Investment in Oil Exploration and Production -- An "Above Ground" Factor

Posted by Dave Cohen on November 24, 2006 - 7:11pm

"The key word is urgency," IEA director Claude Mandil told a press conference in London following release of the study. "Urgency for immediate policies and measures to promote energy efficiency and facilitate technology development ...Had the IEA changed its tune? A closer look at the report's conclusions sends a mixed message."On current trends, we are on course for an expensive and dirty energy system that will go from crisis to crisis. It can mean more supply disruptions, meteorological disasters or both. This energy future is not only unsustainable, but it is doomed to failure.

"Governments can either accept such a future, or they can decide to come together to change course."

What are the "Above Ground" Considerations?

CERA's peak oil Decision Brief identifies "aboveground" risks as the limiting factor in expanding the world's oil production to meet projected rising demand for oil.Aboveground risks may limit upstream investments. An apparent peak in world oil production could appear if aboveground issues--such as war and political changes, or intractability in decision making by governments--limit upstream investment and activity. But such an outcome would not be rooted in a belowground geological constraint in the next few decades. An apparent peak could also be triggered by technological change that substitutes for oil in transportation, capping demand.It's a safe bet that we can dismiss the possibility of some miraculous technological change that would cap conventional oil demand and make our liquid fuel & climate change problems just magically disappear — something akin to fusion at home powering a global fleet of electric cars.

CERA's underlying assumption, shared by the IEA, is that above ground factors curtailing upstream investments supporting new E&P activity will be the real cause of a peak in global conventional oil production flows. This argument is tantamount to saying that were it not for those nasty human political realities, you could throw enough money at the peak oil problem —a problem explicitly acknowledged by both CERA and the IEA but posed differently— and all would be well, at least out to circa 2030. About this faith-based free market approach, Ken Duffeyes said that The economists all think that if you show up at the cashier's cage with enough currency, God will put more oil in ground. Ken neglected to add that God put a lot of that existing recoverable oil in some pretty geopolitically & geographically inconvenient places as far as the OECD consumers represented by the IEA are concerned, which is, one supposes, their main point.

Let's take a brief look at the IEA's findings about the current level of oil E&P investment and some factors affecting it. Finfacts presents a more detailed media story on the IEA's conclusions.

Oil E&P Investment Levels

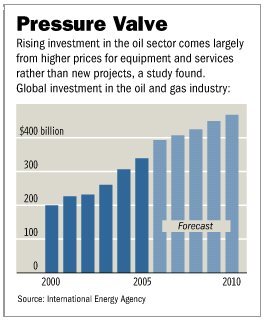

On November 8th, a Wall Street Journal article Investment by Oil Industry Stalls reported on the investment problem.Data compiled by the International Energy Agency show that investment in the oil-and-gas industry was $340 billion in 2005, up 70% from 2000. But cost inflation for goods and services used by the industry accounted for almost all of that increase, according to the IEA, the energy club of 26 of the world's major industrial nations. Adjusted for inflation, the oil industry's investment increased by 5% between 2000 and 2005, the IEA, based in Paris, said...Figure 1 shows the investment pattern since 2000 and what is projected to 2010."That's almost nothing; it's inadequate," said Fatih Birol, the IEA's chief economist and principal author of the agency's latest annual World Economic Outlook...

Mr. Birol, the IEA economist, said in an interview that he expects the oil industry's production capacity will slightly outstrip demand through the end of this decade -- or by 1.3 million barrels a day [mbd] -- "if all the projects see the light of day."

Even then, when added to current spare oil-production capacity of roughly two million barrels a day, the total reserve of 3.3 million barrels a day still would be well short of the five million barrels a day needed to put the world into the comfort zone, he said.

Figure 1

Needless to say, it seems safe to assume that not all projects will see the light of day because, outside of real above ground concerns, now customary delays are likewise due to geological, technological, environmental and inflation-driven economic constraints on new conventional oil production which extend normally long lead times. So much for that 1.3 mbd of additional spare capacity vis-a-vis increased demand projections. If you're seeking CERA's cap on demand, the ceiling on available supply is where peakists recommend you look.

As to the cited current spare productive capacity ≅ 2.0 mbd, we are still looking for it but perhaps we should stop searching, just as there is no longer any reason to look for weapons of mass destruction in Iraq. If only we had a geopolitical magic can opener, perhaps social justice, an end to ideological conflict, redistribution of the oil wealth and suppression of greedy human impulses could restore lost production in Nigeria, and resurrect that now useless pipeline running from Kirkuk to Turkey in Northern Iraq. One should never discount the power of above ground disruptions to the oil supply but reality dictates that all of us, including the IEA & CERA, must learn to live with it.

On the other hand, the assumed global decline rate of ≅ 5% in existing conventional oil production would not seem to be solvable even by historically unprecedented political readjustments followed by massive capital expenditures.

Factors Weighing on Investment

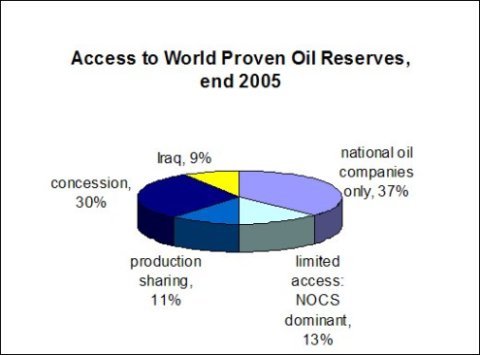

The IEA states that inflation costs for goods & services have mostly swallowed up increased expenditures for conventional oil E&P —this includes, but is certainly not limited to, licenses for oil exploration blocks, bribes, seismic survey and test well costs, direct equipment costs (pipes, valves and fittings), oil services, leased drilling infrastructure (scarce rigs), operating costs (eg. consumables like fuels, energy lubricants, chemicals) and so forth.A commonly heard argument is that new E&P is held back because the International Oil Companies (IOCs) such as ExxonMobil, BP, Royal Dutch Shell, et. al. are increasingly prohibited from operating in what the IEA and others would consider prospective areas in the OPEC countries or elsewhere, as in Russia. Look at Figure 2, based on IEA's WEO 2006 data.

Based on a total proven reserves estimate of 1.293 billion barrels

The estimate apparently includes OPEC reserves calculations as

revised upward in the 1980's — Figure 2

Only in the case of concessions, as in countries like the Nigeria or Kazahkstan — where no national oil company (state-owned NOC) exists— are the IOCs able to operate freely after they are awarded the E&P lease blocks following the bidding phase. Figure 2 indicates that 37% of countries exercise complete control on access (eg. KSA/Saudi Aramco, Mexico) and 13% allow limited access where there are dominant NOCs (eg. Russia). Countries like Iran, Algeria and Qatar use production sharing or buy-back arrangements, whereby control over the oil remains with the NOCs there. The Oil Investment Climate by Vahan Zanoyan (June, 2004) provides a detailed analysis of the investment issues.

The not-so-subtle, often overt, message of the IEA is that the NOCs are either incompetent, hamstrung by restrictive government policies, or otherwise not motivated to provide the necessary levels of investment to produce more oil in order to satisfy growing demand in the OECD nations or the "Asian Tigers" —China & India. If only the IOCs were able to operate freely all over the world, the peak oil crisis would be solved. While this narrative contains elements of truth, it is by no means the whole story regarding development of new conventional oil, as The Oil Drum has repeatedly pointed out.

Indeed, the trend is not favorable. Russia is now harassing Shell at Sakhalin II. Bolivia nationalized all of its upstream oil & gas assets. Venezuela pressured IOCs operating there and, according to the IEA, effectively re-nationalized 0.565 mbd of oil production.

Tense relations between private firms and Mr. Chávez's government escalated last week when the government seized fields operated by two European oil giants - France's Total and Italy's ENI - after the two companies snubbed government demands to convert their contracts to joint ventures with the state by April 1.Finally, it almost goes without saying that investment in Iraq or Iran is a tad risky at this point for reasons that all too obvious."This country does not allow itself to be blackmailed," says energy minister Rafael Ramirez. "These two multinational companies resist adjusting to our law. Our sovereignty isn't under negotiation."

Sixteen companies - including Chevron and Shell - did agree to new terms giving state oil company PDVSA at least a 60 percent state stake, a success which analysts say could embolden Venezuela to demand a majority stake in more valuable projects in the country's Orinoco heavy-oil belt...

"Chávez is in the driver's seat because he has what everybody wants," says Roger Tissot, energy analyst at PFC Energy consulting firm, about Venezuela's heavy oil. "It's not any kind of oil. It's the oil of the future.

Conclusions about Investment

The IEA's investment argument contradicts the position that petroleum geologists have left no stone unturned looking for oil all over the world. Surely it is the case that some onshore oil remains to be discovered —how much oil is really the question. Outer continental shelf exploration in the Gulf of Mexico, West Africa, Brazil, Malaysia etc. has proceeded apace. The melting Arctic is the final frontier. On the whole, oil discoveries peaked in the 1960's. This fact alone hardly inspires confidence that there will ever be another renaissance of new conventional oil discoveries that supplements continuing reserves growth in existing fields.Above ground issues play an important role in current and future oil supply but they are not paramount. When the peak of oil production arrives sometime before 2015, so-called peakists will say "I told you so". The IEA or CERA will say it was due to lack of investment — this is their fall back position as some commenters have pointed out here at The Oil Drum —a CYA stance meant to preemptively deflect future blame. But, does it matter who is right in the end? No, not after the keen hindsight we get from seeing the peak in the rear view mirror. However, it still matters now as we struggle to get the world to pay attention to a crisis which may still be down the road.

Dave Cohen

Senior Contributor

davec @ linkvoyager.com

It's 2.0 million barrels per day. Choose the short form you like, just choose one that someone else somewhere uses and makes some sense - i.e. stop putting slashes immediately after the number. Personally I like Mb/d, but that's because I happen to think metric prefixes make sense.

This may seem petty, but in one of your other excellent posts you had this, and other unit confusion, littered throughout, and it really detracts from the article. It's not just me saying this, other people I have referred to the article have said the same thing.

ie, there's not much else it could have meant.

-- Dave

Anyway, superb article.

Thanks for the piece, David. Excellent as always.

I'm a bit confused by this statement. Over a 5 year span, a 70% increase to $340 billion means that we invested only $200 billion in 2000. Assuming a 5% inflation rate for the industry, I come up with this:

2000 = $200.0

2001 = $210.0

2002 = $220.5

2003 = $231.5

2004 = $243.1

2005 = $255.3

340 / 255.3 = 33% increase

In order for this statement to be correct, and net investment to only increase by 5%, the global inflation rate would have to be at a rate that increases investment to $324 billion. This rate would have to be around 10%.

Does anyone here really think the global oil industry inflation rate is 10% annually? That would make it something like 2.5x the global inflation rate.

Scarity has bid up a limited supply (in some cases dramatically) and even the raw materials used (steel & oil products are two largest) have gone up substantially.

Alan

How to calculate a percentage of increase using simple mathematics.

A = Last measurement

B = increase

C = Percent of increase

A-B/A = C

(A-B/A)*A = C*A

A-B = C*A

-B = C*A-A

If we replace with actual numbers we get

-B = 0.70 * 340 - 340

-B = -102

B = 102

That's the increase of 70% in 5 years. Starting year would then be 340-102 = $238 billion. Using that REAL starting number, see what we get with an increase of 5% each year.

2000 = 238

2001 = 249.9

2002 = 262.4

2003 = 275.5

2004 = 289.27

2005 = 303.73

Well, that wasnt enough. What about 7%, lets see :

2000 = 238

2001 = 254.66

2002 = 272.49

2003 = 297.20

2004 = 318

2005 = 340

Actual yearly increase should have been 7%, that pretty near real inflation rate as stated by shadowstatistic web site.

If you make an argument about some calculation (any) be sure to have enough mathematical literacy.

I had a physics teacher that was always saying that before pointing at the straw in the eye of others, someone should first notice the wooden beam that's in his.

In some sectors, Personnel rates have almost doubled.

Rig rates have never been higher.

This significantly impacts on Operator costs and an operators ability to get things done even with the higher Capex for Exp. and Appraisal drilling.

Simmons's presentations of late keep coming back to this issue.

Well put Dave.

We can expect this argument to drag on until we are well down the energy descent.

When we are down to 65% of peak, we'll still be arguing about whether peak really happened, or whether another invasion, more investment, less IOC collusion, less OPEC interference would bring back the "Good Old Days."

The argument will go on until the descent is too obvious to deny.

This from the chief economist at IEA:

I guess none of the other (externalized) costs besides production have any bearing on the ultimate cost for oil...

Just last year/year before that OPEC were pledging to add to quotas to stabilise oil prices as they were at the time rocketing. It had no effect. Even the promise of more oil should have had an effect. So this year price slides even though OPEC actual production has been fairly flat. They even priomised to cut 1.2 mb/d. Now 2 years ago if this much oil was threatened the price would have jumped $5-10. Not now.

So we seem to be at the mercy of violently fluctating oil prices whose control in my opinion is outwith OPEC. As for $4 pb costs - I wonder what the real cost is. And do they pay for steel or other equipment in dollars?

Marco.

How does all this come together to keep the price stable just under $60?

OPEC may have lost its pricing ability just as the Texas Railroad Commission did in the mid-1970's because they no longer have the spare production capacity to ramp up and lower prices.

But it may actually go up in Saudi since to maintain flows, a lot more rigs and kit is moving in. When you add this to the cost then of course it will impact lifting costs. But they still have a long way to go compared with Jack or Thunderhorse. Even so, KSA Lifting costs are just about the lowest in the world historically (lots of oil, few wells)

Assume lifting costs will increase with time in all regions and you wont go far wrong.

I don't think that's a safe bet.

First, renewables can supply all the electricity we need. We don't yet have global commitment to them that is needed, but that's not a technology problem, it's a problem of social change.

2nd, a number of battery chemistries are being developed which promise to reduce costs dramatically. Some of them are very close, like A23systems (in use in Dewalt tools now, though not yet optimized for EV's), Toshiba and Firefly (both promised for large-scale production in 07). Others are farther, like Altair. Others are longshots, like Eestor. Scaling up production would also require somthing of a social commitment to change, but the technology is very, very likely to be there.

The safer bet is on the tech. The problem is resistance to change, which is painful for those whose industries get left behind, and which therefore slows progress. Social & political change is where the innovative work is needed.

Do they require expensive manufacturing processes?

Do they require elements or materials that may be more difficult to get at or more scarce than oil?

"How well do these technologies scale to replace oil?"

Renewables scale very well. The current estimate from Stanford researchers for the total wind resource for the world is about 72TW, versus current average equivalent demand of about 4TW. Sunshine provides about 100,000TW.

Lithium appears pretty scalable. Firefly's technology uses lead and carbon. Solar's silicon is, I think, the 2nd most abundant element in the Earth.

Wind, at about $.06 per KWH, is arguably the cheapest energy source we have after taking into account the external costs of other sources (direct pollution, global warming, security of supply, weapons proliferation, Price-Anderson, etc). Solar thermal is cheap. Solar PV is roughly $.25 and costs are dropping very fast (though not prices, due to skyrocketing demand).

Does that answer your questions?

I agree with the technologies you've mentioned having great possibilities for growth, and deserving our immediate investment.. but as it applies to Dave C's post, I think they will be 'late to the party', and that those predicting PO to be a cakewalk are too confident that technologies will show up when we need them with enough power to keep business going without much of a 'flicker'..

As I tried to say, I think tech isn't the problem: tech is here or very close. It's the social comittment to implement it quickly that's needed.

I probably won't have the time or energy to build models to evaluate the sort of replacements you propose.

I wanted to point out to the readers that new energy technology requires, along with social adjustments, new materials or resources that may be just as expensive or scarce as oil eventually will be.

These are hard questions we have to ask ourselves when consider replacement technologies. I think the best way to find out their limitations and benefits is through actual use. The barrier there is social apathy, which you mentioned.

hmmm. This is a broad statement. Are there any specific materials or resources that you are concerned about, as limits on wind, solar or batteries?

As for wind and solar, my concerns are for their ability to provide on-demand energy. That is, they aren't consistent enough to depend on.

Solar panels are expensive to produce, although there is much effort being spent to reduce their cost. I believe Dow just opened or plans to open a new factory in Brazil with a promising new (cheaper) fabrication process.

Finally, products wear out. Solar panels become broken and batteries fail after a certain number of cycles. I would think wind generators would be resistant to storm damage, but that might be another issue.

The more energy hungry a civilization is, the more wear and tear will manifest itself on solar panels.and batteries. There will be a replacement cost in terms of manufacturing, transport, chemical-use, and metal-use.

Unfortunately these are still broad observations, I know.

However, look at commodity prices over the last 5 years for gold, silver, zinc, copper, and lead. These resources are not cheap right now. Imagine how scarce/expensive they'll get when we make the move to a real renewable economy.

nanosolar has received a $100 million investment for a 400 megawatt per year production facility. That is truely awesome.

See: http://www.nanosolar.com/

First production is expected in 2007 so we won't have long to wait.

Nanosolar is just one of numerous other next-gen solar technologies. Which works and which doesn;t will be interesting to see.

In addition the EV's are so efficient that replacing the US auto-fleet requires less than a 20% increase in total GRID electric power. Any combination of wind/solar/nukes could easily manage that.

What will be much harder is scaling up the production of the EV's.

On the other hand once Oil averages $100 per barrel there will be a big financial incentive to shift.

What led you to that notion?

With light water reactors, energy recoverable uranium is about 1 trillion tons, or 25000 years worth if the world had 20000 1 GW reactors. With thorium breeders it extends into the hundreds of millions of years.

http://www.nuclearinfo.net/Nuclearpower/UraniuamDistribution

In Heat, Monbiot states that PV panels have a payback period of 25-30 years and an operating lifetime of 25-30 years. On this basis, dollars in equals savings out.

Cheers!

PV is still expensive, at $.25/kwh. Where electricity is cheap, PV don't pay back. Where it's expensive, like Japan and parts of California, it does. Costs are plummeting and volumes soaring (40%+ growth per year), though prices aren't dropping due to skyrocketing demand. Prices will drop dramatically pretty soon, as silicon supplies catch up, and thinfilm PV expands.

The concern over raw materials seems to revolve mainly around indium in the newer generation of thin film solar panals. These are somewhat described below, and are the new CIS and CIGS type panels. The confluence seems to be that these are rapidly surpassing the older silicone panels in both efficiency and reduced cost of construction:

http://www.aip.org/tip/INPHFA/vol-9/iss-2/p16.html

http://www.azom.com/details.asp?ArticleID=1165

http://www.nrel.gov/ncpv/thin_film/pn_techbased_copper_indium_diselenide.html

http://www1.eere.energy.gov/solar/cis.html

The rare mineral seems to be Indium:

On Wikipedia, we get the scoop on indium, which is not exactly a common element, and in 2005 the price is given at $900 per kilogram, "unusually high" (it has been given as $188 per kilogram in 2000, by the USGS, so the price appreciation has exceeded even oil).

Other useful stats here:

http://education.jlab.org/itselemental/ele049.html

Now, the bigger picture, per Wiki,

"he Earth is estimated to contain about 0.1 ppm of indium which means it is about as abundant as silver, although indium is in fact nearly three times more expensive by weight. Canada is a leading producer of indium. The TeckCominco refinery in Trail, BC, is the largest single source, with production of 32,500 kg in 2005, 41,800 kg in 2004 and 36,100 kg in 2003. Worldwide production is typically over 300 tonnes per year, but demand has risen rapidly with the increased popularity of LCD computer monitors and televisions.

The only sourcebook I have seen (but cannot afford!) on Indium:

http://www.amazon.com/exec/obidos/tg/detail/-/3540431357/qid=1113491823/sr=8-2/ref=sr_8_xs_ap_i2_xgl 14/104-6756629-3293514?v=glance&s=books&n=507846

The largest supplier of indium, founded in 1934, based, in all places, in Utica NY:

http://www.indium.com/corporate/

The largest supplier comments on supply concerns:

http://www.indium.com/supply.php

Brief aside: This is an absolutely fascinating little company to me, nearly silent and invisible, with only 300 or so employees, it is rapidly becoming a very important firm. Indium itself is extracted mainly from zinc mining as a byproduct, but the price has often been so low and unstable, most zinc miners didn't even mess with extracting it.

USGS data on indium:

http://minerals.usgs.gov/ds/2005/140/indium.pdf

http://minerals.usgs.gov/minerals/pubs/commodity/indium/#contacts

a very concise and fascinating little page here:

http://minerals.usgs.gov/minerals/pubs/commodity/indium/490495.pdf

----

Technology improvements in crystal growth

http://www.afrlhorizons.com/Briefs/June01/SN0008.html

The technology is moving VERY FAST. Indium is mainly used in flat screen panel displays for computers, TV's and handheld devices, but apparently the volume of indium per foot of screen is very small, with one source claiming that even a doubling of the price added only one dollar to even a large screen display or TV. If the volume needed is this small in PV panels, then it is not a major problem. Recycling the indium is easy given it's softness, and it is claimed that 85% is in fact recycled. More could be if the price stays high, and much more could be claimed from zinc and other mining operations. We just don't know how many millions of square feet of solar panel may be called for soon, thus, the volume of what has been an obscure little metal up to now could take off.

JUST HOW BIG CAN THIS BE?

http://www.cnn.com/NATURE/9907/26/solar.enn/

http://www.physorg.com/news9186.html

I just want to close by putting this in some perspective. The advances in thin film solar has left everyone somewhat disoriented in the speed with which they have occured, and we are still at the front end of this. The fact that true giants like Honda and Siemens have joined the chase is setting the stage for a true worldwide CIS/CIGS panal race. With American Nanotech firms in the fray, the industry has much in common with the computer chip industry and the rabid competition which broke loose there, and we are aware of the staggering cost cutting that proved possible in the 1980's and 1990's there. The question is, was many of the cost cutting and efficiency gains discovered there, and so will not be so easily achieved in the solar panel business? Only time will tell. It is obvious that in some very large markets, especially the sunny and heavily populated sunbelt, this could begin to have major impacts and soon. The remarks by CERA, the discomforted remarks by OPEC spokemen somewhat disparaging the too fast adaption of "green energy", and the concern by ExxonMobil and others that people might take this "peak" talk seriously shows that for the first time, alternative energy is posing at least a percieved future threat.

What has to be of concern is the possibility that the cat is out of the bag, that is, even if oil prices drop, the technology is moving so fast, that alt energy tech prices will drop even faster and efficiencies will continue to climb. People are starting to look at the alternatives as competitive on much more than just efficiency grounds. Reviewers who have driven the Toyota and Lexus hybrids sing praise on the smoothness, quietness, all around comfort, and efficiency of the cars, and are starting to think about the possibility of the plug hybrid as a car you would refuel less often than you used to have to get an oil change in the old days. Solar panels are promising a backup in case of storms, distributed clean power AND cost possibly matching that of fossil fuels. We may actually be at the edge of the long promised revolution.

Right now, the "rare" minerals needed to keep the revolution going seem not to be in such short supply as to halt the advances. In fact, the shortage of silicone often touted is not a shortage of raw material, but instead a shortage of factory and facilities, encouraging both alternative material development (CIS and CIGS panals) and added fabrication facilities. This is the sign of an industry on the march. Economics of scale are moving in the right direction.

Likewise, the battery developments brought on by the cordless power tool market and the handheld devices market are speeding the advance of advanced batteries.

If we want to think about where we could be in a few years, think back to this:

Computer and internet industry, 1989, compared to the IT industry, the internet, handhelds, Blackberrys, wireless net industry of 1999....it can happen that fast.

Roger Conner known to you as ThatsItImout

- Battery systems tend to have a negative EROEI. We accept this as we want the associated energy quality, portability, and storage. Automotive battery systems would therefore increase primary energy demand not substitute for it. Your view?

- Domestic PV systems would also appear to require battery storage to ensure stored power during night and periods of cloud. Same problem as above, an increased primary energy demand.

- With respect to OPEC concerns over growth of substitutes, the past strategy has always been to open the manifolds, flood the market, drive down the price, kill the competition. OPEC's apparent inability to respond in this way is supportive of peak.

- A second interpretation of 3 is that OPEC members now face socio-economic constraints in that they cannot accept lower prices. Once habituated to spending $60 a bbl income then a drop to $40 a bbl represents a domestic fiscal crises. Given the underlying instabilty of the petro-states, we then have the possibility of flow interruptions resulting from these above ground factors.

Cheers!On 2: solar is probably most cost-effective up to about 35% of the electricity market. Beyond that you start to have increased marginal costs to handle intermittency, as you mention. Wind is somewhat negatively correlated with solar: wind is often stronger in winter, night and cloudy weather, so the combo of wind & solar is more cost-effective. There are many strategies to handle intermittency: pumped storage, geographic diversity, and so on. Hydro and gasified biomass can fill in the remaining gaps.

on 1: I'm not quite sure what you mean. Batteries will always put out a little less than what was put in, though li-ions lose much less than NIMH or lead-acid (roughly 90%, vs 70% or so). E-ROI isn't really a concept I would apply to batteries.

Battery EV's are likely to be about 8x more efficient than the average gasoline car, including battery losses, greatly reducing primary energy needs. Further, the energy needs can come easily from renewables.

My concern in 1) is with issues of scale and Net Energy Analysis. We accept the negative EROEI on batteries as we desire the benefits that only batteries can provide. But at present batteries represent only some minor % of our energy utilization system.

If we are contemplating the conversion of global roadway transportation systems to battery stored energy then there would be scale effects. If current energy consumption is X then the proposed conversion is X+Y.

My sense is that we are contemplating meeting energy constraints through proposed utilization of systems that require higher energy inputs then the current system.

Those inputs may be from renewables. But the infrastructure to support the renewables will have an energy demand associated with it. In other words, we recognize a series of pending energy constraints and seek to switch to alternate energy sources. However, there will be significant switching costs both in invest dollars and in energy required.

It strikes me that we may have only a limited opportunity window in which to make the transition. Hirsch mentions 20 years. That is not a long period of time.

I think you mean efficiency: sending energy through batteries means a loss of energy at that point, the magnitude of which depends on the efficiency of the battery. As I mentioned, li-ion batteries are pretty efficient, losing less than 10% of the energy cycled through them.

"My sense is that we are contemplating meeting energy constraints through proposed utilization of systems that require higher energy inputs then the current system."

Not really. Liquid fuels are incredibly inefficient: in a typical light vehicle (car, SUV, pickup) only about 15% of the energy in a gallon of gasoline gets converted into motion.

OTOH, electric vehicles (EV's) are much more efficient: including battery, power electronics and motor efficiency you can get 80% efficiency.

Converting biomass to liquid fuels is perhaps 4% efficient: in a typical process 25% of the feestock is converted to biomass, which is then burned at 15% efficiency. 25% x 15% = 4% total efficiency.

Converting oil to liquid fuels is perhaps 12% efficient: drilling is 90%, refining to gas is 90%, which is then burned at 15% efficiency. 90% x 90% x 15% = 12% total efficiency.

So electric transportation, whether through rail or EV's, is much more efficient than liquid fuels like ethanol or gasoline and will allow a large reduction in total energy useage.

As far as Hirsch's timeline is concerned, he did an overly simplistic analysis, and didn't even look at EV's or rail - he just looked at alternative supplies of liquid fuels, all of which are extremely large scale (and so very slow to build) and capital intensive. Vehicles can be converted much more quickly: new designs can be on the road in 3 years; new vehicles are used more than older ones so 5 years production could replace 60% of highway miles driven; and hybrids can be upgraded to plug-in hybrids in a day.

Does this help?

I have a worksheet on a renewable grid and would like your input.

Best Hopes,

Alan

Thanks for the feedback and thoughtful analysis. We seem to have full consensus on points 3 and 4 of BOP's list. I think the schizoid behavavior of Saudi Arabia and it's confused remarks are indicators of deeper proplems. You hit the nail exactly, I think, in that they may be having difficulty holding and raising. This is not to say they cannot do it. But the problem is they are having to take bigger chances and spend more cash in the attempt. As you pointed out, with a growing population and debt to service they need that cash for other things. I feel that if we do not see Saudi Arabia make a bid to ease prices to somewhere in the $45 to $50 and bring some sense of "comfort" to the markets soon and hold their position as the "swing" producer, it is indicative that they are having difficulty raising production. One would love to hear the internal debates in Aramco and Saudi policy circles, oh to be a fly on that wall! :-)

On BOP's other two points, (1) as another poster mentioned, the EROEI calculation is decidedly different between non-rechargable disposable batteries and rechargable batteries. The key with rechargable batteries is raising the life cycle number of discharge/charges they can withstand.

I want to pause here for a second, and ask all reading to think about this one barrier because it is a HUGE one. The ability to withstand deep discharge/charges in every increasing numbers of cycles is the absolute holy grail of the battery revolution right now. When used in a hybrid plug format, we have batteries now that are capable of storing enough power and energy per volume and weight to set the revolution in motion. But can they take thousands, even tens of thousands of deep discharges? That is now the deciding factor. As the life cycle durability goes up, the EROEI of the battery goes up. And as the life cycle durability goes up, the cost and risk of plug hybrid goes down. In other words, they are on the good side of the EROEI curve and getting better, while fossil fuels are on the down side and getting worse. To use a fashoinable word, the "trajectory" is with grid based transportation in both battery and renewable development.

The open question is how fast we can scale this, and whether the fossil fuel industry has one last blast of cheap fuel left to try to slow the advance of the revolution at hand. If you accept impending peak, you have to believe they do not, and the alternatives are on the march. But if you believe peak could still be 20 plus years in the future, that is simply too long to wait for a return on investment for most boomer age investors, either in the cash they invest in the markets or in the products they buy. They will play status quo and ride it out.

(2) on the intemittency problem of solar and wind, I think that far too much has been made of that as a major problem. First, there will be for a very long time "baseline power" by fossil fuel, i.e., the remaining coal plants (I know we hate it,but they are not going to junk them until they are spent) natural gas plants (and as wind and solar reduce the strain on natural gas supply, these may actually prove very efficient) and one hopes that the revolution toward reclaimed sewer and landfill gas, distributed generation involving small scale efficiet distributed natural gas and even propane generators, and pumped hybrid storage, we will see one of the most distributed, efficient and sustainable "smart" grids in the history of the industry. With talant, it is doable. (for those who have been asking what the kids should be learning for a future in the post carbon era...hint, hint :-)

BUT, no one should make this sound easy. It is going to take an effort on the scale that the original industrializing of America took. Roll the effort, talant, money, and propaganda effort that was needed in the Depression, the World Wars, the TVA project, the Cold War and the Apollo race into one great fight, and you get a mental picture of what is called for. The youth MUST be informed and won over, this will be the career of their lifetime, We can help, we can inform, but those of us over 40 years old are really like coaches, not players in a football game. It will be theirs to win.

Roger Conner known to you as ThatsItImout

" Roll the effort, talant, money, and propaganda effort that was needed in the Depression, the World Wars, the TVA project, the Cold War and the Apollo race into one great fight, and you get a mental picture of what is called for."

This may overstate things a bit. WWII, for instance, was pretty all-consuming: that level of effort would certainly do it. That would be an appropriate level of effort to prevent global warming, though I'm not optimistic that we'll get to that level. I'd be pretty happy if we got to the level of effort of the Cold War.

"I'd be pretty happy if we got to the level of effort of the Cold War."

I would accept that, at least it would be more effort than say the invasion of Granada, which is comparatively about where we are now! :-)

Roger Conner known to you as ThatsItImout

It will always be more politically expedient to develop an excuse other than 'the planet has finite resources'

I've previosly cited the example of the Texas State Geologist last year talking (33 year after we peaked) about the possibility of Texas mathching its peak production (and at a minimum, vastly increasing our production), through the use of "better technology."

I will place my bets on them investing in the older mature fields and less on exploration.

oilcan

So, on what, exactly, are you placing your bets?

And, do you believe everything Total tells you?

Others here should be advised that the revelations assigned to IEA above are not new. The IEA initiated the "Alternative Scenario" as a cautious version to the Reference Scenario in 2004. This is its third Update. It is the version that we use on our Depletion graph. Last year they commenced an even scarier version: the Deferred Investment Scenario.

The article did not speak of OAO's taking new positions in existing JVs so for the moment I have to assume they are talking about new JVs. Still with this move it would seem that we are seeing a new level of State/political control in the Russian oil sector.

My expertise lies in none of these fields.

Dan Amoss email post caught my attention.

http://www.prosefights.org/gas/gas.htm

regards

http://www.aci.net/Kalliste/bw1.htm

Thanks for another great post, Dave! I appreciate your writing and research skills, they really help clarify the positions in the peak oil discussion!

Copy of what I just posted on REDDIT:

--------------------------------------------

This is a great read by a very informed writer. The Law of Diminishing Returns is profoundly affecting global fossil fuel supplies, and continuing geo-political crises will only make this worse going forward. Please study and forward this article to others.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

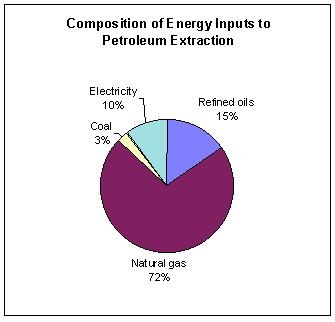

Dave, given that natural gas has gone up several hundred percent since 2000, and that it is by far the largest energy input into the oil and gas sector, its no wonder that energy companies budgets have skyrocketed.

Beneath the thin veneer of higher costs lurks our old friend (and enemy) net energy analysis

Let's not fall into the trap of denying the role of "above ground issues" just because CERA mentioned them. That would relegate our intellectual process to oppositionalism.

I do think it is fairly obvious that a portion of the production fall off in Mexico and Venezuela are related to management and investment. If the above ground situation improved it would provide more supply relative to the non-improvement scenario.

This does not mean that the primary cause of production declines in the world's fields is geological and unavoidable. I am not claiming that any kind of technology, investment or management improvement would reverse the decline in those countries.

CERA is wrong in claiming that these factors could turn the situation around. That doesn't mean they are insignificant. The corollary to this is that even if increased prices and improved methods do allow production to increase somewhat, or the peak to be delayed, it ain't gonna change the big picture.

I'm glad you presented this issue in a balanced light and wanted to highlight it as I don't think all other commenters give it the same treatment.

"Santos considers Jeruk oil future

The future of Santos Ltd's Jeruk oil discovery in offshore Indonesia is in doubt, after the Australian energy company again downgraded its reserves and said it was considering whether to continue with its development.

Santos said that the upside recoverable oil resource for Jeruk, in which it has a 40.5 per cent stake, was likely to be under 50 million barrels.

.....Santos' pre-drill resource estimate for Jeruk was for a maximum potential of 170 million barrels."

http://www.theage.com.au/news/Business/Santos-considers-Jeruk-oil-future/2006/11/24/1163871588444.ht ml

So, pre-drill (think Freddy Hutter's estimates) equals 170 million barrels, now less than 50 million and mabye being capped? Where else will this be repeated? Geology wins every time.

This is a common failing of analysis (particularly those that want to minimize PO). The highest # in the range is assumed to be the best estimate.

Jack and all other deep water Lower Tertiary plays are estimated to have 3 to 15 billion barrels of oil equivalent. But this translates into Jack #2 discovered 15 billion barrels of oil (equilavent, i.e. NG gets lost as well).

Take a data range based upon massive uncertainity and assume the Best !

For once NOT Best Hopes,

Alan