Drumbeat: October 5, 2011

Posted by Leanan on October 5, 2011 - 9:42am

The Peak Oil Crisis: Turmoil Erupts

The Financial Times and Wall Street Journal have gone into full crisis mode with live blogs continuously reporting unfolding events.Equity markets are falling and London oil prices have been flirting with $100 a barrel for the first time since February. Talk of recessions, depressions, and even collapse of the euro zone is everywhere. There seems to be general agreement that a Greek debt default is inevitable. This is to be followed by insolvency of many European banks, which in turn will lead to the possibility of debt defaults by Italy and Spain. These countries, of course, are too big to be bailed out by the rest of EU, which is what has everybody worried. Economic contraction in Europe - perhaps even a major contraction - looks likely.

Harry Brekelmans on the future of Shell

People talk about peak oil in the sense of supply. But I think of Sheikh Yamani's classic quote, "The Stone Age didn't end because we ran out of stone." People simply moved on to different and better things. The same will happen with fossil fuels. It's very important to realize that we'll be moving on to alternatives before we run out of oil and gas.The year 2040 is not necessarily the demand peak either. The interaction between supply and demand will govern at what point -- 2030, 2040, 2050 -- we really see the peak. But rest assured, I think there will be gas and oil left by the time we've moved on to those alternatives.

The Energy Expert You Shouldn’t Trust

Nearly all the data cited in the book is from his company and is proprietary and non-public, so it can’t be verified or challenged. He doesn’t appear to take seriously the views of people he doesn’t agree with, and they are not included in his extensive bibliography or interviewee list. When he makes (or quotes himself making) forecasts, it is almost always at the high end of “as much as,” putting the best possible picture on things. He treats overall supplies and continued growth as assured. He is skeptical only when it comes to the concept that new sources of energy could upset the status quo.One thing Yergin never asks, though, is what if he’s wrong?

The geopolitics of energy in the 21st century

Daniel Yergin: One of the key features is the idea that I focus on -- the "globalization of energy demand." Energy demand used to be a business of the developed world, and now the growth is all in the emerging world. So, for instance, the Middle East will increasingly look east for its growth markets. That raises interesting geopolitical questions about responsibility for security in the Gulf.

Daniel Yergin: The perils, prizes and pitfalls of the post-Gaddafi era of oil

The modern oil era began in 1969 when the 29-year-old Muammer Gaddafi seized power in Libya. A year later, he used threats of production cuts and nationalisation to begin forcing western oil companies to accept new terms. At the signing of the first of the new contracts, one of the western negotiators said: “Everybody who drives a tractor, truck or car in the western world will be affected by this.” He was more prescient than he knew.Riding a wave of rising oil demand and in a tightening global petroleum market, Col Gaddafi initiated the dramatic shifts that burst upon the rest of the world with the 1973 oil crisis, thrusting oil to the centre of world politics. Today the price of oil, when adjusted for inflation, is 10 times higher than when he took power – beyond imagining then.

S.Arabia puts record premium on Asia oil price

KHOBAR (Reuters) - Saudi Arabia has raised the price of its flagship Arab Light crude oil for customers in Asia, who buy more than half its crude exports, to a record premium to Oman/Dubai prices while cutting costs for U.S. and European buyers.

Shell: More Than 100 Oil Wells Drilled in Jordan in 2 Years

Shell has drilled more than 100 wells in Jordan in the two years since it a concession agreement to explore for oil from the country's vast oil shale reserves, a person familiar with the project said.

Power outage: protests continue across Punjab

LAHORE: Violent protests, demonstrations and strikes against power cut continued on third day in Punjab as the energy crisis is aggravating in the country.

When it comes to Arctic oil drilling, all geopolitics are local

The great Arctic oil race is under way. In Russia, where one needs only Vladimir Putin's signature to drill in the most environmentally vulnerable region on the planet, ExxonMobil a month ago sealed a deal to explore underneath the Kara Sea. Now, the United States may allow Shell to explore the Chukchi Sea offshore from Alaska. At stake are the world's largest remaining untapped oil and gas reserves, and for Russia a chance to extend its economic and geopolitical power.

Arbitration Ruling In Chevron Case -Ecuador Attorney General

QUITO -(Dow Jones)- Ecuador plans to launch an appeal in a court in the Netherlands next month against an Aug. 31 ruling from an international tribunal in the Hague that awarded oil company Chevron Corp. (CVX) $96 million in connection with claims made in Ecuadorean courts in the early 1990s."We are on time to prepare an action for annulment of the ruling," Ecuador's Attorney General Diego Garcia told reporters Wednesday.

Doctors Urge N.Y. to Weigh Health Risks of Fracking

New York’s environmental study of the possible risks of high-volume hydraulic fracturing, a technique for natural gas drilling, addresses everything from the possible impact on job creation and the character of communities to damage to roads and wildlife. But a group of doctors, medical associations and environmental groups say there is one glaring omission: the possible effects on public health.

GM teams with car-sharing company RelayRides

NEW YORK (CNNMoney) -- General Motors is making it easier to let complete strangers take your car. An arrangement between the automaker's OnStar division and RelayRides, a peer-to-peer car-rental company, will give GM car owners a simple way to rent out their cars on the RelayRides network.

A peak oil Technocrat ignored the power of technology

“Hubbert’s Peak,” says U.S. energy historian Daniel Yergin, “is still not in sight.” This is true: Global oil production is still on the rise with no evident decline any time in this century. We should take a moment to acknowledge this fact. It’s not only that resurgent oil and gas reserves have abruptly extended the world supply of fossil energy for another 100 years. It’s that market economics has again triumphed over the Luddite left, that democracy has prevailed again over “Technocracy” – the ideology, memorably captured in 1984, that George Orwell once described as “a prerequisite for fascism.”

Oil Climbs for First Time in Four Days on Surprise Drop in U.S. Stockpiles

Oil rose from its lowest in a year in New York after a surprise drop in crude stockpiles and on signs the U.S. may take further steps to sustain an economic recovery.Futures rose as much as 3.7 percent after sliding 7.9 percent in the past three days. Crude inventories dropped 3.1 million barrels last week, the American Petroleum Institute said yesterday. An Energy Department report today was forecast to show a gain of 1.5 million barrels. Federal Reserve Chairman Ben S. Bernanke signaled yesterday he’ll push forward with further expansion of monetary stimulus if needed.

OPEC Risks Bear Market as Libyan Output Recovers

(Bloomberg) -- The decline in OPEC’s oil below $100 a barrel for the first time since February is raising the likelihood the group will cut production, as Libya revives output and the global economic recovery falters....“Saudi Arabia stepped up production to help compensate for the loss of Libya, and they will probably calibrate and go the other direction as production comes back,” Daniel Yergin, co- founder of IHS Cambridge Energy Research Associates and author of the 1991 Pulitzer-winning “The Prize: The Epic Quest for Oil, Money and Power,” said in a Sept. 21 interview in New York. “The impact of Libya will be determined by what’s happening in the overall global economy.”

Iran To Propose Maintaining OPEC Output

LONDON -- Iran's oil minister will call for unchanged crude oil output by the Organization of Petroleum Exporting Countries at the oil body's next meeting in December.Speaking to Iran's oil ministry website Shana, Rostam Ghasemi said "Iran's request at the next OPEC meeting is to maintain the production ceiling."

The UAE's Opec governor has warned of dark days ahead for the global economy and urged oil producers to prepare for a slump in demand.

Prices for food and gas could soon fall

Consumers may catch a break on the price of gasoline and baked goods and sweets as the Thanksgiving-Christmas season approaches, thanks to a sudden tumble in worldwide commodity markets.The consumer price outlook has brightened, in part, because commodity speculators have fled the energy and grain markets in the face of fears of a global recession triggered by the European debt crisis, says Tomm Pfitzenmaier of Summit Commodity Brokerage.

Commodities Climb From 10-Month Low as Bernanke Vows Steps to Boost Growth

Commodities rebounded from the lowest level in 10 months after Federal Reserve Chairman Ben S. Bernanke said the central bank may take further steps to sustain an economic recovery.

Saudi Arabia Vows ‘Iron Fist’ After Attack

Saudi Arabia vowed to use “an iron fist” after 11 members of the security forces were attacked and injured during unrest in a Shiite Muslim town in the east, the official Saudi Press Agency said.The government accused an unidentified foreign country of seeking to undermine the stability of the kingdom as a result of the violence in Awwamiya, in which the assailants, some on motorcycles, used machine guns and Molotov cocktails, the Riyadh-based news service reported late yesterday. A man and two women were also injured, it said.

U.S. to regulate contractors of offshore oil firms

STAVANGER, Norway (Reuters) - U.S. authorities are looking to regulate the contractors of oil companies that work offshore in the wake of the Gulf of Mexico oil spill, a senior federal official said on Tuesday."We will regulate contractors as well as operators. There is no compelling reason or logic not to do so," Michael Bromwich, director of the U.S. Bureau of Ocean Energy Management, Regulation and Enforcement, told an oil conference.

Ruble's fate depends on Greek tragedy

Debt-laden Greece is holding a sword of Damocles over the fate of the ruble, with a solution to Europe's debt problem key to boosting the price of oil, Russia's key revenue source, analysts said on Wednesday.

Russia-EU energy relations too politicized - EU official

Energy relations between Russia and the European Union are still heavily politicized and a new gas war between Ukraine and Russia is still possible, an EU energy expert said on Tuesday.

Russia vetoes UN resolution against Syria

UNITED NATIONS (AP) — Russia and China vetoed a European-backed U.N. Security Council resolution Tuesday that threatened sanctions against Syria if it didn't immediately halt its military crackdown against civilians.

Turkey says sanctions on Syria to go ahead

ANKARA, Turkey (AP) — Turkey's prime minister increased pressure on Syria to halt its military crackdown on protesters Wednesday, saying his country and other would press ahead with plans to sanction Damascus.Turkey's military meanwhile, was scheduled to carry out exercises close to the 850-kilometer (520-mile) long border with Syria.

Lax Law Gives U.S. Subsidiaries an Opening to Sell to Iran

“U.S. and international officials appear to agree that the sanctions have not, to date, hurt Iran’s economy to the point at which the core Western goals on Iran’s nuclear program can be accomplished.”That was the conclusion of a report last month by Kenneth Katzman of the Congressional Research Service, a nonpartisan group that writes policy and legal analysis for lawmakers.

Belarus, China to join Venezuelan oil deposit project

Belarus and China are to take part in the development of an oil field in Venezuela, Belarusian state television said on Wednesday.

Basic Minigrids Promise Major Fuel Savings in Afghanistan

A simple change being made to military camps in Afghanistan will save enough energy to take an estimated 7,900 fuel trucks off the road over the next year, an Army officer in charge of battlefield energy said this week.

EU to put higher pollution price on tar sands

The European Commission on Tuesday (4 October) proposed that oil derived from tar sands be given a higher greenhouse-gas emission value, a move slammed as "unjustified" and "discriminatory" by Canada, the world's largest producer of this fossil fuel.

Shale gas discovery should be a cause for celebration in UK

The fells of Northern England hold a treasure for the United Kingdom - shale gas.

Poland lobbies against EU shale gas regulation

Poland, long seen as promoting a common European approach to shale gas, has now published a surprising study describing possible EU regulation on the industry as "unfeasible".

LNG Market May Tighten Further on Japanese Nuclear Shutdown, SocGen Says

Kyushu Electric Power Co.’s nuclear shutdown may exacerbate tightness in the global liquefied natural gas market as demand for the fuel used in electricity generation has exceeded estimates, Societe Generale SA said.

Cooling Problem Shuts Nuclear Reactor in Japan

TOKYO — In a fresh blow to public confidence, a reactor in southern Japan went into automatic shutdown on Tuesday because of problems with its cooling system, clouding the outlook for an imminent restart of the country’s idled nuclear plants.

Japan panned for pushing nuke plant exports after accident

Japan has been given the Fossil of the Day "award" at a U.N. climate change conference in Panama for pushing a scheme to promote its exports of nuclear power generation technologies to developing countries as a way of curbing global warming, an international environmental group said Monday.

Nuclear power essential to cut emissions: UK expert

SEOUL (AFP) - Britain's chief scientific adviser voiced concern on Wednesday at moves to abandon nuclear power after Japan's Fukushima crisis, saying it remains vital to combat global warming.

Like it or not: Hybrid cars are here to stay

There's been lots of handwringing lately about the future of hybrid cars. "Too expensive" the critics say. "Since buyers believe they will never recoup their additional upfront cost with savings from improved mileage, hybrids will remain a specialized niche."They remind me of the same people a few years ago who didn't see any future for navigation systems because "$2,000 is too much to pay for an electronic map." Today, very competent aftermarket systems are available for a tenth of that price, and nav systems have become as essential as power steering and anti-lock brakes.

Consumer Reports recommends Chevy Volt

NEW YORK (CNNMoney) -- The Chevrolet Volt, General Motors' plug-in car, has earned a recommendation from Consumer Reports magazine.

Molycorp Set to Announce a Rare Earth Rediscovery

An all-but-forgotten rocky outcropping in Southern California contains ore that could help break the country’s dependence on China for certain types of rare earth metals, according to the only American producer of rare earths.

Overbearing Brasilia at fault in ethanol shortage

SAO PAULO (Reuters Breakingviews) - Once seen as a potential supplier of ethanol to the world, Brazil is now itself short. Lack of investment in the past few years and squeezed margins mean biofuel production is not matching demand growth. The industry's predicament is also affecting oil giant Petrobras and shows the risks of a crop-based fuel market constrained by government policies.

Sahara Solar Project to Outline First Plant Next Year, CEO Says

The Sahara solar initiative backed by German turbine maker Siemens AG (SIE) and Deutsche Bank AG (DBK) will sketch out plans in 2012 for its first power plant, a 600 million-euro ($800 million) station in Morocco, its project manager said.

'Solar-coaster' hits as sun sets on federal subsidies

The booming U.S. solar industry faces a potential tipping point — what some call a "solar-coaster" — as the sun starts to set on billions in federal subsidies.Can it make it on its own? Can it compete with China, which U.S. officials say spent $33 billion in 2010 alone on solar loans?

Obama warned not to visit Solyndra

A Silicon Valley investor and senior administration officials warned the White House to reconsider having President Obama visit a solar start-up company because of its mounting financial problems, saying he might be embarrassed later.

As farmers markets thrive, so do concerns

Although the fare sold at farmers markets often is perceived as more wholesome than what’s available on grocery shelves, there is no evidence that it is less prone to cause foodborne illness — and it generally receives less federal and local oversight.

Ameren cites EPA rules in closure of 2 Ill. plants

ST. LOUIS (AP) — Ameren Corp. said Tuesday it will close two power plants in Illinois by the end of the year, blaming the cost of complying with new pollution rules issued by the Environmental Protection Agency.

Climate Change Policy: Should We Tax the Poor to Help the Rich?

If the government limits carbon emissions now through taxes or direct caps, it is taxing the poor today to benefit wealthier future generations. Perversely, such limits would also deprive future generations of the additional capital that would accumulate if the money were invested in the market instead of being used to combat climate change.

Who's Bankrolling the Climate-Change Deniers?

As the sociologists Riley Dunlap of Oklahoma State University and Aaron McCright of Michigan State University suggest, climate denialism exists in part because there has been a long-term, well-financed effort on the part of conservative groups and corporations to distort global-warming science. That's the conclusion of a chapter the two researchers recently wrote for The Oxford Handbook of Climate Change and Society. "Contrarian scientists, fossil-fuel corporations, conservative think tanks and various front groups have assaulted mainstream climate science and scientists for over two decades," Dunlap and McCright write. "The blows have been struck by a well-funded, highly complex and relatively coordinated denial machine."

Coastal Cities Face Serious Threat From Rising Sea Levels, Warns UN Sec Gen

UNITED NATIONS (Bernama) -- UN Secretary-General Ban Ki-Moon has warned that rising sea levels could put coastal cities from Kolkata to Miami at "serious" risk in the years to come...."Major coastal cities - such as Cairo, New York, Karachi, Calcutta, Belem, New Orleans, Shanghai, Tokyo, Lagos, Miami and Amsterdam - could face serious threats from storm surges and are at risk of being inundated by rising waters.

Arctic Sea Ice Continues Decline, Hits Second-Lowest Level

WASHINGTON -- Last month the extent of sea ice covering the Arctic Ocean declined to the second-lowest extent on record. Satellite data from NASA and the NASA-supported National Snow and Ice Data Center (NSIDC) at the University of Colorado in Boulder showed that the summertime sea ice cover narrowly avoided a new record low.

Melting Arctic ice clears the way for supertanker voyages

Supertankers and giant cargo ships could next year voyage regularly between the Atlantic and Pacific Oceans via the Arctic to save time, money and emissions, say Scandinavian shipowners.New data from companies who have taken advantage of receding Arctic sea ice this year to complete several voyages across the north of Russia shows that the "northern sea route" can save even a medium size bulk carrier 18 days and 580 tons of bunker fuel on a journey between northern Norway and China.

Morning, I Would like to pass on a little timesaver to my fellow TOD'ers that use Firefox.

https://addons.mozilla.org/en-US/firefox/addon/find-to-center/

An add on that brings the "found" object to the center instead of the bottom. Useful for looking for [ new] comments.

Takes a couple days to get used to after years of having to scroll up after every click.

Thanks for the tip! I always wished for a feature like that...

Interesting. I would always go to the bottom of the page and do a "Previous" find to deal with this issue.

I did that sometimes, but other times it's useful to read in sequence.

I use GreaseMonkey and the todban script to automatically collapse all non-new posts. It makes skimming TOD much easier.

Does the todban script work in FF 7 ?

Works for me in FF 7.0.1

Thanks, useful.

NAOM

It’s that market economics has again triumphed over the Luddite left, that democracy has prevailed again over “Technocracy” – the ideology, memorably captured in 1984, that George Orwell once described as “a prerequisite for fascism.”

Technocracy is "a prerequisite for fascism.”? Anyone have the actually source document for this quote? VS just saying the quote and calling it true.

For some reason, I don't quite remember that quote.

I do remember this http://orwell.ru/library/articles/As_I_Please/english/efasc Perhaps Mr. Yergin doesn't like the idea of a replacement economic system, based on energy and therefore what he does not like is to be called Fascism?

http://www.brainyquote.com/quotes/authors/b/benito_mussolini.html

So say - hows that Corporations are people and laws/treaties like the ACTA working out for ya all?

The author of the piece was not quoting Yergin about Fascism that was the author's own words. I had to read it twice before understanding who said what.

quoting Yergin about Fascism

I was under the impression the claim was George Orwell had a quote about Technocracy. And I'd really like to see the source work for such a quote.

re: A peak oil Technocrat ignored the power of technology

There is a lot of errant nonsense in this article, the Luddite left remark being just part of something resembling a drunkards walk through peak oil theory.

M. King Hubbert was a a geoscientist who worked at the Shell Oil research lab in Houston, Texas, so I don't think he could be described as a "Luddite". I don't his political leanings but odds are, considering his employer and his city, that it wasn't very far left.

Mr. Hubbert got everything wrong – as End Times prophets are wont to do. U.S. oil production did not, in fact, peak at 1.5 million barrels a day. By 2010, U.S. production was 3.5 times higher than Mr. Hubbert had anticipated: 5.5 million barrels a day.

Hubbert said nothing of the sort. When he published his original paper in 1949, US oil production was already running at 5 million barrels per day. By 1951 it was higher than today and the good times were starting to roll as if they would never end.

What Hubbert said in 1949 was that there wasn't enough geological data to give a petroleum peak for the US, so what he showed was a ballpark estimate of an "all fossil fuels" (mostly coal) peak.

By 1956, he was giving a low and high estimate - the high estimate was that US oil production would peak around 1970 at about 8.2 mbpd. What actually happened was that it peaked in 1970 at 9.6 mbpd. That's not just a ballpark estimate, that's a three-base hit in any game I've been in.

Mr. Yergin foresees not a finite peak but a never-ending plateau. He anticipates further increases in U.S. production of oil – noting that production has increased by more than 10 per cent in the past three years.

Mr. Yergin is selectively quoting statistics. He fails to mention that US oil production fell by nearly half, from 9.6 mbpd in 1970 to 4.9 mbpd in 2008 before the minor uptick to 5.5 mbpd in 2010. In 2008 it was lower than it was in 1948, while in 2010 it was back to where it was in 1950. Yergin is arguing that the historic 40-year decline is over on the basis of 3 years of increased production.

Mexico has huge reserves... China is already drilling in Cuban waters... Australia has vast reserves of gas and coal. Greenland possesses large oil reserves...

Thank gosh we're all saved. Did he notice that Mexican production has crashed in recent years as their supergiant Cantarell field went south, suddenly; That Australia has lots of coal, but that's not oil; or that the Greenland "reserves" are based on six dry holes (so far).

But the greatest oil and gas rush of them all will probably take place in the United States and Canada – where the five largest shale oil zones in the world are all located. Drill, baby, drill.

The author doesn't realize that shale oil is not oil shale, which is where the US hypothetically has most of its non-conventional oil deposits (there's nothing going on there at the moment, not even a pilot project). He also doesn't realize that oil shale is not oil sands, which is what the vast Canadian non-conventional oil deposits are. The Canadian reserves are going on production, but it's slow, baby, slow.

This is in a Canadian newspaper so you would think the editors would catch the last blooper, even if they are in Toronto. I mean, Toronto isn't that far away from Canada (Canadian in-joke).

No, No, RMG. You don't understand. The thing is, the author claims that if prices go high enough there is sufficient oil to last another 100 years! Ergo, no peak! If the price went to, say $500/Bbl, someone would undoubtedly produce a whole bunch of oil! Everyone, in fact. That it is environmentally ruinous is unimportant. That the (rest of the) economy would be destroyed, also unimportant. Capitalism would find a way, and there is simply no peak, ever. If the price was even higher, by many multiples, no doubt someone would find a way to turn rocks into oil. Then we are back into the stone age! All courtesy of your friendly, neighborhood capitalist/corporatist/facist.

I like the drill baby drill part the best. In Canada, as you know, it is "dig, baby, dig!"

Meanwhile, in the US of A, we are decapitating mountain ranges, and filling in valleys to access our particular answer to the energy problem.

Can you dig it?

Craig

I don't his political leanings but odds are

One of the founding members of Technocracy. The 1st time I saw/read it - http://technocracy.ca/tiki-index.php

Later others were at - http://www.technocracy.org/

Both seem to claim to be 'the voice' of Technocracy.

From the wiki

From the other site

So Hubbert may not be "of any party".

I only went through the first page of comments, but I didn't see anything close to a supporting post in there.

I suppose it's too much to hope that the Globe and Mail editors are paying attention to this..

Gas? If you change the goalposts to include natural gas then you are tacitly admitting that your argument against peak oil is weak.

I found this comment on Climate Progress to be succinctly on-target - applicable to peak oil as well as climate change:

http://thinkprogress.org/romm/2011/10/03/335022/organized-climate-change...

I loved Reynold's stuff about Luddite Technocrats. You don't see nearly enough newspaper articles these days where you can tell the writer was 3 sheets to the wind.

I had a pause with the Luddite technocrat, something like a steak-loving vegetarian.

Meanwhile, quite a stream of denial articles, not just clever ones but off the boards.

Such as the one that presumes people will be richer 100 years from now so best to get these future wealties to pay for climate change rather than doing something about it now ...

Just to raise one of my pet hates, the Luddites weren't actually anti-technology. They were against the mistreatment of workers by the implementation of new technology by unscrupulous mill owners. A bit like an early Trade Union.

I just thought I'd make a general point.

I do not understand why Yergin gets so much traction. It really isn't about total amount of oil but actual EROI of that oil (or coal or gas). If one gets a million cubic meters of gas from one straw in the ground, that is not the same energy out if you need a 1000 or 10000 straws in the ground. It might also be pointed out that oil per capita has been declining a long time and that oil production is no where near keeping pace with the world's birthrate. But I guess that does not matter to first world ( soon to be 2nd then 3rd and maybe 4th) journalists.

Hasn't Rockman covered the value of EROEI elsewhere? I thought I saw it somewhere around here.....industry just doesn't use EROEI as a measure of economic value in their business, so why would Yergin?

I think people need to give Yergin a break. He is only saying what the people who pay him want him to say. That is true for the "journalists" who cover him. Would you blame a dog who does stupid tricks for looking stupid?

A domesticated dog has little or no own will - nor has Yergin, is that your point?

You are presuming bias with no evidence. Perhaps you made your comment because you are paid by the Sierra Club to disparage anyone or anything with doesn't fit in with their anti-fossil fuel agenda? See how easy that was, as long as no one requires me to prove it first?

Do you have some knowledge that Yergin is paid to lay down a particular position, or are you just accusing him of it because you can, it sounds good, and it's easy? And has the same basis as the claim I just made about you?

Nobody has to be paying Yergin-he is a business in and of and unto himself-nobody has to pay me to advocate for local farmers, as I am one myself.His AUDIENCE pays him -he doesn't need a "front" organization to support him, he owns his own, sfaics.

Now my personal opinion, but backed by good communications theory, is that Yergin should be treated with respect, in order to draw HIS audience into an educational scenario wherein they are introduced to his simply enormous errors in predicting prices, etc, and can be invited to take a look at THE DATA from OUR pov, when WE get to do a bit of cherry picking of our own.Or not. We don't even need to cherry pick, since the data are overwhelmingly on our side.

Just calling him an xxxx or a paid mouthpiece-even if this happens to be true-will not bring the members of the cornucopian church into our little reality based free thinkers club for a visit.

Quite the opposite, actually.

Oh brother. Trying to be "fair and balanced", Bruce? Try again. There most certainly IS evidence on which to presume Yergin has a bias. He has a vested financial interest in providing industry-friendly analysis. They actually do pay him, and he (surprise!) does seem to say what they want him to say. He also consistently includes misrepresented and even flat-out incorrect data in his essays and "expert" talking head appearances. And it is consistently incorrect in favor of his (surprise!) industry-friendly positions. It's not a smoking gun, but it's what them lawyers like to call circumstantial evidence. Now, since you seem to like condescending rhetorical questions, see how easy it was to call you out on that?

My 2c on" I do not understand why Yergin gets so much traction"

I personally pay some attention to what Yergin has to say because he is an insider (knows a lot of people of power and knowledge)

Do form my opinion solely on what he says? Of course not.

Do I weigh his opinion more heavily than the opinions of some of the oil drum experts? Probably not. but I cannot ignore his opinion, since I cannot have a valid independent point on the subject.

A lot of lay people have similar standing and are interested in the opinion of an insider.

Yergin announces 70% cut in predicted rate of increase in total liquids "Capacity"

Someone else may have picked up on it, but I initially missed a crucially important point about Yergin's 2005 Washington Post column versus Yergin's 2011 essay in the WSJ. Following are the two key excerpts:

Yergin in 2005:

http://www.washingtonpost.com/wp-dyn/content/article/2005/07/29/AR200507...

It's not the end of the oil age

Yergin in 2011:

http://online.wsj.com/article/SB1000142405311190406060457657255299867434...

There will be oil

In the following linked article, I analyzed Yergin's 2004/2005 predictions, with a special emphasis on his item in the Washington Post in 2005:

http://www.aspousa.org/index.php/2011/10/three-strikes/

Three strikes and you are out?

Regarding Yergin's two predictions:

A 20% increase in six years would be a 3.0%/year rate of increase (2005 prediction).

A 20% increase in 20 years would be a 0.9%/year rate of increase (2011 prediction).

Yergin cut his predicted rate of increase in "Capacity" by 70%.

When you take out increasing volumes of biofuels and NGL's, it seems to me that Yergin is now, in effect, forecasting a zero rate of increase in crude oil production, and it may be close to a zero rate of increase in total petroleum liquids (crude + condensate + NGL's). Incidentally, assuming a continuing increase in consumption in oil exporting countries, a flat forecast for crude oil production effectively means a forecast for declining Global Net Exports, and assuming increasing Chindia net imports, in effect Yergin is forecasting an accelerating rate of decline in Available Net Exports of petroleum liquids (although I doubt that he realizes it).

However, the general consensus among WSJ readers seems to be that there is no reason to worry about future oil supplies.

The meme that that we will have abundant oil supplies (however defined) for the foreseeable future is winning and will continue to win. The sophistication required to see through this meme, constantly repeated on a daily basis, is well beyond the capability of the average citizen, reader, viewer, consumer. The establishment is completely in the pockets of the cornucopians and will continue to be so.

Do not resist. Embrace the future of abundance. You have nothing to lose but your wallets, your livelihood, and your planet. But that is for the next generation to worry about.

The most insidious part of this meme is that since we will continue to have an abundance of oil (however defined) and energy, we can continue life as we have always known it. Even if it were true that this abundance would continue for the foreseeable future, the way we are reacting to that "news" is a tragic of existential proportions.

I would imagine that many people concerned about global warming have seen peak oil and other scarcity as another way to get people to cut back on their profligate lifestyles. Since appeal to environmental concerns has clearly failed, it was thought that the problem could be addressed by appeal to their self interest. Well, that is not working either and will not work as long as there are charlatans like Yergin around.

"The establishment is completely in the pockets of the cornucopians and will continue to be so. "

and:

"Well, that is not working either and will not work as long as there are charlatans like Yergin around."

While getting ready for the last few days I listened to Bloomberg....ate quick breakfasts tuning in Wall Street protests...CNN, renovating listening to NPR etc....all efforts trying to fathom opinions on economy from 'down there'.

Over the last few days I have heard numerous segements on energy and auto sales, but nary a thought on constraints or limits of pet. reserves. The knashing over new recession...swings of the markets....whatever, makes me want to shout into the radio, "oil is 107....or 104, not 78. What happens if growth never returns?!"

No one has even dared to ask, "what happens if growth never returns"? All seem to assume if this gets done, or if Obama does that, or leaves, or if Greeks only....but no one has asked what if economic growth is finished?

How many years or election cycles will it take before the truth sinks in?

I think that such a question is absolutely too extreme to be even considered by most, and yet if you accept that the world and (her) resources is/are finite, sooner or later the question has to be asked and answered.

Now is the time for sociologists to become involved in more dramatic ways. Now is the time. Or, if American Airlines does go broke, B of A continues to drop, Boeing shuts down due to airline failures....the f35 cancelled, something has to spark this discussion. I just don't see any current change despite the continual barage of decline. There once was a world before jet travel and time shares, right?

A good analogy are possible reports of the recent eastern seaboard hurricanes without met. services. Picture the news..."wind is picking up, no one knows why. It has rained for 1"/hr for 3 days, but no one knows just why, although the wind has increased and it feels warmer. If this continues, there may be flooding." "Some say it could flood, but we have never had any flooding here so it isn't possible...after all, this is America".

Thank you protesters and good luck. May it produce some questions at the very least.

Cheers Paulo

"No one has even dared to ask, "what happens if growth never returns"? All seem to assume if this gets done, or if Obama does that, or leaves, or if Greeks only....but no one has asked what if economic growth is finished?"

I wake up every day hoping growth is finished. That's a good thing. You folks knash your teeth over climate change and overpopulation, but you never think out of the box either. Peak resources is the solution to human unsustainability. Stop wishing for a political solution that can never happen. You wouldn't like a world government lording over you, and any uber leader would just be owned by industry anyway.

Right, MK. There is a tension between fear, frustration, and hope that prevails on TOD. We see what is coming; we recognize that people will not agree to change absent a crisis. And, we know that 'crisis' in this case is TSHTF, at which time "people" will turn to their "leaders" and demand... not request or ask, but DEMAND that the crisis be solved.

Overwhelming problem: more than one crisis. 1. The Population Crisis (if not done top down, it will be done bottom up, and be very messy); 2. The Energy Crisis - needed to begin acting about 30 years ago, but instead we elected Reagan and had a nice, but short, party; 3. Water / soil crisis - we will eventually have to come to sustainable, local farming; 4. Climate Crisis - it may be too late, but we don't know. The longer we wait, the behinder we get though. Plus, most of these 'problems' have already become conditions, incapable of solution. We need to learn how to deal with them. Nature can and will solve them all.

Maybe we can terraform Earth?

Craig

The situation is viewed as simply not being handled correctly. Some factor among numerous possibilities must be out of tune with the other moderating factors and it is causing a non-growth period. Must be Obama, or must be Bernanke, or Geitner, or the interest rates, or a failure to invest in infrastructure, or something we haven't quite put our finger on yet. But maybe one of these hate the middle class Repubs running will have the right answer. Maybe if we just rewarded the super wealthy a lot more we'd all be better off.

Anything and everything but the willingness to look the situation square in the face. Fact is oil supply hit a plateau in 05, and from there rose in price until the economy faltered and since then growth has been stalled except for minor GDP resulting from massive borrowing against the future. As long as oil remains expensive relative to the what the economy needs to get it revved up, no growth will occur.

I agree. Growth is over. Now it's just a matter of deciding as a society how best to handle no growth. The trouble with that is its not conducive to lending. Without loans the system falters.

Who? There will be no deciding anything, even the ants who think they're steering the log are just passengers now. Someday far in the future, perhaps people will be able to make some decisions about what type of society they will build from whatever is left, but this one will be long gone then. Although the damage done will not. Our lot is to weather the fall of this one as best we can.

Correct. Finally someone who understands politics and human nature. There is no deciding as a society. There is no leader who can "save" us. There is only narrow-minded special interests. Some are very large and have clout. There are also 300 million who are small and just sound like thousands of cackling hens.

There are also broad minded people who are working selflessly and tirelessly.

"There is only narrow-minded special interests."

I'm sorry that's the way you see the world, and I'm glad it's not as narrow and cackling as you describe it. Careful where you aim those slippers, someone could lose an eye..

I'm not entirely sure what "There is only narrow-minded special interests." was intended to mean. There certainly are a lot of folks perusing their own narrow-minded special interests at the expense of the common interest. But that is not the whole picture.

There are many things one can do, many things worth working selflessly and tirelessly on that will make a real difference in people's lives. Beyond the walls here at TOD there are many lively discussions on appropriate responses to our predicament worth thinking about and taking up. But deciding what society is going to do to re-invent itself is not one of them. We will live out the rest of our lives in a time of consequences, dealing with the accumulated results of our (and other's) past actions.

If someone says 'we as a society need to decide', I'm willing to look at that language with a little charity. I don't think it means 'everyone votes on a plan', or 'create a centralized ruling structure that sets our course for us..'

Societies do move and change as influences and habits develop or erode. Our society 'decided' to give women the vote.. and yet it was a gradual process with a lot of inputs and false-starts. I don't think it necessarily has to be some palpable conscious moment.. but new perspectives take hold as need warrants, or as some stroke of genius or some extraordinary notion catches fire in a population that's ready for it.

Yes, these are 'consequences', and yet they are also tied in with choices that individuals have made, groups have committed their fortunes to..

It's a bit like debating Nature/Nurture, and expecting one to come out as the absolute winner over the other.

Yes, and if you look you can find good things that any past civilization did for their people - when they were in their prime, before they overran their resource base, before collapse. People in collapsing societies are concerned with where their next meal will come from, will they have shelter, how to stay out of the way of competing warlords, etc. Universal suffrage, not so much.

Societies in collapse don't do the things they might want to, because they are collapsing. By definition, they do not function as they once did. Rational decisions about how we might adapt to no-growth, to much less energy, are not going to happen. But this is obvious, it's just your mission to see only the positive getting in the way of understanding again.

"Rational decisions about how we might adapt to no-growth, to much less energy, are not going to happen. "

It looks to me as if you are taking any positives that are brought up to be unacceptable counters to the wholly hopeless conclusion you have set yourself upon.

I don't use the bits of encouraging news or the hopeful tools I bring up to say "No Problem, we're out of the woods." I never have done that at TOD, Ever. I frequently describe how dire our situation is, but that we also have opportunities to take advantage of. There are a great mix of positives and negatives around us, and I'm talking about both ends of it regularly.. but moderate views seem to be the enemy of BOTH extremes. What are you gonna do?

You were holding out the fact that we granted women the right to vote as specific evidence that a nation in the predicament ours is in might make rational decisions about things such as how to handle a move to no-growth. This is absurd twaddle and I pointed that out. The problems we face are by and large not things that can really be solved while allowing the greater society to remain. And societies that are collapsing do not function properly anymore. The formal mechanisms to make decisions fail, and they are unable to adapt or respond effectively to the circumstances they find themselves in. That's pretty much the definition of collapse, and you can see it all around now.

Yes, once we had great infrastructure projects, passed clean air and water laws, expanded the rights of women and minorities, etc. This is not evidence that we can or will make rational choices about how to deal with peak oil and resource limits together with climate change and the follow-on effects. Undoubtedly a few wise choices will be made, but for the most part we won't be able to effectively respond. Take a look at how our governmental systems are working now. What other mechanisms do you see that might work more effectively?

A large, complex society built upon growth and ever greater resource extraction will not "decide" to become something else. It will fail and eventually be replaced by something else of much lower complexity, not dependent on the things that are no longer viable. Individuals and local groups may, and likely will, make good rational choices about how to adapt. That was not the point being made.

You appear to have assumed the role of gatekeeper here on TOD, trying to make sure a positive spin is placed on everything. This is not grade school and we don't need to have everything sugar-coated - we're adults and should be able to see the reality without having someone constantly jumping in to tell us it's not all that bad. We, as a society, will not make any rational decisions in an organized way about how to transition to a no-growth reality. That was my statement, which I believe is both true and fairly obvious - now you can paint pretty flowers on it or try to distract by pointing out the cute bunny over there, but I'm done responding to your obfuscations.

We as a society have never decided. This has always been a raucous, fractious country. We did get it together enough to fight a revolution, muddled through the Civil War. Probably the only time we truly came together was after Pearl Harbor. To some degree with Kennedy's goal to put a man on the moon. Unfortunately, our situation is clear only to a few. Roosevelt knew what was coming, but he had to wait until circumstances were right for the country to pull together. The US only pulls together when attacked--this probably true for most countries. Our looming crises are invisible to most people. There is plenty of gas at the pumps. Most people believe that the oil companies or the Arabs are responsible for prices and they deny that supplies are ever an issue. In what little public discourse exists, there is little consensus amongst experts. Whose voice is heard? Yergin? Lynch? Laherre? Cacophany is what the public hears so they tune out. It is unlikely the public will perceive the crisis until well after the earthquake hits and the tsunami breaches the walls.

From a book manuscript on my computer, wich will most likely never hit the book shelfs. Translation by Google Translate, some effort to clean up by me:

"When we left the Stone Age or Middle Ages, it was not because any committee decided it is time for some reform, it just happened that people took the initiative."

That's a very good line!

Scary but true. 10+

Craig

My dad (85) and I were talking about this about a month ago. When he was growing up in Washington, DC his dad (my paternal grandfather) used to describe this as the "fall rains." With the limitations of early radio and the telegraph, conveyance of news over a long distance on a schedule anything like we are used to (or used by) now, was unthinkable.

My dad said, that in retrospect, they now realize that these were hurricanes and tropical storms passing through or by the region.

No one has even dared to ask...

You need to read The Great Disruption

Which one? There are several in print which may fit the bill.

Al

<< for sociologists to become involved in more dramatic ways. Now is the time. >>>

I know, I know. We are trying.

I am working in one of the most progressive community mental health centers in a very progressive city, and it's just a really tough sell, and a long hard slog. The economic and career displacement is massive, it's in our face, and still-- changing our policies and procedures, trying to adapt... it's like trying to change the course of some enormous vessel at sea, and it feels like the ship just isn't answering the helm sometimes.

We will not give up. Sure feel like it some days, but we won't.

There are a few analysts, for example Albert Edwards at Societe Generale, who are saying an economic "Ice Age" is descending on the world. Yesterday CNBC had an article about how the word "Depression" is becoming more and more commonly seem in the mass media. They had a few other analysts' names----economists and the like---who are saying exactly that "GROWTH IS OVER".

It is being talked about, slowly. The world is starting to get its head around the picture of no more growth.

I happen to think that personally it will be a huge relief for billions of people. Finally we can start to count on the simple things we counted on for so many millenia. We can just live simple lives without worrying that the bulldozers and other huge machines are arriving to claim everything around for the mass elite in some city miles away. Those mass elite will also be relieved. They can pack up and move on to some simpler more useful job.

Once the phenomenon of "no growth" is truly recognized, it is just a matter of time before some of the ugly cement buildings start getting knocked down so that some hungry and enterprising person can grow food there, or pay someone else to do so.

Still I don't see recognition of resource constraints (and saturated pollution sinks) as the cause of the end of growth.

I'm sure the economists will come up with some phlogiston based theory for the decline of GDP.

If it's on CNBC I doubt it's genuine. More likely a banker planting fear so he can justify another bailout or goad the fed into printing more money.

Let's say the "elite" and mass media agree peak oil is here or coming soon. Imagine what they'd do. I think it's safe to assume they'd react by allowing drilling on every square inch of land. Be careful what you wish for. Peak oil will mean the last standing ecosystems will be decimated. That will give us a new, higher peak, about 40 years out. One more generation of status quo, then the slow decline into a more sustainable world.

I think Plato nailed what's going on in his Allegory of the Cave...

Nice image, of course, but the philosophical idealism (as opposed to materialism) underlying Plato's metaphysics (the theory of Forms) is, in my opinion, very questionable.

It's all good up too this piont:

I'm always leery of people who think they are in possession of 'secret knowledge'. We're all prisoners in the cave. We never come in direct contact with reality. We only imagine reality; building upon our senses and memories of past sensations. Anyone who claims to know 'what is really going on' is most likely full of sh!t. At least that has been my experience, your experience may vary.

I often think of Plato's cave when I watch TV in my living room. I have a projector positioned behind the couch, and I sit and watch the shadows dance on the wall. My mind transforms them into a story convincing enough to physiologically and physiologically affect me.

I wonder what Plato would think of modern Americans; sitting in their artificial caves, watching shadows from artificial fires (T.V.'s). It seems that we are going in the opposite direction of what his teaching's prescribe.

(A lot of people taking the blue pill - if you're a 'Matrix' fan)

I just liked it as a literal metaphor.

Many people don't have the courage, desire or maybe even the time to really look at their lives and society directly.

Or, they are so bought in to the "story" they are told they will not look away from the shadow world to glimpse the real.

If we can't rely on Yergin for soothing Cornucopian reassurances, who you gonna call?

I'm betting if you got fists full of money to give soothing Cornucopian reassurances, you'd be on call too.

Yergin might just be cheaper than others is all.

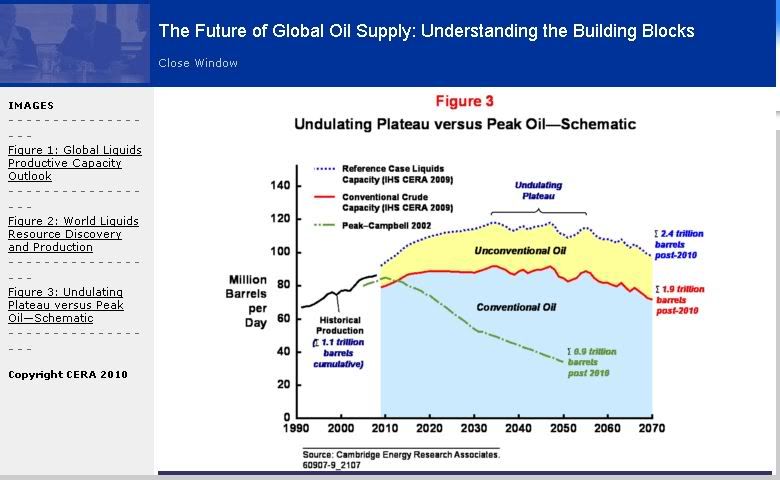

Nice catch, Westexas. And if you want to show their changes visually, you can dig up the IHS/CERA oil production graphs that show oil production growth with the 'undulating plateau' around 2030. I've seen at least couple different versions and the height of the undulating plateau drops in the later version.

I am beginning to suspect that IHS/CERA's celebrated field by field analysis largely consists of extrapolating recent total liquids production numbers.

When Yergin predicted a 3.0%/year rate of increase in global total liquids "capacity" from 2004 to 2010, global total liquids production was then increasing at 3.1%/year (2002 to 2005, EIA).

He just predicted a 0.9% rate of increase in global total liquids "capacity" from 2010 to 2030, after global total liquids increased at at 0.9%/year (2007 to 2010, EIA).

Note that the actual 2005 to 2010 rate of increase in total liquids was 0.5%/year (EIA), and as noted above, if we subtract out biofuels, global petroleum production has basically been flat for six years.

wt - Have you mentioned Yergin's comment ("Global oil production is still on the rise with no evident decline any time in this century.") to many of your cohorts yet? Coincidentally we had a company wide update meeting this morning and I mentioned it. It was good to start off such a meeting with a big laugh. I'm very willing accept anyone's guess as to where we're heading with re: PO. But I do have my limits. IMHO I cannot...will not accept...that he really believes that. He may not be degreed in geology/pet engineering but he's been in the room for a long time. As much as I want to not say it out loud I have to believe he knows he's telling a big lie. Either that or he's had a stroke and doesn't know what he's saying. I don't recall the most pie-eyed cornucopian making such a prediction. He's essentially predicting that we will produce as much or more than we have since the beginning of the industry. Not sure how old he is but he probably won't be around to be proved wrong. So he has nothing to lose and just a big consulting fee to earn in the meantime.

Even if the stuff's there, are they willing to produce it?

The Rick Perry Hustle, by Larry McMurtry

Ever read any of Julian Simon's stuff? Talk about pie-eyed.

Here are the graphs of the shrinking plateau obtained from CERA's web site. Notice how much the peaks of both conventional oil and total dropped.

CERA's view in 2006:

CERA's view in 2010:

So CERA is a gang of peak oilers as well. Why would they, or Yergin in particular, draw so much derision when he obviously believes in the same idea?

"It is difficult to get a man to understand something, when his salary depends upon his not understanding it!" -Upton Sinclair

I understand the quote. I do not understand what it has to do with Yergin actually being a peak oiler, admitting it freely, yet getting pounded pretty hard for...not being a particular brand of peak oiler?

Bruce - Try this take on Yergin's position: everyone is a "peak oiler". Except the fringe who truly believe there is an endless supply of oil continually being produced. The difference for the rest of us is when the peak has/will occur. The date and rate of when oil production peaks is, in and of itself, not relevant. What is critical is how it will affect the world's economy and its population. And how we respond. So what truly matters is how we plan to deal with PO subject to when it occurs: 2005, 2050, 2100, etc. And accepting any one date will have a huge impact on policies...both private and govt. If it happened in 2005? Then obviously significant measures should be taken now. Measures that try to mitigate as best as possible the worst effects of PO. If it won't happen until 2050 then we could focus on more pressing matters such as slow/no economic growth and unemployment. And that would mean increased energy consumption and less concern about conservation...at least for the next 20+ years or so.

So the difference between Yergin's position and others isn't just a different "brand of peak oiler". With respect to how we react/don't react it's two different realities IMHO with drastically difference consequences.

Do you realize Rockman, that some peak oilers claim that the timing of peak isn't really all that important, versus the consequences they wish to associate with it (some of which you allude to). Under that scheme, Yergin has just as much a claim to peak-oilhood as any other peak oiler does. He may not advocate it for the same reasons, but certainly he is perfectly willing to show peak oil happening.

"..but certainly he is perfectly willing to show peak oil happening."

No, he's really not. He chooses a set of directions and conclusions that seems to please what certain people want to hear, and this crowd at TOD has demonstrated pretty clearly that his specific predictions have been reliably and seriously as bad as he is CLAIMING the PO community's are, and yet he is mysteriously not being called to the carpet on them in the Public Discussion on Oil Supply.

In the first chart, look at how supply is comfortably above demand even after the plateau. This is obviously a "prediction" designed to push the effect of PO far into the future with no consequences. It deserves a laugh and derision.

One thing is obvious. Supply WILL NEVER be that far above demand. Simply because that would crash the price putting the producers in financial straits. Producers will try to match demand or keep supply tight.

Once not predicting the future correctly is the basis for laughter and scorn, can we apply the same rule to Hubbert's prediction of a world global oil peak of 13 billion barrels a year, rather than the 30 or so we actually achieved? Or do we laugh at Colin for being deluded enough to predict that in 2010 the world would only produce some 30-35 million barrels a day or so? Good for the goose, good for the gander, those in glass houses, etc etc.

I would prefer we laugh at neither, and try and learn why they all missed their marks. Certainly heaping laughter and derision on any of them is hardly a productive exercise.

That's more misinformation about what Hubbert predicted.

What he actually said, in a 1971 paper in Scientific American entitled Energy Resources of the Earth was that, given an estimate of URR at 2.1 trillion barrels, world oil production should peak around the year 2000 at about 37 billion barrels per year.

So, given that according to the BP Statistical Review of World Energy said that in 2010 world oil production was about 32 billion barrels per year, Hubbert might have been a little too optimistic.

It's still a 3-base hit in the oil prediction game.

What he actually said, in a 1956 seminal paper entitled Nuclear Energy and the Fossil Fuels...etc etc. You have what he said, I have what he said.

Are you mentioning his later work to demonstrate that even the originator of the theory could miss flowrates by 230% over just a 15 year time span, and that is okay because one of those guesses was better than the other?

If Hubbert is allowed these sized error bars, why isn't Yergin?

That is entirely relative. Apparently Yergin considers the error bar on US oil production to be somewhat less than what you describe as a 3-base hit. Not saying his predictions are any better, but relatively speaking and with a 230% error bar? Even Colin Campbell is inside that metric, and he missed 2010 oil production rates by some 30+ million barrels a day.

No, I'm saying that in 1956 he didn't have enough data to accurately estimate the oil production in 2010 - 54 years later. In particular, nobody knew at that point in time how much oil was in the Middle East, which happens to contain most of the world's conventional oil resources.

And that was a serious flaw in his data - the current estimate of Middle Eastern oil is roughly double that.

By the time he wrote his 1971 paper he had a much better estimate of how much oil was in the Middle East and other places, so his estimate of 2000 production was much more accurate. Remember, he's predicting 30 years ahead.

Hubble did rather well predicting oil rates 30-40 years in advance. Yergin is having trouble being as accurate 5 years in ahead, and is having to adjust his predictions constantly as they turn out to be too optimistic.

Hubble's methods produced increasingly more accurate curves as the oil reserves are depleted. Yergin's seem to mostly involve a lot of misplaced optimism.

Maybe he didn't. But did HE say that, or are you just making an assumption for him? Colin Campbell some 18 years after your 1971 reference certainly had more data, and he decided that peak oil was in 1989 or so.

Could be. But I haven't seen anyone break down predictions, Hubbert's or Yergin's, by % miss/years in advance of the guess, and we are talking about multiple guesses, some with multiple scnearios. It would be a nice metric though wouldn't it? As far as Hubbert's undiscovered assumptions, if he thought his Middle East number was low, he could have beefed it up any way he wanted. Hindsight is 20/20. Just because the size of the Middle East was unknown doesn't mean Hubbert didn't already have a system in place to assign a size to what was yet to be found. If that didn't work out, it didn't work out, and demonstrates an area of needing improvement certainly.

Yergin's estimates appear to be hinged on a bottom up analysis from Jackson, or perhaps someone else within CERA. Because they have access to the international production data available through IHS, this makes sense. As far as what Hubbert's method does, or does not do, I recommend Caithamer, P., 2008, "Regression and Time Series Analysis of the World Oil Peak of Production: Another Look", Mathematical Geosciences, v. 40, Number 6, p 653-670

Here is what Yergin wrote in the WSJ essay:

What he did not say was that his prior prediction, circa 2005, for a 3%/year rate of increase in total liquids was wrong, and he did not highlight the fact that his new prediction is for a 0.9%/year rate of increase in total liquids. Instead, he talked about a 20% increase in six years in 2005, and in 2011 he talked about a 20% increase in 20 years. In any case, I am beginning to suspect that CERA seems to charge a lot of money for simply extrapolating the previous three years or so of total liquids production data.

The trouble is that for people like Yergin, there are no consequences for being wrong. He just has to talk fast and confuse the press, and his future is secure.

When you actually have to find oil, it is quite different. We used to have a picture on the bulletin board of an old petroleum geologist that some of us knew, dressed in rags, pushing his shopping cart from dumpster to dumpster in hopes of collecting enough refundable bottles to pay for his daily supply of whiskey. We put a caption on it, "THIS COULD BE YOU!". HR made us take it down. However, these are the consequences of being wrong when your decisions count and your neck is on the line.

OTOH, the consequences of being right are a lot better. Some junior oil companies who couldn't afford to pay a top-flight geologist used to offer them a deal: a 2% overriding royalty on all the oil they found. I can think of a lot of big mansions in ritzy areas that were paid for using those 2% overrides.

+∞

But again . . . he weasels out by saying . . . well, we have the 'capacity' to produce that oil. Such 'capacity' is in a nonexistent world where we have much more money to pay for the drilling & extraction.

In the real world, we really do not have the 'capacity' to produce that oil because our economies simply do not have money to extract it. The world is filled with people who would like to be driving more . . . but they lack the money to buy cars and gasoline.

This "capacity" of his is nothing but a fictional construct that makes it impossible to 'prove' him wrong because 'capacity' is fuzzy and unmeasurable pseudo metric.

From my "Three Strikes" article link up the thread:

Their peaks has dropped- but the total amount of oil they dream about is almost the same (2010 = only .23 trillion less) - they just smears it farther into the future ... just like that.

The takeaway from them 2 charts should be obvious to all who has eyes : CERA is not to be trusted!

Their predictions doesn't even last for 4 years--- and they claim 100 mbd 60 years from now ??!! gimme a break

Well no one's predictions are to be trusted. They are all just guesses as to the future. But it is pretty clear that in the last 10 years, the "pros" as CERA have proven to be far too optimistic. It is also known where their funding comes from. So their public pronouncements should be taken with a grain of salt.

But the word 'public' may be critical there. When I hear about publicly available Wall Street ratings on stocks, I just always say "they are worth what you pay for them". Studies show they are pretty bad and generally over-optimistic. But what do they tell their big clients privately? Where do they invest their own money?

Besides the oil companies, another set of big customers for CERA's private data is the auto companies. And when you look the way they are all working on EVs, hybrids, transmissions with tall gears, CVT, start/stop systems, ecoboost engines, lighter materials, more aerodynamic shapes, etc. Well, their actions speak louder than words.

The oil company actions speak loudly too. Pushing for a pipeline to carry tar sands oil. More ultradeepwater drilling. Pushes for polar oil. That is not cheap oil they are going after . . . it is what is available.

The first inkling that there were problems with oil supply was when everyone started changing the definition of oil. When they started adding biofuels and other things to make up the drop in production the jig was up. I am trying to think of other components that we can now call oil. Lets see, how about waste french fry oil, drippings from finished salads, 4th press olive oil anyone.

A Swedish energy firm was making ads about them selves a year ago bragging aout howthey crushed olive seeds to get energy out of them. They claimed tobe inovative. Yestrue,but I' say desperate as well.

That little skirmish in Saudi's back yard didn't seam to bother the oil markets. I guess they are all looking at the consumption side of things again (like, is EU going to hold together, and employment numbers).

The Shia in SA are a relatively small minority. As long as income from oil exports hold up, the bulk of the population can be bought off, and the Shia minority can be kept under the thumb.

However, a collapse of export quantity or a sustained fall in oil prices will leave the Princes very nervous.

Shiites (Twelvers) are primarily concentrated in the Eastern Province, where they constitute over a third of the population. Another third are non-nationals (migrant workers). The Eastern Province includes 80% of KSA oil.

http://en.wikipedia.org/wiki/Demographics_of_Saudi_Arabia

As Ramius said in 'The Hunt for Red October'... "Ryan, some things in here don't react well to bullets..."

The Oil fields are guarded by Drones, F-22's, Tomahawk's, Abrams Tanks, 100,000 infantry, AI robots and genetically modified rottweilers, nothing to see here, move along.

I didn't know about the genetically modified rottweilers. Thanks ;-)

Another example of the psychopathic/sociopathic mind hard at work on Capitol Hill....

Apocalypse on Capitol Hill: Lawmakers Who Love to Vote No

Another example of the psychopathic/sociopathic mind hard at work on Capitol Hill....

Apocalypse on Capitol Hill: Lawmakers Who Love to Vote No

On Capitol Hill, they are the apocalypse caucus. Twenty lawmakers, from both parties, who calculate that the best way to fix government is to act as if you wouldn’t mind if it burned down.

Really? Dennis J Kucinich 'wants to burn down the government' and is an example of 'the psychopathic/sociopathic mind'?

Ron Paul - Dr. No isn't even on the list at the link.

Capuano agrees with Kucinich on most things, (our district would lynch anybody they thought was a Wall Street tool) but is a really low-key guy. He was the office manager in 2006 when the Democrats took the majority. He's voting against bills on substance, not just to make a point. Him turning to bombthrowing rhetoric is as surprising as if Joe Lieberman voted against a war.

If we can get past the name calling- and stipulate that there are reasonable sane people who actually believe that a small government , increased privatization and the role back of the welfare state is good thing for everybody in the long run. Looked at from that perspective the default by the Greek government is not a bad thing- since it will result in a smaller government, greater privatization and the role back of the welfare system. I think irrespective of where one stands on the political continuum one has to accept that despite all the protesting the American people are addicted to big government. The only way that you are going to break that addiction is through a government default.

Those who believe that you can "starve the government" must not understand the American psyche very well- retailers are well aware that you can get people to spend more money with a 25% off scheme. Whats not to love about big government if you can get it at 25% off. Off course Americans are addicted. I have always believed that if you want to get smaller government demand that you raise taxes to pay for it. How long do you think the stupid wars would have gone on for had we been required to pay for them with a tax?

How long do you think the stupid wars would have gone on for had we been required to pay for them with a tax?

Less time then the impeachment or sex scandals of the politicians how voted for the tax and the President who signed it.

Sure we know there are sane people who believe the above ideology. But where is the real world evidence supporting that belief?

Where is the country that has "small government , increased privatization and the role back of the welfare state" and that has actually delivered a better quality of life for the general public?

It is easy to observe the European social welfare states like Germany and Scandinavia and see that almost every every single quality of life metric is among the world's highest (low infant mortality, high life expectancy, low poverty rate, low crime rate, low rate of homelessness, high educational levels, etc., etc.). But where is the real world example of "increased privatization and the role back of the welfare state" that works for the general public (and not just for their corporate overlords)?

In the absence of such examples, a belief in the mythical success of "small government" could be considered sane, but not reasonable.

If there are sane people out there who want smaller government, I ask that they be very specific about which part of government they want to shrink. I want to cut defense expenditures in half. That does not mean, however, that I am just vaguely calling for a smaller government. If the government is not serving the people or is not actually doing what a government needs to do in an efficient way, then cut it. But what is going on is just general statements that government is wasteful or over burdensome.

What you have to consider is after 200+ years a government gets clogged arteries. We have layer after layer of laws and bureaucracies that have lost all purpose. 200 years of narrow minded lobbyists screaming for their bailouts. 200 years of candy for the masses to buy votes. Now we have confused mass of spaghetti that nobody can put their arms around.

That is why some people believe it's time to just kill the whole beast and start over. Imagine a model T car with 200 years of improvements tacked on haphazardly. It would look like a pile of junk reaching the moon.

What the Founders omitted from the Constitution is a fourth branch of government to dismantle the errors of the other 3.

There should be a Fourth Branch, numbering the same as the House, elected by proportional vote in the states, which has the power to abrogate any treaty or foreign agreement, revoke any regulation, repeal any law, or nullify any court decision that is over 4 years old in whole or in part.

The other branches should be prohibited from reinstituting the same for 4 years.

The fourth branch shall meet Jan, Feb, March each year in Havre, Montana. All lobbyists, diplomats, agents of foreign governments, and party officials should be forbidden from a 100 mile radius of Havre.

you total chaos then?

I think it would look like a new Camaro.

People are drowning in Ideology, even among the so called preppers I find this debilitating disease which clouds one's vision. It's either Karl Marx or Milton Friedman, there's absolutely no other choice. I think both socialism and capitalism were initially designed to work at very small levels, think about the local teachers union or the local coffee shop.

Countries which have retained this essence of size have done well, countries which have gone to the extremes have done badly or are going to do badly. Even democracy works only at a small level with citizens who are not willing to cut corners, today's nation states are monoliths of a bygone era, either you devolve power(economic and political) at local level or go the way of dinosaurs.

Thank you wise Indian for saying something that I have been in agreement with for years. Democracy works best at grass roots level. It is about devolving power downwards, where the people who are effected by it can change things quickly . Here in Europe we have been delegating power to an unelected bureaucracy and putting more and more layers on the political cake that does not understand what the people want and ignore what is happening at grass-root level. This creates a level of inertia that cannot react with the speed needed in a crisis. This means that when it hits a crisis it cannot react swiftly enough and breaks down, into its component parts. History tells us that Multicultural societies break down very rapidly when they hit a wall of sustainable. The best examples are of cause the Hungarian Austrian Empire USSR in in 1989 the British Empire after the second world war Yugoslavia and perhaps the best case for you is the break up of India once it gained its independence in 1948, into its Muslim and Hindu parts. For groups of people to stay together there has to be a sense of communality. This is lacking here in Europe. The Nightmare of Europe I am living in is doomed and will most likely dissolve into a set of countries that will themselves be no more than a set of city states caused by the massive immigration of millions of unassimilable muslims who have flooded into Europe over the last couple of decade forming vast ghettoes in our major cities. They will demand independence when they are strong enough. My children and grandchildren are in for a rough time.

You had small city states and look what happened. They fought for hundreds of years, culminating in 2 world wars. Get this through your head. Humans are ungovernable. Shit -- most families can't get along. There are a small number of humans in any society that crave power. They are never satisfied with a small amount of power. They are driven to get more. And then more after that.

Your choice is small govs that fight wars with each other, or large govs that have clogged arteries. Both are terribly flawed.

Working in sports I agree, but I would change "small" to "moderate". If you want to see a collection power grubbing megalomaniacs and self righteous hypocrites just go to any mid-level sporting event (the type where the athletes get a small scholarship, and the administrative apparatus gets small grants).

Personally I don't want to be around when my colleagues and clients aren't sublimating all of their energy into fighting which child is the best/worst athlete.

It always seemed that the EU was swimming against the tide of history.

The dissolution of the pre WW I empires, the multiplication of sovreign states after WW II, the dissolution of the Warsaw Pact and the USSR, and the breakup of Yugoslavia all pointed in the direction of smaller countries with more cohesive populations becoming the norm.

Gluing a couple dozen European countries together into the EU and the Eurozone seemed ill-fated.

Former Soviet republics within current Russia, provinces of China, parts of the Phillipines, parts of India, parts of Myanmar, and various sub-Saharan ethnic groups are among those still trying to gain independence.

In the book of Daniel, Old Testament, there is a prophecy of some sort of future union of nations. Daniel predicts about it that "As you saw iron mixed with ceramic clay, they will mingle with the seed of men; but they will not adhere to one another, just as iron does not mix with clay."

Translation: they will marry across borders, but unity will not come.

I always think of those words in such contexts: You can merge countries politically, but they will never become one. We could not even keep Norway and Sweden together and we have very friendly relations... And this has been known since the day of the Persian empire. Yet we try.