Angola Joins OPEC

Posted by Dave Cohen on December 21, 2006 - 11:34am

At a gathering in Abuja on Thursday [December 14], ministers from the 11 member countries opted to cut their production by another 500,000 barrels per day from February and accepted African producer Angola as a new member from January 1.More details will follow below the fold but let us set the correct tone at the start.

"What did we do before?" he asked rhetorically,

alluding to the move to ramp up output in 2004 after the

aborted cut. "People don't know the trouble we go to, to

balance the market," Mr. [Ali al-] Naimi said. "Without us,

the oil market would be chaotic."

From OPEC's Cut Aims to Prop Up Prices.

Now that Christmas has come early, let's examine what's going on in the Organization of Petroleum Exporting Countries.

On December 14, the OPEC announced that Angola would become its newest member effective on January 1, 2007. Angola would be the second country from sub-Saharan Africa and the first new member since Nigeria joined in 1971. Ecuador and Gabon joined OPEC in 1973 and 1975, but left the organization in 1992 and 1994, respectively. The 11 current members are: Algeria; Indonesia; Iran; Iraq; Kuwait; Libya; Nigeria; Qatar; Saudi Arabia; the United Arab Emirates; and Venezuela.

Note on Angola's Oil Production

While Angola will join on January 1st, the African nation will not be part of the OPEC quota system until March. The quota will be set based on Angola's February production. According to the EIA supply data, Angola produced 1.446 mbd in September with a 9-month average of 1.412 mbd in 2006. However, Angola is one of the most prolific deepwater suppliers in the world and these numbers are expected to increase. Just this month, Dalia came on-stream.Discovered in 1997, Dalia lies in about 1,400 metres of water. It is expected to reach plateau production of 240,000 barrels of oil per day during the first half of 2007...According to the World Bank, Angolan production will peak in 2011 at 2.6 mbd. However, the EIA is somewhat more optimistic — projecting that Angola could produce 3.4 mbd in its International Energy Outlook 2006. Skrebowski lists the following projects coming on-stream. The current status is indicated in the text.The field has been developed with 37 production wells, 31 water injectors and three gas injectors tied back to a floating production, storage and offloading (FPSO) vessel.

This is similar to the solution adopted for the Girassol field, also in block 17. Both FPSOs are among the world's largest, with a storage capacity of roughly two million barrels.

Girassol came on stream in late 2001, and the Jasmim satellite was tied back to its FPSO two years later.

- Chevron is the operator of Benguela-Belize (2006) and Lobito-Tombuco (2007), phases 1 and 2 respectively of their Angolan offshore development. Each of these projects will produce 100 kbd by 2008 and they appear to be ahead of schedule. Benguela-Belize is on-stream now at 0.88 kbd and Lobito-Tombuco has produced its first oil.

-

Greater Plutonio is operated by BP and is scheduled to come on-stream in the 4th quarter of 2007. Ultimately, it is expected to produce 240 kbd. However, there are a number associated of "challenges" (see the link) in its development.

- According IHS Energy, Kizomba-C is scheduled for production in early 2008. ExxonMobil will commence drilling in the 1st quarter of 2007 and the project is expected to produce 200 kbd.

Skrebowski also lists Total's Rosa development for 2007, which will add 40 kbd as a tieback to Girrasol. Angola deepwater production has been a success story. There is little reason to believe that story won't continue. Thus, one of the non-OPEC's world's brightest stars has been moved over to the other side of the ledger.

Who Benefits from OPEC's Expansion?

Let's sum up at the beginning.

- OPEC — clearly, a beneficiary

- Angola — presumably benefits

- IOCs (ExxonMobil, et. al.) — further at risk

- United States, China — business as usual?

In this analysis from Rigzone, we find —

Although a move by Angola to join OPEC could theoretically affect the long-term profiles for the private companies, analysts said the prospects of a draconian OPEC production cut are small for the foreseeable future.Paul's right. Why would Angola put themselves in a quota system if they were expecting to cut production? It only makes sense in terms of price. From the Angola Press —"I don't know why Angola would want to join OPEC to cut production," said Paul Sankey, an equity analyst at Deutsche Bank (DB) who covers big oil companies....

"To the extent Angola will try to adhere to quotas at some point in time, it could affect things," said Lysle Brinker, an analyst at John S. Herold, who covers big oil companies. "I don't think it'll have much impact in the near term, but it could over the long term."

Speaking recently on the country`s adhesion to the oil organisation, [Angolan oil minister] Desidério Costa said this enables that Angola, as producing country, is not left isolated from the world.In this day & age, OPEC can not flood the market with conventional oil to bring prices down, despite Saudi Arabia's threat (within OPEC) to drive Iran to financial ruin as a response to the Sunni/Shia' civil war in Iraq. What OPEC can do — with limited success — is cut production to defend a floor on the oil price. It did not escape OPEC's notice that prices in the $65 to $75 range during 2005 did not affect demand much. At this time, OPEC is trying to maintain a $60/barrel price but it is easy to imagine OPEC supporting a $70/barrel price a year from now. However, they are having trouble with member compliance and the most recent announced cuts (500 kbd in February) may not go into effect at all if prices rise before then. Costa's disingenuous remark about price policies should be understood in this context. By adding Angola's leverage to OPEC's ability to slash supply, OPEC's ability to prop up prices is stronger.He also said that the price policies do not depend on the country`s being or not being part of the organization. "There is a policy established by the organization and the other countries, both affiliated and non-affiliated, [we] just have to respect it," he said.

Costa's second statement, that Angola should not be "left isolated in the world", is more interesting still. Indeed, if this analysis from the Afrol News is to be believed, Costa's statement can be read as saying that Angola does not want to become an oil colony of the United States.

Angolan politicians have played with the idea of joining OPEC for a long time, but strategic assessments had hindered an application until now. Yesterday, however, a cabinet meeting headed by President José Eduardo dos Santos took the formal decision to seek membership, according to a government press release.... Many reasons had spoken against Angola joining OPEC, in particular its very close and warm ties to Washington - contrasting its ruling MPLA party's hostile relations with the US during the civil war. Washington historically has seen OPEC as a threat to its supply of cheap energy as the cartel is able to set high world market oil prices at its pleasure. The US government therefore always has urged Angola to stay outside OPEC.The United States has had no official reaction to the Angolan news that I could find, being preoccupied by that world of hurt called Iraq. Angola has long been an observer member of OPEC, attending all OPEC meetings. Having moved past its long civil war, and with it's oil production booming, Angola appears to be seeking a secure, powerful and balanced role in the world market. About 70 to 80% of their exports are split between two countries — the U.S. and China. Last summer, China's Sinopec won a 27.5% stake in offshore block 17, a 40% stake in block 18 and a 20% stake in block 15, paying an astronomical $2.2 billion for the first two blocks alone in addition to a $240 million payment (bribe) to build schools and other social projects. See A Bidding Frenzy for Angola's Oil. A picture is worth a thousand words.Until now, Luanda has been dependent on the US to realise its current oil-based economic boom. Most companies operating in Angola are US-based and more than 40 percent of Angola's oil exports go to the US. In addition, Washington has an outspoken policy of getting less dependent on the OPEC-dominated Middle East for oil imports, focusing on Atlantic Africa. This government focus has made private investments from US oil companies in Angola easier.

By now, however, Angola is freer to follow its own interests as the national oil boom is secured for many years ahead by extensive explorations and production investments by companies from all over the world, including China. Production is also set at such a high scale that Angola can start negotiations with OPEC without fearing too much limitation on its future quotas.

Resourceful friends: Chinese Premier Wen Jiabao (left)

visits Angolan President José Eduardo dos Santos (right),

one of the resource-rich countries of Africa, on Wen's

itinerary. — from China's Portuguese Connection (Yale Global)

From the peak oil point of view, what makes this even more astonishing is that these offshore blocks that China bought stakes in are geologically well-trodden ground.

All the more remarkable, the bidding was for tracts that had already been "cherry picked" by other international oil companies. These bids were "the highest ever offered for exploration acreage anywhere in the world," says Catriona O'Rourke, an analyst at Edinburgh consultants Wood Mackenzie...So, you can bet that OPEC is as pleased as Punch to have Angola, which will be a top-10 world exporter soon enough, in the fold.Oil companies won exploration rights for these three blocks in the early 1990s for bonuses in the range of $6 million to $35 million.

Some excellent discoveries were made there. They include Total's (TOT) Girrassol project in Block 17, which produces 240,000 barrels per day. Because of this stellar track record, later Angolan acreage next to these blocks went for as high as $350 million. Now, Angola, which has a relatively generous though toughening tax regime for oil production, is taking advantage of high prices and the scarcity of good opportunities to maximize its short-term revenue....

While not impossible, what works against the likelihood of massive finds is that companies including ExxonMobil and BP have already worked over each of the blocks, presumably drilling what they thought were the best prospects. ExxonMobil, for instance, has already found 3.3 billion barrels of reserves in Block 15, making 17 discoveries with 19 wells.

Angola is a very poor country — hence, a large net exporter

Angola is a very poor country — hence, a large net exporter

The Prospects for OPEC

Two factors are eroding OPEC nations' revenues: 1) the continued weakening value of the dollar and 2) exponentially increasing domestic consumption, especially in Saudi Arabia, Indonesia (net importer), Iran, Kuwait and the United Arab Emirates. Again, from OPEC's perspective, having Angola on-board helps them enforce oil price floors. With burgeoning demand, which shows little sign of letting up yet, OPEC cuts can be viewed as an effort to manage OECD inventories, which have short-term effects on price. From Bloomberg —Saudi Arabia's [esteemed & beloved] Oil Minister Ali al-Naimi said OPEC members are about "80 percent" compliant with the 1.2 million barrels a day cut agreed upon in Doha. "Compliance is quite good, otherwise why would inventories come down," said Naimi, talking to reporters in Abuja.From a longer term perspective, two recent OPEC documents are of interest to us at The Oil Drum.

- Monthly Oil Market Report (December 2006, big pdf)

- OPEC Bulletin (Nov/Dec 2006, big pdf). The interesting part is available here (small pdf).

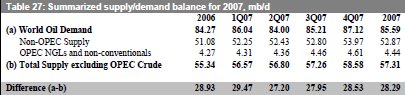

The market report makes the usual kind of fairly bullish supply/demand projections, as we can see in the figure below.

Non-OPEC supply will be up 1.79 mbd, OPEC production

actually be down 0.64 mbd on average in 2007

There are a grand total of 7 references to Angola in the 55 page document, the most relevant of which appear to count their production as part of the non-OPEC tally. So, one must take the increased Angolan production away from the non-OPEC number and add it to the OPEC number in 2007. Either way, the net gain is 1.32 mbd, including OPEC NGLs and non-conventionals using the OPEC accounting practices — in which non-OPEC NGLs are bundled together with crude + condensates. In any case, whether this these projections are accurate or not remains to be seen.

Of more interest are the remarks of Shokri Ghanem, Chairman of the People's Committee, the National Oil Company (NOC) of Libya, who gave a "thought-provoking address on the 'peak oil' theory and the possible end of cheap oil", reprinted in the OPEC Bulletin.

Shokri Ghanem

[editor's note, by Dave Cohen] I will quote Ghanem at some length for the purposes of keeping an historical record at The Oil Drum — DC

Ghanem points out that oil prices at $50/barrel did nothing to stem demand. Neither did $70/barrel. He goes on to say —

Having said that, I would like to turn now to the fundamental question: what is keeping the oil price high? The simple answer to this question should be first and foremost strong world oil demand. We can see this growing demand evident in China, India, and the United States, coupled with dwindling spare production and less economically viable recoverable reservoir capacities. Other factors, such as a lack of refining capacity, geopolitical uncertainties, market speculation, and natural disasters are also important....And, Ghanem on future oil prices —Furthermore, serious concerns exist about future supply-demand imbalances. Some analysts are raising doubts about the collective abilities of the oil-exporting countries in general, and the OPEC Countries in particular, to deliver the increasing volumes of oil needed in the future to the world's biggest and fastest-growing economies, namely the US and the OECD, China, and India.

... The question of peak oil output, which once was the concern of few individuals, has become a concern of some countries, as well as several organizations. Despite the fact that many are unhappy with Hubbert's peak oil predictions, his 1970 peak oil theory for the US turned out to be quite accurate, and for many, particularly the pessimists, his end-of-the-century peak oil predictions for the world also proved to be correct.

However, while some of the more pessimistic oil specialists are declaring that peak oil has already been passed, or at best is here now, others believe it is not going to arrive before 2010. Some optimists give the world a little more breathing space -- that is to say up to 2020, and perhaps even up to 2030. However, all in all, most would appear to agree that peak oil output is not very far away for all of us. It could take place sometime within the next decade or so, which in fact means that there is not much time left for a world economy to be driven largely by oil.

Furthermore, under any of these scenarios, and since peak oil output is not about the time at which oil will run out, but the time at which production can no longer be increased to cope with increased demand, it seems the only way the oil price can go is up.

This conclusion seems to be in line with the view held by the peak oil output advocates who argue that the ongoing oil price rises are mainly due to supply-demand imbalances. This is because we are at, or near, the production peak of world oil, if not on the downward slope of Hubbert's peak curve. This is not to deny the role of other factors (such as geopolitical), but only to stress the importance of supply and demand for crude oil as the prime factor in determining the price of the commodity.

Some analysts now say that nothing short of a major worldwide economic recession in the major consuming markets can turn down the price of oil. So, what can we conclude from this? First, it is highly likely that $20/b or even $30/b oil is a thing of the past.Thus, we have an open admission by a high ranking official of an important OPEC nation that peak oil factors are likely determining the world's supply/demand balance for conventional oil. It is an historical moment, completely at odds with the intended implications of recent statements by Abdallah S. Jum'ah, president and CEO of the state-owned Saudi Arabian Oil Company, better known as Aramco, who said in Vienna, on October 3rd —Second, if current supply-demand imbalances, both for crude oil and refined petroleum products, persist -- and there is no reason for this situation not to persist -- then one can only conclude that a return to $40-50/b seems quite unlikely. Even though there are some who would still disagree and would hope to see the price of oil falling -- even below $40/b -- they also say that the history of the oil industry is characterized by volatile changes in price.

Third, $70/b plus oil may be quite likely if the world economy continues to grow at the rates experienced in 2004 and 2005. These rates may cause demand for oil to increase proportionally and it may even start to exceed available supply.

"The world has only consumed about 18% percent of its conventional potential."While some believe that less than 3 trillion barrels of recoverable oil remain in the earth, Jumah said there is a "potential of 4.5 trillion barrels in reserves -- enough to power the globe at current levels of consumption for another 140 years."

Abdallah Jum'ah

It is worth noting that Jum'ah is a bit sketchy about the conversion rate of these vast amounts of hydrocarbons into incremental production flows that would stave off the peak, both in Vienna and in The E&P Challenge: Achieving the Four Trillion Barrel Vision at the Saudi Aramco website.

Let us now to turn to the future prospects for OPEC in this context. Does the OPEC leadership believe the peak of oil production is upon us or near? Most likely not; the view here is that Ghanem's opinions are his own and do not reflect some clandestine view inside OPEC. However, it stands to reason that OPEC will control a greater and greater market share of the world's conventional oil production as time goes on. Moreover, both Sudan and Ecuador have expressed interest in joining OPEC this year. Unless the cartel's hegemony over the available oil is trumped by geopolitical events, they will become more and more powerful as a result, with the caveat that they will have to enforce greater discipline within the organization. OPEC will continue to influence the floor price for conventional oil. However, in the case of much higher prices — $80/barrel or more — OPEC will not have much ability to lower prices by means of large supply additions — only significantly lower global oil demand could do that. Historically, OPEC has wanted to hit the sweet spot where the oil price is perfectly in balance — the highest price possible that does not lower demand growth or, even worse, decrease actual consumption over time. Eventually, these policies will become moot, with OPEC benefiting from very high prices.

Iraq has been a disaster for OPEC, not just since the invasion by the United States in March, 2003, but for many years prior to the current war. Iraq has not participated in OPEC's quota system since 1998. Hence, the phrase "the OPEC-10 & Iraq". With the addition of Angola as their 12th (11th) member, OPEC is attempting to re-establish their up-stream market share and geopolitical position.

Dave Cohen

Senior Contributor

The Oil Drum

dave @ linkvoyager.com

Cheers and Happy Holidays from The Oil Drum!

The only thing I would add is that exports are dropping much faster than overall production is dropping.

Total non-OECD demand is not dropping, either, even though specific states do have decrease demand.

What is going on?

I think the weakest link in the oil economy is shortages. They can cause massive disruption and social problems. Thus the situation of OPEC trying to control price via cuts could very well backfire big time if it leads to shortages even if they are temporary. Erratic supply could easily and quickly become a factor even if overall supply is still okay.

The current mucking with supply by OPEC can easily end in unintended shortages instead of slow rises in price.

Regardless of the cause the biggest problem we will face with tight of expensive oil is supply disruption. Its the achilles heel of the oil industry.

Note that even situations such as Mexico production dropping can cause a lot of problems is refineries are optimized for oil of a certain quality thus its not trivial to change sources. Maybe Robert could comment on issues caused by changes in the oil quality type at refineries.

I've got to go now. I'm doing my Christmas shopping in my car powered by an perpetual motion device, using my magic debit card that never falls below $1,000, no matter how much I spend.

Exporters are likely to reduce exports over time because of internal demand, geological factors, and a shortage of rigs. The us is already reducing consumption, evidenced that for years the us wanted 2% more/year (400kb/d) every year, and now is somehow making do with <1%. No doubt everybody save europe, where prices have been steadier, are making do with less than they would have if prices were still around 25/b.

China wastes an enormous amount of energy, teh US somewhat less/unit gop. We will see prices move everybody towards greater efficiency, just as happened in the seventies.

So how long can this (taking oil from the inventory instead of importing it) go on? At this rate how long will the inventory last?

Suyoghttp://www.eia.doe.gov/pub/oil_gas/petroleum/data_publications/weekly_petroleum_status_report/curren t/txt/wpsr.txt

But, I did notice this endnote and never realized what it could mean:

This could literally mean we have tanks or fields reserved just for the US all around the world?

There is the possibility that some of this is Iraqi oil, being held as collateral for all of the uranium the US is shipping over there, just in case they decide not to pay their bill.

Anyway, given those rough numbers, the current gap can be covered for a long while (a few years) unless the gap grows larger. This is the question that WT has raised - can we continue to expect growing imports at a time when the exporting nations are cutting back production and seeing internal consumption growth of their own? A key consideration is whether this is peak or not. If not, then theoretically and at least for a few more years, production could increase although demand could still outstrip production pushing prices higher even as production rises. But if this is peak and production cannot rise while demand continues trying to rise, then the market mechanism will balance the distribution of oil production to consumption - via price. However, even if this is not the exact peak, we can still get what I believe Robert calls "peak lite" effects of production failing to keep pace with demand.

My own view is that I agree with Stuart's previous assessment that peak is about now. However, even if not, and if peak is 2010 or 2011, it doesn't matter much because we're likely to get Robert's "peak lite" anyway. We're too close to the peak to alter the impact appreciably at this time and so we get to ride whatever wave emanates outward from this, positive or negative. We gave up our chance to control that wave years ago.

- Inventories were drawn down only recently after the summer driving season and refineries going into maintenance. US refineries saw a huge drop in prices for Canadian oil and little storage space to buy more oil to store away. This led to dramatic declines in NYMEX WTI crude oil. After this event, we saw a draw down. I thought you were showing export numbers going down before the drawl down?

- Over demand is not down. The WSJ reports only small users cutting back. There are actually bigger users cutting back like Japan, Germany, etc.... These are the ones who will show up in the data. Even after accounting for these, we are still seeing increased OECD demand.

When I asked this same question else where, they said it might be a delay between oil production numbers stated by producers versus oil supplies in transit through pipelines or ships, but I have not heard anyone here mention this.Its a shame that common sense seems to have escaped the majority of posters here. If there is no place to store the oil, imports have no choice but to decline, and we have no choice but to use the oil we have in inventory.

WT is the minority even amongst peak oil 'prophets' in believing that the peak has passed.

Explain why the inventory or the richest largest oil consumer on the planet will be the first effected by peak oil. Looking at US inventory as some sort of indicator of peak oil is navel gazing at its finest.

When US inventory becomes a problem and it will one day we are well past peak oil.

US inventory and peak oil have nothing to do with each for some reason people like to use US inventory to somehow indicate we are not at peak. This is a increadibly flawed logic. I see a lot of people following peak oil making this assumption.

Now with all that said the current economic/political intrigue going on in the face of tight and declining oil supplies may cause a engineered or shortage but its root cause would be political not economic. Peak Oils role is simple the shortness of supplies allows political moves that cannot be circumvented by using alternative suppliers.

Finally depending on the depletion rate post peak vs demand the time period between peak and when the US becomes effected is not long but its certainly post peak. My guess is if we peaked in 2005-2006 then the US will start experiencing strong effects of peak oil in 2008-2009.

In any case by the time the US experience real supply problems we will be obviously past peak.

When this occurs, your imports must decline. If anything, this could be a indication that a good portion of our petrol demand is now being offset by various biofuels, or that some industries and consumers are cutting back on their consumption. Or any number of other reasons.

Why is it that it has to be because exports are falling, and that we must have reached peak oil in 2005?

Agian who cares about the US right now ? Show me it matters.

All US demand does is set the base price for oil. We have plenty of oil at 60 a barrel with a economy in recession.

And we will have plenty at 100 and 200 dollars a barrel.

If price is going up on a commodity you try and stock up on the goods. So I expect the US will have high inventory right to the point that depletion is high enough to cause real shortages.

Again.

1.) The wealthiest consumer will be the last to face shortages.

2.) If price is rising you keep maintain high reserves.

Note its more complex than this but this is a basic factor.

Peak or no peak tying US supplies to peak oil makes absolutely no sense. A lot of people make this mistake your not the only one.

Next US reserves are not large anyway outside the SPR less than 30 days supply so we don't keep huge quantities of oil on hand the storage here is strictly to ensure we have enough to cover most reasonable supply disruptions. The SPR covers extraordinary disruptions. Thus the ability of the US to use their reserves to manipulate price is very limited.

What's really going now if you paid attention is OPEC is pissed the US is willing to allow the dollar to slide its a money game and has nothing to do with oil.

East Coast PADD 1 stocks peaked in November 1981 at 276,956,000 barrels http://tonto.eia.doe.gov/dnav/pet/hist/mttstp11m.htm

Midwest PADD 2 stocks peaked in January 1981 at 339,795,000 barrels http://tonto.eia.doe.gov/dnav/pet/hist/mttstp21m.htm

Gulf Coast PADD 3 stocks peaked in July 2005 at 1,166,519,000 barrels http://tonto.eia.doe.gov/dnav/pet/hist/mttstp31m.htm

Rocky Mountain PADD 4 stocks peaked in March 1981 at 41,262,000 barrels http://tonto.eia.doe.gov/dnav/pet/hist/mttstp41m.htm

West Coast PADD 5 stocks peaked in January 1982 at 186,768,000 barrels http://tonto.eia.doe.gov/dnav/pet/hist/mttstp51m.htm

Assuming that all peak storage levels were "full tanks", implied total availability of storage in the USA is 2.011 billion barrels, almost 300 million barrels more than current stock levels.

I assume that some of the regional storage (PADDs 1 and 2) have been mothballed or decommissioned due to locational redundancy, more recent peaks in 1998 (November and August respectively) were 216.5 million and 258.8 million barrels respectively.

PADD 5 stocks were as high as 185.5 million barrels in 1995, so I would guess that storage levels remain the same as they were in the early 1980's - logically this makes sense as PADD 5 grows increasingly reliant on imports.

Using the more recent PADD 1 and 2 data, we can still extrapolate upper capacity limits in the region of 1.870 billion barrels, which is almost 160 million barrels above present levels.

"SANTA MONICA, Calif., April 6 /U.S. Newswire -- The Foundation for Taxpayer and Consumer Rights today released internal Shell documents showing the oil refiner is set to close and demolish its Bakersfield refinery despite the fact the site had the biggest refinery margins, or profits per gallon, of any Shell refinery in the nation as of yesterday."/

I have posted facts and links - you have posted unsubtantiated theories and opinions.

You do yourself no favours on this site with cantankerous rebuttals and a demonstrable inability to structure a carefully considered argument. You might consider once in a while doing some research before stating an opinion. You might consider once in a while conceding that you are wrong when so proven. You might consider the virtues of grace and humility.

You might, but you won't.

And I am the one that can not structure a carefully considered argument?

You already acknowledged that storage capacity was reduced by a significant value from the 80s until 1995, yet when I ask why you believe nothing has happened since 1995, I'm some crank? The irony is not lost :P

The tanks were very nearly full. This was the primary reason that prices dropped so quickly in the late summer and early fall. When things are near the top, they generally have no other choice but to fall. Is that in dispute?

I did NOT acknowledge that storage capacity "was reduced by a significant value from the 80s until 1995" - I speculated that this might be the case, though I do not know this as a fact. The intention was to demonstrate that even if there have been substantial reductions in capacity, that we are still some way from "virtually full". Specifically 8.5% away from that level, or 7% if I accept your unsubstantiated postulation that PADD 5 capacity is 30 million barrels lower than my number...

My view on unchanged capacity since 1995 in PADD5 was explained in the previous post - it would make no sense to reduce storage capacity in an area increasingly reliant on imports - did you miss that part or just choose to ignore it? I would add that reducing capacity makes even less sense from the perspective that PADD 5 has no substantial liquids pipeline links with the rest of the nation and as such is pretty much an "island".

Tanks were very full in late summer (about 90% full by end September in my opinion), both in north America and across other OECD countries. I believe the actual reason prices came off was the lack of hurricane activity. Stocks had been built in anticipation of hurricane-related supply disruptions, none occurred. In this respect, you are right that high stocks were one of the major causes of the sell-off, another (possibly more important) being the liquidation of approximately 150 million barrels worth of speculative "stocks" held in the futures markets by hedge funds et al.

I did not call you a "crank", but note that you are essentially calling me one by stating that "the irony is not lost". I would agree, however, that your behaviour is cranky.

This will be my last reply to you on this or any other thread. Your hostility and overbearing arrogance is insufferable - I have better things to do. I hope others have benefitted some from the discussion about storage levels, which was my sole original intention.

It is clear Hothgor simply misrepresents shamelessly what you are saying - I don't know if he's just being deliberately provocative, irritating or what - but it is clear there is nothing you can say that would actually engage him in a productive debate. I encourage you not to respond to him unless it is for the benefit of the rest of us, who will read what you have to say thoughtfully. I think you stuck it out far longer than most would have.

Ask Westexas that please. I too want to know why this is the case :)

First I've posted before that I can't see the US have true peak caused supply problems until well after the peak and I've mentioned that in posts following West Texas. As I said a lot of people are making this mistake I'm not sure in the hundreds of great posts that WT has made if he as made it or not. He can speak for himself.

I do however think two things will happen the price we pay will go up as significantly as we bid against other first world nations WT is 100% right on this side.

Next the vast majority of the work done on this site is on supply side not demand and certainly not speculation on the distribution of oil except with as I've noted what I feel is a incorrect assumption that US supplies and peak oil are correlated. The only correlation is the price we pay which by any standard is high.

Now with that said you can imagine that under these conditions that the chances for supply disruptions are very high and it almost certain that the first effects in the US will be temporary shortages that become more frequent and longer.

I'd love to see this site explore issues on the demand side of peak oil more. I've suggested several times that asphalt prices and real shortages here indicate are one effect of peak oil. Others exist if we collectively start looking at issues such as real demand destruction examples price/supply problems etc on the consumption side I think we can collect real and useful examples of the effects of a constrained expensive oil supply today.

It won't initially be in the US gasoline supply.

The big problem is not that some people that believe a peak is near are incorrectly following the US oil supply.

I've probably made the same mistake myself in some of my posts. Since we have the data to look at its hard to not get drawn into making false interpretations. The price we pay is important and it pays to watch our supply since disruptions that are related to peak oil will happen but I'm as guilty as anyone of reading too much into US supply numbers.

Thats what happens when a data junkies get free data :)

The problem is people disputing Peak Oil are incorrectly assuming that since the US has plenty of oil we are not at the peak. If we are going to convince people of peak oil we need to look beyond the US gasoline supply and find real examples of peak oil effects.

Agian I implore people to look...

Look at Propane supply in the third world.

Look at Asphalt.

Look at bunker fuel and fuel oil.

I have no idea what products are made from oil but I'm pretty sure that we are probably starving markets right now of other oil products in order to keep diesel and gasoline supplies up.

If we look we can find this information.

I've tried.

http://www.bunkerworld.com/

But the data is behind a pay wall maybe someone with connections can get them to release historical data for free.

Asphalt seems to be a local product from what I can tell I've found no compilation of data for it.

Next of course the places we are most interested in are in the third world and I've no clue on how you would find stats on for example asphalt usage in Africa.

But this is what we may need to look at and even more important we need to discuss what oil products might be the canary in the coal mine for peak oil.

Asphalt also exists in huge quantities close to or at the surface. The ancient Summerians of Iraq used it as mortar in their cities and to waterproof adobe brick. The egyptians used it as boat caulking, and it could theroreticially be mined and used that way today. In Texas we have extensive deposits in Uvalde and Real Counties, the La Brea Tar pits in Los Angeles are asphalt, the Orinoco tar sands and the Alberta Tar sands are all asphalt mines.

What I'm saying is I don't think asphalt is a good indicator of the peak. Your bunker fuel idea though has a lot of merit, and probably watching the total import figures of countries without much foreign exchange, like Haiti, Guatemala , Mali or Chad. Since kerosine is a big import for poor people's cooking fuel, perhaps we should try to find those figures? Kerosine is virtually the same thing as jet fuel, so the kerosine markets will suffer before airlines and national govt. airforces give theirs up.

As I have repeatedly stated, IMO, the forced conservation has first shown up in poorer regions like Africa, where there are numerous documented examples of forced price based conservation.

I think that the US import data are sending price signals, to-wit, that if we wish to continue consuming petroleum products at our current rate, we are going to have to bid price up. Only, this time we are going to be bidding against regions like China and Europe.

Are we really the "richest largest oil consumer?"

Consider the simple fact that the majority of Americans live off the discretionary income of other Americans, or the fact that we use twice as much energy per capita as the EU. We have the illusion of a prosperous economy, where vast amounts of energy are in effect wasted on businesses that amount to little more than transfer payments. For example., instead of going to Las Vegas, you could just mail the various companies checks and it would have the same economic impact.

As I outlined up the thread, if you think that we can continue to increase our total petroleum imports by close to 5% per year, while world export capacity--as I predicted--is falling, I have a perpetual motion car to sell you.

The depth of denial--on a Peak Oil website of all places--is simply amazing to me. What part of the impossibility of an exponential growth rate in a finite world do you people not understand? The problem is not in 2010, 2015 or some other multiple of five. The US is expecting a perpetual increase in petroleum imports, while world exports are declining.

And the fact that a majority of Americans have a lot of discretionary income is precisely what makes us a prosperous economy, isn't it? If you can afford it there is nothing wrong with going to Las Vegas and enjoying yourself. And the fact that we use twice as much energy per capita as EU is what gives us room to conserve without jeopardizing our survival. In N. America, peak oil will be an economic event; in many other parts of the world physical survival will be at risk.

Of course, the fact that we have had a net negative national savings rate for over a year, combined with the highest debt to GDP ratio in US history, doesn't exactly put us in good shape to bid against Europe and China, does it?

Also consider the nature of the "GDP," when the majority of Americans live off the discretionary income of other Americans. As Americans have to spend more money on energy and food (and other items), what is left of their "discretionary" income is going to shrink rapidly.

WestText I agree with you 100%.

As far as being the richest as long as the petrodollar reigns supreme we are. The could end at any moment. It should have ended years ago if Japan had clean up their act and with the new Euro. America has taken advantage of the fact the world did not move to a basket currency for world trade.

I think we are the richest country in the world right now but a lot of this wealth is from selling debts we will never repay to suckers around the world.

I also have serious doubts on how long we can maintain this financial scheme. As I learn more about how wealthy America has in many ways leveraged its middle class to allow it to control the majority of the worlds international corporations I've become convinced that chances for a real response to peak oil from the US is basically zero.

Once you realize that many American companies make more money outside the US than inside you realize the full extent of the problems we face.

Basically they no longer care about the American consumer and are happy to pump them for their last dime. And of course the American consumer is quite happy to be pumped.

This situation is quite relevant to peak oil since we are suggesting a major investment on the part of the American government which would of course mean additional taxes and investment on the part our our corporations. They have no interest in the long term survival of the American consumer.

No grand conspiracy is needed for this to happen its a side effect of globalization. In a global economy worker pay is driven down too the global mean.

This added with WT export land model implies that at some point the US will become a second world nation

with demographics similar to Brazil.

We probably will see our oil consumption drop at that point but its not a pleasant way to achieve the goal. Any chance of a rational response to peak oil from the American goverment assumes that they care I see no indication that this is the case.

There are several ways to look at this.

One way is to look at it from currency point of view:

Prior to 2006, the situation was a lot different than post 2006, so let's go back to 2005. If the world's economy is frozen and all assets are liquidated to payoff all debts, US will have a positive cash balance. Post 2006, US foreign earnings will no longer compensate our account deficit. So from a currency point of view, we are living on past capital accumulations/savings starting from 2006.

A second way to look at it is ability of US citizens to payoff debt, US citizens own more assets than all US debt combined. US income is also quite high, so no danger of defaulting. This is only a valid way to look at it due to US debt is denominated in USD, so currency depreciations do not alter US ability to repay debt. Other states do not have this luxury. As the more money they paydown US denominated debt, the less their own currency are worth and the more money they need. Of course, they get around this by dealing with hardcurrency.

There are more ways to look at it. The point being it is not too late for US to get their act together. Not like they will, but they are not at the point of insolvency or close to it.

Where did you get $50Trillion?

I would hope with an annual $13+Trillion revenue economy that assets are at least value 4 times revenue.

I don't know what you think our assets are. I also have no idea why you think we are not bankrupt. All the methods that I mentioned points to US being in a bad position going forward.

Good review.

I will like to point out that Angola joining OPEC is about politics and not economics. British and US oil companies are putting tremendous pressure on Angolan governments to clean up their act. This pressure is created by NGOs and other human right groups.

Remember at one point Angola had to tell BP and other oil companies not to publish the amount of money they pay the Angolan government as that had add fuel to corruption charges.

Now that Angola is part of OPEC, they have more political power to ignore NGO demands and create an oligarchy state funded by oil if they are not already categorized as one.

Remember there is still a lot of discontent brewing in Angola and a future civil war cannot be dismissed.

Thus, if production and/or exports are falling as some here suspect, that is going to be masked for a while. If other nations join OPEC it will in turn serve to further mask perceptions about OPEC's production.

Getting the story out in a compelling and convincing manner will be just that much more difficult. Most people find numbers confusing enough as it is. Something to think about.

OPEC does not officially announce their official production figures. They only announce production numbers using secondary sources and not primary sources.

As Dave pointed out, Ecuador and Sudan are planning to join. This means OPEC will grow very strong politically. Who would have thought the counter balance to US hegemony is OPEC?

That is becoming a possibility.

So what will OPEC do? Threaten with another boycott and an energy crisis? Hardly. The world would react very quickly with enormous conservation efforts and OPEC would never return to the same level of income, again. You don't slaughter the cow you like to milk every morning.

Without this strength, they are afraid they get overthrown by US and Great Britain who have a history of meddling with their domestic politics.

For all the failures in Iraq, the goal of toppling dictators are fresh in their minds. Also, the constant NGO pressure is relentless. If you believe these rulers are not afraid of US, then just look at what is going on in Africa. Libya is opening up to the West and Nigeria, Angola, etc... are about to have real elections. You think these rulers want to see elections? Look at Sudan, they are forced to have foreign troops in their land, and all this talk of having UN troops deploy there.

Remember NGOs are viewed as an invisible hand of US hegemony. Just look at Russia having a hard time pushing these NGOs around and they are supposed to be the strongest and most able to stand up against US.

Once oil prices double, the US will have to spend another $300 billion on oil imports annually. Not to mention the $200 billion a year that a Saudi adventure would cost. Half a trillion dollars of additional spending next year... much of which would go to Iran... wonder if the US economy can handle that without breaking? What do you think? Not to mention the political effects of the draft.... professionals comming home in body bags is one thing... college kids comming home that way, is another. :-)

Neocon policies have failed, on all levels and for all practical purposes. The US is not a super-power any longer. It is a power which has shown its limits. And both Iran and KSA know that they are way beyond the limits of US military might.

Not sure what you call elections, but neither Libya nor the African states you are talking about will turn into real democracies anytime soon. And the KSA is also taking a VERY paced approach...

"Remember NGOs are viewed as an invisible hand of US hegemony."

I've been reading about that conspiracy crap since the 1960s... and none of it has ever been taken seriously by anyone with half a brain. One man's conspiracy theory is another man's diagnosis of mental illness.

You are looking at it from a Western perspective.

If you just stop and look at through a dictator's perspective, then you will understand the pressure. This ain't some conspiracy. It is about US and Europe forcing other states to accept their norms and values.

You think Nigeria wants to have elections?

Why are they having elections next year? Yes, b/c of US hegemony.

Highly desirable, long overdue, and a prerequisite to peace. No doubt controversial in Israel in the near term, but if and when they will eventually look back on the event and wonder at the long delay that led to substantial emmigration.

Plateaus look very good for many decades. But flow rates from newfound conventional (in politically unstable regions) and non-conv are far from obvious (to wit canada - only 4-mbd targets from the second largest global reserve).

At present trends, the upper range of Peak Rate targets in coming down about 3-mbd /yr and the lower range is rising 2-mbd/yr. This would presently indicate that our TrendLines Scenarios will converge at about a 105-mbd Peak Rate in future versions. This compares with its present AVG of 95-mbd.

Put it all together and concensus would lead to Peak of 100-mbd in 2020 with a very long decline tailing off to end of the 22nd Century.

How long do you see us being able to maintain "current levels of consumption" -- concerns about GHG emissions aside?

Explain this. I haven't seen any such suggestion on authoritative climate sites (RealClimate - the TOD of climate science).

In short, the scary 850ppm stuff was based on pie-in-the-sky junk science. See IPCC, ASPO, Laherrere, IEA, ExxonMobil or google the abstracts on the subject for more.

And clean coal? What clean coal? There isn't going to be any clean coal, except for show purposes. We live in a bottom-line economy where one of the most important factors in profitability is the ability to externalize costs - to pollute. You will see precious little 'clean coal' simply for this reason.

In any case, the consensus is that the danger level is much lower than 850ppm, so calling that the IPCC was wrong about that particular figure nearly one hundred years out should provide little comfort to anyone.

I think you're full of it on this. Let's see you duke it out with actual climatologists at RealClimate if you're serious.

Considering we don't really know the absorption capacity of the ocean and we do have evidence that its saturated in the past resulting in 1000 ppm C02 levels we can assume that somewhere between our current C02 levels and higher ones we will see a saturation even resulting in a increase in CO2 levels in the atmosphere with even today's level of emissions.

http://www.ens-newswire.com/ens/jul2004/2004-07-15-03.asp

Now since the oceans uptake of CO2 has a strong biological component from the formation of carbonate shells a negative feedback is possible between water temperature stratification salinity changes etc that can cause a widespread die out of marine life. This would lower the absorption capacity leading to more C02 greater warming etc.

Not to mention the potential releases of green house gases from the warming arctic regions.

You should read this paper before glibly assuming our grand experiment is a good idea.

http://www.pubmedcentral.nih.gov/articlerender.fcgi?artid=123621

Waste your time? You already waste it yourself by posting cr*p. You might want to watch the old Monty Python scene where it is proved that a woman who weighs the same as a duck is made of wood, and therefore a witch. It would be an improvement over your current application of logic.

:-)

does anyone know if we will continue to get accurate and separate production figures for Angola? if so then we can still follow the decline of 'old opec' oil separate from other countries.

Andrew

--

eagles may soar, but weasels don't get sucked into jet engines.

http://www.opec.org/opecna/Press%20Releases/2006/pr212006.htm

He ran for office and got a total of 19 votes, something his forecasting ability apparenly was not able to tell him. I mention this to tell you how little his opinion on anything is worth.

He often refers to himself aw 'we'. Which leads me to believe that he either suffers from schizophrenia or is referring to his dog.

Based on his used of language I'm guessing Hothgar is no more than 15 years of age. He does not understand what the scientific method is, and seems to think an argument can be resolved by appealing to character rather than fact.

they (all) seem to have in hand the karl rove playbook

and on the telescreen this morning there was a doj mouthpiece denying the ridiculous "contrary to popular reports there are not parentless children (of apprehended suspected illegals from the swift meat packing plant) wandering the streets of marshalltown" (no word on the whereabouts of these "employee-combatants)

The First World Importers and those countries that export have to totally reform their mindsets if they wish to cooperatively blunt the obvious effects of TODer WT's Export Land Model:

"

any FF exporting country that dedicates itself to Detritus Powerdown and Biosolar Powerup will enjoy long-term advantages over those that do not adopt this cultural mindset."Exporters will be glad to sell if they don't need their FFs.

http://www.theoildrum.com/comments/2006/12/19/8553/6333/268#268

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Well, things improve - it took the Nazis full 6 years to get from power grab to their first "hot" war. Probably because the weapons caches were not full enough in '33 due to armament limitations in the treaty of Versailles.

Now the Bushzis got there much quicker - and why not, if you have weapons, why not use them?

Now the thrilling question is when they will finally start to use all the claimed power (MCA, Patriot Act, commander-in-chief-ism) to install a proper dictatorship? Come on guys, do you really want to wait for the next elections so you can cancel them due to some cleverly manufactured incident?

</rant off>

TOD is such a wonderful site but their are a host of posters I wish we had an ignore button for because their virulent posts are disgusting and lower the quality of the discourse here. I don't typically agree with Hotgor or Freddy but they are entitled to thier opinion as long as they maintain a civil level of discourse and inspite of the incessant personal attacks on them they tend to maintain a higher level of discourse than many of their detractors thus appearing to hold sway over those that chose the low road.

May I consider your comment contex-free? My rant did not aim at anybody in particular (it was rather supporting the comment I was answering), just the Bush crowd in general, which I think pretty much mimics many aspects of the Nazi regime.

Or did I miss something?

Cheers,

Davidyson

If the US government won't impose a gas tax or an oil import duty to reduce consumption of gasoline and curb CO2 emissions, let OPEC do it.

Sure, it be better to have a tax so we keep the money at home - but this is better than nothing.

Furthermore, weird, pathological arguments between people that often occur on the open threads (but elsewhere as well) have been carried over to this discussion as well.

Needless to say, it is disappointing to me that members of this weblog do not "get it" with respect to the issues I brought up in my story. I am sorry that they do not understand the role of OPEC in their future and why a discussion about this subject is necessary.

Frankly, it is beyond me as to what people think is important about peak oil around here and what is not, anymore.

-- Dave

Thanks

Nonetheless, there is so much that still befuddles me about OPEC in a PO world.

Cartels are designed to create a false scarcity - ie. De Beers - inorder to set a price floor wherein all producers can share the wealth; a sort of enlightened self interest, if you will, among the players.

In a PO scenario there is an actual scarcity, so why participate in a cartel?

1. You don't get any political cover, as evidenced by Iraq.

2. You're pumping all out so the floor is buttressed by demand.

3. If you're Saudi Arabia - and truly have excess capacity of 1.5mbd-- you can exit OPEC and regulate prices on your own, as any small change in supply - in a PO world -- can move price $10/bbl.

Also, what are the liabilities in a PO world, in joining OPEC ? ; to wit, why hasn't Russia or Norway petitioned to join? What would they gain/lose?

And sadly I have to agree, this site as been degrading recently.

Excellent article Dave, keep up the great work. There are many of us lurkers in the back ground that are hearing the message here on TOD. I am sure many of us are working on our own preparations for our families and business. Thanks again.

That's about the same as this article, where Sadad al Husseini, recently retired head of exploration and production for Saudi Aramco, says peak oil will be in 2015.

And the mainstream types will just say OPEC is trying to drive up prices with this crazy peak oil talk.