Tech Talk - China's Offshore Oil

Posted by Heading Out on August 26, 2012 - 7:50am

The recent post on Chinese claims to territory in the China Sea mentioned the rush to plant flags on different islands in the South China Sea portion as a sign of the ongoing nature of the disputes that continue to develop in the region. That status has continued with protests this last weekend in China over Japanese flag-waving over an island in the East China Sea. The islands are called Diaoyu or Senkaku, depending on whether the report is Chinese or Japanese.

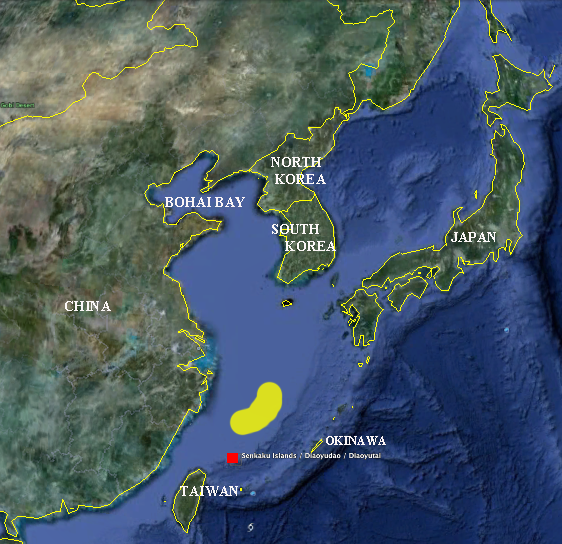

Figure 1. Location of the Senkaku/Diaoyu Islands in the East China Sea (Google Earth). The yellow patch shows the rough location of the Shirakaba/Chunxiao gas field. The Japanese claim runs through the center of the field, China says the boundary is to the East of the field (half-way between the disputed islands and Okinawa).

CNOOC, the China National Offshore Oil Corporation, and the company designated to handle their offshore deals, has been producing oil and natural gas from the field since at least March of 2011. Back then:

"China has complete sovereignty over the Chunxiao oil and gas field and administrative authority," Chinese Foreign Ministry spokeswoman Jiang Yu told reporters at a regular news briefing.

The gas field is 7 minutes flying time for the new Chinese air base at Shuimen.

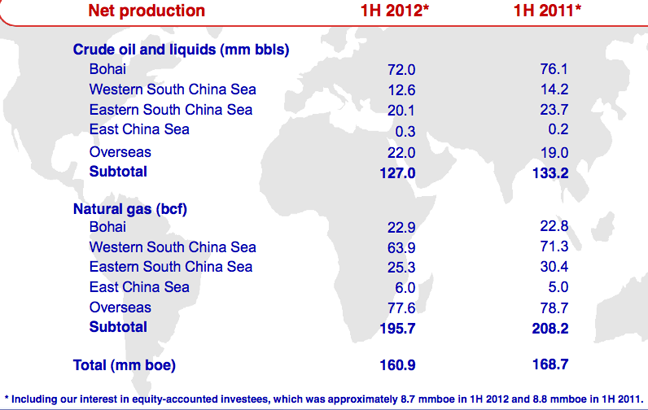

CNOOC has just released their Mid-year Review noting that they are on track to produce between 330 and 340 million barrels of oil equivalent (mboe) this year. They have 10 new discoveries and 18 successful appraisal wells, and have signed an agreement to co-operatively develop coalbed methane onshore in China. (Their realized gas price is $5.90/kcf, up from $4.92 over the same period last year.) However, they are running about 4.6% down in production y-o-y, which they blame partly on the production outage at the Penglai 19-3 oilfield, in Bohai Bay, due to the oil spill last year. The shut-down reduced overall company production by 40,000 bd, from a field which has been producing at some 160 kbd. The field, the largest offshore discovery in China is run in partnership with ConocoPhillips, came on line in 2002 and was the site of another small spill this June. Production at Penglai 19-3 was restarted in March, with the intention of ramping up to close to the original flow volumes.

The review notes that of the three appraisal wells drilled in Bohai Bay, Penglai 9-1 was the largest oilfield in recent discoveries in the Bay, and it tied in with the discovery of oil at Penglai 15-2, which is some 8 km south. When included with a third successful appraisal in the Bay (Qinhuangdao 29-2) they have collectively expanded the reserves in the Bay area. CNOOC also note new discoveries further north in the Bay at Luda, which originally came on stream at 11 kbd in 2009.

The second largest oilfield in China, the Shengli field, lies just to the west of Bohai Bay, but the onshore fields will be covered in more detail in a later post.

CNOOC is also producing oil from the Xijiang oil field in the East South China Sea. This field started production in 2008, when it was projected to produce 40 kbd from fifteen wells.

(Note this should not be confused with the Xinjiang Oil Province in northern Xinjiang Uygur Autonomous Region, which is a heavy oil deposit which the Chinese are developing using a SAGD technique.)

However, oil fields off the China coast have been in development sufficiently long that some are now depleting. The Lufeng 22 field some 150 miles south-east of Hong Kong has been officially shut down in June 2009. It had 5 long horizontal wells, which ran up to 2 km in the lateral.

Thus when one compares production from the different CNOOC sources in the first half of this year, relative to last year, the increasing role that overseas investments will be called up to maintain overall production levels becomes more evident. Those investments are in the Long Lake Oil Sands in Canada which they acquired with Nexen, and the Missan Oilfield in Iraq. It should be noted, however, that this is still up considerably from the 469,407 bd that the company averaged in 2007. However the 450 kbd anticipated from Iraq is sure to help more.

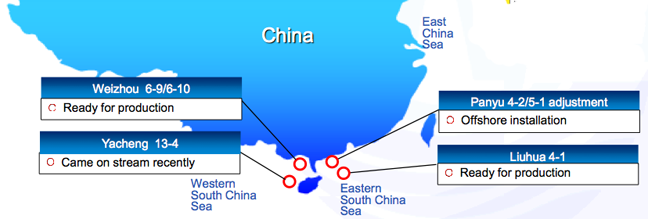

When one realizes that about 25% of the oil comes from the South China Sea, this tends to draw a little emphasis to the ongoing disputes in that region. There are four projects scheduled for production in the region this year - they are Weizhou and Yacheng in the Western South China Sea, and Panyu and Liuhua in the Eastern. Added to these are the discoveries at Enping in the Eastern South China Sea, and Dongfang in the Western.

( CNOOC Midyear Review).

Weizhou is actually an old sandstone reservoir that has been in production for quite some time, but CNOOC now has an interest in some of the fields that are still being developed in the region, which lies in the Beibu Gulf. The reservoir has a relatively low permeability such that various different EOR techniques are being considered for the region. The new developments this year should add around 20,000 bd to production in the Beibu Gulf region.

Yacheng is a gas field that has just started production. It is anticipated to reach peak production of around 1 mcm/day next year.

Panyu is a field that CNOOC acquired from Devon Energy and ConocoPhillips has an interest as the operations move into an expanded Phase II, over the 11 kbd which has been achieved prior. Two new drilling and production platforms are being fielded. Weather in the region is considered a problem.

Liuhua, while one of the largest discoveries in the South China Sea, has a relatively heavy oil, with about a billion barrels in reserve, found in a carbonate reservoir. It was originally discovered in 1987, and was first developed in 1993. It was successfully restarted in 2007, with 25 wells producing some 23 kbd of oil, after being closed due to damage from typhoon Chanchu. The new development is Liuhua-4, which has low reservoir pressure, and so will require the use of electric submersible pumps.

Whats more interesting about the Asian oil market is that Malaysia, an important exporter for fuel to both Australia, Japan and China, is soon to become an importer. They produce around 600k barrels a day and use just a little less than that. But their consumption is rising, and their production is declining (at about 5% a year). This means countries like China and Australia will have to struggle in an already tight oil situation, where theres less imports from Iran and a lot of strain on KSAs export ability. China will probably try to secure as many near by fields as possible, even though conflict with Japan and Taiwan is eminent. But with a military budget at $150bn a year and rising at 10%++ a year, they don't seem to have any other plan.

Let assume that China spends 10% of its military budget to secure the contested oil field. Over 10 years that is $150B. Is there really 1.5B barrels of oil in that field? I doubt it.

Sounds similar to the $1,000B US financial misfortune in Iraq and the effort to "secure" their oil that is worth about $100B per year. Too bad we can't keep the money and pay ourselves back. Perhaps Cheney will get some of it and trickle it down.

Perhaps the US government should consider energy policies that will get us off our crack habit. Drilling one (or even three) million barrels in heartland along with an XL pipeline ain't gonna do it.

China will make matters worse.

It's not just the oil, although it's part of the equation. That area isn't that well explored, it could out to be much like the offshore parts of Brazil.

But aside from oil, it's also about a natural extension of Chinese power projection. The U.S. more or less has hegemony over the Gulf of Mexico(a misnomer if there ever was one). Nobody can even come close to challenging it in those areas.

China, on other hand, has America breathing down it's neck via it's allies in the region. Do you think Americans would be pleased if China had a bunch of military bases in the Carribean, regularly patrolling those seas with their navy?

It's also a way for China to finally show Japan who's really boss. And Japan, for both nationalistic reasons and for pure pragmatism(they want those resources too!) isn't going to just roll over although I suspect they will be more or less forced to. America won't risk a military confrontation with China, especially as the contested territory is so close to the Chinese border.

That the area in question is closer to Vietnam than either China or Japan is another debate...

Can someone explain to me why Japan, a country desperately in need of energy supplies, does not bother to develop its own gas fields.

They could have developed the gas fields decades ago, but instead just write complaint letters to China.

There must be some hidden reason!

According to http://www.eia.gov/cabs/Japan/pdf.pdf, Japan had 738 Bcf of proven natural gas reserves as of January 2012, and produced 174 Bcf of natural gas in 2010. At that rate, they have about 4 years worth left.

One Japan bussiness man made a understanding with Chinese goverment about joint develop gas fields at east China sea at 1991, but after the talk with CNOOC began, it was turned down by Japan government.

plus, the sea floor have a oceanic trench which do not permit transport of NG from chunxiao directly to Japan. must transported to China first.

I checked in earlier in the day and have looked online to try to understand the quality/makeup of these various crudes. I need further guidance. Can these be used to alleviate China's lack of low-sulfur Diesel? How are the chlorides and other catalyst antagonists? Are the answers easy to find?