A little more on gas, European and Asian

Posted by Heading Out on March 16, 2006 - 1:49pm in The Oil Drum: Europe

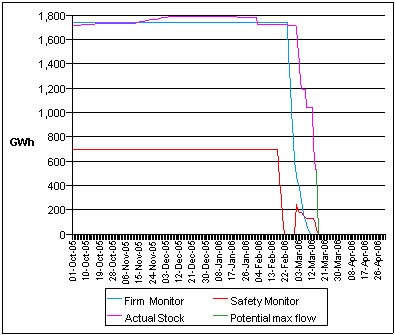

The Medium-term (above) and Short-term storage pictures. (click to enlarge)

As was pointed out in an earlier post, the UK gets gas from Europe, through an Interconnector pipeline. However, despite the fact that the UK has quandrupled gas prices and thus is willing to pay more than Continental Europe for the gas, it is not receiving enough. The reason is that the gas that is being produced, is already committed to long-term contract to existing customers, so that just waving a checkbook is not enough. The alarm appears to be roiling the market a little.

It is in this regard, perhaps that we need to look at where the long-term gas will be coming from. One of the standard replies is Russia, particularly for the European sector, but also, with the development of the Shtokman field, for the United States. However, as Schlumberger reports

Russia must develop its untapped proven natural gas reserves soon, in order to arrest the current decline of production at its existing fields and help feed global demand for gas, leading industry analysts said Tuesday.The article points out that Russia has about 29 trillion cu.m. (tcm) of proven reserves, but has a domestic demand that is growing toward a consumption level of 564 billion cu m (bcm) with a planned level of exports of around 1 tcm with Europe getting around 400 bcm of that. But the infrastructure and investments may not be there.

Jonathan Stern, director of Gas Research at the Oxford Institute for Energy Studies, said Russian gas exports to Europe will have a political limit.The contretemps that occurred between Russia and Ukraine and that led to reductions in Western European supplies due to Ukrainian use may be apparently resolved, but the Italians are still unable to get the levels of gas supply that they need from Russia."200-220 billion cubic meters a year may be deemed a limit on Russian gas exports to Europe," Stern said. "It depends how dependent Russia wants to be on European markets," he continued.

"If supplies from Russia are limited post 2015, Europe will have to look elsewhere," he concluded.

The flow of gas from Russia to a number of European countries has been affected by the cold weather in eastern parts of the country.At the same time Russia is in talks with the Canadians to install an LNG plant near St PetersburgEni said it expects supplies from Russian gas monopoly OAO Gazprom (GSPBEX.RS) to fall 3 million cubic meters short of the 74 mcm requested daily.

President Putin is going to visit China again, both to look into a new oil pipeline but also

Lazov said Russia plans to supply 15 million tons of crude oil to China by railways in 2006. In addition, the two countries are discussing exports of natural gas to China.One of the major interests being the Kovykta field, which has evolved, and which is a topic over which Japan and China are also in competition , and there are still problems, despite earlier positive comments by a Dr Yergin some two years ago. Part of the problem may be the need for money although with all the big players involved you would not have thought that would be an issue. However, since as the Moscow Times just pointed outHe said relevant corporations of Russia and China are jointly studying the feasibility and plan of exporting gas to China.

The current task of the two sides is to complete the business discussions, which are key to the signing of a large-scale contract of gas supply, Lazov said.

TNK-BP has offered Gazprom a 51 percent share in the vast Kovykta gas field in eastern Siberia with an eye to supplying energy-hungry Asian markets, the company's director of gas development, Viktor Vekselberg, said Tuesday.maybe this whole issue is really more about politics. Certainly the Moscow Times is also noting that Putin is extolling the virtues of long-term delivery contracts, but this is where we came in.

And one notes that an attempt to increase funding for DOE R&D went nowhere.

The UK is offering a cautionary look at the future for California and for many other areas that are on the ends of the distribution systems.

There are two worrisome prospects: Canadian depletion and their increased domestic consumption and the new pipeline Kinder Morgan is building eastward from Wyoming to Chicago.

That means increase competition for our two main suppliers! Heck, Texas is building LNG terminals - talk about hauling coals to Newcastle!

That's why Arnold is so hot on a LNG terminal off Malibu and Sempra is expanding their still-under-construction terminal below TJ.

Compounding the problem is so much existing electrical generation in California is NG-fired (18 GW) and ALL serious new generation has to be NG to get emissions permits. (Solar and wind are insignificant in the big picture.)

My analysis, albeit self-serving, is that California needs to start construction on at least 4 big nuclear reactors today. Looks like Tony Blair has come to the same conclusion in the UK too.

http://www.pbs.org/wgbh/amex/carter/filmmore/ps_energy.html

Basically, conserve and cooperate for Powerdown to enjoy energy security because the alternative of a short-lived Energy Fiesta spells disaster--the British Isles did not listen to Carter's advice either. Thus, waving a checkbook at this late date does not increase supplies. The first country to widely implement Powerdown can then create a profitable short-term 'black market' selling its excess long term contract supplies to those desperately willing to pay any amount for it.

Bob Shaw in Phx,AZ Are Humans Smarter than Yeast?

Regionally rates of oil extraction have been falling for decades, of note the US in 1971 and more recently UK, Norway, Venezuela, Indonesia... these regional falls in oil extraction rates haven't caused problems (although the '73 and '79 oil crisis wouldn't have affected the US nearly as much if they had been able to increase domestic extraction) since oil was still abundant in other places in the world and very easy/cheap to transport (it only cost ~$2? to ship a barrel of oil from the Middle East to the US).

With gas however the regional extraction rate falls are far more important since gas is extremely hard to transport compared with oil, hence the common practice of flaring gas at oil wells since it just isn't (increasingly wasn't) economic to transport it to market. Europe is facing a gas crisis due to the regional North Sea extraction rate falls and the challenges of transportation even though Russia, Iran, Qatar have plenty.

I think about it like this. If we in the UK were short of oil we could import oil from the other side of the world - moving oil is cheap and easy. We could also afford to outbid many poorer countries. So assuming (perhaps unreasonably!) the whole global economy stays reasonably intact the UK will be okay for oil, demand destruction will come from elsewhere. Also, virtually all oil is used in transport in the UK, most in personal cars. It wouldn't be hard to cut our oil use in half and still maintain a resemblance of business as usual.

Gas on the other hand, we can't import it from the other side of the world since it is very expensive and hard to move, we operate in a much smaller regional gas market of Europe and Russia. Unlike with the global oil market we can't afford to outbid all the other countries in Europe. Gas is mainly used for heating and cooking domestically and generating electricity industrially. It would be very hard to cut out gas use by half, much harder than cutting our oil use.

So - it's easier for the UK so source more than it's fair share of oil than it is for gas and we're more reliant on gas than oil. That's why I think gas is the UK's problem not oil.

This ignores the larger global economic problems that global peak oil causes compared to regional peak gas - but these will be the same for many countries so aren't a UK specific issue.

- 70% of these reserves are in 3 countries - Russia, Qatar and Iran. This is potentialy devastating for the security of supplies and for our ability to bring them online quickly enough. A single blast in Moscow and the whole West Europe could be frozen.

- The cliff NG production falls after it reaches its peak production is making it much more harder for the local economies to accomodate. I hardly imagine what would happen if we went to NG on large scale lured by the Russian reserve figures and their fields start to decline.

- The increasing usage of NG as substitute for oil, where NG is abundant locally

- Our only significant source of conservation on world scale is from NG fired plants, and we don't really have anything to replace them with, except coal.

Overall the prognosys is for a calm weather on average. with occasional storms, hurricanes and tornados here and there.The whole of the European gas pipeline network must be evry vulnerable to determined efforts to damage it.

The physical security of pipes, storage depots (remember Buncefield) seems to rate very low on future plans... although they talk of little else with nuclear power.

JESS is just a bunch of civil servants coevering their backsides.

http://www.rrc.state.tx.us/divisions/og/statistics/production/ogismcon.html

What came as a surprise to me was to see that nat gas production in Texas (producing approx. 30 % of the US nat gas) has declined approximately 13 % through 2005, and looks as it fell of the cliff as of Nov 2005.

The nat gas production seemed to recover from the hurricane related shutdowns through Oct 2005, but as of Dec 2005 it is down approx. 2 Gcf/d (or Bcf/d) at 14 Gcf/d down from 16 Gcf/d as of Jul 2005.

Anyone else aware of this?

This looks like bad data.

Chris

GAS WELL GAS CASINGHEAD GAS

2005 GCF/D GCF/D

JANUARY 14,08 1,80

FEBRUARY 14,26 1,84

MARCH 14,34 2,00

APRIL 14,42 1,89

MAY 14,18 1,88

JUNE 14,07 1,97

JULY 14,06 1,95

AUGUST 13,88 1,96

SEPTEMBER 13,12 1,77

OCTOBER 13,24 1,92

NOVEMBER 12,91 1,89

DECEMBER 12,27 1,76

(Sorry bout the table, but hopefullu it is readable)

GCF Giga cubic feet; or Bcf which is more commonly used in the US.

Why the significant drop for gas well gas from October 2005 till December 2005?

Bad data?

Creating a perception of decline helps them in their negotiations to increase domsestic prices, may less taxes and get more money to "invest" in production or transport projects, money under the sole control of the top management of the company.

The fact that they had some difficulties delivering this year can be chalked to the extraordinarily cold winter this year in most of Russia and Eastern Europe, which pushed their systems to the max. But it was really unusual circumstances.

I don't believe for a second that production capacity will a limiting factor in the foreseeable future, and the fact that they are building, or planning to build more export infrastructure demonstrates that they have the gas to do it. Gazprom is not so good at the middle term management we're used to in the West, and they sometimes get too focused on very short term crises, but their long term planning has been absolutely brilliant in the past decades. Just look at how they've built the export pipeline infrastructure to the gates of Europe.

I'll provide links with more details if requested.

http://www.eurotrib.com/story/2006/3/22/104724/979