New IMF Working Paper Models Impact of Oil Limits on the Economy

Posted by Gail the Actuary on May 11, 2012 - 5:19am

The International Monetary Fund (IMF) recently issued a new working paper called “The Future of Oil: Geology versus Technology” (free PDF), which should be of interest to people who are following “peak oil” issues. This is a research paper that is being published to elicit comments and debate; it does not necessarily represent IMF views or policy.

The paper considers two different approaches for modeling future oil supply:

- The economic/technological approach, used by the US Energy Information Administration (EIA) and others, and

- The geological view, used in peak oil forecasts, such as forecasts made by Colin Campbell and forecasts made using Hubbert Linearization.

The analysis in the IMF Working Paper shows that neither approach has worked perfectly, but in recent years, forecasts of oil supply using the geological view have tended to be closer than those using the economic/technological approach. Since neither model works perfectly, the new paper takes a middle ground: it sets up a model of oil supply where the amount of oil produced is influenced by a combination of (1) geological depletion and (2) price levels.

This blended model fits recent production amounts and recent price trends far better than traditional models. The forecasts it gives are concerning though. The new model indicates that (1) oil supply in the future will not rise nearly as rapidly as in the pre-2005 period and (2) oil prices are likely to nearly double in “real” (inflation-adjusted) terms by 2020. The world economy will be in uncharted territory if this happens.

It seems to me that this new model is a real step forward in looking at oil supply and the economy. The model, as it is today, points out a definite problem area (namely, the likelihood of oil high prices, if growth in oil production continues to be constrained below pre-2005 rates of increase). The researchers also raise good questions for further analysis.

At the same time, I am doubtful that the world GDP forecast of the new model is really right–it seems too high. The questions the authors raise point in this direction as well. Below the fold, I discuss the model, its indications, and some shortcomings I see.

The Two Models

Economic /Technological Approach. With the economic/ technological approach, the assumption is made that high oil prices will encourage substitution and/or new oil production. Because of this, high oil prices are not expected to persist. Instead, the most important consideration in determining future oil supply is the level of future demand. The level of future demand, in turn, is primarily driven by anticipated GDP growth, since world GDP growth and world oil production growth tend to be highly correlated.

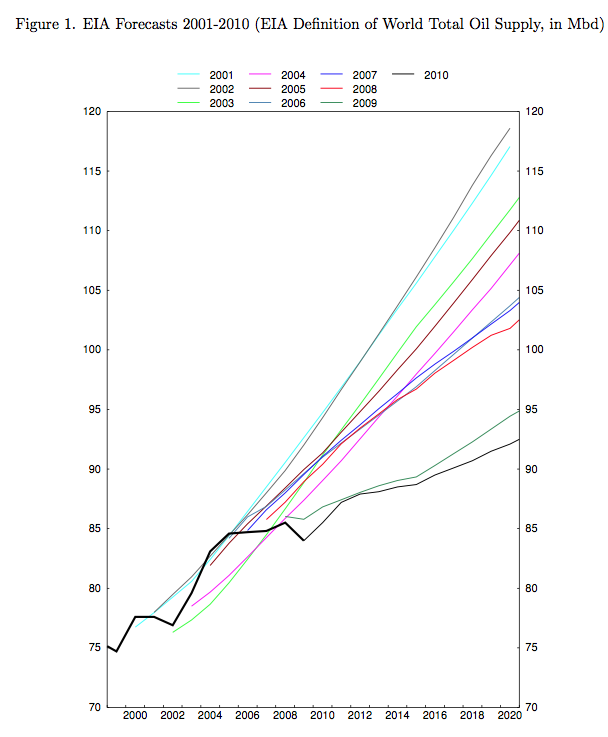

In effect, models of this type assume that whatever oil supply is needed will be available; they don’t consider the possibility that geological considerations may limit oil supply over the long term. As an example of how well these models have worked for prediction, the paper shows a graph of historical EIA forecasts (Figure 1, below).

Each year, EIA’s forecasts have been adjusted downward, because actual oil supply growth was lower than forecast.

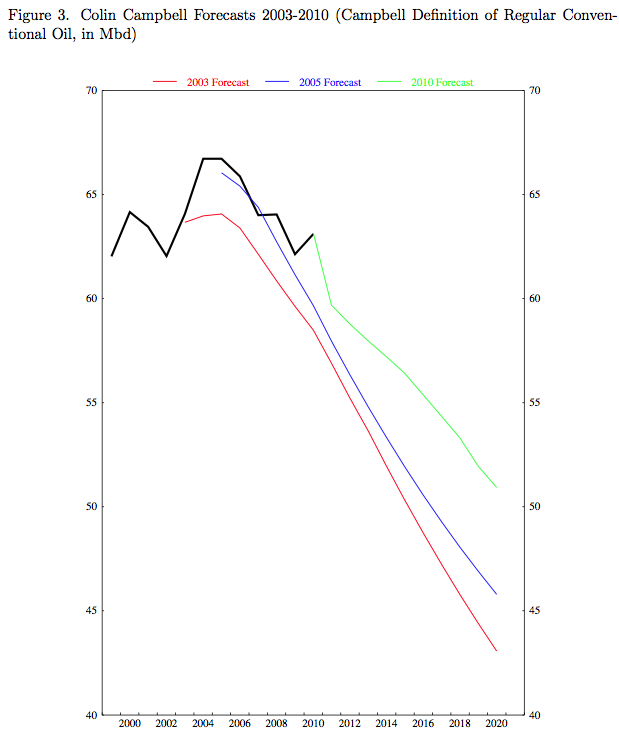

Models Based on the Geological View. The paper considers forecasts of oil supply such as those of Colin Campbell (shown in ASPO-Ireland Newsletters) and forecasts based on Hubbert Linearization to be models based on the Geological View. The paper observes that forecasts of oil supply based on geological view have tended to be too low, but not by as big a margin as those made using the economic/technological approach. As an example, it gives the following graph of changes in forecasts by Colin Campbell.

A review of the two methods by the IMF group indicates that neither works precisely as hoped, but each has some validity. While oil production did not rise as fast as the economic/technological view would predict, higher oil prices have allowed oil production to stay on more or less a plateau after 2005, rather than declining as predicted by geological methods. The new model in the IMF Working Paper combines indications from both points of view, using an approach that allows them to estimate the relative contribution of geological impacts vs higher prices.

How the Two Methods are Combined

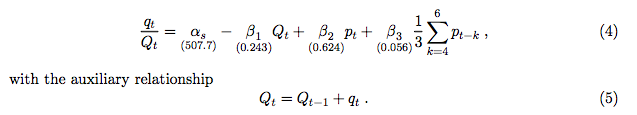

The oil supply equation in the new model is set up so that there are two different ways that the forecast oil supply can change. There is a downward tug from oil depletion at the same time that there is an upward tug from oil prices. It is expected that in the short run, high prices will get producers to utilize spare capacity, and over a longer period (estimated at 4 to 6 years), it will get producers to add new capacity. I will not try to explain all the variables and coefficients, but the blended supply equation is

In the above equation, qt is the quantity of oil produced in year t and Qt is the cumulative quantity produced in year t, so the ratio qt / Qt produces the familiar downward-sloping line one sees in charts used for Hubbert Linearization. The first two terms to the right of the equal sign are the ones based on the geological approach to depletion. The later terms depend on pt, which is price of oil at the time “t”. Adding the pt terms tends to raise the line at later periods so it does not slope downward as quickly as if depletion were the only factor affecting the relationship.

Growth Rate of GDP

In the model, high oil prices have some impact on GDP, but as we will see in Figure 5, below, not very much. There are two places in modeling GDP where high oil prices come into play. The first is in the Potential Growth Rate of GDP. According to the paper,

The growth rate of potential world GDP is specified as fluctuating around an exogenous long-run trend, with oil price changes making the fluctuations more severe. Oil prices are allowed to have persistent but not permanent effects on the growth rate of GDP. . . The estimated steady state world potential growth rate of potential GDP equals four percent. The average annual growth rate of real oil prices, which is the growth in oil prices at which the model assumes zero effect of oil prices on output growth, is seven percent. The results indicate that an oil price growth that is higher than that historical average has a small but significant negative effect on the growth rate of potential. [emphasis added]

Interesting–the model assumes real oil price growth of 7% per year has no impact growth rate of GDP. Perhaps this is supposed to be picked up by the second place where high oil prices come into forecasting GDP, called Output Gap. This is an excerpt from what the paper says about Output Gap:

Apart from allowing for an effect of higher oil prices on the growth rate of potential output, the model also allows for the possibility that higher oil prices can cause fluctuations in the amount of excess demand in the economy. . . . Similar to the equation for potential, the coefficient estimates show that high oil prices have a small but significant negative effect on excess demand, and that this effect is highly persistent.

Model Output

When all is said and done, what does the IMF model forecast?

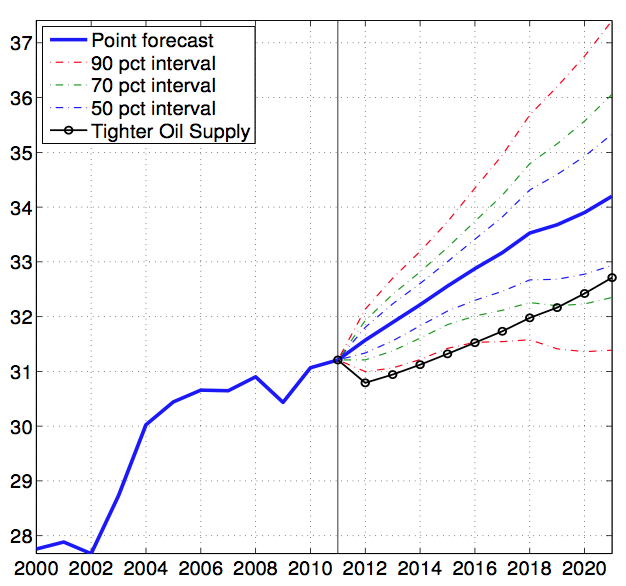

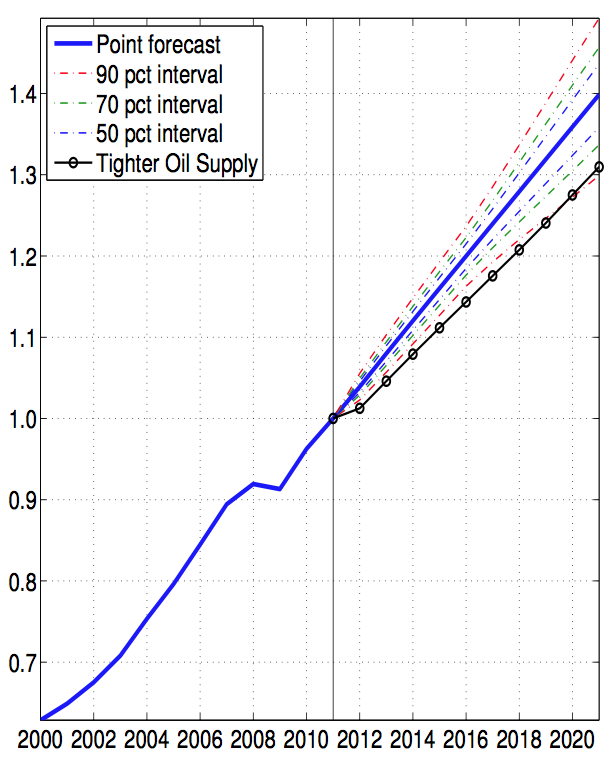

The forecast for future world oil supply, shown in Figure 4 above, is similar to EIA’s most recent forecast of world oil supply (but lower than earlier EIA estimates). Oil supply is expected to rise a 0.9% per year. An alternate tighter oil supply forecast is given as well.

The forecast for world GDP growth (shown in Figure 5 below) is not too much different from standard estimates, either. The point forecast is about four percent per year.

The thing that is different in this analysis is oil prices (in inflation adjusted dollars). Forecast oil prices are expected to be much higher that what the EIA is estimating.

The report points out that these high oil prices are a real concern. The report says:

The predicted average annual growth rates of oil output are well below the historical forecasts of EIA, but above the forecasts of proponents of the geological view. . . . However, this projected positive trend in oil production comes at a steep cost, because the model finds that it requires a large increase in the real price of oil, which would have to nearly double over the coming decade to maintain an output expansion that is modest in historical terms. Such prices would far exceed even the highest prices seen in 2008, which according to Hamilton (2009) may have played an important roll in driving the world economy into a deep recession.

Need for Enhancements /Areas of Concern Pointed Out by Authors of Paper

The authors raise of the IMF Working Paper raise the following issues:

1. Impact of high oil prices on GDP growth. The expected impact of a continued rise in oil prices on forecast GDP is small, according to the model as constructed. Perhaps the relationship should be non-linear (convex) instead of linear. More generally, what is the importance of the availability of oil inputs for continued overall GDP growth? The report mentions studies showing the close connection between energy growth and GDP growth, such as by Ayers and Warr.

2. Substitutability for oil. What is the substitutability between oil and other factors of production? Is it reasonable to assume that elasticities of substitution will become greater over time? Or is there a possibility that there are limits to the extent of substitutability of machines and labor for energy?

3. Is there a pain barrier? At some point, does the effect of high oil prices on the economy change, and become much worse?

4. Independence of Technology from Fossil Fuel Availability. Perhaps a reduction in fossil fuel availability will negatively affect the availability of future technology improvements since, for example, it takes fossil fuels to make new more efficient cars. This has not been reflected in the model.

5. Smaller Amounts of “Spare” Oil Capacity Available in the Future. The model reflects amounts of OPEC spare oil production capacity available in the past. In the future, less spare production capacity seems likely.

My Comments on the Paper

The IMF is to be commended on putting together this analysis. To me, the big step forward is that questions about the impact of geological depletion of oil on the economy are starting to be addressed. The fact that the paper also points out the level to which oil prices will need to rise, if oil production is to rise at 0.9% a year between now and 2020, is important as well.

Some of the issues I see that aren’t addressed in the paper:

1. Factors underlying world long term growth rate, other than energy. It would seem to me that there are a number of factors which have permitted long term world economic growth, over and above the economic growth enabled by fossil fuels. Some of the following seem to be diminishing in importance, so perhaps the forecast of a 4% world GDP growth rate going forward is too high, apart from oil supply issues:

a. Trend Toward Globalization. The trend toward globalization has allowed greater synergies to occur, and thus has contributed to world GDP growth. The trend toward globalization started over 4,000 years ago, with trade from northwest India to the Mediterranean region (Chew). In recent years, we seem to be approaching a maximum level of world globalization. In fact, higher price of oil has been raised as an issue cutting back on trade of bulky, low valued items (Rubin). Higher cost of oil may also have an adverse impact of commercial airline flights for international companies to oversee their distant operations, because the costs of these flights is now supported by a large number of international tourists, and this international tourist trade may dry up. Thus, the trend toward globalization that has been supporting world GDP growth in the past may not persist, and may even reverse.

b. Growth in Education. Part of what has supported world GDP growth is likely growth in education, since literate workers are better able to use technology. There is evidence that the advanced economies are now plateauing in terms of educational level of new workers, relative to the existing work force. Even less advanced economies, such as China, are showing much higher levels of literacy. (See this post). To the extent that educational levels are reaching a plateau, the “boost” to historical GDP rates that came from this factor can be expected to be lessened.

c. Growth in Debt. GDP growth is enabled by debt growth. Consumers are able to purchase more goods and services, with increased levels of debt; businesses are able to increase their investment in new plants and equipment through more debt; and governments are able to undertake the development of new construction, roads, and other development, through the addition of more debt. But we seem to be reaching limits on debt growth. Theory also suggests that higher levels of debt are enabled by higher economic growth rates (Tverberg). Governments have been aware that increased borrowing can be used to pump up economic growth, but limits are being reached on the amount of debt that can be added. To the extent that debt fails to grow as quickly in the future as it has in the past, this can be expected to have an adverse impact on world GDP growth rates.

d. Quantitative Easing and Extraordinarily Low Interest Rates. An argument can be made that GDP growth of advanced economies in recent years has been held up by quantitative easing and extraordinarily low interest rates. These would seem to be a temporary fixes that cannot be continued long-term. If this is the case, world GDP rates can be expected to be lower in the future, regardless of oil supply growth.

2. Limits on Substitutability of Other Fossil Fuels for Oil. The paper does not address the issue of whether there are limits of substitutability of other fossil fuels for oil. Stationary (as opposed to transportation) uses of oil have been substituting away from oil for years. There are millions of vehicles and other machines that use oil currently in operation. There will be a high cost in replacing these before the end of their normal lifetimes. Also, significant fossil fuels will be required for making vehicles and supporting infrastructure that use another fossil fuel source.

3. Limits on Capital Available for New Investment in Substitutes for Oil, and in New Oil Production. In recent years, we have made heavy use of debt financing for new investment. Government subsidies have also been used. To the extent that debt financing and government subsidies are less available, less investment can be expected in the future.

4. Impact of High Oil Prices on Diverse Parts of the Economy, Not Reflected in the Model. For example, prices of homes may be affected by high oil prices. People with less discretionary income are less likely to “trade up” to a more expensive homes, so high oil prices seem to be one of the reasons for the decline in home prices (Tverberg). Lower home prices affect ability of homeowners to borrow against the value of their homes for new purchases, so affect GDP, apart from oil price’s direct impact on the number of new homes built.

5. Which comes first: Oil Growth or Economic Growth? The assumption in the model is that GDP growth drives oil growth. While this is true, it is to some extent a “chicken” and “egg” situation. Perhaps the availability of inexpensive oil and other fossil fuels is one of the main drivers of economic growth (in addition to the other drivers I mention in the subparts of Item 1 above). Perhaps the cycle is started by the availability of cheap fossil fuels for industrial use and continued by the increased demand to which this growth gives rise.

* * *

I appreciate the work that has been done by the IMF in putting together this model and look forward to seeing further enhancements to the model. The work that has been done and the questions that are being raised are important ones.

I expect that commenters to this post will be able to point out other plusses and minuses of the model. The report itself is very interesting. Again, it can be found at The Future of Oil: Geology versus Technology.

This article originally appeared on Our Finite World.

Interesting article. If august organizations such as the IMF highlights oil's price and availability impact on 'growth' then it should raise the subject's profile in other mainstream media, which has to be progress of sorts.

With regard to the EIA's ever decreasing forecasts it would be interesting to see them plotted as some kind of 'error' chart - for example deviance from the 'latest year's 2020 production predictions' (or maybe a 'moving' window, say 20 years out, if such data is available). We would also have to represent the over-pessimistic peak oil decline forecasts to show due impartiality of course!

This is a research paper of the IMF, and doesn't represent the position of the IMF as a whole. Perhaps it will get the rest of the IMF thinking as well.

"doesn't represent the position of the IMF as a whole."

True, Gail

But I see nothing in this paper which contradicts the observations made in last year's World Economic Outlook, Chapter 3 of which contained some rather pointed observations re. "oil scarcity:"

http://www.energybulletin.net/stories/2011-04-14/review-imf-analysis-oil...

The new WEO is not as focused (re. oil supply) as last year's, but the importance/role of oil is addressed in several sections and from various perspectives. I have gone through the new WEO (though not as carefully as I'd like) and I'd like to offer the following observations:

- IMF lists among its key assumptions that "the average price of oil will be $114.71 a barrel in 2012 and $110.00 a barrel in 2013 and will remain unchanged in real terms over the medium term" (p. ix).

I did not see an explanation for the predicted $5 drop next year other than that this prediction is "in line with prices in futures markets" (p. 9). Elsewhere it says, "Risks through 2013 remain to the upside for oil prices" (p. 14).

- "geopolitical uncertainty could trigger a sharp increase in oil prices: an increase in these prices by about 50 percent would lower global output by 1¼ percent. The effects on output could be much larger if the tensions were accompanied by significant financial volatility and losses in confidence" (p. xvi).

I have a hard time believing that a 50% spike in oil prices would reduce global GDP by only 1.25%. Their second point is more plausible: a 50% price spike would surely result in volatility and shaken confidence.

- The possibility of unsettled financial markets is stated more clearly later: "The short-term impact could be significantly larger if the adverse oil shock damages confidence or spills over to financial markets, effects that are not included in this scenario" (p. 16).

- The potential for interactions to set off multiple negative feedbacks is mentioned here:

"In the current environment of limited policy room, there is also the possibility that several adverse shocks could interact to produce a major slump reminiscent of the 1930s. For instance, intensified concern about an oil supply shock related to the Islamic Republic of Iran could cause a spike in oil prices that depresses output in the euro area, amplifying adverse feedback loops between the household, sovereign, and banking sectors. In the meantime, the oil price shock could also trigger a reassessment of the sustainability of credit booms and potential growth in emerging Asia, leading to hard landings in these economies. This could, in turn, prompt a collapse in non-oil commodity prices that would hurt many emerging and developing economies, especially in Latin America and Africa. More generally, a concurrent rise in global risk aversion could lead

to a sudden reversal of capital flows to emerging and developing economies" (p. 18).

Here's the link to the April 2012 WEO ("Growth Resuming, Dangers Remain"):

http://www.imf.org/external/pubs/ft/weo/2012/01/pdf/text.pdf

You and others will be much more familiar with the IMF than I am, but my sense is that its analysts are much more willing (during the past 14 months) to acknowledge the validity of PO concerns, which is encouraging.

Thanks for your additional observations. There is a lot in the report--hard to cover everything.

I know that there was some overlap in the people who worked on Chapter 3 last year vs the new IMF report. The issue was definitely raised last year in Chapter 3 as well. It is good to see the issue getting some "traction".

I just read with interest that Iraqi officials and Shell have agreed to reduce the planned target output from the super-giant Majnoon field from 1.8 million/bbl/day to 1 million (must be nice to have such large fields eh?). Again, a quick calculation shows that as about 0.3 billion barrels per year.

If this has not been factored into the chart then you can take a third of a gigabarrel away from the thick blue line in figure 4 above. The upside is that the plateau will last a bit longer.

This news item also suggests other oil majors will seek to reduce their earlier optimistic production targets for Iraqi developments. Those earlier contracts were agreed upon boosting Iraqi production to 12 million barrels per day by 2017. Those targets are now alleged to be nearer 8 million per day, with some analysts predicting 6 million barrels per day being more realistic.

Again, I wonder if these revisions factor in the EIA estimates anywhere? Some must do already. If not take another 2.2 giggabarrels off the 2017 production...!

http://uk.reuters.com/article/2012/05/08/uk-iraq-shell-idUKBRE8470H22012...

Bargaining phase.

Methinks that the IMF analysts are gradually trying to break the news to their audience that we live in a finite world, with finite natural resources.

Above is a model for world output using Webhubbletelescope’s oil shock model and dispersive discovery.

Actual discoveries from 1900 to 2009 were used for the discovery curve with a dispersive discovery model used to fill in discoveries before 1900 and after 2009 where the actual data is unknown (this is essentially a statistical guess using a maximum entropy estimator.)

URR for the four scenarios is 2795 GB for crude + condensate, a Hubbert Curve with a URR of 2560 Gb is also presented, based on a Hubbert linearization from 1993 to 2011 using EIA annual C+C data.

For future years beyond 2011 four scenarios were created low, medium, high and plateau. The difference lies in different rates of extraction from mature reserves. Below is the extraction rate profile for the four scenarios.

The profile is the same for every scenario from 1858 to 2011 and then varies from there until 2150, after 2150 the extraction rate is the same in all scenarios.

The low scenario matches the hubbert curve rather closely from 2011 to 2035.

The most likely scenarios are the plateau, medium, and low scenarios.

The high scenario attempts to ramp extraction rates to 1973 levels over a 30 year time frame, this seems quite unrealistic when considering that Saudi Arabia and other middle east OPEC members were aggressively ramping up production at the many of largest oil fields discovered to date. I doubt that such world wide extraction rates will be seen in the future, but included it to illustrate that even if it were accomplished the peak would only move by a few years (to 2021 from 2019 in the medium scenario).

Even the medium scenario is somewhat unrealistic as it ramps to 1990 extraction rates over just a 5 year period, the reality may fall between the plateau and medium scenarios.

The future is quite hard to predict, this model does not benefit from the inclusion of price forecasts that the excellent model presented by Gail does.

If there were an easy way to incorporate price forecasts it would be through the extraction rate in this model. Higher prices would push extraction rates up, though I think the 1973 rate could be seen as an upper bound.

I chose 2800 Gb as an optimistic URR for crude plus condensate.

Fallow=6 years,build=8 years, mature= 10 years in the general shock model.

DC

Thanks for a sanity check.

URR

The 2800 trillion URR is a number that is definitely high-ball for crude and it gives lots of reserve growth potential in the tail of the production curve.

Another high-ball estimate is 3500 trillion which Shell Oil has given as a BOE (barrel of oil equivalent) estimate. If one were to use that number, it would definitely have to apply to the all-liquids curve.

Extraction Rate

The effective extraction rate spiked into the 1970's as the world was increasing production at the rate of 5% per year and reached a peak at the time of the Arab oil embargo. The west was paying such a low cost for oil that it was flowing like water, and the middle east had no choice but to try to throttle the flow. In the ensuing years, consumers basically learned how to practice conservation and essentially cut the demand way down, and the late 1970's/early 1980's world-wide recession created demand destruction as well.

The question is whether we have sufficient capability to increase the extraction rate like we have in the past. As DC shows, to even maintain a production plateau for a 2800 URR number will require a significant increase in the average extraction rate. The oil is getting tougher to extract, and in many places the flow is rate-limited as it is (i.e. stripper wells) or it is high flow-rate over necessarily short time-spans (i.e. high operational cost deep-water).

--

So the technical detail in the modeling amounts to an accurate accounting of grades of oil and trying to project the effective extraction rate. Is the 2800 URR value realistic or should we use that as an all-liquids cumulative? I haven't a good answer for this apart from doing a dual plot, one oil shock model plot consisting of a lower URR for "crude-only" and a higher URR plot for "all-liquids".

WHT,

Thanks for the comments. I tried the higher 2800 Gb URR to present the optimistic case for C+C, also I know you do not think highly of the HL method, but it points to around 2500 Gb based on annual data from 1993 to 2011 for C+C (using EIA data). It seems that the HL often underestimates the URR due to the thinner tail in future years so I wanted to choose something higher than 2500 Gb. In your suggestion at the end were you thinking maybe 2600 Gb for C+C and 3500 GB for all liquids and would you try to remove the biofuels from the all liquids (because this has nothing to do with petroleum extraction.)?

DC

Beautifuly put...

There are millions of vehicles and other machines that use oil currently in operation. There will be a high cost in replacing these before the end of their normal lifetimes. Also, significant fossil fuels will be required for making vehicles and supporting infrastructure that use another fossil fuel source.

Do we really have to replace most vehicles faster than they are presently being replaced ?. If not then no additional FF would be required and todays infrastructure would be adequate to support ICE vehicles replaced by electric or PHEV's.

Well that would depend on when the world stops building ICE vehicles and starts building an all electric fleet. Right now that point is not in sight. There is not even a plan to replace heavy load trucks or off road work vehicles such as tractors or construction equipment. They are all ICE with no replacement in sight.

Only when it becomes very obvious that crude oil is in very serious decline will there be any Manhattan type projects to replace all ICE vehicles. By then it will be way too late to avoid any draconian hit on world economies.

Ron P.

Darwinian,

converting all ICE vehicle production to EV and PHEV is not on the scale of a Manhattan project. For the US this would enable about 50% of VMT to be electric in 7-8 years. We would expect very high oil prices to favor high mpg ICE vehicle use over low mpg vehicles so additional savings would occur during the transition until most ICE vehicles are replaced. The is no immediate need to replace ALL ICE vehicles just drastically reduce oil consumption by having most VMT under electric power.

By then it will be way too late to avoid any draconian hit on world economies.

That really depends upon how quickly oil price increases occur. Would $10-20/gallon gasoline cause a draconian hit to the world economy??

Are you kidding? First gasoline prices are not linear around the world. But if crude oil prices increased enough to cause a tripling of US gasoline prices the effect would be draconian. And such an increase in crude prices would hit European nations just as hard and some much harder. And since many European nations are already on the brink of collapse, this would no doubt push them over the edge.

Yes, crude prices rising enough to triple US gasoline prices would most definitely have a draconian effect on the economies of most world nations. With the exception of oil exporting countries of course.

Ron P.

But if crude oil prices increased enough to cause a tripling of US gasoline prices the effect would be draconian.

Are you implying that in time it would not be possible for the US economy to adapt to say a price( in 2012 $$) of $12/gallon.?

The adaptations I would expect would be a rapid shift(over a 10 year period) from low mpg cars and light trucks to high mpg ICE and HEV's and as manufacturing capacity is expanded to EV and PHEV's. While this is happening other adaptions possible are more car pooling for work commuting a slight increase in mass transit use, perhaps less driving and flying vacations( but staying longer), less frequent shopping visits( but buying more per visit). Longer term structural changes would be more local corner stores less shopping malls, local schooling enabling children to walk to school rather than being driven.More rail and less truck long distance transport. Conversion of diesel/gasoline long distance trucks to CNG.

What I wouldnt expect is;(1) mass relocation from suburbs to inner city (why not just buy a new or used high mpg vehicle) (2)collapse of world trade( ocean transport can just go a little slower) (3) collapse of vehicle sales( demand for high mpg and EV will remain strong, mass transit would not be able to handle all car commuters)

If these changes result in about a 2/3 reduction in oil imports then the US balance of trade would be about the same at $300/boe as it is now at $100-120.

For starters I was talking about the world economy. The USA is not the world. And if the world economy collapses the USA is very likely to collapse right along with it.

Car pooling? The problem would the gradual collapse of buying power because of high oil prices. High oil prices would drive up the price of everything else right along with gasoline prices. People would have a lot less to spend which would be a huge drag on the economy. Millions of people would be laid off. They would have no jobs to car pool to.

A mass relocation to the city would mean trillions of loans to homeowners would be defaulted on. Banks would collapse and that alone could sink the economy. And the collapse of vehicle sales you speak of would collapse millions of jobs... more unemployment.

It never ceases to amaze me how so many people can come up with such magic bullets to fix everything then completely ignore the fact of massive unemployment that these massive changes would bring about.

It would be a vicious circle. More people laid off means these people buy a lot less. And when these unemployed people buy a lot less, more people are laid off. And the vicious circle continues.

Very cheap energy has been responsible for the massive increase in industrial production, cheap driving, cheap vacations and cheap everything else. Very high energy costs will cause everything to collapse like a house of cards.

Ron P.

"The USA is not the world. And if the world economy collapses the USA is very likely to collapse right along with it."

You're talking here about a world economic collapse as a direct consequence of high oil prices, right?

But today and for as long as it doesn't reduce oil consumption below its current ~25% of world production, the USA is the world's "swing consumer", just as the USA once was and Saudi Arabia is (or was until very recently) the world's "swing producer". Voluntarily or involuntarily, it is millions of barrels of American demand that is "destroyed" each time the oil price spikes.

So the pertinent questions are not, "will the world economy collapse, and if so, will it take the USA with it?", but

"Will the USA economy collapse, and if so, will the world be able to carry on without it?"

I would not be surprised to find the answers are yes and yes.

At least for the North American economy there seems to be a fairly hard limit to how much of the household budget can be devoted to energy consumption. That limit seems to be between 4 and 5%. The oil price spike in 2008 drove energy costs above 5% which contributed to a large swing in consumption patterns -- especially for light vehicles and real estate in low density areas.

The forecast period that is used in this article seems to end in 2020. I note that 2020 is only 8 years from now. Most of the technology that will be used to deal with a doubling or tripling of oil prices is in place now. Gail's point that the use of expanded credit to help ease the transition to higher oil prices is temporary is very valid. Many European economies have already hit debt to GDP levels above 120%. The US isn't far behind. I expect that contracting debt levels will combine with higher oil prices to cause a painful adjustment period. The adjustment period might not start tomorrow or even this year, but 2020 is not really that far away.

I am not sure what would constitute a collapse. Five years ago would we have said that persistent 10% unemployment levels and a growing number of jurisdictions becoming essentially ungovernable due to slow economic growth and high debt levels constituted a collapse?

At least five European countries are in danger of collapse right now and they are likely to collapse long before the USA does. Then the rest of Europe, then the USA, Canada and many Asian nations will fall like a row of dominoes.

But the real problem will be, in Europe, In America, and in Asia will be unemployment. Debt default will be rampant. With no money to borrow massive unemployment will be the obvious result. And this all started when oil prices shot up due to peak oil.

But unemployment is a subject you don't seem to want to address. On well.

Ron P.

With:

1. The Bush tax cuts

2. Oil imports

3. Trade deficit with China

4. military budget

it's hard to see how the US economy won't go down.

Trade figures with China:

http://www.census.gov/foreign-trade/balance/c5700.html

2. Oil imports

Have fallen from 60% to the 40's.

4. military budget

Yes too large, but its growth is trivial compared to entitlement growth (Medicare, Medicaid, etc).

The USA isn't broke because of growth rates, it is broke because of the raw total expenditures.

I could have mentioned the other wealthy countries that are also on the brink of financial disaster, yes.

But they're tiny in comparison with the USA and the portion of their GDP spent on oil is significantly smaller. Their financial woes are less directly a result of high oil prices (not that high oil prices don't contribute).

There are also of course people who will suffer greatly from high oil prices even in the world's poorest countries.

But by and large the "demand destruction" is principally an American gift to the rest of the world. America responds to the tight supply by going into a mild recession and thereby keeps the price rise steady.

I'm not sure why it matters to you that I didn't address unemployment. There are tools for addressing it (such as local currencies) but they're rarely deployed in earnest without a severe collapse in governmental fiat currencies.

We are now over three years into an expansion phase in the economy. The last bottom occurred in April 2009. The longest expansion phase since WWII was 59 months. A lot of the good opportunities for gaining efficiencies and growing the advanced economies have been implemented.

The recovery has been kind of anemic because a number of major economies are working off debts that, in retrospect, should never have been incurred. These debts include mortgage debts in the US, UK, Spain, and Ireland. Government debts had clobbered most of Southern Europe. This unwise borrowing has sapped the strength of the recovery.

High gas prices haven't made a lot of the distressed real estate particularly attractive. Gas prices nearly destroyed the US auto industry (and indirectly real estate values in auto producing states). Gas prices caused much development in Florida and much of the Southwest to be much less valuable.

It looks like real estate prices are starting to stabilize, but are not showing any signs of returning to previous high levels. I am not sure if Europe is making any progress or not in dealing with their stalled economies.

However, no apocalyptic reasons for a new recession within the next 2 years or so are necessary -- reduced profits and austerity induced by high government debt levels should do the trick nicely. Any adjustment required by persistently high (and increasing oil prices) will just make things worse.

The "expansion" in the US since 2008 is a statistical trick from constantly understating inflation via manipulation of the CPI calculator. This turns economic contraction or stasis into growth.

Yes those debts should have never occurred, because we shouldn't have a debt-based monetary system! Those debts were incurred due to zero % interest rates imposed by central banks to attempt to kick start the economy, which predictably failed since the world is nearly out of resources and cannot grow its way out of its debt problems anymore. There will be no economic recovery.

When Europe collapses in the next year or so it will likely trigger the derivatives ponzi scheme and then the US, Canada, and the rest of the world's financial system will collapse, likely into hyperinflation or something similar, as it is a gigantic ponzi scheme.

Yes several EU countries are in danger of default (not 'collapse'), though the end of the common currency is more likely. Why is that, to your mind? Whatever your answer, it needs to explain these countries all over the world where unemployment is high and the economies are strong, who pay the same price for oil +/- as everyone else.

http://www.google.com/publicdata/explore?ds=d5bncppjof8f9_&ctype=l&strai...

Most of those countries in that chart differ from the EU countries under threat: government spending under control, low trade barriers, easy to start a business, taxes not exorbitant relative to other countries, regulation not exorbitant.

More recent IMF figures:

http://www.google.com/publicdata/explore?ds=k3s92bru78li6_&ctype=l&strai...

The timing of replacements looks to be decades away, if ever.

One issue is the higher front-end cost of new electric or PHEV vehicles. Either people/businesses/government need to have more savings, or they need to go further into debt.

This is parallel to what is happening in the oil and gas production area. There are more and more front-end costs, so there is more need for accumulated savings or more debt.

The economy cannot handle a continued shift in this direction, IMO. This is a limiting factor on how quickly a change can be made, and indeed, whether it can be made at all. See my post, Can we invest our way out of an energy shortfall?

I wonder how fast prices for EV's will drop as they become mass produced. The only real cost increasing factor is the batteries, as everything else in the car is significantly less complex than an ICE and therefore should be cheaper. The Tesla Roadster's motor windings were hand wound.

$35K for a Prius or a Chevy Volt. $20K for a Ford Focus which has greater range and is in many ways a more capable vehicle. The reduced fuel costs, spread over a period of years, have to cover the higher purchase price and the total cost of transportation has to leave room in the household budget for other things like food, clothing, shelter, education, health care etc.

I, too, wonder how fast prices for EV's will drop and when the drop in prices will begin. If there is no price drop, it is likely we will switch to bicycles (in the rain) before the price drop occurs.

Gail's comment is apropo!

The Prius and Volt will always be more expensive all else being equal because they are by definition extra complex -- they are hybrids. Not only do they have an ICE but they also have batteries and an electric motor, plus all the mechanism to switch between the two. A pure BEV need not be anywhere near this complex (you can buy a remote control one for $20) and could conceivably drop below an equivalent ICE powered mobile when mass production of batteries ramps up.

Considering that EV's have been on the market for 1 year so far I think there's some room for relative price drops!

I am looking forward to the relative price drops, lower maintenance costs, and increased usable ranges for pure electric vehicles. The old pickup truck is getting a bit long in the tooth.

I'll believe it when I see it.

Gail, and all others participating in/monitoring this discussion:

Would you please cross-check these figures and sanity-check my thought processes (see below)?:

According to this source, some 12.8M light vehicles were purchased in the U.S. in 2011:

http://online.wsj.com/article/SB1000142405297020351360457714044085258108...

According to this source,The mean price paid for light vehicles in the U.S. as of May 2012 was ~$30,000.

http://blogs.ajc.com/business-beat/2012/05/07/average-price-of-new-vehic...

I will offer just two plausible examples, plausible meaning examples of vehicles which have been sold in the U.S. for at least several years (granted in various model year incarnations), and which are vehicles which could easily meet the base transportation 'needs' (as opposed to the 'Like a Rock' and 'Built Ford Tough' wants)of most consumers.

Honda Insight: Base MSRP, no extra geegaws, $19,290 USD, 41 MPG City/44 MPG Highway.

http://automobiles.honda.com/tools/build-price/summary.aspx?ModelName=In...

Hyundai Elantra, MSRP, with added automatic transmission, no other geegaws, $18,470, 29 MPG City/40 MPG Highway.

http://www.hyundaiusa.com/build-your-hyundai/?vehicle=elantra&year=2013

Here, Motor trend has an informative article about a goodly selection of real cars which are in its '40 MPG Club) That;s Highway, of course, but the City Cycle mileage is always above the mean of the spectrum of vehicles currently being purchased by U.S. Americans.

http://www.motortrend.com/features/mt_hot_list/1103_the_40_mpg_car_club/...

My premise is this: The purchase price of many new light vehicles which significantly exceed the mean MPG of the spectrum of all new light vehicles currently being purchased in the U.S. seems to be significantly lower than the mean purchase price of new vehicles in the U.S.

This leads me to provisionally conclude that the purchase price of more efficient vehicles is not the reason more such vehicles are not purchased...the reasons are otherwise.

I also would opine that, from an objective reality standard, the reasons are not that such more fuel-efficient vehicles are incapable of meeting the basic transportation needs of most people (Note: I get the fact that some minority of vehicle owners are farmers, ranchers, contractor/construction workers, and/or live at the end of a 20-mile dirt track on top of a mountain somewhere, and I estimate that these cases probably represent less than20% of the U.S. light vehicle purchasers.)

Ergo, I judge the reason that more highly-fuel efficient vehicles are not purchases is due to style choice, not purchase price or fundamental utility.

I also would opine that the facilitating factor to this is that the price of fuel is sufficiently low to allow style preferences to dominate purchase choices.

Gail (and everyone else), if you have data and reasoning which prove that purchase price is the factor preventing more of the the some 12M light vehicle purchases in the U.S, from being of the high-MPG variety, I would be interested in reading it...because I just don't see purchase price as the inhibiting factor...we need to not focus on outliers such as the Chevy Volt and Nissan Leaf, but, IMO, we should look at the broader spectrum of real-world vehicles being offered for sale.

I found this Transportation Energy Data Book for the U.S., produced by some folks at Oak Ridge, TN for the US Government...it seems to be current I think (at least within a year or two):

http://cta.ornl.gov/data/tedb30/Edition30_Full_Doc.pdf

Perhaps there is useful info in there to do conduct an analysis on the matter.

[Edit] I realize the OP for this sub-thread spoke about the purchase price of PHEVs and EVs being prohibitive...but I think that approach to the idea of how to increase U.S. light vehicle fleet MPG and commensurately reduce oil used for U.S. light vehicle use is overly narrow.

{Concerning Jevon's Paradox} Yes, there would likely be be a small increase in vehicle miles driven per person, but not nearly enough to negate or even seriously dent the reduction in oil use brought about by the increased MPG, IMO. There are still going to be only 24 hours in a day, and 365 days in a year, and increased MPG will not magically allow people to quit their jobs or forgo 6-8 hours of sleep per night, nor forgo time at their home spent on waking personal hygiene activities etc. Then there are issues about vehicle maintenance and insurance costs, etc. which are invariant to the vehicles' MPG.

H

I am personally mystified as to why so many people in the US are willing/able to shell out large amounts for oversized vehicles. I wonder whether in the next downturn, the big default problem won't be on vehicles that people can't really afford (or maybe people make a choice between the cars and their homes, decide that they have to have the cars, and default on their homes, instead).

Yes, you are right, people could buy more efficient cars if they chose to, especially if the average cost of cars is in the $30 range. People seem to be very interested in looking at advertising, and impressing their friends and neighbors with the big, fancy, new car they are driving.

Even people who drive fuel efficient cars can fall into the "impress-your-neighbor" mentality. The difference with them is that they are impressing them in different ways--"fanciest Prius" or first in the neighborhood with a Nissan Leaf.

Gail, you and me both regarding scratching our heads about people's buying choices.

I imagine there are lots of psychological factors involved...keeping up with the Jone's, the idea that bigger and faster are better, the perception that large vehicles are safer...

Of course the Advert industry is in the business of pushing people's mental buttons, and we know that bigger/faster/more gadget-laden/more expensive vehicles have bigger profit margins.

I can try top boil it down to 'sound bites' or 'bumper stickers':

1. Small fuel-efficient and relatively inexpensive vehicles do not produce the high profit margins companies desire.

2. Advert agencies craft adverts which magnify people's tendencies to want bigger/faster/more expensive vehicles

and

3. The price of fuel and the overall affluence of Americans are such that people feel able to afford to cater to their base tendencies/desires, as amplified and stoked by the experts in the Advert industry on behalf of the profit-maximizing vehicle industry.

Add to this some inherent and much manufactured/amplified hostility towards environmentalists/greens/conservation/ and the very idea of there being 'Limits' as antithetical to the liberties and freedoms folks imagine as part and parcel to the 'American Dream'.

I suspect that the 'stair-step' 'three steps back, two steps forward' sawtooth dance of fuel prices, and economic indicators in general, will continue as oil becomes more scarce and harder to extract, with an overall commensurate decline in vehicle miles driven, vehicle sales, and a gradual move towards more efficient vehicles, carpooling, car sharing, etc. as coping mechanisms.

I find it a shame that folks can be bedazzled by the 'poster children' of top-of-the line Priuses, Volts, and Leafs, and swallow those as an excuse to ignore the base model Prisus (there are 4-5 trim lines for Priuses...for each model...the regular Prius, small Prius, Prius V, Prius plug-in), Honda Insight, Hyundai Elantra, and all the other models described in the Motor Trend article I linked to above.

U.S. light vehicle fleet mean fuel economy could be significantly improved if half-three-fourths of those 12M new vehicles bought each years were selected from this stable of practical, useful, inexpensive, high efficiency cars...and folks would actually save a bunch on purchase price (and save even more if they bought the base vehicles), have very reliable and function vehicles, and would save a bunch on their fuel bills.

It is what it is...

I think you're pretty close with your reasoning.

I still remember the appalled look on the salesman's face when I told him I wanted the base model Aveo (as in the advertised loss leader). No "convenience" package, no power windows, manual transmission, and no air conditioning. He almost stroked out on that one. That must be when he realized the bait and switch wasn't going to work. You have a brand new car advertised at $9,500, and that is the one I want. (At the time, the next best car I could find to buy was a 5 year old Neon listed for $8,000.)

And when one of the ladies at work saw it, she asked me how that little thing could be "safe." I reminded her my other commuting vehicle is a motorcycle. She drives a Suburban, of course. And complains about gas prices.

Expectations, stereotypes, and marketing.

America has lots of hybrid cars parked in the driveways of 2000 sq/ft houses. IMHO even most eco-friendly vehicle purchases are made for reasons other than raw efficiency.

IMHO there is another problem that is still on the horizon: The average new vehicle purchaser is not the average American vehicle owner anymore. As people get poorer and vehicles get more expensive, this problem grows. If we get into a situation where "the 1%" are the only people who can afford new cars, then the other 99% will all be driving used versions of the 1%'s vehicle priorities. Good luck getting the 1% to give up their luxury options for the sake of the next few owners of the car.

Gail - A great and balanced presentation...mucho thanks. I've seen numerous "geologic" models of that have not predicted future oil development accurately but the model structure itself wasn't really flawed. The flaw was almost always in the price forecasts. And that error has pushed both ways but typically more towards an underestimate. As you know so well the oil patch thrives on the discounted cash flow approach. Obviously that model is dependent not only on the geologic/reserve/flow rate input but also price forecasts. The typical convention is to use current pricing with a minor inflation factor. Unfortunately this can lead to significant inaccuracies...both pessimistic and optimistic.

Consider the 2008 shale gas bust. I was on contract with Devon during that period and watched first hand future reserve development based upon a NG assumption that was more than 5X the most recent low prices. Obviously as prices fell the amount of economically recovered NG reserves fell. While improvements in horizontal frac'ng may have aided the effort the high cost of that tech worked in conjunction with falling prices to push the recovery model lower. Likewise I've seen the industry pull back from activity based upon an inaccurate low projection of future prices. Negative price forecast are a method of adding an additional risk factor while positive forecasting tends to be avoided. Just as it is today: we've shelved many of our deep NG prospects because they don't cut the mustard at current prices. So why don't we use a higher price forecast? NG prices are bound to rise eventually. But in a NPV calculation "eventual" is not acceptable. If I want to use a higher price I have to present specific "proof" of that expectation. As a wise catcher once said: Predictions are difficult...especially about the future. You simply don't stand before management and argue that you can accurately and precisely make such predictions. You're already making a case for reserves being present when in fact there may be none discovered when you finally start turning to the right.

If I ignore the inability to predict future prices and assume some clever engineers will figure out the tech side of the effort just watch out: we geologists can truly go hog wild with reserve speculation. Consider the current DW GOM play. When I started at Mobil Oil in 1975 I drilled from a fixed platform that was in the deepest water in the GOM: 600'. But the seismic data I had at this edge of the continental shelf showed clear signs of the possibility of a depositional model that would allow transport of reservoir quality sediments to the Deep Water trend. Hydrocarbon generation wasn't a concern: the GOM was long known as one of the greatest oil generating systems on the planet. I had just completed my masters work on such DW deposits in the San Joaquin Basin in CA so it was an easy leap for me. My graduate professor was deeply embroiled in a debate with Exxon over the possibility of such deposits in a certain onshore trend in Texas. He published a number of papers supporting the idea with XOM publishing counter arguments. BTW: have you noticed who the big DW GOM players are? And also noticed that the largest oil company on the planet has had little exposure to the DW GOM trend compared to others? Established corporate mind set can be very difficult to overcome.

OTOH no one was counting any of those potential reserves at the time. Predicting the future price of oil and the cost of tech that far in advance wasn't given any consideration at all. We geologists were full of DW sugar plums dancing in our heads over 30 years ago. But no one was going to generate a recovery model based on those expectations without a solid economics grounding.

And even when you have a handle on the tech and economic factors it's still easy to be on the low side in predicting reserve development. As I've pointed out before my privately owned company has been focused on deep NG development along the Gulf Coast. Not that we don't like oil prospects but there just aren't enough of them to drill. But wait...plenty of oil prospects in the Eagle Ford Shale. Why didn't we jump into that play? Easy answer: the ROR wasn't sufficient for my owner. He could make a better return investing in one of his other companies. So what was our estimate of recoverable EFS reserves? ZERO. But that's just us. But that is our recovery model. So maybe Chesapeake et al are using a different economic model than we use. Actually their models, despite their press release hype, don't differ from ours significantly. CHK's recent finance problems would seem to confirm that IMHO.

A year or so ago when Petrohawk made a huge profit from their EFS play. But they didn't do it by drilling and producing the EFS: they sold their company and UNDEVELOPED EFS acreage for $12 billion. And that's the motive behind the development of the shale plays IMHO: the opportunity to book a significant amount of proved (although not terribly profitable) reserves. And that allows Wall Street to assign a higher value to their stock. This is nothing new to the oil patch. I've seen it many times in my career. The EFS and many other shale trends are not oil/NG plays...they are stock plays. That's where the big profit comes from: Wall Street...not the well head. The good news is that this "profit" can be generated very quickly as the hype sets in. The bad news is that it can disappear just as quickly. Consider that CHK has plunged deeply into the oil rich shale plays during a period when oil prices have sustained the highest year long prices in the history of the oil patch. And CHK stock has lost about 1/3 of its value in the last 12 months. So if CHK isn't making any profit on the stock side of the equation and a small profit on the well head side (a profit but insufficient cash flow to sustain current operations) what does that say about the huge amount of future recoverable reserves some are assigning to the fractured shale plays? And remember companies are using the current high oil prices to justify their efforts and others are using those efforts to justify their optimistic expectations of future reserve development. And if demand drops due to economic troubles in the EU and a slowdown in the US economy resulting in a 10-20% drop in oil prices how many of those projected reserves will vanish? We've already seen trillions of cu ft of anticipated dry NG reserves vanish as prices fell over 75% during the last 4 years. And now there seems to be developing legitimate concerns that even with the high current oil price the economic model for the oil shale plays might not be sustainable on a cash flow basis.

As I would characterize you excellent post: it ain't the geology, stupid...it's the economics.

I agree, it is the economics that is the problem on future oil and gas plays, just as it is on replacement electric vehicles.

I think part of the problem is that decline rates aren't certain. Also, it isn't certain how much technology will improve, and it isn't certain how the undrilled areas differ from the drilled areas. As you point out, prices are also not certain. It is easy to create the impression of a possible very good business model, by making favorable assumptions. People can see that we have an oil and gas problem, and it is easy to jump to the conclusion that any so-called solution will work, and generate money for investors. Unfortunately, workers salaries are stagnant. They can't pay higher prices for oil and gas, without cutting back somewhere. So the model breaks down.

I am wondering if Chesapeake will make it past June 30, 2012.

It will probably be fairly hard to ramp up cheap oil for world wide consumption. Consumption won't be more than demand. It isn't logically necessary that consumption will use up all available supply, but large surpluses seem pretty unlikely.

The logical predictions are that higher oil prices plus excessive debt levels will constrict production and economic activity and will further shift production and economic activity to areas that are more energy efficient and less debt heavy.

It is not a pretty picture.

...and as someone said recently, all unconventional oil is 'manufactured' not 'natural' - in that the good old Texas Tea gets into the transport pipelines at the rate it comes out of the ground all by itself. While unconventional 'oil' and the like (shale, sand etc) is a manufacturing or industrial production process that is controlled by the maximum economic and practical rate of production of the plant involved.

With shale it will be with the rate wires can be strung to provide the energy that can be put into the shale to heat it and the rate water can be supplied and disposed of. With sand its could be the rate trucks can cart it or diggers can strip the overburden. In each case there are capacity-limiting elements in the process that cannot be easily ramped up by several orders of magnitude to get the unconventional oil to be any useful proportion of our daily 81 million barrels.

I think it was Aleklett who recently found that the maximum production of unconventional oils is not likely to get beyond about 8 million bbl a day by 2030. So basically the 'unconventionals' are - as Westexas suggests - Share Plays rather than Energy Plays.

Next topic anyone?

The graph of the EIA production estimates caught my eye - the trend seems so obvious. I wanted to see where their estimate might converge with reality in 2020, so I created the following graph from their 2020 estimates. I used three trend lines to establish a range: linear, exponential and a second order polynomial. If I were a betting man I'd put my money on 60 mbpd...

Interesting! But not so good for the world economy!

Total US Crude Oil Production (EIA):

2002: 5.746

2003: 5.681

2004: 5.419

2005: 5.178

2006: 5.102

2007: 5.064

2008: 4.950

2009: 5.361

2010: 5.476

2011: 5.662

Total US Crude Oil Production, using RRC data for Texas, instead of EIA (Gap):

2002: 5.615 (+131,000 bpd)

2003: 5.548 (+133,000)

2004: 5.303 (+116,000)

2005: 5.059 (+119,000)

2006: 4.948 (+154,000)

2007: 4.898 (+166,000)

2008: 4.813 (+137,000)

2009: 5.199 (+162,000)

2010: 5.285 (+194,000)

2011: 5.324 (+338,000)

RRC Data: http://www.rrc.state.tx.us/data/production/oilwellcounts.php

http://webapps.rrc.state.tx.us/PDQ/changeViewReportAction.do?viewType=Mo...

EIA data: http://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_a.htm

Art Berman will address this topic in his ASPO-USA webinar presentation on 5/17. More info at www.aspousa.org

Note that the net increase in US crude oil production from 2008 to 2009 was equivalent to rising Gulf of Mexico production, as GOM production rebounded after the hurricanes and as some (quick to peak and decline) deepwater projects came on line.

The RRC sums the reported production from Texas producers, while the EIA apparently uses a sampling approach to estimate Texas production. If the EIA is this far off for Texas, what about the other producing states, and what does it say about the EIA's global data?

In any case, based on the RRC data, it appears that a thousand rigs drilling for oil in the US in 2011 served to keep production flat year over year. Note that--based on the RRC data--all of the expenditures by the US oil industry from 2005 to 2011 inclusive only served to bring US crude oil production back to the pre-hurricane rate of 5.3 mbpd.

Glider

Is our "100 year" supply of Shale Oil being included in the projections?

I have no idea - I just used the EIA graph that Gail posted above. My graph is more a check on how quickly the EIA is recognizing world reality rather than a prediction of future production values.

I thought it was "shale gas", not "shale oil" that there allegedly was a 100 year supply of, with sufficiently high price. I don't know of any huge estimates of tight oil supply.

Great article.

I am just once again agog at the ability of economists with strong numeracy skills to have somehow evaded the part of education where one learns about limits, especially the natural sort, and complexity.

I see in their wonderful projection of future economic growth that they've, once again, used the 'ruler approach' very popular among economists where the economy just grows merrily along at a non-changing pace. In their case 4% +/-.

Using this extrapolation they have the world economy growing by 40% at a time when petroleum production is growing at 9% which - surprise! - is the same ratio that has been true of the period from 1970 through 2010. So they really didn't go out on a limb there, they instead went for 'status quo' which is a career safe move. Not very bold, but safe.

What catches my eye the most is that nowhere does the idea of EROEI seem to creep into their views, which is a classical economic blunder...all things are contained within price as if money itself were the primary consideration rather than the derivative.

The reason I think they are desperately wrong here is that even though one could argue that a lower EROEI simply means that there will be more economy being directed into energy even as it steals from other parts of the economy (so it's a wash...GDP wins either way) this utterly ignores just how much of our current economy is built upon faster-than-GDP debt growth that directly supports such useless things as an overbuilt financial sector whose 'profits' and contributions to GDP are really more illusory than real.

So the tasty economic pyramid that currently exists will totter and topple as more and more effort is directed back into energy production and it becomes obvious to all that the prior four decades of too-fast debt expansion was really an aberrant if not abhorrent historical diversion not to be repeated again.

Beyond EROEI, the final section, Factors underlying world long term growth rate, other than energy... seems critical if one is to do a systemic analysis of peak oil; the Peak Everything hypothesis, virtually impossible to predict. So many factors contribute to BAU and the continuing ability to extract and market oil at current rates. I expect that there is more synergy going on than is, or can be, accounted for.

We tend to compartmentalize our analysis of oil production (or debt, food production, industry, politics) as if they are standalone processes, but that's not how the world works. All of these things rely on the others for sustenance , a hyper-complex arrangement lacking the sort of resilience found in distributed, independent modular systems. Welcome to peak globalization. Taking a generalist's view, I expect that human ingenuity and substitution will have minimum impact on the slow declining spriral of industrial civilization. The only solution will be declining consumption due to declining population imposed by bio-physical economic reality. Our attempts to overcome basic physics will eventually steepen the curve as diminishing returns beget increasing negative feedback.

This process is well underway, ie: ethanol production in the US.

Good points, Chris.

Somehow there seems to be a view that resources don't really matter, even as billions of more people need to be fed and housed and clothed.

Factoring in the resources needed to produce the resources would seem to be a worthwhile way of approaching the situation.

A somewhat related issue: One problem I have when looking at GDP projections is that energy (and a lot of other things) seem to impact GDP calculations multiple times in a single year. For example, high oil prices impact food prices and the cost of goods transported to market. To the extent these costs get passed on to customers, it would seem like these would be impacts to GDP for a year as well. HIgher extraction costs would also impact GDP in multiple areas--perhaps favorably in some, because companies that do Fracking and other processes are selling a lot more services.

GDP doesn't reflect physical reality well and GDP and the value of money are uncoupling from the underlying reality of the physics that governs much of the economy. In scientific terms, real work is force exerted times displacement as a hard and fixed law that can not be inflated or manipulated or misstated. See http://en.wikipedia.org/wiki/Work_(physics)

Most of our economy when dealing with work in a physics sense is pushing things around with a force from one place to another. Tractors push around dirt and food. Trucks and cars, trains, and planes push around food and people, resources and wastes, etc, and all of that sums up into the total physical work that we do. The sum of all energy sources is the total available force that we have to work with, and that limits the amount of pushing, displacement, and work that we can do. Our total sum of energy sources to use as force would seem to be directly tied to the total amount of physical work that can done, which is a more true measure of the economy relationship from year to year than GDP for me. GDP uses inflatable money in it's calculation that is not in any way tied to the underlying physics. If our total supply of energy sources declines overall, the amount of real physical work done must decline as well too. That's just physics. Each individual energy sources contribution to real work done can be viewed in the same way. Some sources may grow while others decline, but it is always the net total energy that limits the amount of real physical work that can be done in the economy as a whole.

Sure, we can do some things smarter, and more efficiently, and invent some interesting things to increase our knowledge and level of entertainment. But it does seem like the bulk of much of the work being done is in pushing critical things like food and resources around. Any changes to our ability to push critical things around will reflect themselves in the economy in some way. In a situation where more energy is available to do work and push things around, the economy tends to expand, and in a situation in which there is less energy to do work and push things around the economy tends to contract.

Simplistic, but true. It applies for knowledge based industry as well, it's just that the energy inputs go into hardware, software, wetware, and all the supporting infrastructure.

See my comment below, it has the same theme. Maybe this is why engineers don't get invited to magic shows as we tend to spoil the illusions?

Physical growth in population and infrastructure is a much more energy intensive part of GDP growth than growth attributable to increased productivity. It is possible to increase GDP without increasing energy use. What we have become accustomed to is equating growth from increased population and the resulting increase in infrastructure to growth of incomes due to increases in productivity.

I disagree. This is the conventional approach to measuring energy inputs and productivity outputs without considering the entire cycle. GDP can be increased without increasing the traditional measures of energy, but energy is used all the same. Or, more basically, what is GDP? That measure in itself is flawed.

Increased productivity typically requires more condensed forms of energy - this has been the historical record. Human productivity is fueled by food and water. If food production is increasing, do we also include the solar energy that went into growing the food? No. Yet, is there a real increase or decrease in energy inputs?

If we were to make a more accurate ratio measurement that would benefit the species and the planet, we should be comparing REAL GDP to Entropy. i.e. Lawyers fees and earnings shouldn't count (do they?) because the national economic transaction is a zero sum. The same could be said for insurance paid disaster reconstruction - and I am by far not the first to state this.

Dr. Albert Bartlett postulates the greatest failing of the human species is to appreciate the exponential function, and my corollary is we fail to appreciate the boundary conditions.

So, how do improvements in energy efficiency factor into this? The economy consists of both goods and services. To the extent that both can be delivered in a less energy intensive manner should lead to the ability to consume more of both without increasing energy use. If the population is stable there shouldn't be a need to increase food production or build additional houses that require heating and cooling. I'm not suggesting that growth can continue forever but that there is room within current technology to increase the delivery of goods and services without additional energy. Conversely, we could focus on just maintaining the current level of consumption while reducing our energy use.

In theory, if the FF supported supply of real work were to be remaining constant or growing, or if renewables or alternate could make up for any decline in work available from FF, or increases in efficiency were to offset declining FF, then your statement about being able to consume more of both without increasing energy use could be valid. But if decline rates of 2 to 6 percent per year for FF becomes the norm without anything to offset it, then it may be much more probable that there will just be less goods and services available. The physics suggest that, even though GDP or debt trends may not reflect it.

In terms of oil, a good part of the EROEI is nat gas so to the extent that nat gas is currently relatively abundant, I would think it would somewhat mask the effects of lower EROEI for awhile.

Shale gas may be relatively abundant, but I expect the EROEI of shale gas is pretty low. It is a situation where sales price is far lower than the cost to produce the product.

Some of the other types of gas are essentially byproducts of oil or "liquids" production. The EROEI depends on how much of the energy in is allocated to oil and how much to natural gas.

The reason EROEI doesn't rate much of a mention in the report is that oil is a massively, globally traded commodity on which almost half the world's energy-using technology relies, and other energy sources (which are less widely traded and rather cheaper per unit of energy) still have a very high EROEI. As long as prices can be modeled and energy in other forms is assumed to be abundant, the actual EROEI of oil itself doesn't matter much to the model. Low-price but high-EROEI gas, coal, wind, nuclear and solar energy (in roughly that order) are leverage for getting high-priced, low-EROEI oil out of the ground.

Moreover, at the same high oil prices those energy supplies can also dig "negabarrels" out of the power grid.

You probably still have a strong point about the debt/growth relationship. Do expect large defaults in coming years. But remember, debt defaults are not really novel nor earth-shattering. We've been trained in recent decades to think of money markets as a close reflection of reality, but they're just paper and numbers. Fiat currency debt can still be issued in the midst of a financial meltdown, and after it. Only when *physical* resource limits are being pushed should the economic system fail for real. I just don't see economic collapse happening while high-EROEI, non-oil energy supplies are available.

"and it becomes obvious to all that the prior four decades of too-fast expansion was really an aberrant if not abhorrent historical diversion not be repeated again."

IMHO the public at large will never understand this. Four decades is too long and the evidence of the problem is not clear-cut and direct enough.

Certainly the authors of the IMF paper have taken an improved approach to forecasting. Of course, there are many factors which they probably have no way to take into account in any reliable way. What is the impact of climate change on world GDP? How does water depletion affect economic growth? Which industries are affected by oceanic acidification and what impact does that have? Each of these individually may have small impacts in the next 8 years, but have increasing impacts in the following 30. What is their cumulative impact on GDP? Rockman adds important, although idiosyncratic microeconomic information about how the oil and gas economics works at the level of the producers. When mainstream commentators speak of speculators influencing price, who are these speculators? Wall Street investors trying to time the markets? No model will account for every variable important to the mix which creates oil output. The model which makes very good predictions today may make poor predictions tomorrow as important, unnamed factors change.

Should I lead with the qualifer first...? Yes, like many on TOD I appreciate an attempt at a more balanced model that takes both sides of the dynamics into account. However, the math is not good enough, they can do better. (And using beta for a constant had me thinking they were using Bessel functions).

As we know the production and pricing are results of potential differences. The same principle applies to electrical power system load flow models. If we construct a network model for the entire industry and convert to well known physical parameters a dynamic iterative solution can be achieved. This uses partial differential equations and sparse Jacobian matracies to resolve an NxN node network with a Newtonian numerical method algorithm. (I could be a little dated on this since I haven't looked under the hood of the software for years).

Your lights stay on because of it and is highly reliable. The same principle is applied to other engineering disciplines with "Dynamics".

I would recommend those Tooders of the academic profession take an Economics doctoral candidate and the same from Electrical Engineering and splice the two together in a joint Dissertation. (Since it is my idea, the independent variable goes on the horizontal axis!!).

Get hold of me via email should you wish to discuss further.

I think the limited flow-rate argument is missing from both the economic and geological models.

Where a matrix or network model will truly be useful is in applying to WT's Export Land Model. What happens is that we have all these geographically arranged producers and consumers jockeying for each other's piece of the oil pie. The matrix consists of the imports and exports between every nation-state. This is a very doable NxN node network math project that is only hampered by filling in all the transfer coefficients. The end-result is that one can tweak a transfer coefficient and see how that causes repercussions in the global allocation.

WHT,

A nice idea but I wonder if the assumption of the transfer coefficients remaining stable over time would be justified. If not then using such a model for forecasting would be problematic.

BC_EE,