Total Production by the Top Five Oil Majors Has Fallen by a Quarter Since 2004

Posted by Luis de Sousa on April 19, 2013 - 3:09am

This is a guest post by Matthieu Auzanneau, a freelance journalist in France, author of the Oil Man blog at Le Monde, where this post first appeared.

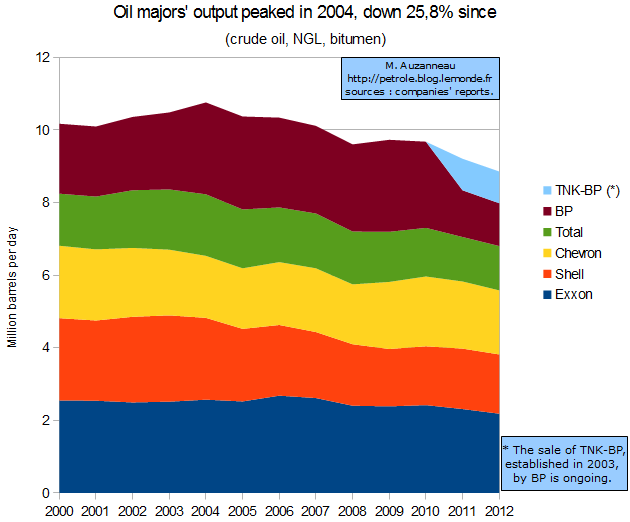

The combined crude oil production of the five main international oil companies (Exxon, BP, Shell, Chevron and Total) hit an historic high in 2004. Since then, it has fallen by 25.8%, despite large increases in investments.

Click to enlarge |

Total crude oil produced by the majors was 10.760 million barrels per day (MB/D) in 2004. In 2012, it reached only 7.981 MB/D. It has decreased by 2.779 MB/D in 8 years (-1/4), as I have been able to calculate from figures that appear in the twelve latest annual reports of those five companies.

Is this a clear early indication of an imminent decline in the worldwide production of black gold, a phenomenon predicted since 1998 by former oil company scientific executives, from the French Total group in particular?

The majors are all facing a decline in their crude oil production, which began in each case before 2007. This comes despite extremely large growth in their investments, allowed by the significant increase in crude oil prices experienced since the late 2000s. Total, for example, has seen its production fall by almost 20% since 2007, although the French giant now has at least 40% more extraction wells.

Since 2004, the total oil production by the majors has only increased once, between 2008 and 2009, and by just 0.13 MB/D, despite the unprecedented level of sales and purchases of oil assets experienced in recent years. So-called production sharing contracts, which allocate a larger share of production to the host country when the price per barrel rises, do not appear to explain the lowering of production by the majors, far from it. The production share of the five majors in worldwide production dropped from 13.39% in 2004 to 9.98% in 2011. It diminished further in 2012.

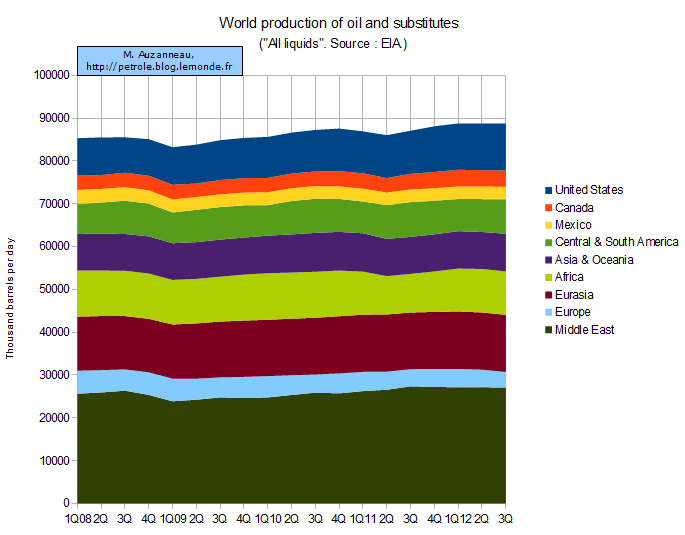

Worldwide crude oil production rose by 4% between 2004 and 2011. It has hardly increased at all since 2006, however: since then it has been on an undulating plateau, within a small margin of less than 1.25%.

The significant decline in extractions by the majors has been compensated for by the OPEC countries (+ 2.189 MB/D), primarily Iraq and Saudi Arabia, and also by the countries of the former Soviet Union (+ 2.131 MB/D). In the rest of the world, where the majors often occupy the key positions, oil production (excluding agrofuels) has fallen by 1.104 MB/D, once again between 2004 and 2011.

In 2012, worldwide production appears to have increased significantly, firstly thanks to the boom in shale oil in the United States; full detailed information is not yet available (to follow).

Click to enlarge |

The case of BP

Since 2011, the decline in the total production of the majors has been significantly amplified by the sale to the Russian national company Rosneft of parts of the BP group with TNK-BP, an important joint venture established in Russia in 2003. The sale of TNK-BP alone has eliminated around 40% of BP's previous production. This production reached its record level in 2005. If this sale had not taken place, total production by the five majors would have still declined by 17.7% in 8 years, reaching 8.86 MB/D in 2012. And BP's production would still have been in sharp decline.

Since 2011, BP has had to sell other major production assets in order to settle the account for the oil spill in the Gulf of Mexico in 2010. In this case, as in that of TNK-BP, it is the need to go in search of intact sources of oil in increasingly extreme conditions that has hindered BP's development: the drill site responsible for the catastrophe in the Gulf of Mexico holds a drilling depth record; the conflict between the TNK-BP shareholders at the root of the sale of parts of BP was about the opportunity of a huge drilling campaign in the Arctic Ocean, where the oil majors, notably BP, have recently met with a number of failures.

The "seven sisters" have aged

Exxon, Shell, Chevron, BP and Total are still forces to be reckoned within the oil industry, as much for their still considerable outputs, for their investment capacities and technical expertise, as for their strategic role as the preferred providers of consumers in the old Western industrial powers. These Western majors, starting with the most powerful, Exxon, remain, now more than ever, at the top of the ranks of the largest private companies on the planet.

The majors came into existence between the late 19th century and the early 20th century. Long dubbed the "seven sisters", they are now only five in number as a result of the mega-mergers that have taken place over the last two decades.

Until the 1960s, the Anglo-Saxon majors, as well as the forerunners of the French company Total, largely dominated worldwide production. The OPEC cartel of oil producing countries was created in 1960 to stand up to the restricted and secretive cartel of the "seven sisters", which reigned supreme outside the United States for half a century.

Throughout the 1960s, and especially in the 1970s, as the OPEC member countries nationalised their oil fields in the wake of Algeria, Libya and Iraq, the control wielded over production by the Western majors was reduced.

The response at the end of the 1970s broadly stabilised the balance of the market share, thanks in particular to the launch of the North Sea and Alaska, two extraction areas that have been in significant decline for more than a decade because of the exhaustion of their crude oil reserves.

OPEC is now content with a little over 40% of worldwide production. But it controls more than 70% of the planet's proven reserves.

Consequently, as the known oil fields are getting depleted, production should become more and more concentrated in the major OPEC countries, starting (or finishing) with Saudi Arabia, as well as, to a lesser extent, in the former Soviet Union.

It seems unlikely for the moment that the development of non-conventional and extreme sources of oil, in particular shale hydrocarbons, will be able to change that fact. We will come back to this again.

For this translation, a very big thank to Laura Bennett: culturetranslation.com

With more and more countries, nationalisation there oil productions, I think it will continue go down. I know that main focus of Shell is for at least 5 years no longer on crude oil. But there main focus is on inovating new stuff, for better oil etc. I have been to the Amsterdam Shell business and talked to some of the employees there. I also write my experiences about this here: energieleverancier kiezen. Shell is also trying to invent new materials etc. It was a very inpiring day!

Wow. This pretty much says it all. And OPEC remains mired in secrecy and in a race to sell as much oil as possible for the benefit of a few. Imminent decline would be so much easier to understand and work to transition from if information was shared. "Why didn't you tell us"? will ring pretty hollow when the 5 sisters trend spreads and is acknowledged throughout the industry and consuming world.

Regards...Paulo

Best article I have read in a long time. Thanks

Just one note on the BP comment about Macondo -

"the drill site responsible for the catastrophe in the Gulf of Mexico holds a drilling depth record"

That is not true. The Macondo drill site was in only about 5000' water depth, and 13,000' below the mud line, or around 18,000 total depth - relatively tame by deepwater standards. The Deep Water Horizon drill ship had previously drilled a well in Keathly Canyon at Tiber prospect that was, at the time, a drilling depth record, some 34-35 thousand feet or so.

Sorry, my mistake + translation hiatus :

The oil platform (and not "drilling site") responsible for the catastrophe in the Gulf of Mexico held a drilling depth record

Thank you !

"OPEC is now content with a little over 40% of worldwide production. But it controls more than 70% of the planet's proven reserves."

I thought the reserve numbers of the OPEC countries were quite suspect (the way they doubled around 1988, their failure to decline when production continues--yet no new discoveries are announced...)

Actually OPEC claims 81 percent of world reserves and relegate to Non-OPEC only 19 percent. They claim 1,200 billion barrels of reserves and give Non-OPEC 282 billion barrels. Of course those OPEC reserve numbers are grossly exaggerated. While I think they underestimate Non-OPEC reserves their OPEC numbers are totally unrealistic. I believe Non-OPEC reserves are slightly largely than OPEC reserves.

Search OPEC Share of World Crude Oil Reserves and it will be first hit you get.

Ron P.

In the title of the world production graph, it includes liquid oil substitutes. Does this include ethanol or natural gas?

Read: International oil companies’ oil production peaked in 2004 and declined by 2.1 % pa, by Australian TOD commenter Matt, which has a lot more detail (data from Jean Laherrere). It's basically the same story with more detail; I assume Auzannieau's story was the inspiration since that was published some twenty days earlier.

As for the data itself, I wonder. I seem to remember a lot of stories like these:

ConocoPhillips in 2013: More Asset Sales, Focus On North American Business (Trefis)

Quarterly forecast for Big Oil: sunny and profitable (Fuelfix)

(my emphasis)

---

While this does smell of desperation to me, if all the majors are selling 'non-core assets' at a rapid clip their production numbers are going to give a misleading picture of what is happening: sold production capacity doesn't disappear, it just moves from one set of books to another.

That is, the decline is going to look steeper than it 'really' is.

Finding out how much will take a substantial amount of detective work... not for me I'm afraid.

---

So what is going on here, apart from the obvious, that they are having trouble keeping up with decline?

Possibilities:

1) They think that the assets they are selling are overvalued due to present very high oil prices; i.e., they think we're in an oil price bubble and want to cash in before it pops (I find this unlikely, but possible)

2) Finding and 'developing' new oil is horribly expensive. They're basically betting the farm on finding The (Last) Big One

3) Their role is changing -- they are becoming the world's expert "integrated oil-finders", leaving the tedious process of producing it to others

4) ???

Whatever is going on, they seem to be doing rather well financially.

Natural gas seems to be the investment of chose these days. At $15 MCF and friendly jurisdictions, it is the only profitable game left for the majors.

It appears, and as evidenced in the Shell facility visit above, the oil majors are looking to move up the value chain. They see no future in slugging it out with nationalizations, and may have come to the oldest paradigm change in our modern commercial world. That is, what do people really want?

They don't want a barrel of oil, they want the products that fuel and accommodate their daily lives. That's where the money is. Not a hard one to figure out.

Simply evolving in the market place to garner the same/ more profit from the same/ less amount of resource.

UK north sea oil is declining as predicted

So how come I'm not shocked? >;-)

How about this: Margaret Thatcher was the Prime Minister of the United Kingdom from 1979 to 1990 and the Leader of the Conservative Party from 1975 to 1990. That spans the entire first hump of UK's oil production era, ending with the Piper Alpha platform disaster.

Was she responsible for the UK's economic turnaround or was it enhanced by the oil bonanza?

How much did the oil help the Iron Lady keep from rusting?

Interesting question. Some facts are here

http://www.guardian.co.uk/politics/datablog/2013/apr/08/britain-changed-...

We have had a chance to reassess the legacy this last two weeks.

We had 2 recessions under Thatcher, a large rise in poverty (and inequality) in the mid 1980s and decline in British manufacturing continued apace. She was fired from her job as PM by her cabinet and members of her parliamentary party in 1990 because she was seen to have become detached from political reality (and perhaps from reality more generally). A house price bubble at the end of her time collapsed and only later ejection of UK from the early version of the Euro monetary union and the immediate forced large devaluation of the currency allowed growth to restart. The 1990s then saw growth in exports and GDP and a drop in unemployment. (It had been 12% in the first recession under Thatcher). Where we would have been without N Sea oil and perhaps as importantly cheap N Sea gas it is hard to say. Thatcher’s early adoption of neoliberal global finance arguably helped set the scene for the 2008 crash. Continued re-structuring of our economy to dependence on financial services and services generally leaves us vulnerable it seems. So here we are. Imported energy is increasingly the name of the game from now on.

No North Sea Oil = No Iron Lady. Here:

http://transportblog.co.nz/2013/04/12/oil-dependancy-and-the-wealth-of-n...

Thanks Patrick.

I had missed that great summary comment by Jonathan Callahan on TOD April 8th.

Your link to the Auckland Transport blog is one for my record book.

best

Phil H

http://www.newsnetscotland.com/index.php?option=com_content&view=article...

Do a search for "UK squandered North Sea oil" - pops up quite a few results, including this gem from Nobel Laureate in economics Joseph Stiglitz.

Indeed!

It might also be worth noting that at about the same time, her bosom buddy and partner in crime, Mr Regan was simultaneously riding high on the rather steep drop in oil prices after 1980. Which was in large part caused by a global oil glut due to demand destruction which in turn had been caused by the previously high prices of the oil crisis of the 70s.

Without the sudden and fortuitous access to cheap oil, Reganomic's disastrous long term consequences would have been felt much sooner and it would have quickly become apparent that the emperor was actually naked. So many missed opportunities. I truly believe that this was where the US and much of the western world really went off the rails.

I'm saddened but still not very shocked!

Not sure if the misspelling was intentional, but it's Reagan, not Regan. As far as what helped the U.S. "go off the rails", we have long been a lot more conservative and religious than most European countries --at least since WWII. The 'cargo cult' cornucopian denialist mindset goes hand-in-hand with typical conservative/religious magical thinking. The fall of the Soviet Union around the same time oil prices hit their nadir also convinced many here that unregulated capitalism was God's own economic system and that unions and redistributionist social(ist) programs had to be destroyed. It convinced a large cohort of two entire generations (Boomers & Gen-X) that radical right Libertarianism combined with fundamentalist Protestantism is the perfect basis for a free and prosperous society.

No, it's a typo, thanks for catching it. Though I had been toying with the idea of writing 'Ray gun' >;-)

Here is a brief summary of UK North Sea production that I wrote today:

http://theoilconundrum.blogspot.com/2013/04/the-rise-and-decline-of-uk-c...

Figure 3: PM Margaret Thatcher was at the right place at the right time. Leader of the conservative party starting in 1975, and then became Prime Minister in 1979, she reigned during the huge buildup in oil production, which was temporarily halted by the Piper Alpha explosion in 1988.

So does that mean much of the Bakken is being done with small mom & pop oil companies?

I guess one can conclude that the amounts that are retrieved from fracking can't mask medium to long term decline of 'the good stuff'.

What the graph shows is well in keeping of what we've expected for quite some time now. What I was looking for (for benefit of the BAU crowd), was the uptick point, aka "then a miracle occurs"...must be in next 12 year data set I expect (insert appropriate "roll eyes" smiley here).