Updating oil price graphs

Posted by Stuart Staniford on April 24, 2006 - 12:18pm

Seems like an interesting time to update some oil price graphs again.

Last time I got around to covering it, on January 20th, it meant we were within a week and and a couple of bucks of topping out, before going into a $10 decline for a month. After that bottom, we started up into the rally that's been going on until now. My guess is it's starting to get ripe for for a correction again unless we really do bomb Iran.

I had predicted at the beginning of the year that prices in 2006 would be $65 ± $20 in the absence of a major oil shock. I'm sticking to my story for now.

Right. Daily closing price of West Texas Intermediate. 2002-present. Expressed in then current US dollars. Source: EIA. Click to enlarge.

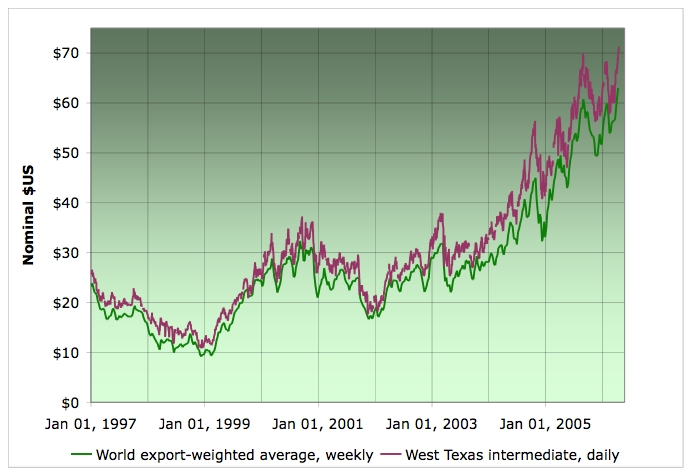

Average weekly price of all oil grades weighted by export volume of each, together with daily price of West Texas Intermediate. 1997-present. Expressed in then current US dollars. Source: EIA, and also here for the world data. Click to enlarge.

Here's the history from the beginning of 1997 on. The purple line is the daily spot price of WTI - West Texas Intermediate (Freight-on-board in Oklahoma - ie you have to pay for the shipping on top of this). The green line is the weekly average closing spot price of all grades of oil around the world. The EIA weights each grade according to how much is exported globally. This line is probably a more realistic measure of the oil price forcing function on the world economy, since it includes all the heavy grades in a reasonable proportion according to how much of them is being exported. However, WTI is the price that is often quoted in the US media (though the front month contract on NYMEX for light sweet crude is also quoted often).

According to Econophysicist Didier Sornette, one signature of a bubble is that the price rise starts to go superexponential. This has happened in US house prices in the last few years. The following quick and dirty study suggests oil prices have not got bubbly yet:

Average weekly price of all oil grades weighted by export volume of each, together with daily price of West Texas Intermediate. 1997-present. Expressed in then current US dollars. Source: EIA, and also here for the world data. Click to enlarge.

Optical illusion, I suppose..?

I want to repeat an example I used in another post on TOD, and re-ask the question:

Is crude oil and gasoline really that expensive?

My father commuted 21 miles each way per day in the 1970's energy crisis and seldom complained. Inflation adjusted oil prices were higher then than now, even at the current record $75 a barrel. Divide the per price barrel by what the average income was then...I made $1.50 an hour when oil went over $30 dollars a barrel in the late 1970's, or twenty hours a barrel. Now, at only $75 a barrel, most folks make over $7.50 dollars an hour, which would be only ten hours per barrel. If you make $15 dollars an hour, that's 5 hours per barrel. Why was my father so nonchalant about gas prices? He was getting 50 miles per gallon. Not only that, he was burning Diesel, in a Volkswagen Rabbit Diesel. He moved to it after having driven an Oldsmobile 98 for years...his fuel costs actually went down, while the cost of oil went up!

There is a serious problem of logic for any proponent to have to argue when trying to explain the absolute certainty of "Peak Oil" occuring either in the past or in the very immediate future to someone of a clever mind:

They will ask as a first question, "If that's true, why isn't gas and oil higher in price, in fact, WAY HIGHER?

This is difficult to explain. So to turn a question asked earlier on TOD, in another string, Instead of asking, "Why has gasoline risen so high?", let's ask it the other way around: "Why isn't gasoline far, far more expensive?"

If there is even so much as 30% chance we at the point (or past it) of sustainable oil production, the gasoline should be extremely high in price, at least as high as European prices, and European prices, given the PROVEN peak (and very rapid depletion) of Atlantic North Sea production, should be FANTASTICALLY higher.

Likewise, any competitive replacement, i.e., natural gas. It is high, but not nearly as high as one would expect in a real "Peak" scenario. And one more thing: In a true "Peak" scenario, there should be little fear, as there obviously still is, of a massive downward correction. All the corrections would have to be UP, and UP BIG. But even confirmed "peak aware" folks still speak of possible downward corrections, possibly of fair sized magnitude, as though the "market" in oil is still like the market in stocks or houses, rational, and with room to spare in both directions....in other words, just a routine "auction" type market? Is that really believable in a true catastrophic "Peak" energy scenario. (and by the way, where is the hoarding one should see at the point of "Peak" oil? It should begin soon if realization of a runaway demand exceeding dropping supply takes hold. Do we have evidence of hoarding yet?

I say this not to argue against "Peak" but to ask why the "price signal" is a complete failure at such a potentially historic moment. The implications of this pricing problem could be very foreboding, because if the price is being somehow artificially detached from real information, then when the "real" price has to be unleashed, it could happen VERY fast and with a magnitude that will stun the public and the system. Of course, that's the argument of those who believe in a severe collapse. Combine that with Matt Simmons warnings based on the fast top and rapid depletion curve, the warnings in the Hersch report, and you get virtually no forward warning from current price signals.

The only way the price can be maintained at this level must be (and I am playing through the possibilities here, please give more if you can find and argue for them) (a) currency being artificially strenthened to maintain artificially high purchasing power of gas/oil. (b)military force being of such magnitude that we are effectively "enforcing" our price (c) markets operating in the dark on false and or "stacked" statistics (ala Enron type accounting) showing that somehow the oil and gas is still out there and easily recovered with a bit more investment (d) Peak Oil is either a fallacy or far in the future (we have to admit that possibility if we are to do an honest evaluation and prepare properly)

O.k., give me your best! Which is it?

You have to separate taxes from European prices before you compare them alongside American one's. If you want to relate prices to peak-oil, you should probably just be looking at wholesale prices. Gasoline is also only indirectly involved with peak oil, which is of course about oil.

As far as prices being "fantastically" higher, we just don't know. This is uncharted territory. We'll only have some of these answers looking back.

In your last paragraph, it is hard to answer these questions because I don't dont know what you mean by,"...maintained at this level..." Is that a high level or low level?

I think it is hard to artificially strengthen a currency on the scale you suggest for a significant amount of time. I don't think you can enforce the price militarily. I don't think markets are operating in the dark. Peak oil is a lot of different things to a lot of different people. When you give me a one paragraph definition, I'll tell you if I think you're right or not :-)

A.Peak Oil falls into three (3) catagories all of which are directly related to a geologic peak. These are:

1.Feild peak extraction (FPE)(by which is meant pulling out, pumping out, forcing out or otherwise retaining crude oil to the surface of the earth before that product becomes part of a specific nation's physically exportable limit. {The ammount currently available for export but held back or otherwise consummed by that country domestically. Further, marine terminal limitations will also impinge upon a givin nation and their ability to either get it in the pipeline or aboard a Tanker (VLCC)}

2. Cummulative Rig maximum output: Derived from the sum total of production of crude oil possible for a givin feild during its moment of highest output. CRM is not theoretical it is demonstrated and like all good science experiments it is repeatable otherwise the feild or well or series of wells extracting from a givin feild are past Peak Oil and are in decline.

3. Maximum country production capability(MCPC): This figure in Mbd is derived from either Feild(s)peak extraction (FPE)or(CRM)or a combination of both. Domestic use before export is NOT a factor in Country or feild peak oil production.

For sake of discussions "Peak Oil production exported" (POPE) to the rest of the world is the maximum demonstratable ammount of oil in the tube or on the vessel over time (month/day/year). It is independent of domestic use but is of course subject to it because POPE = MCPC- domestice use.

Further sake of discussion: Global demand has impact on the study of peak oil because market conditions as they move to the back side of the cliff may be mitigated by efforts derived from the study of market fluctuations during other non-peak times. However; demand has nothing to do with rig, feild and country peak production (These are internal and physical limitations not subject to the vagarities of demand) and export which may be influenced by demand but this does not necessarily need to be so. Study should not be inclined to discount the ability of Net exporting countries to decrease their domestic allowance wether by market or political forces. Market forces can only look upon events ex post facto. Otherwise they are speculative forces impacting upon a market.

Opinions: No ammount of graphing and analysis of oil price or gas price over time will indicate (exponential or not) arrival of "Peak Oil" in total or country or world peak oil pruduction(X)Mbd. Price is derived from supply and demand and other factors not the other war around. Prices may certianly demonstrate that Peak oil has arrived and market forces are looking at the peak in time past.

I don't think the oil markets understand peak oil yet. I don't think that there is a severe shortage of supply yet. We can't tell if we are at peak yet. There is probably the capability to raise production to over 90 mbpd as Chris Skrebowski's (optimistic) megaprojects update would suggest but I think it more likely that we never really get much higher than we are now.

I think we are in a waiting game to see what demand does, and what crisis happen in oil producing countries.

Its pretty horrifying to think of a few badly placed hurricanes and Iran even reducing production, let alone military action.

I think the price is somewhat detached from reality and when demand truly exceeds supply that it will escalate extremely rapidly.

We might be fortunate enough that somehow someday soon the US economy could take a turn for the worse and consume something closer to the global average of 4.8 bbl per person per year instead of 25. If US oil consumption could decline to maintain no supply shortage until they no longer import at all, that would suit the world just fine. If the US didn't import any oil and just consumed domestic production then they would consume the same per capita as the UK.

If I drive 40 miles a day to get to work and back, 5 days a week, 50 weeks a year that's 385 gallons of gas at 26mpg. Thats 9 barrels of gas per year already assuming nobody else is in my car, most of the people I know drive solo to work and back. Its so crazy to think that people elsewhere on the planet might be seeking this lifestyle when it just isn't gonna happen for anyone else. I don't know what the average distance is in the US for people to get to work but my friends here in KC drive at least 40 miles a day.

After having been involved in the markets a great deal my vote would go to "C". Most investors are in the dark to the full extent to which the gap between supply and demand for oil will grow.

Secondly, because the market is made up of hundreds and thousands of individuals, the market does not sharply rise or fall with out BIG news to influence the crowd. That is some Investors may be catching on to the facts about peak oil, however, at the same time if they are wrong about peak oil they do not want to be caught in a price bubble and lose money. So most of them are playing it safe. Testing the waters if you will.

This is evidenced by the chart above with annual price comparison. Investors will bid up the price of oil 20% then, back off for a while and take some profits. After 3 to 6 months investors will test new record highs and push the price of oil up again, it goes in a fairly predictable cycle. This just happened in the last couple of weeks. The market had a physiological ceiling of $70 per barrel, however once this barrier was broken the price was free to rise to $75. The price may dip down again however now that oil has crossed $70 per barrel, there is no longer the physiological ceiling. A new ceiling might have just been created at $75 and maybe a couple of months from now in August investors will push it to $80 ceiling.

In stock market theory this is referred to as the "Tea Cup Chart". That is "A strong stock's price will Rise, Stabilize, Rise Higher, Stabilize, and Rise again Etc...

My central point is that prices will continue to rise as more and more investors test the waters of the peak oil theory. This will allow the price to slowly rise, reflecting the growing understanding of the situation. The only way I see a huge $200 price jump in a short period of time, due to knowledge of "peak oil". Is if the president called a oval office speech and explained the whole "Peak Oil Theory" situation to the American public on prime time TV. Then he would need to call in a panel of Bi-Partisan oil experts to witness to a study of the theory they had just completed, finding it completely correct and more then that, they found it was far to late to do anything about it. However I don't see that happening any time soon.

In a way it could be argued that public and investor ignorance of Peak Oil is the only thing saving us from a panic reaction that would crash the markets and destroy any chance of a transition to coal liquidation, shale oil, and massive amounts of solar power. The economy can not handle a shock of $300 per barrel over night, however if you spread that same rise to $300 over a 10 year period the impact is manageable and it gives time for businesses to adjust to a new model.

Of course this means that the sellers of Oil are not getting, what the oil is truly worth in the long term, however this is a better alternative then a Great Depression to end all depressions, in the next 10 years.

And I thought "ignorance is bliss" was just a cliché saying.

However, 'events' or 'surprises' could come along and upset our delicately balanced 'apple cart' sending oil prices through the roof, with 'catastrofic' results. I think Dan Simmons is concerned about this unsettling prospect in relation to Saudi Arabia, and the possibility that they may have 'damaged' their major fields and production could fall drastically, triggering the 'panic market reaction' and price explosion he fears.

Dan Simmons is the author of the Hyperion series, the greatest science fiction of all time. You probably meant Matthew Simmons. :^)

RR

:)

Price only reflects the true supply if the buyers and sellers have perfect knowledge. Which they most definitely do not.

Don't worry, prices will go back down any day now. Or so this guy says.

In 2002 I was visiting my father, an old oil man, who told me there's no reason to want to get back into oil at the moment - besides, everyone else is getting out. That was my first clue that "oil's not well" - a sure clue that the markets were about to change. Even back then it was hard to get a rig if you wanted to drill...

Following is an excerpt from my Energy Bulletin article on the MSM and Oil Prices

http://www.energybulletin.net/15126.html

Why Aren't the MSM Discussing the Import Situation?

I think that we are seeing an "Iron Triangle" of sorts defending the status quo concept of ever expanding energy supplies: (1) most housing, auto, financing and related companies; (2) Most MSM companies that are selling advertising to Group #1 and (3) some major oil companies, major oil exporters and energy analysts that are working for the major oil companies and exporters.

The housing/auto group wants to keep selling and financing large homes and SUV's.

The MSM wants to keep selling advertising to the housing/auto group.

In my opinion, some major oil companies are afraid of punitive taxation, and some exporters are afraid of military takeovers. This group of oil companies, exporters and their analysts provide the intellectual ammunition for the other two groups, i.e., promising trillions and trillions of barrels of conventional and nonconventional oil reserves."

I listened to part of Ed Wallace's local Dallas/Fort Worth (auto related) radio show yesterday. Mr. Wallace by the way has an article coming out in Business Week on ethanol.

In any case, the show yesterday had all three elements of the "Iron Triangle." Mr. Wallace started off with a long discourse on a speech last week by Lee Raymond, retired CEO of ExxonMobil, to the effect that the recent run up in oil prices was temporary and that the market would adjust, more supply would appear and prices would fall.

So, we had the ExxonMobil guy providing the intellectual ammunition.

The journalist took Raymond's comments and ran with it, asserting that the price run up in temporary.

And all of the advertisements were by auto dealers, trying to sell and finance cars.

So, who ya gonna believe? The sour pussed guy that tells you that you might as well start cutting back on your expenditures (energy and otherwise), get out of debt, look into organic gardening, or the guy that tells you that soon you can resume your blissful hour long commutes in your $50,000 SUV and from your $500,000 mortgage?

Mr. Wallace went on to assert that Peak Oil would not occur for 50 to 80 years, because conventional reserves were 50% greater than expected (three trillion total) and because of trillions of barrels of nonconventional oil.

This may be part of the reason for the political inertia so far. Hopefully, as more people become aware of the situaion they will attract the attention of politions. The recent activity in Washington surrounding immigration being an example.

It also may mean that these folks, who tend to be investors, as they gain awareness, may continue giving upward impetus to the price of energy companies.

I give this white paper, with more detail, for people who want to know more.

In Texas and the Lower 48, once we hit about 50% of the Qt mark, price had essentially no discernible impact on conventional oil supplies. As I have documented many times, using the Texas case one could assert that rising oil prices correlate to falling production. Of course, the reality is that the smaller fields we found post-peak could not make up for the declines from the large, old fields.

I continue to believe that the Lower 48 and the North Sea are our two "cleanest" HL (Hubbert Linearization) case histories. The Lower 48 peaked just slightly less than 50% and the North Sea peaked at just slightly more than 50% (crude + condensate)--and production has not increased since peaking. Deffeyes asserts that we are past the 50% of (crude + condensate) Qt mark worldwide.

Look at the ages of the large fields in the top two exporters SAR (Saudi Arabia/Russia) and the top two importers USC (United States/China). All of the large fields are old, and consumption in all four countries is growing, in some cases quite rapdily. Anyone think that this is a stable situation?

IMO, in the first quarter of this year demand for crude + condensate exceeded supply, and we are meeting the demand by drawing down inventories. The best short term data in the world appear to be the weekly and monthly EIA data (a case of damning with faint praise). In any case, the weekly data since February show much sharper declines of total petroleum imports than is normal.

What I found odd is the combination of rising light, sweet crude oil prices and falling imports.

Most of the MSM are attributing the price increase to speculators and geopolitical tensions. I disagree. I think that we are in the early stages of a bidding war between importers for rapidly declining net export capacity. Nonconventional production will help, but IMO it will only serve to slow the rate of decline of total oil production. IMO, from the first quarter of 2006 forward, the total net energy supply will decline until the rate of growth of alternative energy is equal to the rate of decline of conventional energy.

IMO, oil prices would be higher were it not for a coordinated effort by the "Iron Triangle," who have a masssive vested financial interest in the status quo concept of constantly increasing energy supplies.

So, a lot of energy consumers are going deeper into debt in order to try to hold on to their current energy intensive lifestyles.

Longer term, when the reality of Peak Oil becomes apparent to even Daniel Yergin, the irony is that it is people like Lee Raymond, Daniel Yergin and the journalists in the MSM, who are actually going to cause demand--and thus prices--to be higher than they would otherwise be, because they are, in effect, telling us today that there is no problem with the $50,000 SUV and $500,000 mortgage way of life.

If you believe the Peak Oil guys, you cut spending, get out of debt, and live much closer to where you work--which is precisely what the Iron Triangle does not want you to do.

If you follow the Peak Oil guys advice, tomorrow, if the Peak Oil guys are wrong, you will have less debt, more money in the bank and a lower stress lifestyle. If the Iron Triangle guys are wrong, you could end up bankrupt--except of course that it is quite difficult to file for bankruptcy, now, courtesy of our Iron Triangle friends.

Still, it probably is ironically helpful to have the realization dawn slowly as a poster above noticed. The panic of $300/bbl oil would create "collateral damage." I am pessimistic about the possibility of any of the orderly transitions suggested by Hirsh being implemented, even if it weren't too late, and it may not be. It is too late to do it without a lot of pain, but democracies don't accept pain without really compelling reasons. The UAW has accepted some (fairly small IMO) reductions in benefits as Ford and GM disintegrate, though.

Like the Iron Triangle explanation and this re: oil prices.

Logical. Makes sense. god knows nothin else does.

Thanks

One is almost tempted to the well-worn Titanic analogy again. We are on the deck, we can, sort see the iceberg, we choose to ignore its existence, because at this latitude it shouldn't really be there! We decide to return to the bar for drinks and a dance; a dance that may well be our last.

Bruce Ismay, managing director of the White Star Line, says that's impossible, the ship is unsinkable.

Thomas Andrew replies that the ship is made of iron and that she can and will sink.

Cognitive dissonance, then and now.

The important lesson to learn from the Titanic episode is that the ones that survived were the ones that heeded the warnings and headed for the lifeboats right away. Of course, proportionally far more steerage and third class passengers died than first and second class. However, when the end came and all of the boats were gone, it didn't matter if you were first class or steerage.

Unfortunately if citizens want to find the truth they really have to dig for it and think about these issues - and for many this is just too much work.

Fortunately there are sites like TOD that provide some push back on the "party (Iron Triangle) line" - hopefully some are starting to get at the truth and realize that the rosy picture they've been sold on over the past decade (?) is just that - nothing more than slick marketing used to continue to sell, sell, sell...

First off, doesn't that scenario apply only if the exporting nation's oil resources have been nationalized? What you're proposing is effectively the same as having one price for local consumption and another (higher) price for export. If that's the case and the free market prevails, then the exporting county's oil companies will simply export their oil, and the exporting country essentially continues to "buy on the open market" by paying the global price. The only way to prevent this would seem to be restraining the companies' actions either through legislation or nationalization, which in this case seem almost indistinguishable to me. Is there some aspect of supply allocation that I'm missing here?

Related to this is the provisions of NAFTA as they relate to Canadian petroleum exports to the US. Essentially they prevent us from favouring local consumption over exports to the US, by mandating that reductions in exports to the US can only be done if matched by reductions in domestic consumption. If the analysis in my first question is correct, this effectively makes it illegal under international trade law for Canada to nationalize its oil resources. Leaving aside the question of the desirablility of such an action, it seems to me that this law has removed one of the main possibilities for Canada to address Peak Oil for its own citizens.

* First off, doesn't that scenario apply only if the exporting nation's oil resources have been nationalized? What you're proposing is effectively the same as having one price for local consumption and another (higher) price for export.*

In Saudi and Kuwait, carfuel is cheap. Maybe they dont tax it? If the state provides free healthcare, writes off personal debts when a new Emir arrives [like Kuwait], low taxes etc, then there is more money for the citizens to buy fuel. Also many of these citizens are very wealthy by world standards

Essentially, this means that rising fuel costs makes them richer to pay for their own fuel. The lower the rate of export to us, the richer they become - so they can buy it themselves. So they are not part of the rest of the world's demand/supply balance [at this moment in time] and can continue to consume as their population multiplies.

So, what the net exporters can, or will, export is going to be squeezed between falling production and increasing consumption, while what the importing countries want to import is increasing, because of increasing demand and falling production.

http://online.wsj.com/article/SB114584641133933834.html?mod=hps_us_pageone

I never paid more than 79 cents for a gallon of gas in the

70's..

The Peak in the Seventies in crude

was short lived.

The Bottom 80% of America were never better off

than in 1974.

And since then thru various mechanisms

Ex-the Reagan Social Security Tax increase

their purchasing power has steadily eroded.

The Only thing keeping the bottom 80% in the game

has been the ability to extricate wealth from homes

and a gallon of gasoline costing

less than a dollar.

Those days are over. America's

saving's rate is negative.

We are $15 Trillion dollars in debt.

I will argue that this $15 Trillion

dollars would be the exact amount needed to

pay for all the Hydrocarbons we have imported

since 1980, when, happily for us,

not so happily for them,

the Iran/Iraq War started. What a coincidence,

that's when Reagan's Happy Days started.

Well, there are no more happy days. The till is empty. We can no longer borrow on

the Internationaal Stage to finance our addiction.

From now on it's how many BTU's did you earn this week, honey. Did you earn more than you did

in 2000?

I don't think so.

As a Nation we are 6% of the World's Population, using 25%

of it's Hydrocarbons, and borrowing 85%

of the cost.

Our Military is the only thing keeping the wolf

at bay.

Oh yeah, when the oil markets actually start reflecting the

real price of gasoline, they will be shut daon.

James

Having lived in the NYC area through the 1973 oil embargo--and, at the time, I was making less than average salary--I found the rationing and long lines the most irksome. The embargo lasted maybe six months. I did not find the price particularly onerous. Additionally, the brevity of the embargo prohibited any kind of deep effects on the economy.

The back-to-back problems with Nigeria and Iraq dwarf the magnitude of the 1973 disruption or any other disruption, according to the EIA.

http://www.intertanko.com/tankernews/artikkel.asp?id=5715

The above article has a good chart on the magnitude of disruptions since 1951. A couple of points are worth mentioning:

1. The U.S. is much more dependent on long supply chains for its goods. Consequently, rising oil prices will impact the price of goods, especially imported ones. And, yes, the U.S. is a net importer of food stuffs.

2. The U.S. labor force is under pressure from cheap labor abroad.

3. If the dollar tanks (yuan rises), then we will see prices sky-rocket.

4. The growing disparity between the have and have-nots is growing--in the U.S. and elsewhere. Consequently, the greatest effect on rising prices is on those least able to afford it.

5. A long squeeze--such as the one we are in--is harder to deal with than the short jolt of 1973.

6. A policy of preemptive war makes everyone jittery, as does the possibility that peak oil is within our attention span. In other words, PO is between now and ten years out.

The current price increase, ignoring the silly $10/barrel that occurred when opec had an internal quarrel, is from the $25 level that SA tried to maintain for years, thinking this price would avoid both recessions and any search for substitutes. We are now at 3x this price, so we are 1/3 the way to a level that might have the same overall effect on the economy (it is often said that today's price is below the 1981 peak of around $90 in today's terms. I think we are far below the 1981 inflation-adjusted price because I think inflation has been severely understated for many years, thoroughly explaining today's fondness for SUV's).

Sadly, the cavalry might not save day this time.

Futures are very highly leveraged. For a few thousand $$ margin you can buy a thousand barrel contract, so for each contract and each $1 move in price, you gain/lose $1000. Futures contracts expire into delivery/receipt of the actual commodity, so they must converge with the spot market, the market for the commodity RIGHT NOW. Which is what makes the market so short-sighted.

For example, if your belief in peak oil led you to buy december crude last summer, when oil had pushed up to $70, so as to get in before everyone realized peak was upon us, by november/december you would have lost something like $15k/contract.

So in the market fear is the balance to greed... it would be great to own oil for 2012 (as far as contracts go now, I think) but how many tens of thousands of $$ might you have to put into margin to hold that position if the price goes against you (esp. if the economy falters)?

There are two ways to prevent this. One is to not use so much margin, or equivalently to back up your position with a lot of cash, and just bite the bullet on those short-term reversals, holding to your confidence that eventually you will be right.

The other is to buy options rather than futures. You can get $100 or now even $150 options for relatively cheap (not nearly as cheap as they were a couple of months ago though!). The bad part about an option is that if the price never gets that high, you lose your whole investment, unlike with a future where you only lose money if the price actually goes down (assuming you are long). OTOH you don't necessarily have to hold to expiration, so you could for example have bought a $100 2010 option a few months ago and now sell it for a pretty good profit.

The big benefit with options is huge appreciation. I just checked, a 2010 $100 call option is $4.40 per barrel, so in units of 1000 barrels, one contract is $4,400. Then if oil goes to $200 by then as Matt Simmons believes, your contract will be worth $100,000. Making 20 times your investment is pretty sweet, especially for a Peak Oil true believer who sees this as a relatively sure thing.

And yes, commodity futures offer terrifying leverage. Be careful.

The advantage is that if price increases or, very importantly, stays the same, your stock will increase because at 60/barrel these companies, growing production and reserves, are very profitable. If price rises further, all the better.

Some of the obvious periods when basic supply/demand was not the market's only consideration:

a)the beginnings before a world market for oil was established

b)the Iran/Iraq war wherein they attacked each other's oil facilities for 10 years (it was even called the tanker war)

c)the Kuwait invasion and first Persian Gulf war

d) the artificial glut of oil in '97-'99 that was, in fact, a "glut of bad data" as Matt Simmons has phrased it. This "glut" devastated the drillers, who were beginning to seriously gear up for what they correctly were foreseeing as a tidal wave of demand from Asia.

This kind of chart pretty clearly shows the price signal you would expect to encounter as global demand begins to leave behind global production increases, whether that be exactly at peak production or just near it. At $75/bbl now, you would have to look at this chart and conclude that something has fundamentally changed with the supply/demand of this resource and it seems to be centered around the year 2000. You would have to conclude this even if you had never heard of Hubbert or seen a bell curve in your life.

The demand surge of the 70s broke the 100 year price resistance level and will probably wind up being a mild foreshock of the climb we are starting. In the 70s, we had a huge amount of unused well head capacity in OPEC to somewhat control the climb in the price of oil. That throttle mechanism is gone now.

Please take a look at the Google home page! It shows a windmill and PV panels basking in the sun. A long time ago I asked them to include a "I feeling Unlucky" button that would automatically take the user to Dieoff.com. Maybe we are halfway there.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Hmmm... Increasing numbers of books being published, increasing numbers of visitors to specialized websites, anomalously growing interest by the public, average Joes piling into the market. Sounds familiar. You guys should run a poll, and see how many visitors to TOD are long on oil.

Someone once quoted. "You can never underestimate the intelligence of the voting public"

RR

The man is obviously not poor, as he paid $40,000 for the Jag. And he's got a collection of antique watches; he talked about selling more of them if necessary. But he's retired and on a fixed income, so when prices go up, he pawns something.

Apparently, selling the Jag and getting a Corolla is out of the question...

I think very many people were already extremely overextended and this oil price jump is now a proverbial camel back-breaking straw.

So will the second quarter of 2006 have been the start of a major recession or the second great depression?

IMO energy costs are still too low relative to average income, to affect personal spending that much.

It would seem also that these prices could be a factor in a spectacular housing bubble burst as people consider the cost of driving from distant suburbs to work.

Great graphs.

I wonder how price increases affects demand for oil and petroelum products like gasoline?

The below link

http://energikrise.blogspot.com/

Brings you to a piece with a graph (in English) showing development in gasoline consumption and average gasoline retail prices in the US for the period Jan 1993 through mid April 2006, and the graph illustrates that despite close to a doubling of average retail gasoline prices, it seems it have not curtailed demand.

Should not gasoline demand be affected by prices? Or does this tell something about "oil addiction", and if so, at what prices will demand (consumption) become significantly affected?

Of course it should be. At some price, people will drive less. It is already happenning; see:

http://www.usatoday.com/money/industries/energy/2006-04-19-gas-use-usat_x.htm

All stories of drivers driving less are purely anecdotal at this point.

I personally feel that you if gas prices continue to rise at the rate they have been that you will see demand destruction shortly. But to date it hasn't happened. It has simply been alot of hype by a media which thinks that it has a story and which we all know is insufficiently capable of reporting that story.

But there are more and more people in the U.S. every year. If we aren't using more and more gas every year, someone is cutting back.

- The American way of life is non-negotiable(but we might live it a little less often if we have to);

- Much more importantly, there's a LOT of countries out there that subsidize the cost of gas for their own citizens.

Many of the countries that do subsidize happen to be large net exporters with poor domestic populations. As more money flows in, more demand will arise, but production will be falling, and removing those subsidies will be politically impossible in such unstable environments.Oh, and the other one where gas and diesel prices are set and subsidized by the state?

China. 2nd largest consumer of oil in the world. Obscene growth in cars. Not about to run out of dollars to use to subsidize their people, and concerned only with domestic stability. Fat, lazy people in steel cages are happy people.

As someone noted on another thread, we keep looking at this in terms of USD. We also look at it in terms of American consumption and demand. There's a lot of merit to both of those since the dollar is 66% of world reserves and we eat 25% of the oil, but in economics, most of the chain happens at the margins. We flattened our margins starting about a year ago. The rest of the world hasn't. That's the biggest reason I think prices will continue to climb.

sticksell them all of ours. That solves a couple of problems for us. Creates others for the Chinese.We can't fix the problem by making someone else own it. Borders are a convenient fiction. It's like climate change - just as we all breathe the same air, we all burn the same dinosaurs.

I think this description is more aptly applied to americans than to chinese, very few of which drive cars.

The Battle Over the Blame for Gas Prices

This angle is of course frightening because it suggests that the real price increases wont start to happen until well beyond peak (1-3 years?).

I have said for some time that I believe we will have a minispike approaching Peak to $100 or so and that will slam the world economy so bad that prices drop to $40 or so, the world rebuilds and the next time demand breaches its old highs, production is significantly lower and mrs-sasquatch bar the door...

When the US stops getting free money from the rest of the world we will have to pay for the gas and the price will go up, but since the price will go up in real terms in the US the US will use less and the price will go down in real money terms.

IE, if we stop buying overseas oil, 14 million BPD of world demand will evaporate. Imagine what that will do to the price of oil.

What I see is inflation in the US and deflation in the rest of the world as we stop importing.

The first substitute was coal oil, then kerosine from oil wells, then calcium carbide lamps, then DC current from Edison generators, then AC current from Tesla generators.

Each new techology required at least one new invention to make it practical.

So, where are the inventors?

Is the American Dream Still Possible?

It's about the American outlook in general, not really about energy in particular. Though it does have this segment:

What struck me was the last part, where Parade offers its recommendations.

Parade is the essence of middle class, mainstream America. I suspect their reaction is America's: the government must lower gas prices.

Cal thomas has a brilliant idea; "Become independent from foreign nations for oil." He uses "if we can get to the moon..." argument.

Article titled

www.sacbee.com/content/opinion/story

Isn't it so frustrating that the only thing that's just as bad as the Rupublicans is the Democrats? Somebody should just buy all of the copies of Ted's book and get him to go back the the bar and be quiet.

Those are all good (on longer timelines), but it still needs to be driven home in the MSM and public consciousness that we need a short-term solution too.

Pushing Bush on why his Energy Bill (and etc.) now is a good thing.

I know it's not just me. Anyone else having probelms?

There was some trouble for IE users earlier this week, but it was quickly fixed.

The site looks fine to me, in the latest versions of Firefox and IE, running on Windows XP.

Other than that, I've not had any problems. I'm running Windows XP with IE 6.0.

But, wonder of wonders, after posting the above problem, it seems to have been resolved. No idea why or how. Whoever among the gods of TOD is responsible, many thanks.

Rick

RR

Finally we'll all agree on the need to start killing millions of people and taking their oil by force.

If you haven't checked Dieoff_Q&A forum lately: Jay Hanson is permanently signed off--he said these websites have become 'toxic' to his health--severely affecting his mood and ability to sleep! He is trying his best to move on to a pure survival mode--I consider this a Leading Indicator of travail directly ahead. I am surely going to miss his comments, but I wish him my best.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Cognitively Jay (and us) may acknowledge that some of the things we do in modern society are maladaptive and bad for our health, but our limbic and reptilian systems will seek them out just the same, because they are available.

"Survival mode" really means getting dopamine and other chemical cocktails that met with evolutionary success in todays culture and environment. Even if Jay throws his computer out the window, he would have to SERIOUSLY train himself to get dopamine from other sources in order to avoid buying another computer or going to Kona internet cafe to check energyresources,etc.

The energy subsidy we have received on the planet has doubled as an 'unexpected reward' subidy - as long as the current infrastructure and culture exists, the options available to us to get these chemicals are just too many for our small intellect to overcome (in general).

I write this, of course, when I should be planting spinach and green beans.

Today however, I have a slight grump--not so much from this thread but the one answering the "Economist."

If price is allowed to rise freely, then the statement "demand is greater than supply" becomes meaningless. At a high enough price, there can be no shortage, because there exists a price at which quantity demanded equals quantity supplied.

There is one and only one way to create a shortage: And that unique way is to impose a price ceiling below equilibrium price.

Thus, the problem we face is not the meaningless, "Supply will not be enough to meet demand!" but rather the question of how high prices will go to bring the amount supplied equal to the quantity demanded.

At some point of extreme increase in price there will probably be the imposition of price controls and rationing to allocate a diminished supply. Then and only then--with price controls in place--will demand exceed supply (at a price below equilibrium price), and in that situation there will be shortages, in which willing buyers at the controlled price will be unable to buy.

In the absence of price controls, buyers can always get oil or gasoline--if they are willing to pay a sufficiently high price. I do not like the phrase "demand destruction" but it seems we are stuck with it: It works. At a sufficiently high price people will be unable or unwilling to buy as much as they are willing and able to buy at lower prices.

Thus what we should focus on is not the imaginary situation of people not able to buy oil products at all--but rather on the consequences of rising and someday extremely high prices.

To belabor the obvious: Our economy and our whole way of life is based on cheap oil. As oil prices rise to double and perhaps triple current prices, the pain and disruption will be enormous, and to simply assume that "the market" will assure a smooth transition to very high-priced oil is fatuous.

The only good news for those of us who live in rich societies is that most of the pain and by far the worst outcomes will be in poor societies.

Relative fitness only works to a point. If Im the only guy out of 100 with any food or money, I doubt the other 99 are going be kowtowing sycophants.

I agree with your points though - implicit in the statement is

"Demand (in the current neo-classical paradigm of cheap oil) is greater than supply (in the soon-to-come hubbertian downslope, irrespective of price.)

Like almost everything else, this is true, within limits. The problem of course is the volume. Again, I will trot out my trusty old Texas model. Vast sums of money have been spent on advanced drilling and recovery techniques in Texas, but production has fallen every year for 33 years. If we were the sole source of crude oil for the world, for every four gallons of gasoline that we bought in 1972, we would be bidding for one gallon today. So there is oil available, but it appears that no amount of money will bring us anywhere close to our peak production.

Suppose production of oil falls at the rate of 5% per year for the next twenty years: Quantity supplied can still equal quantity demanded if the price rises far enough.

There will be a microeconomic effect in which households and business firms are unable to buy as much gasoline, diesel, etc. at higher prices as they were at lower prices. Eventually (not yet) there will also be a macroeconomic effect in which greatly increased oil prices will produce recessions or depressions that lower real economic output, real incomes and hence the total demand for oil.

What I should make clear is that unlike most economists, I do not expect price variation ("the market") to enable most societies to make a smooth transition away from dependence on cheap fossil fuels for transportation and food.

Economies and societies can collapse while quantity demanded equals quantity supplied.

I have to take exception to this - there are other ways. For example, there was a real housing shortage in German cities like Hamburg, Berlin, Köln, etc. ca 1945 (and in Germany in general, as millions of ethnic Germans flowed west or were pushed out) - and this shortage had absolutely nothing to do with price. Worse, price would not have played any role at the time - the infrastructure was as gone as the cities themselves. Of course, over time the situation was dealt with, but in the winters of 1944, 1945, 1946, and 1947 there was a very real housing shortage which was not an economics problem. I have noticed that economics seems to make very little provision for the actual destruction of war, even though humanity engages in it on a regular basis.

This to me is what makes peak oil a difficult problem - there will be less coming out of the pipeline (whether today or in a decade or two), and absolutely no price will change that.

Whether it feels like a shortage isn't the same as whether the absolute quantity is less, every year. At least till now, that has been the pragmatic result of extracting a finite resource from places like the U.S., the North Sea, etc. There is no reason to believe any other major oil field is qualitatively different.

This conflict between absolute quantity and human determined demand does not have a simple resolution, however. And price will undoubtedly play a major role. We may not feel any real need for oil in 15 years, for whatever reason.

But there are shortages which have nothing to do with price, and I suspect peak oil (or peak natural gas in North America) will contain a number of elements which are not related to price at all. When the oil or gas is burned, there is no price level imaginable to get the used energy back for further use in the same way. More efficient use? - certainly influenced by price. Alternatives - why not? More energy from already burnt fossil fuels? - only if you consider the greenhouse effect a net energy gain. (A curveball - thermodynamics isn't something to casually toss around in such discussions, so I try to avoid that line of argument. It is conceivable that the amount of solar energy trapped over the next 5 centuries far outweighs the original energy of the burnt fuel, and that wind farms end up pulling more energy out of the air, so to speak - thus dancing around the idea that burnt oil and gas are 'gone' as an energy source after being burnt. Oil is a very slippery subject.)

I did not mean to imply that at a high enough price output will always increase. My main point is that at a high enough point "demand destruction" will occur (where markets are functioning) to drive price up. People will be deprived of consumption not because there is a shortage but because they will not be able to afford to pay extremely high prices.

Thanks for your observations. I'll try to be clearer in the future.

And in all fairness, I was also reacting to the idea of another poster from another article that peak oil means that demand exceeds supply, which was too absurd for me to even bother commenting on, though it really, really bothered me. Peak oil means, in part, physically less, regardless of how much demand exists. Assuming, reasonably in this case, that people still feel the need to use oil as the decline begins.

I may add that such examples essentially only work with the basic needs of survival, and don't really apply to a shortage of anything not directly related to staying alive. Also, such shortages are generally caused by such catastrophes as war, weather, earthquakes, etc. All other 'shortages' can definitely be defined in terms of price. And much of the current demand for oil and natural gas is far removed from such survival needs. Though watch the next few winters - that is where real shortages may lead to real problems in some areas, such as the British Isles.

"The only good news for those of us who live in rich societies is that most of the pain and by far the worst outcomes will be in poor societies."

I have read this opinion before. Why is it true?

No energy importing society is less financially leveraged than ours.

No economy is more dependent on oil than ours.

How will Costa Rica or Vietnam suffer more than us when the SHTF?

As the price of oil and natural gas increases, so also will increase the price of food. Fewer people will be able to buy adequate amounts to eat, and therefore the higher prices for oil and natural gas will cause increases in deaths resulting both directly from hunger and also indirectly from diseases that kill undernourished people.

Note that all this can happen with no global "shortage" of food at all. The United States and other countries can (and do) have huge surpluses of crops while a substantial portion of the world's population goes undernourished. The underlying problem is too many people on earth to be fed with agricultural techniques that do not depend on fossil fuels. The probable trigger for a major increase in death rates among the poor of Asia, Africa, and Latin America will be major increases in food prices that will inevitably follow major increases in the prices of oil and natural gas.

Rich countries may suffer economic crises comparable to the Great Depression and come through eventually without experiencing a dieoff. Rich countries can cut back consumption of fossil fuels enormously and still produce plenty of food for their own populations or produce manufactured goods that can be exchanged for increasingly expensive food, and they can afford welfare programs. Poor countries do not have these options.

Suppose, for example, the U.S. reduces its consumption of oil and natural gas by a quarter over the next ten years; the resulting disruptions might be severe but not catastrophic. If higher prices force, for example, India, to cut its use of fossil fuels (and products made from them, such as fertilizer) by a quarter, much of that decrease would cause food production to decline.

Briefly, people in prosperous countries are much better able to absorb the effects of reduced supply and increased prices of fossil fuels than are poor people in poor countries.

What a week! I'm traveling and haven't been able to get near a computer -- watching CNN as oil prices rise $5 and watching this television nonsense. Without TOD, it's like an out-of-body experience. Finally got to a library.

Well, Stuart, my story was approximately your story (without any geopolitical oil shocks) but I'm backing down on the high end. The Iran deal can only get worse as can Nigeria. (Did you see that Nigeria was conveniently forgiven some of their immense debt the other day?) Hurricane season is not yet here but I expect it to be about like last year since sea surface temperatures are exceptionally high now and all the other forcings (eg. the NAO) are still in place. So, I figure after that first big one hits the GOM, we could see prices over $85/barrel -- now that we've broken the $70 barrier and set a new ceiling on Friday of $75 plus. This would be significant because it would represent the highest price ever in inflation-adjusted dollars. It will depend on when the hurricane hits. If it's before Labor Day, then I think prices could exceed $85/barrel. I expect profit-taking to lower the price next week but I wonder where prices will stabilize now that the barrier has been broken?

I thought that Iron Triangle comment was terrific because it's so true. I just needed to watch more TV (which I rarely do at home).

As for oil prices not being bubbly, I'm glad you put that graph up because this is definitely not a bubble situation. Volatility yes. Bubble no. The fundamentals have changed. Only a few on Wall Street know this. In fact, approximately 0.006% of them

Have a good one, Dave

CNOOC, Sinopec, and PetroChina are cheaper than almost any other oil companies in the world. That's because they sell oil with domestic price caps on gasoline, diesel, and probably other products. They were adjusted upwards slightly this year, but it's still very, very cheap.

They can do this if they wish, but they are still buying oil on the open market, and as prices go higher and higher, it costs them more and more.

I guess they have all of our $ from the crap we buy at Walmart.

In October 2004 the price hits the top in the mid $50s then retreats. In March 2005 the price tests previous maximum but fails to break. Then in June 2005 the price breaks the range and what was the top becomes the bottom (see June, July, November 2005 and February 2006).

And once again, August 2005 was the top. In January 2006 the price climbs to the previous maximum and retreats. Now the price breaks the range and...........

Right! If you do believe in Peak Oil and techno-trading, it's time to buy, because the next maximum will be somewhere near $90.

As for me, I am not a believer :-)

I take that to mean that this is an extremely noisy system.

We may be focussed on a single fundimental driver in that system (depletion), but we know from reading the news that there are many more drivers (the mood of militiants in Africa, etc.)

I think the key take-away of that Econombrowser article, reinforced perhaps by my reading of "fooled by randomness," is that oil prices are on a random seeming walk, and there is no reason that walk should resolve suddenly into something more "rational."

The EPA is offering a research grant opportunity that I believe is a perfect fit for this idea. I have sent an e-mail to a hand picked list of university professors who have experience with government research projects. I'm looking to form a research team to apply for the EPA grant, conduct a social-economic experiment and surveys to determine to what extent the American public will support it, project the economic potential of WPH, and identify logistical, social and political obstacles as well as opportunities.

All government grants are awarded based on merit of the proposed research. I believe WPH has merit but your help is needed to verify it. You can help by posting your feedback. Let the professors and the EPA know what you think about WPH. Do you think this idea is worth pursuing? We need to know if Americans will support a plan like this.

Do you have any ideas to improve the plan?

Share any and all of your thoughts.

Tell your friends and family about this Blog post and ask them to post their thoughts on WPH

http://wepayhalf.org

Thank you

Craig