Energy Supplies and Climate Policy

Posted by Euan Mearns on May 7, 2012 - 11:54am

This is a guest post by Dave Rutledge. Professor Rutledge is the Tomiyasu Professor of Electrical Engineering at Caltech, and a former Chair of the Division of Engineering and Applied Science there. This post originally appeared on Judy Curry's Climate Etc. blog here.

In this post, I consider the limited impacts of climate policy on fossil-fuel production and discuss estimates of fossil-fuel production in the long run. Since this is a cross post, with the original aimed at an audience with a climate interest, it includes introductory material that will be familiar to most Oil Drum readers. I would like to acknowledge the comments on my two earlier TOD posts, The Coal Question and Climate Change and The Coal Question, Revisited, that have helped me in writing this post.

1. Climate Policy and Fossil-Fuel Production

I will start with the notion that the response of carbon dioxide in the atmosphere has slow components that will dominate over time, like the exchange with the deep ocean and weathering of rocks. David Archer expressed this vividly, “A better approximation of the lifetime of fossil fuel CO2 for public discussion might be 300 years, plus 25% that lasts forever.” This means that from a climate perspective, it really does not matter whether we burn a particular ton of coal now or at the beginning of the Industrial Revolution—what counts is the total that the world burns in the long run.

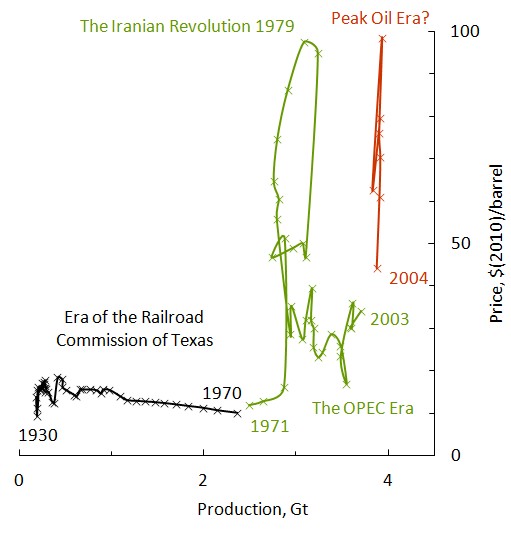

This has several consequences. First, a national policy to reduce fossil-fuel consumption, like mileage standards for cars, will have little climate impact if it does not change world consumption in the long run. Actually, because oil is traded in a world market, mileage standards may have no effect on world oil consumption even in the short run. Figure 1 shows a plot of annual production versus price. Except for the years around the 1979 Iranian revolution, production increased steadily, and the price stayed below $50 per barrel in today’s money. However, starting in 2004, the plot went vertical, with a price range of more than 2:1, but with production varying by only 2%. If this is the case, when the United States reduces consumption, it will be offset by increased consumption elsewhere.

Second, a new fossil-fuel resource resulting from improved technology like shale gas adds to long-term fossil-fuel production, increasing any climate effects. This is true even if the shale gas reduces carbon-dioxide emissions temporarily by partially displacing coal in electricity production.

The final implication is that resources must be walled off from future production to have an effect on climate. My favorite example of this, not least because of the political skill involved, was the creation of the Grand Staircase-Escalante National Monument in Utah by the Clinton Administration. This area contains most of the Kaiparowits Plateau coal field, which is a big one. The Utah Geological Survey estimated the minable coal at 11Gt. For comparison, annual US coal production is about 1Gt. The action was not popular in Republican Utah, which might have gotten $30 per ton for the coal. President Clinton, a Democrat, made his announcement across the border in swing-state Arizona, which he carried in the election two months later. Even though we can acknowledge President Clinton’s political ability, we should be cautious in crediting him with a full 11-Gt reduction in future production because it is not clear how much production would have taken place without National Monument status. Past production only comes to 40,000 tons, with none since the 70′s. It is worth noting that the US Geological Survey estimate for the recoverable coal was 4Gt, much less than Utah’s.

Can climate policy significantly reduce world fossil-fuel production in the long run? At the G8 meeting in L’Aquila, Italy, in 2009, our leaders pledged an 80% reduction in greenhouse-gas emissions by 2050. This proclamation is certainly meant to encourage the countries of the world to commit to this reduction, but so far only the UK has passed the legislation for it.

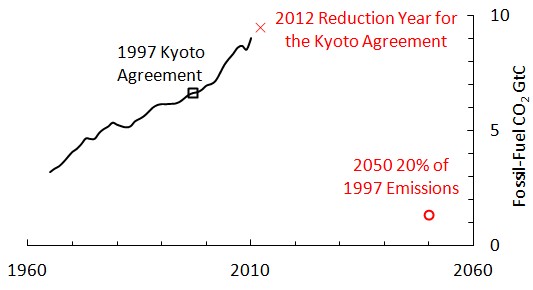

For perspective, it is worth looking at the historical record before and after the Kyoto Agreement was signed in 1997. Figure 2 shows world fossil-fuel carbon-dioxide emissions, taken from the BP Statistical Review. Do you see a decrease in emissions after the agreement was signed? I don’t either; if anything, emissions accelerated. It is worth noting that the EU and the US show the same percentage decline in emissions, 0.4%/y over the last 10 years, even though the EU countries all ratified the Kyoto Agreement and the US did not.

The figure also shows where an 80% reduction in 2050 would take us. It is not easy to convey the enormity of what our leaders agreed to. One comparison we can make is to the collapse of the Soviet Union. From 1990-1999, fossil-fuel emissions fell 40% there, and this was no one’s idea of a good time. To get to 80%, the entire world need to do this four times, voluntarily. Not going to happen. What were they smoking?

What about policy impacts at the local level? My home state of California has implemented an ambitious renewable-energy policy through a series of laws, starting with Assembly Bill 1078 in 2002 and culminating in Senate Bill 2 in 2011. These commit the state to a 20% renewable share for electricity in 2010, and a 33% renewables share in 2020. In California-speak, renewables means no large hydro and no nukes. In his signing letter for Senate Bill 2, Governor Jerry Brown wrote, “With the amount of renewable resources coming on-line, and prices dropping, I think 40%, at reasonable cost, is well within our grasp in the near future.”

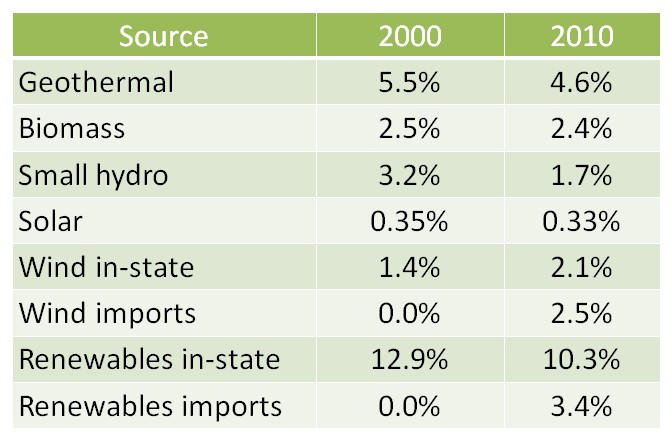

Well, we are half-way from 2002 to 2020 now. How is California doing? You can judge the progress in Figure 3. The in-state renewables share has actually fallen during this period. California missed its 2010 goal badly, but it appears that the only result of this was to set an even more unrealistic goal for 2020. Governor Brown seems to be smoking something also.

It is hard for me to think of a bigger disconnect between the politics and the reality. What is going on here? Table 1 shows the renewables shares by source. The biggest is geothermal, which peaked in 1992. Biomass is stuck because pollution rules make it is difficult to get permits to build an incinerator in California. Small hydro is no longer favored and it shows. The one bright spot is wind from Oregon and Washington, but wind imports are not going to get us anywhere near 33% by 2020. Most surprising is that the solar share has been flat for ten years, even though California’s solar resources are stupendous.

What this tells us is that there is no magic climate-policy wand that will let us set the total fossil-fuel production in the long run to a particular number. This is not to say that climate policy does not have short-term effects. The EPA’s proposals for carbon-dioxide emissions limits certainly discourage utilities from building new coal plants. If I were a Kentucky coal miner who lost his job this year I would likely blame the EPA. However, the current coal plants could be operated for generations to come, so the coal can be consumed eventually. In addition, even if American customers are lost, an offsetting export market may develop because American coal mining costs are low. Wyoming miners can make money selling coal at $10 per ton, while the price in the main export market, East Asia, is over $100 per ton. This depends on being able to ship the coal to East Asia at a cost that would meet the market price there.

2. Reserves vs. Resources

So, independently of climate policy, how can we estimate production of oil, gas, and coal in the long run? Economists have shown surprisingly little interest in this problem, but many geologists and engineers have been fascinated by it.

First we need to distinguish two terms, reserves and resources:

Reserves refers to oil, gas, and coal that have been discovered and characterized (proved), and that one could produce and sell at a profit now. People distinguish between the oil (or gas or coal) in place, and recoverable reserves that make an allowance for what is left behind when production is finished. Proved, recoverable reserves for oil, gas, and coal have been tracked at the national level for many years.

Resources refers to oil, gas, and coal that are of economic interest. This is a broader term than reserves. At the national level, resources are not well defined or tracked, and they are subject to political winds. In practice, resources means whatever a speaker wants it to mean. As a result, the statement in the President’s recent State-of-the-Union Address, “We have a supply of natural gas that can last America nearly 100 years,”conveys little information.

The boundary between the reserves and resources is not fixed. New technology and higher prices can cause resources to shift to the reserves category. For one example, because of new horizontal drilling and hydrofracturing technology, some shale gas can now be counted as reserves rather than resources. As another example, high oil prices have enabled production from the Canadian tar sands, and Canadian oil reserves are now 3rd largest in the world.

Perhaps surprisingly, reserves can also shift to resources. In 1913, US coal reserves were 4Tt (trillion metric tons). A hundred years later after 60Gt of production, American coal reserves are now 240Gt. The early reserves criteria were too optimistic—seams as thin as 1 foot down to a depth of 4,000 feet down were counted. However, this coal was not mined a hundred years ago, and it is not mined now. Over time, as it has became clear that the criteria were too optimistic, the US Geological Survey tightened up the rules, and other countries followed their lead.

We will develop estimates first for coal, and then for oil and gas together. At this point, future production for other sources like methane clathrates and oil shales is speculative, and they will not be considered.

3. Coal Production in the Long Run

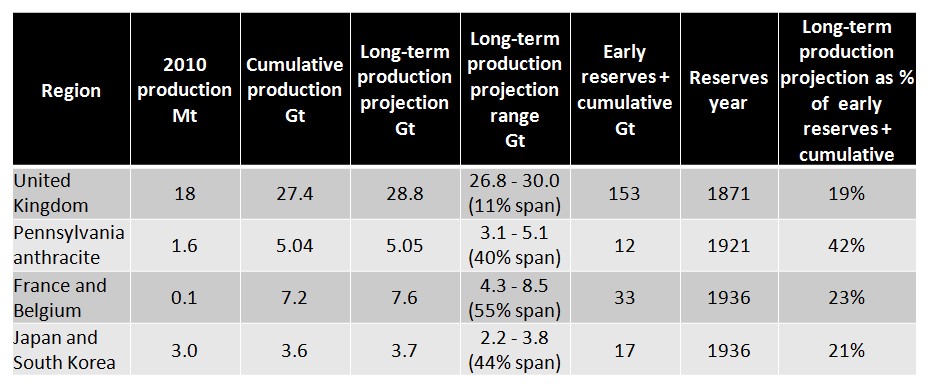

In energy terms, world coal production is 95% of world oil production, and coal is on track to pass oil this decade. Coal markets are regional—85% of coal is consumed in the country it was mined. This means we need a regional analysis. I have given one in a paper in the Journal of Coal Geology that considers the world in 14 regions. I will only summarize the results here. The approach in the paper is to fit an s-curve (logistic or cumulative normal) to the cumulative production history, and to use the top of the s-curve as an estimate of the total production in the long run. Coal has a long production history that we can use to test our ideas. Several regions are very late in the production cycle, with a current annual production that is a thousand times less than the cumulative production. The results for these mature regions are summarized in Table 2 below.

One way to estimate the long-term production is to add reserves to the cumulative production. Early reserves and production history are available for each of the regions. Surprisingly, this approach gives numbers that are too high. For example, Japan and South Korea have produced only 21% of the early reserves plus cumulative production. The other regions also show this pattern. Across the four regions, the average is only 26%.

The results of the s-curve fits are given in the “Long-term production projection” and “Long-term production projection range” columns. “Long-term production projection” gives the current estimate, and the range column indicates how the projections have evolved since 1900 (since 1950 for Japan and South Korea). The average range in percentage terms is 38%, so this gives the uncertainty in the estimate. It is interesting that in each case, it appears that the range will include the actual long-term production. However, we cannot be sure of this until the last mine in each region shuts down.

How should we interpret these results? None of the mature regions has come close to producting its reserves, so for coal at least, we might take the reserves as an upper bound on future production. It is interesting that the IPCC in its scenarios assumes that a multiple of the reserves could be produced. However, there is no historical precedent for this in any of the mature regions. On the other hand, the s-curve fitting ranges do appear to predict the long-term production correctly, with an error of about plus or minus 20%.

We can estimate the long-term production for the entire world by adding the results for the 14 regions. The latest world reserves at year-end 2008 were 861Gt and the world cumulative production at that time was 303Gt. This gives a total of 1,164Gt. The s-curve fits updated for the 2010 production give a long-term production of 723Gt, 62% of the reserves plus cumulative production. Thus, the pattern of underproducing reserves that we saw in the mature regions appears to be repeating.

The analysis also indicates that the world reaches 90% of the eventual long-term production in about 60 years. This result should be viewed as a current trend, rather than a projection with uncertainties, because historical shocks that changed the production rate. For example, production slowed after the collapse of the Soviet Union. For the mature regions the production at the 90% point had fallen to about 40% of the peak production. So at that point you would need a Plan B or use less.

4. Oil and Gas Production in the Long Run

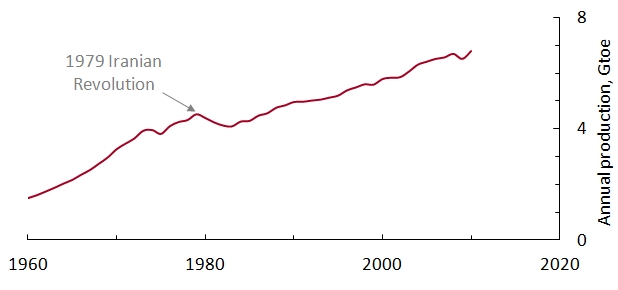

In contrast to coal, about half of world oil and gas is exported, and we can consider a world analysis. Usually oil and gas are considered separately, but there is really not a clear distinction. They often come out of the same wells and some products like propane are sold pressurized as liquids and burned as gases. Figure 4 shows the production history.

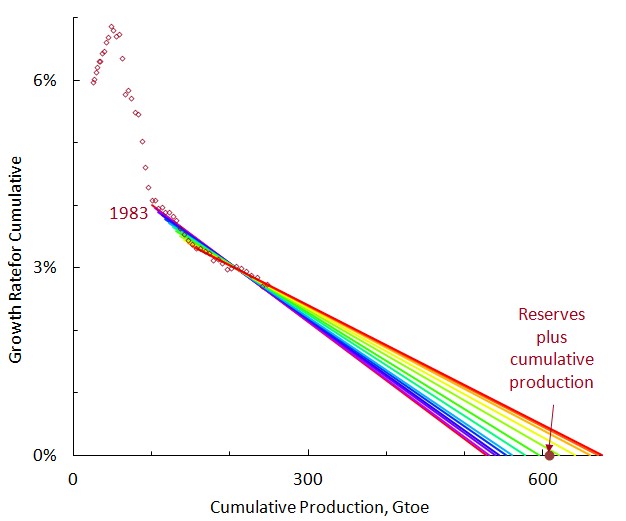

Notice that the world shifted to a slower pace after the 1989 Iranian Revolution. For this reason, I will start the curve fits a few years after the revolution. The approach I use here was popularized by Ken Deffeyes in two very interesting books, Hubbert’s Peak and Beyond Oil. The technique is called Hubbert linearization, in honor of the geophysicist King Hubbert, who first used it for this purpose. In Hubbert linearization, the cumulative production is plotted on the x-axis, and the growth rate for the cumulative is plotted on the y-axis (Figure 5). Algebraically, the growth rate can be expressed as p/q, where p is the annual production and q is the cumulative production. This kind of plot linearizes a logistic function. The chief advantage of Hubbert linearization is that it gives one an excellent way to visualize the fit. There are some disadvantages that are discussed in my Coal Geology paper.

In the Hubbert linearization, the x-intercept gives the estimate for the long-term production. In the figure, I vary the starting point from 1983 to 1995 to give a sense of the uncertainty. The range is 530-680Gtoe. This range contains the reserves plus cumulative production, 608Gtoe. This is different from coal, where countries under-produced reserves. This agreement is fortuitous; it is easy to identify factors that might bias oil and gas reserves high and low. US oil reserves have historically been close to ten years of future production, which clearly makes them too low as an estimate for total future production. On the other hand, OPEC oil reserves have often been criticized for arbitrary increases and lack of outside auditing, and may be biased high.

I will not give the analysis here, but it turns out the curve fits indicate that the world reaches 90% of the long-term oil and gas production around 2070, just like coal. Again, this does not mean that production would cease by then, but it is likely to be half the peak value and dropping. And as for coal, we would either need to use less or replace the energy from a different source.

5. Discussion

Oil and gas are really quite different from coal, and we should not expect their reserves to necessarily have the same relationship to long-term production. Oil and gas are usually hidden in geological traps, and they are difficult to find. Once found, however, oil and gas are relatively easy to produce—the pressure helps. Governments can even arrange turn-key concessions, and the money starts rolling in. On the other hand, coal is a rock, and it is easy to identify most of the major coal fields at outcrops. But there is nothing easy about mining coal underground. To get a sense for this, watch Michael Glawoggen’s documentary on Ukrainian coal miners. I am sure most of us would prefer to get our electricity from solar panels in our yard to manually hewing coal underground if we could afford it. However, coal provided the first rung on the energy ladder for many of the world’s economies, and our society reflects the scientific, technical, and social experience of underground coal mining. And coal has a similar importance in many countries that are on their way up today.

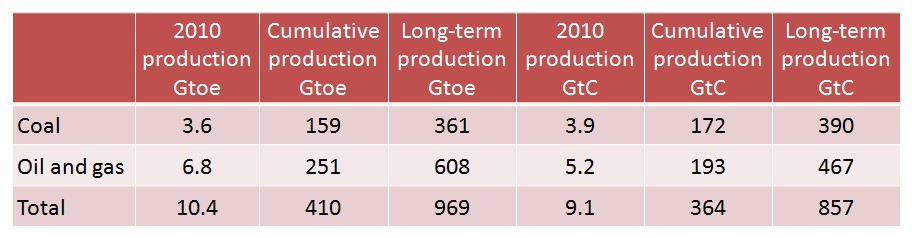

Table 3 summarizes the results. For coal, I use the curve fits, because they have proved more reliable in the mature regions than reserves. For oil and gas, the curve fits are consistent with reserves, and reserves are used. The current world production is also shown for comparison.

How do these emissions compare with the IPCC numbers? The forthcoming 5th Assessment Report uses representative concentration pathways, RCPs for short. The total carbon-dioxide emissions here, 857GtC, fall between RCP2.6 (peaking around 660GtC in 2070) and RCP4 (1,100GtC and rising in 2100). However, these RCPs assume an effective climate policy. They start with a prescribed top-of-atmosphere forcing and work backwards to a published scenario. It would be more appropriate to compare the emissions here to RCP8.5. This is the only RCP that is unconstrained by climate policy and it might be said, even by geology, with cumulative emissions of 5600GtC in 2500.

For people in the renewables business, what are the implications of a 60-year time frame for reaching 90% of the eventual long-term production? I do not know, but I will guess. You will be facing economic headwinds for decades, and competing with rent seekers who are better at securing favorable rules than they are at actually producing energy. You will be dependent on subsidies and renewables targets, in other words, on other people’s money. But as the Iron Lady observed, other people’s money runs out.

Hi Dave, thanks very much for this candid portrayal of utter failure of climate based energy policies so far. Just to recap:

1) There is no difference in emissions reductions between USA and Europe even though the latter ratified Kyoto and the former did not. It is further possible that reductions achieved are in part due to economic hardship and not policy.

2) There is no discernible reduction in emissions trajectories either side of Kyoto.

3) California (along with many other States / Nations) have set and totally missed renewables targets.

4) If National governments want to get serious about emissions reductions then they need to start ring fencing those fossil fuel resources that will never be produced. US could start with Powder River basin coal and shale gas, The Saudis could shut down Ghawar, the Qataris shut down North Field and the UK and Norway could shut down North Sea production. All this would lead to a reduction in global emissions, there is absolutely zero chance of this happening, and so politicians should abandon their Green posturing and get on with planning secure and affordable supplies of energy for their populations.

In Scotland we are right in the thick of it. We are bound by UK Climate Change Act of 2008 and on top of that, not to be outdone the Scottish Parliament has set even more ambitious targets of 100% electricity from renewables by 2020 - the clock is ticking. The harm being done here is that our heritage power generation assets are being neglected. When they break down / are decommissioned the lights will go out.

We have a major drive at present to install solar panels in Scotland - subsidised of course - even though we occupy a sub-arctic zone where the sun barely rises above the horizon in Winter and barely shines in summer. These things are being installed on roofs everywhere, regardless of orientation - that's right North facing roofs are in play. One of the vendors told me that they did not need direct sun light operating purely on daylight;-( If someone would like to post data on capacity factor for solar PV in Aberdeen - summer and winter and annual average: South facing and North facing - that would be interesting data to have - I will be sending links to this post to local politicians and to DECC.

Amidst all this it is easy to come over as anti renewables - which I am not. I am all in favor of a sensible renewables strategy based on evolution and not revolution. Based on engineering and not comic book analysis found in lobby group propaganda. As a starting point, I would like to see large renewables suppliers mandated to provide dispatchable power. In that way, large suppliers would have to own (or partner with those who own) Hydro or CCGTs used for balancing or to build storage. The cost (energy and financial cost) of intermittency is met by the renewable supplier and not by some third party. In this way third class renewable energy flows can be converted to first class dispatchable power.

It seems to me that the problem with renewables is that since they are today mostly made out of fossil fuels, that their 'price' will increase as the 'price' of fossil fuels increase. I put price in scare quotes because if the price of oil goes down because people can't afford it, it might as well be the same thing as a price increase. As natural gas in the US has crashed, renewable energy companies crashed, too. In a fossil fuel price slump, the price of renewables will probably not go down as much, keeping them relatively more expensive.

The reason that renewables will remain problematic is a matter of people thinking that changing their economic/money system to look further into the future (i.e., more than 6 months) is impossible. I suppose that makes changing it impossible. I think people will 'Margaret Thatcher' their way down the slope of scarcer and scarcer fossil fuels, the whole time bad mouthing renewables because renewables cost more. I don't see any way that they couldn't cost more!

A rational person would say that we should right now be investing other people's money in renewables, even though they cost more and will always cost more, because otherwise we will just end up riding down the downslope like Major Kong without ever being able to get off. Unfortunately, I think we *will* all do just that because we will not be able to change our short-sighted monetary system in time, for fear of repeating previous failures of large scale planning (the topic of the article).

People are a lot smarter than yeast, but the barrel they are in is so much more complex that their smartness/barrel ratio may be the same.

It seems to me that the problem with renewables is that since they are today mostly made out of fossil fuels, that their 'price' will increase as the 'price' of fossil fuels increase.

Even a quick passing glance at the figures shows this is not the case. The cost of fossil fuels has increased (with the very recent exception of natural gas prices), yet the cost to manufacture a PV panel fell 4X 2000-2010. Wind turbines are likewise at an all time low per MW.

Well my post was remarkably free of numbers...

The low cost of wind turbines is particularly hopeful.

But in the case of PV panels, how much of the lowered price was due to one-time Chinese labor plus environment arbitrage?

China dumping PV panels on the world market below their cost of production is a factor, but the cost of refined silicon has also declined as the shortage of it has been eliminated by expanding the production of photovoltaic grade silicon. The silicon used in PV panels used to be primarily rejected stock from the microelectronics industry. The PV industry outgrew that source and had to transition to manufacturing their own. That transition kept the price high through out the last decade.

Another reason to be cheerful! I remember the price spikes from shortages of rejected stock and it's good to hear that PV grade (not over-engineered) silicon is now separately manufactured.

Well, it's also Critical to look at Purchase Price versus Operating Costs, since renewables, when done right, will be offering a continual ROI to the owner, while anything that has to be fed a fuel- has a ring in it's nose that HAS to follow that fuel's cost.

Even if cheap PV right now is just an unfortunate fluke of comparative Labor costs and International Undercutting.. there is still a fundamental difference in where the prices of the Renewables come from as opposed to Fuel-burning sources, and how they will play out in the long term.

A continuous stream of technology improvements over time have been the largest driver: single crystal, wire saws, and recently - improved light capture from surface structure, etc, etc.

Hi Falstaff, this looks like an interesting chart, but its a log log scale plotting somewhat obscure variables. But noting that PV may get to 7% global generation by 2020 is an interesting observation to make. Looking at the log scale it seems we are about 0.07% today. So what are you proposing? That this exponential increase will continue? This is an honest question, if PV becomes cheaper than FF then exponential uptake will continue.

That is why FF companies are terrified.

NAOM

LOL

The only thing the oil companies are terrified of is running out.

Deepwater drilling, fracking, tar sands, arctic exploration, BP Solar and coal hasn't peaked yet but on an upward trend. We are burning at peak and PV will help us maintain the rage.

PV Schmee Vee, this house is going down. Unless a way is found to leave FF's in the ground unburnt...forever, then efficiency and alternatives will help maintain the peak all the way to collapse. We are attempting to burn everything and at this rate we will, including ourselves.

Bandits is quite right on that point, but makes the mistake of then identifying the desires of the oil companies with those of society as a whole.

As the price of renewable energy comes down and that of fossil fuels goes up, there will be a point at which there will be mass switching. What I'm worried about is that, left to the market, the switch is likely to be too late for sufficient mitigation of global warming. That's why I advocate an emergency program of conversion to publicly owned renewable energy (with compensation for displaced workers), funded by a levy on the rich. I don't want to wait till we've baked in enough global warming to ensure that the Greenland ice cap melts 50 years from now and endanger the West Antarctic ice sheet another 50 years further on.

There will be some switching, perhaps even more than now. Whether it will be mass switching depends on the availability of credit.

However, restricted credit always accompanies economic contraction, just as economic expansion is correlated to available credit.

My view is that we will devote the scarce capital we will have to keeping the fossil fuel infrastructure working as it falls apart from lack of maintenance. The problems Matt Simmons raised about our energy infrastructure haven't gone away even though he is no longer here to talk about them.

Declining oil means the absolute re-arrangement of our world economy. It would be very unwise to think that what we see now (an upward trajectory of renewables penetration) will necessarily continue. It might, but in my view, there is a very low probability of it.

The graph below is still the operating future regardless of any technological advances that are still before us. If we were somehow to "solve the energy problem," we would just bump into the next limiting factor, then the one after that, then the one after that and so on. This is guaranteed because we are already operating in overshoot. And even if that were not true, the ever-diminishing returns on capital that the Limits to Growth team identified would guarantee contraction. The technocornocopians blithely ignore these factors, think technology will trump all and try to convince people that contraction isn't inevitable. The only thing that isn't inevitable is that we enter another Dark Age as we contract, though I think Greer is probably right on this score, too.

Preparing for contraction is, in my view, the only sensible course to take. I recommend that people take the time to really understand what contraction means, especially to the monetary system. Once they understand that, they can go back to the technology and see what will work and what will not work.

I'm curious. Don't you feel at least some need to offer up at least one or two pieces of actual historical data when forecasting another 'Dark Age'?

There is tons of work being done in this area and Greer discusses it in various locations. I'll just a say a bit about it here.

Personally, I think we'll go through a period that will look like the science fiction movies in which there was high technology right beside people barely getting by. This is already the case if you look at the world as a whole but will become common in the formerly developed nations soon, too. It all starts with unemployment and our inability to take care of ourselves without the capacity to generate monetary income. Institutions of higher learning go away first. (After all, why create more college graduates when the market is already flooded with millions of them who already can't get a job?) Then it works down the educational system. Specialization gives way to generalization as people increasingly deal with subsistence issues.

Widespread education is, in my view, currently at its apex and its prevalence just goes down from here.

I'm guessing most of the dark age forecasters have never built or designed any large structure, complex, tool or machine in their lives, and have never worked in close collaboration with others doing the same. They really don't have a clue what we humans like to do.

Forecasting us shredding the planet as we try to keep things rolling along is far more supportable historically, but then again we really are breaking all new ground with our tool use these days. Finance may be a weak link but as I said in another comment it will be trumped by the tools we have in hand find some way to keep us digging stuff out to make more of them.

Of course we are also breaking all new ground with our population numbers, you don't have to go too far to find evidence of population crashes happening after a some creatures have eaten themselves out of house and home. As long as we keep the food supply streaming in we will keep rolling along...unless of course we blow ourselves up in the process.

"I'm guessing most of the dark age forecasters have never built or designed any large structure, complex, tool or machine in their lives, and have never worked in close collaboration with others doing the same. They really don't have a clue what we humans like to do."

I've been involved in many such projects, so I also have a clue about the massive inputs required to continuously conduct such feats, not only for the projects themselves, but to support the people involved and a society with the capacity to do these things. What we like to do and what we're capable of are parting ways in a sense.

Up until now, there have been few physical constraints upon our activities. What happens when virtually all inputs become more scarce? To begin with, there's the problem of supporting/maintaining what we already have, and have become dependent upon just to support the vast armies of worker bees who really just move things around, use things up,, and the dependent populations that don't, in fact, produce anything. Our overhead has increased faster than our accomplishments. Overshoot, indeed; until now many thriving on a surplus,, net consumers by the billions?

Moses didn't free the 'slaves', biophysical economics did. I expect much of humanity will wander the deserts for far longer than 40 years. And just as Egypt dealt with a period of climate change, our get will be challenged with adapting as well, adapting to less complexity, naturally imposed austerity, challenged to cooperate on things that matter most for survival. We're reaching peak humanity, of that I have little doubt. Our species is being retasked.

Like I said in couple other comments it all about food supply and as aangel brought sci-fi into play Soylent Green handled that in a not so unbelievable way--assuming major climate impacts and discounting 2022 as not being out near far enough.

Yes when I fly into O'Hare I really can't comprehend how we could possibly keep this going, but then I can't comprehend the size or distance to the sun much less the sequence since the big bang in a very hands on fashion either. But then I look at the crap we spend money on to keep things rolling along and realize there is plenty of room in the OECD for spending to shift to the basics, lifestyle to become dramatically more austere and for the technology/machine base that supplies us to remain essentially intact.

Coal on the north slope of the Brooks Range is not out of reach economically in a dire straits situation as it can supply all the energy itself to get itself to the major food production and manufacturing centers. We are like every other creature on earth that way, eat everything in our reach until it is gone.

Maybe I should have qualified what I meant by 'rolling along' in my earlier post. If energy supplies do not stay cheap it just means we ants will live shorter lives transporting resource longer distances to the machine hearts of our 'queens'. Of course that is my opinion but it is likely far more realistic than seeing us lose our tech and fall into some dark age before every scrap has been clawed in (again barring sudden and continuous dramatic contraction of the food supply or us blowing ourselves up in the process of dragging in all we can get).

Huge swaths of the earths population could fall off the map and barely dent the industrial world's ability to rake in more and more for itself. To me it looks like the financial implosion dark age predictions emanate from denial of just how much energy we are capable of expending to exploit every possible resource we can reach to keep our monster fed. 'Know thyself' is where we have to start and granted a moral compass is critical to keeping society functioning. But our hard wiring to discounting the future and our tremendous rationalization capabilities hardly suggest that human society's moral compass need be tuned to long term sustainability. 'Feed me now' gets to be a pretty strong driving force.

Of course it doesn't have to go that badly--we might manage to find some way to keep energy somewhat cheap through what certainly looks to me to be an approaching bottleneck (size and shape subject to wide variations). I linked Jevon's 'The Coal Question' farther down the page, might as well link it here too. If you haven't read it you probably should--it certainly highlights how even some of the most informed and brightest of analysts of the time can totally miss future events when they go out on a limb and predict.

Oil has more merits than other FF (aircraft travel and such).

But the utilities are certainly terrified of PV on its customers roofs, which is also why there is substantial PR-campaign against PV in Germany.

I disagree, totally.

German PV has a capacity factor of 10%, meaning that the 25 GWp installed now generate 22 TWh, i.e. less than 4% of the German consumption in 2011 (550 TWh, I believe).

Large utility companies are afraid of the foolish plans set in place by the government, aiming at shutting down the remaining nuclear plants within 10 years, as do all electricity-consuming businesses.

German PV is a total failure, a financial scam which is costing the country more that 10 billion Euros/year, has led so far to the bankruptcy of tens and tens of small and large PV technology companies, has created a fake work market, and most of all has increased and will continue to do so the electricity bills of tens of millions of Germans.

In the end it will be remembered as an ideology-driven scheme, based on wrong science and technology concepts.

Wrong.

1. The utilities are particularly mad at PV, because not only do they sell less coal power but PV significantly lowers peak prices at noon. This means they get less for ALL kWh they sell -> merit order:

http://www.transparency.eex.com/de/

Even the utilities in Switzerland are mad at German-PV because they cannot export pricy peak power during daytime anymore:

http://www.drs.ch/www/de/drs/nachrichten/wirtschaft/301909.schattenseite...

2. The renewable industry in Germany not only created nearly 400'000 tax paying jobs, the industry and its employees pay more taxes than what they indirectly receive in feed-in tariffs (paid by the electricity consumer not the tax-payer).

http://www.forium.de/redaktion/steuereinnahmen-der-solarindustrie-ist-ho...

3. The feed-in tariffs for wind power lower the electricity prices more than what the consumers pay for them:

http://www.tagesspiegel.de/wirtschaft/art271,2147183

4. Thanks to the renewable energies, Germany has lowered its fuel import bill by €11 billion:

http://www.solarserver.de/solar-magazin/nachrichten/aktuelles/2012/kw06/...

5. The feed-in tariffs for PV in Germany are meanwhile between 13.37 and 19.31 cents/kWh. Even if Germany would still install 7 GW of PV per year, it would only add 0.1 cents/kWh on the electricity costs. (This is besides the fact that the roofers and electricians have jobs and pay taxes.)

http://de.wikipedia.org/wiki/Erneuerbare-Energien-Gesetz

6. Even though some German PV factories shut down, the job numbers in the entire renewable industry has still increased in 2011:

http://www.solarserver.de/solar-magazin/nachrichten/aktuelles/2012/kw13/...

German inverter factories, German PV equipment manufacturers and German electricians and roofers are in fact not Chinese.

If anything feed-in tariffs haven't increased electricity prices enough such that people actually even care about wasting less electricity.

Well Molflow was right about German PV capacity factor, it was indeed 10% or less.

Sure they are mad, with a reason, as they are obliged to keep their thermal power stations (gas and coal) ready to go to cover the fluctuations in power production by PV, and as a matter of fact they increase the price of the evening peak hours... same happens in Italy, easy to check. About the high paying jobs I invite you to read the following study, by a German research authority, which shows that heavinly subsidizing PV has been (still is) a very poor way of helping the economy and providing jobs. Similar studies can be found for other countries where high-penetration renewables have been subsidized, like Spain and Denmark:

http://www.instituteforenergyresearch.org/germany/Germany_Study_-_FINAL.pdf

That's more likely, but the need to keep spinning reserves by power companies stays for wind too...

"solarserver"??? Sorry, I don't buy into PV's PR front office spin! Try again with something serious, like the expenditure of (correct me) 11 billions in PV "incentives" over 2011? The 25 GWp presently installed in Germany produce about 22 billion kWh/y, which corresponds to about 4.5 billion cubic meters of natural gas/year (burned at 45% CF in thermal units), I can't see how this could amount to 11 billion Euros/year. Burning coal/lignite (which is what Germans do in large part) would cost even less, of course. So, check your numbers please, or provide serious refences, not PV PR spin.

The values you quote are for NEW PV installations!... the problem is that the OLD ones which have been installed at times when the "incentives" were much higher will be paid for 20 years! PV "incentives" are a blank check for elecricity users to be paid for 20 years, not one or a few only. Big difference.

Anyway, that PV is a total waste of money in Germany is given by this simple fact: on short winter days German PV (25 GWp, not peanuts) can generate a PEAK power of 2 GW or less, during a couple of hours... for a total daily generation of 20 GWh... to be compared with a daily total consumption of up to 2000 GWh!

Yes, and let's wait a few years and will see whether this market will follow the same course as the cell/module one has done, moving massively to China/Taiwan/FarEast, shall we?

Now it's my time to say "wrong" to you: recent data released by the German Federal Agency show that overall CO2 emissions have gone down for Germany in 2011 (by 1%), but electricity production has actually INCREASED CO2 emissions. Following the decision to shut down 8 reactors on March 14, as a result of Fukushima disaster, German export has considerably decreased (to the point of affecting the price of electricity in Denmark and Sweden), imports have considerably gone up,

Germans are very marginally consuming less, how could anybody who, as per PV galore, "produces electricity at no cost" consume less rather than more? Jevons anyone? :-)

Roberto

Offline pumped storage and hydro provide the bulk of the spinning reserve and can even out the fluctuations with solar & wind in Germany. Some supplied from Switzerland which has a vast surplus of both.

And with solar taking most of the lunch peak, they can alos take care of most of the evening peak w/o fossil fuels on many days.

Alan

The prediction part of the graph, an extension of prior exponential growth, comes from E. Sachs, a founder of 1366 Technologies and MIT professor. For what it is worth I agree solar PV growth will continue as he indicates up and until the percentage starts to bump up against base load power, probably somewhere around ~20% of total electric capacity. If no inexpensive storage mechanism has been identified at that point, then I expect solar growth will slow and stall.

1. In Europe there's enough hydro storage capacity for over 20 days:

http://www.claverton-energy.com/european-hydro-capacity-compared-to-the-...

There are simply no nights and dead calm periods which last that long.

2. Wind and PV complement each other very well: http://www.q-cells.com/uploads/tx_abdownloads/files/6CV.1.32_Gerlach2011...

3. Replacing fossil fuel heating and hot water systems with flexible heat pumps saves fossil fuels and increases the grid flexibility.

4. It's simply cheaper to overbuild than to store every single kWh. If the inverter reaches maximum production at 70% of the installed PV-capacity you only loose 3% to 6% energy yield.

No, not even close. We've been through this before. The generation capacity of European hydro is a small fraction of even the average Euro demand load. No matter how long the hydro could run on stored head, its output per instant is way too small. And then of course Euro hydro generation is not universally connected via transmission to all Euro demand.

In the case of PV solar, which I was discussing, overbuilding PV infinitely will still produce zero power 14 hours a day in the winter. Thus PV solar needs a backup, at least for overnight. As I said above, the existing fossil/nuclear/hydro grid will handle that nicely for sometime, but beyond somewhere around 15/20/30/40% PV share (I dunno) a lack of storage is going to be a problem. However, I don't believe there will be a lack of storage in that time frame.

We have this thing called transmission? It's allowed to run across time zones, and latitudes.

The point in contention was whether or not over building power generation was economically preferable to storage. Yes we have transmission, but transmission costs money, extreme amounts of money when running the distances you suggest. And, at least to the degree a post fossil system is depend on solar PV, unless transmission will also carry *all* the power from one hemisphere to the other, then storage is still required to back up solar at night.

Yes... but it also costs a fortune and it is a nightmare from the point of view of control, with literally tens of thousands of network points, see "smart grid" (which, in the words of the MIT professor who has supervised the writing of a study on electrical networks, "is is not so smart, after all")

I don't believe that Chinese PV manufactures are truly dumping. The most efficient manufacturers are not selling below cost. Smaller, less efficient Chinese PV manufacturers are being squeezed out just as fast as those in this country. What we're seeing looks like the normal consolidation that occurs in any new market.

The more interesting question is whether the production volumes that the low cost manufactuers depend on can be sustained, in the face of global economic recession and forced govermental austerity. Subsidies are evaporating everywhere, but the loss has bitten most deeply in (formerly) huge German PV market.

I think that the answer is that the PV market will continue to grow. We won't see the rapid plunge in costs that the last few years have brought, but I don't expect to see module prices increasing. I think the market will be sustained by development in India. Prices have gotten low enough that PV is cheaper than the alternative of diesel generators for villages not connected to the dismal national grid. Intermittency isn't so much of an issue for rural India, since they major applications there are refrigeration, water pumping, and battery charging.

There are some big silicon fabbers getting into the market in a big way. They KNOW how to handle the stuff. They will not aim for big bungas to the CxOs and they will look for a slim margin, 5% or less, compared to 30% to keep shareholders happy. Just turn it fast and as cheap as possible to turn that small profit sliver into a big win on the large quantities.

NAOM

Installing PV on northerly oriented structures anywhere in the northern hemisphere is basically a waste, and installing subsidized PV facing north in the UK is outright fraud, IMO.

http://www.inference.phy.cam.ac.uk/withouthotair/c6/page_38.shtml

The area of roof covered by PV may last a bit longer, but in terms of electrical production, you may as well build a hydro dam in a dry riverbed...

Spend the money on efficiency. It's the first rule of RE.

Love it! Solar works better in the desert, hydro works better in Scotland. And looking at the next page MacKay says:

So it seems that UK receives 10% of the solar energy received at Equator and panels are typically 10% efficient - we will capture 1% of energy in UK (much less in Scotland I'd guess) on S facing roofs - virtually nothing on badly orientated roofs. Solar PV has large range in reported ERoEI, and I'd guess this in part due to range in quality of sunshine from area to area. Wouldn't surprise me if Scottish solar is competing with biofuels for the wooden spoon.

Hi Euan,

Thank you for your comments. I'm with Ghung. PV in Scotland? Nuts. Isn't Scotland's biggest electric load in winter, at night?

Dave

Peak demand will be a week day in February at around 18:00 hrs - pitch dark!

Not specifically Scotland, but for Great Britain as a whole see,

http://www.geog.ox.ac.uk/~dcurtis/NETA.html

"Peak demand will be a week day in February at around 18:00 hrs - pitch dark!"

Good call: peak demand for the period covered by the data was 56 GW on Wednesday, 8 Feb 2012 at 18:00. Minimum demand was 25 GW.

While coal is "on all the time", its output is actually quite variable. It's often reduced 40% from the evening to the early morning, though more gradually than gas.

. . . . or Anchorage, or anywhere except small scale in low latitudes if you're wealthy. Optimistic emergy yield ratio for PV in Italy from Paoli et al. at the link below is 1.03, early less optimistic calcs are a fraction of that. And below the citation, also at the links, bar graphs of emergy yield ratios for NR and R. Notice how we're now scrabbling around in PV in Scotland and oil shale in Utah--what does that tell you about our current emergy basis for society?

How does your garden grow?

http://prosperouswaydown.com/principles-of-self-organization/empower-basis/

I think the Scottish PV is just a poorly thought out piece of planning rather than telling about our current energy basis. Somebody has not done the job right. OTOH I agree with you about oil shale.

NAOM

I lived in Aberdeen for a year working week on-week off in the BP40's, and am surprised they are not doing more with wind. Definitely the windiest place I've ever lived. Even small wind turbines on the roofs of houses would probably produce more energy than solar in Scotland in the Winter.

I lived a winter there without any heating. Just get use to it.

Yet the authors state in their abstract:

Solar Power: An Approach to Transformity Evaluation, C. Paoli, P. Vassallo, M. Fabiano; Ecological Engineering, v34, i3, 6 October 2008, Pages 191–206.

Your source at "A Prosperous Way Down" confuses ERoEI with EYR in "The energy return on energy invested (i.e. Emergy Yield Ratio) was 1.03...." ERoEI of PV is on the order of 10.

Yes, Twilight, the authors make an irrational leap and say that we should go ahead and do PV anyway, when it is not net yielding.

Odum invented EROI, and then he refined it with Emergy Yield Ratios. EYRs will be more inclusive and lower than EROI, because they include transformities such as human labor that weren't included in EROI. But even when Odum was using EROI back in the early 70s, he came up with values less than 1 for PV. I The Paoli citation is in there for some variety, even though the authors come to such an illogical conclusion. Odum's calculation of solar PV grid electricity was an EYR of 0.41 (in Austin in 1991). (Environmental Accounting, 1996, p. 149). The bar chart at the link below gives the different values for electricity, from 15 for tidal electric to 10 for hydro, to 0.36 for solar voltaic array in Nashville.

http://books.google.com/books?id=j1PHFoVb7rYC&pg=PA149&lpg=PA149&dq=envi...

If the EROI for PV was 10, we'd be seeing them going up on every house in the country right now. Empirical validation is all we need right now. The value of 4.6 for nukes in the figure above was from the mid-80s in the US. What is the current Emergy Yield Ratio of nukes in Japan?

"...do PV anyway, when it is not net yielding. "

Not yielding?

NREL:

Methinks your assumptions are location biased and grossly out of date. I shed my gridweenie status years ago. Now I have to deal with other folks' electro-carbon... Thanks for that :-/

I really don't care how we do it, just get'er done... Not interested in other peoples' excuses.

Ghung, most other peoples' excuses are that they cannot afford solar panels when faced with more ordinary, important, and imminent expenses in their family budget, such as mortgage, utilities, food, gasoline, etc. Inflation is now increasing, while salaries remain fixed for the middle class in the same place they've been essentially, since the 1970s. In the meantime, the emergy basis per capital globally has been decreasing.

(Brown, http://prosperouswaydown.com/subsystems/economics/ )

The only reason we can buy those PV panels is that we are still wealthy in this country, as long as the petrodollar reigns. You have made a decision to take your store of wealth as represented by greenbacks in order to buy security for the future. But that security is based on a very high level of transformity. As complexity wanes, will our lifestyles warrant justifying large portions of our vanishing household income and saved wealth to go to a very expensive way to make electricity? As soon as our ephemeral greenback wealth disappears because we can't print money to buy oil, the perceived relative value of PV panels compared to gardens and greenhouses that use nature's help to convert sunlight will become apparent? The relative advantage of some ways to make electricity below seems so obvious when it is not obscured by "comparative Labor costs and International Undercutting" as Jokuhl says, in addition to subsidies, subsidies, subsidies.

(Odum, 1996, p. 149)

Why are you hammering figures from 10, 20, 40 years ago on a field that is changing so very rapidly especially in the last 2,5, 10 years?

NAOM

NAOM, isn't that the basis of the concept of net emergy/energy? The values go down over time (the global emergy/capita graph). So those values from 20 years ago are optimistic, more than offsetting any heralded improvements in technology. Take a look at Euan's great cliff figure above. Yes, it has been changing rapidly. Instead of spindle top we get oil shale in Utah. Instead of building more nuclear plants, we consider whether we can afford to decommission them at all. Instead of large scale solar PV, the companies are going belly up, even with subsidies. Empirical testing.

175 Watt Sun laminate PV panel from China sells for $.75 / (rated watt).

(175 W * $.75/W) / (175 W * 6 hour/day * .65 (efficiency, clouds) * 365.25 day/year * 30 year) / 1000 = $.0176 / kW·h.

It seems to me that ideology, education and motivation are greater barriers than affordability.

You can probably get that level of production in Arizona and a few other sweet spots. You assume a zero discount rate. You forgot to pay to install it (free wire and labor, me like). Are you buying new appliances to run on DC or do you need an inverter?

Yes, I calculated the price for the PV panel, not an entire system. One can get better than 65% in Arizona. Education allows one to install it avoiding the cost of someone else's labor. For these laminates one also must buy a junction box and silicone to attach them. A mount is necessary and maybe a building permit. The electronics depends on the application. Batteries add significantly to cost, but other less expensive storage devices are possible depending on the application, such as pumping water and thermal mass in a refrigerator/freezer. For the motivated demand side management is available to reduce cost. There are tax rebates and incentives.

I've looked at these panels and the process of installing junction boxes and framing them. In the US/Canada, with quality polycrystalline panels available for $1.17/watt, made in Canada, with an excellent warranty, I've decided that buying ready to install PV makes more sense. I'm trying to get a group together to buy a pallet of these.

If more folks would ban together and have PV raising parties, we could continue to make a dent in people's CO2 debt, especially if municipalities and utilities could help streamline things. Professional installation is a big factor in costs and there's nothing particularly difficult or complex about PV installs. Most jurisdictions allow homeowners to do their own installations, requiring only an inspection and connection by the utility for grid-tie.

I'm sure some comments are to follow about the negative aspects of this route, but I've been helping folks' in my area do their own installs for years. Many have chosen to go off-grid and install their own parallel systems, eventually firing their utility or paying only the minimum monthly fee.

I have no problem from a utility standpoint with PV parties as long as they have competent design/execution (it takes a leader who is usually a professional or a serious enthusiast). Much better than typical solo DIY IMO. At least you have folks involved with SOME experience. Also, they tend not to be nearly as interested in cutting corners as the commercial installers. The big advantage of this approach from the individual's standpoint is that: Equivalent labor income is untaxed income (as long as it isn't formal barter where a contractual obligation to work on another project is incurred for receiving the labor on your own project), and you aren't dependent on an employer to get the hours spent reducing your utility bill. The problem is that incentives are usually based on project cost and so your incentive payment goes down if substituting free labor, which means the free labor isn't AS valuable/lucrative. Installers and governemtns have exactly the reverse experience of DIY, it takes money out of their pocket.

You are right, my Dad's AZ installs (non tracking) typically are getting 2200-2300kwh/kw and typical there is 1800. I grew up in a home with self-installed solar DHW which now has self-installed PV on the roof, and have helped friends install PV. I personally value my own labor higher than zero, however. My brother and his wife and seven kids lived grid-free for years with scrounged PV, batteries, small wind, DC lighting, and inverters for A/C appliances and well/pressure pumps. The grid is a subsidy for PV installs.

In Germany in 2012, you get 1 kW(p) for less than 2000 EUR, this would be high quality stuff with an expected life span of more than 35 years, the costs include installation. This 1kW produces 1000 kWh per year. Therefore, with 7% for write off and capital costs (20 years), 1 percent for new inverter, 1 percent for insurance (if you do not have new contracts) you pay for one homemade kWh around 18 cent. Typical consumer prices for electricity from the grid are 22-29 cent/kWh.

With 25% own consumption (you save 4-11 cent per kWh) and 19 cent feed-in tariff for the rest you get a yield of 1-2% at the beginning, each increase of consumer prices for electricity (very save bet) improves the situation, so your money is not eaten away by inflation, quite contrary you see deflation.

After 20 years your written off PV gives a very nice yield in the range of >10%. In Germany investment in high quality PV products is IMHO a good alternative to secure your retirement savings.

That sounds implausible to me. Just look at all those great necessities people are spending their money for: booze, cigarettes, cosmetics, too large SUVs - you name it. Our society is full of pointless spending, if we just focused that on the task at hand, it would quickly be solved.

Ghung, he is referring to emergy yield ratio, not energy returned over energy invested. As input energy emergy includes the solar, gravitational and geologic radioactive decay energy that was used to make sand and bauxite deposits. It includes some formula for including the energy to evolve humans and power our operation. Things that have EYR < 1 could easily have ERoEI > 1. I do not care how much energy nature used to make sand. Input energy begins when humans dig up sand and includes the energy for transporting and processing it into refined silicon and glass.

Having read Odum, et al, I understand where Iaato's coming from, but not where it leads. PV is only a part of a system; passive heating and cooling, solar/gravity water, wood heat, more,, utilizing local resources rather than massively centralized energy sources, a system that, IMO, reduces overall emergy compared to my contemporaries. We've powered down dramatically. I'm just not sure what Iaato's point is. We make the best chioces we can with what's available at the time rather than according to some theoretical ideal. I have serious doubt about the emergy levels posted above; out of date and not all inclusive, and I don't do circular arguments well. Emergy metrics are of limited usefulness, out here in the real world, IMO.

And right now the best net energy from all the new energy sources comes from solar and wind. It also looks like economics are starting to come in line with this fact. My bet is that by the end of this decade it will be pretty clear that wind and solar are far less expensive, long term, than fossil fuels. The industry is doing its best to fight this trend -- using whatever political and public relations resources it can muster. And that is a huge amount considering their current and very large profits. But the base of that profit is a society-wrecking nightmare. Ever-increasing costs + climate change means that the days of the oil and gas industry are numbered. And ever-lowering costs for solar and wind + increasingly visible climate change makes it ever more clear what our better options happen to be.

Yes, yes, there's been much rumbling on the new cold fusion lately. We'll see. For now, I'm putting it in the same category as fuel cells. Until something practical is demonstrated it's still vaporware. Possible. Hopeful. But still a glimmer in the eye.

With 100,000 homes sporting solar panels in California and with those 100,000 pushing 5% of the entire grid's peak capacity, I think it's pretty clear we have demonstrated viability. And not a moment too soon.

Is it 5% of peak, or 5% of real-time load?

Apparently the utilities are arguing that it should be the peak load for their systems, while the PUC is proposing that it should be the sum of all their customer's individual peak demands. Which makes a difference.

http://solarindustrymag.com/e107_plugins/content/content.php?content.10262

But all this only applies to people who want to qualify for the net metering program.

I read the proposed decision. I find the utilities' arguments about legislative intent cogent. I find the proposed CPUC decision to be pandering to a novel interpretation of the language proposed by special interests. DRA supports the utilities! That has to tell you something.

. . . . or Anchorage, or anywhere except small scale in low latitudes if you're wealthy.

Well maybe not quite rich.

Each array is 2640W and at the CCHRC facility, a bit north of you at about 64.5° N.

Panels are getting to the price that we up in the interior where 60% of the electricity comes from diesel powered generators can consider them--but siting must be top notch. I've been paying more attention to my location this winter/spring, but I'm guessing my Solar Pathfinder image won't be looking even this good,

Anchorage is quite a bit more overcast than Fairbanks so likely any slight gain due to slightly lower latitude is more than cancelled out by cloud cover not to mention your much cheaper natural gas fired power generation.

Big hydro (Susitna dam) and heat pumps (though not up in the permafrost laden interior) will beat solar hands down in railbelt AK. Think it will get built this time? The world still has a few good hydro sites left but not near enough to pick up the slack declining fossil fuels will leave. Don't expect powering down to be voluntary.

Hi, Luke. I'm rooting for the Susitna dam. No, I don't think we have the time. It's no more likely to be built than the bridge to nowhere, or the road to Nome, or any other hare-brained schemes our legislators can come up with? No, powering down won't be voluntary except in the case of those smart enough to see where we're headed. There will be a lot of folks standing around wondering who moved their cheese.

Hi Iato.

I think you badly underestimate the effort that can be made by the industrial world to keep from powering down, we haven't started to tear the place up yet. Very likely plenty of time to build the Susitna dam. As a matter of fact I believe the argument on the other and much more controversial large Alaska dam is framed all wrong. It is not whether or not we will mine Pebble but whether we will be able to do a cleaner job of it now or in the not so very distant future. Unless of course we blow ourselves up or have continuous catastrophic global crop failures first, in which case resource demand will drop dramatically.

Enough of that kind of talk. I think I'll go outside and listen to the robins, they sing round the clock now that really never gets dark. Hope your having a fine spring on the other side of the mountain as well.

Luke

Okay, Luke, I conveniently forgot Pebble Mine. You forgot that the state of Alaska doesn't think we need to test our salmon for radiation, since it's not a threat like Mercury is. I'm just hopeful; I keep trying to push the button on all of this.

I'm up early because it has been light for two hours. I had to chase a moose out of my raised beds last night, but we've still got a pile of snow by the street. The onions and strawberries are already on their way, and it has been a great spring. Same to you.

A bit of extra radioactivity in our food supply will just kill some people off a bit quicker, and of course if the hard times you are expecting start to overtake us the sick and elderly will get precious little of the resources, with seven billion strong there will still be plenty of hands to tear the crap ouy of the place for a good long time...again as long a we don't blow ourselves up or have a drastic collapse of our food supply first. Finance may be a weak link, but when push comes to shove tools in hand will overtake it and force money to find a way to help us extract what we use.

I have very serious doubts that Fukushima Daichii will add much radiation to the wild salmon stocks. The old soviet nuke dumps in the northern seas might have a more significant impact, of course no one knows. I'm all for testing the wild fish though, even the faintest traces of radioactivity from known sources would tell us that much more about just what the salmon do out there for 3,4 or 5 years. Of course that might negatively impact wild fish sales even if the amounts found were barely measurable. Human fear of radiation is a black box thing, not readily quantifiable.

From an ecological point of view, people getting afraid of eating some animal doesn't seem like a necessarily bad thing. I'm sure readers here know what eco-people say about eating meat.

You must have missed the extensive discussion on meat eating in the comments to Tom Murphy's post here a week or two ago. No need to out that again here. I will admit I do have a bit of a dog in at the fish testing fight as almost all of my in-laws make/made their living commercial fishing (mostly for wild red salmon). I've a few season's of that under my belt as well though now personal use dipnetting is my biggest involvement in the fishery.

Alaska is among the best at managing wild fish stocks in the world, that is not to say that the management is either flawless or done without any controversy. Of course major changes to the ocean will add huge challenges to interpretting fish population data. The more data the better for that.

I did glance it over somewhat. Not sure if it came to any significant conclusion, though.

Pretty much how I felt about it but the last post I saw added was about as over the top as you get. I will throw it in for entertainment value.

A poster was writing about some Gary Null who gives lectures and claims his hair grows a quarter inch a day

Gary consumes a very rich diet in fruits and vegetables - he reported that he consumes the equivalent of 130 pounds per day of raw fruits and vegetables, their fresh juices and powders from fresh juices.

I've no idea how that 'equivalent' number is reached but my horses never consumed 130 lbs a day counting the 7-8 gallons of water they drank and they weighed 800-1000 lbs and worked a fair amount.

Great chart that answers many of my questions. First of all....

.... shows that siting panels on randomly oriented roofs is a waste of time and money. To be fare, most panels in and around Aberdeen are S facing, but if you don't happen to have a S facing roof should you really bother?

So a 2.64 Kw array should produce 1900 Kw hrs in 30 days. In May, the fixed array has capacity factor of 18.5% and the tracking array a capacity factor of 31.6% - the latter is impressive.

Over the year, the fixed array looks like it will have capacity factor of about 10% and the problem remains of miss match between demand and supply. So only outstanding question is EROI / energy pay back? I'm asking so many questions cos I have a S facing roof and could be tempted. Should those be mounted vertically - to face the low angle Sun more directly?

CCHRC is a great local resource. I pulled the chart from this 445KB PDF on the arrays' performance. Quite a few other good charts in it.

I'm tempted as well but my site is likely not quite up to it. I believe vertical would work best at the poles as proper angle of orientation corresponds pretty closely to the degrees of latitude. My brother used the Solar Pathfinder to get a feel for his site. I'm off to look for some such tomorrow as the ground is now thawed enough to drive stakes into (to secure my ladder) and the leaves haven't quite shot out yet. I want data both with and without leaves on my boreal forest hillside.

Euan, consider the cloud patterns. If the winter is mostly cloudy, then do not point them vertically (pointing direction horizontal) because there will be no sunlight. Point them to favor Spring, Summer and Autumn.

Ignoring clouds, the optimal direction is due south in azimuth and (90 degrees) - (your latitude) as measured from the horizontal to the direction that the PV panel is pointing. With cloudy winters, point them 10 degrees higher in altitude as measured from the horizontal to the pointing direction. If you have fog in the morning that typically evaporates by the afternoon, then point them 15 degrees west of south in azimuth.

If you want to get more even power output through out the day from a fixed array, then point half of the panels east and the other half west in azimuth. It also works well if half of them are pointing southeast and the other half southwest in azimuth.

Bill,

Great site. Do you know a way to get the data in Excel format?

Thanks,

Dave

You could try contacting Mr. Curtis. Or rummage around on the NETA site he's getting the data from.

Bil,

I will follow up with Mr. Curtis.

Dave

Same is true for nuclear (France's) which modulates its production by more than 3.5 GW over 4 hours, during weekends, to follow reduced power demand in low-consumption days.

Not so !

I rather tediously tracked EdF generation for several days on a TOD post a couple of years ago. There was no correlation between nuke generation & load. The second highest generation hour was the 18th highest (out of 24) hour load, and so forth on one day, while the highest load hour was the 10th (out of 24) highest nuke generation hour and so forth.

One day out of several I looked at had a fairly close match nuke generation & load, but random walk variation could explain that.

When fresh fuel is in a reactor (and a multi-month shutdown has allowed fission products to decay in the fuel rods not replaced), it is possible to vary nuke reactor generation. But this capability apparently declines quickly.

At that time I did find a quote where EdF was "de-emphasizing" load following in their nukes.

The new EPR reactors are supposed to be specifically designed to load follow (100% to 60% on a DI-urnal cycle). We shall see.

Claims vs. Reality,

Alan

National Grid

http://www.youtube.com/watch?v=vX0G9F42puY&feature=plcp

Actually Scotland has excellent wind resources:

However, if wealthy golf players can't enjoy the landscape if there is a windfarm far away in the distance, then Scotland should do whatever the wealthy golf players tell them to do.

Who knows? Maybe these wealthy tourists will stick around indefinitely and in that case Scotland can even rename itself as Golfland. And if not: They will then just have to pay dearly for FF imports without the help from any foreign golf players.

Robin Williams on Scotland inventing golf brilliantly hilarious but quite profane.

Hilarious!

On off shore wind....

The East coast of Scotland is a major navigational route, elsewhere water is deep. Water is much shallower around the English coast - and that's where all the people are. What Scotland does have is topographic relief and water and we should really be expanding pumped hydro much more aggressively than we are. Pumped hydro is much less environmentally damaging than conventional hydro.

You don't necessarily need to go offshore and don't even need to pump.

You just need to replace fossil fuel systems with flexible heat pumps and power them with wind.

Meanwhile there are wind turbines with very high capacity factors. This windturbine produces over 90% of its nameplate capacity between 14 and 42 knots of wind speed: http://www.gamesacorp.com/recursos/noticias/2012-marzo-g114-20-mw-data-s...

So the probability is extremely high that a flexible heat pump can be powered by wind all the time (in Scotland). http://www.metoffice.gov.uk/climate/uk/ws/print.html

So the probability is extremely high that a flexible heat pump can be powered by wind all the time (in Scotland).

What are you on about? Yes Scotland has some of the best wind resource, but that table shows mean wind speed, meaning a variance to either end will yield zero power. In the best onshore wind resource areas with the best turbines no wind farm in the world breaks 40% CF, and nation exceeds 35% CF. The probability is high that an entire onshore windfarm in Scotland would either go idle or offshore suffer shutdown gails for up to a week or more during its life. With better turbines and higher towers CF will continue to creep up, but it will never replace base load without backup.

"In the best onshore wind resource areas with the best turbines no wind farm in the world breaks 40% CF, and nation exceeds 35% CF."

You've been misinformed, or perhaps your numbers are very old. For example, New Zealand has an average capacity factor of 41% from its operational wind farms and the best few get around 47%.

Also, citing CF figures as the basis for a response to a comment about how much of the time wind might be providing electricity, is ignoring what a wide gap there can be between capacity factor and the proportion of time there is some generation. Again for example, those NZ wind farms with over 40% CF are typically generating electricity around 85% of the time - may seem high compared to the CF but not really surprising, because that's the proportion of the time that the hub height wind speed at those locations is between the turbine cut-in (usually around 3 or 4 m/w) and cut-out (often 25 to 30 m/s) specifications.

Arg, though as of 2008 EIA shows NZ at 36% CF, I'll grant you are right about NZ in 2012 and it's .6GW of wind recently installed wind. Alright, none of the twenty largest wind generation countries in the world exceed 35% capacity factor with their wind production.

Countries sorted by installed capacity (2008), CF

US 0.26

Germany 0.18

Spain 0.22

China 0.13

India 0.15

Italy 0.15

France 0.18

UK 0.23

Denmark 0.23

Portugal 0.22

Canada 0.17

Netherlands 0.21

Japan 0.18

Australia 0.22

Ireland 0.25

Greece 0.24

Austria 0.22

Sweden 0.27

Poland 0.17

Brazil 0.15

Egypt 0.25

Norway 0.25

Turkey 0.25

Belgium 0.21

NZ 0.36

S.Korea 0.16

Taiwan 0.25

Cz 0.18

Finland 0.20

Hungary 0.17

Morocco 0.26

Bulgaria0.12

Mexico 0.29

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=2&pid=37&aid=7&c...

http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=2&pid=2&aid=12

I did not state that CF and down time were equivalent. My point was that, absent daily generation figures, a low CF (<.5) means it is unlikely that power is being generated all the time, in contrast to the claim of the poster above. Furthermore, when you let this go above by 'anyone':

and raise objections to my use of CF I suggest you are chasing an agenda and not accuracy.

First of all, why stick with such old data? 2008 is a fair while ago compared to the pace of renewable energy growth.

Second, even using 2008 you have used a dodgy methodology. Example for the first country in the list, the USA: you've taken the 2008 Wind generation 55.4 TWh and used the installed capacity at the end of the year (24.7 GW) to get a capacity factor of 26%. But that's a lower bound which assumes every new wind turbine installed in the country that year was added on January 1 and available the whole year.

Using the installed capacity available at the start of the year instead (16.5 GW in the data set you used) we get an upper bound on the capacity factor that year of 38%.

So all we can say is the 2008 USA wind capacity factory was in the range 26 to 38%. It would be in the middle of that range if the new capacity added was at a constant daily rate. But it wasn't; in recent years there has been a common trend for half the annual new US wind capacity to be installed in the fourth quarter, as this graph from the AWEA 4Q 2011 quarterly report shows:

So even four years ago, the US mean capacity factor was much closer to 38% than 26%.

Hmm, I'm starting to get an agenda over accuracy vibe myself.

First of all, why stick with such old data? 2008 is a fair while ago compared to the pace of renewable energy growth.

Because internationally that's what EIA had available for both generation and capacity (I see now they go 2009?). You have access to more recent data, internationally?

Fair point about the year start, year end data. The most recent data I can get from EIA, on the US alone, has has US 2010 generation at 94.6 TWh with US 2009 installed capacity 34.3 GW. Best case US 2010 CF: 31%, and the US leads the pack of the top twenty wind produced with regards to CF. Summary: i) so far nationwide CF doesn't exceed 35% for the top wind producers, ii) NZ gets a big hat tip for the highest CF in the world.

There's a lot of more recent data, but not easily collated on one website.

From the EIA, you can get 2011 full year generation (wind almost 120 TWh) and for that the worst case to best case range of capacity factor is 34 to 39%. Again likely being closer to 39 than 34 because a majority of capacity added during the year came online in the 4th quarter.

Do you have a link for installed wind capacity year end 2010? Agreed 120 TWh is the EIA generation figure for 2011. From the US NREL, I have year end 2010 installed US wind capacity as 40.3 GW, giving an upper bound CF of 34%. Year end 2011 installed capacity was 46.9 GW, giving a lower bound CF of 29%.