Drumbeat: September 8, 2012

Posted by Leanan on September 8, 2012 - 11:21am

The Repricing of Oil: Traditional pricing dynamics no longer apply

If oil prices can’t fall that much because of the cost of marginal supply and overall flat global production, and if oil prices can’t rise that much because of restrained Western economies, what set of factors will take the oil price outside of its current envelope?Those who still don’t understand the past ten years cling to the antiquated view that prices will eventually return sustainably to levels of 2002 in due course. They believe that a great volume of new global oil production will start to appear and prices will be driven back to the cheap levels of last decade. Many who take this view also believe that market manipulation and inflation largely account for the high price of oil and that once reflationary programs like quantitative easing (QE) come to end, the price of oil will lose its speculative bid.

Oil Rises as Jobs Report Stokes Stimulus Speculation

Oil advanced for a third day as U.S. payrolls increased less than expected in August, raising speculation that the Federal Reserve will boost stimulus measures to spur economic growth.Prices gained 0.9 percent after the Labor Department reported the economy added 96,000 workers last month, less than the 130,000 median estimate in a Bloomberg survey of economists. The Federal Open Market Committee will meet Sept. 12-13 to discuss monetary policy.

Vehicle fuel economy up for the first time since March

(Phys.org)—Fuel economy of all new vehicles sold in the United States is up for the first time in five months, say researchers at the University of Michigan Transportation Research Institute.

The lengthening life of your ride

(Money Magazine) -- More and more, people are in a committed relationship -- with their wheels.The average age of cars and light trucks (SUVs included), says Experian, is now 11 years -- double the age in 1970. Driving this: higher quality and, lately, a poor economy.

Plus, as auto historian John Heitmann notes, buyer frenzy about new tech and dramatic model changes isn't at the car lot anymore; it's at the Apple Store.

Mexico's outgoing president calls for oil reform

(Reuters) - Mexico, the world's seventh-largest oil producer, needs to change its oil exploration laws to boost output by allowing foreign oil firms greater access, outgoing President Felipe Calderon said on Saturday.Mexico's oil industry is dominated by state monopoly Pemex and private companies have limited access to the market. The country faces a key test as production has fallen sharply in recent years and Pemex risks becoming a net importer of crude within a decade.

Gulf, Iran Say Oil Stock Release Talk Politically Motivated -Source

DUBAI--Gulf oil producers Friday joined Iran in dismissing any talk of U.S. oil stockpile release as politically motivated, not market driven, a rare display of agreement between both sides.New speculation emerged Thursday that the U.S. government may tap into its emergency oil stockpiles, after prices rose back above $110 a barrel in recent weeks.

What's to blame for lost coal jobs

The coal industry is indeed facing some tough times, and increased regulation is partly to blame. But its woes go beyond Obama's policies.The main culprit behind coal's current troubles is natural gas. Utility companies are increasingly ditching coal in favor of cheaper, cleaner natural gas, which has hit near record-low prices.

Official: Iran, Turkey agree to transfer Turkmen gas to Europe

Iran and Turkey have agreed to transfer natural gas from Turkmenistan to Europe, the National Iranian Gas Company's managing director Javad Owji stated.The Mehr news agency quoted Javad Owji as saying that tantamount to the volume of natural gas which is projected to be exported to Europe via Turkey, Turkmenistan will transit its gas via Iran to Turkey.

Russia, Japan back LNG; could delay export pipelines

VLADIVOSTOK, Russia (Reuters) - Russia and Japan signed an agreement on Saturday to develop plans for a $7 billion (4 billion pounds) liquefied natural gas plant on Russia's Pacific coast, potentially delaying gas export pipeline projects to neighbouring China and South Korea.

Russia and Japan Move Forward on Major Natural Gas Deal

Gazprom already sells natural gas to Japan, but another major deal would further reduce Russia’s reliance on Europe as its primary market.In a statement, Mr. Miller said that the Asia-Pacific market was “the most capacious in the world” and that within the next few years, sales by Gazprom to Asia would exceed its sales in Europe, where the company fills roughly a quarter of the continent’s demand.

Qatar wants to raise Shell stake to 7% - report

Qatar wants to become the biggest shareholder in Royal Dutch Shell by raising its stake to 7 percent to strengthen its ties with the oil company and further invest its wealth in western assets, a report said on Friday.

Nigerian airline collapses as industry struggles

The collapse and the mass firing of about 800 workers at Air Nigeria comes as only four domestic airlines are currently flying in Nigeria, down from nine flying at the start of this year. The dramatic decrease highlights the current turmoil of the nation's troubled aviation sector.

Deutsche Bank Faces Fine for U.S. Power-Market Manipulation

Deutsche Bank AG’s energy trading unit faces a $1.5 million fine and must give up $123,198 in profit for allegedly manipulating U.S. power markets, the Federal Energy Regulatory Commission said.

Enbridge 'doesn't want a spill,' executive says

The executive spearheading the Northern Gateway pipeline says Enbridge knows it needs to do more to convince the public the project is safe and that the company will clean up if a spill occurs.

EU study sparks regulation debate over ‘high-risk’ shale gas

Tough new regulations could be slapped on the shale gas industry if the EU acts upon legislative and environmental failings identified in its most comprehensive analysis yet of the sector, due to be released today [7 September].Shale gas drilling poses a ‘high risk’ to human health and the environment that is worse than that posed by other fossil fuels, according to a 300-page report prepared by the EU's environment directorate. It is also currently unregulated.

Test Drive: Electric Focus EV is appealing, but practical?

There's nothing wrong with electric cars that three times the driving range at half the price wouldn't cure.

Life Without Indian Point, Redux

The consequences of running the Indian Point nuclear reactors or shutting them down run from easy-to-spot to hard-to-calculate.Is a serious accident plausible? Would retiring the reactors open the way for alternative sources of electricity that pose a lower safety risk? Or simply ensure an economic blow?

More than 50 million Americans short of food

NEW YORK (CNNMoney) -- More than 50 million Americans couldn't afford to buy food at some point in 2011, according to federal data.Children in some 3.9 million households suffered from food insecurity last year, with their families unable to provide them with adequate, nutritious food at times.

US, Canada sign Great Lakes water quality pact

TRAVERSE CITY, Mich. (AP) — The U.S. and Canada have approved an updated version of a 40-year-old pact that commits both nations to protecting the Great Lakes.Environmental Protection Agency chief Lisa Jackson and Canadian Environment Minister Peter Kent signed the Great Lakes Water Quality Agreement on Friday in Washington, D.C.

At One With the Earth, and the Clients

The skeleton of the straw bale house has risen with remarkable speed. In little more than a week, we framed out the walls and almost finished the roof. Now there is no doubt that a house is coming into being, although at this point it is not obvious that it will be anything out of the ordinary. The trained eye will notice the lack of the evenly spaced studs that are normally needed to hang drywall, as well as the presence of a second set of wooden sill plates to support the inside edge of the 18-inch-thick straw bales.

As Coolant Is Phased Out, Smugglers Reap Large Profits

Under an international treaty, the gas, HCFC-22, has been phased out of new equipment in the industrialized world because it damages the earth’s ozone layer and contributes to global warming. There are strict limits on how much can be imported or sold in the United States by American manufacturers.But the gas is still produced in enormous volumes and sold cheaply in China, India and Mexico, among other places in the developing world, making it a profitable if unlikely commodity for international smugglers.

Obama Counterpunches on Climate Change

Mitt Romney, the Republican presidential nominee, took a not-too-subtle jab at President Obama in his convention speech last week, mocking Mr. Obama’s soaring 2008 campaign language about rolling back the rising seas and healing the planet. Mr. Romney’s gibe drew thunderous applause from the Republican delegates, many of whom express doubt about the existence of climate change.Mr. Obama jabbed back on Thursday night in his acceptance speech while detailing his energy program, which includes increased investment in renewable energy and higher mileage standards for vehicles.

New Zealand court rejects global warming challenge

New Zealand's High Court on Friday dismissed a challenge launched by climate change sceptics against a government research agency's finding that the temperature had risen in the past century.The court backed the science that led the National Institute of Water and Atmospheric Research (NIWA) to conclude that New Zealand's climate warmed almost one degree Celsius (1.8 degrees Fahrenheit) between 1909 and 2009.

The driest season: Global drought causes major worries

In much of North America, July was the hottest month since such a record was first taken. Crop yields have fallen sharply; thousands of livestock have been lost.The Midwest has suffered its worst drought in 56 years, and the International Grains Council has cut its forecast for the U.S. maize harvest by 25 million tons.

Study: Hurricanes whip up faster in warming world

(LiveScience) Global warming may fuel stronger hurricanes whose winds whip up faster, new research suggests.Hurricanes and other tropical cyclones across the globe reach Category 3 wind speeds nearly nine hours earlier than they did 25 years ago, the study found. In the North Atlantic, the storms have shaved almost a day (20 hours) off their spin-up to Category 3, the researchers report. (Category 3 hurricanes have winds between 111 and 129 mph, or 178 and 208 kph.)

"Storms are intensifying at a much more rapid pace than they used to 25 years back," said climatologist Dev Niyogi, a professor at Purdue University in Indiana and senior author of the study.

Strongest Cornucopian Argument I have heard

Bakken fracing is just the start of a trend to extract oil from source rocks rather than from traps. Expensive, yes, but *LOTS* of oil is still trapped in the source rocks.

I do not know enough geology to reject this argument out of hand. High darcy source rock ("loose" rock) will see most of it's oil migrate out. Fracing will do little good there.

But "tight" source rock (low darcy) ? Perhaps full of oil where little has migrated ?

Many source rocks, after letting the oil out to migrate, may have subsequently been cooked into NG & asphalt. But what % ?

Any comments from the rock lickers ?

Alan

Hydraulic fracturing was invented over 50 years ago and the Bakken Formation was found over 50 years ago. What is allowing it to be developed now is the high cost of oil. However, it is a very costly play, with a per-barrel cost probably in the same range as Canadian oil sands, and an EROEI that is probably also in the same range as oil sands. It's something of a marginal exercise.

Americans get focused on the Bakken and assume that it represents some kind of global trend. That's not true - few other oil-producing countries have the free-enterprise economy and aggressive privately-owned oil companies that make development of the Bakken possible.

Mexico, for instance, has a similarly difficult oil field - Chicontepec, that it is relying on for its future oil, now that production from its supergiant Cantarell field has collapsed. The American oil companies now developing the Bakken would probably have similar success with Chicontepec, but the Mexican constitution forbids foreign oil companies operating in Mexico. PEMEX, the government-owned oil company, is having approximately zero success developing Chicontepec. Mexico will probably become a net oil importer in a few years.

And while the Bakken and similar developments in Texas are providing a useful increment of production to the US industry, pundits have failed to notice that production from Prudhoe Bay in Northern Alaska, the biggest oil field ever found in the US, is only producing 1/4 of the oil it did a couple decades ago. It is on a steady downhill slope to its ultimate demise - which may be only a few years in the future.

Production from the North Sea oil fields is in steep decline, and the big Gulf of Mexico fields that have provided much of US production in recent years are due to go into similarly steep decline soon, if they haven't already. The high costs of offshore production don't allow the kind of rapid and intensive development of marginal plays that onshore locations like North Dakota allow. Oil companies run offshore wells at their maximum flow rates for as long as the flow stays high, and then abandon the oil field when it drops. The economics don't tolerate low flow wells.

The cheap oil of the post-WWII era largely came from the Middle East, where most of the world's conventional oil is found. Once the huge Arab oil fields go into terminal decline, which they will sooner or later, world oil production will go into decline. Developing resources like the Bakken Formation and the Canadian oil sands will put a "fat tail" on the production decline curve, but they can never be developed fast enough to cause it to go up again after the slope becomes steep.

The Cornucopeans need to clean their glasses and take a closer look at the big picture. Sure, they will always be able to buy all the oil they can afford, but at future prices that may not be very much oil.

I agree with the gist of your post but I would add a few things.

Even if the techniques are old, the mastering of them in recent years have been quite spectacular.

If we take Bakken as discussed above(and below, by me), then you have a situation where some of the oil companies don't even need to disassemble their oil rigs anymore since they've built them in a way so that they can be moved.

That in turn has meant that the process of drilling test wells have greatly quickened. We're talking a 200 % increase in the speed of test wells per day over just the last five years.

Another point, tangental but not directly related to Bakken, is the plateau of drilling costs for offshore oil.

In the past half-decade, the costs increased a lot, but the funny thing is that today the drilling costs for ultra-deep per barrel is not that much higher than more shallow offshore.

Of course, part of this is because the oil fields that are being drilled in ultra-offshore are so much bigger to justify the capital costs requires, so that pushes the costs down. So while the recovery rate hasn't increased that much(the industry now hails 45 % as something to celebrate), the costs and the way the technology is used has indeed both improved and gone down in price.

Technology isn't a magic fix, but it's likely to smoothen the slope downwards, not save the day.

I would also challenge this statement that RMG has made:

By success, do you mean gaining a quick buck and losing it in the long term?

Where is the real production flow rate analysis for the Bakken?

By "success" I mean actually being able to get oil out of the ground. That is one of the strengths of the American oil industry, to actually produce oil from difficult fields at a reasonable cost (i.e. comparable to OPEC).

By contrast, the Mexican oil industry (i.e. PEMEX) is unable to get much oil out of its Chicontepec field at all, never mind at a reasonable cost. This creates a huge problem for Mexico because its government depends on oil to provide a large portion of its revenues.

Mexico was turning into a classic Petro-State, with the government simultaneously subsidizing oil consumption and spending money freely on government services without increasing taxes, and now that is rapidly coming to an end. Mexico will likely become an oil importer in a few years. It's not going to be a fun time to be Mexican.

Bakken is not a success by previous measures. The oil production flow starts declining immediately for each well.

People ought to stand back and understand the significance of this observation. There is no plateau or maturation increase, and definitely nothing even close to resembling a classic Hubbert peak.

The scale of the Bakken extraction will look completely different than past expectations. As long as there is an exponential increase in new sites, the production will appear increasing. However, as soon as that levels off, the decline will immediately set in.

That's what the math analysis says: http://theoilconundrum.blogspot.com/2012/05/bakken-growth.html

Any "success" is that of a stop-gap measure. I have a leaky gas tank so I patch it with some duct tape. I call that a resounding success because I have temporarily fixed the problem. But in reality, I haven't.

So the USA uses better duct tape than Mexico. Whooo-hooo.

Is the Bakken play being subsidized? Since everyone and their dog has qualified energy independence as a national security issue, why not take it out of the military budget?

EIA data for Alaska + North Dakota (C+C):

1/12: 1.15 mbpd

6/12: 1.15 mbpd

As I have frequently pointed out, the Texas natural gas well model is a cautionary tale. A common data source, the RRC, shows steady year over year increases in annual Barnett Shale gas production, but total Texas natural gas well production started declining in 2009. In other words, increasing production from shale gas plays in Texas could not keep total Texas natural gas well production on a continuous upward slope.

And the EIA shows that total US crude oil production has been between 6.2 and 6.3 mbpd for February to June, 2012, inclusive.

Running harder to stay in the same place. Once upon a time not to far away alaska produced somewhere around 2 mbpd.

No, Bakken oil is not on par with Canadian oil sands, neither in cost of production nor in quality. The tight oil in the Bakken is ~40° API light, sweet crude, not ~10° API extra heavy bitumen, and the cost of production is significantly less than that of the oil sands as well.

Bakken Boom to Squeeze Oil Sands Margins

From the various sources I've come across over the last few years, I'd put break-even cost of production closer to $50-55/bbl in the Bakken, and the economics will improve considerably for producers as more transportation capacity comes online.

The higher price the sweet, light Bakken crude commands certainly helps the economics of it. There are a lot of refineries who can run Bakken crude with no modification, while they would require major upgrades to handle Alberta bitumen.

However, I'm following the Rune/Rockman dialog below, which seems to indicate the production of newer Bakken wells is poorer than older Bakken wells. If this is the start of a trend, it predicts a steep rise in the per-barrel costs of Bakken oil, which does not look good for the future.

The trouble with conventional oil is that companies are always on a tread mill which is running faster and faster. Eventually it runs too fast and they begin to fall off it. It's the old "Red Queen" effect.

In oil sands production, the treadmill is much steeper and has a high barrier to getting on, but it is running at constant speed, or even slowing down as technology improves. Companies have trouble getting on the treadmill, and struggle for a while initially, but once they have been on it for a while they find they are passing the companies on the conventional oil treadmill.

Suncor, which built the first oil sands plant in the 1960s is now the biggest oil company in Canada, while a lot of the conventional oil companies are gone. I used to work for a few of those companies which are gone now.

Rocky - Do you buy the rapid drop in initial 12 month cum that Rune's data is indicating? I trust Rune's data but I've never seen such a drastic drop in productivity in my career. It's over a rather short period so I wonder if it might be a statistical fluke. But it does cover 100's of wells so that doesn't seem very likely. If you had asked me how long I would expect to see a 25% drop I would have guessed 4 or 5 years...at least. I wonder if this is an indication of how relatively small the Bakken sweet spot may be. It would also imply that Bakken economics are becoming much more sensitive to even modest decreases in oil prices.

Hello ROCKMAN and RMG,

I decided to hang along a little longer on this thread.

I have no bias with regard to shale or oil sands. I am strictly (and has always been) a numbers guy, show me the numbers and I will form my own opinions. It is hard to argue against numbers.

I have pointed to the sources that data was compiled from and nothing is better than having a third party verify the numbers. I went to great lengths to make sure that the quality assurance system was diligent. Of course in a process involving huge amounts of data some bugs occur, these were few and due to missing character(s) on the well identifications.

I had no idea of what to expect (actually I was expecting growth in well productivity). The data was sorted in several manners and presented in several manners and they show an unquestionable decline in well productivity.

For wells starting to flow as from August 2011 and later (that presently has less than 12 months of reported production) there is no sign of the reversal of this trend.

For the studied wells in Sanish the decline in well productivity was around 40% over a year. Brigham’s wells (all of them which are spread over a huge area) showed a decline of around 10% in well productivity over a year.

Marathon’s wells show some gain in well productivity.

Overall the decline in well productivity was around 25% in one year.

So in light of this it becomes interesting to read that Marathon has decided to cut down on their activities in Bakken.

So did Occidental

There is a saying that goes like; “Do not listen to what he says. Look at what he is doing!”

Rune

Rockman, I really don't know. I didn't like the rapid run-up in production from the Bakken because it didn't look sustainable, and I don't like the fall off in well production because it might indicate they have already drilled all the "sweet spots" and might have nothing left except not-so-sweet spots.

Time will tell, but as you have no doubt experienced, some fields can go south in a very short period of time, if the geologists misunderstood the nature of them. (And by south, I don't mean to Texas).

I worked for a company that had a major gas field water out on them in six months. They spent hundreds of millions drilling wells, they turned them on, they produced huge amounts of gas - and then some of the wells started producing water. Six months later, all of the wells were producing 100% water. The geologists never did explain what went wrong. The company just abandoned the field, salvaged all the equipment, and walked away.

The Bakken won't be like that, but the geologists may have overestimated its potential. Initial flow rates are not always a good indicator of ultimate production.

Rocky/Rune - Thanks for hanging on to the thread. I don't know if folks are paying attention to us number crunchers but Rune's analysis may be the most important news we've seen about the Bakken since the start of the upswing in activity. Granted a lot of the future production rates some have offered are based upon ever increasing drilling. But the math used seems to always assume no change in productivity over time. And based upon that assumption they project continued robust drilling. Assumptions based upon assumptions...I'm sure we've all seen where that can lead sometimes.

I understand about field development turning sour quickly...we've all had that happen to us. Like my tale of my first 5 offshore "development" wells being dry holes. But these were individual conventional fields and not trends. OTOH the Bakken isn't a new trend despite all the hype in the last few years. Rocky knows it much better than me but looking at a map of the older vertical wells indicates that the sweet spot had been fairly well delineated by the time hz drilling kicked in. In an odd way the situation may be more analogous to the hz redevelopment of Ghawar Field: initially a nice bump up in well productivity but once done it's done. And the bump only last as long as the initial high rate wells last.

The announced slow up in Bakken drilling may be a combination of operators seeing the diminishing productivity and the recent softness in oil prices. This may have pushed us closer to economic limits much sooner than many would have projected. I'll wait a couple of months and update the initial 12 month cum vs. time stat for the Eagle Ford. I'm hearing the same "let's go slower" chatter from operators in this trend also. Maybe the ones with poorer acreage positions are beginning to see the economic limits on the horizon.

Small quibble here Alan. Very deep source rock, or even very deep reservoir rock will, if the temperature is hot enough for long enough, will cook everything into natural gas, but not asphalt. Asphalt is at the opposite end of the spectrum from methane. Methane is the shortest polymer and asphalt is the longest. Or more correctly "asphalts are the longest" because all asphalt polymers are not the same length, they vary.

Natural Asphalt Asphalt is found in nature wherever crude oil seeps from the ground. Many early roads used mined natural asphalt for pavement. Asphalt is the heaviest fraction of petroleum, left behind when the more volatile compounds evaporate.

Ron P.

My understanding is that prolonged heat & pressure will transform oil (say C12H26) into CH4 and long chain asphaltenes, many with double bonds.

If I am wrong, let me know.

Alan

asphaltenes are derived from kerogens at the same time oil is formed from kerogens.

They have large molecular masses - 500 - 1500 or more, so contain of dozens to a hundred or so carbon atoms,

mostly in rings,

with few/no linear structures except at the edges.

http://en.wikipedia.org/wiki/Asphaltene

some images:

http://tigger.uic.edu/~mansoori/Asphaltene.Molecule_html

http://unit.aist.go.jp/energy/afg/asphaltene/Chapter4str.htm

search "asphaltene structure" for more.

http://en.wikipedia.org/wiki/Kerogen

An alkane like you mention will not tend to form a ring under (mild) thermal cracking,

it would tend to form a shorter alkane and an alkene (double bond).

(and with water present, would tend to also form shorter alkanes + CO2).

Thermal formation of rings from alkanes requires catalysts,

or, high temperature (850 deg. C) and rapid processes:

http://en.wikipedia.org/wiki/Benzene#Steam_cracking

thence

http://en.wikipedia.org/wiki/Steam_cracking#Steam_cracking

I never realized those asphalt molecules were that big. They are hugue. Do they even float? They must be a solid lump in room temperature.

I've never experienced asphalt fresh out of the ground, but the stuff they sell in 50 LB blocks for roofing cleaves like glass when dropped.

Interesting science: Tar is a very slow liquid: http://www.geekosystem.com/watch-tar-drip/

Many of them in fact do NOT float - density upwards of 1.2 g/cc. (water is 1 g/cc)

And by themselves, they are solid at room temps.

This PDF from Schlumberger, (originally they're French - pronounce it "SHLUM ber JAY")

a large oil field services company, has pictures of clogs and isolated asphaltenes, and more info.

www.slb.com/~/media/Files/resources/oilfield_review/ors07/sum07/p22_43.pdf

Asphaltenes are often problematic in the oil business.

They can clog formations ("tar mats"), production strings, pipelines and refinery equipment.

Often it requires chemicals injected into a well or pipeline to avoid premature clogging.

As the light/sweet easy oil is used up, it becomes more expensive to deal with asphaltenes.

The molecules tend to be flat, like mini-sheets of graphite, so the central "island"s

tend to stick together due to the de-localized 4th valence electron. (Carbon has 4 valence electrons, so when in a hexagonal structure like polycyclic aromatic hydrocarbons, only 3 are in a conventional covalent bond, so the 4th is spread out above and below the bonding plane into a "pi" orbital. These will also have a weak attraction between planes and to other things, but strong enough to make a mess in a pipe - like on pg 41 of the above pdf.)

The Oilfield Review is an interesting technical journal Schlumberger publishes in English, Spanish, Russian and Chinese.

Not too technical, but lots of details for the curious.

http://www.slb.com/resources/publications/oilfield_review.aspx

http://www.slb.com/resources/publications/oilfield_review/en.aspx

Alan – First, let me kick the revisionist historians to the curb: “Bakken fracing is just the start of a trend to extract oil from source rocks rather than from traps.” We’ve been producing from source rocks for many decades. At one time the Austin Chalk play in Texas was the hottest play in the US even when it was being drilled vertically prior to horizontal drilling taking off in the trend. I went to my first seminar on this subject over 30 years ago. The shale plays are hot today for the same reason the AC got hot: a surge in the price of oil.

“Perhaps full of oil where little has migrated?” Very true. The very nature of the rock allows for a relatively low percentage to be expelled. But “full of oil” misses the mark a bit. The fractures in these shales may be full of oil some of which could be recovered. But it makes no difference if the rock matrix (the non-fracture component) is full of oil or not: it will never be recovered because the matrix permeability is too low. Some cornucopians like to toss out some analysis that notes that Shale X has Y% of organic matter per cubic yard of rock volume. This can lead to a calculation of a huge volume of hydrocarbons in place. They fail to mention that only a very small percentage of that material is recoverable.

“Many source rocks, after letting the oil out to migrate, may have subsequently been cooked into NG & asphalt. But what %?” I doubt anyone could come up with a defendable number other then saying “a lot”. But does it really matter? Whether 5% or 95% has been cooked off we have what we have today. As mentioned before the vast majority of hydrocarbons ever generated on the planet have leaked off the surface. The conditions and timing to generate hydrocarbon traps are actually rather rare.Which is exactly why we have the shales to chase today: very low oil mobility.

As long as oil prices stay high and the pubcos have no other option for increasing their reserve base, the old technology of horizontal drilling and frac’ng of the shales will continue. Unfortunately for the cornucopians these high rate wells decline to relatively insignificant levels in several years unlike the older conventional fields that comprise the majority of global production today. I remember one that showed up on TOD a while back bragging about a specific Eagle Ford that came on at 950 bopd. Unfortunately for him I had the data base and pointed out that very same well was doing 86 bopd just after 12 months of production.

And then there was wild speculation over URR per well since there hadn’t been a sufficient production history to nail it down. But as I said then: wait a couple of years and the fog will lift. I suspect you’ve seen the new estimates of fractured shale URR by the USGS (the former fair haired child that the cornucopians loved to quote). I doubt we’ll hear the cornucopians toss their new numbers out now.

And lastly, eventually every potential drill site in every known shale play will be drilled. The only hot play that stands out today IMHO in the Canadian tar sands. And they seem to be approaching their own PO. But a peak that might last a couple of decades…or more. Just one more reason to expect Canada to become the 51st state one day. Excluding Quebec, of course. We got enough Cajuns already to satisfy that slot.

FYI – Alan’s use of the term “rock licker” is not derogatory. While doing field work we use our little magnifying hand lens to look at the rocks. But this technique works much better when the rock is wet. Yes…we could use our canteens but after the first hundred times you get tired of pulling them out. Just easier to lick it and deal with potential diseases by pre-medicating with large doses of alcohol.

As previously discussed, a recent SPE paper put the median EUR from existing Eagle Ford wells at 160,000 BOE. If we subtract out natural gas, I suspect that the median crude oil EUR for Eagle Ford wells would be about 120,000 BO.

Hello,

I just posted the results from an in depth study of actual well data from the North Dakota Industrial Commission on my blog.

I am in the process of translating it into English (or perhaps it becomes Engwegian) intended for a near future post on TOD with the working title;“Is Shale Oil Production from Bakken headed for a Run with “The Red Queen”?

The posts are rich on illustrations/charts in English that presents the results, so I take it any TODer is able to get the picture.

Part 1

Part 2

Rune

Rune – Very interesting. If I’m reading your charts correctly the performance of the newer Bakken wells are falling below the earlier wells. Not a huge surprise since the sweet spots are usually drilled first and the less promising areas later. But I might have thought that an improvement via the learning curve as well as drilling longer laterals and doing more frac stages would have produced better (even if more expensive) results.

I especially liked Fig 5 that shows the cumulative curves. I use them all the time to give a quick and telling non-mathematical impression of where URR is heading. But we plot it on log-normal scales which really emphasize the diminishing return over time. We plot the vertical oil cum on a base 10 log scale (10 – 100 – 1,000 – etc) and time as linear. Give it a try some time: IMHO it’s a very handy way to eliminate arguments over URR.

ROCKMAN,

That is right the data shows that the performance of newer wells in Bakken are in general decline. This despite applying "state of the art" technologies and learning curves.

The law of diminishing returns at work, or "the lowest hanging fruit is picked first".

As you know it is hard to debate actual data!!!!

All the wells that was subject to the in depth study had a reported production history of 12 months or more.

Studying reported production data for newer wells started post August 2011 (in Bakken) there is so far not a sign of reversal of the trend in decline in well productivity, as expressed by total produced during the first 12 months.

Other have looked at the development of IP and found the same trend.

I also have the plots on log-normal scales, but opted for the format to make it "less" technical. It is always a challenge to find an adequate format to present studies, especially if you also have to consider an audience with poorer technical background.

And I agree on using the format you refer to present the story of URR or EUR.

Rune

Rune – I am a little surprised to see the Bakken slipping this early in the game. In conventional plays you often see a slight uptick before the decline kicks in and then usually quite a few years, if not decades, down the line. But, in general, the Bakken trend covers a relatively small area compared to some others. What’s particularly disturbing is the lower productivity with the higher capex per new well. I don’t have a good handle on those costs in the Bakken. But in the Eagle Ford any increased in average well performance has come at a high price. Originally wells had 4 or 5 frac stages. Now with the longer (and more expensive laterals) 20+ frac stages are not uncommon. I’ve seen numerous reports indicating that many frac job are costing more than the drilling the well. Original wells cost $4 – 6 million and now I’m hearing of costs exceeding $10 million at times.

I understand about not confusing folks with a log-normal plot but I would hope anyone with an interest to study such a plot would understand it. It’s not as though the data is being altered…can read the same values just as easy. What I find particularly useful is to plot some cornucopian’s expectation on the l-n plot of the actual data. It doesn’t prove his projection is incorrect but it emphasizes that there will have to be a very radical change in the system to even come close to his prediction. But even on your linear-linear plot it would seem rather clearIMHO

ROCKMAN and others interested,

One of the key charts to understand is the one below.

The chart above shows the development in the moving average reported production for the first 12 months (yellow circles connected by black line) for the 193 wells started between January 2010 and July 2011 being subject to in depth studies. Wells from August 2011 and later had as of June 2012 not 12 months of reported production.

All the wells in this study came from companies/areas with above specific production bbls/day/well in the Bakken area.

Then the 25 moving average, that is the moving average reported production for the first 12 months of production of the 25 most recent wells. This is done to speed up and smoothen the function.

The wells in the chart are by sequence in time, that is first well in Januray 2010, last one started July 2011.

I did not expect such an outcome from the study given the exceptional growth in shale oil extraction from Bakken. It was by studying individual wells a different picture emerged.

Without the observed decline in well productivity there would not have been a story.

So who are you to believe; those happy stories created for a purpose or your own lying eyes?

Rune

As a supplement to this information, one also needs to look at the trend of individual wells.

Two Bakken analysts, Mason and Brackett, have done independent analysis of the production rates.

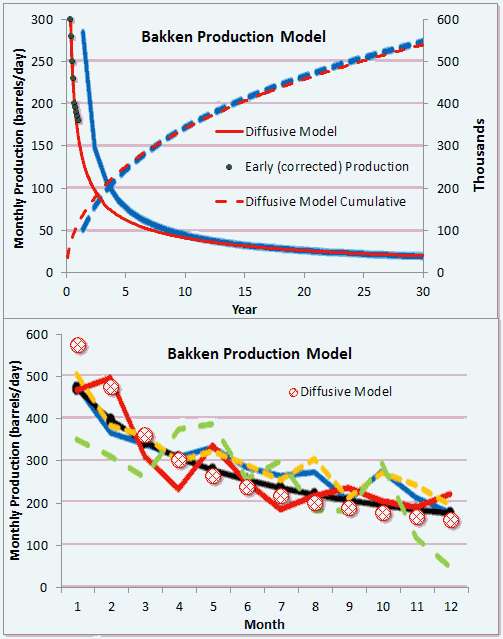

From Mason's data, the flow of oil out of a hydraulically fractured well appears to be controlled by diffusional dynamics.

This is what an average Bakken well decline looks like if one uses Mason's charts.

The cumulative is the important part of the curve I believe because he plotted the instantaneous production incorrectly (which I tried to correct with the black dots).

But then if we look at Brackett's analysis of Bakken (see below), I can better fit the average well to a hyperbolic decline model. A hyperbolic decline is an ensemble average of exponential declines of different rates, assuming maximum entropy in the distribution in rates (this works to describe lots of physical phenomena).

That result conflicts with the diffusional model that better describes Mason's data.

Now I believe it's possible that Brackett simply took the 1/e decline point on each well and then tried to extrapolate that to an average production. That's the easy way out and is definitely wrong as this will always approximate a hyerbolic decline; of course I can check this if I can get access to the 3,694 samples that Brackett says goes into his analysis. Rune, do you have access to this data?

Mason and Brackett can't both be right, as there are sufficient differences between diffusional flow decline and hyperbolic decline to impact projections. The former is steeper at first but has a fatter tail, whereas the latter will definitely decline more in the long term. Brackett says the average well will generate 250,000 barrels of oil while Mason shows twice that and still increasing.

The analysis doesn't end here as there are lots more possibilities on what to look at -- unfortunately the actual data is so hard to get a hold of. Someone was saying that the state of North Dakota had at one time made all the information available, but now only provide roll-ups in the form of PDF files. That is not enough to infer the specifics and you can make the neophyte mistakes that Brackett has made, which may be a result of only using rolled-up data. Mason may have more information available, but unfortunately made mistakes of his own.

This is kind of frustrating that given what is at stake here, that we can't nail this bean-counting exercise down. It's really not that hard.

Hello WHT,

I downloaded the data from here. The data for the individual wells split by areas and companies are published in monthly pdf-files.

It is a time consuming effort to reformat them into spreadsheets that makes them more convenient to work with. Therein lays the tedious leg work.

I found it useful to establish purpose built templates for areas/companies as this also makes quality assurance easier.

When you have the templates (lots of consideration needs to be taken in their design) it becomes easy to transfer data from the pdf format to the spreadsheet.

If you have a flexible spreadsheet and for an advanced user thereof….you can arrange the data just as you wish and charting them becomes a child’s play.

Using actual data eliminates a lot of discussions and theorising………hard data are just that, hard data.

There may of course be revisions either way to the data, but I found that the revisions on an aggregate level are well below 1%. Using lots of representative wells should also help to get a representative picture of the developments.

Rune

People don't realize how grueling that work is. Rune had to take these unwieldy PDF files and extract the raw data, all the while trying to work around all the extra characters and line breaks that a PDF contains.

The ideal plan is to take each one of the reported locations and extract the monthly data. Either plot this as is or as a cumulative over time. For each curve, find the best fit, either as an exponential, hyperbolic, or dispersive/diffusive decline. My own findings suggest that these wells show a dispersive diffusive decline -- http://theoilconundrum.blogspot.com/2012/07/bakken-dispersive-diffusion-....

Once this is done, compare it against Mason's or Brackett's analysis, which is the only prior work that I am aware of.

I took a peak at some of your cumulative curves and they do indeed look more like Mason's, which I model as diffusional flow.

Is it possible that wells may fall into different groups represented by each of the models and that taking these as a whole can confuse matters? Perhaps different local geologies can affect this?

NAOM

Yes, it is grueling - more than anyone that has not done it can realize.

The set-up is crucial - but several mental checks need to be made at every step of the process.

Again and again and again ...

Best Hopes for Appreciation,

Alan

I downloaded the data from here.

Rune - thanks for the link. How does one determine the age of the well from those NDIC monthlies? I see well location, monthly oil, gas, etc, but not age?

Hello,

The hard way! ;-)

It is a grueling systematic task, so developing a suitable template is a "must" also to maintain quality assurance.

What I did was to use individual wells (like those listed in the most recent report) and then work my way backwards....then you will find that production increases as you move backwards in time..until the said well disappears from the production reports and maybe appears as confidential (in progress).

Note that production figures are monthly....so keep track of the days.

When that is done you will immediately be able to identify first month of reported production..... (and hopefully you will see the well disappear from earlier reports).... but as a safety measure check out a few of the previous reports....it helps if you have Acrobat (late printer version) and is familiar with its possibilities.

When you have a good template, good handle with Acrobat and good spreadsheet, good working routines it all works out....takes some time for preparing, but makes it a charm when extracting data.

When the data have been transferred to a flexible spreadsheet........it becomes easy to work the data.

I was surprised of the findings....the decline well productivity.

Rune

The chart is only 18 months. Is it long enough to establish a trend?

If I look at ND Monthly Bakken* Oil Production Statistics, the production per well has held up remarkably, despite a huge increase in the number of wells.

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

aardvark,

The study comprised of the production history of 446 wells of which 193 had a reported production of 12 months or more, and was reported to flow as of January 2010 or later. This to include effects from technological innovations. All wells were from areas/companies that had a history of specific production above the average for Bakken.

The chart you attached describes "The Red Queen" effect an accelerating number of wells are put into production without any effect on average specific well production as expressed by Bbls/day/well.

The observed trend is unquestionable.

So as you (aardvark) have just barely started to look into this issue I highly recommend that you move on to study the development of individual wells.

Rune

I'm not questioning your numbers. You have obviously gone into the matter deeply. I'm trying to clarify in my own mind what you're saying.

Basically, you're saying that

A) The seeming plateau of around 140 bopd per well in the Oil Production Statistics is an artifact created by the fact that there is currently a very high proportion of fresh young wells in the mix (the "Red Queen Effect").

B) The newest wells show a declining productivity compared with slightly older wells employing the same technology. This implies that the best areas have been drilled and lower-quality areas are now being exploited.

Someone who puts a lot of data into a diagram is Hans Rosling. If one had to use his software to create bubble charts I'm guessing you'd get something like this. (Using the full dataset of 193 wells would look something like my receding hairline.)

Another way to present the chart from EIA (in aardvark’s post) is what has been done below,

The chart above shows the development in the specific average production (Bbls/day/well) for all wells in Bakken, black line together with reported net added wells by month, blue columns.

The chart shows how an accelerating number of wells are needed to sustain the average specific production. It is this acceleration of added wells that both grows total production and sustains average specific production in Bakken now.

I studied the time series of a total of 446 wells of which 193 had reported production of 12 months or more and that was started as of January 2010 or later. I good qualification was found to look on total reported production for the first 12 months. As time goes and more data is made available 24 months, 36 months etc will be added.

Other studies has looked on IP or first month production and found exactly the same trends.

What the results from these studies suggest is that the “sweetest spots” has been drilled and increasingly well productivity should in general be expected to continue to decline. This follows the same pattern as with developments of other petroleum basins.

Yes, what you show could be an alternative way to present the results. Rosling has great presentation skills, amongst other skills.

Rune

Rune – Aardi is a clever guy but I suspect he, like many clever TODsters, underestimate how tricky Mother Earth can be. After 37 years she still screws with me from time to time. You understand very well what I’m about to describe…this is for others.

Today I had to check on 3 locations I’m about drill so had plenty of “highway thinkin’” time to work out an explanation. I had to drop out of the discussion this morning just as we started to beat on the time domain and statistics. First, the easiest aspect: changes in technology vs. time. This will be somewhat inflammatory to some but bear with me: there has been very little improvement in horizontal drilling and frac’ng tech in recent years. Some tweaking, of course. Yes: they’ve been increasing the length of Bakken hz wells. I’ve seen reports of 5,000’ to 8,000’ not being uncommon. New tech? Not hardly: Maersk has been drilling 30,000’+ laterals for years in the Persian Gulf. We were drilling 8,000’ laterals in Texas 20 years ago. Frac’ng? Again some modest changes but the general process has changed little for decades. Bigger fracs? No…just more frac stages. Over 30 years ago I did a 4 million gallon and 600,000 lb propant frac. Individual frac stages in the Bakken are much smaller today. The pump trucks and tubulars have changed little in several decades. The chemical components have changed some but more like flavor variations that significant differences.

What has changed over recent times is the length of the hz wells and not how they are drilled. And they were drilled longer to expose more reservoir which naturally required more frac stages to take advantage of the longer laterals. This does result in skewing the data WRT the time domain: newer wells should have better initial flow rates and better initial cumulative production (i.e. the first 12 months) IF ALL OTHER FACTORS REMAIN UNCHANGED. But if they did show improvements it wouldn’t necessarily be because of better tech or better understanding of the Bakken: an 8,000’ lateral should do better than a 3,000’ lateral IF ALL OTHER FACTORS REMAIN UNCHANGED.

Next time domain factor: geological understanding. When a virgin play first begins a learning curve has to be established. Every trend ever developed has sweet spots and sour spots; better geothermal history and poorer; oil windows and NG windows; tectonic histories that produces better and poorer quality reservoir conditions, etc, etc. So as drilling progresses results should improve for a while as the knowledge base expands. But the apparent decreasing productivity of Bakken wells might argue otherwise. But the Bakken isn’t a virgin play…it started producing over 50 years ago. I’ll switch to the Eagle Ford Shale to expand on that thought since I know it far better than the Bakken.

The EFS, like the Bakken, began producing from vert wells decades ago. I drilled, frac’d and produced an EFS well over 25 years ago. Not only produced wells but many more wells tested and abandoned because they proved to not be commercial. And beyond these wells literally thousands of other wells drilled thru the EFS testing deeper formations. A great many studies have been conducted on the EFS just evaluating its quality as a source rock. I doubt any “new” horizontal EFS wells have been drilled more than a few miles from older wells which penetrated the section. There are areas in the EFS where oil is the dominant production and others where NG dominates. And this knowledge was well known long before the first hz EFS well was drilled. In a similar fashion there were areas where older vert wells produced much better than in other areas. If companies knew there were areas where better vert wells that produced more oil were to be found wouldn’t it be logical for them to concentrate there first with their hz wells? And as those areas are leased up and exploited wouldn’t it seem likely for future drilling to move to the less productive areas?

And this may be exactly what Rune’s analysis of the Bakken may be showing. As hz drilling and frac’ng (along with higher oil prices, of course) proved up potential to make Bakken drilling more profitable would they have not started in the sweeter spots first? And as those were developed wouldn’t they then have to move to less productive areas. And wouldn’t they consider drilling longer laterals and more frac stages to make up for the less productivety?

And this is what I find so shocking in Rune’s chart showing the variation of the first 12 months cumulative production vs. time. Even with drilling more expensive wells with longer laterals and more frac stages the initial 12 month cum has dropped 25% in an incredibly short amount of time IMHO.

Let me continue with my long essay and give another example of productivity vs. time vs. tech improvements. The 3 wells I mentioned earlier are targeting oil productive Frio reservoirs on the Texas Gulf Coast at a depth of 5,000’. These are conventional reservoirs I’ll be drilling vertically. This same trend began its initial development in the late 1940’s. This shallow play alone has produced over 4.5 billion bo. The initial fields were on the order of 30 to 150 million bo each with 50 to 200 wells in each. The potential of my 3 wells was identified with state of the art 3d seismic. I really can’t give a sense of how much more advanced this tech is then the tech used to develop this pay initially. The difference is beyond the magnitude of the difference between the first PC and the tech most folks have in their cell phone today. And what about drilling tech? I’m poking holes with state of the art tech.

So with this greatly improved tech and high oil prices am I going after fields with tens of millions of bo and dozens of developments wells? Not hardly. My target reserve for each well is 30k to 50k bo of oil and, if successful, each well will be the only one drilled into its trap. So why am I using this vastly superior tech to drill such relatively small reserves in this truly prolific trend? Easy answer: it’s all that’s left to drill. All the best tech in the world isn’t going to create oil fields where they don’t exist. I wouldn’t even be drilling these 3 little wells if the seismic tech hadn’t gotten good enough to image their potential.

And this may be what Rune’s chart is indicating with what’s currently happening in the Bakken: even with the greater application of newer (and more expensive) tech the better days (on a per well basis and not total daily rate) of the Bakken may be behind us. But the time frame is still difficult for me to believe: the life cycle I just described for the Frio took several decades to manifest itself. But appears to be happening in the Bakken in just a few years. ASAP I’ll put together a similar chart for the EFS as Rune has done for the Bakken (initial 12 month cum vs. time frame) and see if there’s a similar down trend.

Wow, that's a lot of work! thanks. Looking forward to the English version. In the meantime I'll try to figure out the plots.

Thanks a lot for noticing!

It is/was a lot of work, luckily I had access to some very useful tools.

Rune

Rune, if you don't mind, I could translate the posts into English so that people can read them with a clearer prose than the choppy Google Translate mongrel versions.

And then I could send those translations to Leanan for a post if there is interest and consent on both sides.

He can handle the translation. He's said this will be an article. Rune is on staff here. He doesn't need me to post things for him.

Alright, sounds good.

I've read the posts and they're some of the best on Bakken I've come across so far.

Rune does great work. You can see his previous articles here.

Svamp and Leanan,

Both, thanks a lot for your offers and the publicity.

Using Google translate from Norwegian to English….makes it almost impossible to retain the content.

I am in the process of translating it into English, then I will have someone help improve the language then load it up for review by the editors (Art Bermann is one of them.....just mentioning) and if they find it worthy for posting they will allocate it a slot.

I hope this will be a Monday or Wednesday….hopefully about a week from now.

I am quite impressed with your diligent data mining :-)E

Best Hopes for Recognition of Your Efforts,

Alan

Thanks a lot for recognizing the amount of work and time such an effort requires.

Aloha Rune,

When one uses then GIS server on the North Dakota Oil and Gas site to look at the existing wells in the Bakken, it seems to my in-expert eye that many areas are already "saturated" with either horizontal or vertical wells. How long before they simply run out of real estate at current drilling rates?

W – Hopefully Rune can paint a better picture but I do know that the original straight holes in the Bakken established some distinction between better and poorer recovery areas. Naturally companies would concentrate in those better areas. I know it doesn’t sound very scientific but in such plays it often boils down to taking the leaseholds closest to the better old wells. The technical geologic term is closology . LOL. Seriously.

But I made this point before about the formerly very hot Austin Chalk unconventional play of many years ago. If you check out a map of the now fairly dead play you would see one hz AC well after another drilled as close to each other as the regs allowed. And the graveyard of now dead AC wells carries county after county. The play ended for the most part when nearly every possible location had been drilled. I can’t guess when but that same terminal day will happen for the Bakken, Eagle Ford, Deep Water GOM and Brazil as well as every other play being drilled today. The big difference between these plays and the older heritage fields is that those older fields are still producing a significant percentage of our current production. These new plays don’t have such legs. To maintain production anywhere close to current levels will require finding new plays and finding them quickly. The new hot plays will become the worn down old plays in the not too distant future IMHO.

Regarding "closology", a more sophisticated approach is "trendology". In other words, if good wells appear to line up in some sort of linear trend, one wants to buy leases and drill wells along that trend.

;-)

Geo – Na…trendology doesn’t narrow it down good enough for this career development geologist. Even closology fails sometimes. Remembering when I drilled my first GOM well for Mobil Oil it twinned an expendable hole that found a 150’ NG sand near its total depth. So set the platform and drilled to within 200’ of the original hole and, SOB, no dang gas sand. Not only did the very closology not work but I never saw the sand in any well in the field. And I meant the sand…neither productive nor wet. And drilling on a 5,000 acre based on the exploration dept’s mapping my first 5 wells off the platform were dry holes.

I’ve never seen a trend that didn’t contain numerous non commercial wells and dry holes. Exploration is a tough job. But so is explaining 5 dry holes drilling for “proven” reserves. LOL

Rock,

Like I always say, the earth is full of surprises. Sometimes good surprises .....sometimes not so good.

;-)

Rock, It seems that RMG's oil sands is the only long term oil play in North America.

The thing about oil sands wells is that they are highly predictable. You drill a SAGD horizontal well pair, and start injecting steam into the top well of the pair. After a few months the bottom well starts producing oil.

The production rate rises to about 600 bpd, stays there for about 4 years, and then falls off. When it falls off too much, you plug and abandon the pair. Total production might be 500,000 barrels out of the pair. Then you reclaim the surface equipment and install it at the next well pair. They are drilling up to 100 wells off a single gravel pad these days. It takes them about 12 days to drill each well pair.

Ultimately, though, the fact is that you can drill well pairs about 300 feet apart laterally and 3000 feet or more long, and you can do this over an area the size of Florida. You just keeping moving down the lease drilling wells, and then when you use up one pad, you move on to the next pad.

Once started, you can keep doing this for decade after decade after decade, so it gets to be something of an assembly-line process. The big issue is initially high capital costs. Once you get rolling and capital costs are amortized, it turns into a money making machine assuming oil prices stay high.

How about the energy required to run these things ? I understand it is from local natural gas right now, and that there has been some thoughts on nuclear, but how the natural gas reserves used can be characterized ?

Do some of these operations run from the extracted "crude" ?

The local natural gas supply is more than adequate in the short and medium term. Because Alberta gas production is now declining, the Alberta government is curtailing natural gas exports and diverting the gas to the oil sands, which it has the legal right to do. If there were a North American shortage of natural gas that might be a problem for the US, but with the current US surplus of shale gas, I doubt the US government even noticed.

Some of the operations use bitumen gasification to turn the heavy ends into fuel gas. Others burn coke (the carbon solids produced by the upgraders) for fuel. There are a variety of other alternatives, but with the current oversupply of cheap natural gas, nobody is bothering to use them.

There are also massive shale gas resources nearby in NE BC, and Alberta probably also has big shale gas deposits, but at this point in time nobody has evaluated them. Maybe they will if gas prices go up.

The glut of natural gas in the U.S. is probably temporary. If there is 200 billion barrels of URR of bitumen in Canada that is extracted at an average of 5 Mb/d, then 109 years will be needed to extract it. The global production of natural gas is likely to peak before even half of this time elapses sending the price up. The CIA World Factbook indicates Canada's proven natural gas reserves are 1.754 trillion cu m (1 January 2011 est.) and production was 152.3 billion cu m (2010 est.). Even if Canadian production decreases to its level of consumption, 82.48 billion cu m (2010 est.), the proven reserves will not last long. Canada will need a higher price to get at some of their presently uneconomic reserves probably within a decade.

I'm not too concerned about the CIA estimate of Canada's gas reserves because I know where there is a lot more gas that the CIA doesn't know about. The real question is, "How much will you pay for it?" because if the answer is high enough, I can point to the map and say, "Drill here." I'm not unique in that regard, there are a lot of people who are a lot better at it than me, which is why they do it for a living rather than personal amusement and are richer than me.

The reality is that these reserve estimates are just stakes in the sand to mark a limit, and the only reason they are there is that everyone needs a planning number to work with. The current estimated URR of the oil sands is about 170 billion barrels, but that is just an arbitrary marker that the government set, and everybody knows that there is at least twice that much oil there. But, an official stake is an official stake, and everyone will use the government number until the government decides to move the stake. When they do move the stake, everyone will nod their heads and say, "Yup, that's the amount of oil that is there now. Amazing how it suddenly doubled."

However, the oil sands region is one of the most energy proliferate regions on Earth, and there are energy resources of various different kinds all over the area. In order to run the steam generators for a SAGD project, they need energy of some sort, and they currently use natural gas because it is the cheapest and most convenient sort. If it became in short supply, they would use something else, and there are numerous different alternatives available.

The ultimate constraint is price. If the price is high enough, they can find the energy to produce the oil. What type of energy doesn't matter, only the price matters.

it turns into a money making machine assuming oil prices stay high

... and natural gas prices stay low.

Alan

Low natural gas prices certainly help. Some companies were experimenting with bitumen gasification as a way to provide fuel gas for the steam generators, but with the current oversupply of cheap natural gas, there's no point.

Joe – As Rocky describes the oil sands are rather unique. More like mining than exploration or even development drilling. I wonder how big Venezuela might be if it weren’t for the local politics. When Hugo is gone it might change radically…or not at all.

I would think the SAGD technique would work very well in the Orinoco oil sands, but with the current political climate in Venezuela nobody is likely to use it to develop them.

Venezuela can't attract the financial risk capital to build an expensive steam injection system like SAGD, and I doubt it can attract the technical experts who could make it work, either. In driving out private capital and firing all the country's heavy oil experts, Hugo has kind of burned all his bridges behind him.

I suspect that China would be willing to provide the risk capital and develop the expertise (which will take some time) or just hire the expertise directly.

How many ex-PVDSA employees would be willing to cash a CNOOC paycheck while living close to their parents, cousins, etc. ?

Alan

Well, if the $15 billion CNOOC takeover of Nexen proceeds to completion, it is likely that a lot of ex-PDVSA employees will be cashing CNOOC paychecks. However, I suspect their first priority will be to get Nexen's troubled Long Lake oil sands project running properly.

Going back to Venezuela? I don't know if either they or the Venezuelan government would be keen on that. The politics are problematic.

I just posted the results from an in depth study

Nice work.

A couple questions about your figure 10 in part 1 if you are inclined?

1. So the most of the wells started pre-2010 (black) are have past two years old now. They're peak output in 2010 was ~1100 bpd and ~two years later (June 2012) are above ~800 bpd? Am I reading that correctly?

2. Wells from 2010 (red) had early peak output of ~3000 bpd and wells from 2011 had peaks of ~5000 bpd. Is that due to more wells (3X and 5X?) or mproved production techniques?

F,

Re your questions,

1) The black area are wells that started to flow pre January 2010 and have various production life, that is more than 30 months. And yes you are reading the numbers right. The interesting thing about these wells are that they for a while improved production which could suggest some kind of stimulation.

2) During 2010 there was reported flow from an additional 15 wells.

During 2011 there was reported flow from an additional 15 wells.

As from January through June 2012 flow from 13 wells were added.

If you look at figure 05 in Part 1 you will see that this area (Reunion Bay) operated by Marathon has seen growth in specific production. And looking at well data these has shown some improvements in productivity.

If you look on figure 04 in Part 2 you will see that Marathon had some of the poorer wells of those studied.

So in light of this it becomes interesting to read that Marathon has decided to cut down on their activities in Bakken.

Normally it should be expected that oil companies are somewhat ahead with regard to results than what is presented in my study.

Rune

Is we is or is we ain't getting near Peak Oil "Point Of No Return"; time for serious work on Matt Simmon's "Plan B"?

Scrolling down 33 inputs here tells an objective observer we have to get going on the multitude of changes needed to keep on keeping on...

Alan is one of TOD contributors apparently train savvy,so we took the liberty of grabbing your coat tails. Here are some "Plan B" requisites to consider. TOD Webmeisters can think about a "Plan B" section for TOD? (that's job #1) Besides train therapy, we include a few other subjects-

Water for North American agriculture- see NAWAPA, a comprehensive civil engineering extravaganza, should be under way ASAP while diesel fuel for construction phase is still adequate. Aquifers recharged, hydroelectric generation enroute, and deliveries to Mexico included to offset yankee water grabs from watersheds trying to reach Mexico.

Education, exchange of information- Electronic information transfer is not the last word in an unstable era, suggesting continued maintenance of US Postal system, even re=opening of smaller offices on closure list. In 1838 the US Congress passed a "Post Road" Statute, putting all railroads into the category of "Post Roads" as stated in Article I Section 8 of the Constitution: Duties of Congress... This segues us to

Transport- Replace lost secondary and branch/feeder rail lines to assure "Societal & Commercial Cohesion" including mobility, distribution of victuals and necessities of life and Postal service points, letter & package movement.

Employment- After WWII, President Truman made deliberate shift from rail to highway based economic model, successfully tapping cheap oil from home and overseas sources to propel massive auto production, new suburbia, and mechanized agriculture. It shall be difficult to reverse suburbia to a level commensurate with energy units/capita projections TOD discusses. See Kunstler's "The Long Emergency". More than simply a transport subject, railroad mode scaled back to local orientation is an employment enhancer. Stepping rail back to a local service component will require more effort from railway executives than any particular technical hurdles... "Retail Railway" is a study along the line of local communities with energy and water supply and mobility not dependent on massive scale systems we now see deteriorating before our eyes. "ELECTRIC WATER" is a 2007 book (New Society Press" by Christopher C. Swan, a compendium of technology and applications to achieve employment in the Post Carbon era.

Aviation- It seems likely aviation faces transition to more expensive fares and fewer routes operated. Larger airframes with fewer scheduled flights, with most short hops showing very high seat costs. With Federal Executive Emergency Orders for motor fuel allocation, expect partnerships with airlines and new High Speed Rail lines where corridors are shared. SF/LA HSR invites a Southwest Airlines partnership, for example. Airborne derivatives like dirigibles/blimps are subject to climate change weather oscillations, and probably will experience high liability insurance overhead.

Herbert Hoover was our last Republican civil engineer president, Jimmy Carter our last Democratic president with engineering savvy. We need another one PDQ. Please, Oil Drum site governors, try reaching out to the political parties, including Tea Party offices. Social engineering will need to play second fiddle to crucially needed CIVIL engineering emphasis for the decades coming at us. Geopolitical realities in the Middle East (see George Grant's "The Blood Of The Moon") are about to spill over on the Peak Oil calculation...

I do not think NAWAPA is a good idea.

http://en.wikipedia.org/wiki/NAWAPA

http://www.polarisinstitute.org/turning_on_canadas_tap

http://aquadoc.typepad.com/waterwired/2008/01/kennedy-to-cana.html

Without a strict Zero Population Growth implementation, along with an entire societal paradigm shift regarding growth and consumption, NAWAPA would lead to even more severe overshoot and even more dire consequences down the road.

Regarding NAWAPA, shut down coal and nuclear powered electrical generators that use fresh water for cooling and replace them with wind and solar power sources. Constructing an aqueduct from Alaska to the Colorado River is another grandiose, expensive project to postpone what we really need to be doing.

Coolant water for coal, nuclear and gas-fired thermal plants doesn't go away, it just gets used as a thermal dump and then gets returned to the river or lake (or ocean in the case of coastally-sited plants as in the UK's nuclear fleet) so shutting them down won't make more water magically available in areas with limited resources.

Solar power plants, both PV and mirror-thermal require fresh water to wash the panels and mirrors to clean them and keep efficiency up and that water does go away as it evaporates on use. There are already concerns in some desert areas about depletion of local aquifers to keep existing solar plants operational and this is limiting further expansion plans for solar energy.

"Coolant water for coal, nuclear and gas-fired thermal plants doesn't go away,"

It does if they are closed loop, as in if they have cooling towers. One pound of water for every 1000 BTU of heat that has to be rejected.

And for the open-loop plants, warming the discharge water increases the evaporation rate from that plume too, though not as much.

Most hydrologists label river or pond cooling as nonconsumptive and cooling towers as consumptive. My take is that nuclear plants are less efficient thermally, not even using superheated steam in many cases, because the fuel cost is low relative to the increased maintenance cost of high temperatures. A cooling tower raises the efficiency by two or three percent from the typical <30%, a 10 percent increase in electrical production with no downside other than up front costs and ongoing water consumption.

Coal plants generate steam around 550C, nuclear plants around 300C. Thus coal plants can be designed to minimize water consumption as they are indifferent to the exit steam enthalpy.

http://www.brighthubengineering.com/power-plants/40814-differences-in-a-...

If I recall from several years ago the low thermal efficiency of nuclear plants has to do with the maximum operating temperature of the metallic fuel cladding, resulting in generator inlet temperatures of only 700 degrees F. The metal selected for fuel cladding had special characteristics that allowed it to maintain some strength in the high radiation field in combination with water. To get the same 1000 degree steam that a coal plant utilizes would put the metal out of its safe operating range.

The General Atomic gas cooled reactors of the '60s and '70s had no metal, only graphite, in the core and were thus able to generate outrageous temperatures, 1460 degree outlet gas temp as I recall, and steam temperatures over 1000F. Unfortunately they were not able to do much else very well and only two reactors were built, neither economically successful.

Talking about cooling water for thermal plants, and cleaning PV panels in water in the same discussion, as if they consume similar amounts of water isn't correct. The later only needs small amounts of water, whereas thermal plants consume much larger amounts of water. Water that is used and returned hotter, will cool in the pond or river largely via increased evaporation, so much is consumed. PV cleaning can be delayed, whereas thermal plants require the water at the same time they generate power, so in a water pinch, PV could keep producing even without cleaning water. In many locations panels don't need to be cleaned at all, i.e. you can wait for the rain to do it for you.

What rain? The best places for solar power plants are desert locations with 300+ days per year cloud-free, like Barstow in the Mojave desert where the SEGS complex is located.

http://en.wikipedia.org/wiki/Solar_Energy_Generating_Systems

The only local source for water to wash the mirrors is an aquifer which is being drained and not replenished quickly -- Barstow gets about 4 inches of rain a year. As for not washing the mirrors, that would cut down on the generating capacity of the plant which impacts the financial bottom line so the mirrors get washed weekly during the summer.

http://www.nrel.gov/csp/troughnet/images/photo_14952.jpg

On the other hand you posit that a river feeding heat exchangers for thermal fossil and nuclear power plants loses more water but it is a river with continuous restorative flow, not an underground reservoir with a very limited restorative capability and which has other demands on it. In the case of Barstow that includes Edwards Air Force base to the west, a major consumer of groundwell water.

Can the dust/dirt be removed by rotary brush made with an appropriately soft bristle material that would not scratch the PV glass cover sheet, or the reflective mirrors, as the case may be? Perhaps mated with use of high-pressure air?

There would be an opportunity for some manual labor...a few jobs for people who like to be outside and have some 'alone time'?

Perhaps if some water cleaning must be done, a nozzle/brush system could be used that recaptures most of the used water...something akin to a carpet shampoo machine?

To cap it off: I think that if there were large deposits of oil under the same deserts which required fracing to produce, the large quantities (much larger than required for the occasional solar system washing) of water would show up PDQ.

Dust itself can be highly abrasive. We get a lot of it here and trying to brush it off a surface causes scratches. As for compressed air systems, think sandblasting.

NAOM

Question. I live in Arizona, and a number of neighbors have solar panels on their roof. I must confess, I have never seen them using a hose to clean them. How often should they be hosed down, and how much energy generation is lost over time if they don't?