Tech Talk - Oil and Natural Gas in Eastern Siberia

Posted by Heading Out on February 5, 2012 - 7:05am

In the last post on Russian oil production, I discussed the amounts of oil produced from Western Siberia, the region with the highest current production, which in its prime contained the second largest producing oilfield in the world at Samotlor. Those fields are now in decline, and while modern technology is seeking to retain as much production as possible, Russian investment is moving further East to the region known as Eastern Siberia. It is not the most hospitable of places, even when compared with Western Siberia.

The cold is staggering, even for Siberia: winter temperatures can fall to minus 70 degrees Fahrenheit, the point at which all outside work is banned. The nearest human settlement is 250 miles away, and the forests are full of bears, wolves and elk. . . . Workers shivered in winter and in summer were tormented by midges so vicious they have been known to kill cows.

Depending on who it is you consult, Eastern Siberia can either include, or not, some of the northern part of the Western Siberia Basin:

Clearly, when one compares the two regions, the prospects for Eastern Siberia are much less well defined, and much less well developed. However, it is a region that the Government is anxious to develop and in July 2009, the export duty on the 13 oil fields in Eastern Siberia, including Vankor, was annulled - at the time, the duty on $70 a barrel oil would have been $34. This was expanded to all 22 fields in East Siberia the following January. The tax was re-instated at a lower level than usual - 45% of the excess over $50 a barrel - in July 2010.

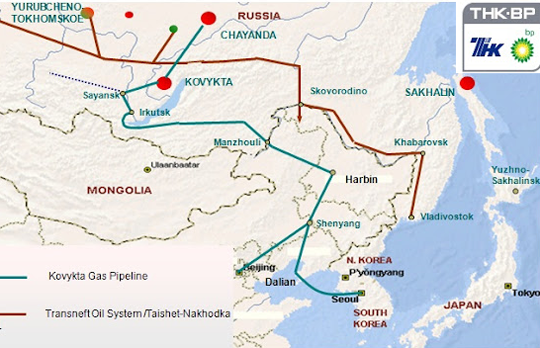

When the Eastern Siberian Pacific Ocean (ESPO) pipeline started shipping oil to China in 2010, the two fields that it initially tapped into included both Vankor, which came on line in 2009, defined as located in Eastern Siberia and described in 1988 as the largest discovery in 25 years; and from Samotlor, as mentioned last time, in Western Siberia. That feed flows through the Purpe: Vankor pipeline) When Phase 2 is completed this year, the ESPO pipeline will be able to carry up to 1.6 mbd, about a third of the total amount that Russia exports. There is some question, however, whether Russia will be able to achieve the volumes that are going to be required for sales to the East, at the same time that it meets demand from the West. Projected demands of over 11 mbd would require an increase in production over last year of more than 600 kbd, and the ability of Russia to meet that increase is one of the current questions.

The initial fields scheduled to feed into the pipeline included Vankor (400 kbd), Verkhnechonsk (200 kbd), and Talakan (140 kbd). In Phase 1, which first delivered oil to the port in Kozmino Bay on December 28th, the oil is transferred to rail cars in Skovorodino and carried by rail the rest of the way. Phase 2 completes the pipeline.

Vankor, now connected through Purpe into the Transneft oil pipeline network, can supply oil to the West as well as to the East, and has been delivering to both, with roughly 55% going East. Vankor is operated by a subsidiary (Vankorneft) of Rosneft, and has proved reserves of 1.6 billion barrels, and probable reserves of about the same. In 2010 there were 124 production wells in operation, with another 19 drill pads completed. The average well was producing at 2,606 bd, though this was constrained as the surface treatment plant had not been completed. (It now has). Plans are for a total of 425 wells to be drilled, of which 307 will be horizontal completions. Peak production is scheduled to reach 510 kbd in 2014, and be held at that level. Gas injection will be used to hold reservoir pressure, and is expected to increase the oil recovery factor from the 0.34 Russian average to 0.434. Advanced technology has also helped:

The well drilling operations also involve advanced technologies. Rotor-controlled systems increased overall drilling efficiency by 2.5 times, while the use of smart well systems for inflow management produced over 500,000 additional tons of oil in two years.

Wear-resistant equipment used at the field ensures a flow rate of up to 1,500 tons per day (over 430 tons per day on average compared to the national average daily flow rate of 39.5 tons).

Gas production will drive a local power plant, as well as being available for re-injection.

The gas - its volume exceeds 1 billion cubic meters per year - will mainly be consumed by a gas-turbine power plant. In order to maintain the reservoir pressure, 2.5 billion cubic meters of associated gas will be re-injected annually. There are plans to deliver up to 5.6 billion cubic meters per year to Gazprom’s transportation system.

Verkhnechonsk, which came on line in 2008, is still only pumping at around 100 kbd. It has recently hit a problem in that there is more than the usual amount of natural gas coming out with the oil, but there is nowhere to deliver it - Irkutsk is 750 miles away and there is no gas pipeline. It is therefore being flared. It is hoped to start reinjecting the gas in 2013 (they have to build a compressor first) when the field should reach its 200 kbd peak, four years earlier than initially expected. It has around a billion barrels in reserve, and is about twice as old as the average oil field. Perhaps as a result, the oil is cooler than that found almost anywhere else, and has to be heated to stop wax precipitating out and to allow the water and the high concentration of salts to be removed. It is being developed with horizontal completions.

Talakan came on line with the ESPO pipeline connection in October 2008. It is operated by Surgutneftegaz, who paid 1.66 billion rubles ($45.8 million) for it. It is believed to hold about 0.8 Tcf of natural gas and up to 2.3 billion barrels of oil. It is sometimes referred to as the Severo-Talakanskoye field and initial production has been low, until a booster station is built in 2013. Output will then be 16 kbd snd it will only slowly ramp up to the 140 kbd target.

Within Eastern Siberia's Sakha (Yakutia) Region, the major strategic fields include the Verkhnevelyuchanskoye oil and gas field, the Sobolokh-Nedzhelinskoye and Srednetyungskoye gas condensate fields, and the Chayandinskoye and Tas-Yuryakhskoye oil and gas condensate fields.

The Chayandinskoye oil and gas field will be developed by Gazprom, starting in 2014 for the oil (576 million barrels), and 2016 for the gas deposits (about 46 Tcf), with the products being shipped to Valdivostok for export. It is expected that it will produce at around 2.9 bcf/day.

The Tas-Yuryakhskoye oil and gas condensate field will also be developed by Gazprom; however, that process was just completed last December and so plans are indefinite. The prices paid are:

The company will pay 7.29 billion rubles for the right to use the sites: the payment for the Verkhnevilyuchanskoye gas condensate field is set at 3.63 billion rubles, Tas-Yuryakhskoye is at 2.479 billion rubles, Sobolokh-Nedzhelinskoye gas condensate field is at 344 million rubles, Srednetyungskoye is at 836.6 million rubles. [There are roughly 30 rubles to the dollar.]

Development of the fields will require additional pipeline construction, which is anticipated to start this year. The total gas reserve in the four fields is estimated to lie around 17.5 Tcf.

The ESPO pipeline is also now, since last November, carrying oil from the Irkutsk region, where the Yaraktinsky field has begun producing at 35 kbd.

And speaking of Gazprom, they have just taken control of the Kovykta gas field from BP, after a long struggle. Kovykta remains relatively undeveloped with about 70 Tcf of natural gas and 500 million barrels of gas condensate. It is suspected that the gas will now go to a market in China, though whether this will happen before 2018, when Gazprom was anticipating developing the field, is open to question.

In total, the reserves in Eastern Siberia are likely to be only a fraction of those that were found in Western Siberia, but as the latter are in decline, finding a replacement means that even these smaller and more difficult reserves become more attractive. Not all the fields have yet been defined. There was a new one announced with a billion barrels of reserves, near Irkutsk in January 2010, so there is still a possibility for greater finds. It remains, however, along with Alaska and Fort McMurray, one of the last frontiers that are not in deep water.

Vankor Oil Field is part of the West Siberian Petroleum Province.

The main objects of the development of sandstone: Nizhnehetskaya Formation NKH-I, NKH-III and NKH-IV (Нижнехетская Свита НX-I, НХ-III и НХ-IV) (Berriasian - Valanginian) and sandstones Yakovlevskaya Formation YAk-I – YAk-VII (Яковлевская Свита Як-I – Як-VII) (Aptian - Albian).

Oil Production:

2009 3640 thousand tons

2010 12700 thousand tons

2011 15146 thousand tons

Well, it is perhaps a good thing that the cows are only remotely related to gas production in eastern Siberia so to speak. What I wonder, is if the cows are banned from work on minus 70F days, too.

Thanks for the work, Heading Out.

for your viewing pleasure:

http://www.youtube.com/watch?v=A7RD5ONjv8M&feature=player_embedded

maybe they can reuse the infrastructure of the Stalin concentration camps for the workers?

They shut almost all the gulags between 1953 and 1955.

Peak Gulag.

Thanks for putting this together Heading Out. Very interesting. I wonder what's more difficult...pronouncing the names of the fields or producing oil and gas from them?? "Verkhnevilyuchanskoye gas condensate field" By the time I figured out the correct pronunciation of that, the Siberian summer would be over!

Does any one know if there are any oil and gas prospects in the Kamchatka peninsula and the extreme north east of Russia?

Funny video too, PDV.

Any information on the size of undiscovered resources in this area? I can find USGS work on Western Siberia, but haven't noticed any similar work in Eastern Siberia.

Anthem Vankor

http://www.youtube.com/watch?v=rhYgSD_mvnc&feature=related

Vankor Oil Field

http://www.youtube.com/watch?feature=endscreen&NR=1&v=vGCDic8eI9I

http://www.youtube.com/watch?v=E2QTAnNc8pY&feature=related

http://www.youtube.com/watch?v=43KLL_bBdOk&feature=related

Regarding the geographical definitions I prefer to talk about the Central Siberian Plateu (the land between the Yenisei river in the west and the Lena in the east) and the Eastern Siberian Highlands east of Lena. Those areas are well defined. Not only due to its different topography.

The debate about what constitutes east and west Siberia respectivly may go on for ever.

This is an excellent article. You might include the Russian Maritime province and the Sakhalin region into this picture if you expand on this.

Thanks. This was a great article on the Russian O & G sector. The spread out diverse locations of the field make it tough to co-ordinate equipment supplies though (i am an oil&gas supply chain officer). It is difficult to keep the equipment running on time without any rig downtime unless you quickly locate a local supplier to fill the gap. Turns out we can get a lot of local content in many regions on short notice through this online portal : www.ogpnetwork.com . Good website which i will recommend to anyone in the oil&gas or even power sector. Have registered there now to begin creating a network of multiple equipment suppliers. Please let me know if you know anymore such websites.