Kidding Ourselves About Future Middle East/North Africa Oil Production

Posted by Gail the Actuary on October 21, 2011 - 10:00am

Recently, the International Energy Agency’s Chief Economist Fatih Birol was quoted as saying,

In the next 10 years, more than 90% of the growth in global oil production needs to come from MENA [Middle East and North African] countries. There are major risks if this investment doesn’t come in a timely manner.

While I agree that we need more oil production, I think we are kidding ourselves if we expect that 90% of the needed growth in global oil production will come from MENA countries. In this post, I will explain seven reasons why I think we are kidding ourselves.

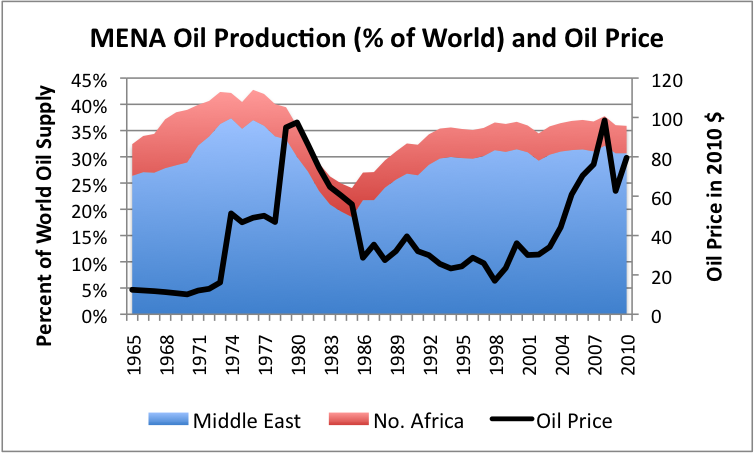

Reason 1. MENA’s oil production, as a percentage of world oil production, has not increased since the 1970s, suggesting that MENA really cannot easily ramp up production.

MENA’s oil production amounted to more that 40% of the world’s oil production back in the mid-1970s, but is now down to 36% of world oil supply. It is hard to see anything that looks like an upward trend in MENA’s share of world oil supply, even when high prices hit. OPEC talks big, but its actions do not correspond to what it says.

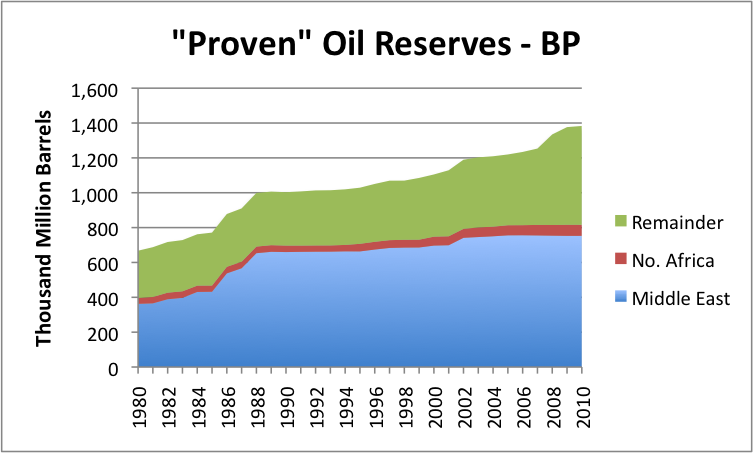

Reason 2. MENA claims huge oil reserves, but these reserves have not been audited, and there is little evidence that they can really be transformed into corresponding oil production in any reasonable time-frame.

Countries don’t all use the same standards when reporting oil reserves. Reserves of countries following SEC reporting requirements have historically been conservative, but Middle Eastern countries do not follow these standards. A small country with high oil reserves will appear rich to the rest of the world, and its leader will appear important in the eyes of local residents, so there can be a temptation to “stretch” the amount reported. There is no timeframe specified with respect to the stated reserves, either. If the oil is very heavy or difficult to extract, the expected extraction period could be hundreds of years.

Because of these issues, it does not necessarily follow that high oil reserves mean that with only a little effort, production can easily be increased. The Wall Street Journal published an article called Facing Up to End of ‘Easy Oil’ which talks about the lengths to which Saudi Arabia (with Chevron’s help) is going to develop techniques to steam out the Wafra field’s thick oil. If there were easier-to-obtain high-quality oil, Saudi Arabia would no doubt be working on the other sources, instead.

Reason 3. Saudi Arabia has said it does not intend to increase its capacity for oil production. According to the Oil and Gas Journal:

Birol’s comments [quoted above] came just days after Saudi Arabian Oil Co. Chief Executive Officer Khalid Al Falih told the Wall Street Journal that his country had no plans to increase oil production capacity to 15 million b/d [barrels a day], given the expansion plans of other producers such as Brazil and Iraq.

“There is no reason for Saudi Aramco to pursue 15 million b/d [of output capacity],” said Al-Falih, whose remarks ended speculation that arose in 2008 when Saudi Arabia’s Oil Minister Ali I. Al-Naimi said his country could boost its capacity by another 2.5 million b/d to 15 million b/d.

The excuse that Saudi Arabia gives is really strange (from same article):

“It is difficult to see [an increase in capacity] because there are too many variables happening,” Al-Falih said. “You’ve got too many announcements about massive capacity expansions coming out of countries like Brazil, coming out of countries like Iraq. The market demand is addressed by others.”

This is a strange statement to make; it is like General Motors saying it is not going to add automobile production, because Ford will be selling as many cars as buyers will want. If it is really making a profit on each barrel, why would it do this, unless it really is not capable of making the expansion it claims?

Reason 4. While Saudi Arabia claims current production capacity of 12.5 million barrels a day, this amount is not audited, and its actual capacity is quite possibly lower. Its highest recent production is 9.84 million barrels a day.

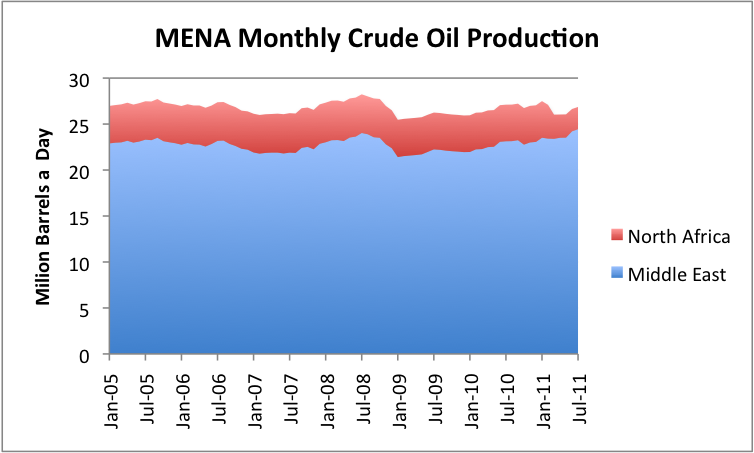

When Libya’s oil production was taken off line, Saudi Arabia was not able to make up for the loss with the type of oil that the market required. Recently, Saudi Arabia made a statement that it would ramp up production to 10 million barrels a day, its highest in 30 years. Saudi Arabia did manage to increase its crude oil production to 9.84 million barrels a day in July, 2011, an increase of 700,000 to 900,000 barrels a day over recent months’ production. But even with this big ramp up, MENA crude oil production has not made up for the shortfall in Libya production (Figure 3). And of course, Saudi production is still far short of the claimed 12.5 million barrel a day capacity.

Reason 5. MENA’s oil consumption is rising, so even if MENA’s production should rise, the rest of the world would not necessarily get much benefit from it.

The amount shown in green in Figure 4 is the amount of oil exports. These are declining, because consumption is rising, while production is flat. The above graphic is for the Middle East only, but MENA in total is showing a similar pattern of rising consumption leading to less exports.

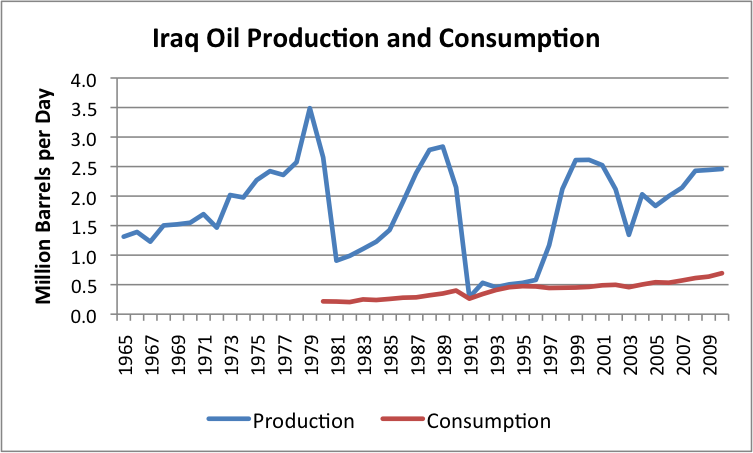

Reason 6. Instability is a huge problem in the Middle East, leading to rising and falling oil production. This is especially the case for Iraq, a country which has planned large production increases.

Figure 5 shows the extent to which oil production has varied in Iraq since 1965, as a result of past instability. Overcoming this pattern will be difficult. Besides instability, there is a need to add a huge amount of new infrastructure–particularly additional port capacity to handle increased oil exports. Both the problems with instability and the need for new infrastructure will make it difficult to ramp up Iraq’s oil production quickly.

Iraq plans to increase its oil production to 6.5 million barrels a day by 2014, and to reach 12 million barrels a day by 2017. Neither of these targets will be possible without huge investment and political and economic stability. These targets are seen as unreasonably high by many.

Reason 7. High oil prices lead to high food prices, and a recent study shows that high food prices are associated with riots. So the high oil prices required to produce the difficult-to-extract oil are likely to sow the seeds of governmental overthrow (repeat of “Arab Spring”) and political instability in MENA countries.

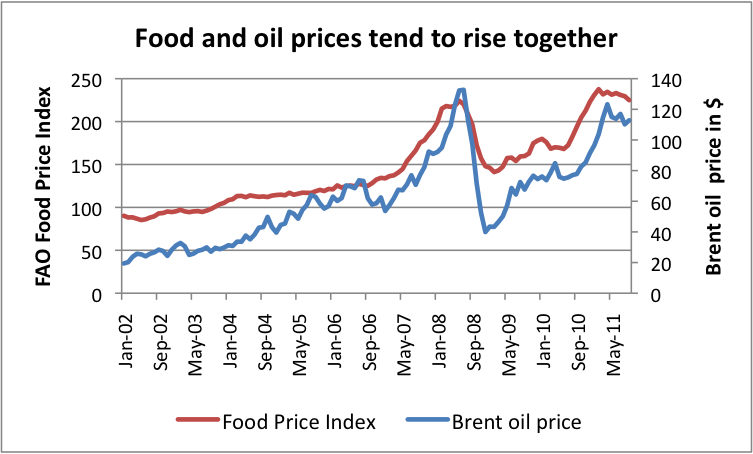

Figure 6 shows the correlation between food and oil prices. A person would expect food and oil prices to be highly correlated because oil is used in the production and transport of food products. The FAO Food Index relates to imported food, such as is often used in MENA countries. Because this food is often transported long distances, a person would expect its cost to be especially affected by oil prices.

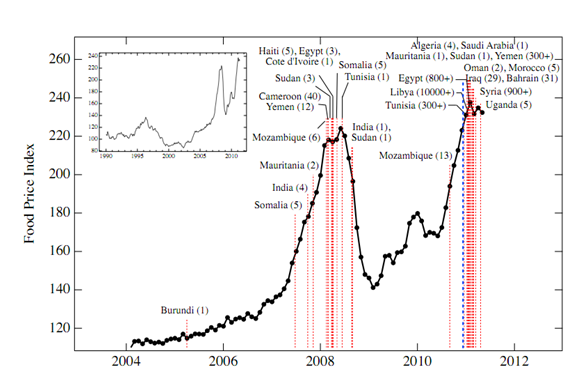

A recent academic study called The Food Crises and Political Instability in North Africa and the Middle East by M. Lagi, K. Bertrand, and Y. Bar-Yam shows this graph:

in North Africa and the Middle East

The authors show that there is a high correlation between high food prices and riots. They say, “If food prices remain high, there is likely to be persistent and increasingly global social disruption.” They also point to the possibility of the situation getting much worse, in the 2012-2013 timeframe, as a result of a continuing rise in food prices.

We saw in Figure 6 that rising oil prices are associated with rising food prices. Thus, the fact that oil prices are rising because the “Easy Oil” has mostly already been extracted, and we now are moving on the more expensive oil, could contribute to riots. This association is likely to make it more difficult for MENA to raise oil production, because riots lead to political instability, and without political stability, it is difficult to increase or even maintain current levels of production.

* * *

For all of these reasons, depending on MENA for 90% of the growth in global oil production between now and 2020 seems unwise. I have shown in previous posts that what the world really needs is a rising supply of low-priced oil, if we are to avoid long-term recession. But MENA is unlikely to supply this. The Middle East claims huge oil reserves and Iraq offers high production targets, but in the end, we are likely to be kidding ourselves, if we believe that these will fix world oil problems.

Originally posted at Our Finite World.com

Great post, one addendum for Reason #2: OPEC quotas are allocated on the basis of "reserves", and when examining time series data of claimed reserves we see a significant spike in OPEC reserves soon after the expropriation of assets by the NOCs... there are material economic incentives for overstating the reserves base above and beyond the social arguments posited in the post.

And in the case of Saudi Arabia, there were material economic incentives for understating the reserve base. Namely, Saudi Arabia paid 'book value' for the nationalized reserves. Saudi Arabia increased their reserve base after nationalization was complete(1989).

Ghawar and Abqaiq have already produced more than their pre-nationalization reserves(1973).

Well the reserves never belonged to the four American companies. They were developed by the American companies in partnership with Saudi Arabia. ARAMCO was the ARabian AMerican Oil Company. There was never a reason for the American oil companies to underestimate reserves because they were not paid by the number of barrels estimated left in the ground. But if you have a link stating such I would love to read it.

And I would love to see your link giving the proven reserves for Ghawar and Abqaiq in 1980 or whenever you say their proven reserves were quoted at such a low point. Saudi, in 1980, claimed about 170 billion barrels of proven reserves. File:Saudi-Venezuela Oil Reserves.png The lions share of those 170 billion barrels were in Ghawar.

Ron P.

The links you are asking for were posted previously - and lost in the purge of 2011.

Where were they posted previously and what purge are you talking about?

At any rate you should not make such claims if you cannot back them up with some reference. That would allow anyone to make any ridiculous claim then say the link has been deleted.

The point is that the very idea that Saudi Arabia has 264.52 billion barrels of proven reserves is preposterous. Even that number is ridiculous. It implies that they know their reserves to within 20 million barrels. They pump that much oil out in just over two days. But the figure hardly changes from year to year. For every barrel they pump out, another barrel replaces it. Magic oil.

But if you have some evidence which you can link to that proves Saudi likely does have this much oil we would love to see it.

Ron P.

Here you go Ron. Our problems are solved.

I thought about including a statement about raising the reserves, because of the belief that higher reserves would provide higher quotas, but decided not to get into the detail, for several reasons:

1. As I understand it, it was only the belief that higher reserves would provide higher quotas, not that this was actually the case.

2. If I added this, I would probably have needed to add another exhibit showing who added what when, and explain it.

3. Reserves outside of MENA have recently been rising too. One of these places is the heavy oil of Oronoco in Venezuela. I didn't want to get into that as well.

4. I was trying to make the post accessible to readers not very familiar with the oil story. Some of these are readers on websites other than TOD, such as FinanicalSense.com.

What do you mean a "belief" ? It's just the way OPEC internal rules work, so yes higher reserves (even if just published figures) provide higher quotas, but then of course nothing guarantees for a given country that its production will reach its quota ...

Btw about 3 above, Venezuela is part of OPEC, in fact one of the key founding members :

"Venezuela and Iran were the first countries to move towards the establishment of OPEC in the 1960s by approaching Iraq, Kuwait and Saudi Arabia in 1959, suggesting that they exchange views and explore avenues for regular and closer communication among petroleum-producing nations.[citation needed] The founding members are Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Later members include Algeria, Ecuador, Gabon, Indonesia, Libya, Qatar, Nigeria, and the United Arab Emirates.

In 10–14 September 1960, at the initiative of the Venezuelan Energy and Mines minister Juan Pablo Pérez Alfonzo and the Saudi Arabian Energy and Mines minister Abdullah al-Tariki, the governments of Iraq, Iran, Kuwait, Saudi Arabia and Venezuela met in Baghdad to discuss ways to increase the price of the crude oil produced by their respective countries."

(wikipedia)

And in fact when it is clear that a country hasn't any "leeway" anymore to produce less than it could it gets out of OPEC, what happened to Indonesia and Gabon for instance, and today it isn't very clear whether any country has any leeway besides KSA (and even KSA ...)

Regarding Venezuela, I meant outside MENA, not OPEC. I'll change that.

Okay we should understand one thing here. OPEC, in the early 80s, discussed allocating quotas on the basis of proven reserves. They never implemented that policy. They have since indicated that proven reserves is one of the things considered when allocating quotas. However OPEC has never allocated quotas on the basis of proven reserves. If they did then Venezuela would have a larger quota than Saudi Arabia and Angola and Algeria would have virtually no quota at all.

Bottom line, proven reserves has never been used as a basis for allocating quotas. Those huge, and obviously false, vast stated proven reserves are mostly for bragging rights although it might have started because OPEC was discussing using proven reserves as a basis for allocating quotas.

Ron P.

In the 80s and the "oil glut" many things happened, mainly the Irak/Iran war (longest conventional war of twentieth century), which makes things a bit difficult within a cartel for quota discussions. Besides, Reagan pushed Saudi Arabia and succeeded in having them increase their production in order to cut USSR foreign currencies revenues by 2 thirds.

So even if a perfect rule has never been used by OPEC to define production limits (quotas) according to reserves, it was indeed the general idea, and the one used in the 70s. And it did lead in the 80s to everyboy increasing their reserves and prod, and for instance Saddam getting quite pissed about Kuwait (point on which April Glaspie more or less agreed) ...

Meanwhile, bitching Americans are still driving totally ridiculous SUVs while making graphs ...

It helps to put this in context. Chevron is taking the up-front risk on this project, as far as I can tell. In other circles, this might be called a 'farm-out'. Why wouldn't Saudi Aramco take the oil if Chevron is willing to take the risk ? Also there is a third party involved, namely Kuwait.

This is the first large scale steamflood effort to recover heavy oil from a carbonate reservoir. Chevron claims vast Canadian heavy oil resources housed in carbonate rocks. Saudi Aramco may also have vast heavy oil resources housed in carbonate rocks.

In fact Saudi Arabia is working on other sources - how else is Saudi Aramco able to replace their reserves ?

At this point, it is not clear that Saudi Arabia has anything new coming on line very soon. The October issue of Oil and Gas Journal shows the only oil project in the "works" as Manifa heavy oil, at 900,000 barrels a day. Its date as shown there is 2013+. This article gives a date of 2014 for the project.

Without major new projects coming on line, Saudi Arabia's productive capacity may very well be going down. In fact, it could possibly start dropping quite quickly at some point. There is a constant battle between decline and new technology combined with additional spending and infill drilling, to try to keep production going as long and at as high a rate as possible.

Gail the Actuary posts my favorite articles.

Egypt has about 83 million people living in an arid climate crammed along the Nile River. It does not produce enough food to feed its people. They import 40% of their food and 60% of their wheat, a staple in the Egyptian diet. Libya imports ¾ of its food. Some countries in North Africa have a nice aquifer below the Sahara, but Yemen has serious water problems and so does KSA. KSA pumps less and less water than they did in 1990. For many of these people, food is the greatest expense. Libya has plenty of oil and water to meet its own needs but oil but not food.

I knew the spike in oil prices caused a spike in food prices. Add to that mix the La Nina which made this year bad for crops, and that explains the “Arab Spring.”

I never saw the graph showing the correlation between food prices and riots.

The developed world has a transportation problem. Europe and Japan is in better shape because they have better mass transportation systems that require less energy to operate. The third world has a food problem.

The combination of the J-curve of overpopulation and ever increasing consumption plus the bell-curves of depletion are clashing right now. The taboo of overpopulation must be lifted.

The fact that America has 300,000,000 people rather than 1.2 billion is an advantage for us right now. Let’s hope we don’t reach one billion in 100 years.

Democracy will not prevent spikes in food prices in MENA.

You may want to read my post What's Behind Egypt's Problems? It has been very popular.

You can follow my new posts on twitter. My "name" is gailtheactuary.

I just found this blast from the past, dated 3/28/08, googling for a different post of yours.

A Rebuttal to 'Peak Oil' Doomsday Predictions

At The Oil Drum, a detailed article by 'Gail the Actuary' speculates on how declining production of oil combined with rising demand will cause an economic catastrophe, leading to the global economy contracting so severely, that by 2040 it is much smaller than it is today. The author actually believes that in 2040, most people will no longer be able to afford cars, electricity will be unreliable, and goods and services will be fewer and rarer than today.

blah blah blah, ad nauseum

Could I be wrong and they be right? Well, let us first see if oil rises substantially above $120/barrel, and if that year has negative World GDP.

Does anyone feel like defending the doomsday prediction from The Oil Drum?

http://www.singularity2050.com/2008/03/rebuttal-to-a-f.html

oops

I can understand that many replies posted here would be considered excessively pessimitics in a 'Limits-to-Growth' Ehrlich vs. Simon kind of way to the general public. Even so, "Maoist-Malthusian cult"? There have been many exhaustively and meticulously researched white papers by R. Rapier, Gail, Nate, Ugo, etc. that could hardly be described as propagandistic or doomer-cultish. Unless you believe that facts and scientific principles are cultish.

One might also say that 90% of nothing is nothing. If we are talking about crude + condensate, or even C+C+NGLs, growth over the next ten years does not appear to be in the cards. So we can safely count on MENA to provide 90% of that 'growth'.

You are right. I often think of the same thing, when people say that 25% (or whatever) of electricity production in "State x" will be from renewables in the year 2020.

Saudi net oil exports (BP, Total Petroleum Liquids) Versus Annual US crude oil prices:

And Texas & North Sea crude + condensate production Versus annual US crude oil prices, relative to respective peaks:

Take home: Why pump more when you can get three times more by pumping less?

So, you think Texas and the North Sea operators cut back production, in order to boost revenue, as prices rose?

Apologies - I was referring to OPEC and the benefits of cartel action.

The great uncertainty is whether OPEC's actions are due to policy or geology. e.g. starting to constrain the rate of growth in 2002, and plateauing in 2005.

Of course, some of us round these parts think that Texas, the North Sea and Saudi Arabia all have finite resources. And just like Texas & the North Sea, Peaks Happen.

In any case, why are you sure that Saudi Arabia voluntarily reduced production and net exports after 2005, but that Texas and the North Sea did not voluntarily reduce their production after their respective peaks?

Not "sure", but if you look at the Saudi production figure below they were able to achieve higher than 2005 production in 2008 and 2011, as well as to strongly "modulate" production in 2008/2009 to rapidly raise prices again.

The problem with monthly data is that it is hard to tell the difference between actual production and inventory changes. I think that average annual is a more reliable indicator. But in any case, the most recent net export data showed 2010 annual net exports of 7.2 mbpd, versus 9.1 mbpd in 2005.

As noted elsewhere, frequently the simplest explanation is the best, i.e., Peaks Happen.

the Saudi looks irregular unless you consider it to be just the scaled up tip of the other two.

I'm not exactly sure what your point is, but the Saudis increased net oil exports by 1.8 mbpd from 2002 to 2005, in response to rising oil prices.

Then, in response to generally rising oil prices from 2005 to 2010 (four of five years showed year over year increases in oil prices), Saudi net oil exports fell by 1.9 mbpd.

If we extrapolate the Saudi's 2005 to 2010 rate of increase in their ratio of domestic oil consumption to production, they would approach 100%, and thus zero net oil exports, in about 14 years.

westexas:

yea, i read it OK and I'm not arguing the facts.

I was looking at the weird spike at 2008 and wondering what it meant. Then I realized that the other two were on a 20 year timespan whereas Saudi was on a 10, so - and this is totally conjecture - I was suggesting that if you look at a ten year span for the Tx and NS, say 67-77, and 94-04 respectively, you'd get a big lumpy irregularity much like the Saudi, and on the same timescale.

It was just a random observation tho, because I'm guessing Saudi is working on a bigger timeframe than TX or NS, although I'm not an expert.

The net export boomerang. That is a pretty damning graph.

I wonder what the possibilities are for the Saudis to go on a crash course of efficiency and alternative energy investments? The Kingdom has to be aware that the continuation of their consumption/production trends is inconsistent with the continuation of their sovereignty. They need to cap consumption before it eats away all their income (i.e., the basis for their claim to power).

(On the other hand, you could say all the same things of the United States...)

Gail, figures 6 and 7 are quite stunning. I had a quick look at the Lagi et al paper and couldn't see that they were drawing a connection between high food prices, high oil prices and peak oil that would confirm the riots are part of societal disintegration linked to PO. Did the authors discuss this?

I believe that the Lagi et al paper is only talking about food prices and riots. I don't think the authors are peak oil aware.

I knew about the oil price connection to food prices, so brought up the issue.

The August 17 Drumbeat had a link to an article about the academic paper called, The Cause of Riots and the Price of Food. So I should thank Leanan for pointing this out.

I think it is likely that OPEC is currently producing flat out and only new fields coming on line in the next few years will be able to add anything to their production. Manifa is supposed to come on line for Saudi in 2013 but don't look for any increase in production from Saudi then. Their old fields are depleting fast and Manifa will only keep production flat, if that. Saudi obviously knows that

Ghawar and a few other old fields are watering out fast and would really like to cut production.

But they also know that high oil prices are contributing to the worldwide recession so they are in a kind of "Catch 22" situation.

Anyway all OPEC nations except Saudi Arabia, Kuwait and the UAE have been producing flat out since early in 2010. Hear is a chart of those three nations, crude only, oil production along with the other nine "Flat Outs" as I call them From January 2005 thru September 2011 in thousands of barrels per day. The data is from OPEC's Oil Market Report.

That last spike up for the flat outs is in January 2011 and the drop beginning in February was caused by the Libyan civil war. If you remove Libya from the mix then the data would continue flat from about September 2009 thru September 2011.

I now believe all 12 OPEC nations are producing flat out. The three who in 2010 actually had a little spare capacity have now exhausted that. Things are really getting interesting now and it will be interesting to watch what they do for the rest of this year and in 2012.

Ron P.

Thanks for the article, Gail.

Regarding Saudi Arabia's lack of desire to increase capacity, could this be down to the country's rulers seeking to extract the maximum value from its oil reserves. After all, investing in new output capacity is expensive and given the recent run-up in prices, they might well be trying to avoid doing what we've done in the UK and USA, which is produce the vast majority of our oil during a period of low oil prices.

It has always amused me the way that many people seem to assume that a strongly growing OECD economy is in OPECs best interests. While governments in the Middle East need to balance their budgets, the fact remains that the optimal way of generating value from finite oil reserves is to try to maximise the price per barrel sold rather than the number of barrels sold per day.

It's certainly true that something changed in 2006. See the Saudi net export versus price chart up the thread.

Perhaps. But I think that Saudi Arabia is now at the point where it needs to keep current production as high as possible, so as to generate enough funds for public programs to keep people from revolting.

There is also a question of how high oil prices can go. High oil prices bring about recession in oil importing nations (and even cause problems, like food riots, in oil exporting countries). So it is not all that clear that waiting will produce a higher price. Economists with very incomplete models seem to think that prices can go up and up, but this is equivalent to EROI being able to go down and down, endlessly, but we know that we cannot use more than one barrel of oil to extract an oil. (The minimum EROI is something greater than 1.0, when one considers the required roads, ports, schools, medical facilities, and other necessities required to maintain production.) At some point, the economics simply do not work--the system fails.

KSA was willing to be a true swing producer back when they could afford to cut down their current income stream. That is no longer the case. Nowadays they seem to swing between producing "only" flat-out, versus overproducing their fields and risking damage.

The people in charge of a country will never sacrifice their present-day internal stability for long term gains. If there is a case of it happening then I can't think of it. Sacrificing for the future is only done when there is a true surplus in the present. KSA has eaten away their once-formidable income surplus with their internal population growth & resource consumption just like the USA has.

What is their capacity and what level of production will damage their fields ?

Gail,

Your presentation is persuasive.

Perhaps Birol had the new drilling rig of choice in mind?

The one that "selects" and takes home the "easy oil"? ;)

Cute photo of "drilling rig":

Gail, WHAT was it before it became what is is?

Like, what is the chassis? Where did you get the photo? They don't have one at Bovington Tank Museum.

It is from the link in the comment above by Dredd.

It says:

Seems strange to me.

Thanks, Gail

This rig will not go down well where I used to work.

My apartment had 5 mosques within 3 blocks. Come Ramadan, I also had an old-fashioned Islamic marching band up and down the street every 0400 hrs every morning, playing very badly.

I walked a mile and a half to work every day (the locals thought I was raving mad not to use a driver but I'm English / Canadian) and walked past another four mosques and a ghastly religious radio station, plus the NOC had its own mosque outside my office window ... and another two mosques right down the street ...

Now a drilling rig with an attached minaret and loudspeakers, that will sell ....

For once I agree with Gail: It is unrealistic to expect MENA to supply 90% of the additional new oil needed.

But that's only because there's going to be so much additional production from non-OPEC sources. It's going to be funny over the next several years watching TOD get all excited about flatlining MENA production (except maybe Iraq) and claim it all means DOOM DOOM DOOM! But completely passing beneath their radar will be new records for non-OPEC production.

"It's going to be funny over the next several years watching TOD get all excited about flatlining MENA production ..."

It won't be funny when the inevitable decline becomes undeniably apparent and noone has prepared for it, because they were misled by wishful thinking. Best hopes for an abiotic global sense of humor.

Non OPEC needs to get on the stick if it expects to set those new records you speak of. Below is non-OPEC oil production in thousands of barrels per day from January 2002 thru August 2011 according to JODI. Production from Gabon, Equatorial Guinea, Kazakhstan, Sudan and Syria was taken from the EIA since these nations did not report their production to JODI.

Production for May, June, July and August was down considerably. The EIA's Short Term Energy Outlook did not predict this. The EIA shows a very similar pattern but with all points averaging about 1.4 mb/d higher and their data only goes through July. Also, the July EIA data for the five non reporting countries listed above was carried forward thru August in the chart above.

Ron P.

Yawn. And laugh!

Let's see ... we were supposed to be down to about 38 million bpd by now.

concept:

So what's the real one look like?

Darwinian just showed one version right above my post.

Ace was simply wrong in his prediction. A lot of people have been mistaken. There was Yergin, the EIA, the IEA and everyone else who predicted world oil production would be approching 100 million barrels per day by now.

What I posted was not a prediction but the actual non-OPEC production. You laugh at a chart of actual non-OPEC production? Kindly tell me just what is so funny about that?

Ron P.

He can join a long list of those who think that best fitting some favorite data is a valid way of forecasting these things. It isn't, and I am continually amazed that this mistake gets made over, and over, and over. I recommend we invoke the law of holes and actually try and learn something rather than doing the same behavior, getting the same result, and pretending it matters.

Prophets of doom are often wrong:

http://www.guardian.co.uk/world/2011/oct/21/rapture-end-world-harold-cam...

Hey guys, we have been on a plateau for six years. Everyone who predicted a huge production increase and everyone who predicted a huge decline have also been wrong. So before anyone starts laughing at anyone else we need to just wait and see which way we turn off this plateau.

Abundance.concept is predicting new records for non-OPEC production. I have no idea what he is predicting for OPEC production but I suppose he is predicting new records there also. As for me I have no idea what will happen but I doubt that any grandiose new records will be set.

Ron P.

Prophets of BOOM BOOM BOOM of the explosive kind have a much better record.

When they generically say "a war is coming" not many will dispute that.

The dispute tends to ripen over the location and time of the war that is coming.

"Your Highness, the people are revolting!"

"They soytenly are!"

Nice piece, Gail. I appreciate your "Carl Sagan" knack for keeping your analysis stripped down to the barest, clearest essentials.

Saudi Oil Policy:

New oil fields saved for future generations: King The Saudi Gazette July 3, 2010 – WASHINGTON

Bloomberg.com Apr 24, 2011 7:25 AM ET

Saudis See No Reason to Raise Oil Output Capacity WSJ OCTOBER 10, 2011

Saudi Aramco Plans to Double Power Supply, Conserve Energy to Save Crude Monday, May 16, 2011

Unofficially:

WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices guardian.co.uk, Tuesday 8 February 2011 17.00 EST

We have been warned!

Thanks for the analysis, always clear and to the point, however about "I have shown in previous posts that what the world really needs is a rising supply of low-priced oil", we know that we won't get it, so what the world really needs it to adapt to the new supply, and it will in any case ...

I am not sure how well that adapting will work. I worry about "systems" that will break. Our businesses were not set up to run at, say, 70% of capacity. They will go bankrupt instead. Governments are not set up to pay unemployment insurance to 10%+ of the population. They cannot collect enough taxes to make the system work.

I am afraid that we run into discontinuities that are hard to plan for, like major changes in government, and even in national boundaries, and in financial systems.

Yes agree with that, but these discontinuities will still be a form of adaptation. My point was more that you don't really need something that will not happen anyway, and in the meantime we really don't do much about things that could be done, cars do not really need to be that big and powerful for instance, houses can be better insulated, etc. But pushing for that would require policies, like high volume based redistributed taxes on fossile fuels for instance ..

While I half agree, that's the systems breaking that are the worry, I'm not so sure that '70% capacity' and '10% unemployment' are the issue or will create the discontinuities.

Look at it like this, big businesses are designed to be scalable, on the way up if you're not scalable then you get overtaken by those that are. On the way down the easy route is to cut and retrench to profitability. Provided there are multiple suppliers, you can scale the businesses with the depression. Also provided its gradual, not overnight.

Unemployment costs money, but there are lots of tricks to stop paying it, and indeed to force the unemployed labour force into work, with a spot of printing money to pay for it.

Provided its gradual, not overnight, you've a good chance to adapt.

No, I'm looking at the basic way oil is priced and allocated.

All the while the exporters get to sell to the highest bigger, the world paupers itself to get access to the declining resource. The exports get a bonanza, but nothing really to spend their wealth on except weapons and land/resources (everything else is going to hell). All the other countries cannot transition, because all funds go to pay for oil. Countries get picked off one by one, collapsing (like Greece is about to) into a good 100+ years of civilisational regression.

Sooner or later the whole collapses because key blocks get removed.

Will the last exporter standing please turn out the lights.

Rather, I think it's going to have to be recognised that another approach is needed. One where oil gets allocated and the price gets capped. As oil declines, so the ration of each country declines, but they always only ever pay one affordable price for the oil. Exporters wouldn't like it, but it sets up a system where enough time is available to transition and most countries can make it to the other side.

It's a case where the world has to work together and agree - which is the problem. How long will it take to realise that sharing out the pain equally is the only way? I think we may well be a distance down the decline slope before it's realised. By which point it maybe too late.

Call it the "Shared Pain Model" if you like, but it gets you from a situation where every country eventually sees double digit decline rates and collapses after exhausting their treasuries, to one where everyone sees close on the physical decline rate, and thus has a chance to adapt.

Only it requires a political maturity that's manifestly lacking.

Ration the available oil by country and, in some countries, a significant share of the oil imported at a "reasonable price" will be re-exported at a higher price to whoever is willing to pay the most. There will be an official price and a unofficial price, the unofficial price determined by supply and demand. Why bother. The current system has prices determined by supply and demand. A rationing system with prices determined by Big Brother will work only for those who get the ration coupons from Big Brother, often after paying bribes.

Why bother?

Because a system as you describe will have the effect I describe - dragging countries down one-by-one till finally the global system fails and everyone collapses. That's what the maths seems to be saying.

Sure, what you are advocating is let's go grab what is left in essence, that is basically WAR, and more or less already happening.

For the US, just start by putting a sizable volume based tax on gas, and maybe somebody will take you seriously

The US is still the 3rd producer, and could consume around half what it does currently for similar "functionalities".

Gail,

A recent study by The American Journal of Public Health indicates disruption of public health systems as decline in production emerges.

I would think that "say, 70% of capacity" would cause severe problems with health systems.

Thanks! I think you are right.

Good riddance. As an ostensibly-new kind of feudalism, it appears far worse than classic feudalism.

Was the US and other empires founded in part on slavery?

And we can worry about the new ones that will form too...

Maybe they resemble permaculture, (where those involved don't think they need more oil)...

...Or, instead, they resemble systems that replace those "cheap-energy-slaves".

A job? Or slavery? Or both? Or one-and-the-same?

What are the options beyond them? When oil, for example, gets expensive/rare/inaccessible?

It's all connected.

KSA anyone? The king? The US gov't? The slaves, the peasantry?

The Occupy Everything movement?

Hello-o-o?

(Personally, I think that greed or feudalism or whatever have you has hit a wall, a glass ceiling. But a global one this time.)

Ironically, and/or paradoxically, the internet, "borne of war", has, via its industrial strength communicational capacities, sufficiently crunched people together to become a kind of global tribe, on the same landmass, what I call, metaphorically, Tribe Of Pangaea.

We're all members here.

Tribes may be the most democratic of human systems... So a global tribe may be what's needed to counter problems of the kings and nation-states, etc..

Wikileaks and Anonymous come to mind, as do the "brick-and-mortar" protests/camps/support.

This is a strange statement to make; it is like General Motors saying it is not going to add automobile production, because Ford will be selling as many cars as buyers will want. If it is really making a profit on each barrel, why would it do this, unless it really is not capable of making the expansion it claims?

That is not at all a valid comparison. For the comparison to work General Motors would have to believe that there was a finite number automobiles it would ever be able to make, which is of course the case with Saudi barrels of oil--the Saudis know only a finite number will ever be produced. GM instead believes it will be able to make cars it will be able to sell at a profit forever, no upper limit to total sales--and its policies reflect that belief even if the belief is somewhat in error.

The food price/oil price relationship you show though important really needs refinement. The oil revenue/food expenditure spread is at least as important as the price rise correlation. That certainly would vary greatly from country to MENA country and would exert ever more leverage against stability in countries quickly moving toward importer from exporter status.

like you said in your comments, Saudi certainly wants the world economy to humm along and knows that too high an oil price too fast puts the brakes on everything...

Countries with high population and low oil exports, like Egypt, Syria, and Yemen are especially at risk for food issues. Libya theoretically should have been spared, because of high oil exports compared to its population, but it didn't turn out that way.

Yes I should have said oil export revenue/food import expenditure spread.

As you pointed out in your January post What's Behind Egypt's Problems, by the time oil consumption overtakes production

countries importing a high % of their food (Egypt imports 40%) are likely to be in a world of hurt.

A quick Wiki calculation based on oil production per capita but

only including those countries producing more than 1e6 barrels :-

Qatar 0.71497

Kuwait 0.69929

Norway 0.47231

UAE 0.33857

Saudi Arabia 0.32428

Libya 0.28166

Azerbaijan 0.11031

Angola 0.10208

Canada 0.09499

Kazakhstan 0.09323

Venezuela 0.08405

Iraq 0.07574

Russia 0.07375

Arab League 0.06713

Algeria 0.05853

Iran 0.05507

Mexico 0.02671

United States 0.02496

UK 0.02405

Nigeria 0.01395

Brazil 0.01348

European Union 0.00471

Indonesia 0.00431

China 0.00297

I live in the UK but Norway looks good ;)

Are you kidding?

If there's one thing I've learned over the years is that we need less oil production.

Ah ok, phew. You had me there for a minute.