New Dept. of Energy Priority-Setting Analysis Seriously Flawed

Posted by Gail the Actuary on November 4, 2011 - 11:42am

The US Department of Energy (DOE) recently issued a report called Report on the first Quadrennial Technology Review (QTR), which has as its purpose helping the DOE choose among conflicting priorities.

The new report sets priories based on a distorted view of the future. One issue is that it is trying to set priorities based on an overly optimistic view of energy supply presented in the EIA's International Energy Outlook 2011 (IEO 2011). Another issue is that it overlooks the way the US and world economy can be expected to change as a result of lower oil and natural gas supply. A third issue is that its view of climate change mitigations is based on a view of fossil fuel supply that is far greater than is likely to be the case.

The DOE needs to re-think its priorities for an entirely different kind of world--a world of energy scarcity. In a world of energy scarcity, citizens are poorer and less able to pay for basic services, much less higher-priced services. Maintaining basic transportation and electrical services for as much of the population as possible needs to be a top priority. Some government agency, presumably the DOE, will need to make certain that rationing systems are set up so that essential industries get the fuel they need and essential workers are able to obtain transportation to work.

This change in approach in priority-setting requires a very different mind-set than is currently being promulgated through the press. Let me start by explaining where we are today.

Where we are today

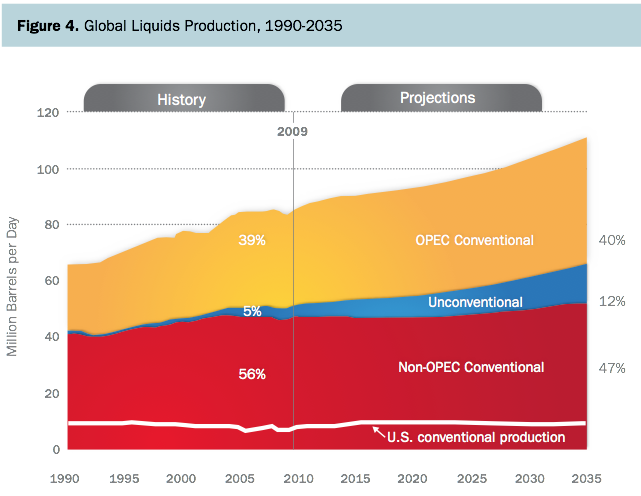

Oil and Substitutes. If we believe the QTR, global "liquids" production (oil and oil substitutes, like biofuels) will begin rising to 110 million barrels a day, after its flat period since 2005.

Data in Figure 1 is based on IEO 2011. I recently wrote a post called IEO 2011: A Misleadingly Optimistic Energy Forecast by the EIA, explaining why the forecast is unrealistic. Among other things, oil prices would need to be much higher than EIA is forecasting to reach the production amounts shown in Figure 1. Unfortunately, these high oil prices would lead to recession and economic decline, resulting in lower oil consumption. Because of these issues, the increase in production shown above is not feasible. In fact, I would expect a decrease in production by as much as 50% by 2035.

Many people do not understand the issues behind the likely decline in oil production. There is plenty of oil in the ground--this is not the issue. The problem is that the oil that is left (such as that in the Bakken and in the oil sands) is slow and expensive to extract, because the "easy-to-extract" oil was mostly removed first. There is plenty of demand for low-priced oil, but high-priced oil tends to "choke" the economy, leading to recession. James Hamilton has shown that 10 out of 11 US recessions since World War II were associated with oil price spikes.

Some people would describe the phenomenon as "peak oil," but I am not sure that this is the best description of the issue. The problem is that the price of oil is increasingly high, partly because of the high cost of extraction, and partly because governments of the countries where the oil is extracted are increasingly "needy," and require high taxes on oil companies to meet their budgets.

High-priced oil tends to choke economies because high oil prices are associated with high food prices (because oil products are used in food growing and transport), and people's salaries do not rise to offset this rise in food and oil prices. People have to eat and to commute to their jobs, so they cut back on other expenditures. This leads to recession. Recession leads to lower oil consumption, since people without jobs can't buy very much of anything, oil products included. In some sense, the reduction in oil extraction is due to reduced demand, because citizens cannot afford the high-priced oil that is available.

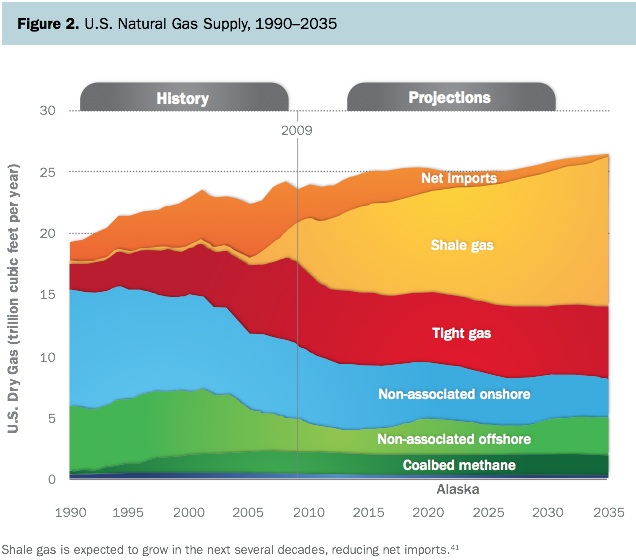

Natural Gas. If we believe QTR, US natural gas consumption is expected to rise modestly by 2035, because of a huge increase in shale gas production. IEO 2011 indicates the expected natural gas consumption increase to 2035 is 10% (24.1 tcf in 2010; 26.5 tcf in 2035).

The huge increase in shale gas shown in Figure 2 is by no means assured. The United States Geological Survey recently produced an estimate of Marcellus Shale resources, which will cause the EIA to reduce its estimate of shale gas reserves for the Marcellus Shale by 80%. There is also considerable uncertainty about long-term decline rates of wells, which would make a major difference in the ultimate recovery of wells. Furthermore, there are concerns regarding whether fracking and disposal of waste water can be done safely, especially near highly populated areas.

If shale gas production in fact decreases, Figure 2 suggests that US natural gas consumption could drop by as much as 30% or 35% by 2035, rather than rising. So there is a wide range of possible outcomes, with DOE's optimistic estimate being a 10% increase in US natural gas consumption. US natural gas consumption is smaller than oil consumption (about 68% as much), so the 10% increase in natural gas consumption would do very little to offset the likely oil supply decrease between now and 2035.

As with oil, there is an economic issue in all of this. How high can natural gas prices rise, without inducing huge recession? How long can shale gas producers "hang on" if natural gas prices are as low as they are now? Without higher prices, there is not much incentive to produce shale gas. If there is recession because of high oil prices, this may cut into demand for natural gas, because laid-off workers cannot afford products made with natural gas, either.

Liebig's Law of the Minimum Effect. If we think of the economy as a "system," it is very difficult to make changes to the economy quickly. We have a huge number of cars, trucks, trains, farm equipment, heavy construction equipment, and airplanes that are not designed to run on anything other than petroleum products. There is no way to change to another energy source for this equipment in the next several years because of the research timeline and the cost of building replacement equipment.

If there is inadequate oil, what happens is that oil prices rise. Because of the long timeframe required to change existing equipment to use other fuels, the rise in oil prices leads to recession. Recession cuts back on demand for all energy products, not just the oil that is in short supply.

If we think of the economy as a system, and oil as a necessary input, this is really an application of Liebig's Law of the Minimum. In agriculture, this law says that if a necessary nutrient is lacking, overall output will be reduced in proportion to the amount of the limiting nutrient. With the economy, if there is not enough oil (reflected in high oil price), the rest of the economy is restricted as well--the amount of electricity used; the number of workers employed; the amount of new loans outstanding; the demand for new homes, etc. This seems to be what happened in the 2008-2009 recession, and is threatening to happen again.

Climate Change. Climate change models do not assume that fossil fuels are a limiting factor before 2100. If more realistic amounts are assumed, the CO2 amounts forecast will be much lower. See for example this estimate by De Sousa and Mearns. If fossil fuel limitations were reflected in the models, the indicated temperature rise would be lower. If the indicated temperature change is lower and if fossil fuel use is declining rapidly regardless of what happens, the need for climate change mitigations would appear to be lessened.

Carbon Capture and Storage (CCS). CCS burns fuel more rapidly than today's approaches, because of the large amount of energy used for sequestration. If oil and natural gas are in limited supply to begin with, CCS is likely to cause us to exhaust the economically feasible supply sooner. Adding CCS also tends to make the cost of electricity higher. Because of theses issues, CCS research should probably be halted, and CCS options should be removed from consideration in the choice of future fuel sources.

Renewables vs Fossil Fuel Extenders. "Renewables" such as wind, solar PV, cellulosic ethanol, and biogas could more accurately be called "fossil fuel extenders" because they cannot exist apart from fossil fuels. Fossil fuels are required to make wind turbines and other devices, to transport the equipment, to make needed repairs, and to maintain the transport and electrical systems used by these fuels (such as maintaining transmission lines, running-back up power plants, and paving roads). If we lose fossil fuels, we can expect to lose the use of renewables, with a few exceptions, such as trees cut down locally, and burned for heat, and solar thermal used to heat hot water in containers on roofs.

What the DOE Should be Focusing On

We do not know precisely how soon oil and natural gas supplies will be declining, but it would seem to be worthwhile to start preparing now. It is clear we are already running into recessionary forces. Since these recessionary forces are tied in with high energy prices, they can only be expected to get worse with time, rather than better. The two major issues I see are

1. We need to keep some form of transportation system operating as long as possible.

2. We need to keep some form of electrical system operating as long as possible, probably transitioning to only local electricity.

What do we need to do to accomplish these goals?

This is too complex an issue to handle fully in a single post, but let me point out a few things that I can perhaps expand upon in later posts.

Low-Priced Oil Substitutes. The DOE should be focusing on dealing with a world that is in long-term recession, with many people unemployed, and governments limited in their ability to pay subsidies. Since a major reason for recession seems to be high oil prices, it would seem to be clear that any substitute for oil that is more expensive is likely to make the situation worse. What we need is oil substitutes that cost $50 barrel or less--cheap substitutes--to help counter the recessionary force of high oil prices. The idea of waiting until oil prices rise, so that some high-priced substitute is competitive, is ridiculous.

Remove subsidies. High energy costs lead to economic contraction. This is true even if the true cost is "buried" through subsidies or feed-in tariffs, because the true cost must be paid, one way or another, either directly, or indirectly, through higher taxes. Subsidies relating to high-priced energy products tend to increase the amount of high-priced energy consumed, so are counterproductive from an economic point of view, unless the subsidy is temporary, and truly leads to a lower-cost energy product.

Alternative Transportation. As the economy encounters more and more recession, fewer will be able to afford to drive. Because of this, there will be a need to provide transportation for poorer people, without adding huge costs to the system. Car pool systems would probably make more sense than adding buses, but buses might be helpful as well. Substituting bicycles for cars would be another worthwhile approach.

People will be giving up their cell phones, not adding them, so systems for using car pools should be simple ("Pick up a rider if you have room, and are going that way") not technically complex ("Call on your cell phone, and an operator will log you into a registry and send a vehicle your way.") Furthermore, technically complex approaches depend on oil for their maintenance and repair, so are more inclined to breakdowns over the long term.

Long-Term Maintenance of the Highway System. As oil becomes less available, highway maintenance will likely become more expensive. At the same time, the number of vehicles using the roads will likely be decreasing. Vehicles that do operate will use a variety of fuel sources--gasoline, diesel, electricity, and natural gas. In such a situation, an efficient approach for collecting needed funds for maintenance might be to use more toll roads. Eventually, as costs become too high, some roads will need to be changed back to gravel, or no longer be maintained.

Long Distance Electrical Grid. The electric grid was never set up for long distance transport of electricity, but in recent years, we have been attempting to use it for this purpose. If we want to use it for this purpose, and in fact upgrade it to add wind and solar production, it seems to me that some governmental organization needs to take ownership of the long distance transmission system. This organization needs to charge fees to long-distance users of these lines, analogous to tolls for highway use, to obtain adequate funds for maintenance, upgrades, and electricity storage. These fees will tend to raise the cost of wind and solar electricity.

Maintenance of the electric grid is petroleum dependent, so costs can be expected to rise over time. At some point, we may find it too difficult to maintain long-distance lines (because of inability to obtain fuel for repairs using helicopters, for example), and may need to abandon some long distance transmission. We need to plan our long-distance electrical use with this in mind. It may make sense to go back to more of a vertically integrated electrical utility model, applicable to individual communities, instead of a system based on long-distance trading. As with "local food," perhaps we need to be thinking of "local electricity".

Solidity of the Electrical System. The electric system and the oil-based transport system are very interdependent. Oil is needed for maintenance of roads and electric transmission lines. At the same time, if there is an electrical outage, oil and gas pipelines stop running, so gasoline stations lose their supplies. Furthermore, pumps at the gasoline stations don't work without electricity. Thus, if we lose one, we lose the other.

We keep making demands of the electrical system that the system was not originally designed to handle--for example, to incorporate more renewable energy; to run the system with less slack through the use of "smart meters," and to sell electricity long-distance using competitive pricing. It seems to me that there needs to be an organization that oversees the electrical system from the point of view of what really makes sense for the system. With the current ad hoc system, even basic maintenance is a problem--much of the transmission system was built in the 1960s, and is beyond its expected lifetime.

Some of the problem areas may be indirect. For example, if the pricing system for wind and solar electricity causes financial problems for companies generating electricity using natural gas and coal, this could lead to the bankruptcy of operators needed to keep the overall system working. In Europe, where more wind and solar PV are used than in the US, the pricing system already seems to be having an adverse impact on companies generating electricity using fossil fuels.

Rationing. At some point, rationing may be needed for both oil products and for electricity usage. The DOE should probably be the one coordinating planning for this contingency. Even if rationing is not needed for quite a few years, planning the details ahead of time would seem to be helpful.

Adapted from a post at Our Finite World.

Gail, while I agree with most of your points here I'd be more cautious about assuming the inevitability of the pending demise of industrial society. The impact of high energy prices upon our economies are two fold. First there is the inflationary impact and as you know price changes drop out out of the statistics one year down the line. The main run up in the recent oil price spike began over a year ago now and by April 2012 most of the inflationary impact of that will drop out of the stats.

The second impact as you point out is on the squeeze on discretionary spending. And here adaptation and improved energy efficiency may make us more tolerant of higher energy prices in the future enabling large lower grade energy resources to be produced. Shale gas presents an interesting test case. If the USA can adapt to run on shale gas then a vast new FF resource enters the CC equation.

"The second impact as you point out is on the squeeze on discretionary spending. And here adaptation and improved energy efficiency may make us more tolerant of higher energy prices in the future..."

Since a huge segment of employment relies very much on discretionary spending, what will those people be doing to "become more tolerant of higher energy prices"? I'm just askin', because many commenters here seem to be systemically challenged. Even greater efficiency and conservation has it's costs. Case in point: My propane guy just left after telling me they've laid off 4 employees due to conservation and lower sales. Two of their five (new) trucks went back to the leasing agency. All of these discretionary and non-discretionary modifications to the economy affect jobs, debt repayment, and growth. Our economy isn't setup for flat or negative growth, and sufficient capitol won't be available to invest in these transitions being spoken of here.

Our family's transition to being far more self-reliant has been quite successful, all-the-while depriving the formal economy of thousands of dollars each year. The propane company, mentioned above, has been only one of the victims of our increased efficiency and adaptations.

As you say, we'll adapt, but I consider Gail's vision of that process to be more realistic. Robbing Peter to pay Paul doesn't make Peter disappear.

I usually draw an important distinction between conservation and efficiency. Conservation is consumption foregone and will be highly recessionary. Efficiency is extracting greater energy service from each unit of energy consumed, enables consumers to afford a higher price and will ultimately be good for growth.

Whether it's efficiency, conservation, or demand destruction, someone is deprived of the opportunity to extract, produce, market, distribute, whatever, said product. Current levels of consumption support current levels of commerce/taxes, current levels of money velocity, current levels of debt, and current levels of employment. Even a one to one replacement of anything for something else requires growth, all underwritten by finite resource extraction, processing, servicing, etc.

Higher efficiency and productivity in the service sector also results in loss of jobs or reduced incomes, in turn depriving the economy of both discretionary and non-discretionary expenditures (inputs). It's what we're seeing now. Our western economies are bloated with non-essential services and products which our planet can't support much longer. Our economies are also bloated with jobs related to these non-essential services and products.

Governments are desperate to maintain this layer of non-essential production/consumption as long as possible because they have nothing to replace it with, at least not at levels required to maintain reasonable employment levels and revenues. Resource extraction will continue until it can't, along with the resulting biosphere degradation. At some point (now?) even the essentials (soil, water, air, rock phosphates) are being depleted to support the layer of non-essential production/consumption (e.g. biofuels, rare-earth metals for smartphones, fish for sushi, on and on), because the jobs/incomes/taxes,etc. that they provide/support are considered essential to the immediate needs of economies. The PTB know their survival depends on maintaining the illusion. Populations will not choose to adapt; they will be forced to, only to find that the essentials for adaptation are in critically short supply. Negative feedbacks ensue.

I'm afraid I find this part to be full of contradictions, though I agree with much of your comment, but then would return to ask what you regard as "essential" and then ask when we last had a world running on "essential" and how we got from then till now without collapse?

Maybe we could agree to define 'running on essential' as the time before fossil fuels became readily available.

We basically got from there till now without collapse because we were able to exploit the cheap energy contained in oil.

That cheap oil it seems is no longer quite so readily available and all indications seem to point to increasingly more expensive (whether you frame it in terms of capital or EROEI) energy.

So the fact that we haven't yet seen the complete collapse of our industrialized civilization should be of very little comfort to any of us. It really is just a matter time before we do see clear and undeniable signs of collapse.

IMHO it is already happening all around us even now! I invite you to spend a day with me, listening to the stories of the people who bring me scrap metal to be recycled... If these people aren't already suffering the consequences of collapse then I'll eat my hat.

The reality is that many of us are still safely isolated from the very stark realities of what is actually happening to more and more people!

"I'm afraid I find this part to be full of contradictions..."

Please clarify. As for what is essential and when we last had a world running on essential,; I find this thinking to be a bit binary. I expect virtually all human societies have expended time, resources and energy on non-essential endevours. Were cave drawings and red ocre truely essential to survival?

The questions should be: When, if ever, has a human society devoted as much of its energy and resources to non-essential production of what is essentially junk destined for the landfill? When, if ever, has an economy been as reliant upon the production and marketing of said junk to support a huge percentage of its population? When, if ever has such a small percentage of a population been employed in the production of things that really matter. When has there been a convergence of unprecidentedly massive resource extraction and a systemic, utter reliance on these declining resources to support economies devoted to the production of things other than shelter, food, clothing, water, and the tools to provide these things?

While these paradigms aren't unprecidented, the scale of our current paradigm certainly is, and while civilizational collapse is in no way unprecidented, the potential scale of this one certainly is. Seven billion humans, running blindly, swiftly into hard, permanent limits to the things they need to survive, suddenly realizing that they squandered must-haves on didn't-needs.

I ask again: What will perhaps billions of humans do to support themselves when it becomes apparent that their economies (and the planet) can neither support, nor need, the services and goods they provide? This is the inevitable result of overshoot. Like Hebrews, suddenly "freed" to wander in the desert because the Pharaohs could no longer support their consumption or afford their services....like Roman Legions, suddenly "released" from duty because the gold ran out...

Obviously they will be all be working double-time for decades to build out those hundred-thousand Gen III/and/or Thorium Breeder fission reactor complexes hooked up to the atmospheric CO2 mining and synthetic liquid fuels production facilities! There will be Spandex jackets for everyone...what a beautiful World it will be! :)

Or, folks are going to adopt much simpler, slower lives, and be engaged in gardening, carpentry, etc.

Or, ...well, go rent Mad Max...

Or some combination of the above, depending on where one is on the future time and location domains...

+1

NAOM

If your area is like the middle of the US where I live propane is a rural fuel.Maybe this is just an indication of people speeding up of rural flight.The cost of transportation plus the heating/cooling the load on a structure standing by itself can be 3x or more than a city home.Just remember 50% of the US population wasn't even born when we had gas lines,10 gal max purchase, even odd tag number days to buy gas and no Sunday sales.

In our case the reduction in propane consumption is the result of efficiency gains (passive solar, more insulation, solar hot water, clothes line, biodiesel generator replacing a propane generator, wood stove). In our (rural) area, heating with wood has seen a resurgence, families are moving in together, combining trips, staying home more, eating out less, turning lights off, etc. There are also many empty, foreclosed homes, as the real estate, vacation home markets crashed.

Lets take added insulation, etc. as a point: Good for energy efficiency; not so good if your job is selling/distributing propane. The propane business is an ongoing system; insulation a one time installation. While you may save 50% of your propane consumption, that 50% reduction in propane sales to you is essentially gone forever, as are the related jobs. The answer is "growth", which is facing hard limits. Distribute this meme across many sectors of the economy and you have to find something for a lot of folks to do. Even the local electrical utility is raising rates and cutting jobs, increasing employment pressure, driving pay down, forcing folks to conserve and be more efficient. Feedback loops.

"Since a huge segment of employment relies very much on discretionary spending,"

That's a point a lot of people keep missing. Even if the Keynesians managed to ban home kitchens (due to health and sanitation concerns, wink wink,) that is only 21 meals a week I can eat out. The increase in the velocity of money has an upper limit. I only need a haircut so often. I suppose the government could ban home use of razors too, and hope the vast increase in barbershops could drive the economy onward.

And of course twice in my life I've listened to an in-office politician promise me that the key to a prosperous future was eco-tourism. Both completely missed the fact the eco-tourism requires cheap oil.

So where exactly the economic growth, or even economic stay-even is supposed to come from is an open mystery.

There are sure to be at least a few growth industries... How about debtor prison guards and undertakers?

Debtor prisons are not profit centers. Their only "benefit" was to terrorize people into paying their debts. To make them profitable the government would have to convert them to labor camps. If we had a labor shortage then it might work, but a labor shortage is not one of our problems.

Undertakers are a luxury often dispensed with when times are tough. So no help there either. A CAT 320 track hoe can convert diesel or bio-diesel into 'instant hole' with commendable efficiency. Given the health consequences of large number of corpses laying about, a few gallons of oil will certainly be reserved for that purpose even in Gail's most pessimistic scenario.

PVguy you did realize that was sarcasm on my part, right?

As for:

Actually, newly deceased corpses, especially the plump ones, have a reasonably high btu content and could be used as fuel, so you probably wouldn't want to waste them by burying them in a hole... In case you are wondering, that's also sarcasm.

Thanks Ghung for raising an important point.

I might mention too that besides the problem you mentioned with the laid-off workers, people with less income are less interested in more expensive homes. So their lack of demand tends to hold down home prices, and leads to pain for people who try to sell or refinance their homes.

Once oil prices rise, there is a substantial chance they will rise a year later again as demand rises, and supply is in even shorter supply (unless the economy has fallen into recession again). So then there are yet more layoffs.

And when it comes to energy efficiency, usually there needs to be a cash investment, for that greater efficiency--say buying a new or used car to replace an old car; or buying a more efficient furnace (or heat pump) to replace the old one, or perhaps adding insulation. If people have less discretionary income, they may be less able to afford the capital investment required for greater efficiency. For example, new auto sales are down significantly since the early 2000s, when people could refinance their homes (because of the appreciation), and use the cash taken out to buy new cars or fix up their homes.

If there is an example of a country losing a significant amount of energy/resources without taking a major hit to their standard of living, I can't think of it.

Hi Euan

re: "assuming the inevitability of the pending demise of industrial society."

Can I offer a change of wording and a question?

1) What about the current trajectory?

A. Can it be analyzed?

B. Does it lead to the demise of industrial society?

C. Can this demise trajectory be altered in any way?

D. If so, how?

In other words, is there any case to be made for assuming and then analyzing, based on the assumption?

2) It seems your points are omitting the "relentless decline" aspect of peak, regardless of peak what, although we are primarily talking oil, yes?

In other words, "run on shale gas" - for how long run?

Run to where?

To a different infrastructure?

http://www.global.ucsb.edu/climateproject/papers/index.html

www.oildepletion.wordpress.com

I count 10 questions:-(

Aniya you got me here, can you simplify so I can respond?

Hi again Euan

First, I was trying to respond to your saying that Gail is quick to assume the demise of industrial society.

I was trying to put it a little differently: Gail may not "assume" this, per se, (or she may, I'm not sure) In can any case, my argument is: it may be what she sees as the trajectory, if nothing changes. BAU leads to "demise."

You propose two ways that peak impacts the economy, and then one factor that will make each not "demise." In the first case, time makes the inflationary impact not matter, and in the second case, you say a new resource (shale gas) can offset the negative impact.

So, what I was trying to suggest:

1. Not to think in terms of assumptions, but rather scenarios with particular trajectories. I ask if those trajectories can be altered in any way.

2. Then, I tried to ask you a question about shale gas and what's the "adapt" you speak about? Doesn't it require a different infrastructure or changes in infrastructure?

Euan makes a good point about predicting a pending demise of our industrial society. Notwithstanding all of the challenges we face with an ever decreasing EROI, and other ecological offenses, I would argue we need to focus more of our time and energy on trying to improve upon our situation. There are lots of things that can be done at least in the short to medium term while we still have oil to make us more resilient and it is important to be open to these possibilities.

For example, here is a recent report on the leadership role that Nordic countries are taking on energy

http://www.powermag.com/gas/4121.html

Author, Vicktor Frankl, wrote a very famous book, "Man's Search for Meaning" about the personal characteristics of those who survived the concentration camps during WWII. Generally speaking, those who made the best of a bad situation had a better chance of survival....those who gave up early, died early.

Gail, this is an interesting post. However, I would like to point out that USA have a huge energy consumption per capita; twice the European one. In consequence, there is a lot of place for energy saving that can be done without damaging the productive economy unless you believe that US economy is based on pickup. In consequence, you could extend the transition over a very long period of time.

IMHO, the main problem is psychological. I way or another people will have to drop to notion that growth is the goal. We have some embryonic economic vision able to deal with that. But, for a population that has been brainwashed that growth is the only thing that matter, this will be unacceptable.

"...for a population that has been brainwashed that growth is the only thing that matter, this will be unacceptable..."

For a nation (the US) with a $15 trillion (and rising) public debt, growth is an imperative. The opposite of growth is recession/depression. Add in trillions more of private debt, also unrepayable over time without growth, any sort of transition to greater efficiency, austerity, and a non-growth economy becomes problematic at best; very problematic if history is an effective predictor.

I disagree. It is no problem to repay debt with constant income. You just allocate a part of that income to amortizing the debt and eventually, it will be gone.

Sounds good until you realize that debt has been increasing faster than real incomes or GDP (for decades); a system banking that debt will be repaid by growth. When growth slows or stops, income must be realocated (redistributed) from other sources, already supporting systems that are reliant upon that income to continue. Robbing Peter to pay an ever-hungrier Paul, all enabled by declining resources (oil).

The other option is to default on the debt, which, in our world, has been leveraged to support other systems. This is the nature of a debt bubble.

Doesn't matter. As long as the rent burden is bearable, the debt can be repaid.

Debt is repaid by income. Loans are seldom given on any other premise than current market conditions and incomes.

debt can't be paid in the current system. only a small fraction of money is covered by coins and banknotes. basically if the debt would be paid there would be no money. without debt there would not be enough money to do business.

As PVguy says, FED can expand the money supply to counter contracting credit.

The key point you both agree on, though you may not realize it, is that the debt has to stop growing. Then it can be paid back out of current income. But since paying off debt destroys money (see fractional reserve lending) and given that net new debt can't be issued, the money supply contracts.

So Congress has to issue money to replace the repaid debt without borrowing it into existence. They can do this, but keeping the balance between inflation and deflation is not easy, especially with all the squalling as those companies that expected perpetual exponential growth collide with the flat line.

Note that the term "money" above includes money + credit. On the macro scale, which is what we are talking about here, they are the same thing. On the home scale they are not the same thing, or at least those who think they are end up in trouble.

It is no problem to repay debt with constant income.

Bless your heart, you live in a world where income is constant, debt is constant, and spending on other things is constant.

In the world where most of us live, the prices for things that are considered needed are rising. Like food, heating, taxes et la.

Constant income and constant debt with rising prices for other things leads to problems for real humans.

I'm talking about constant real income, of course. (inflation adjusted)

As Ghung points out, there is the need for growth, so that in the aggregate, there are enough funds to pay back debt with interest, and not have to cut back on discretionary spending, so as to avoid layoffs, and other negative effects (falling home prices, for example).

The other issue is that US population is spread over a larger area, and within that area, homes are laid out in a way that can most efficiently be served by a private passenger auto. If population is very dense, public transit works well, but it is much more difficult to make work when homes are scattered with little density. It is not easy to make a change, once the homes have been built up that way--theoretically, some homes would need to be torn down and moved to a different location.

Again, that's what quantitative easing is for - keeping the money supply up when debt rewinds. You can avoid layoffs by liberalizing labor markets.

Making US population density higher requires investments in construction and lots of labor.

As I 'drive' to work every morning at 6:00am, I meet a horde of pickup trucks heading out to the bush for their work....some driving 150 km each way. They will then spend the day using machines to harvest wood for the Chinese market. Sooner or later, the Chinese debt bubble will pop like everyone elses and the trucks will dwindle to nothing like they were just two year ago, or the rising price of fuel will simply choke the feasability out of it.

At work, yesterday, two colleagues came to me for advice, (my grey hair an all), and said how they just wern't making it anymore. They cited rising costs....particularly food...as the culprit. To one I simply asked "is son in hockey a need or a want"? (Canada....hard choice). And suggested he lose the truck and buy a beater.

he was going to refi to pay off the debts. No No NO NO.

Life is changing for people who still seem to be okay. I see no option to an evitable decline. Looking at history and the great idea of increasing debt to solve debt problems....all in order to sustain the impossible paradigm....if Industrial civilization does not drop to zip I will be astounded.

We are broke, busted, and running out everything but population. What other inference can their be?

Cheers and good morning Paulo

I was at the ASPO-USA convention today, and a person came away with some of that same feeling. Wes Jackson of the Land Institute told us that soil was as much a problem as oil, if we want another problem to add to our list.

Guy Dauncey of British Columbia Sustainable Energy Association told us that GDP really stands for "Gross Depletion of the Planet".

British Columbia actually has a very small proportion of Canada's agricultural land due to the fact that most of the province is mountainous, so naturally they worry about disappearing farmland. However, the vast majority of cropland in Canada is in the prairie provinces:

Land in Crops ... Province

(hectares)

586,238 ... British Columbia

3,660,941 ... Ontario

4,701,010 ... Manitoba

9,621,606 ... Alberta*

14,960,103 ... Saskatchewan

source: Statistics Canada 2006 census data. One hectare = 2.47 acres.

* Alberta, due to the amount of potential farmland in the far north, could probably double its amount of cropland if there was a local market for the crops produced.

FOR ALL

Referring to Fig. 2. A couple of points that many here already appreciate. First, everyone should be familiar with the decline rate of the fractured shale reservoirs. A 50% to 90% first year decline in flow rate is common. Within the first 4 - 5 years of production flow rates of individual wells will have dropped 95%+. Thus the reason the public oils are accelerating their drilling efforts as fast as possible: the more NG reserves they book the more wells they have to drill to replace those rapidly produced. That replacement is the primary metric Wall Street uses to value their stock. Just eyeballing the chart it appears we'll be producing 3X the volume of SG by 2035. The wells drilled after 2030 will have to be contributing almost all that rate. Wells drilled 5+ years prior to that date will be contributing almost nothing to that number. So the bulk of the 2035 volume will have to come from wells drilled just 2 to 3 years earlier.

Today we have a little over 2,000 rigs drilling. If we triple NG flows during 2035 then it reasonable to assume we'll have to have 6,000 or so rigs drilling in 2035. Maybe we will...maybe not. And during the next 23 years well have to average 4,000 rigs drilling (2,000+ 6,000/2). So to get the curve represented we have to drill twice as many wells per year (20,000) on average as we are drilling today X 23. Just a rough estimate but around 10,000+ SG wells are being drilled per year today. So the math, however accurate, is simple: the chart projects we will drill 460,000 SG wells in the next 23 years. At around $6 million per well (drilling/completion, land and overhead expenses) that will require about $2.8 TRILLION in capex. And that with no inflation factor. That doesn't include my estimate of $100+ BILLION to expand the oil patch infrastructure required for those extra 4,000 rigs. Each can decide the probability of this much capex being available.

And let's not forget the obvious: to prevent the NG flow rate from crashing post-2035 the drilling efforts needs to continue drilling at least as many wells as were drilled in 2035. If not the rate will drop very quickly.

I bet no one paid much attention to the conventional non-associate NG both onshore and off. First and foremost, the onshore projection is absurd. Many here know my primary exploration target is onshore conventional NG. I'm about to return $50 million of my 2011 budget back for lack of prospects. And that's not because we weren't able to generate them: we don't generate any of the projects we drill...don't have the 4-5 year time lag required. We buy them from prospect generating shops. And everyone of them knows we have a fat check book and a maniacal desire to drill. And we can't find enough prospects. The chart indicates we'll be producing about 70% of current rate of onshore conventional NG. That must mean there's a lot of these reserves out left to drill: virtually none of the existing convention NG will be producing anything in 23 years. Remember we're not talking shale gas...convention NG fields. Fields that companies like mine will have to drill. Fields that I have all the money I need to drill. And fields that I can't find enough of to drill today. And the projection is that in the next 23 years we'll find at least 70% of all the conventional NG fields we've discovered in the last 20 years or so? I suppose me and my cohorts just aren't smart enough to find all those hidden treasures out there. And neither are the rest of the oil patch who aren't finding enough conventional prospects for me to drill. Despite the fact that we have exploration tools today that are easily a magnitude better than we had 20 years ago. I'm guessing the chart assumes some group outside the existing oil patch will generate all those new discoveries. I sure wish they would give me a call. I've got a $300 million budget for next year and it seems unlikely I'll spend even half of it.

Offshore conventional NG development also seems rather optimistic but not as much as the onshore projection. DW GOM will likely be the majors source of those reserves. Individual NG fields out there tend to be large compared to onshore fields. OTOH the cost of developing those fields is also much greater. There will likely be 100's of smaller NG fields offshore that will never be developed for economic reasons. There won't be that many major offshore fields found IMHO. In fact, just my WAG, but in the next 20 years we will have likely developed the vast majority of the big fields left out there. And remember offshore DW fields are designed for rapid depletion...typically around 7 years. Thus nearly all the offshore conventional NG fields developed in the next 18 years will be depleted by 2035. Thus we must assume a huge increase in offshore conventional NG discoveries post 2028. Time will tell. And notice that I haven't offered any guess to the capex required to support this projection: my calculator doesn't go that high.

rockman:

i'm not sure if i understood correctly. so basically "wall street" uses the amount of reserves to value the stock? but if the company just keeps the reserves without producing then surely the value of stocks will diminish? i mean i don't quite understand the logic of producing and finding reserves. for example if prices are low then why not wait with reserves and produce them later? especially since you say that there is money around. so why don't companies just keep on finding the reserves, at least for some time? they could just produce a small amount now and then increase the production when prices go up?

jukka - The key metric for WS is how much reserves a company adds net to their books every year. If a company produces X millions of bbls of oil during 2011 WS will reward them with positive recommendations if the add X+ bbls of oil to they books the same year. IOW they consider a company's value to hinge on their oil/NG assets in the ground. Produce more than you find and your asset base declines...not good. Add some asset base...good. Add a lot more asset than you produced...very good. Remember: folks might make a little money from the dividends. But the prime reason most buy a stock is to sell it at a higher price later. Seeing growth in the asset base gives them confidence they'll be able to do just that. See little or no growth for a couple of years and they get worried...maybe worried enough to sell at a loss. See negative growth and they run like hell.

But you notice I didn't mention what that new asst base cost me to find. I might sell that X bbls of oil for a nice profit compared to what it cost me to develop them. I may replace them with X+ bbls that same year but maybe I drilled a lot of dry holes in that effort. And the wells that were successful cost a lot more than planned. So maybe I made very little profit (maybe I even lost money) adding those X+ bbls. And it's very difficult for folks outside a company to figure this out.

Given the time lag between the monies being spent and the production life of the well it's not an easy matter even for a company to project its ultimate profit. How screwed up can WS's view of the oil patch get? Here's a real example of what I personally did 20 years ago. For a very small public company I drilled 4 horizontal wells in a producing field. These wells were drilled into reservoirs already on production but the vertical wells were producing very slowly. The 4 hz wells I drilled increased company production from 10 million cu ft/day to 50 million cu ft/day. But since these wells were in existing reservoirs the effort didn't add $1 worth of new reserves. IOW no increase in reserve base. And what did WS do? So impressed with the increase in cash flow they quickly bumped our stock up over 250%. But understand it cost $18 million to drill those 4 wells. IOW the company spent (LOST) $18 million. And the stock shot up. And we didn't lie about what we did: it was all spelled out clearly in our outside audited reserve report.

There's an old saying by some WS brokers: they don't sell the steak...they sell the sizzle. WS didn't care that the company lost money in the effort...they sold the sizzle of the increase in cash flow. BTW: one of the big successful(usually) WS raiders bought it hook line, line and sinker. He was successful in the hostile takeover of this little company. Not too long afterwards (after me and the other oil/NG finders left) the company filed bankruptcy and disappeared for every.

Low prices??? I know it sounds logical to cut production when prices drop. In reality more often than not it works just the opposite: many companies will try to increase production in the face of declining prices. The oil patch is very much dependent upon cash flow. Add that to the need of public companies to add reserves year over year. They keep producing and take that cash flow and drill to add back to the reserve base what they've produced. Privately owned (non-public companies) have a problem reducing production when prices drop: they still have loans to repay and employees to retain.

A recent example was the NG price bust in '08. I was working with Devon at that time. They were spending $'s as fast as possible in the shale gas play of E. Texas. Had 18 rigs running. But prices dropped so fast and so far they dropped 14 of those rigs and paid $40 million to cancel those contracts. Yep: paid $40 million to not drill wells. And without drilling they couldn't maintain their reserve base let along increase. As a result their stock dropped from the high of $124/share to $38/share. The CEO of Chesapeake had the margin called on the money he used to buy his company's stock and lost many $billions as a result. The wells both companies were still able to drill were profit The wells both companies were still able to drill were profitable. But WS didn't care: that didn't create the sizzle the earlier hype about shale gas created.

If you try to apply logic to this process it will just drive you nuts. LOL

"If you try to apply logic to this process it will just drive you nuts. LOL"

yes maybe the logic was a wrong word...

but anyway: "many companies will try to increase production in the face of declining prices"

so they have so much debt that they can't wait?

jukka - Not just debt but overhead to maintain, production operating expenses that don't decrease as prices drop and, equally important, capex to drill more wells. Unlike a manufacturing company they deplete their assets daily. Stop drilling and you lose future income. A widget plant can shut down completely and restart when the market improves. An oil company shuts down drilling, depletes its reserves to pay debt and eventually when prices recover there isn't enough cash flow left to function. I've personally seen at least 100 companies disappear during my career for this very reason.

And remember there is a time lag for profits in the oil patch. In the last 2 years I've spent $140 million drilling successful wells. Yet we haven't gotten our first $ of profit yet. Close but not quite yet. Profitable wells often don't go into into the black for 18 to 24 months. And we all drill dry holes that have to be recovered by the good ones. So companywise a successful operation may take 3 years to show a net profit. Reduce you production rate and they can extend that period much too far in the future. When you see reports that Company A made $X billion profit last year that doesn't mean they drilled profitable wells that year...they just had more income than outgo. When prices fall many public companies will quickly layoff folks to reduce the outgo to keep "profit" up. But they keep drilling in order to continue the reserve replacement game. I've spent much of my consulting career replacing those laid off employees. Did it by knowing how to be very efficient and very bottom line.

Well, if you squint your eyes just right...

Some one could have put the wrong numbers into the NPV function in 123, (this was 1991, when serious businesses used Lotus, after all) and decided high cash flow today was worth $18,000,000 more than low cash flow for X years, and therefore a good deal.

Or they wanted a tax loss

Or they were simple idiots :-)

Take your pick.

PV - Actually none of the above. Their objective was simple: run the company stock price up as fast as possible, cash in their stock options and bail out. They knew the drilling program reduced the NPV of the company significantly: I did the calculation and presented it to them. This was my first experience with a very small cap public company. Like they say about making hot dogs: if you watch the process up close it kills you appetite for the product.

My engineer and I did all the work…busted our butts. And then sat back and watched them ruin the company. And then sat back and watched the next idiot forcibly take over the company and drive it the rest of the way to the grave. Made me a tad bitter with corporate games so I spent the next 10 years doing well site consulting. Now I work for a private company. No games: just drill wells and make a profit.

Rockman,

Thanks for your wonderful perspective! A few trillion here and a few trillion there or needed expenditures for development, and opportunities for drilling that you can't even find today make the story we are being told totally ridiculous.

Gail

Gail - I truly wish my expectations weren't what they are. Especially with the potential to eventually swap more blood for oil. I also have 12 yo daughter who will likely be confronting the beginning of the worst of PO as she moves into adulthood.

But "perspective"" is what I strive to share. I entered the oil patch just after US production peaked. As I've said before my first mentor clearly explained the reserve replacement problem (what folks call PO today) the oil patch then faced…36 years ago.

Perspective: the simplest I can offer – In 1975 I was drilling 12,000’ wells testing potential 2,000+ acre reservoirs. Today I’m drilling 16,500’ wells (that cost 3X as much) to test potential reservoirs that cover 100 acres…or less. Globally we still have big targets. But just as we did here they will be exploited and removed from play as they deplete. It’s impossible for me to ignore the perspective I’ve developed over 36 years and not see the same path for the rest of the world. Perhaps I’m so blinded by my experiences I can’t see another alternative.

I’m always open to other visions of the future. But that story has to be built on concrete facts and not what-ifs. I’ve had world class explorationists try to blow smoke up my butt my entire career. Someone wants to try they better tie their story down tight. I’ve heard it all a 100 times before. LOL

Rockman,

Thanks for your insightful comment.

Why is it that offshore depletion rates are so fast; geology, the cost (get in and get out quick)?

Thanks,

Andrew

aws - Exactly. Offshore development is very expensive and companies view it as a simple rate of return proposition. Thus the longer it takes to produce the lower the ROR. Additionally offshore operations costs during the production phase is much higher than onshore. You won't see stripper wells offshore: can't justify the overhead. So companies will spend extra money to engineer the highest possible flow rates possible.

Thanks a lot for the down to earth detailed field info RM, when you say "we don't generate any of the projects we drill." that is you don't prospect/discover any of the projects you develop/produce ?

Otherwise about the "non-associated offshore curve" on figure 2, there are these strange "waves" with a top around 2020 then a bit down, then going back up around 2030, do you think it corresponds to some background figures/studies, or is it more like "ok it cannot be just just a straight line that would look a bit ridiculous, let's just draw something a bit more irregular" ? :)

Y - Company A will buy the seismic data and hire a staff to generate drilling projects. Then they'll lease the land and market the project to companies like mine. Typically they'll recover the money the invested and get a little extra back. Additionally we'll pay 100% to drill the exploratory part but perhaps only earn 75% of the production with the rest going to Company A. This is the "promote" on the deal. Company A might be required to pay for their 25% of the completion costs but at that point they know they have a profitable well.

Why do we pay the promote? It takes many years to generate a portfolio of viable prospects. And not all efforts lead to marketable prospects. We're a new start up created to take advantage of the oil patch collapse back in '08 as well as the coming of PO. We didn't have time to wait to generate our own projects. But we are doing some of it now since we've been finding too few outside deals to buy. BTW; in August of '08 we went to a prospect expo: over 300 companies trying to sell their projects. We were one of about 10 potential buyers there. Obviously a true buyers market if you had the capex.

And yes...the wavy line is to give the illusion of having such details IMHO.

Thanks for the clarifications RM, I don't know the oil/gas industry directly at all, but from the info I got reading or seeing docs, the US is truly unique in this aspect of having many companies on the oil gas/patch, and this from the beginning, this also being a result of the law being that you own what is below your land, which isn't the case in most countries.

About the promote part, is it also a way to make the deal honest, company A having a share of the project production revenues ? Are there some trials or penalties/recrediting if a sold project doesn't deliver as promised when sold ?

Canada is similar to the US in that there are hundreds of companies drilling for oil and gas (the US probably has thousands).

It is not true that the law in the US says you own the land under your property. Both American and Canadian legal systems evolved from British common law, in which you can slice land more ways than baloney. You have to look at the title to the property to see who owns what. It is entirely possible that a previous owner separated the mineral rights from the surface rights and sold them separately.

In the older US states, people got mineral rights by default, but in much of the American West which was settled after oil drilling was invented the federal government retained the mineral rights when it gave away homestead land, and of course it owns the mineral rights under the federal land which constitutes most of some states.

Y – In the oil patch it’s real simple: you pays your money and you takes your chances. You drill a dry hole on the prospect I sold you that’s too bad. Now suck it up and get on with your business. A company does its own evaluation of the prospects it buys and makes the decision. How good you are at doing this determines your profitability. How bad can this be done? Back in the insane boom of the 70’s a company bought into a drilling program with a promoter company. They paid to drill 18 DRY HOLES…not one success. And how did the promoter make out? Besides recovering their initial investment the senior guys retired millionaires. Drill 18 dry holes and make millions…now that’s a company that knows how to cut a trade. And the company that paid for all the drilling: obviously not very good at the job. BTW: that company went out of business not too many years later. I was just starting my career and got out of there a fast as I could.

This is why I’ve always strongly recommended individuals to NOT make direct investments in drilling projects. There are many con men out there just ready to skin those folks alive. Back in the 80’s a company moved onto our floor. It was a “boiler room” selling an investment in a Texas well. I looked at their deal…an obvious scan. I called the state attorney general and gave him the company’s name. They knew of the company and had shut down their operations in Dallas. Told them they were up and running in Houston. One of my great regrets was not being there the day the Texas Rangers hauled of the two managers off in hand cuffs. The really irritating part was that the managers figured since we were oil patch we didn’t have a problem defrauding investors. BTW: the manager’s previous job: selling used cars. I’m not kidding.

A fair promoter will recover their investment. And if they generate successful prospects they’ll make a very nice return. Both the buyer and seller do well if everyone knows how to do their job.

Thanks a lot for the info RM (and a pleasure to read)

Some weeks when I think I've read about the best Rockman post ever, he moves the peg higher by laying out the logic, the timeline, the investment cycle, and production rate profiles in even more substantive and clarifying terms...

Hmm, so we will have to build around 200 rigs a year plus ancillary equipment plus fracing equipment. I wonder if current production lines could do that or would that entail new factories as well. Then we need to triple the output of muds, pipe, other consumables, frac fluids etc. Tall order?

NAOM

2.8T/23 years is ~$122B/yr. For $122B/yr at a ridiculously high cost of $2M/MW, you could build 60,000MW of wind power per year. Now, building more than ~15,000MW a year is probably silly (boom-bust), but let's say we wanted to replace the total kwh production of all existing natural gas fired electricity in the U.S. instead of producing the natural gas to run it. In 2010, 30% of U.S. natural gas consumption was used to produce 23.8% (981.8 million MWh) of electricity net generation. If a MW of wind produced 3000MWh/yr (conservative 34% capacity factor), then to fully replace that energy would require 327,266MW of installed capacity. To replace 30% of natural gas over 23 years we'd need to build 14,228MW per year at a cost of 23% of your estimate, if turbines cost twice as much to develop as they 'should.'

This has more than a few issues as a wholesale solution, but it is clear that at the margin, building wind turbines to displace natural gas consumption makes more sense than ramping up drilling $6M dollar wells.

21 – Your logic is obvious. Unfortunately it’s also irrelevant froma practical standpoint. Neither the public nor the govt will be spending that capex…the oil patch will. The oil patch doesn’t make alts…it drills wells. It doesn’t employee folks who know how to build alts. And most important: the shareholders who bought the stock of the public oils didn’t do so expecting these companies to build alts.

If ExxonMobil decided to build alts and not drill wells they would first have to fire a lot of employees. Then hire folk folks to build the alts infrastructure. But we don't have a lot of folks who know how to build alts...they have to be educated/trained. And then watch their stock become nearly worthless as shareholders bailed from a company with no certain probability of profitability.

Now had the govt enacted policies 30 years ago that offered an incentive for energy companies to begin a very slow transition to alts we might be in a different situation. But they didn’t and IMHO it’s too late to take that tact now. Just don’t have the time.

Hopefully, either government or utilities like the one I work for will provide the capex for the alts to supplement/compete with the drillers when they realize that if they don't, the fuel they have been increasing dependence on for the past 25 years is going to get progressively more expensive.

ben - Hopefully. And as much as I don't care for too much govt involvement in the free market, I think the challenge is so big/expensive/immediate it can't be done alone by the folks you mention. The oil patch needs to continuing doing its thing because without that economic input we have no chance of changing the system. That's the point I think some folks keep missing: without the energy the oil patch brings into the sytem today the alts don't have much of a chance IMHO. Even with it the future will still be very difficult. As we keep saying: we're at least 30 years late beginning the transition.

Gail, you really need to tone down the doomsday predictions. It doesn't help your cause. It just makes your whole movement and everyone involved appear shrill and in need of strong meds.

Others have pointed out the logical flaws in your arguments, so I won't repeat them. I'll just say, you have no more skill in predicting the future than anyone else -- which is to say, zero. You could at least be humble enough to admit that much.

Here we go with the “Meds” talk. I think anyone who assumes that we can have infinite economic growth on a finite planet is in need of medication. The global economy is on the verge of a meltdown, with crippling debt rampant throughout industrial civilization, but everything is fine. I guess the German military may need meds to after publishing their peak oil report so Gail has some good company. I know of plenty of investors who have researched trends, made a prediction, and been right. You should fire off a letter to Richard Rainwater and Michael Burry to inform them no one can predict the future.

Mark (and others), for bonus points, pick the type and subtype that mkkby exhibits;

http://www.peakoilblues.org/blog/?p=132

now that was funny, thanks Will.

mkkby

You really need to review the fundamental basics of economics. Your polyanna approach does not help your cause. It makes your comments appear shrill and in need of a strong dose of reality medicine.

Our economy runs on transportation. 97% of transportation depends on liquid fuel from petroleum and natural gas liquids. See Peak Oil Perspective

Available net crude oil exports peaked in 2005 and have declined 12% since then (after China & India's imports.)

High fuel prices directly reduce economic growth and increase unemployment.

Consequently, trillions of dollars easy money has not raised the economy. Thus the current economic malaise is directly constrained by transport fuel prices - with projections for worse to come!

Wake up and look at the reality.

>>Wake up and look at the reality.<<

David, you might do well to drink some of your own medicine. You claim that the economy "runs on transportation," but that is bogus. 17% of the total 98 quadrillion BTUs used in the US last year were from non-fossil fuel sources, and only 28% of energy used in the US was used in the transportation sector. Electricity is an easy, if not always the most efficient, substitute for any form of energy. There is no need for fossil fuels, only for a cheap source of electricity, such as renewables (wind is now below grid parity and solar is on the cusp) or thorium. Even helicopters can run on biofuel (and they are not used to maintain transmission lines as much as you think). I agree that we need to continue to move away from fossil fuels, but the argument here, and in this greater claim that renewables need fossil fuel, is deeply flawed.

Refuel;

There's an old saying, 'If you bought it, a truck brought it..'

It's not just the sheer quantity of energy used by the transp sector, but the dependence we all have on everything it does for our current way of getting things done. Sure, it can be somewhat replaced by electric rail and cars.. for a hefty price, and on a cumbersome schedule. I'm in favor of both of those options, but I also say again and again, we're starting far too late, with an economy that is already staggering.

Almost anything you want to do today to change something significant in your world will require ordering stuff, be it led lightbulbs or I-beams and Windmills, stuff that trucks will have to bring down the road from a hub with a lot of other trucks.. we have to build tomorrow with little but the brick and mortar we're starting out with today.

Trucks and trains are minor uses of petroleum, it's mostly about light vehicles. Only about 1/7th of petroleum use in the U.S. is for trucks and trains.

And just the same, as shortages and price hikes hit, more and more things that once were shipped that are today available on your nearby shelves will become scarce, or suppliers who built their companies on models assuming the availability of farflung sources will start to shutter.

It's not just the overall 'Amount of Petroleum' but the balancing of the system that has driven multiple routes to supply various bits for every product and service.

You might think it's no big deal. We differ. I think it could be a really big deal. Each chain only needs one weak link to fail.. and while we can do workarounds and patch the bad links for a bit.. and ultimately we can create 'non FF chains' for things.. at this point we have so many FF dependent blindspots where shortages and price-induced closures can block the flow of stuff, we simply don't have enough of an alternate plan assembled to get much through it for some time. (It seems to me)

I tend to think that increasing oil prices will reduce 'just-in-time' and increase local inventories, shift freight from road to rail, and from air to road, and squeeze personal auto use so that freight is a higher proportion of a smaller consumption of oil for transportation. At some point in the next few years, I anticipate a wholesale shift from diesel to LNG for rail.

electricity is no good substitute for transportation. the energy density of fossil fuels is around 42 MJ/kg (oil) and about 0.5 MJ/kg for li:ion batteries - that's a factor 100 (ballpark) of difference! making energy efficient transport requires lighter vehicles, which is hard with electric (the nissan leaf battery weighs 300kg and you get less than 100 miles range....). for air travel, you need oil in some form (can be biofuel of course, but electric is a no go for aviation).

also keep in mind that typically something like 80-90% of all energy use (depends on which country you look at) comes from fossil fuels. replacing this with electricity is very hard to impossible. after the oil shock of 1973 the french decided to build out their nuclear power at an unprecedented rate, i.e. using a well known and proven technology of that time. it took them 15 years to basically switch over from fossil electricity generation to near 100% nuclear, building 50+ nuclear reactors in those 15 years. and remember, this is only something around 20% of the energy the french are using. this gives you an idea of the timeframes involved - we can't just "switch" to electricity. even if we do absolutely massive crash programs, it takes decades. and if every country on earth wants to build out on the same resource, you can already project big supply shortages of everything needed...

"electricity is no good substitute for transportation.." ??

That's a bit too broad, Fierz, unless you have a way to apply it to Electric Railways, which beat Fossil Fuels on Rubber Tires with a wide margin.. They just demand a big investment, but also can deliver a substantial return.

I seem to recall you being from Switzerland, and maybe were one who has taken an inconoclastic view of the successes of Electric Rail developments in your own country and elsewhere..? I'd be curious to know why, if you are him.

Respectfully,

Bob

Hi Bob,

of course you are right, I only talked about cars. Trains are by far more energy efficient (factor 10 or so more efficient than cars), and electrification there is easily possible in contrast to cars. But in the big picture, electric trains today are not important at all - in Switzerland, they provide a bit under 20% of all passenger transport, and that's here with one of the best and most electrified railway networks. the challenge will be to replace the cars! That isn't easy, because our trains are already full, and the tracks are full too...

The Leaf is rated at 99 miles per gallon gasoline equivalent (2.4 L/100 km), which should be three times better than a comparable ICE car. Thus the "kilometer density" (km/kg) is more like a factor of 30 better with ICE. Then that is somewhat offset by the rest of the drive train being lighter in an EV.

Actually, it is more like half of their energy, since you should either count the waste heat of nuclear production OR the three times higher energy efficiency in transport. (Two sides of the same coin, actually, you trade heat for improved energy quality.)

If we need to wean off oil by electric transport due to high oil prices (i.e. "scarcity"), then we'd simultaneously ramp all electricity sources to avoid bottlenecks, but first and foremost, we'd provide more fuel to electricity plants that doesn't go all the time (to let cars charge in off hours). We can also save some electricity that we use for other purposes to fuel our vehicles. The electricity production issue is really, really easy, in fact. The crucial bottleneck should be in electric car production, especially batteries.

The VW polo bluemotion is rated at 3.3 l/100km. The leaf is a whopping 1.5 tons heavy, which is one of the reasons that it isn't that much better despite the electric drivetrain. And whether we are talking of a factor of 30 or 100 doesn't really change the picture - the energy density of the batteries is so much lower that electric vehicles need very heavy batteries and nevertheless have a very short range.

If you want to count the French electricity as half their energy, that is fine too. The point is, it took 15 years, all with a technology that was readily available to them. The Germans have been building solar PV and wind turbines at high speed over the past years, and are still in single-digit-energy-production with these. It takes a lot of time to move to a new technology!

I disagree that the electricity production issue is easy. It's technically easy, but practically, you are limited in many ways. For example, current nuclear reactor technology with its one-way-through fuel cycle cannot be ramped up in big style globally, because we don't have enough reserves of Uranium. All other technologies don't deliver the massive amounts of power you would need to substitute fossil fuels...

Battery energy density will likely improve as we go along. Also, the fact that there are ICE cars that are efficient is very good - this makes it less urgent to ramp EVs. Also, I'd guess families with two cars could have one EV and one EREV (hybrid) for different purposes. Families with a single car could either have an EREV for all purposes, or have an EV and then hire an EREV or an ICE for long trips.

Germans have been going slow since they have chosen inefficient tech. They could have (should have) been coal-free in the early 90-ies just like the French, if they had chosen to persue nuclear as well.

Actually, nuclear can be ramped quite well even with once-through cycles. Uranium is abundant. But sure, really long term we'd need at least a part of the fleet to be fuel-producing breeders.

mkkby -

I think it is fair to say I have read most of Gail's work here over the years, and most of the replies to it also. I think, insofar as it will affect her message, that the flaws you may be referring to will, for the most part, amount to no more than opinion. I doubted her views re the future initially, but have come to believe her viewpoints are, for the majority of people, essentially correct, timing uncertain. Prove me wrong. Likely we will both be gone before you can. You are welcome to try though, I've not lost the ability to be swayed by a good argument.

An addendum while I'm thinking of it -

Details here and there may or may not come to pass,eg "Eventually, as costs become too high, some roads will need to be changed back to gravel, or no longer be maintained." - I live with dirt roads here in backwoods Maine, my opinion is that paved roads are cheaper for society to maintain until volume of traffic becomes extremely low, and that a decision to revert to a dirt road is essentially abandonment. Note the paving stones under the streets of our older cities, or the Roman roads, or recently excavated paved Mayan roads or even a few paved ancient Greek paths.

Central message unaffected.

That said I think that some cities will maintain their ability to attract sufficient resources and continue manufacturing and trade. To what degree I don't know. It depends on maintaining access to affordable electricity, rail, water & waste management, deep water ports etc.

Other cities will wither.

"I'll just say, you have no more skill in predicting the future than anyone else -- which is to say, zero. "

heh, so all people have zero skill in predicting the future?

Well, I know one guy who can duck a shoe when it's thrown at his head, and he's an idiot. Therefore there must be a way for some people to predict some of the future with some accuracy some of the time, provided they have good information input and can form an intelligent model from it. It can probably be proven statistically, where you test native models for accuracy within different contexts - so Warren Buffet scores higher in predicting the price of pork bellies than I, but I can tell how my wife's mood will be this evening more accurately than he. In this way a predictive power could probably be factually established. O'course there's the well informed but outmoded predictive models that seem to make your case - the economists who were caught completely unaware by the housing bust, but we pro-clairvoyants can say that their perfect model of economics didn't include an input for certain streams of real data, while others whose did reported it coming a mile away. But you're saying it's all just luck of the draw eh? Well, I admire your humility! :)

I strongly disagree.It doesn't take a genius to understand the situation as Gail has so capably described it;and while she may not be a genius, she is obviously a LOT smarter than the average person, and a highly capable independent thinker.

I will agree that the future cannot be predicted in great detail, or that time future lines can be predicted in detail.

But speaking as a reasonably well educated person, in both the sciences and the humanities, I can say that the generalized predictions made by people who understand the basic sciences well stand up pretty well, especially in the cases where the scientist has a good real world grasp of "human nature".

Now some might for example point out the "failure" of Malthusian predictions of nature to take care of population pressures as being a valid counterargument, but he was born too early to foresee the industrial revolution.His predictions have been borne out again and again, on the local and regional level.

And guess what?

They will be borne out world wide in a few more decades when we run short of easily obtainable and affordable fossil fuels and minerals such as rock phosphate, not to mention clean water.

I have a friend visiting relatives in Arizona at this minute.He tells me that he can easily walk across the Colorado at the point where the old Yuma ferry was located in the early days;it seems that the river was a mile wide at that point back then.

Some of us are capable thinkers,including many cornucopians, and I believe in the mind stretching qualities of science fiction, fantasy, and television programs such as Star Trek.

But such stretching of the mind is useless or worse than useless unless it it counterbalanced by a strong basic knowledge of the physical sciences.Barring a breakthrough in fusion power, or some other similar near miracle, there is simply no way we can continue bau too much longer-this conclusion is inescapable if ones applies basic arithmetic to the basic relevant facts as Gail has done, and done superbly well.

Depletion is inescapable, although the exact time frames when various non renewables run desperately short are debatable.

Renewables themselve are not concievably scalable enough to save our mangy hides.

The eroei of solar panels might be theoretically important, but it matters not a hoot in practical terms for the next few decades.