China's Coal to Chemical Future

Posted by Rembrandt on August 2, 2012 - 4:59am

In this post, I give an overview of developments in China to create a coal to chemicals industry, primarily using methanol as an intermediary feedstock. In doing this research, to my surprise, I found that the Chinese chemical economy is advancing rapidly in its use of coal as a chemical feedstock, as opposed to crude oil in other countries. In many cases, coal already represents 20% or more of chemical feedstocks, and in special cases such as PVC, the country already sources virtually all of its input from coal. Since China produces 20% of the world's PVC, such transitions have a substantial impact on the global energy system.

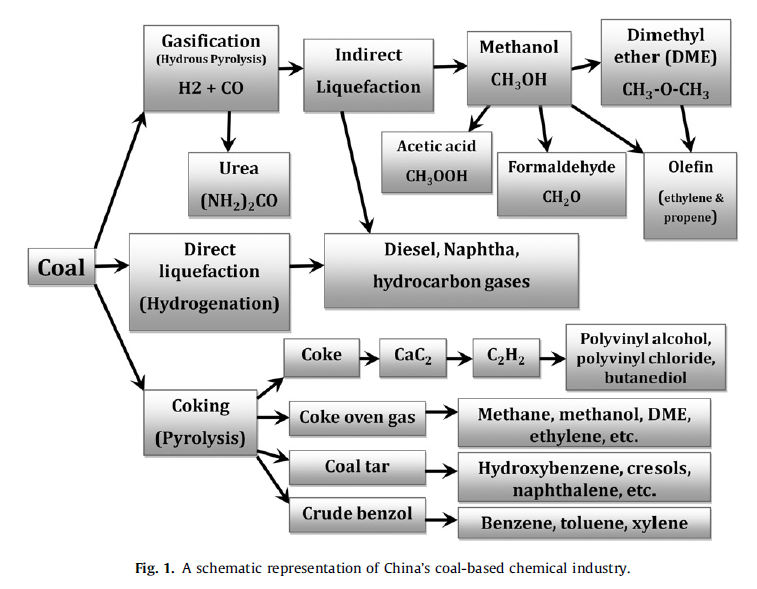

The primary raw chemical input produced from coal is methanol, which is produced through coal gasification and subsequently, methanol synthesis and refining (see picture below for overview of process steps).

Figure 1 - Block flow diagram of coal to methanol synthesis. Source: Inouye et al. 2008

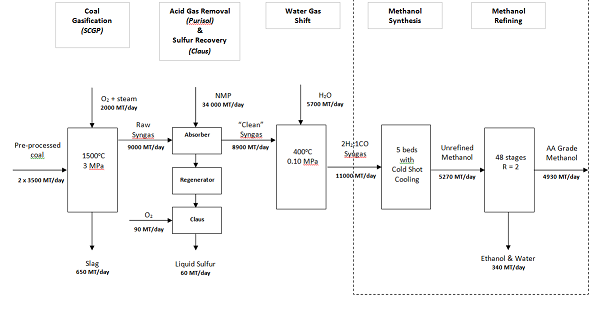

Today, methanol is used to produce a wide variety of chemicals including formaldehyde, MTBE, acetic acid, DME, esters, olefins, and other products. These are used for fuels, pesticides, medicines, plastics, fibres, resins, etc. China currently produces approximately 25% of the world’s output of methanol.

Figure 2 - Products produced in the coal to chemical's industry of today. Source: Yang and Jackson 2012

The current status of China’s coal to chemical industry.

Since 2000, China has been investing an increasing amount into the production of coal-based petrochemicals, substituting these for traditional crude oil based processes. The plausible reasons are the cheap price of coal and the strategic desire to be self-sufficient in resource inputs. The industrial base originally focused on five areas of petrochemical replacement. More recently, the industry is gearing up to produce other petrochemicals by Chinese R&D, and through establishing technology partnerships with non-Chinese players such as TOTAL Oil Company.

The five base chemical products currently made from coal in China are:

• Light oil (containing benzene, toluene and xylene) as a by-product of coke oven steel industry operations. The COLO (coke oven light oil) is utilized in the production of aromatics. It has been estimated that approximately 27% of benzene production in China is coming from this source. Benzene is a precursor for tens of thousands of chemical products including cosmetics, drugs, pesticides, lubricants, dyes, explosives, detergents, nylon, polymers, and plastics. Source: Jeffrey Plotkin 2012

• Acetylene used for production of vinyl chloride monomer (VCM) and 1,4 Butanediol (BDO). VCM is used to produce polyvinyl chloride (PVC) plastics. BDO is used for a variety of plastics, elastic fibres, and polyurethanes. It is estimated that approximately 85% of VCM produced in China is through coal based routes. Source: Jeffrey Plotkin 2012

• Urea and Ammonia used mainly for the production of fertilizers. Roughly 70% of nitrogen fertilizers in China are produced from coal feedstocks, and all expansion in the future will likely be coal, given the lack of natural gas supplies in China. Source: China Fertilizer Consultants 2010

• Coal to Olefins (CTO), also referred to more commonly as alkenes. These are used to process into a large number of other building block chemicals including ketones, carboxylic acids, ethylene, and alcohols. The first commercial plant was started in 2010.

• Monoethylene Glycol (MEG) production, utilizing a new process route based on gasification of coal with several further reactions to obtain methyl nitrate into dimethyl oxalate into MEG. The first commercial plant began operating in 2009 at a rate of 200,000 tons per year.

Future ventures

The country's industry is expanding its current operations rapidly, as well as implementing new process routes. For example, the company Celanese is looking at commercializing technologies to produce ethanol from coal. A few of the upcoming developments include:

• Dow Chemicals together with Shenhua will launch a large multi million tonnes coal to many chemicals plant in 2016, called the Yulin Integrated Chemicals project, for the production of methanol, methanol to olefins, monoethylene glycol, ethanolamines/ethylendiamines, polyether polyols, acrylic acids, acrylic esters, chlorinated methanes, ethylene dichloride, vinyl chloride monomers, and PVC’s. Source: Business Wire 2010.

• A substantial number of companies are planning to expand methanol to olefins production at commercial scales. Currently there are three methanol to olefins plants with a capacity of 1.56 million tonnes, using coal based methanol inputs. Another nine such plants have been approved and are under construction, and thirty such plants are in the planning stage with a combined capacity of 20 million tonnes. It is estimated that half of these projects would be sufficient for China to become self-sufficient in ethylene supply (primarily from Coal).Source: Ken Yin 2012

• PetroChina is planning to build two coal to paraxylene facilities, one of the main building blocks of PTA for the production of polyester. The facilities are planned at a capacity of 1.6 million tonnesSource: Ken Yin 2012

While ambitions exist, the Chinese government has announced that it aims to cap methanol production capacity at 50 million tonnes by 2015. Current capacity is around 40 million tonnes, of which only 50% is utilized. I.E. half of the plants stand idle due to over-expansion of the industry. Beyond the obvious too fast expansion, there appears to be other strategic reasons such as potential competition over coal use for electricity, and restrictions on water availability to produce coal. Some other key challenges lie in the distance of the coal seams to major consumer markets, and competition over other fossil fuel feedstocks from the Middle-East.

This is frightening. I wonder how many floods and droughts the Chinese must get to realize that this is caused by global warming from CO2.

In the meantime, Beijing floods are discussed as a drainage problem:

http://blogs.aljazeera.com/blog/asia/beijing-storm-deaths-spurns-online-...

The above blog also contains a picture on what could actually be a warning on sea level rises but the title says: "Remember the touching moments, but also remember to fix the drainage system!"

And the author of this coal article is from Holland which will also be flooded.

From the Potsdam Institute

http://www.pik-potsdam.de/sealevel/

Floods are nothing new in Chinese history, having killed millions. For instance the 1931 flood is estimated to have killed 4 million people. Despite the fact that its population is higher than ever, China's massive dam projects address flooding and such devastation is less likely today.

A large part of the Netherlands has been recovered from the sea artificially and this process continues. Indeed,for visitors it is often strange to find historic port cities so far inland.

In any case, mankind has had to deal with sea level rise ever since the end of the last ice age. When it begins to fall again...

Al Jazeera was showing a film with dams overflowing

http://www.aljazeera.com/indepth/inpictures/2012/07/201272252718208826.html

Perceptions of Climate Change:

The New Climate Dice

5/1/2012

....

The other extreme of the hydrologic cycle, unusually heavy rainfall and floods, is also expected to be amplified by global warming. The amount of water vapor that the atmosphere holds increases rapidly with atmospheric temperature, and thus a warmer world is expected to have more rainfall occurring in more extreme events. What were "100-year" or "500-year" events are expected to occur more frequently with increased global warming. Rainfall data reveal significant increases of heavy precipitation over much of Northern Hemisphere land and in the tropics (3) and attribution studies link this intensification of rainfall and floods to human-made global warming (24-26).

http://www.columbia.edu/~jeh1/mailings/2012/20120105_PerceptionsAndDice.pdf

Re: sea level rise. We are not nomads anymore. Our ports and other infrastructure are concreted in.

Sea levels will definitely not fall. That would require the ice sheets to grow, but they are melting. There is already too much CO2 in the atmosphere. In an ice age - under natural climate change (Milankowitch cycles plus CO2 feedback) CO2 concentration is around 200 ppm. We are approaching 400 ppm, 100 ppm higher than in any warm period of the last half million years.

The sea level rise will happen when oil production will be in full decline and there may be no money or even diesel to rebuild what NASA climatologist James Hansen calls "transient coast lines". This is the real tragedy of the combination of peak oil and global warming.

I think their is less denial about climate change in China, but more people tend to think "if we go hell, we go together". With the opening up, more Chinese had a chance to observe the luxurious, energy intensive and carbon intensive life style of westerners. And it becomes a resistance to curb emmisions. After we cap eletricity production based on emittion cap, people start to ask:"Why should I turn off AC at 37 degree to reduce CO2 emmision when westerners are producing ton of them on expensive trans-atlantic flight for vacation and STILL drag everyone to hell?"

I do not think this deadlock will be solved until a life style change in western countries lead to drasitically reduction of recreational (or service industries's) carbon emmission.

The thing is that Chinese's emission per capita is now about as high as the European's one. So this argument is running thin.

Country statistics are only useful when taking account of embedded carbon flow. Chinese used huge amount of their quota to produce carbon intensive product to supply the world while rich people around world consume their quota on recreational air travel and import those carbon intensive products for their own luxury.

I think a better way is not to count by country but by life style. Some economically hit Europe countries are decarbonising with big reduction of spending, with people go back to country-side and pickup farming again, and dropped out from global trade cycle. It would be very hard for them to cut more CO2 emission drastically. However, the new riches in developing countries starting to produce a lot more CO2 even surpass average EEA or US citizens. However, current carbon trade wars are hurting those work intensive-recreation low working people around the world, not restraining those with luxurious carbon intensive life style. If those luxurious emitters around the world do not decarbonise, poor people will acquire wealth by hard work and follow their example and start emitting (BRICs as example). And those old emitters cannot do a lot about it beside lead by example.

@jmdesp, would you care to share your sources? from the World Bank data [see source]:

Even including their manufacture of junk for the rest of the world, their massive infrastructure buildup, their deforestation ... their lifestyle puts them below half of european standards. Or is there another source of data we're missing?

On the contrary, keeping coal in high demand as a chemical feedstock in lieu of petroleum may well be the only market mechanism of sufficient force to keep coal in an economically uncompetitive price range for electricity production relative to lower carbon and more efficient natural gas and renewables.

If electric utilities forecast greater competition for coal on the internatoinal market, it may disincentivize them from investing in more coal-based electric infrastructure, particularly as the fuel continues its climb in price.

What fraction of China's coal use does this represent? Are we talking 0.01% or 50% or what?

It's in the low% range right now but is growing. http://www.shenhuagroup.com.cn/english/productsservices/product0introduc...

This is probably a stupid question, but what's the point of making urea with coal? It's in urine, right?

Urea is a better fertilizer without the salts found in urine. Most urea is made from reforming of natural gas concomitant with ammonia.

I know nothing of the matter, but it seems common sense that the chemistry to remove the the salts from the urine is easier and cheaper than coal gassification a 1500 deg, followed by tens of chemical processes. I assume the problem is a logistical one. How do you modify the sanitation and sewage system (and culture) of a society, and how do you (economically) gather all this incredibly spread urine? Do you send a person with a bottle to each house? build underground pipes? That's probably where the economics fail for the large scale.

Clearly those who predicted that peak oil would mean the end of supplies for the chemical industry were much mistaken.

It was always pretty obvious really, but those emotionally wedded to societal collapse exaggerated the difficulties.

In the US, for instance, the same problems of excessive distances of the coal seams to the markets are not so pronounced for substantial parts of the coal resource, and so It should be perfectly possible to transition chemical products.

Or perhaps those predictions were not mistaken at all. This is the first wave of "the end of supplies for the chemical industry (as we have known it)". Peak oil is upon us and we are seeing the generation of whole new industries to deal with it.

I will agree with the sentiment that any doomsday predictions failed to take into account the inventiveness of the human spirit.

Still, the days of one-stop-shopping using oil are over. Those of us without ample coal would do well to begin our own explorations into locally plentiful materials.

Yep; especially considering the costs of many of these products (excluding fertilizers) is more in the production and less in the feedstock.

Besides, if plastics become costlier, we'll use them more wisely than in throwaway everything.

Also, most global fertilizer production is from natural gas, not petroleum, especially in the US where it is almost exclusively so.

And of all the fertilizer produced in the US, this only accounts for about 3% of our natural gas consumption.

So there's plenty of room for adaptation.

Absolutely correct. I observed back in the 1970s that increased oil prices didn't affect all uses of oil equally. Basically, they priced oil out of some markets completely, forced economies in others and went pretty well unnoticed in the remainder.

As a response to the two oil shocks of the 1970s, industrialised countries converted power stations and cement manufacturing from oil to coal. This caused a massive boom in the Australian coal industry, as Japanese companies hurried to finance the construction of as many coal mines as they could. Oil fired power plants continued in some poor Third World countries, as well as OPEC countries, but otherwise oil was priced out of that sort of market.

During the 1970s, there was a boom in small cars and the first concerted push to make car engines more fuel efficient, while large cars were avoided by most car buyers. This led to a decline in oil consumption in the transport industry.

In the petrochemical industry, however, oil prices are not very relevant. The most expensive part of petrochemical production is the depreciation on the massively expensive plant needed to make it. The next most expensive is the wage bill for the relatively small but highly skilled workforce which runs that plant. The cost of the feedstock is very much small beer. As should be obvious, the demand for plastics of various kinds exploded in the 1970s and 1980s, regardless of the price of oil.

Observing these phenomena, I learnt a lesson for the future. The lesson is that, when it comes to a bidding war between petrochemical manufacturers and car drivers, the petrochemical manufacturers will be willing to pay a higher price than car drivers will. The private car will be bid out of the market by the people who make all the squillion varieties of plastics, as well as other high value products. Not all plastics will be affected the same, though. I can see the plastic bag industry going backwards really fast. Look around your home, though. There is an awful lot of plastic being manufactured to take the place of metal - which, because it is heavy, is costly to transport.

So, the industrial users of oil will be the last ones standing. And I'll only need enough to keep my bicycle chain lubricated.

This is why China produces 9.4 of the world's 34 Gt of man made CO2. They may have all this clean energy on the drawing board but until they dramatically cut coal use they are taking us all down. I think the West is justified in imposing carbon penalties on goods made in China. It hurts us as well as them since we pay more and they sell less. When Chinese emissions drop to say 3 Gt of CO2 then the West can drop the carbon tariff.

Disguised protectionism some will say to which I ask do we want to solve the CO2 problem or not? Surely the Chinese themselves want clear skies and a more sustainable basis for their economy. They have escape the wrath of the Kyoto protocol by sheltering under the status of a 'developing' country. Surely they have become 'developed' by now.

Put it is this way, the feeble carbon abatement methods in Europe, Australia and elsewhere are getting us nowhere fast. They have encouraged dirty industries to move elsewhere, giving others a free ride. Now China should be forced to decarbonise at the same time as the rest of us.

Regulations in the West aimed at reducing coal use here actually in effect subsidize cheaper coal for the Chinese, who by the way care less about toxic emissions. Further, the Chinese don't care as much about efficiency either, so the net effect is greater CO2 and toxic (soot, NOx, SOx, Hg, etc.) emissions.

United States: 18 tons of CO2/capita

Netherlands: 10 tons of CO2/capita.

China: 5 tons of CO2/ capita

[source]

Would you care to explain what exactly you mean by "decarbonise as the rest of us" ???

Perhaps when we cut by half our emissions we can start pointing fingers. (I know it doesn't help with total CO2 emissions, but that argument that they should do like us doesn't hold at all ... because if they do they would have to double their emissions!!!).

Rembrandt,

Thanks for this work. Do you have news on coal-to-liquids in China?

@David,

There is an excellent article called:

Coal liquefaction policy in China: Explaining the policy reversal since 2006 from Fang Rong and David Victor published in Energy Policy 39 (2011). I hope to format it one of these days for TOD.

Rembrandt,

Yes, that is an excellent article. It is not completely internally consistent though. From numbers quoted on various pages, one can derive Chinese recoverable coal reserves ranging from 319 billion tonnes (on page 14) to 5 trillion tonnes (page 9). The latter number would make 10 ten trillion barrels of liquids. Do you have a number that you think is most likely?

Has anyone looked into Chinas coal future? Using quick Wikipedia research, I figure out that China has 114,500,000,000 tonnes of coal in reserves (12.6% of world share) and has an annual production of around 3,000,000,000 tonnes. Fast math calculations gives them a reserves/production ratio of 38 years until empty. Obviously they compete with Japan and India for imports, mainly from Australia, but considering Japan is having issues with their expensive oil imports and trouble with nuclear, they will likely be a country willing to pay a lot to keep bringing in coal from abroad. In a quick comparison, the US has 246,600,000,000 (23.3 % of world share) tonnes of reserves and produce annually 1,000,000,000 tonnes (one third of China) and gets a ratio of 246 years. http://en.wikipedia.org/wiki/Coal_by_country

Chinese coal dependence must be touching a nerve because they now claim they can't be held responsible for most CO2 before 2005

http://theconversation.edu.au/rich-nations-should-do-more-on-climate-say...

Next muggers will be giving us lessons in manners. Maybe it's also OK to have 1.35 bn population shooting for Western middle class levels of energy consumptioni, instead of say 0.5bn. New coal deposits are being developed in Australia with Asian export markets in mind. One big mine will be called 'China First'. Not only will the coal add CO2 to the global atmosphere but the coal ships will come perilously close to running aground on coral reefs

http://en.wikipedia.org/wiki/Jia_Yong#Great_Barrier_Reef_grounding

The GBR gets it twice, coral bleaching/ocean acidification and physical collision with ships. Shame that carbon that was withdrawn from the primordial atmosphere a quarter billion years ago (Permian era) couldn't stay underground.

I'd say to China have all the coal u want but the deal is all your goods exports gets slapped with a 20% punitive tariff when they arrive in Australia, the EU, California etc.

Fine, but only after every American family agrees to pay a tax of $1,000,000 toward their past CO2 emissions over the past two hundred years.

Or invest in $2,000,000 in wind, solar PV, solar heat, solar cooling, heat storage, electric storage, electric transport, with the right to maximize the return on that $2,000,000 investment made anywhere in the world.

That's my SWAG on the advantage American families have had over the past two centuries from almost unrestricted pillage and plunder of the global environment.

Over the last two centuries?!

You silly git, americans weren't "plundering the global environment" in any meaningful way until WWII and after. We were only plundering North America pretty much (except for a few industries like whale hunting) until the 1880's. We started to bend the South American continent, Caribean and ex-Spanish Pacific to our will after that. Didn't get to proper raping and pillaging on a global scale until the end of WWII. Now the British empire, on the other hand...

You forgot to include a slavery tax. And by the way, wouldn't that tax also apply to the people of Italy (former Romans) for enslaving all those millions from Gaul, Britain, Germany, North Africa, etc? The Greeks also had some slaves, and no doubt the Persians too. Who else?

Oh, and if your recommended electric transport runs on electricity generated by coal, then you yourself will owe some additional tax. Just send in a blank check and we'll fill in your amount paid when we have a grand total for you.

China's use of coal to feed their chemical industry is not a recent development. When I researched hydrogen production about ten years ago, I learned that in China, hydrogen for industrial use was produced by gasification of coal. In the West, it's produced by partial oxidation and steam reforming of natural gas. Using natural gas is cleaner and more efficient than using coal, but the processes are actually quite similar. The first step, in either case, is making synthesis gas. Once you've got clean syngas, you can go on to make pretty much any hydrocarbon you need.

One thing prominent by its absence in figure 2 (or the second "figure 1") is Fischer-Tropsch synthesis. I guess that's not entirely surprising, since the capital and operating costs for making FT liquid fuels are a lot higher than they are for making methanol. Still, the hard step in any CTL process is the initial gasification and cleanup. If you've gone to the trouble to make clean synthesis gas, you're "over the hump" for making gasoline, diesel, jet fuel, and assorted other products via FT synthesis. They're high-value products. It would be interesting to know why China has stayed away from them.

Another thing that surprised me was the statement that China has more capacity for methanol than they can currently utilize. Huh? From methanol, it's easy to make DME. DME has an existing market as a propellant in spray cans and as a substitute for LP gas in cook stoves. It's one of the products that's shown in figure 2. But DME also makes a very clean and efficient fuel for diesel engines. The fuel system needs to be modified for DME, but it's not a particularly difficult mod. Volvo has for several years been operating a test fleet of 14 heavy trucks modified for DME. China could easily create a domestic market for DME that would quickly absorb any methanol surplus.

Using coal as the root feedstock for synthesis of hydrocarbons does produce a lot of waste CO2. About half of the coal is oxidized to CO2 to provide the energy for reacting the other half with steam. The product of that reaction is synthesis gas. However, the yield of synthesis gas can be doubled, and CO2 emissions virtually eliminated, by driving the reaction via heat from an electric plasma torch.

China will almost certainly do that, once they have enough clean electricity. (It wouldn't make sense to use electricity from coal-fired power plants; the coal plants would produce at least 50% more CO2 than the use of electricity to drive gasification would save.) Given China's rapid build rate for nuclear power, I'd say that China is being more responsible about its long term carbon emissions than the West.

Any of the synthetic fuels the Chinese are making from coal are destined to end up as CO2 in the atmosphere anyway when they are burned by the end-users. Plastics and other materials will end up in landfill and probably not add to the atmospheric CO2 burden but that is true of petrochemical-derived plastics too.

China is going to dig up and burn a lot of coal over the next thirty or forty years at least. They're also building out hydro, nuclear, wind and solar but they aren't a substitute for coal, they're a supplement. They need the electricity. That means a lot more CO2 is going to be added to the atmosphere and a lot more miners killed.

Thanks for the article.

"I found that the Chinese chemical economy is advancing rapidly in its use of coal as a chemical feedstock, as opposed to crude oil in other countries"

Obviously the Chinese have taken a strategic economic decision to use coal rather than oil. It would be interesting to know the economics of coal vs oil for these Chinese chemical plants. Probably difficult to uncover, given cheap (state) financing, cheap labour costs and probably subsidized (below internationally traded) coal feedstock prices.

(btw it should be 1,4 Butanediol)

I think it would also be interesting to see if coal is cost effective versus natural gas at current LNG prices. If so, the NREL cost estimates for the nth size coal to methanol plant may be realistic.

From what I understand China doesn't have access to large amounts of natural gas. They do have lots of coal within their own borders with infrastructure in place to mine and transport it. This gives them security of supply (no nice Mr. Putin with his hands on the NG pipeline taps as Eastern Europe has discovered) and security of price since the coal they mine is not subject to international price fluctuations although they are free to buy low-priced coal on the open market if the price suits them. Win-win.

Arson, that's what it is.

We taught them the rhetoric. We labeled these earthly treasures as "fossil fuels." Just burn 'em. Not worth that much. Just crumbly dirty (very old) rocks.

The Stone Age rages on. Burn baby burn.

It's time to put our own house in order, set an example. Is there time?

I was thinking today, that with the latest things I learnt, Peak Oil seems less of a worry but Climate Change seems more, than I thought even a year ago. Then I log in to read this. I am not so sure Monbiot was wrong; there realy is enough carbon in the ground to fry us all. The only thing there is not enough of, is to make the economy work the way it used to again. We realy have the worst of two worlds.

I'm not sure there is.

Chinese coal production seems close to peaking, and their appetite for it is so large relative to the rest of the world that countries such as Australia and Indonesia (the two largest coal producers) will be really hard pushed to make much of a difference. Australia already exports nearly 70% of total coal production, and Indonesia over 80%. Total coal production for each of these two countries is roughly 10% of China's coal consumption. China is now the world's largest coal importer, as well as being the largest producer and the largest consumer.

We've burned all the easy coal, as well as all the easy oil. The vast figures quoted for coal reserves are on a par with the vast oil reserves of North Dakota.

The problem that China will have is that eventually they will not be able to run huge trade surpluses with the US and will have to rely on more balanced bilateral trade to procure raw materials. To the extent that they are buying from more democratic/socialist countries that will not want to run big trade surpluses with China, they will be limited on how much they will be able to import. Spreading their resource needs over many countries is a good strategy. So is identifying countries run by sociopaths that are more interested in personal wealth than the well being of their country. The west has used that model extensively for decades.

So, the problem China will have is how are they going to get the resources they desire once every garage in Australia is full of stuff? Or, the Australian dollar has appreciated to the point that the Australian economy has been completely hollowed out and their is a backlash against coal exports.