Speaking of bumpy plateaus

Posted by Stuart Staniford on February 15, 2006 - 9:30pm

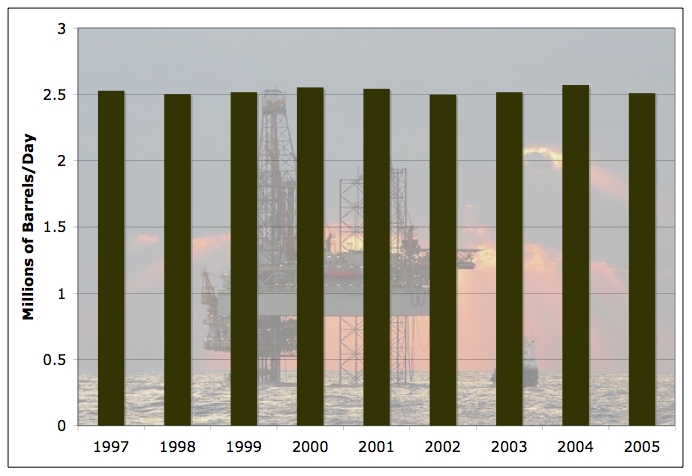

Anyone care to estimate the price elasticity of oil supply from this time series? Let's see, if you double or triple the price, and supply doesn't change at all, 0/N = 0. At least as perceived by Exxon, oil supply appears to be completely inelastic - no response to price whatsoever.

Doesn't matter any more, there's not much more oil to find and Lee Raymond knows that. They've got their current projects and there are few more to put onstream.

This is why I believe Lee only reads the financial reports but is unconcerned with the actual production data.

Why would he care--given his mission to increase company and stockholders profits? So the bottom line is that consumption is inelastic given flat production and the profits go up and up and up and up and up.....

Win-Win for Ray. Lose-Lose for us.

The year 2005 (not shown) saw revenue of $340,000,000,000, a significant jump over 2005.

Exxon doesn't need to increase production to grow it's revenues. I would think the company is simply managing it's reserves, much like an insurance company, in order to smooth the growth path.

"The year 2005 (not shown) saw revenue of $340,000,000,000, a significant jump over 2004".

One other thing you don't capture is Exxon's status as a "baseline producer." It is the marginal producers that increase production in response to pricing changes, and based on the ramp up of the Canadian oil sands (a whole colony of marginal producers) and the money spent on production enhancement technologies (fracing and pumping), pricing does have some impact on supply.

Oil is relatively inelastic, I'd imagine (especially at high prices where all marginal fields are profitable), but it isn't as cut and dry as you portray with your simplistic charts.

The EIA appears to believe that US oil production would have at least some elasticity (they show substantially different production profiles based on price). Of course Exxon is only one data point, but as either the largest or second largest of the oil majors, and a highly diversified one, they are exposed to a significant cross-section of the industry, so that the fact that they cannot (or won't) increase production is significant. Most of the other majors are actually in decline:

The main exception, BP, has primarily been benefiting from significant exposure to a Russian subsidiary.

Here's their exploration spending from the 2004 annual report. Doesn't look like we should expect a fundamental change in the next few years.

Furthermore, "ExxonMobil's reserves life at current production rates is 14.5 years." Since they replaced 112% of production, roughly the same as they do each year, the business can go on this way forever.

I also take comfort in the fact that "The portion of proved reserves already developed increased to 64 percent." It's good to know there aren't many more places they need to drill ...

This years reserve release:

____

IRVING, Texas--(BUSINESS WIRE)--Feb. 15, 2006--Exxon Mobil Corporation (NYSE:XOM) announced today that additions to its worldwide proved oil and gas reserves totaled 1.7 billion oil-equivalent barrels in 2005, excluding the effects of using single-day, year-end pricing. Production totaled 1.5 billion oil-equivalent barrels in 2005, with 917 million barrels of liquids and 3.7 trillion cubic feet of gas produced. The corporation replaced 112 percent of production including property sales, and 129 percent excluding property sales.

Consistent with our significant investment and growing participation with Qatar Petroleum in the development of liquefied natural gas and pipeline gas sales from Qatar's North Field, proved reserves additions in Qatar totaled 1.6 billion oil-equivalent barrels.

_____

Compare this with last year's release:

_

____IRVING, Texas--(BUSINESS WIRE)--Feb. 18, 2005--Exxon Mobil Corporation (NYSE:XOM) announced today that additions to its worldwide proved oil and gas reserves totaled 1.8 billion oil-equivalent barrels in 2004, excluding the effects of using single-day, year-end pricing. The Corporation replaced 112 percent of production including property sales, and 125 percent excluding property sales.

Consistent with our significant commitment and growing participation with Qatar Petroleum in the development of liquefied natural gas from Qatar's North Field, proved reserve additions in Qatar totaled 1.7 billion oil-equivalent barrels.

_____

What Exxon has done is found a way to add reserves in Qatar essentially without exploration in a convenient manner, evidently massaged to give 112% reserve replacement. They are VERY quiet about their liquid base, hiding it in the depths of their annual report. Liquids production was 935,000 bbl/d in 2004, and 917,000 bbl/d in 2005, for reference.

Note too that the only scenario where it makes sense for them to be trying their best to increase production, but failing due to supply constraints, is where they think prices will fall soon. That doesn't really work, because if it really were so impossible for them to increase production despite their best efforts, that would be a strong sign of an impending peak, meaning future shortages and increased prices. And as noted above in that case they should be holding back production in order to maximize profits.

It's pretty hard to square their behavior with a Peak Oil Now scenario and have it make business sense.

Obviously Chevron has a different view...

You and the other bright lights on this topic have been building a thorough and convincing case that peak oil will happen fairly soon. If the executives at Exxon honestly don't agree, that would be really interesting. Everyone can't be right about how soon oil is peaking, can they? While you've done some really excellent analysis, I can't imagine that the execs at Exxon don't know the truth. So either your analyses are right, and the Exxon execs know it but aren't willing to say it, which seems perfectly plausible, or your analyses are wrong and they know there is nothing to worry about.

I'm laying most of my money on you being right and the Exxon braintrust knowing it but not letting on. If you really think they understand otherwise, I might have to rethink things.

I suppose we don't have enough evidence to say really. Are they more like, say, Bernie Ebbers who clearly believed his own hype as his company crashed to the ground and took him with it, or more like the Exxon execs who were cynically selling stock hand over fist while boosting the stock price to analysts. Could be either way.

That doesn't translate to impossible. I'm going to think about it and try to square it, just for the hell of it. After all, that's what we're here for, if we can't do it, nobody can.

If I were running such an organization, I would only hold back now to the extent that it wouldn't trigger investigations. It seems perfectly reasonable to hold production at the current level in that case.

When in fact they knew that these projects would only cover their declines.

That way they could claim in any investigation that they under-estimated their rates of decline in their existing FIP.

Sound plausible? Sound familiar, in fact?

First, Exxon-Mobil it too huge to start hoarding oil without the risk of investigation.

On the other hand it is too small for even a moderately-sized cut (say 200 kbd, which is 10%) to influence prices in a world-scale market. They will lose market share and their shareholders will ask them where are our profits?

Actually most likely both the government and shareholders will sue them. AFAIK in USA laws require that public companies to protect the interests of their shareholders by all means. In both cases willingfully cutting the production will be a very very bad idea.

It discusses the work of Harold Hotelling regarding the Extraction of Exhaustible Resources, including the idea that there is an incentive to leave the oil in the ground for later when the price will be higher. But the price has to be expected to rise quite a bit to justify leaving the oil in the ground:

(from Dave's article, quoting Francis de Winter at hubbertpeak.com.)

Oil companies could believe near-term peak oil is likely, but still not be convinced that the increase in prices will justify pausing production now.

As for risking an investigation by congress, I really don't get that. It's a free market, and they don't have to pump at full blast if they choose not to. Is there some law against that??

Now, suppose Israel bombs Iran back to the stone age in a few weeks, and Iran stops exporting oil . . . now there is a third great premise for a thriller.

Writerman, get to work!

For those that remember the Miner's Strike in the eighties, when Maggie Thatcher defeated Arthur Scargill. Scargill decided or was forced by circumstances to go on strike as spring was starting, the power stations had massive amounts of extra coal mined by his union members during the winter period. Using coal as a weapon of choice was negated for 6 to 9 months, until demand for electricity picked up again next winter. Thus Scargill and his union members had a very long wait on no pay before anything that could bother authorities occurred. Thatcher forced Scargill to declared a war that he could not win.

If you see the similarities with US (Maggie Thatcher), Iran (Arthur Scargill) and coal (oil). The US has had a few months of record levels of imports of crude, petrol and distillates. The storage tanks can't have much more storage left to fill up. If Iran decides to play silly buggers and stop its oil exports, its 2.5 million barrels a day being taken off the market could be a useless ploy. We are coming into slack (spring) period in the oil market, OPEC may need to cut back on oil production to stop the price of crude falling too much. If Iran stops its exports, the US thumbs its nose at Iran saying we have plenty of oil stocks for 6 months - go ahead and make our day, OPEC instead of forcing its members to have production cuts now tells them to carry on producing as normal, the oil price stays within acceptable boundaries to OPEC and the US, Iran looses out on oil money and gets a black mark on its copy book.

Does this scenario make sense to people (okay to UK TODers. US TODers may not know who Scargill was)?

Exxon-Mobil has a share less than 3% of that Market, and there are 4 other companies with a market share above 2%. Thinking about a Cartel in this situation is quite impossible.

If they aren't producing more it's because they can't.

http://www.rigzone.com/news/article.asp?a_id=29432

http://www.sdenergy.org/uploads/SC_TomStarrsKeynote.pdf

Check out page 8. Exxon is "top US" company in reserves, but that puts it in perspective.

Like an airline who sees a short-term demand spike and flies at capacity but doesn't buy more planes vs. the airline who interprets the demand as a long term shift and takes a bunch of debt to buy more planes. In the short term, airline A looks like a genius. If/when the spike subsides, the latter guy is screwed. If not, of course, airline B is the only one with capacity to win the long term.

So perhaps the plateau you see is a function of that strategic plan. You can envision high-risk or $35+ site projects getting nixed at the executive level.

So here's a question for you. I'm a (gasp) XOM stockholder. Love those dividends baby! Been a fantastic investment over the last few years. And will be over the next few, I suspect.

But let's assume that their $35 projection is folly. Let's assume we're headed for $100+ sustained. That means someone else will capitalize while XOM falls behind. Who is that? (maybe that's the deepwater guys like Diamond, DO)

That is, help me pick the investments for 2008-2012 Who do we see optimizing the company around $100 oil rather than $35? (and for the sake of argument, let's exclude social consciousness from this decision. Let's simply answer who is the best positioned to grow market share and profits in the next X years, assuming $100 oil.)