How to address Contrarian Arguments - part II

Posted by Luis de Sousa on December 24, 2006 - 12:40pm in The Oil Drum: Europe

On this second installment of the Contrarian Arguments series we'll look into

the We have huge reserves rhetoric.

The first part can be found here: Part I : Fundamentals

We have huge reserves, but I have bad news for you, they've been huger:

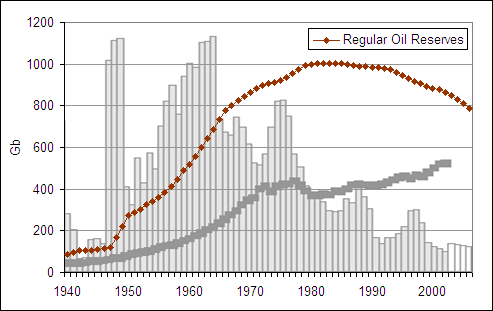

Regular Oil Reserves, as computed from Colin Campbell's "Growing Gap" graph. Data source: Exxon-Mobil backdated to year of discovery.

Warm Up

The "Huge Reserves" kind of argument is probably the most important one to address, beyond all the madness and delusional arguments like infinite oil, this one can be used be serious geologists and researchers. It is the kind of argument you can get from people that have seriously (or close to it) studied the stuff, but came up to slightly different conclusions of those got by the regular peak researcher.

At the head of the serious people taking this kind of argument is CERA, our nemesis. So we'll look closer to CERA's work and understand what differentiates our conclusions.

Before digging in to it I'd like to make one thing clear first: this argument cannot be used against the Hubbert Method, or the Hubbert way of thinking. Advocating for larger Reserves numbers will only let you put the epoch of Peak later in time, never to dismiss it. Remember the sweet chestnuts? It's like buying 150 instead of 100, the peak will come, only a bit later. Like seen below even in CERA's graph there's a peak.

A Tale of two tales

Studying Reserves is not an easy task. When doing it we are in some way looking in to the future, because they tell us in what point of depletion are we, projecting a picture of how we'll fare.

Declaring reserves is a political act, one must never forget about it, and that's why it is so hard to get a clear picture of the real situation. When declaring reserves companies have two worries:

- Avoid taxes, in the case of Private Owned Oil Companies;

- Take hold of a good share of production, in the case of OPEC's State Owned Oil Companies.

So current reported Reserves suffer from both these evils: over-reporting and under-reporting. As we'll see ahead the later was stronger in the past, whilst the former has taken over during the last two decades. This means that public declared reserves by both private owned and state owned companies have never matched to the physical reality.

In order to correctly access the amount of remaining Reseves it is imperative to compensate for both these artifacts. Chris has already linked us to a very important article on this subject by Roger Bentley, I recommend it too.

Above all Reserves are dwindling

The graph shown on epigraph was obtained by computing existing reserves on each year using the Growing Gap graph published every month on the bulletins compiled by ASPO-Ireland (Colin Campbell & Uppsala). This graph depicts discovery backdated to the original year of first successful drill, and not to the year of reporting. This technique eliminates the artifacts of under-reporting used by private owned Oil Companies in order to avoid taxing. The data reports to Regular Conventional Oil, defined as light liquid hydrocarbons found on land and on sea above 500 meters deep, using Exxon-Mobil's data. Current Reserves are estimated at 790 Gb, computing it backwards in time we get this:

Regular Oil Reserves, as computed from Colin Campbell's "Growing Gap" graph. Data source: Exxon-Mobil backdated to year of discovery.

The picture is clear; a plateau circa 1000 Gb was reached in the early 1980s followed by a decline that set in from 1984 onwards. A clear downward trend is being felt for more than 20 years, and the rate of decline is accelerating.

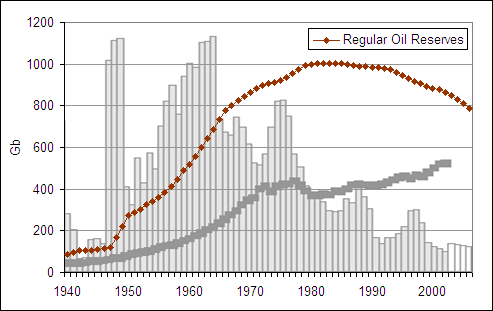

A view from another angle can be taken from Jean Laherrère's multiple works. Jean uses two databases, one from IHS Energy and another from Wood-Mackenzie, and he also compensates for the reporting artifacts, computing what he calls Technical Reserves (Proven + Probable), opposing to the Political Reserves:

Conventional Oil Reserves from Political and Technical sources. Compiled by Jean Laherrère using data bases from IHS Energy and Wood-Mackenzie.

This graph reports to Conventional Oil, defined as light liquid hydrocarbons no matter were found. A peak in 1979 circa 1100 Gb is quite clear followed by a decline up to today's 800 Gb of remaining Reserves. Again a downward trend has clearly set in, a steady decline of more than 25 years.

In Jean's graph the artifacts of under- and over-reporting are very clear. In 1950 declared Reserves were around 100 Gb, in 1960 stood around 300 Gb and in 1970 even after the Middle East discovery galore they were just above 600 Gb. This was the time of private Oil Companies. Reserves remained pretty much unchanged for over a decade (in spite of major discoveries in the 1970s) until the mid-1980s. Then an oil price collapse brought some restrains on production, triggering a fight between OPEC countries for production quotas. The National Oil Companies became the most important elements in the market. A slow end for the private owned companies unfold, with mergers covering the fact of rapidly dwindling reserves on private hands.

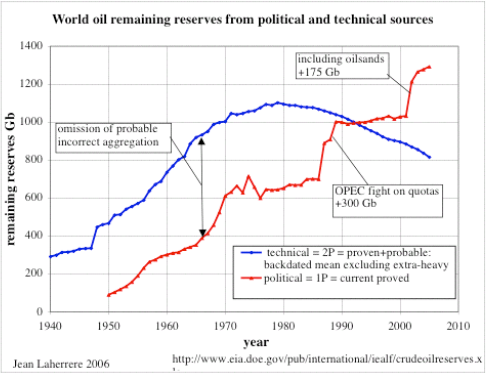

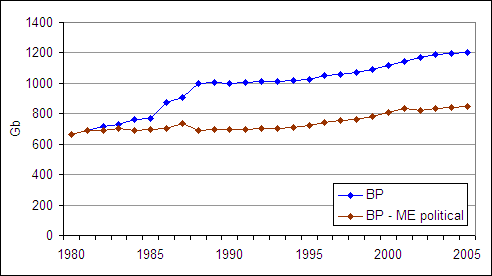

To complete this section I'll give a view from another angle still. The handy BP Statistical Review shows "proved" Reserves of 1200 Gb at the end of 2005. BP has been sane enough not to include heavy tar sands on the final accounting, meaning that by compensating solely for OPEC's political additions we can get close to physical figures. Using Middle East Reserves as assessed by Ali Samsam Bakhtiari (Peak Oil Review Vol.1 No.7) we get this:

Conventional Oil plus NGL Reserves from BP's Statistical Review. Blue - raw data. Red - corrected for over-reporting in the Middle East using Samsam Bakhtiari's estimates.

We don't get a declining curve, but computed like this the figure for 2005 is 850 Gb. This figure also contains Condensate and Natural Gas Liquids and it still includes political reserves for Venezuela. If a backdating process was used a declining curve would be a likely outcome.

Three models, four databases and the Reserves numbers dist 60 Gb between them. As for Conventional Oil the time of increasing Reserves is long past.

Using Mathematics to see the Future

Beyond these techniques of looking at reported Reserves and compensating for bad reporting habits, several mathematical tools are available for assessment of Ultimate Reserves.

Ultimate Reserves can be defined like this:

- all the oil that we've already used plus

- all the oil we know to exist plus

- all the oil that we still don't know to exist but will be sometime in the future found and used as well.

First of all: dear old Hubbert's Method. A simple technique that has a single magic step of assuming that the plot of P/Q versus Q follows a straight line (P - production at each year, Q - cumulative production at each year). See how Stuart Staniford introduced it for All Liquids to TOD here.

Using this method for Conventional Oil (the same definition used by Jean Laherrère) Kenneth Deffeyes arrived at an Ultimate Reserves number of 2000 Gb.

Kenneth Deffeyes' graph showing the mid-point of depletion crossed in late 2005. Deffeyes arrived at an Ultimate of 2000 Gb using Hubbert's Method; in 2005 Cumulative Production went over 1000 Gb.

Secondly, the Creaming Curve. This was a technique invented at Shell, and is defined by Jean Laherrère as being "the plot of cumulative mean discovery versus the cumulative number of exploratory wells". This plot follows a hyperbolic curve (or a sum off hyperbolic curves), and can be modeled that way. The magic step is this: with time discoveries go down in volume, and although you drill more the total volume of your findings is less. Experience from mature regions has been showing this assumption a correct one, the low hanging fruit goes first. Here's Jean's data for each global region:

Creaming curves for several different global oil regions. Adjusting hyperbolic curves to these data Jaean Laherrère arrived at a global Ultimate of 2000 Gb (note the geographic dispersion). Click to enlarge.

Again 2000 Gb for the Ultimate Reserves. Jean usually calls our attention to the evenly geographic distributed pattern that this graph shows. Some regions, like Europe were not privileged by Fortune in what comes to hydrocarbon endowment.

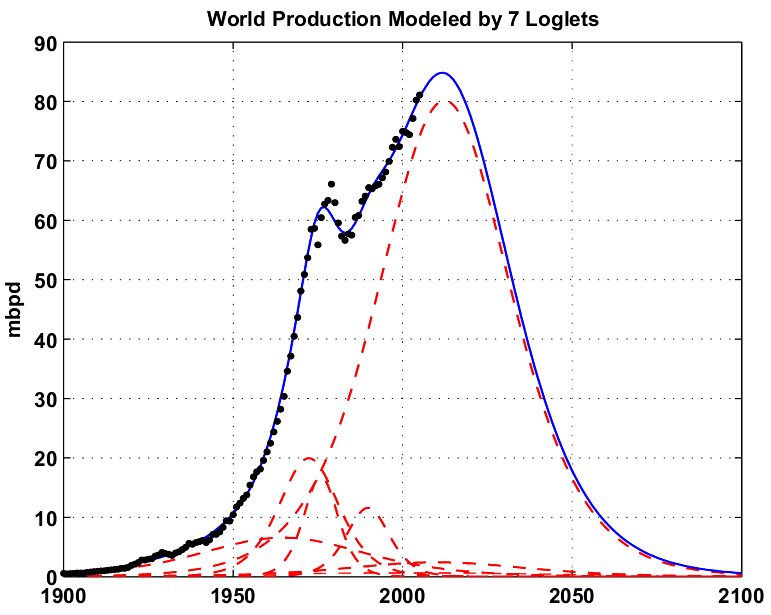

And thirdly a recent technique introduced to us by our Canadian peer Khebab, the Loglets Transform. This technique comes from the Hubbert Method family, but it looks at the data considering the hypothesis of several curves being concurrently driving events. Instead of using a single Logistic Curve we use several to see if it gets closer to the data. Here's Khebab's graph:

The seven logistic curves identified by the Loglets Transform for World Conventional Oil + NGL production. The net Ultimate is 2100 Gb. Click to enlarge.

2100 Gb, a slightly different number but this one includes NGL, which the previous models did not; taking out this extra the result is essentially the same. Using the Loglets Transform seven different curves can be identified, but we get a number for Ultimate Reserves pretty close to that got with a single curve. The Loglets Transform allows us to get a clear picture of how production evolves over time, but interestingly it confirms the result got from the Hubbert Method.

Three different mathematical techniques, one result.

From the previous section we got that current Reserves stay somewhere circa 800 Gb, the 2000 Gb figure given by the math models for the Ultimate confirms this number, with around 200 Gb yet to be found in a slow, declining, expensive, discovery process.

Kenneth Deffeyes' projection of the mid-point of depletion in 2005 was labeled as bold and pessimistic. It isn't, it is a sound result from a sound mathematical method. Passing the mid-point of depletion doesn't mean exactly that a production decline sets in immediately, it just means that the oil used up to that moment is equal to that left to use. But it means that a decline is at hand (like 2010-2012 when deep offshore production peaks).

And what about CERA's ?

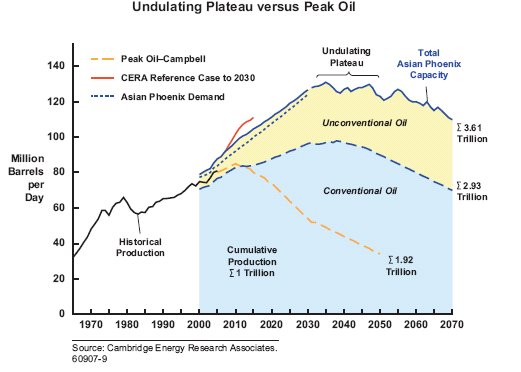

Let's have a look into the figures that support the argument that Peak Oil is still a bit further in the future. We'll use CERA's numbers, for they seem to be the best paid of this bundle, but the following words apply broadly. Here's CERA's graph:

CERA's outlook for Conventional and Non-Conventional Oil production. Up to 2070 the Ultimate for Conventional Oil is already 50% larger than that given by mathematical methods.

Peak Oil is a myth to CERA, but not for their graphs, Conventional Oil is projected as clearly peaking circa 2040; on top of that is a convenient All Liquids plateau. What really demarks the mathematical results from CERA`s is the Ultimate: for CERA cumulative production will go over 2900 Gb in 2070 implying an even greater Ultimate.

From the above it is clear that CERA isn't using a mathematical approach to Ultimate estimation. CERA uses a Bottom Up analysis to forecast future production, adding up the flows from fields currently in production to fields in development or with perspectives of development. Euan as looked closer to the way they do it in his assessment of UK production.

There's one thing that makes me wonder, how can such analysis predict a peak in 2040? Moreover, how can you forecast Ultimate Reserves with such analysis? You can't forecast Ultimate Reserves with a Bottom Up technique because you can only account for currently known fields. So how can CERA's projection be at least 50% above that given by three different mathematic techniques? Even counting with political reserves the Ultimate from BP for instance would be 2300 Gb, where will almost another 1000 Gb come from?

In the end this can amount to a "my model is better than yours" discussion. I don't' like CERA's, CERA don't like mathematics. But one thing is for sure, CERA is waiting for a new cycle of discovery that will amount to more than 1000 Gb, meaning that at least four new Saudi Arabias will be discovered in the near future. Yes near future, because with current known Reserves and depletion rates, decline will surely set in before 2015. Take for instance the Lower Tertiary in the Gulf of Mexico, it was discovered in the early 2000s, but will come on stream by 2013 (all things going right) a gap of more than 10 years. So CERA's implicit new discovery cycle will have to come really fast and against all current trends.

Non-Conventional Reserves

Non-Conventional Oil Reserves have to be considered separately for a simple reason, the EROEI of these energy sources is lower than that of Conventional Oil. Resource numbers can be huge but Reserves are considerably lower, production rates will never get close to those we get for Conventional sources today.

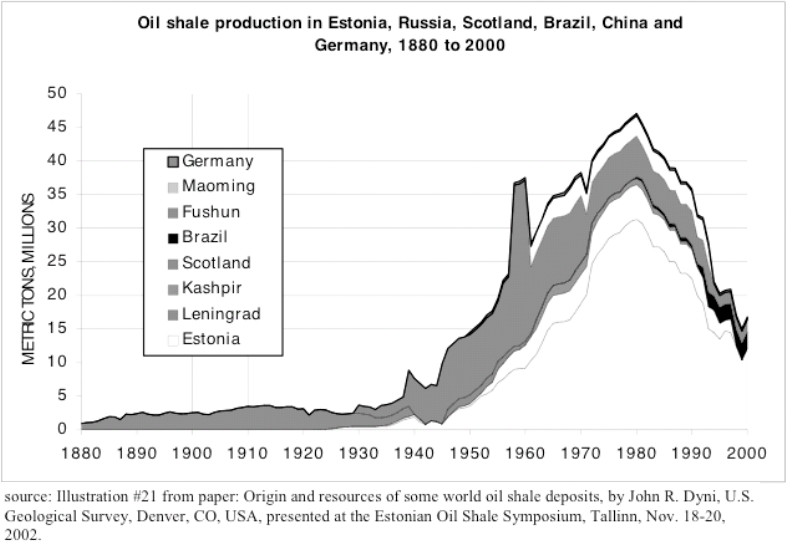

Oil Sands suffer not only from a very low EROEI (negative?) but also from spatial constraints that limit the amount of final liquids produced. Heavy Oils also have to be pre-refined at the production site in order to facilitate its transportation using Conventional Oil infrastructures. A good example is that of the Orinoco basin which also yields an immense Resource, but production stands at 650 kb/d and will probably never go over 2 Mb/d. Shale Oil Reserves are also huge, but production is marginal, and peaked in 1980:

World Oil Shale production breakdown by country of origin. Click to enlarge.

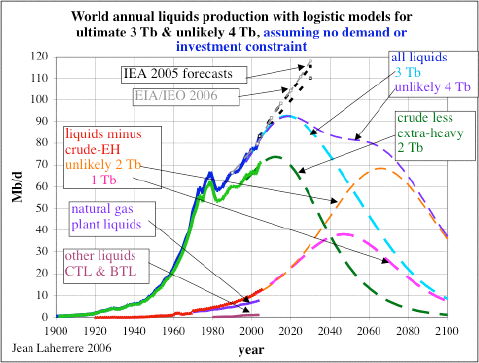

Even CERA acknowledges these lower prospects for Non-Conventional Oil in spite of the Resource numbers. In CERA's graph the cumulative production from Non-Conventional sources is 700 Gb, peaking at a rate circa 40 Mb/d. This is very close to Jean Laherrère's lower assessment of an Ultimate of 1000 Gb with a peak rate of 40 Mb/d:

Jean Laherrère's outlook for Conventional and Non-Conventional Oil production. The lower case for Non-Conventional Oil is very close to CERA's.

In sum, Non-Conventional Reserves are yet to be mater of disagreement between early peakers and late peakers.

Conclusions

Knowing the Ultimate Reserves accurately can give a clear picture of where the mid-point of depletion stands in time, and in tandem the unfolding of production decline. It's not easy to assess correctly Reserves numbers for exiting bad practices of Oil Companies in reporting.

Looking at four different databases for Conventional Oil Reserves (Proven + Probable) and correcting the numbers for reporting artifacts we get a number around 800 Gb. The decline in oil discoveries means that this value is dwindling for at least 20 years.

Using three different mathematical methods we can estimate the Ultimate Reserves, which in all cases stays around 2000 Gb, of which roughly 1000 Gb have been consumed. This is in line with the Reserves number of 800 Gb, and the decline trend of discovery, meaning that 200 Gb of producible Conventional Oil is left to find.

In light of this it is hard to support Ultimate Reserves numbers in excess of 3000 Gb for Conventional Oil, like CERA and others put forward. There's no indication at present of any region in the world that could have such amount of unknown Reserves. If existent this(these) region(s) have to be found in the short term to avoid the final Peak in Conventional Oil production.

As for Non-Conventional Oil, there seems to be a general view that in spite of large Resource numbers, the producible Reserves are much lower. There also seems to be consensual that these Reserves can never be tapped at the same rates that Conventional Oil is today.

Advocating larger Reserves can not be an argument against Hubbert's Peak and seems a weak one in pushing the Peak date further in to the future.

Previously on the Adressing Contrarian Arguments series:

Luís de Sousa (fka lads)

Excellent analysis!--especially where CERA needs to find 4 or more Saudi Arabias real fast to prevent the downslope from occuring soon.

I hope some expert data-freak TODer could create some charts using confidence levels of 'ultimately true' URR:

- In the early oilfield days-- a blind man could find the low-hanging fruit. But

- Nowdays, extreme seismic & geologic 'superman vision' is required to find the high-hanging fruit, but the high-tech computer & drilling tools allow

- Using the 'superman vision' back over the older oilfields allows us to find the final 'fleas' on the dying elephant, thus we have a

After scratching and poking away at these 'final fleas' with great determination, do we now have a high degree of confidence that we have maxed out 'confidence levels of exact & true size was very low; it took quite some time to fully realize the fruit were huge 'elephants'.confidence levels of exact & true size to be very high; we clearly, andvery early know,the 'flea' will never become an 'elephant'.very high confidence that this is the very last fruit.flea fruit juice'? And it is downhill now or very soon?Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Apparently Dave Cohen does so as well (click to see Dave's post):

Merryl Streep, are you down here Merryl? Merryl Christmas to one and all :-)

My favorite aunt, Alda Passel, claimed to be able to use a dousing rod on oil, and used to get very angry that my Uncle Charles wouldn't spud any locations based on her methodology. He was a Geologist from the Abilene, Texas area and an excellent oil finder in the Ft. Worth Basin and Permian Basin areas of Texas. His main claim to fame is that he invented the Windchill Factor during the 1930's while working on his Masters in Geology in Antartica, and was honored for this at the Houston Museum of Natural Science about 15 years ago. Uncle Charles told me that if he just had a nickle for every time the Windchill factor was mentioned on TV he'd be richer than H.L. Hunt. They are both gone now to a Cemetary in Buffalo Gap with pumping units just over the fence in a mesquite patch.

Uncle Charles was a big believer in peak production, although he never described it in Hubbertian terms. He told me around the late 1970's that he'd rather go rabbit hunting than elephant hunting because there were a lot more rabbits than elephants left in the Ft. Worth Basin. I distictly remember his discussion of this with my father, an oil and gas lawyer in the mid or late 1970's after the Cub of Rome report. My father didn't have any faith in Alda's dousing abilities either.

Perhaps the greatest story of blind luck though is the story that the Abilene Petroleum Club set up an old cable tool rig to demonstrate to the youngsters how wells were drilled in the old days at the county fairgrounds. They started drilling, and made a well!

drilling a 1700' well in eastern Kentucky back in

1983. It was amazing how straight they were able

to drill the hole and how they bailed out the

cuttings. The rig was fairly new so someone was

making them til recent times; maybe they still

are. I remember a friend telling me about coming

up on a cable tool rig seemingly running by itself.

He looked around a bit and finally found the driller

and roustabout down by the creek fishing. Seems that

once line feedout was set, they would run themselves quite a while

til it was time to bailout cuttings. They were a very cheap way

to make hole, but there was no way to have any kind

of blowout prevention.

I worked for a few months this year at Seminole in Gaines County, about 70 miles north of Midland and 30 miles E. of Hobbes. There were several cable tool rigs around there too, a couple of reasonably modern vintage plus a city block of rental cable tools. The water used to irrigate is from the Ogallala, and the locals use the cable tool rigs for water wells and also for sometimes setting surface casing and drilling rat holes.

There's a cable tool rig exhibit at the Permian Basin Oil Museum in Midland with animated figures, and also some out behind the Odessa Convention Center.

There are a few cyprus tanks still in use there, plus used to be some at Batson and Saratoga in Hardin County in the Big Thicket, but I haven't looked for them in a few years. The old steam boilers for the old time rigs have become exceedingly rare. There used to be one at Damon Mound in an old operator's barn, Gordon Dement, but he died and his estate was auctioned off a couple of years ago. The steam boilers could use any kind of fuel, even wood, and were used on both rotary rigs and on cable tools as power. There also used to be one on Moonshine Hill in Humble, but its probably rusted away by now. I guess all that stuff would be industrial antiques if somebody cared to store it. There's quite a bit around the Permian Basin Museum.

For people in northern California who are interested in steam powered equipment (in this case mostly used for logging), there is a great display at the Mendocino County Museum in Willits, CA. It's run by a bunch of people who still love steam. One friend of mine who is involved even has a steam engine and about 1/2 mile of track at his home. To get an idea of what they have check out:

http://www.rootsofmotivepower.com

I did some work at the Sour Lake dome in Texas and also over at Ged Lake near Sulphur, La. back in the late 70's and found both of those places to be loaded with oilfield relics. After each boom came

a bust and everything was just left to rust. One story I heard about Sour Lake was

that during the original boom times they built a big hotel to house all of the workers but one night it sank into a big

sinkhole caused by all the drilling activity washing out a cavity in the salt.

If you ever get up to Kilgore, Texas be sure to through the East Texas Oil Museum. I partnered with a gentleman on a couple deals who actually was an oil scout during

the early days of the East Texas field. He

and I went through the museum and he showed

me his picture posted there in several places.

there's another one (oil field museum) in or near russel,ks right off i-70

I've got to go to Longview in the next couple of months to chase down a formerly producing mineral interest my grandfather bought around 1950. I've never seen that museum, but would love to. Who knows, maybe I'll even look up Hothgar.

One of my favorite people was a guy named LLoyd Butler in Houston. He was a 13 year old black kid in Kilgore, and used to make a living steering people to crooked card and dice games in Kilgore during the boom. LLoyd was a kind, honest, and gracious gentlemen who did a lot of community service in Houston. Times were really rough on black people in that red neck part of the world, but he really grew past his roots. I'll bet that the streets of Tashkent are just as wild today!

I like poking around old oil fields, a sort of reverse ecotourism. Sour Lake, Spindletop, Saratoga and Batson are all fun. The Spindletop museum is only O.K..I get more of the real flavor by looking at the hundred of thousands of broken pieces of whiskey bottle glass than the buildings erected by the city of Beaumont.The Big Thicket Museum at Saratoga has a bunch of great photographs. The old AAPG oilfield reports generally have a lot of history of the areas, but, like all technological history, its pretty obscure.

I've got to go to Longview in the next couple of months to chase down a formerly producing mineral interest my grandfather bought around 1950. I've never seen that museum, but would love to. Who knows, maybe I'll even look up Hothgar.

One of my favorite people was a guy named LLoyd Butler in Houston. He was a 13 year old black kid in Kilgore, and used to make a living steering people to crooked card and dice games in Kilgore during the boom. LLoyd was a kind, honest, and gracious gentlemen who did a lot of community service in Houston. Times were really rough on black people in that red neck part of the world, but he really grew past his roots. I'll bet that the streets of Tashkent are just as wild today!

I like poking around old oil fields, a sort of reverse ecotourism. Sour Lake, Spindletop, Saratoga and Batson are all fun. The Spindletop museum is only O.K..I get more of the real flavor by looking at the hundred of thousands of broken pieces of whiskey bottle glass than the buildings erected by the city of Beaumont.The Big Thicket Museum at Saratoga has a bunch of great photographs. The old AAPG oilfield reports generally have a lot of history of the areas, but, like all technological history, its pretty obscure.

"the greatest gamblers" by ruth sheldon knowles and "texas rich" by harry hurt III have a lot of information, stories and just plain bs about the hunts and early efforts in oil exploration

Just poking fun -- good points there...

" Even a blind hog finds an acorn once in a while"

" I'd rather be lucky than smart"-attributed to H>R> Cullen, who found two of the largest fields on the Gulf Coast, Thompsons and Tom O'Connor.

Production Rates vs Reserves

I'm not convinced that production rate will peak as late as 2010 because the rate or production of reserves on the back side of peak production is always less than the front side of the curve thus the remaining reserves will be produced at a lower extraction rate.

The fact that extraction rate continued to increase even after total reserves decrease could be a signature of advanced extraction methods developed over the last 20 years.

Plus the oil shock effects of the 70's.

A easy way to see that the remaining URR is not a good number is to split the URR into two groups. New fields and old fields or better into fields that are not at peak production and ones that are at or past peak.

The vast majority of the remaining URR is in fields that are in decline. Thus the URR coming from new fields is a small percentage of the total. This is a very different profile from the past. In fact a time-line showing this flip over would probably so that the majority of URR coming from declining fields probably occurred in the 1990's. Which makes sense since they would have been the point at which we reached peak theoretical production capacity.

I think a graph such as this would go a long way to explaining URR and the fact that URR in fields past their prime is very different from URR in new fields.

Hi memmel, you know, extracting is a slower process than discovery, so it is quite likely that you can still be on the upward side of extraction when discovery is already way in to the down slope. The several decades between peak discovery and peak production don't have to do exactly with technology it's all about different flow rates.

Correct I just mean that advanced methods may show in later fields say post 1970 as peak after 50% QT.

Fields have seen double peak after new methods where employed.

So they certainly change extraction rates at least around the peak. Technology is touted as a potential savior so if you can discern the effect of technology on oil production it would be intresting. I'm assuming of course its actually had and effect large enough to skew data. HL analysis in a sense assumes a field is developed with traditional methods.

Horizontal drilling was introduced here in the mid-1980's, and is still being used to hook up the fracture zones that contain the oil. Horizontal drilling has definitely made the Austin Chalk more economic, also other Cretaceous stratigraphic plays like the Edwards and the Buda

Holifield is a definite optimist, but he thinks the Giddings play may contain between another 500 million barrels and 10 billion barrels, dependent on price. I can vouch he's a hell of a good oil finder and a good guy, and certainly enriched me and my family over the last 30 years.

The other technique that has really helped enhance production is 3 D and 4 D siesmic. It shows where new development wells can more thoroughly drain reservoirs by showing the geometry of the reservoirs and their actual arial extent so that the operator can drill more effective development wells. This is the technique I see as most likely to give real reserve growth-it works great, but has not been run on many depleted reservoirs onshore. These fields were watered out prematurely by overproduction, and independents may come up with some great locations with 3 D. I'm talking about fields along the Talco-Mexia-Luling fault zone, or old salt dome fields on the gulf coast.

I'm not so sure about CO2 on small fields, and waterflood has problems on small reservoirs. I'm pretty well familiar with onshore Texas Gulf Coast, but Roger proved to me conclusively that I'm talking through my hat about offshore.At any rate, old onshore fields were often abandoned early and could really show potential for shallow enhanced production techniques.

A little zoom, we can see that according to the backdated discoveries we should have peaked in 2001 (assuming no reserve growth). The corrected 1P reserve number is crossing cumulative production at the end of 2005 (Deffeyes estimate) and the non corrected probably around 2012-2015:

Any chance you can show reserve growth taking place in mature or post peak fields vs fields not in decline.

I bet most of the reserve growth has actually occured in mature fields so the production rate of these reserves will be much lower than is indicated by the total.

Above ground factors play a lot into Russian production profiles. But they don't change the overall trend of most of the URR booked today is coming from older fields.

A URR quality analysis of Russia would be interesting since they actually have a mix of new and old fields. So comparing a time-line of Russian URR quality with that of the US which has a known production profile will give you a good idea of the production rate profile for the remaining Russian URR. The Alaskan discoveries could even be used to match the double peak of Russian production. A URR "quality" profile is basically a physical interpretation of HL. HL works because URR becomes concentrated in older and older fields resulting in production rates eventually scaling the same as generic field rates. Since scaling laws apply you can readily match up regions with similar URR growth patterns and predict the actual production profile. Other composite methods should work the only requirement is that the baseline regions URR quality profile matches up to the region which is being investigated. With enough data model regions can be constructed.

Thus for a given field distribution you should be able to actually make a accurate prediction of production profiles.

The nice thing about this approach is above ground factors can easily be added to model back to Russia you should be able to model it with and without the effect of the collapse of the Soviet Union and predict the profile post collapse.

Since URR quality can be assigned based on individual field production profiles its a robust measure.

As and example all the reserve growth in North America and the North Sea can be placed in the declining producers column with certianty. Thus these regions will never increase production agian. The important number is the amount of reserve growth coming from new discoveries and more important a timeline.

Now with this partition you could then add back say 20% of the URR in older fields to come up with a total URR of oil we can extract at reasonable production rates. This accesible URR is what I feel is important total URR today with so many regions in decline distorts the reality of the situation.

Then of course given this number you can simply divide it by todays production rate to come up with a estimate of the number of years we could produce enough oil to support a transitional economy.

Any attempt to moderate the effects of peak oil would need to take into account this production window and the results should match up with HL.

What's the source of that data? IEA I presume.

What do you exactly mean by "corrected"? If that means compensated for the ME additions, it would mean at least less 100 Gb.

The reserve numbers are from BP.

The correction removes the two big reserve jumps (1986 and 1988) or about 200 Gb.

Merry Christmas to you Khebab!

P.S.: Shouldn't you be helping with the Christmas baking?

It's probably my last post for today, The baby is taking a nap, I manage to sneak away with my other son before my mother in law comes with the turkey :).

But real life is not so simple.

It is in the best interest of major exporters (eg OPEC) to create opaqueness and manipulate reserve numbers in the oil market. They ARE a cartel, after all: the oil market is not a free one, despite oil trading on futures exchanges. What is more, it has never been a free market (think back to Standard Oil, the Texas Commission, etc). Why is that so?

Consider these three alternatives:

- We knew for a fact that reserves will "run out" in 5 or 10 years. The world would then immediately start jumping into alternatives and would never allow exporters to jack prices up in the meantime, because it would be viewed as holding the world hostage as it transits to other energy sources. The exporters would be screwed from both sides: less export volumes and less price.

- We knew for a fact that reserves are adequate for 100+ years. The world would then not accept high cartel pricing because the "scarcity premium" in people's minds would go away. If exporters tried to jack up prices the world would view them as profit hungry blackmailers and could even move away from oil. The exporters would again be faced with downward price and volume pressures.

- We knew for a fact relatively little, or whatever exporters lead us to believe at any given time. Not too hot, not too cold: the production and price of oil could then be manipulated with relative ease to maximize total revenue and/or achieve other geopolitic objectives. The scarcity premium remains but not so high as to convince consumers to stop using oil.

Condition (3) is where we are today and have been for at least 30 years.Point? Price IS a determinant of "reserves" - not the actual ones in the ground, of course, but those that we are "allowed" to see - at least from the very big,price-setting exporters. And that is precisely why KSA has stopped publishing oil data decades ago and just keeps serving everyone soothing pablum.

Corollary: we will not be allowed to see or calculate the real URR numbers of the swing, price setting producers until the very end. But there are clear signs that URR are closer to 5-20 years worth of consumption than 100+. Watch closely what major consumers and exporters are doing strategically and financially:

The US has planted a flag in Iraq, the one and only oil nation that has both huge (?) reserves and potential for ramping up production.

*Russia is flexing its geopolitic energy muscles with impunity.

*Kuwait, Qatar, Dubai are heavily investing in non-oil/gas sectors.

*China is building hundreds of coal-fired electricity plants and is scrambling to negotiate global oil supply agreements.

*Europe is attempting to move away from fossil fuels ASAP.

Sorry if the comment ran a bit too long.

*Regards and Happy Holidays to all at TOD

Hellasious,

First, never apologize for length of writing if it takes that many words to say what you have to say...the "bumper sticker" logic and worship of brevity is one of the the things that got us into these problems.

Next, you did have something to say, but I am not sure that I am bought in on one or two of your points, for example, "Theoretically the price of oil should have no impact on reported recoverable reserves because as oil prices rise so do the costs of extracting it and in the end you are left in the same place."

That would be true if costs of energy to get energy moved in lock step with the energy itself, but I don't think that really happens, does it? If the price of oil tripled tomorrow, would the cost of getting it triple at the same time? I doubt it. Getting the oil as far as the actual cost of extraction goes, would be terribly cheap if that was the deciding factor.

On your "three alternatives" I agree with you right up front that number 3 is what is preventing the world from disclosing oil information. Information is power almost as surely as oil itself is, so the producers are going to hoard information as surely as they would try to oil in a full crisis.

But I want to veer off a bit, and address your point one: It is becoming apparent that the ONLY way real change in energy consumption and reduction of energy waste is going to occur is if the majority of the WORLD population (note: no one nation can do it alone now), or close to it believes that we are at or beyond peak essentially NOW. If that cannot be demonstrated, people seem to be willing to pray for a miracle and avoid change. THIS is the emergency, not peak itself. The fact that information is EXTREMELY unreliable (I do not, for example, accept any of the URR numbers I have seen in this who discussion as useful, for instance. They are blind guesses in my view, but I will return to that thought at the close) and people will NOT essentially destroy their lives, careers, homes, futures the futures of their families, and give up their stake in the current economy based on a hunch. There is only one possible option, and that is to reduce consumption almost "transparently" that is, with no real dislocation, and without the public realizing that they are in fact dropping consumption (this is done through artistic design and technology, as much as many hate to admit it).

I have long said that a price on crude oil in the conventional sense we know it is not sustainable above $120 to $150 a barrel, in today's dollars, and that price is survivable. The reason for this is that the alternatives and the efficient design will gain what some folks have called "trajectery" and what I have called "confluence" and be unstoppable from destroying demand for crude oil at an ever accelerating pace, and gaining EROEI as crude oil loses it.

I now believe, however, that crude oil could in fact exceed the above prices for some length of time however, due to the unwillingness of the world population to accept the real possibility of peaking production. I still do not think it can hold at that price indefinitely, but it can go above $150 for a short time.

To return to the blind guessing on URR of the world, we cannot even get consensus on limited areas of the world! Let's play a guessing game, and the TOD statistics whizes kick in some numbers, o.k. (because these guys are some of the best I have seen, easily the match or better than EIA, IEA, USGS, CERA, etc.), so here goes:

1.What is the consensus guess on URR of:

(a) Russia

(b) Mexico

(c) Northern Africa, including Libya, Algeria, and off coast oil on the North African coast (Europe's doorstep)

2. What is the consensus guess of URR of offshore Persian Gulf oil?

(a) Saudi offshore oil?

3. What is the consensus guess of URR off coastal United States IF the OCS (Outer Continental Shelf) were thrown open? Never mind whether it should be, how much oil is there? Including reserve growth? Including deep drilling technology...(see, for those who say technology does not enhance URR I say bull. Before deep offshore drilling, HUGE areas of the world that are now recoverable, at a price mind you, are now an accepted part of URR....technology brought these areas from URR zero (and not that long ago), to URR whatever, PLUS reserve growth...ONLY the technology and the money made the URR possible at all)

(a) How about deep offshore coastal South America? And I mean DEEP. At what price?

4. Does anyone want to take a serious guess at URR of Canada...and, at what price? MONEY TALKS, BS WALKS...oil at $110 bucks a barrel will be recovered in Canada that NOBODY is going to go after at $65. URR anyone?

O.K., I am willing to sit back and watch the fur fly....because since I have been coming here, I have seen estimates ranging from zilch to "infinity and beyond!" on all these areas above, depending on who does the counting...this should be fun! :-)

I will close with my old refraim....it is the ABSOLUTE BLINDNESS that is the enemy. As Hellasious points out in his alternative 1., if we KNEW peak was coming in a set timeframe, we could get rich and be comfortable, because we have no fear of pouring our investement, efforts, and talant in ONE direction, and could move mountains. But what everyone fears is 1982, and the sheer wall down that followed the sheer mountain wall up....it could destroy those who banked on peak oil as surely as peak oil itself.

Roger Conner known to you as ThatsItImout

You said that...

...if we KNEW peak was coming in a set timeframe, we could get rich and be comfortable, because we have no fear of pouring our investement, efforts, and talant in ONE direction, and could move mountains.

I wish it were that easy...From my analysis (not geological, but geopolitical and economic) it looks pretty certain that at least the very top people at the major global powers (let's call them the G8) know that Peak Oil is approaching. What is different is the way in which they choose to play their cards in this resource depletion poker game.

*The US is sticking with controlling oil through guns.

*Russia is using oil as a gun.

*China is hedging its bets: coal + as much oil as it can get out there.

*Britain has oil but as it starts down the depletion curve it will increasingly shift to the EU position, which is..

*The "continentals" of the EU are scared witless at energy poverty and are trying to rapidly expand alternatives.

*Japan...I admit to knowing very little about their strategy. Anyone?

In summary: Look at what powerful nations are doing not what they are saying. We are witnessing the middle rounds of a huge energy poker game and it has become clear how everyone is betting. I dearly hope that both the US and Russia are betting wrong, because their way is the way of interminable resource wars.

Regards

So, for the far term it is nukes and biodesiel. Nearterm adds the strategy of making sure no single source dominates oil imports.

They are officially relying on IEA numbers wrt peak production, when they discuss peak oil in their policy documents. They do mention the possibility of other scenarios though.

Additionally, there is a very significant drop in population that has now just started - this year 2006 was the first real decline in total population nationwide, though the birthrates of the past 30 years indicate that will accelerate very quickly and over the next 70 years shrink to around half the current size.

1st - Such a statement or the statment about The US is sticking with controlling oil through guns. might be mistaken that 'the government' is planing with 'someone else' in a grand plan.'

Much of the actions seem to be a simpler transver of wealth via force of law. Taking taxes for guns has less resistance than taking money for other reasons. Get yourself on the inside of that cycle and you can become well off.

Japan at one time had a freeze on building fission power plants. The 'name of the game' there seems to be importing materials of low value, adding value, then exporting. The difference allows buying energy to keep the process going. Kyocera, as an example is a leader in ceramics (Things like the knives) and solar panels. PV/Wind/Wave would let them levelage the resouces of the island. I don;t know what is being done in the wind/wave department in Japan, but Japaneese firms have been working with PV for some time.

Oil was formed in the geologic past in very specific conditions. Almost all conventional oil was formed in perhaps 3 or 4 epochs. If the market price goes up or down the amount of oil in the ground doesn't change.

You could argue that a higher price would allow for the exploration of resources in places with difficult access or constrained by any other means. But what makes possible the exploration of a resource is it's energy profit ratio, not it's price. The price just tells how the product of that resource will be received by the market.

I'll address this issue in more detail in the third instalment of this series.

Thanks for your response. I appreciate that the amount of oil in place (OIP) doesn't change, and that higher prices allow for expanded exploration within the limits of energy profit ratios.

However, the issue I remain concerned about is the growth of oil reserves - i.e. those defined as being economically recoverable - that growth being driven by higher oil prices. Another way of stating this issue is whether or not higher oil prices improve the oil recovery factor.

It doesn't seem so. The recovery factor is a pretty stable number, if changing is going downwards not up (falling field size).

I don't remember who initiated that round of debate because the topic was, what should our kids do when they finish college? (We're old geezers and our kids are already in college but unsure of what career to pursue even though they have picked their majors. So we were mostly discussing that.)

Rather than arguing about the 4 Trillion number, I said:

Smiles went around the table and that kind of ended that line of argumentation. We returned to our original topic, what should our kids do?

The concensus was Nuclear engineering or anything else having to do with a re-emergence of the nuclear generation business (i.e., becoming a lawyer who specializes in lawsuits involving the nuclear industry). We agreed that even if coal kicks in first as a substitute to "high energy prices", people will quickly tire of the air pollution and they will clamor for nuclear power. What do you think?

P.S. Happy Holidays.

And A Methane River Runs Through It...

Happy Troll-a-days to one and all!

Very pretty! Poor girl looks like she's just read one of Kunstler's books..

I find it amazing and appalling that anyone equates Cornucopianism with a political stance. Its the same craziness of the Darwin deniers, or creationists, and not in keeping with any political stance. Since the Russian Communists were so ivolved in promulgimating the abiotic theory, they are better equated with old line Stalinists. The word Conservatism has as its root "conserve", or save or preserve. If we allow the nuts to politicise any stance we are doing the world the worst disservice imaginable as we cannot afford the time to allow geologic reality to challenge their beliefs, like global warming/climate change has begun to sink in to their conciousness. People are political, not scientific theories or historical facts

Oilmanbob,

In defense of my "nut-wing" dinner friends, some of them are from top Ivy league schools, PhD's in engineering, in physics --extremely brilliant when it comes to science, math, etc. Their IQ's way outclass mine.

It is not about "rationale". It is all about being macho, about being emotionally bonded to an alpha male (i.e., GWB -hallowed be his name), about showing "them" (i.e., the Ay-rabs) that "we" are not to be messed with and that "we" know in the end that might makes right and that all the rest is BS for some certain types of people.

Although I strongly disagree with that kind of thinking, I do not disengage from friendship with these people. Mutually respectful dialogue helps us to see the other person's point of view even if we disagree with it. It is so much better to understand how "they" think and why they believe what they believe so that you can find the right kind of song to resonate into their brains rather than coming at them foaming from the mouth and appearing to be a fringe left-winger who is suggesting an unpatriotic "cut and run" from the herd.

Their blink think brains were startled into an awakened state for a moment (a very brief moment). And that is when I lobbed in the second psycho linguistic bomb --the one about finding oil on Saturn and Jupiter. You see, some of them are "rocket scientists" in the truest sense of the word and they can tell me down to the penny how much it costs for every extra ounce of payload on missle X or Y or Z.

So they instantly understood that it is the craziest of ideas to suggest that we get our oil from outside the Earth's gravitational field. And they also knew that it is scientifically undeniable that hydrocarbons are abundant on the frozen surfaces of these planets.

That is why they smiled and did not reply. There was an unfortunate "ring of truth" to the explosion that I had stealthily hurled into their circle of consciousness. (My apologies to Rober DeNiro and his "circle of trust". BTW, DeNiro's The Good Shepherd is an interesting movie if you like stealth, nuance and all that.)

click on sheep-to-slaughter picture for inside story

Happy Holidays.

I recommend the roast lamb. It is especially delectable this time of the year as we celebrate the birth of a good shepherd.

Happy Holidays to you, too! Another psycho-linguistic bomb is to agree with George W. Bush that we are addicted to oil, and then state that importing 2/3rds of our transportation fuel is a threat to our national security and financial stability. Since its about transportation, perhaps a car bomb?

I also try to point out that we all love our country and want the world to be prosperous and free. Our similarities are much greater than our differences, and we all need to remember this.

The so-called cornucopians are not wishing for anything bad.

We all want the best for our immediate family, for our tribe, for our country and maybe even for the world as a whole if we are grown up enough to understand that everyone is a human animal and everyone wants similar things -they want respect, they want security, they want a future, they want hope, they want to have dreams.

The best solutions are the ones that work out to be live-live ones.

I for one do not understand how an "us" versus "them" view of the world ends up with anything but war, killing, destruction and misery.

The human race as a whole faces some big scale, global scale problems. Fisheries are declining world wide. The air is getting more and more polluted. The oil is reaching a point where we realize it may actually "run out" in a foreseeable future.

Because in truth, it's not. There is a whole Universe of energy out there. We are just so technologically backwards, emotionally backwards, and too Neandrathalic in our ways to see it yet.

But Nuclear energy could really have a very important role on our transition to a steady state economy powered by renewable sources. And who knows about Thorium?

As for that 4 Tb number it can actually be true if it includes all other sources of non-conventional oil. But PO is not solely about reserves it is mostly about flows (hence the concern over conventional reserves). More on this in Chris Skrebowski's letter to Petter Jackson.

Merry Christmas. (Which one is you, and who's the young lady in red dress? ;-))

Do explain ~_~

I referenced “negative” for U238, read more on Nuclear EROEI here:

EROI, the Key Variable in Assessing Alternative Energy Futures? by Charles Hall

Nuclear power - the energy balance by Jan Willem Storm van Leeuwen and Philip Smith

The storm/smith paper has been repeatedly taken apart as an excercise in how to lie with statistics.

They take selective theroetical models with the worst possible asusmptions to attempt to paint nuclear energy as an energy sink, and even then it comes out positive with modern ores. They use the gasseous diffusion process (1950's technology thats 50 times more energy intensive than modern centrifuge enrichment) arbitrary theoretical models of mining, etc. This curious result led a group at the university of melbourne to actually _measure_ the energy inputs for modern nuclear power.

http://www.nuclearinfo.net/Nuclearpower/TheBenefitsOfNuclearPower

From the paper you referenced:

Not very scientific either...

If taking setnances from the study out of context is high rhetoric, I'm not sure what there is to say that wont be likewise dismissed without thought or consideration...

But if you would actually look at the paper we can easily show the viability of uranium utilization for tens of thousands of years from ordinary ores alone.

Now if you had included the whole statement:

We hardly see any cause for the ad-hominem attack on their credibility. Its a statement of the relative costs of nuclear power.

Further:

http://www.nuclearinfo.net/Nuclearpower/UraniuamDistribution

Has a breakdown of the distribution of uranium in the earths crust, along with what explicit assumptions are made, and they are quite reasonable:

It is worth remembering this is before we enter breeder reactor regimes or even reprocessing of uranium in spent fuel.

It also is before considering thorium and liquid fluoride reactors.

There is enough nuclear fuel with breeder reactor regimes to supply power for thousands of years. You cant use it up faster than that because we make the reasonable assumption that generating nuclear power on the scale of the solar flux has makes the planet somewhat hard to live on.

You know, we spend our time here at TOD arguing that money doesn't make resources appear magically underground.

If you're going that way with Uranium why don't you do the same for Oil? If the barrel goes up to 200 $ what's your hunch for the resource that'll appear on the ground by then?

EROEI works the same way for whatever non-renewable energy source you chose. I do not contest the info you have given for the net energy of the mining process, but that's just a part of the hole life cycle of a Nuclear plant. The numbers shown by prof. Hall were not subject of contest by the Nuclear folks at Pisa.

Just as a closing remark I completely dismiss the hypothesis of block quoting a sentence from a paper being an ad hominem attack.

Apples to oranges really. At 400 per barrel synthesis of oil products from water and any carbon feedstock (eg, limestone) becomes something to consider. With uranium the price is relavant to how much fuel is avaliable for mining interests, but largly irrelevant to power companies because the price of uranium is such a small component of the cost of nuclear power.

The rest of the nuclear fuel cycle isn't that energy costly. Outside of enrichment, which isn't even required (see CANDU reactors, and any breeder regime), why do you believe nuclear is even close to an energy sink?

I think the situation in uranium is very different from oil, and EROEI of direct mining in one-pass operation (mine uranium, separate and throw out waste) is much less relevant to the future of of nuclear as compared to non-conventional oil, where EROEI will have huge effects on nonconventional oil.

First, there's the obvious observation that the exploration for uranium has been much less intensive than for oil. There are probably a number of uraniuim "Ghawars" remaining to be found. In mining, the 'reserves' reported to financial authorities is even smaller than total physically realistic reserves. Mining companies generally just drill nearby so as to make sure they have 10 or 20 years of production bookable---beyond that is just wasted spending at the current time.

Even after uranium has increased by a factor of nearly 10 in the last few years (after old stocks were used up) the cost of fuel is still small in the operation of a nuclear plant, in contrast to all other fossil fuel uses. That bottom line shows that EROEI of current uranium must still be very high, and estimations showing otherwise must be fundamentally erroneous. High EROEI doesn't necessarily mean economical operation, but low EROEI must always mean uneconomical operation unless the final product isn't intended as an energy source.

But more importantly there are many alternative nuclear fuel cycles which enhance the utility of any input of mined uranium. Some more far out ones, like accelerator based reactors could both burn up present nuclear waste as well as use more abundant thorium.

An important take-home point is you can't predict anything from proved reserves.

Reserves increase from discoveries + reserves growth. However, if everything is backdated to date of discovery, then there is no meaningful distinction between them -- all you have is a backdated discoveries curve. About how much to expect from reserves growth, here is what Bentley has to say:

What Bentley is saying is that we have no useful way at present of estimating reserves growth -- ie. the changes in the backdated discoveries curve. Testifying before Congress, here is what Robert Esser of CERA told them using IHS Energy data compiled by Ken Chew -- The 175 billion barrels -- quoting from my CERA's Perception Management published in World Energy Monthly Review (September 2006) -- is from IHS Energy & was compiled by Ken Chew. From the discoveries perspective, we used more than we found (144/236 = 60.8%) but from CERA's reserves growth perspective, stocks (backdated discoveries) actually replaced 135% of cumulative production in the 1995 to 2003 period. It is not clear to me how Chew's conclusions square with Jean Laherrère's (who is also using the IHS Energy data). 175 billion barrels is a whole lot of oil. I can't get a handle on the P50 (2P) reserves. I hear many stories. This is why I generally avoid the whole reserves question because I don't know who to believe and, importantly, I don't need to know what the reserves are to conclude that peak oil is upon us -- see directly below.From Bentley -- conclusions.

As for Middle East reserves being over-estimated -- I'm sure they are. But they are still so vast, in any case, that near-term production should not be affected either way. Bentley's last point, which is more important in my view, concerns the discounting rate used for new production. The IOC's maximize up-front volumes. The NOC's (eg. Saudi Aramco) may be switching into slower production mode ie. they use a lower discount rate. If this is true, then their production will have "effectively" peaked via a policy strategy as opposed to "geologically" peaked in which it is simply not possible to get the oil out of the ground at a higher rate. This ties directly into OPEC managing the supply to set price floors. Saudi Arabia is clearly trying to build up their capacity -- but it may not affect the production numbers we see. However, this is contradicted by greater production from the UAE, Algeria and others. Kuwait (where reserves are now admitted to be lower than has been stated) still seems to be trying to raise daily output. Perhaps they are trying to maximize profit before the nightmare on their border becomes a horrible reality. I think Kuwait is the key to understanding what is going on over there. I don't know how all this relates to OPEC country-by-country internal accounting of what they think their reserves are -- and neither does anyone else.As Bentley points out, it is deepwater and Russia/other FSU that has kept us afloat (so to speak) up to now. As delays continue with production becoming more difficult (Kashagan, Gulf of Mexico), the Russian rate of yearly production increase slows dramatically and deepwater incremental production reaches it's inevitable "high water mark" circa 2011, the writing appears to be on the wall. A mini-glut? Maybe. For a few years at best. What does "mini" mean? And "glut"? Does it matter? No.

Merry Christmas.

The discovery curve looks backdated:

Reserve = Cumulative(Discoveries) - Cumulative(Production)

so that when we look at the reserve peak in Luis' first chart, and figure out where reserve peaks by taking the derivative and setting that value to zero:

dReserve/dt = Discoveries - Production = 0

Which occurs pretty much exactly where yearly Discoveries=Production in 1980, in other words, where the downslope in discoveries meets the upslope in production.

If discoveries are not backdated, then

Reserve = Cumulative(Discoveries + DiscoveryGrowth) - Cumulative(Production)

Which essentially means that if DiscoveryGrowth is dissociated from Discoveries, it can only push the reserve peak into the future (unless DiscoveryGrowth goes negative).

So we have lots of latitude for pessimism vs. optimism.

http://mobjectivist.blogspot.com/2006/04/reserve-peak-proven.html

That would be interesting.

I've never understood why the creaming curves follow a hyperbola. If nothing else, a simple first-priciples argument would show that they would follow a parabolic growth law. This kind of growth ends up being proportional to square root of time. If NWF increases linearly with time, I don't see much difference between a creaming curve and a reserve growth curve, which also show the so-called parabolic growth to first order.

http://mobjectivist.blogspot.com/2006/01/grove-like-growth.html

The only full and transparent ongoing study of regular conv oil reserves is done by Colin Campbell of ASPO Ireland. His current URR Estimate of 1900-Gb includes 145-Gb of yet undiscovered resource. While he and i agreed last year that the half-way consumption passed in April 2004, recent increases in his URR Estimate in 2006 have shifted that Conv Peak to April 2005.

Colin is concerned that very many nations seem to have not updated their Reserve figures downward despite years of extraction. IEA noted in 2004 that of 95 nations, 38 had unchanged Reserves from 1998. 13 of those were unchanged since 1993. If reserve growth is the factor, all is ok. But if they are remiss, then a drastic downward revision could be in store. The latter is unlikely as annual production has increased virtually annually to 2005.

The study of the Conv Peak is an exercise limited to academics and purists. With Campbell's URR of All Liquids recently upwardly revised to 2500-Gb, the real Peak is indicated in 2010 and is similarly validated by Monthly & Quarterly Supply Records being set in 2006H2.

My Trendlines compilation of 18 recognized Reserve Estimates indicates the AVG Estimate is currently 3008-Gb and a half-way crossover around 2017. 10 of the 18 Estimates are higher than Campbell's. Six of them are between 3967-Gb & 5174-Gb. FYI, that highest URR estimate would indicate an All Liquids crossover in 2050.

Some of the Estimates include much higher figures for Non-conv liquids than Campbell and forecast that Conv Oil has yet to see its Peak ... possibly in 2010.

In summary, the Conv Peak (as defined by half consumed) would seem to lie somewhere between April 2005 & 2010. The All Liquids Peak between 2010 & 2050.

Do you realize how absurd the entire assumption is of every nation that has failed to change its reserves has also had reserve growth to exactly match consumption? Yet here you sit proclaiming that all can be ok if the results are because of reserve growth when that reserve growth has to exactly match production, year after year after year.

How anyone can believe that 13 nations have reserve growth that exactly matches production for 13 straight years boggles the imagination. How anyone can believe that 38 nations have reserve growth that exactly matches production for 8 years is even more astounding. One? Maybe. Two? Remotely possible. But 38??

Give me a break, Hutter. What you cite as reliable data is nothing but obvious falsehoods, because it is flatly impossible for reserve growth to have perfectly matched production year after year after year. This is one reason why none of us take your trendlines seriously. They are based on data that is obviously falsified. Get the real story if you want to be taken seriously. Obviously, if the reserve growth is falsified then all of your conclusions are invalid.

I think you over looked one part of Freddy Hunters comments:

The latter is unlikely as annual production has increased virtually annually to 2005.

From what I gather, he believes that it is unlikely that reserves have grown perfectly in line with production, but that the ratio is not lagging far behind because production has obviously been increasing over the times mentioned.

But why does there have to be a close relationship between growth in reserves and growth in production? I do not see how it is a given? A country can have a finite amount of reserves which doesnt increase significantly from day one and yet steadily ramp up production by increasing extraction rates via more wells etc, until the point that production collapses due to geological constraints etc. Rather like we have seen at Cantarell etc etc

It seems to me that Mr Hutter is making a rather big, and very unscientific assumption here........

"If reserve growth is the factor, all is ok. But if they are remiss, then a drastic downward revision could be in store. The latter is unlikely as annual production has increased virtually annually to 2005."

Let's do some reading comprehension.

former:"If reserve growth is the factor, all is ok."

latter:"if they are remiss, then a drastic downward revision could be in store"

In other words, Freddy is saying that reserves don't need to be updated because production is increasing, and therefore reserves are also growing or staying the same.

Hi Freddy, thank you for your words.

Colin Campbell’s estimate for All Liquids is just 2.5 Tb because as far as I know he doesn’t include CTL or BTL. Including it he would likely get close to that 3 Tb.

I disagree with you on the study of the Conventional Peak, because it seems that it will set the All Liquids Peak.