Getting gas from Crude

Posted by Heading Out on March 13, 2006 - 2:19am

This then will be a relatively simplistic look at the different potential hydrocarbons that might make up a crude oil, and how we can get them apart. I'll post next time on how we can break the separated flows into other products. This, then, is a short techie talk in the oil production series, earlier posts in which are given at the end of the post.

Crude oil is made up of a mixture of hydro-carbons, which are the different ways in which carbon and hydrogen can combine, starting with such simple compounds as methane (CH4) and progressing to more complex ones with greater numbers of carbon atoms. Oils from different places have different combinations of the major constituents, for example, this is from Kuwait. Because they are fluids mixed together, it is not very easy to separate out the different valuable parts (known as fractions) by a mechanical means. However if you heat up the crude oil blend, then it will vaporize.

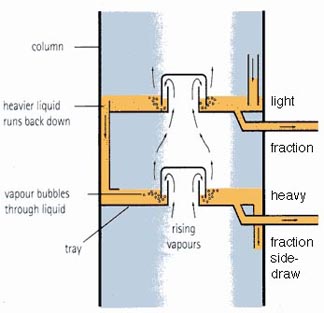

As the combined vapors from the heated crude enter at the bottom of the tall tower (called a column) they pass up through different trays that are placed at set heights up the column. When the gas reaches a tray it passes up through it into a bubble cap, this is a cover over the hole that pushes the gas down so that it has to bubble up through the liquid that has already condensed onto that tray.

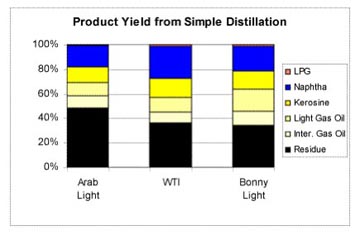

The liquids in each tray, as the vapor rises higher in the column, are kept at lower temperatures, so that the heavier oils, that condense at a higher temperature, will condense lower down the column. As the lighter vapor rises through successive trays, the temperature of the liquids drops, and lighter fractions of the oil also begin to condense out, until the very lightest are collected at the top, still as gas, and fed on to a cooler. The liquids then drain, either back down to a lower tray, or through a side-draw pipe that taps the fluid from the trays and takes it away for either further division or for storage and sale. A typical initial distillation might yield

Each year the EIA publishes its world distillation capacity which is the necessary part of getting from crude to useful product.

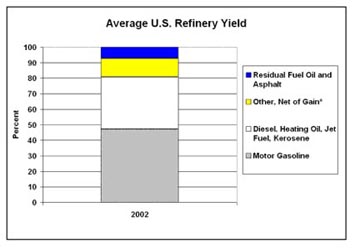

I will continue this next time, talking about the further stages in refining, and cracking of compounds to break them into lighter fractions, so that the next product from a refinery might at the end, look something like this (courtesy of the EIA).

This is part of an ongoing weekend series on technical aspects of oilwell (and natural gas) drilling. Previous posts can be found at::

the drill

using mud

the derrick

the casing

pressure control

completing the well

flow to the well

working with carbonates

spacing your well

directional drilling 1

directional drilling 2

types of offshore drilling rigs

coalbed methane

workover rigs

Hydrofracing a well

well logging

seismic surveying

gravimetric surveying

carbon dioxide EOR

As ever, if this is not clear, or if there is disagreement then please feel free to post, and I will try and respond.

the problem was they could not make it fast enough, it's been theorized that if they were able to produce enough if it they would of lasted long enough to bring jets and the other weapons they had in the wings online.

"The Haber process now produces 500 million tons of artificial fertilizer per year, mostly in the form of anhydrous ammonia, ammonium nitrate, and urea. 1% of the world's energy supply is consumed in the manufacturing of that fertilizer (Science 297(1654), Sep 2002). That fertilizer is responsible for sustaining 40% of the Earth's population."

http://en.wikipedia.org/wiki/Haber_process

Uses natural gas.

Estimated to have roughly doubled the amount of biologically available nitrogen on the planet.

Interestingly, the Germans had plenty of ethanol and liquid oxygen to fuel the V-2s until very close to the end of the war.

The answer is: he shot down 23 Messerschmidts.

What was the question? Why was Hans Schmidt kicked out of the Luftwaffe?

===========

I get blank stares when I tell it to young people.

Took me some time to understand the humor though.

in 1944. The German armed forces were still chronically short of all liquid fuels. Most evident in the battle of the Ardennes when even the crack units involved in the attack were not equipped with enough fuel to reach the Meuse River. They were supposed to capture it along the way. Most German tanks just ran out of fuel and were abandoned rather than lost to US action.

F-T is very inefficient. But when desperate and have access to slave labour then you will try anything.

My recollection from Speer's memoirs is that oil production from coal peaked higher and later than you state, but Speer could have been wrong, or (Yes, it has happened a couple of times.) my memory could be in error.

The Germans were always chronically short of gas, made much worse after the loss of the Rumanian Oil fields.

In fact , perhaps The Second World War should really be called 'The First Oil War'. Japan and Germany both

had the same problems. Anyway, thats history. I believe that South Africa has made the best shot at the

F-T Process during the years when they were under economic sanctions. But again, more I think from desperation than economics.

I suspect you might have slipped a decimal place there, and that it should really be 160,000 barrels per day instead of 16,000.

While I don't have the German synthetic fuel production for 1944, one of my military books cites a 1940 production of 4.25 million metric tons. That would translate into an equivalent average daily production rate of roughly 78,000 barrels per day. So, if the Germans ramped up production to reach a maximum in 1944, that would constitute about a doubling over the 1940 production level, and therefore indicating that 160,000 barrels per day is very likely the correct number.

While it took a tremendous effort on the part of the Germans to attain this level of synthetic fuel production, by modern standards it's pretty tiny, about the output of a medium-size oil refinery.

I bring this up not to nit pick about German production numbers but to perhaps add some perspective on what a major undertaking it will be to get even several million barrels per day of additional coal-to-liquid production.

pay attention Mudlogger.

What I am getting at here is that in regard to Peak Oil, you are only as good as your engineers, your geologists, and your managers. The focus on equipment limitations, etc. is valid, but I think in the real world often the most serious bottleneck is the shortage of highest quality well-trained talent.

The U.S. impending shortage of steel is scary. To me ten times scarier is our shortage of engineers.

Right now on CPSAN, Arlen Specter is running a Senate Panel investigating the rising prices of Natural Gas (NG).

Their solution?

Pass laws.

The law shalt provide.

That is even more profound than the "free markets" providing.

http://www.c-span.org/

Will they arrest and bring to trial Mother Nature when she refuses to comply?

Are you writing the script and getting ready to videotape it?

Title: "Munity of the Oil Bounty"

Mother Nature is put on trial for refusing to put out anymore.

Casting:

Role of Mother Nature: Sharon Stone (Whata ya going to do, arrest me for running out of lube?)

Captain Blight: Jack Nicholson (We don't want to hear the TRUTH. We can't handle the TRUTH!)

Young Ensign Christensen: Russel Crowe (We are masters and commanders of our own destiny. We got to turn the ship of state around! Call it mutiny if you must.)

I am sure that the UK have passed just as stupid laws in fairness.

The best one is still the "monkey trial" of Creationism vs. Evolution.

Next one will be stem cells.

With so much of our manufacturing being outsourced, maybe we really don't need as many engineers as we used to (('m talking here in the aggregate, shortages or gluts in certain highly specialized areas notwithstanding).

Even if there really IS a shortage, no problemo - we just import more engineers from India, Pakistan, China, or wherever. Engineering has become fungible, like almost everything else.

Regarding steel, I was not aware that there is an actual steel shortage in the US, though heavy manufacturing is not something I follow anymore. We actually use far less steel than we used to. If I recall correctly, the peak year for US steel production was 1957 (big cars and a construction boom). One must also keep in mind that a large fraction of steel is recycled. I don't recall the actual figures, but a surprisingly high percentage of the steel in a junked car becomes new steel. I would think we're going to run out of energy to smelt, shape and manufacture steel goods long before we run out of iron ore + recyclable scrap.

We could get iron by using our baseload power plants to electrolyse sulfide ores for metal, yielding electrolytic iron for feed for electric heated minimills, and also produce plenty of byproduct metals like copper, nickel, PGMs, zinc, lead, silver, gold, etc. This would not be economic at present prices. But if the dollar dropped 90%...

Gasoline is way more complicated than most people know or want to know or need to know. Best people to talk to on this topic are the people actually in the business at the wholesale level; buy the guy a couple of drinks and he'll probably tell you a tale of woe (related to boutique blends) and way more than you wanted to know. What I find fascinating is the way prices are set in reality--and it has almost nothing to do with what is written in economics textbooks that are regarded as gospel truth by undergraduates.

Volatility matters since the evaporated portion contains a lot of VOCs (volatile organic compounds) that contribute to air pollution, and thus are controlled in most locations. Volatility is why most pumps now have the hood on the nozzle to capture the vapors as you fill the tank.

The Federal blend formula requires 7 RVP in summer and 13 RVP in winter, but most states set their own blend constraints, sometimes county to county depending on the air pollution situation. In California, we have the California Air Resources Board (CARB) formula requiring 7 RVP in summer and 10 RVP in winter (because of our mild winters and bad air pollution).

Blending to RVP (and octane, and sulfur, and all the other simultaneous requirements of final gasoline) is tricky. For example, butane gives you a very high octane rating so is good for the octane target, but it is very volatile, so it is bad for the RVP. Refiners have to change their blending recipe between summer and winter to achieve these targets, sometimes creating shortages or surpluses of particular fractions (such as pentanes) in the refinery.

As might be expected you get a lot more naphtha from the distillation process than you can possibly use. In Saudi Arabia they use it, occasionally, as boiler fuel. I worked for awhile at the Gazland Power Plant, just about five miles west of Ras Tanura, in Saudi Arabia. About once a month, for a day or so we would use naphtha as a fuel. Occasionally we would use raw crude as well but most of the time we used natural gas. The plant had both gas and oil burners or injectors in the same boilers and you could switch from one to the other without ever losing your flame.

However in Saudi Arabia today, most of the naphtha is simply injected back into the wells to help keep the pressure up. At least that is what my son tells me. He has been in Saudi, working for Aramco, since 1991.

Note: Technically gasoline is sometimes considered naphtha, however as the term is normally used, it is the light colorless fluid that dry-cleaners and Zippo lighters used. It is also used in many manufacturing processes as well, blending naphtha with heavier compounds to make various household compounds. Gasoline has 7 to 9 carbon atoms and anything from 6 to 11 carbon atoms is considered naphtha.

http://www.gcsechemistry.com/o5.htm

The biggest problem with naptha, I read, is the octane (35-40). It is complicated, but one of the functions of a catalytic reformer is to convert naptha into higher-octance gasoline blending components. The transformation isn't really adding carbon atoms, but rather the structure of the molecules are changed.

It yields net hydrogen and is called dehydrogenation.

The problem is making shorter ones out of longer ones. The basic issue is that you have to ADD hydrogen. Refineries can do this and the more facility they have the higher the capital investment. If we had a great source of cheap hydrogen or cheap energy, we could turn coal into gasoline.

As to octane ratings for naptha, remember that pure octane is 100 octane, by definition (research and motor.) Shorter strings have lower octane rating until you get methane or ethane when it turns back up (methane is 120 octane?)

Hence, a naptha that has a lower vapor pressure than gasoline has an octane rating lower than standard gasoline.

On the other end, longer chains do not vaporize easily enough so are used for diesel fuel which burns as a mist.

The refiner will adjust his mix of output products based on his feedstocks, product market demands and prices, and capital investments.

http://en.wikipedia.org/wiki/Naptha

My understanding it is more of a feedstock for Petrochemicals mainly olefins but not exclusively

How can we have "Switch Grass for Victory!" if the wildfires keep burning the grass? http://www.cnn.com/2006/US/03/13/wildfires.ap/index.html

The Scuderi Group is an engine development company currently building an Air-Hybrid Engine which it claims will be to be the world's most fuel efficient internal combustion engine. Currently in production at Southwest Research in San Antonio, Texas, it is claimed that the Scuderi Air-Hybrid Engine will allow diesel and gasoline automobiles, commercial vehicles and other applications powered by internal combustion engines to be 60 percent fuel efficient (compared to today's 33 percent), http://www.gizmag.com/go/5318/

Researchers at GE say they've come up with a prototype version of an easy-to-manufacture apparatus that they believe could lead to a commercial machine able to produce hydrogen via electrolysis for about $3 per kilogram, down from today's $8 per kilogram. http://www.techreview.com/BizTech-R&D/wtr_16523,295,p1.html Hot Dog! They will be ready for production "in a few years" Dang!

Solar concentrator company is claiming about $3.50 per PV watt...Not bad! http://www.parc.com/about/pressroom/news/2006-02-16-solfocus.html

Iran threatened Saturday to use oil as a weapon if the UN Security Council imposes sanctions over its nuclear program. http://www.canada.com/topics/news/world/story.html?id=35f56a71-53ee-48d9-b8f0-38dccfec22c0&k=210 72 Oh, wait a minute, we meant that we will use oil as a "what you ma call it..." http://today.reuters.co.uk/news/newsArticle.aspx?type=topNews&storyID=2006-03-12T071331Z_01_OLI2 25315_RTRUKOC_0_UK-NUCLEAR-IRAN-OIL.xml On the other hand, "Iran's Supreme National Security Council, which represents Iran in nuclear talks, has said Iran has no plans to play the oil card at present but could do so if "conditions change". Now lets see how the future's market responds yet again with instantaneous efficacy... My slow-moving inefficent self is buying a few more shares of XOM.

Generaly.

But not very good either. That amounts to a capital cost of $3,500 per kilowatt capacity. A big coal or nuke should cost less that $2,000 per kW.

The capacity factor for solar is rarely 20% while the nuclear industry is averaging over 90% so a kW of nuclear capacity produces 4.5X the kW-hours of a kW of solar PV.

Adding fuel and O&M for nuclear of 1.5 cents per kW-hr and ignoring PV maintenance makes solar PV electricity about 7 times more expensive than nuclear power.....IF this claim is true and comes to eventual realization.

Then again, prices going up may just be speculation.

But this is at current electric rates I presume -- it will go up as rates go up.

Coal plants can't be turned off once every day because it plays hell with reliability when you go through the thermal shock, so you have to run them 24/7. How much do you charge for nonpeaking power if the coal plants are selling peaking power for only eight hours a day? 16 hours a day at 1/8th cents an hour, right?

Like most on this blog, I think that hydrogen is a distraction, but if it is going to be forced on us we might as well see what's out there.

However, there are many current and possible applications for industrial H2 where capital costs are more important than operating costs (electricity rates). This invention will allow many NEW applications of industrial H2 and will therefore increase aggregrate electricity demand.

Nice interactive diagrams for moving through the refinery processes

http://www.exxonmobil.com/Norway-English/PA/Operations/NO_R_prosessen.asp

So, if I've got this right. Let's say the vapor is 1000'C, then the lowest tray might be 890'C, the second up 850'C, and the third up, 820'C, progressively cooling the vapor?

Thank you for all your efforts...

ONLINE NEWS REPORT (ONR)

A Service of the Public Relations Dept., Saudi Aramco, Dhahran

Friday, March 10, 2006

CURRENT EVENTS:

- Saudi Arabia: Al-Qaeda vows more attacks - Aramco, Abqaiq, Yanbu' cited; Ali Al-Naimi quoted (Energy Compass)

- ENERGY COMPASS, March 10, 2006:

Saudi Arabia: Al-Qaeda vows more attacksIt's a nightmare scenario: A successful attack on a giant oil facility that cripples oil exports, sends oil prices soaring and damages the world economy. Such a nightmare was averted last month, when Saudi security forces foiled an attack on Abqaiq, the massive complex that processes 6 million-7 million barrels per day of Saudi Arabia's oil output, but it may have been a much closer shave than initial reports suggested (EC Mar.3,p8). Moreover, such is the determination of a small group of Islamic extremists to create havoc in the world's largest oil exporter and strike at the heart of the Saudi ruling family that the audacious suicide mission may well be repeated. "We expected something like this to happen," a Western executive in Riyadh said, "and we expect something similar to happen again."

For terrorists, Abqaiq is the same kind of "iconic" target as New York's Twin Towers or the Pentagon in Washington, and a successful attack would have inflicted maximum actual and psychological damage on the Saudi leadership, as well as the US. It is one of the world's most important oil installations, processing around two-thirds of the oil output of the world's biggest exporter. According to initial reports, the attack failed because alert security guards prevented the perpetrators getting beyond the first of two gates leading to the crude and gas processing plant, firing on the cars, which then exploded. Observers hailed it as proof the kingdom's oil installations were well protected: The US ambassador to Riyadh, James Oberwetter, said, "when they were needed, the systems worked, and the facility at Abqaiq was fully protected."

People familiar with the events of Feb. 24 tell a slightly different story. They say the two attackers, each driving vehicles packed with 1,000 kilos of explosives and with fake Saudi Aramco markings, managed to get through the outer gate of the complex, which is monitored by the Saudi National Guard. Luckily, security services had changed routes around the outer perimeter to make it harder to navigate. Armed with old maps of the complex, the terrorists are said to have become disoriented, panicked and detonated their devices prematurely, averting substantial damage to pipelines and other facilities.

While the attackers would have been unable to get to the heart of the complex because it was more heavily guarded by Aramco private security, damage to outlying facilities would have been enough to send prices stratospheric: As it was, they shot up $2 per barrel, reflecting the impact of the terrorist threat on the world's largest oil exporter. One of the most worrying aspects, sources say, was the apparent lack of communication between the National Guard, which protects the outer perimeter, and Saudi Aramco security, which is in charge of guarding the inner sanctum. The sources say the National Guard failed to alert their Aramco counterparts after the terrorists crashed through the first gate, which allowed them to drive round the outer perimeter without Aramco guards' knowledge. If the account is true, it undermines the widely held view that Abqaiq is one of the world's best-guarded facilities, and will do little to reassure markets nervous about security of supply.

The assailants came in disguise -- similar to the tactics adopted in a series of terrorist attacks carried out in Riyadh, the oil town of Al-Khobar and Yanbu over the past couple of years. They were dressed in Aramco overalls, which Saudi sources say can be obtained relatively easily. The same method has been used to even more brutal effect in Iraq, where insurgents often dress in military uniforms to get close to their targets. This week in Baghdad, for example, gunmen wearing Iraqi police commando uniforms kidnapped around 50 employees from the offices of a local security company.

Aramco, which has a security force of more than 30,000 people, aerial surveillance and other forms of protection, is taking no chances. Saudi Oil Minister Ali Naimi said this week that security has since been tightened at all Aramco facilities. "Naturally, after something like that security goes up. We have been taking additional measures," he said. Naimi added that the Saudi oil giant has the capability to use surface-to-air missiles to thwart any airborne attack and that the government plans to make more powerful weapons available to security forces. Industry sources in Riyadh say Aramco recently issued a tender to recruit 300 Western specialists to help tighten security at oil installations and train the Aramco security team. While that will make major facilities like Abqaiq more impregnable, pipelines remain an easier terrorist target. The strategy has worked effectively in Iraq, where attacks on the northern pipeline running from Kirkuk to Turkey have effectively rendered it inoperable.

Such measures by Aramco are unlikely to deter extremists, who have vowed to continue attacking oil installations in Saudi Arabia and Iraq. Saudi security forces have been battling supporters of Saudi-born Osama bin Laden for nearly three years and while they can claim some successes, a group calling itself "Al-Qaeda in Saudi Arabia" said it would continue the struggle against the infidels. "We renew our vow to crush the forces of the crusaders and the tyrants and to stop the theft of the wealth of the Muslims," it said.

The Abqaiq attack also sends an ominous message to smaller Gulf producers that, like Saudi Arabia, have close relations with the US and could become targets themselves. "There have been a lot of statements recently by Al-Qaeda members threatening to bomb, sabotage and destroy vital economic installations," Kuwaiti Oil Minister Sheikh Ahmad al-Sabah said days after the Saudi attack, adding he was in "no doubt" that security would be heightened around all oil installations.

By Paul Sampson, London

http://www.energyintel.com/DocumentDetail.asp?document_id=170607

Coproduction imbalances are normally taken care of through trade, but if everyone moves in the same direction to displace transport fuels (without considering the non-transport coproducts), then the imbalances could be too large to absorb.

Similarly, if everyone ramps back refining throughput based on declining crude availability, then the output of all other products will decline as well. So though peak oil to most Americans is a transport fuel issue, and nearly all public policy here is geared towards transport fuel substitution, the absence of such policies for the other cuts from the stream will leave us just as vulnerable in those areas of use.

How hard would it be to reconfigure a conventionally-gasoline-powered car (my trusty Mazda, for example) to run on the stuff? How hard would it be for automobile manufacturers and transport fuel suppliers, respectively, to reconfigure their factories and supply infrastructures so as to come up with a naptha-powered fleet?

I was surprised when I saw the large naphtha 'cut' in the distillation but have never heard it mentioned. It would be interesting for the experts here to expand on this some more.

The closest thing to naptha right off the column is white gas, which is already used in small engines.

Naphtha is a major raw material for ethylene crackers in some countries (if natural gas isn't available or cheap), so it is the precursor of all the very PE, PP, PVC, etc plastics we use.