Are We Reaching “Limits to Growth”?

Posted by Gail the Actuary on October 26, 2011 - 11:15am

It looks to me as though 2012 is likely to be a truly awful financial year, with several crises converging:

- Either very high oil prices or recession,

- The US governmental debt limit crisis,

- The Euro crisis,

- The Chinese debt problem,

- Debt deleveraging in the US and elsewhere,

- Further MENA (Middle East/North Africa) political problems, and

- Conflict between need for greater resources and pollution issues.

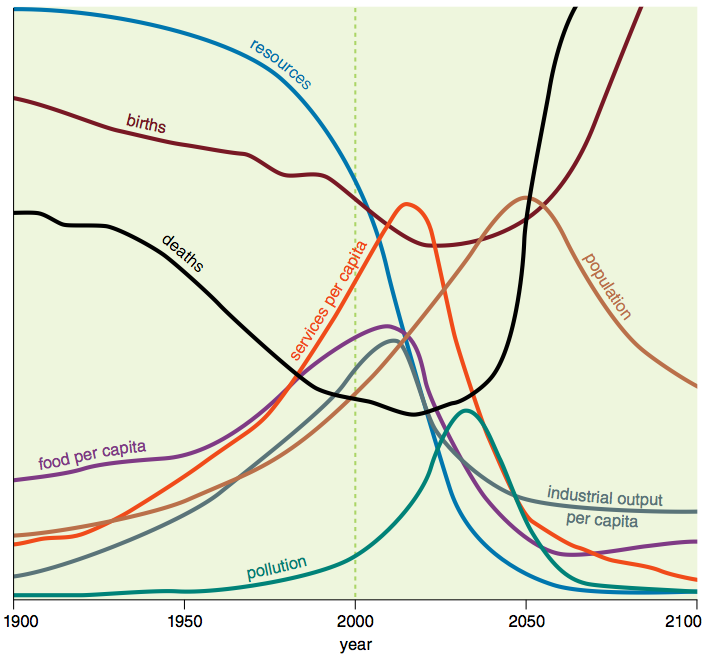

It seems to me that we may be reaching “Limits to Growth,” as foretold in the book by the same name in 1972. The book modeled the consequences of a rapidly growing world population and finite resource supplies. A wide range of scenarios was tested, but the result in nearly all scenarios was overshoot and collapse, with the timing of collapse typically being in the 2010 to 2075 time period.

The authors of Limits to Growth did not model the full interactions of the system. One element omitted was how debt would impact the system. Another item omitted was how prices for oil and other resources would affect the system.

If a person follows through the expected effects of high oil prices and debt, the financial system would appear to be the most vulnerable part of the system. The financial system would also appear to be what telegraphs problems from one part of the system to another. Unless a solution is found, failure of the financial system could ultimately bring down the whole system.

Background

Newspapers print endless articles about the need for economic growth, and the need for return to economic growth. But if economic growth really takes resources of some sort–coal, or oil or copper, or fresh water to produce goods and services–it stands to reason that at some point, the resources needed for economic growth will run short. This is especially true for resources that are used up when they are burned, like coal and oil.

Besides the issue of inadequate resources, growing pollution can also interfere with economic growth. As the world is filled with more people, and resources become shorter in supply, pollution becomes more of an issue.

Logically, at some point we can expect to run into limits that are impossible to get around. One of these limits may be inadequate funds for investment in extraction of resources.

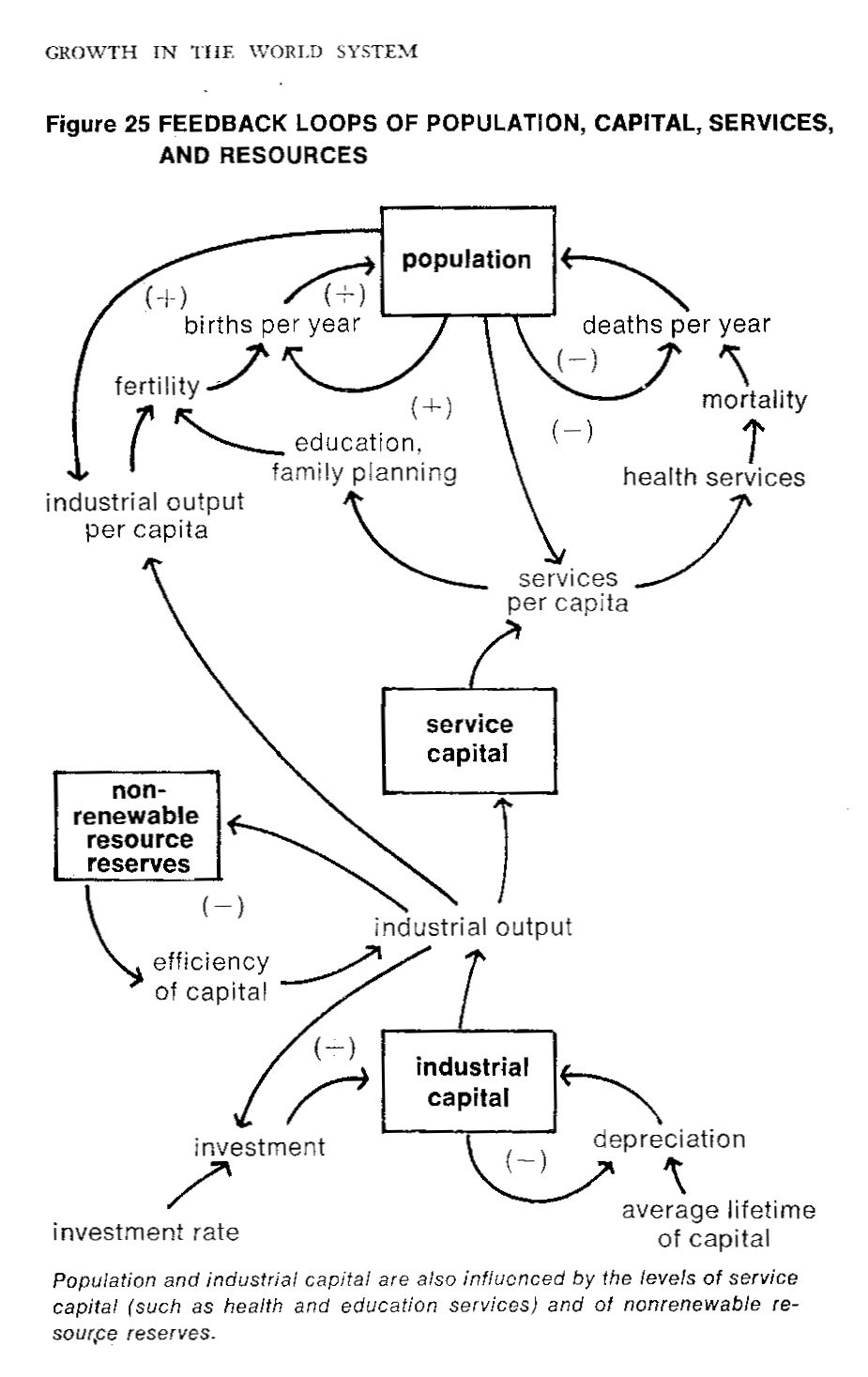

In the Limits to Growth model, investment is based on a number of factors, including the efficiency of the system (Figure 2). In some respects the efficiency of the system is growing–better technology. But in others, the “efficiency” is getting worse–declining Energy Return on Energy Invested (EROEI) for fossil fuels, and lower ore grades for mined minerals.

How would we know if investment in extraction of resources is inadequate? It seems to me, it would be through relatively flat production and rising prices (or high prices except when the major countries which are large users of the resource are in recession), and this is precisely what we are seeing for oil.

Figure 3 shows that even when all kinds of oil substitutes are included, oil supply has not risen enough to keep oil price flat since the 2003-2004 period.

In my view, what has happened since 2003-2004 is very similar to the effect a person might expect from Liebig’s Law of the Minimum, if oil is a necessary component of the economy, and high oil price signals that too little oil is reaching the system. In agricultural science, Liebig’s Law of the Minimum states that the amount of plant growth is governed not by the total resource available, but by the amount of input of the needed resource in least supply (for example, nitrogen, phosphorous, or potassium). In other words, it isn’t possible to substitute one type of fertilizer for another; similarly, it isn’t possible to substitute one energy product for another in the short term. Instead output contracts, if oil is too high-priced. In a way, this contraction might be seen as a dress rehearsal for the ultimate contraction which Limits to Growth models have suggested will eventually arrive.

I am sure that some would say that oil supply would need to actually decline, for there to be a problem. Since the Limits to Growth model does not look at resource prices, it does not consider this detail. It would seem to me that by the time world oil supply actually declines, the world may already be in a major recession, which does not allow prices to rise high enough to keep production up.

Connection with Debt

What relationship does debt have to the economy?

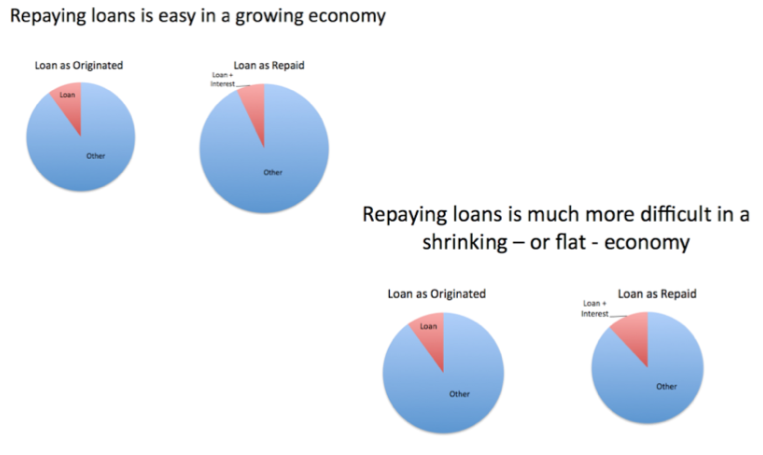

1. Economic growth enables debt, because in a growing economy, the greater amount of resources available at a later date make it much easier to repay debt with interest. I have shown an illustration of this several times.

The above relationship does not mean that debt would disappear completely in a shrinking economy. There would still be some situations where debt would be used, such as in short term loans to facilitate trade, and in situations where high rates of return can be assured.

2. Additional debt enables GDP to grow more rapidly than it otherwise would, because GDP is a gross measure–a measure of what an economy produces and sells–and having more debt helps in two respects:

a. Additional debt helps the company extracting the resource or doing the manufacturing, by giving the company additional funds to work with–to purchase plant and equipment, or to hire consultants. It doesn’t have to wait and only use accumulated profits to fund new ventures.

b. Additional debt helps the potential buyer of goods, because the buyer can pay for the new item purchased (automobile, refrigerator, or house, for example) over a period of years while using the new product.

But higher oil prices tend to be associated with higher food prices. (See Figure 6, below.) When prices of oil and food rise, consumers (except for those making more money because of higher oil and food prices) tend to cut back on discretionary spending. This cut-back in spending leads to lay-offs and recession in discretionary segments of the economy. Some laid-off workers default on their debts, and businesses scale back their plans for expansion, because of the “bad economy”. As a result, they too need less debt.

So debt works well in a growing economy, but once an economy hits high oil prices and recession, debt works much less well. An economy has positive feed back loops from debt in a growing economy, but once oil limits (in terms of high prices) start to hit, feedback loops work in reverse–consumers and producers see less need for debt, and in fact, may default on past loans. Shrinking debt levels make it increasingly difficult for GDP to grow.

In my post The United States’ 65-Year Debt Bubble, I showed the following figure:

Figure 5 indicates that for the entire period from 1945 to 2007, non-governmental debt was growing more rapidly than GDP, helping to ramp up GDP. The ratio was close to flat for 2007-2008, indicating non-governmental debt grew about a fast as GDP, and has been declining since. Looking at quarterly data, this decline has continued through the second quarter of 2011. This continued deleveraging makes it more difficult for the economy to grow.

If I am right that we are indeed hitting Limits to Growth, I would expect the deleveraging to continue, and would expect it to get worse, as oil supply gets tighter. The reason why oil supply and not some other resource is involved is because oil is the limit (of the many which we might hit) that we hit first. We don’t have good substitutes for oil, except for products already included in Figure 3 above, such as biofuels and coal-to-liquid and gas-to-liquid. While there is plenty of oil in the ground, most of what is left is expensive-to-extract oil, because we removed the cheap-to-extract oil first.

Our problem now is different from our problem of high oil prices in the 1970s, because then our oil shortage was temporary, and we could add new inexpensive supply (Alaska, North Sea, and Mexico). Now we have few options, except expensive ones, which cause problems for economic growth.

Part of the problem with high oil price seems to be related to the fact that high oil price permits low EROEI oil to be produced. In other words, with high price, it makes economic sense to use a high level of resources to extract the oil. These resources include both resources used indirectly, such as for roads and ports and education, as well as direct expenditures. Clearly, it makes no economic sense to extract oil if the amount of energy required for extraction is greater than the amount produced. With high oil price, it appears likely that we are approaching this limit as well.

Prospects for 2012

We are heading into 2012 with many clouds over our heads. Oil supply is still tight, and prices are still high by historical standards. No country expects huge additional oil supply during 2012. We can pretty well guess that we will either have high oil prices or recession throughout 2012.

Many of the problems arising from high oil prices/recession in the 2008-2009 period still have still not gone away. Instead they have been transferred to the governmental sector. What has happened is that with recession, employment dropped, as did taxes collected by governments. At the same time, government expenditures rose, for bank bailouts, stimulus funds, and payments to the unemployed. This is true both in the United States and in many European countries who are importers of oil.

Now conditions are not much better, and are threatening to get worse, because of continued high oil prices. Governments already have high debt loads, but still need to bail out more banks and pay benefits to more unemployed. The United States is supposed to have a plan to solve its debt limits problem by November 23, and vote on it by December 23. Any cutback in benefits to unemployed or layoff of government workers is likely to make the recession worse; raising taxes is likely to have a similar effect. At the same time, there are still problems which have not really been addressed–for example, large amounts of “underwater” commercial property. Defaults on some of these debts are likely to lead to the need for more bank bailouts.

Problems with the Euro have been in the news a lot recently. The adverse factors (particularly high oil prices) causing the PIIGS to have financial difficulty are still in play, so the financial condition of these countries is not likely to improve; more likely it will get worse. It appears to me that the Euro has a high likelihood of “coming apart” in the next year, either partially or completely, because of debt defaults. If countries go back to their pre-Euro currencies, it is not clear that other countries would want to trade with the defaulting countries, except on very disadvantageous terms.

China has been growing in recent years, but a lot of its growth is propped up by debt. Now, it is hitting headwinds–high oil prices, rising coal prices, and lower economic growth in countries that might buy its products. With less growth, China is likely to have debt default problems relating to the debt supporting its recent growth. All of these headwinds suggest that China’s growth rate may be scaled back greatly as well.

There is no guarantee that we are through the governmental problems in the MENA region. Getting rid of one leader does not guarantee that the new government will be a significant improvement over the previous one, so one revolution may be followed by another, or by civil war. The US is pulling out of Iraq, perhaps leading to greater instability there.

MENA countries generally import a significant share of their food, and high oil prices usually lead to high food prices, because oil is used in the growing and transport of food. Because of these issues, we may see more riots in MENA countries, especially if oil/food prices rise further.

We are reaching limits in areas other than oil, and these may be problems as well. Fresh water is an issue that will become increasingly important. Pollution is another area where limits are being reached. Examples include hydraulic fracturing of wells in populated areas and conflict over EPA regulations relating to coal-fired power plants.

Impact of Omission of Debt and Prices in the Limits to Growth Model

Figure 1 clearly shows a tendency toward overshoot and collapse, based on the Limits to Growth model as it was originally created. The original model doesn’t consider the impact of debt or of resource prices. The omission of debt means that the model doesn’t consider the possibility of moving from an “increasing debt” situation to a “decreasing debt” situation. If such a change takes place about the time resource limits hit, a person would expect sharper peaks and faster declines to the modeled variables.

The omission of resource prices means that the model doesn’t pick up the interconnections between high prices for one resource, and a cut back on demand for other resources. We discovered during the 2008-2009 recession that electricity demand dropped at the same time as oil demand. If financial interconnections cause a shortage of one resource to lead to reduced demand for other resources, this may mean that substitution will not will work as well as some hope.

Nothing happens overnight with the world economy, so changes are likely to take place over a period of years, rather than all at once. We can’t know exactly what the future will bring, but the handwriting on the wall is worrisome.

This article was originally posted on Our Finite World.

Of course, we have already seen a measurable decline in Global Net Exports (GNE) and in Available Net Exports (ANE). ANE = GNE less the Chindia region's combined net oil imports.

Jim Cramer on CNBC this morning: "We will be a big net exporter of energy, even as we import energy from OPEC."

Here is what BP shows for the ratios of US consumption to production (C/P) for 1998 to 2010 for coal, natural gas and oil:

We are just barely self-sufficient in coal, consuming 95% of production in 2010, and a few years ago, we were a net coal importer for a year or two. In 2010, our natural gas consumption exceeded production by 12%, and our oil consumption exceeded production by 155%.

The ultimate problem is too many people. With unlimited population growth, all other resources are ultimately exhausted. Paul Farrell gets it:

An apocalyptic end to world’s biggest bubble

We may find that it's already too late to avoid the population bubble's implosion...

E. Swanson

Nice link, Dog. Scary as hell, and accurate, IMO. From the article:

A watershed moment in my life was when I came to the same conclusions, and soon, also concluded that neither of these things will occur; that our technology/ingenuity will not save us, and that population will increase until it can't. As individuals we may be quite clever; as a collective species, not so. These changes require a level of cooperation that 7 billion humans won't be in a position to muster.

As for 2012, I see many 'gray' swans coming over the horizon. Best hopes that none turn black.

In other words one of the two things we need is something that is totally impossible. Even China's population control is not voluntary. China's One Child Policy

Many places already have fertility rates below the replacement level but most do not. The world population rate is still increasing by about 1.1 percent per year. That comes to almost 80 million people per year.

The author of the piece says that population needs to "level out" at eight billion. I don't think it will ever "level out" at anything and I do not believe it will ever reach eight billion. At any rate eight billion is way, way above the earth's long term carrying capacity. As proof of that all we need to do is look at what we are doing to the earth with only seven billion.

But, when it comes to predicting the future of the earth people have always posited stupid impossible things as the "solution" to all our problems. This article is no exception.

Ron P.

Why do you say that's impossible? Total fertility rate has fallen by 50% in the last 50 years, and about 25% in the last 20 years. Or is this essentially a difference in opinion on what "rapid" means in this context?

There's a good TED talk on these sorts of stats; the change in fertility rate for all countries can be seen between about minutes 4-5.

True, although I think it's worth pointing out that it's not exponential growth. The growth rate has been falling steadily since about 1970, with the number of people added per year roughly flat since 1980, with both measures projected to fall in the coming decades.

If one sees us as up against the wall already, that's probably not going to be thought of as rapid enough change. If one sees the problems we're facing as a multi-decade challenge, though, these are hopeful signs.

Look at the two countries with the largest populations, India and China and you will have your answer. China's one child policy is the farthest thing from "all voluntary". China has the most efficient propaganda machine in the world. They sell their one child policy with billboards, TV ads, newspapers and magazines but they still do not have anything close to an "all voluntary" policy. If, with that massive propaganda machine they could not sell it to their public then no one can.

In the 1970s Indira Gandhi tried to implement a "voluntary" birth control program and was almost thrown out of office because of it.

Do not confuse a decline in fertility caused by the "General Adaptive Syndrome" with anything voluntary.

Ron P.

I doubt that "General Adaptive Syndrome" has much to do with demographic transition as some have argued. GAS has more to do with physiological stress. Given that lower fertility rates and birthrates correlate strongly with better education and increasing relative wealth, it would make no sense to attribute this [demographic transition] to increased stress.

I agree that lower fertility rates are a hopeful sign, especially since this is the trend in virtually all countries regardless of relative wealth, religious or cultural values. Possibly too little too late, but that remains to be seen.

You are right the General Adaptive Syndrome does not have much to do with the demographic transition. That is because they are two entirely different things, one is just not related to the other. The demographic transition is largely a myth. Poor countries like India, Bangladesh and Burma will never undergo anything like a demographic transition. Even China, which is trying to bring its people into the 21st century, are leaving the people way behind. There are demonstrations all over China every day due to social unrest. If there is a demographic transition in China it is leaving most of the people behind.

A demographic transition implies that the the status of the poor is improved, they enter the middle class, have cars and all the things enjoyed by the developed countries. There are just not enough resources in the world for that to happen.

Ron P.

My observation is that as a species we are very clever...too clever for our own good apparently. We are not wise, however.

Funny you should have noticed!

Question Everything where I have been writing about this very thing for years.

Then we are misnamed. Homo sapiens means "wise man". Perhaps we are wise but just not wise enough. ;-)

Ron P.

Philosophicly speaking I see a hirarchy of information. It looks like this

wisdom

knowledge

information

data

A thermometer can handle data. A computer can compile that data into information. Sentinent beeings can understand and refine that information to knowledge. Humans can use knowedge and reach wisdom. But not everyone can reach this goal.

In my youth I read in Proverbs that "the begining of wisdom is to seek wisdom". This statement was very frustrating to me, since it is a tautology. You will not find wisdom, unless you seek it, so off course the begining of wisdom is to seek wisdom. Then one day it occured to me what the guy who first said this may have meant; You wont find wisdom unless you seek it. Or in other words: "Wisdom is an attitude."

If wisdom is an attitude, then humans as a species can not be labeled "wise" or "not wise", since it is up to the individual what attitude they want to have.

I'm afraid that isn't quite right. There is a whole literature of psychology of wisdom. There is also a growing literature on the neuroscience of wisdom. Turns out that, like intelligence and creativity, there is a heritable component in wisdom that psychologists and neurologists are trying to get a handle on. Not everyone is prone to wisdom and not just because they don't have the attitude. The latter is probably more of an effect than a cause.

I work on the evolutionary neurobiology part of this field when I'm not working on energy or computer science!

You can read my working papers here. The first series is the research. The others are more speculative re: implications.

Just when I was thinking that I was the only one to mix some much different field on knowledge altogether.

Can you share some names of people working on the psychology of wisdom? Or suggest some books?

(Not that I particularly trust psychologists to recognize wisdom if it hit them over the head.)

We're not talking about clinical psychologists! Here is a sampling of the reference list you will find in my working papers.

Sternberg, Robert J. (ed.) (1990). Wisdom: Its Nature, Origins, and Development, Cambridge University Press, New York.

Sternberg, Robert J. (2003). Wisdom, Intelligence, and Creativity Synthesized, Cambridge University Press, New York.

Sternberg, Robert J., "Wisdom and its relations to intelligence and creativity", in Sternberg, Robert J. (ed.) (1990a). Wisdom: Its Nature, Origins, and Development, Cambridge University Press, New York.

Gardner, Howard, (1999). Intelligence Reframed: Multiple Intelligences for the 21st Century, Basic Books, New York.

Gilovich, Thomans, Griffin, Dale, & Kahneman (eds), (2002). Heuristics and Biases: The Psychology of Intuitive Judgment, Cambridge University Press, New York.

Gazzaniga, Michael S., (2005). The Ethical Brain, Dana Press, New York.

Geary, David C., (2005). The Origin of Mind: Evolution of Brain, Cognition, and General Intelligence, American Psychological Association, Washington, DC.

Goldberg, Elkhonon, (2001). The Executive Brain: Frontal Lobes and the Civilized Mind, Oxford University Press, New York.

Goldberg, Elkhonon, (2006). The Wisdom Paradox, Gotham Books, New York.

There are many more. Enjoy.

Thanks loads. Is there one you recommend to start with?

Sternberg, Robert J. (ed.) (1990a). Wisdom: Its Nature, Origins, and Development, Cambridge University Press, New York.

Sternberg is a past president of the Psychological Society and one of the premier researchers in intelligence and wisdom in the field.

Great. Thanks again.

Me too, thanks for the link.

I've been recommending this RSA video this past week to a number of people; it gets at our problem of reductionist thinking. You can be really smart about the trees and miss the forest by a country mile. I'm seeing that now everywhere I look in our techno-society. A lot of really bright people staring at their feet and wondering who moved their cheese.

http://www.youtube.com/watch?v=dFs9WO2B8uI

Gardner's "multiple intelligences" concept is anything but accepted in modern differential psychology. It is very flat and more a "wichfull thing" hypothesis that anybody has a special gift in a special are (Bodily-kinesthetic intelligence or Musical intelligence). Recent research has proved that it is mostly wrong. There is a dominant General factor of intelligence "G" which collides heavily with Gardner's concept of a vide variety of independent "intelligences" not interlinkt to each other. Also Sternberg is anything but undisputed by defferential psychologists.

http://en.wikipedia.org/wiki/Theory_of_multiple_intelligences

Thanks for bringing my attention to "differential psychology". I will have to take a closer look. As to the fact that psychologists often disagree with one another is nothing new. There are schools of psychology just like there are schools of economics. What it has always seemed to me is that they are all looking at similar phenomena but from different angles and through different lenses so see differences that they believe make a difference. What I find exciting is the incursion into the field of neurobiology, especially with the new imaging technologies that allow deeper correlational studies re: behavior, cognition, and brain functions. Exciting times. I think that this newer approach will help filter out the differences of opinions that has plagued the scientific endeavors of psychology.

BTW: according to Gardner the G theory definitely does not "collide" with multiple intelligences. And I never claimed Sternberg was undisputed. I said he was a premier researcher. Science is inherently full of disputes!

Not everyone is prone to wisdom

Wisdom reflects the exposure of a neural net to action/reaction data. Thus as a human ages, its neural net gets actions like 'stove is hot' and reaction 'don't grab hot stove' and thus the "wisdom" of 'grabbing hot stove is not wise'.

Now here's where the 'wisdom' gets off track - Propaganda^H^H^H^H^H^H^H^H^HPublic Relations. If the neural net gets bad action/reaction data sets the 'wisdom' will be 'wrong' (or right if you are the one selling the propaganda)

You are confusing wisdom with conditioned learning. They are not one and the same. The kind of learning that takes place to give rise to wisdom is the acquisition of tacit knowledge about complex relations extending over long time scales. It is true that this kind of knowledge has to get reinforcement from success in its uses. But the scale of complexity is orders of magnitude greater than simple conditioning.

You are confusing wisdom with conditioned learning.

Not at all.

If one accepts the idea of "wisdom with age" - how does one become wise with age other than the exposure of said aging neural net to actions/reactions?

Recommend you read a bit of the literature before expressing opinions like this. There is a great deal more to wisdom (and sapience) than conditioned learning over the years. Your opinion tries to trivialize something that is anything but trivial.

"Conditioned learning" as much Do A get B as is reading about the effect B happening when A is done.

Pile enough A|B relationships together and one can start assigning probability of a C|D relationship given similarities to A|B.

If no human being has ever met a space alien - how are humans to 'be wise' about how to interact with such an entity? We can apply our A|B rulesets - but they could be 100% wrong due to a lack of understanding their %|!@ relationships.

I take it you don't do brain science for a living.

What does "Brain Science" have to do with "wisdom"? Mankind seems FAR more interested in making computers take many A|B pairs and employ a weighting system to generate 'for condition C, D should be the expected outcome' - Watson by IBM being a public example. Unless there are credible plans on injecting DNA/robots/chemicals/or whatever into human brains to "create wisdom".

Wisdom: The quality of having experience, knowledge, and good judgment; the quality of being wise.

The soundness of an action or decision with regard to the application of such experience, knowledge, and good judgment.

How are the above two definitions nothing more than a collection of A|B relationships that get expressed as weighted pairs when a new condition of C happens for a determination of D?

Both definitions use the word knowledge - and knowledge can come from "Conditioned learning" or from the experience/observations of others which become coded as A|B pairing.

But do feel free to explain how wisdom is not a collection of relationships of cause|effect that get sorted by probabilities to determine an effect when a new cause shows up.

LOL! That statement alone says it all about your understanding.

Eric, I am a computer scientist with a pub history in simulating neurons, neural networks and brain-like systems that controlled animatic robots.

http://faculty.washington.edu/gmobus/Adaptrode/causal_representation.html

http://faculty.washington.edu/gmobus/ForagingSearch/Foraging.html

for a sampling.

Since you seem so cocksure of your perspective I will not make any further attempt to discuss this topic.

So you are basicly saying that some people are, for neurological reasons, to stupid to be wise? I find that very hard to argue against.

Stupidity (lack of intelligence) is actually not the problem. There are plenty of examples of very clever people who still lack basic good judgment. The lack of wisdom is neurologically based. But just not directly related to intelligence. The Sternberg books (listed above) provide a good explanation of this differentiation between intelligence and wisdom.

I thought the proverb was "Fear of the Lord is the beginning of wisdom."

The idea that fear could have much to do with wisdom always bugged me. Though I guess a kind of prudent caution is very essential to it. Perhaps something is lost in the translation here. Others have claimed that the word is better translated as 'awe.'

Of course, the definition of wisdom is always a bit tricky. Perhaps only the wise can truly define it. But then who decides that they are wise.

Also, I'm not sure knowledge is always relevant when it comes to wisdom. It certainly helps to have some knowledge of some basics. But piling up vast quantities of knowledge may actually get in the way of wisdom, imho. I am put in mind of the Zen master finally granted an audience to a famous professor. The professor immediately started to talk about everything he (thought he) understood about Buddhism. The master offered him tea, and the poured him a cup, but kept pouring after the cup filled to the brim. As the tea started to pour out of the saucer, the professor sputtered, 'Stop, the cup is already full!" To which the master replied, "Your mind is full. Come back when you have emptied it."

Actually, both quotations are found in Proverbs.

Regarding your second paragraph, the conclusion of it is pretty much what I think about it.

Now let me explain how I connect knowledge and wisdom. I happen to have a lot of information in my head in form of a table with two columns; "nation" and "capital city". This is just information, it is not knowledge. If I know that Rome is capital of Italy it don't mean I know any usefull thing at all about the country. Itis just information.

Now let say I move to the country, learn the langauge and culture, get married with a local girl and adapt to the country. Also I study the geography, its history and legal system, how the economic networks operates and its industries and so on. Compiling all this information, I will in time build a large knowledge about the country. But it is still not wisdom.

But say the place get into big problems. Then they hire me to solve the problem. And I take all that knowledge I have and think up a solution that not only work to solve the problem, but also take care of the long term secondary effects. To do that, you need wisdom. In this case, wisdom is to know the knowledge at depth and how all the different parts inter-relates.

So I guess my view on wisom is that it is the ability to put knowledge into use.

I would actually say that wisdom is knowing when NOT to put knowledge to "use."

But maybe I have read the Tao Te Ching too many times? '-)

Consider a non 1611 translation of the Hebew word to say "respect".

Thanks, schoff. That old King James, he just keeps rolling along...

http://www.youtube.com/watch?v=_DZ3_obMXwU

From usage elsewhere the root Yod-Reish-Aleph means fear. Seem to remember that the rest of the sentence was "beginning of knowledge" (Reishit Da'at) rather than wisdom (would be "reshit hohma") but maybe wrong or maybe there are both and can't be bothered to go look it up.

I believe that there are those who are wise, those who believed the message of Limits To Growth, and have planned accordingly. They set their plans in stone, for all to read.

The coming die-off will not be pleasant, but it is the best hope for Planet Earth.

I find point 3 off the mark. It does not work that way. Children will always speak differently from their parents in order to diferentiate themself from them. Thus laguage evolves and change. This is unlikely to happen the same way in all places, an thus new languages come out of dialects. Language are a living thing since it is spoken by living beeings.

The coming die-off will not be pleasant, but it is the best hope for Planet Earth.

Hope?

It's not "hope" at all.

93% of the earth's human population dying off

If it is what is to be, it is what will be. The Earth will go on whether this is to be or not.

But to call it "hope" reveals a lot...about you.

To paraphrase Kafka: "There is hope...but not for us."

Having a wide variety of experiences in dealing with a wide range of humanity - I can say, with confidence, that most are not worthy. I don't view that conclusion as the attitude of an elitist, merely a statement of fact.

Perhaps you should spend some time perusing this website and you will find many who have no place in a new world that exists under a new paradigm.

Some people are recceptive to the truth - others are not. Free will or pre-destination? I can't answer.

"Worthy" of what?

This is bunk. The earth will be chocked up anyway in about 300 million years and "nature" - ore better the Universe - is neither good nore bad, because there is no such concept as good/bad, no sustainibility or anything else in the eternity of it. Every day and everywhere the growing entropy in our system (our Universe) is doing it's work till the inevitable END!

Maybe because of a mass extingtion done by the human race the evology will "produce" a wide varity of new astounishing creatures in the future, which would otherwise have never lifed was it not for our doing! How will you judge that??? How will you judge a 5km dimater asteroid hitting earth. Is this good/not bad because it is done by "nature"?

Do you really believe that Earth is unique? That humans are the only type of their kind in the Universe? That Aliens are not visiting Earth, or perhaps even living amongst us? Mankind is very arrogant - to say the least. The Ancients spoke of a time when the gods lived amongst them. They had advanced astronomical knowledge, mathematics and built structures we can't duplicate today. Archelogogy is full of lies, ignores anything than contradicts "their line" - just as the lie of evolution does.

If you are interested in a different point of view, here is some interesting places to check:

Open SETI

Sphinx Stargate

THE AGES OF URAS

NICAP

Charles Hall and the Tall Whites

Enicar,

I edited your comment,because I found the wording offensive. Please be respectful of other posters.

You did provide some links, so I left these.

"Homo sapiens has the information to know itself for what it is: an Ice Age hunter only half-evolved towards intelligence; clever but seldom wise." -Ronald Wright, in A Short History of Progress.

We have the information, but most of us won't heed it.

We have the information, but most of us won't heed it.

Do we have the information?

Or do we have a set of data that has been doctored or filtered to support one goal?

Sorry if I'm slow but what's the goal? Here I interpreted information to mean the fact that ignoring the consequences of actions seems to be a ubiquitous human trait. Whether there is actual data to support this is arguable I suppose. I think documentation of the hyperbolic discount rate would be one such such component of that data.

Sorry if I'm slow but what's the goal?

It's ok. Its a world wide audience and and in some places its not the acquisition of small green pieces of paper - sometimes the money is coloured differently.

Here I interpreted information to mean the fact that ignoring the consequences of actions seems to be a ubiquitous human trait.

Such is not ubiquitous - TOD has a few posters who ask on many topics 'have you considered the consequences to that action plan?' - thus not EVERY human is guilty of your charge.

One post I wrote (that is not on The Oil Drum) is quite disturbing. Way back in the stone age, humans were wiping out other species. The post is called European Debt Crisis and Sustainability.

Gail, I read your article. I thought you did a good job, well a great job.

That post has been very popular. I didn't submit it to TOD, because I didn't think it was TOD's topic.

More the pity. It's certainly about "energy and our future", guess I'll have to start checking our your site more often.

No greater truth could ever be uttered. Some person might get the relationship between mass & energy and even figure out the constant C2, but can the world control its population increases - no.

Reptiles have the first brain, in mammals the 2nd brain layer has been added and primates, in particular humans have the 3rd added brain layer, the neocortex. But evidently the 3rd is not used collectively as world population increases by 80 million a year. In other words with respect to population, we are no different from any other specie with either the first or 2nd brain layers when met with increasing food sources and lack of predation - it rises.

Consequently we are subject to the same experiences other species face when their populations meet resource constraints. I suppose that will either be a hard blow or a slow reduction, or one followed by the other, but in either case it will be against our collective, base brain drive to increase population.

I'm surprised that you keep saying that, since that view has been disproven time after time here at TOD by different people. You can't possibly have missed it, but in the event I'm wrong about that, please have another look at the data. Wealth and total fertility rates are inversely correlated!

Disproven? You're claiming too much. Yes, there is a correlation between wealth and fertility and yes it may well be causal.

But what does that mean if wealth declines for the majority of people?

What do we expect to happen to wealth? Here we get to the nub. Optimists say that our society is flexible enough to redistribute wealth, counteracting the innate tendency of markets and human social systems to concentrate wealth. Others are sceptical.

"Others are skeptical." Especially the wealthy? '-)

I agree that population is a major issue. Oil is important both in keeping up food supply, and in keeping transportation operating. Indirect impact on the financial system could affect electricity as well.

We have a system that works passably well right now, but it is easy to see how there could be interruptions to it, that would affect food and water supply. Some of this might occur after storms, when governments don't have funds to fix up roads and other infrastructure. Our system is becoming increasingly fragile.

"We have a system that works passably well right now..."

Yeah, kind of like a kitchen where the dishes are piling up in the scullery, the leftovers are shoved in the fridge to get moldy, and the garbage never gets emptied.

Our sinks are getting full...What now? Order a pizza? Sorry, I just think "passably well" is an illusion. We've insulated ourselves from our true condition, especially in the West.

Our system is becoming increasingly fragile.

Is the 'system' fragile or is the 'system' explained as one thing and acts actually as another thus creating a situation where the reactions are based on bad data?

The government certainly does its part in making sure that decisions are made on bad data. They spew out reports saying that fossil fuel use will grow endlessly. They combine data in such a way that it is hard to see how little wind and solar and biofuels are actually contributing. They contribute to the "shale gas" hoopla. It is no wonder people are confused.

One post on this subject that I did not submit to TOD is

New Dept. of Energy Priority-Setting Analysis Seriously Flawed.

The government certainly does its part in making sure that decisions are made on bad data.

If you were to ask me to choose - good data from Government or Corporations - I would choose Corporations over Government.

Because at this stage of the game, large Corporations drive Government more than the other way 'round.

Don't mean to be facetious but debt is only a problem as long as one aims to repay it. Latin America in the 80's is a good example- a lost decade as they went through every contortion to keep honor their debt to the banks. . However, once the debt was written down they went back to the growth path. Argentina post 2001 or Russia post 1998 are other examples.

TPTB will try and have done everything in their power to make sure that people remain debt slaves. However, inevitably the debt will get written off- peacefully or violently. I think in the model the profile of debt will look a lot like some of the other curves- a relentless build up and then a big crash. Greece is the canary in the coal mine.

"However, once the debt was written down they went back to the growth path. Argentina post 2001 or Russia post 1998 are other examples."

It's global this time. Few places to hide.

Actually I think it is fewer places for the lender to hide. Yes it will be global and that is why a relatively insignificant country Greece is causing the debt holders so much concern. Once the periphery of Europe is pierced it is hard to see how the process of debt write off stops and inevitable last stop is the United States.

I think we are in for a mammoth reset moment.

Ja... reset: Greek debt writedown of 50%.

Now all is wonderful in this, the best of all possible worlds!

Craig

"TPTB will try and have done everything in their power to make sure that people remain debt slaves."

Obviously this is what they are fighting over in the EU. False attempts to pretend that they have a plan while they fight like hell to make sure the other guy takes the fall, while protecting themselves. Problem being they are too interconnected and damn well know it. They do not have a plan because one does not exist that leaves everybody standing and whole. If we are creatures of habit then violence will topple governments and banks.

The fact that resources are more constrained, leading to higher prices, especially for oil and food, is what is making all of the debt bubbles pop simultaneously.

It is hard to write off debt in an equitable manner. If a person has just moved into a home, and has made two payments on it, should he be allowed to keep the home, and the debt completely written off? There are others depending on the proceeds of debt. Our pension system depends on debt repayment, for example. There are winners and losers. Our bank balances also depend on banks getting most of the loans repaid to them. I suppose the Federal Reserve could "print" more money for the banks, but it is hard to see international trade continuing as it is today when it is not supported by repayment of debt.

Gail: Excellent article. With regard to your comment, I wonder about the difference between a debt being completely written off, or partly written off. Consider: A person buys a house for 300K. Times get hard, our homeowner can't meet the mortgage, and gets foreclosed upon. The house, due to declining real estate value, is now worth, let's say, 200k and someone else buys it. What happened to the difference between the 300k mortgage and the 200K one? What if the original homeowner could meet the financial obligations of the 200K mortgage? Could/should the lender "eat" the difference? The lender (or someone) is already doing so by selling the foreclosed property for the lower value, yes?

I am quite sure that a "fair" solution dwells within the realm of the abstract.

Right. And the bank or Fannie Mae or Freddie Mac was depending on the income, to fund interest payments or dividend payments, or just to have the money to give back for the deposit. Pension plans depend on mortgage payments. If you lose payments one place, somehow this gets passed on to someone else. Theoretically, the government is supposed to insure bank deposits and pensions, but there is a question of how possible this will be in practice. The government can print money, but who everyone (outside the US) accept it?

As long as the government also controls mandatory "sinks" like taxes/fees there will be a demand for the government 'money'.

But imports may drop to negligible levels.

Such should please the "Free Market" types who like being touched with Adam Smith's "Invisible Hand" - the hand that is only mentioned in the context of Nation to Nation trading.

(And what happens if the Middle East decides the US Dollar is no good for getting Oil? The US has oil to power Ag in the US - but after that, who's in line?)

China and India would like more oil (and cheaper) if they could get it. Saudi Arabia might sell oil to the US, if they could get wheat in return.

I see the bigger issue to be importing replacement parts for oil drilling equipment and for power transmission systems. If we find ourselves without necessary parts for essential activities like oil drilling or energy transmission, we could find ourselves losing our own capacity to pump oil or to transmit electricity.

Or what if we can no longer import computers from China?

I think there are two types of debt

private to private and public to private. The former will be resolved via the normal process of contract law- I don't think anybody gets to stay in the their home and have their debt forgiven. The debt will be extinguished and the asset transferred from borrower to lender. Those lenders who made unsecured loans well they will learn what an unsecured loan is.

The more difficult one to deal with is the public to private.It seems to me that an equitable way to deal with it would be on a per capita basis. The government honors debts to private citizens either directly or indirectly (e.g. holdings via pension funds) for full face amount up to a certain limit and then progressively applies a haircut. Upwards of 90% for the very wealthy.

I think the key issue is bite the bullet and realize the debt is not going to be repaid a 100c on the dollar.

The question I have is, "What is a bank going to do with thousands of homes?" Somehow, the homes have to go back to people--perhaps rented, with bank ownership.

Government that cannot pay their debts are not likely to last. I would look for a different constitution, different borders, and different currency. Maybe we get something from the new government, but we cannot count on getting what we had before.

I thought that many were being demolished?

NAOM

Gail - Nice piece...thanks. Even with my limited grasp of economics it seems the financial system has gamed itself into an even more precarious position than you describe. With derivatives, etc. they appear to have greatly magnified the downside of the risks. Similar to "double down" except in this circumstance the force multipliers are many times greater than 2X.

Even to a geologist the global ripple effects seem obvious. Greece may be a small domino but it only takes a three ounce detonator to set off a ton of dynamite. Given the instantaneous communications connecting all the global economies that one spark could ignite responses faster than the financial institutions/govt can react. I'm sure most have "a plan". But as we know there is the plan and then there's what actually happens.

I think this is the problem. I don't really understand what will happen with all of the derivatives, but it is hard to see that they would help the situation--only make it worse.

Or in the immortal words of Mike Tyson, "Everybody has a plan... until they get punched in the mouth"

Similar to "double down" except in this circumstance the force multipliers are many times greater than 2X.

not 2X, how about X to the n power, where n = number of years past peak?

Thanks, Gail. "We can’t know exactly what the future will bring, but the handwriting on the wall is worrisome."

You're certainly not alone in your concerns:

Martin Weiss’ “7 Major Advance Warnings.”

Following is a list of annual average US (nominal) crude oil prices for 1925 to 1940. During the Thirties Depression, it appears that global demand fell only one year, in 1930, rising thereafter. And there were reportedly three million more cars on the road in the in US in 1937, versus 1929. Of course, China would be to our current predicament as the US was to the Thirties.

After hitting $1.79 in 1931, the average price for the next 9 years was $2.13.

1925: $3.44

1926: $3.50

1927: $2.91

1928: $3.11

1929: $3.67

1930: $2.38

1931: $1.79

1932: $1.82

1933: $1.78

1934: $2.39

1935: $2.13

1936: $2.43

1937: $2.60

1938: $1.90

1939: $2.06

1940: $2.33

Data source: https://www.globalfinancialdata.com/index.html

A scary thing is comparing those great depression price changes compared to our great recession price changes. Back then, the price of oil crashed down and remained down . . . only slowly rising during the great depression. We had the price of oil crash in 2009 . . . yet despite nagging unemployment, oil has more than doubled since the post crash price. Clearly something (oil depletion) is acting on oil prices now that did not happen back then.

The 1931 price was about half of the 1929 price, but note that after 1931, the general price trend, relative to 1931, was up throughout the Thirties, except for 1933. Note that the East Texas Field was discovered in 1930 and at the peak production rate it was capable of meeting something like one-fifth of global demand at the time, but it caused the local oil price in East Texas to fall to as low as ten cents per barrel at one time.

In any case, it appeared that global oil consumption rose throughout the Thirties, after declining in 1930.

Yes, that was another good Paul Farrell post. Over at on The Automatic Earth blog, "Ilargi" and "Stoneleigh" have been saying essentially the same for many months.

July 22 2010: The Big Picture According to TAE - An Updated Primer Guide

"When bubbles reach their maximum extent, they invariably deflate..."

E. Swanson

"Stoneleigh," Dmitry Orlov, and I will be on a panel at the ASPO-USA conference on November 4, so we can compare viewpoints then.

My impression is that she is of the point of view that things would have fallen over of their own weight. I think they would have fallen over, too, but continued economic growth fueled by fossil fuel growth helped keep debt-expansion going as long as it did. My point of view is that it is not just one country that is running into headwinds, it is the whole world, because of the limits we are now reaching because of high oil and food prices. Other limits also play a role as well, of course.

". I think they would have fallen over, too, but continued economic growth fueled by fossil fuel growth helped keep debt-expansion going as long as it did. My point of view is that it is not just one country that is running into headwinds, it is the whole world, because of the limits we are now reaching because of high oil and food prices. Other limits also play a role as well, of course."

My position exactly. I don't understand why so many otherwise-very-smart people find this so hard to understand.

While we may not "know" the future, people can at least consider possible future scenarios and how they would respond so as to be psychologically prepared.

For example:

What if I lost my job?

What if my pay were cut in half?

What if gasoline cost $9 a gallon?

What if I can't afford my medications?

What if a national emergency is declared and things are "locked" down?

What if WWIII looks like it may be starting?

Obviously I'm of the "be materially prepared" school based on my many posts in the past. But, at the very least people can be prepared to the degree that their preparations, both physical and psychological, buy time so as to not be caught up in having to make decisions without full consideration of the implications of their decisions(s).

Todd

I think our family could adapt to the direct cost of $9 a gallon gasoline as long as we kept working. I think the indirect impacts on other costs (e.g. food) might be more than we would expect. Let us hope it doesn't get that high anytime soon.

Much of the world already has ~$9 gasoline due to taxation. But of course - the taxes we pay to ourselves. It would hurt more if we had to send all of that money to oil producers.

the "be materially prepared" school

There is a movement called "The Preppers" (or even The Mormans) if one wishes to get hints on that.

Be careful.

Martin Weiss and others like him have a history of making apocalyptic predictions. He wants you to subscribe to his newsletter. He was making similar predictions in the Fall of 2002 and Spring of 2003. He was predicting a stock market collapse, a banking collapse and a major depression. Instead we had a huge rally from March 2003 to October 2007. His subscribers lost a lot of money when their put options expired worthless.

Another quack is Robert Prechter. At least Martin Weiss has been right about gold. Prechter has been predicting his "grand super cycle depression" since at least the mid-nineties. He has been constantly wrong about almost everything since the crash of 1987 which he famously predicted. He has been top calling gold since at least $350 and oil since at at least $60. He has also for several years predicted a massive rally in US $ which has failed to materialize so far. Prechter is really bizarre. He has attempted to correlate the stock market with popularity of slasher movies like "Kill Bill", Donald Trump's book writing, Michael Jordan's basketball career and sunspots (I am not kidding). It is a wonder he has any subscribers at all!

Ok, but would you as a business person, in charge of making decisions affecting your business, decide what to do based on the overwhelming uncertainty that exists.

I see nothing, nothing at all, that makes me feel like letting loose of cash to invest in anything. Warehousing durable goods like motor oil and car tires for later resale, comes to mind. Not much else and nothing that will help create jobs.

Obama's executive order for optional debt reshuffling from non-recourse to recourse looks like a desperate attempt to put a floor on housing prices. If that were not enough then the idea of executive orders designed to hold Jello on the wall, seems like a path that will lead to ever greater controls. Top it all off with the Pope calling for one world body to control finance. This will likely get way out of hand, as there will be someone somewhere to whom global domination looks feasible, doable, and desirable to them.

"This will likely get way out of hand, as there will be someone somewhere to whom global domination looks feasible, doable, and desirable to them."

Dick Cheney?

My point was that be careful when you make investments solely based on predictions of someone like Weiss or Prechter.

I got your point. I own/operate a small business and see nothing out there that makes any economic sense. Ignore these guys completely. Even a lower and consistent, foreseeable level, of activity would help immensely in making some decisions. Hells bells, my customers say the exact same thing. If they are scared and clueless, how do I make any decisions, based on what they tell me?

This sucks, and far more than normal. People I have done business with for years are struggling, it has gone beyond the reckless ones, whom you expect to suffer in a downturn. It has come down to A) Lack of Debt. B) Deep pockets. I heard about 3 more bankruptcy's this month. This is a slow unrelenting squeeze. I will do nothing (that will help the economy) until I see daylight.

D - I'll use you to point out some stats that many don't realize. I'll assume you're a small business owner = less than 100 employees. 35,000 large business = more than 1,000 employees. 235,000 medium businesses = between 100 and 1,000 employees. 8 MILLION small businesses = less 100 employees.

IOW the vast majority of Americans draw a paycheck from a small business like yours. I think folks have heard that small business creates the majority of new jobs without understanding why. Today most are focused on large corporations and in particular the blunders they've made in recent years. Especially those in the financial sector. But at the end of the day it will take entrepeneurs like you to expand activity and bring unemployment down. And until the systems starts focusing on what small businesses need to see and hear they'll lack the confidence to do so. It's not really that complicated. The vast majority of the "rich" that so many want to soak are not the Wall Street barons. It the small business owners who typically are taxed as individuals and not as corporations. Take income away from these folks and then expect them to hire more workers? Increase their health care costs and expect them to reduce their personal income or lay off some workers to pay for it?

I think the persistent unemployment we have today, despite the economy "being in recovery", might offer a hint to the answer.

Rockman, I agree. Getting 'lumped' in with BIG companies isn't helping us at all. I have gotten 2 or 3 surveys in the last 4 months asking about our hiring intentions. They asked for 4 things that would help me want to hire. I wrote - more sales 4x. There is not some mythical "Pot of Gold" I sit on. In our good years 80% of what we took in went to pay bills. I paid $9-15 an hr. vacations, bonuses, SIMPLE, but health insurance would have added between $1-3 per hour per person. Every expense we have went up with energy, with our prices flat to falling.

I'm wholesale, so when I ask my retail accounts what they think, they need more sales too. It is as simple as that.

Given that people are financially tapped out. Working more for less. Having energy and food eat larger percentages of their discretionary income. I cannot see any reason to even attempt to go back to the level of business we had 5 years ago- It doesn't exist.

My "situation" is the hard, fact truth, and clearly until I "see" a recovery (not be told there is one) it won't change.

The U.S. Census Bureau, Statistics of U.S. Businesses, provides total numbers of businesses and total employees by business size. For 2008, there were close to 27.3 million total firms in the USA. About three quarters of all businesses, around 21.35 million firms, had no payroll.

Non-payroll businesses are usually self-employed individuals running unincorporated business where the business may or may not be the owner's sole source of income. Three quarters of all businesses in the USA are owner-operated with no other employees. The average sales or receipts for these business was $45,678 each.

Using the same source we can look at the data for firms that have payrolls. The data gives us the number of firms, by number of employees. Employees include full and part time workers, executives, officers and paid board members.

Using your criteria for business sizes (small < 100 employees, etc.) for a small business, in 2008 there were about 5.8 million small businesses with about 42.2 million employees. There were 115 thousand medium size businesses with about 23.8 million employees and about 9400 large businesses with almost 54.9 million employees.

In total, 78.7 million people work for medium and large businesses compared to the 42.2 million working for small businesses. Even if you count the possibly 21.35 million owners of the non-payroll firms the total small business employment would be 63 million, still not a majority of workers.

BTW, according to the U.S. Government's Small Business Administration, a small business in the USA is generally defined as one with 500 or fewer employees (manufacturing companies) or $7 million or less in annual sales (non-manufacturing), though their are exceptions to both those figures within specific industries. Using that definition for a small business, then a majority of workers in the USA do work for small businesses.

I am also not sure about your claim that the vast majority of the "rich" are small business owners who are taxed as individuals. In November 2010 Professor Scott Shane of CWRU wrote that average income for sub-chapter S corporations, favored by entrepreneurs, was about $100K per year, but did reach $250K in four industry sectors (including mining). For sole proprietorships the average was about $11,600, though in some business sectors the average exceeded $100K per year.

IIRC there is another survey out there that says the majority of the domestic hiring is done by the small and medium sized enterprises.

There should be no surprise about this, if you are an SME then you are regional or national, and tend to need and only have the scope for domestic hires. If you are a large company, then:

As a result, putting your support and tax breaks into SMEs is likely to have a bigger payoff for the country, particularly exporting SMEs and those with high profitabilities.

It is amazing how far the invention of our economic system has brought us. Now that we have reached or are reaching the limits of our planet to support life however, the systems and methods developed by our parents and grandparents aren’t working any more. There are two possible outcomes I can imagine. One is that we discover another (well, several more, actually) easily exploitable planet(s) to strip mine. The other is that we start running out of stuff. Important stuff, without which life (human life at least) is no longer easy; then no longer comfortable, followed by no longer possible. The first choice is unlikely, so I am expecting the second result. These are really big changes. Some people may have a hard time thinking about them. In general I believe these ideas are strongly resisted but no longer ignorable.

What startles me the most, though, is how many people and for how many years we lived and flourished under this system, oblivious to its flaws. It is my considered opinion that future generations will classify what we call Economics as akin to Alchemy; a pseudo-science that had a few good ideas but got the big picture completely wrong. There will be at least some humans left on this planet after the oil is gone. In time, they will create a civilization. It may be that this coming society will surpass any now known. On the other hand, it may fail suddenly and disappear. But by necessity life will be different from what we know. Our society runs on oil, and can’t endure without a ready supply.

Your illustration of the links between the abstract economic system and the real world situation under these circumstances is accurate. It demonstrates the predicament precisely. Your analysis is not just accurate and clear, however, it is direct and fearless as well. There has been criticism leveled at this forum in the past for espousing this position. One party will point out a looming critical shortage; the other automatically assumes the decline of Industrial Society is equivalent to “Doom”. Most people have a feeling of being in control of their destiny. The loss of this feeling can seem doom-like, I admit. But it’s pretty darn clear that change is coming, and pointing out reality is not the same (well, not necessarily the same) as predicting “Doom”. It depends on your frame of reference. And what side you’re on to begin with.

The problem with civilization collapse is that it may be a one time event. We've already taken the vast majority of easily accessible fossil fuels especially near the most habitable parts of the planet. People may not have the fossil energy available after everything goes to hell for our descendants to pick up the pieces and build anew. It won't be long before the surviving population won't be able to read even basic literature let alone advanced technical documents. It took years before the people in Europe replicated the technology and infrastructure of Rome, could we replicate a 22nm lithographic process for the most advanced Intel processors even 30 years after a collapse of civilization?

It seems pretty ruthless but western or 1st world civilization may be our first and last shot at achieving that level of technical complexity. Perhaps the reality is that for the western / 1st world to survive the rest of the world must be damned. The other choice is to let the entire thing fall over and hope that some day people will be able to live as we once did. In fantasy novels it is a common theme that people remember back in the past to civilization which was significantly more complicated than their own, our descendants may hold what we take for granted as myths and legends.

This is something I have been thinking about. My assessment is that an extended collapse scenario would leave remaining fossil fuels (virtually necessary for the re-industrialization process) in exotic places (polar, deepwater, oil sands etc.). All the "easy" oil would have been depleted. Since the easy oil was a primary catalyst of the industrial expansion, I would imagine that in this case re-industrialization would take a very long time to occur, if at all.

Perhaps a fast, abrupt collapse on the footsteps of the economic collapse is preferable...

The things we need to keep our fossil fuel system going are likely to be fairly complicated, especially now that the easy fossil fuels are most gone. If we want to use pipelines, we need to keep them repaired and above minimum operating level. We will also need replacement parts. We will need to be able to keep drilling in difficult locations, and probably to keep fracking as well.

We will need refineries of some sort, and people to run them. If we want to do "cracking," we will need whatever inputs are needed for this process. It is my understanding that natural gas is often used as an input when cracking long chains to short ones. So we will need a nearby supply of this too.

There might be some coal that could be extracted with less difficulty. But if it is to be transported anywhere, we will need either our current railroad, or a replacement for our current system using a more-available fuel.

I hadn't given much thought to coal; that could be the crutch to get industrialization going again, I suppose as it did the first time around. I think maintaining infrastructure such as the refinery/pipeline/transport paradigm for fossil fuels will become tricky as the product becomes more scarce and services fewer people. Will people condone the building and maintenance of increasingly complex systems if only a small portion of citizens (likely the rich) benefits? If so, then that infrastructure may last through this coming turbulent economic/political climate.

This is, of course, what Richard Duncan argued in his Olduvai theory, i.e., we have one and only one shot at doing it right. Given the complexities/specialized knowledge that has been built into the "system" over generations, it is likely that the vast majority of "information" and skills will be lost. And, there will be no going back.

I'll use myself as an example: I can tell you how to make polymers. I can tell you how to make synthetic rubber (and lots of other things) but I can't tell how to make the equipment that is necessary to make them. I can't tell you how to produce the chemicals that are necessary starting points. So while I have lots of knowledge, it is useless without the ancillary knowledge. I'd add further that the makers of the equipment don't know how to make stainless steel or copper for the motors.

This is why I concentrate upon old time knowledge since it doesn't require a chain of knowledge to work. This is also why I have such well-known books (that's a joke) such as Deerskins to Buckskins by Matt Richards (to make the squeemish puke, you break open the skull and use its brains to tan the hide - brains have a lot of "oil").

Todd

brains to tan the hide

You can also collect oak leaves and boil them to make a tanning liquid or just use a few bags of Lipton Tea if it is a small skin - or you have alot of tea.

In case you are worried about the deer having prions.

And while you still have the pinnacle of technology one might wish to spend here:

http://chla.library.cornell.edu/

Then ponder if you added electricity you could make your Ag better:

http://www.rexresearch.com/agro2/laemstromelcult.pdf

"brains to tan the hide"

That's the way I feel half the time when I post on this site--other posters big brains really tan my sorry hide... :-/

Thanks Gail for the article, and Sponia for going in the right direction among all of these comments.

The problem is not population per se. The high population is a symptom of easy access to energy and food, not a plan or motivation of any type. Human intentions are not all they are purported to be. Most of the time, people do stuff; they have reasons for doing stuff; in that order. When we look at the collective actions of living things, there is one that is common among species that survive over a long term. That one attribute is that the species (individually or collectively or both) contributes more to its future than it consumes in resources.

The problem with human "wisdom" or "problem solving" or "intelligence" is that it manages to overcome any moderating forces against it as long as resources are available. Without moderation, humans are like rust or yeast or bacteria that consume all of their resources until they contaminate the environment enough to stop growing and consuming, with the subsequent/coincident dieoff.

In order to prevent the dieoff, there would need to be some type of moderation mechanism to prevent the population growth in the first place. Any awake fool can look at the population statistics and see that there is no moderation mechanism in place, and regardless of whether the planet can support 1 billion, 3 billion, or 6 billion people, we are looking at a very few iterations of doubling compared to the other species and the life of the planet. Oil has condensed our population growth time frame, but it isn't the problem or the solution to our oblivious humanistic behaviors.

The opposite of consumption is not frugality: it is generosity. When was the last time you heard any "expert" talk about humans giving up something about our consumerism for the sake of the planet, the other species, or even our future selves? Everything is debated in context of "can we afford to pay for it?" or "Will the public support it?"

Evil: any action taken based on unquestioned faith.

Belief doesn't matter: actions do. If belief prevents us from questioning our usefulness to our own future and to all of the factors that allow us to drink, eat and breathe, then that is an evil belief. We MUST question whether our plans and actions are producing sustainable usefulness. Whether the Net Future Usefulness of the human race requires a population reduction to 1 million or an increase to 10 billion, we cannot be serious about how many people are needed or tolerable until we first think about what people are good for (to the planet). Economists would have you believe that consuming is our purpose. Governments would have us believe that patriotism is our purpose. Humanists would have you believe that being good to other humans is our purpose. Someone has to put this all together and ask which are a poorly structured fantasy of perpetual human miracles, and when is it time to stop the fantasy and consider reality's needs and how can humans contribute rather than consume. The numbers are moot otherwise, and most of the purely technical analysis can only handle one generation or so of current culture. Seven generations out will not be driving Humvees to the Wall Street casino to play the Invisible Hand Job. They will either have found sustainability and generosity or they will be dead.

Well auntie, that just about sums it up.

Cheers,

D3PO

Thanks for your thoughts. Many worthwhile ideas!

Quote of the Month!

There is no guarantee that future people will be smarter than us, or smart at all, so as to understand what our current mythology/religion called Economics is logically tied to, be it one analogy (Alchemy) or another (Voodoo).

It has long been understood that "economics" is just another way to decide who "deserves" more and who deserves less.

In the past it was based on birth, blood line and caste.

Modern economics has this nice "The Little Red Hen" assumption that those who work hard get their just rewards.

But then you run into cognitive dissonance when the Voodoo Banker earns millions for pulling a swindle

while the janitor in the banker's office building gets a pittance for his hard work.

The understanding is exemplified when the OWSt 99%'ers realize there is something unfair about the other 1% owning almost everything.

Gail,

At the end of your article you state:

"Nothing happens overnight with the world economy, so changes are likely to take place over a period of years, rather than all at once."

I have to disagree with this. Have you considered the effect of tipping points in complex non-linear systems?

The following paper covers this in detail:

http://www.feasta.org/documents/risk_resilience/Tipping_Point.pdf

It seems to me that we may see gradual changes for a little while longer, but eventually we must experience rapid, chaotic change.

Well tipping points do happen in a very short timespan. The stock market crash of 29 started with two very hard plunges on October 24 and another on October 29. Losses for October were over 16 billion which was an astronomical sum in those days. That was the tipping point but it took three years before the great depression bottomed out.

I think the coming collapse will play out in a similar fashion. There will be several crashes that happen in short order. There will likely be the bursting of the China Bubble, the collapse of Greece and other European nations. Which will come first is hard to say. But then there will be the repercussions of these bursting bubbles. There will be the collapse of most of the world currencies, including the Dollar and the Euro. Then there will be the collapse of globalization. All these things will likely take two or three years to play out.

Ron P.

"All these things will likely take two or three years to play out."

2011-2008 = 3 years...One wonders how much inertia is left in our systems.

Well you are assuming that the banking crisis of 2008 was the tipping point. It was a tipping point but not too great a one. The banks got bailed out by the government and that pushed all the other tipping points down the road a bit.

I am predicting, and I could be wrong as predictors often are, but I am predicting that the bursting of the China Bubble will be the tipping point that starts the collapse ball rolling. And it will take less than three years from that date until the collapse of globalization. And of course the collapse of globalization means the collapse of every government in the world.

Now that leaves the big question: When will the China Bubble burst? Within two years, most likely.

Time cover: The China Bubble

Caption under that title:

We're counting on China's growth to save the world.

Unless its economy blows up first.

Ron P.

Bubbles bursts all the time. If a bubble in China bursts, it will just constitute a slight pause in their march forward. It may not even be worse than putting their growth down from 9-10% to 2-5% for two years. The European crisis will not be a killer either.

What I'm worried about, though, is a swift continuation of the Arabic Spring. I do hope it continues, but that it happens in such a way that oil production isn't compromised too much.

You seem to be having a very difficult time grasping what 'Limits to Growth' actually means, let alone what the consequences are. China and the Chinese are not immune to those consequences as they are part of the overall interconnected global economy. You can only pull so many threads out of a tapestry before it turns into a pile of useless string...

You seem to have a very difficult time grasping that doomsday predictions are a dime a dozen, and never occur. Ask an old person. The world is always ending in 2-3 years.

Don't bother arguing. We've all heard every scenario.

I think you're missing that you only ever get one doomsday prediction coming true, per civilisation. Then no more doomsday predictions, because no more civilisation.

It's one of those circumstances where no news doesn't imply good news.

This isn't about 'Doomsday' predictions!

It's about real physical limits, which once reached, make growth impossible. It's about physics, chemistry and biology...

Cargo cultism and the invisible magic hand, notwithstanding.

Only fools argue against the laws of nature!

Ron talked about "the China bubble". I'm pointing out that a China-specific bubble bursting (in construction, finance, PV production or whatever) will just be a very temporary setback for them.

A global bubble burst due to an irreversible oil crunch may or may not be a different animal altogether. But no Chinese-specific bubble will be a long-term problem for China, as long as they can maintain social stability.

But no Chinese-specific bubble will be a long-term problem for China