Consumption Winners and Losers

Posted by Stuart Staniford on June 16, 2006 - 9:40am

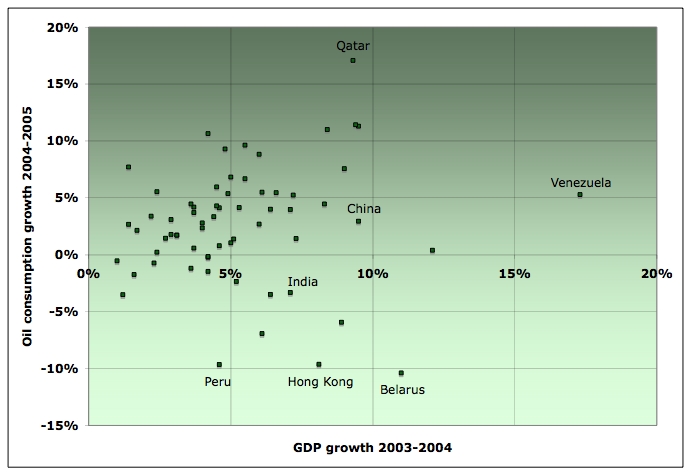

Let's start by looking at those countries that reduced their usage from 2004 to 2005, ordered by the absolute change in usage:

The surprising leader was India, with the US closely following behind. After that we get mostly European countries, with a scattering of middle income developing countries in there too.

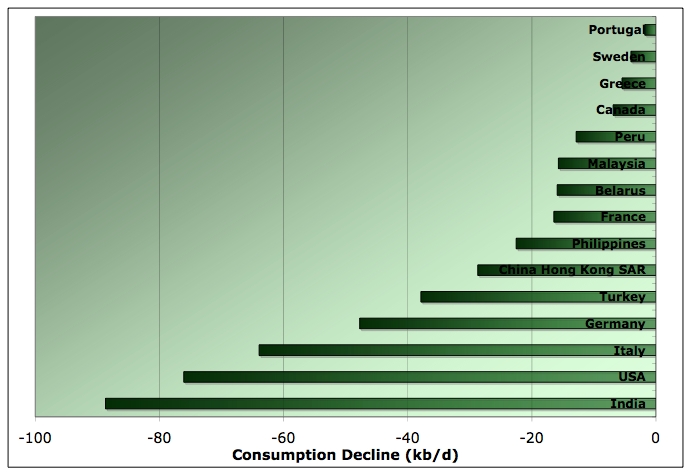

Let's look now at the countries that declined based on how big the decline was as a percentage of their 2004 usage:

The list is the same, but it was the middle income countries making the largest percentage cuts, and the US made the smallest percentage cut of any country that reduced oil demand at all.

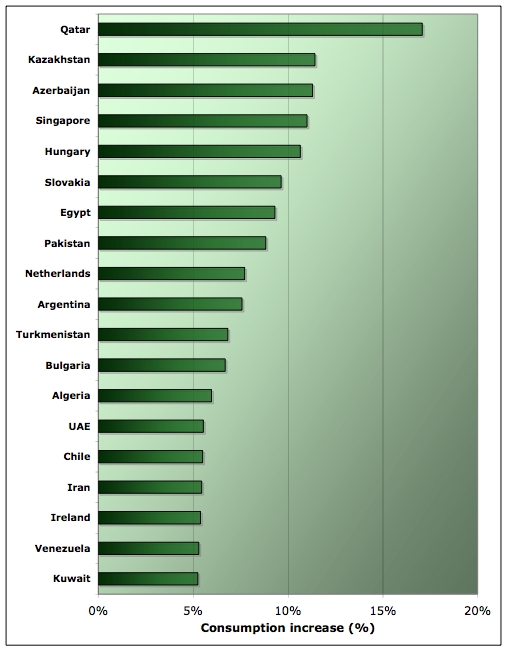

Turning now to countries that increased their usage (all those who increased by 25kb/d or more):

Here China dominates, followed by a group of oil exporters and then a mixture of western and developing countries with no obvious pattern. If we look at it on a percentage basis (for countries that increased 5% or more):

Well, certainly the oil exporters dominate this list, but there's plenty of random developing countries in there too, along with former communist nations. Two western developed countries made this list: Ireland and the Netherlands.

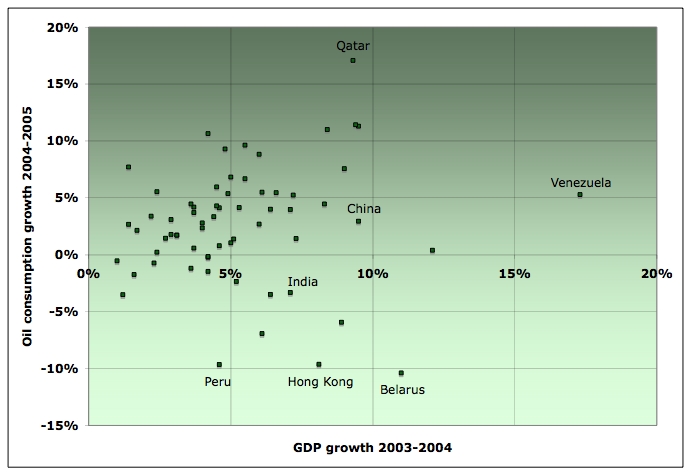

A theory I had was that general economic growth would be a good predictor of who would have to conserve oil usage, versus who could continue to grow it. Unfortunately, I couldn't find 2005 GDP stats, so I had to make do with 2004 GDP growth stats from the UN. These have very little explanatory power for oil usage changes:

For example, fast growing (economically) India conserved oil quite significantly. Some oil producing countries had massive GDP expansion, but they varied widely in how much oil usage expansion there was as a result. Clearly, a more complex analysis is required to determine how things are going to go (if indeed it can be predicted).

For those reading Dave's Thailand study, I note that Thailand is in the middle of the pack, with fairly strong 2004 economic growth of 6.4% and an oil usage increase in 2005 of 4.0%.

In regard to the 2005 oil consumption decline in the US, I wonder how much of that was due to hurricane damage to refineries?

India's growth in GDP is around 7%. Maybe the reason is, India's economic growth is more based on computer services. Whereas China is more the producing place.

I will be interesting to see if this trend will continue. I presume oil consumption in India will increase again.

consumption. It is a shame that we do not

have the figures for the individual

poorest countries. As I would expect them

to be the first to be affected by demand

destruction.

It is easy for the large profligate users

i.e. USA, to cut usage as all in the First World

waste so much energy. One would expect a

percentage of people in the First World to drive

more slowly, check tyre pressures, reduce speed,

and cut out unnecessary journeys and so reduce

demand a small amount.

It will be next year's figures, when oil has

been $70 all year, that will be more interesting

to analyse.

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)

sourced from the IMF.

If you want per capita gdp, I'll need some 2005 estimated pop stats. or is the raw number what you wanted?

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_%28nominal%29_per_capita

Maybe a big share of Singapore's oil consumption goes to its role as a trans-shipment point? Port & air operations?

Singapore Airport (Changi) lists 204,000 aircraft movements annually. I would guess most take on fuel as many are long haul 747s.

All of this will certainly distort the oil consumption you might otherwise expect from the 2005 population of 3.5m.

Post-communist Eastern-European countries usually still get a nice discount on prices of NG and oil from Russia, and they have a real growth rate 2-4x more that of the EU15, while being very energy-inefficent due to significantly higher average vehichle age and poor heating-insulation of houses. Not sure about other countries in the region, but Hungary also has a very advanced (by relative contribution to GDP) petrol-chemistry sector, wich uses up quite a lot of oil, and it was seemingly resistant to high prices so far.

Although the issue is surely not represented in these charts, I still remind you about the NG 'wars' between Ukraine and Russia this winter, which caused severe supply problems in some of these countries. Power plants were ordered to burn oil instead of NG (a lot of them are bound to do so in case of NG shortages by contract).

Since it's impossible to diversify NG import in the short & mid term for these countries, they, AFAIK, try diverting some of NG usage growth to oil, because existing ports in the Adriatic region can be used to ship in oil, and dodge such 'problematic' pipeline-countries like Ukraine. (those ports do not have LNG facilities yet, and it would be a LOT more pricey)

Look at this picture to see the amount oil that is processed and exported as oil products. It shows the primary energy flows for the year 2000. Around 2/3 of the primary energy use in the Netherlands end up as exports. I'm not sure that the figures for oil products end up in the BP numbers. Natural gas exports are reported in the BP numbers. Holland is the fourth largest exporter after Russia, Canada, Norway.

There are definitely a lot of projects in the works. I forget what the overall numbers are, but everyone and their dog has a stake in Canadian tar sands.

RR

I had read that the full development of tar sands on the board would consume the entire MacKenzie basin production, Canada's only huge untapped gas reserve left (as I understand - some may know better).

Northern BC gas pipelines do not go AB, (coals to Newcastle) but to Kimimat and points south.

SOME of the NG will likely come from northern BC in a "V". With much higher prices (imported LNG being the competitor) northern BC gas drilling should see a boom.

My GUESS is that we may see a lot of propane & butane that is now being flared off heading towards Kitimat.

There is an article(diary) I wrote at DailyKos that contains these figures.

http://www.dailykos.com/story/2006/5/22/154616/214

Some anecdotal support:

Signs of an imminent power crisis loom in Sri Lanka

Zimbabwe: Coal Shortage Hits Manufacturers

Interesting, because ordinary people in Zimbabwe have been faced with gasoline shortages and rolling blackouts for much longer than that.

Uganda: Power Crisis Dominates 2006 Budget

And Korea admits they are Addicted to Oil:

Perhaps if a country's "comparative advantage" is essentially just cheap labor then it may turn out that the cost of providing energy to them is greater than the savings attained from their cheap labor.

If high oil prices are causing a global plateau in oil demand, so that the demand/supply picture in the short term becomes a zero sum game, it's going to be even more interesting this year and next to see who the winners and losers are in consumption increases or declines. Who has the smartest policies? Who is most able to conserve? Who is most able to afford consumption at sustained high prices?

It's going to be very interesting.

I too had this theory that the low-GDP nations would be forced to cut back on oil consumption per your graph above, but this was evidently not the case. The surprising case for me was Bangladesh, not known as an economic powerhouse in a good year, but had a 2.8% increase in oil consumption.

There are two other interesting cases: Malaysia and Philippines: In the case of Malaysia, there were reports of chronic problems with diesel, due to governmental ineptitude, and the Philippines, from which there were reports all year of rationing and other problems, and both of these countries had declines in usage.

But, the other thing on this is that a hypothetical 1% decline by the US would equal more than the entire consumption of 9 out of the 52 countries listed in the report. Also, this 200 mbd decrease would be equal to about half of the declines in your second graph, above.

Despite Thailand's desperate fuel switching efforts, they are still heavily dependent on oil to fuel their economic growth. Already, cracks are starting to show up in their recent impressive GDP numbers due to high prices. Read Thailand's Economic Prospects and Financial Stability by M.R. Pridiyathorn Devakula, Governor of the Bank of Thailand. Unfortunately, I can't seem to cut and paste from this document, so I highly recommend reading it. He was addressing executives of Thailand's national oil company PTT. But here's part of what he says:

- The Thai current account went from a surplus of 6.6 billion (US) dollars in 2004 to a deficit of 6.1 billion dollars in the 1st half of 2005, with a bit more than half of this reversal due to high world oil prices. Generally, Thailand must make major efforts to decrease their dependency on oil imports.

- In light of the fact that the US current accounts deficit and it's trade deficit are unsustainable, the dollar may crash. Therefore, Thailand must strengthen their exports in the Asian market and get away from their dependence on exports to the US. The presumption is that the US will not take care of their problems.

His general message being with respect to the US, Danger, Will Robinson, Danger!best, Dave