May IEA Oil Market Report

Posted by Stuart Staniford on May 18, 2006 - 7:30pm

According to the IEA Oil Market Report (which I am late in getting too - apologies but real life has called insistently of late), the oil industry has had a good couple of months:

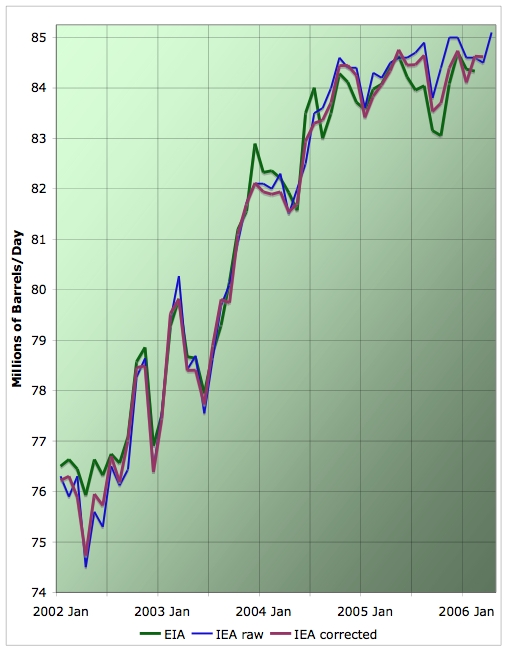

World oil supply in April rose by 485 kb/d to 85.1 mb/d. Increases from OPEC, the FSU, Africa and North America were partly offset by seasonal North Sea outages. ... April OPEC crude supply rose by 170 kb/d to 30.0 mb/d. This followed higher output in Iraq, despite ongoing pipeline problems, and to a lesser extent Nigeria, Venezuela and Libya.Thus not only is their preliminary figure for April the highest ever, but they revised the fairly high figure for March a little higher. Here's the graph of the IEA's initial monthly estimates, together with their revised estimate the following month and the more tardy (and careful?) EIA estimates.

It looks like April 2006 is definitely a contender for highest month ever. That's at this early stage; we'll have to see what the data revisions bring.

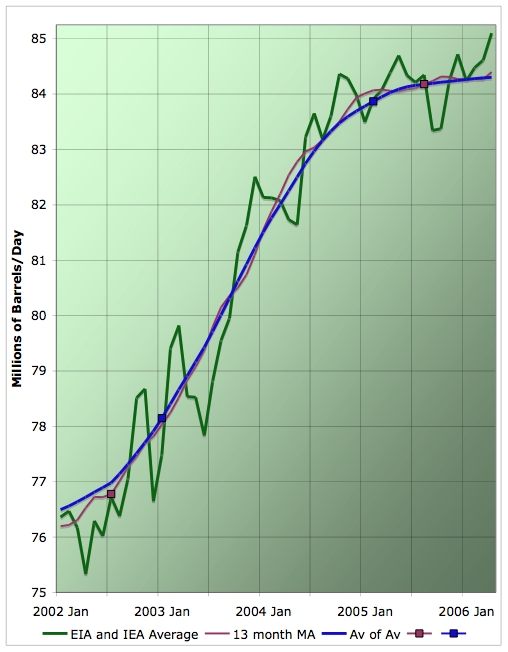

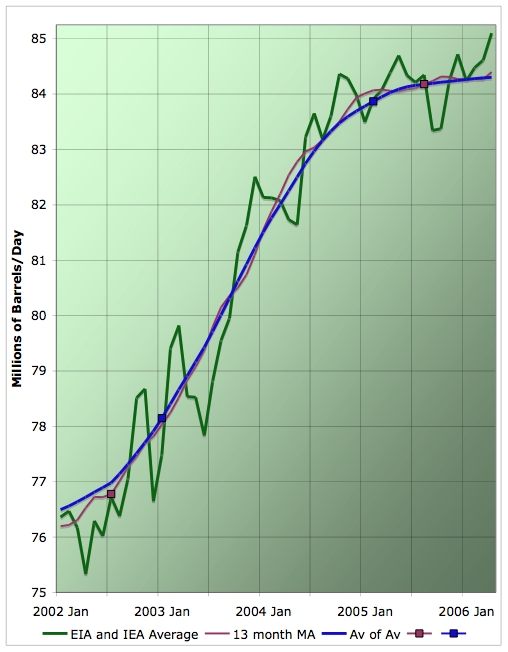

Now to the moving average graph. Firstly, I have a confession to make. When I introduced the second moving average last month, I made a spreadsheet error (or a graph labeling error, depending on your point of view). The thing advertised on the graph there as the "13 month moving average" was actually the 13 month moving average of the 9 month moving average, not the 13 month moving average of the monthly data (which itself is obtained by taking the IEA and EIA estimates of the monthly supply). My apologies for any confusion.

However, I've decided that this average of average is actually more or less what I want. So the new graph shows the 13 month centered moving average, together with the 13 months average of that 13 month average (ie something which draws support from just over two years worth of data, but with the center weighted more heavily). That (the blue line) gives us a nice smooth trend.

However, caution is in order! My preference is to extend the averages out to the limit of the data, with the window obviously being reduced accordingly. This allows us to get the best idea of the trend that the data we have to date can give us. However, a drawback of this, as Halfin has noted in the past, is that future months of data can thus move around the moving average curves in the past. This is particularly noticeable this month. That is in part because I have included the IEA numbers for March and April, even though we have no EIA numbers to average them with. The inclusion of these two very strong production estimates has dragged the moving average curves into a slight upward incline.

To make it clear how much of the two moving average curves are beyond any change, I have added appropriately colored squares at the last data point that is entirely supported by existing data reported by both agencies. Anything past the squares has some potential to change, with the potential for change greater and greater towards the right edge of the graph. In particular, a hurricane season similar to the last two in the Gulf could well put the plateau back into dead flat or even declining mode.

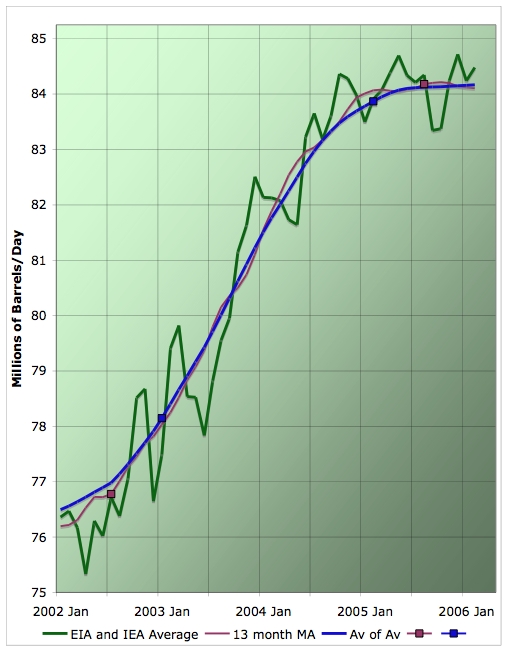

To give you some indication of the sensitivities here, this last graph shows the curves as they would be if I did not include the IEA estimates for March and April (which are not yet balanced with an EIA estimate).

As you can see, that leaves the flatness of the plateau pretty much intact.

Past coverage relevant to the plateau:

- OPEC Declines and the World Plateau

- Plateau Continues, Aided by Outages

- Plateau Update

- Cigar Now?

- Missing Barrels

- Close, but no cigar

- November Statistics Updates

- IEA Monthly Report for December

- Refining the Plateau

- Can Acts of God and Bush Explain the Plateau?

- November IEA global production

- Happy Peak Oil Day?

- Where Supply Increases Come From

I am guessing that the trend will flatten out for the rest of the year. Demand in developed countries will drop due to high prices. This will be evened out by continuing - although slower - rise in developing countries. So overall, production will be flat.

If production continues to rise then inventories will build.

What if the back slope is a mirror image of the front slope?

A few seasons in plateau, then perhaps a drop as steep as the initial rise from 2002 to 2005. Perhaps a 10% drop in three or four years.

Does anybody have an idea what a 10% drop in oil supply would do to the price of gasoline?

It seems that everyone is happy to over-analyse this blip.

Some have even decided that Peak Oil is NOT here yet based on this minor blip.

You are simply giving ammunition to the anti-PO crowd through this indecision. It could be exactly the effect the suppliers of the data seek ...

Peak Oil may - or may not - be around the corner ... but we shouldn't overact to the slightest data point.

Let's just wait a couple of months to see a more accurate trend ... whichever way it goes.

Quickfingers.

How about that?

MTF?!?!? What's the matter, climate change not moving fast enough for you?

I don't know of an earlier period where a systematic bias seemed to be appearing like that.

So one wonders a little bit whether the EIA people have got a memo to highball everything.

upward, and not a small blip.'

Why do we want oil prioduction

to rise? That simply perpetuates

the status quo and means

a) the decline will be faster when

it finally comes.

b) global warming will continue

to accelerate

to rise? That simply perpetuates

the status quo"

When the status quo means people not dying of starvation around the world, it's not that bad.

I am repulsed by commentors who worship every bit of bad news even though their doom porn means suffering to millions of people.

The throw away global warning citation is really a red herring - or a school given the its frequency. The contribution of oil to global warming pales compared to coal. Rapidly declining oil production would certainly lead to enough increased coal use to make it a net negative in climate terms.

My opinion is that a gradual, but steady price increase is the best way to force transition to a new paradigm.

You are free to disagree. Just recognize that when you say "I want oil production decline now", you might as well be saying "I want to see ruined economies and starving people".

Some of us hope for an early production peaks as a wake-up call to end the status quo thinking in the USA. We are addicts and the one thing we fear is loss of our supply.

- Coal is a far greater contributor to global warming than oil

- Reduction in oil supply is likely to increased coal demand

- The net impact is more damage to the climate, not less

I am sympathetic to your desire for a wake up call, but think your train of thought is flawed. Linking oil supply reduction with reducing man's impact on the climate is politically convenient but inaccurate.If you think that lack of oil will jolt mankind into some kind of a post-capitalist utopia, you are wrong. The end result is you are hoping for a scenario that will destroy the lives of those you to purport to care about.

I'm not sure this is true. I live in a developing country where the fishermen just last week stopped taking their boats out because of high fuel costs.

China's move towards a market economy has lifted more people out of poverty than any other single act of mankind I can think of. They thrive because you consume.

Granted the environmental and climate imopacts of their growth are not sustainable, but shutting it all down will drive people back into poverty.

I do think there is a conflict between human welfare and the environment, but pretending that a drastic fall off in oil supplies is a solution is fanciful.

I understand his point, but I'm not anxious for the decline to happen right away. I prefer watching production rise ever more slowly to a good long plateau, and a low decline rate after that (if we should be so lucky).

I appreciate your point about the effect that Market Economy is having on China. My impression of China is one of an essentially pragmatic more than a dogmatic culture, and that trade, entrepreneurship and innovation are more deeply embedded in Chinese history than the recent experiments in Marxism. Maybe these are just stereotypes.. (kites, clockmaking, firecrackers, Silk Trade, etc), but I am hoping that they are grown from fact, and that as China develops in a time of growing resource awareness, that this pragmatism will help them tune their development with adjustments that our own early Industrial Revolutionary Enthusiasms about bottomless wells and 'the Earth is yours to use' did not.

I don't begrudge the hunger for growth and the development of new systems for any country, I do think growth is natural and essential.. I just think that our own culture approached the Technical Age with a corresponding resentment or rebuttal, perhaps, of nature and the living world, due to some of the religious and scientific movements of the Reformation, etc, which have since allowed us to be essentially blind to the overall system that our fabulous tools grew out of, (Both economic tools as well as metal ones) and we have painted ourself into a corner. My sense is that the Chinese mentality tends to be less antagonistic to either Nature or to Science (where ours was/is-still a Love-Hate relationship to Science)

I'm not as upset by those that take some satisfaction in the 'bad news'.. They aren't 'Happy' that there will be suffering and misery, they are simply desperate that something comes along that is 'just loud enough' to wake people up to the changes that must be made. Also like the 'bad news' from Iraq, people who have known from before the war started that this would be a fiasco, would make the 'War on Terror' worse than ever, and would be spending our energies in directions that not only would backfire, but would suck precious resources from the programs that could actually help, this 'bad news' lets us know that we weren't crazy to conclude what we did, when we did. The correlation of that issue to our energy policies and habits is pretty much as parallel as is gets, it seems to me. Is there some "I told you so" in there? Of course. It will be a huge challenge to bring the opposing sides back together on either of these, so that we're able to work together to pick up and move into more sensible directions at this point, with bruised prides, without too much smugness..

It's what you get with a Jealous and Wrathful God..

Bob Fiske

I think that logic may be circular, but I'm now too dizzy to tell.

So what DO we rely on, Human Nature, or was that ultimately determined by nature as well? And would Peak Oil really be determined by nature if we weren't there pumping it out?

I think what we're relying on is our ability to say "Look, guys, here is where it's heading, and here's the data to back it up. Let's go over that way, instead." If you're gonna go out and cry wolf, people want to see some blood, some fang-marks, or a Wolf, or a believable Fox update about 'the ongoing Wolf scare'..

So I'm fairly certain (and for now, that will do) that there's a waterfall ahead, and I will both row backwards with my own oar, try to tell my neighboring rowers to at least consider doing the same thing, I'll have to scan around for the odd lifejacket and such, and I keep looking out ahead too, to see if there are signs with which I can convince my unconvinced fellow-paddlers that its REALLY time to reverse the thrusters or grow wings..

certain uncertainty.. that seemed a little bit of a cop-out line, but brings to mind an alternate.. "In nature, the only thing that is constant is change."

And if that's too holistic,

Someone commented of the philosopher,

"DesCartes thinks he thinks, therefore he thinks he is.."

But - we digressed. IMO it is not useful if we are about to face an immediate crisis; at our current stage it can only result in a rush for wars and/or dirtier alternatives. A prolonged plateue and high prices may be the best we can hope for. Only in a period of peace we will be able to deal with this rationally.

What a thoughtful post! Expressed what I have thought before but could not put into words. It's thinking like this that keeps me coming back every day.

I say this because it seems very few people are paying attention to the debate over peak oil, and even those who do are unlikely to change their behavior until price rises force them to change.

However, we do have a huge and growing environmental problem, which can only be "solved" by behavioral changes. For instance, the fisheries of the world are overtaxed and in danger of collapse, and without a Law of the Sea, the only way for fisheries to see relief is if fishermen lose the ability to put to sea.

The Economist has lately "seen the light" with regards climate change, so they now argue both for reducing carbon emissions, but also for increasing energy production to keep the world economy growing.

In the absence of fusion energy, these two aims are contradictory.

I personally don't relish the prospect of poverty and famine amongst human populations; but nature has a way of making things work out in the end.

Nature is unfeeling, inexorable. And fascinating to watch.

On the other hand, this doesn't mean I want a collapse in oil production. The best scenario is an immediate peak, followed by a long, slow decline. This will produce the requisite "wake-up call" in the form of higher & rising prices, but allow the most time possible for a transition to a sustainable energy future.

Will we get that gradual decline? I'm not as confident about that as I was a few months ago. The signs are ominous that depletion rates in some of the world's greatest oil fields are considerably more than forecast by ASPO - something that does not bode well for the future at all.

Finally, it would be good for contributors in the US to remember that the rest of the world exists in a much less oil-intensive environment. This has certain important consequences. One of them is in the realm of food production & can be seen from the example of Mexico.

Before NAFTA, Mexico produced almost all of its own maize (the staple grain there). With the dropping of trade barriers in line with NAFTA requirements, cheap US maize started flooding into the country and putting Mexican farmers out of business. Now, from what I read, over half of Mexico's maize is imported.

This, however, is a pre-Peak Oil situation. If, as many predict, US agricultural production falls substantially because of extremely high oil prices making current US agriculture unviable, there will be plenty of scope for Mexico to lift its maize production again - they weren't using much oil in agriculture before NAFTA and they wouldn't have a major readjustment to make after Peak Oil. The same scenario, with different crops, will play out in many Third World countries where cheap agricultural imports from industrialised countries have put local farmers out of business.

Yes, Peak Oil will lead to much suffering as the world adjusts, but the suffering is likely to be because of socio-economic structures rather than purely technical ones. And the people who will be doing the suffering might not be just the usual suspects.

Sounds like fun. Sign me up!!

==AC

I see both your points. I'm slightly on the 'only a crisis will wake us up' side though. There is the frog in the pot coming slowly to a boil issue. I'm not sure a gradual price increase will 'force' anything. I worry that if prices gradually just increase at some point societies (like mine) will find themselves not too long from now going to work, in order to earn money for gas so they can go to work. Then, it may be too late to transition to a new paradigm. The main 'need' is to make people realize that we need to get crackin' on that new paradigm -NOW.

anything to slow the creation of greenhouse gasses is a very good thing...so i am rooting for the peak to hit us like a ton of bricks

if we have a slow rise in the price of energy, and therefor humans continue consuming and consuming - we will pass the tipping point for runaway glogal warming

...and then a much much larger number of people will die

take the long view Jack

yes - ruined economies and starving people, that what i want to see....

its either life on earth - or endless economic growth

there is nothing in between

"Under the oil consumption is economic growth argument the conservers of oil are dragging down the economy."

Funny you should mention that. My wife's financial advisor said, when reviewing our abstemious lifestyle, "The economy would collapse if everyone lived like you do."

He agreed that financially there is an end to oil, btu economically speaking there will be no end due to the cost prohibitve nature of extracting the last bits all around the world.

So I don't think people assume oil=growth, but energy=growth. Whether it be people energy or any other type, you need energy to grow.

Since it requires energy to provide goods and services (be it electricity to run the computer you are using to read this, the mining of copper, the harvesting of corn, or the running of a factory in China), one could reasonably argue that the consumption of energy IS economic growth.

Less consumpiton is therefore less growth. In stagnant economic times, energy consumption is severly curtailed. Cause and effect, or effect and cause, they are fundamentally linked.

Is there any indication that our entire economy could be measured like a bell curve?

What if our economic value peaked and never returns to peak value? I know the bell curve is most important to industrial applications, but what's to stop things from melting down to a dribble of what it once was as we live in a protracted state of remembering the "good ol days."

But if there's a 20-car pileup out on the interstate, it increases GDP due to the sudden increase in demand for services from auto shops, hospitals, funeral homes, and insurance companies!

Ditto if you get a brain tumor and spend the next 6 months in the hospital purchasing expensive services. An avid consumer! GDP boosted!

Same if you and your neighbor each stay home and take care of your kids, but then you decide to pay each other to care for each other's kids. GDP goes up! Because caring for kids doesn't count toward GDP unless you pay for it with cash (or credit).

If you travel 5 miles by SUV, that adds to GDP. If you travel the same 5 miles by bike, it doesn't.

So yeah, adjusting to less oil will probably reduce GDP. The question is, who fricken cares???

any slow and gradual move away from a fossil fuel economy will only support the current economic model - therfor keeping the 800 million people in 'developing' countries starving...

we need to pull the band-aid off when it comes to fossil fuels - a little crash (or a big one) will only help civilization in the long run

The slower the crash, the more likely it is to be 'catabolistic', whereby it is meant that we may consume much 'natural capital'.

Imagine the planet in 100 years after a slow transition or fast crash. It is pretty clear which scenario presents the higher risk in terms of global warming.

I don't.

And how would they get the coal? Hike to Tennessee and dig it out themselves with pickaxes and shovels?

But, in fact, they could easily go back to coal. And this is high btu coal we're talking about.

Of course we're probably one of the few communities that has nearby access to its own coal mine.

And I hate to think of the inversion problem if everybody digs out their old coal stoves ...

If people are cold in the winter, or can figure out how to turn wood into bio fuels, they will cut it all down.

You replied, I sense with great cynicism, "I don't" and then proceeded to deliver your killer shot

"And how would they get the coal? Hike to Tennessee and dig it out themselves with pickaxes and shovels?"

I fear you greatly underestimate how easily the switch is made. In the recent Katrina period of $15 MM/btu natural gas prices, I saw the switch made many times....

In Kentucky, Indiana, Ohio, Tennessee, Alabama...most homes are heated with natural gas, but get electric power from coal for the most part...so you back the natural gas heat down, run over to Wal-Mart (Wally World, as us rednecks affectionately call it) and get a couple of electric space heaters....presto! Switch from natural gas to coal for heating! An electric blanket tops off the deal, and your cozy and warm, you heating bills are low (electric rates in the Ohio valley, TVA Tennessee Valley and most of the coal fired south are among the lowest in the nation) and you worry not a wit about global warming as long as your warm right now, and your saving money....

Another friend of mine who heats with propane bought a full load in the summer and then ran the electric heaters in the winter to conserve it, just in case, as he said....in case of what? Extreme high winter prices, or, as the TOD'ers affectionately call it, TSHTF big time....global warming is the world's problem in these folks mind, right now, they are just looking out for numba' one....I think analysis by the energy pros always GREATLY underestimates the consumers ability to put another acronym into play....YAHOO, You Always Have Other Options.....remember the 1970's, when people built basement houses with a woodstove, and took themselves right off the oil and gas markets for heat? Energy supply/demand is MUCH more complicated to model than most folks even imagine...

(It goes for industrial usage too, by the way....have you ever wondered why so many Japanese factories seem to "coincidentally" be located near the great American coal belt, and the cheap electricity it provides? hmmm....)

Roger Conner known to you as ThatsItImout

That is why I say we cannot quickly ramp up our coal use. People living close to coal mines may be able to...but for most of us, it won't be as easy as it was in the past. The population is roughly triple what it was during the 1930s, and the remaining coal is much harder to get to. That's why we machines like this, instead of a bunch of guys with pickaxes and shovels.

Mining will be severely affected by peak oil. (Just look at the trouble they're having keeping the mining industry going in Africa, with the current energy crisis.)

We have needed your calm, level-headedness over the last few months.

Looking forward to reading more intelligent comments from you again.

BTW, you missed several questions about the IOB!

But I really don't think it's a matter of being happy or unhappy one way or another. We all know peak is near or here. We also know that essentially nothing meaningful is being done to prepare for it (excluding war preparations.)

Knowing that a catastrophe is looming, it's natural to want to see some reaction to it, some preparation for it. So there's a tendency, somewhat illogical I admit, to want to the evidence of looming catastrophe come forward sooner than later so that this will take place. I don't think anyone wants to see the suffering that looms, much less share in it.

I'm 65. So I made it to peak. Do I consider myself lucky or unlucky that I'll (probably) see the beginning of the end of the oil age?

Myself, I won't believe in any peak until there has been 5-10 years of declining production, a few months is not enough time.

The oil price at the current time is demand driven- competition for the resources between industrialised and industrializing nations.

Let's party!!

"Will the coming world order be the American universal empire? It must be that.... The coming world order will mark the last phase in a historical transition and cap the revolutionary epoch of this century. The mission of the American people is to bury the nation states, lead their bereaved peoples into larger unions, and overawe with its might the would-be saboteurs of the new order who have nothing to offer mankind but a putrefying ideology and brute force. It is likely that the accomplishment of this mission will exhaust the energies of America and that, then, the historical center of gravity will shift to another people. But this will matter little, for the opening of new horizons which we now faintly glimpse will usher in a new stage in human history.... For the next 50 years or so the future belongs to America. The American empire and mankind will not be opposites, but merely two names for the universal order under peace and happiness. Novus orbis terrarum."

~Strausz-Hupé, 1955 "The Balance of Tomorrow,"

==AC

The Greatest Economic Crisis in Modern History

http://tinyurl.com/emg2g

So, what we've had, is this kind of speculative system, which is integral to this operation with getting money back into these bankrupt banks, through bundling of Fannie Mae-type and Freddie Mac-type mortgages, this system was going to blow! This is a bubble, this is a classical John Law-style bubble, as John Law from the early 18th Century. You had one in England, you had one in France. South Seas Island bubble, and the Mississippi bubble. Same kind of thing. It's a ponzi scheme. It's a pyramid club scheme--same kind of thing. But a pyramid club scheme betting on a pyramid club scheme, betting on a pyramid club scheme--off into the stratosphere.

Now, the money is being printed, which is generally registered under the category M3. And notice that you can't find out what M3 is, any more. They officially decided to hide the figure! Because, if the figure were published, it would show you how much money is being printed, printing-press money by the Federal Reserve System, and being pumped into the system now, to bail out and fund these financial interests.

Anyone knows this, who knows the system: When you build up this kind of bubble, a super-John Law bubble, layer upon layer--this thing is going to pop. Then, if you're a smart banker, what're you doing? How are you going to get out of the bubble, which you are going to cause to pop? Why aren't you going to go down with the bubble? You have to find a landing place outside the system. What is that landing place? Gold, silver, iron, zinc, copper, petroleum!

These are physical assets, so-called natural materials, these are assets which will be marketable in the future. So what you do, is, you corner the market in possession of these materials. You raise the price to the sky, because you're bidding against each other to grab these materials, and trade them back and forth, day after day. It's all done by this bunch of financiers. That's where you get that curve! So, when you look at the curve of inflation, don't look at the groceries--you will get grocery inflation very rapidly; you're already getting it, as many of you know. It's going to get serious, like housing inflation has been. Hmm? But this inflation, is where the powers of the future intend to be: They will control these assets; they will control the real estate; they will control the water systems; they will control the water. They will control the food. They will own you, and decide which of you lives and which dies.

This is not oil companies trying to "gouge the public"--oh, they do that all the time! But, this is nothing new; that part's nothing new. What they're doing that's new, is, they plan to sink the whole world economy, into a breakdown crisis, from which they will emerge, where governments are bankrupt and powerless, and they will emerge as the owners of everything in sight. And their banking systems will come--not the government!--but they will come, and foreclose on you. And there'll be nothing to protect you. That's the game.

I think that claim was for crude + condensates only, whereas these are "all liquids" figures which include the linoleum recycled off your grandma's kitchen floor...

Which is, of course, a pain worse than death for some people..

Heaven forbid that you start making some preparations a few months, or even a couple years "Before" the provable fact. 'You fools! They played you, man! Ha, ha!'

I can only hope that you are less concerned (as are those who 'advocated' a certain point in time) about the proof of it as the implications, and what it will take to deal with it, as the timing eventually becomes clearer.

I'd rather be ready than be 'right'.

Bob Fiske

You would not happen to be an economist, by any chance, would you?

All of these things are consistant with the lifestyle I want to live anyway, so it is reasonable to do and there's no downside for me.

But guns don't figure highly in any of my plans.

I'm something of a firearms afficionado, so I had this angle covered already.

My personal choice is a Romanian AKM chambered for 7.62x39mm. Simple, cheap, reliable to a fault, decent accuracy out to 100m (effective combat range), can be used to hunt boar, deer, small elk, turkey (although not necessarily ideal), cheap steel cased ammunition by the case, cheap magazines. Requires little skill to use effectively. $350.

My second choice is either the Remington 870 Express (synthetic) or Mossberg 500 SP shotgun. Affordable (under $350 retail), versatile, accurate out to 40m or so, good choice for hunting or self defense, readily available ammuntion, very easy to use with a minimum of skill.

The blast and recoil from a full-power shell in a 12-gauge shotgun can be quite startling or painful for inexperienced shooters, so I recommend an aftermarket rubber butt stock and/or reduced recoil ammunition.

I am not a big fan of handguns, for a multitude of reasons, not the least of which is the very poor effective range, the difficulty of using them effectively without substantial skill and practice, and the prevalence of accidental discharges with them.

A pistol is what you use to fight your way to a long arm that you never should have discarded in the first place.

I'd say that a year of declining production coupled with rising prices would give a roughly 97% confidence in a peak call.

Substrate said, "I'd say that a year of declining production coupled with rising prices would give a roughly 97% confidence in a peak call."

If that were true, than Peak Oil was assured in 1977 to 1979...what would happen if OPEC production fell TO ONE THIRD OF IT'S FORMER OUTPUT? We already know...

OPEC production, historically...

http://www.wtrg.com/opec/PROD7398.gif

Yeah, but....the world overall has never NEVER seen a production decline of more than a year or os right? Well, try again....taking Colin Cambell's own depletion scenario, take a look at 1979 to 1988....what a valley that is! That's right folks, oil production did not return to 1979 production levels until about 9 years later! NOW THAT HAD TO BE PEAK, RIGHT? Well, it wasn't, at least not in the true sense...

http://www.albany.edu/geosciences/04oilpeak.jpg

So how did the world survive such a drop in oil production? Looking back, the answer is simple...demand destruction by recession, a move to much lower weight autos, the collapse of demand in the greatest crash of an empire since Rome (the U.S.S.R), and a massive switch to natural gas.

What is almost NEVER mentioned in the rhetorical damnation hurled at the most advanced nations is that the efficiency binge they went on in the early to mid 1990's was fantastic, with combined cycle electric production, improvements in aerodynamics on trucks and cars, mass reduction in vehicle weight and massive improvement in engine and drivetrain efficiency. When production recovered, prices fell, and demand took off again....we gave away the weight loss and got fat with SUV's, and traded away the engine efficiency improvements for horsepower instead of fuel efficiency (a new Honda Accord accelerates to 60 MPH as fast as a Trans Am Firebird did in 1978)

Trying to guess the Supply/demand future is MUCH more complicated than most people imagine.

Roger Conner known to you as ThatsItImout

Two words there that make all the difference....IF production...grows...PROBABLY capable....

I wouldn't be investing in if's and probably's but that's just me.

Exactly that switch is what makes me doubt our ability to adapt this time. The oil that is produced today really is needed. All kinds of adaptation already have been put into effect during those years.

But, we should first deduce the NGL. This is mostly from natural gas production, so if we really want to follow the crude production and use Hubbert methodology, we should not count that in. Secondly, we should start looking at the EROEI, ie. net energy input from oil. It is is obvious that we have here an "EROEI creep".

The new production, especially deep-sea, is much more energy intensive (count in all investments and production costs) than "old" production that is constantly being replaced. Most of this energy input comes from other energy sources (coal, gas, nuclear) so it doesn't "show", but affects nonetheless overall world enegy balance. Another source of the "EROEI creep" is the slowly deteriorating energy content of the production. Heavy sour crude is not the same as light and sweet.

We must also see that the "EROEI burden" is in the oil producing countries, not in importing countries. The energy inputs are made elsewhere than there where oil is imported to (excluding refining). This makes the usage of energy look more effective there where energy imports are high. All this confuses the real energy picture. For instance, if the US tries to substitute its energy imports with low-EROEI domestic energy, the situation will deteriorate rapidly, because the EROEI burden will be heavier and will fall on the US.

I think that there might be some reason to suspect that the world oil production is already higher than it should be. This means that the EROEI of the new marginal production might already be near one or even less, ie. that production doesn't add nothing to the net oil energy, and might even have a negative effect. We should account here all oil investments, exploration. R&D, all drilled dry wells, abandoned projects, replaced rigs in the GOM - everything oil production related. In fact I don't believe that the marginal EROEI (as contrasted to the overall EROEI) is already one or less, but I think that this has already a significant effect.

It is clear that marginal real costs are highly dependent upon EROEI. I am arguing that in the case of the oil industry, marginal costs are less associated with price than is typically the case, and is the case in other industries.

The two most significant issues which give rise to this disjunction are the cyclical history of the industry, which has naturally given rise to the conservative outlook when choosing a costs basis for new projects, and the significant lag times between project start and getting product to market.

By way of explanatory example, the cost of crude was circa $10 back in 1999. Was this some kind of meaningful floor? I would suggest certainly not, and that the price was unsustainably low. Certainly some crude sold for this price had marginal costs above $10 (on a project lifecycle basis), but the oil was worth selling anyway because the capital was already there (sunk costs).

As oil production goes over its peak, the price of oil is even less likely to give any indication of EROEI in any meaningful way. The trading price is more likely to be defined by the interplay between economic strength and the tussle over declining supply (ie. never close to this floor). If there are periods of severe economic downturn, it is possible to imagine oil sold at below cost on a project life basis (like in 1999), because the fixed costs are sunk already. If global demand shrinks significantly, regimes like the Saudi's will be revenue poor and will need to sell as much oil as possible for whatever price they can get. After all, it's their only revenue stream, and they'll need every cent.

And there is still one point here: very heavy investment activity in oil production at some given time may cause a temporary drop in EROEI. All delays etc. will reflect in this. What was the real EROEI of a project can be known only after the life-cycle is in the end. This can make an EROEI creep that is very difficult to predict.

http://www.ker.co.nz/pdf/Cleveland.pdf

I think he predicted that in the US domestic oil production the net energy gain from new oil projects will approach zero already in 1995. This might not have happened but in any case the EROEI in the US oil production is rapidly deteriorating. But increasing oil and natural gas imports is offsetting this. So be careful when you wish to cut the imports! You may be falling to the EROEI trap.

I don't think their heavy oil numbers include that 100+ billion barrels of heavy sour in Venezuela or any productin from tar sands/oil shale. Those sources likely won't delay the peak, but they'll make the post-peak decline less steep.

In general, I've always been convinced that while the HL analysis can work extremely well for a subset of the world production, it fails when talking about the entire world because it doesn't take into account the obvious economic effects triggered by higher prices. More sources, like those Canadian tar sands, only come online once the price of oil is perceived to be "permanently" above a critical level. Likewise, demand destruction/conservation efforts, R&D into alternatives and their roll-out reduce demand now and leave more oil in the ground for later use, effectively, if slightly, lowering and delaying the peak.

Because it is not only oil but the total energy mix that is crucial for the economic growth, we might well see recession taking down oil prices or preventing them rising. In this situation the low EROEI reflects in a situation where exploiting the tar sands, CTL, extra heavy etc. will remain non-profitable. We will see.

Is the decline of Cantarell showing up yet ?

As we know, Mexican population keeps increasing and demand as well (absent a recession), so flat production = declining exports.

Link provided by a TODer about 6 months ago I have bookmarked :-

http://www.pemex.com/files/dcpe/eprohidro_ing.pdf

Nov 2005 2939 Kbpd

Dec 2005 2995 Kbpd

Jan 2006 2956 Kbpd

Feb 2006 2930 Kbpd

Mar 2006 2906 Kbpd

With those figures, you could argue that Norway's production is increasing. It depends on what the comparison is. Looking at the past few months, the figures state that Norway's oil production is about stationary. Compared to Oct 2004 with 3,227 Kbpd it has fallen. Compared to Sep 2004 with 2,883 Kbpd it has risen.

I agree Norway's oil production is falling, but it is not as fast as some people have predicted. With the summer maintenance season coming along, then oil production will fall by quite a bit, before increasing again, but probably below y-o-y values.

So if we're approaching a peak, it isn't a supply driven peak (yet) but a politically driven peak. However a supply driven peak will arive soon enough, probably in the next five years.

regards

The barrels are counted too many times to allow for much monkey-business. Barrels produced minus barrels consumed equals a countries exports. Barrels exported are barrels consumed by someone else. Total barrels produced basically equal barrels consumed worldwide on a yearly basis.

Others may have different takes on this. I'd be interested in hearing them as I am as interested in the details of the system as anybody.

I highly recommend visiting the EIA's petroleum pages. There is a lot of stuff there. I was just trying to find it to post here, but gave up for now - but they have a database that lists every single tanker coming into the US by date, country of origin, port of entry, company(refiner), barrels on board, product on board, etc. Quite impressive.

that when you say "I want oil production

decline now", you might as well be saying

"I want to see ruined economies and

starving people".

When you say you want the status quo to

continue, just recognise that you are

opting for more population growth and more

global warming. Therefore, there will be

even greater misery at some time a

little later in the future, when the oil

supply does collapse, because there will

be more CO2 in the air and more mouths to

feed, with a more sharply decining fuel

supply. Your argument makes no sense.

It is akin to being stuck in a survival

situation and eating all the rations in

the first week, so that everybody feels

happy a short time, then starves.

http://www.forbes.com/home/feeds/ap/2006/05/17/ap2753259.html

These were the key paragraphs:

Sounds less and less likely that we are going to beat the production levels from 2005, this year. Even though they say it is due to weakening demand, ultimately that demand drop is due to high prices, and the only thing that can keep prices high is supply problems. Whether you call it lack of demand or lack of supply, either way it sounds like we will be stuck on our "bumpy plateau" for at least the rest of the year.I know that the oil industry is $1.7T, and thus has a lot of inertia, and lags, and other things which argue for there being a smooth line hidden under all that "noise"

But we also know that our data set is based on few sources, some of which may be in honest error, others of which may be outright lies, and that there is huge motivation, on all sides, such as the oil futures marketsto fiddle the numbers on any public trend analysis

I'm no expert in statistics, chaos theory, or the modeling of res. depletion or the innards of global demand destruction mechanics, but I did spend several decades writing data analysis software for life sciences folks who just beg for you to show them a nice smooth line they can stick in their paper for publication, and I observe that we are modeling a system with this time series that is in many senses "organic" and thus I would suggest "deeply noisy"

Thus, expectant as we all are to see our pet theory validated, or that of our rival zapped, please lets not read too much into the outcome of a simple moving bin swept across this data set. The world is just not that "clean"

Not that I am dising those who do this just trying to put it in perspective...

If I can slip in an off topic comment while I have the floor:

Important as the US is in the world oil scene etc there is an awful lot of US centric red blue dem repub etc posts here that leave the rest of us out of it, just something to keep in mind ;)

I can understand that reporting deadlines can leave data stranded in the wrong time category, but I would have thought that a 2-month backward-looking moving average would take care of that.

The next step is surely to use a least-squares best fit to a polynomial of order 6 to achieve the required smoothness. Alternatively you can fit to a Gaussian curve, using Excel's Solver facility to choose the mean, s.d. and peak.

Example http://home.austarnet.com.au/davekimble/gaussian-fit.World.xls (virus check and approve macros)

The data is certainly jittery, so the trendline should be very thick, thick enough so that 68.3% (+/- 1 s.d.) of the data points fall on the line. This should give a good impression of the bluntness of the tools we are using.

When one upward-jittering data point can alter the slope of your trend line, something is not being done right.

There does seem to be some controversy about the use of a centered average vs. a trailing one. Personally I like the centered averages but they do have the problems noted at both ends of the data set. Perhaps someone will re-post Stuart's graphs with trailing averages. How about an interactive Java applet that lets the user vary various parameters?

I'm also concerned that we are reading too much into every little inflection in the monthly data. Stuart used to publish a graph to "keep Halfin off my back," but this went all the way back to 1860. It would be nice to see a modified version of this graph again as part of these updates that goes back just a few decades instead of almost 150 years. One thing a 25-40 year graph would show is the various production plateaus and outright declines that have occurred in the past. Yes, most if not all of these prior peaks/plateaus have not been associated with price spikes as has the current one, but they would put the current situation in perspective by showing that the current plateau is not yet unique.

People may come to this site without much historical knowledge, see that graph and conclude "this is it, the peak is now". Then if it turns out that this is not quite the peak, as recent months hint, they may decide that the whole thing was a con, tune out and go elsewhere. That would be premature, but it would result from having giving them miscalibrated expectations due to a misleading window for data presentation.

Ultimately, presenting the graph like this is a gamble on the peak really being right about now. If it turns out to be in 2010 or something, the basic Peak Oil scenario would be vindicated but that graph might have driving a lot of people away in the mean time.

- accelerated extraction

- collapse (or rapid change) in demand

- drawdowns or increase in reserves

- bad or manipulated numbers

All these and more complicate world peak more than country (like US) peaks, because the stakes are far, far higher, since all know that it cannot be made up for elsewhere.Now, in a really long view backward, one will know the URRs, and pretty much be able to say when midpint was reached. But nothing absolutely says that peak production had to be just then, does it? So peak is midpoint plus or minus. How much plus or minus? Five years? Smae backwar or forward? Any informed opinions?

Reply to Davebygolly

Well, as the wonderful Muppets skit went, when they rolled a Viking into the surgeon's room to be operated on...the nurse said, "Oh, oh, here come the Great Dane jokes..." to which the doctor replied, "Well, they're good, I don't know about great!" :-)

So it is with my opinions to come, opinions, yes, but I don't know about informed! :-) Judge for yourself....

All the points you mention create a very confused situation in trying to establish a clear date on "Peak Oil" or for that matter, in the ultimate definition of "URR's"

We know that price changes the Ultimate Recoverable Reserves. Oil that would not be considered "recoverable" due to economic reasons becomes so if the price goes high enough. A great example of this is deepwater offshore drilling, which requires massive capital investment. But, at some point, no matter how many rigs you sink in deepwater in a certain geographical locale, you will face that magic word "Ultimate". We have had this discussion here, about the difference between "logistical peak" vs. "geological peak". I have quoted West Texas, a fellow poster here, who points out a "true" geological peak" in history, that being Texas, in which no matter how much you spend, or how many rigs you sink, the production will NEVER rise to it's former levels....this, to me, and to my understanding of real "Peak Oil" is what folks like M. King Hubbert, Colin Campbell, Ken Deffeyes, and even Matthew Simmons are referring to when they discuss true Peak. In that scenario, the 4 factors you mention,

accelerated extraction

collapse (or rapid change) in demand

drawdowns or increase in reserves

bad or manipulated numbers

would be so marginal as not to matter. The non-geological factors could move the so called Peak date by months maybe, but not much more.

HOWEVER, if the world was not at true "geological Peak" but merely at a "logistical Peak" the above factors you mention could be HUGE in their effects.

In an earlier post, I showed just such a "logistical peak", a big one. I will reproduce the links to the two graphs referenced here for your amusement,

http://www.wtrg.com/opec/PROD7398.gif

http://www.albany.edu/geosciences/04oilpeak.jpg

Now, look at the year 1978. The production numbers in that year worldwide were not reached again until 1988 or so....it was a FANTASTIC peak, not to be matched again for almost a decade. What we now know is that it was only a mirage, a "faux peak" if you will, or a "logistical Peak". At the time however, it seemed very much like the real thing, and all things you hear now on TOD and elsewhere was being printed in those days (in hard copy...those were pre internet days, so it wasn't an internet doom hoax!).

Now, we are back in the same spot again. Is what we now see a "geological Peak" or a "logistical Peak". Many here have heard me discuss this before, and may think it is a fixation on my part, but I think it is a CRITICAL distinction. Many people who are so called "Peak Aware" give themselves away as being protagonists of the Peak, but when they speak, it is easily realized that they are referring to a "logistical peak". Some of these people are very famous and important....The remarks of the Chief of exploration and heir apparent to be CEO of the French energy giant Total, Christophe de Margerie, give this important difference away, for example.

http://business.timesonline.co.uk/article/0,,13130-2124287,00.html

de Margerie made TOD and other Peak Oil discussion sites with this remark..."Numbers like 120 million barrels per day will never be reached, never," he said." This was taken as his endorsement of Peak Oil.

But says de Margerie, "The oil reserves are there, that is the good news, but what we can bring on today to meet demand is limited by factors other than what scientists see in a lab or think-tanks." Wait? "The oil is there..." (??) Then how could that be peak? Well, it isn't, at least not in the geological sense, if you take de Margerie at his word....but it is, if you look at the idea of "logistical Peak" de Margerie continues....

"Total's exploration chief reckons the output rise is impossible, given available resources and geopolitical constraints on gaining access to reserves in Opec countries.

de Margerie argued that the resources were simply not available. He said: "Take Qatar. How many projects can you have at the same time? You have more than 100,000 people working on sites. It's a big city of contractors. Now they have the problem of having to build a new power plant to supply a city of contractors."

Now of course, he is talking about a logistical problem by his own admission, NOT a geological Peak. The logistical problem alone could be enough to bankrupt us all, but it says nothing about the geological situation, i.e., Peak Oil in the sense that Hubbert, Campbell or Deffeyes originally described it.

If that's not complicated enough, we have to add in the problem of whether we are talking Peak Oil, Peak Light Sweet Crude Oil, Peak all liquids, including GTL (which it is to be noted, even Campbell accepts in his depletion scenario), and which peak could move based on access to stranded gas, natural gas prices and development, economics, in particular if you take in Polar/Arctic natural gas resourses. Again, if we look at stranded and Arctic gas, and potential deepwater natural gas drilling, you see the potential for wide variance in the theoretical "halfway point" or 1/2 Qt, or or 1/2 URR, however you want to phrase it....and notice we have left out the truly unconventionals all together....(unconventional gas, tar sand, heavy oils, peat, shale oil, coal to liquids, etc.) simply because if you include them as in anyway possibly a part of the URR of oil/gas, you end up with such a muddy picture that not even the Oracle of Delphi could give you a prophecy!

Gee, don't you wish this stuff was just a bit more complicated, to keep it fun!

Roger Conner known to you as ThatsItImout

Minor correction,but an important one....I said, "including GTL (which it is to be noted, even Campbell accepts in his depletion scenario)...that is not correctly stated, sentence should have read "ncluding NGL (Natural Gas Liquids) (which it is to be noted, even Campbell accepts in his depletion scenario) my apology, hope that makes everything as clear as mud! :-)

Roger Conner known to you as ThatsItImout

There is no doubt about it that th distinction you mention is a critical one. But Stuart's graphics are interesting because of Deffeyes prediction of geological peak at the end of 2005.

The example of 1978 shows that a oilpeak can indeed only be recognized in hindsight but an increased production would procve Deffeyes wrong. We should also keep in mind that both Stuart and Deffeyes do this prediction stuff tongue in cheek. both are aware, and have been stating so, that the true, geological peak can only be recognized in hindsight.

is the area under the blue curve the same as the green average of total production?