Tech Talk - Oil Production from the Volga-Ural Basin

Posted by Heading Out on January 15, 2012 - 7:22am

In the last post on the oil and gas fields of the Northern Caucasus, I commented that one of the reasons that these older oil and gas fields were being further developed was due to the introduction of advanced Western techniques. As John Grace points out in “Russian Oil Supply, another reason that there are fields left to develop is due to the philosophy by which the Soviet government marshalled resources to keep the Union supplied with oil for domestic and export use. Because of its centralized nature, as the resources in one region declined, so the financial support and technical equipment were removed and taken to other parts of the country, where a more plentiful supply source was available. This frequently left smaller fields behind, and removed the incentive for further exploration in the older regions.

The first region to see that removal of support was around Baku, and then the North Caucasus, as more plentiful resources became evident up in the region around Almetyevsk, in what is now the Republic of Tatarstan. The region lies considerably north of Volgograd (Stalingrad) and further east, though it still lies on the banks of the Volga, though also just to the West of the Ural Mountains, and thus the more popular and general description is the Volga-Ural Basin.

The Volga-Urals Basin is now recognized to be extensive with the USGS estimating that there remain some 1.5 billion barrels of oil, and 2.3 Tcf of natural gas (at the mean) left to be discovered and produced.

Prior to the Second World War, the region saw little development. Tar pits within the Basin had indicated the presence of oil, and Grace has pointed to outhouses exploding around the town of Orenburg as natural gas from the underlying field collected in the buildings, the first indicator of the field's presence. But the fields all appeared to be small and with enough production from Baku and Grozny to meet existing needs, there was little initial incentive to develop what seemed to be a series of small, shallow fields.

With the German advances into the Caucasus, that oil became lost or more difficult to bring north, and the relative security of the Volga-Urals meant that a greater effort was made to bring those fields on line. Production had reached 55 kbd in this “second Baku” by the end of the war. The first break had come with the discovery of the relatively shallow oil field at Tuymazinskoye in 1937, but it was not until they deepened one of the wells into the lower Devonian layers in 1944 that they hit the more productive reservoirs and the potential of the region became evident. In 1943, a test well had been sunk at Shugurovo and flowed at 140 bd from a reservoir at 2,000 ft. With the knowledge of the deeper reservoirs, a third well in the region near the town of Romashkino was drilled down to 6,463 feet, penetrating the casing on July 10, 1948. Because of formation damage the well was slow to produce, but within a short while was up to 876 bd. Holding 17 billion barrels of oil, and thus the largest oil reservoir discovered at the time, the Romashkino field (which included the well at Shugarovo) had been tapped. In time another seven fields, each of more than a billion barrels, were added to the inventory for the Basin.

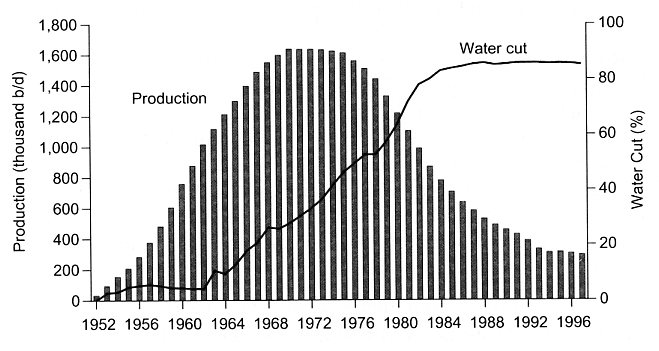

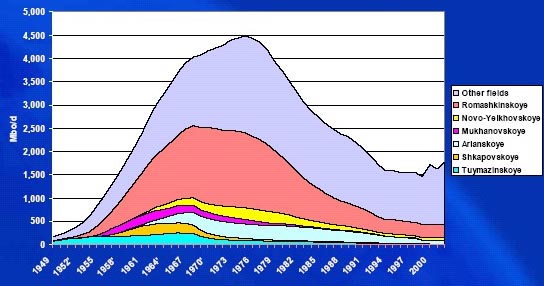

The deeper Devonian beds required a number of innovations to produce at the levels that Moscow required. The first of these was the development of the down-hole turbo drill. Russian steel making was not on par with that available in the West, and the torque requirements for drilling the harder and deeper rocks were a challenge, overcome by putting the turning motor at the bottom of the well. The second problem that arose was maintaining well pressure as the oil was removed. The use of contour water flooding evolved from the initial Master Plan in 1956 and was successively modified to perimeter flooding, so that by 1960 the basin was producing at 2.9 mbd, comfortably exceeding the target 1.2 mbd. Romashkino itself peaked at just under 1.6 mbd in 1968 and began to decline in production in 1976. As production declined, so the water cut also rose and by 1993, production was down to around 300 kbd, with about 85% water cut.

Overall production from the Volga-Urals Basin includes some of the fields that lie outside of Tatarstan; as a result, the decline of the Basin was a little later than that of the main field within it. For example, further to the East lies the Arlan field in Bashkortostan, run by Bashneft. That too, however, is now in decline. In its 50-year life it has produced, with the Shkapovo field, over 4.7 billion barrels of oil. The overall basin produced from over 800 discrete fields.

More recently the EIA reported that the Volga-Urals Basin produced 2.03 mbd in 2009, while the Northern Causasus produced some 800 kbd.

Romashkino lies in Tatarstan, and the Tatneft Company had been formed to develop the oil in the Republic, of which some 6.3 billion barrels was in reserve. Realizing that their geography precluded independence, they became an associate subject of the Russian Federation, and Tatneft was privatized. Through helpful arrangements with the local government production, which had declined through lack of investment, production was brought back to 465 kbd for the region, and has held at that level, through the collapse of the ruble. As the economy was restored, the company began to expand, and has helped Kalmykia to develop their resources, for example. (The Caspian oilfields that are now being developed lie off-shore Kalmykia).

With over 15 billion barrels now produced from Romashkino , more advanced techniques are being used to improve recovery of the remaining oil. These include the use of carbon dioxide injection, which has improved some production by as much as 12%.

Because Volga Urals oil has a high sulfur content (around 2.5%) this has, in the past, led to it being blended with West Siberian oil prior to refining. As the resource has declined, the oil that is left is increasingly heavy, merging into the Melekess oil sands.

(Russia in total is estimated to have around 246 billion barrels of bitumen in sand formations, though most of it is in Eastern Siberia). The USGS has estimated that, at present, some 13.4 billion barrels of the Melekess oil is technically recoverable. Working with MicroPro GMBH, the bacteria Clostridiae has been tested as a means of improving production.

Improved flow conditions in the reservoir and increased gas/oil ratios led to an enhanced net oil production by 50% to 65% without changing production regime. The water content of the entire field was reduced from 74% to 57%. Between 1992 and 1995, the MEOR treatment resulted in an additional MEOR oil production of 4,200 ton (26,400 bbl)

Whether the small fields that remain in the Volga Ural Basin will be developed in the short term (as they likely would be by small independents were they in the West) appears to be currently less likely as both Tatneft and Bashneft see better returns by investing outside the region than within it. They are also reputed by Grace to retain a lot of Soviet-era infrastructure and thinking within the companies, which may also reduce the effort to invest in the smaller fields. It is difficult, therefore, to see the region have much increase in production from current levels, but rather it may continue a decline into the future.

In regard to natural gas, down by the border with Kazakhstan lie the natural gas deposits of the Orenburg field (of exploding outhouse fame). Production began in 1974, reaching a steady state of production in 1979, and holding a 48 bcm production per year until 1984. In order to maintain pressure, water flooding was used, and its influence on the production of a typical well can be seen below. Overall, production has since fallen to 18 bcm per year.

More recently the field has changed to use initially horizontal wells, and since 2009, the use of multi-laterals in order to sustain production and increase reserves, still considered to be around 280 bcm of natural gas (9 Tcf). This is a little more than the EIA estimate. However, given the increasing cost of developing this, when set against the much larger volumes that can be found in other parts of Russia (not to mention Kazakhstan and Turkmenistan to the south) it is reasonable to assume that the region will continue to decline in natural gas production also.

I could find no reference to water flooding in Ivanof's discussion. I believe the field, or areas of the field, are water driven. I don't know of any depletion drive gas reservoirs that have been flooded.

At one point, there is a reference to injection of low pressure gas because it was not considered economical to transport low pressure gas to the processing facilities.

I take it that Ivanof is not English Speaking, with the paper translated by a non-technician.

I may have misinterpreted the paper.

one does wonder if the Russians could embrace the " mom & pop" ownership of the smaller wells how shallower slop the decline would be for this region.

shame it won't happen

just like KSA , the big guys just can't let go - to the detriment of production and the well being of the Human race in the decline of oil.....

the back end slope could have been so much shallower......

Forbin

That's the rules of the game in Russia. The state sets the priorities and makes the decisions, and we have no idea of the reasoning. We have to accept that we don't have the necessary information to make knowledgeable guesses about future Russian oil production. After all, the total amount of oil reserves is classified. Any number you see in any public source is wrong by definition. Consider this: last year they pulled 1bn+ Yamal oil field out of their hat. And we learn that it was discovered in 1987. A couple of years ago East Siberia came on line, and those fields were discovered in the 70's! Now Arctic is becoming the new frontier.

Look at this map. It shows Transneft's pipelines. Red is low sulfur oil, green is medium sulfur, blue is high sulfur. Do you see an empty space? Where no pipelines were ever built? One have to wonder how much oil is there, waiting.

Five years ago the estimated URR of Russia based on the Hubbert method was 172 Gb. http://www.theoildrum.com/node/2689

Any day now Russia will reach that value and we will be hearing a giant slurping sound.

That is why HL is so popular on TOD, it consistantly underestimates future reserves. Megaprojects, a co-ordinate plot of rate -vs- cumulative or worse, rate -vs- time are the other methods of underestimating production forecasts. Tools of the doomer trade.