Tech Talk - Shell Looks to the Future

Posted by Heading Out on April 8, 2013 - 11:18am

Each year the larger oil production companies provide their views of the future, and I recently reviewed that for ExxonMobil. Shell has now produced their projections, though in a somewhat different format as the document “New Lens Scenarios”, which deals with future projections as a set of differing options. That does not make these views less informative.

In reviewing where the world will go, Shell looks more to political impact as the future unrolls. They see the European Union stuck in a Trapped Transition” where:

...the ‘can’ keeps being ‘kicked down the road’ while leaders struggle to create some political and social breathing space. So there is continuing drift, punctuated by a series of mini-crises, which will eventually culminate in either a reset a reset involving the writing off of significant financial and political capital (through pooling sovereignty, for example) or the euro unravelling.

On the other hand, countries such as China and Brazil are resilient:

in their different ways, they had the financial, social, political, or resource ‘capital’ to respond and reform, following a room to Manoeuvre pathway.

Within the next thirty years, as the population grows, so a greater percentage - up to 75% - will live in cities. And these will consume a greater fraction of the global energy supply, perhaps as high as 80%, up from the current 66%.

The document is very much slanted as a socio-political forecast, with considerable polemic in regard to the weaknesses that the company perceives to exist in the West.

Shell postulates two different scenarios for the future. There is the Mountain scenario, where business continues very much as usual, and then there is an Oceans scenario where the ”powers that are” work toward a more accommodative approach to those in the developing world, and to the less fortunate layers of society.

The document begins with the impact if the Mountain scenario is to prevail, driven through a top down control, largely through existing institutions. Shell is not enamoured of this:

In the US, for example, income and wealth inequality continue to increase, with stagnating middle-class earnings, reduced social mobility, and an allegedly meritocratic higher education system, generously supported by tax exemptions, whose main beneficiaries are the children of the successful. Superimposed on this class divide is an increasingly serious intergenerational divide, as commitments to the elderly via entitlement programmes crowd out discretionary expenditures that could rebuild economic and social infrastructure. Similarly, in Europe an ageing population and commitments to high levels of entitlement, which are frequently underfunded, create a mixture of social and political strains that deflect attention from the core structural economic issues facing the region.

Driven by this gloomy picture of the future, Shell anticipates that global GDP growth through the 2030’s will average under 2%. This will, in turn, moderate the growth in energy demand. Through increasing urbanization, the growth of the service sector and the greater use of electricity in developing countries, Shell anticipates that the strong correlation between economic and energy demand growth will be broken.

N.B. All the illustrations come from the Shell New Lens Scenarios document.

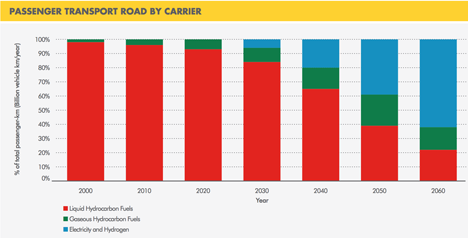

Shell anticipates that hydrogen, an up and comer just a few years ago, and now largely neglected, will undergo a “phoenix-like” resurrection and find a market both in industrial and transportation as an alliance of government and private industry push a hydrogen infrastructure post-2020. They anticipate that the use of liquid fuels for passenger road transport will peak in 2035, and that by 2070 the global passenger transportation network using roads could be nearly oil-free, as hydrogen and electric powered vehicles take over.

The energy burden will transfer from crude oil to natural gas, which will increasingly underpin the global economies as China joins the top tier of natural gas producers.

The increase in the volumes of natural gas that become available from tight shales and coalbed sources are sufficient enough that by 2035, Shell anticipates that natural gas will not only displace crude oil as the primary transportation fuel, but that it will also encourage a robust petrochemical industry based on methane. Shell sees the possibility of US energy self-sufficiency in the 2030’s as peak oil theories are abandoned.

The availability and broad use of natural gas will also allow time for credible carbon capture and sequestration technology to be developed and demonstrated, so that by the time that coal is needed as a fuel (around 2075) it will be usable while sustaining the zero-carbon dioxide levels for electricity generation that become widespread by 2060.

In the alternative Oceans scenario, the more accommodative approach, Shell looks to a willingness to share technology and compromise on issues of ownership and profit as a way of encouraging globalization and developing productivity. Societal interconnectivity is encouraged by greater use of the Web, and this leads to significant changes, with existing leaderships yielding to allow a broadening of governance and significant reform. The greater spread of information and connectivity makes for the more fluid nature of geopolitics that name the scenario, as increasing populism is both a source of innovation and a challenge to stability. Populism is seen as a challenge to US dominance, and is considered likely to cause “destructive and violent reaction #8221; as globalization progresses.

This progress is seen as most likely through technological interconnection between entities that creates a new class of Mandarin who is less accountable to traditional masters. In this scenario, Shell seea the world increasingly run by more flexible and decentralized governments “that have embraced radical pathways to economic sustainability”. And this includes both the United States and China. In this regard they quote the work of Anne-Marie Slaughter of Princeton on a New World Order.

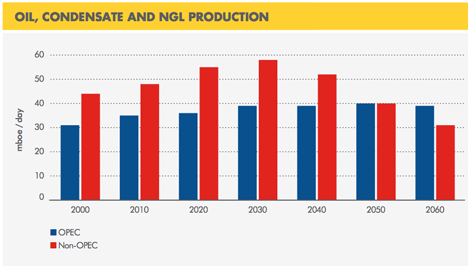

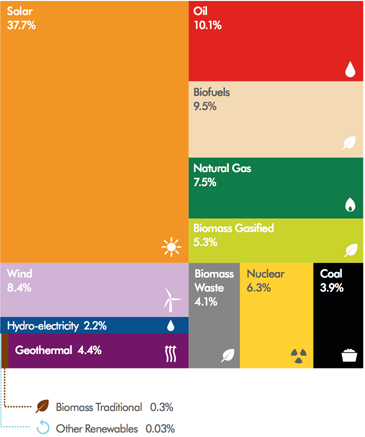

This change from the current business-as-usual (BAU) model has an impact on fuel availability and use. The encouragement of entrepreneurship is seen to significantly increase the penetration of solar power into the energy mix, while sustaining the era in which crude oil contributes beyond that of the Mountains scenario.

In comparison with the projections under BAU, natural gas is less of a player, though Shell don’t explain either where the additional oil will come from or why the rush to invest in natural gas is turned off. They anticipate that the reliance on hydrocarbons will cause a rise in price that will open the door to new resources and technologies, particularly with solar power.

In this future Shell sees the developing world taking more of the energy pie, yet transitioning rapidly into a lighter industrial society with a large service component. (One wonders where the necessary heavy industry goes, as it also transitions to become 80% more efficient?) Heat pumps become a widespread domestic unit, with their benefits in energy efficiency. And in order to sustain their market share, internal combustion engines become increasingly efficient and technically advanced. While crude oil use will increase until the 2040’s, beyond that time the increased use of biofuels will allow liquid fuel dominance to continue in vehicular use. There are two main sources for these biofuels, first generation fuels, mainly sugar based ethanol, which will contribute some 4 mbd by 2050, and second generation biofuels from non-food crops which come to dominate beyond that time. As this transition occurs, so traditional biomass use will disappear by the end of the century.

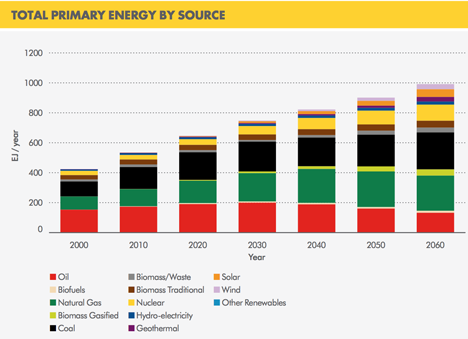

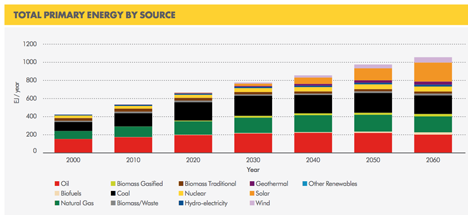

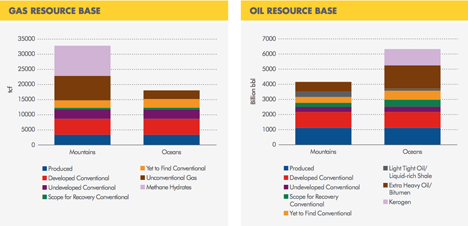

The different consequences of the two scenarios as they impact fuel sources, and the unconventional nature of the Shell, answers to “where will the resource come from” is shown in two plots that summarize the two energy futures.

Under the BAU Mountain view, the additional required energy will come in the natural gas side of the house, with Methane Hydrates being the major new source of fuel. With the competing Oceans scenario, the energy comes from the development of kerogen from the oil shales of Colorado, Wyoming and Utah.

By the end of the century, renewable energy will supply more than half the electricity demand around the world, with solar carrying the greatest share of this. However, they do not see the electricity generating industry becoming carbon neutral until the 2090’s, as CCS penetrates the industry.

Shell foresees that the problems of energy storage (80% of the solar power in many OECD countries is generated in the summer) will be overcome through the use of electrolysis and the storage of the resulting hydrogen.

There is much to debate over the basis on which Shell has derived the scenarios that form this report. It remains more optimistic about the oil and gas futures than I can find a basis for accepting, but nevertheless, it is well worth reading as it provides two views of what might come about. The impact of societal pressures and drivers produce two different energy futures, and while I suspect that reality will be quite different with “unknown unknowns” having great influence, the effort is worthwhile.

HeadingOut,

Thanks for a thought provoking post of how Shell imagines the next 50 years of energy production.

Figures 1 and 4 summarise the future energy production for the two scenarios and they both show total primary energy production doubling to roughy 1000 EJ/year in the next 50 years.

In both scenarios, by 2060, traditional fossil fuels are shown to supply 60% of the energy demand, with the remaining 40% made up from a mix of nuclear, renewables and biomass.

I very much doubt if it is realistic to see at least a 150% rise in all fossil fuel production in 50 years, as shown in the two scenarios.

In the both cases, this mix of nuclear and renewables is expected to provide close to 400EJ - equivalent to 80% of today's primary energy. This is a 4 fold increase in this non-fossil mix in 50 years.

Neither scenario appears realistic. The growth demands on fossil, nuclear and renewables would likely divert most of our economy into manufacturing renewable energy systems, nuclear plants and technology to extract ever-declining fossil fuel resources with ever dwindling EROEI.

At some point, the percentage of GDP diverted to energy production, overcomes BAU. At the moment, I believe that energy production consumes typically 5% of western GDP. There is bound to be a tipping point, where we expend all our efforts trying to produce primary energy - and this cannot be described as BAU.

Can Shell really believe that we can double global primary energy production in 5 decades, and not have a catastrophic effect on the planet and its ecosystems? Not to mention where all these additional fossil reserves are going to be found.

2020:

The answer to your last question is shown in Figure 5, where Shell sees the answer coming either from Methane Hydrates or from the Kerogen in the oil shales. Both of these require some advances in technology, and, I would suspect, a significant increase in the price of hydrocarbon products. And while the latter is fairly certain, one cannot legislate technological advances and thus ensure the former.

I saw an industry projection that showed an increased use of liquid hydrocarbon fuels to the year 2100. You can bet that Exxon, Chevron, Shell, BP and Total will have a hand in that one way or another.

We live under the aegis of a technological carapace (or maybe a Shell), happily constructed for pleasure, profit and the survival of those marginally equipped by nature to survive the natural rigors of existence. It has allowed a cancerous growth of a single species, Homo sapiens. Because of its toxic processes and innate human behavior that promotes unending malignant growth, we will eventually approach a quality of life that is far below the organic conditions from which we emerged. And yet the growth continues with geo-engineering waiting in the wings to save us from our egregious folly. A tumor is a tumor, whether green or festooned with a large yellow scallop shell. Eventually we will have to deal with our original nemeses and the new ones we’ve created through technological escapism. We may even have to deliberately open the door to some of the horsemen to inhibit further growth of the cancer, but I can hardly imagine a cancer doing something against its primary and blind interest. But look at it this way, the cancer lives for at least another fifty years with only nominal amounts of growth as it converts most remaining fossil fuels into atmospheric carbon for the final ecosystem coup de grace and consequent delivery of human souls to the great beyond. I think the likeness of Jack Nickolson breaking through the door with an ax in Stanley Kubrick’s movie “The Shining” is a more suitable corporate symbol than a relatively benign scallop shell.

“Here’s Johnny.”

Methane hydrates and kerogen to maintain and replace the delicate mass produced structures of civilization that will be, by then, mostly reduced to rust and dust? We always have been an insanely optimistic species.

Nice article on Shell's projections, but the rule of thumb in business is that any projection beyond about 4 years is pretty worthless, much less 50+ years.

I wanted to post this next bit in the "Death of Peak Oil" thread but it's closed.

You might call it: "Peak Oil is not dead, it's sleeping!"

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/04/13/peak-oil-isnt...

Peak oil isn’t dead: An interview with Chris Nelder

CN: Not necessarily. In 2005, we reached 73 million barrels per day. Then, to increase production beyond that, the world had to double spending on oil production. In 2012, we’re now spending $600 billion. The price of oil has tripled. And yet, for all that additional expenditure, we’ve only raised production 3 percent to 75 million barrels per day [since 2005].

Oil drilling depth have multiplied, offshore oil prioduction has soared, and tar sands is actually being used to produce oil. We are past peak.

Thanks for the quick review, I'll have to look through the document. Your phrasing describing the power structure in the Oceans scenario was intriguing

This progress is seen as most likely through technological interconnection between entities that creates a new class of Mandarin who is less accountable to traditional masters. In this scenario, Shell sees the world increasingly run by more flexible and decentralized governments “that have embraced radical pathways to economic sustainability

Were giant global corporations (like Shell) classified as the traditional masters or the new Mandarins? Your phrasing kind of makes it sound like Shell sees the new Dutch East India Company's of the world as calling all the shots once they have usurped all the national powers that they found useful while discarding any responsibilities that might have been tied to those powers and concurrently delegating anything that might detract from the bottom line to the shell's of nations remaining so of course the costs could be spread away from the Company shareholders...oh that couldn't be the right interpretation as it is the ultimate outcome of continuing BAU and Oceans is all about shredding BAU if I understood you correctly.

No doubt that shell is very optimistic with their reports. However, from where countries will they get those supplies is still a question.

Great news! Now we only need to abandon climate change theories, and everything will be just right.