Update on Coal

Posted by Luis de Sousa on November 8, 2012 - 5:39am

This a guest post by Jean Laherrère, retired geologist from TOTAL and key founding member of ASPO; in recent years he has been a prolific contributor to this website. In this post Jean updates his model of future world Coal extraction and puts it in perspective within his fossil fuel model.

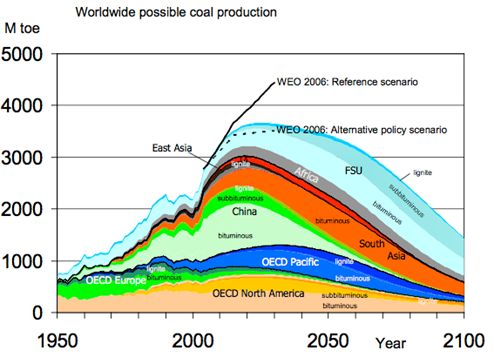

In 2007 the world coal production was modeled with an ultimate of 600 Gtoe and the peak was forecast at 4.2 Gtoe around 2050.

Also, in 2007 the Energy Watch Group (EWG - Zittel LBST) in its report “Coal: resources and future production” was modelling world coal production with a peak around 2030 at 3.6 Gtoe, well below the IEA/WEO 2006 forecast which was at 4.5 Gtoe.

China was forecast peaking in the 2010s and close to exhaustion in 2070. The US coal production was forecast peaking in 2080.

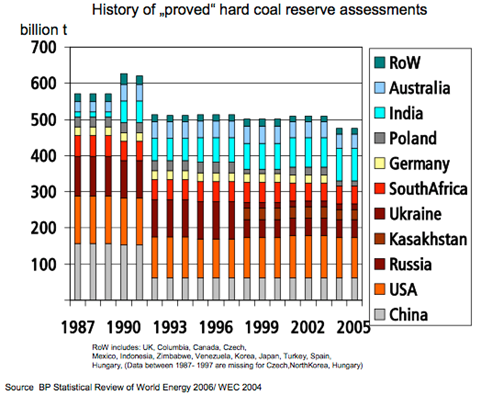

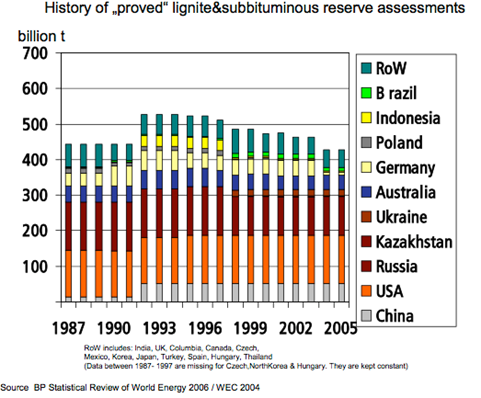

The EWG study was based on the BP 2006/WEC 2004 estimates of about 500 Gt for hard coal and around the same for lignite & sub-bituminous coal, for a total of 1000 Gt, or 500 Gtoe, meaning an ultimate of 650 Gtoe.

In 2010 I increased the ultimate for my model up to 750 Gtoe, to take care of the strong increase in production since 2000, mainly due to China. The peak was then still in 2050 but at 5.5 Gtoe. The cumulative production was 156 Gtoe at the time and the remaining reserves estimated at 505 Gtoe by the BGR, 405 Gtoe by WEC (copied by BP). The EWG was far below these estimates. The Uppsala group model (Hook et al. 2010) was based on an ultimate of 530 Gtoe.

Figure 6: world coal production for U= 600 & 750 Gtoe with IEO 2011, WEO 2010, EWG 2007, Rutledge 2010 & Hook 2010 forecasts

In 2010 David Rutledge (Caltech) published a report accompanied by a spreadsheet available with all the data available on the Internet: "Background material for Estimating Long-Term World Coal Production with Logit and Probit Transforms" International Journal of Coal Geology. His model was for an ultimate of 675 Gt or about 350 Gtoe.

Rutledge models China with an ultimate of 140 Gt (about 70 Gtoe).

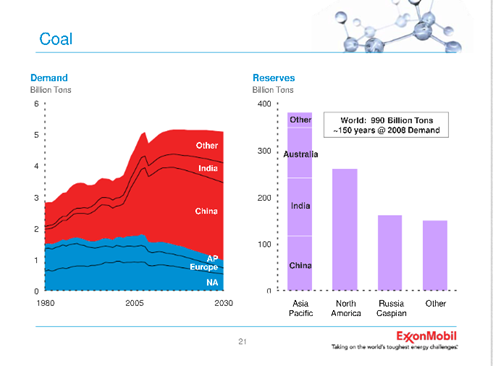

The forecast by Exxon-Mobil in their “Outlook for energy” has varied with time for the last three years. At the US EIA and John Hopkins University 2010 Energy Conference, Tom Eizembe, from Exxon-Mobil's Corporate Strategic Planning delivered a presentation entitled “The Outlook for Energy a view to 2030” where the company's cols reserves estimate was put at 990 Gt.

In 2011, the Exxon-Mobil forecast was flat from 2010 to 2030, but at a higher level of 5.5 Gt

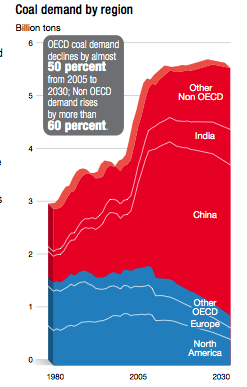

In 2012 Exxon-Mobil in its outlook to 2040 forecasts coal demand in 2040 to be less than in 2010, with a peak in 2025 at 3.7 Gtoe. This is significantly lower than my model at 4.6 Gtoe. The EIA/IEO 2012 is not yet published but the 2011 edition forecasts for 2035 a production of 5.3 Gtoe, higher than my plateau at 4.6 Gtoe.

My new update in 2012 on coal production is based on an ultimate of 750 Gtoe, modelled with 5 cycles and here compared to Exxon-Mobil 2012, IEA/WEO 2012 and EIA/IEO 2011. The forecasts by Exxon-Mobil and the IEA are already too low compared to the 2011 value, only the EIA seems in line with my forecast.

Figure 11: world coal production modeled with 5 cycles for an ultimate of 750 Gtoe with forecasts from Exxon-Mobil, IEA & EIA

The remaining world coal reserves vary between sources (WEC, BP recopying WEC, BGR) and with time. Following the price is displayed and apparently it does not play any impact on reserves estimates.

The big problem is to distinguish between reserves, which are expected to be produced economically with the known technology and resources, in essence the volume without any constraints. Presently, coal seams less than 50 cm thick, deeper than 1500 m or offshore are not considered as reserves. This is why for the world the volume of resources is more than 20 times the volume of reserves. The constraints are mainly energetic: energy return over energy invested.

A big breakthrough could be “in situ gasification” (underground coal gasification = UCG), but many attempts in the last century (first patents in 1910) and in the new century were not successful. In 2007 the WEC estimated UGC potential at 600 Gt.

The spike in WEC estimates in 1989 is sometimes called the Chinese spike. It seems to be a mistake or is it a temporary change in definition?

The BGR displayed an increase of China coal reserves and resources since 2004, broken down into hard coal and lignite (called before brown coal).

China is importing coal from Mongolia and the BGR estimates Mongolia coal reserves at 2.5 Gt, with resources at 160 Gt.

The data on China coal production and consumption varies with source. After 1999 there's been an effort to control the wild local mines (where casualties were recurrent) but even so, the increase since 2001 is spectacularly close to 10%/a.

But the most interesting is the evolution of imports and exports using EIA data. Export have been declining since 2003 and imports are drastically increasing since 2008, because consumption diverges from internal production.

Most of data are in tonnes (Mt) but the heat content of coal is variable, it is better to use tonne oil equivalent (toe).

But the story looks completely different using BP data being production less consumption in Mtoe.

The difference from 1980 was around zero for the data found in BP 2009 (in red) but increasing up to 120 Mtoe in 2010 in BP 2012 (in black), when the data from the EIA (in green) is -75 Mtoe. These drastic changes by BP are suspicious and indicate unreliable data.

In 2010 for BP China is a net exporter of 120 Mtoe when for EIA China is a net importer by 75 Mtoe: quite a difference. By looking at the BGR data for China, it seems the numbers reported by BP are wrong.

The comparison of the EIA data for the difference between production and consumption, and the difference between export and import shows that these two values are not exactly equal, when in principle one would expect them to be.

As the EIA reports the production and consumption data both in short ton (1 short ton = 0.907 t) and in toe, it is easy to plot the ratio t/toe which is about 2. But it varies with time and obviously it is not applied in the same way for production and consumption, explaining the slight difference of the above graph. This confirms that China is presently a net importer of coal, despite the BP data! BP has to improve sharply their data, as so the EIA, but in a lesser manner.

The graph from Chinese customs shows the sharp increase in 2009 of imports from Mongolia, Indonesia and Australia (and also South Africa and Russia).

Mongolia is a growing coal producing country with a lot of potential.

The world coal production forecast has to be compared with oil and gas production. The all liquids production is modelled with an ultimate of 3 Tb plus biofuels (maximum 6 Mb/d).

The natural gas production is modelled with an ultimate of 13 Pcf (2.2 Tboe). The impact of the shale gas is in doubt, despite the IEA's question, “Are we entering a golden age of gas?”, in its WEO 2011, implicitly claiming that today’s production rate can be sustained for over 250 years. The IEA is basing these claims on a very short history of production in recent years in the US (although the first natural gas production in the US started in 1821 in Fredonia to supply the lighting system). There is not yet any commercial production of shale gas outside the US, where the owners of the land, having no right to royalties (in contrast to the US), will do everything to prevent any production, arguing with surface pollution and seismic activity (like recently in Dallas).

The WEO 2012 included a section entitled “Golden rules for a golden age of gas” stating the following:

Yet a bright future for unconventional gas is far from assured: numerous hurdles need to be overcome, not least the social and environmental concerns associated with its extraction

The collapse of the number of gas rigs in the US is due to a collapse of wellhead gas prices, which is ridiculously low compared to the wellhead oil price. This happens because of the lack of gas pipelines (40% of the gas is burned in North Dakota) between new gas production and gas consumption. The lack of new gas pipelines could mean that the long term of the shale gas production is in doubt.

The new updated fossil fuels production and forecast for the period 1850-2200 (displayed in blue) presents a very simple peak centred in 2025.

Using UN 2010 population forecast, the fossil fuels production is displayed per capita and compared to primary energy modelled with an asymptote of 18 Gtoe/a. Up to 2025 this model is very similar to those produced by Exxon, BP, the EIA, the IEA and OPEC.

Primary energy per capita is presently 13 boe/a: it could peak at 14 boe/a in 2025 and decline later to 12 boe/a in 2150. But the fossil fuels production per capita is presently 11 boe/a and will stay at this level up to 2025, to then decline sharply down to 1 boe/a by 2150. It means that in 2150 to keep our primary energy flat, 11 boe/a has to be provided by other energy than fossil fuels.

There are mixed signals coming out about coal mining. Today's business news in Australia said Chinese demand for thermal coal was easing due to increased use of their own hydro (?) but exports to China of coking coal and iron ore were holding up. Brown coal and lignite seem to be doing OK worldwide with the Germans opening a 2.2 GW plant at Neurath recently. Plans to replace brown coal plants with gas in Australia's Latrobe Valley were well advanced with downpayments of $1bn already made. Now it looks like the bigger brown coal plants (~6GW) will stay until circa 2030.

Anecdotal evidence suggests shallow deposits of bituminous coal must be getting harder to find. In Australia dairy farms are being dug up. A new Queensland coal province, the Galilee Basin may be developed with road and rail to a port. The main customers appear to be China and India. Note if that same coal goes to an Australian customer they have to pay taxes on the CO2. My take on the key coal demand factors is

- almost irrelevant..carbon taxes, new nuclear, renewables

- very relevant..economic growth, future natgas prices.

"Note if that same coal goes to an Australian customer they have to pay taxes on the CO2"

This really gets my goat. It has to represent either absolute blindness or absolute dishonesty on the part of politicians. We see the same thing here in the US. We pass stringent environmental and worker safety and health regulations and then don't require that industries that compete with us overseas (or in Mexico) observe the same laws, hence destroying both the environment and our own industy. Am I crazy or are they?

Agree 100%. The Australian carbon tax at $23/tCO2 works out about $55 = $23 X 2.4 per tonne of thermal black coal. That's a lot on top of FOB prices like $100/t. Since carbon tax is revenue neutral with the money paid into green programs I'd invite China and India to pay carbon tax voluntarily on Australian coal. It's a test of their sincerity about cutting back like they are supposed under the Kyoto protocol. Based on their reaction to the EU airline tax I'd say they will pass on it.

Better still is to carbon tax finished goods made in China and India. That way it doesn't matter if they source the coal in Africa. Same goes for imported goods made in sweatshops a penalty should be added for pollution, health and safety etc then the money paid into a government program in that country.

"China and India to pay carbon tax voluntarily..."

When is the last time you heard of anyone paying a tax "voluntarily"?

A simple solution is to tax every ton of coal produced regardless of where it is shipped. The tax goes to the government which will hopefully use it to build renewable energy infrastructure.

yes..

A false dichotomy :)

Seriously, pushing the dirty work onto others is what underpins the business of sausage-making. Noble savages would have insisted on making their own sausage, if Rousseau was correct. Sadly, humans are no longer savages.

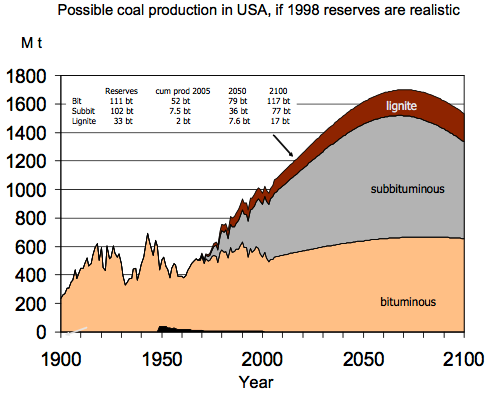

Figure 3 has a heading "Possible coal production in USA, if 1998 reserves are realistic".

A couple of years ago, I read an article looking at US coal reserves, as set out by the USGS, and the result was they were judged to be wildly over-optimistic. As a result, I don't know how much credence should be put on US extrapolations based on official reserves.

Unfortunately, I can't get a sense from Jean Laherrere's graphs about which of the many conflicting projections are most reliable (though at least he specifies a couple as unreliable). If official figures are rubbery, we need to get better ones on which to base estimates. I'd like to see coal use start turning downwards quickly, for environmental reasons, but I'm more concerned with accuracy than just hearing what I'd like to hear.

Jean mentions

this omits a huge category of coal resource in the Alaskan US (and possibly the rest of the far north) currently considered a hypothetical resource

Alaska's Western Arctic coal is not deep, offshore or in thin seams.

It is on the other hand far from infrastructure and bulk shipping terminals and in a very tough place to mine (to call permafrost underlain wetland a challenging environment would be a mighty big understatement). I do hope it stays right where it is but arctic shoreline is open water more and more each year--an energy hungry world might use that increasing open Arctic Ocean to turn a big chunk of huge far north coal resource into coal reserves. Lets hope something more or less like the German model gets purchase worldwide before that happens.

This has been predicted all the way back in 2007.

See http://peakoil.com/forums/china-and-coal-merged-t26793-75.html

2.12 Gt C = 1 ppm CO2, slide 19 in:

http://www.columbia.edu/~jeh1/2012/ColumbiaUniversity_Sep2012.pdf

From the latest New Scientist, page 35:

There is a graph saying: "Temperature reconstructions show that the world as a whole didn't begin to warm significantly until CO2 levels began to rise"

2006

"The effects of a rising sea level would not occur gradually, but rather they would be felt mainly at the time of storms. Thus for practical purposes sea level rise being spread over one or two centuries would be difficult to deal with. It would imply the likelihood of a need to continually rebuild above a transient coastline."

http://www.columbia.edu/~jeh1/2006/CaseForCalifornia_20060630.pdf

New Jersey transient coast line

http://earthobservatory.nasa.gov/IOTD/view.php?id=79622&src=eoa-iotd

So the question is not how much coal there is but how many storms there have to be for the public to realize that we must get away from coal

An aphorism that I encountered during the 70's. "The true conservationist is one who will freeze to death while sitting on a coal mine"

I guess I'm not a true conservationist, then. I am sitting on a coal mine, but I have no intention of freezing to death. I just turn up the thermostat on the 97% efficient natural gas furnace. If it conks out, I'll throw some logs into my fireplace. If I get crippled up to the point where I can't cut firewood, I'll turn on the electric heaters in the rooms. We have two mid-sized hydro plants in this little mountain town I live in, and 5 more nearby.

The thing is, the coal my house in the Canadian Rockies is sitting on is high-grade anthracite, which burns with a hot blue flame. The geologists tell me I'm sitting on the largest deposit of it west of Pennsylvania, but there's no market for it here, which is why the mines are closed and abandoned. They ship some from the southern Canadian Rockies to Japan, but that's the closest market.

Canada actually has substantial coal resources not mentioned in the article, but they are all located far from the industrial centers in Ontario and Quebec, which is why they burn dirty high-sulfur American coal instead of our clean, low-sulfur Western coal.

This emphasizes an important point: moving coal overland is expensive. It's sort of the opposite of natural gas. Gas is cheap to move by pipeline, but expensive to move by ship. Coal is (relatively) cheap to move by ship, but almost impossible to move by pipeline: it is moved by rail or road, both of which cost a lot more than ships on a ton-mile basis.

Much of the world's coal "reserves" are far inland and far from markets (think Mongolia, Wyoming, and the Galilee Basin in Australia). For this reason the above-ground considerations make a very big difference in coal reserves. As oil prices rise, coal reserves will shrink.

As oil prices rise, coal reserves will shrink.

We can't get complacent. If there is no alternative to coal, coal prices will rise a little, and rail will be electrified and powered by coal.

No, geology won't do it for us - we have to choose to kick the habit.

Yeah, that's about my take on it. There is just so much coal, and coal is still the foundation of industrial civilization (look at China). So as long as we cling to industrialism as it exists today we will burn coal. If liquids become an issue, we can make them from coal too!

I was more hopeful when I thought the oil peak would lead to radical changes.

That said, geology will eventually do it all for us. These are all ultimately finite resources, so it is impossible to keep mining/drilling them forever. We just might be able to do it for a much longer time than we should. The end result might kill us, but I no longer see a wall from oil production preventing that.

Since making liquids from coal is expensive and slow, and if we potentially have a couple centuries of coal left, then I wonder if this might create the niche and time scale to allow alternatives to dominate. I would hope that passing Peak Oil with still lots of coal left would convince us to ditch the worship of growth. In this case, renewables could be more competitive with coal-to-liquids than they are with oil today.

I would hope that passing Peak Oil with still lots of coal left would convince us to ditch the worship of growth.

The two are unrelated: we can move to wind and solar (and nuclear) and continue growth or not, as we choose.

What two are unrelated? Peak Oil and economic growth? That makes no sense. Growth on a global scale is pretty much finished, never to return. We have basically maxed out the ecological capacity of the planet to support us, and even with all the energy from fossil fuels we've been throwing at it, it's actually gone down 10%. If we somehow managed to replace fossil fuels at an equal scale with wind and solar we'd still be at or above the carrying capacity of the planet. Your wind and solar fantasies are getting silly. It's not about finding ways continue powering the growth narrative into the future until we all live like the Jetsons; it's about preventing collapse.

Growth on a global scale is pretty much finished, never to return.

Oddly, it's still continuing, and except for one year has been every year since oil plateaued in 2004.

We have basically maxed out the ecological capacity of the planet to support us...If we somehow managed to replace fossil fuels at an equal scale with wind and solar we'd still be at or above the carrying capacity of the planet.

And most of that is due to CO2 emissions. Move to wind & solar (and nuclear) and you eliminate that. All the eco footprint models say that if you eliminate FFs you get well below the carrying capacity of the planet.

it's actually gone down 10%.

What has?

Nick,

How do you measure growth? If it's GDP, you are mistaken. Try GDP/debt and growth stopped a while ago. The world can use enough energy to keep on the treadmill, for now.

You should also write an article on how wind and solar can enable us to "grow." Until then, I think you are engaging in wishful thinking.

How do you measure growth?

Increase in production. Debt is just paperwork, book keeping, an intangible.

More later...

Production of what? Goods and services? What about depreciation? Debt is just paperwork, but GDP is F (debt). So you are using some measure of production other than GDP?

Goods and services?

Yes.

What about depreciation?

Businesses account for it, AFAIK government and consumers don't. What are you wondering about?

GDP is F (debt).

Not really. Debt is one tool for jump starting an economy, but GDP is certainly not a deterministic function of debt. Now, if you're thinking of the credit based money supply, that's a different (and complex) question, but if you're thinking of leverage, then no, it's not.

GDP to total market credit debt suggests the two are highly correlated in at least the USA (and much of the OECD I suspect). I suppose you can say that the rising debt does not CAUSE the rising GDP, but I think you are wrong. Money is debt, isn't it?

My point about depreciation is that gross domestic product does not account for depreciation. What good is "growth" is your net domestic product doesn't grow? Is it growth at all?

If GDP is our measure of growth, we can see that US GDP was above 3% per annum from 1970-2000 and about half that from 2000-2010. We are assuming the government's measure of inflation is accurate, a point open to dispute.

An increasing money supply doesn't cause GDP to rise, it enables it.

Production is real goods and services. If production capacity expands, but people don't have money to buy those goods and services, then you get deflation and the economy stagnates. If production capacity doesn't expand, but money supply expands, then you get inflation and bubbles.

The trick is to get the balance right. Lately, aggregate demand has been too low because people have been afraid to spend their money - technically, the money supply has been too low because the "velocity" of money has declined.

gross domestic product does not account for depreciation.

Well, it does partly. Business depreciation is figured in.

What good is "growth" is your net domestic product doesn't grow?

hhhm. I'm not quite sure what to do with that question. What makes you concerned about depreciation?

US GDP was above 3% per annum from 1970-2000 and about half that from 2000-2010.

Yes, the Great Recession hit hard. And, yes, I agree that "PO lite" has created a real economic headwind.

We are assuming the government's measure of inflation is accurate, a point open to dispute.

Sure. I (and most economists) suspect inflation as measured is too high, as the quality and volume of services is very, very hard to measure. How is the value of smart phones figured into GDP? Everyone can talk to each other, they have access to lots of information and really cheap services (mostly apps) they didn't have before - where is that change in the inflation measure? I can buy an app on my iPad for $2 that would have cost $80 on a PC - how is that deflation captured?

Kids are facebooking and teleconferencing (skype etc) instead of driving - that decline in car and fuel sales is a negative in GDP measurements, but their lives are better and easier - how is that measured?

Can't believe you are arguing hedonism has any relation to GDP, other than in the perverted wishful thinking of government economist spinners.

Independent polls prove that the new 2X more expensive Big Macs are 4X tastier. Twice the enjoyment per dollar! No inflation this year...

arguing hedonism has any relation to GDP

Do you mean hedonics?

Twice the enjoyment per dollar!

Better products and services aren't more valuable to the user?? We should have just stuck with the Model T for the last 100 years? Maybe Ford was right with his "any color as long as it's black" idea.

What makes me concerned about depreciation? If societies cannot maintain their infrastructures, then it's sliding toward game over. I think the big issue here, though, is whether GDP is a good indicator of wealth. I think not because any good and service in the money economy is GDP. But if you think that GDP is a good indicator, then I agree that reported GDP won't turn permanently negative for a long time.

? If societies cannot maintain their infrastructures, then it's sliding toward game over.

Sure. But that's kind've theoretical. What makes you think there's a major problem there?

the big issue here, though, is whether GDP is a good indicator of wealth

It's not supposed to be an indicator of wealth (or well being). It's an indicator of production - whether society is choosing the most useful form of end products is another question.

What we're concerned about here is whether PO (or peak coal) is now or going to seriously impair production. So far it's a "headwind" but not TEOTWAWKI.

Oddly, it's still continuing, and except for one year has been every year since oil plateaued in 2004.

I agree with Nanonano, I don't know what metric you're using to assess growth since 2004 but if it's aggregate prices X volume = GDP, then you have to include a factor for inflation, and that's the whole scam with the Fed and US government understating inflation. The whole exercise of separating out real inflation is fraught with pitfalls. But, I agree with you that since 2004 the world at large has continued to grow somewhat, but at nowhere near the pace which the official statistics would lead one to believe. Although oil production has plateaued, there was indeed growth due to increases in gas and coal extraction (mostly going to the developing world). However, I think this trajectory will now slow and soon stop, due to 1) the imminent deflationary / hyperinflationary collapse which will kill the middle class, and 2) the amount of extra coal and gas that's going to be needed to simply offset the declines in oil production.

What has?

"The ecological capacity of the planet to support us." Or, the total amount of vegetation produced by the planet every year (22 cubic miles oil equivalent/a) which is ultimately where all of our food, biomass energy, coal, oil, and gas ultimately comes (or came) from, and which comprises ~97% of the world economy's energy mix.

All the eco footprint models say that if you eliminate FFs you get well below the carrying capacity of the planet.

Huh? To which models are you referring? That fact is, the amount of biomass energy we burn today in the forms of food, biofuels, coal, oil, and gas, is about at least 5 times greater than the planet could sustainably provide. We currently harvest 12% of the planet's Net Primary Production, and beyond this we appropriate an additional 12% due to ecological degradation. The amount of energy we currently burn, if transferred fully to the planet's biosphere (as would be the case if we do not develop renewable alternative energy systems) would take us into multiples of something like 200% of global NPP. This is the definition of a Malthusian Collapse that would send the world's population to a few hundred million.

Hence the urgent need to develop alternative energy systems like wind, solar, and as you and I both like to put in brackets, (nuclear), and in this regard I am completely on board with you. But when you try to argue that we are going to be able to continue global economic growth based on these future alternative energy systems, keep in mind that the only two energy sources which have a potential scale to provide us with similar amounts of energy to what we use today are wind and solar (and nuclear too, in brackets), but that today, on a global scale, the two of these total about 0.4% of our total energy mix. Add in nuclear, and it goes to about 1%, but nuclear isn't growing anymore, in contrast with wind and solar. Growth in hydro will sputter because of the increasingly unacceptable consequences of flooding productive river valleys.

So how's this for a pact between us, you and me, Nick. --- When we have gotten to the point where 50% of global energy supply comes from renewables + nuclear, and when it has been demonstrated that an independent country or continent can power itself (and its many industries) on these energy sources without having to rely on external training wheels from fossil fuel generation in neighbouring countries to fill in the gaps due to variability in solar and wind (like Germany and Denmark currently do), then maybe we can entertain your growth dreams. But when these energy forms currently total ~1% of the global energy mix, and when growth in coal and gas is outstripping growth in wind and solar simply due to the sheer size scales we're talking about (even though solar+wind is growing faster on a yearly % basis), I am having a very hard time taking your global growth aspirations seriously. I don't think I'll have to uphold my end of our pact in my lifetime.

Here's a list of countries using renewable industry for > 70% of their electric capacity. Some produce over 100% of their domestic electric consumption from renewables. None relies on neighbouring countries' fossil generation to cover variability.

http://makewealthhistory.org/2012/07/09/countries-with-100-renewable-ene...

Here's one with > 100% of domestic demand in solar production alone:

http://reneweconomy.com.au/2012/tokelau-to-become-worlds-first-100-solar...

I'll add that your examples, Germany and Denmark, do *not* rely heavily on neighbouring countries' fossil generating capacity to cover variability in demand and in renewable generation. Denmark relies heavily on hydro power in Sweden and Norway (plus a little on domestic and German fossil power) to cover variability, while Germany covers most of its variability using *domestic* fossil generators. Minor problems with German power transmission and power exports, associated with high levels of wind or PV production, are to do with limits on cross-country transmission capacity (already being upgraded) not inadequate dispatchable power within the national network.

Overbuilding intermittent renewables to double total electrical energy demand could cover 75%-85% of annual demand in most countries. Find a dispatchable load to do something worthwhile with excess power instead of curtailment, and you lose nothing by overbuilding. Include storage and/or keep using existing fossil and hydro peaking facilities, and you're covered.

So as long as we cling to industrialism as it exists today we will burn coal.

Wind and solar (and nuclear) can replace coal quite nicely. Better sooner than later.

If we burn all the gas, a similar result as burning all the coal re CO2.

Let's assume Mr. Laherrere's estimates are correct. We have 5.4 Tboe coal, 3 Tb oil, and 2.2 Tboe of natural gas. In Gt of carbon dioxide we get 2908 from coal, 1200 from oil, and 722 from natural gas. If we look at it per Tboe, for coal its 538 Gt co2/TBoe, nat gas 328 Gt co2/TBoe, and oil 400 Gt Co2/Tb.

DC

Don't forget Green River oil shale.

It's a miserable source of liquid fuel, but it burns just fine.

If we burnt it all, how much CO2 would we get?

A rough model, based on Fig 22 in this post, suggest a CO2 concentration of 550 ppm at year 2100 if Fig 22 turns out to be reality.

This is from fossil fuels in Fig 22 only, land-use changes will influence that, and the CO2 sink might be influenced this century too.

Calculation: Until 2012 we added (80 Gboe/a x 75 years /2) = 3000 Gboe or 3 Tboe. These caused CO2 to increase some two thirds of the total increase from 270 to today 390 ppm. (2/3 x 120 ppm) = 80 ppm.

Until 2100 from Fig. 22: (50 Gboe/a x 90 years /2 + 40 Gboe/a x 90 years) = 5800 Gboe or about 6 Tboe. That is the double as until now, so 2x80 ppm added = 160 ppm. 390 + 160 = 550 ppm.

Excellent info and analysis. I'd love to see one final step taken - adjust that final graph of FF per capita by net energy. As we know the energy return ratio of all FF has been falling, that would show us more clearly the plateau of available net energy per capita that we've been sitting on for some time now, and provide a stark view of the future - if what Matt posted above isn't stark enough...

+1, net energy is what counts. That would also eliminate the double contribution from 1:1 "sources".

How will peak oil affect coal production?

Well, we are at peak conventional now, since 2005. So we are getting to peak oil(s). So if you look at coal production right now, you have the answer. It looks as if we are turning to mining more coal. Why and when will that trend (of increasing coal use) change direction? That trend change will be an indicator to keep an eye on.

(which is why these posts appear from time to time I suppose - funny how this has changed from looking at the peak conventional oils plots from a few year back. King coal is here.)

Mr. Laherrere,

Thank you for the excellent analysis.

Based on these estimates for fossil fuels it looks like climate change may be a problem. If we accept the work of experts such as Myles Allen at Oxford and others ( see http://trillionthtonne.org/ ), then we would like to keep the total emissions of carbon into the atmosphere below 1000 Gt of carbon (or 3667 Gt of carbon dioxide) . Before about 1750 the net amount of carbon dioxide entering the atmosphere over the annual cycle was negligible so we are concerned with the total from 1750 to the future.

In figure 22 you estimate 750 Gtoe for coal, 3000 Gb of oil, and 13000 Tcf of natural gas. If all of this fossil fuel is eventually burned it leads to 793 Gt C (carbon) from coal, 327 Gt C from oil, and 197 Gt C from natural gas for a total of 1317 Gt C (in the form of carbon dioxide) from burning fossil fuels. In addition there are emissions from land use change, natural gas flaring, and cement production which I estimate at 220 Gt C (190 Gt C up to 2011 so this estimate is optimistic) which brings us to over 1500 Gt C (5500 Gt carbon dioxide).

If we assume that your estimates for the URR of coal, natural gas, and oil are correct, then the argument that climate change is not a problem because there is not enough fossil fuel to raise atmospheric carbon dioxide to levels which would cause problems seems incorrect.

DC

Add also methane hydrates, whether potentially burned or released unburned due to warming.

Interesting timing - article on the increasing cost (diminishing return) of coal over on EB today

Looks like Chinese coal imports are doubling every year. How much coal is exported in the whole world? What fraction of that is consumed by China? Eventually China alone may consume all the coal exported in the world. Does anyone know when we reach that state?

The basic information is published by the World Coal Association.

Briefly, China burns about half the coal produced in the world, and mines most of it domestically. But the rate of increase in consumption has outstripped the rate of increase in production, and in 2011 China became the world's largest coal importer, importing about 25% of the coal in world trade.

Straight line extrapolation would suggest that China will consume all the coal exported by other countries well before 2020, depending on how quickly exporting countries can ramp up production. But this can't happen: there is no way China can return to the growth rate it has averaged over the last decade.

Of course, a similar situation for oil. At the 2005 to 2011 rate of decline in the ratio of Global Net Exports of oil (GNE*) to Chindia's Net Imports (CNI), the Chindia region alone would theoretically consume 100% of GNE in 18 years.

*Top 33 net exporters in 2005, BP + Minor EIA data, total petroleum liquids

Some new "Net Export Math." Given the 2005 to 2011 data, and if we extrapolate current trends (as noted, a big "If"), the estimated ratio of Remaining Available CNE (Cumulative Net Exports) to 2011 ANE (Available Net Exports, or GNE less Chindia's net imports) would only be seven years.

Incidentally, China's net imports increased at 9.1%/year (on track to double every 8 years) from 2005 to 2011. From 1949 to 1977, US net imports increased at 12%/year (a doubling every 6 years), but US net imports increased dramatically after 1970, when our crude production peaked. Note that Chinese oil production has stagnated of late.

Have you looked at OPEC's latest analysis of Chinese oil consumption and imports?

They say both dropped sharply compared to the same three month period last year.

But I heard that consumption was up sharply in the last three days, compared to the same three day period last year.

Ridicule isn't an effective argument.

China's commodity consumption is pretty likely going to slow down quite sharply due to the end of its capex bubble, and oil is already showing that impact. I don't think that will have the same effect on oil prices that it will on other commodities, but it will be important.

"For the past two years, as regular readers know, I have been bearish on hard commodities. Prices may have dropped substantially from their peaks during this time, but I don’t think the bear market is over. I think we still have a very long way to go.

There are four reasons why I expect prices to drop a lot more. First, during the last decade commodity producers were caught by surprise by the surge in demand. Their belated response was to ramp up production dramatically, but since there is a long lead-time between intention and supply, for the next several years we will continue to experience rapid growth in supply. As an aside, in my many talks to different groups of investors and boards of directors it has been my impression that commodity producers have been the slowest at understanding the full implications of a Chinese rebalancing, and I would suggest that in many cases they still have not caught on.

Second, almost all the increase in demand in the past twenty years, which in practice occurred mostly in the past decade, can be explained as the consequence of the incredibly unbalanced growth process in China. But as even the most exuberant of China bulls now recognize, China’s economic growth is slowing and I expect it to decline a lot more in the next few years.

Third, and more importantly, as China’s economy rebalances towards a much more sustainable form of growth, this will automatically make Chinese growth much less commodity intensive. It doesn’t matter whether you agree or disagree with my expectations of further economic slowing. Even if China is miraculously able to regain growth rates of 10-11% annually, a rebalancing economy will demand much less in the way of hard commodities.

And fourth, surging Chinese hard commodity purchases in the past few years supplied not just growing domestic needs but also rapidly growing inventory. The result is that inventory levels in China are much too high to support what growth in demand there will be over the next few years, and I expect Chinese in some cases to be net sellers, not net buyers, of a number of commodities.

This combination of factors – rising supply, dropping demand, and lots of inventory to work off – all but guarantee that the prices of hard commodities will collapse. I expect that certain commodities, like copper, will drop by 50% or more in the next two to three years."

http://www.mpettis.com/2012/09/16/by-2015-hard-commodity-prices-will-have-collapsed/

A hyperinflationary monetary collapse, which seems inevitable at this point as a response to the imminent deflationary collapse you allude to, will cause all real world commodities to skyrocket in price, in relation to the purchasing power of hourly wages. But I agree, in relation to oil, hard commodities will generally go down. But those commodities related to building renewable energy will probably fare well since when oil hits the roof, there will be a big push for alternatives (and coal). Food prices will go up.

My made up story may have been accurate. Chinese oil imports in October were up 14% year over year:

http://online.wsj.com/article/BT-CO-20121109-717371.html

Interesting. I wonder what the cumulative Year To Date numbers are?

Well, I started with the notion that China's economy is more than 50% capex, and that's a structural problem which is very likely to cause a sharp slowdown reasonably soon (as has happened with other countries like Japan. Here's a quote from the WSJ article:

Beijing has accelerated infrastructure spending this year amid slowing growth. In early September, China's top economic planner announced a series of approvals for new subways, highways and other infrastructure projects.

That capex doesn't appear sustainable.

What did you think of the article I posted above?

Have you considered the possibility that China is blowing all of its paper dollars on real assets because they know the paper will fall in value compared to those real assets very shortly? That is, they'd rather have the infrastructure than the money and they know they have to spend it all now and not later?

Thanks.

Looks like Chinese coal imports are doubling every year. At this rate, in a couple of years, China alone will import almost all the coal exported in the world. I don't think coal exporters can increase capacity by a whole lot in a couple of years.

China's GDP growth is slowing down but I don't think it is slowing down their rate of import.

Not just in the US either .......

http://www.smh.com.au/business/mitsubishi-flags-coal-mine-cutbacks-20121...

http://news.brisbanetimes.com.au/breaking-news-business/weak-mining-inve...

In Figure 11 Jean presents his latest estimate for ultimate coal production at 750 Gtoe.

I am wondering how to interpret figures like these published by the Alberta government (page 2):

http://www.ercb.ca/sts/ST98/ST98-2012.pdf

33 billion tonnes remaining established coal reserves. But then, get this: SIX HUNDRED AND TWENTY Gt of "ultimate potential recoverable". That is 20X larger than established reserves! Bringing it to oil equivalent, that's about 400 Gtoe, or in other words, more than half the predictions for the total ultimate global extraction of coal, just from Alberta!

What is going on here? Has the Alberta Energy Resources Conservation Board totally lost its marbles? Are they bending to political pressure? Or is everyone else underestimating how much extractable coal there is left? Is the ERCB not considering declining EROEI in making its wild predictions?

This is a BIG issue because clearly if we want to build out a renewable infrastructure to prevent 8 billion people from dying, oil isn't going to power that transition since we're at PO now an it's only going downhill from here on out wrt oil. IMO the potential for gas to power the transition to renewables is overly exaggerated. That leaves coal. It makes a huge difference how much coal we have left and when it peaks because it is our last chance to save humanity. There is a HUGE difference between 33 and 620 Gt!

No, the ERCB has not lost its marbles. Half of Alberta has massive coal deposits under it. When i worked for oil companies, we used to hit coal seam after coal seam drilling for our target oil or gas formation. Both of my grandfathers had their own coal mines (handy if you are a homesteader, and really handy during the Depression when nobody had any money.) My own house is sitting on the largest deposit of high quality anthracite west of Pennsylvania, which is only a few feet down. I could take out my pick axe and start mining coal and heating my house with it any time I wanted.

But it doesn't really matter. There is no market for this coal. I heat my house with natural gas because it is cheap, and could heat it with wood because I can cut it myself for free, The big demand for coal is in Eastern Canada, 5000 kilometers away, and in Asia, even farther away. Alberta has huge reserves of oil and natural gas, which are much more convenient than coal, so why would anybody other than power plants want to use coal?

But this has implications because if other areas are similarly underestimating their coal deposits then those other more populated areas will have more coal than we think, and the 750 Gt ultimate estimate will be way off.

There may be a market for this Alberta coal if coal in other regions runs out first. If it still has a large enough net energy return then it could power its own shipping to elsewhere where it's needed.

Alaska has 2-5 trillion tons of coal, and very likely has at least 200 billion which are "technically recoverable" (a 200 year supply for the US). And, yet, it's not being used at all right now, because it's significantly more expensive than lower-48 coal. David Rutledge agrees: http://www.theoildrum.com/node/6700/674664

Closer to home, the Illinois Basin has 150 billion tons which are being ignored right now because of a relatively small cost differential due to sulfur content. Analysts like the Energy Watch Group take a superficial look at production statistics, and declare that Illinois coal has peaked - that's just....silly.

Furthermore, there's a lot of stuff that can and will be burned to generate power, if needed. We often dismiss "oil shale" as a source of oil, but it's an enormous source of easily burned fuel for electrical generation.

Unfortunately, we have enormous amounts of burnables, and we won't run out any time soon. We will have to make a conscious choice to leave them in the ground.

Nick - "Closer to home, the Illinois Basin has 150 billion tons which are being ignored right now...". Not completed ignored. The White Stallion plant in Texas (ironicly being built on top of a NG field I'm developing...moving another rig in this weekend) will burn Illinois coal for at least the next 30 years. Thanks to the current coal friendly White House the plant received their Clean Air permit (I believe the first such permit granted in many years) so that differential apparently wasn't a deal killer. Some deals appear to be easier to do when you have friends in high places...friends with strong ties to Illinois. Given the current administration need not worry about re-election it will be interesting to see if Illinois coal has an even brighter future. After all, it didn't slow down the coal push during its first term.

it didn't slow down the coal push during its first term.

I think the coal industry would strongly disagree with you, as would investors - coal company share prices plunged the day after the election.

IIRC, of the three top coal companies in the US one is in bankruptcy, and the other two are only being kept from the brink by their coal production outside the US.

Nick - Or put another way the administration did little if anything to hamper coal production. Verbiage perhaps but actual actions? Don't you think the drop in coal demand/stock prices is better explained by increased competition from cheap NG? I don't follow those numbers but that's what I've been reading: between a slide in demand and more Ng usage coal values softened some.? You follow coal closer then I do so your thoguths are appreciated.

the administration did little if anything to hamper coal production.

It could and would have done more if not for the vicious opposition of Koch et al., who spent $125M on this election alone.

Don't you think the drop in coal demand/stock prices is better explained by increased competition from cheap NG?

No, coal stocks dropped 10-20% the very first day after the election - investors felt that the election result was very bad for the coal industry.

There's no question that NG has had a very big impact, but this administration has pushed enforcement of CO2 and mercury emissions control much harder than the previous administration. Those raise operating costs for existing plants and make permitting new coal plants much, much harder.

If true I'd say it's a case of drinking their own poison. Throughout the entire election they've been crying that the coal industry is finished if Obama were to be re-elected...maybe those people actually believed them.

I'd say that the NG boom and the continuing economic malaise is more likely the culprit than anything Obamney has done.

http://en.wikipedia.org/wiki/File:Electricity_Production_the_USA.svg

Alaska has nowhere the amount of coal that you claim. http://groundtruthtrekking.org/Issues/AlaskaCoal/HowMuchCoal.html

US and Alaska Coal Reserves

The most recent estimate from the WEC places US recoverable reserves at 243 billion tons. This represents over 1/4th of the world total of 840 billion tons. Of those US reserves, a 1975 USGS assessment of coal resources in the US found Alaskan recoverable reserves (5.3 billion tons) to be about 3% of the total US recoverable reserves at the time (192 billion tons). Similarly, the EIA arrived at a figure of around 1% using data from 2008.

I don't know where you are getting your info. Did you not read the article here that states that the worlds reserves of coal are below a trillion but yet you keep stating that Alaska alone has 2 to 5 trillion tons.

See my comment to RockyMtnGuy about Alaska.

Look at page 7:

http://library.isgs.uiuc.edu/Pubs/pdfs/circulars/c504.pdf

Illinois has about 6 billion tons of proven reserves of coal. Where you come up with 150 billion tons?

Remember, proven reserves depend on pricing. Illinois coal is high sulfur, so it's mostly priced out of the market.

The normal distinction used by the USGS is "economically recoverable" - that includes economic assumptions, and Illinois coal (and much other coal in the world), at a slightly higher cost as discussed above, is currently uneconomic. But, that's under Business As Usual - if we have a true energy scarcity, Illinois coal will very, very quickly become economic.

More later...

For once I agree completely with you Nick. Here in the state of Victoria, Australia, we have an estimated resource of 430 billion tonnes of brown coal. Even though they are 'resources' at present, most could be reserves without much price rise. It's more like government regulation that stops it being mined.

However, I expect a lot will be mined and burnt, possibly turned to liquid, CTL, as we head down the backslope of peak oil. Unfortunately I do not see the conscious choice of leaving it happening. Even now the hazelwood power station, burning this brown coal was meant to be closed down, yet it keeps getting extensions on its life, the recent extension out to 2031, ie another 20 years. It is 1,675 Mw.

We often dismiss "oil shale" as a source of oil, but it's an enormous source of easily burned fuel for electrical generation.

I wonder if it's useful for anything other than campfires, and chemical feedstock if you provide the external energy. I don't know what the percent-rock-per-total-weight-oil-shale is but it's gotta be huge, probably up around 80-90%? Can a petroleum engineer fill me in?

Imagine burning something in a boiler that's 80% rock! How are you going to be able to produce electricity with that? You'd have HUGE amounts of ash, I don't know what kind of contraption you'd use to get that out. If coal is only 40% efficient and it pretty much all burns, then what's the efficiency of burning oil shale? I bet the amount of heat you'd lose with all the ash you have to take out would make the whole affair a wash. And then how would we transport all that ash away? Even with electric excavators and trucks I can't imagine that ever providing a positive energy return.

Edit: and where's all the cooling tower water going to come from? If they went waterless then we'd take a further efficiency hit.

This kind of shale has been used successfully to generate power for many decades in Estonia, albeit with a lot of waste.

Here's more info: http://en.wikipedia.org/wiki/Oil_shale esp footnotes 2 and 66.

Are we running out of coal?

One could ask several questions related to coal.

First, why ask the question? Don't we want to reduce or eliminate coal because of climate change?

Yes, we do. For better or worse, however, it's important to be realistic about the availability of coal. If we're not running out of it, we have to make a conscious decision to eliminate it, not rely on geological limits. Also, it's good to know whether or not we'll face energy shortages due to coal scarcity. If not, we have more options - if we face an emergency, we will have the option of using coal. Of course, that may be expensive and difficult to do without excessive CO2, but options are usually good to have. In that vein, we should note that if we have coal to spare it's actually easier to sequester CO2 - sequestration consumes a fair amount of energy, and if things are tight it will be much harder to pay for something whose necessity isn't obvious to all .

So, do we face limits on our coal production, as a practical matter?

No. Coal is unlike oil - we have enormous reserves, we know where they are, and in many cases there is no significant increasing marginal cost to their extraction, except for temporary costs of expansion.

Do higher energy prices raise the costs of extracting fossil fuels?

It depends on the individual case. Coal has a high E-ROI. For instance from a recent survey by Heinberg ( from http://www.theoildrum.com/node/4061 ): "Consider the case of Massey Energy Company, the nation’s fourth-largest coal company, which annually produces 40 million tons of coal using about 40 million gallons of diesel fuel—about a gallon per ton" .

That's a very high E-ROI: a gallon of diesel is about 140K BTU's, and a ton of coal is very roughly 20M (see http://www.uwsp.edu/CNR/wcee/keep/Mod1/Whatis/energyresourcetables.htm ), so that's an E-ROI about 140:1! Now, diesel costs very roughly 10x as much per BTU (reflecting it's scarcity premium), so the cost ratio isn't quite as favorable, but it's still well above 10:1. So, the price of diesel rises by $1 (roughly 25%), and the cost of coal rises by $1, or very, very roughly 2% - not a big deal. Also, we should note that coal mining (and transportation) is often electric even now (especially underground), and that it's pretty amenable to further electrification - in other words, coal mining can power itself using a small fraction of it's production.

Will higher coal prices make a substantially larger fraction of the coal available for extraction?

Yes, but only slightly higher prices are needed. Here's what Heinberg has to say: "if Montana and Illinois can resolve their production blockages, or the nation becomes so desperate for energy supplies that environmental concerns are simply swept away, then the peak will come somewhat later, while the decline will be longer, slower, and probably far dirtier.". The Montana "production blockages" he talks about are relatively trivial, and Illinois doesn't really have them. The pollution he refers to is CO2 and sulfur - the sulfur costs about 2 cents/KWH to scrub, and the CO2 might cost out at $80/ton of CO2, which IIRC would add about $30/ton of coal, should we choose to internalize this cost.

Illinois coal simply couldn't compete with Powder River coal with a 2 cent premium for sulfur scrubbing - it's as simple as that. UK and German coal became a bit more expensive, and they couldn't compete with cheap oil.

The same general rule applies to US, UK and European coal: only under Business As Usual is coal declining - people who say otherwise are misinterpreting the data. I discussed this at length with one the often-quoted authors on this subject, David Rutledge, and we came reasonably close to some kind of agreement on this. If there are serious energy shortages, the old reserve numbers will apply, for better or worse.

So, would a doubling in coal prices substantially increase recoverable coal reserves?

Yes. Now, "recoverable" is tricky: the normal distinction used by the USGS is "economically recoverable" - that includes economic assumptions, and Illinois coal (and much other coal in the world), at a slightly higher cost as discussed above, is currently uneconomic. But, that's under Business As Usual - if we have a true energy scarcity, Illinois coal will very, very quickly become economic.

What about the "Law of Receding Horizons"?

That applies only to low E-ROI sources of energy. Coal is high E-ROI, unlike Canadian bitumen (tar sands) or Colorado kerogen (oil shale). I would note that the importance of this "law" has been enormously exaggerated, as it's confused with temporary capex issues and scarcity premia, which are allocating temporarily scarce capital resources.

More coal gets extracted from the ground each year as measured in tons, but hasn't the quality declined so much that net energy content is lower now than 10 years ago?

Powder River coal is lower energy density (sub-bituminous), but it's sufficiently cheaper to mine that the difference doesn't matter. Again, this is a purely economic shift from Illinois coal, which is higher energy density (bituminous). This shift has caused endless confusion to analysts unfamiliar with the coal industry (OTOH, people inside the industry understand this).

Aren't coal prices rising?

In many cases, this is due to the temporary costs of expansion. Oil & gas are much more expensive per BTU due to a scarcity premium, and so demand has increased for coal. Most coal is on long-term contract, not on the higher spot market (unlike oil). But it's important to be clear that in many places, like the US, the long-term marginal cost of extraction isn't really increasing, as it is for oil.

Is Coal-to-Liquids (CTL) feasible?

Yes, but projects tend to be large and expensive, and would be CO2 intensive. That means that investors would like federal loan guarantees, but that such guarantees are unlikely. Nevertheless, CTL is cost-effective even with fairly high carbon taxes, with oil prices at anything like the current level , and projects are slowly moving ahead . The best path would be CTL with CO2 sequestration - this would deserve guarantees.

Is oil-shale feasible?

With oil over $100/barrel, the answer is almost certainly yes. There's something like a $50T incentive there for exploitation, and somebody is going to make something work. In that way its similar to the Bakken basin, which may have 400B barrels of true oil, though much, much less is economically recoverable right now.

Kerogen has the advantage of not needing hydrogenation (which is needed for both tar-sands and CTL), which requires expensive natural gas or a combination of added energy and water (also a significant cost).

On the other hand Green River kerogen (mis-named oil shale) is low density, and a pain to dispose of after burning (it expands). That's why even low-value coal is more attractive for burning (which is what the Estonians do with it). That's also why retort conversion to oil (the conventional method) is unattractive, and why Shell is considering in-situ conversion instead.

Further, kerogen requires a lot of energy to upgrade - the Shell process looks very much like a very slow, inconvenient method of converting electricity to oil (kind've like ethanol, except ethanol mostly uses natural gas). All in all, it seems inevitable to me, but not cheaply or at large volumes any time soon.

I wouldn't reject it, as it is extremely valuable to have diversity in energy supply, but it would be much better to concentrate on electrifying our vehicles ASAP. In other words, we can't let it distract us from the main and best solutions available to us, which are, unfortunately, inconvenient for oil & gas and car companies.

Nick,

thanks for your comments here. We will indeed have to leave coal without the assistance of price, or we'll push the climate system into a very dangerous state.

We will indeed have to leave coal without the assistance of price,

You know we won't, we'll burn it until its no longer economical to do so. But it looks like Nick's estimates on how coal reserves are exaggerated from what other commentators have said.

Chris,

1st, the US, Europe and China are all making real efforts to move away from coal due to pollution problems (mercury, particulates, CO2, etc). Not as strongly as would be desirable, but they are indeed doing something. Wind and solar (and even nuclear) are very affordable, scalable, high E-ROI, etc.

2nd, yes my estimates are higher than some people are used to. But don't rely on their casual comments. Look carefully at the data, and you'll find that there is way more coal than we can afford to burn. There are vast amounts that are not included in current reserves in many parts of the world.

Look at the vast quantity of kerogen (aka Green River shale oil) in the US - that's a terrible source of liquid fuel, but it burns to produce electricity just fine.

So, we're not going to run out of burnables any time soon. There are two takeaways here:

1) We're not facing economic armageddon due to running out of coal, and

2) we can't rely on geological limits to deal with Climate Change.

"Is Coal-to-Liquids (CTL) feasible?

You have to wonder whether we will see more of these developments in the not too distant future ......

http://www.ft.com/cms/s/0/780377ac-1dd2-11e2-8e1d-00144feabdc0.html

We shouldn't underestimate the importance of prices, which can convert resources into reserves mighty quickly.

A recent report by the US Geological Survey looks at the recoverable reserves of the Gilette field in Wyoming, currently the largest producer in the US.

It found that at current low prices, about $10/ton, that only about 6% of the coal in the field could be economically produced.

On the other hand, if the minemouth cost of coal rose to $30/ton, the retail cost of coal-fired electricity would increase only 10%*, but economically-recoverable coal reserves would increase six times. At $60/ton, 77 billion tons would become economic, enough to singlehandedly maintain US coal consumption for about 75 years. And, that's without Montana coal (Powder River), or the Illinois basin, which I discussed previously.

A spirited discusion of the report can be found here.

*Electricity in the US is about $0.10/kWh, and US coal generates about 2,000kWh/ton. That gives a retail price of electricity of $200 per ton of coal used, so a cost of $10/ton for coal represents only 5% of the overall retail price.

"... enough to singlehandedly maintain US coal consumption for about 75 years."

I don't see this mentioned anywhere else, so it seems like a good place to bring up load shifting...

When oil starts to decline (or simply fails to meet increasing demand) and if EV's starting taking up the slack for oil-based transportation, this will probably mean that coal will initially provide the BTUs to run them, which will greatly alter the time estimates of coal.

Wind's biggest problem is not intermittency, it's night time production when demand is low.

EVs will increase demand at night, so EVs and wind are very nicely synergistic.

(the same applies to nuclear)

You'd think Australia with its carbon tax and renewed pledge to Kyoto phase 2 would be making life hard for the coal industry. Not so. The Federal and State governments bend over backwards to give Big Coal whatever it wants. One example in New South Wales is that 600 hectares of state forest and koala habitat will be mined as open cut.

http://maulescreek.org/koala-concerns-raised-with-idemitsu/

A couple of obvious questions are

1) if there is so much coal why dig sensitive areas?

2) how come wind and solar aren't doing the heavy lifting?

I need to check if China and India get promoted from undeveloped to developed countries under the new Kyoto rules.

"The Federal and State governments bend over backwards to give Big Coal whatever it wants."

Are you sure about that ? ......

http://www.businessspectator.com.au/bs.nsf/Article/Qld-seeks-to-repair-r...

Queensland produces about 250 Mtpa of coal. Say it averages $90/t (coking coal more, old thermal contracts less) then that's $22.5bn. I think they can afford another $1.6bn. Nobody has tried to put them out of business like asbestos. Governments give the green light and presumably indirect financial help to expand rail lines and ports

http://www.coalguru.com/australia/abbot_point_coal_terminal_near_to_trip...

Kinda weird for a country dedicated to reducing global emissions.

But if all the government wants to do is look like it's dedicated to reducing global emissions, it starts to make sense.

"I think they can afford another $1.6bn."

I am sure they will learn to live with it, but I am equally sure they would rather not pay an extra $1.6B in government royalties. I doubt that the coal industry sees that as: "bend over backwards to give Big Coal whatever it wants"

"Kinda weird for a country dedicated to reducing global emissions."

Do you really believe that ?

I dont believe it for a minute.

Australias impact on global emissions is minute. Its our Asian neighbours (coal customers) that are growing emissions.

Australia's net domestic emissions are about 540 Mt of CO2e. Add a conservative 700 Mt from exported coal and LNG to get 1.24 Gt out of 34 Gt of global manmade CO2. That's about 5% compared to just 0.3% of world population. We're like some kind of unusually flatulent toy poodle.

"Add a conservative 700 Mt from exported coal and LNG to get 1.24 Gt out of 34 Gt of global manmade CO2."

Exports are not part of Australia's domestic emissions.

(there is a very small component from imported goods, but it is miniscule - see China exports below)

If you want to address global emissions then you need to consider this .....

http://www.consumerenergyreport.com/2012/08/09/climate-change-and-develo...

If we dont export the coal, our Asian neighbours will simply buy from someone else.

http://www.coalguru.com/north_america/us_coal_exports_set_to_break_recor...

If indeed our Asian neighbours will simply buy from someone else (coal that is) the answer is to carbon tax their goods and services. Take a tonne of cold rolled steel. Wiki says it creates 1.7t CO2 others say 5t. If the FOB price is $900 I suggest a carbon tariff of $50. In the case of aluminium assume the 15 Mwh electrical input was coal based and make the carbon tariff $250. If China and India don't like it they can hire lawyers to fight it on a case by case basis, just as in the anti-dumping provisions.

Thus it is a two edged sword. There's little point in China switching from Australia to Mozambique as a preferred coal supplier since their exports would now get slugged with carbon tariff in many other countries. We pay more they burn less coal. In the US the carbon tariff has been supported by Energy Secretary Chu and economist Stiglitz. When China implements tough enough penalties on coal burning the tariff can be dropped. Otherwise we're not serious.

"If indeed our Asian neighbours will simply buy from someone else (coal that is) the answer is to carbon tax their goods and services."

Australia is only 2% of Chinese exports (chart above), so again, this is miniscule on a global basis. If Australia added a carbon import tax to its already implemented domestic carbon tax, it would have negligible impact.

If you want a global solution to a global emissions problem you need global action from all countries (everyone on-board).

"There's little point in China switching from Australia to Mozambique as a preferred coal supplier since their exports would now get slugged with carbon tariff in many other countries."

If "many other countries" adds up to a total where it starts to have an meaningful impact, ie the USA (20%), Hong Kong (12%), Japan (8.4%), Germany (5.6%), Korea (4.1%), UK (2.9%), France (2.7%), Mexico (2.4%), Canada (2.4%), Italy (2.4%), Australia (2%), Russia (2%), Singapore (2%) .....

Can we get consensus agreement from all those countries (UN agreement) ?

Do those countries already have their own domestic carbon tax (hypocrisy) ?

(tricky I think)

It's not all or nothing.

http://earlywarn.blogspot.com/2012/10/avoiding-defeatism-on-climate-chan...

"It's not all or nothing."

If you don't have the big contributors on-board you aren't going to get very far.

That's not being defeatist, its just being pragmatic and realistic.

Does your country have a domestic carbon tax/trading scheme or carbon import tax ?

Did you read the article? What did you think of what it said, specifically?

It doesn't discuss a carbon tax/trading scheme or carbon import tax - which was the topic of discussion above.

"I’ll occasionally get into it with him but you learn to stop as soon as those diminishing returns start to kick in."

http://www.theoildrum.com/node/9583#comment-928842

I sense the point approaching where you start going off-topic from the original discussion point of carbon tax/trading scheme or carbon import tax, so I will politely bow out.

If you want a global solution to a global emissions problem you need global action from all countries (everyone on-board).

That was the argument in question...

That's the complete context

(not your truncated version)

As an Australian, I pretty much agree with Boof above. Our governments are not serious about climate change until they tax all produced carbon, not just domestic.

This argument is put up by many, yet to me it is the cop out approach. If everyone waits for everyone else, then nothing will happen, except we will get cooked earlier than necessary. Some-one has to take the lead, why shouldn't it be first world countries, even if independant from each other?

"As an Australian, I pretty much agree with Boof above. Our governments are not serious about climate change until they tax all produced carbon, not just domestic."

As I pointed out to Boof, if Australia stopped supplying coal to our Asian neighbours they would simply buy coal from someone else, which would do nothing to reduce global emissions.

Boof's counter argument is: "If indeed our Asian neighbours will simply buy from someone else (coal that is) the answer is to carbon tax their goods and services." and "There's little point in China switching from Australia to Mozambique as a preferred coal supplier since their exports would now get slugged with carbon tariff in many other countries."

I think there may be a valid case to carbon tax imported goods and services from countries that don't have a domestic carbon tax, but that only works if other countries get on-board, because the Australian impact is miniscule.

Take China for example (Australia's biggest import country):

World C02 emissions = 33,508,901

China CO2 emissions = 8,240,958 = 24.6%

Australia C02 emissions = 365,513 = 1.1%

According to the World Bank, about 30% of China GDP is exports

So as a ballpark estimate: China C02 export (@ 30%) emissions = 2,472,287

China then exports 2% to Australia (chart above) = 49,445 C02 = 0.15% of world emissions

As you can see the amount is tiny.

Once you start to quantify some of these numbers it becomes clearer as to what the impact actually is.

Unless the other countries also get on-board with a carbon import tax, then China may simply buy coal from someone else.

http://en.wikipedia.org/wiki/List_of_countries_by_carbon_dioxide_emissio...

if Australia stopped supplying coal to our Asian neighbours they would simply buy coal from someone else, which would do nothing to reduce global emissions.

There are several problems with that.

1st, limited exports: there really isn't that much easily available export capacity from other countries. For example, the US has expanded exports, but they're running into bottlenecks in their western ports - further expansion may have to go by rail to the Gulf or to Eastern ports. That would be slow and expensive.

2nd, marginal costs matter: China buys from Australia for a reason - for one thing, it's close. If it had to buy elsewhere it's costs would be higher. Higher cost would reduce consumption.

Here's an example of the limits to fungibility: the US has reduced coal consumption by a substantial amount. US exporters managed to find replacement markets for about 50% of that amount. So, was the decline in US consumption pointless? No, the other 50% stayed in the ground.

3rd, appearances and perceptions matter. If each country waits for other countries to take the next step, nothing will happen.

Actually, China is moving pretty hard towards wind and solar, so we really don't have the excuse that we should wait for them.

----------------------------------------

On a practical level, no one wants to unilaterally kill their domestic industry. But, there are lots of practical alternatives.

-general treaties. These, of course, haven't had much success.

-bilateral treaties. Australia could try negotiating with specific trade partners and trade competitors.

-baby steps. If Australia imposes a modest excise tax, it can set an example for it's competitors to follow, yet not eliminate it's competitive advantage. If the competitors don't follow, Australia has the moral high ground.

I have the impression that Australia has done exactly that - is that correct?

"There are several problems with that."

The biggest problem is that its completely hypothetical - Australia is simply not going to stop exporting coal. Australia is not going to impose a carbon tax on all coal exports, because we don't consume all of that coal. Australia already has a domestic carbon tax. Australia might consider a future carbon import tax on goods and services that we import from countries that don't have their own domestic carbon tax, but as above the impact on world emissions is tiny.

I will ask you again:

Does your country have a domestic carbon tax/trading scheme or carbon import tax ?

Australia is simply not going to stop exporting coal.

I think you mean "voluntarily and unilaterally". Eventually the world will decide coal is a bad idea.

Australia is not going to impose a carbon tax on all coal exports

Actually, any sensible exporting country will impose some level of excise taxes, so as to maximize the value of the industry to their country.

In the long run, reliance on commodity exports is a bad idea - it's much better to develop a more balanced economy.

Does your country have a domestic carbon tax/trading scheme or carbon import tax ?

No, mostly because of the desperate opposition of the FF industry. One of their primary tactics, of course, is spreading memes like "you first", and "we're too small to make a difference".

I, personally, push hard for them - I donate $ to politicians, and try to educate their staffs.

How about you?

"I think you mean "voluntarily and unilaterally"."

I mean economically.

At some future point it will become uneconomic to mine and export coal, but I don't expect that to be for a few decades.

"Actually, any sensible exporting country will impose some level of excise taxes, so as to maximize the value of the industry to their country."

No - I am specifically talking about a carbon tax on all coal exports.

(FYI - Coal miners in Australia already pay state royalties and federal taxes)

"No, mostly because of the desperate opposition of the FF industry."

So no domestic carbon tax/trading scheme and no carbon import tax in your country.

So I guess you are in the USA ?

Good luck then as I think you will need it (at least Romney didn't win).

(off-topic)

No I don't waste my money on political donations.

Most politicians know what the real issues are and those that deny generally just oppose them based on pure political ideology - you will never convert them, so just don't vote for them.

So to sum up your argument would be along the lines of .....

"Don't do anything unless everybody else does it at the same time" ....even if it means cooking the planet quickly.

To get agreement on climate by everyone is going to be nigh on impossible, with developing countries claiming that they need to catch up to developed nations by burning until their economies have reached parity.

How do you suggest climate change be tackled in the short term, as current talkfests like Kyoto have proved to be useless?

The point of my post was to "Do the Math" to quantify the tiny impact (0.15%) that a carbon import tax on goods and services into Australia from China would have.

I hope I made my points clear.

I think quick action on climate change is probably a lost cause.

See my Drumbeat post here: http://www.theoildrum.com/node/9612#comment-928725

(probably best to discuss over there if you want to continue on climate change, rather than this thread about coal).

Here in the UK we are a century past our local 'peak coal' and produce just 18MT or so (down from 287MT in 1913). This month one of our last half dozen or do deep mines is being mothballed, possibly closed by Hargreaves Services. Maltby colliery is 1km deep and has hit geological problems with gas,oil, and water. After 250 years of intensive mining we only have deep coal left.

One of our surface miners, Ath Resources, is also on the verge of going under with 4 opencast mines maybe closing; although at least the coal stays recoverable, unlike a deep mine which will become unusable without maintenance. Ath are blaming the falling price of coal (due to a surplus displaced from the US market by shale gas), and the rising cost of diesel - they say diesel comprises 25% of the cost of their surface mining.

With 4 surface and 1 deep mine going the UK will lose maybe 5Mt of production, we consume about 60Mt.

http://uk.reuters.com/article/2012/10/30/uk-ukcoal-slump-idUKBRE89T16S20...

Time to insulate those notoriously drafty houses!

Shale gas in the USA is a farce. It won't last long. Your UK coal mines will be re-opening in the coming years as shale in the USA pans out.