Tech Talk - Oil Production from Western Siberia

Posted by Heading Out on January 29, 2012 - 8:54am

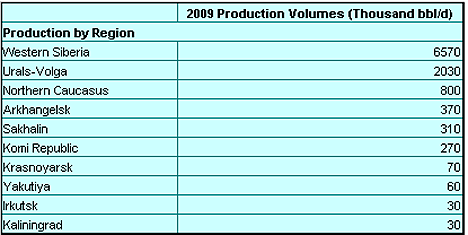

Time marches on, and as I noted in an earlier post, the declining fortunes of the Romashkino and other oilfields in the Volga-Urals Basin led into the development of the fields of Western Siberia, where even some forty years after it was discovered, just over 60% of Russian crude is still being produced today.

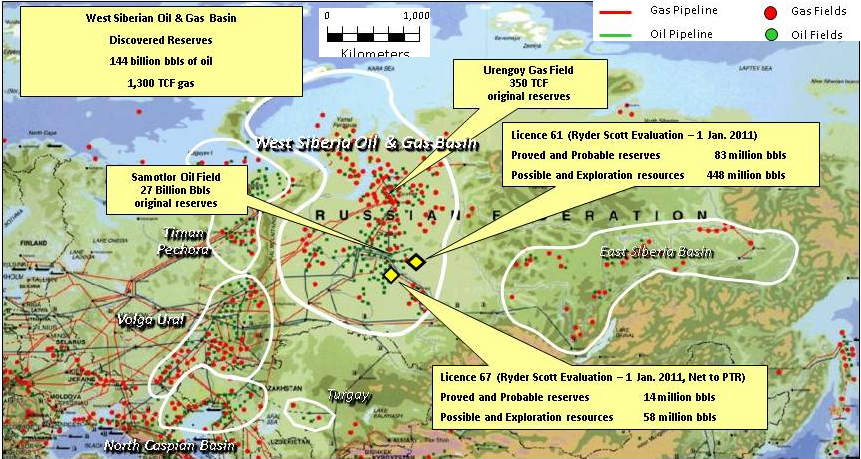

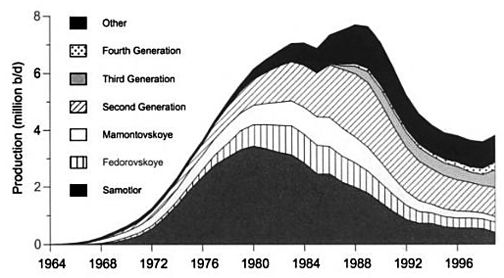

Back in 2007, production was at 70% of total Russian crude oil production with a daily production of 7 mbd., so changes in the mix already were occurring. At its peak in 1980, Samotlor, the largest field in the region, was producing at 3.4 mbd, out of a Soviet production of 12.5 mbd. Samotlor is thus ranked 7th in the world in terms of original oil reserves, and as a comment on the times, it still ranks 6th in the world in terms of daily production even while production has fallen to 750 kbd. Initial reserves stood at 27 billion barrels of oil, though this was not initially evident when the field was discovered in 1965. Water cut has increasingly taken its toll of the field, and now runs at around 90%.

It took some persuasion to get the Soviet oil industry to move that far East. The new fields were some 600 miles further East than those of the Western Urals, and the country was divided between taiga and swamp. There weren’t a whole lot of people, either.

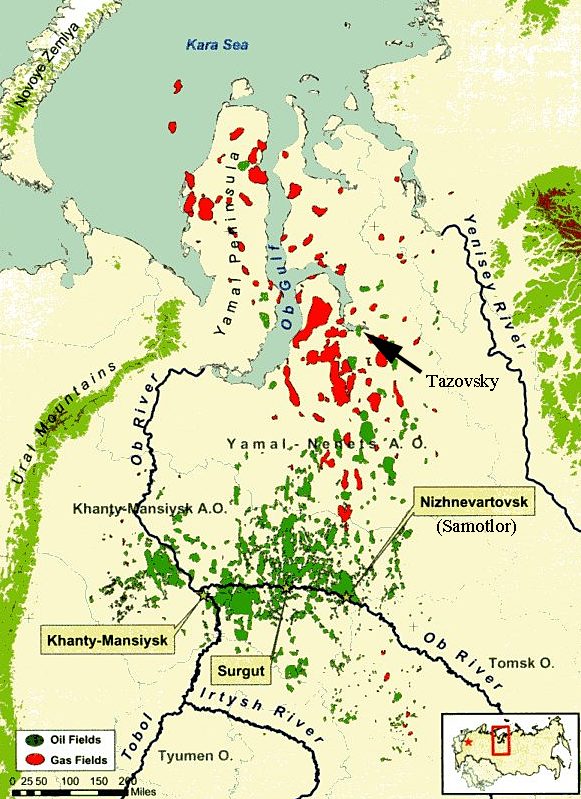

Much of that has changed, with the center of the oil industry now located in and around Khanty-Mansiysk, built mainly after 1931 when it became the capital of the Ostyako-Vogulsky National Okrug. A settlement since 1637, it was given its current name in 1940, and became a city in 1950. As a sign of the changing times, the provincial budget from oil revenues was $4.5 billion in 2008.

Oil seeps have been reported in the outcropping of rocks along the Ob River since the seventeeth century, and I.M. Gubkin, the founder of petroleum geology in the Soviet Union, predicted the presence of oil as early as 1932. Serious exploration began in 1954. In 1962, a well drilled near Tazovsky produced natural gas at a flow rate of a million cu m (35 mcf) a day and the Tazovskoye oil and gas field had been found. Originally it was developed as an oil field, but more recently its natural gas potential has been more fully recognized, as has that of the entire Yamal Peninsula. (And at the same time, that 70% of Soviet oil was coming from Western Siberia, so was 90% of their natural gas.)

The northern part of the West Siberian Basin (which, as Grace points out, covers an area about four times the size of France) has been where the most recent exploration has taken place. But it was further south and east along the Ob River that the first three major fields, Fedorovskoye and Mamontovskoye near Surgut, and Samotlor, which lay further East near Nizhnevartosk, were found between 1963 and 1965. An oil pipeline was laid in 1967, allowing year-round production. From the beginning, construction and development was a problem given the local geography, and ways had to be found of getting production equipment into the marshy ground and getting the oil and gas out. For many years, the Ob river was the main highway.

These three fields underpinned Soviet oil production through the 1980s, and with the 14 fields that were added in the second generation, the 7 that came on line for the third generation, and the 8 that made up the fourth generation, kept the Soviet Union well supplied until its collapse at the end of 1991.

Over the past decade, these fields have been rehabilitated and raised production by more than 60% over that at the depths of the crash, after the dissolution of the Union.

Fedorovskoye is run by Surgetneftegas, a company that drilled 1,403 wells in 2011, including 708,000 ft of exploration. In 1993 the company was allowed to become an open joint stock company. The field, which peaked at a production of around 1 mbd in 1983, is now referred to as the Fedorovsko-Surgutskoye and with a current production of 400 kbd it ranks 14th largest in the world. As a sign of the times, perhaps, the new fields that Surgetneftefas is developing are, however, in Eastern Siberia.

Mamonskoye is run by Yuganskneftegaz and was acquired by Rosneft in 2005. It too peaked at around 1 mbd, though in 1986. The company estimates that in the Khanty-Mansiysk region, its 30 licensed areas still retain a reserve:annual production ratio of 24 years.

This includes the Northern part of the Priobskoye field, the “Pearl of West Siberia,” discovered in 1982, and brought on line in 1989, and the Prirazlomnoye field which is the Russian offshore (a third future topic). The Priobskoye field was producing at 650 kbd in 2009, when it was ranked as the 8th largest producer, with plans to further increase production through 2013.

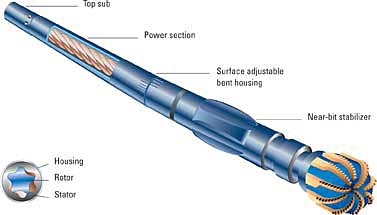

The Southern part of the Priobskoye field is being run by Gazprom Neft, the oil branch of the Russian gas company. In 2007, Rosneft produced an average 550 kbd from the Northern half of the field, while Gazprom was producing 127 kbd. Gazprom has about 40% of the field. Production has been helped in more recent times with the use of Schlumberger’s advanced down-hole motors and technology.

Also in the region, and similarly just coming on line are the wells of the Salym Project, which, last 25 September reached a production record for them of 177 kbd. The oilfields include West Salym (reserves estimated at 630 million barrels; Upper Salym (reserves estimated at 150 mb) and Vadelyp also at 150 mb.

One of the problems of sustaining production, even given this wealth of opportunity, lies in the need for considerable investment to make it happen.

Coburn (pdf) has pointed out that only 60% of the investment needed in 2009 to sustain the industry was forthcoming, and suggests that the $110 billion needed for exploration and development before 2016, and most of this will have to be spent further East in Siberia and Sakhalin (which will be visited in future posts). He further notes that Lukoil have suggested that $1 trillion will be required to sustain production at current levels. This will include a further production from Western Siberia to the tune of 45.5 billion barrels. Given that most of the larger, older fields are showing depletion levels of 70% or so this is going to have to come from developing a larger number of smaller fields. But that will take an investment that is still doubtful, though Lukoil are investing some $24 billion in downstream operations, showing that they are anticipating getting the oil from somewhere.

Given the size of the Basin, I have not spent enough time today on natural gas too much of which is still flared, so I will return to the region again.

4/10/2010

Russia's oil peak and the German reunification

http://www.crudeoilpeak.com/?p=1912

High water cut reservoirs

There are two basic reservoir conditions that lead to high water cuts. First, as a water drive oil reservoir is produced the oil/water interface slowly rises as the oil is withdrawn. Akin to salad oil floating on top the vinegar. Eventually the percentage of water increases to the point where the net oil production is too little to justify the LOE (lease operating expense) and the field is abandoned. Though not as perfect as depicted in an engineering book the recovery is fairly uniform across the field.

Second, a producing well can “cone” water: Instead of the water interface moving up uniformly across reservoir it moves upwards much faster below the well. Thus instead of taking years for water cut to increase it can begin in just weeks or months. Two common causes for coning: the oil mobility is low (often due to viscosity/thickness) or the well is produced at too high a rate. As a well is produce a low pressure area is generated around the well bore. This is what drives the oil (and water) towards the well. Coning can cause a significant variation in reservoir recovery across a field. Near the well bores recovery could be 70%+ and between wells there may be little or no oil recovered.

I don’t know how common oil mobility problems are in the Siberian fields but it probably exists in a certain percentage. But I wouldn’t be surprised if coning due to excessive production rates is prevalent. Typically field management (in Texas as well as the Soviet Union) is judged on recovery rate. That naturally leads to pressure to increase flow rates even if it means reducing URR. In a communist state it means reaching artificial goals. In Texas it means maximizing ROR cash/flow. In either case it can leave a considerable amount of oil left in the ground.

So how do we recover this stranded oil? Just drill more wells. But will the economics justify the effort. Often drilling new vertical wells between the high water cut (or abandoned) wells won’t be economic even at today’s prices. The production problem still exists but now the field is partially depleted. But a knight in shining armor has arrived: horizontal well bores. Three key factors make them appear to be almost magical. If we can keep the well bore in the top few feet of the reservoir it also keeps us farther above the water interface. In a vertical well the upper 10’ to 30’ may need to be perforated to get an adequate flow rate. Thus the lower perfs will see the water level much sooner. Next, the longer interval of the hz well will produce a significantly lower drawdown pressure than a vertical completion. Lastly, all wells have in effective drainage radius: from how far away will oil be drawn to the perfs? In a vertical well it might be just a few hundred feet. Obviously a 2,000’ hz well will have a much greater drainage radius: 2,000’ X a few hundred feet vs. a few hundred feet.

And then there’s the big BUT. But hz wells are not cheap. Depending on the completion design they can cost 2 to 4 times that of a vertical well. And in some cases, such as thick viscous oils, they don’t completely eliminate the problem. I’m about to begin a pilot program in a S. Texas oil field that has suffered from water conning from the start. Recovery rate has not been terrible in this trend: 45% to 55%. Yet many vertical wells have been drilled between depleted wells and discovered the original oil/water contact and tested 40 to 60 bopd water-free. Unfortunate very few of these vert wells payout: they still suffered the same coning problem as the original well…or worse. My hz wells won’t solve the water coning problem either. But what they will allow is production rates of 2,000 bbls of fluid per day. Thus even when water cut reaches 90% the well will still be delivering 200 bopd. The question is the time span between no water production and the high water production phase. That will determine cash flow and thus the ROR. And that will determine if we expand to a major drilling program or not. I’ve ID’s over 2 billion bbls of residual oil in this trend that represents over 300 potential wells. Most of the leases have been abandoned and are of no interest to other operators. A few hz attempts to recover this stranded oil failed due to inadequate completion design and folks gave up. Hopefully my design will get ‘er done. LOL. My wells will cost $2.3 million each. Thus the total potential program could exceed over a $half billion. Even the hz wells will still leave a lot of oil behind: I expect to recover only an additional 5% to 10%. But at oil north of $80/bbl it should prove very profitable. By 1Q of 2013 hopefully I'll know we're good to expand.

Rock,thanks for the excellent write.Most illuminating.

Thank you Rockman, that was very interesting.

The Russians, from what I have heard, drilled relatively few wells on very wide spacings (so far apart you couldn't see from one well to the next) and then produced then for all they were worth in an attempt to meet the 5-year plan and not get sent to the Salt Mines (they were already in Siberia, so it was a short trip).

This of course resulted in severe coning and other problems, which are among the reasons production peaked and started to decline as the Soviet Union collapsed.

Now that these fields are being managed to a profit motive, they are doing everything they can to recover the oil they missed under Soviet conditions. I'm sure this involves a lot of infill and horizontal wells. This is probably why Russian production is hitting a post-Soviet peak.

The Russians have a lot of technical experts and given Western technology I'm sure they can recover a lot of oil they missed the first time around. However, it would have been better to maximize ultimate recovery by developing the fields the same way porcupines make love - slowly and carefully.

Rockman

How do we balance the oil megaprojects data which indicates declining world output with you and your colleagues who are creatively scouring existing resources, as well as the other innovation - fracking?

Oil Megaprojects seems to indicate that 2012 is the "tipping point" year, yet the US (and I assume world) production graph overall has actually started to turn upwards. As you said, oil prices in the hundred dollar range generate a new break even point.

key question: just how long can we prolong, and delay the inevitable?

poly - Really impossible for me to make even a WAG about the balance between the new big fields and rehashing so many old fields.I know a lot about a very small area and just generalizations about the big picture...especially megaprojects. So I can just offer my instinctive feelings: we can't prolong the inevitable very long. The megaprojects individually look impressive but compared to existing proved reserves (let alone what we've produced the last 60 years or so) they don't seem to add up to a game changer. There may be tens of thousands of smaller opportunities but that's what they are: small.

Then factor in never ending depletion and ELM and it's difficult to see much salvation for the industrialized societies IMHO.

There are many problems with the bottom-up approach to forecasting future oil supply.

1) Omissions. I have often posted information on omitted mega projects only to recieve a reply that nobody is updating the oil mega projects. Apparently Ericson, Staniford and Fourcher are updating these projects based on Major Oil Company's Annual reports(and apparently press releases). These three are probably getting additional information from Petroconsultants(Skrebowski,etal)) Ericson,Staniford and Fourcher have a daunting task, projects get omitted.

2) Omissions. I have searched the oil megaprojects and can't find the bakken or others. Using the 10,000 bpd threshold, some of these plays would qualify year after year(actually month after month - in some cases). Bakken NGLs, for example, are also omitted.

3) Omissions. Smaller projects that fall below the 10,000 bpd threshold. Columbia is a good example. Columbia is not even listed on the oil megaprojects list. Apparently the logic is that smaller projects don't amount to anything. Basic math, using any reasonable decline assumption, shows that the Megaprojects understate supply.

4) Omissions. Due to front end loading of projects. Apparently, peak rates are scheduled in the start-up year. Never to be heard from again. Production from years prior to peak year are omitted, as far as i can tell. That is part of the declining world output illusion.

5) Projects that perform better or worse than forecast.

I conclude that 1) Field declines are higher than published estimates 2) small projects and omitted projects are making up the difference 3) bottom-up analysis, taken at face value, gives unrealistic forecasts.

Actually three, there is also waterflood. The majority of waterfloods, in the US anyhow, are pattern floods. Excess water injection also leads to high water cuts.

I am currently working on a study of about 165 waterfloods in the Powder River Basin and the conclusion I am leaning toward is that injection at a high rate does not materially affect ultimate recovery. The economics of waterflooding at a high rate can be adversely affected, but all in all, rate doesn't seem to be make much difference, at least in the fields i am studying.

These results do not seem to apply in a reservoir with a high gas saturation at the start of waterflooding, however.

Khanty of melting Western Siberia

Key oil region masters crisis.

Western Serbian oil is exported though the Gulf of Finland.

Russian Oil Distribution to More Than Double

Oil drilling in Siberia

Oil in Siberia - worker's view

Russian Drilling Rig Mud Pump Engines

Another interesting and educational Tech Talk. Thanks Heading Out. Also thanks to Rockman for his comments. Also very educational.

At its peak in 1980, Samotlor, the largest field in the region, was producing at 3.4 mbd, out of a Soviet production of 12.5 mbd. Samotlor is thus ranked 7th in the world in terms of original oil reserves, and as a comment on the times, it still ranks 6th in the world in terms of daily production even while production has fallen to 750 kbd.

Thanks for the post H. O. (good looking layout by the way). Do you happen to know how Samatlor ranked in terms of daily production when it was producing at its 3.4 mbd peak? That would be an interesting tidbit to have.

I would suspect, given the relative age of some of the other "elephants" that it would, in its time have ranked second behind Ghawar, but that might depend on how you grouped some of the fields in the US at the time.

I recommend this interesting article (in Russian) about Samotlor by a man who worked there. He compares Samotlor to North Slope and finds that although different production profiles, but about the same URR. The article is a rebuttal to those who claim that Samotlor was improperly managed which led to the collapse of the production. The author concludes that the inefficiency was relatively small, no more than $50bn in modern dollars if we include associated gas, and the collapse of the production is best explained by the fact that oil is finite. The easy oil of Samotlor is gone.

I find it interesting that both fields now belong to almost the same company. Also the author (in 2002) never expected Samotlor to overtake North Slope in terms of production again.

What are units on the chart verticle axis?

The North Slope is a made up of several fields with several owners, often several to each field

for example Prudoe Bay oilfield ownership breaks down like this:

36.39% ExxonMobil

36.07% ConocoPhillips Alaska

26.36% British Petroleum Exploration (Alaska)

1.16% Chevron Texaco

0.02% Forest Oil

BP is the single operator of Prudhoe Bay oilfield however.

isn't Samotlor a single field?

Million barrels per year.

It's a huge field with a lot of satellites. Samotlor is operated by TNK-BP, they do a lot of hydraulic fracking to get oil from the satellites.

Thanks, once you told me the units were obvious, I should have figured them out.

ConocoPhillips operates the Kuparuk River Unit and Colville River Unit (Alpine) facilities and holds a major interest in Prudhoe Bay Unit facilities as I mentioned earlier are operated by BP

I believe the two peaks on the downslope of the North Slope portion of your graph can be attributed primarily to the peaks at Kuparuk (1991) and at Alpine (2003)

Is the plateau beginning in 2002 on the Samotlor portion of your graph mostly due to the fracking of the Samotlor satellites or to reworking the whole field?

The link below is to a decent slide show highlighting mostly the North Slope-I happened by it while looking for info on Alpine

http://www.paulcolor.com/index.php#mi=2&pt=1&pi=10000&s=14&p=0&a=0&at=0

The whole field is being reworked since 2000. Now it produces some 750 kbpd = 275 mbbl/year, twice as much as at the lowest point in 90's. It is achieved by the extensive drilling of horizontal wells and hundreds of frackings per year.

Looking at the graph of Samotlor production, I can't help thinking that they must have done a lot of damage to the reservoir by producing it that fast, and if they had produced it at a much lower rate they might not be dealing with a 90% water cut today.

I'm used to Canadian standards, which are restrained even compared to the US, and here government authorities would probably have cut the maximum production off at a fraction of the rate the Russians reached in Samotlor. The result is that they have managed to get far more production out of many oil fields than you would normally expect, and the production curves decline very slowly compared to most other places.

Of course, the Canadian objective was to extend production out as long as possible, in an attempt to maximize both ultimate recovery as well as economic efficiency, whereas the Russian objective was to meet the short-term production targets.

I'm not an oil man, but from reading various Russian sources I got an impression that indeed decisions were made that somewhat harmed the URR. BUT thanks to the new technologies that oil can now be recovered. Of course it makes the oil more expensive than could be with a lower production rate. On the other hand, huge amounts of associated gas were lost irrecoverably.

Also, some sources present cardinally different view of the situation. They claim that the collapse of the production obviously was a result of Soviet ignorance, and if the field was developed by the Western standards the outcome would be much different. Because American oil fields never deplete.

no doubt, American decisions are always on the money--like making the Trans Alaska Pipeline System a four foot in diameter pipe. Three foot in diameter would have had 56% of the volume, which wouldn't have dumped as much on the market at the outset possibly keeping prices a bit higher. It would have allowed for a more even development of the fields and assuming all the North Slope production we currently have came on stream as needed the 3 foot in diameter pipeline would still be full (or very close to it) today rather than being a four foot diameter line getting down toward a quarter of what it was designed to carry.

A whole lot more of the North Slope production would have been sold at higher prices if they were only supplying a 3 foot line, but that get your money out as quick as you can policy prevailed and the bulk of the North Slope's oil to date went out for bargain basement $. There is much to be said for the Canadian approach.

Of course on a human emotional note, I'm always looking forward to the end of my stays on the slope (that is at the oil fields, I rather enjoy my stays at Toolik Lake Research Station even though the conditions are far more primitive and the mosquitoes are ungodly in the few weeks bracketing solstice). The idea of getting the oil and getting away from the place quick may have shaded decision making deep down just a little bit. The beauty of the place is pretty well lost when you spend your whole time on one gravel pad or another or in a stinking diesel crew cab pickup--that never gets shut off 24/7--driving between them.

Yes, I think it would have been wise to use a smaller diameter pipe for the Trans-Alaska Pipeline - the 4 foot line was only at capacity for a short period of time before production started falling off.

They probably thought they would find more fields on the scale of Prudhoe Bay to fill the pipe, and they never did, so it is now at 1/4 capacity.

A smaller pipeline would have taken the top off the peak and spread it out so they would be producing the oil at today's higher prices and the production would have a much longer lifespan. Hindsight is 20/20.

heck I'm lucky when my hindsight gets up to 20/20

BUT thanks to the new technologies that oil can now be recovered.

Probably not. Usually oil is bypassed by water flooding in and is permanently lost. It is best to produce fields slowly and carefully right from the start.

Today, companies put oil fields on enhanced recovery techniques right from the start, and that results in very high ultimate recovery rates such as are seen in the North Sea. The flip side is that since you have already used EOR, you have recovered all the oil you can, and when the production decline comes it is steep and final.

I don't think it is a real advantage, but when a field has been overproduced, you can use EOR to recover some of the oil you missed the first time you produced it, resulting in a second peak. The problem is that the ultimate recovery rate will be considerably lower than if it was produced in a sophisticated manner like the North Sea fields.

What is the typical ultimate recovery rate of the North Sea fields? The 2002 article linked above estimates recovery rate of Samotlor to be around 51%. With the recent developments it will be a bit higher.

But my point was that no matter how you produce the field, it will deplete eventually. Some people start the blame game, trying to find an "evil hand" which took away their oil. Instead of accepting the simple fact that oil is finite.

Actually, oil recovery factors in the North Sea average 46% of the oil in place, with Statfjord being one of the best ones at 61%, so if the Russians manage to get 51% out of Samotlor, they did extremely well.

However, I did a little more digging, and found claims that the Russians overstated their recovery factors. BP now operates the field, and they put the recovery factor to date considerably lower - around 35% in Samotlor South and 18% in Samotlor North.

And then there's this, written when Russia was farming out its oil fields to Western companies:

Enhanced recovery methods attract criticism of Russian government

I find this numbers hard to believe. Cumulative oil production reached 15 bn barrels in 1986. Given that oil in-place is estimated to be around 50 bn, recovery rate had reached 30% by 1986. And 3-4 bn more was produced since then.

The article you linked contains more politics than geology. I remember the talk that Yukos was overexploiting its wells, but when Rosneft took over the assets, the growth continued. The article I linked earlier was written at the same time, as a reaction of an industry insider to the media frenzy.

Another aticle "The oil field with only 7 bn barrels of oil left is still profitable." from 2005 (in Russian) with some numbers. It estimates cumulative production by 2005 aroung 17bn barrels.

If memory serves, Ghawar is the only single field that has ever produced more than Samotlor did at its peak (at any time).

Samotlor oil field

Oil Pool BV8 (Горизонт БВ8)

Original Oil In Place 1369.4 million tonnes (10.0 bn barrels)

Cumulative Production 839.2 million tonnes (6.1 bn barrels)

Recovery Factor 61.3%

Peack Oil Production 1978 and 1979 years 83 million tonnes per year (1.7 mbd).

Very interesting numbers, thank you. Where did they come from?

Samotlor oil field

Oil Pool AV4-5 (Горизонт АВ4-5)

Original Oil In Place 1143.0 million tonnes (8.4 bn barrels)

Cumulative Production 463.2 million tonnes (3.4 bn barrels)

Recovery Factor 40.5%

Peack Oil Production 1981, 1982, 1983 and 1984 years 32-35 million tonnes per year (0.7 mbd).