Tech Talk - New Energy Report from Harvard Makes Unsupportable Assumptions

Posted by Heading Out on July 2, 2012 - 11:56am

The Tech Talks of the last few months have followed a path of looking in a relatively realistic manner at crude oil production with emphasis on that coming from the United States and Russia, as well as Saudi Arabia, the current focus of my weekly pieces. An earlier piece looked at a Citigroup report of considerable optimism, and the post explained why, in reality, it is impractical to anticipate much increase in US production this decade. Since then, after reviewing the production from Russia, several posts have shown why the current lead in Russian daily crude oil production is likely to be soon over and then decline, as the oil companies are not bringing new fields on line as fast as the old ones are running out. Saudi Arabia, as the current posts are in the process of explaining, is unlikely to increase production much beyond 10 mbd, since Ghawar, the major field on which its current production level is built, is reaching the end of its major contribution, though it will continue to produce at a lower rate into the future. The bottom line, at least to date, is that there is no evidence from the top three producers that their production will be even close, in total, to current levels by the end of the decade.

So, (h/t Leanan) there now comes an Energy Study from Harvard which boldly states that this is rubbish - that by 2020, global production will be at 110.6 mbd and these concerns that most of us have at The Oil Drum (inter alia) are chimeras of the imagination.

It is therefore pertinent to begin with examining where the study (which was prepared with BP assistance) anticipates that the growth in supply will come from.

That too is shown as a plot:

It is instructive, in reading this plot, to first recognize that it is a plot of anticipated production capacity rather than projected actual production. The reason for this can perhaps be illustrated by an example. Within the current production capacity that Saudi Arabia claims adds up to 12 mbds, is the 900 kbd that will come from Manifa as it is further developed and comes on line within the next few years. However, at that time. the increase in production will, to some degree, offset the declines in existing wells and producing fields that will become more severe as more existing horizontal wells water out. Manifa is not currently in significant production, and is unlikely to be at such a level for at least another 18 months, with production being tied to the construction of the two new refineries being built to handle the oil. It is not, therefore, a currently instantaneously available source of oil. At a relatively normal 5% per year decline in production from existing fields, Saudi Arabia will have to bring on line (and sustain) at least 500 kbd per year of new production. While it is likely that it can do this for a year or two more, betting that it will be able to do this plus raise production 2 mbd or more in 2020 is on the far side of optimistic. Just because a reserve exists does not mean that it can be brought on line without the physical facilities in place to produce it.

It is interesting, however, to note the report’s view on field declines in production:

Throughout recent history, there is empirical evidence of depletion overestimation. From 2000 on, for example, crude oil depletion rates gauged by most forecasters have ranged between 6 and 10 percent: yet even the lower end of this range would involve the almost complete loss of the world’s “old” production in 10 years (2000 crude production capacity = about 70 mbd). By converse, crude oil production capacity in 2010 was more than 80 mbd. To make up for that figure, a new production of 80 mbd or so would have come on-stream over that decade. This is clearly untrue: in 2010, 70 percent of crude oil production came from oilfields that have been producing oil for decades. As shown in Section 4, my analysis indicates that only four of the current big oil suppliers (big oil supplier = more than 1 mbd of production capacity) will face a net reduction of their production capacity by 2020: they are Norway, the United Kingdom, Mexico, and Iran. Apart from these countries, I did not find evidence of a global depletion rate of crude production higher than 2-3 percent when correctly adjusted for reserve growth.

Sigh! I explained last time that with the change in well orientation from vertical to horizontal, that there was a change in the apparent decline rates. When the wells run horizontally at the top of the reservoir, they are no longer reduced in productive length each year as vertical wells are, because the driving water flood slowly fills the reservoir below the oil as it is displaced. This does not mean that because the apparent decline rate from the well has fallen that it will ultimately produce more oil.

The amount of oil in the region tapped by the well is finite, and when it is gone it is gone, whether from a vertical well that shows gradual decline with time, or from the horizontal well that holds the production level until the water hits the well and it stops. I am not sure that the author of the report understands this.

The point concerning support logistics is critical in a number of instances. The political difficulties in increasing production from the oil sands in Alberta, through constraints on pipeline construction either South or West, are at least as likely to restrict future growth of that deposit as any technical challenge.

The four countries that the report sees contributing most to future oil supplies are (in the ranked order) Iraq. the United States, Canada, and Brazil. For Iraq, he sees production possibly coming from the following fields within the next eight years.

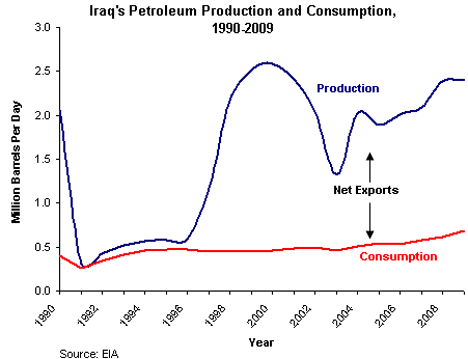

I understand that one ought to show some optimism at some point over Iraq, but it has yet to reach the levels of production that it achieved before the Iran/Iraq War, and that was over some time ago. The EIA has shown that it is possible to get a total of over 13 mbd of production, but it requires investment and time, and some degree of political stability in the country. That is still somewhat lacking. Prior to that war, Iraq was producing at 3.5 mbd, the production curve since then has not been encouraging:

Recognizing that the country has problems, the report still expects that there will be a growth in production of some 5.125 mbd by the end of the decade. This appears to be a guess as to being some 50% of the 10.425 mbd that the country could potentially achieve.

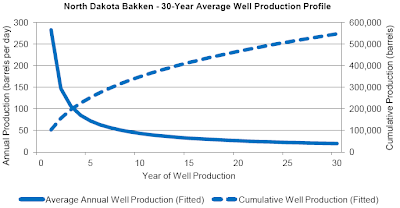

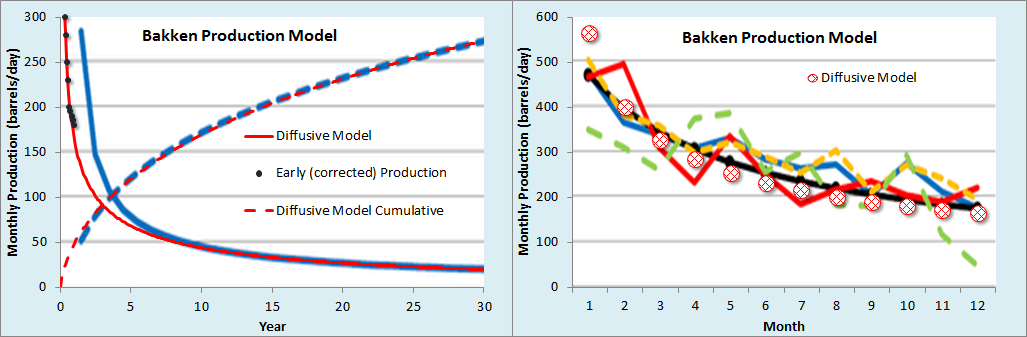

As for US production, this is tied to increasing production from all the oil shales in the country, which will see spurts in growth similar to that seen in the Bakken and Eagle Ford.

I estimate that additional unrestricted production from shale/tight oil might reach 6.6 mbd by 2020, or an additional adjusted production of 4.1 mbd after considering risk factors (by comparison, U.S. shale/tight oil production was about 800,000 bd in December 2011). To these figures, I added an unrestricted additional production of 1 mbd from sources other than shale oil that I reduced by 40 percent considering risks, thus obtaining a 0.6 mbd in terms of additional adjusted production by 2020. In particular, I am more confident than others on the prospects of a faster-than-expected recovery of offshore drilling in the Gulf of Mexico after the Deepwater Horizon disaster in 2010.

As I noted in my review of the Citicorp report this optimism flies in the face of the views of the DMR in North Dakota – who ought to know, since they have the data. The report further seems a little confused on how horizontal wells work in these reservoirs. As Aramco has noted, one cannot keep drilling longer and longer holes and expect the well production to double with that increase in length. Because of the need to maintain differential pressures between the reservoir and the well, there are optimal lengths for any given formation. And as I have also noted, the report flies in the face of the data on field production from the deeper wells of the Gulf of Mexico.

It seems pertinent to close with the report’s list of assumptions on which the gain in oil production from the Bakken is based:

*A price of oil (WTI) equal to or greater than $ 70 per barrel through 2020

*A constant 200 drilling rigs per week;

*An estimated ultimate recovery rate of 10 percent per individual producing well (which in most cases has already been exceeded) and for the overall formation;

*An OOP calculated on the basis of less than half the mean figure of Price’s 1999 assessment (413 billion barrels of OOP, 100 billion of proven reserves, including Three Forks).

Consequently, I expect 300 billion barrels of OOP and 45 billion of proven oil reserves, including Three Forks;

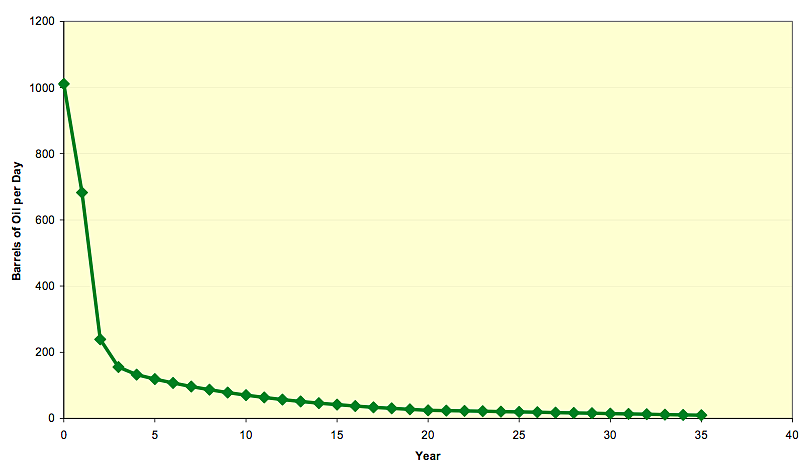

*A combined average depletion rate for each producing well of 15 percent over the first five years, followed by a 7 percent depletion rate;

*A level of porosity and permeability of the Bakken/Three Forks formation derived from those experienced so far by oil companies engaged in the area.

Based on these assumptions, my simulation yields an additional unrestricted oil production from the Bakken and Three Forks plays of around 2.5 mbd by 2020, leading to a total unrestricted production of more than 3 mbd by 2020.

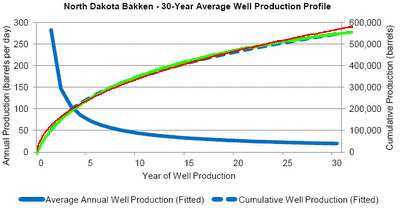

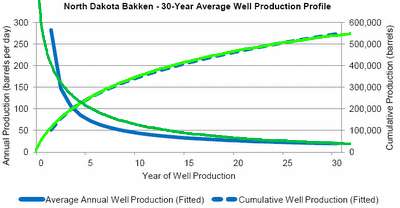

Enough, already! There are too many unrealistic assumptions to make this worth spending more time on. To illustrate but one of the critical points - this is the graph that I have shown in earlier posts of the decline rate of a typical well in the Bakken. You can clearly see that the decline rate is much steeper than 15% in the first five years.

Oh, on a related note, the Alaskan pipeline was running at an average of 571,462 bd in May.

Say they are right - what is the upside for Harvard?

Say they are wrong - what is the downside for Harvard?

And what is the upside in the NOW for making such a report public?

"Think Tanks" understand the lack of accountability on the downside, the benefits in the now, and the bragging rights if they happen to get one right once in a while.

Total Energy = number of people X the use of energy per person.

A = B X C

This "scholarly work" attempts to increase A. Far simpler, but less politically correct to modify B. And right now, with C being rationing via price - it is the C part of the equation that is being adjusted.

Little downside to telling markets and people what they want to hear, especially when looking ahead more than a year or two; short memories and all that. Psychics and fortune tellers have always known this.

It seems to me that this post is advocating genocide. If so, the author is a disgrace to his pseudonym (being the original name of the author who became famous as George Orwell). If I am reading it incorrectly, I would appreciate a clarification.

He might reply that he's simply advocating women's rights, access to birth control, and higher standards of living for the under-developed countries, all of which reduce the birth rate. However, he's still wrong. His equation assumes each new person born consumes the same amount of energy as every other person, which is clearly false. Also, the equation is absurdly, overly simplistic. Energy expenditures are a function much more of a society's infrastructure and economic system than they are numbers of people. Transportation consumes at least an order of magnitude more energy per year than food production, for example. Yet the masses of people in under-developed countries aren't the ones doing the traveling.

This is something I considered, but rejected because he said that his option was "politically incorrect". We are therefore left to speculate on "politically incorrect" methods of population reduction.

Apart from that, I agree with Emanuel.

It is politically incorrect to tell people how many children they can have. It is seen as a human right and of course keeps "growth" going.

Wholesale murder is a little beyond "politically incorrect". So, no, he's not advocating genocide.

I agree.

In fact, the way Ablokeimet has chosen to interpret this discussion immediately into some assumption of fascistic brutality is a stark reminder of how these discussions remain so off-limits, or at least they remain incapable of moving forward rationally without hyperbolic cries of 'Murder!' and 'Nanny State!'

Of course, framing family planning as coercion is misleading, and suggests a worldview that is uninformed about the real-world dynamics of fertility, and prone to seeing the world in terms of coercion, instead of more humane methods.

Which is, of course, Business As Usual at it's worst.

this post is advocating genocide

VS the actions of the leadership class?

VS what various 'holy books' say is acceptable?

I'm just pointing out the obvious. Again.

My previous post was inviting "Eric Blair" to say that he wasn't advocating genocide. Now, instead of accepting the invitation, he posts something ambiguous, but which seems to indicate that political and/or religious figures are also advocating it. I am now more disturbed than I was before. I would like a straight answer from him - is he advocating genocide? I would be very glad indeed to be assured that my reading was incorrect.

Advocates of genocide to "solve" environmental problems are not hard to find. Big Gav and I had a run-in with one on this very site a year or two ago. Though few in number, they can be very determined debaters on the web. I am a big supporter of freedom of speech, as it is an aid to character assessment. I like to know what sort of person I am conversing with. If "Eric Blair" is not an advocate of genocide, I think he should have no difficulty saying so.

For the record, I happen to believe that the world is overpopulated, in the sense that its current population is not sustainable under the current or any rational organisation of society. On the other hand, I believe that:

(a) The Total Fertility Rate for the world has been falling for decades and will, in a few years, go below 2.0. This will cause the world's population to top out at about 9 billion people in about 2050 and begin declining gently. This can be assisted and possibly accelerated by improving access to contraception and improving the education of girls. Neither of these measures are "politically incorrect".

(b) Once we have a rational organisation of society (i.e. not capitalism and not Stalinism) and stop the most dangerous and wasteful activities, we will have a few centuries to reach a sustainable population before non-renewable resources are, for practical purposes, exhausted.

The rising edge of population collapse as the peak is approached looks identical. You are assuming the decreasing birth rate means that humans are getting the population under control rather than resource constraints are forcing a change.

It depends on your location. U.S. conservatives object to all manner of birth control except abstinence. The people who blow up girls schools in Afghanistan object to educating females because they are property of men.

Your (b) is vaguely optimistic. What does a "rational organization of society" mean to you? I think you are trying to steal my stuff with high minded ideals that fail upon practical application. Climate change and peaks in various energy sources will not allow us several centuries to decrease human population. It is already causing drought and crop failures.

Bob Shaw's question from Phoenix, Arizona: Are humans smarter than yeast?

The Total Fertility Rates (TFR) and the birthrates have been going down the most rapidly in the most prosperous countries. This decline has been steady through both good economic times and recessions. I don't see any reason to link these declines to resource shortages. Do you have any direct evidence that resource shortages in countries like France, Italy and Japan have affected TFR and birthrates?

Maybe not resource shortages but declining standards of living that make the DINK lifestyle more attractive than starting a family.

If people in OECD countries multiplied like rabbits, vastly more resources would be consumed beyond what their paychecks could afford. A prosperous life causes many of the people to recognize that children are an expense that lowers the standard of living. The paychecks, which are loosely related to resource exploitation, have not risen enough to allow an increasing standard of living with a large number of children. In general people in OECD countries have chosen stuff over children. Poor rural folk see children differently as slave labor on the farm or a potential retirement plan. In this case, the more children, the better. Then there is religion which advocates large families and blinds the congregation to the consequences.

Massive consumption of stuff can not be sustained along with having many children. The more children urban parents make, the more they have to spend on necessities like food, clothing, shelter and medical, which leaves less money for buying stuff. For a place to have high growth in consuming stuff and large families requires large, increasing income for the average worker. Saudi Arabia might fit this description temporarily made possible by massive profits from exploiting crude oil.

When the economy declines in these urbanized, developed countries, such as Japan and Russia, the urbanites still view children as an expense which they can not afford. Therefore, as the economy declines, they have fewer children because they can not afford children. To reverse the trend the average lifestyle will have to revert to rural (or something) where more children mean more profit.

Low birth rats in OECD countries are not caused by people getting wiser about overpopulation. It is because the system can not provide for more and more and more. Mother Nature is imposing limits.

Human population is in overshoot as evidenced by the souring environment and depleting resources. Mother Nature corrects population overshoot using population collapse.

U.S. conservatives object to all manner of birth control except abstinence.

There is a strange intersection of interests WRT birth control.

The 'inflammatory' version is here. http://www.blackgenocide.org/planned.html

A less inflammatory but selected quotes version is here. http://www.dianedew.com/sanger.htm

In her own words: http://www.gutenberg.org/files/1689/1689-h/1689-h.htm#2HCH0004

Hrmmmm. Feebleminded-ness and a concern about "rational organization of society"

http://ssr1.uchicago1.edu/PRELIMS/Political/pomisc1.html

Now can birth control, eugenics and a Technocracy ("rational organization of society") get tied together?

http://www.intellectualtakeout.org/library/humanities/philosophy/applied...

And who was one of the founders of Technocracy - Dr. Marion King Hubbert met Howard Scot around 1930 and became one of the founding members of Technocracy Inc., where he contributed to the more scientific presentation of their technocratic ideas and was on the staff of the Continental Head Quarter (CHQ) of Technocracy Inc.

Now....how many are having a nice, "comfortable" conversation? Or has the above made you the reader now more disturbed than you were before?

Bringing up ancient eugenics stuff from many decades ago when discussing modern reproductive rights policy is a massively deceitful argument. Is anyone arguing for that today when trying to keep birth control freely available? No. End of story.

It is like the people that argue against evolution because Darwin said some ugly racist stuff. It is not relevant to the modern discussion.

"U.S. conservatives object to all manner of birth control except abstinence." is also a massive over-reach. Certainly there is a good part of the hardcore Christian base that do believe this and some higher-ups like Santorum. But I wouldn't say banning birth control is a majority position of conservatives. (Although just the fact that there is a significant number of people who agree with that is really scary.)

Bringing up ancient eugenics stuff from many decades ago when discussing modern reproductive rights policy is a massively deceitful argument.

And yet - my memory of the Diane Dew site is that is the exact framing there.

Is anyone arguing for that today when trying to keep birth control freely available?

Yes. Because that is how I became aware of the history.

No. End of story.

And yet, how I became aware of the history noted above because a party was using that history in a birth control argument.

'Tis a more interesting framing in light of the 'lets have a rational society' and 'there are taboo subjects' - those who with to argue the Technocratic and birth control positions should be aware of the history so that they have answers to such questions about the history. Beyond "that's not fair" at least.

Look at the list of foundations - foundations connected to the Rockefellers, Harrimans, and Carnegies - then the reasons - To meet the problems of degeneracy, crime, and pauperism it is the immediate and peremptory duty of every State and of all communities to therefore embrace the philosophy of Birth Control one has reason to pause and ask: How close is Humanity to a place where the people at the top, the people who claim that spot because they are "The Leaders", to deciding it is far simpler to wipe out whole swaths of Humanity so that they may continue their present energy consumption patterns VS embracing a change that might upset the system so that they cease being "The Leaders"? Another variation - how bad is the bottom such that the people at the top don't want to join the bottom? What could be done to improve the bottom so that the top won't have a Monty Pyton moment - 'you can tell he's the king cuz he's not covered in shite'?

Perhaps a more modern study of 'leading thinking' would be more to one's liking: http://nymag.com/news/features/money-brain-2012-7/ The Money-Empathy Gap

New research suggests that more money makes people act less human. Or at least less humane.

I don't know who this Diane Dew is.

"Yes. Because that is how I became aware of the history."

Please provide a link. It fun to mock the extremists.

"And yet, how I became aware of the history noted above because a party was using that history in a birth control argument."

Someone else using a bad argument is not a good reason to repeat it. It is just perpetuating a bad argument.

Is there a point to all this cryptic woo-woo?

Someone else using a bad argument is not a good reason to repeat it.

M. Sanger's own words are not worth bringing up?

Either PP was founded with the attributes pointed out on the various web links or it was not.

And either the issue raised by M. Sanger - best not spend limited resources on 'dead ends' - is a valid argument or it is not. (the dead end argument is one seen on TOD BTW)

Is there a point to all this cryptic woo-woo?

Going to the founding documents is 'cryptic'?

Or is 'cryptic woo-woo' short hand for 'I am not doing well in the argument, best attach labels'?

Oh, if I found support for Gold and not a fiat currency in those founding documents - would that make it less cryptic for you?

M. Sanger's own words are not worth bringing up?

Probably not.

Volkswagen was founded by Hitler for ideological reasons - should I consider that when I look at a TDI?

The US was founded by slave owners - does that matter?

I'm sure we can find many more...

Exactly.

If you want to debate a dead woman from a century ago then bring up Sanger's words. But if you want to debate people today, it is strawman argument.

Neither of these measures are "politically incorrect". - It depends on your location.

Well, let's clarify our definitions. "politically incorrect" is code, created by the right wing, for things they like and which progressives dislike. It's part of a disinformation campaign, which was intended to suggest that progressives were exerting oppressive control of the US "marketplace of ideas" (hence, progressive ideas were "politically correct").

So, contraception and education are not "politically incorrect".

inviting "Eric Blair" to say that he wasn't advocating genocide

You have a strange way of inviting.

You have been here as nearly as long as I have been. With my volume of posts, when have I advocated genocide before?

"Genocide"... ? Wow, that's a leap! Let's try free condoms and cash-for-the-snip programs first. :)

Cheers

"Genocide!" or repossess houses, raise the retirement age, default on pensions, default on other retirement plans and reduce interest rates to near zero to undermine the means of support for the elderly. That plan is enjoying great success in OECD countries.

"It seems to me that this post is advocating genocide"

It's still so taboo, as it's always been, to analyse human populations in ecological terms as the animals we are, right alongside yeast, deer, lynx and hares. But we are animals subject to the same constraints as all.

I don't find find pointing out the obvious so offensive since if humanity is using too much energy then the most obvious way of dealing with that, since we refuse to use less on an individual level, is to reduce population. Of course I'm not in any way advocating that, in fact I'm devoting my life to preventing that from happening by pushing hard for renewables and ecological education. But to blindly ignore the obvious is to set the stage for allowing TPTB to reduce population using their own methods, via war and mass murder, when SHTF and we run out of energy and we have no choice but to reduce population.

But to blindly ignore the obvious is to set the stage for allowing TPTB to reduce population using their own methods, via war and mass murder, when SHTF and we run out of energy

We humans repeat patterns that have worked in the past. What has worked in the past for the TPTB is methods of war and mass murder.

How do "we humans" get to learn new, better patterns?

I worked your formula backwards a week ago making Excel charts, dividing populations (globally and for several countries using US Census bureau projections) by every fuel type (Oil,Coal,Hydro, etc.)to model the effect of a continuous annual decline in oil consumption of 3%. The charts are interesting, in my biased opinion, but I rarely post and have no idea how to display them in a reply.

Globally, my assumptions had Gas and Coal largely displacing the lost oil through to 2030. There was so little net effect that population measures wouldn't reasonably take place. Bad global warming scenario.

For Canada the picture was economically worse, but manageable, due to a low natural population increase and abundant hydro supply. Since the country doesn't have the infrastructure for a large increase in coal, the future for renewables looked good.

The US model was picture of disaster due to heavy oil reliance and a relatively high natural rate of increase. I tried modelling a zero immigration policy, starting in 1920, but it wouldn't observably affect the outcome.

Since just about all the population growth of the US and Europe for the last 40 years has been due to immigration, it seems a little difficult to believe that a zero immigration policy would not have had an observable outcome. A population in the US closer to 200MM rather than over 300MM would definitely be a lot easier to transition to a more sustainable path.

I should clarify my reasoning.

For starters, please bear in mind that I only modeled forward to the year 2030. Most sources (BP, IEA, EIA, etc.) do not forecast probable data beyond that point. More importantly, most scenarios have any significant decline in oil supplies happening in that timeframe.

You are correct in believing that a zero immigration policy would eventually have a substantial effect. I don't think it would make much difference within the 18 year time period, at least for the United States.

A democrat administration would be unlikely to bring in such a policy. It might cost them too many minority votes in the tight elections that have become the norm.

I believe that a Republican government will eventually look at such a policy seriously, but not until their constituents are forced by reality to accept that resources really do have limits and that rising sea levels are not in fact a left wing plot.

These things take time. Assuming serious collapse in supply, I can't see such a policy on the table before 2020. Current American population growth is at 0.8 percent per year, three quarters of which is due to natural increase and the remainder from immigration.

In the remaining 10 years, for which I felt I could reasonably guess at results, the overall population would not yet be significantly altered by immigration control.

Over a much longer time frame, if society values followed the current trend, such a policy would stabilize the population because much of the current natural growth comes from first and second generation immigrant families.

As for a 200 million sustainable population, there are no civil ways of getting there quickly. There are over 300 million people in the nation currently. With zero immigration and a one child policy, you might get there in a century. It could happen, but not until a lot of pain brought the need home.

I agree with your outlook and time frames, politics often move very slowly. My comment was in reference to the 1920 date with the thought that without immigration there is a good chance that the US population would have stabilized in the 1970s or 1980s.

That was completely an error on my part. I had meant to enter 2020, not 1920. Shows the problems of posting after midnight.

Immigration control is a very hard sell in a nation born with the concept of Manifest Destiny. Flooding an area with people simply worked too well in dealings with French, the Spanish, the Mexicans, Natives, and British loyalists. How do you reverse a growth policy that worked so well as long as there were unexploited resources?

When the winning side has to share the spoils a little too finely and new factions emerge, things change. We are just reaching that point.

I think the only time American policy could have been turned away, from promoting immigration, is after the Carter administration fell following the Iran hostage situation and the 1979 Oil Crisis.

Reagan might have been able to push for population control in the name of better resource management, but went with deregulating fiscal policy instead. Immigration control at that point could have largely stabilized the population by now.

Deregulating fiscal policy and installing Alan Greenspan and an expansionist Fed who were more than happy to provide/enable the huge run up in debt that financed the population growth. Unfortunately, once the debt bubble bursts your left with the larger population that has to be provided for and a more depleted environment to do it with.

"Democratic", not "democrat", please.

Do you really think a zero immigration policy is going to fly? We have businesses (agriculture) that apparently depend on cheap manual labor, and we've had poor luck thus far making our borders be properly impenetrable. It's already plenty annoying that we have to do the whole I-9 song and dance every time we hire someone at work (interns, in particular; they come and go every year). I can imagine an economic restructuring where most people earn enough money that they're not hacked off at the high cost of food produced by well-paid labor, but then you've just lost the Republican support.

The one thing that might work and would be humane -- improving the condition of people in countries sending us immigrants -- would also boost world-wide resource consumption.

I doubt your average Walmart or Costco shopper would notice the difference if farmers started paying a living wage. Fruits and vegetables require the most hand labor, most other farm operations are largely mechanized.

I agree that the ultimate solution, at least in the US, is to help Latin America improve their standard of living. We could easily start with things like crop supports that undermine grain prices in Mexico and make it difficult for small farmers in Mexico to make a decent living. Of course that would be noticed at Walmart.

And we don't want a zero immigration policy. I do patent work in Silicon Valley and I can tell you that it would be a disaster if stopped immigration. What we should be doing is stapling a green card onto every graduate degree handed out in science & engineering. If we want to stay on top in science & engineering, we should be trying to keep everyone of those foreigners that comes here and receives a world class education.

Democratic, as you say, sorry.

I think it's less a question of whether a zero immigration policy would fly as whether it might be applied.

Twenty five years ago, Reagan was demanding that a wall, designed to keep people in, be torn down. It was, but the son of his own vicepresident built another to try to keep people out less than 15 years later. Who saw that coming in 1989?

Public attitudes and expectations can change a lot in 15 or 20 years. A long period of economic hardship caused by a diminishing resource supply would likely lead to a strong demand for firm and not necessarily humane action. That's a large part of why the Great Depression was followed by World War II. Shutting the door on potential immigrants may be more likely to occur than helping them increase their resource use.

Would it fly? It might. I don't believe in luck. A serious administration acting with public support could make a country a very undesirable destination for prospective immigrants to the point where they would look elsewhere or stay home. History has numerous examples of targeted populations being driven entirely out of lands, stopping entry is all too possible.

I'm not advocating such a policy, but a finite resource base will ultimately lead to some form of population control. At the Global level, every nation faces the same problem. We are likely to see more of nearly every known cause of population decline: international warfare (Iraq), civil war (Sudan), societal collapse (Somalia), mandated population control (China), genocide (Rwanda), epidemic disease (1918 Flu), famine (Ethiopia), environmental catastrophe (Maldive's future?), mass emigration (Ireland), forced expulsion (Russian Jews), and voluntary declining fertility rate (much of Europe).

I might have missed some, but I think only the last option would be palatable for the American public. That's only possible if immigration falls, but by what means? Raising the standard of living for residents of nations with a higher natural rate of increase would mean supporting most of the people of the world from the developed nations. That is unlikely during a prolonged resource decline, as is finding them the resources for development.

I think doors to many wealthier countries will eventually close, partially if not entirely, with sufficient firepower held to protect the resources behind the doors.

The kind of policies and thinking necessary to turn a country into a fortress damage both the resource base and a country's ability to adapt. Countries of this kind tend to become homogenized, inflexible, over-stretched, and risk extremism. The fortresses and islands can't last indefinitely and, in a pretty short time, the barriers erode and become too expensive to maintain. Conceptually, think of a Maginot Line for climate change, resource depletion, and overpopulation. A static defense is a poor bastion against a dynamic assault.

I agree. A static defense with no offense can only fail.

However, effective countermeasures to those three global problems require a clear plan of action including goals with target dates, processes to achieve those goals, consequences for failure, and unceasing vigilance and analysis.

That sounds kind of like Kyoto. The Kyoto Accord failed. There was no process for how the goals would be reached, no reasoned evaluation of success, and no ongoing planning for how the course of action would need to be revised. You can't exclude major segments of the world population on the grounds that they hadn't gotten a fair chance to burn through the resources of the planet on a per capity basis. All Kyoto accomplished was the meteoric rise in China's economic status and a vast increase in CO2 pollution via coal as other nations proclaimed success in turning green by cuting their manufacturing sector and importing from China. Nations theatened by China's success either never participated or will opt out.

So we need something new, perhaps using Germany or Costa Rica as a guide, that requires full global participation. In a democracy, a popular government form, you also need an informed and involved voting public with clear benefits to maintain public support.

Do you see movement in that direction in most of the world? I don't.

What about America specifically? Half the legislators in the country want to dismantle the EPA. Mentioning overpopulation is political suicide. Winning elestions requires a marketing campaign so expensive that representatives are effectively owned by those who finance the publicity. Thus, greed now rules the nation.

It's a nation where having an abnormally large number of children might get you a reality TV program complete with around the world vacations. A place where a state can pass laws that demand that years of study regarding sea level rise must be entirely disregarded so that developers with a link to campaign financing won't have their future swampland fail to obtain a development permit.

The place is already inflexible, over-stretched and extreme. I'll bet you 20 Duggars and one polyamist family group that the United States is currently in no position to attempt anything regarding population control but closing the door.

An ineffective Maginot line for climate change and resource depletion to be sure.

Real change would require an election based strictly on the candidate's competance as evidenced by qualifications and record, with marketing rigorously controlled by a transparent election office. Got any ideas for how that might come to pass? Maybe a county somewhere could volunteer to run mock elections in an effort to find an experimental selection process that wouldn't install a corporate lackey.

Now wasn't that an impressively digressing rant? I need to go buy beer.

I think it's highly skewed to simply frame it as 'Kyoto Failed'. That's like saying 'The UN is ineffectual' .. NEITHER of those associations have any power without the positive and active support of the Key Economic powers on the globe. The USA demurs, these processes are dead in the water, and it's far more OUR failure than that of the folks who actually tried to move the stone.

Credit the right culprits. It needs to say 'Kyoto was sabotaged.. it was pushed.'

The ag and water impacts of global warming on the US look pretty terrible in your timeframe. It saddens and concerns me that we aren't talking more about this current and growing problem. Just one point to note. Climate models, though useful, have tended to underestimate the degree of response to a forcing. We really need to begin ff consumption cuts now if we're going to deal with the problem.

In a related note, it seems Rex Tillerson is having an Enron moment on climate change: http://bottomline.msnbc.msn.com/_news/2012/06/28/12460198-exxonmobil-ceo...

Few governments or corporations seem interested in even discussing cuts. Suggesting belt tightening doesn't win elections and weakens the grip of totalitarian regimes. There is little profit in encouraging customers to abandon the growth concept in favour of sustainability.

Real cuts would need to happen at the level of the individual. People will eventually need to learn how to budget the resources they personally use, including the local environment. Whether we do it as planned sustainability or as disaster management remains to be seen.

The charts are interesting, in my biased opinion, but I rarely post and have no idea how to display them in a reply.

If you wish, you could always ask The mgt.* if the material is worthy of a key post.

Then all of us can read it and point out improvements/errors.

*(not implying any relationship to Markoff but was amused at 'the management' being shortened and wanted a chance to post the link to get to the quote "It was the chains of communication, not the means of production, that determined a social process".)

Yo! My friend, Null Hypothesis,

You say:

Well, neither do I! However we live in a world where the following recently happened:

http://www.dailymail.co.uk/news/article-2159911/Lisa-Brown-Michigan-lawm...

Need I say more?

we are animals subject to the same constraints as all.

Animals don't have contraception.

Human fertility dynamics look very little like those of wild animal populations. Italians are very well fed, have unrestrained sex, have very low death rates, and yet their fertility is well below replacement.

Where do we see that in wild populations?

Human fertility dynamics only look different today because we have contraception, women's rights, education, and social order. Before contraception our fertility rates were no different than other animals.

Historically we see a drop in fertility rates as people emerge from poverty and get educated, aka "development". This pretty well correlates with using more energy. The problem is that as we all know, we are running out of energy. In fact, without fossil fuels the planet would be well beyond a Malthusian die-off by now. If we do not replace them in very short order, as in the next few decades, with other options like wind, solar and nuclear, then we'll get a Malthusian Collapse. Then I fear we may fall off a cliff socially and those factors that tended to reduce fertility may reverse as people are thrown back into poverty, social order breaks down, wars ravage the world, educational systems disappear, and as is being noted here, today we are seeing the rise of religious fundamentalism as things start to fall apart, of burying heads in the sand from the unpleasant things happening around us, denying it away by legislating a ban on free speech on sensitive issues.

As an interesting exercise, I wonder if anyone has looked at how fertility rates changed in countries that recently went though wars or hyperinflations, like Argentina, Yugoslavia, Sudan.

Fertility dropped dramatically during the Great Depression.

I don't believe this is true. There are historical data of populations dropping or stabilizing for various reasons, both cultural reasons (e.g. Pacific islands) and shortage of resource reasons (e.g. post Roman Empire depopulation. In any case, humans have had both the knowledge of how to control their populations and in some cases the will to do it. For that matter, even non-human animals 'control' their populations under some circumstances. This paper by Hopfenberg & Pimentel notes that although population tends to follow food availability, it does not necessarily take starvation conditions to reduce birthrates. (my emphasis)

http://www.oilcrash.com/articles/populatn.htm

I understand that fertility drops in relation to scarce resources for biological reasons (that's why girls these days in the developed world start their periods so young -- due to good nutrition), but based on fertility rates in starving African countries I don't think that would be anywhere near as low as replacement levels...

I think infant mortality rates have a lot to do with the ability of animal populations to inherently control their growth rates without reverting to mass starvation or famine. In a few weeks I'm going to head off into the wilderness of the central BC coast with my kayak and hang out with the wolves and bears. The salmon will be running and the wolves feast on them. Even with this abundance of food, infant mortality is still high, as wolves have quite a few young. But once they reach adulthood the death rates level off.

I wonder how humans managed to voluntarily control their populations before modern contraception became available?

A partial list: control of sex (late marriage, religious restrictions, etc); condoms have existed for centuries; abortion through abortifacient herbs and other means; infanticide.

First, are we agreed that "to analyse human populations in ecological terms as the animals we are, right alongside yeast, deer, lynx and hares. But we are animals subject to the same constraints as all." is misleading, given that humans have the ability to regulate their fertility?

2nd, "we see a drop in fertility rates as people emerge from poverty and get educated, aka "development" is too simple. Actually, economic development leads to a reduction in child mortality, which leads to a temporary population boom. Then, education leads to a reduction in fertility.

we are running out of energy

Well, we're having a temporary scarcity of oil. For better or worse, we have more than enough fossil fuels to cook the planet, which is by far a bigger problem than PO.

We have, of course, an enormous abundance of energy in the form of sun, wind, waves, fission, etc.

It's worth pointing out that the world has done a pretty good job lately of ramping up production of solar panels, wind turbines and EVs. At the moment, the problem is getting people to buy them, given the artificially low cost of FFs.

"humans have the ability to regulate their fertility?"

What happens when all the condom factories get bombed?

"Well, we're having a temporary scarcity of oil."

When oil disappears it won't be temporary.

"We have, of course, an enormous abundance of energy in the form of sun, wind, waves, fission, etc."

I mostly agree with you on the potential of these sources, though only really sun and wind, and possibly though unlikely, nuclear. I'm as big an alternatives promoter as anyone because we have no choice -- we either go solar or we die, quite literally. The problem is the time frame available, and that we may not be able to pull that transition off in time.

Interestingly, even though we're at Peak Oil now, and likely a decade away from Peak Coal and Gas, we may be beyond burning half of the fossil fuels we ever will despite the Hubbert Curve, due to future social decay. These non-conventional fossil fuel sources that would be constituting the decline half of the Hubbert Curve are mostly by definition difficult and require quite a degree of technical sophistication to extract, process, and deliver. In a world of social decay this degree of sophistication may not be plausible. Similarly, if everything gets blown up in a war we won't be building many solar panels.

http://cassandralegacy.blogspot.ca/2011/08/seneca-effect-origins-of-coll...

As one commenter posted here a few months ago regarding EOR in Saudi Arabia, "I can't help but notice that one shoulder rocket launcher would take it all down in a few minutes."

But I still argue for renewables as much as you do, because maybe we'll be able to pull it off but it won't be a future of abundance, it will be more like, will we be able to prevent half the world from dying or not.

When oil disappears it won't be temporary.

Oil won't disappear for centuries, and it's the mismatch between supply and demand that's temporary.

We don't "need" oil - the sooner we move to substitutes, the better.

The problem is the time frame available, and that we may not be able to pull that transition off in time.

No, the problem is the desperate opposition by people in legacy industries. We could move to wind, solar and EVs pretty quickly - far faster than depletion of FF in general and oil in particular.

People who are pessimistic about dealing with Peak Oil wonder: which processes happen to use oil today, because of historical accident, and which truly have to do so? What part of manufacturing, transportation etc, is specifically reliant only on oil?

So many things run on oil - can we possible replace oil in all of these applications?

The answer is yes, primarily through electrification of surface transportation and building heating. Aviation and long-haul trucking can be replaced with electric rail and water shipping, and aviation will transition to substitutes.

This will proceed through several phases. The first is greater efficiency. The second phase is hybrid liquid fuel-electric operation, where the Internal Combustion Engine (ICE) is dominant - examples include the Prius and, at a lower price point about $20K, the Honda Insight. The 3rd phase is hybrid liquid fuel-electric operation, where electric operation is dominant. Good examples here are diesel locomotives, hybrid locomotives, and the Chevy Volt. The Volt will reduce fuel consumption by close to 90% over the average ICE light vehicle. This phase will last a very long time, with batteries and all-electric range getting larger, and fuel consumption falling.

The last phase is, of course, all electric vehicles, which are are slowly expanding, and being implemented widely (Here's the Tesla, here's the Nissan Leaf). Electric bicycles have been around for a long time, but they're getting better. China is pursuing plug-ins and EV's aggressively. Here's an OEM Ford Ranger EV Pickup, and a EREV light truck (F-150).

Here are electric UPS trucks. Here is a hybrid bus. Here is an electric bus. An electric dump truck. Electric trucks have much less maintenance.

Kenworth Truck Company, a division of PACCAR, already offers a T270 Class 6 hybrid-electric truck. Kenworth has introduced a new Kenworth T370 Class 7 diesel-electric hybrid tractor for local haul applications, including beverage, general freight, and grocery distribution. Daimler Trucks and Walmart developed a Class 8 tractor-trailer which reduces fuel consumption about 6%.

Volvo is moving toward hybrid heavy vehicles, including garbage trucks and buses. Here is the heaviest-duty EV so far. Here's a recent order for hybrid trucks, and here's expanding production of an eight ton electric delivery truck, with many customers. Here are electric local delivery vehicles, and short range heavy trucks. Here are electric UPS trucks, and EREV UPS trucks. Here's a good general article and discussion of heavy-duty electric vehicles.

Diesel will be around for decades for essential uses, and in a transitional period commercial consumption will out-bid personal transportation consumers for fuel.

Mining is a common concern. Much mining, especially underground, has been electric for some time - here's a source of electrical mining equipment. Caterpillar manufactures 200-ton and above mining trucks with both drives. Caterpillar will produce mining trucks for every application—uphill, downhill, flat or extreme conditions — with electric as well as mechanical drive. Here's an electric earth moving truck. Here's an electric mobile strip mining machine, the largest tracked vehicle in the world at 13,500 tons.

Water shipping and aviation can also eliminate oil: see my separate post on that topic.

More at http://energyfaq.blogspot.com/2008/09/can-everything-be-electrified.html

"No, the problem is the desperate opposition by people in legacy industries. We could move to wind, solar and EVs pretty quickly - far faster than depletion of FF in general and oil in particular."

In my view, this is a choice that must be made. The more foot-dragging on the issue, the more trouble long-term.

China's investing 90 billion per year on this transition. If we won't keep up, then we cede dominance in a critical new industry. Or worse, we become the advocate for the dirty, old industries, as China becomes the champion for the new industries of the future. Very bad position to be in.

I agree!

Animals do have contraception.

Only one species though.

The genocide would be to not advocate population restraint. There are ways to reduce population that both raise living standards and do no harm to those already living.

Looking up thread, I've seen some pretty scarey things listed. In short, you can restrain population without the terrible choices. Open access to birth control, educating and liberating women, increasing the age of marriage, increasing the age of first child birth (generally through education and more specialized jobs), supporting a middle class lifestyle, income compression (less of a gap between rich and poor), and access to reproductive services all restrain population growth without causing harm.

We should try to bend the trend back to 6 billion not push on to 8. Right now we are looking at 80 million persons per year in population growth.

It's all about keeping up "investor confidence."

US election year knows no boundaries.. but energy/geology does.

Googled Maugeri. He's executive chairman of ENI's petrochemicals arm and has taken the sabbatical to enjoy the Harvard ambience and deliver another cornucupian assessment matching his previous articles (listed on the

advertisementwikipedia entry.Leonardo ain't no da Vinci, that's for sure.

Even DiCaprio seems to be more on the ball on these matters.

I think the problem here is a mis-match between economic cost price and intended purpose - if the intended purpose of oil is as a raw material to say manufacture plastics or fertiliser than the standard classic model probably works, with the usual political / investment / geological problems you get with any commodity. If the price is right, people will extract accordingly..

However if the intended purpose is purely for energy, than you get into more complex issues that the price of say oil at say $180 a barrel might make digging a hypothetical 10 miles deep well economic, but if it requires more joules to extract a barrel of oil than you get from that barrel, it energy-wise wouldn't make sense to do so, despite what classical economists and accountants might say... all they see is a commodity with a price on the international markets and the costs of extracting the commodity, not on the energy balance issues - if that is it's intended purpose.

What the peak oil community I think fails to understand is that the oil investment side doesn't really care about energy economics (other than price of course) - so long as oil can be extracted at a price below that it can be sold at, no problem, the overall net energy issues are for some 'other mug' / politicians to deal with, well after they have banked their money.

The bigger question therefore, is what use will oil be in the future - mostly energy for transportation as it is now, or as a raw material for increased manufacturing in the US, when as I expect more manufacturing moves back to the OECD to compensate for trade / shipping costs from Asia ?

I'm starting to think that when we look back 20 years from now we'll be able to see some sort of correlation between the price of oil (namely, its percentage of global GDP) and the EROEI of said oil.

Exactly! Also linked to expanding debt. Societies that don't tax the rich will have it worse.

A question or two about Iraq's oil production. Your link to the 2002 [?] report of the peak pre the Iraq/Iran war quoting 3.5Mbpd seems to check out OK with http://mazamascience.com/OilExport/, except that this peak was in one exceptional year only. Similarly your number on the graph for recent production below 2.5Mbpd seems about right and compares with your estimate of 'capacity' at 2.8Mbpd. Mazamascience says 'no data' for consumption.

But your graph for production peak before Iran/Iraq war (the one year of peak at 3.5 compares with <3.0 for years either side) seems to represent a smoothed curve, placing the 'old peak' at only slightly more than 2.5Mbpd compared with recent highs of slightly less than 2.5Mbpd. I am confused about future production rates. Can we expect a 'report-guess' of a doubling to >5Mbpd (?) or some other fraction of an EIA guess of 13Mbpd? Are there long-lasting new or old supergiants like SA's Ghawar that will go on for the next 10 - 50 years? Has anybody any good guesses as to to the future decline rates, particularly from newly tested geological structures?

Ya think?

http://belfercenter.ksg.harvard.edu/about/

Sigh! One would like to expect a bit better from such an interdisciplinary and august body of individuals, however it seems they suffer from a combination of wishful thinking, a belief in cornucopian techno fixes or possibly outright denial of reality. Then again, it might just be something as simple as their salaries depending on their not understanding the dilemmas our global industrial civilization is currently facing.

On they bright side, they at least claim, to recognize science... Makes me feel all warm and fuzzy!

FM - Maybe more than paychecks guides them. I think we're all subject, to some degree, to the same dynamic: no task is that difficult as long s we're thinking about someone else doing it. Why should the think tank gurus not be subject to the same prejudice? And now add the financial side to the quation: always easier to justify a porject if someone else is paying the bill. How many times have all of us thought Mr. X should just do Y regardless of HIS cost because it's the right thing to do?

It woud be interesting to see a think tank devoted to studying those inherant problems in think tank analysis.

Think about that for a moment. LOL

Actually Daniel Kahneman has a few interesting things to say about that.

http://www.edge.org/3rd_culture/kahneman07/kahneman07_index.html

A SHORT COURSE IN THINKING ABOUT THINKING

Edge Master Class 07

DANIEL KAHNEMAN

Auberge du Soleil, Rutherford, CA, July 20-22, 2007

AN EDGE SPECIAL PROJECT

Emphasis mine.

I'm a huge DK fan. Glad to run across someone else who reads his work as well.

So I wonder, with all this enhanced extraction, which big well will be the next to callapse? That should give the think tanks something to chew on for a bit, don't you think?

The author of the Harvard paper, Leonardo Maugeri, has every major oil producer in the world except Iran, Mexico and The North Sea increasing in production by 2020. He even has Indonesia, in decline since 1996, holding steady. He holds two degrees (Political Science and Economics) and a Ph.D. in international economics. He holds a doctorate in economics so this paper should surprise no one.

Concerning infill drilling of horizontal wells to stop the decline rate, Russian analysts Alex Burgansky wrote in 2009.

And this massive infield drilling with horizontal wells is going on all over the world. Without them the world would surely have gone into a steep decline around 2006. Could we not expect water to start hitting the wells in these old fields pretty soon? And when it does would not the drop in production be very steep indeed?

Ron P.

There's an economic question here too.

Russia needs a $110 dollar oil price(Brent) to avoid busting their budget.

Drilling many more wells costs a LOT of money. And that investment needs higher and higher prices to pay off, because as the oil is scarcer and harder to get at, CapEx(Capital Expendatures) costs increase at a very high rate.

The same pattern is occuring worldwide.

This is a key reason why even nations untouched by the so-called 'Arab spring' like Russia need $100+ prices or higher to get even. Not all producers are in this position, like Canada which still has increasing production, but those like Russia who are struggling do. And there are many nations like Russia, or those who have already been there, like Indonesia, as you mentioned, who have been in a decline since '96 and will continue to decline. The economics just simply don't add up after a while.

Now, Russia is lucky since it's individual peaking is occuring right at the worldwide peak, so it gets cover by high global prices and thus can prolong the peak for itself. That's a luxury that those who peaked in the 90s(like Indonesia) or early 2000s (like the UK) didn't have as the global oil prices were too low when they peaked to offset ever-higher CapEx costs which made it impossible to hinder their individual peaking by more and more investments(wells, rigs etc).

Obviously, higher oil prices do cover more and more rigs, wells and various other CapEx investments. But only up to a point. And that chart above shows crude oil only(85 % of all oil and not likely to drop much more in the coming decade) up until 2010 and it shows that we're investing record sums and getting precious little for it.

Now the cornucopians say; but unconventional plays! Shale gas! Shale oil! Well, what about those?

You see the same phenomenom in the U.S. shale gas plays where increasing (or even just maintaining the same) volume requires more and more billions in CapEx. Arthur Berman did a good talk about it(too lazy to post too many charts right now but his talk contains all the info and it's all about facts and no hype) at the last ASPO conferenc.

The same dynamic, of course, also applies to shale oil although it's not quite there yet.

However, depletion rates for unconventional, deep water etc is higher than for conventional landlocked oil plays, so this phenomenom may in fact get there faster for unconventional plays. And even so, if you discount NGLs, biofuels etc and look for pure unconventional oil only, not 'liquids' which can contain all kinds of things(some of which aren't even useable by transportation or heating for homes etc) then you see that the unconventional oil production worldwide is very modest, low single digits and not expected to rise by most, even including slightly optimistic, estimates.

It's actually not that hard to completely bust open cornucopians and their fantasy land projections. You just need a brain capable of doing third grade math. That's why it's surprising and slightly frightening to realize that this guy was chairman of one of the largest energy companies in the world.

In my studies of reserve growth, countries such as Russia don't seem to show as much growth as the USA. This has a lot to do with their estimates being more on the mark from the start, whereas the USA prospectors were almost always required to underestimate potential, thus providing more room for reserve growth.

That's been my point as well. The only sophisticated skill is to have some facility with how to apply probabilities. That is how scientists and reasonable analysts attack these problems, and what the cornucopian mind has trouble dealing with.

The other day I found this old quote by James Clerk Maxwell (the grandfather of broadband):

American companies estimated their oil reserves at the 1P level (Probably only) which means a 90% probability of their existence, which was very conservative. This was due to US Securities & Exchange regulations. If you estimate at the 1P level, there is a 90% probability of the reserves increasing as you drill out the field.

The Russian geologists estimated their reserves at the 2P level (Proven plus Probable) which means a 50% probability, which is a more estimate of how much is there, but not nearly as conservative. If you estimate at this level, there is a 50% probability the reserves will increase, and a 50% probability they will decrease as you develop the field. If the estimates are honest, the revisions will average out and they will neither increase nor decrease for the country as a whole.

American oil companies will calculate these 2P estimates and use them internally, but will not publish them for fear of being sued if they don't pan out.

Estimates of risk are intrinsic to the oil industry and are used extensively, but they are very much a mystery to the average person, who doesn't really understand the concept of "risk".

This really backfired on the USA. They not only got bad data but were also fooled by reserve growth that was not real, only a result of overly conservative bookkeeping.

I have this all described in The Oil Conundrum.

Oh, the 'logic' of making a profit and 'damn all consequences' has often required deceiving anyone with 3rd grade math talents.

The trouble with modern production technology is that companies can maintain very high production rates until the very end. With horizontal wells, and gas or water injection, the production rates can stay constant until the oil column is very, very thin, and then *BANG* the gas and/or water hits the perforations on all the wells simultaneously and the field is done.

This is why Mexico's Cantarell field went down so fast - they just cranked up the nitrogen injection rates until they were injecting half the nitrogen produced in the world into Cantarell. However, while it did maintain rates, it did nothing to compensate for the fact the oil column was getting thinner and thinner. PEMEX tried to deny it was going to happen, but when the distance between the rising water column and the descending gas cap neared zero, that was it, production went into freefall and there was nothing they could do about it.

This is more or less what happened in the UK, too. Certainly they managed to get very high recovery rates out of the fields, but there are limits to how much you can recover. Once you reach those limits, it's all downhill from there. The UK government should have seen this coming since they had all the data, but apparently it came as a complete surprise to them.

In the old days of vertical wells and non-smart production technology it was much more gradual. Wells watered out one by one, and sections of the field stopped producing one by one, and everyone knew the glory days were coming to an end. On the flip side, there was lots of oil left in unexpected corners of the field, so the small oil companies would come in and drill for that. Not any more, with horizontal wells and sophisticated injection projects, when it's gone when its all gone.

This is what Maugeri, being an economist rather than a petroleum geologist, is overlooking in this paper. Also, he is taking the blue-sky speculations of the promoters too seriously when adding up world, and particularly US, future production. You always check to make sure you still have your watch and all your rings after you shake hands with those guys. Probably, being an academic and not having as deep pockets as most oilmen, he's never been taken to the cleaners by an oil promoter.

Makes the cliff look pretty steep, doesn't it? These big well collapses are going to catch everyone by surprise. The data's pretty darn muddy. But, if I had to bet money, it would be on those countries requiring high priced oil: Saudi and Russia most prominently. We'll see. But I wouldn't be surprised if one or both fails to maintain current production by 2020.

The Harvard study may as well be an industry study. Any word on who funded it?

Edit: Author is a former ENI executive. So, the usual suspects. Almost like a climate change snuff piece, but this one aimed at peak oil. Nice. But the real target is likely to be investors. So I wonder what they're looking for capital for? Thousands of wells and rigs for fracking?

The thing about Russia is that it is a "very mature" oil producing area, as oil geologists are fond of saying, which is to say it doesn't have a lot of potential for new discoveries.

However, back during the days of the Soviet Union, they used to drill the wells so far apart that you couldn't even see from one oil well to another across the flat Siberian tundra. Naturally, there's lots of opportunity for drilling lots and lots of infill wells, and putting in lots of injection systems to improve flow rates, and that's what they are enthusiastically doing now in this modern age of capitalist profits.

However, as Russian geologists know, but apparently Maugeri doesn't, this is a process with diminishing returns and there is a point at which it will cost more to drill a new well or do more injection than the well will produce in oil. This is the point that capitalists usually stop drilling because there are no more profits to be made.

So the Russian geologists are hoping that if oil prices stay high, the good times will roll for a while longer, but they don't expect it to go on indefinitely.

Recall that MIT wrote a paper in 2007 that predicted a revolution in geothermal energy. Link. IFAIK it never happened and never will. You'd think some kind of short peer review process would stop one faculty at a university undermining the credibility of other faculties.

Academics are always predicting technological revolutions that never happen. They usually only look at the good factors and fail to consider most of the obvious drawbacks.

True technological revolutions are totally unexpected. Steve Jobs was particularly good at creating these - inventing something that no one knew they needed until he produced it. Nobody knew they needed an iPhone until they saw one.

The trouble with this is that it takes a genius to make it happen, and geniuses are in much shorter supply than academics.

I'm not totally convinced that anyone needs an I-Phone. Jobs was certainly a genius, though. He knew how to design products that were so seductive, sometimes people thought they couldn't live without them.

Nevertheless, your central point is still valid. Every true pioneer is by definition an amateur. It's the difference between foresight and hindsight, after all.

I think many academics try to be 'leaders out in front' while staying inside the walls of the castle. The real pioneers are the ones face down in the sand with arrows in their backs.

It must be a sign of our times where the iPhone is considered a "technological revolution"...

Jonathan Huebner, a physicist at Pentagon, has done research into the innovation tempo of societies. Huebner isn't concerned about innovations in general, but rather what he calls significant inventions. He has found a peak year for technological innovation, and it is surprisingly 1873. That it coincides with people starting to use large amount of fossil fuels is probably not too surprising.

The foremost part of industrial society's breakthroughs was in the fifty year period before WWI, like the radio, camera, telephone, airplane, combustion engine, automobile, light bulb and the electrification of society. These cornerstones of innovation have of course been further developed, but this development has mostly been about improving details; the basic function is more or less the same.

I'll add that picturing "pioneers" is probably a quite misleading way of looking at technological process.

It feels very little happened since the seventies. The only real difference is that computers are a lot better but Unix and C is still here. My house, my workplace, the high voltage power grid nearby, the closest highway and this cities airport where all built during the seventies.

The TV is flat nowadays, it is great sometimes but does it make a real difference?

In the industry robotics and CNC machines are a great invetion but they make no big difference in products possible to produce. Most cheap products are assembled by cheap labour in China. Injection molding and die-casting was invented more than one hundred years ago.

The technologies enabled concentration of profits, not actual physical and societal advance. Although, we have had some decent medical progress. Lots of stagnation coming from over-emphasis on privatization and the profit motive. Just euphemisms for government money going to corps and the wealthy while money is sucked out of both actual development and decent paying jobs for most people.

What was built and invented during the seventies is now available to everyone but progress have stagnated. I expect a lot of the products used during the seventies where quite old and some of it built long before the seventies in best case during the sixties but mostly older.

Totally agree. I believe the underlying apathy about many issues including liquid fuels (and why articles like this one from harvard are so comforting) is that most people are end users of everything and expect that someone else will fix the problem with new technology when mostly what we get is version 2.0 of what we already have. Sorry, interstellar travel is not in the pipeline. :-(

Oh I don't know about that, every new version of Microsoft Office gives me SO much more word processing and number crunching power! Every iteration brings in a new feature I use maybe like once a year! It more than justifies the hours, days, weeks, months I spend trying to figure the new format out, cursing at Microsoft the whole while, often out loud, about why the H they had to screw up a perfectly fine interface from 2003 that used simple tabs, so as to take away another inch of screen space with that big honking banner at the top. And then by the time I figure the new version out, another one's here! But it's all worth it I guess, because we all know that what's good for us doesn't taste good, so Microsoft deserves another few billion in revenues in 2012, 9 years after we reached Peak Office Software in 2003. Right on Microsoft! Keep up with that wealth creation, lord knows we all need wealth! Only you can do it, since obviously no other software company is good enough to compete with you in the fair and balanced office software market.

I'm glad I'm not the only one. I finally upgraded from 2003 just because I felt I was supposed to and to use newer format documents. But I hate 2010. I have to spend so much time trying to figure out where they have hidden features.

And let's not even start on Windows 7's Control Panel and user profiles vs. XP/2000. Why is hiding and/or aimlessly scattering essential stuff that used to be easy to find such a great thing? Of course, it does help those who sell training courses and DVDs.

Imagine if car makers changed the location, configuration and handling characteristics of basic controls on a car every 3-4 years? Gas/brake pedals being reversed or just replaced with dashboard buttons. Your steering wheel replaced with a hard to operate toe-joystick. The simple act of locking or unlocking your car doors involving a complex multi-step procedure and entering passwords each time. Sound like fun?

Hmmm, I don't get these issues with Linux.

NAOM

hah!

unity and gnome on ubuntu :-)

Forbin

Don't seem to have that problem with my Mac either, although Pages has some problems opening .doc files when Microsoft changes their file format. It takes Apple a few months to update Pages for the changes.

That may be true about 1873,everything was wide open in just about every field. BUT, the iphone is a symbol of progress and represents a lot of technological achievement.

The 20th century saw the greatest scientific discoveries (relativity, quantum mechanics, and DNA to name a few) and there is still a lot of progress happening now. Dark Energy and the acceleration of the expansion of the universe was just discovered recently. The standard model of physics has been fairly constant only since the 1970's or so. High temperature superconductors were discovered in the 1980's.

Living though incremental changes it's easy to take progress for granted.

I guess the thing I find interesting about smartphones in general is that they are designed to put a reasonable amount of processing power in your hands that consumes extremely small amounts of electricity to actually use (manufacturing is another matter entirely).

Figure 2, first column. It has 2011 Saudi production capacity 12.2 mbd and the next column has the US at a production capacity of 8 mbd. This was oil production capacity not all liquids. If this was really true then why was the actual production only ~5.6 IIRC for US and 9.7 for Saudi?

I believe there was a release of the strategic reserve in 2011, which does not make sense if there really was spare capacity.

Occam's razor, the simplest reason is usually the best. That being there was no spare capacity in 2011 and this was reflected by the release of the strategic reserve and the high prices.

If these known figures are incorrect in the report, then the future guesses are just bunk. (absurd, ridiculous, nonsense).

The spare capacity cited is only theoretical capacity - if you try to bring it on production, you find it doesn't exist.

The US had this problem during the oil crises of the 1970's. Companies had overestimated their capacity for a variety of reasons (higher government allowables, looks good to the investors, the managers needed to meet their quotas, etc.) However, when the government called on the higher production to meet import shortfalls, it wasn't there.

Also, you can't run equipment at 100% of its theoretical capacity for long periods of time - it will suffer premature breakdown. All you can do in the long term is 90-95% at best, and even then "long term" may mean only a few months. You always have to take theoretical capacity with a grain of salt.

Hide - I noticed that also. Obviously ever US oil producers has been selling every bbl possible as a result of recent high prices. If they overestimate production capacity by more than 40% today maybe we should use that as a minimum correction factor for their predicted future capacities. As far as the SPR release you make an excellent point. Perhaps he uses the SPR as a portion of his “capacity” and doesn’t bother to point it out. Needless to say using storage volumes as a production capacity is totally bogus: to the entire world production comes from a wellhead and not a storage tank.

Because Saudi Arabia could not ramp up production fast enough to offset Libyan production losses

The graph is here:

http://crudeoilpeak.info/libya-peak-oil

Refer to Matt Simmons' Twilight in the Desert book

The huge stretch to 93 mbpd current (even with reserve capacity) raised my eyebrows early on. 8 mbpd US and 12.2 Saudi just isn't real (as you pointed out). And the fact that this guy is from ENI just makes it seem like someone trying to puff up investor overconfidence.