Tech Talk - Pipelines, Eastern Canada and Maine

Posted by Heading Out on October 9, 2011 - 7:29am

I wrote last time about the projected pipelines that are being anticipated to take advantage of increased production from the oil sands in Alberta, Canada, with the intent that I would use that to lead into a review of the oil sands operation itself. However, Gail has raised the issue of the proposed reversal of the pipeline (Line 9) that runs from Sarnia in Ontario to Montreal so that oil would flow to the Suncor refinery in Montreal, rather than the current flow, which runs the other way. (Sarnia is right by Detroit). The pipeline reversal is planned to continue beyond Montreal, to include reversing the flow of a supply pipeline from Portland, Maine so that the oil from Alberta might also supply northern New England. The project has been called “The Trailbreaker” and had been postponed two years ago when demand declined.

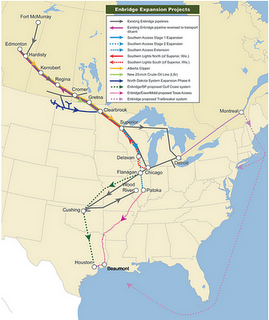

The overall question of the relative role of exports and imports on the Canadian oil supply equation was also raised in comments on the previous post. As a result, I am going to look a bit more into the overall Canadian picture and particularly that in the East Coast, and will postpone the oil sand piece a week (sorry Neil). To begin, it helps to look at the current projects that Enbridge has in mind for pipelines.

The Ozark pipeline, which is shown running from Cushing to Wood River was closed on Friday, September 30, when the pipeline was found to be exposed as it ran across the bottom of the Mississippi River. It carries around 240 kbd and the shut down is precautionary, since there has been no leak detected.

The dark green arrow from Cushing to Houston will be known as the Wrangler pipeline and would carry up to 800 kbd from Cushing to the refineries along the Gulf, competing with the Keystone XL, which is planned to bring an additional 500 kbd down from Alberta (about 500 kbd flows through existing connections). The intent is to move the oil away from Cushing where it is proving to be a bit of a glut.

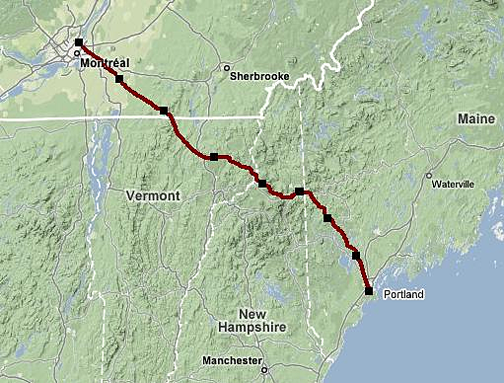

With this surplus, and the ability to move oil around the Mid-West, the need for additional feed down from Montreal dissipates, and thus the argument for the reversal of flow so that crude from Alberta can be sent back up that pipe to the refineries in Eastern Canada. At present oil comes by tanker to Portland, Maine and then enters the Portland-Montreal Pipe Line (PMPL) system. The oil flows through either an 18-inch or 24-inch line up to Montreal, a distance of 236 miles, with flow then continuing to Sarnia. A certain increase in energy security would thus be achieved for the East Coast of North America, if the oil refined on the East Coast was produced in North America instead of coming from Russia and the Middle East. At present, flow would be reversed in only one of the pipes, the 18-inch, coming from Portland. Right now, some 200 tankers a year offload in Portland, and send around 95 kbd up to Montreal. (The pipeline came into being in 1941 to avoid exposing oil tankers moving into Quebec to U-boats).

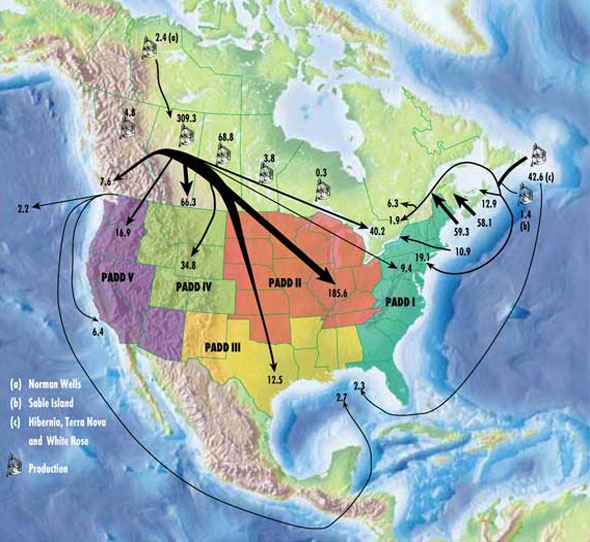

If one looks at the overall flows of oil in Canada, the increasing reliance on Albertan oil can be appreciated.

Canadians consume around 1.5 mbd, of which half is gasoline and 30% diesel. I discussed their exports in the last post.

Interestingly, the largest exporter of gasoline from Canada to the US lies further east, where it comes from the Irving Oil refinery in St John New Brunswick, with the 300 kbd refinery shipping 75% of the gasoline it produces into the eastern United States.

There are two other refineries in the region, the Dartmouth refinery at Halifax in Nova Scotia refines 82,000 bd of crude, largely for the Eastern provinces of Canada. The crude is off-loaded from tankers, refined and then loaded onto smaller coastal tankers for delivery.

Yet further east is the Come by Chance refinery, now the North Atlantic Refinery in Newfoundland. In its time it was one of the largest bankruptcies in Canadian history, but it now refines some 115 kbd that arrives in 320,000 ton tankers at the nearby ice-free port. It suffers from that bankruptcy in that a subsequent sale was commensurate on the product not being sold in Canada (outside of Labrador and Newfoundland), which means that the products largely ship to the United States.

Yet one must go even further east to find the oil fields of the Eastern Canada Sedimentary Basin. And unfortunately, while the nearest refinery might be near an ice-free port, the fields themselves are not.

The fields include White Rose, which is expected to yield around 230 milllion barrels at around 120 kbd, with a life of 12 – 15 years. First oil was in 2005.

Terra Nova is estimated at 406 million barrels. With a production of around 125 kbd, it is anticipated to last 18 years. Production began in 2002.

The seasonal floating ice in these parts varies from 1.6 to 5 ft thick and an average wind speed of around 20 mph leads to ice buildup on the tankers and superstructure, making it a consideration in operations, as are icebergs. (Remember the picture of the tug pulling an iceberg). That was taken around here.

Hibernia is also producing at around 126 kbd, and by August 2010 had produced 704 million of the 1.4 billion potentially recoverable oil from the field. Approval has now been given to extend development to the south.

Current plans to develop Hebron, some 6 miles north of Terra Nova include also the fields of West Ben Nevis and Ben Nevis. Production is expected to begin in 2017, at a rate of around 150 – 180 kbd of oil and 200 – 350 kbd of water. Reserves are considered to be in the 400 – 700 mb range.

Although these numbers are significant and will provide for a considerable fraction of the need in this part of the world and further south, they do not constitute the promise of sustained, increased levels of production that are required for significant help against the declining production seen in many of the world's major oilfields. For some help in that direction it is necessary to head west. And so it is time for the review of the oil sands.

There is, however, considerable controversy over the operation of the oil sands in Alberta, particularly from those objecting who cite the mess that is made of the landscape. In general, the illustrations of oil sand operations that are used show the site during mining, where the black color of the sand tends to make for a dismal picture. It might be more informative to show what the sites are like afterwards. And so, as a prelude to more discussion, here is a photo of some reclaimed land. It is here that the wood bison (as opposed to buffalo) roam.

Thanks very much, HO

It's interesting to see what Enbridge is up to.

If the Easterners don't want our oil, they can freeze in the dark ... but haven't we told them that before?

Thanks, HO. For additional background on the oil supply situation here in Atlantic Canada and its implications with respect to our energy security/resilience, see: dclh.electricalandcomputerengineering.dal.ca/enen/2009/ERG200911.pdf (PDF format)

Cheers,

Paul

Hi, Paul

Thank you for mentioning Larry Hughes' excellent study of eastern Canada's oil supply.

Your URL is missing the first bit... if someone wants to paste it in they will need:

http://dclh.electricalandcomputerengineering.dal.ca/enen/2009/ERG200911.pdf

Thanks, Rick, for fixing the broken link. You can also catch Larry's interview on Information Morning Cape Breton's Running on Empty segment at: http://www.cbc.ca/informationmorningcb/2011/08/04/running-on-empty/

Cheers,

Paul

If the past is prologue, many on the east coast will wait to see what transpires before getting too excited. Our history has been one of enterprises sold to us as beneficial only to see them turned to the advantage of others.

The Come-by-Chance oil refinery is allowed to sell its products to foreigners but not to fellow nationals. Electricity from Labrador was sold to Hydro-Quebec at pennies only to be resold to commercial and residential customers at enormous profit. Even the whole notion of sending petroleum from Montreal through pipeline to Portland, Maine sticks in the craw. Throughout much of the twentieth century Montreal would ship goods through the ice free port of Portland during the freeze up months rather than through an all Canadian route to the port of Halifax. What was good for Montreal was perceived as good for Canada. What was good for Halifax was incidental. The legacy of inter provincial trade has not been a rosy one, particularly between the east coast and central Canada.

The oil sands are a great bonus to the Canadian economy. They provide much needed revenues to the country's coffers, through royalties to Edmonton and income tax to Ottawa. However, if the only way the Maritimes can get access to Alberta tea is through a Quebec-Maine route, forget it. We might as well keep buying crude from Venezuela. At least if Hugo Chavez gives us the stiff, we won't be betrayed by one of our own.

Didn't know about the Come-by-Chance refinery story. Why does Nfld keep agreeing to these silly sorts of deals?

Anyway, for an oil pipeline, it seems to me that what is needed is a pipeline from Sarnia through the NE states to New Brunswick, bypassing Quebec entirely. Quebec would have a fit, of course, but since they are always threatening to leave the country, why build a pipeline through a possible breakaway state? At least going through the US is a known quantity.

Paul, considering the controversy over the Keystone XL project, a similar pipeline through the New England states would not be easily negotiated or navigated politically. There would have to be a perceived net benefit to the United States before any President would ever approve such a pipeline over the noise and hubbub of the environmental lobby. Despite Quebec's intransigence (and propensity for stingy bargaining) an all Canadian route is still, IMHO, the logical choice.

Too bad the federal government wouldn't just step up and insist on the national interest coming first. Quebec could be left out of the negotiations altogether if they played too hard ball since Ottawa could exercise it declaratory authority and simply impose a right of way. Politics being the "art of the possible", however, means the 8 million voters in Quebec will always out rank the 2 million voters from the coast. Perhaps there is a glimmer of hope in the fact that Harper may see better prospects for holding or gaining seats for the Conservatives from Atlantic Canadians than the Quebecois.

Still, as someone who has watched similar dramas unfold all too frequently, I won't hold my breathe for the Maritimes to be burning oil sands crude soon or, if we are, that we won't end up with the unprofitable end of the deal.

The pipeline through the NE states would be well received if it meant they could get some of the oil, and that is how it would be pitched to the US gov. Everyone - except Quebec - can get some of the oil. Quebec gets theirs through the reversed Montreal pipeline.

This, of course, makes sure Quebec is at the end of the line, not in the middle of one, to avoid their 8m trumping your 2m. Combine that with a maritime CFL and NHL team, and Quebec will really be put in it's place!

Even if the oil is no more/less unprofitable than what is being imported today, at least it is not being imported - for any part of Canada - even Quebec - to be dependent on imports from ME/Venez is just wrong.

Leave the import dependency to the US - they are much better at it!

"Paul, considering the controversy over the Keystone XL project, a similar pipeline through the New England states would not be easily negotiated or navigated politically"

Zadok, I helped build one of the two new gas pipelines from Canada through Maine a few years ago (one branch ultimately receives gas from Sable Island, the other from elsewhere (Ontario?). The right of way was obtained for two parallel 24" lines, only one line was built. The other line can be built either for oil or gas. No regulatory hurdles there. Our new governor is extremely pro business, and the people of Maine already want more gas capacity, we are the least served by gas in the nation. No problems here for a new line in either direction. Of course outsiders with agendas can say there piece - I think they would ultimately be wasting their effort here though.

"Even the whole notion of sending petroleum from Montreal through pipeline to Portland, Maine sticks in the craw."

Z, that pipeline has shipped oil from from Portland to Canada for decades - nobody has an issue with that.

I have lived and worked in Canada for about 2 1/2 years of my life. The people of Canada and the US are deeply linked by culture and history. We are ultimately the same people. We can't forget this as the world becomes more difficult.(Quebec is something of a different story - ya gotta live there awhile to really understand this). The two governments are both enough to drive you nuts though.

Anyway, thought I'd put in my two cents after reading that comment -

I'm off running errands -

Dean

"..deeply linked by culture and history. "

There's a love-hate relationship for you.. as with Zadoc's comments about inter-Provincial backstabbing, the first form of murder is said to be fratricide.

(I personally hold no great grievances, here.. just looking at the way English and French relations have been occasionally replayed on our shores, for better and for worser.)

I live right on the tip of that PMPL pipeline, and I watch those tankers coming in to offload right out my window every day.. pretty sight, but I won't freeze in the dark if they stop coming, or if that pipe never starts flowing the other way.

Story re Nfld oil

A few years ago I was talking to a Cdn oil insider and I said, "I guess Newfoundland is the only eastern province which is fairly self-reliant in oil: they have Hibernia, etc and the Come-by-Chance refinery."

The guy laughed and said, "Oh, no, Hibernia's oil goes elsewhere. The Come-by-Chance refinery takes the nasty, sour stuff that nobody else wants."

I would appreciate affirmation or correction on this point, if anyone has any details.

From the Come-by-Chance refinery's page:

http://www.harvestenergy.ca/operating-activities/downstream-refining-mar...

This would tend to confirm what your heard.

However, some Hibernia oil has gone to Come-By-Chance.

On this page:

http://www.hibernia.ca/milestones.html

click on 02-Oct-1998 to find the popup note:

No recent production figures on that site, but the link HO gave

http://www.chevron.ca/operations/exploration/atlantic.asp

says 126 kbpd production,

so the Come-By-Chance refinery could suck up to 115 kbpd.

But Hibernia oil is sweet and light. From:

http://www.offshore-technology.com/projects/hibernia/

Chevron says it's even lighter:

http://crudemarketing.chevron.com/overview.asp?hibernia

35.8 degrees API.

That's lighter than the 34 degrees Come-By-Chance specifies (though it could be blended with heavier crude),

and Hibernia is sold based off Brent quotes, which is pricier than medium and sour oils.

This PDF (mentioned by previous folks)

http://dclh.electricalandcomputerengineering.dal.ca/enen/2009/ERG200911.pdf

says more than half of the crude from Eastern Canada (includes Atlantic) goes to the US. (table 4, page 6.)

And, nearby is the Irving Oil refinery in St. John New Brunswick, at 280 kbpd crude input.

http://irvingoil.com/operations_and_partners/operations/supply/

Their supply comes from:

Given that (a) the Saudis have historically supplied light and medium crude, and Brent (North Sea) is a benchmark for light, sweet crude, and

(b) the only significant production from Newfoundland & Labrador is light, sweet crude (Hiberia, White Rose, Terra Nova), then it seems reasonable that your source is mostly correct.

An occasional dollop of Hibernia crude goes to Come-By-Chance, but mostly they buy cheap heavy/sour crude from many places which they refine to low sulfur high-value products they sell to the rich Yanks down the coast (or anybody willing to outbid the U.S.).

Given the ever-increasing proportion of heavier and sour-er crude, seems like a good business to be in, at least until the rest of the refineries in the world convert to be able to handle sour crude and the total oil supply diminishes, then it seems like an incredibly bad business to be in.

(minor quibble, it's allowed to sell in Newfoundland and Labrador, which takes 10% of the output).

"fellow" nationals? It's now owned 100% by foreigners!

(or at least a foreign based corporation with ties to their government).

When I went to:

http://www.northatlantic.ca/history.asp

I noticed the Korean National Oil Corporation logo.

http://en.wikipedia.org/wiki/Korea_National_Oil_Corporation

And when I checked the company behind the other logo,

I found Harvest Operations Corp. is now 100% owned by KNOC.

http://www.harvestenergy.ca/investor-relations/investor-information/

http://www.knoc.co.kr/ENG/sub04/sub04_4_4.jsp

(n.b. KNOC also took over UK based Dana Petroleum plc recently too,

and opened a technology center in Calgary).

More evidence, I guess, to the extent of the "going to the ends of the Earth" that oil companies are having to do to find/develop/refine oil.

How da' ya' say/spell "eh" in Korean, eh? ;-)

http://en.wikipedia.org/wiki/Eh

sunnnv said:

"How da' ya' say/spell "eh" in Korean, eh? ;-)"

Try 주요 번역

:-D

Cheers,

Bio1

Nice maps showing where the Canadian oil comes from and where it goes. Since Canada is the largest oil and oil product supplier to the US this post is very informative.

Should the province of Alberta decide that the pipeline to the Pacific (Prince Rupert area?) will be financed and built, That flow of 186 kbd to the midwest will be greatly reduced. Same effect of Keystone LX pipeline to Gulf Coast being built. Our $3.15 gasoline here in St. Louis would likely be more like $3.60 in either case. The midwest, except for Chicago, now enjoys the lowest gas prices in the country.

Should the pipeline situation in Canada change, like reversal of line to Montreal or new pipelines to take tar sands oil SE or to Pacific coast, much higher gas and diesel prices for midwest consumers would be expected. In fact the entire continental US could see a rise in prices as North American produced crude met or exceeded world oil prices. Maybe that would be a good thing.

MB - that 185 is in thousand cu.m/day - multiply by 6.3 and you get 1.165 million barrels a day going to the midwest - that is a LOT of oil.

If the Montreal pipeline took some of that, and the new pipeline to Prince Rupert, and expanded pipeline to Vancouver, took all of that oil, you would see quite the price shock in the midwest - which would indeed be a good thing, for Canada and the US.

Of course, not all midwest people would agree -probably even a few people demanding that military action be taken!

What are projected production rates from Canadian tar sands 5 & 10 years hence? The numbers don't seem to be moving up very much.

I spent some time at Anne Arbor interning at UMich and one of my favorite motorcycle rides was to go over to Windsor, then up to Sarnia before crossing back over to upper Detroit. The thing I remember about Sarnia is not a smelly Oil town, but a quaint one with a waterfront overlooking the impossibly turquoise blue waters of the channel to Lake Huron. Hard for me to visualize its true industry.

Really interesting write-up. I had been wondering what the details of the proposed projects were, so thanks for providing the info.

As a frequent resident/worker in fort mac, I'm anticipating the next article about the oil sands operations.

That closing picture makes me laugh...it's like dressing up a corpse after a terrible accident

Thanks for the article, Heading Out.

For reference, "(Sarnia is right by Detroit)": Windsor is actually right by Detroit. Sarnia is about 100 km north of Detroit.

To be fair, I clicked around the Enbridge site for a while and couldn't find a more detailed map of their pipeline route in Michigan, and they just show Detroit as the border crossing point.

Hopefully Enbridge will be profitable enough to keep up on their pipeline maintenance. They dumped about a million gallons in our Kalamazoo River last year. Seems like maybe they could have flow monitors along the pipeline and detect leaks faster?