China Energy Outlook: An Inside Look at Chinese Energy Thinking

Posted by Rembrandt on November 14, 2012 - 11:24am

Globally, only two reports are published on an annual basis wherein the world’s energy situation is fully scrutinized. These have a huge impact because in many government and company decision boardrooms – at least in Western Europe - everything which is written inside the two reports are seen as the truth, the whole truth, and nothing but the truth. We are talking about the International Energy Outlook of the United States Energy Information Administration, and the World Energy Outlook of the International Energy Agency funded by the OECD.

Globally, only two reports are published on an annual basis wherein the world’s energy situation is fully scrutinized. These have a huge impact because in many government and company decision boardrooms – at least in Western Europe - everything which is written inside the two reports are seen as the truth, the whole truth, and nothing but the truth. We are talking about the International Energy Outlook of the United States Energy Information Administration, and the World Energy Outlook of the International Energy Agency funded by the OECD.

A number of years ago China decided it needs its own version of the truth. To develop an expertise in generating models which encompass energy-economy-environment to understand how energy policy affects the future of China. It was decided at the highest levels to create 1) a short term outlook to 2015 which has just been published, and 2) A long term outlook to 2050 which will be published next year. They both encompass the Chinese and World energy situation. However, as usual the communication/language barrier - Mandarin is difficult to read for Westerners - makes this unbeknownst in the western world.

Fortunately, I had the opportunity to attend the first presentation in the western world of the new China Energy Outlook, on 16 October at the Grantham Institute in London, delivered by Professor Han Wenke and Dr. Yang Yufeng. Both work for the Chinese Energy Research Institute, which is a part of the National Development Reform Commission of China, the government body in charge of macroeconomic planning.

More details below the fold for a summary of their talks and the China Energy Outlook (Executive Summary, English starts at page 19.)

At the meeting we received the summary of the report in English; since the full report is only available at this moment in Chinese (Mandarin), with the stated intent of an English version published down the road. I scanned the Executive summary of the first China Energy Outlook of the China Energy Institute, which can be downloaded here (Executive Summary).While there is a lot more to say about the Chinese view, I highlight what I see as key perceptions/expectations from the meeting and the report:

Expectations on short-term changes in the Chinese Energy Mix up to 2015

The China Energy Outlook expects China’s energy demand to grow more slowly (4.7% per year from 2011 up to 2015, versus 6.7% on average between 2006 to 2011). The reason is that exports will grow more slowly because of weak demand.

“Many developed countries have been trapped into the vicious circle of sovereign debt crisis, fragile banking system, weak demand, high unemployment and policy paralysis.”

The energy intensity of the Chinese energy economy is expected to decline. “from 1.03 tons of coal equivalent (tce) per ten thousand yuan at the end of 2010, to 0.87 tce per ten thousand yuan in 2015, down 16%.”

The Asia-Pacific region is expected to be oversupplied with coal due to slow growth in global energy demand.

The perception is that an abundant supply of coal in China exists (I asked this question to Dr. Yang Yufeng at the meeting, about which he replied that China has more than a 100 years of supply left.), with production being estimated to stay around 3.8 billion tons at maximum (China has put a political cap on its coal production at 4 billion tons in the 12th five year plan). But, there is a demand-supply mismatch between West and East China, which by now has resulted in high costs of long-distance coal transportation, more railway capacity demand and traffic jams caused by coal transportation.

In general, decreased output of old oilfields is expected to be roughly offset by increased output of new oilfields, keeping the total domestic crude oil production around 200 million tons. The gap between oil demand and supply will continue to widen during this period. It is estimated that in 2015 China’s oil import will reach 320 million tons, up 41% from 2010. [A ton is approx. 7.33 barrels, which means an import level of 6.4 million b/d by 2015, in 2011 China imported about 5.1 million b/d].

Natural gas imports are expected to rise by 18.5% per annum up to 2015. “The past decade saw a strong growth of China’s natural gas consumption, increasing from 24.5 Bcm in 2000 to 126.8 Bcm in 2011, up 416%. Natural gas consumption in China will maintain the upward momentum to reach 229 Bcm in 2015, with an average annual growth rate of 18.5%.”

A quite pessimistic view is given over the developments in renewable and carbon mitigation technologies.

“There will be hardly be any breakthrough in two core technologies that are highly related with global energy security and climate change. According to field measurement and estimates, lithium batteries will suffer from high energy consumption and high pollution under current technologies in the Chinese market. Coupled with high costs, inconvenient weight and short life, the lithium battery is unable to bring revolutionary changes to electric vehicles. Second, Carbon Capture and Storage is the best hope to reduce carbon emissions from fossil fuel power generation in the world, is facing some fatal problems, including lack of some integrated commercial demonstrations, increasing total costs, falling energy efficiency, lack of legislation support and low public acceptance.”

Perceptions on the changing US fossil fuel situation and US energy independence

The US is seen to have an oversupply of oil and gas due to the introduction of shale oil and shale gas. Note from author: some of the perceptions may have come/have been influenced from this meeting of the China Energy Outlook's authors with members of the US Senate's Energy and National Resources Committee.

In relation the Chinese expect a further change in the US from coal-fired to natural gas-fired power generation:

“Gas-fired power generation will be more competitive in the US and might completely replace coal-fired power generation. It will also widen the cost gap from nuclear and renewable power generation. The latest statistics in 2012 suggest that cost per unit for newly built CCGG (Combined Cycle Gas Turbine) plants in US is 30% lower than that of coal and wind power, half of nuclear power, and a quarter of solar power. Notably in April 2012 the US EPA published CO2 emission standard for new fossil fuel-fired power plants, which limited those plants to a maximum CO2 emissions rate of 1000 pounds per MWh (453g/kWh). This standard is close to that of gas-fired power plants and is half of that of coal-fired power plants.”

“North America has huge potential of energy resources. According to the news issued on April 19 of 2012 by the US Senate Committee on Energy & Natural Resources, the US has 26% of world’s technically recoverable conventional oil resources. This news was a significant change on president Obama’s earlier statement that the US had only 2.2% of the world’s proven oil reserves. Although the technically recoverable conventional oil resources and the proven oil reserves are different concepts, and the data 26% still need to be confirmed further, it still can indicate that a great change had taken place not only in US unconventional oil/gas reserves, but also in US conventional oil reserves. Clearly, this situation means that the North American market will enjoy a lower oil price than either the Asia-Pacific region or Europe in the long run.”

The Chinese seem to hold a rather sobering view of the US strive for energy independence. From the report:

“Unconventional oil and gas resources, represented by shale gas and shale oil, have helped the US take a great stride on its “way to energy independence”. That also helped the Americans win time and raise the possibility for the US government to keep its promise “to rely mainly on slow development of new and renewable energies as well as technologies such as electric vehicles, biomass, wind energy and solar energy.” But we should understand the concept of America’s energy independence more accurate, America’s enormous potential of energy self-sufficiency makes it less dependent on imports year by year. Against the backdrop of oil market globalization, America may import relatively cheap oil from Saudi Arabia and other countries (e.g. Canada and Mexico, etc.) . The U.S. has no need, and indeed would not be able to achieve 100% energy self-sufficiency. America’s energy independence is more a political slogan than an actual policy objective. The essence of “energy independence” is to improve oil supply security.”

Perceptions on international energy policy

Dr. Yang Yufeng during the presentation voiced quite clearly that China has not intent to join the International Energy Agency. As stated in the report:

“Developed countries should cooperate with developing countries in a more active and inclusive manner. This is especially true for global information sharing. With open, transparent, objective and accurate information, IEA should give full play to its advantages and serve the whole world, not just its member countries. Only in this way can the IEA publications strengthen its influence on developing countries and enhance the mutual understanding and cooperation between IEA and developing countries…China should actively cooperate with other international energy organizations. However, China will not and should not join IEA which is dominated by OECD countries. Instead, China should improve its position in global energy governance by joining other developing countries to improve the analytical systems of energy statistics.”

In the report a strong view is given on the importance of progressing to more technology transfer, whereas the international community should re-evaluate the importance of technology transfer in the global energy revolution.

“Wider use of advanced energy technologies can increase both the global energy supply and energy efficiency, so as to popularize low-carbon technology and to accelerate the coming of the era of non-fossil fuel. Therefore, under the framework of the UN or G20, the international community should build a global mechanism of sharing advanced technologies. This may aid developing countries, including those least developed counties, to access the advanced energy technologies, and the whole word to achieve sustainable energy development.”

Perceptions on Energy Policy & Climate Change

In the presentation Dr. Yang Yufeng mentioned that he US nowadays has an easy position thanks to the revolution in natural gas supply to deal with climate change relative to China. The general view seems to be that while China is doing all its can to control fossil fuel consumption, it needs more time and understanding from developed countries because it is in a much more difficult position.

“Developed countries should show more understanding and tolerance to developing countries in coping with climate change issues. The international community should show full understanding of the relatively fast growing energy demand in developing countries, especially those emerging economies. Most developing countries have unfavourable natural conditions (such as drought, harsh climate, fragile ecosystem, heavy pollution, limited energy resources, etc.), while most developed countries enjoy comfortable natural conditions (such as small temperature differences all year round and plentiful rainfall in Europe, fertile lands and abundant energy resources in North America). In addition, developing countries are lagging behind in advanced technologies. Therefore it costs more for the developing countries to develop themselves than that for developed countries. Apart from that, developed countries only have to cope with the challenges of climate change while developing countries have to tackle the problems of local pollution and ecological damage at the same time. Under these circumstances, at the same time as striving for the survival and development of their own people, developing countries must also give priority to solving the problems of local ecological damage, environmental pollution and technology progress.A s the largest developing country located in Asia, where energy resources are most expensive and scarce, China is paying more and more for energy resources for its people’s survival and development while having to consume coal as the basic energy resources.”

On Climate Change targets the view is given that the 2 degree target as addressed by the UNFCC is not realistic, and that international governance lacks any mechanism to promote renewable energy, whose development is still based on national government support.

Picture of November 1st Press Conference in China where the Energy Outlook was presented to invited Chinese stakeholders

Key recommendations for Chinese energy policy – control over energy demand

The Energy institute suggests to the National Development Reform Commission to institute demand side control measures. In the words of Dr. Yang Yufeng, “Make our demand more Scientific!.” Whereas currently China has great control at the macro level of energy, it lacks mechanisms to install incentives and management options at the micro-level. Therefore the Chinese Energy Institute recommends bottom-up energy data measurement, based on which control measures (both technology wise and behavioural constraints) can be instituted:

“Energy demand management should be improved by controlling total energy consumption at the local level. On one hand, China should improve the functions of local energy authorities by incorporating the local energy conservation departments into them. The authorities should control total energy consumption. National energy authorities should instruct local authorities on statistics and measurement of total energy consumption. Based on that, they can manage to achieve the total volume control goals according to relevant regulations. On the other hand, local energy authorities should gradually establish a system of total energy statistics and accounting so as to balance energy supply and demand and to make it more scientific and practical."

The Chinese Energy Institute sees non-fossil energy as a means to control energy consumption.

“The key to control total energy consumption is to control the consumption of fossil fuels, especially coal and oil. Therefore by increasing the supply of non-fossil energy, total energy consumption will be kept under control. To be more specific, the government should implement all kinds of financial and tax policies flexibly to increase non-fossil energy supply according to local characteristics.”

Key recommendations for Chinese energy policy - disconnect energy transports West from East

Currently there is more and more transport on-going from the West where energy is mainly produced in primary form, to the coastal regions in the East where energy demand is growing rapidly. The Chinese Energy Institute recommends to take a different route as to A) stop the idea of meeting all supply of fossil fuels from internal production as far as possible for coal. B) Increase both coal and LNG imports in the East to meet demand growth, C) Halt the construction of more coal power stations in the Eastern coastal region, D) Halt the construction of large-scale long distance DC current transmission lines because of the potential impacts of accidents if the network breaks down.

“Based on the assumption that south-east coastal region accounts for 23% of total demand, the coal consumption of south-east coastal region will increase to 880 million tons by 2015 and incremental demand (i.e. the volume of coal import) will be about 300 million tons. Assuming that the coal imports of south-east coastal region is about 70% of total, China will altogether import 430 million tons by 2015, about 11.3% of the total coal consumption. Therefore, if south-east coastal region imports 300 million tons of coal, it will not only meet its demand at a relatively low environmental cost (because the damage to the ecosystem in West China in terms of producing 300 million tons of coal will be avoided), but also relieve the pressure on transportation, and maintain China’s key and advantageous position in the global coal market…If the coal incremental demand of south-east coal region is completely met by import, it will greatly reduce coal mining intensity of the west region, protect the western ecosystem and mitigate rail transportation pressure. At the same time, the method will provide the west region with moderate space to develop coal chemical industry with relatively high added value according to market demand and local conditions. What should be pointed out is that reducing coal production in the west region will not pose negative influence on the profit of the coal industry because of relatively low production cost and high profit in most West regions.”

More details can be founded in the first China Energy Outlook Executive Summary (Executive Summary, English starts at page 19.).

Very interesting, thanks a lot for that.

@YvesT, thanks its the fortunate situation of being in the right place at right time. My new locale (London) has 2-3 interesting energy events approx. every month.

You can really feel the chinese pragmatism and realism in the report.

For instance on CCS : all evaluations point to something like 30 or 40% efficiency decrease (so 30 40% additional resource consumption, and also 30 or 40% increase in mining pollution for the same energy), and this is about heavy industry, capturing, moving and pumping tons, no Moore law type of progress to be expected there, so really one wonder why it is even still discussed (also a side effect of CO2 market instead of simple volume based taxes on raw materials). The push really needs to be on the consumption side.

@YvesT

I guess because A) many people still hope there are some magic catalysts which can substantially reduce the efficiency decreas, and B) Because many feel it is the only option due to the lock-in of carbon from current infrastructure (IEA calculated in last WEO 2012 that 80% of carbon emissions for a 2 degree scenario are already fixed in place given current infrastructure).

I've seen several blurbs of studies that purport to be about other capture technologies with much lower parasitic energy demand. But I keep seeing the circa 30% numbers thrown out. Either people are unaware of -or the purported alternatives have serious issues with scaling up?

But the energy involved in CCS also has a lot to do with the energy necessary to transport the CO2 to the storage site, and push it there.

(and this part stable whatever the capture mechanism)

Not to forget building the CO2 pipelines infrastructure..

I found the language quoted above curious:

- it sounds to me like they are saying that the more practical experience is gained with commercial-scale CCS, the more monetary and energy costs are discovered, so that CCS looks less and less practical?

Seems to me this points to the high CAPEX (infrastructure required) and OPEX(energy required) to run CCS.

CCS to me is really the poster child of green washing. Grand scale Green washing.

Let's not forget all the pollution involved in coal mining as well (increased by 30 or 40% by CCS)

Basically it is the idea that using some more stuff to push the waste under the carpet is a solution ...

(and accelerating ressource peaks)

Won't ever be set up anyway, for sure.

I remember my father-in-law, retired (senior) environmental scientist for Shell Australia, being highly skeptical about CCS a decade or so ago. "Rivers of CO2", was an expression he used, and how do you capture a river?

Cheers, Matt

STILL a concerned father of three great kids, now all teenagers

Very important assumption of 30% lower growth of 4.7% compared to historic growth of 6.7%.

The IEA 2012 projects similar growth:

Un-scanned pdf file of the Executive Summary:

http://www.eri.org.cn/uploadfile/Executive_Summary.pdf

@parkhun,

Thank you filelink added in post at relevant locations.

For the benefit of your readers who are not quite up to speed with their ability to read Chinese, it might be worth mentioning that the English portion of the Executive Summary starts on page 19 of the PDF file.

The US is seen to have an oversupply of oil and gas due to the introduction of shale oil and shale gas.

No doubt the gas market is oversupplied but this is the first I've heard of the US oil market being oversupplied.

@Luke, this is in relative terms to China as I have written it using wording from report. The general tendency/perception in report is that US has plenty of oil and gas to lower import needs and in long run become net exporter, whereas China will need to keep increasing imports.

"Conclusion 4 (page 24 of exec summary), A new global energy landscape is taking shape with an oversupply in North America..Firstly, North America is on its way to the "Golden Age of Energy"....Clearly this means that the North American market will enjoy a lower oil price than either the Asia-Pacific region or Europe in the long run.. etc."

What I got was that China still has a chip on their shoulder. They are the red headed stepchild. They still see themselves as an underdeveloped /developing nation, which needs special breaks, as opposed to the big bad OECD

This "us vs them" attitude is exacerbated by the west fear and paranoia.

"Two Solitudes" will lead to conflict

Yes. This is very distressing from a climate change perspective. They don't realize that because they are hypercompetitive indistrially, that they should now join in on joint sacrifice for the good of all. And of course their attitude feeds the attitude in north America/Australia of "why should we make sacrifices, when our hyper-competitor China refuses to". So we are on a path for 6C or more!

And could you point to any intiative currently aimed at truly improving efficiency and reducing fossile use in the US or even OECD ?

(besides market price induced demand destruction ?)

Starting with below for instance :

At least some serious volume based taxes were set up in Europe and Japan following the first oil schock(consequence of US peak let's not forget).

US energy policy is held hostage by the republicans. Still we have managed to double fuel economy standards for cars. As long as we make this a game of -look over there those other guys aren't doing a good job, so why should we, no-one will ever get serious. As it is China has huge capacity (and an industry struggling with insufficient demand for) PV and wind turbines, and I bet they can install the stuff for a much lower cost per watt than anyone else. They also are suffering horribly from local pollution, and those issues they talk about with damaging weather -that will get much worse with global warming. Being that they are leading the world in production of PV and windturbines, they ought to try to show that they can do the same with overall green energy.

I don't think the rest of the world any longer thinks of China as needing special help, they are rapidly becoming the worlds strongest economy.

"US energy policy is held hostage by the republicans."

Don't think so, it is simply not adressed, everybody being stucked on "solutions"

I'm guessing you mean stuck because a big part of the solution to the oil energy issue at the very least has to be significantly reducing demand...taxes to quickly encourage that are off the table for Democrats and Republicans alike because the economic structure we've built using plentiful cheap oil holds all Americans hostage. But to say the US does not have an energy policy is ludicruous...simply stated our policy is to use as much energy as we can as fast as we can...we've got away with that...so far...

Yes true, also

...we've got away with that...so far...but maybe I need to check with the girls on that "Sandy, Katrina how is our energy policy working?"

Roughly both parties have a preferred policy, but it is blocked by the other. So no real progress can be made. And programs flip flop depending upon who had the upper hand in the last election. So you get damaging boom/bust cycles in many energy industries, for example, wind which had a record year in 2012, but which will build almost nothing in 2013 -all because of battles over the production tax credit. Such cycles are extremely damaging to the industry, as trained personnel can't put their careers/lives on hold waiting for the next swing of the political pendulum. So we have a policy of sorts, but it is unstable, and the very instability has its own effects.

True but what you are talking is about peripheral to our long standing underlying policy. Open land and send people out to produce what they can off it by harvesting as much of the sun's energy and earth's stored nutrients as they can as fast as they can so we can increase our 'fuel' supply so we can grow and use even more fuel. Ship in labor from Africa to accomplish more of the same thing. Later import swarms of people from eastern and southern Europe to pull all the coal out of the earth we could as fast as we could so we could use its stored energy to grow and use more energy while at the same time building a railroad system that let us do all that bigger and faster. On to oil where we got it produced and sold as cheaply as we could manage while putting in as big a road system as we could manage so we could use more of it while grabbing more of every other kind of energy so we could continue to grow.

Yes a bit of an over simplification but not all that much of one. It is what all life strives to do on this planet, gather and use energy to grow until it reaches some environmental limit which stops that growth. We are very capable, self organizing creatures and our new fangled big brain and the knowledge storage systems it has encouraged us to develop have enabled us to grow and consume more energy faster than any other creature this planet has ever seen. No creature on this planet has ever been able to consume millions of years of stored sunlight at such lightening speed until we figured out that trick.

The US has been the poster child for this explosive energy consuming growth. The environment and times in which it has grown are very big if not the main or possibly only reasons why it could grow so. Use all the energy we can as fast as we can so we can grow more and all can live lives of unprecedented luxury and convenience. Isn't that what the democratic ideal of the market economy we seem to strive for is all about? Sure it may not be all its cracked up to be but once in that cycle it is very hard for us to break out of it of our own free will and remember almost everyone in this country has well above minimum food and shelter needed and there has been precious little in the way of starvation cycles going down for a good many generations.

All life on this planet strives to gather and use energy until it reaches some environmental limit which stops its growth. US society has followed that path to the very best of its ability. Optimists think our big brain will recognize environmental constraints to our growth and energy use and circumvent them, doomers say that was never in the cards for us. One thing seems certain, mama earth really doesn't care one way or the other.

All life on this planet strives to gather and use energy until it reaches some environmental limit which stops its growth.

Not at all. Humans stop consuming more when they have enough "stuff". OECD population growth is stopping, and not because of limits. Consumption of goods like cars, and energy in general, is also plateauing in the OECD.

Not that obvious in the US. The desire for second and third homes, extensive travel to vacationlands often towing big oil eating boats and RVs and on and on is always out there and in the roaring nineties and early aughts every piece of capital was being leveraged to get and use more energy intensive recreational stuff. Joe and Jill everyman where buying and flying to energy eating time shares in Cabo, Cancun or at the very least Palm Springs or Florida.

An environmental limit appears to have been reached (call it a housing bubble if you like--a bit small picture for what I am painting). If the money was still there I gravely doubt the growth of energy intensive vacation travel would have abated one jot in this country. My major back in the day was marketing and it had one simple maxim, locate a dollar and develop a product (inventing a new desire if you are really good) that will run that dollar through your hands so you can get your cut--modern finance did wonders to rapidly increase that pot of dollars.

No doubt the dissemination of electronic distractions can and does cut into what might have otherwise been very energy eating pastime growth, there is only so much time in the day. A major source of hope in my opinion

But look at the economic issues caused by the stabilization of OECD population--one big reason the US economy has been able to keep growing albeit at a very anemic rate is because our population is growing and is not projected to stop doing so anytime soon. The OECD population that is not growing has very strict limits that keep it from doing so--limits on immigration. Plenty are born every day that use far less energy than any OECD citizen and who would/will jump at the opportunity to eat at our energy laden table. When you expand out and say Humans stop consuming more when they have enough "stuff" we get into the needing several more earths to support us scenario and I am certain that was not your intent.

Not that obvious in the US.

Well, you have to look at the data, not at isolated annoying examples that go by you on the road.

The fact is that per capita growth in US car sales ended in the 1970s, and per capita growth in miles traveled stopped before the Great Recession.

An environmental limit appears to have been reached (call it a housing bubble if you like

Actually, this was a classic case of overproduction in a saturated market - the bubble ended because there weren't enough buyers. People didn't need or want that many homes.

IOW, a lack of demand for consumption, not a lack of productive capability.

Plenty are born every day that use far less energy than any OECD citizen...we get into the needing several more earths

Sure. But there's plenty of clean energy available - wind, solar, etc. That "several earths" scenario is based on FF.

The fact is that per capita growth in US car sales ended in the 1970s, and per capita growth in miles traveled stopped before the Great Recession.

very handy way to avoid acknowledging the importance of an increasing population to our economic growth in oh so many sectors.

Actually, this was a classic case of overproduction in a saturated market

perfect economic description of the classic condition that occurs in the natural world bringing on population boom bust cycles as they run up against environmental limits--Isle Royale predator/prey studies illustrate this quite nicely

People didn't need or want that many homes.

IOW, a lack of demand for consumption, not a lack of productive capability.

how convenient not to note the importance of the largest sector of US manufacturing to continued economic growth--that sector needed to consume resources and energy to grow, demand be damned. Six years past the bubble pop and no indication of economic growth climbing back to close to where that huge sector of manufacturing held it.

Curious though, how much housing demand/auto demand (increasing the total miles driven) might there still be with unrestricted immigration? Haven't ever seen a study on that one. Tricky assumptions required for that sort of thing though.

As I said above

Optimists think our big brain will recognize environmental constraints to our growth and energy use and circumvent them, doomers say that was never in the cards for us. One thing seems certain, mama earth really doesn't care one way or the other.

None of your points contradict that one iota, they merely put your interpretation of events firmly in line with the optimists, which is no big surprise.

But there's plenty of clean energy available - wind, solar, etc. That "several earths" scenario is based on FF.

yeah but the reality of increasing coal consumption worldwide and especially in the China and India doesn't indicate we are making a very rapid turn in the clean direction.

Global demand for coal is expected to grow to 8.9 billion tons by 2016 from 7.9 billion tons this year, with the bulk of new demand — about 700 million tons — coming from China, according to a Peabody Energy study. China is expected to add 240 gigawatts, the equivalent of adding about 160 new coal-fired plants to the 620 operating now, within four years. During that period, India will add an additional 70 gigawatts through more than 46 plants.

from NY Times November 12, 2012.

Coal piles behind a yurt in Gobi, Mongolia. Coal remains a critical component of the world’s energy supply, despite its bad image

g the importance of an increasing population to our economic growth

Are you talking about overall increasing population? Why is that important?

Are you talking about the demographic balance between young and old? That only seems moderately important to me.

perfect economic description of the classic condition that occurs in the natural world bringing on population boom bust cycles as they run up against environmental limits

No, it's the exactly the reverse: the housing bubble ended not because of environmental limits, but because of lack of demand!

how convenient not acknowledge the importance of the largest sector of US manufacturing

What can I say - it's the truth. People were building houses and condos for buyers who didn't exist. Even now there are a significant number of empty homes. That's a big part of the continuing housing bust - there's no demand for new housing. The volume of new housing starts at the peak of the bubble was 2x the normal level - just look at the numbers!!

These are old ideas - the boom and bust cycle of overproduction.

None of your points contradict that one iota

Only if you don't look at the data. For instance, housing starts, or car production.

Again, you're asking the wrong question: resource consumption isn't actually growing in the OECD. So, the question isn't whether humanity's appetite for growth can continue forever, or even if it can continue for a while - it's already stopped.

So, clearly humanity does not operate based on the Maximum Power Principal, it operates on the Good Enough Power Principal.

the reality of increasing coal consumption worldwide and especially in the China and India doesn't indicate we are making a very rapid turn in the clean direction.

I agree.

Still, if you had a guest who was walking on your nice wood floors with hob nail boots (because it was inconvenient to take them off), would you describe the problem as a limit to the nail absorption sink/resource?

Or vandalism?

Are you talking about overall increasing population? Why is that important?

when would gross car sales have flattened if population growth had been zero in the US since the 70s? Of course overall population growth is important--it increases demand for everything. I never specified that per capita energy use needed to keep increasing.

Are you talking about the demographic balance between young and old? That only seems moderately important to me. Well in the OECD this is very important. Promises were made that can't be kept because of that imbalance...ah but the soylent green could be the answer there.

Yes

Actually, this was a classic case of overproduction in a saturated market

is a

perfect economic description of the classic condition that occurs in the natural world bringing on population boom bust cycles as they run up against environmental limits--Isle Royale predator/prey studies illustrate this quite nicely

Not enough moose for the new generation of wolves to eat the old and young wolves starve and a new equilibrium is reached. Not enough building buyers for the building builders to 'eat' and the building builders starve and a new equilibrium is reached. Classic preditor prey relationship, but for some reason an especially strong signal was sent for the building builders to increase and multiply this last cycle. Why????

Lots of possible reasons but maybe an economy that had always grown itself by using more and more stuff to make more and more stuff found it easiest to superheat the largest stuff making sector left to attain the growth level it felt it needed to stay healthy. But why??? well maybe

resource consumption isn't actually growing in the OECD. So, the question isn't whether humanity's appetite for growth can continue forever, or even if it can continue for a while - it's already stopped.

now I've a funny feeling we aren't really quite at that level yet as we buy lots of stuff made in Asia and resources and energy are getting consumed at an increasing rate there. One thing does seem obvious, our economies aren't made to function without growth and the demographic shift in the OECD puts an increasing drag on their growth potential...funny the building builders should have been aware of the negative impact this shift would have on them even before they amped up in their last cycle...hmmm...big brains can get sucked into the narrow feed me now focus...maybe???

So, clearly humanity does not operate based on the Maximum Power Principal, it operates on the Good Enough Power Principal.

Well that is what all stable populations end up functioning with in a zero sum game isn't it. We've already wiped out a whole lot of species as we occupied more and more of the landscape getting to the level we've reached thus far and the biggest part of us still have not approached the level of what you are calling the energy sated OECD--

Which brings us to

Still, if you had a guest who was walking on your nice wood floors with hob nail boots (because it was inconvenient to take them off), would you describe the problem as a limit to the nail absorption sink/resource?

What pray tell does that have to do with the price of coal in China? Inconvenient does not at all describe what giving up coal would be to India and China with their huge hand to mouth populations that are trying to reach the next steps on the ladder. And Asians are guests in our OECD house and are scratching it up? The gall, we just spent a couple centuries ripping the crap out of everything we could to get our fancy big house built, how dare they come in and tear it up? Tipped your hand a bit on that one.

Luke,

Why the angry tone? I think we're on the same side here. Remember, excessive pessimism just paralyzes people. I'm not suggesting complacency - I'm suggesting an aggressive move away from FF & oil. And, again, if we suggest that everything is just going to crash whatever we do, and people are just so greedy and stupid that nothing can be done, why do anything?

Ok, on to details:

when would gross car sales have flattened if population growth had been zero in the US since the 70s?

Actually, it doesn't matter: gross car sales have been dropping since the 70s, even if you don't adjust for population.

Promises were made that can't be kept because of that imbalance

The flattening demographic structure makes a difference, but the biggest change is a good one - people are living much longer.

Not enough moose for the new generation of wolves to eat the old and young wolves starve and a new equilibrium is reached....Classic preditor prey relationship

That's an interesting analogy, but I don't think it works. Homeowners and developers both were speculating on rising home prices, and both did well as well as prices went up. Both suffered when they fell.

for some reason an especially strong signal was sent for the building builders to increase and multiply this last cycle. Why????

Investors in general, and FF/oil company owners in particular, are trying to strangle government - that reduces its ability to use fiscal policy for stimulus when a bubble bursts. That left the Fed's interest rate setting powers, which tend to create inbalances in the economy, by stimulating rate-sensitive sectors like housing.

At the same time, banks managed to eliminate Depression-era regulations that would have greatly reduced the bubble.

A perfect storm.

we buy lots of stuff made in Asia

OECD total consumption of stuff has still plateaued. That's consumption, not production.

our economies aren't made to function without growth

Well, people still want their lives to be better. That doesn't mean they want more stuff - at the moment, OECD consumers want more services, for the most part. Healthcare, entertainment, art & music, education, etc.

all stable populations end up functioning with in a zero sum game

No, not at all. OECD consumers have stopped buying more stuff, even when they could buy rather more if they wanted to. That's very different.

We've already wiped out a whole lot of species

That's true, and it's not good.

the biggest part of us still have not approached the level of what you are calling the energy sated OECD

That's true. We can only try to steer them onto a less destructive path.

What pray tell does that have to do with the price of coal in China?

We're talking about limits to growth, and the lack thereof. CO2 pollution is not a necessary partner in growth.

Inconvenient does not at all describe what giving up coal would be to India and China

Actually, it does. Wind and solar would work just fine for them.

Asians are guests in our OECD house and are scratching it up?

It's a metaphor. Think of the house as belonging to Mother Nature.

I'm not going to going to go through your point by point again as this has all veered vary far away from my initial line.

But to say the US does not have an energy policy is ludicrous...simply stated our policy is to use as much energy as we can as fast as we can...

if you don't like that line of reasoning fine...it is an oversimplification and requires a fair piece of abstract thinking but it does describe our de facto energy policy during our phenomenal build out well enough...Everything else has been quibbling around the edges...We appear to have entered a new phase, and so far our economy has found coping with it quite a struggle.

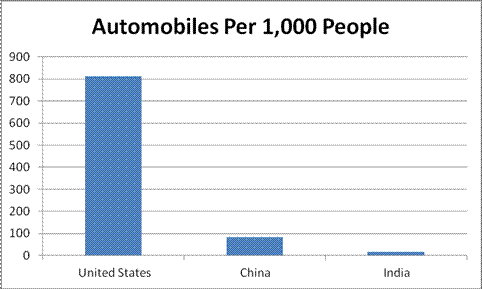

As to US autos, saturation per capita is apparent but not in the 1970s (focusing on sales was not where I meant to be as it is of lesser importance when vehicles are lasting longer) and this vehicle per capita density increases significantly when the light truck sector is added in (this also moves the gross sales peak ahead from the 70s I believe). As I said above per capita does not tell the whole story when population growth is significant. Charts below (except for angel's doomer scenario) fromEnergy and Transportation Data Book edition 31 [7.8 MB PDF].

I don't believe we are headed here (an extremely counterproductive viewpoint in my opinion)

but neither do I think wishing and blaming conspirators will get us away from this reality

Some don't connect this simple spacial illustration with the enormity of what is seen when flying into a major airport as well as others. That can't be helped but wishing hard isn't going to make that tiny little renewable column surpass the combined height of those other monsters anytime soon, and the coal column looks like it may be especially resilient in the near term. For me it helps to see the size of the mountain we have to climb, others might do best just focusing on one ridge at a time.

our policy is to use as much energy as we can as fast as we can.

I'd say that's misleading. Better would be to say that for a long time we weren't worried about limiting our energy use at all.

Energy was secondary - an enabler. HVAC, personal mobility, agricultural and manufacturing productivity, those were the goals.

We appear to have entered a new phase, and so far our economy has found coping with it quite a struggle.

Again, that's misleading. The US has expanded it's GDP by 2.5x since 1979, and it's manufacturing by 1.5x, but is using less oil.

The recent Recession was caused primarily by other things, though oil certainly was a factor in various ways.

As to US autos, saturation per capita is apparent but not in the 1970s (focusing on sales was not where I meant to be as it is of lesser importance when vehicles are lasting longer)

Sales and VMT, both of which saturated during times of economic expansion (i.e., before the Recession), are far more important. We have more vehicles now, but as you note, this is in large part due to greater longevity. Well, the older cars generally get very little use.

neither do I think wishing and blaming conspirators will get us away from this reality

Focusing on the opposition of the oil & FF industries isn't "blaming conspirators", it's just the reality. Heck, much of human history is the conflict between new and old economic sectors: the Civil War, the War of the Roses, etc, etc.

wishing hard isn't going to make that tiny little renewable column surpass the combined height of those other monsters anytime soon

I suspect the chart is misleading - electricity is 3x as valuable as primary energy, and it's misleading to compare electric renewables to all primary energy even with a conversion factor.

In any case, 30 years ago who would have looked at the tiny cell phone market, and thought that land lines would be close to obsolete? How many of your 20 year old friends have land lines?

The US could get rid of it's coal in 20 years pretty easily. China is harder, and unfortunately it appears from this document that their energy planning isn't nearly as realistic or creative as it should be.

I suspect the chart is misleading - electricity is 3x as valuable as primary energy, and it's misleading to compare electric renewables to all primary energy even with a conversion factor.

Your being suspicious something may be misleading is truly the pot calling the kettle black ?-)

Lets at least see a few charts illustrating your objections here (warning: pulling them from PDF files may take a bit more posting effort than you are accustomed to). I'm a visual person who likes seeing spatial representations but I'm not going to chase through a list of links on my slow connection.

In any case, 30 years ago who would have looked at the tiny cell phone market, and thought that land lines would be close to obsolete? How many of your 20 year old friends have land lines?

Come on now! Your not even talking pork chop to watermelons when you try and compare the switch away from low voltage landlines to the entire energy sector switching away from fossil fuels. And that relatively light weight switch which has taken 30 years still has plenty of landlines doing a lot of heavy lifting around the globe. It did however hookup a whole lot more people to phones in a great big hurry. You are starting to see a little of the same thing with remote regions using renewables. Distant communities are getting hooked up to power, but that doesn't reduce the grid load that was already in place elsewhere.

one more chart to address this

Sales and VMT, both of which saturated during times of economic expansion (i.e., before the Recession), are far more important. We have more vehicles now, but as you note, this is in large part due to greater longevity. Well, the older cars generally get very little use

Look at the big impact the US shift to light trucks for personal transport had--hard to imagine anything we could have done more quickly that would have made our traveling from here to there a more energy intensive endeavor.

I'd say that's misleading. Better would be to say that for a long time we weren't worried about limiting our energy use at all.

I'd say water it down like that and you've lost all the hitting power and hitting power is what we need in this national discussion now!!! So one more time with a slight though useful modification

our policy has been to use as much energy as we can as fast as we can

Lets at least see a few charts illustrating your objections here

Here are some calculations from several years ago. Since then, of course, coal has dropped from more than 51% of electrical generation to what, 42%?

We could build enough wind capacity to replace coal for very cheap $400 billion.

Coal supplies half our electricity - can we really do that?

Sure. Here's how I came up with that number:

The US generates about 50% of our electricity from coal, which amounts to an average of 220 gigawatts. Wind, on average, produces power at 30% of it's nameplate rating, so we'd need about 733GW of wind. Wind costs about $2/W, so that would cost about $1,466 billion. Transmission might raise that about 10%, to about $1,613 billion.

Now, roughly 50% of coal plants need to be replaced in the next 20 years, so about 50% of the $1.6T coal replacement investment is needed anyway; new coal plants are just as expensive per KWH as wind, so that half, or $800B of the investment can be eliminated from our considerations.

Coal plants cost about $.035/KWH to fuel and operate, which is about 50% of the cost of wind. That's an expense that we'll have either way, so we can eliminate 50% of the remainder, which is about $400B: all told, we can discount the wind investment by 75%!

Wind's intermittency is often raised as another source of cost: I address that here.

--------

So, that gives us a cost of roughly $400B, or $40B per year for 10 years. That's about 5% of US manufacturing (less than the currently idle manufacturing capacity!), and .3% of GDP.

A bargain.

Here are some calculations from several years ago. Since then, of course, coal has dropped from more than 51% of electrical generation to what, 42%?

Of course wind hasn't been responsible for all that much of that drop as a matter of fact gas is so cheap that one nuclear plant, at Kewaunee, WI, which s licensed to 2033, is shutting down this spring (there could be others, I just happen to know about this one, I remember driving by the construction project for years). Interesting pre election spin from Gov. Walker gives in this linked article by the way. Wind could actually force the plant to stay open if shutting it is deemed to pose a grid reliability issue. Natural gas supply is the driver of all the above and last I heard natural gas is a fossil fuel.

Wish, wish, wish away...real world shows we aren't moving to wind at near the rate you suggest we could, that means easy means something entirely different to the sharp pencils that make the decisions than it does to TOD blogger Nick. And if you had read the twice linked in these threads NY Times article you would have noticed this line

“If you poke your head outside of the U.S., coal-fired plants are being built left and right,” said William L. Burns, an energy analyst with Johnson Rice in New Orleans. “Coal is still the cheapest fuel source.”<.i>

The chart I posted was 'world primary energy' and the coal column looks to be poised for a 'healthy' growth spurt. Of course we know all about the cost of externalities, they are the costs that are always born by the other or the next guy. That standard operating procedure doesn't get wished away either.

Global demand for coal is expected to grow to 8.9 billion tons by 2016 from 7.9 billion tons this year, with the bulk of new demand — about 700 million tons — coming from China, according to a Peabody Energy study. China is expected to add 240 gigawatts, the equivalent of adding about 160 new coal-fired plants to the 620 operating now, within four years. During that period, India will add an additional 70 gigawatts through more than 46 plants

For some reason wind isn't growing in either country at near that pace. What is easy must have something to do with that.

Of course there's a difference between what TPTB are doing, and what they could and should be doing.

Why would we on TOD put much effort into any of this stuff, if that weren't the case??

-------------------------------------------------

There is a basic paradigm that's useful here: "viability" vs "competitiveness". In most industries a very small cost difference can make you uncompetitive. That means that slightly higher cost solutions will be avoided, which can give the impression that those solutions are higher cost than they are. OTOH, if changes in the business environment (or natural environment!) change the costs of alternatives for everyone, suddenly alternatives can become acceptable in that industry.

There is an analogy in sports: "winner takes all". Tiger Woods and Pete Sampras get all of the publicity and a lion's share of the prize money. The 200th best player in either sport gets no publicity or prize money. On the other hand, the 200th best player will mop the field/court with you or me just as fast as would Tiger or Pete.

So, for instance, recycled materials are in general slightly more expensive than virgin materials, plastic included. But, if oil becomes more expensive then recycled materials could suddenly become the standard. If something could be recycled with only 10% loss at each generation, that would reduce the consumption of virgin materials by 90%, with only a very small additional cost for the industry.

As another example, high sulfur Illinois Basin coal costs perhaps 2 cents per kWh to scrub. That's an enormous margin to power plant consumers, who are willing to pay for long-distance transport of lower-quality Powder-River coal. The net difference in cost might be only half of one penny per kWh, which is still an enormous margin to power plant consumers. On the other hand, let's assume power prices rise by one half penny around the globe (to eliminate questions of regional competition) - how much difference would it make to consumers to add a half penny per kWh? Sure, they'd notice it, but would the difference cause any factories to close their doors, or homeowners to not be able to pay their mortgages? No.

No argument on any of that, though I was hoping a detailed analysis showing the proper weighting of renewables in the primary energy use scheme--that must exist or no good comparisons can be made--would be forthcoming ?-) The tininess of of the difference between profitable/not happening does not make the decisions needed any easier for those who have to stick their necks out and make them. The way our system works those decisions can be career ending, especially for a politician who backs one scheme or another--which is where the 'Koch Brothers' boogie man plays so well.

But that boogie man thing looks to be a red herring to me. I think the source of the problem is much deeper than that. Maybe part of it goes back to when we started giving every kid in the classroom an award for something other which often took little or no effort/commitment from them. The mindset that brought that practice on undermined the idea that real achievement is tough (and made stressing that idea politically incorrect)...I thought it was achievement because difficult obstacles had to be overcome...One thing certain, what we have do to change our energy use paradigm requires hard work and real commitment.

detailed analysis showing the proper weighting of renewables in the primary energy use scheme

Well, the analysis for the US a couple of comments up is a start towards that.

Yes, I'd love to see a good analysis of China's situation: the location of the Chinese wind resource, it's recent history vs coal, current costs for wind & coal in China, etc. One factor: Chinese coal generation is still much cheaper than US generation because Chinese coal plants don't have basic controls for particulates, sulfur, mercury, etc. The health costs for local Chinese citizens are enormous, and I think public pressure to reduce this pollution won't be denied forever.

that boogie man thing looks to be a red herring to me.

Look at other countries that don't have domestic oil/FF industries - they're much more successful at dealing with these problems.

Where are cigarette taxes lowest? Virginia, etc. Where are gas taxes lowest? Texas, Louisiana, etc.

Now, is this just because of wealthy FF investors like the Kochs? No, they lead the way, but industry employees (and friends & family) are a big factor as well. It's the whole industry that resists change.

what we have do to change our energy use paradigm requires hard work and real commitment.

Yes, and the US has done that before many times, and it can do it again - the national character hasn't changed. OTOH, getting rid of oil and FF is very far from TEOTWAWKI, and we need to say that very loudly and clearly - the idea that we need oil, gas & coal to prevent economic disaster is just FF industry FUD.

Look at other countries that don't have domestic oil/FF industries - they're much more successful at dealing with these problems

In major economies that would be Japan, seems their energy situation had quite a shake up lately and central to the issues following it was the electric company that was heavily dependent on nuke and which is inextricably entwined with the govt. Don't see a good model for success there.

A person could call France a major economy I guess but then you might have to start including analysis of individual US states (starting with CA) so we won't drop that low down the GDP list.

I guess that leaves Germany, the country that just decided to dump its nukes in favor or burning more coal and a country which has done all it could to protect what is left of its domestic coal industry. True they see the writing on the wall, but that hasn't stopped them from increasing their coal imports. As long as it comes in cheap enough they will burn it, and it will be cheap enough as long as US natural gas frees up more of it for export.

Sorry I just can't find any countries without FF industries for which any comparison to the US would be valid. Whether you like it our not our abundant fossil fuels are a major contributor that has allowed us to attain our $15 trillion GDP. You just don't unplug from them and say all will be well. We've come full circle, you've written a few short sentences which you expect to pass for analysis and proof we can easily move away from fossil fuel while in the real world I see we are even dumping long paid for nuke in favor of power from plentiful natural gas--a fossil fuel.

You have not at all addressed how any huge movement is made toward renewables when natural gas is cheap and gas turbines go in quick and cheap about anywhere on the grid you want to put them, virtually no new transmission required. Yes that won't last forever and if that supply surplus goes south too fast the jones will be humongous.

We are the biggest stored sunlight addict the world has ever grown so no we have not ever before managed any energy use paradigm shift even close to the magnitude of this. We are going on a century and a half of addiction and putting more straws to the glass faster than we ever have before...damn straws are thinner and keep breaking down faster...hurry up more straws

In major economies that would be Japan, seems their energy situation had quite a shake up lately

Well, I guess I was really thinking of the transition away from oil primarily and other FFs secondarily. Japan and most of Europe (Germany, France, etc) have done pretty well reducing oil consumption lately, and petrol prices are properly high (at least for personal transportation).

electric company that was heavily dependent on nuke and which is inextricably entwined with the govt.

I agree - Japanese planning was terrible. They knew they had serious safety issues, and they did nothing.

That's certainly a case of inadequate democracy and transparency.

Germany, the country that just decided to dump its nukes in favor or burning more coal

Partly. Partly they're exporting less power, and building more wind & PV. Keep in mind the European Greens got their start in the anti-war movement (especially against American nukes in Europe), so the connection between nuclear power and weapons is a big component of these things.

I'm not saying that it made sense to dump nuclear, just that it's complex.

a country which has done all it could to protect what is left of its domestic coal industry.

I have the impression that's slightly too strong. OTOH, it would be another example of a legacy industry protecting itself.

Whether you like it our not our abundant fossil fuels are a major contributor that has allowed us to attain our $15 trillion GDP.

I'd agree about the history. The future is another question.

proof we can easily move away from fossil fuel

There's economic/physical analysis, and then there's political analysis. The economic/physical analysis is reasonably straightforward: wind is affordable, scalable, high EROEI, etc, etc. So are HEVs, EREVs and PHEVs.

How quickly we actually move to them is mostly a political question, and that's much harder.

More later...

Sorry economic/physical analysis has to address the natural gas issue in the US. Price determines affordable (externalities are not addressed by price without govt intervention) and it will take major political action to adjust price of fossil fuels, especially natural gas, away from affordable (assuming coal/gas supplies at projected prices don't nosedive). This will be even more true after the incredible wind solar buildup that brings their share of produced power to 30% of the US total--and that right now natural gas is significantly slowing progress toward that.

I don't see how there is any such thing as a straightforward economic/physical analysis that does not include the economic reality of govt. policy/action. Remember even at its theoretical limits Milton's free market assumes govt. protection of private property. Economic analysis has a political element baked right in.

Well speaking of Milton, I think I dig out a copy of his finest work. Paradise Lost may well be the most incredible piece of writing in the English language. Oh that's a different Milton ?-)

economic/physical analysis has to address the natural gas issue in the US.

Sure. NG has relatively low CO2 emissions, and very low "criteria" emissions (mercury, etc) - I think that adding a carbon tax probably wouldn't make much difference with current NG price levels. You have to look deeper to quantify "risk management" issues like long-term planning for energy supply diversity and conservation of limited NG supplies. Or, you can just build a vast quantity of NG plants and hope for the best. That's our usual plan....

I don't see how there is any such thing as a straightforward economic/physical analysis that does not include the economic reality of govt. policy/action.

Sure. Still, it's possible to overthink this. For instance, I think we can assume basic police protection of private property as a baseline for all of our economic scenarios.

OTOH, it's possible to quantify the costs of the various external costs and clarify which strategies are really low-cost and which only maximize "rent" for various players.

Sure. Still, it's possible to overthink this.

No doubt, but I do think it is necessary to remind people who worship at the alter of the ideal free market that the dance between govt. and the marketplace is assumed at the outset. We just keep quibling about the how many and what steps need to be made by whom. Once in a while someone should say that out loud--I really wasn't aiming that at you...though by this point you and I may be the entire audience for this thread ?-)

Yeah, and yeah.

;)

I too sensed an underlying victim-hood, which doesn't surprise me as a "tactical" position.

Their comments on the US becoming less of and energy importer and the Chinese importing more coal. They can use their large account surpluses to get rid of US dollars buying foreign energy and keep theirs for latter... with the diversionary boohoo, sniff, sniff. I bet it really breaks their hearts the price of coal drops.

And yes we want OECD countries to share with us because we are behind the curve and deserve special breaks, but we don't want to join and share with you. I know people like this, believe nothing you hear, don't fall for the victim con, avoid them if you can, keep any and all interactions brief and too the point. Treat them like they treat you, ask for information but give none.

I disagree with the paranoia part. When dealing with a predator keep your focus and never forget what it is all about.

Thanks, Rembrandt. Interesting to see the view from the big dog on the other side of the Pacific.

Do you have a better link the USGS report Senator Inhofe (Rep. OK) is refering to here

"Well, there goes President Obama's favorite talking point. The President's own administration released a report which reveals that the United States has 26 percent of the world's technically recoverable conventional oil resources, and that's not including our enormous oil shale, tight oil, and heavy oil resources."

and Senator Murkowski (Rep. AK) is refering to here?

"According to the new USGS global estimates, it appears that we have much more of the world's oil supply than the 2 percent claim the president has repeatedly used. Furthermore, it seems that some of the countries that we've been relying on to provide spare capacity to the global market have less oil than previously thought."

I'm guessing she is refering to KSA spare capacity. Lisa is about as moderate a Republican as we get these days so I'm not surprised the tone in her quote is the more subdued and forward looking of the two. Both senators are from oil producing states whose production has fallen dramatically since their best pumping days.

@Luke,

No idea this is the link directly cited in the executive summary, don't have time to follow the trail but I assume it refers to some of the recent new USGS work on EOR and discoveries/resources etc. Like this one:

http://www.usgs.gov/newsroom/article.asp?ID=3248#.UKPV04cj4uB

Luke - "According to the new USGS global estimates, it appears that we have much more of the world's oil supply than the 2 percent claim the president has repeatedly used" An easy fact check there. The US has been one of the major oil producing countries (and the largest NG producer of and on) for many decades. While arguing over how much the US is/will be producing they always seem to ingore that elephant in the corner: the US is #1 in a far more important category: oil consumption, which is 18.8 million barrels per day, according to the EIA. That usage puts the U.S. atop the list of the world's largest oil consumers by a wide margin. Indeed, U.S. demand is more than that of the next four nations combined: Japan, Russia and rising economic powers China and India.

That is a very sobering statement and it glaringly underscores the fact that a mere 300 million USians consume more oil on a daily basis than the roughly 3 billion people living in those other countries. And the USians are adamant about their non negotiable lifestyles.

I have read that these same mere 300 million USians consume as much prescription drugs as the rest of the world combined.

Just trying to be consistent with our military spending.

While that link says that the US accounts for 'only' 42% of global military expenditures (remember, 4.5% of pop.) other sources that include such things as DOE weapons programs and VA expenditures indicate that the US spends fully half of the global total for 'defense' in all its aspects.

All that weaponry requires all kinds of energy and all kinds of insanity, so little wonder we also consume so much oil and pharmaceuticals...

FMagyar,

And what would US consumption be like if we factor in the energy used by the others to manufacture stuff for us to buy.

That is the elephant hiding in the corner of the room that nobody wants to talk about. If the US cut its per-capita consumption of fuel to European levels, it would be within easy striking distance of oil self-sufficiency, because it is the third largest oil producer on Earth. However, that assumes Americans adopt a European lifestyle. If the US tried to achieve energy self-sufficiency by increasing production, it would become by far the largest oil producer, with nearly double the production of Russia or Saudi Arabia.

I think the people who predicted it arrived at the prediction by going through the process in reverse - starting with the goal (American oil self-sufficiency), then determining the method (Increasing oil production), and then arriving at what must be true if the assumed goal is to be achieved by the assumed method (the US must have 26% of the world's oil, or it can't possibly happen).

Knowing the geology of the respective countries, I don't think there's a snowball's hope in the Arabian desert of it happening. The oil just ain't there in the US. If it was, Rockman would have found it by now.

If the US cut its per-capita consumption of fuel to European levels, it would be within easy striking distance of oil self-sufficiency, because it is the third largest oil producer on Earth.

Absolutely!!

However, that assumes Americans adopt a European lifestyle.

Not at all. 50% of US oil consumption is personal travel, and 10% is trucking. Move personal vehicles to vehicles like the plug-in Prius and cut overall consumption by 30%. Move half of trucked freight to rail, get another 5%, for a total of 35%.

That's within easy striking distance of eliminating imports.

After nine days now with a plug-in-Prius, I'm estimating that the way I use it I will average 75-80mpg. Thats maybe 30% compared to the standard Prius, but compared to the average vehicle on the road today its probably less than a third of the fuel consumption. And this is probably just the beginning of this slow motion revolution. Of course car pooling, transit oriented development etc. can have an ever greater effect, and frankly the experience is more like BAU or BAU-lite. We could do it, but it requires making it a priority.

By adopting a European lifestyle, I mean driving less and taking transit more, driving smaller vehicles, and living in smaller houses in denser cities. Americans can attempt to maintain their current lifestyle using electric vehicles and living in large houses in vast sprawling suburbs, but I don't think they can all afford to do so. The US does not have infinite amounts of money (although the government seems to think so) and the European lifestyle is much cheaper, not to mention healthier.

By adopting a European lifestyle, I mean driving less and taking transit more, driving smaller vehicles, and living in smaller houses in denser cities.

That's far, far more expensive, less convenient and slower to implement than just buying vehicles that use less fuel.

The plug-in Prius costs less than the average new US light vehicle. Two people in a Prius use less fuel than the average bus passenger, and get there much faster.

Moving to an urban house would increase per square foot costs by 2-4x, so even much smaller houses would cost much more. Further, building those new houses would take many decades in a period when we're overbuilt.

A Prius C costs costs about 60% as much as the average new light vehicle, and uses 40% as much fuel. If everyone just moved to a Prius C that would get the US most of the way!

That's far, far more expensive, less convenient and slower to implement than just buying vehicles that use less fuel.

Ok, let's see. Cost of me drawing the shades when its sunny so I don't need to run my AC, turning off lights and unplugging appliances when I don't need them, riding my bike to the supermarket and NOT buying a new car (mine is a compact stick shift paid for, with over 250,000 miles on it and gets over 30 mpg, runs fine) $0.00 times millions of people doing the same thing...still $0.00!

Cost of new Prius (not counting external ecosystem and embedded energy costs)MSRP $30,000.00 x millions...

You're kidding right?! Either that or you own a Prius dealership and are heavily invested in Toyota stock.

This conversation was about driving less and taking transit more, driving smaller vehicles, and living in smaller houses in denser cities. I think that Rocky was primarily talking about commuting.

Oddly enough, except for the distraction of the Prius, you and I are agreeing (though your emphasis is slightly different): a mix of conservation (doing without cars and A/C) and efficiency (turning things off when not needed).

We agree, conservation is a good thing. And, I think we agree that efficiency is the very first thing to do.

So, why move to a more expensive, smaller urban house when you could reduce things for free as you did, or spend much less money on more efficient cars and windows?

---------------------------------

Regarding the Prius distraction: I agree, there are other cars that could be better. For instance, I think the Chevy Volt has a lot going for it.

But, the Prius is old and tested. It's clearly cheap to buy and run, and there are used ones out there for those who don't want to buy new.

No doubt about the elephant, ROCK. The sprawl we have built with decade upon decade of cheap oil is a wonder to behold...in many more ways than one. It has been fun surfing that wave...up to now anyhow. It is sobering to realize we use more oil than Japan, Russia, China and India combined.

The fact checking might not be all that easy on the 2% though, it appears all kinds of mixed and matched terms are getting thrown around in those couple linked quotes--not sure what context Obama used 2% in either, as I've rarely seen him do much more than mention oil in passing. He doesn't get much air time in these parts.

For whatever it is worth recent USGS reports entail a different methodology than in the past.

Unlike past estimates of reserve growth that relied entirely on statistical extrapolations of growth trends, this assessment is based in part on detailed analysis of geology and engineering practices used in the assessed producing accumulations. The assessment used published

and commercial, proprietary sources of geologic information and field production data.

and did they report both numbers, based on the former method and the new method? If not, and they are any kind of scientists, they were told what to report.

List of countries by proven oil reserves (Mbbl)

13th United States 20,682 (less than 2%)

Total World (2011)[1] 1,481,526

http://en.wikipedia.org/wiki/List_of_countries_by_proven_oil_reserves

http://www.opec.org/library/Annual%20Statistical%20Bulletin/interactive/...

Before comments, I realize that these may not be accepted as definitive sources on here. Just thought I would add some posted numbers to the discussion.

Looks like USA in 2011 consumed less than the next four nations combined.

From the EIA total petroleum consumption data, as cited in http://en.wikipedia.org/wiki/Petroleum#Consumption_statistics :

USA .. 18,835.5

China..9,790.0

Japan..4,464.1

India..3,292.2

Russia.3,145.1

Sum ..20,691.4

Greetings, Wolfgang

Sounds like they have taken the shaleoil propaganda at face value.

well after much searching I found

Assessment of Potential Additions to Conventional Oil and Gas Resources in Discovered Fields of the United States from Reserve Growth, 2012 [1.34 MB PDF]

The U.S. Geological Survey estimated volumes of technically recoverable, conventional petroleum resources that have the potential to be added to reserves from reserve growth in 70 discovered oil and gas accumulations of the United States, excluding Federal offshore areas. The mean estimated volumes are 32 billion barrels of crude oil, 291 trillion cubic feet of natural gas, and 10 billion barrels of natural gas liquids.

No mention in it of the US having the 26% share of the world's technically recoverable oil that Inhofe mentions. I'm not sure who came up with that number or how they calculated it.

Inhofe is a big fan of science, as long as he gets to pick and choose.

The 26% share of world's technically recoverable oil may, at a guess, include

our long promised trillion barrels of Colorado/Utah oil shale, the kerogen rocks.

It's been ten years away for a century, receding like a mirage on a desert highway, but

any day now, bet your biscuits.

There's a small flurry of real-world developments on oil shale. Perhaps I should do a short

post on the subject. The Estonians hope to spend $1B to build retorts in eastern Utah that would

produce 25k b/d by 2020.

This could be an important point.

[minor edit]Does 'kerogen rocks' really account for the "26% share"?

If it does, then the bandying around of such a number does seem unreal.

Similarly, if the number is really about kerogen, then we should infer the previous figure of "2%" is the realistic one.

The report from China clearly wants to differentiate China from OECD, and particularly from the US model. And maybe they still want to represent the US as the ongoing 'Powerful One'?