Drumbeat: February 20, 2013

Posted by Leanan on February 20, 2013 - 10:08am

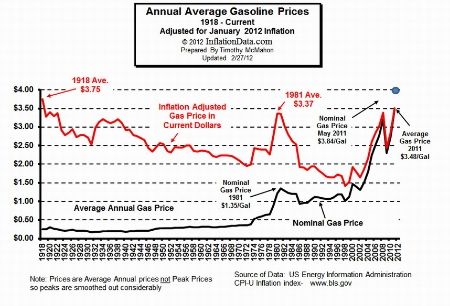

2013 gasoline prices could hit record highs

After sending consumers into sticker shock the past month, how much more can gasoline prices climb?Another 20 to 50 cents a gallon — a level that could propel the cost of gasoline, now $3.75 a gallon, to all-time highs, some experts say.

Gasoline prices typically climb from February to Memorial Day on expectations of rising consumption and costlier summer-blend gas. But so far this year, prices are surging sooner and faster than ever before — up 45 cents since mid-January.

Consumers in some metropolitan areas, such as Southern California, are already paying nearly $5.20 a gallon, up more than 75 cents since December lows.

WTI Crude Slips, Discount to Brent Narrows on Seaway Link

West Texas Intermediate dropped, while its discount to North Sea Brent narrowed after Enterprise Products Partners LP said supplies through its Seaway oil pipeline will increase.Futures fell as much as 0.2 percent percent after advancing by the most since Feb. 11 in New York yesterday. Seaway volume will average 295,000 barrels a day from February to May, compared with 180,000 barrels last month, according to Enterprise. The Federal Reserve will release minutes of its January meeting today. U.S. crude stockpiles probably climbed a fifth week, according to a Bloomberg News survey before a government report tomorrow.

OPEC Seen Cutting by Morgan Stanley as Tanker Charters Slump

OPEC may be extending the longest stretch of production cuts since the 2009 global recession as fewer oil tankers are booked to ship Middle East crude to Asia, according to Morgan Stanley.Hiring of supertankers from the world’s largest export region slumped 33 percent from a year ago, Fotis Giannakoulis, a New York-based analyst at the investment bank, said in an e- mailed report today. The 12 members of the Organization of Petroleum Exporting Countries already cut output for five months, most recently by 1.7 percent to 30.5 million barrels a day in January, estimates compiled by Bloomberg show.

Saudi Arabia ready to lift oil output

Saudi Arabia expects to raise its oil output in the second quarter to satisfy higher demand from China and feed economic recovery elsewhere, oil industry sources said.The world's largest oil exporter kept production steady at about 9 million barrels per day (bpd) last month and sources say production has since hovered around that level because buyers have not asked for more.

Saudi Arabia cut production sharply in the fourth quarter of last year because of weak economic growth abroad and lower seasonal consumption during cooler weather at home. But exports are expected to rise again in the second quarter, driven by growth in Asia, one industry source said.

Shale oil fails to dent Middle East shipments

Will the US be able to say goodbye to its costly military involvement in the energy-rich Middle East because of the shale oil revolution at home?The question is not only important for diplomats and soldiers, but also for the oil market, which for the past 60 years has become accustomed to the idea that Washington would patrol the world’s most important production region.

Gas prices at four-month high after 32 days of hikes at the pump

U.S. gas prices have hit a four-month high with 32 straight days of increases at the pump bringing misery to spring breakers and job hunters.The Automobile Association of America said Monday that the national average for a gallon of regular is $3.73 -- 43 cents more than a month ago -- with prices topping $4 in California and Hawaii.

"It's become the perfect storm," AAA spokeswoman Nancy White said.

Norway Rebutted by Investors Amid Tariff Cut Backlash

Funds that have spent more than $5 billion on Norway’s gas pipelines are contesting the legality of a proposal to cut tariffs charged for shipping the fuel, arguing the government’s plan undermines the value of their investments.The proposal, made public last month by Norway’s Ministry of Petroleum and Energy, constitutes a breach of contract, according to a Dec. 21 letter sent to the government by four companies representing 44 percent of Gassled, which owns Norway’s gas infrastructure. Owners of the four companies include Canadian pension funds, a UBS AG infrastructure fund and a unit of Abu Dhabi’s sovereign wealth fund.

Abe to Ask Obama for Shale Exports as Japan’s Gas Bill Soars

Japanese Prime Minister Shinzo Abe will ask U.S. President Barack Obama to allow shale gas exports as the world’s third-largest economy grapples with soaring energy costs after 2011’s nuclear disaster closed reactors.The request will be made at a Feb. 22 meeting between Abe and Obama in Washington, said three Japanese officials, who declined to be identified because the information isn’t public. The bill for importing liquefied natural gas, combined with a weaker yen, prompted Japan to post a record trade deficit in January of 1.63 trillion yen ($17.4 billion), the Finance Ministry said today.

Japan’s top buyer cuts Iran crude imports

Tokyo: Japan’s top buyer of Iranian crude JX Nippon Oil & Energy has cut by 12 per cent the volume it plans to import under an annual deal, an industry source said, helping ensure the world’s third-largest oil consumer remains exempt from US sanctions on Iran.The cut will reduce JX’s imports from the Opec-member by 10,000 barrels per day (bpd) from a year earlier to 73,000 bpd, said the source who has direct knowledge of the matter. That’s a loss of around $420 million for Iran for the full year at today’s prices, according to Reuters calculations.

China floods Iran with cheap consumer goods in exchange for oil

With the Islamic republic increasingly cut off from global markets due to sanctions, Beijing is in a prime position to benefit.

Total’s Tajik Move Aims for Gas From Same Basin as Turkmen Giant

Total SA’s move into Tajikistan, a former Soviet republic known for growing melons and cotton, aims to produce natural gas for export to neighboring China.

Energy Minister: Power supply critical on April 5

The postponement of planned maintenance on the Myanmar Yanada gas pipeline has not eased concerns of a power shortage in early April, with the Yingluck government warning of the need to cut electricity use during this critical period.Energy Minister Pongsak Raktapongpaisarn said after meeting with energy officials on Wednesday that Total, the French operator of the Yadana field, had agreed to delay maintenance work on the pipeline, scheduled from the morning of April 4 to April 5, until April 14 as requested by Thailand.

Bulgarian government resigns amid growing protests

(Reuters) - Bulgaria's government resigned on Wednesday after violent nationwide protests against high power prices, joining a long list of European administrations felled by austerity during Europe's debt crisis.

Nigerian pirates demand $1.3 million for kidnapped sailors

(Reuters) - Pirates who kidnapped six foreign sailors from an oil servicing vessel off the Nigerian coast on Sunday are demanding 200 million naira (850.1 thousand pounds) for their release, police said on Tuesday.One Russian, three Ukrainian and two Indian sailors were taken when gunmen stormed the Armada Tuah 40 miles (65 km) off the coast of oil-producing Bayelsa state.

Bomb attack causes fire in Iraq fuel pipeline again

(Reuters) - A bomb set fire to a pipeline carrying fuel oil from Iraq's largest refinery to a province north of Baghdad on Wednesday, the second attack in less than a week on the same pipeline, the oil ministry said.

Choice of oil geologist signals BHP shift

BHP Billiton’s decision to pick as it new chief executive a geologist with a history in the oil industry highlights not only the challenges facing the world’s biggest resources group by market value, but also where its future may lie - oil and gas, rather than metals.Andrew Mackenzie, the 56-year old executive who will replace Marius Kloppers, worked for 22 years at BP before joining miner Rio Tinto in 2004 and BHP in 2008.

Iraq gives go-ahead for Iranian pipeline to Syria

BAGHDAD: Iraq has approved the construction of a natural gas pipeline across its territory that will connect Iran to key ally Syria. The move likely to strengthen Tehran’s influence over its neighbors.

E.ON fully opens new UK gas storage facility

LONDON (Reuters) - German utility E.ON has opened all eight gas storage caverns at its new Holford storage facility in Britain, the company said on Wednesday.Two final caverns came into operation earlier this month, completing a seven-year construction and commissioning period at the site in Cheshire.

Petronas $700 mln credit facility for Bangladesh

DHAKA (Reuters) - Bangladesh Petroleum Corporation (BPC) has been granted a $700 million six-month deferred payment facility for oil from Malaysia's Petronas.Under the deal, the first month will be interest-free and the next five payments will have a rate of 4.5 percent, down from the previous deal's 5.05 percent.

Peak Oil Will Be Fully Discredited When Peak Government Is Realized

President Obama recently nominated Sally Jewell to head the Department of Interior. Her bona fides include growing a business — Recreational Equipment Inc. (REI) — to nearly $2 billion in revenue last year. But in her new job, the question is whether Secretary Jewell will grow America’s vast, untapped domestic energy resources.Jewell is now at the gulf between what is and what could be. The Interior Department is responsible for oil and natural gas drilling off the U.S. coast – which is to say, the agency is wholly responsible for the complete absence of new drilling off the U.S. coast.

America’s oil choice: Pay up, or get off

The oil industry has an important message for you, America: You’re not paying enough for fuel. And if you want to realize the fantasy of “North American energy independence,” you will have to pay more for it — a lot more.Getting drivers to go along with this notion will not be easy, so the industry has couched this message in much more careful language.

Governments Must Cooperate to Restrict Buying and Selling of Oil as Production Declines

Decline in output from the world's oil fields is averaging 5% per year http://aspousa.org/peak-oil-reference/peak-oil-data/oil-depletion/, with some speculation that we may have reached the global production limit for conventional crude oil http://www.skepticalscience.com/Climate-Policy-Peak-Oil_U-Washington.html. Once the loss in output overtakes what can be provided from unconventional sources, it can be said that we have passed the point of global "peak oil". The exact timing of this will be known only to posterity, but its circumstance is widely perceived as an unquenchable and imminent disaster of planetary proportions, and the "End Times" movement, hard-line Christian fundamentalists, mostly in the US, are rubbing their hands in anticipation of such "proof" that God really did tell us 2000 years ago that the Tribulation would befall us, in preparation for the second coming of Jesus Christ, who would ultimately transform the Earth into paradise. A cynic might say that since these are mostly people who live in a nation that consumes vastly more energy, and has more cars than anywhere else on earth, such acceptance is really an act of inertia, and they would rather die than change their lifestyles to anything less energy consuming.

Global Peak Oil Production — Where to Invest and Profit

Let’s build upon last week’s long-term bullish case for crude oil. Much has been said about, “Global Peak Oil” production in the last few years, and probably for good reason. We know that U.S. crude oil production peaked in the early 1970s just as Mr. King Hubbert predicted back in the late 1950s.But, is peak global oil production just around the corner?

Energy industry analysts believe that global oil production will peak sometime between 2015 and 2025. That sounds like a fairly broad range. However, the reality is that it’s a fairly short timeframe in geologic time that does not even register a notch, and it’s rapidly coming upon us.

Crude Oil Price BUBBLEOMIX Forecast 2013

Of course, you can’t pay the “right” price until the darn sellers break ranks and/or the hyperventilating hedge-fund managers reach for their brown-paper-bags. The problem is the way it works you get fired if you don’t hedge against a spike but if there is a bust well the way the bonuses are worked out, that doesn’t matter so much.Whenever that happens (not if), what will happen next, as night follows day, is the red-line.

The trigger for that might be when the penny finally drops that U.S.A. will become energy independent sooner than anyone thinks. When everyone finally get’s their head around the idea that the biggest buyer in the world might leave the market-place, the sellers might well break ranks…it’s happened before, like did everyone stop pumping when the price hit $35 in 2009?

Illinois fracking rules could be strictest in the nation

Illinois legislators are expected to introduce a bill in coming days or weeks that would regulate hydraulic fracturing in the state.Known as Democratic Rep. John Bradley’s bill, it is expected to be shaped by months of discussions that have taken place among environmental and industry leaders and legislators. Last year, legislation that started with support from both environmental and industry groups died after undergoing various permutations, including the addition of a two-year fracking moratorium.

Battle Lines Drawn for BP’s Day in Court

HOUSTON — Unless the Justice Department and BP reach a last-minute settlement, the British oil company will return to court on Monday to face tens of billions of dollars in civil claims from the 2010 explosion on the Deepwater Horizon rig in the Gulf of Mexico that could cripple the company for years to come.

BP Wins Approval to Cut Potential Fine by $3.4 Billion

BP Plc won approval of an agreement for the U.S. government to not count 810,000 barrels of oil captured before they became part of the 2010 Gulf of Mexico spill, reducing the potential maximum fine under the Clean Water Act by $3.4 billion.The collected oil “never came into contact with any ambient seawater and was not released into the environment,” U.S. District Judge Carl Barbier in New Orleans said in an order yesterday.

A Strategy to Prevent the Next Fukushima

Among the most striking elements of the catastrophe at Fukushima Daiichi nuclear reactors in Japan were the hydrogen explosions that destroyed the upper parts of some of the reactor buildings. The hydrogen was released by a metal called zirconium in the overheated core.Since that accident, whose second anniversary falls on March 11, researchers have been looking at a variety of ways to prevent a repetition. At the Electric Power Research Institute, a nonprofit utility consortium, scientists think they have zeroed in on one strategy: replacing some of the zirconium with a ceramic.

Swelling found in second battery on Japanese Dreamliner

Cells in a second lithium-ion battery on a Boeing Co 787 Dreamliner forced to make an emergency landing in Japan last month showed slight swelling, a Japan Transport Safety Board (JTSB) official said on Tuesday.The jet, flown by All Nippon Airways Co, was forced to make the landing after its main battery failed.

Peer-to-peer car rentals set to debut at SFO

The way Rujul Zaparde sees it, there are two kinds of people in this world: those who’d let complete strangers drive their cars and those who wouldn’t.As the CEO of FlightCar.com, a new peer-to-peer car rental company, Zaparde clearly believes there are enough of the former to build a viable business on. Set to officially launch at San Francisco International Airport (SFO) on Friday, the company promises to provide significant savings for both car owners and renters.

Home Solar Systems to Be an Option for Honda Customers

Automakers have long resorted to incentives like zero-percent financing, rewards points and rebates to inspire customer loyalty. Now Honda is offering a different deal: inexpensive home solar power systems for customers.Through a partnership with SolarCity, a residential and commercial installer, Honda and Acura will offer their customers home solar systems at little or no upfront cost, the companies said on Tuesday. The automaker will also offer its dealers preferential terms to lease or buy systems from SolarCity on a case-by-case basis, executives said.

UN launches Africa plan to swap kerosene for solar

Nigeria could save US$1.4 billion a year and avoid using 17.3 million barrels of crude oil if it used modern off-grid lighting solutions.That’s one finding of a new UN study into lighting in Africa, a continent that relies heavily on kerosene, candles and batteries to light homes.

Sewage Status Grows as Resource for Utilities to Skiers

United Utilities Plc and Severn Trent Plc, Britain’s biggest publicly traded water companies, are increasingly feeding human waste into tanks of bacteria whose methane emissions generate electricity.Sewage-derived power supplies 22 percent of Severn Trent’s energy, almost double that of 2005. At United Utilities, it’s 14 percent. British utilities are shifting fecal matter to vats of bacteria that consume the waste, releasing biogas that’s burned to drive water treatment. The result is lower energy bills and surplus power sent to the grid that heat more U.K. tea kettles.

Supreme Court Appears to Defend Patent on Soybean

WASHINGTON — A freewheeling and almost entirely one-sided argument at the Supreme Court on Tuesday indicated that the justices would not allow Monsanto’s patents for genetically altered soybeans to be threatened by an Indiana farmer who used them without paying the company a fee.

The Deadly Opposition to Genetically Modified Food

Finally, after a 12-year delay caused by opponents of genetically modified foods, so-called “golden rice” with vitamin A will be grown in the Philippines. Over those 12 years, about 8 million children worldwide died from vitamin A deficiency. Are anti-GM advocates not partly responsible?

Europe’s Rift Over Overfishing and Subsidies

“We won a huge victory for sustainability two weeks ago with a huge majority,” Isabella Lovin, a Green party legislator from Sweden and a longtime critic of European fisheries subsidies, said by telephone. “You would expect the subsidies vote to go the same way. But I’m not sure we’ll have such a big victory when it comes to money.”“My worry is that there is an unholy alliance of between the conservatives and the left,” she added, “one that wants to continue giving subsidies.”

Carbon Plunges as EU Delays Vote on Fast-Track Market Fix

Carbon prices plunged the most in more than three weeks after the European Parliament’s environment committee postponed a decision to seek fast-track approval for a plan to fix a record surplus of emission permits.

Emissions Trade in E.U. Is Sputtering

LONDON — President Barack Obama is trying to persuade the United States to adopt a cap-and-trade system to curb greenhouse gas emissions. But the European Union’s Emissions Trading System — the world’s flagship effort — is sputtering. European carbon permits, which traded at about €30 per ton a few years ago, are now hovering at about €5 per ton or less.

Keystone XL will have 'no impact on climate change', TransCanada boss says

The company that wants to build a controversial oil pipeline from western Canada to Texas said on Tuesday said that shutting down the oil sands at its source would have no measurable effect on global warming."You could shut down oil sands production tomorrow and it would have absolutely no measurable impact on climate change," he said.

New projections of 'uneven' global sea-level rise

Sophisticated computer modelling has shown how sea-level rise over the coming century could affect some regions far more than others. The model shows that parts of the Pacific will see the highest rates of rise while some polar regions will actually experience falls in relative sea levels due to the ways sea, land and ice interact globally.

Unlike other problems caused by CO2, ocean acidification is spurring some action, possibly because the effects are so visibly tied to the cause. “With climate change there’s often a schism between scientists and those who flat out don’t want to believe it,” says Green. “It’s hard to get a man to believe something if his job depends on not believing it.” But in this case, he says, it’s the people in the industry who are leading awareness. “Talk to shellfish clammers—the guys who dig—and every one of them is on board, especially the old timers. They have seen over the years the populations go from incredibly productive to virtually disappearing in many cases.” One bit of anecdotal evidence diggers have reported is clams with thinner shells—so thin, they say, that sometimes it’s not possible to fill bushel baskets to the top because the fragile shells at the bottom will be crushed.

Filipino super-typhoon an ominous warning of climate change impact

The five most devastating typhoons recorded in the Philippines have occurred since 1990, affecting 23 million people. Four of the costliest typhoons anywhere occurred in same period, according to an Oxfam report. What is more, Bopha hit an area where typhoons are all but unknown.The inter-governmental panel on climate change says mean temperatures in the Philippines are rising by 0.14C per decade. Since the 1980s, there has been an increase in annual mean rainfall. Yet two of the severest droughts ever recorded occurred in 1991-92 and 1997-98.

Scientists are also registering steadily rising sea levels around the Philippines, and a falling water table. All this appears to increase the likelihood and incidence of extreme weather events while adversely affecting food production and yields through land erosion and degradation, analysts say.

From links above"

Saudi Arabia ready to lift oil output

and

OPEC Seen Cutting by Morgan Stanley as Tanker Charters Slump

Now these two headlines can't both be correct.

I wouldn't be worried about steep depletion rates, or even cheap oil disappearing any time soon. The tar sands are selling for under $40 a barrel, and they just discovered 233 billion barrels of oil in Australia. Hopefully we can use the remaining resource to develop alternatives.

Does anyone here know whether or not tar sands oil is sustainable at $40 per barrel?

tstreet,

"Does anyone here know whether or not tar sands oil is sustainable at $40 per barrel?"

As long as the BS keeps working.

It is quite funny. Without looking at the familiar names of the posters, those who say TAR sands are Americans, those who say OIL Sands are Canadians.

...and no one calling them BITUMINOUS sands ;)

Interesting observation.

(I replied to your Q on the prev DB.)

At $40/bbl, existing oil sands operations will continue to operate indefinitely, but companies will show little enthusiasm for starting new ones. It would take $80/bbl oil to make that happen.

Note, however, that the world price of oil is not $40/bbl but $118/bbl as indicated by the price of Brent in London. Oil sands production would get something closer to that if it could somehow get onto the world market. The high price of Brent is an indicator that the global supply situation is not nearly as good as some people would like you to believe.

It doesn't matter what the cost per barrel is for the tar sands - it's still the equivalent of saying "don't worry that the shower has stopped, the tap is still dripping in the sink".

And putting aside the fact that those 223 billion barrels aren't really oil, they are in one of the driest parts of the world. Three guesses as to what you'll need to help extract them. Yep, water.

And combined net oil exports from the seven major net exporters in the Americas in 2004, inclusive of rising net exports from Canada, fell from 6.1 mbpd in 2004 to 5.1 mbpd in 2011 (BP, total petroleum liquids).

And I don't recall an average Brent price of $112 in 2012 being called "cheap" before.

How can cost simply "not matter"? Cost is everything. I thought that was the basis of EROI. If the price of tar sands is that low, that might be indicative of a high EROI. And besides, tar sands are good because there's no discernible peaking pattern for them, at least as far as we can tell.

Could it be that "oil" from the tar sands is mostly bitumen, just about the lowest quality goo that can still be called oil?... Nah, that couldn't be it.

Keep in mind your $40/bbl is an incremental cost of production, i.e., what existing legacy operations can produce their oil for. That's what you will typically see in the disclosure statements. The cost to bring new production on from tar sands is more like $80/bbl, though that is just a guess.

Yes, I understand that it's at a certain price, which includes demand, but how in God's name can the tar sands only have an EROI of 5% when it's selling for much less than shale oil and conventional oil, which I've heard have EROI's of around 10%-15%? The tar sands oil doesn't have a higher or lower demand, because it's oil, regardless of where it comes from, so that doesn't explain it.

Western Canadian crude and WTI are selling at discounts to global crude oil prices because of transportation bottlenecks in the North American Mid-continent.

As noted above, Western Hemisphere net oil exports, from the seven major net exporters in the American in 2004, fell from 6.1 mbpd in 2004 to 5.1 mbpd in 2011.

Ah. That explains it. Thanks. I'm still not as pessimistic about the tar sands as many are, though. I think they have a better future than tight oil and shale oil, though.

Yeah, a better future releasing CO2. As do all the other FF sources. That makes me pessimistic about climate change/warming.

Exactly - every time someone gives a sigh of relief that we might be able to continue BAU a little longer, I give a shudder.

Ditto. A narrow focus on availability of fossil fuels sadly ignore all the negative impacts of their production and use. Tar sands are destructive on many levels.

FOR ALL: Something to remember: while the price of oil is obviously important a company's profitability is ultimately determined by what it cost to develop their production stream vs. the price of oil. Two tar sand companies could be selling their production for the same price yet one could be much more profitable than the other. Pubcos being involved can make the distinction even harder. A pubco might continue develop their tar sand reserves even if they are experiencing a zero return on the capex spent. They monetize the value of their effort through their stock valuation.

And as I just explained in another post a company may keep selling as much tar sand production as possible even if their current investment profile indicates the project will never recover the initial investment. At this point it’s a matter of generating a positive cash flow. I’m producing a NG well in La. that will never recover the capex spent on it. But the production cost is low so I make a nice net cash flow. What low prices cause is a reduction/slow up in expending new capex to add production. I’ve seen stories of tar sand companies pulling back on new projects. But that doesn’t mean they’ll stop current operations even if the positive cash flow is skinny. And for a pubco even if the net cash flow is zero.

Thanks for the explanation. *no sarcasm*

MM – You’re welcome. I hope it didn’t come off too preachy. Just one of my perpetual pet peeves. Since you’re the daily lightning rod (LOL) I’ll toss out some other personal observations.

The days of cheap oil are gone: I don’t recall any time in my 38 year history that oil was “cheap”. Times when it cost a lot less than during other times for sure. But when the world dove into a recession in the early 80’s a $20 bbl of oil wasn’t cheap because much of the world couldn’t afford to buy at that price which is why oil eventually bottomed out around $10/bbl. But a lot of the world still couldn’t afford to buy much $10 oil so would you classify that price as “cheap”? Maybe cheaper but not cheap.

Now the flip side: is $100/bbl oil “expensive”? In 2001 oil was selling for about $25/bbl and we were consuming 77 mmbopd. Today oil is selling for about 4X that much and consumption has increased to about 86 mmbopd. Based upon increased consumption the world can afford $100 better now than it could afford $25 oil 12 years ago. Sounds like $25 oil was more expensive than $100 oil today if you judge it by what the world can afford. There was a time when a 50 cent beer was expensive to me yet the other day I didn’t hesitate to pay $75 for a bottle of Islay scotch. So is scotch suddenly “cheaper than beer? LOL

Companies in a panic today to find hydrocarbons. Oi…is this something new? When I started in 1975 my first mentor explained in detail our PO future. We called it the “reserve replacement problem” but it was the same critter. I worked for public companies for most of my first 10+ years and without exception they were always in a panic mode trying to add reserves to their books. I saw countless pubcos go under 30 years ago because they couldn’t deal with the PO monster.

Another point that will be difficult for many to believe: oil/NG has never been easier to find then it is today. I won’t go into the tech details. But think of those first very expensive hand held calculators in the 70’s and compare them to your lap top today. The improvement in our exploration tool bag exceeds the magnitude of the change in computing tech. Our tools don’t limit us at all. The problem is the lack of new fields to find with our great tools. Which is a big reason the shales plays are so hot: they were found decades ago…no exploration required. Over thirty years ago me and every other geologist could draw a circle around all the Bakken/Eagle Ford wells being drilled today. All you had to do was ask where drilling would be focused if oil went over $100/bbl. We wouldn’t even need to envision horizontal drilling…folks would have drilled those wells vertically at $100/bbl. In 1976 I was looking at potential DW GOM fields on seismic when I was with Mobil Oil. We didn’t have the engineering tech to develop fields in that depth of water then but we knew they were posibly out there. So when prices/demand got high enough we spent the monies to develop DW drilling/production capabilities.

If anyone wants to find fault with anything I said please refer your complaints to MinneapolisMan. He seems to handle it well. I still tear up when folks disagree with me. LOL

" I don’t recall any time in my 38 year history that oil was “cheap”".

Compared to human labor? [sorry ROCK]

Ghung - No...cheap compared to good scotch.

ROCKMAN, in my opinion oil is still not expensive. Albeit, it is not as inexpensive as it used to be.

Best hopes for adapting to the rising price of oil.

But gasoline was cheap in the 1950s and 60s wasn't it? Really, really cheap, even adjusted for inflation. Must have been marvellous. A golden age, never to be repeated.

1998 was the lowest inflation adjusted price.

In the USA during the 1950s and '60s "gas wars" were common; competition between nearby stations often drove the price below 10 cents a gallon for weeks at a time.

ROTFLMAO.

And they bribed you by offering you free glasses and stuff with each fill up.

I guess this chart missed the gas wars.

It is pretty obvious something fundamental changed about 1998.

From 1910 until then there was a pretty stable decline in gasoline costs thanks to improving technology and efficiency of scale.

All while demand was increasing, contradicting the simple notion that prices are set by supply and demand.

What changed in 1998? Google variations of "Easy oil over".

Edit: I tried to make that chart smaller, my first attempt was too small. I deleted and reloaded in photobucket, but when I preview in TOD, it never changed size. But it really did?

From Wiki: The General Motors EV1 was an electric car produced and leased by the General Motors Corporation from 1996 to 1999.[1]

That is amazing. Could they have picked a worse possible time? Nope. Right at the nadir of gas prices.

And then they massively compounded that error. Instead of sticking with the program and continuing investment, they bailed on it right before gas prices went into a steep and sustained price rise. Maybe we would have a $30K Volt today if they had stuck with program.

"Maybe we would have a $30K Volt today if they had stuck with program."

Yeah, the timing of the EV1 was a spectacular mess - but there was still demand for it. There was demand for the Toyota Rav4 EV's, too, and there's still a bunch of them running around because people could actually buy them rather than the lease-and-crush campaign of GM.

For anyone interested in a sub-$30k Volt I was rather surprised to find them showing up on Autotrader(dot)com with 15k - 25k mi for around $25,000. Extremely tempting. So they're already filtering through to the secondary market. Would be interested to know why though - whether they thought it was too small, weren't getting the benefit of plugging in, etc.

The EV1 with the NiMH was getting something on the order of 150 Wh/mi by the end of the program - which would give it a range of 140 miles-ish with the battery currently in the Nissan Leaf. I think a battery equivalent of the VW 1L could push consumption to 100-120 Wh/mi giving it a range of 175 - 210 miles with a Leaf-sized battery.

The question is whether anyone would buy a 2 seat vehicle...

http://en.wikipedia.org/wiki/Renault_Twizy

Now imagine that with a heater - and real doors! (and highway speeds and 200 miles of range)

One of the more curious things about a lower Wh/mi is that the Speed-of-Recharge increases. The current Leaf on L2 can charge at 3.3kW, which at 260-ish Wh/mi is 12.7mph. The Renault Twizy gets approximately 110 Wh/mi, so the same 3.3kW charger would yield 30mph. Half the consumption, twice the recharge speed. At L1 120V 12A (1.44kW) this gives the Leaf an SoR of 5.5mph and the Twizy 13.1 mph.

A theoretical "VW 1L-E" with 6.6kW L2 (what the 2013 Leaf will have), Leaf size 21kWhr (useable) battery, and 110 Wh/mi consumption would have a range of 191 miles and Speed-of-Recharge on L2 of 60mph.

And if fast-charge infrastructure shows up...

http://en.wikipedia.org/wiki/Mitsubishi_i-MiEV

As far as the HEATERS in lightweight EV's go, I still suggest putting in Magneto-Pedals at each seat.

1) -let the occupants and driver heat themselves

2) -counteract some of the drawbacks of sitting

3) -put more INTO their batteries as a result, not take more out.

And if prices, for those 88 years, was not set by supply and demand, what were they set by? You have presented nothing that contradicts the notion that supply and demand sets price. During most of those 88 years demand was increasing at the same time supply was increasing even more, causing a continual decline in price. Then in the 70s and especially the early 80 supply got really tight, causing prices to jump in the 70s and to really jump in the 80s.

The term "Easy Oil Over" simply means "The Supply of Oil is Tight". And when the supply of oil is tight, prices rise.

Supply and demand drives price. Short term swings in the price can be caused by any number of psychological factors. But the long term price is always determined by supply and demand and nothing else.

Yes, the easy oil is over and the marginal per barrel price is getting higher with each passing year. Meaning the supply is getting tighter and tighter. And that means the price will get higher and higher. Unless... unless of course, the economy get worse. This will mean fewer people can afford the higher price of petroleum products and this will drive the price down.

Ron P.

And if prices, for those 88 years, was not set by supply and demand, what were they set by?

At the start the price was "set" by the other products of its time - burning fluid (stuff you didn't wanna drink from distilling booze) and whale oil.

C – As Turnbull points out you can’t use absolute costs of anything and compare it across decades. There was a time was gasoline was very cheap regardless of the metric. I’ve always read the reason henry Ford et al went with gasoline instead of diesel was that there was almost no market for the gasoline portion of the refining output. Of course. Building a lot of gasoline fueled ICE vehicles ultimately changed that dynamic significantly.

But beyond inflation adjustments we need to look at the purchasing power at the time. Didn’t matter to my family what gasoline was selling for in the 50’s, 60’s or even half way through the 70’s: we didn’t own a car. But I did grow up in Nawlins and do remember electricity was too expensive to run an air conditioner. I don’t know how inflation adjusted electricity prices compare from then to now but it didn’t matter to us. Like I was kidding in another post: there was a time when a 50 cent beer was expensive for me. Now a $75 bottle of scotch isn’t “expensive”. It the late 90’s when oil was selling for $25/bbl it was still very “expensive” for many folks. Maybe a better term is affordable than expensive. But even with that metric it depends on who you’re referencing.

You have explained this before and it is quite enlightening. However, I do not understand why investors and analysts cannot see through the hype on reserves when those extracting those reserves are not worth the capital required. Same thing goes for negative cash flow.

With tar sands, I would surmise that companies are counting on a new pipeline to increase their prices. So it makes the situation just a tad more complicated. Things no doubt are looking up given Obama's recent choice of oil men golf buddies.

ts - I'm sure an honorable person as yourself will always have trouble grasping that there are a number of ways to make a lot of money in the oil patch that don’t require drilling very profitable wells. Remember the operator I once spoke of that drilled 18 dry holes in a row back in the late 70’s boom. He and his senior guys retired millionaires. Investing in the oil patch isn’t for sheep: there’s a waiting pack of wolves ready to skin them alive. Petrohawk sold their undeveloped Eagle Ford acreage for $12 billion. All on the up and up and sold to a sophisticated and knowledgeable operator. I’ve heard that the company developed a big case of “winner's remorse.”

BTW: just because an analyst is saying buy it does mean he isn't selling his own position to someone else.

I am not sure you're using EROEI correctly (if that is even possible). EROEI is not related to dollars but to BTUs.

http://connectrandomdots.blogspot.com/2012/07/test-post.html

Rgds WeekendPeak

To be fair, he did say just EROI, and while the jury is out on it I suppose, I would be happy to have both terms carry those respective meanings, since 'ROI' is already well established as a monetary term.

I don't agree with RMG that EROEI is a useless term. Maybe just useless for him. I do appreciate that the sales value of various energy sources will have a different dollar value due to their application, but as we most of us know, that's not the point or the implication behind EROEI.

I didn't say that EROEI was a completely useless term, I said it is of limited usefulness because it doesn't account for fungibility, as well as capital, labor, land, water, and other constraints. The oil industry doesn't use it because the basic concept is included in some of the indicators they do use.

The non-linear nature of the measure is also highly misleading for people who don't understand that it is non-linear. A good analogy is SPF factors for sunscreen. As skin specialists are constantly reminding people, SPF 100 sunscreen is not 10 times as good as SPF 10 sunscreen - in fact most people are better off saving their money and buying SPF 10.

Similarly, an EROEI 100 oil well is not 10 times as good as an EROEI 10 oil well and oil companies are better off drilling a large number of EROEI 10 oil wells rather than trying to find an EROEI 100 oil well, of which there are none left to be found.

OTOH, SPF 1 sunscreen is utterly useless because SPF 1 is the sun protection of human skin, and an EROEI 1 energy source is utterly useless because it consumes as much energy as it produces. Biofuels often get close to an EROEI of 1.

The region it is most useful, for both SPF and EROEI, is approximately 2 to 10 because that is where it makes the most difference. Outside that range, it doesn't really matter much.

Sorry I misrepresented your statement. You did and do seem to be dismissive enough as to say it's useless. The point is to understand what kind of information it is revealing.

It's usefulness is not, of course at all a function of those listening who can't understand the point. That's another problem entirely.

A bike is of 'limited usefulness' when what you need is a can opener, but is highly useful when applied as it was designed.

Of course, your example of an energy source with a 1:1 EROEI is exactly the point, while a source that was once 100:1, and has proceeded to get to 10:1 or worse is also the point, because it is informing us of a trend that we really need to be aware of .. and that is for me, almost ENTIRELY the point. Just because oil (sic) 'might' still be hovering above your particular cutoff point doesn't offer much to assuage the concern that the motion of that graph is completely clear. If Solar Hot Water or Windpower has only got an EROEI of 12, but will still by any reasonable expectation maintain that Level when Oil Production has shimmied its way down from 100 to 10 to 2 perhaps, then the 'Usefulness' of EROEI will be quite significant.

I think the cost of an energy source would be proportional to 1/(EROEI-1) if that source had to be produced using its own output. However if a 2:1 source can be produced using the energy from a 10:1 source the output can be sold at the 10:1 price and still return a 100% profit.

That is no cause for any warm and fuzzy prediction that a vast 2:1 source will continue to keep the price at current levels. As the 10:1 source becomes depleted the 2:1 price would go up, ultimately by a factor of 10.

My point was that a change in EROEI from 100:1 to 10:1 is not as significant as the big numbers imply because the EROEI function is not linear. In real physical terms, all it means is that the efficiency of energy production has declined from 99% to 90%. Either is acceptable in the real world and other factors are more important. However at an EROEI of 2:1 the efficiency is only 50%, meaning it is becoming very marginal, and at 1:1 the efficiency is zero, meaning the process is a waste of time and money.

As for fungibility, solar hot water and wind power are not interchangeable with liquid fuels. Nobody I know uses solar hot water to power their car or gasoline to heat their household water. Few people use wind power to propel their cars. Many people would argue that it is technically possible to do the latter, but I don't think they have looked at the EROEI of doing the conversion from gasoline powered cars to wind powered EVs. I don't really think anybody has because the results are just too depressing. The EROEI of it is so low that somewhere in the middle of it the world will run out of energy to make the transition.

Oh ye of little faith. I'm not going to do EROEI calculations since as you point out, they are often pointless. But on a monetary basis it costs MUCH LESS to fuel an electric car per mile with wind power than it costs to power a current fleet average MPG car with with gasoline! I'll grant that EVs are more expensive up front but the cost of fueling them solar or wind is MUCH LESS than fueling a gas car per mile.

This is not pie in the sky stuff. Yes, there are issues . . . up-front cost of an EV, range, etc. But if you just assume that powering cars on wind can't be done cost-effectively because it sounds too good to be true, you are wrong.

And yet you're the one who rightly trumpets the Wind Farms that drive at least a part of your Calgary transit system. Funny that you choose to point at Solar Hot Water instead of the MANY forms of electric generation that are out there working as we speak, and helping to turn train wheels in any number of places.

Of course all these fuels are not simply interchangable.. who said they were? It's not simple, but in cases like that one above, it's at least possible, and with steadily diving 'efficiency' of the sources we've depended on for a century, the signs are very usefully warning us that we need to be figuring out how to do so.

I would be very eager to hear how a PV-EV , of which there are now steadily GROWING numbers (or by reasonable extension, a WIND-EV) stands up in BOTH EROEI and in overall utility compared to Gas Vehicles whose fuel depends on a transport chain that could get spotty for countless reasons, considering how both the PV and the EV can use their power to help support the home or business it's attached to, while being able to accept power from there or any of potentially millions of plugs and other sources around the country.

Electric trains run on electricity and electricity is fungible. One source is as good as another, and wind power works the same as coal, NG, or hydroelectric power. Calgary switched the electricity source for its electric trains from the other sources to wind power. The wind farm was already operating and looking for buyers, so it was a simple matter of signing a supply contract and throwing the switches.

Electric cars are not nearly as easy. Electricity is not interchangeable with gasoline - you can't simply sign a contract and plug your gasoline car into an electrical outlet. You have to change out the entire gasoline vehicle fleet for EVs, replace all the gasoline stations with charging stations, upgrade the electrical grid to handle the additional load, and increase the generating capacity to provide the power for all those cars. In the middle of the transition, you have two duplicated transportation systems, both of which are massive in scale. There would be a lot of abandoned and scrapped infrastructure at the end of it.

I haven't seen any studies of the energy investment required for EVs, but on the basis of a few back-of-napkin calculations, I have a feeling the EROEI on it is very poor. The fact that there have been no EROEI studies indicates to me that people are simply glossing over the problem, which is sufficiently serious that it could kill the electric car (again).

So it sounds like hearing a trustworthy EROEI evaluation of this would be the useful information that you would require to make this judgment, no?

Whatever your personal doubts about whether an EV could match up to a gas car would be answered by a proper pairing of these inputs to the returns.. and sure you can do it for monetary comparisons as well. But as ever, that is not why we look at EROEI. The utility value and price of different energy forms will change with their role in the marketplace and the availability of them to start with.. so just looking at cost gives us a Limited Utility in judging some of the core qualities of these sources.

At this point in time half or quarter electric vehicles are probably the sweet spot. By half, I mean a plugin hybrid, and quarter electric would be a standard hybrid. These do get on average substantially better mileage than pure ICE cars. With any luck vehicle fleets will contain an increasing percentage of such vehicles.

I doubt the embedded energy of an EV or near EV is much more than that of a similar sized ICE vehicle. And for the ICE vehicle, the embedded energy is considerably less than the energy consumed driving it over its lifetime. So this is a way to stretch things out as we exit the cheap oil age.

Now there are plenty of research projects on the creation of methanol -or other liquid fuels, from energy (in some cases sunlight) CO2 and water. I suspect this may be the route to having some volume of sustainable liquid fuels. At this point I think BAU-lite may be possible long term.

One of the reasons I am willing to bang on about EROEI relates to your comment on lifetime embedded energy, and where we can aim ourselves for long-term solutions with the most modest EI requirements.

It's hardest to get really useful numbers for them so far, but I have posed the question a number of times over the years here, just to see if anyone has tried to look into what kind of Energy ROI you get from such things as Solar Hot Water collectors scrabbled together from scrap materials, for the sake of the Glass, Brass, Aluminum and Copper in particular..(whereby their ROEI has already had at least one service lifetime of payback to their credit, and they don't lean on new raw material sourcing as a result) or for EV conversions, which can recycle the ICE hardware, reuse the carriage,etc.. and add in a very modest Motor that is often said to have an estimated lifetime of a Million Miles, and where the battery packs could still be changed out later to keep up with new developments without getting a whole new vehicle..

(EDIT: AND.. as with the suggestion to heat passengers in an EV by having them all start pedalling at their seats, the way you calculate the EROEI of all the personal labor put into building one's own vehicles and collectors, etc, is also highly complicated, but salient, since this effort, like the pains of parenting, are simultaneously tough (debits) and delightful, educating, empowering(!), exercising (hence, Credits) ... call it as you will.)

These are all essentially EROEI considerations.. and to apply it to TK's question yesterday, they go directly to a personal preference of my own, which is to point out the potentially extreme advantages in Net Energy gain or LCA when you repurpose existing local materials, as well as gleaning advantages from some or much of the Sourcing, Transport, Design and Engineering effort that went into providing your resource materials in the first place.

Of course, knowing the concept itself is still very Useful for countless other reasons as well, like those folks who would burn off half a tank of gas waiting in gas lines in NJ after Sandy, with the odds that they might not even get another Half a tank back to replace it with.

How many gas stations would exist if every ICE car owner was able to fill their tank at home, every night? Where would they be located?

To say that the existing system must be duplicated is overly pessimistic in my view, and the existing grid is under utilized at night, when most charging would initially be done. Didn't the U.S. D.O.E. publish a study concluding that the existing grid could handle widespread adoption of EV's?

Another issue is that there must be a certain baseload generated at night and that baseload is not fully realized. At least I believe that was the situation a few years ago when I did research on this issue. So, in essence there is electricity generated that is not being utilized. Therefore, initially, at least, there would not be an increase in fossil fuel burned as a result of charging the EVs at night. This, however, would change over time as coal and nuclear are phased out as fuels like natural gas are better at matching the actual load required.

Beyond that, there are those of us who are not interested in replicating the existing auto dominant transportation system anyway. If EVs were just required to fill a small niche of that system in the future, that would obviously obviate some of the concerns involved in simply using EVs as a substitute for ICEs. However, I assume that the dominant culture will do everything possible to simply replicate BAU by other means.

If one fills up his tank only at home, then the range of his vehicle is limited to the maximum round trip distance that can be traveled from his home.

Sure, if an EV owner only ever does, but that misses the point. Most people, most of the time, drive less than 30 miles a day. Charging at home has this day to day use covered. The more difficult task is solving the long road trip problem.

Take a look a this map of planned Tesla Supercharger stations.

A mere 100 charging stations, nationwide, to provide blanket coverage of long distance routes? Wow! Tesla is budgeting this as marketing, which is brilliant considering that Tesla owners charge for free. Tesla's intention is to power them with solar PV.

Moreover according to the authors of "Transport Revolutions: Moving People and Freight without Oil" Anthony Perl and Richard Gilbert, there are inherent losses in batteries for charging, holding the charge and discharging which are not present for what they call "Grid Controlled Electric Vehicles" i.e. trains. trolleys, lightrail powered by electricity directly from either overheard wires or a Third Rail.

http://www.richardgilbert.ca/transportrevolutions/index.htm

Of course there is a large upfront capital investment for the electrification of Rail and its cousins. But the benefits in the long run should be enormous for the Green Transition from fossil fuels.

Costs don't matter in that at $20 or $220 a barrel, oil sands are still essentially a mining operation. You just can't ramp up high levels of production required by waving a magic wand and saying "the market will find a way".

True, at $20 a barrel almost no new production would come on-line and at $220 no stone would be left unturned. It still won't have a radical change on the scale of output from an "oil-mine" of tar sand. The infrastructure required is enormous.

You're right about the flow rate from the tar sands, they'll be digging that stuff up for decades to come. It's just damned hard to dig it out faster and faster.

Try not to get too hung up on EROI or EROEI. It is an important factor, but 74M barrels a day is a flow rate, plain and simple. If you can't maintain that flow, then you have drop in production.

True. I'm guessing the flow rate of the tar sands isn't that high? (I have no information regarding this, so I don't know.)

IIRC the world production from tar sands is around 2.5MB a day.

Useful, but in context, about three quarters of an hour of daily world consumption.

I think not. Kerogen is not oil.

Major shale oil deposit found in Australia

And Australia estimates that their imports will increase every year between now and 2050 by 2.1 percent per year. Amazing! they have all that oil and still imports will increase every year. Something just don't add up here. ;-)

Ron P.

Sure, it's hydrocarbon that hasn't been cooked at high enough temperatures, but that doesn't mean that the process of refining kerogen into oil like they've been doing at the tar sands won't become cheaper and more economical as price rises.

"...cheaper and more economical as price rises."

Thanks for that ;-)

Yes, I know that the Australian "oil" isn't nearly as profitable as conventional oil, but there's no reason to believe that once price is high enough, more production won't be brought online that used to be unprofitable.

Given sufficient energy input and price support, there is virtually no limit to the volume of liquid hydrocarbons that we could synthesize from water and CO2. Given sufficient energy input . . .

For an alternative view of the global oil supply outlook, that explains current triple digit global crude oil prices, you can do a Google Search for: Export Capacity Index.

I can go along with you there. Increases in production from tight oil plays and the steady increase in tar sands production are both good examples of production ramping up when prices go high enough. But can we agree that when that happens, oil has become less cheap than it was before?

Well, what do you mean? Less cheap? The point of raising production is to reach an equilibrium price. If price goes high enough, production will increase, and the price will fall back down. The only way this won't happen is if production can't be ramped up, which is what peaking is. But there is no peaking with tar sands, as far as we know, so production can be ramped up over time, right? Are you talking about environmental costs?

And, yeah, sure, even if tar sand production increased, it couldn't make up for declination in other areas, but it's still one of the reasons why I think that we'll have really gradual depletion rates.

What do you mean by gradual ?

Let's do some envelope math here

Assume that a 'gradual' depletion rate is 1%. Applying it on the world conventional C+C of 75,000 kbopd over a 10 year period we get a net production of 67860 kbopd.

Now let's assume a more dramatic depletion rate of 3%. Using the same compound interest formula over a 10 year period we have net production of 55,540 bopd.

Using an even more dramatic depletion rate of 4% we get 50240 kbopd.

So for tar sands to make a difference at the end of a 10 year period the tar sands production will have to go from whatever it is today to

For scenario 1 (~3%) 67860 - 55,540 = 12320 kbopd or around 12.3 million bopd

For scenario 2 (~4%) 67860 - 50240 = 17620 kbopd or 17.5 million bopd

Even if you call 2% as manageable the corresponding numbers are 5.8 mbopd and 11.1 mbopd.

You think that is possible ? To keep things in perspective, Saudi Arabia produces 10 million bopd today. That's the magic of compounding.

According to this website http://www.energy.alberta.ca/oilsands/791.asp the production is expected to double from the current to 3.7mbopd in 2021. Even if we assume that the whole world will go into a decline rate of 3-4% only after 20 years time. The production still won't reach the levels needed to keep the things manageable.

Please check my math.

There is no certainty, with demand destruction, that tar sands would even be further developed. Most of the projects were shelved or delayed during the last oil shock. Even if you could manage a 5% annual gain, you couldn't stop a 5% annual decline in world supply for over 40 years.

I wonder about what coal might do? World consumption of coal continued to rise throughout the last oil shock. At a 1% annual coal increase, the world energy output would stabilize within 20 years with a return to current levels by around 2040 (assumes 5% annual oil decline starts now). This also assumes stable natural gas production through a 30 year recession.

That would mean more electrically driven freight and global trade being replaced by continental trade, but it might be a possibility if resource wars are avoided. That would not solve the emissions problem though.

Mark,

The problem isn't an 'energy crisis', it's 'liquid fuels crisis'. As Robert Hirsch put it succinctly we have $50-100 trillion worth of gas guzzling equipment sitting out there and it will be rendered useless without oil. Generating electricity is actually pretty easy, we simply don't know what to do with it or how to store it.

All the coal in the world isn't going to help, maybe it will help KSA keep the lights on since they burn so much oil to generate electricity but it won't help anyone else. Electrification would take decades and trillions of dollars in investment, same with any fuel conversion technology. I am sure there will be attempts made but they will be done in an era of slowing growth where the government and people are short squeezed for any new investments.

WI - Thanks for the clarification. Looking forward then, at some point in the next few years, the situation would look something like this:

Rapidly declining transport capability leads to a steadily worsening global economy, probably triggering a more severe financial systems collapse. In the absence of wages and supply methods, food delivery becomes a major concern, especially if liquid fuels and finances are not available for planting and harvesting. This could lead in turn to a general collapse of law and order as starving unemployed masses take desparate action to survive. At least some states would possibly look to redirect civil unrest toward a scapegoat nation, or a resident ethnic minority, leading to a higher level of global warfare.

All this plays out for decades until/if a new stabilized energy sector can be established while AGW and other pollution factors damage the biosphere.

Worst case scenario being an amplified and extended replay of the Great Depression, World War II, and the Spanish Flu Epidemic set during a climatic extinction level event of unknown severity.

Is that about right?

Nope, I'm not referring to environmental costs. I think the differing assumption between us is in your assertion that price will fall back down. Conventionally it was always believed that commodity prices would fall in real terms, implicitly as new technology, approaches, human ingenuity etc. uncovered new resources. This appears to be the economic thought you draw from. Over the last 10 years however, oil has defied this conventional wisdom. Prices are escalating radically, total production has barely budged, and no great substitutes appear to be on the horizon, although many mediocre substitutes have stepped up, like tar sands.

Broadly speaking, I believe the conventional faith in falling commodity prices is being revealed to be a product of a peculiar era where humanity rode the rapidly increasing slope of the logistic curve. With production quantities increasing so rapidly, unit prices could always fall. But we're not on the steep part any more, and conventional economics has yet to catch up.

Well, I wasn't talking about costs of energy as a whole, but the price of oil from the tar sands, which can fall back down if production is ramped up, though I know it's difficult to. What do you mean by "mediocre substitutes?" True, tar sands are mediocre for our long-term energy needs, but there are many other alternatives like solar, wind, hydroelectric, nuclear fusion, algae biofuel, etc. I see no reason to fret about disappearing fuel. I mean, this has happened before: first, we fretted about forests disappearing. That never happened because we began to use coal and peat. Next, we thought coal and peat would run out. That never happened because we began to use whale oil. Then, after we thought whale oil was becoming depleted, we started pumping conventional oil. Now, we have unconventional oil, and next, we'll have clean nuclear and other clean energy sources. I'm sorry, but industrial civilization is a permanent institution. And it's really been around since the Tang Chinese, not just since the mid 18th century.

Your thesis fell apart at the end there.

As you've just recently learned, the uncoventional Kerogen is not economic and the tar sands is really hard to scale up.

And nuclear power? I'm sure we'll continue using nuclear power but we've been witnessing a contraction of nuclear power in Europe and Japan.

We've been stuck at the current mix of energies for some 60+ years now. We are moving to renewables (as we should be) but it is costly. I'm not worried about running out of energy . . . there is plenty of energy out there for us to harness. The problem is the cost going up has crippled our economies. We humans have innovated great things and will continue to do so. But one wonders how many big new breakthroughs we will see going forward. There are now more scientists & engineers alive today than have existed in all history but the pace of big break-throughs has slowed. We are bumping up against the laws of physics and thermodynamics.

I never really thought that unconventionals could ever make an impact in the long-term, I was just saying that they could flatten depletion curves so that we could develop alternatives in order to elude an economic implosion. But even if we had an economic collapse, industrial civilization wouldn't come to an end. EROI and wether a civilization is complex enough to sustain such a source with high inputs is irrelevant, because EROI is really a sophomoric measure. It doesn't take into account the value of inputs and outputs relative to the economy. Subjective valuations are everything.

Part of the reason that some tar sands operations might seem kinda cheap is that a lot of the imputs still rely on cheap energy from high EROI sources elsewhere (eg, the middle east).

http://evanbedford.com/tarsandsanderoi.htm

Somebody please help me here. EROEI is a concept involving recovery of energy sources as measured by use of energy in the process. EROI involves money or capital of some sort.

I believe that if EROI is high or low only impacts wealth. If EROEI is 1 or less there is no longer any reason to use the source being exploited. Even if you have an infinite energy source, it just makes no sense (from an energy useage viewpoint) to spend more than you can recover in energy.

Of course, some oil/gas may still be extracted at EROEI of 1 or less, for use in manufacturing of plastics, fertilizers, pharmacuticals, and so forth. Or even as a way of transporting or storing energy that would otherwise be unused. But for its energy value, no way.

Or am I wrong about that?

Craig

You are quite right that EROEI is of limited usefulness in evaluating a process. All energy is not fungible. If a process converts low-value energy to high-value energy, then even if the EROEI < 1 it might be worth doing if the value added is high enough. Examples are coal-to-liquid or gas-to-liquid.

It is also highly misleading because it exaggerates the value of conventional oil production. An EROEI of 100 such as you might find in a 1960s Arabian oil well is meaningless. It is only important when it gets into the range of 1:1. Then it tells you whether you are gaining or losing energy on a process.

EROI doesn't fundamentally involve money. It's synonymous with EROEI. Check wikipedia.

what about scaling up nuclear energy? I know it is dangerous and toxic but so is Peak Oil....you take away peoples energy and you will have a panic or collapse...you could scale up faster if you shorten certain restrictions etc...I am not advocating this at all but I see it as a possible scenario to peak oil...smaller nuclear plants and much more of them I am afraid....it seems like America will choose this to living smaller.

You can't fill your conventional car with nuclear fuel rod nor with electricity from a nuclear power plant. (However, you can use nuclear power to power EVs.)

I think an increase in nuclear will inevitably happen. It is already happening in China. I just hope it is done with a lot of careful planning and uses the lessons we have learned from Three Mile Island, Chernobyl, and Fukushima.

Maybe they will *finally* launch the old fifties vehicles into full production...

http://www.damninteresting.com/the-atomic-automobile/

:-D

China is building nuclear, but many more coal-fired power plants, along with India.

http://www.scientificamerican.com/article.cfm?id=beijing-finds-that-drop...

You would need a lot, an absurd amount, of nuclear reactors to replace all the energy fossil fuels currently supply. I think its been calculated on this or a related site. Of course uranium ore is strictly finite too, and alternative fuels have never quite worked out. So America would have to live smaller if it tried to switch mostly to nuclear. And nuclear energy can't be scaled up as rapidly as fossil fuels can. They wouldn't allow the kind of rapid economic growth which America, and the world, has become thoroughly addicted to. But it looks like even fossil fuels won't allow that for too much longer anyhow.

David Goodstein, physicist at CalTech and a former long time vice-provost there, ran some numbers in his first peak oil book, Out of Gas: The End of the Age of Oil. According to him, the largest practical nuclear plant produces 1 Gigawatt of power. To replace the 10 Terawatts of fossil fuels we use would require 10,000 new Gigawatt plants: one a day for 30 years.

Is the 10 Terawatts a global number or USA ? - just curious...

Either way that calculation and the resultant total number / rate required is quite staggering.

That's global.

There are about 400 nuclear power plants in the world, 100 in the U.S.

The thermal power output of coal+gas+oil+nuclear worldwide is near 17 TW and rising. This is based on EIA's combined total use of all fossil fuels, giving a thermal output of 15 TW, and me roughing in a figure for 12.5% for nuclear on top of that. Wood burning, gas flaring, and food comes in on top of that.

Funny you should mention that. Just heard this on my NPR news yesterday. http://wpln.org/?p=45678

Much more here:

http://www.tva.com/news/releases/janmar13/smr_agreement.html

speculawyer,

So far they have made up for that by making up things.

That is the way propaganda works ("break through").

They also have a plan to deal with the graphs of wrath, once they eventually show up:

(Will The Military Become The Police - 3). The fairy tales only work for so long you know.

That final phase won't be near as pretty as the propaganda phase of play pretend.

That is because they will no longer be dealing with the valentines, they will be dealing with the pitchforks.

http://greekcrisisnow.blogspot.fr/

This is an interesting blog by a Frenchman living in Greece. Photoshopping of people the police have beaten, protests everywhere and lots of guys in riot gear. Seems that their minimum wage is on the chopping block, as is many other things. The Greek people are getting raped by the EU, there's just no other way to say it.

Raped by the EU? Or raped by the Greek middle classes who "avoid" paying taxes?

Well, robbed by the Greek rich, upper-middle, and the politicians...and now sold as a sex slave by the EU.

In the end it won't be the police state against the noble angry masses. It will be factions of what's left of the present power structure against other factions vying for power.

Think of the warlords of the failed state to our south. As the economy collapses and the climate deteriorates many will be stranded in the US southwest. There will be plenty of young men with no prospects - fertile ground for those warlords to spread their control northward. Maybe one of them will gain enough power to challenge a weakened government, maybe it will be someone from a different power base.

The existing state will be picked apart from the edges and/or fracture internally. The police state you fear is too complex and expensive to survive the simple lack of availability of the resources that hold it together.

Exactly, and I think that is where we can respectfully agree to disagree. All of your examples of economic substitution are valid, but I don't believe in infinite substitution any more than I believe in the infinitude of any one resource. IMO, we are at a level and scale of demand globally that when we alight on a new resource to substitute for a depleting one, we encounter limits to the new resource quickly.

Your example of Tang China is interesting, because it is widely believed that in that and other civilizations there was essentially no economic growth until the 18th century. If you think the pre-18th century period is a valid regime of industrialization, maybe you and I agree on more than we think. :)

Part of the issue here is the difference in scope of analysis:

http://connectrandomdots.blogspot.com/2012/12/scope-of-analysis.html

Rgds

WP

I'm even sorrier, but unfortunately the old adage of past performance being no guarantee of future results can be applied in spades to that particular statement.

The Planet's been here about 4.5 billion years. To be clear, modern humans haven't been around all that long, maybe 200,000 years? Civilizations even less so, if you stretch the definition maybe 10,000 years. And industrialized civilization has so far been, but a blink of an eye. I wouldn't be crowing about it being a permanent institution just yet.

Edit:

Removed: Snarky Dilithium Crystal reference...

Sigh! No. Not really. I think that it would be fair to say that most people here have invested a great amount of time and energy (no pun intended) to understanding our predicament. It would be nice if those who disagree with the views presented on this site were to back up their statements with a little more evidence.

Our 'Beliefs' matter not one whit. Just the facts ma'am, just the facts!

Those facts, BTW, are pointing evermore strongly towards a grand implosion that spans the entire globe.

Both ecologically and economically.

FMagyar,

Well said.

... there's no reason to believe that once price is high enough more production won't be brought online that used to be unprofitable."

But there is reason (and evidence) that economies can't afford that price; an upper limit at which economies can no longer support the costs of production (demand destruction).

No matter how you cut it Minneapolisman (say hi to the twin cities for me) if we are discussing tar sands in Canada or kerogen in Australia, its in the framework of endgame, peak oil. Either high prices will kill the economy or a reduction in flow rate will close the books on the oil age. These non-conventional sources are only coming into play because of price point, and that's a reflection of conventional production leveling off. Once conventional descends it won't matter how hard we work the gooey stuff, it isn't going keep flow rates high enough to support BAU for very long.

Well said - these are not signs that this can continue, they are signs of desperation.

Do some of you people just vehemently attack anyone coming on this academic publication that isn't part of the echo chamber? Why do you think that I don't acknowledge peak oil? I do, I just don't believe that some grandiose implosion that spans the entire globe is coming. Unconventional sources can smooth over depletion.

No animosity or judgement intended, really, but when you state: "I'm sorry, but industrial civilization is a permanent institution", it indicates that you are not a student of history, or perhaps are still in the denial stage of your Peak awareness.

All civilizations, industrial most of all, will fall. It's the (cyclical) nature of the beast.

The coming of another ice age will guarantee the fall of our civilisation - ironically, global warming will ensure that an ice age comes on much slower, when it does come.

I don't agree that that global warming will necessarily result in a delay of the return to Ice Age conditions. The Earth has been in a cycle of Ice Ages for about 3 million years. These past 10,000 years of so have been a warm period, called an Interglacial. The last Interglacial (the Eemian) ended roughly 120,000 years ago and that period was warmer than the present one. Perhaps that warming was a prerequisite for beginning the buildup of the ice sheets, which then grew to cover much of eastern Canada and parts of the present US...

E. Swanson

I think it is highly unlikely there will be another ice age until CO2 goes below 300ppm. I can imagine the speed of the transition might be faster or slower, depending upon how the dynamics works out. If the system runs like an oscillator, then the momemntum of cooling off after the anthropogenic heat wave might make it faster. OTOH, that might not be the way the system works.

Well, a massive warming will increase the amount of evaporation of water from the oceans, so this would act as a negative feedback to warming..

Water vapor is a greenhouse gas >> positive feedback.

Oh well.

Negative feedback if it blocks out sunlight in cloud form.

I'm familiar with the basics of the ice ages. I suppose if thermal runaway results in massive amounts of evaporation and cloudiness, then we'll see another ice age, but lack of sunlight and extreme storms would be killers here. Anyway, at least the area around the equator will remain liveable. :-)

I admit that there's a level of pessimism here, which didn't come without years of crunching these issues with open minds by many. Once one begins to fathom the scale of our collective predicaments and how they are inter-related, one may realize that the collective assessment being forwarded here is an honest one. While we rarely agree on how this all will play out, or what our responses should be, you'll find wide acceptance that more of the same serves only to dig a deeper hole, which a lack of bias, a bit of clarity and courage will reveal is quite deep. Humanity has drastically overshot its resource base and damaged its biospere. Finding and burning more fossil fuels only continues that process.

Al Gore has a new book "The Future" where he writes about the global collective and states that we are in a revolution that is changing who we are.

He was interviewed in the current (Feb 28) issue of Rolling Stone Magazine and spoke about climate change, resource depletion, factory farms, and political decisions and programs that are decided by lobbyists. The story isn't yet on the web site.

Here's a link to a review in The Telegraph:

http://www.telegraph.co.uk/culture/books/bookreviews/9870050/The-Future-...

"Do some of you people just vehemently attack anyone coming on this academic publication that isn't part of the echo chamber?"

No, it's just that they have been debating and thinking about these things for years now here and have viewed the issue from every perspective and have come to a very definite conclusion on the matter. There are several articles and discussions of the possibilities of the oil sands in the archives. The quick summary of what they say is that they aren't promising as a long term solution.

The search terms you want to use are "Shark Fin" and decline rates. EROEI is also useful to find discussions on the oil sands.

It might seem like an attack, but it's not. It's just repetition of a conclusion hammered out already. If you think you're under attack, you should read the raging debates (always civil mind you, the mods are great here!) that have come to the conclusions you're hearing here.