Cigar Now?

Posted by Stuart Staniford on March 3, 2006 - 8:18pm

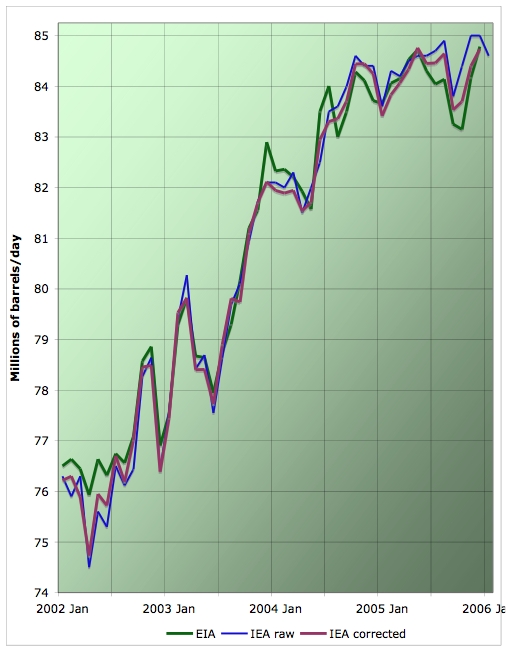

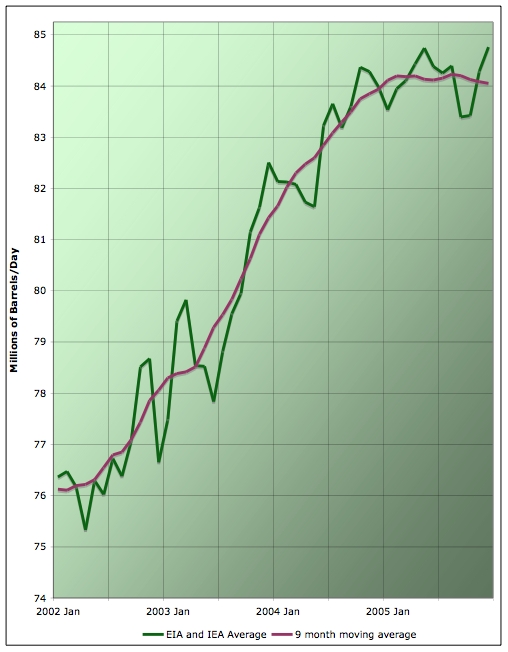

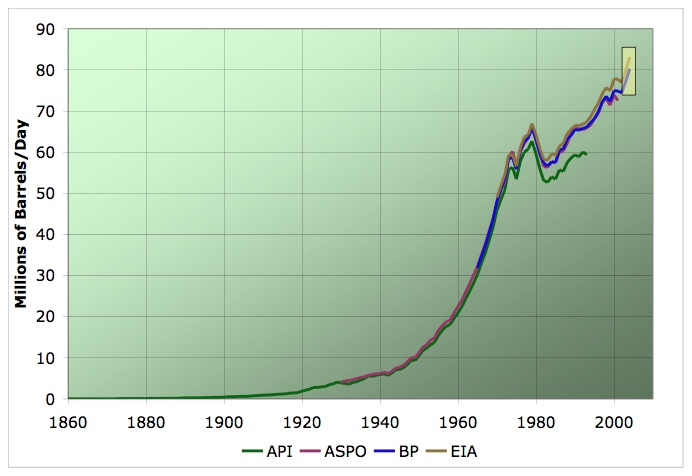

This combined series shows December 2005 to be the new champion. The difference is about 20,000 barrels a day (ie a handful of good wells' worth of production). I don't think this changes anything much about the overall bumpy plateau pattern (particularly not given that the IEA's initial estimate for January is down).

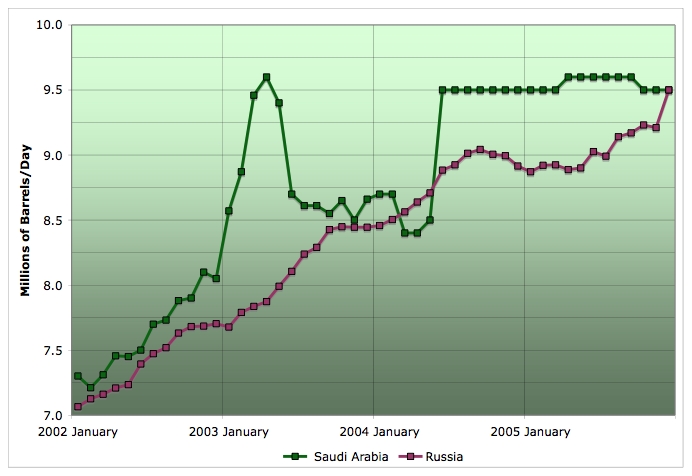

My view is that the leading threat to the "peak oil is about now" hypothesis would be if either Saudi Arabia or Russia can significantly increase production in the next year or two. Checking the EIA country estimates, we see that Saudi Arabia continued flat, but part of the reason for the strength of December global production, besides US hurricane recovery, was that the Russians had a very good month. (I speculate that this may also be why January looks like it might be off a little - Russia had production problems with cold weather). The two countries are now tied for being the world's leading producer.

Update [2006-3-3 22:40:43 by Stuart Staniford]:

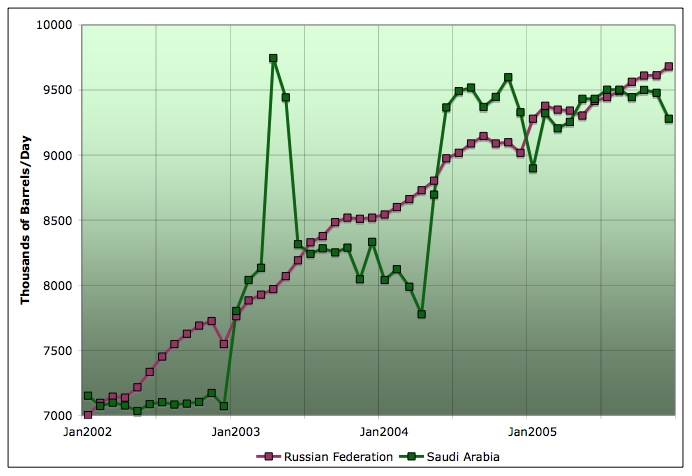

For comparison with that last graph, here's the same thing except sourced from the Joint Oil Data Initiative.

In this version of events, Russian production has been increasing more steadily, Saudi production is more realistic looking but dropped in December, and Russia has been the world's largest producer for several months.

Over at PeakOil.com, Russian Cowboy said the Feb. numbers for Russia showed a 0.2% increase over January. 9.52 mln bpd. He also said the production cost per barrel is increasing 20% a year. He seems to think Russian production could start going downhill very soon.

East Siberia and Far East (the size of Canada) are practically not developed. Judge by leery eyes of Russian president when he speaks about oil reserves in public I think there are large eastern oilfields or at least he believes in that.

Andrei, 3500 km east of Moscow.

Or you can go over there. The thread in question is Russian production discussion.

Pipelines are MUCH cheaper (and more energy efficient) ways to move oil in quantity. In the US very little oil is railed, almost all is either pipelined or shipped via water (also more efficient than rail).

Since Russia will be producing large (if some what smaller) quantities of oil for many years to come, the capital investment in a pipeline may well make sense.

Chinese rail lines are well (and sometimes over) used today. Taking oil off of them would free up space for goods that are trucked today, reducing Chinese oil consumption. The Chinese seem to be quite serious about not growing their oil consumption too much.

IMHO, China wants the pipeline more than Russia does.

IMO China would want to source more from Russia. And if Russia could up its production in the East, why not sell it to China. On the other hand it might be easier to ship it by sea form Eastern Russia...

http://www.russiaprofile.org/politics/2006/2/6/3211.wbp

-Ptone

http://www.danieldrezner.com/archives/002380.html

Further, I am not sure that the number of enegineers, even if comparable, has much to do with the creation of technology. India and Russia have probably always had more engineers that the US has had. But the US has led technology development because the country has a system that fosters and rewards it. This remains true.

There is a backdrop at TOD where engineers ridicule economists and economists keep quiet and roll their eyes. I am neither, but I do think the engineer worship here is misplaced.

I have news.

Only reason U.S. stays on top is because of VSA (Very Smart Asians).

Thirty-five years ago I noticed this, and my background is in economics, astronomy and some other disciplines.

Yes, the U.S. is #1.

And why?

Because we recruit Very Smart Asians.

That is it, in a nutshell.

BTW, have you looked at the percentage of our engineers who were born in the U.S.?????

Wild speculation: the US high-tech industry recruits like this, but the US auto industry doesn't...

In other words, don't expect any German scientists comming to America to build the energy solution that will end the next world war, we already owe them for the last time...

Indeed, one big reason Nazi Germany never put much in the way of resources into developing an atomic bomb is that its development would have had to have been based on "Jewish physics." Thus, any project based on those politically incorrect physics was impossible or practially impossible to fund.

Talk about irony.

BTW, yes, I am aware of some of the fictions published as histories that explain how it was the sweet humanitarian instincts of certain German physicists that suppressed development of the bomb under Hitler. If you choose to believe those accounts, I have a bridge in Brooklyn that is available at a bargain price . . . .

The Indian radio station survey story is interesting, but allegorical and not statistically significant. Your claim "it does not help when the majority of the world does not have a favorable view of America or its leadership." is pure opinion.

The fact remains that the US has hosted the world best incubator for innovation over the last few decades. I don't believe that this has changed, but am willing to listen to actual evidence to the contrary.

In the UK the percentage with a favourable attitude has dropped from 83% in 2000 to 55% now behind China viewed favourably by 65%.

Oil companies have been well into brain drain since 1985. Most of all their best engineers have retired a long time ago. Last of the good ones were on the way out when I started 30 years ago. Most now can't even write a specification, never mind get anything designed and built. I left the USA in 1986. I know another American chemical engineer that left in 1991. Worked in Saudi up to 3 years ago. He went back to the USA. NOW he just left the States last week for Qatar. You've lost the best and can't even hold on to them when they do try to go back. We say, "Let the tax accounts rip up your railroads."

Who keeps the boats sailing and the fuel moving? Engineers, obviously. Perhaps it is time for a mutiny: The ONLY way the Titanic could have been saved is if the Chief Engineer had led a mutiny against the deranged captain, who was ruining magnificent brand-new steam engines by running them flat out for a speed record instead of breaking them in properly.

I rarely advocate mutiny. Most mutinies fail. And engineers do not know how to organize, but when the leadership is deranged and the life boats are too few, you are out of good choices.

(O.K., personally, I'm building a raft and encouraging my friends to do likewise.)

BTW, I've never known either a mad scientist or a mad engineer; both types are generally sane. However, Ted Kacicinski (the Unabomber) was one of my math TAs at UC, Berkeley. He sucked as a teacher--but then so did all of my math teachers until I finally got lucky with one guy vistiting from Annapolis and another one from some Swiss university. Mathematicians for various reasons are way more likely to flip out than engineers or scientists.

One thing I truly enjoy about being around engineers is that they can show me how to fix things. Mending is better than ending.

The most absolute nuttiest professor I had was for (seems appropriate to mention it here, and this is really true)... exploration geophysics. I actually took one course in this. He beat my relativistic modern physics prof by 7 lengths. This guy was 73 years old (must be 103 now) with the wild white hair, square beard and everything and would ware the same searsucker blue and white pin-striped suit every day. He slept in his office for a good six months straight. When he would come in to class, he'd start writing equations on the blackboard, the bell would ring and we'd leave, but he'd keep going for 3 days running. On the 3rd day, he'd find a mistake and start rewritting all over again. The math guys were pretty much normal, except one made me memorize all the derivative and integral formulas, of which now I only remember about 6. Unfortunately, everything I learned about geophysics was in my soil mechanics and foundation classes (taught by civil engineering dept.). I still dream about setting up an oscilliscope and an array of microphones to the PC and hitting an iron plate with a sledge hammer. Supposedly it'll work if you can hit the plate hard enough to "raise the ball" to -88. I've got the PC oscilliscope program, but can't get serious about the mic array. Needs a sound board with too many channels. Guess I'm not the 100% stereotypical engineer, the BAR was pretty good, but my toy of choice would have been Candice Bergen;.. OK!.. I'd take the gunboat.

I've just finished orgainzing a start-up company for production and harvesting of 500,000 Hectares of paper pulp plants, paper company administration org, paper plant conceptual design, international proj mgmt engineering dept, paper plant detailed design, company operations & maintenance org for the next 6 years for a company to be located somewhere in South America.

I have lived in Asia for most of my adult life, so I am familiar with the issues at hand. I disagree with the idea that China's centralized system can "cherry pick" technology winners better then the private sector. This article in Foreign Policy sheds some light on the governmnet involvement in decision-making:

http://www.foreignpolicy.com/story/cms.php?story_id=3373&page=1

"But China's tentacles are even more securely wrapped around the economy than these figures suggest. First, Beijing continues to own the bulk of capital. In 2003, the state controlled $1.2 trillion worth of capital stock, or 56 percent of the country's fixed industrial assets. Second, the state remains, as befits a quintessentially Leninist regime, securely in control of the "commanding heights" of the economy: It is either a monopolist or a dominant player in the most important sectors, including financial services, banking, telecommunications, energy, steel, automobiles, natural resources, and transportation. It protects its monopoly profits in these sectors by blocking private domestic firms and foreign companies from entering the market (although in a few sectors, such as steel, telecom, and automobiles, there is competition among state firms). Third, the government maintains tight control over most investment projects through the power to issue long-term bank credit and grant land-use rights."

I didn't say engineers aren't good or important. I just think there are more important things in the world than engineering. Look at history, we remember great leaders who create things and make changes - not the mechanics who implement them. I think a good political and economic system will produce good engineering. Good engineering can't produce good poltics or economics.

"Engineers have made changes in the world that have outlasted (many for centuries) just about any political leader's changes that YOU can name."

I don't mean to be insulting, its just that I really don't understand. Maybe you just need to broaden your view of history, or is it just that you don't actually have knowledge about this subject.

For every George Washing you can name, I can name a Ben Franklin, but (you know) I can't name any like Hitler and I will say Henry Ford and the Wrights changed the world more than Hitler and Ceaser put together. IMO.

Include some engineers. Ever heard of ARCHIMEDES? Ben Franklin? Maybe the problem is that engineering (as we know it) just hasn't been around as long as Ceaser, so we haven't got your attention??. Is this just because we can't tell you who invented the suspension bridge? I view engineers as anyone who takes science and mathematics and applies the principles towards constructing practicle devices. So, maybe you never really studied history, or only the history of political figures.. or what form of history have you ever studied? Or just maybe you're memory's not so good. I seem to remember for instance, Da Vinci, Galleio, Cassegrain, A. Volta, Anders Celsius, Montgolfier, Guillotin (there's one you've probably heard of), Eli Whitney, James Watt, Michael Faraday, Cyrus Hall McCormick, Bernoulli, Sir Sandford Fleming (time zones), Wright Brothers, Bell, Thomas Edison, Howard Hughes, John Stevens, Sikorski, Henry Ford, Goddard, without even trying very hard.

As a matter of curiosity, just who is on your list?

Yes they did. From here.

What the hell is this nonsense?increase its oil extraction at a time when oil

prices are only moderately high, when it could

sit on production and make more money later on

in the game. Presumably the Russians are banking

on natural gas maintaining their income flow in

the medium term (I don't believe there will be

along term unless global warming is halted).

Clearly major disruption to oil flow from Africa,

the high probability of declining extraction in

Mexico, declining extraction from the North Sea

etc. hold the key to the shape of the graph over

the coming year.

I personally won't be placing any bets till the

GOM hurricane season is over.

He that controls the future world's fuel distribution system controls the USA... by the short hairs.

Have a look on page 17

http://europa.eu.int/comm/energy_transport/doc/2005_green_paper_report_en.pdf

Now, how eager do you think EU governments will want to get on the USA's war path coalitions when Russia has the fuel valve control in their hands? You're running out of allies now.

Andrei, 3500 east of Moscow.

If a producer thinks the price will increase faster than that, he should do as kevinM says, sit on his resource and wait to produce it when the price is higher. If he thinks the price will rise slower than that (or will fall), then he does better to produce as much as he can today, to take advantage of relatively high prices. Both of these responses, if applied by most producers, will tend to put the price back onto the nominal curve where it rises at the rate of interest.

So all you have to do is to guess what future prices will be, and you know what production schedule to apply to maximize your profits. Of course, that's easier said than done, as nobody knows the future course of prices. The best available method is to use the futures markets as a guide. Generally, oil futures are rising slower than the rate of interest, in fact after a few years the prices are falling. This implies, per the theory above, that oil producers should be producing at a maximal rate today, on the expectation that today's high prices may not be maintained. This is at least roughly consistent with what is happening in the world, but is perhaps not what one would expect from a Peak Oil Now perspective.

One interpretation is the production level is being set by policy. The other is that only the reporting is set by policy.

However, the degree to which the overall numbers are off is presumably limited by the extent of the missing barrels.

The EIA say of their sources:

So it looks like both data series are probably made up, but different people do the data invention in each case, hence the discrepancy :-)I was afraid of that. ;-)

here,

http://www.team-terminal.nl/

http://www.valerolp.com/Customers/TerminalDataSheets/

here,

http://www.valerolp.com/NR/rdonlyres/83C1FDE0-ABE8-4B18-B64E-F17DA79FE3A8/0/StEustatius1_25_06.pdf

So, maybe they are holding their production steady by drawing from their tanks. Or by filling the tanks with any surplus, rather than selling it.

All we can say is that 2005 may have contained the peak month - we don't know yet and we may never really know.

I find the Oil Drum a very good source indeed of technical analysis but when considering the world total the real figures of all liquids must be ± half a million barrels a day.

Since Russia is probably expanding and SA probably has spare capacity, we could still have some 85+mbd months in 2006 or 2007. On the other hand the end of the cold weather in Siberia could coincide with the first 2006 hurricane! Of course, if a war is started with Iran, the actual peak month will be of only mild interest.

Only when we are clearly past the peak, can we call it. This discussion is premature.

Thanks for putting it this way, J.

LeGorfou,

It's true that events spaced apart by mere weeks and months may not be perfectly predictive of next year's trends, and the next. But to the extent that current realities diverge from official, published forecasts, I lose faith in the official prognosticators. If they are wrong in such a crucial domain, how much credibility should I assign to other official versions of the truth in this and other domains?

An even more puzzling and potentially troubling question is, "Why is there such a divergence"? Do (or, Are) "they":

???

Or maybe, PO is in fact a myth, there are 7 trillion barrels left, and I can go back to partying!!! Wooo hoooo!!!! (Oh yeah, there is that GW thing. pooey)

My nature and background predispose me to trust in authority, but the engineer in me is swayed by the data. And yes, I recognize that we are measuring inherently long-term functions and analyzing them in a exceedingly short time frames relative to their wavelength.

So although the 2006 production may indeed eclipse that of 2005, my impression from the data is that we are starting to bump our heads on the ceiling. Why isn't offialdom at least explaining away the discrepancies between this data and their versions of the future? Convincingly explain to me that PO is not unfolding as we speak.

I agree that there seems to be zero evidence that 120mbd is achievable, or even 100 mbd. It appears to me that these predictions are increasingly regarded as null and void.

However, my objections are to treating the IEA production figures as though they are accurate to a few thousand tons a day when, at least for most oil producers, they are not.

It reminds me of the newspapers that translate a remark that some one is about 6 feet tall by putting in brackets (1.82880meters). Or as tee shirt I saw once saw a computer programmer wearing, which read "Garbage in, Gospel out!"

You might consider plotting Texas Oil production, from 1962 to 1972 and Saudi oil production from 1995 to 2005 with different vertical scales. Texas peaked in 1972 at about 54% of Qt, based on the Hubbert Linearization (HL) analysis that I did. Saudi Arabia was at about 55% of Qt in 2005, so lining 1972 up with 2005 makes sense based HL.

There have only been two significant swing producers, Texas, from 1935 to about 1970, and Saudi Arabia from about 1970 to 2005. The new "swing producer" appears to be oil and refined products from emergency reserves, which of course presents some long term problems with replenishment.

Texas oil production in 1972 was anchored by one large oil field, the East Texas Field, the largest oil field in the Lower 48. Of course, Saudi Arabia is anchored by the Ghawar Field. The Texas peak matched the final peak of production from the East Texas Field.

Following is a link to the Texas RRC website: http://www.rrc.state.tx.us/divisions/og/statistics/index.html

Unfortunately, the link to historical production seems to be down, but I'm sure the data are readily available elsewhere.

I use the term to predict how long it will take for a region's production to fall by 50%. For Texas, production fell by half in 20 years. Note that SA and Texas have very similar P/Q intercepts on their respective HL plots.

Based on Khebab's HL plots, my guess is that predicted half-life for SA is about 20 years. For Russia, at least from existing fields, it may be only six or seven years.

> The new "swing producer" appears to be oil and

> refined products from emergency reserves, which

> of course presents some long term problems

> with replenishment.

That's an interesting perspective, and very scary if true. Would you care to provide a bit more evidential depth?

All that's missing is the perennial zero-based plot:

Exactly the problem. We won't all collectively know about and begin mitigating for PO until it's already a done deal. The Hirsch report was my coffee-spitting moment, and the thought of waiting until PO is in the rear-view mirror...brrr....

I could have done a better job of framing it with attribution.

I know CO2 floods have been profitable, but the harsh reality is that total oil production in Texas has nevertheless fallen for 33 straight years. We have not shown a single year over year increase in production since we peaked in 1972. It appears that CO2 floods are just slowing the rate of decline.

In response to the "high tech will save us" crowd, I always ask: name me one high tech oil patch innovation that has not been tried in Texas.

To answer LevinK's question (how much extra oil from CO2 injection), "it depends", as does everything in the subsurface, but in hand-waving terms a competent waterflood might eventually recover 35-45% of the stock-tank oil in initially in place (STOIIP), and adding a CO2-based flood might increase that to 50% or even 55% in extremely favorable conditions. Normally you would combine the waterflood and CO2 flood into one phased scheme rather than running them sequentially. And the oil that you got from CO2 injection might cost 50% more per barrel to produce than the oil that you got from the waterflood. All these numbers are VERY approximate.

The problem with using CO2 injection to counteract the greenhouse effect is nothing to do with gas leaking out again - that simply isn't an issue. The real problem is that the CO2 in flue gas is hot, dilute and impure - all the things you don't want in a chemical feedstock. Once you get it underground it might work just fine, but the cost of stripping it out of the flue gas stream will usually kill you, commercially.

- http://www.theoildrum.com/story/2006/2/15/202152/001

- http://www.theoildrum.com/story/2005/10/22/16565/298

and my sources are referenced therein. Thanks for fixing this (though note that I wasn't offended - only mildly amused).I always look forward to reading your accounts of the monthly data.

I used to work in equity research for ten year and I always had the same problem that you do, sales in one period is affected by the prior period. Using a twelve months average was the way to solve this. It also takes away seasonal effects of course.

You should be commenting monthly figures but use the 12 m average as the main figure.

In a market like the global crude market (with a large share of the market participants trying to maximize cash flows and they are able to do it at high prices), when 12m figures decline we can be very certain that we have reached a peak! If they somehow found a new Ghawar close to petroleum infrastructure with spare capacity and we'd have a year withouth hurricanes, peace in Iraq and Nigeria then, the first peak might turn out to slightly premature (bumpy plateau), not likely though, right?

So focus on the 12m figure. It is key!

Thanks for your terrific work, Stuart!