Lies, Damned Lies and Government Oil Production Forecasts?

Posted by Euan Mearns on October 17, 2006 - 10:31am in The Oil Drum: Europe

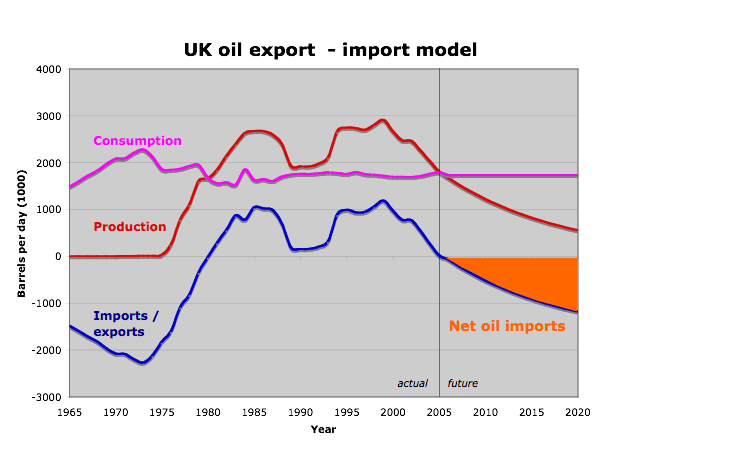

These forecasts have a significant impact upon forecast trade balance, particularly in the UK which has just turned net oil importer. So lets see how the UK and Norway are going to pull off this gravity defying, Hubbert denying stunt.

This post was initially inspired by an exchange of views with the Norwegian Energimann who pointed out that the Norwegian Petroleum Directorate (NPD) was forecasting Norwegian oil production to rise in the coming years. Around the same time, a news item on Drumbeat attributed to a UK Department of Trade and Industry (DTI) spokesman suggested that UK oil production was also set to rise, and that the UK was to remain self sufficient in oil until 2010. This was somewhat contradictory to my prognosis of UK oil production decline that showed oil imports rising steadily from 2006 to 2012 resulting in a major hole in the UK trade balance. It was brought to my attention that the UK DTI also had an oil production forecast that was worthy of scrutiny.

I wrote to named contacts at both the NPD and DTI asking if they would like to explain their optimism. The NPD responded in a timely manner, whilst the DTI have been guarded in their response.

At the outset I should like to point out that the title of this post is a play on the saying "Lies, damned lies and statistics" and it is up to the individual reader to decide where the truth lies.

NORWAY

Norwegian oil production has been examined by Khebab, the Energimann and by myself, Cry Wolf in recent months. Norwegian oil production peaked in 2001 at an average daily rate of 3.418 mm bpd, and when production started to fall in the World's third largest oil export land, the whole world should take note. Norway, Saudi Arabia and Russia account for > 50% of the global oil export market. Norwegian oil production forecasts are therefore significant to both world export capacity and to EU energy security. Throughout this post when I refer to oil production I am doing so in the BP context of crude+condensate+NGL.

The Norwegian Petroleum Directorat (NPD) has responsibility for managing Norwegian oil and gas resources and report on a regular basis to the Norwegian Parliament. Part of this reporting responsibility includes forecasts for future oil and gas production and in 2005, the NPD forecast (in Norwegian) that Norewgian oil production was set to rise in 2007 - 2008.

It seems that the NPD also accepts that Norwegian peak oil production has passed and it is the nature of the post-peak decline that is the subject of this discussion.

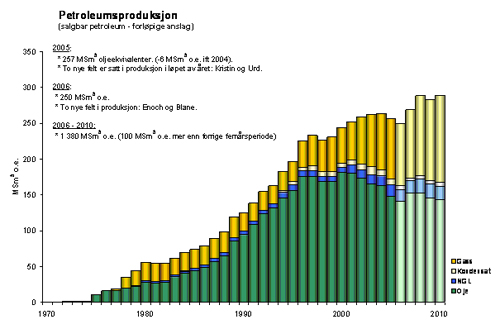

The upper gold band charts Norwegian gas production which is set to grow. The blue band charts NGL which together with oil (green) are forecast to rise in volume in coming years. Chart from the NPD (in Norwegian)

The NPD forecast from 2006 to 2010 is as follows:

| 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|

| Oil (million Sm3) | 140.8 | 152.7 | 152.6 | 145.8 | 143.6 |

| NGL (million tonnes) | 8.7 | 9.4 | 10.4 | 10.1 | 9.8 |

| Condensate (million Sm3) | 5.6 | 3.4 | 5.1 | 5.1 | 5.6 |

| Total mm bpd | 2.73 | 2.91 | 2.97 | 2.84 | 2.80 |

Conversion factors given by BP have been used to normalise to mm bpd.

Norwegian average daily production since 2001 (source BP statistical review) was as follows:

| Mm bpd | Decline% | |

|---|---|---|

| 2001 | 3.42 | |

| 2002 | 3.33 | -2 |

| 2003 | 3.26 | -2 |

| 2004 | 3.19 | -2 |

| 2005 | 2.97 | -7 |

| 2006* | 2.82 | -5 |

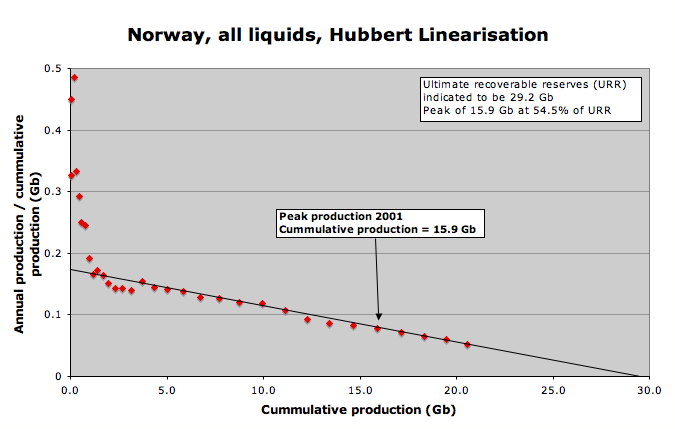

The simple, top down approach (Hubbert) to forecasting future Norwegian production is to presume that the established decline rate of around 7% will continue. The NPD approach is more complex and this produces a very different outcome for forecast Norwegian production by the year 2010, less than 5 years from now.

Hubbert linearisation for Norway using BP data (crude+condensate+NGL). It will require a super-human effort to modify the decline curve established since 2001. NB - this is my first HL - but not my last. Thanks to Khebab for assistance.

Two very different forecasts for future oil production in Norway. The difference between the 7% decline model and the NPD forecast is 700,000 bpd by 2010 - the equivalent of two giant fields.

By the year 2010, the NPD are forecasting 2.8 mmbpd while the 7% decline model implies daily production of 2.1 mmbpd. The difference of 700,000 bpd is equivalent to the production from two giant oil fields and is therefore both hugely significant, and difficult to explain away by different forecasting philosophies. Where does the truth lie?

In a White Paper (pdf warning - in English), presented to the Norwegian Parliament in 2002 the NPD recognised that left unchecked, natural decline will lead to Norwegian oil production close to zero by 2020. This was called the decline scenario. The NPD looked to a more optimistic future based on higher recovery from existing fields, development of new fields and new discoveries and this was called the long term scenario.

The blue line approximates a Hubbert style decline scenario. In their long term scenario the NPD envisaged greater exploitation of existing reserves, development of discovered but undeveloped resources and new discoveries, all leading to furure production growth that would compensate for their dying giant fields.

The 2002 White Paper gives some insight to the thinking (or is it actually hoping) behind the Norwegian view of future production:

The lower of these involves production declining towards 2020, when oil output virtually ceases. This covers anticipated output from fields in production or covered by a development decision, and is termed the decline scenario. In the other scenario, production is maintained at a substantially higher level. This long-term scenario involves the realisation of profitable projects which ensure production of oil for at least 50 years and gas in a century-long perspective. The government's clear objective is to achieve the long-term scenario.

The long-term scenario can be achieved if a commitment is made to efficient exploitation of the resource base. As the curve in figure 1.1 shows, the resources exist to sustain substantial oil and gas production towards and beyond 2050. This perspective is conditional on oil prices staying at a reasonable level and on a commitment by the oil and gas industry and the authorities to developing petroleum resources in a cost-effective manner. The aim is to secure the best possible resource utilisation and the highest possible value creation for the Norwegian community.

The NPD forecast for the period 2006 to 2010 embraces this ambition for a long term future for the Norwegian oil industry based on ever increasing recovery factors, new field developments and new discoveries. But is any of this likely to happen?

In their response to my query about the production forecast, the NPD made the following points:

1) 50 discoveries already made are likely to be developed in future2) There are more than 200 active projects for increased oil recovery (IOR)

3) A tight rig market may result in delays that may undermine the forecast

4) Several large fields experiencing decline

5) In June, actual production was just 0.2% below the NPD forecast

Let us look at these points in order:

Discovered undeveloped

Whilst the NPD may have 50 discovered undeveloped fields on their books, near term the cupboard is nearly bare. One of the most important points here is the fact that the Kristin gas condensate field came on stream in November 2005. So far in 2006, Kristin has produced:

1.777 million Sm3 of condenstate

0.653 million Sm3 of NGL

Over a 243 day period this translates to about 63,000 bpd of liquids. This substantial new production is included in production data that shows a 5% decline January to July 2006 and this illustrates the point amply that even substantial new fields, like Kristin, are not enough to arrest the decline from dying giants (see below).

In 2006, Blane and Enoch, two fields that straddle the UK - Norway median line, are due to come on stream but these relatively small fields will unlikely be able to arrest production decline in 2006 - 2007.

Increased oil recovery

No details are given about the 200 active IOR projects but one has to presume these will include water injection, gas injection, infill drilling, 4D seismic and well work overs. The main point I would make here is that this type of activity was going on last year, and the year before that and the results are included in the production figures to date. Only if there is a great acceleration in IOR activity or some new technology is introduced will the decline pattern be modified.

Tight rig market

For Norwegian production to make a dramatic U-turn, as forecast by the NPD, would require a dramatic upturn in development, and IOR related drilling. For the last 5 years there have been around 18 rigs working offshore Norway (plus platform drilling units) and unless this number were to increase substantially, it is difficult to see where additional drilling related production increases will come from.

The decline of large fields

The decline of Giant Fields is the slippery pole that Norwegian oil production needs to climb.

Production from 7 giant fields is the power behind Norwegian oil production. These fields have performed beyond expectation, and now it is time for them to die.

Decline in these 7 Giant fields was 193,000 bpd in 2005 (13.6% of their combined production). It will take a lot of IOR and new field developments to compensate for this lost production from the dying Norwegian giants. New production from substantial fields such as Kristin is simply swamped by lost production from these 7 fields.

The NPD forecast made in 2005 is accurate for 2006 production

In 2004, the NPD overestimated 2005 oil production by 7.5% and they were at pains to argue that their forecast had statistical uncertainty and that there was a 20% chance of it being wrong - which it was. So in 2005, they have been more cautious and forecast a realistic drop in production during 2006, and the 2006 forecast is indeed aligned with the current production. Herein lies a cause for concern because this may raise the predictive credibility of the NPD in the eyes of policy makers who may now be more inclined to believe the fabulous U-turn in oil production that the NPD forecast for 2007, 2008 and beyond.

This is no trivial matter. Norway is the World's third largest oil exporter and EU energy security is linked to how future Norwegian oil production unfolds.

NPD past forecast performance

In 2004, the NPD published a report (in Norwegian) with a forecast for oil production in the period 2005 - 2009.

A translation from Norwegian:

Liquids production has been between 185-195 million Sm3 o.e. per year (3.2 mmbpd) since 1996 and is expected to stay at this level until 2006/2007. The gas condensate Kristin Field will provide strong support to maintain this level. Decline in liquids production thereafter is estimated at 5% per annum. This forecast assumes that 15 new fields will contribute to maintaining production whilst two fields will be decommissioned.

The NPD production forecast for 2005 - 2009 made in the 2004 report

Whilst a detailed table is not given, from this Figure it appears that the following forecast is made:

2005 185 mmSm3 3.19 mmbpd actual=2.97 mmbpd overestimate = 7.4%

2006 195 mmSm3 3.36 mmbpd actual=2.82 mmbpd overestimate = 19%

As already discussed, in the 2005 report, the 2006 estimate was revised down from 3.36 mmbpd (estimated in 2004) to 2.73 mmbd (estimated in 2005) - a downwards revision of 23% in the course of one year. At $60 / bbl this amounts to $13.8 billion worth of miscalculation.

A glimmer of hope for Norway

One advantage that Norway has over many other oil exporting countries is that it controls a vast area of continental shelf. The North Sea, and small parts of the Norwegian Sea (mid-Norway) have been explored in some detail, but vast tracts remain unexplored, in deep water and the Barents Sea. Not all these areas are prospective, but there is a real prospect that giant fields remain to be found in Norwegian waters. This, however, is unlikely to affect oil production within the next decade.

Norway controls a vast area of the North Atlantic continental shelf and future giant oil discoveries cannot be discounted

THE UNITED KINGDOM

The oil production history of the UK is non-Gaussian. A production peak in 1985 was the result of scaling back of investment following the oil price crash of 1986. This led to the postponement of several new field developments and the Piper Alpha oilrig explosion in 1988 exacerbated this situation. Stuart Staniford provided further explanation by way of bi-modal discovery pattern.

The twin peaks of UK oil production, brought about by a combination of oil price crash in 1986, an oil rig explosion in 1988 and a bi-modal distribution in UK oil discoveries.

Renewed investment during the early 1990s, reinstatement of postponed projects combined with a number of large new field developments (Nelson, Miller and Bruce in the North Sea and Foinaven and Schiehallion on the Atlantic margin to name but a few) resulted in a second production peak in 1999.

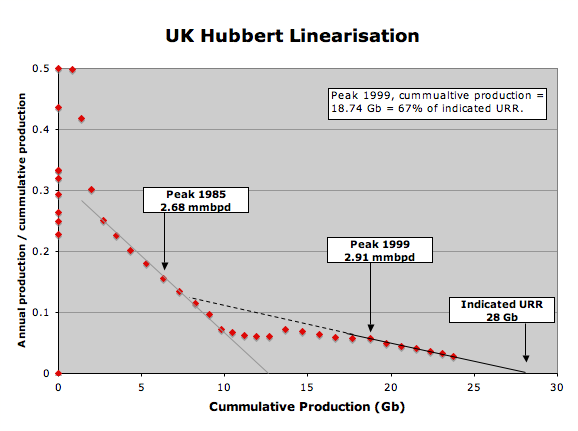

This gives rise to two major trends in Hubbert linearization. One can speculate production may have progressed along the dashed line, had projects not been postponed following the oil price crash of 1986.

Two linear decline trends in UK oil production are related to the twin production peaks described above.

The dogleg trend in the HL that starts in 1990, eventually leads to a linear decline trend that points to a URR of 28Gb, more than double that of the pre 1990 linear decline. The relevance of this type of production evolution for countries like Saudi Arabia needs to be carefully considered and may be discussed at a later date.

The UK DTI oil production forecast is based on a field-by-field analysis of data provided to the DTI by the field operators - so this is a comprehensive bottom up approach. These data are then adjusted by the DTI to history match previous deviations from company expectations and an allowance is made for development of new discoveries made in the forecast period (2006 - 2011).

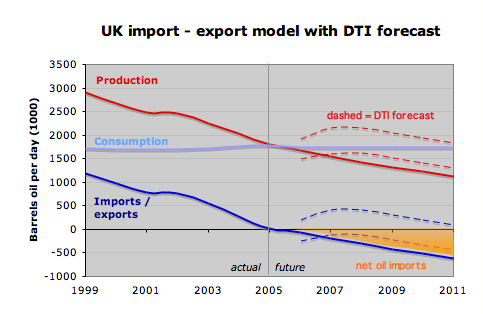

The solid red line charts a 7.5% annual decline from 2005 onwards. The dashed lines are based on the UK DTI production forecast. Crude oil 1 tonne = 7.5 bbls. NGL 1 tonne = 11.5 bbls.

The DTI provide a forecast range (see dashed lines on Figure above) that at face value is a reasonable approach. However, the range between the high and low estimate for 2006 is 28% (of the lower forecast value) and this range grows to 41% in 2011 and this huge uncertainty simply serves to obfuscate what the DTI believes is actually going to happen.

Other aspects of the DTI forecast are reasonable. The lower forecast range for 2006 is around 1.5 mmbpd and this is close to current production levels for 2006. And from 2008 and beyond, the decline rate is similar to that used in my 7.5% annual decline model.

The uplift in production between 2006 and 2008 is attributable to the Buzzard Field that is due on stream soon at an estimated maximum flow rate of 200,000 bpd - and it is here that the DTI forecast and comments made by a DTI press spokesman begin to diverge from reality - in my opinion. The UK North Sea has been declining at a rate of over 200,000 bpd for the last three years and if this were to continue then production from Buzzard would be sufficient to arrest decline for one year only. This would give rise to a shoulder on the decline curve like that seen in 2002 when the Elgin - Franklin fields came on stream. It is wishful thinking to believe that Buzzard alone will have the reservoir potential to reverse the production decline of the whole UK North Sea basin. A new field like Buzzard would be required every year to arrest production decline - let alone reverse it.

In a press statement attributed to Nick Turton of the DTI, which appeared on the unlikely named cattlenetwork.com, it is claimed that the Buzzard Field will offset production decline from the whole of the UK North Sea for the period 2007 - 2010. This would be a truly amazing stunt and smacks more of desperation than informed comment - but unfortunately this seems to be the official view of UK production given to the international financial press. (Note that the DTI did not make an official press release and Turton's comments are presumed to be informal).

Turton, whilst acknowledging that the UK has become a net importer of oil in 2006, sees this as a temporary set back and it is claimed that the UK will remain self sufficient in oil until 2010.

So why does this matter? Well first of all it is worth noting that the $ value difference between the upper and lower DTI forecasts amount to $68 billion between now and 2011 (at $60 / bbl). I am reliably informed that the DTI report to HM Treasury on production forecasts on a regular basis and it makes a vast difference to the UK trade balance whether reality lies closer to the upper or lower forecast limits. The lower forecast limit is in my opinion much closer to reality, but even it may prove to be over-optimistic.

Gordon Brown, UK Chancellor in charge of national finance facing a $68 billion uncertainty in oil revenues / imports.

Secondly, if the UK were to be more objective in their appreciation of declining oil (and gas) production then measures to mitigate the effect of decline could be put in place. In particular, I believe the UK should set a target to remain self sufficient in oil for another decade. This aim to be accomplished by a combination of a significant reduction in the consumption of liquid fuel combined with stimulating off shore production and exploration. The primary targets for reduced consumption must be automobiles, trucks and air transportation.

The Range Rover - off road luxury. A popular choice for the safe delivery of children to school in Aberdeen. 13 mpg urban cycle.

As an initial step, placing limits on the engine size of new cars and reducing speed limits would make significant fuel savings. The reward for this would be lower CO2 emissions, fewer accidents and enhanced energy security. These are all government objectives - so maybe it is time to turn these vote-winning words into actions? I believe that the UK public would be more receptive to fuel conserving measures if the reality about our indigenous fuel resources was more widely known.

THE PSYCHOLOGY OF DECLINE

In these production forecasts Norwegian and UK civil servants seem unwilling to acknowledge that the North Sea oil production bonanza may be approaching twilight. These forecasts seem to draw on the most optimistic of scenarios and in so doing they lose sight of objectivity and reality. Of course only time will tell if these official forecasts do actually prove to be over optimistic and I will revisit this subject in 6 to 12 months time to further evaluate the predictive expertise of the DTI and the NPD.

Norway, already one of the wealthiest countries in the World, and with rapidly growing gas production to compensate for falling oil production is well placed to withstand both energy and economic fallout should the NPD forecast prove to be over optimistic.

The UK and the EU are in much more vulnerable circumstances. The EU is already recording rising energy imports (pdf). I suspect that it will only be a matter of time before news of oil imports giving rise to a deteriorating UK trade balance hits the news headlines in the UK. It is difficult to tell whether UK and EU parliaments are aware of the energy peril that faces them. The official pictures painted by UK and Norwegian energy authorities are optimistic whilst the reality for the EU is increasing competition for oil in a shrinking international oil export market.

Finally, I would like to acknowledge the cooperation of the NPD and DTI in providing some background information for this post.

What we mean by this is sending and rating these links at reddit, digg, del.icio.us, /., fark, stumbleupon, metafilter, and the like. Reddit, Digg, and del.icio.us are available up in the little icons under the title. These services only take a moment to sign up for...so please, if you liked this piece, make sure to spend a few seconds and help this information get spread around--and make sure to hit the European sites for this one.

See this blog entry for how it can be done.

Very well said! Here is a copy of what I just posted on Reddit--hope it gets more eyeballs to read your keypost:

Very astute statistical analysis, IMO. The EU is going to be whipsawed by FFs imports resulting in a massive wealth transference to the exporters. The UK should be pulling out all the stops to encourage massive FF conservation, and maximizing biosolar powerup and permaculture relocalization.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

You have really been busy studying hard facts (and some fiction).

I hope you are aware that BP Statistical Review is listing all liquids (crude oil, condensate and NGL's) in their statistics.

Thus using BP data on HL may give some different results than using actual data for crude oil (+condensate?) from NPD, which maintains a very good database that can be reached through their website.

I have to digest your post in a quiet corner, and then I will return with more comments and perhaps suggestions.

Rgds

Energimann

NGM2

BP numbers are for Crude Oil + NGL:

Their numbers closely match EIA estimates for Crude Oil + NGPL.

Can you update Stuart's charts, specifically including the last few months' production?

TIA

WOW I know of two big projects that appear to have gone kaput. One on beneva road in which a they tore down a golf club house and the adjoining golf course now it is all a pile of dirt with weeds. The other project is on highway 41. Here they displaced dozens of trailer court residences and yet NO construction! And a third project a bit farther down from that 41 project on the way to siesta key another condo project in which a motel was torn down yet no condo. hmmmm

I think you're probably right about the over optimism in forecasts from government authorities, even in western world countries such as UK and Norway.

I think it is however unfair to write off the NPD estimate of liquids increase entirely. There are a couple of other explanations not mentioned in your post for Norway (the first which probably applies to the UK too).

1. With the increase in oil price in 2002 onwards, incentives to re-develop, infill etc increased again after the fall in activity at the end of the 90's - $10 oil and all that. There has been a lot of platform drilling, exploration, development work going on the last 4 years. The offshore supply industry has basically been stretched to the limit - mostly with delivering new projects on existing fields. This is now coming through in production - it will be interesting to see how existing fields produce over the next few years, ignoring new additions.

What the NPD failed to recognise, and possibly still is, is that the services market is so tight that projects are being delayed. The increase in production may not happen because of this.

2. Some reaonsable sized liquids projects will also be coming on stream or ramping up in 2007-08-09-10. These will supply - mostly NGL's / condensates but also some oil too, contributing around 200-300kbbl/d incremental in 2007 / 08 /09 (Snøhvit, Alvheim, Kristin ramp up, Ormen Lange ngls, Skarv, Gjøa). Kristin has a name plate capacity closer to 125kbbl/d liquids - though we'll see whether it gets there.

Taken together I believe that these come close to matching the NPD's forecast in 07,08,09, though I think 2010+ is likely over optimistic based on current investment decisions and fields on track to be developed.

Anyway - don't right off the NPD too much, I think they're probably one of the best government oil / energy agencies out there in terms of expertise and transperancy (and no I don't work there :-).

WRT ramping up of drilling activity - my feeling is that this was a at least partly ramped up last year and the year before - so it is only the incremental increase in drilling that will count this year and next.

The comments you make about NGLs are noted. The only one I checked out was Ormen Lange - where I had input from the Energiman - who reckoned the NGL production here woudl be "minimal" - maybe he could come back with his calculations here.

Are you able to put any dates and numbers on NGL on those other projects.

None appear on Skrebowski's mega-projects data base - so I assume they are < 50,000 bpd. If all these projects together add 200,000 bpd NGL between now and 2010 - their impact will be barely noticed on the decline curve.

CW

I don't know the mega projects database, still new to this site - though I like it! Most of the fields below are new field developments and not tie-backs, none are really huge - though they are mostly at least 200-300mmboe resources each and some a lot more. The data is from public domain sources......

Alvheim - Marathon - 50kbbl/d oil start 2007, plateau 08. new FPSO

Kristin - Statoil - is below capacity - 80kbbl to go in 2007, new semi-sub

Snøhvit - Statoil - 2007, condensate - difficult - no info

Ormen Lange - Norsk Hydro - mostly gas - prob initially 20-30kbbl/d liquids, plateau 08/09

Skarv - BP - oil + ngl's 100kbbl/d 2010/11, new FPSO

Gjøa - Statoil - oil + ngl's 100kbbl/d 2010?, new floater

Tyrihans - Statoil - oil - 80kbbl, 2009

These are all fields close to or past sanction, but a lot are distinctly gassy, with the exception of Alvheim. There are a number of satellite type projects underway too, this is not an exhaustive list, you'd need to look at an industry database like that produced by Woodmackenzie to get a better idea on these.

Agree though - on looking at it again, particularly if only oil production and not total liquids - the gap will have to be closed by successful redevelopment work on the existing larger fields much as the NPD says. Their optimism in this area could well be questioned!

cheers :)

The sort of activity that might make a big difference is new horizontal wells on Troll - I'm not sure to what extent all the vast acreage here has been drained.

No re-development of Troll likely in the near term. This will happen post 2010 and then likely gas focussed.

-----------------------------------------

I think the intention of the post from Cry Wolf was to have an investigative look into the liquids projections from NPD and DTI by summarising historical and present forecasts towards what became recent actual production. And further focus on how hard it is to develop decent projections for future oil (liquids) production even if massive quality data are available.

Something to think about when trying to predict "Peak Oil" and the downslope.

The historical production (crude oil, condensate and NGL's) data from NPD documents that liquids production from NCS is in rapid decline as shown below;

2002......3 319 kb/d

2003......3 264 kb/d

2004......3 188 kb/d

2005......2 969 kb/d

2006 YTD. 2 812 kb/d

Ormen Lange has an initial GOR (Gas OIL/CONDENSATE/LIQUIDS Ratio) close to 17 000 (cubic meter/ cubic meter), which makes it a very dry gas field. Ormen Lange will on plateau deliver 16 - 18 G(B)cm/a natural gas, expected by fall 2009. This would translate into a liquids production of 1 million cubic meters of condensate annually or 16 - 20 kb/d using initial GOR.

NPD in their resource accounting at end 2005, does not list any NGL's for Ormen Lange. However it has happened before that liquids has been reclassified, but this should have only minor impacts on liquids production.

Yes, there has been an increase in IOR projects on NCS (Norwegian Continental Shelf), but as of September 2006 and based on NPD reported production figures; it is hard to spot the effects from these. It could off course mean that they could come later, and if so, it should be expected to result in a stabilisation/reversal in the production declines from the mature fields. That would of course be nice, but it should not be expected to happen.

Condensate fields on NCS with more than 10 kb/d, Kristin, Mikkel, Sleipner East + West, Sigyn and Åsgard. These 6 fields had an average daily condensate production of 166 kb/d versus a total for NCS of 172 Kb/d for the first 8 months of 2006 according to NPD data.

Condensate production is declining with the biggest produces (Sleipner E + W and Åsgard) and this decline will be offset with the ramp up of the production from Kristin for some time.

In August Kristin was close to 70 Kb/d (condensate and NGL's), and is expected to increase to name plate capacity in 2007.

Condensates from NCS had a high of 211 kb/d in 2003, and for the 8 first months of 2006 had an average of 172 kb/d according to NPD data.

NGL's production increased with 37 kb/d from 2004 to 2005. For the 8 first months of 2006 NGL's production further increased with 16 kb/d relative to all 2005. These numbers are from the NPD data base.

Minor increases in condensate production from NCS through the next couple of years could happen, but it is more likely to remain flat for a couple more years and then decline.

For NGL's there should also be expected some minor increases from NCS, but these are expected to be below 50 kb/d. Average NGL's production from NCS for the 8 first months of 2006 was 287 kb/d.

The crude oil production from fields that has been sanctioned and that has started to flow or will start to flow from now to 2010, is expected to "Peak" by 2008, from where these additions will start to decline.

Even Tyrihans with a scheduled start up in fall 2009 will only offset the declines from these new fields. In the mean time all the other oil fields on NCS will continue to decline.

It should be expected that condensate and NGL's only partly would offset the declines in crude oil production from NCS.

These were some hard facts in a hurry.

Rgds

Energimann

If it were the case that theses giants had been mismanaged - and there was a lot of unswept oil, then there would be hope that IOR may deliver significnat returns. But as you know, these fields have been very well managed and have already performed way beyond expectation.

It is perhaps here that the NPD has been caught in the optimistic trap. I came across an old NPD presentation that showed they consistently underestimated production on the way up - and they had to adapt to this by raising their own expectations. But you cannot expect fields to over-perform for ever. Past over performance was a bonus - and the price might be under-performance / more rapid decline, on the way down. The NPD are hoping that these fields will over-perform on the way down too.

To be honest I do not know if there is a link between economy/curreny and oil importing/exporting nor do I have a clear ideal of how to conceptualize this and analyze the relationship. How much of an affect does the money they make from exporting oil have on an economy and currency? Is the US a good example having been an exporter and now an importer?

Any thoughts?

Thanks.

The Brits sell a truly astonishing range of goods and services to the world and we make far more from other people's oil than we make from our own (BP and Shell work all over the world.) We also make more from banking than we make from oil.

For instance, interesting to note, the ferry that recently sank in the Red Sea - the black box came to the UK for decoding and I don't suppose we charged the Egyptians cheap for it.

The Brits will be OK for as long as anybody is OK. If TSHTF the Brits will be among the last to find ourselves up to our eyeballs in doo-doo.

and yes, it's generally considered that oil money was the reason the Norwegians voted No to Europe. Nothing much to gain from it.

The British are presumed to by diehard psychotics in defense of the Pound... but the same applied to the Germans and the DM, and, well, nobody died. I suspect that the UK will join the euro, but probably after a crash of sterling. (as an EU taxpayer, I wouldn't want it at current exchange rates!)

;-)

I think you are on to something here CW.

NGM"

Falling North Sea oil and gas production will hit the trade balance, and the pound will go down. With the onset of recession - maybe mild at first, the government will struggle even more with debt, and may be tempted to raise taxes - again.

So heavily indebted consumers may face higher interest rates, higher energy costs, higher import costs and higher taxes. If the property market turns down - then the debt driven boom will be at an end.

The UK still has a grave pensions crisis, and the government is over extended on spending commitments on health, education and the eledelry - and as a nation we are growing older by the day.

So I am expecting a turn down (or maybe crash) in property and steep fall (maybe crash) in equities. Property and equities are all pseudo wealth - as a nation we have turned lazy and it is difficult to see where all this wealth has actually been earned - all powered by cheap and plentiful energy.

Of course, project managers of all sorts are also chronically disposed to assume all will go well, that resources (rigs) will be available when needed. But as we move down the Hubbert Peak, we will need far more rigs as the discoveries shrink in size but increase in number.

Great analysis. Thanks.

CryWolf Said: "As an initial step, placing limits on the engine size of new cars and reducing speed limits would make significant fuel savings. The reward for this would be lower CO2 emissions, fewer accidents and enhanced energy security. These are all government objectives - so maybe it is time to turn these vote-winning words into actions?"

Hmmm, vote winning actions?

Have you forgotten the fuel strikes already?

I seriously doubt that the general UK population would accept lower speedlimits that we've already got, and few would support such a draconian measure as banning certain engine sizes.

It would smack far too much of desperation, especially as Germany with no indigenous oil reserves not only buys many large engined vehicles but it also manufactures them.

Like the States, the concept of a 55mph limit and turning down your thermostat & wearing a jumper would be seen as a big step backwards.

Other countries survive whilst being net oil importers.

I don't see why the UK can't as well.

Andy

I also think the government backing down over the fuel protests was a big mistake. It was incompatible with their new found "green credentials" and new found concerns over "energy security" - basically spineless vote winning behaviour.

Looks as though airlines are being put into the crosshairs:

http://news.bbc.co.uk/1/hi/sci/tech/6056620.stm

(From the article:)

So, the airline industry's share will add on 0.5% per year for the next 46 years. Possibly significant, but probably not enough to justify the pillory from the press.

Strangely, the increase in less fuel efficient vehicles (like the Range Rover illustrated) is conveniently ignored. Clearly, there are more votes to be gained from not annying drivers than there are to be lost going after the low-cost airlines.

How NPD's forecast have performed YTD based on actual data as of august 2006.

In your introduction you listed;

Crude oil 140,8 MSm3

Condensate 5,6 MSm3

NGL's 8,7 tonnes

By conversion from tonnes to Sm3 NPD proposes 1 tonne = 1,9 Sm3, thus the NPD forecast becomes in kb/d;

Crude oil 2 426 kb/d

Condensate 97 kb/d

NGL's 285 kb/d

TOTAL 2 808 kb/d

Actual year to date production as of August 2006;

Crude oil 2 353 kb/d

Condensate 172 kb/d

NGL's 287 kb/d

TOTAL 2 812 kb/d

Which so far for 2006 is spot on.

The discrepancy in crude oil and condensates may be explained that production on Kristin initially was believed to be classified as crude oil and is presently reported as condensate with 46 kb/d (YTD).

It is the NPD forecast for the years 2007 - 2010 that remains to be seen will be met, given present declines in crude oil production.

Energimann

I have a vain fantasy that they may take heed of what is said here. As always though, I am prepared to be wrong and admit it if I am wrong - because what we are looking at are two different interpretations of one set of data and circumsatnces.

http://news.com.com/Sharp+expanding+beyond+silicon+in+solar/2100-1008_3-6126899.html?tag=nefd.lede

Oil and fossil interests will stop it unless government policy taxes fossil sourced energy - necessary for environmental, depletion and security reasons.

To be brutally honest, I don't see any other course of action actually happening in the real world other than fuel shortages forcing massive efficiency improvements.

I guess I subscribe to the "over a cliff" consumption pattern where business as usual continues (as its impossible to force an alternative in the political climate) right up until shortages kick in.

I'm not too bothered about shortages, as it will hurt others far more than myself. Those with the least efficient vehicle will be forced to travel the least, as I would believe there would be a strong chance of rationing in the event of true long term shortages. By already having one of the most efficient cars money can buy, I'd be able to get the most out of a gallon of fuel. The rest of the time I can cycle.

Obviously road transport and agriculture would get first refusal on limited fuel supplies.

Of course it would be nice if the UK could plan ahead, but frankly, look at our track record on this kind of stuff.

Most railway lines closed in the 1960's

Most city centre electrified trams/busses removed circa 50s - 60s

Rail network privatised in the 80s/90s

near collapse of rail network subsequent bailout by govnmt.

Privatisation of electrical supplies leading to the collapse of the economic business case of the nuclear industry leading to govnmt bailout

etc etc.

So, shortages a'la 1970's here we come.

Andy

http://uk.theoildrum.com/story/2006/9/17/135527/399

One question is where we will import our oil from? Azerbaijan seems a likely candidate - but we may need to send troops to secure supplies?

Here are a couple of letters that they did publish By 2025, aircraft will be flying on empty and A move back to coal will unwind our productivity gains

"The problem isn't that a successful economy can't run on imported energy it's that a successful economy can't manage the transition from exporting ~30% of indigenous energy to importing ~80% energy over a period of ~20 years. The absolute positions aren't so much the problem as the dislocation caused by the rapid transition."

Optimism rules UK.

I don't go with this idea that extraction rates will improve in the North Sea as in the Gulf (As a result of Selim Zilkhas reworking of data with improved computerised data analysis techniques - he bought the data cheap and sold out for US$1 Bn to El Paso)

The DTI are , as ever whistling in the dark.... principally to keep their jobs and please their political masters. Nobody wants to be the messenger that gets shot.