Inflationary Collapses, or The NPV of Grandchildren

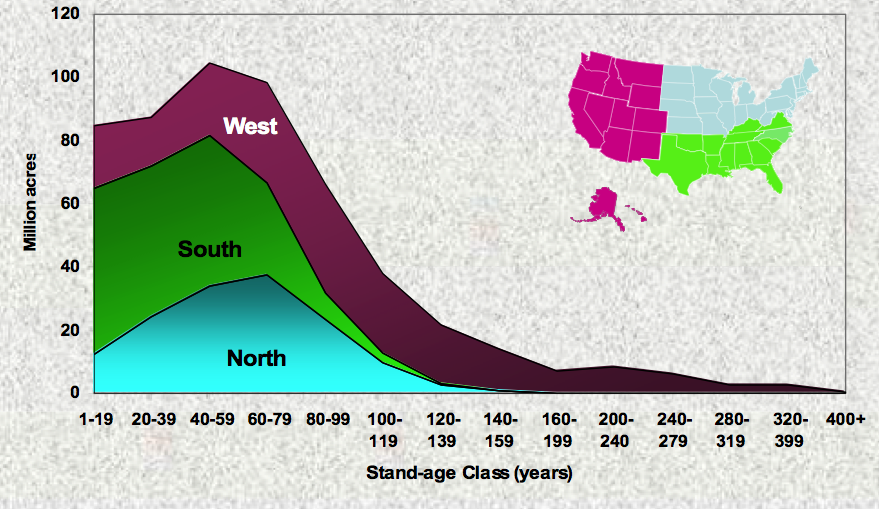

Posted by Stuart Staniford on June 29, 2006 - 3:41am

Your other option is to manage the forest sustainably. You consult a sustainable forestry expert who estimates that you could cut an amount of timber that would net you $kX this year, where k is some number much less than one, and the same amount of timber year after year in perpetuity (which would produce more $$ when adjusted for inflation). Thus k is roughly the fraction of the timber you'd get in one go from the clearcut that you could cut each year on a sustainable basis (the "roughly" comes from correcting for harvesting and management expenses, etc). The expert believes in sustainable forestry and emphasizes to you the benefits for the wildlife (who live in the trees), downstream neighbors (who won't get flooded with rivers choked with your silt), and fish (who can spawn in the unsullied gravels of the streams).

Before acceding to these persuasive arguments, you check with your accountant. What would she recommend?

He or she would probably perform what's called a net present value calculation to determine what was economically rational. The idea is as follows. Somehow we'd like to compare the value of getting a one time payment of $X with an infinite stream of smaller $kX dollar payments from now into the indefinite future. Clearly we'd like to somehow add up the benefits of all the future payments into a single number that we can compare to $X (the sum we'd net if we just clearcut the forest).

It might seem that this sum will be infinite if the forest lasts forever, but it isn't so. Let's take it step by step. Clearly, this year's $kX of sustainable income from the forest is money that is directly comparable to this year's $X of clearcut payment. However, next year's payment seems to be somehow not quite as good, since we won't get it till next year. The trick to comparing is to notice what money we would have to invest now to get $kX next year. If interest rates are currently i%, then it would seem like if we invest $kX/(1+i) now, we would have $kX next year. So the net present value (NPV) of $kX next year is $kX/(1+i) (which is smaller than $kX).

Which interest rate should we use? Well, a sensible thing (since we are overall making a long term comparision) is to use a safe investment like a long US treasury bond. Right now, the nominal yield on those is about 5.25%. However, it's a little tricky because next year we'll have the same amount of wood, not dollars. And the wood will be worth more in dollars because of inflation. We can correct for this, however, by using real interest rates (minus inflation), rather than nominal ones. The treasury also issues 30 year inflation indexed bonds. The yield on those is a decent estimate of what the market thinks inflation-adjusted yields will be over the long haul. That number is about 2.5% presently.

You might think you should compare against something with a higher yield than treasury bonds, but assuming all those hedge fund managers, investment banks, and credit rating agencies have done their homework right on setting bond price/yields in the bond market, any bond that yields more should mainly be doing so because it's riskier and the extra yield should exactly take into account the extra risk. So let's stick with treasury bond yields. Then i, the interest rate, is presently 2.5%. (And let's assume that the $kX is net of insuring the forest so we don't have to worry about the risk in our future income stream from fire etc - in reality companies use higher internal discount rates to account for the various risks/uncertainties that plague projects).

You might also think that perhaps wood will get more valuable in future, more so than the general rise in prices embodied in the inflation rate. But let's assume for simplicity now that the real price of wood is anticipated to stay fixed (eg by the lumber futures market). (Uncertainty in future wood prices would tend to make us choose a higher interest rate to compensate for the risk). We'll take up price changes in a later thought experiment.

So then we can just proceed out to further years. So far, the value of the income stream is $kX (for this year), plus $kX/(1+i) for next year. For the year after that, the amount of money we would need to have to get $kX in two years (in current dollars) is $kX/(1+i)^2 (because that amount would get multiplied in a compounded manner by (1+i) on two years to give the $kX payment). Clearly, we can keep doing this for all the years.

I'll spare you the algebraic detail, but if you work out the series it sums up that the net present value of the future income stream is $X x k(1+i)/i.

So the condition that the net present value of the sustainably managed forest would be higher than profit from clearcutting it is that k > i/(1+i). Now, remembering that the proper i right now is 2.5%, we see that the equation is equivalent to k > 1/41. In other words, if we have more than 41 years worth of forest growth on the land, then we are definitely financially better off clearcutting the forest than managing it sustainably forever.

I note that in translating profit ratios to forest age directly, we are making a crude approximation. In reality, it's worse than this because the economies of scale in doing the harvesting and managing will be greater if we clearcut, and not only that, but it's likely there will be some regrowth after the clearcut and young trees create wood faster than mature trees. Thus where trees take a long time to regrow, you can see why there's a financial advantage to clearcutting as fast as the regulators will allow. And that's why lumber companies often do it: they have a fiduciary duty to provide their shareholders with the maximum possible return on shareholder capital, and clearcutting frequently provides it.

If it seems like this net present value calculation is some kind of complex technical accounting rule that ought to be changed for the benefit of forests, I'd like to try to disabuse you of that idea. As far I can see, any economic system in which:

- natural ecosystems like forests are private property and can be traded for money

- people are allowed and encouraged to maximize their own self interest

- interest is paid on loans

We've been running our civilization on those three rules for many centuries now, so the NPV logic is very deeply embedded in the whole way Western culture works. To change it would be a massive cultural wrench.

An important point is that the actual current price of lumber should make no difference to our decision criterion. Unless we can predict changes in prices in the future, the economics of our decision should mainly be sensitive to interest rates.

Now, in this condition of whether sustainable management of the forest makes economic sense or not, recall k > i/(1+i), the variable k is more-or-less a property of the forest - the speed with which it grows (modulo some correction for the cost of managing it). However, the interest rate i is a property of the economy, and indeed is somewhat under the control of the central bank (the Federal Reserve in the US). (I say somewhat because the Fed targets short-term rates and long-term rates don't move exactly with short-term rates, though mostly so). Because of it's importance to these kinds of NPV calculations, interest rates basically set how much society cares about the future. Specifically, let's first look at some history of real interest rates to get a feeling for the range they vary in:

Note that the best estimate of long-term real interest rates is the yield of the inflation-adjusted treasury (the blue line). However, this series only goes back to 2003, so I've also included an estimate of real rates constructed by subtracting the consumer price index change over the prior 12 months from the nominal rate on regular 10 year treasury bonds. That line (green) goes back to 1955, but should only be viewed as a rough approximation of anticipated real interest rates (since long term expectations of future inflation could vary somewhat from the value the CPI happened to take over the last 12 months). In particular, it's probably never been the case that long term expectations of real interest rates were negative.

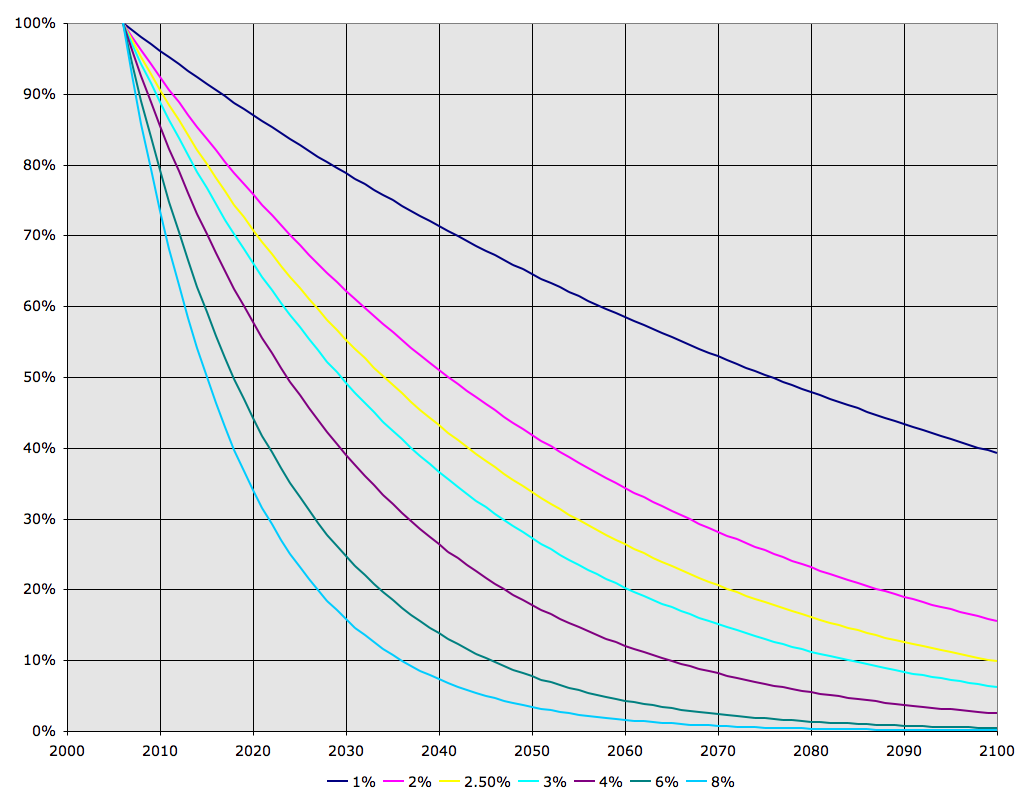

Anyway, the graph gives us the sense that real rates vary from 0%-8% or so over the course of recent history. Let's have a look at the shape of the net value function for the rest of the century as a function of those interest rates. Ie what I'm about to plot is how much the cashflow from the forest (or anything else) would contribute to NPV in year Y relative to how much it contributes in 2006.

In general, as you can see, the degree to which future cash flows contribute to present value is highly dependent on interest rates. When interest rates are high, the degree to which future cashflows contribute is very small and it's very unlikely that it would make financial sense to manage the forest sustainably. On the other hand, when interest rates are low, the discount function is still non-negligible far out into the century, and managing the forest sustainably is more likely to be the profitable option.

A way to summarize the situation is the half life (the point at which the contribution from a future cash-flow drops to half), which is given by log(2)/log(1+i). If we plot that, it looks like this:

Again, when interest rates are low (below 1%), the half life of our interest in future cash-flows gets up around a century. However, when they are high, it drops down to only a decade or two, and the poor trees have no chance.

As an aside, it's interesting to note that the very controversial acquisition of Pacific Lumber (then owners of the Headwaters Forest) by Maxxam, which was financed almost entirely by junk bonds and led to greatly increased cutting of Pacific Lumber's timber holdings (and a long litany of litigation), took place in 1985. If you look back up at my first graph of interest rates, you'll see that real interest rates in 1985 were just about at their peak of around 8% (on the nominal-CPI method of estimation). This suggests that the influence of high real interest rates on unsustainable cutting of forests is a real effect.

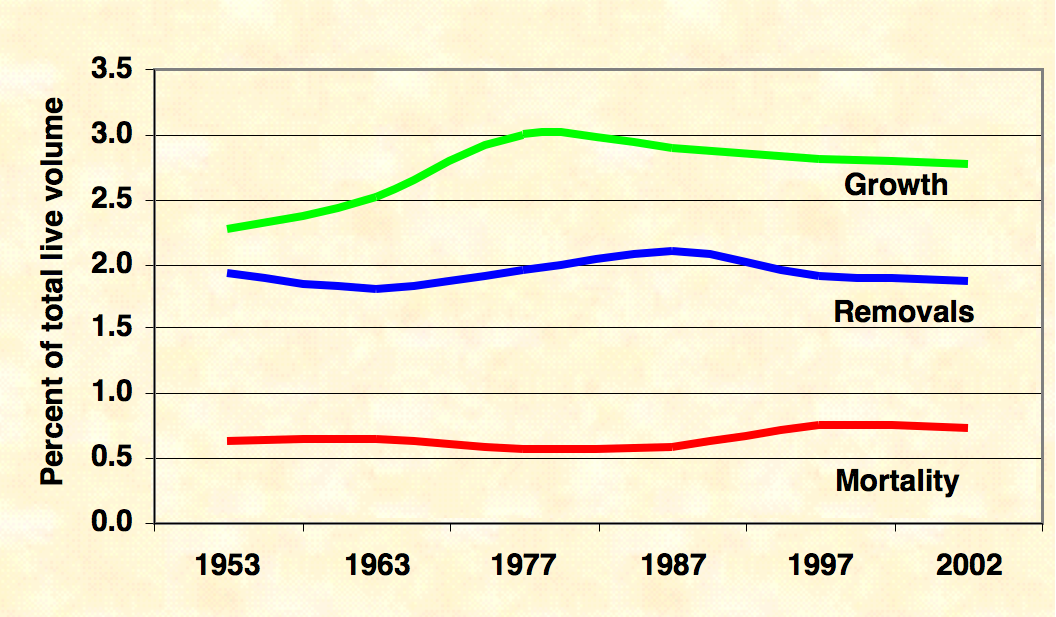

Also, during the era of high interest rates in the 1970s and 1980s, forest cut rates increased. Since then they have been reduced, and we are importing more timber instead. So this is at least consistent with the hypothesis that interest rates are important in affecting the desire to liquidate natural resources more quickly.

So in summary, real interest rates control how far project finances are sensitive to cashflow into the future (what economists call inter-temporal preferences). In a sense, they control how much the economy cares about the future.

Now, this is not usually the main focus that the business community places on interest rates. Instead, the focus is on the effects of interest rates on the short term growth of the economy and on inflation. Generally speaking, when the central bank wants to accelerate the economy (or prop up an ailling one), it targets a lower interest rates. This makes it cheaper for businesses and households to borrow, thus encouraging them to do so, which can increase both consumption and capital investment. It also makes it less rewarding to save, and this also encourages consumption. This tends to increase the amount of economic activity in the near term.

Correspondingly, when the central bank is concerned about inflation (which economist frequently view as aggregate demand for goods and services (and/or labor) growing faster than businesses can supply those goods and services, or trained labor can become available), it is likely to increase interest rates which has the reverse effect and slows the economy. This, eventually, will reduce inflationary pressures.

Note that the Fed does not directly control interest rates - what it directly controls is the size of the monetary base, the amount of currency in circulation and the quantity of bank reserves on deposit with the Fed. However, what it does with that power is adjust the monetary base via open market operations in such a way as to maintain short term interest rates as near as possible to a stated target. And it has got increasingly good at that:

In short, the interest rate is viewed as a big lever that roughly controls the speed of the economy. Push it down (lower rates) and the economy goes faster, but if it goes too fast, inflation is likely to ensue. Pull it up, and the economy slows down. You cannot read the business press or economics blogs for any length of time without reading constant discussion of what the Fed is likely to do to interest rates and how that will affect the economy.

And herein lies the paradox. On the face of it, the question of whether the economy should care about the far future or not is fairly unrelated to the question of whether the economy should be sped up or slowed down in the near future. But in fact, the same lever manages both things. And it seems to me that there is a potential problem there.

Let me switch to another thought experiment. Suppose humanity were faced with the following dilemma. We could carry out a series of projects which would result in unsustainably consuming the entire biosphere to make food, fiber, and biofuels for the present and near-term human population, but which would mean that there would be no biosphere for our grandchildren (who would therefore all die). Under this alternative, we recklessly use up water, degrade soil, and throw away genetic diversity in such a way that plant productivity in future is irretrievably damaged. Alternatively, we could experience a decrease in our lifestyle now, which would mean that the fossil fuels would last longer, and the biosphere could continue to produce a fairly constant amount of food, fiber, and fuel indefinitely. Which should we do?

Again, I stress that this is a hypothetical thought experiment. I realize that the actual human dilemma in the 21st century is more complex and much less clear than this. However, bear with me. I'm making an extreme simplification of the situation because I want to explore what seem to me some less than optimal things about the decisions free market economics suggests in these cases. It's also not totally out of the question that we face a complicated variant of this choice: biologists do estimate that humans already appropriate 15%-25% of net primary productivity and those biologists are pretty concerned about it:

Land use has generally been considered a local environmental issue, but it is becoming a force of global importance. Worldwide changes to forests, farmlands, waterways, and air are being driven by the need to provide food, fiber, water, and shelter to more than six billion people. Global croplands, pastures, plantations, and urban areas have expanded in recent decades, accompanied by large increases in energy, water, and fertilizer consumption, along with considerable losses of biodiversity. Such changes in land use have enabled humans to appropriate an increasing share of the planet's resources, but they also potentially undermine the capacity of ecosystems to sustain food production, maintain freshwater and forest resources, regulate climate and air quality, and ameliorate infectious diseases. We face the challenge of managing trade-offs between immediate human needs and maintaining the capacity of the biosphere to provide goods and services in the long term.So the world is filling up in several senses, and peak oil is just one symptom of that. We can probably expect to be hitting a variety of resource constraints in this century, and having to work around all of them.

Anyway, whether you buy that or not, just suppose that the situation was as I describe it in my thought experiment. In a more-or-less free-market world, each individual decision to cut down this or that forest, or take all the straw from this or that field for biofuels, would be taken separately based on the profitability for the individual or company owning the land. Recall that a main control on whether you want to slash and burn something or manage it sustainably is real interest rates. The higher interest rates are, the faster your NPV discount function decays in future years, and the less sensitive economic decision-making becomes to anything that might happen in the future.

So the question becomes as the economy hits various resource constraints, what is likely to happen to interest rates?

Well both theory and past experience suggest that resource constraints are inflationary. The theoretical argument is that resource constraints reduce aggregate supply of goods and services, and unless aggregate demand is correspondingly reduced also, price levels will increase as people enter a bidding war for the goods and services that are still available. To manage this contraction (possibly in the face of people borrowing more aggressively to maintain their lifestyle) the central bank will have to increase interest rates.

The best empirical evidence of this comes from oil shocks. Major oil shocks have all caused a big spike in inflation over and above whatever the prevailing rate was beforehand (and indeed they've been the main cause of big spikes in inflation in the US in the last 50 years. This is not to discount that other factors have caused lower but longer-lasting inflation. Also, this is not to discount that there are some tempting arguments that we are overdue for a credit contraction - but I view that as something likely to be short-term (decade or sub-decade) if it occurs. Over the mid-to-long term, a cascade of resource constraints has got to be inflationary.

So if that's true, we might expect that a biosphere constraint (along with other resource constraints like peak oil) will tend to cause inflation. In the current economic consensus, the correct central bank response to that will be to increase interest rates with a view to throttling the economy back and reducing inflation.

And the problem with that is those higher interest rates will sway the balance of decision-making towards less sustainable management of the biosphere.

In other words, it appears to me that there is a potential for a nasty positive feedback here that could promote a downward spiral. One might call it an inflationary collapse: the harder the resource constraint bites, the more tendency towards inflation in the economy, the higher interest rates will go, and the less incentive anyone will have to manage their piece of the biosphere sustainably.

Now, there's one dangling point here that I should clear up. In my first example (the individual forest) I assumed that price rises were not forseeable; prices were expected to stay flat. However, in this example of consuming the entire biosphere, someone might argue that the classic Hotelling analysis of a finite resource should apply (eg as discussed by Dave a while back). Basically, the Hotelling analysis says that if you know how much of a resource there is left, then as it becomes more scarce it's price should go up exponentially with the exponential constant being the interest rate. If that situation obtained, then the net present value analysis above (which assumed constant real prices) does not apply.

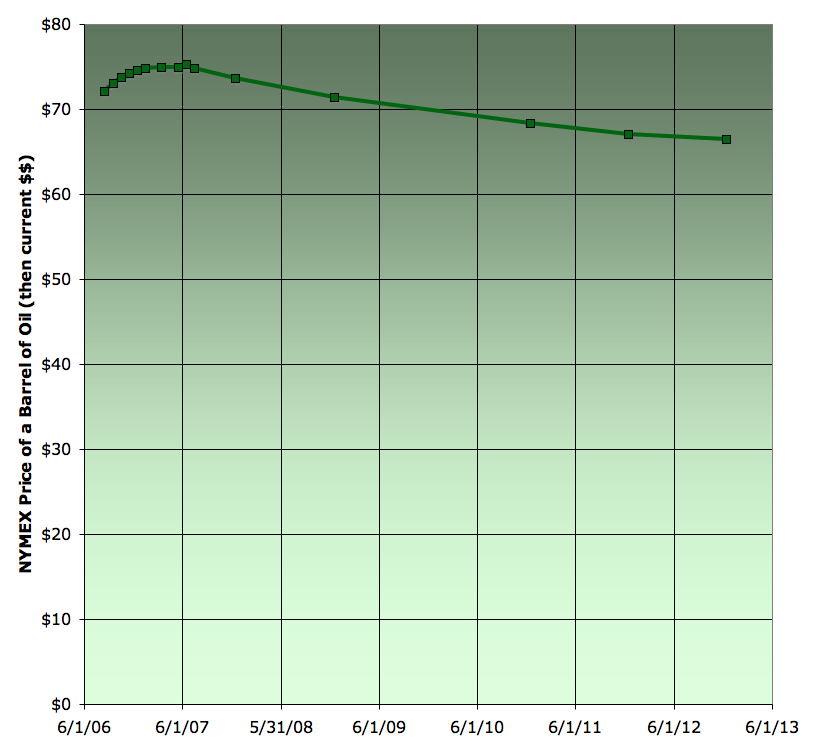

However, it does not seem that the Hotelling model is all that applicable to real resource constraints. In particular, if experience to date is any guide, it seems that we usually have terrible information about the amount of resource left. This is obviously true of oil (think OPEC reserve distortions, uncertainties over future recovery rates, undiscovered oil, etc). So the effect of this has been to make the futures price-curve more-or-less flat. As of yesterday, it looked like this:

However, over the course of the last few years, the shape of the back-end has been whipping up and down (in and out of contango) but always staying within $10 of the current price. Meanwhile, the current price has been rising exponentially at about 30% per year, much faster than interest rates. Thus the Hotelling theory really doesn't seem to help us: at any given time the futures curve has been more-or-less flat, because the information about the resource was too poor to constrain the price curve well, and so what the back end of it is probably doing is wandering up and down driven by momentum traders. In the meantime, the spot price has continued to rise, on average, much faster than interest rates.

Now, the situation in biosphere resource constraints is that the information is even poorer than on oil reserves (this will have to wait for future posts to flesh out, but aquifer volumes, etc are very poorly understood). And thus we might expect whatever resource constraints there are to show up in the same not-very-forseeable way that peak-oil seems to have been showing up.

And that's a problem. Because it means that the economy will not get the right signals to anticipate the problem, and then when it does hit the constraint, inflation and high interest rates will tend to promote exactly the wrong kind of choices.

I'm not saying that this is definitely going to happen - I don't know at present. But it seems plausible enough to be worth worrying about. It also reinforces two points:

- Improving the information available to the economy about the true situation with resource constraints is extremely valuable, environmentally as much as economically.

- Situations in the environment where there are lags between causing the damage and experiencing the consequence are exceptionally dangerous if the lags are long compared to the half-life of the discount function. The oceans warming up in response to carbon emissions and the melting of ice sheets come particularly to mind.

I am experiencing something like this on a personal level. I've sold on Ebay for nearly a decade now, but I think I'm on their S-list, you see, I'm a powerseller but don't do PayPal. Thus, I'm paying about 1/2 the fees I "should" be from their viewpoint, and they seem to be leaning on me. Leaning on me means all kinds of auctions being ended by them and some really scary credit card fraud that is only on the card I only use for them.

Meanwhile I'm finding myself working 14-hour days, running on an increasingly-faster treadmill to stay in one place!

If 10 years ago I'd just kept on drawing and drawing and drawing, and developed my art skills instead of my Ebay skills, I'd not be spending any 14 hour days, since I work fast when I draw hehe. I'd have a valuable skill and some magazine covers under my belt, and a bit of a name, and truth be known, some social capital. It would be a sustainable way of living.

Instead, I only have a long enemies list (everyone on Ebay gets one after a while, some real nuts on there) and am looking at declaring bankruptcy, and living out of some cheap sleep-in-able car since the Prius will go back to Toyota. I chose the short-term better looking fork in the road, and it's led to stress, lack of social capital, and a lifetime of debt.

If I'd chosen the other fork, yeah, I'd have given away a lot of beautiful work for cheap, but kept on living cheap, built up a network of real-life friends (people like ya when you're an artist, it's weird) and prolly have a decent amount of savings in the bank.

This is another reason why I'm skeptical these days of the something-for-nothing hydrogen/ethanol/oil shale crazes now, even if they can be forced to work for a while, you'll end up crashing and having to go back and learn what you should have learned the first time around.

However I have doubts about two elements in your argument:

- Use of interest rate as discount rate

- Role of interest rate in liquidation decision

Interest rate as discount rateA project's cash flows are not discounted at an interest rate. They are discounted according to the weighted average cost of capital of the project owner - called a discount rate. The important distinction here is that cost of capital contains both time value and risk elements.

This is most commonly derived using the Capital Asset Pricing Model (CAPM) according to the formula:

Risk free rate + beta * (Market return - Risk Free rate)

Here the risk free rate is the equivalent of your treasury bill. The second term is made up of beta (a measure of the risk of the individual project relative to the market of projects) times the spread over the risk free rate that a project of market level risk demands.

This is important because the majority of the CoC capital of the forest (or any other) project could come from the risk element, not the risk free element.

This would imply that stable political systems that provide some assurance of returns over the longer term are far more protective of resources than those that do not. This is intuitive and seems to be proven in reality. If you could lose the forest in five year, the incentive to cut goes way up. This is the case in many developing countries where politicians or land owners would rather have a million dollars in a Swiss bank account than 10 million dollars in forest assets.

Maybe the reason that Maxxam was pressured to cut down their holding was not the prevailing interest rate, but rather the contribution to their cost of capital (discount rate) from junk bonds, which require a higher rate of interest than most other debt financing.

If you are looking for a very rough and easy number to use as a discount rate, try 10%. This is not far off of the average return of on US publicly traded stocks over most time periods going back as far as 100 years. While an individual stand alone project with concentrated ownership would require a premium and forest project have their own risk features (more or less than the market), we can ignore that for now.

Plus, a question:

I am a bit confused by the meaning of 41 years in the post, although I expect this is my fault. If we use my 10% discount rate figure, this comes down to 11 years (1.1/.1). Are we now better off after only 11 years?

I think it means that $X = an annuity of $kX for that number of years. An annuity of 10% of X for 11 years is worth X today. An annuity of 2.5% of X for 41 years is worth X today. I can't relate this to your use of 41 years in the post, but again expect this is my fault. It's just after lunch here and my mind is not yet clear.

2) Role of interest rate in liquidation decision

Unless the interest rate only impacts your project, the situation seems far more complex. In the Maxxam case, junk bonds force up their cost of capital, but not those of competitors. However, the underlying interest rate is the same for everyone and thus must be subject to adjustments in the greater economy.

If everyone saw higher rates and wanted to cut, there would be a lumber surplus and prices would go down. To the degree that the interest rate reflects inflation, the increases in discount rates (in the denominator) would be balanced by an increase in prices (in the numerator).

Is there any evidence that resource liquidation follows trends in interest rates? Was it high in the 70s and low in the 90s.

I don't know the answer to this one. I'll try to figure it out while hoping someone else provides the answer first.

The 41 comes from 102.5/2.5. If a higher (real) discount rate was used, then the number would be smaller (eg at 10% it would be 110/10 = 11). As you say, it's the point at which an annuity paying at the discount rate would exactly balance the income from sustainably managing the forest if the forest's characteristics allowed the sustainable income to be k times the income from consuming the forest this year. Probably no forest would stand much of a chance at a 10% discount rate, which would require that the sustainable income is only 1/11th of the immediate consumption income. (Then I suspect equipment capacity constraints become important also - borrowing to invest in new equipment in order to do more clearcutting will be disfavored also and that provides a negative feedback - I have a whole nother post in mind on the issues with capital investment).

I agree that Maxxam's junk bonds were likely a particularly important feature of that particular situation. However, the graph I posted above does suggest that the cut-rate generally increased in the 1970s and 1980s. However, this point could certainly stand to have further evidence adduced. I intend, when I get around to it, to have a look at the international statistics. We might posit that the cutting will show some tendency to move around to wherever discount rates are highest.

In a healthy economy, I agree with you that "If everyone saw higher rates and wanted to cut, there would be a lumber surplus and prices would go down". However, in an economy where resource constraints were causing aggregate supply to struggle to meet aggregate demand, thus sparking inflation, there is excess demand for the products of the biosphere and the high interest rates (plus a high risk premium due to the uncertainties as you note) will provide financial justification for unsustainable consumption of natural capital. We might imagine a world in which an already slightly strained biosphere is now being used also for biofuels to replace depleting petroleum looking that way.

Stuart, my far away favorite website for finance information, data and many free models is that of NYU Sterns school finance prof Aswath Damodaran:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/

Take a look. I will eagerly await your next post.

*

That is if you are able to liquidate 1/41 of the resource each year indefinately you will be in financial tie with cutting it down right now. If you can sustainably take off bigger share per year you would (theoretically) prefer to do so.

I do agree that 10% is more real world discount rate, which immediately poses the question why lumber companies do not liquidate since it seems to be the most profitable decision.

My explanations go along these lines:

- If a company liquidates its principal resource in a snap it would have to invest additional resources for the liquidation process which along with the previous invesments will turn obsolate afterwards and will not payoff.

- Companies do price in the externalities which clear cut would cause. Ruined reputation, moonlike landscapes and Greenpeace members tied to trees are really bad for business.

- The companies (especially bigger once) have much less abstract view of the "market" as economists. Therefore they don't just "produce something" and expect the "market" to absorb it. It is all tied with contracts, and most of them are aware that overproduction by single one of them could cause significant price drop.

- Last but maybe most important, companies are made of people, and people usually have family, and most of them plan for retirement. Both of these lead people to prefer security over the long term than immediate profits in the short term. Whatever Adam Smith may have said greed is not always the dominant motivation.

All of these are very well applicable for all companies consuming non-renewable or slowly renewable resources. I think that both psychologically and economically people become worried if they see the business they run will deplete during their lifetime - some 20-30 years ahead or less. Usually you can not get humans to think 50 or 100 years ahead.People are not rational actors, but rationalizers, and the math behind financial systems is a great excercise in justifying short-term interests over long-term inhabitability of the planet. It basically tells people what they want to hear, given our inherent bias towards present rewards.

Has anyone looked at Richard Douthwaite's work on the issue of responding to inflation from resource constraints by raising interest rates and how damaging that would be?

A quote: "Central bankers must therefore recognise that higher energy prices are necessary to enable the energy companies to develop more expensive sources of fuel, and that, consequently, they must allow the inflation to take its course. They must not choke it off by preventing the higher energy prices being reflected in the prices charged for the goods and services which use fossil energy. Inflation is the only relatively painless way that every price in the global economy can change by a different amount to reflect the new energy price level. The inflation needs to proceed for several years as, initially, firms will put prices up by only the amount their direct fuel costs rise. They will consequently require further increases later when the higher cost of the fuel used in the products they purchase works its way through to them and has to be passed on. Resisting inflation would essentially be an attempt to maintain the purchasing power of money in terms of the amount of energy it buys. This is obviously an inappropriate response if energy is getting scarcer and/or requires more resources to produce."

Source: http://www.feasta.org/documents/energy/November2005.htm

Example:

The forest has 5% of growth, so you can cut only 5% (1/20) sustainably. If discount rates are such (2.5%) the NPV of the forest would be higher if you manage it sustainably instead of clear cutting it.

If the discount rate is 10% the forest still renovates for 20 years but you have financial incentative to cut it right now, because you don't care that much for the future.

This has some very real world implication. Suppose I borrowed the money to buy that forest (with adjustable IR for simplicity). If interest rate is 2.5% and I get a return of 5% from my forest (skipping over some assumptions here) I could be paying the loan interest and get some profit. If IR of my loan goes to 10% then I will probably decide to clearcut the forest and repay the loan as I am forced to think short-term and get the cache now.

Personally as someone who lived once through hyperinflation I could not agree less with it :) What it misses is that with rising rates central banks targed containment rising of general price level, not the energy prices per se. If properly applied tighter monetary policy can suppress uncontrolled devaluation of the currency, while energy prices would be still rising relatively to the other goods and services though slower in nominal terms.

This would in fact benefit energy producers as they would still be facing rising profits in real term, while providing a stable monetary environment.

It is a disturbing thought that the best hope for the planet might be for all wealth to be concentrated into the hands of a few thousand "noble" families. These elites, like Japanese feudal lords, would be biased in favour of sustainability, as their families could rule their domains forever. Unruly peasants could always be culled by the samauri, controlling overshoot.

Tolkein had a similar idea in his fiction. The utopian elven domians of Rivendell and Lothlorien were spared from clear cutting because they had immortal autocratic guardians who protected them with a military force of vassals. No democracy, no upward mobility, and no economic growth were allowed. The wiser people in the various elite clubs, councils, and commissions in our time appear to be working toward a similar goal. (The fools want a nuclear armageddon so Jesus will come back.)

Most of this article is over my head, but I do know that the average American financial advisor will tell you to get it all, and get it now - hang the consequences.

I suppose that Green party members are trying to develop values close to Tolkein's ideal, but they are only 5% of the population. The other 95% just want to buy stuff.

I did read somewhere that he grew up in a village which he saw literally turned into "dark satanic mills" when he returned to it. I in my lifetime have seen ecosystems trashed, just in the space of a few years of my childhood.

Sigh. It's mostly down to overpopulation isn't it?

Looks like the decision is being made for me, but it looks like I'll be Poweringdown quite a bit. First looking for an old Volvo 240 wagon or old Toyota van and the Prius gets sold - there goes a lot of debt. Also to look into renting either a storage space or a small "R&D" office, that means the kind you can run a drill press in. Will cost less than 1/2 times what this apartment will. Officially at least, I'll sleep in the car/van. Got a LOT of stuff to just plain sell, just plain get rid of. No more on-line sales, no more feeding that vampire. The most "industrial" I'll be is taking stuff to the swapmeets locally and selling it. You know, bag up useful stuff like ring lugs and mic connectors, etc and sell for $1 each. What I really want to do is work on artist skills, paper 'n' Conte crayon, technology hundreds of years old or really, thousands. Ultimate desired end result would be I guess, to do without a car entirely and live in a cheep place and just draw, caricatures and cartoons for magazines and stuff like that, the odd sign. And have expenses down far enough so I can live OK that way, or go wash windows and live OK also. But one thing at a time. This isn't even my choice, Ebay/net/computer/credit cards etc are going through their own Tainterish collapse for me right now, and I may only be 6 mos. ahead, a vanguard of large numbers of Tainterish collapses for a lot of people.

So yeah, I'm thinking Tolkian is right on the button right now.

There's no real "journeyman" training in art in the US, it's the plaything of the rich and distrusted by most nose-to-the-grindstone Americans. I was destined to become an artist, but my family crashed from middle class to welfare-class and art was just not trusted.

But no one ever got tired of looking at their own ugly mug!

If you've been around a bit, even the most bone-headed person can see that the present work-til-you-drop way of life is a scam. Most Americans are dropping dead before they ever collect Social Security, it's the top quintile, maybe the top two, living to collect. And everything else in the slush fund goes for .... I dunno, black helicopters or something.

It's looking good, get an old volvo and a shop, and stop spending so damned much money to make a little money. Instead, spend next to no money to make a little money.

If I keep going the way I've been, I'm going to have a heart attack and I'll have to gear way down anyway.

The value a society places on something is neither an economic or a technological decision - it is a human one.

The first of the four, The Hobbit comes across more as a kid's story, and indeed, Tolkien wrote it for his kids in 1936, but it reads well for adults and provides a good prequel, making it easier to get into the main story of The Lord of the Rings.

Tolkien himself apparently always insisted that his sole purpose was to tell a rattling good yarn, and he specifically disavowed any perceived parables or metaphors that anyone might read into the tale. I don't think many believe this, and considering the time it was written, which included the World War II era, (the tale was reworked and evolved even as it was being written; the whole thing took about 20 years following the publication of The Hobbit) it's easy to identify Sauron with Hitler, etc. And in that light, the book's stark rendering of good vs evil makes sense. For in World War II, there was no question as to where the evil lay. And it was evil, beyond the usual depredations of various despots past and present.

Antoinetta III

Actually, the Green Party is not in favour of anything like Tolkien's vision. While they no doubt like the sustainable part of the vision, they also want to keep our current electoral "democratic" type of politics. In fact, they complain that it is not democratic enough. Unfortunately, democracy is very "me" oriented, and leads to short-term thinking, and therefore the pressure to clear-cut or otherwise trash the property for a quick profit come to the fore. Democracy and sustainability are inherently incompatable and can only co-exist until the unsustainability eventually causes the democratic political and economic system to collapse. The question then is, of course, will the planet be so badly trashed at this point that will we have the ability to rebuild any sort of decent existance even when a sustainable, hereditary system returns after the house of cards of our current democratic system has collapsed.

Antoinetta III

It's like Goritsas said in a post further downthread, hereditary institutions have a vested interest in long-term sustainability, and others don't. A monarch will be inclined to think twice over some scheme that will have a short-term positive aspect but also negatives that might not be obvious until a generation into the future. The monarch knows that s/he, or her/his immediate descendants will have to deal with whatever problems crop up after a decade or more, the elected politicians, who generally morph into the puppets of those with the organization and resources that "game" our system operate under no such constraint. Likewise, a farmer is going to try to avoid overworking/depleting his land, if he knows his kids are going to need it in productive shape if they are to eat. So its not only a monarchy per se that's required for long-term thinking, but a hereditary principle in society generally. If a real estate industry exists, anyone who sells their property has no concern about the viability or health of that property once its sold and the money is in the seller's pocket.

Antoinetta III

Good insightful analysis. Thank you.

To summarize: there are different kinds of "valuations" in a "Democracy" / "Capitalist Market" system:

- Short term return on invenstment (ROI) to current incumbents / renters of the office / property, and

- Long term costs to all future holders/renters of the office or property.

The short-termers ignore or "externalize" the long term cost items (#2) because they will have skiddadled and will be distanced or disassaciated from the long term costs when finally TSHF. Therfore the short-termers "account" only for the short term factors.What this says is that in 1973, Peak Oil was a long-term problem which the short-termers (politicians) could conveniently ignore. As the time to impact shortens, it becomes more and more difficult for the system to remain in denial. But then again, we are a resourceful species. We will come up with ever more clever ways to deny. In that I have faith. Uggh.

Democracy doesn't imply 2 party politics, 4 year terms or time limits on what leaders can do, and I think you could argue that the American constitution actually has too many checks and balances in that vein. For instance England has no time limit on how long leaders can remain for and yet it's also a stable democracy. In fact you can have democracy with no political parties at all!

I'm also sceptical of "the masses" being stupid and short sighted. Maybe people vote for short-term-ism because that's the only thing they're being offered. You say "nobody votes for leaner times" but that's a self fulfilling prophecy: nobody can vote for it if no party is offering it.

At the last election I wanted to vote green, but couldn't because there was no candidate in my area. So I ended up voting Lib Dem, a party with no really notable policies :(

A number of points in your posting:

Elected government, unfortunately, involves a rather complex and expensive process. It responds, not to the real overall "will of the people", but to those best constituted to pressure it. This essentially requires two things, organizational capacity and money, the latter mostly to finance the hugely expensive campaigns for the various offices. And who already has a huge head-start with this? Well, those who are already organized, even if influencing the government was not their original purpose, and those who already have access to large amounts of cash. These are corporations, of course, who find it relatively easy to divert a bit of their attention away from whatever they are selling and making money on and to lobbying the government on their behalf. Their ability to provide the funding (or to deny it) to politicians for the spin doctors and sloganeers campaigning requires directly influences what positions and policies both candidates and incumbents will adopt. The only non-corporate interest groups tend to be those of the one-issue fanatics, the partizans on either side of the abortion, death penalty, affirmative action, etc. debates, issues which have been going on all or most of my life (I'm 54) and which our democracy seems unable to resolve, as the losers at any one turn simply retreat, re-organize, and keep pushing the issue.

Ultimately, the complexity of democratic systems means that these above lobbyists etc, learn how to "game" the system to get what they want. The vast majority of people do not follow politics in any kind of depth as their lives focus almost exclusively on the minutiae of daily life; get up in the morning, get something to eat, get the kids off to school, get to work, then come home and eat dinner, while somewhat listening to the crap on Fox News. Since only about half the people even bother to vote, and the vast majority of those who do, do so based on gut "feelings" derived from the newspaper headlines and TV news, "gaming" the system is not all that hard to do; marketeers and admen have long ago made a science of it. Political campaigns have devolved essentially into duels between competing groups of the above marketeers and admen, devoid of real substance, focussing instead on the emotional hot-button issue stuff which will become increasingly irrelevant as the world gets to the top of Hubbert's Peak and continues the trip down the other side. And, I suspect, a political platform offering a long range viewpoint, and "lean times" isn't on the ballot because pretty much anyone out to get elected considers this a big loser.

Its not that people are stupid (I never said this) but their focus and attention is elsewhere. Those of us who participate on The Oil Drum aren't necessarily "smarter" than anyone else, but, in our own way, we are part of an "elite." Just the fact that we are here indicates that we are "plugged in" to what's going on in the political world far more than the general populace. And I doubt the total number of participants on all the political web-logs combined come to more than two or three percent of the electorate; out votes are overwhelmed by those of the masses not so politically aware.

Antoinetta III Posted on The Oil Drum on 7-2-2006

I think it should be noted that just because someone writes something in a story, that doesn't mean they necessarily believe it would work in the real world. So, we have no idea what Tolkein really thought was the ideal government for the real world (unless he wrote it down somewhere outside his books).

But the idea of a perfect heriditary power structure with enlightened rulers simply doesn't work in the real world. If it did, we'd have achieved it long ago, but the fact is, on the whole, monarchies tended to be quite less than idea.

I would say that Tolkein's depiction of the elven society might be considered an idealistic fantasy: what might be possible in a perfect situation, with a benevolent ruler, and where everyone in society was of like mind about everything. That doesn't mean it's a true blue print for the real world. Incidentally, consider that if everyone in society is really of like mind, the form of government becomes irrelevant. A democracy could work as well as an enlightened despot in that situation, because both will come to the same conclusion.

I have to say, I think this is one of the biggest dangers of reading too much into a fantasy novel, or indeed a fiction novel of any type. It is a construct of a person's imagination, and what works in such a constructed world may not be accurate of how things work in the real world (although I do think the best storytellers do try to achieve such realism).

It's can be a grave mistake to cross the line from thinking something is a good story, to thinking it can give you 100% accurate insight into human psychology, or tell you how you should go about living your life. In the end whatever is written in a fiction story is the opinion of the author, and you can often end up with works where the conclusions are simply completely false (Lord of the Flies, for one, and then there's Crichton's novel about Global Warming being a farce).

When it comes to Tolkein's novels in particular, I would suggest that their inherent black and whiteness prevents them from accurately reflecting the imperfect shades of gray, which comprise the nitty gritty of human existence. That doesn't mean they are bad stories, it simply means it's the wrong source to use as a guide for human government and society.

I would say the true value of all literature is in making us think about things. So, there is no harm in thinking about the message Tolkein might be presenting with his elven society. But part of thinking is also rejecting ideas that are clearly outlandish and which would not work in the real world.

It also gets into some of the same things that Lester Brown has been saying in his book "Plan B, 2.0". I am only partway through the thing - I haven't gotten to the actual "Plan B", but I have heard him talk, and I know that in effect he is proposing that our entire economic system needs to be rethought and redone.

The Ecology of Commerce would probably be the best to read for that. Natural Capitalism had some good stuff too.

Highly recommended.

Now, having solved that little puzzle, would one of me out there please tell me how to conjure up more from "there's more", which hasn't worked for this version of me for a long time? I would really like to see what else Stuart wrote.

For example, Germans consider their forests to be important at a level where monetary value is not really applicable - though the forests are also excellent sources of revenue. Anyone proposing to clear cut for personal gain will find that the entire society around them will be opposed, possibly to the point of serious threat.

I realize this is a simple thought experiment, but I am not really convinced it applies equally to different societies even in the capitalist, industrial West.

There is a somewhat old joke that from a cost benefit analysis persepctive, an alien race trading infinite energy, materials, and knowledge for 500 years in exchange for the death of every human at the end of the bargain is a no brainer - the deal is impossible to resist from the cost benefit perspective.

" ... The adventures of Germany's most famous fugitive - Bruno the bear - came to an abrupt end on Monday when a group of Bavarian hunters unapologetically shot him dead. After weeks of attempts to stun and capture the bear, Bavaria's environment ministry announced over the weekend that Bruno could be shot. Three Bavarian hunters took matters into their own hands.

German officials confirmed that Bruno had been killed at 4.50am near the town of Zell in southern Germany. "The shooting has happened - the bear is dead," said Manfred Wölfl, the Bavarian government's bear specialist.

"It's not that we don't welcome bears in Bavaria. It's just that this one wasn't behaving properly," Otmar Bernhard, an official with Bavaria's environment ministry said. ... Environmentalists who had been campaigning to save Bruno - the first bear to wander into Germany for 170 years - reacted with fury.

"It's incomprehensible," Heike Finke, spokeswoman for Germany's Wildlife Alliance told the Guardian. "Other countries like France, Romania, Austria and Italy manage to co-exist with bears. But three weeks after the first one turns up in Germany we have to shoot it dead. It's so frustrating."

... Bavaria still intends to honour the bear it has killed. Bruno will be stuffed and exhibited in Munich's Museum of People and Nature, Mr Bernhard said, refusing to answer further questions."

http://www.guardian.co.uk/germany/article/0,,1806304,00.html

Growing up in Northern Virginia, it wasn't like the national parks on the East Coast I backpacked in are purely natural, but they are generally the result of decades to more than a century of general human non-interference. That is, the national parks are simply nature.

In Germany, there seems to be one true 'national park,' with 5000 hectares. (All from memory here, from Die Zeit.) This tiny parcel of land was intended to be left alone in the normal sense of an American national park. But in the last few years, some beetle seems to have gotten out of control, and many locals were very angry at the non-interference policy, since the beetles were destroying the natural view of trees they had enjoyed.

Germans love 'Natur' as long as it fits into their view of natural. Real nature, however, is something of a problem.

This place is not paradise, and it is not some sort of anti-America. But even in my story, notice how the trees and the forest are considered critical - even nature should not be allowed to tamper with 'Natur.'

I find it all a bit strange. Germany is an eco-friendly industrial society with a general long term view and a faith in long term planning, after all, not some sort of back to the Earth commune.

But then, I'm not German, and never will be.

What's the point then?

In the USA, I'm sure he'd have been considered a problem bear, spending too much time near settled areas, munching livestock, trashing beehives. He was a problem bear in Bavaria too. It may be impossible for a bear in Bavaria not to be a problem.

In the end, he was doomed because sooner or later, he would have hurt sombody.

One of the foremost responsibilities of the state is to protect people from their own stupidity. It was inevitable that some fool (or maybe just an unlucky soul) would get too close and get mauled. Imagine the uproar then, "Why didn't you kill the bear before it was too late?" coming from some of the same voices who are now condemning Bruno's death. Maybe they could have tranquilized him if they'd tried harder. But he had to be "taken out of traffic."

http://www.veganoutreach.org/whyvegan/slaughterhouses.html

;)

Brilliant post. Such a very difficult topic to explain to people who may be used to doing the "right" thing.

I think that your negative feedback theory will play out in many ways other than the economic sphere. The last man standing theory is what most people call it. In other words, when Dick Cheney says, "The American way of life is non-negotiable," he means it. The US will stake out for itself in old school imperialist fashion the energy supplies it needs to continue its long cheap energy run. Unfortunately, the rest of the developed and developing world will also be bidding for those sources.

Every war is ultimately a war for resources. When a particular resource that is necessary to the economic health of a country is endangered, the typical response is a military solution.

Unfortunately the corporate world is stepping up its ongoing war to the death with all of humanity. Because of the inexorable forces of accounting practices and economic theory, the world will be thrown on the bonfire of corporate greed. The only way to stop this insanity is to rescind the idea of corporations as an immortal quasi-humans and take away any and all constitutional rights they have ursurped over the last 150 some years.

For more information on how corporations abused the Civil Rights Act of 1866 which was designed to give freed slaves personhood go to:

http://www.poclad.org/ModelLegalBrief.cfm

The truth is corporations have no legal standing in this country and should be dissolved immediately.

V

No biological organism can merge though they can divide and consume and excrete a wide variety of substances. Think of useful alcohol that yeast excrete as their "shit". Some germs can "eat" oil even. But only corporations can "eat" creativity, plutonium, and other bizarre inputs not found in bio-organisms. And excrete burnt-out workers left to die in the streets loaded with their toxic excreta. Corporations excrete consumer products as they feed on money, people, and raw material.

It can easally be said that humans created life already - in the form of corporations!

Many claim it was not the court - but a clerk. (and a well paid one)

http://www.projectcensored.org/publications/2004/13.htm

lTHE HIGHTOWER LOWDOWN, April 2003

Title: "How a Clerical Error Made Corporations 'People'"

Author: Jim Hightower

this time, just a couple of comments.

I do think wars like the American Civil War are not really about resources - different social systems (agriculture/slave vs. proto-industrial) can find other reasons for war than resources alone. It would also be fair to say that civil wars are a special case, in your defense, and that even a civil war has a resource component.

'In other words, when Dick Cheney says, "The American way of life is non-negotiable," he means it.' - Cheney can tell the rain in DC to stop since the American way of commuting is non-negotiable, and even mean it, but the rain could care less. America's way of life is soon to be facing something a bit harder to negotiate, something even your finest imperialist has to deal with at some point - reality. What is most shocking about watching the current American political system is how utterly unconcerned they seem to be with the real world around them - though who knows, maybe even Cheney's currently undisclosed location is getting a bit wet.

This reminds me of a scenario I read, heard or thought of quite some time ago:

When things start going really badly, what TPTB need is a major terrorist attack on, say, Ras Tanura, and within a few hours of the attack we will be told that it was those evil Ayrabs and Eyeranians who did it and are therefore responsible for the economy going into tailspin. After that most people will be calling for war, and just by magic, that war will have been planned well in advance. So, there is a major conflagration in the Middle East and possibly elsewhere, and very few people will pay any attention to those who suggest things were going horribly wrong anyway. When nukes start flying about, few people will think about PO...

This is, of course, extremely pessimistic, but I find it hard to imagine how major Western governments could survive when TSHTF without being able to blame somebody else. And we know who´s been framed for some time already...

Slavery, like WMD in Iraq, was a red herring propaganda issue. There is no way that Indiana farm boys would have enlisted to protect the wealth of NYC elites. So there had to be a noble quasi-religious excuse for the war, freeing the Africans from bondage.

But in this case, I am not not at all convinced that resources was the cause compared to power, and it is certainly true that the two systems competing with each other in a single framework were not compatible. Civil wars do tend to be special cases - I could have written about Cromwell, but then the whole religious issue comes up.

OK, lack of power to have their way was quite probably the causus belli. But what constrained their power? Would it not be their inability to obtain enough of a very scarce resource called congressional seats?

A lot of paper wealth evaporated; new economic systems had to be developed; new social systems were developed to create an underclass based on skin color rather than ownership (read Freedom Road and Black Boy, for example).

But there's no obvious reason why the South had to implode. Perhaps the carpetbaggers contributed, and the North's anger over Lincoln's death?

Chris

Of course, the forests that I grew up around are now gone again, but there were really no forests in Northern Virginia at the time of the Civil War - it was all farmland. After the Civil War, it lay fallow for a century. Partially because of destruction, partially because more promising areas beckoned out west.

Saying the civil war wasn't about slavery is like saying today's culture war has nothing to do with fundamentalist religion. The continued existence of slavery in the United States in the industrial era would have fundamentally threatened free labor everywhere. When's Sherman's trooped torched southern planations they were looking after their own long-term interests in addition to freeing slaves.

IMO, you are using today's PC logic to interpret history and it gives you a distorted view.

What else was the civil war over if not slavery? 600,000 Americans died over western expansion? Tariff policy? Come on. The war was about who would control the future -- an aristocratic, non-democratic, slave-owning elite, or free labor and industrial capitalism. Banana Republic or Industrial Powerhouse?

Plus, it was the slavery issue that kept Britain and France from recognizing the Confederacy. The British upper-class, being labor-repressing landed elites, were sympathetic, but it was the church-going, voting middle-classes that kept Parliament from siding with the South. That, and Egypt and its cotton was swiftly becoming part of the British Empire.

To quote a primary source, Lincoln said

The War Between the States was about whether the Southern States had the right to self-determination or not.

A President was elected that was not even on their ballots and would likely work against their interests (tariffs & location of railroads to the West as much as slavery). They thought they had the inherent right to self-determination and could secede. The Northern States thought differently.

IF the Constitution had included a single sentence the war would have been avoided.

"The various states shall (or shall not) have the right to leave these United States upon a 3/4ths vote of their legislatures and approval by their Governor".

And what were they fighting to be able to determine for themselves? Tariff policy? Railroads? Are you kidding me? Johnny Reb marched off to slaughter in protest over where Union Pacific was going to lay track? That luxury goods he couldn't even afford had a tariff on them? They risked EVERTHING over railroads?

So what does your Lincoln quote prove exactly? That he was trying to reassure the pissed off and frightened slaver-owing aristocracy that his fire-eating Republican party really wasn't interested in banning slavery? When a moderate conservative today says to liberals afraid the GOP will ban abortion that he will not ban abortion should they believe him? They they should disregard all those fire-breathing fundamentalists who make up the Congress?

You're fundamentally ducking the issue. Waving your hands in order to distract attention away from an institution that (like the social capital map) doesn't paint your area of the country in a good light.

Why was the southern elite afraid and threatened by the Republicans? Why didn't they collectively jump ship earlier? Hell, South Carolina nearly did but realized fighting Andrew Jackson over tariffs wasn't worth a war. Why was tariff policy or western expansion worth a war under Lincoln but not under Jackson? Why was it Lincoln and the anti-slavery Republicans, but not some earlier crisis or president? What was it about them that made them intolerable, but not, say, someone else? Why wasn't the GOP on the ballot in the south? Why were the democrats split?

Lincoln and the Republicans represented a gun pointed at the head of southern plantation elite. Sure, Lincoln promised not to pull the trigger, but the planters felt they couldn't trust him or his party so they loaded their own guns and shot first (at Ft. Sumter). Lincoln shot back. The rest is revisionist history.

But when Cheney says, "...non-negotiable". Maybe he means, non-negotiable in the sense that we can't change even if we wanted to, not that we shouldn't. In particular, the finances of the country(extrapolate - world), it's hard to slow down or stop an economy that is based on debt(staggering amounts), and the only way to pay back the debt is with a growth economy.

Another words, checkmate. Cornered between the Queen of Peak Oil and Rook of Financial collapse.

Ahh..its all fun! ;-P

=========It's all about Population!

I concur, this is an excellent post by Stuart, that has led to one of the best threads I've read on TOD.

Re: "The US will stake out for itself in old school imperialist fashion the energy supplies it needs to continue its long cheap energy run." I'd only change "will stake" to "is staking"

Re: "The only way to stop this insanity is to rescind the idea of corporations as an immortal quasi-humans and take away any and all constitutional rights they have ursurped over the last 150 some years." This is perhaps the most important paradigm shift we could make, and it's one that actually doable. Not that it would be easy, given the power in favor of corporate personhood. But it's a body of law that can be undone with the appropriate amendment/legislation/legal decisions, unlike many of the other shifts that would help, but would require changing human nature to one degree or another.

Well done! Your Quote: "Improving the information available to the economy about the true situation with resource constraints is extremely valuable, environmentally as much as economically."

This is exactly what Matthew R. Simmons has been advocating for: full transparency and full audits of FFs everywhere, but especially in Saudi Arabia. His latest presentation, "The Energy Crisis has Arrived" has even advocated using spies or military force to gain this vital info [see slide 48].

http://www.simmonsco-intl.com/files/Energy%20Conversation.pdf

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

"Two Intellectual Systems: Matter-energy and the Monetary Culture"

(summary, by M. King Hubbert)

During a 4-hour interview with Stephen B Andrews, SbAndrews at worldnet.att.net, on March 8, 1988, Dr. Hubbert handed over a copy of the following, which was the subject of a seminar he taught, or participated in, at MIT Energy Laboratory on Sept 30, 1981.

"The world's present industrial civilization is handicapped by the coexistence of two universal, overlapping, and incompatible intellectual systems: the accumulated knowledge of the last four centuries of the properties and interrelationships of matter and energy; and the associated monetary culture which has evloved from folkways of prehistoric origin.

"The first of these two systems has been responsible for the spectacular rise, principally during the last two centuries, of the present industrial system and is essential for its continuance. The second, an inheritance from the prescientific past, operates by rules of its own having little in common with those of the matter-energy system. Nevertheless, the monetary system, by means of a loose coupling, exercises a general control over the matter-energy system upon which it is super[im]posed.

"Despite their inherent incompatibilities, these two systems during the last two centuries have had one fundamental characteristic in common, namely, exponential growth, which has made a reasonably stable coexistence possible. But, for various reasons, it is impossible for the matter-energy system to sustain exponential growth for more than a few tens of doublings, and this phase is by now almost over. The monetary system has no such constraints, and, according to one of its most fundamental rules, it must continue to grow by compound interest. This disparity between a monetary system which continues to grow exponentially and a physical system which is unable to do so leads to an increase with time in the ratio of money to the output of the physical system. This manifests itself as price inflation. A monetary alternative corresponding to a zero physical growth rate would be a zero interest rate. The result in either case would be large-scale financial instability."

"With such relationships in mind, a review will be made of the evolution of the world's matter-energy system culminating in the present industrial society. Questions will then be considered regarding the future:

What are the constraints and possibilities imposed by the matter-energy system?

Human society sustained at near optimum conditions?

Will it be possible to so reform the monetary system that it can serve as a control system to achieve these results?

If not, can an accounting and control system of a non-monetary nature be devised that would be approptirate for the management of an advanced industrial system?

"It appears that the stage is now set for a critical examination of this problem, and that out of such inquries, if a catastrophic solution can be avoided, there can hardly fail to emerge what the historian of science, Thomas S. Kuhn, has called a major scientific and intellectual revolution."

Ah. But what is appropriate. I paraphrase Churchill (I think) in saying that capitalism is the worst economic system known to mankind except every other one that we have tried. Also:

Capitalism is a bad idea that works,

Communism is a good idea that does not

My feeling is that capitalism does a pretty good job of allocating resources, although it is not perfect. I think the only relevant question is indeed the one asked in your post. Is there a better one? Should we risk destroying the current system in hopes something better springs up? Should we try to improve what we have?

It is a very, very simple thing to do to sit around and say the current system is bad, but unless you have a reasonable expectation that something else is better, it is just complaining. Every day these threads are full of posts saying capitalism is bad, companies are bad, people are bad, modernity is bad, cars, suburbs, etc.

So my answer to the question is no. We can not devise a better system. But we can keep trying improve this one.

If your answer is yes, what does it look like?

The stakes are high. Many people have tried these experiments. You know their names. Americans aren't idiots or sheep for not wanting to go that route.

I'm not feeling adequately philosophical to draft a real answer to how do you tell the difference between chnaging and improving.

My point is that there is a huge continuum between complaining and changing the world. Most of what I hear here is complaining.

Many posters want to ditch capitalism and democracy on some wild die roll of hope that something better comes along. Sorry if I'm not ready to bet my future on the appearance of an benevolent and immortal elf with magic powers.

Since the 1960s has been ditching democracy n favor of a military/industrial autocracy (just as Eisenhour warned). Capitalism has morphed into a casino of financialism coupled with radical deindustrialization. American "capitalism" today has little resemblance to the system envisioned by Adam Smith. The "invisible hand" has turned into an iron fist. Smith's view encompassed mostly localized community-based enterprises such as the blacksmith, the butcher, the baker, the candlestick maker, etc.(sort of like Fleam's wish) An individual learned a trade and then invested/risked his personal "capital": his expertise, land, money (sometimes borrowed) and effort.

According to one or more authors I have read recently, post-industrial financialism (along with imperial adventures)are the final stages of cultural evolution preceding collapse.

Add PO, GW and overpopulation -- fasten your seat belt, it's going to be a wild ride!

Cheers,

--Mort

So keeping the current system for a bunch of fanatsies of change and / or improvement isn't folly? What if the system is so dysfunctional it can never be improved? What if the only way forward isn't to make it work from "within" but to make it obselete? Does that frighten you? Will you cower from the idea or will you embrace it?

Capitalism and Representative Democracy have been given a fair trial. In a vast number of areas Capitalism and Representative Democracy seem to have failed. Distribution of wealth springs to mind. Are you truly happy with the gap between the pay of CEO's and the workers? Are you truly happy with the performance of your senators and your congressman? Why are you not truly free in your own country? Why can your government spy on you? Why can your government take your real property for non-payment of taxes? Even if the deed is yours, your government can take it away. Yet, they don't own it. You don't live in a Democracy and your representatives are not yours to direct. You live in some Disney fantasy that confuses liberty with freedom. That confuses legal justice with truth. That mistakes the electorate for servants of the state.

"Many posters want to ditch capitalism and democracy..."

I would be really surprised if most posters wanted to ditch Democracy. Sadly, it would seem democracy has ditched them. When was the last time you evaluated your representatives voting records? If you do such, do their votes match your expectations? If you believe you live in a Democracy you might like to take a good hard look at your beliefs and expectations.

As for capitalism, perhaps if the rise of the corporation had never happened, then Capitalism would be an economic system worth preserving. But, as it seems to have happened, the lives of people around the world are blighted by Capitalism and, in partciular, the brand that gives the corporation the same rights as natural persons. If you feel Capitalism has served the Niger Delta, or the Amazon Basin, or the Appalachians you have a perspective I cannot share.

England is, I believe another example of this. Its been essentially "democratic" longer than most of continental Europe and by the '80s we saw the free-market corporatic Margaret Thatcher elected and the privatizations that followed, even the national health service, long a sacrosanct institution came under attack, again with calls for privatization. This last hasn't happened yet, but give it another 30-40 years--if the overall eternal growth system lasts that long, which I doubt. And, if the system could hold out another 80-100 years, it would happen in continental Europe or any other country that maintains an elected governance as well.

Antoinetta III

As Gus di Zerega points out, corporations are run by a one share, one vote system. Change that to a one worker, one vote, and you have a cooperative corporation. The Basque country has a cluster of cooperative corporations who are competing successfully in capitalist markets, making white goods, securing big construction contracts, etc. Whether shifting to cooperative corporations would be more oriented to sustainability or not is unproven, but I suspect they might; the current US corporate system is so driven by quarterly profits that the long view gets lost.

Capitalism is a very integral part of our social structure. You can't just rip it out and expect anything we have to survive. That's like curing the disease by killing the patient. When push comes to shove, I highly doubt most people advocating drastic change would really be willing to suffer the consequences of such a change.

Some form of capitalism may be part of what emerges after the anarchy but I hope, if it is, it will be rather different from the current incarnation. Sometimes the patient must go through a period of fever and delerium for the body to cure itself of an infection.

That is what the present model of capitalism has become: an infection. It has, to a significant extent, been a causal factor in putting humans into overshoot; it is also a major factor 'preventing' humanity from rationally solving problems like those we discuss here.

Yes, it will be worse for quite some time. Probably decades, possibly longer. Terminally so for a fair proportion of people. Unless human society, attitudes, behavior, fundamental thinking and drives change very dramatically and very soon that future is unavoidable.

I don't worry too much about pollution as market economies have a pretty good track record of cleaning up after. I do think the Chinese will regret the destruction of their resources and the world may not survive the additions to global carbon or competition for dwindling oil resources. So, see I'm not a cornocopean.

But what would you have them do? Go back to communism and the woes it brought the country?

Sure it would be nice if there were only 100,000,000 people on the earth and we all lived in harmony. But until someone can map out a way to get there that doesn't involve killing everyone, I think working with what we've got is the best option.

Antoinetta III

Antoinetta III

Why do you hate America?

Calling it a Democracy. The CIA says it is a Constitutional Republic.

I guess it depends what one looks at. Did we do a good job with CFCs? Yeah, but they were relatively easily replaced by products that some corporations could profit by. Have we done a decent job with some basic water pollutants that were directly poisoning our drinking water? Yeah, we decided we liked drinking water that wouldn't kill us next week. Did we make headway on the precursors to acid rain? To a degree. SOx are down significantly, but the rain over the northeast is still many times more acid than natural rain. What hasn't the market taken care of. Would that I knew and/or had time for an exhaustive list. Something like 50,000 people die in this country every year as a result of the mercury spewed out by coal plants - all so we can burn lights we don't really need, dry clothes that the sun would for free, air condition space to the point that people wear coats in their workspace or theater... Last time I checked, the sphere we call home was embarking upon meltdown as a result of CO2 our market considers "an externality" - Arctic Ocean will be ice-free in summer in about a quarter of a century, Greenland and Antarctic ice sheets are starting to break up and melt to the sea (look out Florida, Bangladesh, UK - oh hell, just look out). The groundwater we have depleted/polluted/infused with saltwater will replenish and cleanse itself in tens or hundreds of thousands of years - a good market response there. But not to worry, we have a global excess of potable water, right? From my vantage point market economies have a pretty lousy track record of cleaning up after - and it's been made much worse these past 6 years.

Communism is a good idea that does not

I think that with the advent of PO, GW, etc, we are seeing that capitalism is just as big a failure. Or worse.