The Bakken Boom - A Modern-Day Gold Rush

Posted by Jonathan Callahan on December 12, 2011 - 10:39am

This is a guest post by Derik Andreoli, Senior Analyst at Mercator International LLC (dandreoli@mercatorintl.com)

“That men do not learn very much from the lessons of history is the most important of all the lessons that history has to teach.” Aldous Huxley

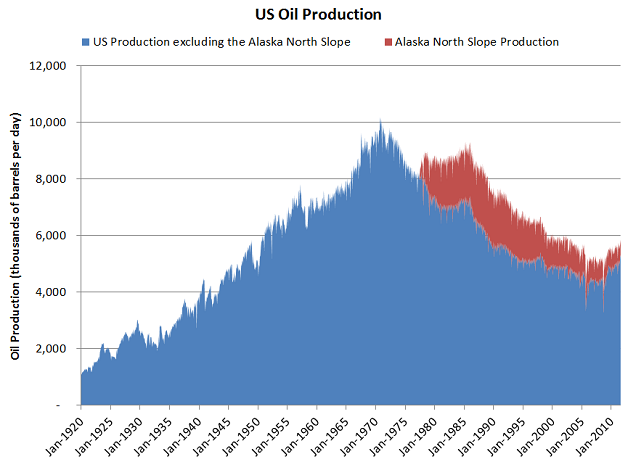

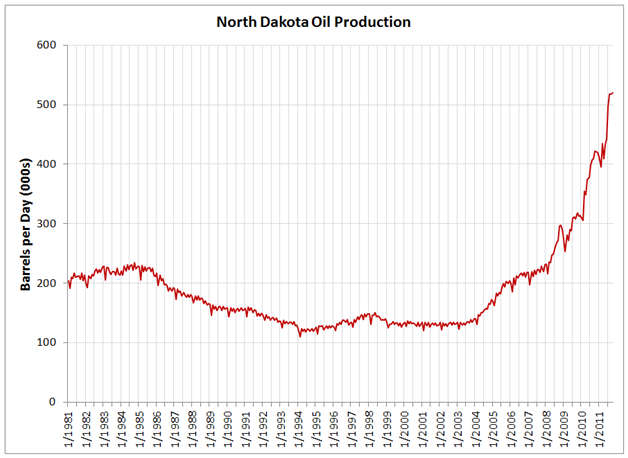

In 2009, U.S. oil production began to climb after declining for 22 of the previous 23 years. The shale oil production of the Bakken formation, which straddles the Montana-North Dakota border and stretches into Canada, has been a significant contributor to this temporary uptick in oil production.

The Bakken boom has inspired a number of prominent commentators to resurrect the energy independence meme. Daniel Yergin was first at bat, asserting in an essay published by The Wall Street Journal that rising prices and emerging technologies (especially hydraulic fracturing) will significantly drive up world liquid fuels production over the coming decade(s). Ultimately, Mr. Yergin argues that tight supplies lead to high fuel prices, and high fuel prices will bring previously inaccessible oil to the market. The trouble with this line of thinking is that high prices aren’t merely a symptom of the supply problem; high prices are the problem.

After Mr. Yergin stole first base through this apparently convincing display of contortionist logic, the next up to bat was Ed Crooks who recently penned an analysis piece for the Financial Times. In this piece, Mr. Crooks declares that “the growth in U.S. and Canadian production from new sources, coupled with curbs on demand as a result of more efficient use of fuel, is creating a realistic possibility that North America will be able to declare oil independence.”

Mr. Crooks thus ‘balances’ rising production from shale oil and Canadian tar sands against declining consumption, which he mistakenly chalks up to efficiency gains rather than the deleterious effects of the greatest recession since the Great Depression. Beyond this obvious blunder, Mr. Crooks manages an even greater and far more common gaffe by neglecting to integrate decline rates of mature fields into his analysis.

But in a game where the media is the referee and the public doesn’t know the rules, Mr. Crooks manages to get on base by knocking a foul ball into the bleachers. With Yergin on second and Crooks on first, Edward Luce steps up to plate and takes a swat at the energy independence meme, directing the ‘greens’ to look away as “America is entering a new age of plenty”. And while the greens looked away, Mr. Luce took a cheap shot at clean energy through an attack on the federal government’s support for the now bankrupt solar panel manufacturer, Solyndra. Luce thus willingly employs the logical fallacy of hasty generalization to sway his audience. Of course the Solyndra bankruptcy is no more generalizable to the solar energy industry than BP’s Macondo oil spill is to all offshore oil production, but in a game of marketing one-upmanship one should not expect a balanced and rigorous evaluation of the possibilities.

With the bases loaded and oil prices remaining stubbornly high as tensions in the Middle East and North Africa persist, the crowd is getting anxious. And the crowd should be anxious. After all, tight supplies and rising oil prices strain personal finances and threaten to send our fragile economy back into recession. It is, therefore, unsurprising that the public is as eager to consume the myth of everlasting abundance, as they are eager to consume these scarce resources.

While the Bakken boom offers a hopeful story in which American ingenuity and nature’s endless bounty emancipate us from energy oppression and dependence on evil and oppressive foreign dictators, musings of energy independence are premature, misguided, and misleading. The problem with the Bakken story as told by Crooks and others is that it lacks historical context. Referring to recent developments as an energy revolution implies that there are no lessons to be learned from history. But as Mark Twain put it, “history doesn’t repeat itself, but it does rhyme.”

Lessons from the California Gold Rush

In 1848, John Marshall discovered gold while constructing John Sutter’s sawmill in Coloma, California. Sutter and Marshall attempted to keep the discovery secret, but savvy newspaper publisher and merchant Samuel Brannan soon learned the news. Brannan hurriedly set up a store to sell prospecting tools and provisions and began promoting the discovery in much the same way that the media has been promoting the Bakken. As the news of Marshall’s discovery spread, the California Gold Rush grew to international proportions.

Forty-niners rushed to The Golden State in search of riches, and California’s population exploded from 8,000 in 1848 to 93,000 in 1850, a quarter of a million in 1852, and 350,000 by 1860. With the majority of the influx of humanity employed in prospecting, precious few engaged in support activities. But with the rapid accumulation of mineral wealth, imports were easily acquired. Timber, for instance, was sourced from the Pacific Northwest, and the small town of Seattle, which was only settled in 1852, entered a sustained period of rapid exponential growth.

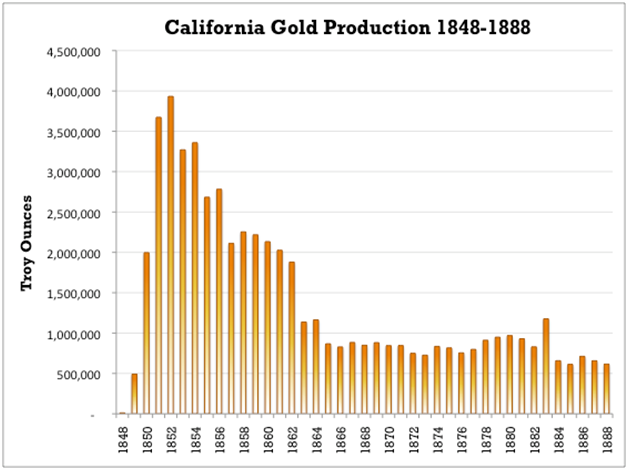

Despite the low productivity of the labor-intensive process of gold panning, annual production grew from just over 1,400 ounces in 1848 to more than 3.9 million ounces by 1852. To put this into perspective, prior to 1848, cumulative U.S. gold production amounted to just over 1 million ounces.

The rapid growth in output was driven not by the backbreaking extraction of gold dust so much as by the discovery of colossal gold nuggets like the twin 25-pounders found in Downieville (1850) and on the banks of the Mokelumne River (1848). By comparison, one could spend decades panning and toiling over rockers and sluices manually sorting flakes of gold from stream sediments and never accumulate such an amount.

Of course nuggets are easier to find than flakes, and the great majority were discovered in the first few years. By 1852, only four years after gold was first discovered, California gold production began a rapid descent. Production declined 50% by 1862 and 80% by 1872.

The decline was only barely checked by the adoption of ‘hydraulic mining’ – a process by which massive amounts of water under intense pressure is used to disintegrate entire hillsides. At the North Bloomfield mine, for example, 60 million gallons of water per day eroded more than 41 million cubic yards of debris between 1866 and 1884. (http://www.sierranevadavirtualmuseum.com/docs/galleries/history/mining/hydraulic.htm)

The runoff from ‘hydraulicking’, as it was called, was directed to sluice boxes where dense gold dust was separated from the other detritus. The displaced earth eventually came to rest in California’s fertile valleys in massive quantities. It has been estimated that hydraulicking generated eight times the amount of ‘slickens’ (tailings) than was removed during construction of the Panama Canal, which, by the way, employed the same process.

The redirection of such massive amounts of water generated conflict. “Legal ledgers dating back to the early years of the California Gold Rush record complaints that existing water rights were being impinged by the diversion ditches for, and the resultant pollution from, mining operations, especially hydraulic mines.” (http://centerwest.org/wp-content/uploads/2011/01/Graduate-There-sGold.pdf)

These challenges were consistently defeated on the basis of the 1857 California Supreme Court decision that gold production provided a greater good for the leading interest of the State and its citizens than would have been achieved had water not been diverted.

This all changed in January 1884 when Judge Lorenzo Sawyer issued the nation’s first environmental injunction after presiding over the case of Woodruff v. North Bloomfield. Judge Sawyer was swayed by Woodruff’s claim that not only was gold production from the North Bloomfield mine not the leading interest of the State, but that the 1857 decision did not supersede laws that protected agriculture and property owners. And with the scratch of a pen, hydraulic mining operations around Marysville were ordered to halt the discharge of tailings into the Yuba River. Other areas were soon to follow.

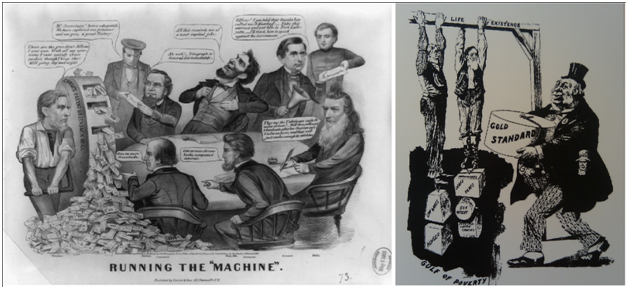

During California’s successive gold rushes more than a few prospectors became rich, but the vast majority spent more cash purchasing claims and supplies than they earned from the gold dust they sold. The main beneficiaries were the businessmen who profited from the search for gold, rather than the discovery of gold; men like Samuel Brannan and Thomas Craig, the manufacturer of the ‘Monitor’ nozzles used in hydraulic mining.

Lessons from the Klondike Gold Rush

A half-century later, a similar story unfolded in the Yukon. In 1897, the nation was suffering through the Long Depression, which, ironically, was in large part the result of the decision to revert to the gold standard upon the conclusion of the Civil War. As ‘greenbacks’ – notes which were not explicitly backed by gold – were pulled from circulation in order to bring the number of dollars back to par with gold reserves, deflation set in. Deflation hit laborers and farmers the hardest and proved to be a significant force behind the populist call for bimetallism.

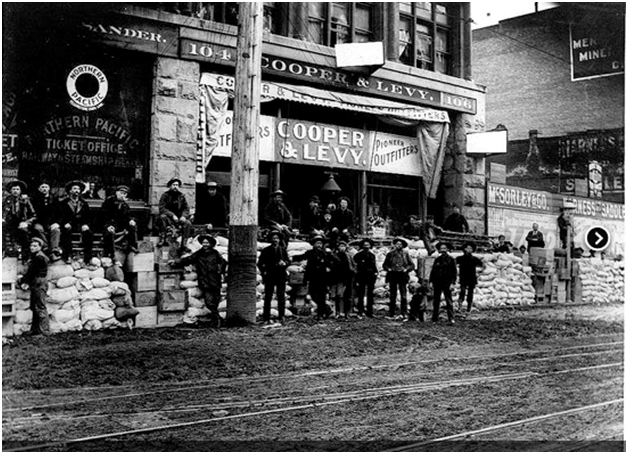

As a result of the Long Depression, people were desperate for work, but even more desperate for a reason to maintain hope in the face of despair. Much as the Bakken has provided hope for contemporary society, the SS Portland provided hope when it arrived in Seattle in the summer of 1897 with a half a ton of Yukon gold on board. The conditions were primed for an outbreak of gold fever, and just as Samuel Brannan advertised the discovery of gold at Sutter’s mill, the Seattle Post-Intelligencer eagerly hyped the Klondike ‘prospects’ to not only sell newspapers but the entire town as the launch site for stampeders.

The next day the Klondike gold rush commenced as the steamship Al-Ki departed with a full deck of stampeders and 350 tons of supplies, including foodstuffs, pack animals, prospecting equipment, and clothing, like C.C. Filson oiled canvas jackets and pants. These garments, which were impregnated with a mixture of paraffin wax and other oils, proved to be as waterproof as they were stiff – the stiffness resulting from the fact that the paraffins, which are solid at ‘normal’ temperatures, are nearly impenetrable under arctic conditions.

The Klondike Stampede caused demand for steamships to mushroom and Seattle quickly rose to become one of the nation’s preeminent ship building communities. And as the demand for steamships spiked, so too did demand for timber and coal, two of the Puget Sound’s most dominant industries. To this day, Alaska depends almost exclusively on the Puget Sound for the delivery of groceries, consumer goods, manufactures, and other commodities.

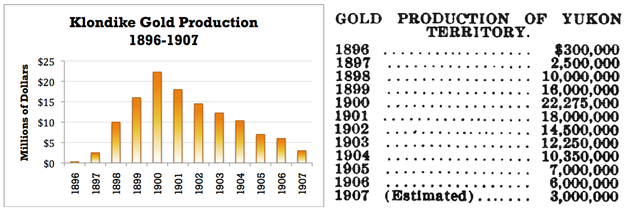

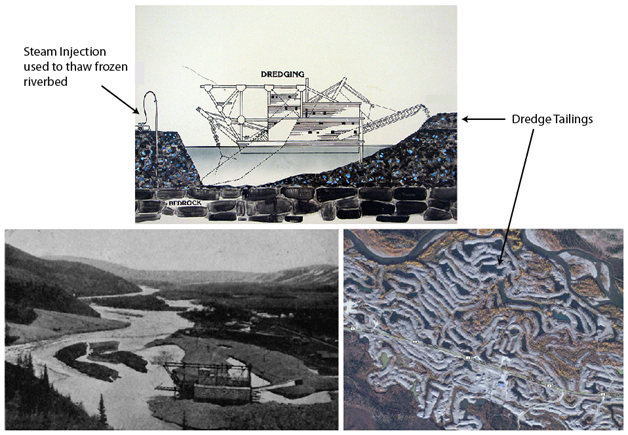

As was the case in California, Klondike gold discoveries fell just as quickly as they had climbed. Between 1896 and 1900, annual discoveries rose from $300,000 to more than $22 million, but by 1904 production had fallen to less than half the peak value, and by 1907 production had declined more than 80%. And just as the new and ecologically disruptive technology of hydraulic mining failed to arrest or reverse declining production in California, the introduction of hydraulic mining and large scale dredging failed to maintain the pace of discovery made by the first few waves of stampeders who employed far less technologically advanced and capital intensive processes.

After studying dredging operations in the Klondike, mining engineer J.P. Hutchins concluded, “The most satisfactory returns were from a dredge working an unfrozen area in the flood-plain of the Klondike River; this was installed before the large corporation, now so prominent in the Klondike, became interested. The dredges installed since that time have been very disappointing in returns. Three powerful dredges began operation on the lower Bonanza Creek, but the experience there has been most discouraging.” (J.P. Hutchins, January 4, 1908, “Klondike District”, Engineering and Mining Journal on January 4, 1908)

While dredging was not able to arrest declining production, the process certainly made an impression on the landscape. Tailings moraines provide a lasting visual testament to the efforts made by dredge operators, who quite literally left no stone unturned.

The similarity in California and Klondike gold production curves was not lost on Mr. Hutchins who further wrote, “[Klondike] figures reveal a marked similarity between this and other placer districts not only in respect to the rapid increase of the annual output to a maximum a few years after the discovery of the placers, but also in the rapid decrease in the output after the maximum figure had been reached. It is of passing interest to note that in both California and Klondike, the annual production reached a maximum the fourth year after discovery. These figures were more than $80,000,000 for California and more than $22,000,000 for Klondike.”

As historian Pierre Burton put it, “The statistics regarding the Klondike stampede are diminishing ones. One hundred thousand persons, it is estimated, actually set out on the trail; some thirty or forty thousand reached Dawson. Only about one half of this number bothered to look for gold, and of these only four thousand found any. Of the four thousand, a few hundred found gold in quantities large enough to call themselves rich. And out of these fortunate men only the merest handful managed to keep their wealth. The Kings of Eldorado toppled from their thrones one by one.”

While gold production continues to this day, the Klondike gold rush ended in the summer of 1899, when over the course of a single week, more than 20,000 ‘sourdoughs’ left the Yukon on news that gold had been discovered on the beaches of Nome, Alaska. The Nome gold rush, which was similarly short-lived, is widely cited as the last gold rush of importance, but only by those whose narrow definition excludes black gold.

The Rush for Black Gold on Alaska’s North Slope

In 1902, Alaska produced its first barrel of oil, and in 1953, the discovery of oil in a small town West of Fairbanks ushered in the modern era of oil production. In 1957 oil was discovered on the Kenai Peninsula, and in 1959, one hundred years after Colonel Drake produced the first barrel of oil in Pennsylvania, British Petroleum (BP) began prospecting for oil along Alaska’s expansive North Slope.

BP was soon joined by Atlantic Richfield Company (ARCO), who in 1968 discovered Prudhoe Bay, the oilfield equivalent of a 25-pound gold nugget. The Prudhoe Bay field is estimated to have had 25 billion barrels of crude before extraction commenced in 1977, making it the largest field in North America. Another major US field, Kuparuk with reserves of 6 billion barrels is also on the North Slope and was discovered in 1969 by Sinclair Oil.

In order to transport oil from the remote North Slope, the Trans Alaska Pipeline System (TAPS) was proposed, but construction did not begin until 1974, after 515 federal permits and 832 state permits were approved. Construction was completed in 1977. At peak construction, in October 1975, 51,000 direct and contract employees were at work on various aspects of the 800-mile pipeline. With construction costs totaling roughly $8 billion, small fortunes were made long before the first barrel of North Slope oil was produced, and once again the Puget Sound economy benefitted as nearly all equipment and supplies were shipped through Washington’s seaports.

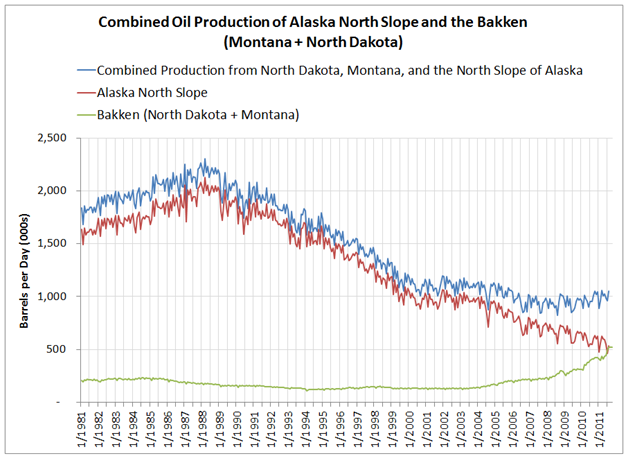

Production from the Prudhoe Bay field peaked in 1988, and production from the Kuparuk field peaked in 1992. With these two fields dominating North Slope production, the black gold flowing through the TAPS then fell into decline after only 11 years of operation.

Eleven years after the peak, North Slope production had declined to less than half the peak volume. To use Mr. Hutchins’s words, it is of passing interest to note that in California, the Klondike, and Alaska, production had declined to roughly half the maximum value within the same period of time it took to reach the peak. Today, production is only slightly more than 24% of the peak, and it continues to decline. Through June this year production was 35,000 barrels per day less than the average production rate in 2010.

Without some type of North Slope game-changer, production will by decade’s end decline to the minimum TAPS operating capacity of 350,000 bpd.2 Currently, it is believed that a flurry of new projects including projects that are already under development and those that are under evaluation will significantly slow the rate of decline.3

One such project is BP’s Liberty project, which is currently a couple of years behind schedule and delayed indefinitely. If or when the Liberty project comes online, North Slope production will be goosed by an estimated 40,000 bpd, which will essentially add one year to the operating life of the TAPS. There is a danger associated with making hasty generalizations from the performance of just one field, but if the technologically challenging Liberty project is indicative of challenges that will be encountered elsewhere, it stands to reason that other new projects may encounter similarly long delays. And if this is the case, production will decline more quickly than is currently being anticipated.

The problem of declining rates of North Slope production is compounded by the engineering specifications of the pipeline system. At lower flow rates, the length of time required for a barrel of oil to make the trip from Prudhoe Bay to Valdez lengthens. In 2008, the trip took 12.9 days, and the temperature of the crude, which entered the TAPS at 110 degrees Fahrenheit, fell to just over 55 degrees by the time it reached Valdez. Longer transport times subject the oil to low ambient temperatures for longer periods, and as the temperature of the crude in the pipeline falls, paraffins begin to precipitate at ever increasing rates. The paraffins, which were once used (and still are used) to waterproof Klondikers’ jackets, behave much like arterial plaque when they precipitate in pipelines.

Longer transit times also allow emulsified water to separate from the crude. As the water separates it collects in low spots where it greatly accelerates pipeline corrosion. Under the right/wrong circumstances the water can freeze, thereby constricting flow, or worse yet, breaking free and damaging pumps.

Additionally, the Low Flow Study Project Team hired by Alyeska Pipeline Service Company explains that, “Lower crude oil temperatures will permit soils surrounding the buried portions of the pipeline to freeze, which will create ice lenses in certain soil conditions. Ice lenses could cause differential movement of the pipe via frost heave mechanisms. Assuming no heating of the crude oil, ice lens formation is predicted to occur at a throughput of 350,000 BPD. Unacceptable pipe displacement limits and possible overstress conditions in the pipe would be reached at a flow volume of 300,000 BPD.”4

If the long-term rate of decline remains fixed at 35,000 bpd, and it makes financial sense to re-engineer the TAPS to handle lower volumes, only 239,000 bpd will be produced in 2020. If it does not make financial sense, and the decline is not significantly slowed by production from new fields, North Slope output will fall to zero. Under this worst case scenario, the annualized rate of decline would be roughly 70,000 barrels per day.

Consequently, in order for U.S. oil production to remain flat in the face of North Slope declines, which have persisted for 22 years despite the fact that no fewer than nine significant fields have been brought online over this period, production elsewhere in the U.S. needs to increase by 35,000 or 70,000 bpd. This will be a challenge because the oilfield equivalents of colossal gold nuggets have, by and large, already been discovered.

There are exceptions, of course. It was estimated that the 1 billion barrel Thunder Horse field in the Gulf of Mexico would produce at a maximum rate of 250,000 bpd. Unfortunately, production peaked within 10 months and then fell into rapid decline.

The Rush for Shale Oil

The Bakken formation is estimated by the USGS to have an impressive 4 billion barrels of technically recoverable oil in place. (3 to 4.3 Billion Barrels of Technically Recoverable Oil Assessed in North Dakota and Montana’s Bakken Formation—25 Times More Than 1995 Estimate—) While this is a significant amount, it should be pointed out that the Prudhoe Bay field was more than 6 times the Bakken’s size, and Kuparuk was 1.5 times larger. It also bears mentioning that the Bakken oil is trapped in two layers of impermeable shale and a layer of ‘tight’ sandstone. In order to extract oil from the middle sandstone layer, producers utilize the process of hydraulic fracturing pioneered by natural gas producers. The process of hydraulic fracturing should not be confused with hydraulic mining, though similarities abound.

Hydraulic fracturing, or fracing, involves pumping millions of gallons of fracing fluid (a mixture of water, propants, and chemicals) per well into the earth under pressures great enough to fracture rock and release the oil. As a consequence of the process, flow rates from shale oil wells are low compared to the high flow rates of wells tapped into large conventional fields.

Whereas conventional wells like those in the Thunder Horse reservoir produce at a rate of 40,000 bpd, only 14 of the nearly 9,000 wells in the Bakken produce more than 800 barrels per day, and the average well produces only 52 bpd. Even at 800 barrels per day, 50 Bakken wells would need to be drilled for each Liberty/Thunder Horse size well, and nearly 800 of the average size Bakken wells would be required.

In order to arrest North Slope declines, 700 average size Bakken wells will need to be completed each and every year.

Due to the massive quantity of water required by the hydraulic fracturing process, the chemical cocktail that is added to the water to create fracing fluid, and the massive amount of dangerous wastewater generated by the process, environmental activists, or ‘fractivists’ as I like to call them, oppose hydraulic fracturing. Thus far, fractivists have turned a blind eye to Bakken production, choosing instead to focus on natural gas fracing in the far more populated areas along the Marcellus Shale formation that runs along the East Coast.

Fractivists have attained some level of success in New York, Pennsylvania, and France. The fractivists’ success has engaged the oil and gas industry’s fight or flight response, and elicited a relentless pro-fracing propaganda campaign. It appears as if this campaign has successfully enlisted prominent boosters who hold court in the Wall Street Journal and The Financial Times.

Regardless of whether or not fractivists target the Bakken, there is no escaping the fact that the Bakken wells are merely flakes of gold dust, and Prudhoe Bay and Kuparuk are the oilfield equivalents of colossal nuggets. And history teaches us that replacing nuggets with dust is at best a stopgap measure. While gold production in California continues to this day, production will never climb to anywhere near the peak reached in 1852 despite the fact that gold now trades at $1,800 per ounce and extraction technologies have improved by leaps and bounds.

Within this historical context we can sift the Bakken hope from the hype. The good news is that Bakken output rose from 130,000 bpd in June 2003 to over half a million barrels per day today, and is well on its way to producing a 750,000 barrels per day of high quality shale oil. Of course an analogous statement could have been said of California gold production in 1853, Klondike gold production in 1899, and North Slope oil production in 1987, so the danger of extrapolating past trends into the future is clear. That said, the growth rate is impressive.

Every silver lining has a cloud, and the bad news is that Montana production peaked in December 2006 and has already declined to 62% of the peak volume. This decline in Montana’s production indicate that what is commonly billed as a homogeneous geologic formation is in fact heterogeneous. The pattern of production suggests that the region of economically viable and productive wells is not ubiquitous, but rather concentrated in a few important areas. (Link for more on this topic)

The Bakken narrative being constructed by the likes of Yergin, Crooks, and Luce is hopeful, yet incomplete. Production from North Dakota is climbing rapidly, but production in Montana and, more importantly, Alaska’s North Slope is declining. When taken together, a picture resembling the shadow of truth emerges. The Bakken boom has simply hidden a much more troubling trend; it has nearly perfectly balanced out the decline in North Slope output.

Parting Thoughts

George Orwell wrote that, ”He who controls the present, controls the past, and he who controls the past, controls the future.” There is more than a nugget of truth in this statement. The future is guided by the stories which shape our imagination and our perception of what is possible, and therefore what is pursued.

Just like Samuel Brannan marketed the California gold rush and the Seattle Post-Intelligencer marketed the Klondike gold rush, the Bakken boom is being boosted by those that stand to benefit from production, namely the oil and gas producers, oil field services companies, and the producers of inputs consumed during the process. These entities recognize their vulnerability to fractivism, and I suspect that they are behind the recent surge in boosteristic promotion of the energy independence meme.

The Bakken narrative being constructed by its proponents thrusts forth two main points. First, recent technological advances have opened the door to bountiful energy supply, so much so, that talk of energy independence has re-emerged. Second, alternative/renewable/clean energy requires subsidies that we (i.e. the U.S.) can’t afford, that the public doesn’t want, and that go against the free market ideology that Milton Fiedman chipped into the impenetrable stone walls that fortify the Chicago School. From these propositions it is concluded that shale oil and gas are not simply the best option for our non-negotiable way of life, they are the only option.

This narrative is enticing to many politicians and much of the public because it fits into a greater national narrative that holds at its core the primacy of market-led American ingenuity. When faced with a challenge, American entrepreneurs always emerge victorious, resource limits be damned! Or so the thinking goes.

A sober reading of history, however, suggests that the Bakken success story fits a well-established pattern in which every natural resource boom is followed by an inevitable decline.

Sometimes history provides us with lessons that we don’t want to learn. Gold dust can’t replace colossal nuggets, shale oil can’t replace giant conventional oil fields, and wishful thinking and ideological fortitude is no substitute for dispassionate analytical rigor.

- USGS National Assessment of Oil and Gas Factsheet: Assessement of Undiscovered Oil Resources in the Devonian-Mississippian Bakken Formation, Williston Basin Province, Montana and North Dakota, 2008 [↩]

- Low Flow Impact Study. FINAL REPORT. June 15, 2011. Prepared by the Low Flow Study Project Team at the request of Alyeska Pipeline Service Company [↩]

- Duvall and Molli, February 16, 2010, “Oil and Gas Production Forecasting: Presentation Given to the Senate Finance Committee, Alaska Department of Revenue” [↩]

- Low Flow Impact Study. FINAL REPORT. June 15, 2011. Prepared by the Low Flow Study Project Team at the request of Alyeska Pipeline Service Company [↩]

Thank you Jonathan and Derik for an excellent post and a fascinating historical perspective on how intractable a problem resource depletion really is and how unyeilding it can be to even the best, so called, technological solutions...

Unfortunately it has made me thoroughly depressed!

I wouldn't get depressed, it's just another of the resource booms that North America has been through, and I worked in the oil industry long enough to be through several of them. You learn to go with the flow.

The take-away message for Americans is that the steeply rising production of the Bakken Formation is not a steeply rising hyperbolic curve that will go on to infinity, it is just the first part of a typically bell-shaped curve that will peak and start to decline in the not-too-distant future.

People who get involved in these resource booms tend to get overly exuberant at the start of them, get into it at the top, and lose their life savings as boom turns to bust. There are a lot of predictions in the media that this boom will go on forever and all of America's energy problems are solved, just like all of the previous booms have been overhyped, dating back to the California gold rush.

A secondary point is that the Bakken boom is masking the reality that the much bigger Alaska North Slope boom has turned to bust. The Trans-Alaska Pipeline is approaching minimum operating levels and will have to be shut down and abandoned if they don't find more oil in the high Arctic within the decade. Odds are they won't. (That's just a personal opinion based on the fact that I used to work for a major oil company which drilled billions of dollars worth of wells in the high Arctic, and which no longer exists.)

That's the part I find depressing. We just can't seem to find a way to accept reality as it is. We want the party to continue and refuse to do what we really need to because of it. Making our long term prospects all the worse.

I find in my reading very mixed signals, reading under the news sound bites, on oil and energy. I definitely think the price is going up, and I do think that will bring online additional supply, but this has an economic cost and will lean hard on demand in developed countries.

Regarding TAPS, there was a court settlement this past summer regarding property taxes for TAPS. To determine property taxes on the asset, its value had to be established in the court. This is the resulting decision:

http://aws.state.ak.us/officeofadminhearings/Documents/TAX/TAX06SARB%20A...

There is a lot of crazy stuff in this document and is a must read for any pedantic oil bug, particularly if you follow US or ANS oil production. Basically they taxed it on the finding of the court that it would continue to operate for several more decades. The court even found that if TAPS didn't exist today, it would be built from scratch to develop the proven reserves as of the property tax date.

Consider all the north Arctic oil fields will flow through TAPS for the same reason Prudhoe did not ship oil and instead chose to build a pipeline.

I have no doubt the rear view mirror of TAPS shows the declines everyone expects, but in this case there is only one conduit for any new fields in the north slope, ANWR, the Naval Reserve, and/or off shore in the Arctic; TAPS.

This also coincides with a huge tax debate on oil revenue/taxes in Alaska this year. Something I have been keeping a very close eye on.

I would very much entertain informed opinions of all stripes on the subject.

Regards,

Cooter

Alaska is going to be in deep financial trouble once the Trans-Alaska pipeline is shut down and abandoned, because that will strand all the remaining oil on the North Slope.

Unless oil companies make some major finds in the next few years, that is going to happen. The pipeline, as noted in the article, is approaching minimum operating levels, since you can't operate a pipeline at low flow under Arctic conditions - it freezes up. The Prudhoe Bay field, the biggest oil field ever found in the US, is nearly exhausted and there's not going to be enough production from it to keep the pipeline operating.

What are the chances of oil companies making big finds in Northern Alaska in the next few years? I don't know, but I did work for a company that spent billions of dollars on the Canadian side of the international boundary, including the Beaufort Sea, and we didn't find much oil there. Lots of natural gas but not much oil. Actually, we did some drilling on the US side and we didn't find much oil there, either.

I googled across this paper about delaying the shutdown of TAPS by doing a North Slope Gas to Liquids facility.

http://www.netl.doe.gov/kmd/cds/disk28/NG7-2.PDF

The 300,000 barrel per day GTL facility discussed would be very large.

Hi RMG,

I am of course a complete amateur when it comes to oil, having never worked in the business except to drive a truck loaded with it on a few occasions.

But it seems to me that it ought to be profitable, considering that everything else is in place already, to burn some of that oil along the way to keep it hot enough to flow.

Has this idea been considered, to your knowledge?

This would obviously involve tapping the line and building some sort of heating stations at intervals along the length of the pipeline.

I can think of a number of ways that this might be accomplished-for instance a six inch flue a hundred yards or so long could be installed inside the main line, and air and ng fed in one end, cool air exhaust well enriched with co2 of course out the other end

It also occurs to me that it should be possible to simply add a thick layer of insulation covered with a metal skin for resistance to the elements to the existing line, considering the cash value of the amount of oil that will be stranded otherwise.

I'm willing to bet that a bunch of motivated engineers could invent (if necessary) a system that would allow this to be done with only a few men and still apply miles of insulation every day.It would be expensive as all get out of course, but a few hundred thousands of barrels a day at a hundred bucks per barrel ain't exactly chicken feed.

Furthermore it might well be possible to salvage all the materials involved after five years or so if this scheme could be implemented and it kept the line open that much longer.

It also occurs to me that it should be possible to simply add a thick layer of insulation covered with a metal skin for resistance to the elements to the existing line, considering the cash value of the amount of oil that will be stranded otherwise.

from a page of general specs you might find interesting.

The foam insulation is 3.75 in thick in above ground sections and 3.2 inches thick when buried. The shiny skin you see at mile 522 (in the picture in the main post) is a metal sheathing aroung the insulation. More insulation would probably be better. I'm betting lots of low flow design alternatives are being kicked around these days, including adding heat as you suggest. If you skip to the near the end of the comments I've a blockquote and a link to an Alyeska low flow study you might find interesting.

Of course anything retrofit would have to be able to stand up to a 7.9 quake as well as the current system has (736 KB pdf).

This winter is the busiest exploration season the North Slope has seen in a very long time--we'll see if it bears fruit. But of course the pipe is still getting older every day and worn with every passing barrel.

Thanks for that drawing & link, it explains a few things I was wondering about.

NAOM

How come the minimum operating level of the TAP has not been used as a powerful excuse to drill ANWR? Or has it been used but it wasn't deemed persuasive enough?

I could be wrong (here to learn!) but my understanding is much development is blocked at the federal level by permitting, safety approvals, design/documentation review, and so on.

I am not saying safety and environmental concerns are not serious nor important (they are very important), I am just saying that its been stalled at the "approval" stage (i.e. federal) for a long time. My read is the stalling is more political than scientific.

A good example recently in the news is Shell off shore arctic exploration. They bought the leases (billions) but were not given air quality permits to being actual exploration. This is coupled with the short summer window to get in and get the work done.

This kind of stop and go seems very much the norm.

Regards,

Cooter

Great article! I really enjoyed how the author tied those two resource stories together. That graph of the combined oil production speaks volumes. It should be the background image when those Peak Oil Deniers speak in public. Then again, most Americans have no idea how to read a graph. I guess the smart thing to do is find and take advantage of the opportunities that decline brings, while others flail around panning for those flakes.

Thanks for a great report! I find it interesting that I had the opposite reaction, this makes me hopeful.

The sooner the myth of oil abundance is squashed, the sooner we can direct our labor towards policies which might mitigate the looming energy shortages.

Now the true believers would not be convinced by this post, they would move on to Tar sands/ heavy oil and keragen (oil shale) and use the resource numbers to paint a bright picture.

I cannot understand why the distinction between resources and reserves is so poorly understood by the main stream media, most of the general public seems to think the "R" words are synonyms.

DC

Jonathan - Nothing to add about the Bakken...not my area. But I will update a bit of the CA gold rush history you offered. In 1980 I went to work for a company (Natomas North America) founded by Mr. Sutter (owner of Sutter's Mill). One of the oldest US corporations. After many decades of gold mining the company reclaimed one of its mined out areas and built a planned community thus becoming a real estate power in CA. Along the way they also picked up the American President's steamship company. Many folks see their containers as they wait for the train to pass. Easy to spot: the containers carry at big red logo that looks a lot like the German Luftwaffe symbol. Watch for them net time.

Now the oil patch connection and the ultimate "bubble" tale. A group had been drilling one dry hole after another offshore Indonesia. One partner gave up and sold their interest to Mr. Sutter's new oil company...Iapco. New in that they had no one in the company with any oil patch experience. I was told it was just one of those country club handshake deals. So with no understanding of the exploration biz at all they participated in the next wildcat. And that well discovered a 1+ billion bbl oil field. Who says you have to be smart to make it in the oil patch?

Now that the company was a "proven oil finder" they decided to open up ops in the US. And that's who I handled operations for...Natomas North America...named after a N. CA Indian tribe. I'll make a long and painful story short: at the height of the post-embargo boom they spent $550 million and developed $40 million worth of reserves. They followed the concept of "if we build it (spend it) they (the oil/NG) will come". They were very wrong. I could go on for 10,000 words about the incompetence/corruption from the top down. So bad 2 FBI agents showed up unannounced a few months after I quit. But I won't. Eventually they liquidated the company to pay off the debt. Somewhat ironic that a commodity boom created and destroyed the same company.

Obviously neither the Bakken or any other shale play will bust on such a breath taking scale. But it does indicate the danger of basing future expectations on current stats...for a very short time NNA was the most successful oil company on the planet. In fact, unless there is a crash in oil prices I don't expect any of the oil-rich shale plays to bust. But they will peak for two good reason: relatively short significant production lives and they will eventually run out of locations to drill. Almost 3 decades ago one of the hottest plays in thw country (much hotter than the Eagle Ford or Bakken today) was the Austin Chalk... essentially a fractured shale made of carbonate (limestone) material. One big factor in the boom: frac'ng. As I've pointed out before fracs are not a new game changer. I did my first 500,000 lb frac over 32 years ago. And neither is frac'ng horizontal wells "new" technology...that was being done in the AC towards the end. But the end did come in Texas: nearly all the viable AC locations had been drilled within 10+ years.

Since the AC boom many companies have tried to develop other shale plays in Texas including the Eagle Ford. I drilled and frac'd my an EFS well over 25 years ago...poor results. The problem with all the other shale plays in Texas was pricing: it wasn't high enough to justify much development. Two major factors have changed. First, obviously oil prices. Second, not obvious to many outside the PO world, is the inability of public oil companies to drill enough conventional wells to survive. IMHO without the fractured shale plays most public oils would be looking at significantly lower share prices. And that'sonly for the ones still in business. The Bakken appears to somewhat straddle the fence between conventional and non-conventional plays. But eventually it will come to an end. Temporarily if oil prices fall or permanently when there are no locations left to drill. No prediction when such events might happen.

My old man has some oil royalties he got from his father. Being a geek with an interest in this stuff, we talk about things to some degree (he used to work for the Railroad Commission in Texas as an auditor). So, very different views on the subject, but not always in disagreement.

One of the "gut feelings" I have with shale/fracking plays is that (1) the capital costs are very high to drill/frack and (2) the production curve is pulled forward in time so it spikes sooner and declines faster. This lead me to the opinion that fracking is dangerous in terms of debt accumulation/speculation; a company can put out great numbers, but only with significant capital inputs, creating a ponzi kindle pile waiting to burn to the ground.

Is this completely off base? I know its not this simple, but looking to validate the observation for at least some of the volume of activity going on ... because I expect a big fat debt bust at some point.

The conversation turned, last we talked about it, to the big boys picking up the lease pieces after the fact, but I digress. :-)

Regards,

Cooter

I think that is what Arthur Berman has been saying about shale gas for a while. Check out his writings.

Great article! I especially liked how you presented the correlation to gold mining. Those in the trade likely have a mental picture of a 'field'. To many it is some spring fed underground lake we suck oil out of, and declining production does not mean 'out of oil'. The gold mining correlation puts an undeniable economic 'limit' to what can be expected. Very well done!

The Alaskan pipeline flow/mechanical problems, there must be an economic point where you just turn it off? Like the gold dredges stuck high up those streams in Alaska, they are not worth dismantlement and removal. They dredge uphill and then are economically stuck. Will the pipeline be the same?

I would think that a news blip about permanently turning off the Alaskan pipeline would send a collective tremor throughout our society. On the other hand maybe by then we will have other much more urgent problems.

I am not an industry professional, but my understanding is that as the flow rate goes down, the operational cost goes up. This is due primarily to corrosion related to reduced flows. I think the current "cut off" is a point on a cost/benefit curve where costs become rapidly more significant.

Regards,

Cooter

The problem with the Alaska pipeline is temperature. The oil is hot as it goes into the pipeline, but the temperature falls as is moves down the pipeline. The less oil moving down the pipeline, the more the temperature falls. If the temperature falls below the freezing point, the water in the oil will freeze and block the pipeline. Then they will have to wait for summer for it to thaw out.

It's actually more complicated than that because the wax in the oil will congeal before the water freezes. They can run a "pig" down the line on a regular basis to clean the wax off the walls, but as the volume decreases and the oil temperature falls, they have to pig the line more often. As volumes drop the wax problem gets worse and worse, they can't keep up, and the wax blocks the pipeline.

If they had built a smaller pipeline, they wouldn't have as many problems, but they assumed that Northern Alaska would produce 2 million bpd for decades, and that didn't happen. It produced over 1.9 million bpd for two years, and then production went into decline. There's not enough oil up there for the size of pipeline they built.

Would a "pipe within a pipe" technique extend the useful life enough to be worthwhile?

Probably not. I'm sure they've gone through all the alternatives. The problem is that new construction would be uneconomic at probable current and future production rates. The fields are at the end of their productive lives, after all.

In the lower 48 states they can keep old fields running almost indefinitely because it costs almost nothing to operate them and take the oil to market after the up-front costs of drilling the wells is paid. The same is not true of Northern Alaska or deepwater offshore.

RMG

Do you know if it is feasible to convert the 48" oil line to transport gas, in the meantime a smaller, more suitable sized oil line could be built in parallel. This could solve he stranded gas and oil problems in one hit with a lower CAPEX.

Obviously a gas pipeline extension to the US or a LNG plant would also have to be built.

The big push now is to build a natural gas pipeline, dubbed the "Alaska Pipeline Project", which would parallel the TAPS down to Delta Junction where it would branch off towards Canada. The alternative would be to follow the TAPS all the way to Valdez, thereby requiring an LNG facility, port calls, etc.

Here's a link to the map (http://thealaskapipelineproject.com/project_map)

My understanding is that Alyeska's preference is to bring more oil online to keep the flow high. If that doesn't work, plan B, would be to heat the oil at one or more spots along the route to Valdez.

Also, if they do shut it down, they are required by law to dismantle the entire thing. OHHH>>> think of the cost (energy, financial, etc.)!

Dandyone,

Thanks for the feedback, I hadn't seen any Plan B options being discussed, except for turning the gas to methanol and sending it down the oil line. A few heat exchangers down the line seem a simple quick short term solution than may need to be for the long term.

When / if the gas is finally sent south and not reinjected into the formation then the well head pressure will drop at an increasing rate and will lead to lower oil production than the current decline rate indicates and thus compounding the problem without other discoveries being brought online.

An excellent post.

I was just wondering if they couldn't ship the oil from the north coast? If the arctic seas are becoming less iced up this surely might be feasible, particularly if there isn't the huge volume of oil. Obviously I'm missing something here though?

I think you missed the most relevant boom 'n bust story of all: Spindletop.

When I first moved to Texas in 1999 a neighbor told me that life in many Texas communities could be summed up as:

"Before the oil boom, during the oil boom, and after the oil boom."

One of the ironies of the current Lower 48 renaissance is that global conventional crude oil production is at about the same stage of depletion at which the Lower 48 and the North Sea respectively peaked in 1970 and in 1999 (HL models). So, the current plateau in global crude oil production and more importantly an ongoing decline in Global Net Exports of oil (GNE) and in Available Net Exports (ANE, i.e., GNE less Chindia's net imports) have contributed to global crude oil prices rising at an average annual rate of 15%/year from 2002 to 2010, which has supported the US Lower 48 drilling boom.

Incidentally, I estimated that the average net rate of increase in total US crude oil production, after depletion, from 2009 to 2011 was 170 bpd per drilling rig (drilling for oil) per year.

Global crude oil (C+C) production in 2005, in black, lined up with North Sea production 1996 (different vertical scales):

And a related essay:

http://www.energybulletin.net/stories/2011-12-02/de-constructing-wsjs-front-page-story-“us-nears-milestone-net-fuel-exporter”

De-constructing the WSJ's front page story, “U.S. nears milestone: net fuel exporter”

About this graph - I may be mistaken, but it seems odd to compare both of these peaks on a 26 year basis. Seems like a more accurate representation would be had with estimates of total recoverables in North Sea, and Global, and showing time frames proportional in ratio to that quantity: say 26 years for North Sea, and 100 for Global - that's just a WAG, but you see my point. Otherwise it seems to easy to point out that these curves' resemblance could be incidental, not relational.

Based on the HL plots, conventional global crude oil production in 2005 was at about the same stage of depletion at which the North Sea peaked in 1999, but as noted above, the North Sea peak was really more of a seven year plateau. I was basically asking a "What if," question, to-wit, what if global conventional crude oil production is on a similar multi-year plateau?

Here is a "Yergin Gap" chart showing where we would have been in 2010, at the 2002 to 2005 rate of increase in global C+C production:

wt

I don't dispute the fact of it or this here yergin gap. I just wonder what the other graph looks like corrected for time proportional to total estimated recoverables. just curious, because the 'features' of the longer term peak can look like anything - they can look like North Sea, or Jesus Christ - it's arbitrary, unless the measure is consistent - at least that's my understanding, correct me if I'm wrong.

Interesting how the author compared early gold mining to shale oil. Today we are way past mining gold flakes, rather its down to gold dust. The same can be said about silver in the U.S. if we factor in the by-product factor of gold, copper, lead and zinc.

U.S. SILVER MINING STATISTICS

In 1935 36.1 million total tons of ore were mined in the U.S. (including copper, zinc, lead, gold and silver). Silver production was 48.9 million oz at an average ore grade of 1.35 oz/t.

In 1979 252.2 a total million tons of ore were mined in the United States. Silver production was 52.7 million oz at an average ore grade of 0.77 oz/t.

In 1993 (last complete records) a total of 483.7 million tons of ore were mined and silver production was 52.7 million oz at an average ore grade of 0.11 oz/t.

Just like shale oil, mining silver takes a great deal more energy to mine than it did when higher quality ore grades were available.

Furthermore, the aspect of GNE and ANE will be impacting gold and silver export in a similar fashion. With the ongoing collapse of the Fiat Monetary System, gold and silver will behave more like a monetary metal and exports will decline due to domestic increased consumption used in backing a monetary system.

Unlike oil, silver has both a monetary and an industrial dual demand. I would not be surprised to see the big exporting silver countries like Mexico, Peru and China keep a larger percentage of their gold & silver production in the next several years when the 4 decades of Fiat Money Amnesia finally wears off.

Would love to talk offline at some point. My email address was in the header.

-Derik Andreoli

In the long run, i.e. 10 years, I think you will be correct. In the near term, however, supply/demand issues along with the need to generate income may keep at least Mexico and Peru exporting. (China is acting with very long term interests in mind.)

Interestingly, as recently as 2003, 1/3 of US silver consumption was used in photography. From the US Minerals databrowser:

I think it is safe to assume that the amount used in photography is much closer to zero today. I wonder what US total consumption of silver was for 2010? I also wonder what the current global breakdown by usage is?

Curious,

Jon

Jonathan... I don't want to spend too much time on the subject of silver in this thread as it is a bit off topic. That being said, according to the 2009 USGS Silver Yearbook we had the following:

TOTAL SILVER USAGE = 5,110 tonnes

Industrial = 3,000 tonnes or 59%

Coins & Medal = 1,050 tonnes or 20.5%

Photography = 680 tonnes or 13.3%

Jewelry & Silverware = 360 tonnes or 7%

---------------------------------------------

Photography has fallen significantly as the consumption has moved into electronics such as digital cameras. What to take notice is the huge increase in Coin & Medals. In 2003 total US Mint Silver Eagle sales were 9.1 million. In 2009 there were 28.7 million and this year it looks like we will see nearly 40 million Silver Eagles sold.

According to my calculation U.S. silver production is going to decline 3-4 million oz in 2011 to about 35 million oz. Thus we are producing less silver domestically than our own demand for US Mint silver eagles.

Lastly, your 10 year timeline for the this sort of change over may be a bit optomistic. I see this occuring much sooner... maybe 1-3 years.

Going to keep my thoughts on this simple, and I have read a great deal on this subject, but silver is an inter-generational gift. By this I mean if you are older and want to buy something cheap today and have it be dear when your grand kids get it, buy silver and will it to them. Otherwise, don't bother with the get rich quick scheme.

With that said, I am full aware of current industrial demand, mining output, investor demand, COMEX issues, re-hypothecation, leveraged paper, and above ground supply. I own silver. I think it has value. But I wouldn't go nuts on silver unless you plan to barter with with during a collapse or you intend to give it to descendants.

For the record (and to illustrate my point), I put together a money game, built around Richard Maybury's book "What Ever Happened to Penny Candy" where the game included an envelope for each chapter where each envelope had a silver dime, quarter, half dollar, or peace dollar in addition to a fiat note from around the world. Only one money could be kept. I also promised silver eagles for the reporting on specific books which I prescribed. The envelopes had choice quotes and history bits, from the likes of Will Rogers, the founding fathers, and so on; good stuff you can experience young, remember, and appreciate as you experience life over the years.

If you are old, think of silver like this, and don't be afraid to keep a little extra to will away. I had a lot of fun putting my game together for my oldest nephew. I plan to do the same for all of my nieces and nephews.

Regards,

Cooter

RE silver use in photography

As I understand, about 60% of silver used in photography was able to be reclaimed by extracting the silver from the photographic chemicals. This had the effect of reducing the actual consumption of silver in photography as illustrated by the pie chart above.

It should also be noted that a lot of photography is industrial and has not been replaced by digital yet, think X-Rays, and these tend to be large area plates.

NAOM

X-rays are going digital pretty quickly. If your dentist hasn't gone digital...they're behind the times.

It is not just dental X-Rays but it is true that there is a move to digital. We have a lot of pretty new and high quality medical facilities around here, we are big in medical tourism, and people are still seen carrying around the big snaps. It is not just the USA but the rest of the world too. There are still many areas where plates have an advantage, think curved for example, but overall the move has not been so sharp. The other point with industrial is that the plates are often a lot larger.

NAOM

I suspect the big snaps are old images for comparison from elsewhere - new medical facility radiology facilities are completely digital.

Yes, I've seen a few large-format applications where film is hanging on, but I think that's a very small niche.

Thanks for the detailed historical comparisons and commentary.

It seems to me what the Yergins of the world constantly forget or conveniently neglect to mention is that high oil prices, the kinds of prices that justify going after resource plays like the Bakken, oil itself is uncompetitive with alternatives (read: rail and transit-oriented development), and high prices will ultimately crush demand, at least assuming the market has the capacity to make decisions that allow the natural course of events to follow. But you better believe as oil stays at levels of $100 and above, more and more people in more and more places are going to start taking a MUCH harder look at transit. Sure there will be plenty of obfuscation and demagoguery around the issue, as there always is, but ultimately nothing is going to be able to obscure the facts, which will plainly show continuing down the path of depletion to be the expensive and unsustainable option that it is. Money talks, BS walks, and there's no shortage of BS coming out of these shale plays, in fact I would say the term aptly describes the entire endeavor, since all we're really talking about is sinking money into a hole in the ground, never to be seen again.

The reason they don't talk about this part, and instead say higher oil prices automatically lead to continuing growth in supply, is of course that the people who pay for their consultation "services" will be put out of business by these perfectly natural developments.

My understanding, and I would love reading to the contrary, is that demand will crush in developed nations who have the discretionary diet. In developing countries, the per capita consumption is so low and the utility value so high, they will pay the price and want more.

Given the growth rates in developing countries and flattening world production, that is a scary realization. I think the high prices are here to stay and will only be going higher as a long term daily moving average regardless of market crashes (i.e. decoupling).

Living close to work is about to be a hard asset.

Regards,

Cooter

I don't much like comparing things that are different. Clearly mining gold and fracking shale for oil/gas are different even though both occur in a bell shaped curve.

The big difference of course is that gold once mined is not consumed.

Most of the gold ever mined still exists today. Whereas oil/gas are used up shortly after production.

Gold at the time of the gold rush was money. So as more gold was produced the money supply increased.

To my mind comparing gold mining to oil production leads to overly optimistic scenarios. So the Bakken causes a little pimple on the back side of Hubbert's curve which some interpret as the beginning of a mountain.

But the mountain is illusory as the article points out. In the case of gold a pimple on the back of the bell curve adds to the total supply of gold ever mined and to what is available for use. With oil the pimple adds nothing but a delay in the decline.

The Bakken buys time which is no small thing at this point, but it does not really add much to the total supply as is the case with gold mining.

Both gold mining and the Bakken are ruled by depletion, but the gold mined a hundred years ago is still with us today. Not so with oil. It is gone in a short time.

true, and gold was never the hard platform of our supply chain including the creation and transport of food, except in the abstract sense of currency. Likewise, when the gold rush dried up, dreams of wealth were simply packed in. It won't be so easy to pack in the expectation of cheap food and water. We'll tear this place apart looking for energy in ways that make the Yukon trailings look like chicken scratch - and we already are.

x, i do so enjoy your perspective, and adopt it as my own from time to time.

i hope you don't mind,

ryan

Oh yes, The Bigga Bakken Boom is also like the music to the ears that somehow eventually manages to gather dust.

Excellent, much appreciated post!

These "gold rushes" are resource-wreckers. If you take a good look at any mining district - you'll get the idea. It's a hodgepodge of staked claims, some patented some not, various ownerships from serious miners to land grubbers, competitors, villians, etc. A real mess. you can have more than one operator/miner on one vein for instance.

In terms of petroleum extraction, there are many operators within the same rock unit/formation all using "propriatory enhanced recovery methods" of extraction. Who the hell knows whos method is working well, whose is working poorly and whos f****ng up the formation? let alone the land issues, which in my mining district are a cluster f***.

Sorry everybody, but the author's thesis gets thrown way off because he is using hopelessly out of date information about the estimated recoverable oil in the Bakken. The number used by the oil companies involved is 24 billion BOE and growing, which already puts it on the same scale as Prudoe Bay. A bias towards peak oil seldom results in accurate articles or credible websites. Try going to contres.com and doing your own research on the Bakken from the people, who know what they are looking for, and where and how to find it. If you don't know who Harold Hamm is you very likely have no idea what's going on in the U.S. onshore oil industry these days. I dare you all to start to educate yourselves by clicking on that link, rather than mindlessly repeating your peak oil mantras.

The chemistry of the fluids and the physical properties of the rock units are completely different.

Thats OK, it looks like he needs some help.

Prudhoe bay:

http://www.d.umn.edu/~hoef0049/prudhoe.html

Bakken:

http://en.wikipedia.org/wiki/Bakken_formation

Bakken:

http://www.ags.gov.ab.ca/publications/wcsb_atlas/a_ch31/ch_31.html#exshaw

Re: Carl Martin: Member for 40 min 40 sec

I am reminded of Chesapeake's estimate that their DFW Airport lease would have cumulative Barnett Shale gas production of about one TCFe, with late 2011 production of about 250 MMCFGPD. The last numbers I looked at suggested late 2011 production would be down to around 25 MMCGPD, one tenth of what Chesapeake predicted (with cumulative production projecting to be about one-tenth of Chesapeake's estimate), and the kicker is that the last numbers I looked at suggested an accelerating decline rate. And of course the permeability relative to gas is higher than for oil.

But one can show aggregate increasing production,from a group of wells and leases showing rapid decline rates, for a while.

The author's primary thesis is that the Bakken is not going to earn the U.S. oil independence.

The U.S. consumes roughly 20 Mbd, or 7.3 billion barrels per year.

Even if the Bakken is 24 billion barrels in size, if we divide 24 billion barrels by 7.3 billion barrels we get 3.3 years of 'oil independence'.

Now, that isn't very long, and I'd really like to see Mr. Hamm or anyone else, for that matter, explain how the Bakken is going to produce 20 mbd. Even if average well productivity quadruples, that's still 100,000 wells, and at the current average, 400,000 wells would be required.

So, the author's primary thesis stands. As do his secondary and tertiary arguments that the Bakken will be hyped by those that stand to benefit from the search for oil, and that the environmental impact will be lasting.

-The Author

True. Try breathing through a straw.

Say, I like that, don't recall having heard it.

The other day folks were asking for useful peak oil metaphors; that's a great one.

Yes! Thank you!

thats what an asthma attack feels like!

As noted up the thread, I estimated that the average net volumetric rate of increase in total annual US crude oil production, after depletion, from 2009 to 2011 was 170 bpd per drilling rig per year (excluding rigs drilling for natural gas).

What I see is a land rush.

You people are blanket-claiming HUGE areas of LAND in HOPES of extracting as much Oil Equivalent as you can. This says NOTHING for the RATE. You have no good plan, you just blanket claim the formation and make it up as you go. OK?

Of course, it's commercial. Money in money out. That's why they know what's going on. Experience. You sure didn't spend much time there.

Well, there's your problem right there: you do not understand the difference between money and energy.

PDV, Did you educate yourself at contres.com yet??? If you don't think oil is black gold, than you have just revealed that you sure don't know much about the oil business. Why don't you just educate yourself, first? Then comment. You are still caught in my time trap.

Black gold, huh? Hmmmm. But you are right about the time trap thing.

There will be lots of oil produced in the Bakken for sure.

Please explain how production rates in the Bakken are going to achieve North American energy independence in the face of declines elsewhere?

How much water will it take? Where will the water come from? Where will it get treated? How will you get 20 mbd of oil to the U.S. refineries? And if it doesn't go to the U.S. refineries, how can it be earning us 'independence'? And how long will production last at 'independence' levels?

Gimme a break!

-The Author

May I assist?

lots of oil produced/time = rate at which the gasoil is produced

The RATE is EVERYTHING.

To rephrase that last statement: the rate at which we can make energy available to do work matters alot.

Dandyone, All your questions are for the oil companies to answer over time. All you have to do is to educate yourself about these matters by going to all the websites of the oil companies doing all the work. Then you will see how things are taking form, otherwise you won't, as you have quite well proven in your article. The Bakken is not the only shale oil play in the U.S. or the whole world for that matter, and CLR is obviously not the only company involved. But, it is now very obvious to all that have gotten this far in the thread, that you do not access oil companies for information on the oil industry. That's what throws you off track, and into the peak oil camp. Meanwhile, you are still caught in my well devised time trap. So, we all know that you are so far refusing to further educate yourself on the oil industry. You would rather inform others of what is not true, rather than inform others of what is true. This clearly indicates the workings of a biased mind.

Please indicate what *exactly* I have written which is *not* true.

I have argued, in fact, that production from the Bakken will increase, most likely it will increase significantly. But that's not the point. You can argue until you are blue in the face that production is going to go up. I don't, won't, and haven't argued that it is not going to increase.

As for referencing the websites of oil producers, I can guarantee you that I won't find anything about North Slope decline rates on a shale oil producer's website. Nor will I find long range plans regarding where they are going to source water, etc.

So, again, please tell me what I've written which is *not* true.

As for my questions, what kind of blind faith are you high on? If the industry can figure all problems out, why has North Slope production been declining for 23 years? And don't say because of regulation, because regulation is a problem just like water, workers, pipes, and energy.

- Derik Andreoli

In the mining industry we call this "promotion" and the people who engage in it "promoters". Just lettin ya know...

I certainly don't see the US getting energy independence from the Bakken or similar shale oil plays, as the author of this excellent article highlight those shale plays are nothing more then gold dust; however in regards to water usage for fracturing, there are alternative waterless fracking technologies such as LPG fracking (using gelled propane or gelled butane) which eliminates a lot of the pollution and water problems associated with hyrdofracking; Gasfrac out of Canada has done over a 1000 fracks using this technology and with better production results then water based fracking.

Regards,

Nawar

The people pushing mortgage backed securities, prior to 2008, had a pretty good story too.

In any case, one can show aggregate increasing production,from a group of wells and leases showing rapid decline rates, for a while.

Carl - OK...you've done your good dead for the day and educated all the TOD fools. I, for one, don't think you're stupid. I think you understand the situation perfectly and don't really believe the implications you're throwing out. And thus think you will impress folks here. But what you don't appreciate is that you've walked into a group of folks who have been well educated in the type of BS you're spewing. Most here know that it has no bearing on PO whether there is 24 bbl, 24 billion bbls or 240 billion bbls of URR from the Bakken or any other play. PO is all about production rates. And reserve volumes in the ground are not relevent.

You can go on all you want about URR and very few here will care. When you want to talk drilling rates, decline rates, capex/logistic demands, etc. then we can have an honest/intellectual discussion. Until that time you will remain an unuseful mammal in my eyes and warrent no further replies.

ROCK and others above,

I don't think it is appropriate to use terms like "industry shill" or "unuseful mammal" in a forum that discourages ad hominem attacks. I'm going to give Carl the benefit of the doubt for a moment. He pointed us to the contres.com site claiming that it had useful information. Unfortunately, he didn't take the time to point out the technical paper they provide on that site.

In that paper we have:

There is also a table:

Carl's point was not that the Bakken would make the US energy independent. His point was that the 4 billion BOE esimate is too low by a actor of six or more.

Now that I've dug up the information he was apparently referring to can all of you oilfield smarty-pants quit throwing darts at Mr. 42 min 29 sec and put your energies to more useful work -- explaining to the rest of us why the Continental reassessment is so wrong.

Yes, I know to be skeptical of estimates by those who stand to benefit financially. But that by itself doesn't make them wrong.

Please, educate me.

Who care how much there is? It is the rate at which you produce that matters, you can't simply count or more correctly ESTIMATE the number of molecules in the ground. For example, how much oxygen is there? Alot, right? Well, try breathing through a straw. The way this society is arranged, people are mortally dependent on a certain rate of production.

Pretty soon, the people will hold those who claim to be expert accountable for their public remarks. It matters. The accounting is shoddy at best see above comments regarding mining claims and I worry that at the worst, outright deceptive. One can not just count molecules.

The people are DEPENDENT - absolutely dependent on a certain rate of production. Should the production rates fall precipitously, there will be hell to pay. Surely, one as an expert, would NOT want to encourage increased consumption in light of decreasing production rates?

Jonathon:

This is a pretty dodgy 2-pager, not written by anyone inside the business.

It's what's called a teaser sheet.

I'm off to a meeting for the afternoon, but for you, for starters:

1. In the heading, the Continental Resources "technical paper" refers to the "Bakken field", but it's a play,

2. Assumptions #2 .... 500,000 Boe per reservoir (this could mean per well?),

3. This report is unsigned,

4. This report is not apparently written by an Independent Engineering Evaluation Company,

I very strongly recommend you look at USGS FS2008-3021 on their website, on the Bakken.

Then look at Figure 1 and Table 1.

And think ... where are the sweet spots ...

I have a shale gas play in Sudan that has Sudapet pulling their hair out, if you want to take a chance.

What do you mean you "have"? Did you discover or map a "shale gas play"? Really, I am wondering.

Johnathan, Thank you for your support. The wise people in Ancient Greece observed that Ad Hominem attacks were always made by the parties that felt they were losing the argument. In fact, they took these attacks, in themselves, to be an admission of defeat. I see no reason to disagree with them.

I'm amazed by the assumption of some of your fellow travelers at this site that the amount of time I've been a member here is of any relevance at all. I've actually been coming here for years, mostly when I needed a good laugh or two, but just never bothered to become a member until about an hour ago. One thing that has always struck me about this site is "The Bakken Blindspot," where not one single author has come up with anything even close to reality about this formation and it's effect on the whole oil industry. And, this article is a classic example.

Thanks for putting that info out there, but if you dig a little deeper you'll know that it too is getting out of date, and the numbers will soon be revised upward. That info is from about March 2010, or so, and apparently no one at the oildrum was even aware of it until now. Yet, millions upon millions of oil investors have been aware of this all that time. Why do you people think that theoildrum is on the cutting edge of the oil industry?

The fact is all you people are really out of touch with reality, because you are all way behind the curve. More and more oil is becoming available in all the world's shale oil formations, because of almost daily improvements in technology, plus new discoveries. That's why CLR is going to up their estimates again, a combination of new technology and new discoveries. If you keep an eye on their website, you will know when they update their info.

Carl,

I think that the wise people of Athens would have recognized a Trojan posing as an Athenian, pretending to present viable information, for example generalized reassurances as to the relative safety of the city from attack, and they would have called him out for what he was.

Personally I don't mind the 'hijacking' of a thread sometimes because I think that a troll has value in a debate - it challenges the fundamental reality of an argument to have to face down the most obstinate and hard headed of opposition, and this is good practice in developing a solid point of view. After all, stuff talked about here at TOD is against the status quo of business as usual, and what good is it to stand in a circle agreeing with each other if we can't spread the word to the less engaged. It's what this site is about after all.

It's absolutely essential that skeptics and disbelievers, (like you, maybe) get a reasonable response at TOD, and in general in the outer world as well. The trouble is understanding your motives. If you show up here, and jump into the comments by declaring that 'you people are really out of touch with reality', then you'll end up being flamed as a troll and ignored. Had you started with your best data, and asked some questions, people would have been more than willing to reply in good faith.

Had Cassandra been a master of fact, and had she been eloquent, maybe the Trojans would have defended their city. Instead she stated the truth simple and obviously and was ignored by her fellow citizens. You Carl, seem exactly like one of these Trojans to me. You seem to have your head planted in the sand, firmly and resolutely. You don't respond to the facts that people present in good faith, in answer to your links and references. You don't want a good debate on the subject, you simply want to "have a good laugh or two". Well, laugh it up, you might as well - the city will burn with you in it.

You made one mistake: it's posters here at TOD that are the Cassandras, and there is no degree of eloquence or factual mastery that could pierce the din of information assailing the general public.

that was my point :)

I think a key point here, and a cause of much talking past each other, is the conflation of reserves and production. Continental's "numbers" and "estimates" are almost exclusively reserves, which have little to do with peak oil. Peak oil is about production RATE, and so far the growth in Bakken production has only just managed to offset declining domestic production elsewhere.

Time will tell how big a bump the Bakken will make on the production chart, but I for one do not expect it to make the USA the world's leading oil producer again, as some articles predict.

This may suggest the purpose of the document. Investors are aware of it because it was circulated in investment circles. Are you sure it is not dog food hyping the Bakken for investors for the profit of Continental Resources? You seem to think a company trying to sell you something is a credible source of information.

On their legal page is a disclaimer:

Translation: the information on their webpage is all lies.

Jonathan - Sorry if my playful use of "unuseful mammal" offended you. I thought it was a gentle way of expressing my opinion that Carl didn't understand the basics of PO. In fact rather gentle given what I took as his rather insulting tone towards the TOD collective. But IMHO the point is still valid: Carl's apparent misunderstanding of the basics of PO made further discussion pointless.