Drumbeat: May 10, 2013

Posted by Leanan on May 10, 2013 - 10:28am

At Least 9 More Decades for North Sea Oil

Oil and gas production in the UK North Sea can continue until the end of this century provided the right government policy decisions are made, according to Scottish Energy Minister Fergus Ewing...."In domestic terms, the [Scottish] industry is having a second major opportunity with a huge number major new developments going ahead, some of which are extensions of existing developments. For example, the Clair Ridge field has the potential to produce oil until 2055 according to BP."

..."The Clair field was actually discovered in 1977, and that's ironic because we were told by London that the oil would run out in the 90s, and then in the 90s that it was going to run out in the Noughties," Ewing said.

"I think it's a theme that's losing credibility because if BP comes along and says the Clair Ridge field will continue to produce until 2055 it's a bit liberal to say the oil is going to run out because it ain't."

Saudi Arabia Seeks Stable Crude Prices, Minister Al-Naimi Says

Saudi Arabia, the world’s biggest crude exporter, welcomes additional supplies from other producers that may help to stabilize prices, Oil Minister Ali Al-Naimi said.“New supplies are welcome,” Al-Naimi said today in a speech in Istanbul, where he traveled to meet Turkey’s energy minister Taner Yildiz. “They will add depth and, I hope, greater stability to world markets.”

Saudi Arabia “remains committed to its role as a stable and reliable supplier” that has consistently stepped up production to offset any shortfalls, Al-Naimi said.

WTI Drops a Second Day; Goldman Sees Brent Gap Narrowing

West Texas Intermediate crude fell a second day, reversing a third weekly gain, as rising supplies countered signs of economic growth.Futures slid as much as 1.8 percent, extending yesterday’s 0.2 percent drop, as the dollar gained versus the euro, damping the appeal of commodities priced in the U.S. currency. Brent crude retreated 1.5 percent, leaving its premium versus WTI at $8.24 a barrel. Goldman Sachs Group Inc. said in a report today that spread may narrow to $5 in the third quarter.

OPEC Crude Production Rises to Five-Month High on Saudi Increase

OPEC boosted crude output in April to the highest in five months as Saudi Arabia increased production, helping lower oil prices amid concern that global economic growth is slowing.The Organization of Petroleum Exporting Countries produced 30.46 million barrels a day last month, up from 30.18 million in March, the group’s Vienna-based secretariat said today in its Monthly Oil Market Report. That’s the most since November. The estimates are based on secondary sources.

OPEC, before meeting, sees higher oil demand in second half

LONDON (Reuters) - OPEC will need to pump slightly more oil than it thought in 2013 and expects global consumption to be much higher in the rest of the year, signs of a stronger market that argue against any calls for supply restraint when the group meets on May 31.The Organization of the Petroleum Exporting Countries in a monthly report on Friday forecast 2013 demand for its crude will average 29.84 million barrels per day (bpd), up 90,000 bpd from the previous estimate.

Mideast Gasoline Imports Shrinking on Refinery Boom

The largest-ever expansion of Middle Eastern oil-refining is poised to curb the region’s imports of gasoline, reducing dependence on shipments from India and Singapore and sapping margins for European and Asian processors.Saudi Arabia, the region’s biggest gasoline importer, will add enough processing capacity to cut purchases of the fuel 50 percent by this time next year, according to a Bloomberg survey of four traders and analysts based on data from state-owned Saudi Arabian Oil Co. The United Arab Emirates expects to become self-sufficient in gasoline when it starts units at the Ruwais plant in 2014, Sultan Al Mehairi, the head of refining at Abu Dhabi National Oil Co., said April 22, while Kuwait, Qatar, Bahrain and Oman are also developing operations.

Shale gas could curb Gazprom prices: EU commissioner

(VILNIUS) - The development of shale gas in Europe could help the continent obtain better deals from its current key supplier, the Russian giant Gazprom, EU Energy Commissioner Guenther Oettinger said on Friday."I am sure (that) to have some shale gas option is a good instrument for our long-term negotiations (with) Gazprom and Russia", Oettinger told journalists in the Lithuanian capital Vilnius.

Success with shale gas in the United States has encouraged exploration in several EU states including Britain, Poland and Hungary. Lithuania is also considering an exploration deal with Chevron.

The finite supply of oil could result in a highly unstable market environment if the oil market reaches its peak. According to a recent report from market analyst's Poten & Partners, "conservationists and industry have been at odds over the ability of crude oil to continue to serve as a primary conduit for meeting the energy needs of an ever-expanding population and associated economic output almost since the inception of commercial-scale crude oil production. Although preceded by other doomsayers, the theory of “peak oil” is most frequently associated with “Hubbert’s peak,” which argues that oil production rates generally follow a bell-shaped curve, tapering off once infrastructure investment reaches a point of diminishing returns and the resource begins to be depleted. While production has struggled in some regions (notably in the North Sea), a common argument among commodity analysts of late has been that we are approaching not “peak oil” in a supply sense, but rather “peak demand”, the report stated.

Peak Oil Revisited - Oil Limits Are Now Debt Limits

Oil and energy limits are more complex than what we have imagined so far. The crossover from OECD Old World dominance of oil market demand, to Rest Of World dominance was more than 7 years ago, but the perception of what this means has been slow. Very slow.

Fracking and Shale May Keep the Price of Oil Low Forever

Good news is here for consumers who hate high gasoline prices. There is something at work that may keep the price of oil from rising too much, but the price may not fall too much either. A fresh report from ETF Securities is underpinning oil at $80 and also putting $100 as the implied peak oil price for the foreseeable future.

California Postpones Oil, Gas Lease Auctions

California's Monterey Shale is continuing to be the talk of the industry after the U.S. Bureau of Land Management (BLM) recently announced plans to postpone upcoming federal lease auctions in the state. The prolific play, that holds more shale oil than anywhere else in the country, has the potential to pull the state out of its downward debt spiral but has been caught in a tug of war between proponents and environmentalists since the shale boom occurred in the nation.

India Says Canada Investment Rules May Cut LNG Spending

Changes to Canada’s rules governing investment by foreign state-owned enterprises may discourage Indian oil companies from participating in projects to ship natural gas from the North American country, India’s top diplomat in Ottawa said.Indian state-controlled energy companies, seeking to meet domestic demand for the heating and power-plant fuel, want to source natural gas from Canada, Admiral Nirmal Verma, India’s high commissioner said today at a conference in Calgary. Revisions to the Investment Canada Act may stop companies from buying stakes in export projects, Verma said.

U.S. Should Export Natural Gas, Not Coal

President Barack Obama’s suggestion last weekend that he may favor greater U.S. exports of liquefied natural gas is a welcome sign. More exports would spur more domestic production and help balance U.S. trade.LNG exports could also help counter the unsettling increase in American exports of coal to Europe. In 2012, the U.S. sent about 66.4 million short tons (60.2 million metric tons) of coal across the Atlantic, 23 percent more than the year before. Exporting coal works against the progress the U.S. has made in lowering its own greenhouse-gas emissions by replacing coal power with cleaner-burning natural gas.

Apache to Divest $4 Billion in Assets and Buy Back Shares

Apache Corp., this year’s third-worst performing oil and natural gas producer on Standard & Poor’s energy index, plans to sell $4 billion in assets by yearend and buy back shares as first-quarter profit missed analysts’ estimates.

China's CNOOC to pay more for BP Indonesia gas

(Reuters) - China National Offshore Company, China's largest offshore oil and gas producer, will increase the price it pays for gas from BP's Tannguh project in Indonesia, the head of Indonesia's energy regulator said on Friday.The existing 25-year supply deal, under which CNOOC ships around 2.6 million tonnes of liquefied natural gas (LNG) annually from Indonesia's West Papua province to China's second LNG terminal in Fujian, was signed in September 2002.

US Imposes Ban on 2 Firms over Trade with Iran

TEHRAN (FNA)- The US Treasury Department blacklisted two companies for their trade with Iran irrespective of Washington's unilateral sanctions against Iran's oil sector.

Source: Patients from Syria being tested for chemical weapons

(CNN) -- The Turkish government is treating around a dozen patients who have exhibited unusual symptoms suggesting they were exposed to a chemical weapons attack, a Turkish source said."They were not injured by any kind of conventional arms. Tests showed excessive results which produced findings to let us make that statement," a Turkish source with access to Turkish government findings told CNN, on condition of anonymity due to the sensitivity of the allegations.

5 reasons Syria's war suddenly looks more dangerous

(CNN) -- While the world's attention was focused on Boston and North Korea, the conflict in Syria entered a new phase -- one that threatens to embroil its neighbors in a chaotic way and pose complex challenges to the Obama administration.What began as a protest movement long ago became an uprising that metastasized into a war, a vicious whirlpool dragging a whole region toward it.

Ex-Enron workers: Keep Skilling in prison

NEW YORK (CNNMoney) News that former Enron Chief Executive Jeffrey Skilling may get out of prison early isn't sitting well with some of the company's former employees.Skilling has cut a deal with the Justice Department that could see his 24-year sentence for his role in Enron's collapse cut by almost 10 years.

For some employees -- who collectively lost more than $2 billion in retirement funds -- that just isn't right.

Senate Republicans Block Committee Vote on Obama EPA Nominee

Republicans on the Senate Environment and Public Works Committee blocked a vote on confirming Gina McCarthy to head the Environmental Protection Agency by boycotting a meeting called to consider the nomination.

Foes Suggest a Tradeoff if Pipeline Is Approved

WASHINGTON — President Obama’s first major environmental decision of his second term could be to approve the Keystone XL pipeline, profoundly disappointing environmental advocates who have made the project a symbolic test of the president’s seriousness on climate change.But could some kind of deal be in the offing — a major climate policy announcement on, for example, power plant regulation or renewable energy incentives — to ease the sting of the pipeline approval?

Chevron Wins Suit Against U.S. Over California Oil Field

Chevron Corp. is entitled to unspecified damages against the federal government in a contract dispute over oil deposits in California worth $37 billion, the U.S. Court of Claims ruled.The Department of Energy “repeatedly and materially violated” two agreements governing determination of equity interests in oil and gas deposits located in the Elk Hills Reserve of California, Judge Susan Braden in Washington wrote in a 90-page ruling.

N.Y. Senate Fracking Backer Tied to Firm With Gas Lease

Senator Tom Libous, a champion of fracking in the New York Legislature, is blocking a bill that would delay drilling for natural gas for at least two more years. Passage of the measure would harm the prospects of a real-estate company founded by Libous’s wife and run by a business partner and campaign donor.The donor, Luciano Piccirilli, operates Da Vinci II LLC, which owns 230 acres near Oneonta, west of Albany. Da Vinci II’s rights to underground natural gas are leased to a drilling company, property and corporate records show.

Russia plowing $32 billion into nuclear over next two years

When a country sits on the world’s largest proven natural gas reserves, possessing nearly a quarter of the known total, it plans an energy future dominated by natural gas plants, right?Not if the country is Russia. The vast land with 47.6 trillion of the planet’s 208.4 trillion cubic meters of the stuff is plowing 1 trillion rubles - $32 billion - into nuclear power development, state-owned news agency Itar-Tass reports. And that’s just through 2015.

Aquino Sweats to Solve Mindanao Power Failure: Southeast Asia

Shrinking water levels threaten to cut Mindanao’s power supply by as much as a third just as President Benigno Aquino seeks to convince voters he’s reducing electricity shortages in the Philippines’ second-biggest island.The water elevation at Lanao Lake, which powers the 700-megawatt Agus hydroelectric plant, may decline this month and require state-run National Power Corp. to cut output from the facility supplying more than a third of the island’s electricity, it said on April 8. Factories and shops must shut May 13 to ensure voting precincts have power for nationwide elections, Energy Secretary Jericho Petilla said May 8.

The market 'bubble' you've never heard of

FORTUNE – Following the collapse of U.S. home prices in 2007, analysts and economists have been eager to spot the next big bubble. There's been talk of a bond bubble. And as U.S. stocks hover near a five-year high, many have wondered if a bubble is in the works. There have also been worries over the market for student loans in which defaults have recently risen.Then there's apparently a new bubble that few have ever heard about: America's farmlands.

Freeloading Yeast Make Unstable Communities

Cooperation is common in nature, but there will always be some who cheat the system. A new study on yeast shows that cheaters can persist in populations but put the entire group at greater risk for extinction.A colony of yeast (Saccharomyces cerevisiae) survives by breaking down sugar (sucrose) into simpler sugars. Freeloading yeast that survive by mooching off others can exist at ratios as high as 90 percent of the population, but a shock to the environment could wipe out the whole population, the new study reported.

Goats to clean up at Chicago's O'Hare International

And while goats are new to O’Hare Airport, environmentally conscious efforts to operating an aviation facility are not.“The CDA strives to be the most sustainable airport in the country,” said Pride.

O’Hare already has a soil-free, aeroponic garden in one terminal growing vegetables and herbs that are used by many airport restaurants and sold to travelers at a kiosk. There are also beehives on property and a host of other good-for-the earth initiatives underway.

Flood alarms threatened by budget cuts

WASHINGTON (CNNMoney) - The U.S. flood alarm system is about to get smaller.On May 1, the U.S. Geological Survey began turning off some 150 stream gauges that monitor water levels on the nation's rivers and streams, thanks to the federal spending cuts, also known as sequester.

It's a one-two punch for the flood monitoring system -- the agency could be turning off another 200 gauges because of funding cutbacks at states, cities and towns that are struggling with their own budget crises.

Why You Can’t Talk About Fixing The Electric Grid Without Talking About Climate Change

This morning, CAP Senior Fellow Daniel J. Weiss testified before the Subcommittee on Energy and Power of the Committee on Energy and Commerce about electric grid reliability. He made a strong case for confronting the elephant in the room –the impact climate change has on the reliability and security of the electric grid. The other elephant in the room is the effect that burning fossil fuels for electricity has on our climate.

Carbon Champions Undeterred by Kyoto Dead-End, EU Envoy Says

Carbon-market supporters from China to California will push for emissions trading even as they prepare for the end of the United Nations Kyoto Protocol in seven years, Europe’s top climate negotiator said.Nations including China and New Zealand and some U.S. states have formed an informal group, “kind of the champions of the carbon market,” Artur Runge-Metzger said in a May 2 interview in Bonn, Germany. “It’s that club that’s going to set international standards” rather than UN talks, he said.

UN Carbon Has Biggest Jump Since 2011 as EU Factories Tap Quota

United Nations Certified Emission Reduction credits had their biggest one-day gain since Dec. 20, 2011 amid speculation factories and utilities are using the carbon offsets to meet European Union pollution targets.CERs for December rose 18 percent to close at 40 euro cents ($0.52) a metric ton on the ICE Futures Europe exchange in London. The contract has jumped 33 percent since May 3 and is heading for its biggest-ever weekly increase.

Does Obama Have a Secret Plan to Combat Climate Change?

The Clean Air Act gives the Environmental Protection Agency the duty to regulate carbon dioxide emissions, and the Obama administration has been using this authority in a number of important ways over the years. What it hasn't yet done are promulgate regulations on existing sources of climate pollution rather than on hypothetical new sources. One reason it hasn't done that is that for a long time nobody could really think of an economically feasible way to do this. Just shutting down random power plants would be extremely disruptive. But back last winter I wrote about a very clever strategic outline from the Natural Resources Defense Coucnil that paints a path forward for using this power in a way that would give states more flexibility in terms of how to reduce emissions, while still making huge progress on climate issues.Jon Chait has recently revived interest in this issue among generalist pundits by arguing that Obama not only can but probably will do this.

Alberta's oil sands crude: the science behind the debate

Canada’s oil sands have been called “dirty oil,” a “carbon bomb,” and “game over” for the world’s climate. But beyond the caustic descriptions of one of the world’s biggest oil resources, almost everyone agrees that production from Alberta’s oil sands takes more energy to extract and process than conventional oil – thereby producing more greenhouse gas emissions. How much more is the focus of widespread study and debate, as researchers assess the oil sands industry’s impact on climate.

Shale gas: green groups condemn methane flaring plans for wells

The two companies exploring for shale gas in the UK have confirmed that they intend to flare methane gas from their wells in a move that has been condemned by environmentalists. It is likely to be the most visible sign of the fracking revolution that many in business and government would like to bring to the UK.

When it comes to climate change, Shell is backing the wrong horse

‘Shell faces up to climate change challenge” ran the headline in this paper last week. I wish it were true but the company has a credibility problem when it comes to the issue. It is betting everything on the presumption that we will keep burning the fossil fuels that it keeps pulling up out of the ground.It is hard for Shell to be talking climate one minute and a new “golden age of gas” the next. It is a major player in the energy game and that cannot but affect how it sees our energy future.

Greenland's Glacial Melt May Slow, Study Suggests

Greenland's galloping glaciers will likely slow their rapid retreat in the coming century, scientists project based on a new computer modeling study.In the study, published today (May 8) in the journal Nature, researchers resolve one of the biggest uncertainties about Greenland's future contributions to sea-level rise: the behavior of its outlet glaciers. These massive ice rivers drain to the ocean, adding both surface runoff water and icebergs to the sea. The researchers discovered that Greenland's outlet glaciers retreat in episodic pulses, which account for the past 10 years of dramatic ice loss.

Studies of the Past Show an Ice-Free Arctic Could Be in Our Future

There are still pieces to the climate puzzle that need to be filled in. The study shows that unusually warm temperatures in the Arctic seemed to persist even as glaciers we’re begin to expand in the Northern Hemisphere. But studies like this one help us understand just how changeable our climate—so secure during the history of human civilization—has been in the past, and underscores just how momentous our impact on the planet through the burning of fossil fuels is likely to be. We are well into uncharted territory.But there’s something about the sheer scale of what’s happening that makes it hard for us to really comprehend. The same day the Science paper came out, a new Yale University poll came out showing that the percentage of Americans who believed global warming had dropped to 63% from 70% in the fall—a change that pollsters blamed on the unusually cold winter and spring that hit parts of the country. That’s not surprising—belief in climate change has usually been broad but deep, easily affected in either direction by passing weather events. But as the deep past show us, the climate works on time scales far bigger than a single season. It’s something we may have to experience before we can ever understand it.

But at what levels?

Plus once the existing wells start to be decommissioned surely the infrastructure will not be available making new drilling expensive especially as I'd assume all the big reserves have been found by now.

UK production is currently declining in a bell shaped fashion, so it's probably true that the UK will be producing some oil at the end of this century. But if this trend continues, it may be producing just a few percent of the current production.

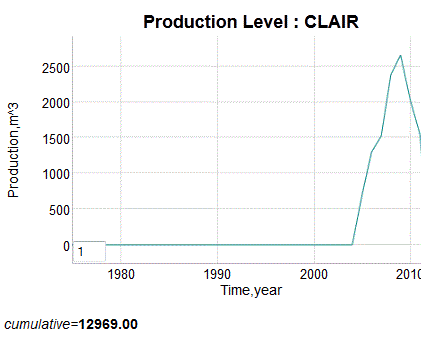

This is what the Clair Field looks like up to 2011

The decline of UK oil has definitely set in, but if that fellow is correct, they should be be able to make an accurate estimate of the discovery size for the Clair additions. In that case I can add that info to the UK Shock Model updated here:

http://theoilconundrum.blogspot.com/2013/04/the-rise-and-decline-of-uk-c...

As referenced in the politics in scotland article, the thing to remember is just how much unreality is going round on the subject of future oil from the North Sea.

This is the bunch that when presented by the EU president saying they would have to reapply for membership, join the euro, etc. should they leave the UK, claimed he was wrong and they would of course get uninterrupted membership on the same terms.

They are much less interested in reality than they are 'the dream', and a key part of that imaginary world is riches from oil. They will claim abiotic oil is real if it would push up the 'yes' vote.

Think "tea party" crossed with "Baghdad Bob"...

If it was truly declining as a bell curve (gaussian) after a few standard deviations it is for all practical purposes zero. Also because of things like MOL (Minimum Operating Level), at some point it would no longer be economic to keep the wells running, as O&M costs would be much greater than the value of the oil.

I suspect the decline to have a fatter tail than gaussian, as at higher prices more and more formerly marginal prospects will be tapped. But at some point the MOL effect will force a complete sessation. Unless someone opens a northsea oil museam with as a tourist attraction, and the tourists revenue is sufficient to keep a historic well running.

Oil and gas production in the UK North Sea and everywhere else around the glob can continue until the end of this century provided everybody ignores the consequences of ocean acidification, sea level rise and climate change! 450 ppm or bust!

At least yeast have an excuse. What's ours?

Political / economic corruption and suppression of the facts from the general populace who "elect" politicians. I think most people would vote intelligently (most people don't want their children to die, or even they themselves to die if they're young enough to otherwise be around another 30 years), but very few people actually understand what's going on and they are therefore susceptible to predatory misinformation campaigns by centralized and powerful vested interests who want people to vote against their own best interests. Plus apathy plays a big part.

Yeah, my own awakening so to speak started back around 2005 when I was working for a company that sold software to oil companies. Part of my job was troubleshooting files and I starting sort of taking a second look at the data on my own.

I hadn't yet actually heard of Matt Simmons but I started looking at data and checking it twice. I also had the opportunity to go to trade shows and speak with petroleum geologists and engineers. Of course no one I met actually talked about 'Peak Oil' back then.

In 2008 I was laid off from a corporate job and I had also found TOD at about the same time and I really started to connect the dots. I have actually put quite a bit of effort into educating myself about what is going on and find it very difficult at times to relate to reactions I get from people who are completely ignorant of the issues and can't even be bothered to take some time understand the reality we are immersed in.

If the MSM propaganda tells them everything is fine then it truly must be, end of story! I can't even get my own friends and family to invest an hour or too to parse non technical predigested information, let alone a couple of years of wading through reams of data from multiple sources that necessitate analysis based on scientific concepts and at least a passing familiarity with the ultimate of all deal breakers 'MATH'!

Let's turn on the Boob Tube or better yet, let's go shopping! Stocks are up, the price of gas is down there is no inflation, and unemployment is way down! It doesn't matter that suicides in the 45 to 65 age groups are way up and it seems to correlate directly to economic hardship due to joblessness.

Life is just great!

Yeah, I have been trying to convince my friends that we are due for a major economic catastrophy and to take steps to protect themselves. What surprised me was that they weren't even interested in looking at the rationale and investigating what I had to say. They just dismiss it off hand. Only now, after a couple years, do they seem interested in entertaining the possibility that maybe the gold price is manipulated. They have their view of the world and they are sticking with it.

It's an emotional thing. You are basically telling them that their worldview is off. I think JMG did a good job of covering this when he wrote about the "religion of progress" a couple weeks ago. What you are doing is akin to telling people their religion is BS - it may be true, but it isn't going to get through in most cases. Even the evidence will be twisted if that's what it takes.

That said, I think 450 is unlikely, because the price of solar keeps dropping. Already there is the beginning of a movement toward solar. Unless we can get to 450 in 10 years, I suspect that milestone will never be reached. Then again, if rather than using solar to replace other sources it is just added to the pile, then 450+ becomes more likely.

Transportation is the biggest issue, and one that, if anything, is even less visible than electric power production.

We will see, in any case. Even with just 400, things are not going to be pretty.

It's easy to be pessimistic, as I am when I talk with my brother, a highly intelligent but non-technical person who simply can't believe the MSM can have it so wrong with energy as I tell him they do.

But there is hope. Around here the solar revolution is growing like a weed after a rain. So many people have wanted to follow my demonstrations of off-carbon gadgetry and substitutions that I have had to gather together some sort-of experts to help me promote the cause.

I bought some pallets of PV and sold at cost- so fast that now I am planning to buy a container of them, and fortunately a young energetic guy showed up to volunteer to do the distribution and such for me.

and another local has set up a PV system installation training program to reduce the goof rate of the handymen who take the panels.

None of this is making a profit- except the very real profit of feeling we are doing the right thing. And there is a very strong motive among most of them to be independent, as well as have fun playing with a new gadget.

Also, when a new PV owner discovers that on a bright day he is getting more electricity than he is using, the invention gene takes over and brings forth wild , sometimes clever, ways to put it to uses previously thought to be off limits.

Cool, wimbi, thanks for sharing. More power to you.

I went to a recent grounding, bonding course sponsored by my state electrical company...and some of the things that can go wrong when electrical is done wrong will make your hair stand up literally. I don't think it is a job for the weekender--- have you heard of the target meltdown? Commercial job but still scary. Just my opinion for what it is worth.

God willing , for the 2014 NEC code cycle forward it will be FORBIDDEN to ground current carrying conductors on DC PV Systems > 300 volts. Such "grounding" problems are unique to the North American code since Inverters inputs with grounded current carrying conductors often can NOT detect electrons leaking or faulting to ground, even though they are required to have circuits to do so. When you get hundreds of panels it's an issue that requires a lot of unnecessary attention and can be hazardous especially with improper installation or age. As Forest Gump said - stupid is as stupid does. Think of it as a bird sitting on a power line vs. touching it with your feet on the ground. Newer solar inverters, "TL type" not the US type solves this nightmare but the system design is different. Disconnects and overcurrent protection required in all conductors but otherwise everything is far simpler and safer. New to many inspectors, since such systems often improperly called "ungrounded" systems and past codes are confusing. See - http://www.solarabcs.org/codes-standards/NFPA/proposals.html

Thanks for the important comments. I have always emphasized the dangers- grounding and shorts. One demo seems to work- I get a thin wire, put it across a PV panel and vaporize it with a little flash and puff of smoke. Apparently people remember that one simple visual.

It is true that a PV panel looks so innocuous, sitting there apparently doing nothing, like a window, that it can fool people easily.

Fortunately, most people around here handle electricity all the time, and have had personal experiences that make them cautious- I certainly have. Is there any voltage on that thing???

The new microinverters greatly simplify the job of installing solar PV at households. It is pretty much as easy as installing a 240V outlet for an electric dryer if you use microinverters.

A local Cape Town guy lost his job in IT and started a YouTube channel on how to use electrical instruments like multimeters, and how to plan and install solar panelling. He makes good money from it.

Solar power was his passion, and he has invested in good cameras and sound, and he gets a cut from Google (owners of YouTube) and a manufacturer of the instruments he features. His opinions are his own. He's not a shill.

The demand for solar knowledge is out there.

While I think solar is going to pick up the pace -at least beyond what the conventional wisdom says, we are still a very long way from even reaching peak emissions, let alone bringing them on a rapid slope towards zero. So 450 will be breached in the 2030-2040 timeframe. Maybe if we can reign in the greed we can stay below 500?

1) Electricity production is only a part of total energy production, to the point where current energy production from solar, wind and geothermal is only 1-2% of the total. Even if you somehow manage to completely replace current energy production with renewable energy, there's the lion's share of energy production left - heat energy. And while it's possible to turn electricity into heat, that comes at a hefty cost - 2 to 3 times in efficiency loss.

2) In the short term, renewable energy is a carbon bad guy in its own right. Silicate rock doesn't melt on its own. Current solar panels still haven't made up for the energy put into making them.

"Unlikely" my ass, do not make light of this extremely grim situation.

"Current solar panels still haven't made up for the energy put into making them."

This comment has been put forward repeatedly, but I don't think it's been properly sourced.

The NREL reports on PV Energy Payback most assuredly DO consider the energy inputs for purifying and otherwise preparing the Silicon.. while they may not have included the more arcane, outer boundary inputs from the Workforce, or the Tertiary Services that the workforce and Supply Chain depends on. Those inputs are real, but of course, they would have to be fairly pro-rated, since they serve many other functions in society apart from supporting the preparation of PV.

http://www.nrel.gov/docs/fy04osti/35489.pdf

If you have a study that challenges this, please share it with us.

It IS a grim situation, but that doesn't mean there aren't factors out there that are still encouraging and helpful.

If you're stuck out in the desert, it wouldn't be wise to assume that every glass of water out in front of you is just a mirage.. you'd be wise to check them first before just swatting them away.

Good points jokuhl! It's nice to see some actual numbers on this because quite frankly the continuous drumbeat that alternative energy, specifically solar PV can't sustain itself is really getting quite old!

Just curious what the payback time is on a nuclear energy or typical fossil fuel generating plant.

And let's include externalized costs and a the need for a never ending supply of fossil fuel. Let's also take into account what it costs to safely maintain the nuclear plants and store nuclear waste for thousands of years.

What's the payback on maintaining our for fossil fuel infrastructure including our war machines?

Imagine if we could somehow divert those funds and invest it in alternative energy technologies.

For now it's pedal to the metal, 450 ppm or bust! The non negotiable lifestyle uber alles.

Edit: I almost forgot, we are the now the new Saudi Arabia...

As I said, my comment reflected on the current infrastructure. I can't find it right now, but apparently they aren't due for payback until between 2016 and 2020 - which doesn't directly challenge above report.

To build upon your metaphor and steal a page from the Chthulhu mythos, let's say an empty glass represents your fragile sanity. All the sand that's added to it represents the arcane lore that gradually drives you to the edge. You add a bit of sand to the glass all the time. If one then comes up with a device that lessens the amount of sand that needs to be added, that's good, but one must first add more sand to get it going - the vast construction of PV, wind turbines etc. and the assorted infrastructure such as pump storage they need will inevitably add to world glass's sand pile. It's "good sand", but it too can add to the glass.

Yes it does, but show me a scenario where we work to move off of the current and fully wasteful systems where it DOESN'T require an energy input. Your comments sound to me like a customer who wants to pay nothing to get a product that they really need. Sure, I'm putting it into more of this 'consumer' context, but frankly it fits there pretty well. New Energy tools are something we need to BUY at this point. We need to Market them, Manufacture them, Research them and Invest in their Evolution. It's not a free ride, it takes water to prime a pump, takes money to make money.

One of the other considerable 'Goods' of adding sand into efforts like Solar PV, is that as a useful technology that does FULLY return all the energy that went into creating it, and in a very reasonable amount of time, it is still clearly constrained by physical realities. Even installing a great amount of it will still leave us needing to find all sorts of reductions in power demand as well. Negawatts are absolutely being uncovered as people look to make the most of the 'free' power that their PV provides, in order to offset more of the purchased KWHs.

Another way to put it: we have to invest energy in maintaining and replacing our current infrastructure - why not simply divert that stream into renewables??

Joe,

It's worth noting that's 15 year old data: PV's E-ROI is probably 3x better now, given that prices have fallen by about 5x. Can there be more than one kWh of energy input in a panel that costs $.60 per kWp?? Such a panel will likely produce 100kWhs in a good location over it's probable 50 year lifetime.

I wonder if we can find something more current...

For the sake of making an argument lets consider a $3 gallon of gasoline and a $3 watt of PV (panel, inverter, wiring). The assumption that this will rest on is that the dollar figure is mostly related to the energy required to produce it.

$3 gallon of gasoline: Contains approximately 34,000 Watt-hours for 11,333 Watt-hours/dollar.

$3 Watt of PV: 1W*4.5hours/day*365days/yr*25 years = 41,062 Watt-hours for 13,687 Watt-hours/dollar.

You can take that figure and run with it...or you can take what I believe is a legitimate next step and translate it based on conversion efficiency into other items.

That gallon of gasoline if converted to...

Electricity:

1 gallon of gasoline: 11,333*0.4 = 4,533 Watt-hours

Watt of PV remains at 13,687 Watt-hours since it is electricity

Automobile motion:

In a Leaf-like petrol car 1 gallon of gasoline: Approximately 35 miles

PV electricity in a Leaf @ 270 Wh/mi: Approximately 51 miles

That's all based on scrapping everything after 25 years...yet the racking and wiring should last 100 years, the panels are showing themselves worthy of at least 35 years now, but you might have to replace or refurbish the inverter once during that time.

That's good.

A few thoughts:

PV is at $2/Wp in Germany, because their planning and permitting is so efficient. Planning and permitting costs are higher elsewhere, but they are labor intensive and have very, very little extrasomatic input energy. Another big cost is installation, which is also pretty low in extrasomatic energy.

The energy inputs would primarily be in the manufacturing costs, which are perhaps $1/Wp. Manufacturing costs are in general very roughly 5% energy - crystalline PV has a significantly higher percentage, but it's very far from 100%.

Also, "Automobile motion" needs comparable units:

In a Leaf-like petrol car 1 gallon of gasoline: Approximately 35 miles

PV electricity in a Leaf @ 270 Wh/mi: Approximately 153 miles

Finally, I think you can assume more than 4.5 hours of sun per day, as there are enough consumers who live in that kind of sunny area to absorb the installation of enough PV to drive costs even lower.

Whoops! Good catch - accidentally used the "per dollar" figure instead of the $3 gallon equivalency.

Unless, of course, you use electricity to power a heat pump, which typically have seasonal COPs ranging between 2.0 and 3.5.

Cheers,

Paul

And apart from that, there is the enormous potential for use of Solar in Direct Heating, which has some great advantages in immediacy and simplicity.

I'm all for heat pumps on PV, but with Copper pipe and a circulator, I know it can be fixed and rebuilt and substituted almost entirely locally, too, offering far greater resilience.

Very true, Bob. We need both and sooner rather than later.

Our Nyle heat pump water heater usage today: 1.92 kWh -- this same day last year with electric resistance: 4.86 kWh. A 60 per cent savings for basically an $1,100.00 investment.

Cheers,

Paul

While heat pumps could definitely be an improvement than the electrical heating currently used, I don't think they can be used to melt iron.

(Yes, there's a decent pretender for providing heat energy in the solar thermal system, but curiously enough it never seems to be discussed, perhaps because electrical energy needs is treated as the only factor contributing to carbon emissions.)

The lion's share of our requirements pertain to low-grade heat, i.e., space conditioning and domestic hot water -- we already have electric arc furnaces.

Cheers,

Paul

Henriksson wrote:

"Electricity production is only a part of total energy production, to the point where current energy production from solar, wind and geothermal is only 1-2% of the total. Even if you somehow manage to completely replace current energy production with renewable energy, there's the lion's share of energy production left - heat energy. And while it's possible to turn electricity into heat, that comes at a hefty cost - 2 to 3 times in efficiency loss."

Three remarks:

1) You can very efficiently convert electricity into heat, that works with 100% efficency. There is no problem with Carnot for this process. :-)

2) You can of course pimp your heat production with a magical device that is called heat pump. My delivers for each unit electric energy four units of heat. :-)

3) Then there is another magic trick: the so called thermal insolation of buildings, worked as advertised in my house. :-)

While heat contributes indeed the lion's share of the demand in most European countries, it is quite easy to solve with AVAILABLE technology. My goal would be to reduce the demand of the building by 60% with better insolation, then provide the heat with a heat pump, you could substitute 1000 TWh final energy used in current situation with 100-150 TWh electricity.

Hey hey Null Hypothesis,

Yes and no, I think you have a very valid point as evidenced by this NYT poll:

http://www.nytimes.com/interactive/2013/05/01/us/domestic-poll-graphic.h...

But I also think its not that simple:

Climate Change Poll Finds Most Americans Unwilling To Pay Higher Energy Costs:

http://www.huffingtonpost.com/2012/11/02/climate-change-poll-energy-cost...

Yeast are smarter than humans.

With regard to oil prices remaining between $80 and $100 per barrel above.

(Fracking and Shale May Keep the Price of Oil Low Forever)

As far as North Dakota Bakken/Three Forks output goes, prices will need to rise to at least $173/barrel (in 2013 $) in order to meeet the recent USGS mean estimate of 5.8 BBO from the North Dakota portion of the Bakken/Three Forks play.

If one is optimistic and assumes costs will slowly fall, oil prices will gradually rise, the oil companies balance sheets remain healthy, and the sweet spots don't become fully drilled too quickly, so that average well productivity does not decrease rapidly, my prediction would be for a peak between 950 and 1000 kb/d in 2017 at about 13000 wells drilled at a maximum rate of 167 net wells added per month. After this decreases in well productivity will reduce profitability.

If we make the further assumption that real (inflation adjusted) drilling and fracking costs per well decrease to $8.5 million per well (2013 $) and real oil prices rise by 7 % per year, then the breakeven oil price of $247/barrel (2013 $) is reached in April 2025 and net wells added decreases rapidly to zero with total producing wells at 29500 wells in Feb 2026. Total URR from the North Dakota Bakken in this (admittedly optimistic) scenario is 7.2 BBO (billion barrels of oil) from 1953 to 2073.

A more realistic scenario with all of the same assumptions as above except for a more rapid decrease in well productivity which affects the breakeven oil price and the total # of producing wells. The breakeven real oil price of $173/barrel (2013 $) is reached in April 2020. Peak is about 960 kb/d in 2017 at 12500 producing wells and total producing wells reaches 20250 by Sept 2021 and no more wells are added. Total URR for the North Dakota Bakken/Three Forks in this scenario is 5.8 BBO from 1953 to 2073 which matches the recent USGS estimate.

If long term real oil prices cannot rise above $102/barrel (2013 $), then breakeven oil price is reached by May 2017 at about 12,900 wells and total wells producing only reaches 14,700 wells by 2019 with no further wells added.

Total URR for the ND Bakken/Three Forks from 1953 to 2073 falls to 4.8 BBO. Peak output remains at 960 kb in 2017.

Note that the 18 month, 3 year, 5 year, and 30 year EUR for the average Bakken well are 115 kb, 158 kb, 191 kb, and 311 kb in Feb 2013. In the optimistic scenario well productivity falls to 54.4% of the Feb 2013 level by April 2020 and falls further to 30.4 % of the 2013 level by April 2025 at the breakeven oil price point of $247/barrel (2013 $). The more realistic scenario has well productivity decreasing to 43.5 % of the Feb 2013 level (which is the same in both scenarios) at the breakeven price of $173/barrel in April 2020 and by April 2025 well productivity falls to 18.1 % of the 2013 level.

The Arps hyperbolic equation for the average well profile is

q(t)= qi/[(1+b*Di*t)**(1/b)]

where * is multiplication and ** is exponentiation and qi is the initial production rate at t=0, b is a real number between zero and one, Di is the initial decline rate and t is time (usually in months from first output).

In these scenarios I used qi=14925, b=.95, and Di=.19.

DC

Wow, DC! What a wealth of information you have generated based on the available Bakken data. Kudos & thanks to you. Let me take a stab at what an MSM headline based on your above analysis might look like:

(from your 1953 to 2073 cited time frame, of course...)

All sarc aside, your and Web's and Rune's and others' work on debunking this

Bakken and shale oil in general will 'save us' myth is much appreciated, by this other DC.

Clifman,

Thanks. The work I have done has been inspired by Webhubbletelescope and Rune Likvern, without the incredible work they have done, I would have no idea where to start. I do really miss Rockman pointing out the many ways my scenarios miss the mark as these criticisms, both improve my thinking and I learn a ton from his insights. I echo the many people here who have said they miss his commentary.

I think the title would be Bakken May Provide 12 Months of Current Refinery Crude Inputs but the text would note that this output will be over the next 60 years. We currently input about 5.5 BBO per year into US Refineries. If oil prices stay at $102/barrel or less in inflation adjusted dollars, it will only be 4.9 BBO from the North Dakota portion of the Bakken.

DC

DC,

Nice work and thanks for sharing.

For what it is worth I made some quick estimates on how the breakeven price at the refinery gate for the “2011 average” well I presented in a recent post would develop as productivity declines from 100 % (the reference well) to 50%.

Assumptions used is a well cost of $9 Million, OPEX $4/bbl, financial costs $3/bbl, and transport to the refinery gate of $12/bbl, total taxes and royalties at 25% of gross at the wellhead (nat gas not included) and a return of 7% (numbers rounded). Estimates do not include costs for acreage.

100%;....$65/bbl

90%;......$70/bbl

80%;......$76/bbl

70%;......$84/bbl

60%;......$95/bbl

50%;.....$109/bbl

If the unit cost gets above the market price (due to declining productivity), what could happen is a slowdown of drilling until the market price gets above the unit cost required to meet aimed at returns.

If actual data proves my “2011 average” well to be too optimistic, unit costs will rise and vice versa.

Rune

Hi Rune,

Thank you.

Do you look at the 5, 10, or 20 year EUR when considering breakeven? To make sure I understand this correctly, could you check out my calculations at "dc78image", go to files page and the spreadsheet is called "breakeven calc" (xcel and ods). I don't have the values you used but tried to approximate with a hyperbolic with qi=14700, b=1.48, and Di= 0.28. I do a monthly net present value calculation and get a slightly different result than you, possibly because my well profile does not approximate yours correctly.

DC

Rune,

The link to the speadsheet page is

https://sites.google.com/site/dc78image/files-1

The file name is "breakeven calc.xlxs" or "breakeven calc.ods".

Aslo of possible interest is "bakken well profiles" where NDIC attempts to match the NDIC well profile in the Emmons pdf from Oct 2012 at the NDIC recent presentations link, Model 1 tries to match the well profile in your recent Oil Drum post, Model 2 uses your first and second year cumulatives and tries to use a hyperbolic to match the first two years and then uses the monthly decline rate from the NDIC profile to match months 25 out to month 360, then a hyperbolic is matched to that profile. Model 3 is the well profile I used for my recent models.

Note that the hyperbolic used to match the first two years of your data (I only have the 86,000 and 130,000) has qi=14,500, b= 1.4, and Di= .25.

DC

DC,

Only difference I found is that "my" well has a higher EUR of about 6-7 kb after year 10, but that should be within expected error bars and the difference should be moderated by discount effects.

Truth is that when it comes to later life production we are now just using our best guesses, and as of now my gut feeling is that we could probably end closer to your Model 2/3.

DC,

What I did was simply scale the "2011 average" well down in steps of 10%, thus the EUR changes accordingly and I ran the economics over 38 years. (Late life volumes have little effect due to discounting).

I will look at your calcs later.

Rune

Hi Rune,

I was aware you had scaled the EUR by 10%, 20%, ... I actually tried to match your breakeven with the initial profile, but I only did this for 120 months. I didn't think my estimate of your well profile was so far off that it would make a big difference. When I carry out the calculation to 38 years I am close to what you get, thanks. I will update the spreadsheet so you should get a new copy before checking calcs, I get $63 at 100 % and $105 at 50 %.

DC

38 years? I will get more oil from my car when I drain my crankcase than you will get from a Bakken stripper well after 38 years.

Ron P.

Ron,

That is the most amusing post I've read on TOD in a long long time. Thanks - I needed a good chuckle!

Hi Ron,

I agree. This points to the shape of the average well profile. The hyperbolic decline curve that approximates the well profile that Rune Likvern used in his recent post on the North Dakota Bakken/Three Forks has a fairly thick tail in an attempt to match the NDIC typical well. After 38 years, this well is still producing over 13 barrels per day, which I believe is unrealistically high. The well profile I use is somewhat better, but still produces over 4 barrels per day after 38 years, not a lot of oil but more than is found in most engines (168 gallons).

Also note that calculating out to 38 years was what Rune did so I was trying to match his breakeven calcs.

One possible solution to this apparent problem is to combine the hyperbolic decline model for the first 5 to 10 years with the OU Diffusion model introduced by Webhubbletelescope at The Oil Conundrum. The hybrid hyperbolic/OU Model has a well profile which tapers off in the later years more rapidly than the hyperbolic model.

To visualize this check out "ouhyperbolic hybrid.png" by searching dc78image click on images and then find the png (the list is mostly alphabetized).

Also for anyone interested in breakeven calculations, there are two spreadsheets in the files section of dc78image comparing model 1 (Rune's) and model3 (my variation) "breakeven model1" and "breakeven model3" in xls and ods formats.

Quick summary

I compared breakeven oil prices using a 7 % and 10 % discount rate for model 1 and 3 with EUR declining from 100 % to 50 % and then 38 %.

At 7 % discount rate model 1 gives a breakeven oil price of $63.5/b, $105.5/b, and $132/b at 100 %, 50 %, and 38 %. For model 3 it is $74.2/b, $127/b, and $160.5/b.

At a 10 % discount rate model 1 has $69.8/b, $118.5/b, and $149/b and model 3 $79.4/b, $137.5/b, and $174.5/b.

Thank you Rune for clarifying this for me.

DC

Re: Studies of the Past Show an Ice-Free Arctic Could Be in Our Future

The study referenced in this article from the TIME web site is in pre-publication on the SCIENCE web site. Here's the citation:

Pliocene Warmth, Polar Amplification, and Stepped Pleistocene Cooling Recorded in NE Arctic Russia DOI: 10.1126/science.1233137

Abstract

Understanding the evolution of Arctic polar climate from the protracted warmth of the middle Pliocene into the earliest glacial cycles in the Northern Hemisphere has been hindered by the lack of continuous, highly resolved Arctic time series. Evidence from Lake El’gygytgyn, NE Arctic Russia, shows that 3.6-3.4 million years ago, summer temperatures were ~8°C warmer than today when pCO2 was ~400 ppm. Multiproxy evidence suggests extreme warmth and polar amplification during the middle Pliocene, sudden stepped cooling events during the Pliocene-Pleistocene transition, and warmer than present Arctic summers until ~2.2 Ma, after the onset of Northern Hemispheric glaciation. Our data are consistent with sea-level records and other proxies indicating that Arctic cooling was insufficient to support large-scale ice sheets until the early Pleistocene.

---

This work is important because it shows that the conditions in the Arctic were warmer than now when the ice sheets began to build over North America and Northern Europe. So, one might conclude that warmer conditions were required to start the last round of Ice Ages, some 3 million years ago. Any bets on a repeat of that scenario as we add more CO2 and other greenhouse gases to the atmosphere? Humanity has been living in a Goldie Locks world, which may soon fade into a new geological reality...

E. Swanson

Interesting following the Arctic sea ice data. The focus has been on areal extent but the volumetric numbers are more telling. It would be analogous to having an interest in volume of an oil reservoir as opposed to the area. Well, duh.

While we are on the topic of a future ice free arctic,

http://news.nationalgeographic.com/news/energy/2013/05/130510-earth-co2-...

Climate Milestone: Earth’s CO2 Level Passes 400 ppm

If the seas were 30 feet higher when CO2 levels were previously this high, means the heat hasn’t had sufficient time in the atmosphere to penetrate the oceans. So that is how much sea level rise is already baked in, presuming CO2 is not sequestered enough to avert those consequences. Camels in the Arctic? We better really be sure this is the kind of planet we want to live on.

The report just published on the SCIENCE web site covers this period, comparing data from other areas in addition to the lake bed core. They mention that these other data suggests that Greenland was not covered by ice during that period, which would have provided lots of water for higher sea levels. The authors also mention that the West Antarctic Ice Sheet was smaller as well. The report includes 105 references, should one wish to dig deeper. Too bad it's behind a paywall, which will limit most folks access until it hits the library shelves in the print edition...

E. Swanson

The requirement for glacier growth is that more snow falls in the winter than melts in the summer. It is possible that the Wisconsic occured while the Arctic Ocean had less ice, the Atlantic was cooler and there was heavy precipitation over central Canada. The maximum thickness of the Wisconsin ice sheet was fairly far south in Canada, which indicated that that was the area of maximum snowfall.

With no ice motion, it is accumulation minus melt. But real glaciers are more complicated, you have zones of net accumulation, and zones of net melting, and flow in between them. If it reaches a body of water you can add calving and/or melting from underneath. And you may lose some with sublimation, and lose vie a buildup of frost. The dry valley glaciers in Antarctica "ablate" due to sublimation.

Even accumulation minus melting: we can measure that on the surface, but what happens to snow and meltwater that goes down cracks in the ice? Does it freeze and add mass in excess of the surface balance? Does it melt even more internal ice?

Your discussion of glacier growth/melt would apply to today's mountain (or high altitude) glaciers. The ice sheets over Eastern Canada built up over relatively flat lands. Indeed, the area of Hudson Bay is below sea-level and at the time of the Last Glacial Maximum, the surface was considerable depressed due to the mass of ice above. Hudson Bay is still rebounding after the removal of those glaciers and is slowly shrinking in surface area.

The geological record shows repeated periods of ice sheet collapse, which resulted in massive quantities of icebergs flooding into the North Atlantic. After LGM, the ice sheets melted but the melt water was trapped behind the ice sheets until a path opened for the water to flow into the ocean(s). The Younger Dryas period is thought to have been the result of a flooding of the waters of the North Atlantic as one of those large glacial lakes drained. The 8200 bp event may have been another (though smaller), such event.

I think it's rather obvious that the start of an Ice Age must represent an accumulation of ice over land. That would be the result of frozen precipitation falling faster than it could melt (or ablate) over a year's time period. The presence of sea-ice is not required for this to occur, indeed the lack of sea-ice might provide the source of the water later appearing downwind as ice over land. Given the snow/ice albedo effect over land, once the ice begins to build, the positive feedback might reduce melting locally, allowing the ice sheets to begin to grow again.

We know from geophysical data that the Earth's climate over the past ~3 million years has been repeatedly plunged into Ice Age conditions. About 110/120 years of the data show that Ice Age conditions are the "preferred" climate. Although mankind has already caused major changes in some of the variables even before we began to pump large quantities of CO2 into the atmosphere, if the historical pattern repeats again, the Earth will slide back into another Ice Age, though when and how remain unknown, IMHO...

E. Swanson

Its not just thermal inertia of the oceans. Even with the sea ice gone, we will still have big icesheets in Greenland and Antarctica adding their cooling (and their water as they melt). The feedback from melting thick ice caps is going to be a slow one.

Then again e of s;

http://www.wunderground.com/resources/climate/abruptclimate.asp

The Science of Abrupt Climate Change: Should we be worried?

If it happened before it can happen again.

There is always that chance. But what I am saying is the forcing (greenhouse plus solar as modulated by planetary albedo), won't reach that of 3million years ago because the lagging ice melt helps in the albedo department.

The more ice the more albedo, reflectivity back into space. The less ice the more absorption of energy. As the Arctic melts and more energy enters that ocean, more methane will release. We don't know how much forcing it will require to initiate large releases. Russian scientists are worried about east Siberian shelf. It's leaking methane bubbles each Summer, but if it did all release that will be a game changer.

Note that neither the start of peak oil in 2005, nor the financial crisis in 2008/2009 - which was triggered by high oil prices - managed to put a kink into the Keeling curve which just continues on a linear path.

http://bluemoon.ucsd.edu/co2_400/mlo_full_record.png

Annual CO2 emissions went down in 2009, Fig 2 in:

CO2 emissions from the IEA

http://www.iea.org/publications/freepublications/publication/name,32870,...

http://www.iea.org/publications/freepublications/publication/CO2emission...

Annual emissions from burning oil (p 54) have gone up by just 1.5% between 2005 and 2010 (8.4% between 2000-2005), also with a temporary 2009 reduction of 2.2%

This means the reduction in total annual emissions in 2009 and the flattening of the emissions curve from oil had no impact on the Keeling curve (which is a cumulative curve)

Fig 19 (p 22) shows reduction of CO2 emissions of 30% over 5 years during societal collapse in the Soviet Union after 1991

Something dramatic has to happen to change the current trajectory

Something dramatic has to happen to change the current trajectory

Clearly, coal is the recent problem, especially in China.

The Chinese increased renewable kWhs more in 2012 than they did kWhs from coal. They're actually working pretty hard on this problem.

The US has reduced coal's market share from 50% to 37% in the last 8 years - that was mostly because of shale gas, but it's still encouraging.

Electricity theft could mean lights out for JPS

JPS gets waivers from major lender

This utility and this country seem to be facing quite a conundrum!

Alan from the islands

Alan, it is hard to run a business when 1/3 of the folks are stealing from you.

Do you see any way forward?

Yes and our children's and grandchildren's, etc., futures are being stolen.

A comment from below the article:

It's a little misleading to talk about the number of customers that are stealing from you without pointing out how much they are stealing. The term "non technical losses" has been used to describe theft and a cursory search brought up a figure of 13%. There is the problem that people who are stealing electricity are unlikely to make any effort whatsoever to conserve.

One story about that concerns one inner city community that was the home of a notorious gangster that had established a virtual state within a state. This individual had built a criminal enterprise that extended it's reach to the US and had become one of the DEA's most wanted. An extradition request was made back in 2010 and despite his political connections his organization was broken up and he was extradited. Following his departure the utility went into the community to re-establish normal business operations in what had become a nest of non-paying customers. The stories that came out were that, there were residents who had installed up to two air conditioners and were in the habit of running them around the clock, every day, during the hot months. Other stories involved residents opening up their fridges to "cool down" the apartments in the absence of air conditioners.

The fact of the matter is that, many of the people who steal electricity can't afford to pay for it, certainly they cannot pay enough to run fridges. Yet politicians over the years have given potential voters the impression that they have a right to electricity, as well as health care, education and housing, regardless of whether the individuals are in a position to pay for it. Responsible parenting has never been discussed during election campaigns, instead state funded health care and education and the economy are usually front and center.

In general, people know that times are hard but, are being fed stories about the island becoming a "logistics hub" and there is hardly an inkling of any appreciation for any limits to growth. If the general populace could be sold on the need to conserve, plan their families (restrict reproduction) and use renewables as much as possible it would help but, that's not really high on the agenda right now. As with most places we're trying to go full steam ahead with BAU.

Alan from the islands

Being connected to the grid, and being allowed to use as much as you want are two different things. I'm fine with the poor having subsidized access to some power -but less than the median paying customer uses.

When I was reading through reports trying to find statistics on Jamaica's power consumption I ran across those figures on theft. I'd guess as in most places that people are segregated along economic lines in various neighborhoods and they gave the impression that there were certain neighborhoods in particular with 80%+ who were non-paying. So it occurs in pockets and they compensate for the non-payers (subsidize) by raising the rates on everyone else.

"Other stories involved residents opening up their fridges to "cool down" the apartments in the absence of air conditioners."

Epic Fail.

I wrote a letter to the Gleaner a while back, gave them an overview of Peak Oil, the status of Bakken, solar potential of Jamaica, etc, as well as a link to TOD. Didn't hear back from them but if someone read it, it might plant the seed of looking at headlines in terms of energy (my intent).

http://jamaica-gleaner.com/gleaner/20130510/lead/lead1.html

Cars sold avg. $4,238.60 - Transport Authority offloads vehicles for less than the cost of a tank of gas

And those guys in Sweden think they have it bad - $4,000 for a tank of gas!

Jamaican dollars, I gather...meaning about US$40.

Along those lines, I submitted the following comment:

My comment has not yet been approved and I doubt that it will. Since a moderator has to read through all the comments, I will continue to hammer home these points and hopefully one day, something will sink in. As a buddy of mine said earlier this week, "shout loud and shout often".

Alan from the islands

"shout loud and shout often"

It sure as hell has been working for the lies...maybe we can get it to work with the truth, too.

Here's something interesting for all American folks on TOD

Biometric Database of All Adult Americans Hidden in Immigration Reform

Well, the country's finished. I think physically speaking Americans might do ok, but there is a huge risk in America of all sorts of scenarios, such as a military coup of the federal government followed by resistance and civil war. Americans are already arming themselves to the teeth anticipating this.

I don't see that risk as strongly in other places. For example, you look at the UK, and the Scotland issue is not going to cause a war.

But in America we're getting perilously close, and I do think it's prudent for Americans to hunker down and prepare or just emigrate now if they can. I wish I didn't have to say that.

Yeah, I can see those old dudes with their AR-15s mounted on their hoveround and Rascal scooters storming Federal office buildings. Poor Feds won't stand a chance. All they got is 11 Nuclear-powered Aircraft Carrier groups, nuclear submarines, drones, ICBMs, stategic bombers, Stealth Fighter Jets, satellites, tanks, attack helicopters, cruise missiles, nuclear weapons, etc.

Taken from the slave by the master to clobber the slave with?

For it to become a true civil war, the military would have to split. But I will tell you this: as much as we say this or that, there are a ton of people in the military who would not be willing to attack Americans.

Also, carrier groups are not very effective against guerilla warfare.

That depends upon whether the rules of engagement are ethical. If they are prepared to go Roman -just wipe out the whole population to be sure all the enemies are dead, then they can just use tactical nukes and other heavy stuff. If you try to be humane, and actually make an effort to separate true enemy combatants, from sympathizers from civilians caught up in the conflict, then things get dicey.

Oh sorry we dropped a bomb on your mom, carry on being a loyal soldier though...

Those aren't very scary. Surveillance cameras and wiretaps are the more likely threats to a budding revolt.

And so much the better when you can get the surveilled to voluntarily help pay for their own surveillance.

Even if I grant that security cameras may not be unalloyed evil, this idea of "adopting" one strikes me as an indication that the weird have definitely turned pro.

"Surveillance cameras and wiretaps are the more likely threats to a budding revolt."

Everyone fears the "Jackbooted Thugs" coming in with the howitzers and machines guns while their freedoms are actually evaporating at the stroke of the pen. Patriot Act, NDAA, Citizens United...the laws like they used against Aaron Swartz are the most insidious because they seem innocuous. There was a case just recently where they used the same tactic (violation of a Terms of Service agreement "TOS") to go after someone because they couldn't get any real evidence...so they used a mistake where they filled out the wrong information while setting up a Myspace page to charge them with a felony.

MidAmerican says locations of new wind turbines still unknown

Best hopes for Iowa to have at least 40% wind-powered electricity.

I had to go to the state boys (6th floor of the Henry Wallace Building) to get a leak fixed by MidAmerican. Two businesses side by side had natural gas coming into them via their water mains. (30" hp pipe had a leak). It had been going on for at least a year according to the pharmacist at one business. I flagged a leak once reading meters in December and then flagged it again 1-1/2 year later doing leak testing. Etc. Etc.

In the late 90's they have made a conscious decision to not invest in new residential gas pipeline and to maintain more. However the data got stuck often somewhere between leak testing (and complaints) and the service foremen.

The bigger story these days is the two hush hush possible sites for a nuclear plant in Iowa by MidAm, after they did not get the o.k. previous to bill ahead for years from the Iowa legislature. Strong push back for the possible Muscatine IA site, not so much on the NW Iowa site.

Gov. Branstad is so in bed with MidAm it isn't even funny.

Interesting book on shale.

http://www.postcarbon.org/reports/DBD-report-FINAL.pdf

Next month is the 5th anniversary of the June 2008 price spike, which had $123.34/bbl (US Free on Board) for its monthly average. Coincidentally, it was five years after the February 1981 high price of $36.93/bbl when KSA turned on the taps, leading to a massive drop in price, and calamity throughout the fossil fuel industry as well, with the price sinking as low as $9.74 in July '86, and maintaining an average of ca. $15/bbl throughout the 90s. The price steadily declined all through that period in the early 80s, with spare capacity >10 mb/d at times. If the June 2008 price had declined following the same pattern as seen in the 80s, we'd be enjoying prices around $85/bbl right now, before the price would go through the floor to ca. $40/bbl in the span of a few months, assuming history will not only rhyme but repeat, of course. But the past has definitely not been the key to the future here, although other parallels are more exact, like how we've been drilling the crap out of the planet.

However, Brent only traded above $100 for six months in 2008. In contrast, Brent has traded over $100 for 26 of the past 27 months, starting in February, 2011:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RBRTE&f=M

I know; actually according to the FOB series price only held >$100/bbl for 5 months. What I was posting about is that the price hasn't "recovered" like it did back then, meaning it slowly deflated before crashing to the floor for 15 years, excepting the spike from Gulf War I of course. No comparable production rebound has happened, either, despite the sustained price swell. Any pundits like Yergin blaming it on lack of storage? That was one leg of his trifecta for prices dropping back when, along with fresh supply and cuts in demand. I see they're still pounding the ol' Peak Demand drum, but how about Peak Tank Farm? Like anybody would care. But it would make for yet another column.

wt, do you have an opinion on whether QE is what's holding the damn together for OECD oil importers while price remains this high? Japan just recently dove in head first on QE, and I read some time ago China also had easing. Is this a sign of end game or just another odd way of cooking the books without much in the way of repercussions?

I have not seen the below article here and think many would be very interested in it as background info on the choke points of oil shipping, protection strategies, and costs to the US historically for carrying the burden of the defense costs. I think that some of the numbers (8 trillion total) might be high but it does bring home the rather hidden costs not shown at the pump.

http://oilchangeproject.nationalsecurityzone.org/choke-points/

Wyo

Harrison H. Schmitt and William Happer: In Defense of Carbon Dioxide

http://online.wsj.com/article/SB1000142412788732352840457845248365606719...

I'm not a biologist, so I don't know if their primary claims about C3 and C4 plants are true; maybe others here can chime in.

However, they do pull out the "no warming in 15 years" card. All I can say to that is look at the icecap over those same 15 years - a lot of energy is going into latent rather than sensible heat right now. If the polar icecap disappears in the next decade or so, we could see warming resume in force.

Another possible explanation is the enormous magnitude of emissions from developing countries. If there's another economic slowdown for an extending period of time, temps could rise fairly quickly in this situation as well.

Increased CO2 only has an impact with C3 plants, not C4. And because of Leibig's Law of the Minimum, it only has a beneficial effect if no other input to the plant is limiting... and as we all talk about here, the inputs to modern agriculture (fertilizers, water) are definitely not getting more plentiful.

http://www.skepticalscience.com/co2-plant-food-advanced.htm

You don't need biology when simple solid geometry shows all you need to know: There is more of the earth's surface in the tropics than in the temperate zones. Now consider this:

The African Sahel and the African Sahara are huge. Global warming expands the Sahara at the expense of the Sahel. Global cooling would do the reverse.

Their claims about C3 and C4 are true: increased CO2 doesn't help sugar and corn.

But as often happens in the WSJ, many things are left unsaid. I am not an expert in any of these fields, but here are the lies of omission that i've detected:

I have seen quite some presentations by plant biologists on climate change, and I have never seen any of them claim that the net effect of climate change is an increase in agricultural productivity.

But paleo-evidence shows extremely high correlation between CO2 and temperature.

Munich Re, the big reinsurance company that actually pays for all those extreme weather events, states that extreme weather disasters are increasing, due to climate change caused by carbon.

Wikipedia shows that this is a simple lie.

Indeed. And all this evaporation is significant enough to have major climatic consequences. Daytime temperatures in the tropics would be about 10° celcius higher were it not for evaporation. We know this because we're actually trying this out at the edge of the amazon, replacing trees with soja beans. During the dry season, the roots of the soja beans cannot reach the water table any more so evaporation stops and temperature shoots up. Nearby pristine forest doesn't have that problem.

And we also know that this was so long ago that the sun was actually much weaker. And we also know that the life that flourished was very different from the life that flourishes now. The life that flourishes now must die before the other type of life can come back. Humans can not survive 35° at 100% humidity for a day.

The Daily Show on the new realities of college education:

http://www.thedailyshow.com/watch/thu-may-9-2013/stay-out-of-school?xrs=...

Q: I assumed that there was a college major for bartending.

A: There is one, it's called English Literature.

India declined to accept natural gas, via pipeline, from Iran, now it wants to import it by sea, from Canada!

Isn't it possible to make a list of accepted posters here and exclude them from the spam filter?

No, I don't believe it is. It's just not that kind of a filter.

From Whitelist Users entry at Drupal:

What do you think? Does this make any sense?

That isn't the spam filter we use.

Well, that comment from ToPFM did not flag up as new but the last time I looked it was not there and the last comment was your previous one. This gets hard to follow threads.

NAOM

I can confirm the phenomenon with my own postings. I'll post, it'll go to the moderation queue, then I refresh the page to pick up the new tags that have come in while reading (my post not being there of course), then later I'll come back and my post will appear with no "new" tag. So it appears as if the posts that go into the moderation queue are published but invisible to the general audience - so if you read the page while they're in the queue it marks them as read, so when they become visible they are no longer marked as "new."

Yup, that is how it works. Unfortunately.

Also, articles with new comments that are hidden by the spam filter do not show any new comments (on the front page, say, or on the Drumbeat page). So it might looks like an article has no new comments, when in fact there are a lot.