Wednesday Open Thread and News Dump

Posted by Prof. Goose on April 12, 2006 - 12:35am

Well, hmmm...let's see...Iran has more nuclear capability than most suspected (though it's not confirmed by the IAEA yet...and of course, Iran isn't pursuing nuclear weapons), and then Oil supplies from Russia will fall short of expectations over the next four years, just adding to the supply concerns that have driven world oil prices to record highs this week.

Yeah, I'd say that ought to be enough to get things going.

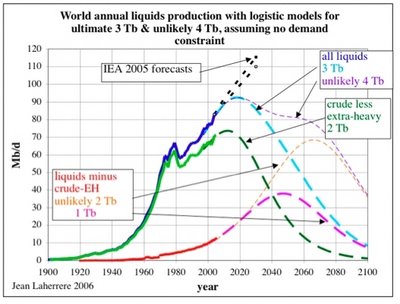

The chart:

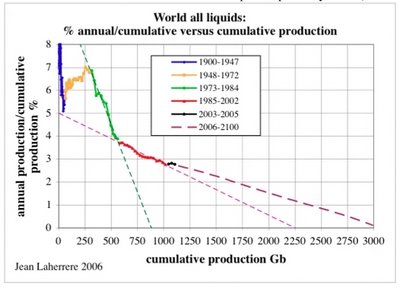

And, for all you Hubbert-Linearization true-believers, here's Laherrere's new liquids linearization. Note how the linearization goes haywire after 2003. We were all set to hit 2250, and then Bing! the unexpected happens, and now we're heading for 3000 -- maybe even 4000. Which just goes to show how completely worthless HL is as a predictive technique:

As Laherrere writes in his presentation:

"Oil demand is for all liquids. So the forecast of oil supply has to be given for all liquids."

Welcome the "The Liquids Drum"! ;-)

On a more serious note, I think Laherrere is right to focus on what will happen, as opposed to what should happen in an ideal world. I seriously doubt that climate concerns will keep people out of their cars. A massive move to coal may not be the best idea, but it's hard to imagine any social force that could stop it. (Not that I approve, of course. I don't. I detest cars.)

There is much to what you say. At least for me, my thinking on it has always been more that to understand the problem I have to break it into its constituent pieces and understand them one at a time. Since conventional oil production is by far the biggest piece on the supply side, it's behavior will dominate the situation in the short term. In the longer term, of course the question becomes about which of the various alternatives wins out.

I agree about the pressures for coal. I think everything depends on the hurricanes though. If we have more hurricane seasons like the last two, and if a scientific consensus emerges that the mode switch is due to global warming, I think the politics of coal will look extremely different in very short order. My own investigation of the climate issues has changed my view from thinking coal was the obvious stopgap solution to peak oil to thinking we shouldn't even go there.

That would be a great thing, and I'm definitely on your side. However, even if the hurricanes continue, I still think it's going to take the mother of all political streetfights to keep any fossil fuel in the ground.

But this is where Synergy and the Power Laws come in.

Climate Change is underway. And instead of preserving

Carbon Sinks, the West does a China.

The Tragedy of the Commons. Amazonia lose it's Carbon

Sink Status by 2015 (maybe sooner) Kilimanjaro loses it's

Snow Cap by 2015. Expect the Atlantic Thermohaline Conveyor

to quit by 2020.

But that is just the beginning, a report in Nature said last week. Future disasters around the Himalayas will include 'floods, droughts, land erosion, biodiversity loss and changes in rainfall and the monsoon'.

At the same time, rivers fed by these melted glaciers - such as the Indus, Yellow River and Mekong - will turn to trickles.

Even as humans do the Rule of 70, our ecology is screaming

it's loss.

We've got our foot on the accelerator as we slam into the Time Wall.

James

James

But you cannot dispute the truth of it.

Coal burning steam power plants are what worry me as far as CO2 is concerned. That is what is going to be built over the next ten years.

I think there are investors willing to gamble on high risk high return.

There is a reason why conventional is conventional - by definition that's the solution most often implemented. Do you see forces that would change the equation, and make non-conventional solutions more appealing from a business point of view?

"Montana is actively pursuing development of coal-to-liquids technology as a means of converting our significant coal reserves into synthetic gasoline and other fuels. Synthetic versions of petroleum fuels have been made for almost a century, and this technology offers great promise for reducing American dependence on foreign oil."

http://governor.mt.gov/hottopics/faqsynthetic.asp

"How long will it take for America to produce enough synfuel to make a difference?

There are already a number of small plants being designed around America, but a large-scale national effort must involve the federal government and would take a number of years. Given South Africa's success in this field, we should assume that if the federal government became meaningfully invested in this concept, America could have a strong synfuel industry by the next decade."

The last sentence, does that mean by 2010 or 2016?

Anyway this and other tax breaks do make alternatives viable in a business sense. Ten years is not a long time for a major corporation to invest on a known return. FT method works and is proven. It is just as conventional as any other current use for coal.

I was just listening to a report on NPR a couple of weeks ago about how New Mexico (I believe) was trying to force consideration of a coal gasifaction plant, but was having a very hard time.

"Actively pursuing development" is a long way from actual serious proposals. There's nothing in that link about Montana that sounds like any more than talk - are there any drawings, any plans? Have they figured out wher they'll get the water from yet? If the answers are no, then they are decades away.

Except that it's obvious we're not going to start this year, and no corporation is going to make that investment, despite having large profits. The best shot is that a few governments like Montana will do something.

Also, a lot of the posts here have criticized Laherrere's curve because CTL can't be scaled up to fill such a large gap. But that totally misses the point. It is not the case that liquids=CTL. Lots of things fall under the category of liquids: NGL, GTL, CTL, heavy oil synthetics, tar sand synthetics, sugar cane ethanol, biodiesel. Even CNG can be regarded as a liquid, in that it can be (and is) used to fuel vehicles and supplant demand for conventional oil.

So, that's the liquids dragon you pessimists have to slay. You have to show that the full ensemble of liquids can't fill the gap. Liquids=CTL is a straw man.

Not gonna happen. If you want to worry about CO2 worry about old-fashioned coal steam power plants.

Not to mention the coal availability constraint - with 70% efficiency 10 mbpd would require about 4 million of tons of coal per day or 1460 mln.of tons annualy. World coal production (2003) was 5408 mln.tons... This would be a 27% increase just for oil! I guess here HO would need to give a hand, but I don't think this is realistic to expect.

The biggest proposal I ever saw was for 200,000 bpd. Even that required multiple equipment trains (like multiple air separation plants). 300,000-350,000 bpd is a WAG for the biggest plant that would still have any economies of scale. Could be wrong.

Of course you're right that the mining probably couldn't keep up, unless again we had already started to expand it. Just another reason to disbelieve any big alternative liquids production ever coming online.

I agree with your assessment. IF the world must burn the remaining coal and tarsands, either as rock fuel or liquids: some kind of agreement needs to be reached that most of this energy goes directly into making biosolar infrastructure like PV Panels, windmills, tidal gen., bicycles, etc. It will be our very last chance to use detritus energy to ramp up a biosolar civilization.

Gaia may not even give us that chance.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Some (possibly large) fraction has to go into the energy-consuming parts of the infrastructure as well. What good to have PV panels that generate clean electricity if the transportation infrastructure is still dependent on gasoline and diesel and space heating is dependent on natural gas? If the end-state is much more electrified than today -- and if you believe in PV, wind, tidal and such then you do believe that, because electricity is what they produce -- the energy consuming infrastructure has to be converted as well. I believe that there's a real danger inherent in this larger view that we may take a path that precludes successfully reaching a sustainable end-state. That's the "siren song", if you will, of CTL and LNG: that the consuming infrastructure doesn't have to change.

I am very interested in evolutionary models of both the producing and consuming sides of the equation. Can anyone recommend sources of models that attempt to look at the interactions between those two aspects?

If you look closely at the first graph you'll see how Laherrere models each liquid individually. Noteworthy is the URR for crude less extra-heavy, 2000 Gb, the same number got by Deffeyes (know what method he uses?)

Hubbert's method is not supposed to work when you model several liquids at the same time or several discovery cycles for the same liquid, that's what Laherrere shows with the last graph.

I would advise you to read an older Laherrere's paper:

THE HUBBERT CURVE : ITS STRENGTHS AND WEAKNESSES

Homework: apply the Hubbert Method to each discovery cycle in the UK and comment the results.

Laherrere's linearization graph has this epitaph:

You're trying to put something in Laherrere's mouth that he didn't say. If you want to do so, do it in your blog and leave it out of TOD.

This time he gave a connotation to Laherrere's work which isn't true. If he thinks that HL isn't worth he may say it, but not pretend that Laherrere thinks like him.

This forum is made of truth not lies.

I think some participants may be using English as a second language and this may be resulting in a set of interpretations at variance with their true intent. Pointing out that a statement may have been misconstrued is not the same as calling someone a liar.

The use of English may be excellent. Mais il y a des personnes qui emploient l'anglais comme deuxième langue. And that makes a considerable difference.

Speaking personnally, I find the great attraction of this site to be the diverse, multi-national, group of participants. Some of these persons may be hesitant to express their views due to the possibility of making a faux pas in communication. This is especially likely to be true if they come to be labelled as liars when they seek to express an alternate understanding, or seek to challenge another participants interpretation of the facts.

JD made a statement and IMO was a little selective with the facts supporting it (and with the interpretation of these facts). I don't see him being correct in that... lads reaction was aside from the impersonal tone and I don't think he was right to do that either... you presented JD's words as "opinion" and defended his right to support it - I would also agree on 80% with that; the other 20% is for the cases we have manipulative arguments. Most of the time it is unintended manipulation due to the authors preconceptions, but this doesn't change the fact, does it?

The purpose of using Hubbert Linearization (HL) is to give us an estimate of the area under the curve, ultimate recoverable reserves (Qt). As I described before, it's a gross simplification, but you can loosely compare oil reserves to water in a bottle. You can pour it out a low rate, all the way up to the maximum rate, without affecting the total volume of water in the bottle.

Khebab, using only pre-1970 Lower 48 production data, predicted post-1970 cumulative Lower 48 oil production using HL. Actual production was 99% of what HL predicted, through 2004.

Khebab, using only pre-1984 Russian production data, predicted post-1984 cumulative Russian oil production using HL. Actual production was 95% of what HL predicted, through 2004.

Now, the production profiles were vastly different, i.e., different rates of pouring out the water, but the rates did not affect the volume of water in the bottles.

This was not a case of curve fitting. Khebab is a careful objective scientist, and at my request he simply used the historial data to predict a produciton profile, that could then be compared to the actual production.

Deffeyes is predicting that we have used 50% of conventional crude + condensate recoverable resrves, and based on the above case histories, we have to assume that he is right, and all of the data that we are seeing right now suggest that he is probably right.

The HL method does not apply to nonconventional sources of oil, GTL on the light end and CTL on the heavy end. But all we are talking about doing by going to the end points is increasing our rate of extraction of fossil fuel resources, which are already being commercially exploited. IMO, nonconvetional oil will simply slow the rate of decline of our total oil supply.

As I pointed out in January, the Russian HL plot is suggesting a severe production decline ahead. I find it ironic, that just as we continue to get more evidence that Russia is going to have--as predicted by the HL method-- production problems, the HL method is described as being "completely worthless."

How severe can production declines be? Consider Cantarell, the second largest producing field in the world. Internal Pemex reports suggest a decline rate of perhaps more than 40% per year, which seems reasonable when one considers the fact that the remaining oil column of 825' is thining at the rate of about 300' per year.

Texas, the Lower 48, Total US, Russia and the North Sea have never equaled the production that they had in the vicinity of 50% of Qt. To argue against the HL method is to argue in favor of what we have never seen in large producing regions, i.e., conventional production increases past the 50% mark, in excess of the production in the vicinity of the 50% mark.

You can argue all you want to about the volume of liquids from nonconventional sources, but that is not relevant to the HL method.

Westexas, you're not digesting Laherrere's statement: "Oil demand is for all liquids. So the forecast of oil supply has to be given for all liquids."

The accuracy of your HL forecasts for conventional oil are irrelevant to the real world because the forecast of oil supply has to be given for all liquids.

I know it's tough to accept because you are so psychologically invested in the idea of an imminent crisis. But Laherrere is experienced in these matters, and you should heed his words. He got burned once before by neglecting the role of unconventional oil. If you're stubborn, you're going to end up "right" about a pedantic subset of liquids which no one cares about.

The only peak that truly matters is peak liquids.

Now that is a news flash. It had never occurred to me that no one cares about the conventional crude oil + condensate supply.

I have never denied that nonconvetional oil production will increase. It will. But one key point to keep in mind is that natural gas and coal can't be used twice. You can't move natural gas BTU's and coal BTU's to the liquids column and pretend that we have a net increase in the energy supply.

The central question is how fast total nonconventional oil and alternative energy supplies can be brought on line. That is why the cornucopians always argue reserves--not production rates. The Canadians themselves are only predicting an increase of about 2 mbpd from tar sands in about 10 years, when we will probably start losing about 2 to 4 mbpd in conventional production per year. Note that 2 mbpd increase is gross--not net--energy.

We simply cannot offset all of the declines in the big oil fields like Ghawar, Cantarell, Burgan and Daqing. Historically is has never happened in regions that have peaked, and it won't happen today because of incremental increases in production from noncoventional sources.

No one cares about Campbell's "regular conventional oil" -- except Campbell. Regular conventional oil peaked in 2004, and nobody even noticed because irregular unconventional oil took up the slack and then some.

So the important date is when all liquids peak and decline. But to calculate that, you need to linearize with liquids, not with oil, just like Laherrere did.

Of course, that's going to make things a lot more complicated. For example, what's the URR of ethanol or biodiesel?

At approximately $65.00 US per barrel, I'd say goddammed near everybody has noticed.

According to my model simulations 'Peak Oil' should now be occurring (within the 2006-2007 time frame [1]) and 'Peak Gas' will promptly follow suit in either 2008 or 2009 [2].

Put in a nutshell, Gazprom's present predicament is untenable. With a dwindling production based on declining major gas fields (and no fresh giant field on tap), the Russian gas monopolist will inevitably have to curtail its exports as it cannot (or rather dares not) cut domestic supplies (delivered at extreme-low prices which many indigenous consumers fail to pay). Thus, it will have to boost export prices in order to compensate for internal 'manque a gagner' and also hope to somehow lower external demand.

A.M. Samsam Bakhtiari,written over a month ago, right on the money. http://www.sfu.ca/~asamsamb/Peaks/PEAKS.htm

Gazprom has two main export market: (a) the CIS countries, and (b) Western Europe . It chose to put pressure first on its ' Orange ' CIS members. But it will eventually have to push all of them to pay higher prices before turning the screws on its 'bread-and-butter' Western EU clients.

The Confederation of British Industry [CBI] had always been skeptical of adequate gas supplies for the 2005-06 winter and has now been vindicated in the teeth of the Government's reassurances that Great Britain was "awash with gas" (as late as November 2005 [5]). The CBI is bound to be the major loser in this game...

Forgotten in the critique of WT, is the EROEI. Every "new"

liquid will be harder to turn into what it will replace, even as our "growth" is supposed to continue.

Thus the coming nuking of Iran, the Geo Washington, threatening Chavez, Castro, Obrador in the Carribean.

Demand Destruction is the only way out for the Uber Rich.

The catch-There is no Planet B.

James

In the case of the US48 peaking circa 1970, MKH hit it on the nose largely because it was just one piece of the world's production. As the US48 approached peak, there was plenty of other production and therefore no price increase that changes consumption patterns and financed R&D for alternatives and the search for non-conventional sources. We just bought oil from other places and went merrily along, so the US48 was able to follow its own peak curve with no market interference.

When you model the entire world you drag in a host of mitigating factors, most notably the market response to rising prices as you approach and pass the peak. And in this context "market response" includes the development and use of alternatives and the exploitation of non-conventional sources.

This is why I've been preaching for a long time that the "bumpy plateau" scenario was by far the most likely outcome: geology + economics = a slightly shorter and slightly delayed peak, and one that's much flatter. If things play out that way it's extremely good news, as that would give us a prolonged period of higher prices that would spur the transition away from oil consumption before the actual decline sets in.

Basically what Lahèrrere is saying is that the production mid-point will be several years after peak production because of technology and non conventional sources (the production curve will be skewed). I don't understand what is defining as extra-heavy oil (EH), I guess it's synfuel from tar sands + NGL. I'm having a hard time in believing that EH production alone will reach 40 mbpd in 2045. For instance, oil production from Canadian tar sands is planned to double in 2015 to reach only 2.0-2.5 mbpd. This small increase alone will require a huge investment in new infrastucture. I think he applied a HL fit on the EH production that gave him an URR of 1Tb for EH. The problem is that the EH production is very immature (<25% URR), in that case the uncertainty on the URR estimate is fairly large (about 10% to be correct within 10% of relative error).

However, since the beginning of the year, this has aquired a much more emotional, urgent sense to me. I have tried to keep an open mind, but literally every bit of news has done nothing but confirm my fears. It does appear that the world has advanced right to the edge of an economic cliff that we are going to step off of in the next 6 months. I am afraid that we are going to very shortly find out how fragile the modern economy really is.

I think the trick is to break through the most pessimistic stage, and sort of reintegrate with what the rest of the world, outside the peak oil community.

In my opinion the world is slowly mobilizing. There is a lot happening. The "denial" that we used to talk about is fading.

http://www.editorandpublisher.com/eandp/news/article_display.jsp?vnu_content_id=1002314621

Speaking for a momement as a social psychologist, what scares the brown stuff out of me is the history of how people behave when their way of life is threatened or when they have lost middle-class status.

Two of the examples that insistently come to mind is how the Confederate States of America refused to come to terms with the end of a way of life based on slavery, and the vulnerability to Hitler of the former German middle class wiped out financially by the German inflation of 1923.

From despair, confusion, fear, deep resentment, and the rage that comes from not being able to buy shoes (or cars) for one's children come demagogues promising to restore the good times--and to eliminate the scapegoats who caused all the trouble in the first place.

With good government I believe a moderately painful transition through peak oil to a good society in the future is probable for prosperous countries. However, based on my reading of history, the day may come when citizens of the U.S. look back with fondness on the reign of Bush and Cheney as a time of sanity, moderation, security, and intelligent policy responses.

Stupid and corrupt and arrogant as the U.S. government now is, it can abruptly become one helluva lot worse in the future. That is my #1 worry.

A sudden death of a way of life would indeed be frightening, and possibly lead to social disruption.

On the other hand, the Hirsch Report, or Terkzakian's "A Thousand Barrels a Second," lead me to believe the total changeover will take 1-3 decades. The level of change required will be (here is where I move from Hirsch/Terkzakian modeling to my gut) greater than the 70's but not so great as the 30's.

However, the problem is that prices can spike upwards in the range of 250% to 1,000% (that is, by a factor of 2.5 to 10) very quickly. Such huge and fast price increases in petroleum products will almost certainly lead to government price controls and rationing, together with stagflation and possibly massive unemployment combined with severely accelerating inflation.

When 20% are unemployed, when 20% of cars have been repossessed, when perhaps 30% of homes are worth less than the mortgages on them--then IMO all political bets are off.

None of these musings should be misunderstood as predictions. What I am suggesting is that we need wisdom and courage and integrity in our political and economic leadership to get through hard times to come.

I am not a doomer--but in large part because I have no confidence in my ability (or anybody's ability) to predict chaotic and complex phenomena.

Herewith one last caution: There are far more ways in which things can go seriously wrong than there are ways in which they can be fixed to work better.

How much do we invest (financially and psychologically) in that possibility?

Is 250% to 1,000% increase from current prices (spiked) like that?

(a 1000% increase from the 10 year average would probably only be $250/bbl and not that bad, as a short lived spike)

Or the Sunni "rump state" after the Iraqi partition becomes a haven for al Queda, and the corrupt Arab monarchies on the Gulf go up in flames...

It is easy to imagine sky high oil prices.

You invest in one days pay each in dried corn, dried beans, canned fruit/peanut butter, and throw in a box of vitamin pills. Every year you cycle them to a food bank and buy new ones. That's how you insure against a volcano wiping out the harvest.

http://www.questconnect.org/ak_chilkoot_supplies.htm

Your post is right on the money. I don't want to be a doomer because I believe that humans are very ingenious and creative in solving problems. I am not a curnucopian because I believe that humans are not very good as a race at planning change. I believe we should be planning for peak oil the way we plan for a camping trip to the BWCAW. Plan for bad weather and know that you can survive any conditions by taking the right food and clothing, but hope for sunny weather and no wind! Packing the extra weight that might not be needed is always better than freezing your butt off in a snow storm in May.

Your last sentance says it all.

Herewith one last caution: There are far more ways in which things can go seriously wrong than there are ways in which they can be fixed to work better.

And that's the catch-22. Don says "I have no confidence in my ability (or anybody's ability) to predict chaotic and complex phenomena."

And yet his driving visualization is for a scale of havoc not seen since the civil war?

That is a very specific prediction.

By itself, I do not think Peak Oil could lead to conflict and violence on the scale of the Civil War. However, combined with other factors, such as conflict between generations as to how to pay (and how much to pay) for the retirement and medical care of the Baby Boomers, conflict between wealthy and newly impovrished social classes, conflict and possibly major urban rioting among groups of people at the bottom of the econonomic ladder such as Blacks vs. illegal immigrants, regional conflicts between the food and energy-producing "heartland" and what many in this region view as parasitic and nonproductive region of rich city folk on East and West coasts, all these conflicts combined could lead to . . . :

A man on a white horse. Left, right, populist, it does not much matter. When TSHTF, people will trade democracy for promises of security and prosperity.

Again, I want to emphasize, it does not HAVE to come to this. If our legislators and executives at various levels of government act with courage and decency and even a modicum of wisdom, then we can get through the next thirty years fairly well. If corruption and cowardice and short-sightedness and selfish cronyism continue, then the future is bleak.

A "Mad Max" world? Probably not. But it could resemble Hitler's Germany or Britain under Cromwell, or perhaps the last days of the Roman Republic, when Marius fought Sulla, and everybody lost until Julius Caesar restored order and founded the Empire.

In my opinion, once we move from the semi-physical facts (oil reserve estimates, production estimates) out to societal repsonse, we get to a family of outcomes. They can't all be high probability, at least not individually.

Each of various diverse outcomes can all be likely if they come in sequence.

For example, I would not expect hyperinflation to come before serious social disorder, including major urban riots and fires that burn large portions of cities.

I think dictatorship is unlikely to occur before hyperinflation, and if Ben and the rest of the Federal Reserve Governors have the guts and political support from a president and a senate to inflict the pain of very high interest rates over a period of years, then there will be no hyperinflation, even though price increases could go into double digits.

One future scenario that I think highly unlikely is a rerun of the Great Depression, in which the Fed took no action to prevent a collapse in the money supply. My subjective probability of that is about one chance in fifty. For even a mild deflation, maybe one chance in ten. On the other hand, I think chances of a major drop in financial assets (real estate, stocks, commodities) are large, perhaps one chance in three. But with appropriate action from the Fed, we can survive crashes in asset values and a severe recession without deflation.

I, for one, am becoming more pessimistic, as I see nothing like that from our current leadership.

This is where I think the prices signals are really going to help us out here. If the price goes up, who do we blame? You can have lots of finger-pointing at a whole raft of different entities, but if you can't identify a single source of the price hikes (apart from natural geology) then there is no-one that we can 'attack'. You certainly cannot attack a hurricane!

As long as all the parties in the process of oil extraction, refining and distribution cover their asses and don't look like they are gouging or inflating the price, then it will just come back (eventually) to one thing: There is not enough oil in the ground (or anywhere else). And as that realisation becomes widespread, then we will just have to change our lifestyles. I'm already doing it, and I know lots of other people are doing it, too, and they don't even know about Peak Oil. They are simply reacting to the price.

Unfortunately, I don't think there are any histroical examples of an essential commodity, central to all human life, that just runs out. Except, of course, Easter Island, but there's not a helluva lot of analysis we can do about that situation.

In other words: "All bets are off"

My unselfish #1 worry is that we will get needless global political meltdowns leading to wars with manny dead people and an enourmous waste of resources. #2 is the next election in Sweden, what if we dont replace our current half corrupt and incompetent leaders and get stuck with them for another 4 years unless they realy make a mess? #3 Will EU survive differences in how countries handle peak oil? #4 Will we build more post peak oil infrastructure while it is cheap?

And in the hybrid claim, I mostly hear the technology will save us hope, and Hybrids are one thing the press has been focusing on. I know some hybrid sales are up, but it's still a small market segment. Most people are still driving gas pigs, and big pickups are still hot.

Hybrids definitely won't save us. It takes too long for them to displace existing cars in the fleet. Recent numbers are a slightly higher than 4% retirement rate.

I only mention them as a baromoter of consumer intent, as evidence that it isn't all denial out there.

A journey of a thousand miles begins with a single step, and I for that good old reason, I try not to castigate first steps.

I think the Peakoil concept [go TOD!] is starting to elevate blood pressure and anger in the corporate world. EnergyBulletin has a great link on Auto Executives sniping Oil Executives, and vice versa-- called "CATFIGHT" !!!!

http://gristmill.grist.org/story/2006/4/11/13847/7988

I personally think more Powerdown progress could be made if these guys worked together instead of starting a shouting match. Yikes!

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

over time as prices climb. That's OK since it takes heat

under people's assess to get action. The fighting is a

positive sign of a slow wake up.

I think gouging isn't really all that bad since it acts

indirectly as a motivator. Cheap oil has meant little or no

action on the part of the public, corporations, or

governments. Expensive oil will force action. The bickering

is just the beginning.

Similar to what is happening in Brazil. Staple prices rise, amplifying inflation of foodstuffs caused by rise in oil prices.

Little game of Last Man Standing, anyone? Too bad! We're playing it anyway!

http://pqasb.pqarchiver.com/sptimes/access/1018227861.html?dids=1018227861:1018227861&FMT=FT& ;FMTS=ABS:FT&date=Apr+9%2C+2006&author=JEFF+TESTERMAN&pub=St.+Petersburg+Times&editi on=&startpage=1.B&desc=Investor%2C+or+pauper+or+merely+a+front+man%3F

(this one is bouncing around the net a lot, sorry if you read it already)

http://www.pastpeak.com/archives/2006/04/going_nuclear_1.htm

Why does such a line of thinking sound like 'they will welcome us and throw flowers at our feet' way of thinking?

Being a TOD reader and poster since nearly its inceptions I see a disturbing trend.

This site is set up to track oil reserves, production and make predictions based on the hypothesis that oil will peak in the future. The timeing of that peak is the whole point of citing statistics and making predictions.

In the last few weeks there have been numerous MSM reports on the high porice of oil and gasoline, SA inability to meet their production target, Russia's declining production, and Nigeria's inability to deliver oil for whatever reason.

All these support a closer peak oil event but there are numerous posters here who are arguing that it is just an artifact of reporting, short term dips in production, lack of refining capacity, etc. which are constraining current supply but that will be fixed in the future.

These arguments would carry more weight with me if posters such as Stuart, Dave, West Texas, etc., had not predicted the current events we are seeing today 3, 6, 9 montyhs ago. Many of the issues, lack of refining for example, were discussed at least 9 months ago. At that time the consesus was that near peak every possible excuse except the peak would be dragged out as a reason for high prices and lack of supply.

We are seeing all these events now reported in the MSM pretty much as predicted almost a year ago. This tells me that the people making the predictions know something and I should continue to pay careful attention. I should also not accept everything the other side is saying in a refutation argument. Both sides have valid points but the peak oil people appear to have a much better track record of predicting over 12 months time.

My point is that for new posters (less than 6 months) many of the issues we are discussing now were previously discussed, they are just being updated. Check the posts from May, June of last year to get perspective.

And the US gov would not be handing out $3K credits on hybrid cars if they did not believe it too.

"And the US gov would not be handing out $3K credits on [predominantly Japanese] hybrid cars if they did not believe it too."

Think about how strong the politics must have been running against a US tax credit ... for the Japanese.

Four were made in America, one was made in Canada.

Globalization and all that.

Of course all the gas I purchased came from the middle east, with the profit going to Texaco...

(or with "borrow and spend" government, they don't care)

Every now and then somebody has to tell me I have a "jap car" and it gets my hackles up, since near as I can tell they were built in America (and I've been paying American mechanics to fix them on occasion and American oil companies to keep them running far too often). To me it isn't that big a deal. I certainly don't tell Chevy owners that their Tahoe was probably built in Mexico, it just doesn't matter. (GM is Mexico's single largest private employer, or darn close to it)

However, my father in law never forgave me, he was at Pearl Harbor and would have nothing to do with Japanese cars, although he had a Japanese brand television because, well, his Curtis Mathis bit the dust a long time ago.

I am a new poster, but I have been reading the site for a long time. I have been following the Peak Oil debate for at least 10 years, and first became involved in working on alternative energy (cellulosic ethanol) in the early 90's. In fact, I mentioned Peak Oil when defending my thesis in 1995. I can tell you with almost absolute certainty that what you are seeing right now with prices is not due to a true production peak, but instead is due to a severe supply/demand constraint that doesn't look to get better any time soon. What this means is that you will continue to see production increases, but demand will increase just as quickly, if not more so. For all practical purposes, this has the effect of a peak, and yes, this situation is probably here to stay.

How can I say this with confidence? Because I know a lot of refiners, and they aren't having any trouble securing oil to run their refineries. If we were at an actual production peak, suppliers would be putting us on allocation. This is not happening, which indicates that there is spare capacity. There may be some local instances, such as Saudi Arabia, who are production constrained at the moment.

RR

RR

Fair point and I know you try to bring clarity and data to your posts .

It may be irrelevant to the central issue however. I think it was Stuart or maybe HO who said we are on a Hamster wheel. We have to run ever faster just to stay in place. The world is built on needing ever more supply of oil/petroleum products. At what point can supply not be increased? Even if a peak isn't imminent or we are entering a plateau, the likely hood of supply meeting desired demand (what demand would be with demand destruction via high prices) appears unlikely in the future. There is more consensus today (than 1 year ago) that even if we don't peak this year, the peak is not very far away. We may be able to hold a plateau of production (oil, NG, gasoline, liquids) for awhile but not be able to increase.

Too many things have to happen simultaneously. New wells, new fields, new refineries, new LNG ports all have to come on line synchonized with each other to increase supply to the end consumer. This is clearly getting harder and harder to do. As many posters here have illustrated just keeping up with declining wells gets to be an overwhelming problem, even assuming large volumes of oil yet to drill into, which appear to be quite scarce.

The Hirsch(sp?) report clearly spell out the timeline in reducing and switching away from this energy source. There is this vigorous debate ongoing if the peak will be in 2006, 2010, 2020 or maybe we peaked in 2005. The absolute date of peaking is irrelevant and will only be known in hindsight. Even after a majority of oil experts agree that we have peaked there will still be some who will stay convinced we can increase if we only commit more resources.

There is too much data indicating the peak is coming sooner rather than later. We need to be focusing on how to minimize the impacts of peak oil, whenever it occurs, not argue that it isn't going to occur soon enough to bother anyone. I am confident that the oil experts will always figure out how to improve oil extraction and refining. That will happen regardless of a concerted message of peaking oil.

I am worried about the non oil people who don't read this site and haven't a clue that energy could be real scarce and very expensive going forward. What will be the economic harm if peak oilers are off by a decade warning people to cut back and find other energy supplies? Getting off oil sooner just minimizes the pain when large declines are unavoidable. It might also shift the investment engine away from oil and to other forms which would be bad for oil workers but good for society as a whole since there is general agreement that oil reserves are finite.

Very clearly stated. I am copying this post for referencing when introducing PO to others.

I wrote a paper as an "addendum" to Hirsch.

http://www.lightrailnow.org/features/f_lrt_2005-02.htm

RR

To me, it looks like you are misunderstanding the nature of markets. The fact that refineries can get oil is to say that the market is clearing. Prices have risen high enough to cut demand enough that the available supply is enough to meet demand. But to understand where the bottleneck is, we need to look at prices.

Did you not see the profits turned in by the oil majors over the past few quarters? I have some detailed knowledge of margins within my own company, but I obviously can't share it. Do you have a public source that discusses margins? If so, we can discuss.

To me, it looks like you are misunderstanding the nature of markets. The fact that refineries can get oil is to say that the market is clearing. Prices have risen high enough to cut demand enough that the available supply is enough to meet demand. But to understand where the bottleneck is, we need to look at prices.

Markets are not always as efficient as they should be. You see bubbles all the time. Did the price of tech stocks a few years ago justify their value? There is no good reason that oil prices should be going up right now, especially since inventories are building. What's keeping prices up right now is fear and nervousness about geopolitical issues. It is not a supply issue.

If it was a supply issue, why are crude inventories building week after week? Why are we at an 8-year high on crude inventories? I don't need to look to prices to understand where the bottleneck is. I have firsthand knowledge of where it is. I don't need to try to come up with a model and interpret it. All I have to do is get on the phone, and call a crude trader and ask him how supplies look. To this day, I have never heard anyone say "We are having trouble getting oil".

RR

Are, now we are getting somewhere. We agree that you do not understand why oil prices are high :-)

Yes, there's stock build. The extra is around a weeks worth of supply on a global basis (treating missing barrels as stocks). That's a pretty modest buffer given the geopolitics. Not exactly tulip territory. When hedge funds are building warehouses to stack their barrels in, I'll be willing to call it a bubble.

I maintain that you are confused about what it means for there to be a problem with supply. According to your test, oil is only in short supply when you can't call someone and get some. But that only happens when there's been a complete breakdown in the market for some reason. In more orderly adjustments, the way supply problems get expressed is that some people can't afford oil based products that they would have otherwise used, and so don't use them. That has been happening for some time.

An article a couple of days ago in the Wall Street Journal had some interesting stats: "Institutional money managers have between $100 billion and $120 billion in commodities, at least double the amount three years ago and up from $6 billion in 1999, says Barclays Capital, the securities unit of Barclays PLC."

(1999) 2 billion

(2003) 50-60 billion

(2006) 100-120 billion

That's quite a stampede of money into some small markets, and that's just institutional investors.

To that you can add lots of little guys. I asked the folks over at peakoil.com, and gobs of them are long on oil. I would bet that a very large fraction of the people who visit this site are long on oil. You should run a poll. Those are the customers for the new oil ETF. Why not jump on the oil/commodities train? The DOW isn't doing any anything. I get the feeling everybody in the stock market is just moving over to oil/commodities because that's where the bull is running.

Personally, my radar goes off when I notice that everybody seems to be investing in something, and saying you'd have to be an idiot not to. It's a "New Era". All the Joe Sixpacks piling on after a long run-up. That itself is a warning sign.

However, the warehouse I would agree might well be a sign that things are starting to get a tad frothy.

The 3-2-1 crack spread is currently over $17 (source: back of an envelope). From 1985 to 2004 it didn't go above $11, and the average was around $3.

Those refineries with coking units to handle the heavy sour stuff likely have even better gross margins (using the envelope again for Mexican Maya coking spread).

Would seem logical for this to be the case with the run up in gasoline prices outpacing crude prices, and also looking at the change in gasoline stocks vs crude stocks.

(Just look at the individual heating oil/gasoline crack spread graphs on this page)

RR

I did not suggest that I don't understand why prices are high. I am saying that the market fundamentals don't support such a high price. There are many reasons oil is high, but investor psychology is an important factor that you seem to overlook. People pay too much for things all the time. I have been predicting for a while that what we should see is a divergence between oil and gasoline. Oil prices should drop back in the short term, and gasoline prices should rise (given that there is a true shortage). One insider told me though that many times he has seen high gas prices have the effect of supporting high oil prices. I told him this didn't make sense to me, but he said he has seen it happen on a number of occasions. I guess oil producers feel like since the refiners are getting a good price for gasoline, they can ask for a good price for the oil.

Yes, there's stock build. The extra is around a weeks worth of supply on a global basis (treating missing barrels as stocks). That's a pretty modest buffer given the geopolitics. Not exactly tulip territory.

Not tulip territory, but the ability to build inventories does not suggest supply constraints. Supply is certainly tighter than it used to be, but there is still excess capacity out there. When oil inventories start to get drawn down faster than they can be replenished, then you have a problem. That's what is happening right now with gasoline inventories.

I maintain that you are confused about what it means for there to be a problem with supply. According to your test, oil is only in short supply when you can't call someone and get some.

No. It's not because I can call someone and get oil. I can call almost any supplier and get oil. There is a big difference. When you start having a number of suppliers say that supplies are tight, or suppliers start to put refiners on allocation, that will be an indicator that there is a supply problem.

I want to make a few additional points. Refiners are spending billions to expand refineries. Do you think they would be doing that if they had not secured their supplies? Do you think Saudi would be building a big new refining complex if they thought they were about to peak? I maintain that there is a lot of information that you don't know, and you are making conclusions based on incomplete information. For example, are you aware that the posted price of oil is not necessarily what refiners pay for it? Unadvertised discounts take place all the time with various suppliers. Nobody wants to advertise these discounts, because they don't want to give them to everyone.

I will make a prediction. One of these days, you will look back and say "Well, I guess Robert was right". Production will increase from here. It may remain a bit flat until refiners can get finished with some expansion projects, and it may remain a bit flat while the 3 big gulf coast refineries are still down, but as refinery constraints are eased you will see production pick up for at least a few more years. That's my prediction.

RR

Don't shoot the messenger. Just relaying something I was just sent from the Amarillo Globe-News. I don't have a direct link.

Giovanni Paccaloni, an Italian oil company executive and president of the Society of Professional Engineers, doesn't buy that estimate, which is derived from U.S. government data.

Give him that time frame, show him a chart of the last half-century of oil production, and he'll shake his head.

Those charts, which assume an ultimate worldwide supply of 3 trillion barrels of oil, only take into account what the oil industry has done. They're useful to a point, he concedes, but they don't speak to what the industry will do.

He suggested four ways that output can be extended:

--Increasing the efficiency of current producing fields. If oil producers can raise production efficiency 5 percent or 10 percent, Paccaloni said, they will postpone the peak. This is accomplished by investing in technology and encouraging divergent thinking.

--Derive oil from nontraditional sources. Deep offshore wells in the Gulf of Mexico aren't included in the 3 trillion barrel figure. Nor are Canada's oil sands, which are thought to contain 175 billion barrels of crude. Energy also can be derived from coal-bed methane and methane hydrates, a technology that's not yet cost-effective.

--Decreasing energy use. The world consumes an ever-greater amount of power, with a fairly steady growth rate of 2.3 percent. Using that energy more efficiently will have an impact -- one that's not being felt.

--Maximizing exploration in areas that are currently producing.

If the industry can take meaningful action in these areas, Paccaloni said, the peak could be postponed to at least 2050.

Now, I don't buy his estimate. I think there is a pretty good probability that we peak within 10 years. I also think that even if the peak was further out than this, the supply/demand imbalance is going to be a far bigger factor long before Peak Oil.

RR

... my sense is that all these things could stretch the tail, but not move the peak.

RR

My question is, does the effect really require conservation to lead to lower prices, and then a re-expansion in consumption?

I don't think we are likely to see that. I think (whether we are peak oil constrained or purely production constratied) that is unlikely to happen. Prices are going up. Conservation might moderate the price increase, and pain, but I think we are unlikely to get to the point where someone says "hot dog, time to trade in the Prius on a 450HP Mustang!"

http://en.wikipedia.org/wiki/Jevons_paradox

Definitely sounds like some refinery issues.

Oil is at $70.50 now...

This market really surprises me. Gasoline stocks continue to fall. I can understand gasoline prices spiking. But crude inventories continue to build. They can't do that forever without forcing prices back down.

RR

What matters from an oil supply perspective is that crude oil + gasoline + destillate stocks are down 4.9 mln.barrels! In this regard I find the market response disproportional - we have a net loss of almost 5 mln.barrels (700 kbpd) and the prices rises with some 20-30c. My guess is that there is a lot of resistance at 70$ and many options are set to trigger on that level - and probably we will see delayed response to bad news again.

The switch from MTBE doesn't affect how much crude can be processed. It only affects how much gasoline can be produced. MTBE was a substantial input into the gasoline pool, and ethanol supplies can't make up the difference. I really expect the EPA to start writing waivers as gasoline shortages start to pop up in various regions.

One reason refineries can't process enough crude is that there are still 3 refineries offline from the hurricane. I read yesterday that they account for 4.5% of the nation's refining capacity. In a tight market, that's huge. There is also the legitimate issue of spring turnaround work, which is in full swing right now. Production should pick up over the next few months.

RR

Technically yes, but if I was a refiner and I had a bottleneck in sales of gasoline I would see it as an opportunity to delay production and perform the regular maintenance you are talking about.

Again this is just a short term issue... what interests me long term is whether the drop of the aggregate of all inventories will continue... if it does, this might mean that prices are suppressed just temporary, because of the mild winter crude stocks build up. When it vanishes (by mid-end summer?) oil will break loose.

Also, on the same week last year gasoline inventories increased by 0.8 million barrels. This year they fell by 3.9 million barrels. Dangerous perhaps to only look at one week, but unless production ramps up soon, where's the summer gasoline coming from?

The gasoline stocks graph in the report looks a little scary (top left, page 7), although it's not the first time stocks have plunged.

RR

Very confusing. They're showing May for gasoline and heating oil, but June for crude. And July for platinum.

http://money.cnn.com/data/commodities/

The falloff in the four week running average of crude oil imports year over year continues to widen. It is now down 4.5%, versus 4.0% a week ago and (about) 3.6% two weeks ago.

Granted, total crude oil + product imports are only down 1.8%, year over year.

However, we are seeing huge, historically unprecedented spreads between heavy, sour and light, sweet prices. The US market is sending a price signal that we need more light, sweet imports, but total crude oil imports continue to fall, now down about a half million barrels per day versus a comparable four week running average last year.

We do not know what percentage of crude oil imports and what percentage of crude oil inventories consist of light, sweet versus heavy, sour.

We do know that the HL method is predicting a severe shortfall in crude oil export capacity, and we know that US crude oil imports are falling, relative to last year, and we know that the shortfall in imports is growing as time goes forward.

We also know that Cantarell is on the verge of a catastrophic decline.

As I have said before, we have hit the iceberg. What we are now doing is debating whether or not we should head for the lifeboats.

What? Down 1.8%? "Total Net Imports" are UP 4.3% (year-on-year 96 day cumulative daily average) or UP 1.3% (year-on-year 4 wk avg). See latest EIA report.

Now, I was talking about crude + condesate imports, but the above table shows average daily net imports of 12,034 mbpd (four week running average) for the week ending 4/8/05 last year. The most recent four week running average is 11,743 mbpd, which is a decline of 2.4%, year over year.

Anyway you slice it, dice it or manipulate it, we are looking at falling imports, as in shrinking, declining, less next month than this month.

But why in the world is this a surprise?

Look at where our oil imports come from. Only Canada is showing the possibility of increasing imports, but they are having trouble just matching the falloff in production from their own conventional production.

And the real time bomb, Cantarell, is ticking away at our back door.

Or not.

Forty years later, Hertz customers will again get the chance to rent a Shelby. This time, 500 black-and-gold Shelby GT350s will have 325-horsepower engines and high-performance suspension. A standard Mustang GT has a 300-horsepower engine.

The black car with broad gold stripes will be unveiled Wednesday at the New York Auto Show.

Hertz will not be renting out the Shelby GT500 which goes on sale this summer with a 475-horsepower engine.

Full story at link.

Maybe arguments over who has to have the gas car so they can take the kids to a soccer game in the next county, or who gets the battery car so they can use the carpool lane?

More generically, I think the potential undoing of the human race stems partially from the tendency of the set of people that become leaders to thrive on chaos more so than those who don't become leaders. We've had such limited success in overcoming our more destructive "animal" tendencies built into that pesky brain stem. Our ever increasing ability to cause higher levels of destruction with less energy and effort through our technical skill and learning abilities has to be offset with overcoming our chaotic animal tendencies but it isn't happening.

Boy, this site sure turns me into a doomer...

Beyond the claim to be running a proof-of-concept cascade and being able to enrich uranium in small quantitites there is no confirmed evidence to support the claim that the Iranians are engaged in the production of fissile material in support of a clandestine weapons program.

In 2002 Iran voluntarily disclosed that it had a program to enrich uranium for purposes of power generation.

http://regimechangeiran.blogspot.com/2006/04/west-cant-let-iran-have-bomb.html

This is from it:

Mr El Baradei was even prepared to accept at face value the Iranians' shame-faced admission that their failure to disclose the existence of their massive nuclear enrichment plant at Natanz was no more than a bureaucratic oversight.

When the inspectors were finally granted admission, they were dumb-founded to find themselves in a 250,000-acre complex containing two vast underground bomb-proof bunkers designed for enriching uranium to weapons grade.

Mr ElBaradei is now prepared to concede that the Iranians have run out of excuses, and Teheran has been given until April 29 to implement a total freeze on its nuclear enrichment activities at Natanz and its other key plants, or face the wrath of the Security Council.

An estate of 250,000 acres would be pretty cool.

translation: "or face the loss of travel visas."

Oh the humanity! : )

Does anyone seriously believe that the Security Council will levy meaningful sanctions? Will the Chinese risk their energy supplies, sems unlikely.

Interesting link. About two years ago Pakistan and SA struck a deal. It is speculated that in the event of Iran getting nuclear weapons that Pakistan could park a couple of missiles in SA as a deterrent. Remember, Iran and India have a limited military pact.

I also came information that stated that there was a strategic alliance between Iran and North Korea. I have not been able to find out anything further or even confirm if the original statement was correct.

There have been three major areas where the two have exchanged information over the years. One is the nuke program, another is the missile program (both Iran and North Korea start their respective rocket designs from the elderly Scud and have made them bigger and bigger over the years). The third is midget submarines. North Korea is famous for them, originally based in part on Italian WWII designs (who sold some to Yugoslavia in the 50's and 1960's - hence the Korean connection). Iran currently has a factory they opened last year making them.

Since they are both outlaw states it is easy to see why they cooperate.

I found this which may be of interest to you too:

Mehran Riazaty: Iran Analyst

Unclear Activities: While today Ahamadinejad in the city of Mashhad announced that Iran has succeeded in accomplishing the first uranium enrichment cycle at Natanz Nuclear Facility, his administrative members such as, Secretary of Iran's Supreme National Security Council (SNSC) Ali Larijani was in the Saudi capital of Riyadh, the head of Iran's Majlis (Parliament) Gholam-Ali Haddad-Adel in Turkey, the head of Iran's Expediency Council Hashimi Rafsanjani in Kuwait, and Iran's Foreign Minister Manouchehr Mottaki in African country of Uganda, were assuring these countries that Iran will use its unclear technologies in a peaceful way.

That is interesting for two reasons. First, it suggests that the release of information on Iranian enrichment was pre-planned. At the same time the public announcement is being made by Ahamadinejad, Iran has envoys positioned to provide assurances to neighbour states. This supports the view that Iranian actions are not irrational but are purposeful and directed. Second, it partially serves to confirm my understanding that nuclear weapons technologies are prohibited by Sharia law. I am not clear on this but but have seen this stated in several different places but do not have a authoritative sourcing.

Lastly, I compliment you on the use of the term "unclear technologies." This is the most appropriate use of language I have seen in some time. Perhaps we can carry this interaction forward to a newer thread.

All the best,

Meanwhile, don't India and Pakistan already have nukes? And some place in North Korea, right?

If Iran wanted a bomb, couldn't they just buy one a hell of a lot faster?

There has been a lot of speculation on that very idea. Some think if the Iranians at some point set a nuke off it may be a North Korean one and that it will be part of a trade deal between those two nations. North Koreans get to see if what they have work, and they get money, missile stuff, oil whatever from Iran.

Lots of possibilities.

But it's not all bad news:

Bush was right, ethanol is the way to go.

The lead partner, Chevron-Texaco, is disbanding the project team. Hebron, which has an estimated 414 Mb recoverable, dates back to the 1980s but contains heavy oil. The field is in the Jeanne d'Arc Basin.

There is a lot of bluff and bluster coming off the Rock (the local term for Newfoundland). If memory serves, Hebron is heavy sour crude and there is a global surplus of that now and for the future.

Under NAFTA the ability of Newfoundland to expropriate is severly curtailed.

Atlantic premiers have always overpromised the electorate the level of benefit to be derived from the offshore. Williams is acting to protect himself from blowback.

Newfies always figure they are being screwed over on any natural resource basis. Think the oil field situation is bad? Look at what happened to the Voisey Bay NiCuCo deposit, and how long it took for Inco to develop it the way the Newfies wanted.

However, the discussion above concerning 3 trillion barrels (all liquids) just seems pointless to me. You throw in the tar sands, the Venezuelan heavy crude, the coal conversions, etc. -- sure, the ultimiate URR number is going to be much higher. So what? IMHO, peak oil is about peak flows. The maximum amount of liquids you ever get measured in mboe. So, it's timeframes and ramp-up times that matter. Does it matter if there's 175 Gb estimated in the tar sands if all you're going to get by 2015 is 3/mbpd? By 2015, inexorable existing field declines will have occurred as expected, deepwater will have peaked and be in decline, etc. CTL takes decades to get ramped up. Massive investment is required to develop Venezuela's heavy stuff and that too will come online slowly.

So, pick a number, people--you too, JD -- What's it going to be? To get Stuart's cigar today, we need to get to 85/mbpd. Maybe, in the ideal case, we'll get to 90/mbpd. But probably not.

-- What's it going to be? To get Stuart's cigar today, we need to get to 85/mbpd. Maybe, in the ideal case, we'll get to 90/mbpd. But probably not.

Re: JD's "I still think it's going to take the mother of all political streetfights to keep any fossil fuel in the ground."

I agree completely.

As I said (or implied) in IEA Revisions--The 2006 Forecast, if you convert all the hydrocarbons on Earth into liquids (including far out stuff like methane hydrates and oil shales--which is kerogen in marl rock), then why not 4 trillion? 5 trillion? 8 trillion? That's basically what the IEA does.

None of that is going to alter the daily liquids flow rate. For some reason, this reminds me of a story I heard on the radio around the time of the recent Mars mission. Ray Bradbury, whose science fiction I read when I was a kid, said Mars is the Future! Yeah, sure, right, Ray. We'll just terraform that damn planet and put the extra people there.

I just love Sci-fi. Fuel for the imagination...

A) the production of ethanol is not 'entirely dependent on government subsidies'... Bill and Vinod could attest

The fact is that this industry could not exist without subsidies. Ethanol has consistently cost more than mid-grade gasoline on the spot market for 20 years, and yet has only 70% of the energy value. In addition, ethanol production uses up substantial amounts of fossil fuels. It is a political answer, not a scientific answer.

B) mandates for the usage of ethanol are no different than mandates for other things used in society today... smart investors capitalize on this

I agree. There are a lot of stupid politically motivated mandates out there.

C) the EROEI of current methods of ethanol is MARGINAL not horrible... as technology evolves with the industry, the EROEI will increase significantly

How is technology going to evolve? Fertilizer production and distillation are both very mature technologies. The only way the EROEI can increase significantly is to use something other than grain as a feedstock. And an EROEI of 1.34 IS horrible. It is about 1/4th of the energy return for gasoline.

D) the waiver has been put in place because demand is going to outstrip supply... there's NO WAY california ethanol producers are going to be hurt ANYTIME SOON

That is patently false. Feinstein sought a waiver because they showed that use of ethanol actually increased pollution, and that they could meet the pollution requirements without it. The ethanol was adding a lot of costs to California consumers, and they were getting worse gas mileage as a result. It had nothing to do with supply/demand constraints. I previously posted some of her press releases addressing this issue.

F) yeah you might request a waiver but farmers and greens wont

Most "greens" I know are against ethanol because they see it for what it is.

G) dellusional my ass... post your exchanges better yet post your calculations - I've had a few exchanges with ethanol proponents out of MN and found that they are at the top of their game

I have documented these in detail at my blog. I will be posting the exchange with the official at the MN Dept of Ag in short order. But here is one. See if you can refute it:

The EROEI for ethanol is reported to be 1.34. (I have shown in my blog that this is actually exaggerated, but let's go with that). So, let's say that our goal is to create 10 BTUs of energy. We will do it by producing gasoline, and we will do it by producing ethanol.

In the case of ethanol, we have to use 10/1.34, or 7.5 BTUs. We only net out 2.5 BTUs. In the case of gasoline, the following pieces of information are widely known, and I can personally verify that they are correct. The EROEI for oil production is about 10/1, and then for refining the oil into gasoline it is also about 10/1. Overall, the EROEI is about 5/1. So, to produce 10 BTUs using gasoline, we will need 10/5 or 2 BTUs. We netted out 8 BTUs, over triple what we netted out using ethanol. In addition, we wasted far more BTUs during the production of the ethanol than we did during the production of gasoline.

There you have it. Attempt to refute it. The MN Dept of Ag couldn't. All they could do was say "I disagree". I said "Fine, but show me some calculations". They never did. Maybe you can?

RR

In my opinion, we would be better off to just let prices rise as liquid fuel shortages start to mount. That would force us to get on the road to conservation, and perhaps try to find a sustainable solution (which grain ethanol is not).

Incidentally, I blogged on biodiesel recently. It would be a far superior option to ethanol, and could theoretically supply all of our fuel needs.

See: http://i-r-squared.blogspot.com/2006/03/biodiesel-king-of-alternative-fuels.html

RR

http://i-r-squared.blogspot.com/2006/04/challenge-to-minnesota-dept-of.html

RR

Yeah... that's what I thought. The ethanol industry CAN and WILL survive without subsidies.

B - Agree with what exactly? My was response was that one is smart to invest his money on mandates (hint: they tend to be legally binding) and your response is... stupid politics?

Word to the wise dude - POLITICS IS EVERYTHING.

C - "How is technology going to evolve??" Are you serious? Let me guess, you're using a Commodore64 right now aren't you... aren't you?!

There are many other ways to produce ethanol... fermentation is but one. Technology is ALREADY increasing viability, economics and yields of ethanol production. Oh and if you want to break out the different TYPES of ethanol to support your argument than perhaps you should have stated so in the first place. I'll accept that corn-based ethanol derived from fermentation has a 'sigh' horrible EROEI but I'll take you down with cellulosic-ethanol everytime : )

D - That patently false feeling... tra la la la....

"A waiver would allow refiners and marketers to use reduced quantities of ethanol during periods of time when supplies are inadequate to meet demand" - Governor Davis Urges Feds to Grant California's Request for Oxygenate Waiver 05/22/01

F - Uh huh. Maybe you should get outta Texas mor 'ofen

G - Thanks for your posting.

NOAA calls this an 'unseasonably strong' cyclone barreling into the CA coast:

http://www.osei.noaa.gov/OSEIiod.html

Makes one wonder how 'unseasonably strong' the upcoming hurricane season will be, especially after the warm national winter and with SSTs already elevated.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Anyway, wikipedia has a page, with some interesting facts:

http://en.wikipedia.org/wiki/California_hurricanes

Down in my part of So Cal the problem is that the land and flood control are built for relatively small and infrequent dumps of rain. Average rainfall in any month is <3", and the average for this month is 0.70"

... I'm just going to go get a mountin bike ride in this morning before everything gets muddy.

Millions missing from Nigeria's oil accounts - audit An audit of Nigeria's oil industry showed on Tuesday discrepancies amounting to hundreds of millions of dollars between what oil companies say they paid the government and what authorities say they received.

... Oil revenue is shared between the federal government and Nigeria's 36 states. The federal government frequently accuses states of embezzling the money, while states make similar accusations against the central government, but neither can do much about it because the president and the state governors are all immune from prosecution.

...Nurse said that as well as uncertainty over financial flows, there were problems in the way physical volumes of crude oil were measured. There was good data on how much oil reached export platforms but almost no data on how much was originally pumped from oilfields.

This is problematic because vast amounts of crude are stolen along the way in the oil-producing Niger Delta and Nurse said it was impossible to determine how much oil was missing. ... Oil industry officials estimate that Nigeria loses about 100 000 barrels a day, or five percent of its output, to a highly sophisticated international network of oil thieves.

... Chevron Nigeria Limited['s] ... refus[ed] to implement a Memorandum of Understanding (MoU) signed with [Ugborodo Community women in Warri which is part of Nigeria] in 2002. ...

... The women, who laid an 11-day siege to the strategic Escravos [river in Nigeria] Tank Farm owned by [Chevron] in 2002, said they have concluded plans to invade the company again in protest against the oil firm's refusal to implement the July 17, 2002 agreement. ...

... The women leader told newsmen in Warri that about seven villages that make up the entire community have lost too much for them to let Chevron abandon the documents in its entirety. ... According to her, "Ugborodo women cannot allow [Chevron] to dump [the agreement] because so long as it continues to do that there cannot be peace in the area. ...

http://tinyurl.com/grqad

"There is a certain portion of the marketplace and customers who want that flexibility that is provided with a traditional SUV," Mark Fields, president of the automaker's Americas division, said during a conference with analysts.

"So I don't think our strategy would change too much."

My first comment would be that Ford has to say that, even if they don't beileve it. The need to reinforce the belief by however few customers that the "flexibility that is provided with a traditional SUV" is valuable.

My second comment would be that Ford and GM need more than a small "core" of $4/gal SUV buyers. They need a huge market for their flagship vehicles ... and $4/gal I don't see a huge SUV market.

Maybe, but there will be various inflection points where rising gas prices will make people choose smaller vehicles, then pull a trailer when they need more hauling space, or they will rent an SUV when they need to carry a larger # of people. I think the SMART mini-car has a great future as the model for daily commuters. Scooters and motorcycles after that, then bicycles last. Time will tell.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Yes but the B1s can deploy from Homestead or Diego Garcia. And a CVN battle group would have enough Tomahawks and strike aircraft to make an impression.

My hunch is that if there is a strike that there will be little or no build up. One of the objectives will be to kill or injure as many of the technical staff as possible and this is best achieved through a no warning "decapitation" strike.

I suspect that it will be much harder to quickly replace lost technical personnel then to replace hardware.

Good comment. But there are a lot of targets. You figure the Iranian navy and naval militia (small craft manned by religious fanatics) will be a major target given the tanker traffic.

The B2's will be the first in, with the B1's.