CIBC in more detail, and the first Chevron debate

Posted by Heading Out on January 13, 2006 - 12:13am

The initial Chevron discussion was on the topic "How can we make oil and gas supplies last longer, as the search for other fuels continues?" The debate was summarized by the Aspen Institute, which also provided a couple of contrasting expert opinions to get the debate started. They also seemed quite happy to editorialize a bit when it came to the reporting as in:

Perhaps surprisingly, no one mentioned the potential of cellulosic ethanol, using as a feedstock biomass composed primarily of plant fibers that are inedible by humans."Although biofuels were the subject that generated the most discussion among the participants, with some 1,072 responses which were mainly from individuals, about 10% coming from academic addresses.

From this perspective, for instance, the 2005 Energy Policy Act demonstrates the inability of government in the U.S. to act in the long-term national interest.The legislation's 2,000 pages are laden with subsidies to oil, gas, and electricity producers but fail to include adequate steps toward energy conservation, such as more stringent fuel economy standards for cars and light trucks. Based on this evidence, elected offi cials are so beholden to the energy industry and so reluctant to impose sacrifi ces on the public that a balanced policy based on the long-term public interest is currently impossible.It is worth comment to also quote from the summary comment on Peak Oil

Alternatively, some contributors argued that government should play a much smaller role in energy and allow markets to guide corporate and consumer decision making. If oil and gas supplies are limited and approaching a point of resource decline, markets--via the price signal--will provide adequate incentives for conservation, fuel-switching, and technological innovation. The contending perspectives of most of those favoring more government intervention and those advocating free market principles, however, share one important point of agreement--the need to allow prices to reflect more accurately the true costs of energy resource use.

Some contributors suggested that the peak had already occurred in non-OPEC countries, and that the OPEC peak was likely to occur between 2015 and 2030. Proponents of the peak oil theory might disagree on the date when global oil and gas decline is likely to occur, but agreed on the substance of the issue and on the urgent implications of peak oil for the global economy. Some participants urged immediate action in the near term to spur a transition to non-fossil fuels, while others expressed confidence that exploration and production technology, including for unconventional liquids, would continue to postpone the peak and that market signals would be the best and most efficient agents of change. A few forum participants argued, however, that the notion of peak oil was fundamentally fl awed, since it may be possible that oil and gas supplies are not limited as most people assume. They point to a line of thought in the geology field suggesting that oil and gas are not fossil fuels at all, but rather are created through chemical reactions deep in the earth's mantle.Sigh! And there is no discussion of a possible earlier date for peak oil, nor is there any rebuttal (bear in mind this is a Chevron project) of the incredibility of the final idea cited.

From that point of view it was a relief to turn to the CIBC report, which is factual, comes from experts, and has justifications for the opinions expressed. It is very sobering. It begins by pointing out that with non-OPEC supply remaining virtually unchanged over the past two years, the world production grew by a meager 900,000 bd this past year. (Their choice of adjective). The segment by Rubin and Buchanan on pages 6-9 recognizes the problem that depletion of existing fields is playing with future supply reliability. It chooses, as does ASPO, to consider Deepwater oil as an unconventional source. This, then is the basis for its comment that conventional oil production peaked in 2004.

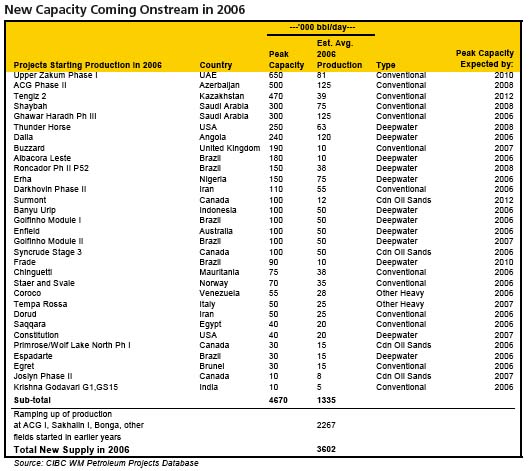

They recognize the input from new fields, broadening the listing of fields beyond that included by CERA and by Chris Skrebowski.

What is additionally useful is that they include, for this year, the project production for the field, rather than the optimal production the field will achieve. Their comments on GOMEX production are valid:

As the past fall's one-two storm punch from hurricanes Katrina and Rita clearly showed, that lack of diversification entails appreciable risks. We think as much as half of the planned 750,000 barrels per day of new Gulf of. Their pessimism over GOMEX production may even be understated, given the growing problems, that we have discussed earlier, in regard to insurance for rigs that will be put in storms way.

Mexico capacity over the next three years could be delayed, as the industry grapples with recovery from extensive hurricane damage to fields and industry infrastructure in the Gulf region.And if this year's weather patterns are repeated in the Gulf of Mexico over the balance of the decade, it is debatable whether deep-water production in the Gulf can even be sustained at today's level, let alone increased significantly as planned.

The growing shortage of offshore rigs poses another constraint on the pace of deep-water development, particularly in fields off Brazil and the west coast of Africa.

Their final conclusion, while not a surprise to those here, might be to those who inhabit the Chevron site instead.

oil consumption will soon exceed projected global supply growth, requiring further price rationing to bring demand growth back into line with the very modest supply growth we see lying ahead.

I saw the report from the Aspen Institute, and I wasn't impressed at all. As best I can tell, it was just a 12 page summary of the points that people had made. They didn't really analyze all that much - they let the abiotic thing go without pointing out that the theory is highly controversial at best.

I missed the bit where they said peak in OPEC would be between 2015 and 2030. Part of me wants to say "yeah, what would you expect from Chevron", but the fact that they even have this thing going is a lot more than any of the other oil companies are doing.

In an unrelated note, I was watching CNN earlier this evening, and out of the corner of my eye I saw a promo for "CNN Presents" coming in February. I believe that one of the programs was titled "Running out of Oil". This was just a 10 second bit - no substance in the promo at all, so I have no idea how they will cover it, or what they will say.

For that matter, I wasn't paying 100% attention until about halfway through, so I cannot even be completely sure I am relating this correctly.

Bullshit. Sorry, I'm not buying that assumption. Deepwater production is no different from any other kind of conventional source--it is a matter of economics and new "plays". In fact, I was shocked to see that ASPO has deepwater production at 12/mbpd by 2010 as you recently noted citing their latest newsletter. A lot of things have to go right for that to be true.

There seems to be a lot of playing around with definitions here and this only adds to the general confusion about available supply in the 2006 to 2010 period.

To be clear, an unconventional fossil fuels source, at least for liquids, includes IMHO

- oil (tar, bitumen) sands eg. Alberta, Canada

- extra heavy crude resources eg. Orinoco, Venezuela

- Coal-to-liquids (CTL) or (gas-to-liquids) GTL

- Oil shales (marl rock containing kerogen - sigh)

Now, this is an important point. Cornucopians like Michael Lynch would argue that new "plays" involving my list above make the future look good (aside from very questionable assumptions that EOR technology increase URR yields over time in mature oil provinces -- in almost all cases, technology only pushes the production curve to the left (immediate gratification) and results in a sharper drop-off in the tail (junkie runs out of drugs more quickly) without increasing the ultimate yield. As we've noted on previous threads recently, NGLs should be taken more seriously as far as future all liquids supply goes. Fine. But really, for conventional crude oil, which is the greatest thing that ever happened energy-wise, there really is no substitute at this point in time, is there?Do you have any scientific evidence to substantiate this statement? I don't mean anecdotal evidence.

In regard to the increased rate of decline that this gives after major production you have only to look at the two major Russian fields (Romashkino and Samotlar), Yibal, and the North Sea to see examples where the decline rate gets over 10%. Incidentally as Cantarell goes over the top that is also what is being predicted for it (14%).

I agree with you that the OOIP does not change. The question is whether technology changes the recovery rate (=% of OOIP ultimately recovered). In order for your reasoning to work, I believe you are committed to the position that technology does not change the recovery rate. That seems a little extreme. What scientific evidence do you have to support that view?

I've looked at the nonsense on your Peak Oil Debunked website. I made an assertion and both HO and me have now provided some evidence to back it up. In science--you are perhaps unfamiliar with the nature of this subject--a hypothesis is stated and as new evidence comes to light, this hypothesis is either contradicted (falsified in the language of Popper) or the evidence is consistent with the hypothesis. So why don't you provide us with some evidence that shows that we're wrong? Then we can talk about it. In some cases I've seen, it appears EOR does perhaps seem to increase the URR. My original assertion may not apply in all cases but does seem to apply in those cases where we have the best production history. What's gained on the front end from EOR is lost on the backend from very large decline rates. Unfortunately, there is uncertainty because the URR is not actually known beforehand with an unshakeable degree of confidence. However, that is why Stuart and others use the Hubbert Linearization--to predict the URR after a field is mature. The URR seems to be known to a good degree of confidence after approximately 50% of its predicted production has occurred but may be inferred before that in its production history using a statistical line fit. The method seems to work pretty well in the best test cases we have. Stuart has been working this out for months now with more precision than anyone else, IMHO, working in this field.

I am not writing this just to address a jerk like you--it's also general information for readers of TOD. Does the word "troll" have any particular meaning to you in this context? Please, contribute some useful information if you have any. TOD is reality-based. If you're looking for anecdotal evidence, go visit Mike Ruppert's website or some other appropriate place (like the EIA forecasts, the IEA forecasts--these are especially recommended--, CERA, Lynch or Mr. Abiotic Oil himself, Jerome Corsi. Otherwise, get lost.

I think there is a different URR associated with each successive level of technology. For example, suppose you went back to the day of Colonel Drake, and froze technology at that level. How much total oil could you recover if you deployed Colonel Drake technology to its maximal capability? That would be the URR with Colonel Drake level technology. It's clear that deepwater oil is not included in that URR. Which leads me to believe that the technological advances since Colonel Drake's time are associated with a larger URR. You can recover more oil with better technology.

That doesn't mean that peak oil is infinitely far into the future. It means that it might be farther into the future (or less serious) than you expect if you don't analyze technological gains very carefully.

Anyway, it's a complicated but important subject. I hope we can talk about in more detail sometime on The Oil Drum. Thanks for the link. I'll read it.

If you need any other anecdotal evidence, let me know. It's the only kind of ever use.

Here's a discussion of Valhall in the North Sea.

I agree with you. It is a little bit odd how people classify conventional/unconventional.

On the other hand:

Who cares? The point is that we consume 85 mbpd. So we need to supply that much. This rate increases by anywhere from 1% to 2.5% in any given year(with exceptions, of course). But as long as supply keeps up with demand-rate there is no problem.

Peak-oil is not a new idea, but the fervant debate surrounding it is. As proof, this website and all its popularity has only been happening for less than 6 months(please correct me if I'm wrong).

The key is to document predictions and who they are coming from. With a database of these predictions, we can very quickly identify who is full of it and who has a grasp on the truth.

When I track my data, I have 3-4 lines for every producing country. The first is BP's, then I have two separate lines for the EIA's different tables, and then a fourth for maybe another EIA table or a 3rd source. It doesn't matter that EIA doesn't match BP. Know that they don't and WHY.

The big mystery to me is how we are going to match record forecast demand in 2006 with supply. Will it be Saudi? Will it be Angola? It's not going to be Canada, not this year, at least.

These numbers are fairly simple. It will be pretty hard to dupe the oil community. Price will be a pretty good indicator to what is going on in 2006. So far, no crisis.

I think you put your finger on the bottom line. There may be all this conventional (land and deep sea) and unconventional oil sources but can those reserves be brought to market? At some point we get into splitting hairs in our discussions.

Is field development or refining restricting supply? Are prices or difficulty in maintaining platforms the choke point? Are unconventional not producing because conventional hasn't been limiting enough to make tar sands attractive economically? There is so much complexity in the overall, world supply of liquids that one can't point to a single issue as the major area of concern.

The converse of this is that to maintain (and grow) worldwide supply, all these diverse areas must increase simultaneously to offset conventional oil declines. Declines defined as shrinking daily output not field size. This is the part I have trouble with. Going forward it will be ever more difficult to remain on schedule on all the difficult projects. The oil supply is getting exponentially more complex than a decade ago. Complex things can be very efficient but they are also much easier to break or disrupt. I think the cornucopians discount the effect of the added complexity. As you say, 2006 should tell us what we can do and what we can't.

1 Declines Rates - They used 1.5% for Middle East aand 3% for the rest of the world. In UK Pretroleum reviewthey used 5%. What is the right answer? Can anyone help out here?

2 They only projected out to 2008. Would have been interesting a bit further out say 2010.

They certainly talk about higher prices and demand destruction.Still I have my doubts about Tar Sands. Nothing about Natural gas prices and declining supply as limiting growth.

If I recollect correctly from reading the CIBC report yesterday, their analysis resulted in an overall average decline rate of 3.4%. If planned new production comes online as projected and demand increases as predicted (in the CIBC report) that would give about 2mbpd spare by the end of 2007. A decline rate of 5% would evaporate that, higher implies very imminent peak oil. Even given the 3.4% decline rate they envisage supply and demand coinciding by end 2008.

Since a large proportion of current production is using enhanced recovery techniques and what data we have on decline rates for more mature such fields is generally coming in at the upper end of the 5% to 10% range (in some cases even higher), my guess is we may be facing supply shortfall sooner than most people expect. However, I also suspect that geopolitical events could bring that yet closer.

Thanks.

Is it possible to break out some of the big fields into subsets to get some sort of average based on the various subsets?

Reading between the lines on this subject I suspect that as the newer fields have formations that make oil harder to extract, more expensive to develop and drill due to depth etc. These use water flood etc from the start, so declines will be higher. Is this correct?

So consequently the decline rate may increase longer term, as the average will include more fields with bigger declines. Average may go up, as Cantarell is a big field with big declines. Is this valid?

I suspect this is why Schlumberger is saying 8%. They see more, younger fields with higher decline rates as compared to the older slower decliners. It also backs up what Simmons says as well as technology is pushing up the decline rates.

Are the formations more complicated to extract from then say 50 years ago?

I suspect this may be part of the answer as well.

Am I the only one noting that out of these 31 projects, they expect 17 (SEVENTEEN!!) to PEAK in 2006?!?! The same year they come on-line.

Or do I misunderstand something?

Hey!

Solar mega-obese fat-to-oil rendering technology: America's untapped energy reserves.

It's Clean! It's Green! It takes care of the obesity crisis while fueling our Hummers!

you could allocate say 10 gallons of gas a week per registered driver at a fixed price. Then you could have a second tier and third tier pricing for additional amounts, Beyond say 30 gallons per week you might make the price of fuel uneconomic. Tiered pricing already occurs with natural gas with baseline usage less that above baseline. Fuel prices would have to be high enough to make conservation by consumers a priority.

With my diesel Jetta, I think I am already below 10 gallons/week. If I go an collect waste oil and make my own fuel, that would mean I would use even less of the stuff out of the ground, and I could then sell the coupons. Whee - I like this plan.

Seriously...

Regarding rationing, for it to be really effective, it seems like you would also need national quotas as well. If the U.S. cut back 10%, and other nations sucked it up, then the price of oil would still be high. Then again, I guess you need to have a clear idea in your head as to what the purpose of the rationing is to begin with - is the point of the rationing to try and reduce world demand and keep the world price more reasonable, or is the more modest goal just to reduce national demand and reduce trade imbalances?

Any rationing scheme would have ways around it. As an example, perhaps you have an elderly relative who no longer drives - you might get that person's ration coupons, and you can double your driving. I think you would just have to accept that and try and limit the opportunities for mischief as best you can.

How, pray tell, would you apply them? Surely not the fair way of an equal per capita amount worldwide (which would mean a US reduction of over 75% in consumption). In fact, if the US reduced it's consumption to that of the world per capita mean we (the world) would have a spare 15 to 20 mbpd sloshing around, LOL.

I do like the extension of the idea of tiered pricing to apply to countries, now that does have some merit. Perhaps doubling the barrel price once consumption exceeds mean world per capita amount and increasing it 10% futther for every 10% level above that.

I doubt one could impose limits on net exporting countries, perhaps the US would seek to circumvent such price escalation by becoming a net exporter through occupying: Iraq, Iran, Saudi, Venezuela, Mexico, Canada... Ooops, seems I've given the game away ;)

The rationing proposed seems about as close to fair as might be devised, though I would propose allowing the lowest consuming nations some increase in oil usage to enable them to economically catch up and perhaps an additional, higher, price tier for oil above twice the average per capita usage. One aspect that the story ignored: the currency for trading in oil - I would predict that G.A.I.L. would establish a new currency for all purchases of their oil.