Our Investment Sinkhole Problem

Posted by Gail the Actuary on February 20, 2013 - 1:14pm

We are used to expecting that more investment will yield more output, but in the real world, things don’t always work out that way.

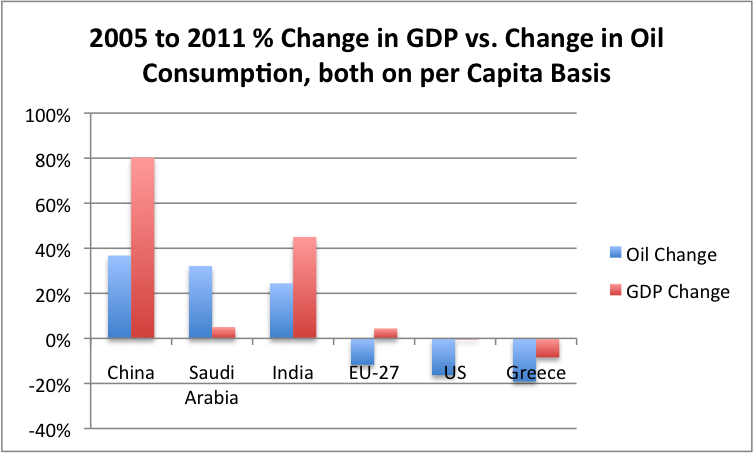

In Figure 1, we see that for several groupings, the increase (or decrease) in oil consumption tends to correlate with the increase (or decrease) in GDP. The usual pattern is that GDP growth is a little greater than oil consumption growth. This happens because of changes of various sorts: (a) Increasing substitution of other energy sources for oil, (b) Increased efficiency in using oil, and (c) A changing GDP mix away from producing goods, and toward producing services, leading to a proportionately lower need for oil and other energy products.

The situation is strikingly different for Saudi Arabia, however. A huge increase in oil consumption (Figure 1), and in fact in total energy consumption (Figure 2, below), does not seem to result in a corresponding rise in GDP.

At least part of problem is that Saudi Arabia is reaching limits of various types. One of them is inadequate water for a rising population. Adding desalination plants adds huge costs and huge energy usage, but does not increase the standards of living of citizens. Instead, adding desalination plants simply allows the country to pump less water from its depleting aquifers.

To some extent, the same situation occurs in oil and gas fields. Expensive investment is required, but it is doubtful that there is an increase in capacity that is proportional to its cost. To a significant extent, new investment simply offsets a decline in production elsewhere, so maintains the status quo. It is expensive, but adds little to what gets measured as GDP.

The world outside of Saudi Arabia is now running into an investment sinkhole issue as well. This takes several forms: water limits that require deeper wells or desalination plants; oil and gas limits that require more expensive forms of extraction; and pollution limits requiring expensive adjustments to automobiles or to power plants.

These higher investment costs lead to higher end product costs of goods using these resources. These higher costs eventually transfer to other products that most of us consider essential: food because it uses much oil in growing and transport; electricity because it is associated with pollution controls; and metals for basic manufacturing, because they also use oil in extraction and transport.

Ultimately, these investment sinkholes seem likely to cause huge problems. In some sense, they mean the economy is becoming less efficient, rather than more efficient. From an investment point of view, they can expect to crowd out other types of investment. From a consumer’s point of view, they lead to a rising cost of essential products that can be expected to squeeze out other purchases.

Why Investment Sinkholes Go Unrecognized

From the point of view of an individual investor, all that matters is whether he will get an adequate return on the investment he makes. If a city government decides to install a desalination plant, the investor’s primary concern is that someone (the government or those buying water) will pay enough money that he can make an adequate return on his investment over time. Citizens clearly need water. The only question is whether citizens can afford the desalinated water from their discretionary income. Obviously, if citizens spend more on desalinated water, the amount of discretionary income available for other goods will be reduced.

The same issue arises with pollution control equipment installed by a utility, or by an auto maker. The need for pollution control equipment arises because of limits we are reaching–too many people in too small a space, and too many waste products for the environment to handle. The utility or auto makers adds what is mandated, since clearly, buyers of electricity or of an automobile will recognize the need for clean air, and will be willing to use some of their discretionary income for pollution control equipment. Mandated renewable energy requirements are another way that governments attempt to compensate for limits we are reaching. These, too, tend to impose higher costs, and indirectly reduce consumers’ discretionary income.

All types of mineral extraction, but particularly oil, eventually reach the situation where it takes an increasing amount of investment (money, energy products, and often water) to extract a given amount of resource. This situation arises because companies extract the cheapest to extract resources first, and move on to the more expensive to extract resources later. As consumers, we recognize the situation through rising commodity prices. There is generally a real issue behind the rising prices–not enough resource available in readily accessible locations, so we need to dig deeper, or apply more “high tech” solutions. These high tech solutions indirectly require more investment and more energy, as well.

While we don’t stop to think about what is happening, the reality is that increasingly less oil (or other product such as natural gas, coal, gold, or copper) is being produced, for the same investment dollar. As long as the price of the product keeps rising sufficiently to cover the higher cost of extraction, the investor is happy, even if the cost of the resource is becoming unbearably high for consumers.

The catch with energy products is that consumers really need the products extracted–the oil to grow the food they eat and for commuting, for example. We also know that in general, energy of some sort is required to manufacture every kind of product that is made, and is needed to enable nearly every kind of service. Oil is the most portable of the world’s energy sources, and because of this, is used in powering most types of vehicles and much portable equipment. It is also used as a raw material in many products. As a result, limits on oil supply are likely to have an adverse impact on the economy as a whole, and on economic growth.

The Oil and Gas Part of the Problem

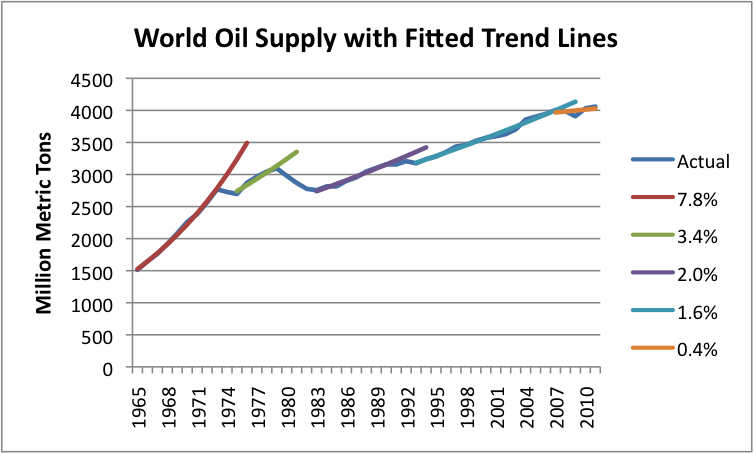

A major issue today is that oil supply is already constrained–it is not rising very quickly on a world basis, no matter how much investment is made (Figure 3).

As noted above, the easy-to-extract oil and gas was extracted first. New development is increasingly occurring in expensive-to-extract locations, such as deep water, Canadian oil sands, arctic oil, and “tight oil” that requires fracking to extract. This oil requires more energy to produce, and more inputs of other sorts, such as water for fracking. Because of rising costs, the price of oil has tripled in the last 10 years.

Investment costs also continue to soar because of rising costs associated with exploration and production. Worldwide, oil and gas exploration and production spending increased by 19% in 2011 and 11% in 2012, according to Barclays Capital. Such spending produced only a modest increase in output–about 0.1% increase in crude oil production in 2011, and 2.2% increase in the first 10 months of 2012, based on EIA data. Natural gas production increased by 3.1% in 2011, according to BP. Estimates for 2012 are not yet available.

If we want to “grow” oil and gas production at all, businesses will need to keep investing increasing amounts of money (and energy) into oil and gas extraction. For this to happen, prices paid by consumers for oil and gas will need to continue to rise. In the US, there is a particular problem, because the selling price of natural gas is now far below what it costs shale gas producers to produce it–a price estimated to be $8 by Steve Kopits of Douglas Westwood. The Henry Hub spot natural gas price is now only $3.38.

The question now is whether oil and gas investment will keep rising fast enough to keep production rising. Barclays is forecasting only a 7% increase in worldwide oil and gas investment in 2013. According to the forecast, virtually none of the investment growth will come from North America, apparently because oil and gas prices are not currently high enough to justify the high-priced projects needed. The flat investment forecast by Barclays suggests a major disconnect between what the IEA is saying–that North America is on its way to becoming an energy exporter–and the actual actions of oil and gas companies based on current price levels. Of course, if oil and gas prices would go higher, more investment might be made–a point I made when writing about the IEA analysis.

What will the ultimate impact be on the economy?

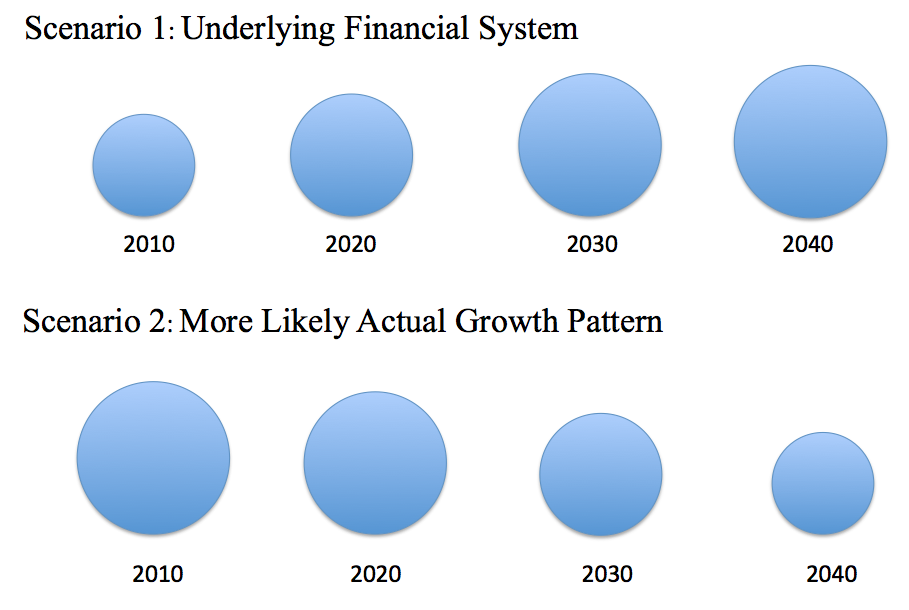

I would argue that for most of the developed (OECD) countries, the ultimate impact will be a long-term contraction of the economy, similar to that illustrated in Scenario 2 of Figure 4.

What happens is that as we increasingly reach limits, more and more investment capital (and physical use of oil) is allocated toward the investment sinkholes. This has a double effect:

(1) The prices paid for resources that are subject in investment sinkholes need to continue to rise, in order to continue to attract enough investment capital. This is true both for goods that directly come from investment sinkholes (oil, gas and water) and from products that have a less direct connection, but depend on rising-cost inputs (such as food and electricity).

(2) Products outside of essential goods and services will increasingly be starved of investment capital and physical resources. This happens partly because of the greater investment needs in the sinkhole areas. Also, as consumers pay increasing amounts for essential goods and service because of (1), they cut back on the purchase of discretionary items, reducing demand for non-essentials.

In some real sense, because of the sinkhole investment phenomenon, we are getting less and less back for every dollar invested (and every barrel of oil invested). This phenomenon as applied to energy resources is sometimes referred to as declining Energy Return on Energy Invested.

As discussed above, world oil supply in recent years is quite close to flat (Figure 3). The flat supply of oil is further reduced by the additional oil investment required by sinkhole projects, such as the ones Saudi Arabia is undertaking. Also, there is a tendency for the developing world to attract a disproportionate share of the oil supply that is available, because they can leverage its use to a greater extent. Both of these phenomena lead to a shrinking oil supply for OECD countries.

The combination of shrinking OECD oil supply, together with the need for oil for many functions necessary for economic growth, leads to a tendency for the economies of OECD nations to shrink. It is hard to see an end to this shrinkage, because there really is no end to the limits we are reaching. No one has invented a substitute for water, or for unpolluted air. People talk about inventing a substitute for oil, but biofuels and intermittent electricity are very poor substitutes. Often substitutes have even higher costs, adding to the investment sinkhole problem, rather than solving it.

Where We Are Now

When resource prices rise, the impact is felt almost immediately. Salaries don’t rise at the same time oil prices rise, so consumers have to cut back on some purchases of discretionary goods and services. The initial impact is layoffs in discretionary sectors of the economy. Within a few years, however, the layoff problems are transformed into central government debt problems. This happens because governments need to pay benefits to laid-off workers at the same time they are collecting less in taxes.

The most recent time we experienced the full impact of rising commodity prices was in 2008-2009, but we are not yet over these problems. The US government now has a severe debt problem. As the government attempts to extricate itself from the high level of debt it has gotten itself into, citizens are again likely to see their budgets squeezed because of higher taxes, lay-offs of government workers, and reduced government benefits. As a result, consumers will have less to spend on discretionary goods and service. Layoffs will occur in discretionary sectors of the economy, eventually leading to more recession.

Over time, we can expect the investment sinkhole problem to get worse. In time, the impact is likely to look like long-term contraction, as illustrated in Scenario 2 of Figure 4.

Is There An End to The Contraction?

It is hard to see a favorable outcome to the continued contraction. Our current financial system depends on long-term growth. The impact on it is likely to be huge stress on the financial system and a large number of debt defaults. It is even possible we will see a collapse of the financial system, or of some governments.

In a way, what we are talking about is the Limits to Growth problem modeled in the 1972 book by that name. It is the fact that we are reaching limits in many ways simultaneously that is causing our problem. There are theoretical ways around individual limits, but putting them together makes the cost impossibly high for the consumer, and places huge financial stress on governments.

This article originally appeared on Our Finite World.

Gail

Thanks for your ongoing thoughtful and thought-provoking investigations.

You raised early in your article Saudi Arabia's anomalous low 'GDP-response' to its high and rising per capita consumption of oil. (Incidentally, your chart in Fig 2 titled primary energy per capita actually seems to show for SA their rising curve for 'oil consumption' - c.f. http://www.indexmundi.com/energy.aspx?country=sa&product=total-primary-e... )

I draw attention to an apparently similar anomaly within the EU - the highly prosperous Netherlands (NL has overtaken UK per capita GDP PPP in last 15 years) does indeed consume more oil per head, but to such an extent that one must point to the special circumstances of the NL's position as perhaps the major oil/energy hub within EU (Rotterdam). I wonder if likewise SA huge oil per person consumption reflects a similar industrial factor.

NL consumes ~1M bbl/oil/day (population 16.75M) versus 1.62M bbl/oil/day in the UK (pop. 63M). Per head consumption in NL is well over twice that in the UK).

I note that the majority of oil-rich countries that rely on exported oil for revenue perform very badly in economic terms, reflected in poor levels of GDP PPP per capita. Saudi Arabia has not escaped that fate. http://iis-db.stanford.edu/pubs/21537/No_80_Terry_Karl_-_Effects_of_Oil_...

best

Phil

Thanks for the observation.

Of course, the reverse of this situation is the growth and low utilization of resources in countries that are de-industrializing. This is focused on as the way to the future, without thinking about where these goods really come from, and the energy inputs required for them. Something serious is lost in the analysis.

The industrialized world externalized its industry to low-cost labor markets. This is what neo-liberalized trade got us. The resulting sucker punch to the middle-class based economies in the OECD -- the countries you reference -- accounts for at least part of the problem you mention above.

Incentivized to trade this way, the rich got richer and Asia rapidly grew -- devouring the 'growth potential' of mature western economies. De-industrialization is just one euphemism for this process. And, as you astutely mention, it's not really de-industrialization, just shuffling the sources of industry around. In this case, to lower-cost labor pools.

In short, this is the 'economic growth' BAU advocates defend. But it's not really a formula for prosperity growth. Just for going after the 'low hanging fruit' of looting middle class resources and driving industrial production to ever lower cost/higher efficiency pools. When added to the BAU philosophy of 'push consumption higher at all costs and damn energy and climate limits,' I think you end up with a pretty unadulterated picture of our current age.

I'd submit this as a fourth limits paradigm -- human greed. Add it to the increasing cost of access to energy, increasing size of human population/consumption, and increasing damage due to pollution (CO2 and other), and I think you end up with a picture of what "Limits to Growth" alluded to in 1972.

Cheers and thanks for the excellent article.

-R

Living here in the Netherlands I've made a similar observation. My take is that not only is it an energy hub, it is a hub for all kinds of imports into the EU and a lot gets shipped on to places like Germany for further processing. Our consumption of oil is holding up well I think largely because Germany still makes things and needs a lot of inputs that need shipping and a lot of products that need shipping overseas. The economy in the Netherlands is officially in its third recession since the credit crisis began. Car sales have been all over the place in the past 15 years but are on another down trend:

Jaaroverzicht

Jaar Aantal

2013*

47.686

2012

501.898

2011

560.045

2010

484.432

2009

389.131

2008

499.811

2007

502.400

2006

479.355

Jaar Aantal

2005

463.763

2004

484.370

2003

488.159

2002

510.744

2001

530.287

2000

597.625

1999

611.776

1998

543.056

Jaar Aantal

1997

478.318

1996

473.473

1995

446.388

1994

433.913

1993

391.934

1992

491.970

1991

490.407

1990

502.704

Jaar Aantal

1989

495.653

1988

482.617

1987

556.574

1986

560.411

1985

495.720

1984

461.391

1983

459.129

In 2012, 83 billion euros or about 20 per cent of record exports were oil and other fuels:

http://www.trouw.nl/tr/nl/4504/Economie/article/detail/3397683/2013/02/2...

I'd say car sales have been flat for thirty years in the Netherlands.

Gail – Timely post…thanks. But: “These higher investment costs lead to higher end product costs of goods using these resources.” Perhaps in some industrial output this is true to some degree. I suspect you understand what I’m about to say and made that statement to emphasize another point. I’ve sold oil/NG from my wells for 38 years and not one bbl or mcf was priced based upon what it cost me to generate the production. Obviously I can give 100’s of examples. One will suffice. Two years ago I drilled a well in Cameron Ph. La. Target was about $40 million of NG/condensate. Economics were based upon $4.50/mcf price. We had severe drilling problems so instead of costing $8 million it cost $19.9 million. Even worse, though we found the NG, it wasn’t as much as we anticipated. Such is the nature of exploration. Based on current pricing we’ll never recover our investment. In addition to the cost overrun and finding less reserves we aren’t getting $4.50/mcf. And not even the $2.00/mcf folks were getting at Henry Hub last April. We have to pay a transport fee to get our production to HH. Taking that into account last April we hit the low point and were getting $1.65/mcf.

Obviously our finding cost was significantly higher than $1.65/mcf. My buyers couldn’t care less what it cost me to develop that NG. In fact, they had no idea. I had a choice: sell at their posted price or plug and abandon the well. Production costs for the well are low and thus it generates a nice net cash flow. But a net cash flow that will never return the initial investment. We did cut the rate back 50% because we are fortunate to not be totally dependent on income. Most companies are which is why there has been very little NG production curtailment since prices collapsed back in ’08.

And then the cycle repeats itself. High NG prices led us to spend $180 million during 2010-11 drilling for NG. In the last 12 months we’ve spent exactly $0 drilling for NG. Despite the long time lag the effects of lower prices will show up on the production volume side of the equation. But lag helps the oil patch sometimes. There are companies selling oil today for $100/bbl that they used $30/bbl to justify that development 10+ years ago. Needless to say they are happy campers. And needless to say the folks buying their oil aren’t basing that purchase price on those low finding costs. They are paying market price. I won’t put a number to it but I would guess the great majority of global oil being sold was developed at costs far below current market prices.

Higher drilling costs do not cause higher oil/NG prices. Never have…never will. But obviously higher oil/NG prices allow higher development costs as well as accepting higher risks. The boom/crash of the late 70’s is the epitome of this relationship. Higher prices led to 2.5X as many rigs drilling then as we have today. Then came the price crash and hundreds of companies went under. And a toll was taken even on the big companies. There are probably some younger TODsters that aren't familiar with the names Gulf Oil, Getty Oil, Tenneco, etc. And no more Mobil Oil…now ExxonMobil. If there is much of a drop in oil prices for an extended period there will be more companies added to the body count as a result of unrealized expectations.

Sorry I didn't have time to respond earlier. I have some appointments today, and will have to fit in commenting when I can.

Perhaps I should have said that the decision to drill is based on the price that is available at the time the decision is made to drill. Unless this price keeps ratcheting up, the law of diminishing returns that there will be fewer and fewer places to drill that meet the price threshold, because the easiest to extract resources tend to be extracted first. (Of course, there will be some easy to extract sites that have been overlooked, and this is what your employer will be especially interested in.)

Once the decision to drill has been made, it is not likely that you will be laid off on a current job. It is more an issue of whether a new site will be drilled. As a result, there is some time delay in the connection between price and oil supply.

Gail - I was sure you understood the dynamics better than most. My post was really directed to other Todsters

Rockman, Gail,

Its interesting that I just finish reading Apache production number this year. Their share prices has gone down due to decrease in bottom line.

2013 LOOKS better for them, reasons

1. They are expecting a lot next year from their recent deal with chevron in kitmat project 50/50 JV....

2. Apache is planning to focus on horizontal Permian activity (117,898 barrels of oil equivalent (Boe) per day, of which 74 percent were liquids) from 13 to 17 rigs by the end of First quarter of 2013, which analyst believe will help grow production 25%.

On their website they claim that they claim

"During 2012, Apache replaced over 262 percent of its production in the Permian Region through exploration and development activities (excluding revisions) and ended the year with 800 million barrels of oil equivalent (MMboe) of proved reserves, making the rgion now the largest in Apache’s portfolio on a proved reserve basis."

3. Also they are planning to run 28 horizontal rigs with the largest amount activity planned in the Granite Wash and Tonkawa plays. Both of these plays are suppose to be rich in liquid (74%) so good on economics of producer. Each well cost around 6 million which is low compare to cash flow from well...

Same with Encana

Encana is resuming activity in the Haynesville play. Because of the low supply costs in this play, Encana expects that the Haynesville will be able to produce solid returns at current natural gas prices. The company currently has two rigs running in the play with plans to increase to five rigs through 2013. (Encana's February 14 press release)..Encana is targeting the price of 3.5/MMbtu for making rates of return at the project level of approximately 30%

-------------------------

Both of these companies looks like positive about their future

So, I am not sure how much from above is unrealized expectation...

g - If I were to bet on any one company Apache would be at the top of my list. I've seen their operations up close and they are very good especially at long range planning. Encana...I'm not so sure but I don't know as much about them these days.

Even if tight oil production is sustainable for only a short time, there may very well be some oil companies that do well financially. The part of the economy that does badly is governments, as high oil price leads to recessionary tendency, more layoffs, and less tax revenue.

A very timely post indeed. The latest example of a sinkhole is the financial collapse of an Australian toll-way operator.

20/2/2013

Brisbane Airport Link: At the end of the road tunnel, investor money flies away (part 2)

http://crudeoilpeak.info/brisbane-airport-link-at-the-end-of-the-road-tu...

I will be recording a Jim Puplava interview on this post, tomorrow. I am not sure when it will be available.

I wonder how much of reported GDP growth, such as it was, in net oil importing OECD countries since 2005 was due to debt financed government spending?

The GNE/CNI* ratio, from 2002 to 2011, versus total global public debt:

And the GNE/CNI ratio versus annual Brent crude oil prices:

In my opinion, net oil importing OECD countries like the US have gone increasingly into debt, from real creditors and from accommodative central banks, in a desperate attempt to keep their wants based economies going, based on the premise (or more accurately, the desperate wish) that high oil prices are temporary, and that we will once again have abundant and cheap supplies of oil.

*GNE = (2005) Top 33 net exporters, BP + EIA data, total petroleum liquids

CNI = Chindia's Net Imports (China + India)

I am not sure that governments really understand (1) that it is high oil prices that are their problem, and (2) high oil prices aren't going away--in fact, diminishing returns suggests that prices will have to keep rising or production will fall off.

As I dig deeper into the situation, it appears to me that high price has the potential to lead to limits to growth, in and of itself. Of course, if oil supply dropped off, this would force the issue even further.

I talk about the Limits to Growth issue in this post: The Connection of Depressed Wages to High Oil Prices and Limits to Growth.

Wouldn't classical economic theory suggest that this would be the time that substitutes for oil would be found. We are at a point where continued rising prices are providing a drag on the economy. If there were viable substitutes to be had, wouldn't they be showing up? Wouldn't there be innovation?

Classical economics, however, seems to treat biology, geology, physics, and chemistry as insignificant variables because innovation has led to advantageous substitutions in the past. Limits to growth is triggered by price, but also limitations imposed by nature. The sciences describe and predict the workings of the natural world. Our current science has not found any substitute of equivalent or better energy which is useful in the sectors which oil is most essential (transport, agriculture). Humans are very good at manipulating the natural world to our ends, but there are apparent limits (which could change). Robert Rapier (and many others)could attest that it is not for lack of trying. These limits contribute to the continuing price rise of oil because as oil depletes, we have only inferior substitutes to date.

Until we have some viable substitutes, the overall direction of prices for oil is up. We can't find enough oil to continue with increasing worldwide production. With the increasing debt of OECD countries, who will be able to purchase oil and for how long?

A primary hindrance to the development of substitutes is that cheap fossil fuels have set the bar incredibly high, and virtually all of our current infrastructure is based on this one-time endowment. Simply maintaining current infrastructure is using a higher percentage of GDP. Forget growth. The 20th century saw humanity go all-in on oil. Finding substitutes compatible with 20th century investments seems imposible, considering the scale of these prior investments. Add to that global expectations and growing political impotence, we're entering a perfect storm of overshoot. I could throw in numerous other obstacles to transition, but the financial/resource nexus we're experiencing will be more than enough to throttle back the growth required to solve these things.

Triage comes to mind as the primary choice going forward; not really a choice.

Indeed. Oil is an amazing energy dense treasure that we literally dug up out of the ground. Nothing else we have can compete with it.

But as an EV person, I get annoyed with people demanding a perfect substitute. So many people act is if you can't drive an EV 300 miles and refill it in 5 minutes then it is completely useless. Never mind that some 95% of daily driving is less than 100 miles and everyone of us sleeps thus giving our cars at least 8 hours every day of recharge time. This is a psychological barrier that needs to be broken. It is slowing being broken but I worry that too many will go broke clinging to unnecessarily expensive and inefficient gasoline cars when an EV or PHEV would work just fine for them.

I'm sorry, but an EV is never going to work for me. Why? Because I live in a small city and park on the street. I don't even think it's legal for me to string an extension cord over the sidewalk to my car (assuming the parking spot in front of my house is available, which it often is not).

So, it's fine for you to say "everyone of us sleeps", but that doesn't mean everyone can charge at night. And I can't charge at work either. What then?

I wish we could skip the EV step and go right to where people don't need their own vehicle at all. You know, decent public transportation (trollies, trains, busses).

Well as you point out . . . why do you need a vehicle at all? If you live in the city, can't you walk or take public transportation? If you have a gas car that just sits there most of time because you don't need it to commute then it is not much of a factor in oil consumption. I owned a gas car when I lived in San Francisco but it mostly just sat there.

Yes, I do most of my errands on foot, and burn very little gas. I would probably still be car-free if my mother hadn't passed away and left me her really nice car (she was always the one telling me, "Well, you NEED a car!", despite my getting along just fine for four years or so without one.)

But if there's anywhere I'm likely to drive it's to work, which is about 10 miles away. If the weather's bad or I'm pressed for time, I take the car. There is a bus, but it takes as long as riding my bike, costs as much as driving the car, and forces me to their lame schedule (only runs once every hour or hour and a half).

That's why I'm non-plussed with talk about EVs. Can't we just skip that step? We still have rails on the right-of-ways. We used to have streetcars. Heck, I'd settle for regular bus service every half hour!

Well I fully agree that we need more and better public transport. And future housing development must be done with transport in mind.

That said, we have trillions of dollars in existing Real Estate stock that was built on the premise of cheap oil. We can't just push all those suburban houses closer together. So we will still need some car-type of transport.

Alright, as long as we recognize that not everyone lives in suburban houses. Anyone know the percentage?

It just seems like EVs are an excuse to continue BAU and suburban sprawl because, Look! No oil! Meanwhile those of us already living downtown have to subsidize the car culture while we wait for better options. For me, EVs are a distraction from what we should be doing. YMMV.

http://www.pbs.org/fmc/book/1population6.htm

WaterWeasel: "Why? Because I live in a small city and park on the street."

Sounds like an infrastructure project waiting to happen - run an electrical line under the street and pop up a little pay charging meter next to the sidewalk like a parking meter. If there's a parking meter it can just go beside it. We've certainly sunk money and resources into more stupid projects. Promoting quiet and point-of-use cleaner transport in cities will make them more pleasant.

Speculawyer: "So many people act is if you can't drive an EV 300 miles and refill it in 5 minutes then it is completely useless."

This gets back to a society/time/money issue. Just conjuring a scenario say, going on vacation...few people get more than two weeks of free time and usually they have to reserve one of those weeks for doing necessary things and not just leisure. So if you only have a week to go voyaging you want to get there quickly so you can enjoy your time there. On the flipside, if you had more time and enough money you could use a short range/slow charge ev and make use of the time in transit - staying at hotels, eating at diners and visiting towns - making something of the trip and not just the destination becomes a viable option. So the background societal context matters and in the US anyway, the go-fast get-there-now mentality is dominant. We are a stupid country pissing our lives away for trinkets and GDP numbers (and fouling the rest of the world in the process).

http://en.wikipedia.org/wiki/CHAdeMO

As far as technical aspects of EV's I think lack of dedicated and well published infrastructure is the biggest problem. There needs to be a standardized plug and there need to be publicly accessible stations everywhere. The places that make sense for this particularly are eateries, grocery stores, and other places where you can pass some time while the car charges. There should be chargers put in next to parking meters and in parking garages. A national standard charging card that you can load money on would simplify things - there would be the charge station, a place to swipe the card, a button, and a light...push the button and the light turns red, swipe card for green light, plug in and charge. The same everywhere you go. Large scale adoption limit is probably around 150 mile range and 30 minutes for 110 miles of quick-recharge. Those levels would allow the vast majority of people on each coast to make it to the beach with only a few stops and the addition of 1 to 1.5 hours for charging. Example: Atlanta, GA to Savannah, GA ~250 miles Start with 150 miles of range, travel 140 miles (10mi range remain) elapsed time 2.6 hrs, charge 110mi in 30 minutes (120mi range remain) ET 3.1hrs, travel 110 miles (10mi range remain) ET 5.1 hrs - arrived at destination, recharge at leisure. [used 55 mph average speed to account for traffic, non-highway roads]. With enough charge infrastructure having 10 miles of remaining range shouldn't induce range anxiety, but if that's the case then expect one more stop in that sequence. I think many people shown those numbers would find it viable. As a comparison, currently the same trip in a Leaf would require at least 4 stops to recharge, primarily on L2 infrastructure, adding approximately 24 hours to the trip. The 2013 Leaf is getting a better on board charger that can halve L2 charge time bringing that to only 12 additional hours.

Since I've gone off the rails a bit, I'll pull it back in a little and ask the question...Would investing in high-speed public charging infrastructure be an investment sinkhole? Short term - I think Yes...Long term - No (depending on how you view personal motorized autonomy). In the short term it is basically having to spend more energy/money to make an alternative infrastructure to what we already do now (which is questionable in itself) and it will not even be useable right away - so on the surface there's no added value. In the long run, for the US, it will allow decreases in foreign oil, decrease in oil use period (presumably less energy overall), create a larger electrical demand which may attract investment into the electrical infrastructure - hopefully with a higher mix of renewables, reduce pollution in cities, and reduce noise pollution. Current dual-fuel vehicles such as the Chevy Volt take advantage of the easy availability of home electric infrastructure for primary commuting, and take advantage of the legacy liquid-fuel infrastructure for distance driving.

The answer is fly to your destination. If it is a driving distance then rent/borrow/carshare a hybrid car. With the exception of the Tesla and its big battery, I think these people taking excessively long trips with EVs are just being zealots.

Talk to someone you know that owns an EV. They'll probably tell you that they never use the public infrastructure. The biggest problem with EVs is the high up-front cost, not the lack of an infrastructure. The infrastructure bit is mostly a psychological reassurance for people who think they'll be running out of charge all the time. No, people just learn the limitations and deal with them.

"The biggest problem with EVs is the high up-front cost, not the lack of an infrastructure."

High up-front price for a glorified commute-o-box. There are plenty of people that buy far more expensive cars...but they're capable of more than just going to work and back and the occasional trip to the grocery store. I wouldn't want to pay nearly $35,000 for a crippled turd either.

Having a longer range, rapid charging, and public support infrastructure also opens up electrics to those people who "live in a small city and park on the street" who don't want to or can't tear up the sidewalk/street to put in a home charging port. It pushes the vehicle into the range of meeting about 99.5% of people's needs/desires making it not just a 3rd or 2nd vehicle option, but making it a Primary vehicle option. Besides - anyone in a proper small city is probably living there because they can cycle, walk, or take public trans to where they're going and they're going to have a car so they can make long trips to places those transportation options won't get them to.

Here's a mind bender for you: http://en.wikipedia.org/wiki/Race_Across_America

Those are bicyclists who are faster than the Leaf on an L1 charge. Bicyclists who are as fast as a Leaf on an L2 charge. A Leaf using 120V recharging would be destroyed in a long distance race against these guys. Of course the Leaf can carry 5 people, in luxury, with no effort because it's a car - but jeez, isn't that a little sad?

Just for the sake of thinking about it I've been evaluating trips based upon a Leaf's range and recharge time. Almost all of my favorite places to hike? Too far without a recharge - no charge stations out there either. A trip to see my cousin? A normally 4 hour trip would be turned into a two-day affair with at least 4 six-hour stops to recharge. Going to the lake? Too far. So with a Leaf I'd have to rent a car every time i wanted to go to my favorite hiking spots, or down to the lake for a weekend, or down to my cousin. So for me owning a Leaf would require owning two cars, with two insurance payments and two license plates - which could be seen as inflating the cost of ownership a wee bit.

I can tell this will be interesting. First of all, you are right, a lot of people won't buy EVs because they don't have to. And that disproves much of the doom & gloom here on TOD. EVs are just around equal economically and given the range issues most people dont' buy them. Of course this will change as oil price continue to rise (and hopefully the EV prices drop more too but I can't guarantee that.).

$35K? Really? The base price of the Leaf S is now $28,800. The Smart ED is $25K. Those are the unsubsidized prices are before the $7500 Federal tax-credit and any state incentives.

But can they bicycle in their sleep? The EV charges while you sleep. Heck I can run faster than a L1 charge for 3kw charge on a car like a Leaf but I'm not sure what that has to do with anything. So it is a pretty obtuse pointless comparison.

Ah, now you sound like the "well an EV doesn't work for *ME* thus they are completely useless crowd. Like the "Well, a Leaf can't tow my boat so it is useless!" people. You have chosen to have discretionary leisure activities that are heavily oil-reliant. Fine, nothing wrong with that. But I'm not gonna cry for you when gas prices go up further. And again, the fact that you continue to enjoy these activities points to the fact that the situation is not as doomerish as many here spout. But for most people, they could easily drive an EV and rent/borrow/carshare for the occasional long drive. Don't let your personal habits blind you to the bigger picture.

And second . . . did you forget about PHEVs? In fact the the PHEV has become the dominant form of plug-in vehicle. The Volt has done consistently better than the Leaf. Other car makers are now adding new PHEVs to the market. In addition to the Volt, you can right now buy the Plug-In Prius, the (beautiful but terribly engineered) Fisker Karma, and the Ford C-Max Energi. The Honda Accord PHEV, the Ford Fusion Energi, and Mitsubishi Outlander PHEV are coming soon. So even you could do all your typical workday daily driving (mostly or completely) gas-free. And when you want to do your oil-dependent discretionary leisure activities, you can drive on gas after the battery has depleted. Problem solved. The average Volt driver is getting some 125 miles for each gallon of gas used whereas the fleet average is 22 or so MPG. So that is a 5X reduction in oil usage. Imagine if everyone did that.

The high up-front price is the main problem . . . not charging infrastructure. As you pointed out, it would very annoying to try to drive a long distance on a short-range pure EV. I think it is stupid when people do it except for occasional trips that are well-planned.

"I can tell this will be interesting."

Avast! and prepare to be bored-ed!

You see - you've got this backwards...the thing is that I'm *frustrated* that the current crop of EV's is poop-schmear compared to what they can and should be. I'm willing to put up with a lot of inconvenience to make something like that work - but it won't effin' work within reason and my demands are pretty low compared to the majority of the population (who appear to think that anything less than 600 mile range and 5 minute recharge is not enough). The reason it's so frustrating is that the technology is there - it just needs to be applied.

But it gets worse...because these Turds are going to eff up the perception of electrics again. That's the real tragedy. By selling these "compliance cars" people are going have something to point to and and go "See, electric cars don't work." They're now out there lurking with their already crappy range which might plummet even lower within a few years. This is why Tesla built the Roadster and has 40 kWhr packs into their base Model S. The Model S which, by the way, does about 250 Whr/mi - the same, if not better, than the Leaf and can do crazy shizite like this: http://youtu.be/Y_gS2KZmnbg

I really don't rack up that many miles/yr and I'm strictly a second-hand car buyer and let "the other guy" take the initial depreciation - so whatever comes out will take a few years to make it down to a point I want to buy. So right now what's coming down the pipeline is junk to me - except the Volt. Not a fan of GM's products, but that one might be solid.

"But I'm not gonna cry for you when gas prices go up further."

;) I drive a Prius, btw, and had a CRX which got about 40 mpg before that. I've been eyeballing a plug-in conversion, but I'm not entirely sure how this will effect its longevity.

"And second . . . did you forget about PHEVs?"

Nope - just decided to gloss them over during that rant. With the current infrastructure and the lame EV's that are being produced right now PHEVs are really the only viable alternative as a primary car in the transition period. It's a real bummer though because I would like to get away from the ol' suck-squish-bang. Maintenance on an electric car would be almost nil. Trans and diff oil every 50k, and some coolant every 75k. My Prius still has the factory brake pads front and rear at 185,000 miles. The gas motor is the most pesky bit of it - wanting coolant changes and oil changes, oil filters, spark plugs, air filters - the nerve of it! The Prius-Pi is, unfortunately, a disappointment - that's what punting looks like. Fiskar? Tee-hee! Now there's your too-high up-front price. The others are wait-and-see at this point. Ford usually doesn't miss a chance to disappoint.

The Mitsubishi is going to be the one to watch...they've done interesting things to that one, including electric all-wheel drive through twin electric motors (one front, one back). The rear assembly looks like it was pinched straight from the iMiev, but the front is looking more like a Prius-esque PSD parallel - which means they won't take as much of a conversion hit as the Volt does when the motor is running. It looks like they've put some serious thought into the control software as well, even allowing driver control to call for it to charge the battery with the engine, or "save" which prematurely puts it in charge-sustain mode so you can save the E power for lower speeds where it would last longer and where the gas motor is less efficient.

You guys aren't realizing the elephant in the room. EV's and alternative vehicles based off anything requiring electric shortage requires rare earth elements for the production of such vehicles. There is a reason they call them RARE earth elements. If we tried to switch everyone in the U.S. to EV's there wouldn't be enough materials in the world to produce them. There is hope with one company who has developed an engine that doesnt require rare earth, but whats the chances of that taking over.

Rare Earth elements are NOT required. Some motors use them but if they go up in price, they can easily switch to induction motors that don't use them. Tesla cars do not use them. The rare earth thing is a red herring.

It's also not true that rare earth elements are rare.

"Despite their name, rare earth elements (with the exception of the radioactive promethium) are relatively plentiful in the Earth's crust, with cerium being the 25th most abundant element at 68 parts per million (similar to copper)." http://en.wikipedia.org/wiki/Rare_earth_element

Yeah, that was boring. ;-)

There are certainly going to issues with the new EVs. Nissan may not have sufficiently heat-tested their cars. I think temps are going to be an issue that needs to be dealt with. Too much heat and batteries deteriorate. Too much cold and batteries don't work well. The latter can be solved with battery heaters but you need to be plugged in overnight. The former is more difficult. Different battery chemistries may do better or else you'll have to do battery cooling which will be expensive.

I'm not sure what you are looking for from the EVs. Having a long range is easily do-able but it is just damn expensive. It is not going to make economic sense to have a massive battery pack when you only use it 3% of the time. Hence PHEVs will be best for many. But for many 2 car families or those that rarely do long trips, a pure EV that can do 100 miles may be enough. I like the fact that you can avoid oil changes, spark plugs, smog checks, exhaust system issues, etc. But you either have to pay a lot for a huge battery or deal with reduced range. I'm fine with the latter. I just have an old gas car that sits in the driveway for the rare times I need it. I may get rid of it eventually though and just use carshare programs.

"Having a long range is easily do-able but it is just damn expensive. It is not going to make economic sense to have a massive battery pack when you only use it 3% of the time. Hence PHEVs will be best for many. But for many 2 car families or those that rarely do long trips, a pure EV that can do 100 miles may be enough."

And there's the rub. We have all of the manufacturing capability to churn out millions of standard ICE engines and associated components and do it with amazing (monetary) cheapness. Batteries, on the other hand, are not as well supplied and not as settled a technology. There seem to be a gazillion different chemistries and construction competing right now. If they would settle, we might start to see economies of scale and learned cost-reduction over time.

Where things go kaflooey is the battery size requirement between ICE, HEV, PHEV, and BEV and the benefits and useability thereof. Most people don't even think about them until they go flat or die but an ICE requires (unless you have a crank sticking out the front of your car or motorcycle) a battery to start - a tiny battery which for this discussion can be disregarded as negligible. To get real horsepower out of a battery without killing it, the battery (in practice) needs to be large. The Prius has a 1.4 kWhr battery and it's electric motor is capable of about 30 ish horsepower, the PiPrius is 4.4 kWhr and will put out 80 hp (which sounds a bit much actually), and the Volt is a bit cagey on what it's pack actually delivers but is over 100 hp. Prius fuel economy is somewhere in the 45-50mpg range and long term PiPrii I've run across seem to be settling in around 100mpg-ish (practical and not hyper-miler figures here). Volts seem to be getting practical averages of 250mpg with a 16kWhr battery.

So we have Prius baseline of 47mpg @ 1.4kWhr, PiPrius two-times base fuel economy with 3 times battery size, and Volt with 5 times FE with ~12 times the battery size. This has all the markings of diminishing returns - and in a way is - but stopping there doesn't tell the whole story. The Prius is a gasoline car but the battery allows that gasoline to be stretched. The PiPrius, as a practical matter, is an electrically supplemented gasoline car. Because of the size of the battery it operates in blended mode A LOT - besides a certain inefficiency in doing that, it's an annoyance and will probably have an impact on the longevity of the ICE. The Volt actually crosses over into being a real EV - if you pulled the gasoline engine out, it would still work. This is why GM's hair catches on fire when people call it a "PHEV" instead of an "EREV" or "extended range EV." You could theoretically go something like a year without the Volt's ICE coming on until it starts to panic that your gas is going bad so it starts using some just to get rid of it.

Going from the PiPrius to the Volt results in a threshold being crossed - from being a car that definitely requires gas to work (but stretches it substantially) to one where it's really optional. If you could only get a hold of 10 gallons of gas per year you could still use the Volt for going to the grocery store and getting back and forth to work (in most cases) for the entire year...the PiPrius will be dead in the water in about two months.

So there are certain thresholds reached for various battery size levels. The small battery of a normal hybrid does wonders for increasing fuel economy in traffic and otherwise adds a piddly bit of gain. When your battery is large enough to supplement the ICE from an outside power source is where the really big gains start to be seen and even a large truck can stretch a gallon of gas. It's better in my opinion to size the pack large enough that the gasoline motor does not need to come on until the battery is "depleted." Cold starts are bad on fuel economy, emissions, oil quality, and wear-and-tear.

The question that might need to be asked...with limited battery production - is it better overall to have more small-battery hybrids like the Prius or would it be better to have medium battery hybrids like the PiPrius or large battery hybrids like the Volt? Take 16 kWhr of battery: one can make about 12 Prii, 4 PiPrii, or one Volt. If battery production is your limiting factor - which would make the most impact?

Based on my possibly poor assumption that hybridizing a car will take it from 35mpg to 45 mpg - the difference between 12 Prius conversions vs 4 Prius conversions, assuming cars not converted remain the same, it's a bit of a wash...but limited to one Volt conversion it looks grim. So if we run off the assumption that batteries are our limiting factor - if by availability or that the price runs people off - then I would have to mark the normal Prius as winner. But those numbers are too close and too loose, so based on other external factors I would rate the PiPrius as more beneficial.

So have I killed the argument for a long range EV? Mmmmm - highly depends on one's assumptions. The pondering above (not rigorous enough to be called an analysis I reckon) sees the world as it currently is with a bunch of large, pokey 35mpg vehicles and not one with smaller cars getting 45 mpg on gas alone and no fancy tricks as well as a constraint based on battery availability. It also assumes something like the Leaf is the norm. I presented the made-up "VW 1L-E" as an alternative vision, now I'll do another. The Honda Insight (the real one, not the new fake one) got an honest 60mpg in most people's hands.

Using magic hand waving (60 mpg - 34,000watt-hours - 567 watt-hours/mi --80% -- 113) the Insight converted to electric will get 120 watt-hours per mile. Chuck the ICE, close 90% of the cooling holes, smooth the underbody, raise the height so you can put the batteries in the floor, lengthen (but not widen) the body allowing for a third seat (much more appealing than a two-seater) and taper the rear a touch more. Some beneficial for efficiency, some not...all of that done and with a Leaf-sized 21 kWhr battery...wave the hands some more, say 150 watt-hours per mile. L1 @ 9.6mph, L2 @ 44mph. This should yield a three seater with decent cargo room that would suit a two-adult, one child household, and have a range of 140 miles (and handle like a Ferrari due to the CoG). If the battery is the biggest cost issue, with this you've effectively halved the cost of the battery - double the range with the same size battery - but at the loss of two butt-spaces (though hardly anyone ever really puts 5 people in a 5 seater) and maybe a little cargo room.

With EV's I think the thresholds are a little more fluid than the transitional jumps of the P/HEV - every person can do their own analysis...some one-car households will be able to deal with a 70 mile range EV as a primary vehicle, many more will find it acceptable as a 2nd or 3rd. But I think something will happen once EV's move out of the commute-o-box category and become viable long-range cars capable of suiting ~99% of trips for ~75% of people. I reckon this to be as low as around 150 mile range, with 100 miles per 30 minutes charge. At these levels there would really be pressure for infrastructure development, as now people just scoot from house to work, or house to town for shopping and back...not down the highway from city to city or to vacation at the beach or in the mountains or go down to the lake - things people really enjoy doing. "Buy an EV and go to work!" vs "Buy and EV and go to the beach!" One of those is a whole lot more appealing.

I do like this guy's case for L1 charging leading the evolution: http://www.aprs.org/EV-charging-everywhere.html

So as you might have gathered by now - my mind isn't completely settled on where things stand. PiPrii would probably be the most cost effective use of limited battery availability, but Volt levels of battery packs really push things into another realm of existence...a true dual-fuel vehicle. When you go to the BEV you can sell the benefits of not having the ICE - no frequent oil changes, air/oil filters, exhaust systems to "rot" out, lower noise, yadda yadda. There are real benefits from making the total leap...but it has to be a large enough leap that it doesn't force lots of people to lose out on a lot of those benefits by the need to have a second car, or having to rent a car a dozen times per year. Tesla went for the hueueueuge battery packs, Nissan et al. went cheap, and no one shot for what I think is the sweet spot - something that's not hyper exotic so it can be built inexpensively, but still efficient on battery so a reasonably size/priced battery can give it ~150 mile range and improve speed-of-recharge given currently available charging options.

Well I don't think anyone is settled. And the manufacturers certainly haven't figured it out either. I suspect there are buyers for all sorts of battery configurations so make them all available and let the consumers choose what is best for them. Many people don't want an ICE and thus will want pure EVs. Others won't want to plug in at all and thus conventional hybrids provide a way of improving MPG with electricity without plugging in.

With respect to the problem of Leaf range and " ... Almost all of my favorite places to hike? Too far without a recharge - no charge stations out there either." I own a Leaf (my home in Hawaii) and spend more than half my time in SoCal (no Leaf). I did the following analysis based upon MY situation in SoCal. I, too, like exploring the SW (AZ, CA, NV, UT, etc.) but don't want to own a large 4-wheel drive for commuting. Nor do I need 2 cars in CA with one sitting in the parking garage (apartment) most of the time. When my wife comes to SoCal (every 6 weeks or so) and we want to drive, drive, drive ... we rent a cheap car through Hotwire!! Last week I rented a 4-wheel (Jeep Liberty) for $35/day and we drove to LA and LV, 4-wheeled it through Death Valley (visited the Queen of Sheba Mine!). Gas mileage? Not so good, but convenience? Yeehaw! I've rented cars for $15/day to drive to LA, TUC, etc. at 35 mpg. But, this decision (buy/no buy? rent? what car?, etc.) was based upon a complete cost analysis of our predicted behavior and needs. It turns out that the rental approach is a bit more expensive, but not by much, and lot, lot more convenient.

Transition to Hawaii: My neighbor did the same analysis some time ago with the big Ford truck he used to haul his (big) boat to the boat ramp once/twice a month. After 20 years he finally figured that it was much cheaper to rent a U-Haul pick-up every time he took the boat out than to keep a large truck in his yard (capital cost, ins, reg, gas, etc.). Again a quantitative (and honest) analysis of costs.

Transition to Nebraska: On a farm? My bet before any analysis? Buy a Ford diesel truck.

Another infrastructure thing that would help the EV cause would be ubiquitously available emergency battery charging service. For the hapless EVer whose batteries give out between stops, instead of the tow-truck, call the retro-fitted tow truck with the diesel generator that will charge you up at least enough to make it to an actual charging station. Put it on your insurance, or your AAA membership. This might ease the minds of a lot of potential EV buyers/users.

You have summarized in a nutshell what is wrong with virtually all public transport: it is slow, infrequent, and costs as much or more than driving. No doubt your bus service gets more money from taxpayers than it does from passengers, as mine does.

Don't get the impression I'm a car nut who can't bear the thought of not having my own private two-ton cocoon of protection. I'm quite happy to travel by public transport where it is available. I've done so often, in Sydney, Paris, London, Copenhagen, Calgary, the Netherlands, Melbourne, Manila, Perth, and even in Houston. But it seems an unwritten rule that public transport will be slow, expensive, and does not go where you want to go when you want to go.

I'll give some figures for the Houston transit system: $0.60 per passenger mile for light rail, and $0.70 per passenger mile for bus. That is just operating costs. Capital costs, depreciation, etc., are not included. The cost of owning and driving a car, van or SUV in 2012 was $0.44 to $0.76 per mile. That's per mile, not per passenger mile, and total costs including maintenance, depreciation, and insurance, not just operating costs.

These figures strongly indicate that driving your own car is cheaper (for all concerned) than public transport in most cases, and certainly if the car is small and cheap, and emphatically true if two or more travel in the car.

As there is a strong correlation between energy usage and dollar expenditure, I would not be at all surprised to find that public transport (as implemented in OECD countries) uses more energy than private autos for most travel. Low cost public transport, as implemented in many third world countries using underpowered and overloaded small vehicles is obviously more energy efficient. I've seen an auto-rickshaw (which I'm told gets about 80 miles per U.S. gallon) in New Delhi carrying the driver plus six passengers and their luggage.

I took the effort to calculate the energy used travelling by bus and by small diesel car in Madrid (Spain), and the car won, even counting that our buses are not empty as in some places.

I think the we should just assume that it is more energy and pollution efficient to travel by private car, unless you count the resulting traffic jams because of transport density: it is he whee mass transit wins!!

As for the bike.. well, it is way more efficient that my car or public transport, and it is my preferred transport method (up to 10 miles). But not as cheap as you might think it is (about 4$ per 60 miles, just minimal maintenance).

I think you compare apples and oranges by excluding opportunity costs of car use:

1) cars needs a lot of parking space that could be used in a profitable way.

2) Compare inpact of streets on real estate value. I live in a historic city and can tell that you loose a lot of money when a double track tramway is replaced by a four lane street in front of your house. The high price appartments become within a few years quite avarage appartments, millions are destroyed by cars, costs you do not consider.

3) Car sharing is in principle possible, but >90 percent of the cars I see during rush hour transport only one person. The tramways run with 50-110% at the same time.

I have only data for Europe, here the sold tickets cover "only" 50-60% of the costs. This means my tramway/bus ticket for 35 EUR means that the real costs are around 70 EUR per month.

A car costs >250 EUR per month and the parking lot at my university 25-40 EUR per month, so the public transport wins for me as customer without any problem. Neighbourhoods with tramway connection have higher real estate value.

I have an EV and PV to charge it. I am fortunate enough to own a house and to have had the capital to fund both (several years ago). Currently, my neighbors are putting up PV with $0 down - no capital expenditure from the start. Why? Because the PV companies realized they could get a steady, long term revenue stream well past the ROI by structuring the deal correctly. I have thought a lot about and talked a lot with people in apartments and condos and have come to the conclusion that complaints such as "I park on the street or in a parking garage" are easily overcome with either private or corporate (condo) investment in the infrastructure. For example, on-street parking can be accommodated by "parking meter-like" charging stations (see Europe). The same can be done in apartment buildings - the one I use occasional in San Diego has assigned parking spots. What easier way to accommodate (even share!) a recharge station (a beefed-up electric outlet). Work with your local city/county boards to develop the laws and ordinances to accommodate, govern and regulate how this is done. The capital cost of the infrastructure is not an issue if you have any sense about it. Do the same calculation I did when I considered PV and then EV: the cost savings from the gasoline not used alone more than offset the cost of both the PV and the EV over just a few years. Given this ROI it will not be long before the private sector will see the investment benefit and provide the capital cost for the infrastructure given a growing set of long term customers and a steady revenue stream. However, it will first take favorable ordinances, regulations and laws to promote the development of the recharging station infrastructure for on-street and apartment parking EV owners. So, don't complain ... make a change!

Better public transportation can be achieved with a similar approach -- get involved in the public governing bodies. A frustrating experience, but the only way to will happen.

Wait, are you saying it's cheaper to rewire all the streets to accomodate "parking meter-like" charging stations and buy everyone an EV than to build a light rail system? Got any actual numbers to back that up, because I'm skeptical.

I'm also looking sideways at EV's because so much of our current electricity comes from fossil fuels, including coal in a lot of cases. So "electic vehicle" = "coal burner" in a lot of cases.

And frankly, everyone in their own cars contributes to social isolation and intolerance. Nobody has to talk to any strangers anymore.

I smiled when you brought up Europe, because that is sort of the image in my mind (although I don't remember seeing parking meter-like charging stations). I spent some time in Berlin where you'd be a fool to have a car. That's what I want. Fast, reliable, cheap public transit. And I worry that spending money on EVs will take away from that. It looks like we may have bigger problems in the near future, so the window of opportunity to build out light rail may not be that long.

Cars, whatever we power them with, are just a bad idea that we need to get past. The sooner the better.

I don't suppose there'll be room in your mass-transit-only world for rural folks. Maybe we'll all just move in with you. Can I bring my poodle? ;-/

I agree that rural areas have their own set of problems, and mass-transit will not be as effective there. Then again, the long distances will be a big challenge for EVs there too, especially if it gets cold. Frankly, if things get bad, I think rural people may have trouble getting around.

I don't really want to harsh on EVs too much. They ARE a good solution for many people, particularly if they have PV at home. And I don't want to hijack the thread. It would still be interesting to see how many people just should not need cars (i.e., highly urban, e.g., New York City), how many people could be happy with light rail (i.e., suburbs) and how many people need something close to cars (i.e, exurbs, rural). But we can talk about that later. I'll try to do some research myself.

What got me started was the claim that we can all just charge at night while we're sleeping, so what's the problem? Well, it's not that simple. Not for me anyway and I know there are millions like me.

PS. Of course you can bring your poodle! My cat loves dogs.

I spend time in both Hawaii (house) and San Diego (apartment) for work. I am familiar with the transportation issues in each area. In a way each is different and each is the same. (If you are in Honolulu on Feb 28th you might consider attending the Hawaii Venture Capital Association meeting on transportation issues - and the political fisticuffs that entails - see http://hvca.org/?cat=8 for details).

As far as wiring streets: In Honolulu, rewiring streets is cheaper than installing light rail and other infrastructure development. Consider this: the cost of the 34 mile light rail line in Honolulu that accommodates only 25% of the population is now estimated at $12 billion and will take 10 or so years to complete (http://www.hawaiireporter.com/honolulu-rail-cost-escalation/123). I do not have the $ figure for the cost of upgrading HECO distribution power lines, but I am sure that upgrade can be done by HECO faster and service a wider population distribution than the rail with $12 B to work with ($30,000 per taxpayer in Honolulu). The reason is that the right of ways for overhead (and underground) already exists and the environmental impact (of disturbing large amounts of dirt and people's houses) is much less. You may not know that about 85% of Honolulu's electricity is generated by imported oil and coal so the State of Hawaii WANTS alternative energy sources for transportation and electricity -- energy $$ stay in the state, not exported. PV on the roof and an EV in the yard works ($$) in Hawaii.

In San Diego, the same analysis needs to be done, but I have not done it. I posit that the issues are the same: rewiring existing right of ways is much less expensive than creating a ground level right of way for rail systems (this is not an argument against rail or public transportation system – it is a response to your question about $.)

Apartments: I talked with the apartment complex I live in (San Diego) about EVs. The Management (not the owner, who I have yet to contact) was very interested and was amenable to having EV parking stalls (all stalls are assigned); renters would pay a premium. (Note – in Hawaii the apartment complex gets a state tax credit for these installations). Since we pay for our individually metered electricity, the Management has no problem. The issue then comes down to the regulatory and capital costs of doing so. Colleagues I have talked with in Hawaii are now talking about apartment communal PV systems – NOT on the roof of the apartment but on the roof of a large structure (warehouse) elsewhere. The idea is to spread the capital investment for the very large system among the dwellers, all of whom end up benefiting. There has been some discussion of using the $0-down approach now used by home owners.

On street metering: Honolulu does this already with commercial units (albeit limited availability but growing rapidly) where EV (Leaf for the most part) owners charge their cars overnight. On street meter in dense housing would require a different approach for each area. Putting in an underground cable from the house to the street is technically easy and not overly expensive, but does require regulatory compliance (there may be none right now so that needs to change through local ordinances) and regulatory governance over issues such as “assigned parking spots” on the street. This last issue is why local governments or housing associations need to be involved at the get go and as citizens it is imperative that each of us brings this to the attention of our city council, etc. Changing the parking behavior requires collective agreement. This is no different than how collective agreement changed the behavior of driving during the transition from horse and buggy to the automobile. No one complains about stop signs, traffic lights, rules of the road and speed limits … our behavior had to change to accommodate the technology.

Europe: Italy has CC-paid EV meters. I do not know about Germany.

China. Shenzhen: Electric scooter all over the place because of pollution (offsets point of pollution since coal-fired generation is done elsewhere - strong argument for PV/wind/etc. generation). Beijing: Delivery for fast food is done pretty much with electric scooters – delivery guys bring in the battery inside to recharge and pick up a new one with an new order to deliver (with same issue of coal-fired generation/pollution). Shanghai: LOL - try walking down the residential/shops streets and not trip over an electric cord recharging all the E-scooters.

By the way, I am not against "public transportation" and strongly support it when sensibly implemented. I have used The Bus for many years when commuting between Kailua downtown Honolulu - I took The Bus commuting between UH and Kailua a few weeks ago - convenient. No parking problem! But, as always (every time I ride The Bus) I am reminded of the old joke, "There's nothing wrong with public transportation, except the public," which for those of us who regularly take buses/subways, etc., know what that means and how to accommodate.

Thanks for the long reply. But I was kind of hoping for actual numbers and not just "I am sure" and "not overly expensive".

Too bad that 85% of Hawaii's electricity comes from imported oil and coal. So 85% of Hawaiian EVs are oil/coal burners. I suppose it's not that different here on the mainland.

We've got a long way to go.

Too bad that 85% of Hawaii's electricity comes from imported oil and coal.

Yeah, tricky...Alan of Jamaica is in this odd situation as well. Were he to get an EV it would still be oil fueled. Ironically it would be worse than burning it in an efficient car directly - unless he's able to get his PV going and put on enough to "offset."

Yeah, apartment dwellers are kinda screwed as far as EVs go. So here is my standard pitch on what to do.

1) All new Apartments should have parking spaces that have CONDUIT installed to allow for the later installation of charging systems.

2) At the request of a tenant, an EVSE should be installed at the tennant's parking space with the cost of installation split between the tennant (who will be able to charge their EV) and the landlord (who will receive the benefit of a permanent upgrade to their property).

Wow. So I get my own parking spot on the street? Sweeet. /snarc

I don't think we can afford to retrofit our existing apartments in the time remaining. But I don't want to be a wet blanket so I'll stop dissing EVs now.

I'm actually thinking (as I get older) about getting an electric bike (that I can carry upstairs). That counts as an EV, right?

No. *New* apartment buildings, which already typically have mandates for parking for all the residents now, should also be required to install conduit for EVSE wiring, IMHO. Conduit is just cheap plastic tubing but if you install it when you build it can make adding an EVSE later MUCH easier. Just pull the wiring through conduit and install the EVSE.

I agree with everything you said, but want to use your post to discuss what I consider to be a rediculous requirement: that all new apartments must provide at least one off-street parking spot per unit.

My "apartment" is actually a third of on old Victorian house (built 1889). In the back, along the alley, is an old leaning water tower attached to a falling down (but large) shed. I've always thought it would be really cool to right the tower, tear down the shed, and build a nice 1,000 sq. ft. apartment back there. Well, the city won't allow it because there's no room for an addtional parking space (and they consider the POS falling-down shed a "historic structure", but that's another story).

This is an eco-groovy town that's always talking about infilling and saving the surrounding farmland. And, it's a college town (20 minute walk to any classroom), so there should be no lack of tenants who don't need a car. So, dispite the green talk, a prime piece of downtown real estate sits more or less unused due to worship of the automobile. It makes me crazy!

Thinking about it more, what would work well for me would be a PV covered carport at work, and charge there. Not much chance of that happening, but way easier than trying to jigger something at home.

I'm not sure if even electric cars have a future long term. How much energy would be available from sunlight, either through PVs, biofuels or wind? It must be very limited compared to the torrent of energy you get from burning FFs. My intuition suggests only the wealthiest could afford to run even a lightweight four wheel car. The best common folk could hope for is an electric scooter.

Your intuition is wrong. Less than $10K of PV equipment thrown onto the roof of a typical American home will provide all the fuel needed to go 12,000miles/year in an EV for 25 years. Most people don't realize this because (1) PV prices plummeted in the last 3 years and (2) EVs are very energy efficient

Is that same PV going to supply the energy required to continue maintaining highways and roads and infrastructure for electric motored automobiles? How about the money to pay law enforcement, the courts, and emergency services required by automobiles?

I'm assuming all local roadways must continue to be subsidized by the non-driving public, just as they always have- I'm just wondering if you're saying they will be cleared, plowed if necessary, and periodically repaved using energy from PV?

Where will the energy to build all the "EVs" come from? Will PV smelt the iron and produce the plastics for EVs, and if it can do that, is that the best use of PV we can think of? Will PV provide the energy to mine and process the bauxite, copper, and magnesium used in building the "EVs"?

Will the new plants constructed to manufacture our new fleet of electric private automobiles also be subsidized by the non-driving public, just as every one built in the past quarter century has been? And if they get into trouble, will they receive bailouts, just as GM/Chrysler received 75 billion taxpayer dollars in 2009?

I see you have a lot of questions. Why not try to provide some answers some time.

No, PV does not provide the energy for EVERYTHING. Duh. It is merely one energy source among many.

In Hawaii most homeowners install PV with $0 down. The same is happening in SoCal, too. Capital investment is no longer an issue. Also, I lease my Leaf (Hawaii) for about $375/mo. I offset the lease cost with about $225/mo saving in "gasoline not used if I had leased a gasoline car". I do this because cause I was able to capitalize the PV system AND the PV capital costs have now been recovered (3-1/2 years ) by savings in electricity ($0.32/kWh) and gasoline not used. And, a nice tax rebate for the initial capital costs.

What we need is inexpensive substitutes--substitutes that would compete with the price of oil before it rose so much. $30 barrel or less in today's dollars. I don't see this happening.

Indeed, there are none. But at least there are alternatives that will act as a ceiling on gas prices such that rising gas prices won't cripple us forever. Although EVs struggle to compete against gas cars today, if the price of gas continues rising there is inevitably a cross-over point where consumers will switch to electric vehicles since although they cost more up-front, they will be much cheaper to fuel. Where that cross-over point is differs for each consumer depending on their local market conditions and their driving habits.

However, I expect many consumers to foolishly cling to gas-powered vehicles long past the time it would be economically wise to switch. Old habits die hard.