The price of a gallon of gas

Posted by Heading Out on September 1, 2005 - 8:10pm

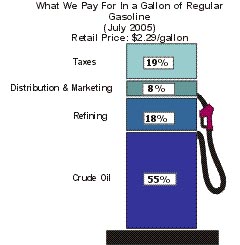

As the price of gas starts to move upward, many people wonder where the money goes, this picture is from the EIA.

For the last two days I have been on a trip, and talked with people about, among other things, energy. Away from the South there seems still to be some disconnect from the reality of Hurricane Katrina. Despite the increasing amounts of ink that the MSM are starting to devote to this tragedy, those in Washington and New York as well as many intermediate stations to New Orleans may not know where their gas comes from. The CNN story has a map as well as a story about the Plantation pipeline that carries 26 million gallons of gasoline to Washington, and the Colonial pipeline that carries 100 million gallons up to New York, it does also have a map showing the route.

"We'll be delivering what's in the lines as soon as we have the power back on, " Baker said. The firm would be able to pump fuels from refineries in Texas, he said, even if refineries shut down by the storm along the Gulf Coast remain off line.The shutdown of Colonial's pipelines and one operated by Plantation Pipeline, based in Atlanta, means key terminals and distribution centers along the eastern seaboard, including near Greensboro, N.C., and in Doraville, Ga., are not being replenished with refined fuels. It's not clear how much gasoline and diesel those distribution centers have on hand. Baker said the terminals usually keep more than a week's supply.

That, of course, means less supply and much higher prices.

Technorati Tags: peak oil, oil, Katrina, Hurricane Katrina, gas prices

I have always believed that at their heart, Americans are not very ideological, but are rather a very pragmatic people who ultimately just do what works. I hope we are finally tapping into that.

The MSM is actually doing a great job IMO.

He is also calling for a 20% reduction in Oil company profits - now that's pandering to the populist streak....

The title of his post is: "Please Buy Gas"

What a simpleton.

However, the energy hit from the storm is really only a small dimension of the overall economic hit when compared with the loss of the ports. The exports that transit NOLA do a lot to pay for imported oil and gasoline, keeping our trade deficit less precarious and interest rates lower. Further, modern just-in-time inventory/delivery/production schedules demand smooth running infrastructure; otherwise, their systems become disrupted and unusable. Lastly, existing infrastructure is unable to support the volume of goods needed to be rerouted to other ports and distributed from them. As with there being no close substitute for oil, there is no close substitute for NOLA's port facilities. A back of the envelope guess is a workforce of about 100,000 people were directly linked to port facilities trade, although I think this too low. Another WAG has a minimum of 150,000 needed to fully run and support all trade related facilities in the NOLA region, without any frills like jazz halls, gin joints and whore houses--the entertainment norm for any port city worldwide.

Not having the port greatly decreases efficiencies increasing costs that will result in additional inflation. Time will provide us with some interesting outcomes.

By creating a choke point between consumers and upstream crude producers, it is possible that we may be able to smooth out the peak somewhat. Higher prices can also kick start conservation at the individual/firm level.

I had an email conversation with my wife' secretary yesterday about fuel prices (my wife has told her about my predictions in the past, and now she thinks I have a crystal ball). She wanted to know when prices are coming down. I told her that we might have some temporary relief in the spring if we're lucky, but that she should really expect a long term trend towards much higher prices. After a few emails, and some gentle suggestions on how to conserve, I could see the lights start to come on. Fuel prices really matter with her family's budget.

A lot of Americans are stirring from their 20 year slumber and are starting to be attentive to energy. As difficult as the road ahead seems, I find this encouraging.

(actually as I check my makes and models now, i see that the "fiesta" badge is still used by ford in europe. it's at least one size below "our" focus.)

Are oil companies making record profits?

Are gas prices high simply because demand is high and oil companies can charge what they want?

Or, are prices high because the cost of acquiring crude is high, and the oil companies are passing this extra cost on to the consumer? (In this case, profits wouldn't go up, right?)

Or, are the oil companies trying to maximize profit now so that they can undertake the more expensive oil exploration that will be required in the future?

Here's one of thousands of news pieces on them:

http://www.foxnews.com/story/0,2933,163935,00.html

Putting it simply, if they can make X percent on producing and processing a barrel of oil, when the price of oil triples then the dollar amount of that percent goes up too. Also, your fixed costs may not keep up (just because gas is selling for $3.00 a gallon doesn't mean you'll pay the delivery truck drivers 3X what you did when gas was $1.00 a gallon) so that means more profit on everything they do.

If what you're saying is true, then wouldn't an outcry for the oil companies to hold their profits constant during this crisis be reasonable?

Let's say their price increases are not commensurate with their expense increases during a crisis, and profit goes up like you describe. Is that considered price gouging?

The author is basically accusing them of taking advantage of this situation, raising prices higher than they need to in a time of national emergency. Is that going too far? Should they be allowed to make their usual profit (and then some, I guess, we've been "at war" for a few years but you wouldn't know it looking at their financial statements)

I dunno. On the one hand they have a business to run, and they are very good at making a profit. On the other, there was a report of a guy selling hot dogs in New Orleans the other day for $1.50 and the mob screamed at him that he should be giving them away. Why is one entity allowed to make a "fair profit" when others are expected to just donate their proceeds? Who gets to decide these things?

And I'm not saying that Exxon or whatever Oil Company is not contributing. I hope they are wise enough not to post record profits this quarter, even if they make them (as we have said here repeatedly, these are global corporations and the GOM is just a small yet important piece of their companies).

Do some of that Arthur Anderson voodoo and make it look like you had a loss, fellas.

Yes, if prices go high enough there will be people who cannot afford to drive to work. If they can't car-pool or take a bus, it's better that they stay home than that e.g. emergency vehicles are stranded because there is no fuel.

John Doe may not be able to pay $3.50 a gallon for gas to make his fifty mile each way commute, but he can't afford NOT to since he has to make the minimums on his credit cards and his car payment. So what does he do? What has always been done before .. charge it!

And then six months from now when he can't make the minimums, then he finally quits buying gas.

It's hard to raise the price of gas enough to limit demand/consumption in a country full of people with credit cards. That's my impression (I've said many times, I'm not an economist, but I am a consumer -- and I know how to abuse credit with the best of 'em)

Am I way off on this? I know that's a pretty broad brush but that's how I view the bidness at this point.

Their market value is based on the value of their assets - oil fields - and as the price of oil goes up, so do their earnings and therefore their stock prices.

HO, PG, Ianqui - any other thoughts

Once ExxonMobil extracts crude oil, does it just get sold on the open market as crude oil?

Or does it get refined and then sold on the open market as gasoline?

Or does it only get sold in Exxon and Mobil retail gas stations?

This is one reason I am so critical of the medium-truck preferences written into the tax code in 2001. These vehicles consume far more fuel than the passenger cars which many users would otherwise have purchased, and have contributed greatly to the capacity squeeze in refining (and now in production as well).

It's like the party in power is TRYING to set this country up for a collapse.

Does Bill O'Reilly think that he is gouging Fox news because his salary is way higher than his consts for appearing on the show?

Do any of us who reap a widnfall of any type hand it all back because it's only fair to do so?

Stop the stupidity.

If you want more of something raise the price.

If the supply coming out of existing wells is not meeting demand the price goes up.

But the cost of getting it out of the well is the same because it is a fixed or decreasing amount. The price to deliver goes up only as much as the percent energy used to deliver. Wages don't instantly go up. So somewhere in there somebody is getting a whole lot more profit today than they did yesterday.

Now I agree that oil companies need to invest in cleanup, exploration, new wells and the like after this storm. But the fact remains that the profit per barrel pumped is going up because those prices are pretty fixed after everything is online.

The assumption is that all this extra profit can be used towards more exploration to expand supply. But not all that money goes to those uses.

Despite my lower speed I had a lot more company keeping pace with me than usual, and the number of vehicles (esp. 4x4's and SUV's) whizzing by in the left lanes seemed much lower. Even the Corvettes seemed to be holding to the posted limit.

People are responding. If we cut 5% by driving slower and 5% by reducing mileage, that's enough to handle the immediate problem.