Tech Talk - Chinese Gas Shale Development

Posted by Heading Out on September 10, 2012 - 12:57pm

On occasion, the British Government goes through an internal shake-up that leads to various pundits trying to explain to us lesser mortals what it all means. Thus, with changes in the Ministers who work in the Department of Energy and Climate Change, there is a suggestion that the UK is pulling back from their commitment to wind energy, and instead beginning to look more seriously at shale gas supplies.

The UK is not unique. The success of the American development of long horizontal well drilling, with follow-on multiple fracture of the shale beds to release gas at economic volumes into the well, has caught the world’s attention, and with it a desire to emulate that success. Though it should be said that the American success comes in part with the volume of the release in supply and the consequent fall induced in the price of natural gas. That, in turn, is providing a less well-recognized boost to the US economy, through lower energy costs.

This has not been lost on the Chinese, who are fully aware of their own need to keep finding resources at as cheap a price as possible to keep their own economy growing. It is, in relative terms, however, still an industry in its infancy. Earlier this year China agreed to buy 65 billon cu m of more conventionally produced natural gas from Turkmenistan – about twice the initial buy - roughly the equivalent of 6.3 billion cu ft/day (bcf/d). In addition, from April 1, China has started to import natural gas from Uzbekistan. That sale has been projected to be at around 10 bcm/year (1 bcf/day) and there has been a move in Uzbekistan to increase coal-fired power generation in the country in order to free up more gas to meet export demands as the sales to China ramp up to perhaps double this level in the next few years.

Further China still has the option of buying more natural gas from Russia, which has the potential to supply an additional 65 bcm/year into China. (6.3 bcf/d)

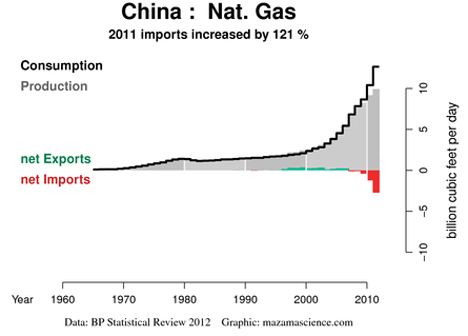

To put these numbers into perspective, China consumed around 12.5 billion cu ft/day (bcf/d) in 2011, which translates into roughly 130 bcm/year, but this rate increased 20% (23 bcm) from 2010 to 2011. (BP 2012 Statistical Review). It is also on track with the stated Government plan that China will consume some 375 bcm/yr (36 bcf/day) of natural gas by 2020, roughly tripling the current volume.

Thus, although China has been able to provide for most of its needs until relatively recently, it is now starting to buy increasingly large volumes of natural gas on the international market, just to keep up with demand.

There is a flexibility in the supply of natural gas, through pipelines, that make it easier for a country with much mountainous terrain in the West to be able more easily to supply energy to more remote corners without the heavy infrastructure demands that would be required, for example, to run new rail lines for coal delivery.

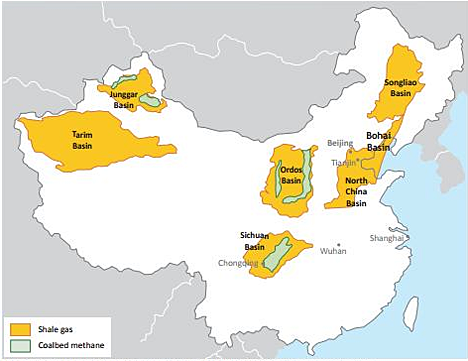

This June Sinopec has started drilling for natural gas in the shales under Chongqing in Sichuan Province. It is the opening step in developing a resource that might be as large as 1,275 Tcf, according to the EIA.

Note that while the supplies coming in from Turkmenistan and Ukbekistan are more easily connected to the northern of the trans-country pipelines, the new drilling in Chongqing looking for shale gas, will supply that into the more southerly of the two major pipelines that Sinopec runs across the country.

The Sichuan-Eastern China Natural Gas Transmission Pipeline passes through eight provinces including Sichuan, Chongqing, Jiangxi, Hubei, Anhui, Jiangsu, Zhejiang and Shanghai;the length is 2,246 km.

There will be nine wells in the initial test site, with the anticipation that this will yield some 11 to 18 billion feet of gas (per year). Outside this unconventional source of natural gas, Sinopec produced some 517 bcf of natural gas in 2011, up 76 bcf from 2010. Much of this came from the Sulidge gas field in the Ordos Basin , which is also considered to have the second largest potential natural gas resource in shale in the country.

It is hoped that with the development of the shale gas in the two Basins that shale gas will provide some 6.5 bcm/yr by 2015. As with the Chongqing field, there are existing pipelines at the Ordos field that will allow a fairly simple tie in to the national network to bring the new fuel to market, once produced.

The potential of this new market for technology has already led Schlumberger to buy into a Chinese Oilfield Services company that will likely be used in the fracturing of the wells, necessary to China since they still lack expertise in the new technologies as they are evolving.

That evolution was highlighted recently by articles that have highlighted a number of different technologies that are now both lowering the costs, and increasing the performance of well fracking.

These have included the Hiway technology that is now being introduced and which, as with some of the other innovations, allows a significant savings in water, and proppant use during operations, while lowering costs and increasing productivity. These factors, particularly the significant lowering of cost, are likely to help in improving the economics of a shale gas industry which continues, at least in the United States, to have problems with return on investment despite (or perhaps because of) the large volumes of resource that it is making available. That is, however, much less likely to be a problem with the Chinese resource.

According to http://blueshiftideas.com/reports/021207HiWAYWillNotBeSchlumbergersSuper...,

HIWAY is warmed over technology from the 1970s that Schlumberger is charging a 20% premium for. The report is worth a read. It says that Petrohawk's success with the technology has not been repeated by engineers in the field.

Does anyone have non-hyped results for HIWAY?

When I go to both references I get brought back to TOD. I think that the link that you want is this:

Blue Shift..

I did a post back in May when I wrote a little about the improvement in fracking techniques. The use of pulsation rather than a single push makes sense to me, and we used that to control crack growth direction back in the day. Incidentally there are other fluids than guar that can be used, and some of them have better holding and lubrication properties - part of the problem, though, is getting them back out of the well to allow the gas to flow after the job is done. And then, of course, there is the cost issue.

thanks.

I've seen a few wells with HIWAY. At first glance, it worked, but a conventional frac would have worked just as well given the rock properties. Very brittle, hard rock with high young's modulus doesn't need as much proppant or water. In terms of treatment size in these reservoirs, the point of diminishing returns is reached quickly. So in that sense, the credit must be given to mother nature, not the completion technology.

It's very difficult to make apples/apples comparisons in frac designs, since each completion needs to be optimized for the local rock properties. But even with optimized completions, there will only be incremental improvement. Again, mother nature has the most influence over the performance of these different completions.

Halliburton warns on higher fracking costs.

Oilfield services provider Halliburton (NYSE:HAL) warned that its margins would continue to drop in Q2 because of higher pricing of a key raw material used in fracking fluid. The company expects its operating margins for the quarter to slide down by 5% because of the shortage of gaur – a legume that is mostly sourced from India. While the shortage is expected to ease by next year, higher prices for gaur currently account for up to 30% of the price for fracking. The latest hit comes after Halliburton saw margins drop in Q1 after explorers shifted focus from pure gas to oil rich plays to offset the impact of low natural gas prices in the U.S.

US gas rig count continues to drop. Weekly U.S. Gas-Rig Count Down 21 in Week to 452. One year ago it was 892.

Dude - you linked to the very TOD article we're reading. Here's one more like it: Energy Business Rewind: Baker Hughes' Rig Count DOWN, Hess Sells MORE Assets | Wall St. Cheat Sheet

EIA says supply is still up 0.77% YOY.

The shale gas bonanza seems to be confined to the US. Infill drilling and fracking around depleted onshore conventional gas fields has produced some extra gas but producers want top dollar

http://beyondzeroemissions.org/media/releases/santos%E2%80%99-shale-gas-...

We're talking $6 a gigajoule now but that could quickly double. In eastern Australia natgas, shale gas and coal seam gas will all go into export LNG from the gas hub in Gladstone, Queensland. That will draw gas away from the inland towards the coast.

This has immediate consequences. The Gillard government was supposed to buy out 2 GW of brown coal fired generation to be replaced by combined cycle gas. This was cancelled with the stated reason being that the buyout price was too high. The unstated reason was that east Australian gas price is expected to escalate too fast. To the west at Olympic Dam mining of the world's largest uranium deposit was supposed to be stepped up with a new 400 km gas pipe and 250 MW power station. BHP Billiton cancelled saying that 'input costs' were too high. Fracking has been a major disappointment.

boof - A couple of aspects jumped out at me. Not a big thing but most of the shale gas drilling isn't associated with conventional fields...depleted or otherwise. Just my hunch but I think the reason you see much more shale gas activity in the US isn't due to our shales being more profitable than someone else's. First, look who the big SG players are in the US: public companies. How many privately owned companies have you heard of playing these trends? The pubcos have little choice but to go after the shale plays: there aren't enough convention prospects to drill in the US to satisfy half the demand by these companies. many have to chase the shales or close down. Most of the rest of the oil and NG rights on the planet belong to national oil companies. They have vry different goal than the pubcos.

Secondly, we have the greatest concentration of infrastructure to drill, frac, produce and transport NG on the planet. Some folks still don't know that the US is the largest producer and consumer of NG in the world. We also have a local NG retail distribution system like no one else. Some countries, like China, might develop SG trends and have sufficient transport systems to get a significant volume of NG to industrial users but I suspect the staggering cost of building local retail distribution systems will prevent wide spread local consumption.

Also, another small point about us producers wanting top price. Hell yes we do. LOL. But what we want isn't relavent to what we get paid. The market place determines that...not what it costs us to get the NG out of the ground. The only control we have there is deciding whether prices are adequate enough to drill or not. Which is why your link to the discussion about what the Santos company thinks will happen to NG prices if they begin major shale gas drilling is a bit confusing. From what I gather they are a public company and not a utility. So it would seem as though they may eventually find themselves in the same situation many US companies find themselves: many companies are selling their production below the costs they incurred in drilling the dry gas plays. Again, the market place sets the price. I truly wish I could force my NG buyers to pay me based upon what my wells cost. Just doesn't work that way.

I won't try to guess what NG production and consumption will look like in The Land Down Under in the future. Just don't know that much. But with the huge offshore NG fields, the LNG export issue and unknown future shale gas development, I suspect few really have a good handle on it.

Development of these unconventional resources is starting to look more and more like insanity.

1. Arctic sea ice hits new low this year. So far sea ice area is down 20% from the previous record low of last year, sea ice extent is down 16% from 2007. From 1979, both sea ice area and extent are down by more than 50%. Volume losses from 1979 are 78%.

2. Arctic methane. Satellite record shows a growing Arctic Methane signal since 2005. Recent years have seen large and growing inflows from Arctic sources.

3. Marginal fossil fuel energy costs rising. Marginal costs for oil are now around $90 per barrel. Higher marginal costs for fractured gas are creating tough economic times for some nat gas producers. First oil, then the other fuels become less economic hurting capital flows at a time when capital could be used to tansition away from fossil fuels.

You may think that loss of Arctic sea ice doesn't result in economic damage. To the contrary, a recent Pew study found that increased cooling costs due to loss of Arctic ice and resulting warming feedbacks would add from 5-90 trillion dollars to the cost of cooling by the end of this century.

For fracked oil, the costs are very high in the US. Development costs for fields like the Bakken are expected to cost more than 800 billion by 2020. The costs for keeping other oil resources within the US producing at higher rates is expected to be another 800 billion within the same time-frame. For the same money, would could replace 70% of our coal infrastructure with solar and still have money left over for storage.

It just doesn't make sense, long-term, to keep pushing these fossil fuels.

Several charts on the sea ice I posted to Gail's latest key post graphically display those numbers--the chart below them indicates a major accelerant to the process which open northern seas could liberate.

didn't want to sidetrack the discussion earlier, but the trend line below (and the linked NSIDC monthly summary) might interest a few

It makes *plenty* of sense if you're an oil company. Or, if you're a politician bought by an oil company, or an average uninformed American who votes on the basis of which propaganda tickles the fear center in your lizard brain most effectively, or... well, you get the picture.

Or if you're a young guy looking for work, or a landowner who could use lease cash, or a state who wants royalties, or a shareholder in a local refinery, or....

In general, all the money gets made and spent close to home. Even if the cost is high, it's a much better net to produce locally than to send money overseas. This is no small thing -- it's why the oil belt down the center of the country is doing better economically than other areas.

Many will decry the long-term effects of hoz drilling, but it's undeniably an economic boon to those involved anywhere in the process. Practically speaking, it's not going to stop and it's probably not even going to slow down. All hydrocarbons will be burnt -- slower or faster maybe, but inevitably. Might as well jump on board and enjoy it while it lasts.

Paleo - "...but it's undeniably an economic boon to those involved anywhere in the process." And that's exactly the source of much of the strife in the NE IMHO. I still throw PA out as the best example. The companies, workers and royalty owners get a payoff for what risks and inconveniences they accept. But other than a theoretical gain in local NG supplies down the road not much benefit to other citizens. And the supply gain doesn't mean a lot if you or your utility don't burn NG. Even those citizens in Texas and La. that haven't gained directly from oil/NG drilling have gained a lot: $trillions in production severance tax over the decades. At one time the ST and royalty revenue to the Texas covered almost the entire cost of the university system. When I was in grad school at Texas A&M my tuition ran just a few hundred $'s per semester.

But PA, the land of Col. Drake and the first oil well drilled in the US, has never collected one penny of ST and still doesn't. I saw an estimate that if the state of PA and it's counties collected the same ST as Texas they would be pulling in several hundred $million per year just from the Marcellus play. Such income wouldn't pull everyone onto the frac'ng band wagon but at least many would feel some satisfaction. I don't enjoy paying ST. OTOH it doesn't bother me and, more important, has never stopped me from drilling a well...never.

PA...wake up and tax the bastards! LOL.

Shhh, don't tell people!

What if they knew that transport from the gasfields of the central US to the NE cost almost $1/mmf, and that the Marcellus fields thus enjoyed a larger margin for gas sales to the consumption areas of the East Coast? Let's just go lease up the land quietly, drill some wells, dump some fluids in the city drains, pump cheap, sell dear, and bring our dollars home to God's country.

Those silly Yankees!

Paleo - Na...since I don't drill in PA or NY I'll blab all the secrets. Screw Cabot Oil! LOL. I'm on the side of the citizens. Especially if it isn't coming out of my pocket. Lots of folks still don't get it: oil patch companies are more often ruthless competitors and not co-conspirators.

"All hydrocarbons will be burnt -- slower or faster maybe, but inevitably"

I have to agree with this statement. We will burn everything, everywhere and kill everything just to survive. What will the world look like in 150 years? Well, a human population of less than 1 billion people and an animal population consisting mostly of cows, pigs, horses. As for beautiful birds? Chickens and turkeys will fill that menu selection.

It may be bleak but it is unlikely we will evolve fast enough to prevent this. Thinking our small brains (95% DNA makeup is the same as the chimpanzee) will be able to manage the global resources effectively enough to become good stewards of Earth are about as likely as having chimpanzees successfully design and build skyscrapers.

So, enjoy it now! It just may be the peak of human civilization with all the very high EROEI energy resources available to extract and transform the stressed but still available raw resources. The Limits to Growth may have just been reached so...

Ah, remember how American's lived back in the 50's and 60's (cold wars aside)? Beautifully huge cars and only the father had to work. The air was still very clean and the world was not so overpopulated. Sure there was no Internet and iPhones but... Some would say that was also a plus. ;)

It makes lots of sense short-term though. And that's all that matters, for better or worse.

If I can hijack this thread to discuss South African shale gas development. (I started reading TOD as an interested layman, but recent developments have made me a concerned citizen.)

It has just been announced that Shell has got the go-ahead to explore the Karoo for shale gas. The potential is enormous:

Shale Gas: A Global Resource

Schlumberger, Oilfield Review vol 23 no 3, 09/01/2011

"The Karoo basin in central and southern South Africa covers nearly two-thirds of the country. The Permian-age Ecca shale group contains significant volumes of gas, estimated at 51.9 trillion m3 [1,834 Tcf] of GIP, of which 13.7 trillion m3 [485 Tcf] is technically recoverable.* The shales found in this basin are characterised as highly organically rich, thermally mature and in the dry gas window."

[By comparison, Marcellus Shale estimated original gas in place (GIP) is 42.5 trillion m3 [1,500 Tcf].]

http://www.slb.com/~/media/Files/resources/oilfield_review/ors11/aut11/0...

* http://www.eia.gov/analysis/studies/worldshalegas/

Estimated shale gas technically recoverable resources

This is potentially an enormous resource for South Africa, a country of 50 million people with no domestic oil or gas fields (but lots of coal).

Two questions:

1. How realistic are the EIA estimates?

2. What is the significance of the phrase "highly organically rich, thermally mature and in the dry gas window"?

aardi - First, as always, take anyone's estimate of recoverable reserves in a relatively little drilled region with a huge grain of salt IMHO. Many thousands of wells have been drilled in the Eagle Ford, Haynesville, Marcellus et al shales and folks are still arguing over future URR. Can't argue much about URR when there's very little hard data. Must I remind of my crude (pun intended) view of modeling: it's a lot like masturbation...it's OK as long as you don't start believing it's the real thing.

"Organic rich": not all shales are deposited with significant amounts of the precursors to allow hydrocarbon formation. IOW no dino...no grease. LOL. "Thermally mature": the process for turning the precursor into hydrocarbon isn't perfectly understood but we do know that a certain temperature and pressure history of the rock is required. Too cool and the stuff doesn't cook properly. Too hot and the oil can be cracked to NG. Even hotter and the NG can be cooked to dead carbon. As the temperature/pressure profile varies across a trend you can go from no hydrocarbons - oil window - NG window - burned out window. And even when you develop an oil window it can still be degraded if it get's pushed up too shallow and bacteria start eating it. They'll need to drill a lot of wells and do geochemical analysis on actual rock sample to start putting the pieces of that puzzle together.

Thanks, Rock. That's very informative.

So far, every US shale field has had some unique characteristics, and the "recipe" for the frack has had to be optimized. It took decades to get the first one right, and the progression now goes more quickly. Last I knew, though, int'l fields struggled to get the overall formula right -- right mix of knowledgeable service people, equipment, test wells, analysis, fluids, production approach, etc. They will eventually, though.