DrumBeat: October 5, 2006

Posted by threadbot on October 5, 2006 - 10:01am

Oil jumps on OPEC's first output cut since 2004

Oil jumped more than a dollar to above $60 on Thursday after an OPEC delegate said the producer group will cut output by 1 million barrels per day as soon as possible to prop up prices.Top world exporter Saudi Arabia will lower production by 300,000 barrels per day as part of the plan, the delegate said. Oil has slid from a peak of $78.40 in July, alarming OPEC, partly due to brimming inventories.

Why Are Saudis Approving Cheaper Oil?

Unbelievable as it may sound, Saudi Arabia is practically applauding the 22% plunge in global oil prices since July. On Sept. 19, Saudi Oil Minister Ali Naimi called a price of about $60 per barrel "reasonable." Analysts think the Saudis could even live with a price in the mid-$50's per barrel. "The Saudi price target is probably lower than the rest of OPEC; they are still happy at $50 per barrel," says David Kirsch, an analyst at PFC Energy in Washington.

The price of oil has been dropping steadily since peaking at $US78.40 a barrel in July. One bullish commentator, Michael Lynch, was reported in Forbes as predicting a fall to $US45 by mid-2007 and even lower in 2008.

Oil a better bargain than Starbucks?

If you think you’re paying through the nose every time you fill up at the pumps, think again, says Matthew Simmons.Crude oil now costs 11 cents per cup, says the energy industry expert, who recently returned from Beijing, where he paid $2.25 for a cup of tea at Starbucks.

"Eleven cents a cup — it is the cheapest thing we sell in the world today. It doesn’t make any sense," said Mr. Simmons, head of Simmons & Company International, a Houston investment bank that focuses on the energy industry.

Nigerian militants call off attacks in oil delta

Militants in Nigeria's oil heartland said on Thursday they had called off attacks on troops after two bloody gunbattles and would fight only in response to actions by the military.The Movement for the Emancipation of the Niger Delta (MEND) said it had killed 17 soldiers in separate firefights in the Niger Delta on Wednesday but would now hold back.

"This whole thing wasn't supposed to happen this way. We were still in the concluding stages of our plans to completely halt Nigerian exports in one swipe," a MEND spokesman said in an email to Reuters.

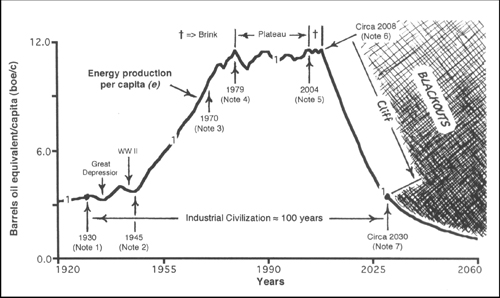

From the Wilderness still thinks we're heading for Olduvai: Industrial Society Rides An Unstable Plateau Before the Cliff

(A graph from TOD is also featured.)

US car buyers want reliability, not fuel economy: survey

Could 2007 Be Even Worse for Detroit? Despite drastic cost cuts and new vehicles, history and market forces could conspire to do even more damage to U.S. automakers next year.

BP faces declining profitability

You've heard of "peak oil", the idea that world oil production is already close to or even at its peak. Now comes the idea of "peak profits", the possibility that oil profits too may have reached their zenith.

UAE to focus on alternative and renewable sources of energy

French PM Unveils Environmental, Energy Saving Plan

The Oil Conspiracy: Is the Bush administration manipulating oil prices to win elections?

Tom Whipple on The Peak Oil Crisis: Election 2008

ASPO-USA World Oil & Gas Conference is heading into the final stretch before the actual Conference in Boston, 25-28 October.

Conference registration rates will go up after October 9th, so if you've been planning to register but putting it off, now is a good time to do it.

The registration fee provides breakfast and lunch for 2 days and receptions for Wednesday and Thursday evenings.

We now have a special evening session on October 25th on climate change with Dan Schrag of Harvard, Cameron Wake from UNH (ice-core drilling results from Antarctica and Greenland) and Charles Komanoff from New York City, advocate of a universal carbon tax to reduce CO2 emissions.

This will be followed by 2 very full days focused on oil and gas depletion (latest information from the experts), alternative fuels including Milton Maciel from Brazil to talk about sugar-cane-to-ethanol, alternative power sources from wind and solar PV, transportation, global energy security, economic impacts of energy scarcity, and local-to-global energy policy presentations.

Saturday morning we will have workshops and breakout sessions on Reducing Your Fossil-Fueled Footprint, Climate Change, the Internet and Peak Oil, energy modeling and net energy analysis, and more.

The News and Updates section of the website indicates that the conference had about 250 registered as of September 29. At this registration rate, they are projecting about 450 will attend. The site will hold about 600, so they would like more to encourage more to attend.

Speakers include Matt Simmons, Stuart Staniford, Tom Whipple, and Ali Samsam Bakhtiari. This is the agenda. I will be attending - hope to meet some others from TOD there!

Look back at Jimi Hendrix, Jim Morrison, and Kurt Kobain. I did. And I learned lessons. Either I did, Or I'm setting you up.

Staniford is trying to make a disappearance, And my ham-handed spelling pre-dates this attempt. Yarga-Yarga-Yo - Give me a belly dance.

Yeah, I'm setting you up. Or I'm setting Stuart up.

Thanks for filling in for me with the link. That's what happens when you're in a hurry and don't check things. I will be there doing media liaison, coordinating, whatever. My wife will be at registration. Her name is Mary so be sure and let her know you are there. Hopefully I will be surrounded by a bunch of reporters trying to get interviews with the speakers. We have about 30 media people at this point though there are several video groups with large crews. One big name news service so far.

Rick Block

I have seen the future, and it is heavy. Very heavy.

There is of course much more CO2 coming from the fuel that powers the heavy equipment used throughout)

I guess it gets down to fixed vs marginal costs....?

This year, Shell and Total have announced long delays for some projetcs, and there may well be much more of that, certainly now costs are rising fast due to lack of people, equipment etc.

However, since the greens (and everyone else) are increasingly calling for alternative fuels, the question becomes "are there any viable alternative fuels?"

http://www.planetsave.com/ps_mambo/The_News/Mother_Earth_News/Who_Needs_the_Electric_Car?_2006100479 12/

For instance the knee jerk reaction to nuclear power generation is a prime example. Granted nukes have issues, but they will become a needed part of the mix for a transition until enough technology gains are made in Wind, Solar, storage and other "green" technologies to supplant nukes. Currently, most people state that Wind, Solar, and storage technology is not ready to supplant nukes.

That leaves us with coal or nukes to fill the void, its choose between lesser evils time at that point.

Lack of high-grade uranium ore

See also: www.oxfordresearchgroup.org.uk/publications/briefings/factsheets.htm

lots of CO2

There is a short 4 page summery and a longer technical report.

The 4 page summery has a description of the "energy cliff" (point where EROEI hits 1) by ~2070.

The longer report has a discussion of why breeder reactors have not been used (and why they most likely cannot function).

If these claims are true, then this is much more bleak than I was expecting from nuclear. I did not expect the fuel would run out this quickly. All these new reactors going into operation will just speed the end.

Then you haven't thought it through. In addition to the fact that usable Uranium ore is not unlimited (as mentioned above), you need to account for the mining, refining, shipping, concentration, etc. This all takes a lot of energy. Then there's the building of the plant, and its subsequent decomissioning, and guarding forever. Of course you have the wastes to think about forever. That, to me, is a deal-breaker.

Then when you look at the mining, refining, shipping, concentration of the ore, the building and subsequent decomissioning of the power plant (they don't last that long, really), you will realize that CO2-wise, nuke plants are not the answer, and, of course, good-for-life-on-earth-wise, they make no sense whatsoever and never have. It's even debatable if, over the life of the plant, the technology is that much of a positive EROEI.

The economics, energetics, greenhouse gas issues, and politics of building, feeding, decomissioning, and guarding forever the wastes is all wrong, if you're thinking "green" (whatever that means).

There are some good analyses of these things out there - I can't seem to find the paper that I thought I had bookmarked, but Google is your friend.

No, nuclear power makes no more sense now than it ever did. In the immortal words of Amory Lovins, it's a future technology whose time has past. Another great Lovins quip: "Using nuclear energy to make electricity is like cutting butter with a chainsaw". Sure, you can do it, but honestly, you can't say it's the appropriate tool for the job...

- sgage

Some people say that, but I would argue that they're misinformed (or working for competing industries).

Nuclear has a very long lead time, around 10 years in the US. Wind is already the largest form of planned US generation in 2007, and in 10 years solar will be where wind is now.

My gut feeling is telling me its somewhere in between the best and worst stated returns. But I'm still looking for additional material to help make up my mind.

Substantially better than oil, lately.

Wind is, what, 0.6% of generation?. Say they add 25% of that, that would be 0.15% of total installed capacity. Or a complete collapse of the economy, certainly if some capacity is taken out because of age. Not credible at all.

Don't forget that wind's capaciry factore is around 25%.

Let's see the numbers.

http://www.nei.org/documents/Energy%20Markets%20Report.pdf

And, here are the numbers.

Planned Capacity in 2007:

Natural Gas 9,111

Coal 1,450

Wind 11,754

Hydro 160

Wood/Wood Waste 249

Solar-PV 97

Geothermal 155

Biomass 215

Petroleum 0

Landfill Gas 44

Waste 20

23,255

Here are the capacity factors:

Cap Factor

Natural Gas 0.376

Coal 0.71

Wind 0.30

Hydro 0.296

Wood/Wood Waste 0.224

Solar-PV 0.188

Geothermal 0.9

Biomass 0.9

Petroleum 0.262

Landfill Gas 0.9

Waste 0.5

Here are the figures adjusted for capacity factor:

Natural Gas 3,233

Coal 1,053

Wind 3,526

Hydro 47

Wood/Wood Waste 56

Solar-PV 18

Geothermal 140

Biomass 194

Petroleum 0

Landfill Gas 40

Waste 10

8,316

And here are the percentages:

Natural Gas 38.9%

Coal 12.7%

Wind 42.4%

Hydro 0.6%

Wood/Wood Waste 0.6%

Solar-PV 0.7%

Geothermal 1.7%

Biomass 2.3%

Petroleum 0.0%

Landfill Gas 0.5%

Waste 0.1%

100.0%

You can see that wind is the largest contributor, at 42%.

I looked up some coal numbers. since I think coal will, of necessity, be the no.1 power producer. I'm sorry this DOE file is a pdf. it has cool info though.

Whenever you see a number as low as that for coal, an antenna should start beeping. 153 new coal plants planned for the US, capacity 93 GW. There are hardly any "green" restrictions on coal in the US today, but they are expected, so expect frantic construction, way beyond 153.

I know building natural gas plants for electricity has been huge the past 10-20 years. Natural gas is much cleaner, and cheap right now.

Here's a pic I stole from the DOE pdf: I'll steal more, but am doing 826 things at the same time right now.

NOTE: it states 8 GW of new caol capacity, not 1.05.

I showed you that when we had this debate before.

The world produces 106m tonnes of steel a month.

100,000 wind turbines is going to be less than 1m tonnes of steel. What people are complaining about is the price of steel has gone up (but then it's gone down again)-- that is the China factor (but they are nearly now a net exporter of steel).

And of course any alternative plant is made of steel-- coal, gas, nuclear what have you.

See how much lower the coal numbers are than the NETL report for the next several years? I think the answer comes in the footnotes at the end the NETL report, where we see that much of the data is several years old.

So, I think the NEI numbers are reliable. Please let me know if you're still not sure, and if you can find further clarifying info.

Keep in mind that coal plants take a while to plan and build, so the recent rise in natural gas prices and utility interest in coal (as well as and wind) won't be reflected in 2007 yet. The real competition between wind and coal will come a couple years later, when the country has to decide whether to go with coal or wind.

My point is that wind is a viable choice - it is large enough to do the job, should we decide to be just a little cleaner and a little more forward thinking.

So it is worthwhile to project the future using current technology (it works) BUT a fudge factor for better technology needs to be included to come up with a realistic estimate.

Best Hopes,

Alan

Why is this so remarkable?

1-they're invisible

2-the winds are so strong and reliable that you get 60%+ capacity factors

3-turbine cost is a linear function of size, but power is the square of the size: double the size, cut the cost/kwhr in half - but if they're invisible size doesn't matter

4-offshore is traditionally twice as expensive because of the underwater construction in 20 meters of water - this is traditionally only offset by the higher capacity factor - but the floating base is much cheaper

5-very high quality offshore winds exist on all coasts, including the southeast, which conventional wisdom holds has very litte wind resource

So, you're talking maybe 1/3 the cost/kwhr of existing wind farms!!

It will take 14 months to build the second GW.

That is geometric growth.

The US is quite striking: 10GW of installed capacity, from nowhere 5 years ago. Obviously Germany, Spain and Denmark are even more impressive (but smaller economies)-- Germany and Spain about 12GW, Denmark 3GW but nearly 20% of all electricity generation.

What the US has that the UK doesn't have is compliant planning regulations-- big chunks of the prairie where no one seems to mind much if someone plonks down a turbine farm (I won't mention Cape Cod ;-).

however

there is a tax distortion in that (Congress hasn't renewed the subsidy programme past 2007-- there is a typical stop-start pattern to these, where it gets renewed, but there is a period where no capacity is installed, in between). There is therefore currently a worldwide shortage of turbines (but that can, and will be addressed-- the Chinese are already starting to make them).

Wind can, and is, growing at an incredible rate. 100GW of capacity in the US by 2020 is not now inconceivable.

Even if the US started on new reactors now, and there were not long planning inquiries/ licensing processes, they wouldn't start production before 2014. So 2014-2020 is a reasonable window, by which time I expect new nuclear capacity will only offset retired capacity.

I expect the gap will be made up by coal. The best we can hope for is that the coal stations are designed for the time when CO2 sequestration becomes a legal or economic requirement. That time, I believe, is coming, but the political will is not yet here to implement it.

I continue to be skeptical that sequestration is all it's drummed up to be. The scale that it is now being done on doesn't really speak to the viability of the scale that would be needed to even hope to affect the trajectory of GW.

Remember a wind station can be built in 3 years from conception to finish. Even a coal station typically takes up to 5 (less on an existing site, maybe 3).

So the 2010 number for wind is very soft.

Best Hopes,

Alan

This is primarily due to the roughly 2 year or less planning & construction window for wind (very roughly 1 year planning, 1 year construction), and not so much to the possible expiration of the production credit (which is believed to be very unlikely to lapse).

The planning horizons have to be kept in mind. Wind is shortest, so you really have to regard years after 2007 as badly understated. Nat Gas is next shortest, coal is longer. Nuclear isn't even on the table, though there are a number of proposed plants (up to 19, I believe).

For all forms of generation, more will be proposed, and many will be cancelled. This info is most useful for comparison purposes.

Bearing in mind they are building it on the site of existing reactors. That probably gains them five years.

The British it will take 5 years of public enquiries before the damned things get built.

One problem is a lot of the best sites (those of existing nuclear stations) are now in the official planning for Global Warming-- to put it bluntly, the government does not expect them to be above the water line in 50 years time.

Our government is starting to plan which bits of the coastline it will, and will not, seek to protect over the next century. It is likely the UK coastline will look very different in 2100, and the civil servants are beginning to plan for that (nobuild zones, where and where not flood protection will be restored, etc.).

Has the US government embarked on a similar exercise?

It's poignant that Saudi Arabia is proclaiming a voluntary reduction and massive spending. I think it's here.

http://biz.yahoo.com/ap/061005/retail_sales.html?.v=2

As soon as gas dipped people forgot en mass. It's like finding out about a bunch of lemmings who jumped off a cliff after the fact.

Here's another oil cut quote but from the FT.com...

http://www.ft.com/cms/s/fca030f6-53d8-11db-8a2a-0000779e2340.html

So they project demand to now decline by 10%? I have a better answer. Supply will be 10% less, so demand will HAVE to be 10% less. I feel crazy this morning.

Not entirely.

Not unimportantly, they have said more than once this year that they expect non-OPEC supply to increase 'dramatically' in 2007. No explanation yet as to why clients would prefer that oil over OPEC's. OPEC can't compete?! Sounds like spin.

I found one instance, link may be dead, so long quote follows.

From mine, 6 weeks prior:That would be a NO. Nothing much adds up so far.

Just keep changing the numbers till everyone is too tired to care or notice or add up anything.

The shopping spree is indicative of an addiction. The angry chimp posted this BBC video that I hink offers a good insight into that addiction

http://tinyurl.com/gumcv

Pro: I could give everyone some worthwhile information e.g. on anticipated flows from applying CO2 injection EOR on various lower U.S. fields

Con: It would be a waste of time arguing with you.

Like I said, I'm still making up my mind.

Hothgor's Speculations

You never provided any evidence of this collusion charge. Do you have some now? Or is speculation only OK when you are doing it?

Note: I think speculation is just fine, and I think contrary positions are just fine. But don't speculate if you are going to complain about people speculating.

- What is the estimated recoverable reserves for CO2 injected fields? What is the source of this data? Is that data reliable?

- What is the anticipated production flows from CO2 injected fields by what dates?

- What is the current U.S. decline rate?

- How does CO2 injection work? Is it cost-effective? Is it currently contributing to U.S. production?

Start with these questions, we'll see how you do and then take it from there.A CO2 Injection EOR Primer And from your very web site to boot! Take from it what you want.

For those too lazy to read or re-read the article, CO2 injection is a fairly simple process. CO2 is captured from NG power plants or coal plants on a commercial scale "tons at a time". This CO2 is then pressurized and pumped into existing oil fields through pipelines into key areas. The CO2 dissolves some of the 'stuck' oil, increasing its viscosity AND increasing overall well pressure. This allows for more oil to be produce that would have remained locked underground forever at an increased rate.

The Christian Science Monitor had an interesting article showing how this process was currently being applied in Canada. Some quotes of interest are:

The $28 million demonstration project in Saskatchewan began in 2000 to investigate the feasibility of storing CO2 in the 44-year-old Weyburn Field. The CO2 is shipped in via a 220-mile pipeline from the Dakota Gasification Company's plant in Beulah, N.D. (The plant converts coal to clean-burning natural gas.)

In addition, oil production at the field has increased 50 percent since CO2 injection began four years ago. The project aims to recover an additional 130 million barrels of oil worth over $5 billion.

28 million demonstration project for 5 billion in oil revenues? Nope, it's not economical to do this! But the environmental impact is staggering:

Under Mr. Bush's energy plan, power plants would capture 90 percent of their emissions for underground storage by 2012. Since the plants are a major producer of CO2, the plan would reduce by about 40 percent the 1.6 billion tons of CO2 the US emits annually, about one-quarter of the world's total.

40% of 1.6 billion tons is 640 million tones of CO2. Utilizing existing technology, we can reduce our green house gas emissions and in a few years produce an 8th of the worlds pollution instead of a 4th of it. 'Obviously, this isn't an exact figure'

But before I continue some more, Dave, I would like to ask you first off why you even want me to bother highlighting these facts, as you yourself already pointed out several months ago:

"Was this "technically recoverable potential" booked as reserves to begin with? The question matters because one of the common arguments used against peak oil is that EOR increases the URR. And that appears to be the case in these CO2 injection cases if the oil is indeed "stranded" and was never counted as reserves. If that is indeed so, then this would appear to be a case of reserves growth without new discovery due to the application of technology."

Your exact words, not mine. I wonder if Mr. Campbell will add this to the already discovered category just to keep his neat chart menacing...

However, you wanted to know exactly how much we MIGHT be able to recover in the US alone? According to the Department Of Energy We could conceivably pump out an additional 430 BILLION BARRELS OF OIL from the 1,124 billion estimated oil reserves that are currently 'locked' underground:

Your question on the projected production increase from enhanced CO2 EOR is a bit tricky: there simply isn't enough data at the present time to accurately gauge if and by how much oil production might go up. Logically, you can't extrapolate this from one or two test fields, as this is a poor sample size. While it is true that US production is declining somewhere between 4 and 8% a year, I feel fairly confident that a country wide CO2 EOR project could arrest the decline and possibly result in a net increase for a few years at least. Maybe you could shed some more light on this.

Some more CO2 EOR Injection fun can be had from what is probably your most hated blog site on the planet, Peak Oil Debunked.

So what's cost of this? And what's the feasibility of having 90% by 2012? I know the answer to the second question is zero. So, would like to know how this is physically done and in what time frame?

Which as all here know, has done wonders for West Texas.

http://www.lightrailnow.org/features/f_lrt_2006-05a.htm

I working quite hard, desperately so, to preserve my "way of life" in New Orleans, where I use 6 gallons of fuel/month in my car. If your way of life uses significantly more oil, then I want to end your "way of life".

You may find a better quality of life using less oil.

Best Hopes,

Alan

Just a thought but "your way of life..."

How much energy, divided per capita in NO does it take to pump out the water every day? If you put that factor with your 6 gallons how do you compare to the average american?

I am not picking a fight, and I agree with your light rail proposals and many other things you have posted. I work for a company based in NO and I am there often, but if you believe in GW won't NO eventually sink. We were given a pass from the hurricanes this year but I have not seen anything from fed or state to convince me the situation with FEMA or the levees will improve soon.

matt

TOO early in the morning, but roughly 200 km2, 2 m of water, lifted 2.5 m on average. 400 million m3 lifted 2.5 m. Multiple and divide by seconds in a year and I get 1/3 MW average load (before morning coffee). Divide by population, and we spend more on our LED traffic lights.

We have fewer traffic lights/capita than most US cities, what we save on traffic lights can "pay" for our pumping out rainwater.

We get our potable water from the Mississippi, very energy efficient from a pumping POV.

We have a secret weapon against GW that NYC, LA, DC, SF, London do not have. We have the Mississippi River, or rather the spring sediment from the river. This mud can be spread out where needed to protect our coasts and build them up by just building diversions for spring flood waters. The prototype Caenarvoen (spelling) is considered an outstanding success.

The US Army has promised us what they promised us 35 years ago, Cat 3 levees, in 3 years. I figure 4 years. They knowingly built Cat 1.5 levees then but they promise to do better this time. Cat 5 levees are affordable, even with sea level rise.

Just give Louisiana half the offshore oil & gas royalities, and we will hire the Dutch instead of the incompentents of the US Army.

Best Hopes,

Alan

To most of us, that is people with the capacity for logical thought, the Saskatchewan example you cite indicates that $23 million was spent testing an oil recovery method. Someone speculates that the method might lead to the recovery of some billions of dollars worth of oil, depending on price. I don't see any estimate of the cost of recovering said oil. It certainly isn't the $23 million, which has already been spent and has not brought the supposedly recoverable oil to market.

I don't really wish to be insulting because you may suffer the affliction of a severe learning disability. In which case, I commend you for your attempts to make a cogent argument. Keep trying. You may eventually succeed. Only, why don't you go and practice on some flat earth blog.

...

And I am the one who is incapable of rational, logical thought process?

Sorry, I must be getting tired. I forgot to answer your question.

Yes.

Frankly, we'll never know how you actually voted. A paid disinformer or a zealot would have every reason to misinform.

Maybe you're a republican, maybe you eat babies, or spill oil in street drains for fun. None of us will know, so we should focus on your arguments.

I am personally tired of people trying to smear commenters they don't like by comparing them with Bush, Republicans, Nazis, etc. Just deal with the facts or shut up.

however the scale of the CSS problem is such that that will never be more than a small fraction of the CO2 so sequestered.

CSS is about surviving as a civilisation to 2100 (we've buried the problem, but hopefully we will be able to deal with it when it reemerges out of the geology). It's not about making money per se.

The good news is in the PWC report I cited.

World energy is 4% world GDP (so roughly 2 trillion dollars).

Double the cost of energy (to account for dealing with the CO2, a currently unrestricted pollutant) and you have still only spent 4% of world GDP.

(the exec summary is 20 pages. The whole report 450 pages or so-- happy reading ;-).

http://www.colloqueco2.com/IFP/en/CO2site/presentations/ColloqueCO2_Session1_02_Socolow_PrincetonUni versity.pdf#search=%22socolow%20co2%20wedges%22

good ppt summary

The short answers:

- we don't know how to do all of it, yet

- the costs are likely to be c. 25% of the power generated

- we don't know where to put all the CO2, and the legal and liability problems will have to be underwritten by government (as it does with nuclear liability: the Price Anderson Act limits nuclear industry liability to $1bn)

It's coming, for sure, but no one knows how fast. BP has a station being built on the North Sea, and the Norwegians have Sleipnir.balanced against the costs of a 10 degree centigrade global warming, or even the chance that that might occur by 2100, the costs are trivial.

http://www.pwc.com/extweb/ncpressrelease.nsf/docid/DF9A9DF6F22B8CD8852571F80055B73E (the download is at the bottom)

estimate 1 trillion bucks (1-2 trillion USD). Which sounds like a lot, but is only 2.5% of current world GDP.

Pretty cheap insurance.

Google DOE FutureGen.

http://www.fossil.energy.gov/programs/powersystems/futuregen/

"Today I am pleased to announce that the United States will sponsor a $1 billion, 10-year demonstration project to create the world's first coal-based, zero-emissions electricity and hydrogen power plant..."

President George W. Bush

February 27, 2003

There is nothing like a plan, AFAIK, to sequester all CO2 from large power plant by 2012.

In fact there is no goal to do so by 2050.

The acid question of global warming is whether we have until 2050 to sort all this out.

Second question, must the C02 be captured from power plants or can we extract it from the atmosphere?

The estimate of 1,124 billion barrels is, in my opinion, a gross overestimation. Because OPEC has grossely overestimated their reserves, we actually have from 300 billion to 350 billion fewer barrels of oil in the ground than that estimate.

But if this thing does work, it would be a win-win situation. We could stick the C02 in the ground while increasing the oil we get out. Of course we would still have to seperate the C02 out of the oil and put it back in the ground.

I think you mean it decreases the viscosity. It makes it thinner. The higher the viscosity, the thicker the oil.

Somewhere it's done on a small scale, and then the cheering starts, it can be scaled up a million-fold or more and we are safe and the angels be singing. NO they won't. No matter if you want to get more oil or just get rid of the CO2. NO singing.

Any 12 year old these days knows or should that these places are few and far between, and not many oil fileds would be considered safe, and so on and so on. Chemical reactions underground, outright leaks, sequestering is bogus, unless you lay a few 100.000 miles of pipelines. It's just nonsense. Next.

You do know what a filter is, dont you? Can this be scaled up? Yes, and probly a lot cheaper then mass producing solar cells at the present time. This is how'clean coal tech' plants work, FYI.

I said that this is what 'clean coal tech' plants are essentially, and what the electric companies are lobbying lawmakers to allow to be built again. At no point did I say that we have a massive number of these clean coal tech plants.

...

I'm beginning to worry about some of you :(

you have not a clue

never asked for massive numbers

but zilch?

matt

http://en.wikipedia.org/wiki/Integrated_Gasification_Combined_Cycle

pt 3 in the wiki

AEP has filed for 3 IGCCs (one in Ohio, 2 in W VA?) and Southern Company already runs one (in Florida I believe).

This is how FutureGen will work.

My suggestion would be to learn to love sequestration, even if it's expensive and doesn't produce any oil, because you've got more than enough CO2 producing power plants already installed that aren't going away any time soon.

Canada has lagged behind the U.S. in using CO2 due to its limited availabilty. CO2 deposits in the U.S. have provided the Texans and Okies with a reasonably priced source that they have been able to use for years. Canada does not have the same so they have not used it as much.

In addition not all fields are geologically structured for good results with CO2 and your API's generally need to be high. I don't know how effective it is on heavy grades of crude. I also believe CO2 is pretty much the last trick in the EOR bag as we currently know it.

http://sequestration.mit.edu/

There's good evidence the CO2 will stay, or at least only leak out slowly (over centuries)

Again I refer you to the IPCC study

http://arch.rivm.nl/env/int/ipcc/pages_media/SRCCS-final/IPCCSpecialReportonCarbondioxideCaptureandS torage.htm

http://www.colloqueco2.com/IFP/en/CO2site/presentations/ColloqueCO2_Session1_02_Socolow_PrincetonUni versity.pdf#search=%22socolow%20co2%20wedges%22

nice picture in the above.

No one knows what happens after 40 years of CO2 injection, but a steady trickle of oil seems reasonable in theory.

The Hirsch et al DoE study overstated CO2 EOR IMHO.

I see CO2 as a post-Peak Oil mitigation strategy that will not preserve "The American Suburban Way of Life" but may help fuel some farm tractors while reducing GW.

Best Hopes,

Alan

Hmm, raison d'etre of the "consumer" is to consume, and to continue to increase the rate of consumption, so higher prices in a fundamental feedstock and enabler such as oil seems like it would have to "hurt" the "consumer".

Humans, on the other hand, might benefit since they might be given pause enough to find some worthy persuit for their lives other than mastisizing into "consumers".

We should strive to make the policies of petroleum exporting countries largely irrelevant. Traditionally, there was some concordance with their interests and our interests. Keep prices high enough to make large sums of money, but not too high so as to kill the golden goose. Well, the golden goose has to think beyond short term economic impacts and think in terms of long term sustainability and environmental impacts.

why always pick on the poor lemme's?

sheep go over cliffs too ya know.

bison go over cliffs.

humans make their pledge to the ledge.

their allegience to those who get caught foleying aroun(d) and cheatin'

so why is it always the lemmings?

That is not a lemming ....

... jumping over the edge

(MM= Manipulated 'Merrycans)

Signed: thirtysomething

I think one person between 18-22 or so. Course, I'm sure there are many more lurkers but probably not much different in their age makeup.

IME, older people are more likely to reveal their ages. You reach a point where you don't care if people think you're an old fart. (Though not all. A neighbor of mine is sensitive about her age, and so lies about it. She's 84, but tells everyone she's 82.)

People in their thirties and forties may be having middle aged crisis issues, so may be reluctant to reveal their ages. And younger people may fear that they won't be respected or taken seriously if everyone knows they're only in their teens or 20s.

The old tale of the Cretan who said that all Cretans lie. Did he?

I never do, unless it's unavoidable, and I guess it's paid off. I'm not in the intellius.com database, though most of my friends are - name, address, age, etc.

Not that I give out any more info than necessary either-I have never subscribed to commercial websites (mags, news, et al), and to very few uncommercial ones (does TOD count?)

TOD is my video game now, playing a hopeful lemming who's trying to persuade Humans not to drive themselves over a cliff in their 'shiny, metal boxes'.. I call it 'Deathrace, 2006' .. maybe I should change it to Synchronicity II and try to win some Karma points.

regarding Disney (our misunderstood friend)..

"Art is the Lie that tells the truth" -picasso

.. except when it doesn't.

Here at the Lemming Institute of Enlightenment (LIE), we refer to it as the game of "EDGE-u-OK shun" (a.k.a. Economics 101). Keep on playing dude. And ... oh yes, be most excellent. ;-)

You probably can, because you were at the site and the image is in your cache.

Rodney DangerRat

They didn't use the phrase "Peak Oil", but the commercial went along like this...

Two utility workers are walking through the desert, and come upon a manhole. They pop the manhole and look down and its a LONG way down. They do the paper rock scissors bit to decide who gets to go, and the loser starts his trek down. Meanwhile the other guy is sitting up top in the desert, watching TV, having coffee, and doing various other random things to pass the time.

Eventually the guy who went down the hole pops back up with a giant dip stick with an indication that the oil is low.

Then a narative kicks in saying something along the lines of (and I paraphrase please forgive my memory) "Some people think the world will have used half of its oil supply by 2020. Some people think its already half gone. Either way we need to be investing in alternative energy, and conservation to prolong the oil we have left for as long as possible."

The ad was run by Chevron.

I know a lot of flack gets thrown at the MSM, but considering this ran at primetime, I'd have to say it was a head turner.

http://www.willyoujoinus.com/advertising/television/

The one with the yellow sand dunes.

That's enough to keep me going. But I certainly owe much to thoughtful responses like yours.

Though I'm not much of a tv watcher, I've been keeping a file of the major oil companies ads from magazines and newspapers over the past year or so. Chevron and BP are trying to inform the public by running full page ads in newspapers and magazines about conservation, and the limited supply of oil. What better way to convince a friend or family member who denies the problem when you present it to them? Or ask them why Shell is a major investor in solar technology? I'm pretty good at ignoring advertising these days, so it probably takes quite a few ads before the average person even notices one of them. But, you're right, pretty soon the public will become educated and I think this is a pretty effective method.

I am "addicted" to TV.

That Chevron ad is old old stuff.

It's been shown on prime time for years. (Since Chevron launched their willyoujoinus site.)

The sheeple do not notice it.

Based only on anecdotal evidence from my home front, when that ad played on TV in our kitchen, I asked housemates: "What did that mean?"

The response ...

(drumroll)

(be patient now ...)

"Huh? What did what mean?"

In other words, they don't see it. It is not designed for frontal lobe processing. It is intended for storage and retrieval at the appropriate political moment in the future. You were warned.

If they really wanted to reach people they would have Paris Hilton covered in crude saying 'that's hot, until it's not'

Advertisers are balking at paying big bucks for network time that will be Tivo'ed into oblivion, while ad agencies are trying to make Tivo-proof ads.

When I look at an old VHS copy of something.. I LIKE the commercials.. it's like a little glimpse into the 'decade' or whatever when I recorded it, since ads are so thoroughly ephemeral, of the trends of the day. My copy of 'Grinch' is from around '90, I think, and it has the old CBS "Special Presentation" Graphic, and toys and computers that are just hillarious!

Put that in your Tivo and delete it! Nostalgia thru Marketing!

Bob Fiske

A friend of mine had a boyfriend who was an aspiring actor for awhile. Years later, after they had broken up, she gave his fiancee a tape of one of his old commercials as a Christmas present. He was dressed in a chicken costume, in an ad for a used car dealership.

Ahahhhaaahhaa. Oh, that's a good one. What accounts for this brilliant observation? Cuz last time I checked, you couldn't be more wrong. Better go back and try to find some proof in Tainter.

Here are some clues:

Go ahead, click on Cindy for more.

http://www.jpost.com/servlet/Satellite?cid=1159193368922&pagename=JPost%2FJPArticle%2FShowFull

If MEND succeeds in their plans, everyone will take notice in a hurry.

Here they are

I think Africa is very closely watched by TPTB, but the current conflict and export reduction is good for supporting high prices and profits--therefore, it merely appears that this is a minor issue. Rest assured, if Gulf of New Guinea exports start falling below some critical threshold: a world of hurt will tragically descend upon the people. Nigerian sweet, light crude and its relatively short distance to US & European markets will be critical going forward. How could it be otherwise?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

A little more info to support my position. I agree with RR's upthread post that the future is increasingly heavy and sour crude, with much coming from oilsands. The price spread between sweet & light vs heavy & sour is a critical ratio to help induce refineries' abilities to process the poorer stuff, along with providing a bottom pricing floor for Saudi heavy & sour, and the Orinco and Athabasca Basins.

The US is setting up a African command:

------------------------

The U.S. European Commander, General James Jones, discussed the importance of Africa at a news conference in early September.

"There's a very compelling case to be made that our competitive stance in the world is going to be affected by what we do or don't do in Africa," said General Jones. "There are certainly some overriding security issues that have to be addressed. But there's far more potential and far more reason for optimism than there is pessimism, in my view. With regard to the existence of a new unified command, my opinion is that at some point this is something that we probably should do as a nation.

General Jones says U.S. military activity in Africa provides great benefits for U.S. security and commercial relationships at little cost, and he favors further expanding those activities.

----------------------------

There is a multitude of ways to vastly reduce the insurgency in Africa. Everything from covert releases of diseases to infect people and livestock, to funding mercenary activities [recall my earlier post on Blackwater's new Oil Platform Security subsidiary], to the full-on resource war totality of the '3 Days of the Condor' and precipitous decimation of the entire geo-strategic area.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

That's interesting....no, I mean this....that no one can recall a "Willyoujoinus" ad by Chevron that is relatively recent, but almost everyone recalls "Three Days Of The Condor" which is 30 years old! Why would that be?

Roger Conner known to you as ThatsItImout

How does it work? The government stitches up a deal with some oil companies. Foreigners come and build facilities to extract the oil. Enviro regs are lax. The locals get the barest of trickle-down economic benefits. Members of the government drive big foreign cars, have big foreign bank balances.

There have been oil coups and oil wars, e.g. Congo-Brazzaville.

Local people try to organize to gain more of the benefits for the local economy. They get ignored or squashed.

Objectively, oil companies have no interest in local economic development. After all, that would serve to increase local consumption of hydrocarbons, thereby diminishing net exports.

Hugo Chavez must be a shining beacon to Africans.

BTW, I did spend 9 days in Lagos on one occasion without being able to take a bath - the hotel's water supply didn't get up to the nineth floor. So I do have an idea of how hot it can be over there.

I think you'll find this program enlightening

http://www.kpfa.org/archives/index.php?arch=16356

it is biased but informative none the less

If this is not credible, why are similar assurances by the Saudis credible?

For about two months, I have been quoting statments made, at the recent PBS Peak Oil debate, by an energy consultant--recommended by Saudi Aramco--that the ME oil exporters were going to be voluntarily cutting back production to prolong the life of their fields.

If you can't produce any more oil, do you admit it, which would invite military takeovers and energy conservation, or do you claim that you are "voluntarily" cutting back production?

The HL method gives us a way to mathematically model the production from a group of fields in a given region. Texas is not KSA, but the Lower 48 is not the North Sea, and the Lower 48 and the North Sea peaked at exactly the same stage of depletion. KSA is now where Texas was in 1973, when Texas started declining.

However, KSA is much, much worse off than Texas, since their biggest field, Ghawar, accounts, or accounted, for more than half of their production. I don't know how many different ways I can say this. The Saudis have already redeveloped Ghawar with high tech horizontal wells. The water cut is between 35% and 55%, and the remaining oil is between a rising water leg and an expanding gas cap--which is the same situation as Cantarell.

As I have repeatedly said, the HL model, combined with the decline of big fields is why I think that we are post peak (at least post crude + condensate peak).

As several people have noted, if it were not for the oil from the SPR, US commercial crude oil inventories would be much closer to normal, especially on the basis of inventories divided by (rising) daily consumption.

Also, we don't know what percentage of commercial inventories consists of heavy, sour crude. IMO, building inventories of heavy, sour have been obscuring flat to falling inventories of light, sweet--based on the spread in prices between the two grades of oil.

A question: Does anyone know if the release of oil and petroleum products from international emergency reserves has been replaced?

We want liquid transportation fuelds (LTF's): gasoline, diesel and jet fuel. You get the most LTF's for the least expendtiture of money and energy from light, sweet crude oil. Light oil is like new motor oil. Heavy oil tends to be something more akin to tar than to motor oil. Sour refers to the amount of sulphur in the oil. Heavy, sour tends to go together in most cases.

Since we get the most bang for the buck from light, sweet, it only makes sense that light, sweet would peak before heavy, sour, and that appears to be the case. Historically, the price spread between light sweet and heavy, sour as been about $5. In recent months, the spread has been as high as $17 or so in some cases.

With enough money and energy, we can make LTF's from the "endpoints" gas and coal, and that is what we are going to do. However, note that we are simply talking about accelerating the rate of depletion of our fossil fuel reserves.

I would like to add, there is a limiting factor when considing FT processes. Converting non-liquid fossil fuels into liquid fuels requires a considerable amount of infrastructure, and they aren't very efficient either.

We can see this with Shells Oil sands upgrade project to add a mere 100,000 bpd production costing about $11 billion. The production costs will grow expotentially for the amount of added production capacity because of the excessive complexity of feeding and maintaning a large infrastructure. For instance to add an extra 200,000 bpd would probably cost well over $25 billion. This is of course assuming that Shell would be able secure enough water and natural gas (or some other heat source ie coal/nuclear) for the additional production.

The beauty of conventional oil is that it doesn't damage or destroy the above landscape to extract it. Using coal or even biofeedstock for FT strips the land, requires a large source of clean fresh water, and a substantial processing footprint for conversion.

- do those "higher costs" include the use of more input energy? Doesn't that mean lower EROI? Perhaps you mean that the coke is burnt to supply that energy? Doesn't that mean higher CO2 emissions? If you don't have a coker, what happens to the residual stuff?

If you don't have a coker, the resid ends up getting sold as roofing tar.

The system is meant to be meshed between the different industrial/importing nations, with a certain division of resources part of the planning (though I don't you will see much mention, the 'strategic' part of the name was as much in terms of Soviet aggression as for OPEC - that part about 'blackmail' wasn't just OPEC, it was also directed against any power which could deny (read nuke) the Middle Eastern oil fields - shades of Iran, except that Iran is part of the home team, so to speak).

For people who think of resource wars, the dissolution of such intricate interconnections would be a sure sign. As it is currently, the system functions quite well, as seen last fall.

Some interesting background about the European history of their reserves can be found at http://www.cores.es/cores_in.html Most interesting that the Europeans formed their first reserve in 1968 - the United States only followed in the mid-70s (post Texas peak and post oil embargo - it does seem as if Europeans do take a longer pragmatic view, while Americans need to be forced by circumstance). The new Eastern European EU members have been building strategic reserves in accord with EU / IEA policy - quite honestly, I can't imagine that much impact on world markets, but it is something in the background - Poland expects to be finished in 2008. Another interesting fact is that Germany seems to have 237 million barrels in its reserve - per capita, that is roughly the size of America's SPR, even though Germany uses less than half the oil per capita of the U.S. As a wild guess, this is partially a Cold War relic - a lot of tanks were scheduled to hit the road during WWIII, along with a lot of airplanes - and whether east or west, Germany was center stage. Plus, Germans are dour pessimists when it comes to planning for the future, not sunny optimists like Americans, who seem to have a deep faith that problems are best left to take care of themselves.

however

I do think it represents the German strategic perspective. A country surrounded by potentially hostile neighbours on all sides, with no power projection capability overseas since 1918. They have no long range power projection assets, no aircraft carriers, no overseas bases.

And which imports north of 70% of its energy needs, excepting only domestic coal production. And 100% of its hydrocarbon needs.

Add 2 oil crises in 18 years (72-74 and 1980). Result, the Germans build big oil stockpiles. They, like the Japanese, feel very vulnerable.

They did this on gas too. When the UK price went up 4-fold this winter, German operators by law could not sell their stockpiles (something like 60 days worth) to UK operators.

But the general plan in terms of conventional warfare was a build-up to WWIII - the fuel would have been used in large part getting everything in place.

But then, Germany has been almost destroyed twice in the 20th century, and before that there were the Napoleonic, 7 Years and 30 Years Wars, each of which turned Germany into a parade ground for various marauding armies. So maybe history reinforces their view ;-).

I wonder in how many of the last 100 years $60/barrel (inflation adjusted) was also considered to be too low?

First of all the price of oil until sometime after 1900 is irrelevant given both the minimal quantities being exploited and the marginal importance of oil in the economy of the time.

During the 20th century, the average annual price of oil, adjusted for inflation, only reached or exceeded $60 for four years. Only once in the 1980's and 1990's did oil dip below the level of any year during the 1960's.

This information is freely available from the US DoE.

But who would compare the pre U..S peak of the 1960's when Texas Railroad Commision had an American monopoly, to the post 1971 peak? That's silly.

And we must compare oil to the cost of other items and dollar inflation, not to it's own controlled/cartel history. I have said it before, if oil at $60 a barrel is considered "expensive", I will take that "expensive oil right on out to the end of natural days, and happily! Anyway, how about something to read?

Here goes:

First, let's look at some wild gyrations.

http://www.wtrg.com/oil_graphs/oilprice1947.gif

http://www.wtrg.com/oil_graphs/crudeoilprice01_05.gif

If we compare the price of crude now compared to the price of crude in any period post the wild superspike of 1981, it is certainly high in price at $60 compared to it's history. But that does not tell the whole tale. What about the price compared to inflation across the board

We must recall that dollar cost inflation means that average inflation has reduced 59.00 purchasing power to $31.00 purchasing power from the early 1980's across the board.

And sure enough, that's not far off the spread in price from the early 1980's to the current (post the recent superspike to almost $80) of today. So compared to inflation at large, oil at $60 is really pretty close to right. And we must recall that compared to certain other high inflation catagories, oil price inflation averaged from 1983 or so to now is not bad at all. Think of the inflation in housing, medical costs, university education, and stock market prices in that period, and you will see one of the biggest expansions, but also inflations, in history.

Comparing the post 1970's price to the pre 1970's price is of couse useless and a case of card stacking that tells us only one thing. Something BIG happened in the 1970's:

For a long range picture we get

http://en.wikipedia.org/wiki/Image:Oil_Prices_1861_2006.jpg

Here's where it get's interesting. Crude oil in 1947-48 suffered a bit of a spike as part of the post war prosperity and boom caused by the returned troops and birth of the baby boom...but then....crude oil prices declined from 1947 to 1971 overall by almost half in inflation adjusted dollars! It's an incredible thing to see, during the whole of the growth of the baby boomer growing to adulthood, the muscle cars, the housing boom of the postwar years, from "I Love Lucy" right through "Leave It To Beaver" to "The Mod Squad" and Kent State killings, the nominal price stayed flat, and the inflation adjusted rate fell in half!!

How could that be? Of course we know, as Westexas often reminds us...there was a cartel in control: The Texas Railroad Commision set the price, and it STAYED PUT, because they had control of almost all American oil. It was a great period to drive!

And then....the U.S. Peak. The United States lost it's control of it's own oil and energy destiny. Nothing has been the same since. The prices since the U.S. peak have been all over the place, reflecting every rumor, political tussle, and burp of the unstable regimes we are forced to rely on. The oil price since the U.S. Peak have in no way reflected "inflation" in the conventional sense, controlled by another cartel. Just as the Texas Railroad Commision could resist inflation and hold prices at givaway before 1971, OPEC can control prices, and resist inflation the other direction since, at least as long as they have the "excess supply" to do so. How long that will last is the question for the world to face now.

The crisis everyone seems to fear now is only the most recent little "fire" in the real crisis, the one that began in 1971 and has never truly ended to this day, the real "Long Emergency". Does it tell us a damm thing about "geological" oil supply" around the world? Nope. It just tells us that are fate is in the hands of others, and that we are running blind, relient on every rumor and tall tale that comes down the pike. The one "geological" event that matters to us is already behind us, the one that Hubbert called, that Westexas references, in 1971. The "peak" that mattered to us is long behind us.

Whether the world peaks next month or in 2050, are fate is still the same: We are being bled to death.

There is one peak potentially upon us that does matter and does change things: The North American natural gas peak we discussed on TOD recently. Because when it takes full effect, as the the crude peak of 1971 did, and we go over to "global" gas the way we have already had to go to "global" oil, or fate will be the same as it has been since 1971, only doubly so. Is it possible to be bled to death twice?

There is one more fact on the Wekipediia graph to take notice of, and it is ominous in the worst way: Note that just as U.S. production was about to peak, almost within months, the price of oil fell to it's all time historic low, a low only matched twice before....at the moment of the birth of the oil industry, and at the depth of the great depression in 1931.

Months before the United States peaked in oil production for good, the price was as cheap as IT HAD EVER BEEN. THERE WAS NO WARNING. Except for that one great geologist, M. King Hubbert, and the tiny group who believed him, we could not know it then, but WE WERE RUNNING COMPLETELY BLIND. It is the greatest testimony to the man, and the theory that can be shown, and what keeps us studying and reading the words of his students and disciples.

Roger Conner known to you as ThatsItImout

An alternative explanation for why oil has been so cheap during the 80's & 90's is that the Saudi's were less interested in OPEC's goal of maximizing revenue, and more interested in their own stability. The previous king of Saudi Arabia was very close to the US. The agreement through that time was simple. They provide us cheap oil and we guarantee they stay in power.

That has changed. There is a new king in Saudi Arabia, and he has moved the KSA politically away from the US and more towards Europe and more recently China. The vast majority of US military forces have left KSA, and the royal family no longer feels compelled to keep oil cheap. I believe you will continue to see KSA act in their sef interest, which means higher prices.

The Saudi's saw Carter's Coal to Liquids projects, viable at $40/bbl, as a shot across the bow. They tried to keep oil under $35 after that.

Does that mean they (the "royals") no longer feel the need for US military protection, or they feel they'll get it anyway, or they feel they'll get it from China? Does China care if they'd buy the oil from OBL instead? Or does the KSA feel that the US is no longer capable of protecting them? These are not idle questions, these are at the center of the geopolitical future of the planet.

At the same time, it is easy to see that US power is waning, so it makes sense to have other friends. And it may have been uncomfortable having so many US soldiers on their soil when their interests (wrt the price of oil) were diverging from the US's.

He is an old man, and in a hurry. He reminds me of the Czars before the Revolution in Russia in some ways.

A major division between the US and Saudi Arabia is that the US has washed its hands of the Palestinian question, and the Saudis see resolving that as absolutely critical to dealing with Al Quaida. Since the Administration will not get involved, the Saudis don't feel they have anything to lose by distancing themselves from the US.

They were also very opposed to the Iraq invasion because they feared chaos on their border more than they feared Saddam. In fact they are now building a big fence, for the first time, to try to reduce cross border infiltration (both ways).

Simple.

We lie to them from over THERE (ksa),

So we don't get caught lying to them from over HERE (kgb).

(kgb= kingdom of george bush ... aka Tex'ass)

Satire Alert:

Real news story:

http://www.bahraintribune.com/ArticleDetail.asp?CategoryId=5&ArticleId=124250

Kuwait may cut oil output

That is primarily why I find these claims of unilateral, voluntary cutbacks by just a select couple of OPEC nations so hard to digest. They have worked so hard to formalize across-the-board cuts in the past to share the pain, even requesting Norway, Mexico and Russia to help out, and never have nations "voluntarily" reduced their own output without asking or actually insisting that others do the same.

Scientists issue global warming report

Just heard today on NPR that there are almost no pumpkins in the Northeast this year. To much rain this spring rotted the seeds and prevented replanting.

A little thing, since pumpkins are mostly about Halloween fun. But imagine similar problems every year at some point during the growing season.

Global Warming isn't about one big huge change. It's impact is a death by a thousand cuts.

Speaking of baseball...I just found out last night that the Dodgers got their name via Brooklyn's old streetcar system. Back when they were in Brooklyn, they used to call Brooklyn residents "trolley-dodgers," because of their streetcars. Hence the Brooklyn Dodgers (now the LA Dodgers).

If citrus in Florida had lost almost the whole crop we would hear more on the news about the link between GW and business risks.

If pumpkins are failing, then wouldn't it stand to reason that other squash/gourds are as well?

In addition, the total area planted in trees has fallen to its lowest level since the freezes of 89 (I know this as its been in the news here quite a bit recently). The primary culprit in this decline is suburban and exurban development.

New England is also seeing the Sugar Maples pack it up and head North. A lot less syrup from VT and ME, look at yours, is it from Canada or from corn?

.. say Maple-sugar ethanol, and I'll bite you.

I've still been keeping track of this. Maybe it is just an academic exercise, but it's interesting.

The shortages are continuing unabated. What's interesting is that now bottled water is in short supply. That's an odd thing to have shortages on. Furthermore, several people (including George Ure at Urban Survival) have mentioned ammo shortages in the past few weeks.

I refuse to draw any conclusions from this data set. There is simply not enough data to do so at this point. But, it has gone on long enough now to declare it a trend.

I've been keeping track of what you've found. I remember this kind of started when someone brought up bare shelves at stores. As an update, I haven't noticed things getting worse per se, but nothing has improved. Wait! I just remembered we no longer have FUJI apples (my fiances FAVORITE), so we had to go to the local UPSCALE grocer and paid way too much. I think she's had her fill of those for a while!

Other than those apples, I see shelves thinly stocked. I have never in my life so often grabbed something from the shelf only to realize, there's none behind it - at all. I ask managers, but they seem aloof at best. I wonder myself.

My guess would be this is the logical conclusion of "just in time" inventory systems.

It's actually MORE cost effective to run out of something occasionally then it is to have a surplus on hand, especially when you are talking about something perishable like Fuji Apples.

The pumpkin shortage was due to an exceptionally rainy spring. I wouldn't read too much into this. Boston had the rainiest May EVER. Lots of farmers lost crops. It happens. Just like sometimes you get bad Hurricane seasons. Other years you get perfect weather.

I was down to buying maybe 3-4 out of the lot since I found only junky apples.

Forgive me, but I think you answered your own question. Your store STOPPED carrying the Fuji Apples because they couldn't get them in sellable condition.

Fuji apples WERE still available - just down the street at a different store and at a higher price. You don't mention if the quality was any better there or not, but if I had to guess I'd say it most likely was.

I know I answered my own question, but I also prefaced it by saying I should have seen the writing on the wall sooner. Oh and the quality wasn't better, it was FUJI quality. I will say they did have a higher concentration of quality fuji apples to pick from though. So in that regard I suppose yes they had better quality. Most of these come from Washington anyway.

I don't know what the cause of this is, but I have seen enough of it to be sure its important. A sign of things to come, perhaps?

Cause I'm just not seeing this in Houston. I go grocery shopping and get pretty much everything I listed and then some. And this is at Super Wally World, Kroger or HEB.

About the only thing that has been in shortage is spinach, and that's because of this whole E. Coli scare.

Sorry, but I find some of this extremely suspect. Care to take a few dozen digital shots of these store's inventories and link them? Might have to come up with an excuse for the management like you are writing an article for something, or heck, most cell phones allow pictures to be taken now.

It's a hassle but it's given me the opportunity to pay attention. Shelves have been really thin lately and like I said, some things just aren't there. I live in the center of the universe in STL. Just just joking about the center part, we're right center unfortunatly.

Houston has just gotten over another phase of the "super-market" wars recently (buh bye Randalls). The remaining survivors are Super Walmart, Kroger, HEB, and Super Targets. By far these stores have been consistantly the best stocked, and cleanest places to go.

Starting from about 15 years ago, the dieoffs have been Apple Trees, Food Lion, Alberstons, Fiesta, and Randalls.

I expect the grocery wars to be on hold for a bit. Still, given the fair amount of competitiveness in the Houston market, perhaps this explains why we are not seeing barren shelves? To not have something in stock is tantamount to surrendering a customer to an opponent in a very tough marketspace.

And Houston is a pretty big place. These observations are mainly centered around the towns surrounding Johnson Space Flight Center, aka Clear Lake, Friendswood, Pearland, Webster, League City, Kemah, Deer Park, and Alvin.

Trader Joes are maybe 4 years old around here and we've got one whole foods in the ritziest neighboorhood. There's Aldi's everywhere, but they dont matter in the pecking order in STL. We've got small shops but those are frequented only when the unions are on strike and STL wants to support the striking grocers union. Go figure, it's about price.

I think there was a problem with Johnson and Johnson contact lens solution too. Other then that, I haven't seen any shortages either. I get the same stuff I always did.

Corn has been more expensive this year, and local cucumbers and squashes are small, but I'm in New England and that was due to the bad weather this spring.

The cheap supermarket around here, Market Basket, does a huge business. In a lot of cases they are 20-30% cheaper then Stop and Shop. On Saturdays and Sundays they have 20+ cash register lans open, all with baggers. It's amazing. No stupid "discount cards" either. One week they were out of Coca Cola, and another week they were out of the small Hellman's Mayonaise (they had the large jars), but I don't think it's because there is/was a shortage of either product.

What products can you not find?

Bausch & Lomb suspends shipments after reports of eye infections

Geroge Ure over at urbansurvival.com has made the same claim in the past.

OPEC to hold extraordinary meeting

That's it. That's the entire article.

The Oil Drum theme tune should definitely be performed by a Trinidad steel band. It should be in the form of a satirical calypso song. We should pick a well-known tune, and have a competition to compose the lyrics.

oops ... we are outside the "normal" range

That was a cover story.

Here is the real reason for the emergency meeting.

Tell no one !!!!

Our very way of life is at stake.

Other possible scenario is that Iran has called it to rally OPEC support against UN Security Council santions. The Security Council is likely to take up the sanctions issue next week.

LONDON (Reuters) - Oil exporter group OPEC has taken no decision to hold an emergency meeting on October 18-19 in Vienna, a spokesman for the exporter group said on Thursday.

"There is no such decision," OPEC spokesman Omar Farouk Ibrahim said.

The comment contradicted a report on Algerian official news agency APS, which said OPEC would meet on those dates.

What ever happened to the "conventional wisdom" of just a few years ago that said that oil prices over $30/bl would cause worldwide economic damage? That's what all the economists said then! But I guess that's economics for ya, change the "rules" as we go...

We've also had massive inflation over the past 5 years with the USD. $20 isn't what it once was.

Campbells Soup and Scotts toilet Paper were recently downsized as well while keeping the price constant. The inflation is in almost everything. Energy. Govt fees. Food. Content.

Home electronics are one of the few things still getting cheaper.

http://www.itulip.com/forums/showthread.php?t=482

For all of us who keep saying the FED will increase the presses, no they won't. They will increase the debt issuance and until foreigners stop buying, this will work. Once they start balking I think the FED monetizes the debt for as long as possible through traditional printing/pushing buttons until they convince the foreigners that everything is fine, we can pay this later. Maybe they start buying again, maybe not. We won't know until that fateful day.

In our monetary system that's basically the same thing, as long as somebody does take on the debt (as you said).

For me as an individual, "money supply" does not matter. Prices do. Also, as a mortgage-slave with a fixed rate, "homeowners equivalent rent" doesn't matter. As a homeowner who does not regard the house as an ATM, a "correction" in the value of the house is not "deflation". What I actually need to buy (food, fuel, health care, etc) is rapidly getting more expensive.

We need to statistically predict when our fiat paper currency is a better buy than an equivalent paper amount of real toilet paper, of course with an appropriate discount to offset for the painful paper cuts. The recent revaluation of Zimbabwe's currency generated tons and tons of toilet paper.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

The message is clear. Downsize your ass.

The closer you get to the end, the faster it seems to run out.

You need something lower-case in your diet

Thxs for this info. Water shortages will be bad enough, but World Bank Chief Honcho Wolfowitz says that if they hope to secure future funding: they need a ruthless pricing and revenue collection policy to keep their remaining electrical infrastructure functional.

Excerpts:

------------------

A fortnight ago Adriaan Van Der Merwe managing director of the power utility firm Tanzania Electric Supply Company (Tanesco) said that Tanzania risks being plunged into total darkness if the government fails to take immediate steps to avert severe load shedding.

The World Bank has urged Tanzania to overhaul its energy policy to avoid load shedding.

According to World Bank president, Paul Wolfowitz, Tanzania needs to review its policy on power to "enhance the generation of electricity in the country."

According to Mr Wolfowitz one of the problems leading to Tanzania's power crisis is the issue of pricing policy. He said electricity is heavily subsidised, which leads to unrealistic demand for it.

-------------------------------

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Next thing you are going to try to tell me that bad old World Bank thinks people should be charged for oil too.

Nope, just the opposite. In my postings I have argued to drive the price of electricity up much faster than inflation so that those who can afford juice don't have to worry about blackouts. Check the archives. I think it is better for families to double up in one house postPeak for energy savings and have reliable electricity, than to live separately with both houses suffering from recurring blackouts and homeowners unable to pay their bills.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Those that require higher levels of reliability will have to do it on their own, I would guess.

However, in developing countries, I agree that higher rates would improve infrastructure and power delivery. There have to be adjustments made to ensure that the poor get access to energy. However, I do not believe that the current practice of underpriced or subsidized power benefits the pooor as much as some claim.

Bloomberg announces US has launched plane to monitor for possible NK nuclear test activity:

-----------------------

A U.S. military plane capable of detecting radiation today took off from an airbase on the island of Okinawa, Japan's Kyodo News reported, citing unidentified people. The flight may be intended to monitor North Korea, Kyodo said.

-----------------------

Recall my earlier post. IF Russia, China, SK, Japan, and the US can agree on overthrowing the truly mad NK leadership-- I wonder what kind of message that will send to Iran's nuclear ambitions?

Bob Shaw in Phx,Az Are Humans Smarter than YEast?

Thxs for responding. You may be correct, or not. I claim no expertise as a foreign policy expert. Have you seen this Time magazine article?

An above ground nuclear test by NK would be a local disaster [but obviously Kim Jong II wouldn't care how it affects the populace], but it would be the optimal way for the NK leadership to re-jigger the military balance throughout the Eastern Pacific.

Sad as it would be for the NK poor, I think the best thing to do is for China to be given tacit approval by the other powers to pre-emptively attack NK. If China wants to use conventional and/or nuclear battlefield scale weaponry--that would be up to them-- whatever is deemed necessary to decapitate the NK leadership. As mentioned before: it makes no sense to wait until NK can fire nukes back, or covertly sell the weapons to other countries. Time will tell.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Thxs for the info. I think the value of preventing this test outweighs the NK harvesting of test data. I could be wrong, but I would think it would be relatively easy to destroy this shaft with a series of non-nuclear bunker-busters. I could again be wrong, but I doubt if the NK leaders would declare war just because we bombed a vertical shaft. Who knows?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

http://en.wikipedia.org/wiki/Korean_War

Interestingly, the DMZ between the countries is of particular interest to those who study the peninsula's native wildlife:

http://www.newint.org/columns/currents/2004/10/01/from-conflict-springs-life/

This natural state is of course is in jeapordy as long as there is a danger of peace breaking out between the Koreas.

I was thinking the same thing. No human has been there for 50 years. There are however lots of landmines. Wait, maybe that's exactly what it takes to preserve the area for another 50 years, peace or not (of which there is a fat chance).

It is simply the last Soviet state, and that is how Soviet states collapse.

The challenge will be what to do with the mess afterwards. 20 million brainwashed people whose society has collapsed. It will be like East Germany, only 10 times as bad.

The other challenge is that the collapse will be messy. One factor or another might be tempted for a 'final throw of the dice' eg nuking Seoul.

They can detonate a bomb pretty easily, I suspect. Their problem is more delivery system. It takes a lot of engineering to put a bomb on top of a missile and get it to work reliably.

Plans for ethanol plant canceled

Mexico Update: "Crisis Escalates as Marines Land in Oaxaca."

Obviously, I have no way to verify if true or not. These must be Mexican Marines, surely not US Marines.

In other news, Fox is upset with the border fence:

-----------------------

Outgoing Mexican President Vicente Fox, who has spent his six-year term lobbying for a new guest worker program and amnesty for the millions of Mexicans working illegally in the United States, has called the barrier "shameful." He compares it to the Berlin Wall.

-----------------------------

Can Fox and/or Calderon retaliate by cutting FF exports to the US?

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Teacher Hacked to Death in Oaxaca. The Washington Post article doesn't clarify exactly who did the murder.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

I'm not gonna ride Jim into the ground on this one. He should just try to be a little bit more careful about what he says, that's all. More of that kind of talk and then maybe one of us (you know which one) will make him wish he had never such a thing.

I ain't making a living riding around on the Peak Oil chitlin' circuit.

'nuff said.

Fireangel posted a link to a very interesting Raymond James post:

http://www.raymondjamesecm.com/industry_1300_main.asp?indid=71

Click on Energy Stat

They suggest that Saudi Arabia may have peaked.

And this one from James:

directly contradicts OPEC's (Gulf Times Aug 23) claim thatLife is connecting dots.

Great job pulling these together. I wonder why no one is getting more into this? It's a LARGE difference and I stumbled into it and you pointed it out. Is there some reason someone can tell us why this isn't a big deal?

He is also one King-Hell conspiracy theorist.He just likes to differentiate between his own conspiracy theories and the definitely debunked ones.