Drumbeat: April 6, 2013

Posted by Leanan on April 6, 2013 - 11:35am

Energy is the largest component of the world's Gross Domestic Product. It is a measure of our state of civilization. Its availability determines our standard of living, but also threatens to undermine it: the excessive use of stored energy through burning fossil fuels is a cause of Climate Change. Now, the depletion of these fuels will force us to reinvent how we can continue to advance our civilization in a sustainable manner.

Oil Caps Biggest Weekly Drop in Six Months on Jobs

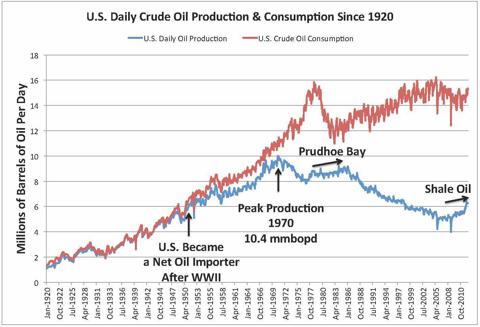

West Texas Intermediate crude capped the biggest weekly drop in six months as U.S. employers hired less than half the number of workers forecast in March, raising concern that economic growth won’t be strong enough to support oil demand.Prices tumbled for the fourth time in five days after the Labor Department said payrolls climbed by 88,000, the smallest gain in nine months. Economists surveyed by Bloomberg had expected an advance of 190,000. U.S. inventories increased to a 22-year high in an April 3 Energy Information Administration report as oil production stayed near the most since 1992.

Canadian Heavy Crude Jumps to Six-Month High on Spring Breakup

Canadian heavy oil prices reached a six-month high on the spot market amid a seasonal decline in production from Alberta.Canadian oil rig counts dropped by 30 to 117 this week, down from this year’s high of 509 during the week ended March 1, Houston oil field-services company Baker Hughes Inc. said today. Canadian energy activity typically dips in April during the so- called spring breakup, when warmer weather turns roads and drilling sites in remote areas to mud, slowing production.

Los Angeles Jet Fuel Rises to Three-Week High as BP Repairs Unit

Spot jet fuel in Los Angeles gained to the highest level against futures in more than three weeks as BP Plc (BP/) performed maintenance on a jet fuel hydrotreater at the Carson oil refinery, the second-largest in California.The 266,000-barrel-a-day Carson plant was scheduled to shut the treater for planned repairs beginning April 1, a person with direct knowledge of the schedule said March 28. The work is expected to last until at least April 8, a person familiar with operations at the refinery said today.

Trade Deficit in U.S. Unexpectedly Narrows on Oil Imports

The trade deficit in the U.S. unexpectedly shrank in February as stabilizing overseas markets boosted exports and Americans imported less oil.

Government plans to give LPG subsidy in cash to beneficiaries

New Delhi (IANS) The government is planning to start transferring the subsidy for cooking gas in cash under the direct benefit transfer scheme, Finance Minister P. Chidambaram said Saturday.Addressing a media conference here, Chidambaram said he would soon meet Petroleum Minister Veerappa Moily and sort out the issues related to the direct cash transfer for liquified petroleum gas (LPG).

How US Shale Blew Up The Global Energy Market

Late last month, Alexey Miller, CEO of the Russian energy giant Gazprom, dismissed the energy boom occurring in the U.S. right now as a “soap bubble [that] will burst soon” – and said the United States was “not a competitor” to Gazprom.“Currently, there aren’t any projects that we know of where shale gas production would be profitable,” Miller said. He added that “absolutely all the boreholes” in the U.S. are empty.

U.S. Energy Boom Won't Change Anything

Despite the previous woes of the American energy industry, there is a wave of optimism around the production of domestic energy. We may have a long way to go before we can consider ourselves energy independent, but we're heading in the right direction.Whenever times are getting better, it's easy to get caught up in hyperbolic rhetoric. Mostly because we want things like $2.50 a gallon gas and for the country to be a net exporter of oil. Unfortunately, we need to take a step back and realize there are some things that are just not going to change. Here are three things that will still happen no matter how strong the U.S. energy resurgence may be.

Total ruled out of Bab gas project

Total has not been selected to develop Abu Dhabi's multibillion-dollar Bab sour gas project, the chief executive of the French oil major has acknowledged."Indeed, we have not won," Christophe de Margerie said on the sidelines of a conference. "We will win the next round," he added, referring to another mooted gas project in Abu Dhabi.

Kazakhstan to increase oil exports to China

Kazakhstan and China have signed a number of bilateral documents within the frameworks of the President Nazarbayev’s visit to China, a Tengrinews.kz journalist reports from China.

South Sudan resumes oil production -state oil company

(Reuters) - South Sudan has restarted oil production after agreeing with Sudan to resume cross-border oil flows last month, an executive at the state oil company said on Saturday.After months of negotiations both African countries agreed earlier this month to resume cross-border oil flows after tensions between them eased.

Official: Iran to Export 40 mcm/d of Gas to Iraq Soon

TEHRAN (FNA)- Managing-Director of the National Iranian Gas Company (NIGC) Javad Oji announced that Iran plans to export 40 million cubic meters per day (mcm/d) of natural gas to Iraq soon."We will be exporting 40 mcm/d of Iran's natural gas to Iraq by summer," Oji said, saying that the country's export of gas to Iraq has been 20 mcm/d so far.

Need for simpler and fairer energy tariffs

This week’s £10.5 million fine by Ofgem of the UK’s second-biggest energy company, SSE, for mis-selling comes at a time when consumer confidence in the energy market is at rock-bottom.This record fine might send out a public message to the energy industry that such bad practice is unacceptable, but it is too little, too late for those customers who were mis-sold.

Meet the U.S. billionaire who wants to kill the Keystone XL pipeline

Tom Steyer is a man at odds with himself. He made his fortune by founding a hedge fund with a keen interest in the energy sector, including leading oil, pipeline and mining companies. The firm also gobbled up stock in BP a year after its Deepwater Horizon oil spill in the Gulf of Mexico. All this should hardly make him a darling of environmentalists.

BP Payouts Are Upheld; An Appeal Is Likely

NEW ORLEANS (Reuters) — BP can proceed with its appeal of the way a court-appointed administrator apportions payments for claims related to the 2010 Gulf of Mexico oil spill, some of which BP has called “absurd,” according to a federal judge’s ruling on Friday.

Exxon Oil Spill Photos From Mayflower, Arkansas Posted By EPA

The EPA's On Scene Coordinator website has posted disturbing images of the ExxonMobil pipeline oil spill in Mayflower, Arkansas.

Oil spill keeping Ark. residents from homes indefinitely

MAYFLOWER, Ark. — Some residents of this Arkansas town on the shores of Lake Conway may not be able to return to their homes until next month after a pipeline break last week that sent tens of thousands of barrels of heavy crude oil into their streets and yards.Two property owners in the neighborhood where the incident occurred filed a federal class-action lawsuit Friday against ExxonMobil, owner of the 65-year-old Pegasus pipeline that ruptured, saying their property values are permanently diminished.

U.S. board faults California safety regulations in Chevron blaze

(Reuters) - The federal agency investigating the fire that broke out in August at Chevron Corp's oil refinery in Richmond, California, faulted the state's regulatory system for not being proactive enough in preventing accidents."The California process safety regulatory system lacked sufficient well-trained, technically competent staff and also lacked more rigorous regulatory requirements to require Chevron to reduce safety risk," said the U.S. Chemical Safety Board's lead investigator Dan Tillema at a public hearing in Richmond on Friday.

Turkey raps US absence in $22bn nuclear tender

Ankara: Turkey's energy minister has criticised the United States not joining in the $22 billion tender to build the country's second nuclear power plant, local media reported on Saturday. "If we are not building the nuclear power plant with America, which strategic project will we handle with them?" Energy Minister Taner Yildiz was quoted as telling the daily Hurriyet newspaper.

Japan's Fukushima nuclear plant leaking contaminated water

(Reuters) - As much as 120 tons of radioactive water may have leaked from a storage tank at Japan's crippled Fukushima nuclear plant, contaminating the surrounding ground, Tokyo Electric Power Co said on Saturday.The power company has yet to discover the cause of the leak, detected on one of seven tanks that store water used to cool the plants reactors, a spokesman for the company, Masayuki Ono, said at a press briefing.

TEPCO likely to expedite setup of tank

Tokyo Electric Power Co. is likely to accelerate the construction of a new tank to store radioactive water at its Fukushima No. 1 nuclear power plant, as the existing tanks are expected to be filled by July.The company has to urgently review control measures for radioactive liquid at the plant, as up to 120 tons of contaminated water seems to have leaked into the soil below a storage tank.

Salazar Looks Back on a ‘Joyful Run’ as Interior Secretary

WASHINGTON — Ken Salazar, a man of unnaturally sunny disposition in an often gloomy town, may be the happiest person in the Obama administration these days. He is going home to Colorado next week, provided his successor as interior secretary is confirmed as expected.

Breach Through Fire Island Also Divides Opinions

FIRE ISLAND, N.Y. — If on some stretches of this barrier island the scars of Hurricane Sandy are fading, at a spot called Old Inlet, a physical reminder of the storm remains: a channel, now 856 feet wide, through which seawater pours into the Great South Bay. The breach, in a federal wilderness area at the eastern end of the island, has already helped clean the much-compromised bay.Now the question being debated by local residents, scientists, environmentalists and government officials is what to do about it: leave the gap as it is for the time being and see what happens, or close it up?

Midwest Farmers Looking for Best Crop in Decades

A cool spring in the Midwest has farmers eager for soils to warm up before planting what is expected to be the region’s biggest crop in decades.

A Stubborn Drought Tests Texas Ranchers

The persistence of the drought here has forced ranchers to use all the creative techniques they can muster to survive. For some, it has meant knowing as much about land management and grass as they know about the bloodlines of their herds. King Ranch Blue Stem, for example, makes for great grazing but is invasive; Snow on the Prairie aerates the land but cattle will not eat it.As Mr. Price put it, “You’re now marketing the grass through the cow.”

Don’t fret for the oil sands. We can afford new rules

The costs of the proposed regulatory tightening therefore seem modest. On the other side, the benefits may be large.

Majority Of Republicans Feel America Should Address Climate Change

The analysis of environmental polls and surveys conducted in the US often focus on the political split between Democrats and Republicans. Unsurprisingly, really, given the public divide between the two parties and the almost Messianic qualities attributed to any one particular candidate, qualities that are as easily described as satanic by the opposition.So it was a bit of a surprise the other day when a recent survey conducted by the Center for Climate Change Communication (4C) at George Mason University of Republicans and Republican-leaning Independents found that a majority of respondents — 62% — said they felt America should be taking steps to address climate change.

I'm posting this article because it illustrates one thing that has been widely overlooked by the MSM - the production from the US's widely hyped Bakken boom is being shipped to market via the Canadian export pipeline system, which happens to be quite convenient to the Bakken.

Another thing that neither the MSM nor the pipeline companies want to talk about is that the companies are not going to build new pipelines from the Bakken on its own because they don't expect the boom to last long enough to pay for the pipe. OTOH, the Canadian oil sands have >100 years of reserves to back up production - which is something that pipeline companies like to see: a nice long, long term growth in business.

Montana fracking boom sparks Keystone pipeline support

People in Baker, Mont., say the pipeline is needed — along with the economic boost that comes with it

Good post, RMG.

I especially like the KPL promoters who claim that completion will lower US oil/gas prices. It seems to me that, if all that Bakkan oil gets to market on the coast, it will be competing with the rest of the world, and it is more likely the price will go up to match Brent.

Most people don't realize that the folks who are going to make out well from Keystone are the major oil companies. And they, frankly, don't care about what we pay for gas, or anything else beyond their quarterly balance sheet.

Craig

Prices will go up in the Midwest.

Cushing will not be remote anymore.

hightrekker-

The part of Keystone (Gulf Coast Project) that will raise Midwest prices by opening more capacity to coastal markets is already approved and under construction. It is set to come online later this year. The WTI Brent spread is currently closing quite rapidly. The Midwest WTI "bargain" prices are just about over.

The part being discussed here would bring more oil to Cushing and if it were enough oil it could potentially bring the Cushing bottleneck back. This part of Keystone has the potential to lower Midwest prices again and most certainly won't raise them.

It seems the only people pushing hard for Keystone are those who expect to benefit economically from it. Easy to ignore external and defered costs when one sees the world through that lens. Others of us have decided to reject 20th century thinking and "economies of scale". This rush to get this oil to market as fast as possible,; dig it, pump it, burn it all, stinks to high heaven of desperation and greed, IMO. I can smell the sulfur...

...so explain to me again how I'll benefit, personally, from this pipeline being built.

... explain to me again how I'll benefit, personally, from this pipeline being built.

Ghung! You just aren't greedy enough!!!

Ah... the sweet smell of money.

/sarc

Craig

Greed is the Planet killer :-0

It is by greed alone that I set my mind in motion.

By the juice of Lucre the mind acquires speed, the fingers acquire stain...

It is by greed alone that I set my mind in motion.

Mentat Peiter deVries (?sp?)

Craig

"There is no escape--we pay for the violence of our ancestors."

--from "The Collected Sayings of Muad'Dib"-- [Frank Herbert]

"Greed, for lack of a better word, is good. Greed is right. Greed works. Greed clarifies, cuts through, and captures, the essence of the evolutionary spirit. Greed, in all of its forms; greed for life, for money, for love, knowledge, has marked the upward surge of mankind and greed, you mark my words, will not only save Teldar Paper, but that other malfunctioning corporation called the U.S.A."

- Gordon Gekko (in the Wall Street movie)

Alia: "My brother is coming with many freman warriors."

Mother Mohian: "Kill this species, it's an abomination!"

Ok, so I took some liberties with what said in this part of Dune, but we are like a virus as the agent in the Matrix says. For us we are better off alive, but for the planet-hmm???

Matter is composed, chiefly... of nothing.

Unfortunately, whenever there is a rush to exploit finite resources, this is a symptom of extreme short term thinking. The concepts of stewardship and conservation are being trumped by a near religious zeal to use everything now and as fast as possible. This is beyond simple greed. This is a wanton disregard for all life that comes after us. It's all about us. We have a license plate here in Colorado that says "Respect Life". I assume it was made possible for the so called right to lifers. Don't think those who slap it on their SUVs understand the extreme and obscene irony of their license plate choice.

Respect life? Not.

No. they do not understand at all. I had a discussion not too long ago with a friend who drives a big SUV.

ME: What are you going to do when gasoline hits $7/gal

Friend: Oh... I am not worried about that. "They" will never let the price get that high.

ME: Don't you think you should consider cutting down on driving or getting a more economical vehicle?

Friend: No! I like driving my SUV. I have a right to drive what I want.

ME: ::decides not to continue this conversation::

Like most of us at TOD, I just don't get it. These people are absolutely barking mad!

Craig

I was at a family gathering last weekend where I ran into my cousin and her husband who have been living in Portugal for the last 20 years. In a conversation I think I might have let on that there seemed to be a connection between the current economic crisis in the P.I.I.G.S. and things like resource limits. Boy did I get an earful about how Malthus and his ilk were wrong and how the current crisis was soon to be overcome because of human ingenuity and we could support many more humans on this planet, etc... Oh, I forgot to mention, my cousin and her husband are devout Catholics. They also believe there is going to be another 'Green Revolution' thanks to genetic engineering.

All in all a very depressing conversation.

What do you hear in Brazil? (Are you still working there, or did you fully relocate?)

What kind of memes do you sense in your travels down there?

Hey Bob, I'm still here, I'm planning on staying at least till the end of October. As for memes, I wish I could report that people here are saner than in the US... unfortunately the more I travel around the world, the more I find the delusion to be a truly global issue.

Almost everyone here seems to be firmly hitched to the infinite growth model.

Being that I'm currently based in Sao Paulo, which is a huge city, literally bursting at the seams and knowing what I know from having been on TOD for quite a few years now, it can be a bit difficult to remain optimistic about the long term future of humanity.

BTW, The other day I posted a picture of an over crowded subway car in Shanghai as a response to a comment about the new strain of Bird Flu virus which happens to have some mutations that with very minor modifications could make it transmissible from human to human. I can't help but think that the subways in Sao Paulo, New York, London, Paris, Cairo, etc... are but a few hours flight from China.

Best hopes for 'sanity' going viral >;-)

Well, Malthus was wrong, but he wasn't really writing about resource limits, he was writing about population and social class dynamics.

Malthus was wrong because we still had largely virgin continents to expand into and fossil fuels to exploit. But we are out of new continents and the fossil fuels are just starting to become a bit more difficult to extract. His views have been expressed via public protests in Tunisia and Egypt. The problems are just beginning.

"Malthus was wrong because we still had

largely virgin continentslandmasses we could steal from easily killed natives to expand into and fossil fuels to exploit."Fixed that for me. The Americas and Australia weren't virgin, but the Europeans had a number of advantages (militarily, advantage in numbers, disease resistance, other technology). And Europe really did do a good job of dumping off people onto the "new" land, when you think about it. Even with the remanant populations out there, sometimes substantial like the Maya, the Europeans really did mostly overwhelm the continents.

In any case, though, what you say is true. On a spherical planet, there IS a hard limit - to believe otherwise is insane. We are only arguing about where that limit is. But consider Ireland; from what I understand, they still haven't topped their pre-potato famine population. Limits have been hit before, many times in history. This time is only different in that the scale is planetary rather than local.

I humbly accept that wise correction.

Again, Malthus was wrong, but he wasn't really writing about resource limits, he was writing about population and social class dynamics.

The most important refutation of Malthus is on the population side: world population as a whole has clearly stopped growing exponentially (or geometrically, if you like), due to the demographic transition (it's roughly arithmetic at the moment). This is a key point: in many ways, growth is generally self-limited, and follows a logistic (or sigmoid curve), generally referred to as an S-curve. For instance, US car sales peaked about 35 years ago, and the US has a clear over-supply of vehicles, due to increasing vehicle longevity.

In fact, in most of the world population growth is on a long-term negative path, due to fertility rates well below replacement, including Western Europe, China, and the US (excluding immigration). Russia, Eastern Europe, Japan and Italy are starting to show absolute declines in population. This is detailed at the UN site below, where we see that the growth rate was as high as 2.19% back in 1963. The total population peak is currently expected to be at about 9 billion around 2075 and population is expected to drop after that.

See especially Figure 3, page 6: http://www.un.org/esa/population/publications/longrange2/WorldPop2300fin...

http://www.un.org/esa/population/publications/longrange2/WorldPop2300fin...

Let's explore a couple of key concepts: the difference between arithmetic and exponential growth, and the difference between high fertility and "bottom line" growth.

Consider the following series of numbers: 10, 11, 12, 13, 14. There is growth of 7.7% at the end, but this is arithmetic growth: the change from number to number is constant, not growing with the base. Malthus assumed exponential growth for population, and arithmetic growth for agriculture. At the moment overall world population is increasing, at about 72M per year, IIRC. However, that number is stable at the moment, and very likely to decrease soon. What we see, then, is that exponential growth for population has ended.

Growth varies enormously by country - in Japan, for instance, absolute growth will be negative next year. Italy and Russia will follow soon after. These alone are sufficient to refute Malthus's general rule in a simple, clear fashion.

For many more countries, the fertility rate is below replacement. If every couple has less than about 2.1 children (the definition of the replacement fertility rate), the population is very young, and the death rate is low, there can be a lot of children and "bottom line" growth in the population, but in the long run the population will stabilize and decline, as every generation is smaller than the one before. So, if we clearly have fertility rates below replacement, we clearly have in the long run stable or declining population growth.

Now, are there still parts of the world growing pretty quickly? Sure, but they're in the minority. Just as importantly, the parts of the world that aren't growing clearly refute Malthus's idea that population always grows until it hits a resource limit - he couldn't conceive of voluntary birth control.

Do we still have huge, basic sustainability problems? Sure, but it's important to know that the broad, simple framework that Malthus proposed is just plain wrong.

This kind of logic also applies to energy. Like population, US car sales, and many other examples, energy markets (at least renewable ones, like those for wind and solar electricity - so no, I'm not talking about oil) will naturally mature and flatten out long before we reach theoretical limits.

For far too long we've been talking about a false dichotomy between "infinite exponential growth" and collapse. In fact, with a little luck, growth in resource consumption will gradually come to a stop, while humanity switches it's desire for improvement to what are generally known as "services": health, education, art, etc.

"growth in resource consumption will gradually come to a stop"

It most certainly will come to a stop, but it won't be voluntary.

Underlying man’s malignant growth is his unceasing competition for position within the social hierarchy. There can be no real limits to the absurd wastage inherent to this competition. Even if we were able to provide the basics of survival to our expanding populations without destroying our environment, the base human behaviors in which competition is paramount and winning of primary importance, guarantees in the end, absolute poverty if not a more catastrophic result.

In a natural environment these behaviors are benign, but when equipped with tools of mass destruction (backhoe, chainsaw, automobile and so on) these behaviors guarantee complete wastage on a planetary level. Like a cancer, man celebrates cheating, deception and breaking any rules that would restrict his efforts at gaining wealth, reproductive success and dominion over those less aggressive and malignant.

Mankind’s one and only strut upon evolution’s catwalk, blinded by the glare of technology’s lights will undoubtedly end prematurely, face down in the mud from whence its hapless journey began.

My goodness, that's certainly a strong presentation of a negative view of humanity.

Fortunately, it's not realistic: both in the US and Europe, hard resource consumption leveled off quite a while ago.

Now, Climate Change is different, and harder: it's invisible, and has very long delays in it's negative (e.g., big storms) and positive (e.g., tundra thawing) feedbacks. Humanity does indeed have a hard time being farsighted in those conditions.

Alas.

Even if consumption levels off, if it's up there sitting at a high level, you can still run out of road mighty quick..

E.g., the bad news is that the accelerator pedal remains stuck to the floor. The good news is that we have reached maximum speed and are no longer accelerating...

Not as much as you might think.

US steel production (and consumption) is as large as ever, but almost all of it's recycled.

99% of scrapped cars are recycled.

US coal consumption is dropping fast.

Some encouraging things...

US coal consumption is dropping fast.

US coal consumption

iswas dropping fast.Now that Nat gas prices are on the rise, some utilities with a choice of which sort of plant to idle (coal v nat gas) are keeping the coal plant running. I've heard our coal consumption has shown a recent uptick because of this. And the expectation is that NG prices haven't reached a psuedo-equilibrium price yet. [By psuedo equilibrium I mean a price where new supply is brought on line roughly as fast as depletion].

What's the latest data you've seen?

The EIA has monthly data thru 12/12. It shows 4th qu dropped YoY very slightly.

On the contrary, the slowing of population growth shows that Malthus was right. A lot of people would be having more children if they felt they could afford it. But since they lack the the resources, they have voluntarily decided to have less children. And thank mankind for developing birth control, plan B, and abortion as techniques to help us voluntarily limit our population growth.

People are not having less children out of some random change. They are having less children because it is incredibly expensive to provide them food, clothing, housing, education, and healthcare.

Malthus said:

The misery & vice varies. In parts of Africa it may be literally starvation. But in the industrialized world, the misery is from foreclosure, massive student loan debts, unemployment, etc. The means by which population growth has improved from starvation to economic deprivation. And I actually have radical views in that I think that welfare & food stamp payments should be contingent on proof of birth control usage. But reduced population growth due to lack of resources is EXACTLY what is happening.

Malthus assumed population wouldn't be limited by people choosing not to make more babies, but by deprivation bad enough the death rates increased to meet death rates. We are seeing some evidence that our species is a bit smarter than Malthus gave us credit for. Now part of the pessimism about having kids, may be a response to projected overpopulation effects, so we could be quibbling over small differences in the meaning of words.

AFAICT Malthus stated his assumptions, and his results follow from them -which is correct modern scientific procedure. So he was never proven wrong, it was just that his stated assumptions were not met.

I think you are just projecting onto him. I think you give Malthus and the people of that age less credit than they deserve. They knew what created babies.

Thank goodness, someone else understands what is really happening. I thought I was the only one who had a clue but now I know at least one other person on this list understands.

Of course there are others who also understand. One such person is Virginia Abernethy who exposed the silly nonsense of the so-called demographic transition. However she turned out to be a real nutcase on other subjects so I really cannot promote her as a person who understands anything outside the population realm. But she does get peak oil so at least she gets two things right.

She has been posting on the "energyresources@yahoogroups.com" list for several years now, that's how I came to know her views on other subjects.

Ron P.

No, desired family size has fallen.

People everywhere are deciding to have fewer children.

In addition, child mortality has dropped, so people don't have to produce a "spare" or two to ensure achieving their desired family size.

A lot of this has to do with the education and freeing of women to be more than baby factories.

There's a saying among Brazilian women (that sounds more musical in Portugese): The factory is closed.

A fábrica está fechada

You do not understand the Gaussian function because you are mislabeling an exponential function as an arithmetic distribution. If one looks at certain small segments of the function with noisy data, it looks linear.

You have not established why the rate of growth has declined, and why it has become negative in the countries you mention. Food is not the only resource constraint. An increasing fraction of the population can not afford houses, medical, transportation, education and other things they want. Jobs are paying less than they did. On a traditional farm children are slave labor generating profit. In an urban environment children are an expense. Urbanites can reduce expenses by having fewer children. Expenses are a burden because resource constraints are making all that other stuff expensive. If the resources were ample and the wealth spread around, then the population could afford children and the stuff.

The population growth in China is being artificially constrained.

Sigh.

I don't have time to provide you with all the research. I suggest you explore on your own...

An exponential function is by definition a function that grows at a constant rate. By contrast, the growth rate of the world's population has been falling for 50 years, from 2.2% (in 1963) to 1.1% (in 2012).

50 data points is more than enough data to conclude the function is not an exponential.

Nick, would you agree, that there is a direct relationship between resource limits and population dynamics?

If so, then it should be clear that Malthus was indeed writing about resource limits. Social class dynamics notwithstanding. Granted that since the beginning of the industrial revolution a small group of wealthy upper class individuals have tended to control and use up, what might be construed as more than their fair share of available resources.

So at the end of the day I find it very difficult to see exactly how it is that Malthus was wrong, at least in a general sense. And despite your comment, Malthus's own words clearly contradict your statement.

For the record, I interpret the phrase:"limited by the means of subsistence" to be equivalent to:"limited by resources".

Malthus thought that population would necessarily grow until limited by resources. We're seeing right now that's not true.

Look at the OECD countries, indeed almost all countries outside of Africa and the ME: fertility rates are dropping like a rock because of affluence and personal choice, not because of poverty or resource limits.

He was also a religious ideologue, and a class bigot.

Malthus believed that population growth would continue forever because he believed that contraception was morally wrong, not that it couldn't work.

His argument was principally a class one, designed to rationalize why the poor must remain poor, and why the class relations in nineteenth-century Britain should remain as they were.

His greatest fear was that due to excessive population growth combined with egalitarian notions “the middle classes of society would . . . be blended with the poor.” Indeed, as Malthus acknowledged in An Essay on Population, “The principal argument of this Essay only goes to prove the necessity of a class of proprietors, and a class of labourers.” The workers and the poor through their excessive consumption, abetted by sheer numbers, would eat away the house and home (and the sumptuous dinner tables) of the middle and upper classes.

He made it clear that the real issue was who was to be allowed to join the banquet at the top of society.

Charity simply encouraged early marriage and larger families, he concluded, inspiring an 1834 Poor Law that effectively limited public relief to people toiling in workhouses. Charles Dickens, appalled, rebuffed Malthus with the tale of a flinty miser who had a change of heart. "A Christmas Carol" is still in print.

Quite an interesting story, you learn something everyday I didn't know that. It is easy for me to imagine being part of the upper-middle or middle classes in his day, and thinking that way, in fact it would have taken quite a bit of intellectual pushback to think otherwise.

If you remove the filter of his time, the observation's were that unreasonable.

"Those societies that ignored the imperative for moral restraint—delayed marriage and celibacy for adults until they were economically able to support their children—would suffer the deplorable “positive checks” of war, famine, and epidemic, the avoidance of which should be every society’s goal. From this humane concern about the sufferings from positive checks arose Malthus’ admonition that poor laws (i.e., legal measures that provided relief to the poor) and charity must not cause their beneficiaries to relax their moral restraint or increase their fertility, lest such humanitarian gestures become perversely counterproductive."

Just think what US society would be like if more people didn't "relax their moral restraint" until they were "economically able to support their children".

Malthus isn't politically correct, but I still think he's mostly right. It would be far better to have 500M relatively wealthy people in a world of plenty than 10B mostly in dire poverty in a denuded world. Except that the other 9.5B won't agree with this when the time comes.

Me, I don't see much purposeful action on population control, but while we're wiping out major life forms there are microorganisms who will increasingly see us and our chosen feedstock animals as a stepping stone to their expansion, in that mindlessly cruel way that the natural world evolves.

Well, birth rates have been falling far more rapidly than even the optimists predicted. Just last week a paper was published containing a scenario where world pop would peak at only 8B in about 2050. And that scenario isn't an improbable outlier. So while it may be true that our species hasn't done much in terms of enacting strong population controls as government policy, the people seem to be getting with the program nevertheless.

Because of affluence? I don't understand how that limits fertility growth.

But personal choice . . . yes! People are making the personal choice that they will have fewer children because they LACK THE RESOURCES. If you told Joe Six pack that he could have free nannies watch his kids and his kids would get a free college education . . . do you think the birth rate would increase? I think you'd be foolish and wrong if you said "no". The "personal choice" is largely due to the lack of resources.

If that were true, then rich people would have more kids than poor people. But that is not the case. It's the opposite. The elite have fewer kids than the peons, and this is true cross-culturally and historically.

One theory is that even if you can afford all the nannies you want, children take up time, and you can't buy more of that. Therefore, if people have a choice, they don't want too many kids.

But this trend is so universal, some believe it's hard-wired. Perhaps for people of high status, having fewer kids is beneficial. Only one of your children can inherit your position, so having too many might just create conflict. Perhaps high-status people are better off investing more in fewer children than low-status people are. It's also possible that having children has a physical cost - even for the male. There's some evidence that having many children leads to a shorter lifespan. If so, there's no point in having lots of kids unless you actually need them, and the elite probably need them less.

But then you have some pretty big counters, Like Ghengis Khan, whose Y chromosome (which doesn't combine in reproduction) is identified in something like 2% of Asians. Under the old despot system, the sovereign usually had lots of offspring (legitimate, and illegitimate). The later consisted of semi-legitimate offspring -of concubines) who usually got some benefits of minor royalty status, and many truly illegitimate offspring -of conquests and rape victims).

Maybe the difference, is that today few societies now condone having many illegitimate offspring.

That's an interesting situation, but still speculative. They won't be able to tell if that's really Genghis Khan's DNA unless they find his grave and get a sample for comparison. It does seem possible that there is the occasional super-successful male, but that is clearly not the norm for our species (though it is for some others).

I'm also a bit doubtful about how acceptable illegitimate offspring were, even back then. Sure, it was acceptable for Khan to rape and pillage...but what happened to the women once he was done with them? Their families were likely killed, and if not, they probably wouldn't be too happy at raising the illegitimate child of their enemy.

It appears that Khan's genetic success may have been due to selection, more than volume. Claiming descent from the "golden family" was a political requirement in the region. No Khan blood, you're out of luck. Even claiming descent from the Prophet Mohammed was a poor second.

I haven't researched this, but it seems to me that women do raise the child of their enemy. I'm thinking Germany after the Russians came through, Rwanda where many women were raped and raise their children, and here in the Western Cape where we have a large mixed-race population which genetically is something like 80% European male/indigenous female.

Sure they do. But how successful would they be, when the mother's family has been killed?

They won't be able to tell if that's really Genghis Khan's DNA unless they find his grave and get a sample for comparison.

But what you do have is family histories of 'my Forefather was a Khan' and with those people's DNA along with Math!-power of statistics one can come up with an answer that is most likely correct.

Elsewhere on the topic of who's your Grandpa

http://garyfelix.tripod.com/~GaryFelix/index63.htm

I'm also a bit doubtful about how acceptable illegitimate offspring were, even back then.

http://www.familytreedna.com/public/MexicoAmerindian/

But that's not what they did. And the researchers themselves admit that there may be other explanations.

Not really. Even the "rich" people would struggle to pay for a college education for several children these days. And the ultra-wealthy, well they didn't get wealthy by spending their time pumping out children and driving them to school. Even the very wealthy have a limited resource of time. Sure, we don't have as many kids as in the 1800s. But modern birth control has helped make that much more easy.

I guess you can say that Malthus didn't know about modern birth control methods, Plan B, and abortion. Thank mankind that those things DO exist and if they didn't then things would play out with far more misery. Just look at any 3rd world country to see an example.

As has been pointed out already in this thread...Malthus knew about birth control. He was a religious man, and thought birth control was immoral.

So he projected his own superstitious views onto other people? Then he was wrong in a way. People can and do quite rightly use birth control to limit reproduction when they feel they lack the resources to have another child.

Not the case in Spain, where the rich are fanatic Catholics, often members of the Opus Dei.

Isabel Tocino, ex-Minister of the Environment

http://es.wikipedia.org/wiki/Isabel_Tocino

She has six, sometimes she says seven children, one -a girl, 16 months old- died drowned in their swimming pool when they were having a reception or party.

http://elpais.com/diario/1988/07/02/espana/583797611_850215.html

Members of the Opus Dei, the real power in government in Spain, usually have between 4 and 12 children

Of course they are a danger, because if they have inherited a million dollars from their parents they believe they have to leave a million dollars to each one of their children.

The cow doesn't give so much milk !

As one of them told me, wen we were walking on the gangway, looking down at the workers in blue overalls toiling at the machines, and he pointed at them and said.

- We are here in this life to steal from this people!

----

Rick Santorum, another opusdeísta, has 7 children.

en.wikipedia.org/wiki/Rick_Santorum

Because of affluence? I don't understand how that limits fertility growth.

Poor people have too many children, in order to make sure that enough survive to adulthood. As their society becomes more affluent and healthier, they feel safe in having fewer children.

As their society urbanizes, there's less incentive to have children to work on the farm. As pensions/public social security evolve, there's less need for children to care for the elderly.

That's why fertility rates have been dropping in affluent countries, and not in very poor countries.

I've written on this before, but I think generally throughout history in every society people have regulated their fertility to ensure population stability. 5-6 children with maybe 3 surviving to adulthood. If everyone pumped out as many kids as possible we'd see Malthusian crashes like clockwork every 50-100 years, but they seem thankfully to be fairly rare. What has happened is that the deathrate has dropped so fast traditions governing fertility haven't been able to keep up. Even a relatively small excess of births over death can produce explosive growth, as we've seen.

I'm wondering what will happen if we really are at "peak resources." It seems like a lot of the factors that led to lower fertility might reverse. The death rate might increase, there might be a return to a more agrarian lifestyle, education for women might become less affordable, etc. Will there be a similar lag (maybe with a population crash?) before fertility increases?

Ahhh, but if there is still enough technology about the trend of Baxter (a 22K assembly line robot) along with replacing waitstaff with tablets for ordering and the increasing complexity and quality of machine vision means the need for field hands may not rise as a robot to go out into the field and work it will remain cheaper than human labor.

I don't think that robots will be cheaper than human beings for that kind of work. Have you ever worked in a factory with complex hydraulic and electromechanical machinery? They break down all the time, parts need replacing on an hourly basis, and the technicians "engineers" earn much more than the manual workers, and they have their tricks, they know how to make themselves indispensable.

In a factory I used to work the Chief Technician was forbidden to go on holiday, and when he got some days off work the manager ordered him to stay home and wait until the machines began working in the morning -that was the low trust he had on the real Engineer plant bosses.

At 5 O'clock the plant starts: the main machine doesn't work, dozens of workers idle. The Engineer huffs and puffs trying to get the blasted thing working.

At 11 o'clock he gives up, goes to the manager

- call that s.o.b.

The technician arrives, throws some switches, pushes some contacts and five minutes later the plant is back on production !

Well, that was in Spain, I am sure that kind of things don't happen in the UK or in the USA...

This is outdated stereotyping from a few decades ago and it needs to go away. The problem is lack of low-cost access to birth control. Many people in these countries want fewer children but they lack the access to birth control to make it easy.

Demographers think that the problem is really cultural expectations - the pressure to conform to a "norm", and the issues of status that go along with that.

I think it's true that in all countries with a total fertility rate over 3, women want fewer children than men do. But they have the extras to pacify the men.

The lack of economic opportunity for independent women is a bigger problem than the lack of contraceptives.

Yes. This article about Rwandan birth control efforts give a hint of how complex it is.

Curiously, it suggests the ethnic conflict there made it both more difficult and easier. At first, the government was extremely reluctant to tell their citizens that they could not replace the people who were lost. But on the other hand, many in the church were implicated in the genocide, and that has reduced their power there.

It is an outdated stereotype, it all depends on access to birth-control, education and a changing cultural narrative. Many states in India are wretchedly poor by western standards but are below replacement fertility levels.

There's a suspicion here in South Africa that poor young girls are having babies to get the child grant. And there are cases of them drinking while pregnant hoping the baby will get fetal alcohol syndrome because the grant for a disabled child is much bigger.

Then there are people like Mick Philpott in Britain who had 17 children by different mothers and lived off the benefits.

I don't think the problem was lack of low-cost access to birth control in previous centuries. As pointed out elsewhere, people have *always* limited their birth rates below the maximum theoretical possibility, as even Malthus tacitly acknowledged (though indeed he thought various forms of birth control available in his time were sinful). However it has also always been true that when and where child mortality rates are high, people do tend to have many children. The "poor people" bit is almost irrelevant, except as it affects the mortality rates.

Well, that's it exactly - poverty causes high infant and child mortality.

Affluence, in many ways, tends to cause population growth to stop.

Thus, the best answer to population growth is to help people, rather than try to coerce them into having fewer children.

I think people are powerfully influenced by the events that happened as they came to maturity.

When Malthus was 14 the American revolutionary war broke out, and Britain fought actions against the Americans, the French, and the Spanish. By the time he was 17 there'd been the Anglo-Dutch war and the Anglo-Mysore war in India as well, Britain had conceded America, and the Laki volcanic eruption in Iceland brought a sulphurous haze leading to crop failures and 10,000 deaths in Britain and 6 million globally.

So a somewhat apocalyptic turn of mind is understandable.

I think you are are talking about the following passage from Malthus that appeared in the second edition of his Opus, "An Essay on the Principle of Population", and no other. He received so much criticism for the paragraph that he removed it from the next edition and never published it again. Anyway here is the paragraph in question as explained by Garrett Hardin.

Ron P.

If memory serves, I was quoting directly from his writings...

Maybe a Soylent Green revolution?

Yep!

What bothers me the most about all this, is that in my cousin's case, she happens to have a degree in Agronomy and soil science. At some point, she had to have taken and passed, college level math and science courses in physics, chemistry and biology etc...

Which goes back to what Craig was saying about all these people being barking mad! I think this is a case of severe cognitive dissonance and compartmentalization of what you at some level know to be true, yet refusing to admit it, even to yourself because the implications of that knowledge would cause you to have to reject or at least seriously reassess society's conventional views about Mankind somehow being exceptional and therefore not subject to natural laws and limits.

The blinders are firmly in place for the majority!

Right on, Fred! Now, about cognitive dissonance- right here on good TOD, Lots of talk about oil, distribution, price, etc etc. Same time, everybody every now and then says "Sure, we know if we burn it it's gonna kill us off, but but--what about that new find off Brazil".

My own read is that the one overwhelming task of the technological/economy /political community is to show ways to get OFF carbon right now, not later after we have had our fun, and passed a free ticket to hell to the next generation,

I dunno,wimbi, every green action just seems to keep the tarballs in the air longer.

I do not see any change in attitude from what I saw in the 80's. In fact quite the reverse. For instance, it seems like everyone feels they have a right to a vacation flight to pago pago every year now, rather than in the 1980's a once in a lifetime car ride to Disneyland.

The only solution I see is to go with the flow and hope we can blow the gaskets on our industrial/financial machine. Cyprus looks to be a bit of hope in that regard!

Pray for bigger better cracks.lol

Well, Ignatz, your remark causes me to pause in my attempts to fix my haywire woodfired water heater so as to examine my own soul. Am I, by doing all this greenery, just keeping the tarballs afloat? Probably yes, since I and they do swim the same sea.

And while I personally have no lust whatever for pagopago, my friends scoot off far too frequently and far, and worse, seem to resent my reminding them on their sin thereby.

So, all my piety and wit being destined to naught, why do i persist? I am forced to face the truth- It's fun do do gadgets, which I, by accident of birth or something, seem constructed to do, And almost as much fun to be holy. Or, at least, holier than thou.

I do the same with gadgets and am just finishing a cold frame addition to my greenhouse, which I plan to stuff with hot dung this fall and grow lettle lettuces.

I have given up shouting warnings, I find it much quieter that way; watching the universe unfold as it will, can be quite entertaining. And as far as 'holy' goes, a simple exclamation of 'holy cow!' seems to be sufficient for me on most days.

Cognitive dissonance, and groupthink narrative? What is the (corporate/state-media-modulated) narrative, but through the lens of large-scale centralized oligarchic state structures? BRICS this, Venezuela that, etc.?

Seems that particular, salient, narratives determine, or influence the likelihood of, particular outcomes.

Fred,

What does she say about Climate Change?

Green food you say?

http://www.foodenquirer.com/video/rabbit-recipe-how-to-make-chlorophyll-...

http://www.ehow.com/about_4744828_alfalfa-chlorophyll-benefits.html

While I didn't find the old link - this 'll do ya all.

http://www.leafforlife.org/assets/downloads/Ch07-21stCentGreens.pdf

Yep, all chlorophyll, not just from Alfala, and hemoglobin molecules are quite similar in structure,I wouldn't go so far as to say "almost exactly the same":

http://alliedhealthblog.com/2010/11/the-similarities-between-chlorophyll...

I once created a 3D computer model of a chlorophyll and a hemoglobin molecule just for the fun of it.

I also like to remind people that one of the reasons I dislike the moniker 'GREEN' is that plants discard most light in the green spectrum and absorb mostly in the red and blue wave lengths for optimum photosynthesis... Having a slow Sunday here >;-)

Cheers!

30 years ago, one could read about the in vitro studies that showed qm electrical tunneling in porphyrin based enzymes (cytochromes) up to about 40K, but not provable at higher temps and definitely not in vivo. Now I hear that the studies have moved over to chlorophyll where they can prove tunneling in vitro up to about 40K. Very interesting molecules and we may never truly understand them. I think they just want to be our friends.

It's definitely not a simple picture of those who see it as good or bad. Gulf coast refiners - good. Mid-state refiners - bad. ND producers - good. S Tx producers - a little bad. World - good. East and west coast - meh. Canada - freaking great! Rockies - bad for consumers, good for producers. Cushing investors - great! Buffet - bad. Koch - probably bad (hard to tell what angles they have going). Pickens - good.

Bringing cheap oil sands supply to market should move world prices down a hair, and the coastal prices (closer to Brent than WTI) as well, so "most" US consumers would probably tangentially benefit from the pipeline. But for those with 401Ks or such you could choose to benefit by picking and choosing what you go long or short upon.

For me, all production and drilling and piping is a good thing, but I know it's a "common" tragedy.

Note that the leg of the Keystone that will drain Cushing is rarely discussed in the media, but it's quietly moving to completion. Once Exxon gets its little leak fixed, we're likely to see the WTI-Brent spread slowly closing, and the WCS-WTI spread as well.

"...all production and drilling and piping is a good thing, but I know it's a "common" tragedy."

...so it's a good tragedy? Is this a conflict or a conundrum?

Sorry, I meant a tongue-in-cheek reference to "a tragedy of the commons". I'm simply saying I know which side of my business bread is buttered, though I realize I'm doing my part to sell us all down the river of climate change and other peak-world conditions.

That sounds to be a refreshing attitude!

But of course you might, as well, think that by making our industrial machine run faster and faster that it will sooner have a stop. Should we encourage the beast to extremus? Join in the party-time and help the wheels come off?

The Koch family made its fortune in heavy oil refining technology beginning as early as the 1920s and has very large, long-standing investments in the Athabasca oil-sands since the 1940s. The brothers Koch are without doubt in favour of the pipeline.

http://insideclimatenews.org/print/14818

Texas drought.-- "The upshot? “We’re not doing any better now with $1,000 calves than we were at $600, ” Mr. Smith said."

Sounds like every industry I know of, prices are higher and so are expenses.

It will be interesting to see what the GDP for the first quarter will be when announced at the end of this month. With WTI averaging $92.94 for March and Brent averageing $108.56 for March, then that brings the average of Brent and WTI for the 1st Quarter at $103.42.

Graph below shows the nominal annualized quarterly GDP growth for the last 8 quarters, plotted against the WTI-Brent AVERAGE for those same quarters. The red data points are the first 3 quarters of 2012, the yellow data point is the last (most recent)quarter for 2012. The red line is the inflation fate for 2012, the blue line is the inflation rate for 2011

As can be seen, nominal GDP growth has actually done pretty well considering that the Brent-WTI price has averaged over $103 for the entire 2011-2012 period of time. One might have reasonably expected oil prices to have taken a bigger bite out of the economy by now.

Of course, "real" GDP growth (growth adjusted for inflation) is what counts, but with inflation being so low right now (only 1.74% for all of 2012 but already up 1.1% in just Jan. and Feb alone), even a moderate nominal GDP number might not look too bad to the stock market.

On the other hand, the last quarter of 2012 had only a 1.35% nominal growth, making real growth negative. It will be interesting to see what kind of rabbit gets pulled out of the had for this quarter.

[Edit: just to explain that while the 4th quarter 2012 nominal GDP growth WOULD have been negative on an ANNUALIZED basis, in fact the inflation for the 4th quater was so low that even the low nominal growth rate was still positive as far as growth-adjusted-for-inflation was concerned.]

Elmo,

I think you're presenting too much information in one chart. You might want to change this chart to just show real growth rates vs oil prices. Then, if you want, you could do a 2nd chart comparing real growth rates to inflation.

Price in 1998 around $15 per barrel, price today around $100, around 70 million barrels produced per day:

($100 - $15)*70million barrels per day = almost $6 billion a day.

($100 - $15)*70million barrels per day * 365 days a year = a little bit more than $2 trillion a year.

Around $2 trillion each more money is spent to get the needed oil now than 1998. The numbers may not be perfect but they should get an idea.

Things are getting interesting over the the Far East.

http://www.cnn.com/2013/04/06/world/asia/koreas-tensions/index.html?hpt=...

Interesteringly, whilst Britain and Sweden are keeping their embassies open and staffed, Russia (NK's ally) is considering pulling them out. What do they know?

I don't think Kim is stupid enough to actually take actions in accord with his words, it would not be impossible and is not likely to be a "black swan event." The Bird Flu news from China is more apt to be that. Or would that be a Black Chicken event?

http://www.zerohedge.com/news/2013-04-06/chinese-h7n9-bird-flu-strain-fo...

Craig

"Russia (NK's ally) is considering pulling them out" and On May 7, NATO bombed the Chinese embassy in Belgrade "by misstake" but I guess they simply learned the lesson from before. If you are hit by a bomb it make no real difference if it is by misstake or not.

Of the 16 known cases of this new virus, 6 people have died. That appears to be a rather high rate of mortality, which, if it were to be the experience in the larger population, would be a serious epidemic. Of curse, we don't know how many other people have contracted the disease, but never went to the doctor for treatment. I'll have my chicken fried from now on, thank you...

E. Swanson

So far, it doesn't seem to be spreading person to person. But it has the potential to:

New Bird Flu Seen Having Some Markers of Airborne Killer

It reminds me of this Jared Diamond essay, which I believe became part of Guns, Germs, and Steel:

The Arrow of Disease

It's about why disease flowed from Europe to the Americas, and not the other way.

Part of the answer may be population density. Diseases that spread human to human require a large, dense population to survive. Otherwise, the disease quickly goes extinct after it has killed or rendered immune all its possible victims.

But there were large, dense populations in the New World, so why didn't they have disease like Europe did?

Diamond argues that it was the lack of domestic animals. Most of the infectious diseases we know today have their origins in domestic animals.

We have managed to dodge a few bullets in the past. Question is how will our luck continue to hold up should we suddenly find ourselves facing the perfect storm?

http://www.nytimes.com/imagepages/2005/07/12/international/12china.ready...

Eventually we won't be able to dodge all the bullets.

Awful lot of available hosts walking around, and it is a niche to be filled.

an interesting book on this topic is Spillover by David Quamen

Diamond argues that it was the lack of domestic animals. Most of the infectious diseases we know today have their origins in domestic animals.

http://www.activistpost.com/2013/04/antibiotic-resistant-bacteria-transm...

Alas a copy of the Read the text of the letter by clicking here. link cannot be found be me.

(lets see if the new comment system flags this one)

I'm sure the Chinese version of the FDA is taking note... NOT!

BTW, Am I the only one who finds irony in the fact that her name just happens to be 'Slaughter'.

I'm sure the Chinese version of the FDA is taking note... NOT!

Why should they? The USA version is just barely paying it lip service, not actually doing anything!

Not expected to turn into an epidemic (i.e. uncontrolled human to human transmission is unlikely). And I would agree with that, I'd give odds of at least nine to one, that it will be just another blip. But one of these days we will run into that one out of ten virus.....

Mobilising the propagandists in North Korea

US Is Bound to Meet Fate of Tiger Moth

You read it first in the Pyongyang Times.

(Note also funky drip effect at top left.)

They certainly are. Although Japan is probably the black swan.

Japan is on the edge financially and is going for a desperate double or quits with their "inflation or bust" money printing gamble. They are also moving closer to possible war with China over territorial rights. Then there is Fukushima and its endless release of radioactive contamination, breached containment vessels and cores that have gone walkabout. Also there is the 1500 spent fuel rods sat in a pool teetering 30m up in a seven story damaged building which is leaning dangerously (just waiting for the fickled finger of fate). And last but not least N. Korea, a spoilt brat throwing a tantrum and a big red button... Japan wouldn't be exactly difficult to hit.

Globally there are so many hair triggers that could go off any minute with world changing impacts, I will be surprised if at least one doesn't go off. But I guess that's what collapse is, a chain reaction that creates a complex web of chaotic events that defy comprehension and are therefore beyond affective control. Japan seems to be already tangled up in the web and its desperate government taking on an increasingly "devil may care" attitude.

Sounds pretty ominous to me. The child is throwing a tantrum, will he knock over the torch and set the house on fire? Ominous that he put this date: April 10th on it. I think the child is planning something provocative, probably sending a missile towards a sensitive target, -then if it gets shot down, he can say it was a peaceful launch, and play the victim. This could easily spin out of control.

What would happen if NK detonated an EMP device over their own territory? What sort of range do these devices have? Just an idle thought that came to mind. I'd imagine something like that would have a devastating effect on an advanced economy, but very little on a backward economy.

I notice the US has cancelled a planned inter-continental ballistic missile test. Presumably to remove any NK justification for doing the same. Then there are the two missing (if they're still missing?) NK submarines. Hope they're not in the disputed waters between Japan and China.

Seems to me, the child throwing a tantrum, only has to light one of the many fuses lying around to bring down the house. Japan seems about ready to self-combust and burn down the house all by itself without any help.

I do not think the actions of the leader of North Korea have to do with his smarts or stupidity.

The situation seems to remind me of what I think I learned when watching "the history channel's" 'declassified' telling of the attack on Perl Harbor from the WW2 era. It was my impression from that show, that Japan felt forced, due to fuel blockages to their country, to strike.

So circling back to North Korea I keep thinking to myself: What things are that country's leadership experiencing or interpreting, that makes them possibly feel forced to be doing the actions and statements they are currently doing? I do not feel like I know.

I heard that wildly threatening talk is sort of a norm in Pyongyang. Maybe it is part of the culture to talk like that. Part of our problem with Iran, is that wild exaggeration is a staple of Persian. Just like sarcasm is often missed over the internet, part of these threats may just be the use of a language norm that generates false threats. [I also think they are being deliberately provocative, for whatever political reason (probably Kim is afraid of appearing to seem weak to his military, and this his his means of compensation).

There's only one problem with this...North Korea has actually exploded nuclear weapons. It's not some mystical "One day, after centrifuging for 7 years, Iran might have enough fissionable material for ONE teensy-weensy nuclear bomb. OMFG!" North Korea also supposedly has a pretty big stockpile of chemical weapons. So unlike our other Bogeymen, Iraq and Iran, they actually do have some WMDs - but no oil, so we mostly don't care.

One of the most hysterical things though was seeing an "expert on North Korea" on MSNBC talk about how the NK was "Funding the military while ignoring the plight of it's people" and I was like "Wait - was that comment about North Korea or the United States?"

Just a reminder of History and echos of what was done in the past now in the present:

http://www.iraq-war.ru/article/169000

The below article is more of that same old "peak demand" theory floated by Citi a few days ago. That idea seems to be catching fire all over the place. Now it is "The Motley Fool" who is making a fool of itself. These people don't seem to realize that peak oil has never been about geology alone, it has always been about geology and economics. The marginal price of a barrel of oil is now around $100, more than a lot of people can afford to pay. So they cut back and demand drops. Soon after that marginal barrel will not be produced.

Peak oil is peak oil whether it is caused by geology, economics or a combination of the two.

Uncharted Territory: A Modern Peak Oil Theory

But scarcity of oil is a problem and has been for several years. Cheap oil is very scarce and only high priced oil can be added to the world supply and that is what is causing peak demand. And we will see peak demand and peak production long before 2020.

Ron P.

After that $100/bbl marginal barrel is not produced, price has to drop to the level that the last marginal barrel CAN be sold. Until all of the low cost oil is gone or demand-priced upwards out of range. Then it all stops. There is no one left who can afford the next barrel produced. There could be Billions of Barrels of Oil left somewhere - in oil sands, deep ocean plays, or as kerogen in Wyoming. They will not ever be extracted, because you see, no one can afford them. Simple as that.

And the strangest thing is that Motley Fool can be so throughly fooled about it. Or is blinded by greed and desire into trying to justify continued BAU beyond what is possible. Mind boggling.

Craig

"There's growing evidence that global oil supply is fairly abundant. . ."

Where is the evidence for this? As I have said before, there is nothing more dangerous than a faulty assumption. If you start out with the "right" assumption, you can then go on to prove just about anything. How do they (the author) square the fact that if there is so much oil and so little demand, that the price is so high?

There is a reason why I never read anything by The Motley Fool--almost everything they put out is a teaser of some kind for their website, and I refuse to bite. They must have robots that write their stuff, because almost every Sat. night (in preperation for Monday morning), they send out "analysis" of hundreds of stocks, some with only a paragraph or two of content.

Anyway, sorry for the rant--the Motley Fool is one of my real Internet peeves.

The marginal price of a barrel of oil is now around $100, more than a lot of people can afford to pay. So they cut back

Well, it's more than people choose to pay. Most new car buyers can well afford to pay $.20/mile ($3.75/19 MPG), but they may decide that they just don't want to waste their money, so they might choose $.075/mile ($3.75/50MPG by buying a hybrid.

Then, of course, some people price CO2 emissions into the equation, and decide to buy a hybrid for that reason.

Nick, in case you haven't heard, we are talking about the world price of oil here, and what people of the world can afford to pay, not just what SUV drivers in America can afford to pay. For every dollar the price of oil rises, a few people of the world are priced out of the market. And for every dollar the price falls, a few more people can afford to heat their homes, cook their food, buy their food, and yes pay their transportation costs.

Only a very small percentage of the people of the world drive big cars, and an even tinier percentage drive hybrids. It is not about big cars, it is about the price of petroleum products that people buy, things like... well... you know... food. The price of oil is indirectly indexed to the price of everything oil provides and/or produces.

A lot of people live at the margins, barely getting by. And the higher the price of oil the more they have to pay for everything. So they cut back on things they can do without, or barely get by without. This, in many cases, is food.

Ron P.

Sure, there are a lot of people at the margins. But, they don't use much fuel. For instance, the US uses almost 1/4 of all fuel. The OECD probably uses more than 2/3. The great majority of fuel is used by people who can well afford to pay more, yet they're beginning to choose not to. Why should they overpay?

I've noticed that the average Prius driver is well over the average age and income. They're smart enough to not waste their money.

The average fuel economy in the US is about 22MPG. The average new vehicle is $30k. And yet, a Priuc C can be bought for $19k, and it gets 50MPG. People have choices, and oddly enough, it's the cheaper cars which get better MPG. Hybrid sales are jumping - people are getting a bit smarter, and shaking off the SUV sales propaganda a little.

Finally, it's countries like the US and Germany which are sharply reducing their fuel consumption. It's the smart thing to do. Why export your income elsewhere for vanity's sake?

The US is reducing it's imports - that's a very good thing, not a sign of things getting worse.

We need to kick the oil and fossil fuel habit - that will be a good thing.

Hi Nick,

I hesitate to answer, because it seems your post doesn't reflect a response to Ron's. So, I'm concerned, because I don't want to perpetuate people talking past each other.

I'll try:

Nick says: "Sure there are a lot of people at the margins. But they don't use much fuel."

Ron had said: "A lot of people live at the margins, barely getting by. And the higher the price of oil the more they have to pay for everything. So they cut back on things they can do without, or barely get by without. This, in many cases, is food."

Nick, I believe the point is that when people are "at the margins," the fuel they do use goes towards (or, is embedded in the cost of) necessities, such as water, food.

This means that the impacts of high fuel costs are greater for people "at the margins," than those who are not. With the example of food, the result is a decline in nutrition and thus, overall health, as an example.

When you say "they don't use much fuel," this seems to miss the point that the relatively little fuel they do use counts for more, in the sense of providing for basic needs.

Aniya,

I agree, high fuel prices have disproportionate impacts on the poor.

But, that's not the question I was addressing, I was addressing "why are fuel consumers reducing their consumption? and "what do those declines mean?"

Most fuel is consumed by the relatively affluent, so we have to look primarily at their decisions to answer these questions.

OECD countries consumes less than half of all oil consumed. List of countries by oil consumption The first 34 non-OECD countries on this list consume 45 million barrels per day. I stopped counting when I got to half the oil consumed.

So you are wrong right out of the gate. And a lot of people, even in OECD countries, live near or at the margin. In other words, those who are affected adversly by the high price of oil make up the lions share of the world population. Their food prices are higher because of the price of oil. In fact everything they consume is affected by the high price of oil. And they are consuming less because they can afford less.

And the rest, the middle class of even those OECD countries are consuming less because they are having a hard time making ends meet. The middle class is getting smaller and it is not because they are moving into the upper class, it is because more and more are moving into the lower class. The average wage, adjusted for inflation, is decline while the prices of all products are increasing.

Ron P.

Generally speaking, I think you are both right. Many people in places like the U.S. are consuming less fuel even though they can afford more fuel. People at the margin, wherever they live, are suffering as a result of the price of oil.

However, it is all part of the demand mix. If richer folks in the OECD countries consume less fuel, this will affect price if if significant enough, and this will help those at the margin.

This, however, assumes everything else is equal. With the continued population increases and the increases in demand in places like China, the net effect will probably mean that we will end up with more people suffering at the margin.

Food prices are affected by other things besides the price of oil. The drought had a major impact last summer in raising the price of corn, for example. The southwest drought continues but there are reports of expected bumper crops in the Midwest.

'There must be some way out of here,' said the joker to the thief, 'There's too much confusion, I can't get no relief.'" Dylan

I remembered this as "there is no way out of here ..."

But the rich are getting a lot richer so yay for the rich.

"Many people in places like the U.S. are consuming less fuel even though they can afford more fuel."

Like Nick, you completely miss the point. The price of anything affects the demand for that thing, whether you can afford it or not. Affordability is a nebulous thing. If you can afford to pay a higher price for oil and do so, then that means you must buy less of something else. Everything in the economy is interconnected. The price of oil affects everything whether you can afford it or not.

"Food prices are affected by other things besides the price of oil."

Of course they are. No one in their right mind would suggest otherwise. It is not "either-or, drought or oil". That is not the point. The point is food prices, along with the price of everything else, is greatly affected by the price of oil.

Nick is trying to blame the decline of oil consumption at high prices on people who can afford to pay more but choose not to do so as if affordability had nothing to do with it. That is simply incorrect.

Ron P.

In the aggregate, I agree that the price of oil affects demand. Duh. However, I don't think it is missing the point to say that there is an indeterminate number of people who are consuming less without regard to price. Personally, the price of gas has nothing to do with the fact that I have been driving hybrids since 2002.

High prices are no doubt the biggest factor in declining oil consumption. But there are people whose demand is driven more by ethical choices.

Greetings, t,

Is anybody still reading? :)

re: " there is an indeterminate number of people who are consuming less without regard to price. Personally, the price of gas has nothing to do with the fact that I have been driving hybrids since 2002."

1. Are you saying that you are one of those "number of people who are consuming less"?

2. Have you kept track of how much gasoline you have personally consumed while driving your hybrid? In other words, total miles driven: same? higher? lower?

3. Speaking of hybrids, I suppose we'd have to start to think about the individual oil consumption (if we were talking about oil, specifically) on the part of a consumer who purchases a new hybrid v. someone who drives the same old car-not-a-hybrid. If you see what I mean.

What is the "oil consumption payback period" -(a phrase I just made up)- for a new (or even used) hybrid, as opposed to...for example: a) keeping same car; b) decreasing total miles driven - ?

Aniya,

I can give some thoughts.