price, from what I've read, a large part of the propane supply (in the USA) is as a byproduct of the refining of oil, which may explain why its price is unlinked from that of NG, and tracks oil fairly well, despite NG "liquids" being the other source of much propane. As usual, the price is determined by the marginal, most expensive, source.

A larger solar water heating project could supply some hydronic heat to supplement your propane & wood heat. especially on clear days.

Just wondering ...

Will this Qatar (in)action block new long term LNG contracts?

Will it also block liquefaction train builds?

And what about new gas-to-liquid plant?

If so, which importers are likely to lose out?

Without getting into specifics, "Yes". I think they overestimated the size and quality of some of their fields, so they had to slow down development of them.

RR

In contrast, there have been very few "Hey, look at all this oil & gas I have found" reports.

Is this just normal industry or media "noise" ... or will we get a nasty shock in a year or so when several varied sources splutter and lose production?

Are people in the industry quietly gritting their teeth and hoping that it will all be OK at the end of the day?

Here's my 5 cents of contribution, prof. Bakhtiari is forecasting Peak Gas to the 2008-2009 time-frame:

After 'Peak Oil', 'Peak Gas' too

Secondly, one could interpret the RasGas trains (p11)as selling into global spot markets. That would be a big leap for the industry as they usually have contracted buyers to support financing.

Further, by 2011, about 17% of gas+liquids production goes into GTL. I've often thought that GTL was a growing competitor to LNG for resource and this gives me a number. How the market will shape the allocation of gas between LNG and GTL is very difficult to predict. My hunch is that GTL will ultimately have the higher value-added.

Lastly, as the resevoir extent and quality, I remember a quote in "The Prize" - "Nobody knows for sure except Dr. Drill."

From some producers, the US Gulf Coast is closer than most alternatives (Great Lakes, US NorthEast).

I suspect this is sensitive to the used capacity of the pipeline since pipeline gas is consumed to provide pumping power and pumping power required is a power function of flow rate.

For ship travel, boiloff seems the more important factor rather than propulsive power demand but I could be wrong although LNG tankers seem to have a higher design speed than equivalent freighters. Capital carrying costs of the ships is yet another factor.

Guess I'll leave this problem to the experts. Certainly Cheninere has a more hospitable local environment for their LNG terminals than do those developers in Maine and Boston.