Tech Talk - Saudi Arabia Then and Now

Posted by Heading Out on July 23, 2012 - 12:05pm

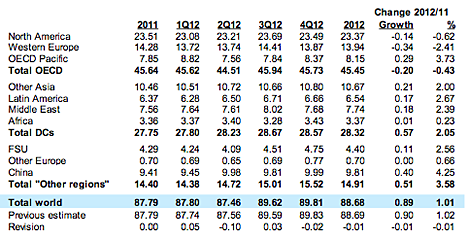

The latest OPEC Monthly Oil Market Report (MOMR) foresees that demand for OPEC crude oil will decline over the next year by about 300 kbd. This is largely in anticipation of additional production from elsewhere:

Non-OPEC supply is forecast to increase by 0.7 mb/d in 2012, supported by the anticipated growth from North America, Latin America, and FSU. In 2013, non-OPEC oil supply is expected to grow by 0.9 mb/d. The US, Canada, Brazil, Kazakhstan, and Colombia are expected to be the main contributors to supply growth, while Norway, Mexico, and the UK are seen experiencing the largest declines. OPEC NGLs and non-conventional oils are seen averaging 5.9 mb/d in 2013, indicating an increase of 0.2 mb/d over this year.

Overall, OPEC sees demand staying below 90 mbd over the remainder of this year, with total growth in demand lying at 1.01 mbd.

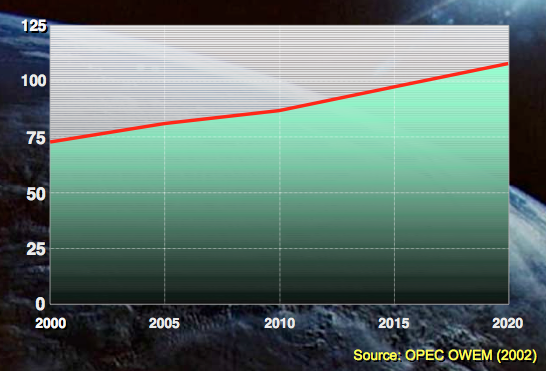

Much has happened since the late Matt Simmons and Nansen Saleri got together back in February 2004 to debate scenarios for future oil production in Washington. While Matt had developed his research that led into the publication of “Twilight in the Desert”, this was the meeting where Aramco pushed back to explain that there would not be a global problem for at least fifty years. As this series of posts on Saudi Arabia comes to a conclusion and moves on to other countries, it is perhaps of some value to look back on the presentation by Mahmoud Abdul Baqi and Hansen Saleri to remember what was said. Back in those days, oil demand was expected to steadily rise with increasing rates to reach 100 mbd in 2015.

At the time, Aramco had no concern over the industry being able to meet this increase in demand, and fully expected that Aramco itself would be able to more than sustain its share of the increased demand. They had 9 seismic crews out surveying the country, and some 48 rigs drilling both to sustain their then current level of production, and also to explore for new resources.

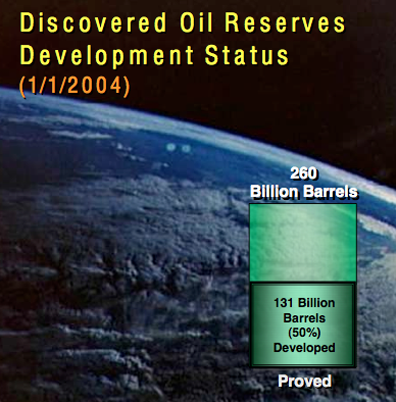

Aramco reported that with 700 billion barrels of oil initially in place that had been already discovered in the country, they expected to find another 200 billion barrels. Of that discovered oil, they considered 260 billion barrels as their reserve, of which they had 131 billion barrels in development by 2004. (Note that they defined the reserve as the total amount of extractable oil, not the amount left to recover; they have done that in later computations also, and the latest annual report uses 259.7 billion barrels as that discovered reserve). The Annual Report notes that they discovered one new field in 2011 - the Wedyan-1 well in the Empty Quarter flowed at 2.3 kbd from the Mishraf reservoir, while they drilled 161 exploration and development wells.

For a short arithmetic problem, consider that 260 less 131 equals 129, and if one adds another 21 as a percentage of the 200 billion barrels to be found, then one gets 150 billion barrels. Divide this by 3 billion barrels a year of rough annual production and you get the 50 years of remaining life that Saudi Arabia considered, back then, that their oilfields have left.

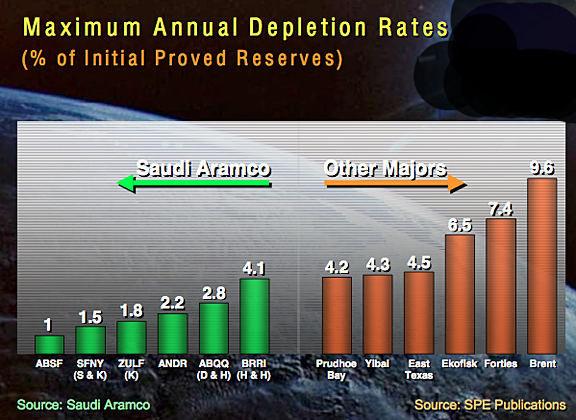

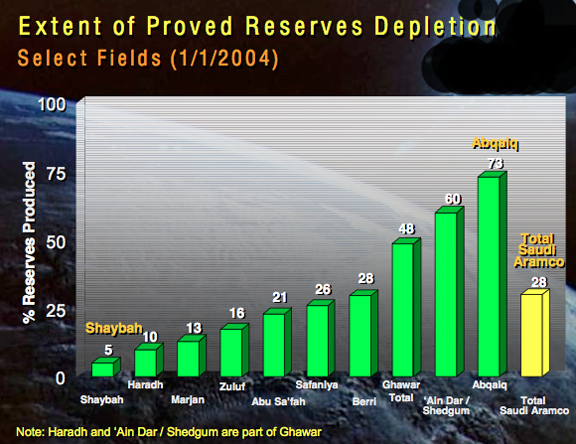

And this is the interesting plot, for it shows what Aramco defines as their depletion rate, which is annual reduction of the initial proved reserve. The relevant term is the annual depletion rate:

This should be read in conjunction with the state of depletion of the different reservoirs in the KSA, as reported for 2004.

And remember that this was eight years ago, so there has been that much change in the numbers! Aramco also expects to recover about 75% of the Original Oil in Place (OOIP) in all fields. They have been able to reach around that level with Abqaiq, which also suggests that the days of that field are now very numbered. But whether this will be possible in the other reservoirs is more open to doubt, and if there is less recoverable oil, then the actual depletion rates go higher.

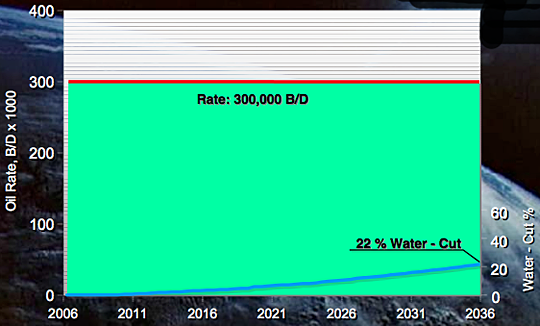

But where the field is just starting, such as the new development of Haradh, if they hold the extraction rate to 1.7% of the anticipated total recovery, then they anticipate that the field will continue to yield 300 kbd for decades.

It was this anticipation of success across their endeavours that led the company to project that they would be able to hold a Maximum Sustainable Capacity of 10 mbd until 2042, with it only then becoming necessary to replace reserves from the probable and possible fields yet to be found and developed.

The last few posts have described how, as declining output now hits the original fields, Aramco has moved to add production from other fields (Shaybah, for example, will soon be producing at up to 1 mbd) and is introducing multiphase pumps to Haradh and Shaybah to improve production from marginal wells, and in Safaniya to sustain a maximum production capacity of 1.3 mbd. Production from Manifa is also anticipated to step in to cover declines in other fields, and will come on line in 2014, with a capacity of 900 kbd.

But these new additions are required to offset the decline in existing fields, which have been somewhat protected from the severity of declining well production by the switch from vertical to maximum reservoir contact (MRC) wells. Although this conceals the depletion of the oil in the reservoir during normal production, it does not by itself improve the ultimate production from the field, but rather can shorten field life since these wells have proved to be more productive in rate. Nansen Saleri now appears to duck questions which ask if KSA can increase production beyond 10 mbd.

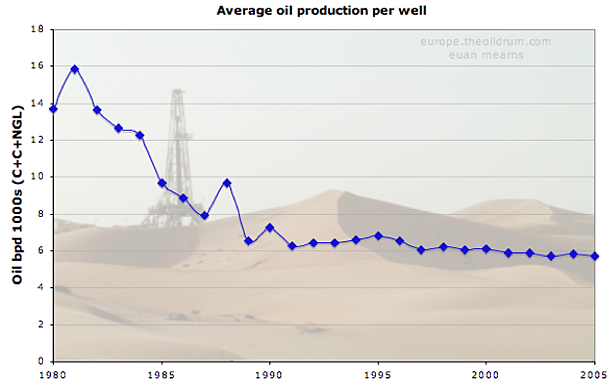

Within The Oil Drum (TOD), there has been considerable discussion over the rate at which well production declines, and the remaining reserve in the field depletes. One impact of the shift in wells from old established fields is that production from the average well will decline over time, a subject that Euan has visited in the past.

It should be noted that the use of the submersible pumps are reported to have brought wells back to around 3,000 bd. But the move over to horizontal and MRC wells has slowed the impact of other changes in the country.

Nevertheless, after putting all this together, I re-iterate my conclusion from last time in that I doubt KSA will increase production much above 10 mbd (in June it was producing 9.888 or 10.103 mbd depending on source, and with the rising internal demands (domestic use in the Middle East is now projected to average 7.7 mbd in 2012) world markets will get tighter in the shorter, rather than the longer term.

Dave, thanks for a fantastic article. You make the same point I have been trying to make for years now. And that is that Saudi has been able to offset declines in their old fields by bringing on new fields and with horizontal wells and in some cases MRC wells.

But when the water hits those horizontal wells the decline is likely to be swift and sudden. However with Manifa coming on line we may not see the decline hit with any impact until late in this decade. But we are all waiting with abated breath.

Ron P.

This explains why Middle East reserves always go up, even after several 100 billion barrels have been extracted. The problem with this type of reserve definition is that the rest of the world defines reserves as the amount of oil that hasn't yet been extracted. Yet the IEA, EIA, BP, and even OPEC themselves do not take this discrepancy into consideration when reporting world reserves. All these organizations should deduct the amount Middle East oil already produced from their reserve estimates. But are they going to do this? If not, why not?

Is it possible that the MRC wells are increasing the percentage of OOIP that is recovered? I have only a vague understanding of the mechanics of flow in a reservoir but it seems that some of the problems of getting oil out can be mitigated by having shorter flow paths from regions in the resevoir to the point of extraction.

If so that would extend the Saudis productive years assuming that they used the extra yield at a lower than possible extraction rate, right?

But I assume it would not alleviate the problem of production dropping off faster once the water hit the MRC inlet.

jj – “Is it possible that the MRC wells are increasing the percentage of OOIP that is recovered?” Not only possible but likely. But impossible to estimate without much more detailed data than the KSA releases. In additional to probably having a longer commercial life than a vertical they’ll have a better “sweep”: the effective drainage radius. But there’s the potential to be too optimistic of the gain based upon the higher flow rate. As pointed out the new hz wells won’t show a significant increase in water production (indicating not much life left) until very late in the game. Though a different reservoir dynamic this is the same phenomenon we’ve see in Mexico’s Cantrell Field

Extend field life for years? Since we don't have the data to make that call I can only offer a WAG: no. Not only not add years but perhaps reduce life. These wells might recover some additional URR but they will produce what is recoverable much faster. IOW recover more oil but do it faster than the vert wells alone would have done.

Thanks, Rock, for the usually cogent reply but isn't " These wells might recover some additional URR but they will produce what is recoverable much faster." a choice? They can, and do, choose how fast they produce each resevoir.

I'm always impressed by the sophistication of the Saudi resource management and use of technology. Within the constraints of ELM (per Westexas)Saudi Arabia seems to be managing their output quite sensibly. It seems possible that they might keep their production rates down rather than use these capabilities to produce at the maximum possible rate.

As a congenital doomer I am constantly suprised at the resilience of BAU. After reading "Twilight in the Dessert" I expected KSA to have been in serious trouble by now, but they aren't and I now suspect they are much smarter than Matt Simmons gave them credit for.

If I were Saudi I'd like dessert more than desert.

JJ, the very purpose of these new horizontal wells is to produce the oil much faster, to stem the decline rate. Had they not needed this oil much faster than they were getting it, they would not have spent the billions required to get it out faster. Saudi Arabia’s Strategic Energy Initiative

As Dave (Heading Out) points out above Saudi has been able to offset the decline of older fields by bringing on new production from Haradh, Shaybah and Khrais. They still have Manifa yet to come on line.

No one has suggested that the Saudis were dumb, they know exactly what they are doing. They have kept their peak production, over the years, at between 9 and 10 mb/d with gaps in between where they cut production back substantially. Right now they are, in my opinion, producing flat out. Manifa will likely keep them able to produce at this level for a few more years before they start to decline. But the rest of OPEC may start to decline well before that.

Ron P.

** the very purpose of these new horizontal wells is to produce the oil much faster, to stem the decline rate **

That may not necessarily be true. It could be something benign such as simple economics. Hypothetically speaking (because I don't know if this is true or not) let's assume a horizontal well can recover 2x the oil that a standard vertical well could recover. If the horizontal well costs less than 2x the vertical well your cost per recovered barrel is lower by going with the horizontal well design.

You don't necessarily have to produce it at twice the rate of the vertical well so you could have a longer life per well in comparison. In other words the choice to go horizontal may not be a sign of impending doom at all.

Yes it is true because they said that's what they were for.

Saudi Arabia’s Strategic Energy Initiative: Safeguarding Against Supply Disruptions

That is the reason for more wells. There is another reason the wells are horizontal. Vertical wells water out from the bottom up and, over their lifetime, produce a lot more water than a horizontal well. Horizontal wells do not water out until almost all the oil is gone then the water hits the entire length of the well all at once.

Obviously they still have a lot of their vertical wells still producing. But some of their horizontal wells may be watering out since they were installed, many of them over a decade ago. They all cannot be at the top of the reservoir because it is an anticline. Some of the vertical wells has to be further down the side of the anticline.

Ron P.

Nawaf Obaid didn't define 'maintain potential'. Your definition seems to be an extreme interpretation with an 'impending doom' pre-assumption.

There is no law against increasing recovery by closer well spacing, development drilling or developing deeper reservoirs, as at Berri.

Yes he clearly did say why they were doing it. "drilling to make up for production, Saudi oil fields would have a natural decline rate of a hypothetical 8%. There it is in black and white! They are doing it to make up for production losses due to decline.

There is nothing about "impending doom" in my saying exactly what the Saudis are saying. They are saying why they are doing it and I am giving the common sense results of such a program. If the natural decline rate is 8 percent but you suck the oil out a lot faster then you may get the decline rate down to almost 2 percent.

You guys are just trying to nitpick my words, and words of Heading Out, in an attempt to deny the obvious implications of massive new infill drilling even though the decline continues.

Of course drilling hundreds of new wells in an old field will increase the overall production by a certain percent. No one has ever denied that. But it also increases the depletion rate. All that extra oil pulled up by those new horizontal wells will not be oil that would never be recovered otherwise. Much of it is oil pushed up from the bottom with water driven injection and pulled out a lot faster by many new wells will be oil that would eventually recovered at a slower rate.

It is not either one or the other. It is not black or white. It is not that new wells will either be for slowing the decline rate or producing oil that would not be produced otherwise. It is both! They will produce some oil that would never be produced otherwise and produce oil that would be otherwise produced but a lot faster.

How much of each is debatable of course. But there is no denying it that even back then they only got the decline rate down to somewhere between 2 and 3 percent. That they still had a strong decline rate even while spending billions on new horizontal wells should tell you something. Billions and billions on many new wells ans still the decline continues. Even a cornucopian should gather something from that.

Question: What can be inferred from the fact that billions of dollars spent on massive infill drilling with the latest horizontal well technology does not stop the decline but only slows the rate of decline?

Ron P.

What can be inferred is that: the natural rate of decline of their 'average' field would be a 'hypothetical' 8 % (without additional drilling).

Additional drilling can include such grey area activities as increasing reserves by drilling wells on closer spacing, increasing reserves by drilling deeper horizons and increasing reserves by developement drilling in existing reservoirs. You apparently attribute additional drilling 100% (i.e. black and white)to acceleration drilling.

Put another way drilling to make up for production doesn't in any way specify accelleration drilling alone.

Drilling is expensive whatever the purpose. Spending millions, billions or trillions of dollars on maintaining capacity is a meaningless metric.

No, Stuart Saniford says only 60 to 65 percent of additional drilling, back then, was accelerated drilling. I agree with Stuart.

Saudi Arabian Oil Rig Count

Notice that this accelerated drilling occurred right at the time (2005-2006) when they said they were spending billions in order to stem their decline rate.

You will notice that in early 2011 Saudi started to increase their oil/gas rig count. I cannot find another chart like the above but they have since, in 2012, increased their rig count to 145, or about eight times what they were in 2004. Those rigs added this year are for Manifa however.

Saudi Aramco drilling-rigs count to jump 12% in 2012

However Saudi rig count seems to have increased in 2012 a bit more than was expected by Baker Hughes. They expected Saudi rig count to be 118 at the end of 2011. Apparently it turned out to be a bit more than that.

Saudi Arabia Increasing Rig Count 28%, Baker Hughes CEO Says (March 2011)

Saudi seems to be have been really accelerating their drilling activity in late 2011 and early 2012.

Ron P.

jj - see my note below to Tony about URR vs. cash flow

Drilling additional wells will almost always increase recovery(i.e. reserves) by an incremental amount.

How in the world could Saudi Aramco possibly drill wells between two 1 km spaced wells and not increase recovery ?

It doesn't take a rocket scientist to figure that out - more wells = improved recovery.

Ghawar Arab D reservoir averages up to 200 net feet thick. How could anyone possibly drill a 200' net thickness reservoir 1/2 km from the nearest well and not recover additional oil ?

http://www.gregcroft.com/ghawar.ivnu

Tony - Very true especially for carbonate (limestone) reservoirs. I don’t know the details of this reservoir but in general semi-isolated pockets of oil can easily be distributed throughout the field. But there’s the $64,000 question: better URR but at a faster rate so which wins the footrace? Perhaps the closer spacing recovers 10% more oil but at a 15% greater rate so the field depletes sooner as a result. Or maybe reverse those numbers.

I’ve always heard the KSA had some of the best Swiss engineers with some of the most powerful computers managing their fields. But decisions about withdrawl rates are controlled by different factors. And such decisions are not always made to the benefit of URR. I’m about to work on a project where the previous operator produced 5 oil wells at too fast a rate for the sake of cash flow. He destroyed all 5 completions prematurely and lost all cash flow so he can’t afford to fix the problem. If for no other reason than ELM I suspect the KSA may sacrifice URR for cash flow in the future. Perhaps even more so if prices stay lower long enough.

Just sharing my perspective...

1/2 Km = 1640 feet

Lets see... radius, 820 feet, height 200 feet, volume = 3.14 * (820^2) * 200 = 422 267 200 cubic feet.

422 267 200 (cubic feet) = 75 209 000.4 oil barrels

OK, about 75 million barrels.

That's the volume of a cylinder of that dimension, now how much of that is oil, and of that, how much is recoverable, hopefully someone else will comment.

hh – There is an answer but no one outside of the KSA can make a legitimate calculation IMHO. And I wouldn’t bet the farm on their accuracy. Here’s the rest of the parameters you need. Porosity: how much is rock and how much is pore space containing oil, NG and water. In a limestone reservoir that can range from a few percent to 35% or so. More complication: it can be 35% at location A and then be 10% in location B just a few hundred feet away. The KSA has those maps…we don’t. So take a guess and multiply the fractional porosity times you cylinder. We’ll call that ALPHA.

Only a portion or the porosity contains oil. The oil saturation can range from a few percent to 70% or more. And it can vary significantly as the porosity varies. Take a guess and multiply the oil sat by ALPHA and you get BETA: the percentage of oil per cubic foot of rock. Now let’s talk recovery factor. You can never produce 100% of the oil inplace. RF can range from a few percent to 70%. This is one of the most difficult metrics to estimate. Usually done looking thru a rear view mirror. And of course it also can vary significantly spatially. And if that’s not difficult enough the RF can vary greatly depending on how fast you produce a well. Produce it too fast and you can easily leave half of your potention recoverable oil stranded in the reservoir. And there are a number of more very technical parameters I wouldn’t try to explain related to NG saturation and pressure transients.

The KSA has a huge reservoir simulation model that tries to come up with the answer. And the best approach they have is to reverse engineer the process: take depleted areas and fit the model to known outcomes. If two very qualified reservoir engineering groups were given all the data it’s possible their honest answers could vary 10%, 20% or more IMHO. In 37 years of studying such efforts significant inaccuracies were not uncommon. Even without a bias it’s a very difficult exercise.

Thanks, Rockman.

With all the variables, unknowns, and spatial variances, I find it amazing you guys can get even a 50% accurate estimate. Even the most powerful computers in the world won't outdo a hand calculator if the models are inaccurate. Looks to me there is a lot of intuition and gut feeling into estimating reserves. It must be gut-wrenching to come up with numbers for the investment guys who deal in millions of dollars, resolving cost to the penny.

hh - Actually if a petroleum geologist were accurate 50% of the time he would be a millionaire rock star of the oil patch. "It must be gut-wrenching..." Not the process per se...we get use to making up numbers we don't fully beleive. What does get gut wrencing is not coming up with the numbers management demands. LOL.

Your observation about not coming up with the numbers management demands... boy does that bring up memories. I worked in aerospace for a while, and quickly found out that I could give management numbers I believed in, or I could be a "team player", give them the number they want, and keep my job.

That was the hardest job I ever had. The technical part was easy - but I never was good at "faith based" estimates.

You should see how the MIC is scrambling to produce 'faith-based' estimated of future business for defense contractors in the face of present and future budget realities.

People in the MIC, at some level, know that we are at 'Peak Defense spending', and but they cannot/will not publicly acknowledge it, and they are in great denial/outrage/coping...

What was seen as great outcomes for the textile, steel, auto, and electronics industries by virtue of globalization (job cuts in the U.S.) will come to Defense, but in this arena, it will be resisted tooth and nail by the same folks who preached that the rest of the economy had to 'suck it up'...except the Defense jobs won't be out-sourced...they will just go away.

It will be fun to see all those Federal GS and KTR Arm-Chair Ayn Rand acolytes in their comfy Aeron office chairs in their bureaucratic paper-pushing fed and KTR jobs forced out into the 'free market' and have to scramble to make a buck 'in the wild'.

I bet they will scream bloody murder if they don't get unemployment benefits, or if their pensions and health care are whacked....again, they see themselves, by virtue of their defense industry association, as better and more deserving of pension and health care than their non-defense-indutry citizens who have their benefits whacked.

The movie 'Falling Down' was prophetic.

A reservoir such as Ghawar with 180 Gb original oil in place, developed with 3400 wells. In other words 3400 - 53 million barrels(average) segments.

Wouldn't you think additional drilling would result in improved recovery from some of these segments ?

Manifa, Khurais...some really musty reservoirs here. Going over my old megaprojects spreadsheet I calc 5.3 mb/d coming online 2009-2020 from fields discovered before 1996, to use an arbitrary cutoff; the newest one after that is 1990. Earliest is Nahr Omar/Bin Omar Ph 1, discovered way back in 1949. This was an Iraq project, due online next year. There have been many more of those since of course, I compiled my worksheet years ago and haven't updated it.

These are just projects with a discovery date attached too. Only 79 out of 299 have them. Total for the whole shebang? 22.5 mb/d. So 1/4 of the new oil is old, very old in fact.

re: Aramco also expects to recover about 75% of the Original Oil in Place (OOIP) in all fields.

That seems excessively optimistic. I've seen recovery rates as high as 80% of the OOIP, but that was for extremely favorable reservoir conditions and very restrained production rates. Saudi Arabia has been producing its biggest field (Ghawar) at very high rates for most of its life, and most of its other fields have significant problems (e.g. very heavy oil), so one would expect that the ultimate recovery rate would be considerably lower than 75% on average.

I believe, with Darwinian, that KSA is finding problems sustaining their original targets, and has been developing other fields to cover as the production from the earlier fields declines. But, within the context of the last few posts, my concern is that they can't replace tier 1 reserves with tier 2, because those have been already called into play. So as Ghawar etc fade, the new front line fields will be much smaller, and from tiers 3 and 4. This will require much more development, and will become an increasing scramble to drill more and more, less and less productive wells. It is a concern that Euan and I have shared for several years.

Heading Out,

Thanks for your great series of articles on KSA. On your comment about proven reserves for KSA, would it be correct to assume that from the KSA perspective that the URR for crude would be about 260 Gb?

Note that a HL plot for EIA annual data from 1993 to 2011 indicates a URR of 224 Gb with a 95 % confidence interval from 170 to 306 Gb. A hubbert curve would have peaked around 2006 to 2007, but the hubbert curve assumes a steady increase in depletion rate.

A production plateau at 9.55 mb/d could be maintained out to 2024 by increasing the rate of increase in depletion rate. Such a scenario is highly speculative and might be confirmed by an oil shock analysis (using WebHubbleTelescope's generalized shock model.)

Note that output would decrease more steeply than a hubbert curve once the end of the plateau was reached. There is a limit to how high the depletion rate might be raised over a short period of time.

Currently if we assume the KSA URR is 260 Gb the trend in depletion rate points to 3.15 % depletion rate in 2024 (from 2.6 % in 2011). To maintain a production plateau at 9.55 mb/d out to 2024 the depletion rate would need to rise to 4 %. Whether this is possible remains to be seen.

I have done a few of the oil shock analyses for world crude output and Norwegian oil and gas. They can be found at:

http://oilpeakclimate.blogspot.com/

DC

DC,

I think that the engineers at Aramco are realistic about the recovery rates that they will be able to achieve, and it is proving to be quite a bit less than 100% of the initially estimated URR. They are, as I have documented, doing a fair amount of work on trying to get that number up, but while they may be somewhat successful in the long term, it will vary by field and will - because of that long term impact - not be as successful in sustaining rate - which is where the concern lies.

Saudi ECI* for 2002 to 2011

*Export Capacity Index, or the ratio of domestic total petroleum liquids production to domestic liquids consumption in (net) oil exporting countries (BP)

The 2011 ECI value (3.9) is slightly above what the 2005 to 2008 rate of decline suggested we would see in 2011 (3.8).

The post-2005 Saudi CNE (Cumulative Net Exports) estimate of about 45 Gb is based on extrapolating the 2005 to 2011 rate of decline in the ECI ratio.

What is the basis of the statement: "Saudi Arabia has been producing its biggest field (Ghawar) at very high rates for most of its life, and most of its other fields have significant problems (e.g. very heavy oil)," ? ?

The IEA says Saudi output capacity will drop next year before Manifa comes on line and ramps it back up in 2014.

OPEC 2013 Oil Capacity Growth 85% Lower Than Estimated, IEA Says

This is in line with what Heading Out, I and others have been saying, that production from fields recently brought on line have been masking the decline in older fields.

Also notice that the dramatic increase in oil rigs, from less than 20 in 2004 to over 140 this year, has not stopped the decline in older fields though it has slowed it somewhat.

Ron P.

They increased the number of rigs seven times and a small decline is expected although just temporary. So what will come after the great Manifa project?

More rigs of course. They will have to drill more and more infill wells just to try to stay even.

Ron P.