IEO 2011: A Misleadingly Optimistic Energy Forecast by the EIA

Posted by Gail the Actuary on September 23, 2011 - 3:43am

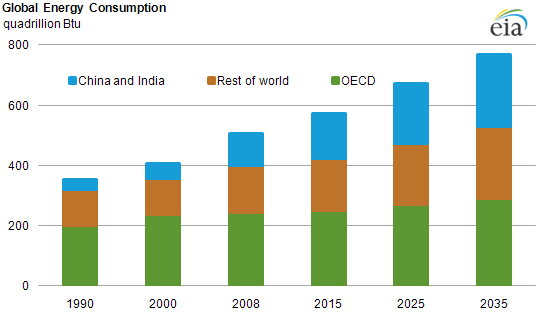

The EIA published International Energy Outlook 2011 (IEO 2011) on September 19, showing energy projections to 2035. One summary stated, "Global Energy Use to Jump 53%, largely driven by strong demand from places like India and China."

It seems to me that this estimate is misleadingly high. The EIA is placing too much emphasis on what demand would be, if the price were low enough. In fact, oil, natural gas, and coal are all getting more difficult (and expensive) to extract. Prices will need to be much higher than today to cover the cost of extraction plus taxes countries choose to levy on energy extraction. The required high energy prices are likely to lead to recessionary impacts, which in turn will cut back demand for energy products of all types.

We live in a finite world. While it is true that huge resources of oil, natural gas, and coal are still theoretically available, we are starting to reach practical limits regarding extraction at prices that do not lead to economic contraction.

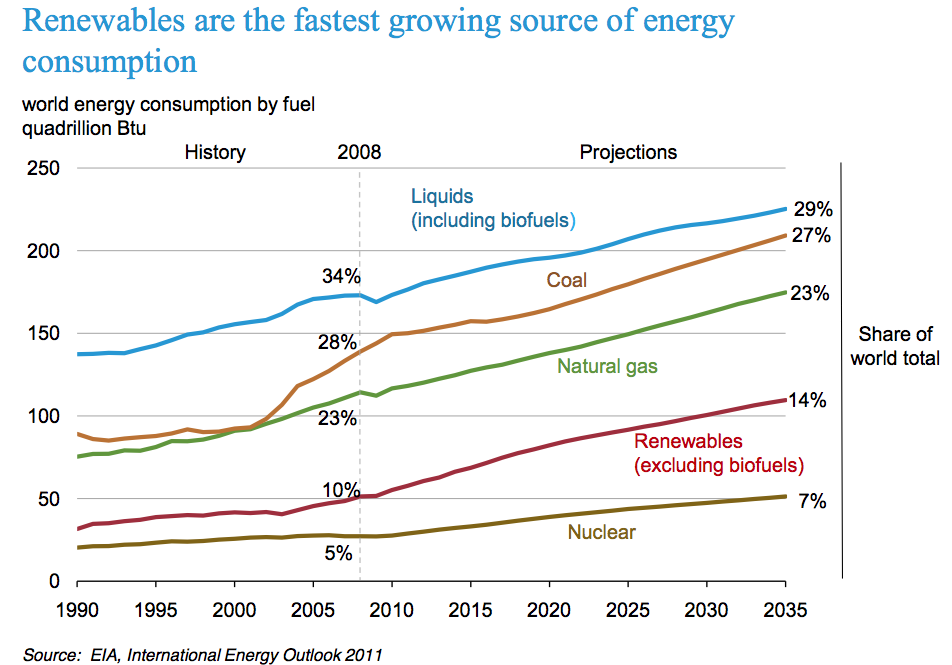

An IEO 2011 summary exhibit shows that world energy consumption will more than double, between 1990 and 2035:

It is only by drilling down into the report that we can see what the problems with the forecast really are.

Liquids Projections

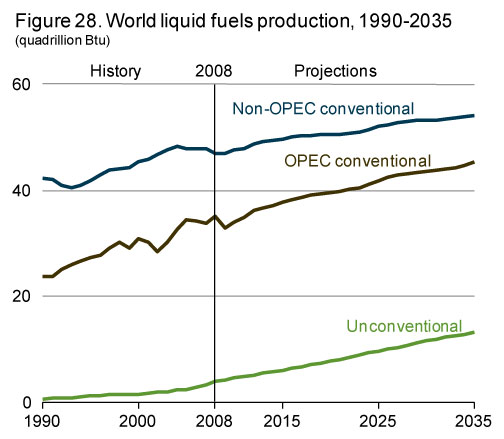

Clearly oil and other "liquids" (used to extend oil) are one of the potential problem areas, since the price of oil has been rising rapidly since 2000. EIA's liquid fuels projection is shown as follows:

The first thing a person notices when looking at the graphs is how poorly the forecasts of future production match up with recent past actual production. Non-OPEC production has recently been declining, after reaching a peak of 48.1 quadrillion Btu in 2004. Somehow, miraculously, the EIA expects that Non-OPEC production will start increasing, rising from 46.8 quadrillion Btu in 2009 to 53.9 quadrillion Btu in 2035. The text suggests this will come from ultra deep wells, from the arctic, and from enhanced oil recovery.

Oil production from individual wells naturally declines over time, by about 5% per year, so new fields must constantly be added, to keep production level. The graph indicates that since 2004, non-OPEC countries have not been able to add enough new production to keep conventional production level. What makes the EIA think that this problem can be turned around, with very high cost, risky new investments?

The forecast for OPEC conventional is even more of an enigma, because it shows even larger increases. OPEC countries claim very large reserves, but these have not been audited, and when it comes to what should be a simple task--replacing the lost oil output of Libya--they seem to have difficulty. Recently, King Abdulla of Saudi Arabia has been quoted (for example, in a WSJ an article titled, "The Next Crisis: Prepare for Peak Oil,") as saying that new oil finds should be left in the ground for their children.

If the OPEC countries we are depending on are not planning for the big increases we are hoping for, we have a problem. I am not aware that OPEC has given any indication that their production (conventional oil or otherwise) can reach as a high level as the EIA is forecasting. Even big increases in production from Iraq would not seem to be enough to provide OPEC's hoped-for increase.

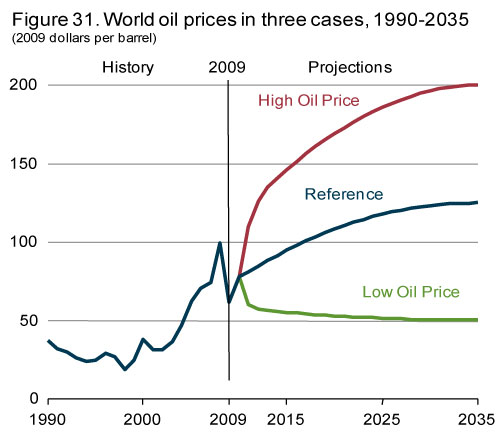

I suppose that a person could argue that if oil prices were a lot higher, oil companies might be willing to use more expensive techniques to extract oil. But the EIA shows this graph regarding price expectations:

In the reference case, oil prices do not rise much above today's high level between now and 2035. (The EIA does not indicate what oil benchmark is being used, but the context suggests it would be an average price level, more similar to Brent price than to today's distorted West Texas Intermediate price level. Such prices have recently been in the $110 to $120 barrel range.)

Part of the reason that very high oil prices are needed is because governments are becoming more and more "needy," and see oil companies as a potential source of revenue. According to the Economist, next year Russia (the world's second largest oil exporter) will need a price of $120 barrel to meet its spending obligations. Also, President Obama keeps talking about raising taxes on US oil and gas companies. Higher taxes will mean that higher oil prices will be needed to encourage development of very deep and very risky resources. These issues mean that to have a chance of raising oil production, oil prices really need to be on the "high oil price" trajectory of Figure 3, not the "reference case" scenario.

If oil prices really rose to the high oil price trajectory, there would be huge transfer of funds from importers to exporters, and importers would be in even worse financial trouble than they are today. Food prices would be expected to rise with oil prices, so even oil exporters (who are food importers) could expect to have problems. At such high oil prices, it seems likely that we would see even more revolution and replacement of governments than we saw this spring.

The written analysis in the IEO 2011 report is based on the reference scenario, but schedules are available showing the indications of the high oil price scenario. Amazingly, with EIA's high price scenario, energy production is even higher, and world economic growth is even higher. The world's average annual growth in world GDP is 3.4% per year in the reference scenario (with an unrealistically low oil price), and 4.0% per year in the high oil price scenario. When people are spending a disproportionate share of their paychecks on oil and food, and road repairs are becoming increasingly unaffordable for governments, how are economies possibly going to be growing more rapidly? If a greater share of investment will need to be plowed back into the oil and liquids sector, how can this mean that there can be more growth elsewhere?

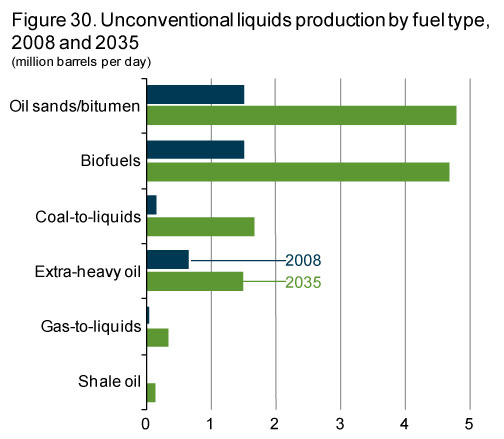

Besides OPEC and non-OPEC conventional oil, the third category is unconventional liquids. An explanatory chart gives the following breakdown:

With alternative fuels, high price is again important, because it helps make the big investment required profitable. The Oil Sands / Bitumen projection is perhaps reasonable, if prices can actually follow the high trajectory without sinking economies (a very big if). The biofuels projection depends on the development of biofuels which do not use foods as inputs. So far, technological progress on these has been slow. Even if very high prices can be maintained, the biofuels forecast seems like a "stretch".

Some gas to liquids increase seems likely, perhaps even more than the EIA is forecasting. These plants appear to be profitable now, even without $150 to $200 barrel oil prices. Coal to liquid and shale oil would seem to be farther away economically than gas to liquids. However, if the world economy could really withstand $200 oil prices, perhaps these types of plants could be built.

Part of the issue with very high oil prices is that they imply that it makes economic sense to use very high energy inputs (and water inputs) to produce these liquids. Clearly, at some point, the cost simply becomes unacceptably high because it takes more than one barrel of oil to produce a barrel of oil, or because the pollution issues become unbearable. For example, theoretically, it would be possible to pump water uphill from the Great Lakes to Colorado to be able to produce shale oil, if the price were high enough. But it is hard to see this making sense on any reasonable terms. The assumption that prices can rise arbitrarily high is simply not true.

Natural Gas

Natural gas indications are less clear, because the forecast is a summary of forecasts for different regions, each with different issues. Transport is more difficult for natural gas than oil also.

New techniques are now being used to extract more difficult-to-extract natural gas, but these are controversial in more than one way:

- Long term profitability is difficult to calculate in advance because a huge up-front investment is required and calculation of long-term profitability includes several assumption which can easily be "selected" to produce the desired result. Are natural gas operators claiming profitability at lower prices than is really possible? If prices were high enough to be profitable, would demand stay at high levels?

- What are the environmental consequences of such huge fracking operations? Will it be possible to dispose of all of the polluted water that comes back up in an environmentally friendly way? Are there other environmental issues? Will governments permit wide-scale use of fracking?

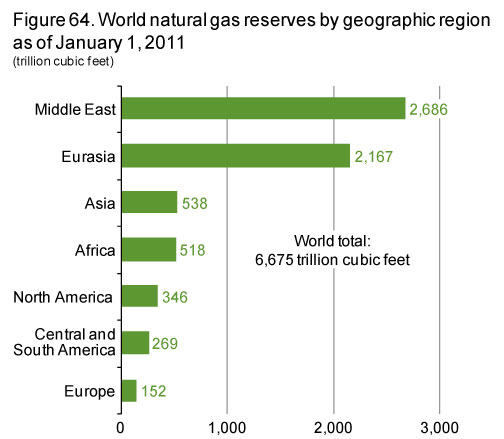

The EIA appears to have decided that these controversies will decided in the direction of allowing big increases in natural gas production. The IEO 2011 shows this estimate of natural gas reserves:

The indication is that North America and Europe have relatively little in reserves. There are huge reserves in locations where it is difficult to verify the accuracy of the reserves, and where transport to North America or Europe would be difficult. While ships carrying liquefied natural gas (LNG) can be used, there would seem to be a practical limit as to how much can be transported in this manner. Pipelines can be built, but it is expensive to build these pipelines, and they need the approval of all of the countries along the pipeline.

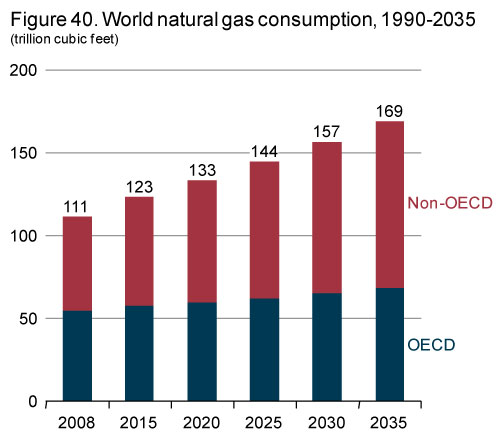

In total, the EIA sees a huge increase (52%) in natural gas use between 2008 and 2035, with the majority of increase outside OECD, according to the report's Figure 40.

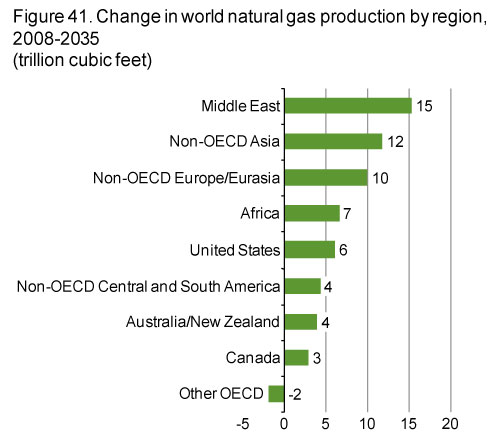

The countries that are expected to increase production tend to be concentrated in the Middle East and in lesser developed countries around the world, according to the report's Figure 41.

One area which shows an increase in production is the United States. This is controversial, for reasons mentioned above (likely high price needed for profitability; environmental impacts). Europe shows a continuing decline in production. A number of European countries are already finding themselves in financial difficulty. If more natural gas needs to be imported, this can only add to financial difficulties.

Coal

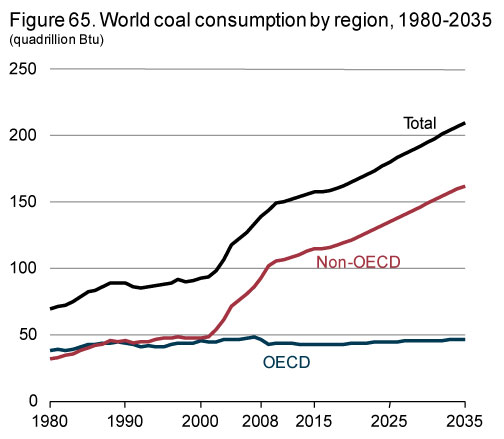

The EIA shows continued growth rapid growth in coal production and consumption.

Is this kind of coal projection realistic? As with oil and gas, there is an issue of needing to extract ever lower-quality resources, from greater depths. Many of the seams that are left in easily accessible locations are thinner and more expensive to extract. IEO 2011 indicates that an increasing portion of the coal will be imported. Thus, the cost of shipping will add to the cost to the final customer. All of these factors mean that we can expect the cost to produce a Btu of delivered coal to rise over time. We can think of this as lower Energy Return on Energy Investment (EROEI), or as higher cost of production.

If the price of coal rises, a person would expect coal demand to fall, if coal demand is at all elastic. Because of this relationship, it will be difficult for long-term consumption to rise as much as the EIA forecasts suggest. This expected slowdown in coal production due to higher price is not very different from peak coal indications arrived at through curve fitting techniques, such as this analysis by Dr. Minqi Li.

With coal, there are also environmental issues, both from a CO2 point of view, and from the point of view of other pollutants. Will the world really be willing to put up with such high coal use, over the long-term?

Note that the issues with any of the fossil fuels is not that the resources are not there. The issue is that the cost of extracting them keeps escalating, making it increasingly difficult for society to afford these high costs. There are also environmental costs that must be considered.

Renewables

Renewables are not shown in a separate section in IEO 2011. Instead, the biofuel portion is included with liquids (see Figure 4 above) and other renewables are shown as a subsection of Electricity. The Electricity subsection says:

Although renewable energy sources have positive environmental and energy security attributes, most renewable technologies other than hydroelectricity are not able to compete economically with fossil fuels during the projection period except in a few regions or in niche markets. Solar power, for instance, is currently a "niche" source of renewable energy, but it can be economical where electricity prices are especially high, where peak load pricing occurs, or where government incentives are available. Government policies or incentives often provide the primary economic motivation for construction of renewable generation facilities.

Renewables are mentioned in the summary. There, one of the key findings is

Renewables are the world’s fastest-growing energy source, at 2.8% per year; renewables share of world energy grows to roughly 15% in 2035

This graph is also provided in the summary presentation:

A backup exhibit shows that hydroelectric amounted to 85% of renewables in 2008, so the 10% of energy consumption is split roughly 8.5% to hydroelectric, and 1.5% to other renewables. In 2035, hydroelectric amounts to only 68% of the renewable subtotal, so the 14% in 2035 is roughly 9.5% hydroelectric and 4.5% other renewables. Thus, "other" renewables used in electricity production are expected to roughly triple as a percentage, from 1.5% to 4.5% of the total, by 2035.

Concluding Thoughts

The EIA estimates of future fuel consumption seem to be optimistic throughout. It is hard to see what benefit such a bias would have, other than to protect the careers of political leaders and to keep people from understanding that there is a real possibility of energy limits affecting the economic system in the not too distant future.

There is widespread misunderstanding of our fossil fuel problems. The belief is that the fuels will somehow "run out." In fact, the issue is that they will become too expensive to afford, or, if you think in terms of "peak oilers," the Energy Return on Energy Investment (EROEI) will drop too low. High energy prices will likely lead to reduced energy consumption, which in turn will lead to recession, reduced economic growth, and eventually lower energy prices (as we saw in late 2008). At these lower prices, the high cost (low EROEI) resources will no longer be profitable to extract, and the extraction of these high cost resources will disappear.

Thus, the issue is really that high price / low EROEI is the limiting factor on resource extraction. That is what the EIA missed in their forecasts.

Originally posted at Our Finite World.

Excellent article, Gail. The EIA has indeed been fairly useless at projecting energy production and prices. The current price projection itself is a farce - between $50 and $200? That's so wide of a projection that one could fly a 777 through it - they obviously learned from Yergin that the wider the projection, the more likely one is to be right. They don't stop there, though, and add additional qualifiers, such as "they do not span the complete range of possible price paths."

To assess the worth of EIA projections, all we have to do is look at past projections, such as the EIA World Outlook 2000, with some charts below;

Figure 40 is a real killer. They could be forgiven back then, at the end of the great oil bear market, for not foreseeing the future. But it is unforgivable that since they don't seem to have learned how and why they were wrong.

Thanks for posting those old forecasts. They are truly amazing.

Is suppose what they are really saying with their current Figure 31 (and with the text) is they really don't know what path prices will follow. But if they don't know to this extent, what is the point of putting our the forecasts? And if the prices don't fit with the forecast, it seems like there is a real problem.

I had a quick look at the 2000 forecast and presume EIA in Fig 31 are referring to production of total liquids? If that is the case, they miss the flattening after 2004 for the world, but just eyeballing, it looks like [edit] 90 mbpd around 2010. That does not look wildly out? Beyond that, they look seriously optimistic of course.

It was 93.5 million barrels per day projected for 2010. The actual value according to the EiA for consumption in 2010 was 87.1 - that's a miss by 6.4 million barrels per day. We should be at 103.4 by 2015 in the 2000 reference case.

What's so "amazing"? So a 10 year old forecast is "wrong". A 10 hour prediction will also be wrong. This was supposed to be a big hurricane season. How many have there been? If you can predict the price of oil in 10 seconds, you would quickly own all the money in the world.

Folks on this site can't even agree on what yesterday's production and demand were. Any future prediction has as many independent variables at the weather.

So let's hear your predictions, Gail. What will global demand and supply be in each year for the next 10 years? What will the prices be? When will your mad max world begin -- I think the year and month should suffice.

Try these on for size. They were made on January 9th, 2008. More accurate predictions I have never witnessed. With the possible exception of #2. More and more people influential in financial markets will begin to recognize peak oil. ;-)

Peak Oil and the Financial Markets: A Forecast for 2008 Posted by Gail the Actuary

Ron P.

You are right--people still don't talk about peak oil. But I expect more and more people understand what is going on to some extent. They know there is something really wrong, and they are not being told the whole story.

My other forecasts still hold, and we are still heading for the big unwind.

mkkby - is really necessary to be so antagonistic? Gail has been here for many years contributing tirelessly with articles. I see about O contribution from you other than nasty finger-pointing and endless claims that everybody here "could be wrong". If you are so convinced that all herein are wrong, why waste your time here at all? Really, if there is absolutely no problem in the near-future with oil production, I would think almost any use of your time would be better than sitting here and reading "flawed" analysis. Or, perhaps you could do some research that is as well-done as Gail's or Westtexas or Euan or any of the other regular contributors. Hell, I'd be overjoyed if there is no foreseeable oil problem, so please demonstrate it, or try and keep civil about your disagreements (and perhaps use numbers and charts etc rather than mere speculation that "we just don't know!").

I for one value this site and the experience and hard-work contributors put into it, and bickering in the style you do really has all the value of baboon pack dominance displays (where is The Chimp Who Drives when you need that perspective?). Try and be civil and provide value and content - or do what I do and quietly read (for the past many years) and learn and agree or disagree at my leisure and privacy.

mkkby, I concur with MacDuff...the number of hours that Gail and the other contributors put in with no remuneration is astonishing. Disagree with them all you want (lord knows the rest of the planet does) but please at least be civil about it.

Yes, it is. Because she is just as "misleading" as those she criticizes. Don't be such a suck up.

I like to address each and every article purely on its own merits. I see this article as informative, factual, and insightful, though you seem to have a chip on your shoulder.

"Or, perhaps you could do some research that is as well-done as Gail's or Westtexas or Euan or any of the other regular contributors."

I had to reply again to the "tireless" effort comment. All the contributors here do is CUT AND PASTE other people's original research. Then they add their commentary. I wouldn't call that a tireless effort. And you have no idea who these people are. You may be a sycophant for some psyops or astroturfing operation. So don't be a hypocrite and let ANYONE get away with misleading or unscientific comments -- on either side of the argument. It hurts your cause to have religious nuts making mad max predictions. It makes you all look like nuts.

mkkby - Here's a golden opportunity to prove your point: "All the contributors here do is CUT AND PASTE other people's original research." I've submitted many hundreds of post and many tens of thousands of words. So it should be easy to highlight a dozen or so of my cut & pastes.

OTOH I'm not sure what you have against folks posting the research of others. Have you never referenced the work of others? Dang...wish I were that knowledgable.

I do my own original research. In fact, when people ask what I do, I say I am a researcher, rather than a writer.

I am giving quite a few talks to actuarial groups now on the subject of oil limits and energy limits, and how they can be expected to affect the energy industry.

Nothing amazing about it being wrong . . . but it was amazingly wrong. The real price of oil turned out to be 4 times higher than their "high" oil price case. They were not in the ballpark . . . they were not even in the parking lot. And that may show some overoptimistic bias that they have.

Edit: Actually, 4 times higher is an over-statement since one needs to account for inflation. Someone should go back and inflation adjust their predictions and the actual numbers such that a fair comparison can be made.

Gail, what's with the screwed up horizontal scale on several of the charts where 2008 is not where it belongs?

Must have fixed it. I don't see any big error.

You're right. It's just kind of unusual to switch scale markers in the middle of a chart: 1990,2000,2008,2015,2025,2035. It just fooled my eye.

I just took slides off the EIA website, that they had made. They provided a link for most slides giving the year by year amounts that I used when describing what the actual amounts were.

I notice that when 1990, 2000, 2008, 2015, 2025, 2035 is used, the spacing is closer for the numbers that are closer together. So it is pretty much OK to do it that way.

The EIA has a track record of being consistently overoptimistic in its projections. These graphs are just a confirmation of that trend.

I don't know why anybody pays any attention to EIA estimates of future events, but I guess it's all the US government has to work with. It's sad, because it leads to gross errors in economic planning.

Quite a few people think that Peak Oil people must be crack pots, if the EIA sees such big increases in production ahead. Bad estimates are worse than no estimates.

One has to remember that many government agencies are mandated by law to issue forecasts.

The Weather Service, for example, is not allowed to say:

Nope. That kind of honesty is simply not allowed. While this statement might actually be more useful information than a forecast that is known to have huge error bars, that's not the way the system works.

By having a range of $50-$200 in their oil price forecast, the EIA is basically issuing a coded version of that "Aw shucks." statement. Unfortunately, not enough people understand how to interpret the code.

Best Hopes for communicating the uncertainty of predictions.

Jon

Actually, I used to hike with someone who was a meteorologist. I used to ask him, "What do you think the weather is going to be today?" and without looking up or breaking stride he would say, "50% chance of rain."

Later, around the campfire, he would gripe about the difficulties of predicting the weather, since he had been working on Vancouver Island. "We had no idea what was coming at us. We didn't have enough weather stations out on the Pacific to tell us what was happening, and we had no idea what the weather systems would do when they hit the 6,000-foot mountain ranges on the island. Maybe they would come through, maybe they would stall, maybe they would come through at one place and cause huge thundershowers, and some place 10 miles away would have bright sunshine. Most times we just rolled dice or cut cards to come up with a forecast."

Hopefully the US EIA has better techniques of forecasting, but I suspect not. They mostly look like wild guesses.

Thanks for the analysis Gail, and let's see what the IEA will come up with this year (after having admitted crude peak in 2006 last year, even if in a convoluted sentence), their world energy outlook being planned for Nov 9.

A preview of 2011 report by Fatih Birol :

http://www.youtube.com/watch?v=M8NWnA64A_4

Fatih Birol being, might be important to remember it, the only IEA guy that "survived" 1998 report :

http://petrole.blog.lemonde.fr/how-the-global-oil-watchdog-failed-its-mi...

or :

http://seekingalpha.com/article/279561-why-europe-needs-its-own-energy-a...

I notice that the video says that this year's IEA report will have a report on Russia; also a "low nuclear" scenario.

But it will be interesting to see what the rest of the report looks like, especially if the next couple of months are troubled financially.

I would like to think that the high prices we are paying for oil and gasoline today are directly translating into more jobs in the energy industry. I would hate to think most of this money is going into a few already rich peoples pockets. Anybody have employment data in the industry to confirm this?

As the economy contracts from high oil prices, I believe more people would be willing to work for lower wages including the oil industry. This would have a negative feedback effect on prices and keeping them from rising as fast as they would otherwise and also keep us on the plateau longer.

A major and growing part of it goes into OPEC countries pockets that's for sure, and even post peak the only sensible strategy for the US and net importer countries in general is to increase volume based gas (and fossile fuel in general) taxes : decrease trade deficit, can replace some other taxes, and more importantly pushes industries to produce, and consumers to buy more efficient or alternative products. Globally doesn't change a country GDP ("all things remaing equal"), but decreases its sensibility to fossile fuel prices and associated trade balance. Only chance if there is one, to "manage" the peak oil turn, to push the technical infraastructure in general in the right direction (but indeed there might well be none of these chances anyway).

The US should clearly increase its gas tax in a hurry !

Why don't you do it ? (at least 20 cents a gallon or something, targeting $2 or more a gallon ?)

Anything with the letters t a x attached to it is automatically radioactive in Washington, apparently. In other words, insanity rules.

Yvest, I agree with your suggest. However, as dohboi mentions any tax increase will probably not get passed. The existing federal tax on gasoline will be expiring and it will be interesting to see if it is increased when it is renewed. I am guessing it will be renewed at the old rate.

The State gas tax is 37.5 cents a gallon, at least here. Remember the Feds are not the only ones with their hands out.

http://www.wsdot.wa.gov/NR/rdonlyres/AC3F7237-BDA3-4F2A-A0B9-4A72CB97576...

I know I have heard the comment here in Georgia, "Why raise the gas tax? We won't get back out what we pay in, because of the allocation formula."

I'm thinking that comment must have related to the Federal Gas tax. Because of that issue, it may be that if gas taxes are raised, it will need to be the state taxes that are raised. (Of course, some states will be winners with the federal tax allocation formula, just not all of them.)

The ownership of oil and gas company stocks tends to be by pension funds and small investors. So if higher prices are really is going back to higher profits for these companies, the ones who would benefit are your and my parents, and others who depends on pensions for their income. They are also keep our own pension plans from failing. (Pension plans do very badly in a low interest rate environment. Governments claim that they will guarantee at least the fixed benefit type of pension plan (up to certain limits), but as a practical matter, it would be very difficult to do.)

Around the world, governments are very dependent on oil and gas companies for revenues, especially now that many jobs for other industries are going offshore. Countries like Saudi Arabia and the other OPEC nations need high oil prices, in order to pay for benefits to the many unemployed in their countries, and to subsidize the cost of imported food. As I mention in the post, Russia needs high oil prices, for the high taxes companies can pay. The UK has recently raises taxes on oil companies.

Yes but don't forget that private oil companies now account only for 15% or even less of current global reserves. Something like buildings insulation has most probably currently more potential for creating jobs in the US than additional drilling.

Remember that the base to which the 15% reserve amount is calculated is hugely inflated.

The question is how much really can be extracted at a low enough price to be helpful to society (without causing huge recession). It is not clear that it will be very much.

"Remember that the base to which the 15% reserve amount is calculated is hugely inflated."

Yes true, but really the case when Campbell or ASPO people give these numbers ?

They are using the official numbers in the base, so the answer is, "Yes, they are still inflated."

The high prices that Americans are paying for oil and gasoline are, in fact, translating into more jobs. The problem is that they are jobs for Canadians. The Alberta government is talking about having to import about 75,000 American immigrants to fill the demand for skilled trades in the oil sands over the next decade. There just aren't enough Canadians with the right skills who are willing to work in Northern Alberta.

The average heavy equipment mechanic in Alberta makes a six-digit yearly wage and welders in the oil sands get paid $1000/day just for showing up on the job regardless of whether they do any welding or not. This kind of high income for skilled tradespeople who don't mind working long, hard hours in a remote place where the temperature can hit 40 below in winter will probably continue. Most people can't handle it for long.

RM Guy you're right most people can't handle it for long. Many if not most of the workers work 2 weeks on, 2 weeks off or some variation of that. Another interesting bit is that workers come from places a long ways off, like Newfoundland. They fly in, work 2 weeks and fly back to Nfld for 2 weeks.

They do call Fort McMurray, "Newfoundland's second largest city", because of the number of Newfies working there. It's true, there are more Newfoundlanders working in Fort McMurray than any city in Newfoundland, other than than the capital of Saint John's. They add a certain cultural element to the city that the local wolves and bears don't really supply.

It's kind of a natural for them, because Saint John's arguably has the worst weather of any city in Canada. Don't blame me for that assessment, I just read what Environment Canada says.

The weather is crappy when you are working, and then you fly home and it's still crappy. There's no point in getting depressed because it's what you grew up with. Working in the oil sands is not much worse than fishing in the North Atlantic among the ice floes, except the money is better.

An oil worker's wife thought it was pretty good, too. "When your husband's away, it's nice because he's not around to annoy you or tell you what to do, and then when he comes back it's like another honeymoon again." Or, as an oil worker said, "When you come home you have to bring the kids lots of toys and some big bags of junk food because nobody's going to talk to them or cook them dinner for about two days".

The high prices do mean higher profits for OPEC countries, even as net exports from them decline (WestTexas's phase one decline).

These profits are being used to prop up ever expanding populations of under-employed youth, lavish lifestyles (even by US standards) heavily subsidised and profligate domestic energy consumption, imported food subsidies, pay-offs to fundamentalist Muslim sects, cheap oil exports to poorer Islamic neighbours, etc, etc.

Some money is recycled to the Western military industrial complex, to buy expensive and massively over-speced military systems that will never be used, and in Western casinos and other retreats.

However, out of control population growth due to paternalistic society, poor education or work opportunities for women, etc., and high food prices due to climate change are making even these command economies shaky, as we have seen with the Arab rebellions in the countries that are falling behind with the subsidies.

European countries have had a more rational oil strategy for about 20 years now, by progressively ramping up fuel taxes to extreme levels. This has helped stabilise oil demand through more efficient, smaller vehicles, and provided considerable tax income for governments, which has meant other taxes could be lower to balance the state funding.

The net result is that the average European spends about as much fiat currency per year buying fuel as the average American, but the quantity bought is only about half, and only half the money is exported to OPEC, the rest is recycled into the domestic economy by the government.

Putting taxes on oil also keeps other taxes lower. European taxes include health care; American's do not.

American's taxes do include health care. Just not, generally, for the Americans paying the taxes.

T – Don’t have the stats but employment in the oil patch has boomed as usual during high price periods. As far as who’s making the money the majority of big oil companies and service companies are public. Thus much of the profit goes to the shareholders. And much of the oil patch equity is owned by retirement funds. So some of the profits go to union members, etc. There is no Mr. ExxonMobil stuffing money in his mattress. LOL. Something around 20% of all the monies from the sale of all oil/NG in this country goes to private landowners. They in turn pay taxes on that income to the states and the feds. As do all the folks drawing salaries in the oil patch. Additionally the counties and states collect production taxes right off the top. For instance La. gets 1/6 of all the oil sales from every well in the state…biggest cut out there. The feds also collect 1/6 of all the monies generated by all oil/NG sales from offshore fields.

So while it still may be painful when you fill up your car you can take some satisfaction that that you’re contributing to our society. Unfortunately a very big chunk of that money is going overseas.

If we're trying to point fingers at where the oil price increase money is going, the biggest finger should be pointed at the ground.

All money spent on oil eventually goes to people, one way or another.

How is it going into the ground?

Also scary.....fig. 40

In 1998 dollars, today's price is much lower and look at the recession(s)!! What happens when the price really climbs?

Great article Gail, I think you hit the nail on the head. I would also add that the EIA vastly underestimates the potential for technological change between now and 2035. Its as if they see almost no possibility of renewables/thorium becoming substantially cheaper than the cost of fossil fuels today - nevermind the fact that renewables will be much more competitive even without technological innovation as fossil fuel prices continue to rise. At this point it really is about an economic imperative to diversify away from expensive fossil fuels - not just about energy security or the environment. It will be extremely difficult for us to exit this economic malaise without a sustainable, cheap source of energy to replace volatile and expensive fossil fuels.

There is no exiting this economic malaise in our lifetime, even if we were to find that cheap source of energy — we would just bump into the next resource limit.

Once the world economy begins to contract due to declining oil production, we'll have a hundreds of millions of extra people without work spread across the major economic regions. Our economy has been overheated by fossil fuels and high unemployment is simply one of the consequences of coming down the other side of the curve.

Make your money now because it's going to be really hard to make money once official unemployment hits 20%, then 25%, then 30% (apparently the height of the depression). Wages will be depressed and a full time job will be a very valuable thing indeed.

But what do you do with your money? Equity markets? Housing? Farming? Systemic collapse will remove all value from all classes of asset. Even so, having money is better than not having it.

Invest in that which will continue to 'pay' a return (or will at least mitigate heavy losses). There are many examples, from nut trees, garden tools, and greenhouses for those who think think there will be a soft landing to more systematic preparations for those who understand the more serious ramifications of oil production decline.

Will is right...there is lots to do with your money while it still has value. But you just can't buy your way out of what's happening (unless you are really, really wealthy, and even then there are no guarantees). It's skills and the network (i.e. community) you set up now that is important.

So far, we really don't really have a sustainable, cheap source of energy to replace fossil fuels--and it is hard to find one.

I am not sure the EIA underestimates the potential for technological changes between now and 2035. Technological changes tend to depend on fossil fuels, because most goods are transported with oil, and fossil fuels are the primary source of electricity. Difficulties with fossil fuels will make technological change more difficult, I would expect.

One thing that is needed for Technological Changes is money for investment. This money for investment tends to come from surpluses elsewhere in the system, and these are less and less available. If the financial system is having difficulty with huge debt defaults, debt for investment in new technologies will be harder to find, also.

Money and debt can be created by fiat. And it's been reported that US corporations are sitting on 'mountains' of cash.

But the incentive for investment comes from the expectation of growth. And that's the problem.

If you expect your income to fall, you'll save. You'll hang on to your car for another year, or two, or five. You'll get your washing machine fixed, rather than buy a new one. You'll put up with the old computer, the lumps in the mattress and the sofa, the stain on the ceiling, and the cracks in the driveway. (This is a general 'you', not you personally, Gail.)

The same with businesses. If they can't see where the sales will come from, they won't invest. With one exception: the investments that are happening are those that cut costs for businesses -- the main cost being labour. So everybody's incomes spiral down another notch.

Edit: This is not to take away from your main point, that technological progress will be slow until costs are favourable. Rather, it's to support it.

If energy trends continue as depicted in the EIA charts above, I suspect that it will be mathematically certain that other resources will run out first, eg Gallium, Indium, Silver, Fish, Forests, River water, Phosphates etc etc.

Basically more energy means giving more incentive to cannibalize what little is left of anything else on this planet.

Has anyone wondered whether life will be worth living on a planet where all the forests have been cleared away, where almost ALL animals are extinct except for a handful of specimens at zoos which are "commercially viable to keep alive," where all the oceans are completely lifeless, where all coral reefs are dissolved and gone? Man has been empowering himself thus far by stealing secrets from nature. But now, he will extinguish nature and in so doing destroy the source of many of his greatest insights and powers. Hundreds of millions of years of natural history will be erased and man will find himself even more alone on this planet, without a history to refer to, and without a future to look forward to.

Will life be worth living in 100 years?

It seems to me that most people seem to like the human built environment more than the natural environment. The Italian peninsula is my favorite example of a reasonably large land mass where all the terrible things you describe have already happened. Most of them hundreds of years ago. And let's include things like "urban areas are completely paved, trash piles high, decrepit abandoned factories litter the landscape, yadda, yadda, yadda".

Yet people still love visiting Italy. Go figure.

I wouldn't underestimate most societies' enthusiasm for eradicating nature in favor of the built environment. Nevertheless, some communities understand the importance of the natural world and are undoing "human progress" -- see Elwha Dam Removal.

As always, the world is a very heterogeneous place with widely differing values systems.

Best Hopes for valuing nature in your community!

Jon

"Will life be worth living in 100 years?"

I prefer nature over man made. I believe "peak resources" is what finally forces man to live sustainably and at a much lower population level. 100 years may be about the right time frame. Unfortunately, we are probably living at the peak of human economic growth. I would prefer to have been born 100 years after the peak, when the earth is recovering from human over consumption. Call me a peak oil cheer leader.

You are optimistic that the earth will be recovering from human over-consumption 100 years after the oil peak. Global climate change is proceeding at a geologically unprecedented rate. It is possible that the earth may deviate from its previous cycles, which occur on much, much longer time scales than that which encompasses human civilization. By the time the earth has recovered from the climate chaos set in motion by us, we will have long gone extinct. The least brutal outcome will be realized only if humankind immediately curtails fossil fuel consumption, confronts head-on what lies ahead, and takes deliberate steps toward adapting to a new reality. And that reality goes far beyond development of newer, greener energy sources.

Not to worry shox. In event of the total collapse of the Ocean Ecology, the only thing we will have to worry about is who can survive longest with the least Oxygen because, as I recall, the oceans (and their Phytoplankton), are the biggest supplier of the planet's oxygen.

I have been wondering about this for a long time myself. Many people write enormous volumes about the disruptions to the carbon cycle, the hydrological cycle and other cycles pertaining to the natural ecosystems. But scarcely anyone ever mentions anything about the Oxygen cycle, which would be gravely imperiled should the planet become so warm as to be inhospitable to plant life. As you pointed out, most of the oxygen does indeed come from the ocean, from plankton. If the ocean were to acidify too much, plankton would disappear almost everywhere. And of course, the next biggest producer of oxygen - terrestrial forests - will no longer be able to grow in the Amazon because climatologists predict that the temperature rises in the Amazon basin will range from a simply staggering 6-8 degrees.

Basically, it seems to me, after this planet has been rendered sterile of other forms of life, the oxygen in the atmosphere will either remain stagnant or be slowly drawn down. Perhaps the reason many people, including scientists, do not say much about it is that it takes rather a long time to unfold, like thousands of years. But think of the amazing evolutionary force that will have been unleashed: Plants and animals which grew in the Jurassic era were much larger than now because the oxygen concentration was much larger millions of years ago. It's conceivable that the men living in the future will probably have to shrink in physical stature in order to adapt to the changed climate.

I believe the EIA is far too PESSIMISTIC on OECD demand growth for oil. I am wary of the linear relationships on price and demand assumed in making these forecasts. For example, when the price of oil increases along comes forth the usual speeches of domestic oil substitution with natural gas, renewable energy growth - solar PV energy, energy efficiency etc etc, and hardly any focus on the non-linear relationships with regards to price. As far as I can tell the EIA forecasts assume only weightings on the linear relationships, and almost zero weights on the none linear effects such as trade re localisation from asia to the OECD via inward investment of foreign exchange to avoid the higher freight costs which are a result of the higher oil prices necessary to trigger the linear demand offsetting effects used in the demand forecasting (due diligence studies). In modern manufacturing wages are a small percentage of the overal cost of productionm, where transport and raw material costs tend to be higher. I see strong signals that companies in China are likely to try to buy up cheap American companies (notice the US share prices have been somewhat drifting down of late) to offset the rising cost of transport. It doesn't matter how efficient US production may become, nothing is 100% efficient, so any production moving from China to the net consumer (distance costs money) will require both additional energy and oil. Peak demand in the OECD in my opinion is a complete myth.

At some point, OECD countries are going to have to make a higher percentage of the goods they consume themselves. (This could partly mean consuming a lot less.) If we make the goods we use ourselves without fossil fuels, not very much will get made. If we do use fossil fuels, you are right, it will tend to raise demand. People have to have the salaries to buy things. This is the one thing that may keep fossil fuel demand down.

Peak salaries wouldn't sound nearly as good to people talking about this issue!

Thx- a timely article! and EIA IS USELESS !

I checked up an old bookmark of mine from way back in 2007 -

titled "OIL PRICE FORECASTING - Systematic bias in EIA oil price forecasts: Concerns and consequences"

Why is it the EIA always sees the oilprice going down for 5 years not reaching the price of the day of forecasting f0r another 10 years or so ..?

... and then a chart on the never ending wishful oil_price estimates

The graphs seem to show what they would like, not what will happen.

Strikes me that the same comment be made about peak oil forecasting? Rockman mentioned that predicting stuff is hard, particularly the future. Hubbert's forecast of 13 billion barrels of global oil production per year in 2010 strikes me a tad low? Natural gas production of 6 TCF/year in the US in 2010? Seems like politicians, they all lie, we cheer for ours, bash the other guys, neither of them know what they are talking about, and once elected will do the same things anyway.

Hubbert's prediction was based on a 2% consumption growth rate, which was the rate during his projection. That was affected by the massive political price increase and actually declined for many years, only to eventually recover at an average 1.7% growth rate. So all it did was to push the global oil production peak into the future a decade or so.

He cast his forecast into the wind just like all the rest. It didn't work out. Just like the EIA. And certainly when he made the prediction I referenced, he didn't say a word about political price increases, efficiency changes modifying the bell shaped curve, EROEI, embargoes, heavy oil, light oil, medium oil, NOCs or the price of rice in China.

I wasn't commenting on the accuracy, or lack thereof, of Hubbert's predictions, only on the "those who live in glass houses might reconsider preening on how clever they are PRIOR to firing firearms inside the house".

He cast his forecast into the wind just like all the rest.

No, he gave a *projection* based on a growth rate (i.e., "if present trends continue"). That growth rate did not continue.

The EIA conveniently ignored production limitation warnings, and gave glowing reports under pressure from Administration officials eager to keep the masses fat, dumb, and happy...

Of course that growth rate did not continue. Hubbert's genius was choosing when to stop it, put in an inflection point, and roll down the far side. Worked pretty good for the US in oil production. His entire game was stopping the growth rate, and picking the right spot to do so. Not bad for US oil, not so good for US natural gas, or the world in oil.

As far as what the EIA knows, doesn't know, or what warnings they take seriously, are you an employee of the organization and in a position to comment on which warning was received, and why it was "conveniently ignored"? Or are you just making an assumption?

Interestingly, you became a member when this particular article came out, so I would assume it struck a nerve with you.

No, but more tellingly, I was not born yesterday...

http://www.guardian.co.uk/environment/2009/nov/09/peak-oil-international...

Neither was I. Your reference link is about the IEA. The lead topic, and the organization's estimates we have been discussing, is the EIA. Do you wish to reconsider your assignment [edit] until you have at least decided on the proper target?

I'll step in for Will for now -

Du you Bruce_S believe that the US has a looser strangulation grip for the national 'barrel counter' EIA ? Of course not, IMHO.

On another note I tend to agree with you that the 'barrel counters' are sort of admitting their faults and flaws from yesteryears in reducing their estimates annually- but this is NOT good enough!

They better start to prognosticate the possibility of an 'early Peak Oil'- kicking in any year now - with a reference to the conclusions in the Hirsch report >>>> where 'we' must start 20 years BEFORE Peak Oil to remedy what will eventually come ...

Nothing of this importance is done - Hence EIA is an useless Joke - with a capital J -

As Paal said, if the US has so much influence on the IEA, they obviously have much more on the EIA. My point stands.

Your claim might stand, for what that is worth. As long as you meant it for the organization we are talking about, not the one you referenced. It is easy to bash this group, or that group, to assign random motives because we don't like their results. People do it to peakers all the time. I was just asking for the basis for you to do this to someone else, and your response was that allegedly there were some hijinks with another organization. That is not a basis.

Have you ever talked to anyone from the EIA? Ever called them up, asked a few questions? Written them an email inquiring as to why they don't incorporate some concept you happen to like?

to assign random motives because we don't like their results.

The results have been horrendous, and continue to be absurdly optimistic. The motives are not random, as noted in the article. And since the EIA is fully under US control, one can put 2 and 2 together...

Have you ever talked to anyone from the EIA?

Naturally, and rather high up on the food chain at that. While the public message was provided as the stock answer, the person privately mentioned that the US should be focused on reducing consumption in the near term through dramatically increased mass transit, etc.

You consider absurdly pessimistic to NOT be horrendous?

Did he/she admit to making stupidly optimistic projections for the fun of it? Substituting answers he/she liked into the results table rather than letting the model predict the end of oil production? Was he/she bribed or ordered to design the model to only produce optimistic results?

I am a firm advocate of reducing consumption as well. I prefer bicycles to mass transit, and good choices in housing locations. Does that mean the models I build or supervisor the building of are wildly optimistic because of it? Or is reducing consumption just a reasonable thing to say when someone is concerned about contributing to better human stewardship of our planet, and has nothing to do with model building, pessimism versus optimism, etc etc?

Will/Bruce - A favor: what's the link to Hubbert's "global" projection? I recall his work on US production but not a global forcast. Thanks

Google "energy bulletin Hubbert fossil fuels nuclear energy"

It should be the first return.

World oil is Figure 20.

I have no particular problem with EIA, CERA, et al, being wrong. Very few predictions of oil price and production are consistently right. However, EIA is consistently wrong in the same direction with no acknowledgement of the error. Do CERA, EIA, et al, discuss the reasons for their errors? What irks me is when someone who is consistently wrong on price continues to make errant price predictions and then says that predictions of peak have been wrong in the past so they are wrong now.

They always acknowledge their error. How do we know? They change their forecast like every year. Looks like acknowledgement to me.

Perhaps someone from ASPO should invite them to the big pow-wow in Washington D.C. and ask them? Maybe instead of jawing with the suits ( overpaid Congressional staffers and related minions who don't give a good damn about actually solving problems as demonstrated by decades of historical precedent on energy issues ), they should be heading over to the appropriate building housing the EIA and lobbying for better models and forecasts?

They always acknowledge their error.

If they had acknowledged their error, they would have stated so openly, which they haven't. They continue to justify their previous errors with fantasies like the following graph;

You are putting a unique condition on how you might like to see an error admitted, and an unnecessary one I think. Every year they explicitly admit their error by changing their estimates. Not only do they state it openly, but they publish it in big books, brief some Secretary or another on it, heck maybe they brief the President.

As for their estimates being fantasy, you think Hubbert's call for a maximum world production rate of 12-13 billions barrels a year is somehow better? He got his estimate wrong, so do they.

Having said this, I tend to agree with you that we need better models and estimates. Which is why I wonder, why in the heck would ASPO waste their time on Congressional flunkies, who's job it is to listen to everybody, nod politely, and then giggle behind their backs as they leave the office, versus going after the EIA and asking for better models, more consideration for peak oilish ideas, because people, and those Congressional flunkies, really do pay attention to what the EIA says. Therefore, making what they say more accurate has long term and real value. Co-opt them as it were, rather than preening for a picture by someones Congressman, who in five minutes will be doing the same thing with the organization demanding voting rights for chimpanzees, and will treat both with equal consideration, because it is what they do.

As for their estimates being fantasy, you think Hubbert's call for a maximum world production rate of 12-13 billions barrels a year is somehow better? He got his estimate wrong, so do they.

It's one thing to make projections 40 years ago that are off in volume (but basically on in timeframes), versus making projections now (EIA) that are clearly insane.

What is your relationship to the EIA, directly or indirectly? If you know so much about who the EIA reports to, how are you personally making a difference in this regard?

Then is it not more reasonable for the fine folks at ASPO to spend their time educating them on the error of their ways rather than glad-handing and getting their pictures taken with do nothing Congressmen or their staffers?

What is your relationship to the EIA, directly or indirectly? If you know so much about who the EIA reports to, how are you personally making a difference in this regard?

My relationship with the EIA? It is the same as yours I imagine, if you are a US citizen. You and I, as citizens, contribute into the coffers which fund their people, computers, office space, and publications. Are you suggesting that you and I and our fellow citizens have unduly biased their projections to be rosey and optimistic, versus the stated goals we gave them when they were founded during the last great oil crisis?

Are you even familiar with how they generate those estimates you are so unhappy with? Do you disagree with the means by which they make their calculations?

http://www.eia.gov/smg/asa_meeting_2008/spring/2008_spring_abstracts.pdf

Is the American Statistical Association the wrong group to keep an eye on these models? Perhaps ASPO could lobby to get a seat at the table of the ASA to interject their own ideas into what and how the EIA should be doing their job?

Bruce_S,

Thank you for providing the link to the EIA abstracts. I found them illuminating.

"The model adds new production capacity in a manner that maximizes producer surplus (net present value - NPV) of the capacity additions consistent with exogenous, pre-determined constraints. The primary constraint is that production must equal an exogenous, pre-determined consumption trajectory in each year (2008 – 2200 in the current version of the model). Other constraints are typically associated with government or national oil company decisions to restrict capacity additions to maintain a certain market share of the market (e.g. Saudi Arabia) or to address environmental concerns (e.g., Alberta oil sands). The NPV of additions are calculated using assumptions about capital (finding and development - F&D) and operating costs, tax rates, and a pre-determined oil price trajectory. The model uses exogenous assumptions of initial-in-place (IIP) quantities and ultimate recovery factors (RF) for each resource in each region. F&D costs rise as cumulative additions to production capacity approach the product of IIP and RF and decline as technology advances."

Without finding access to the papers (transcripts?) themselves, the above portion of one of the abstracts is revealing in itself. The authors' repeated reliance on "exogenous" and "pre-determined" data is .....troubling. These are the people that I would expect would research and determine these data independently, or at least determine the validity of the numbers they use in their model. Even more importantly, the assertion that "production must equal an exogenous, pre-determined consumption trajectory " indicates that the authors did not consider constraints on production capacity - they simply matched future production to an "exogenous", "pre-determined", increase in demand. I can appreciate the attempt to model a "pre-determined oil price trajectory", but the point they seem to be missing is the one repeated over and over on this blog site: the primary constraint is production, not consumption.

Jon F.

Their primary constraint appears to be the amount of oil actually in the ground. And then they use this model to drive how fast it is developed, which translates to production rate. Isn't this like a "super projects converted into rate" peak model? How does a peak centric model drive continued development of existing oil fields, or future development of discovered but undeveloped ones?

Their primary constraint appears to be the amount of oil actually in the ground.

?? Do you take OPEC reserve estimates at face value? And what exactly does "oil actually in the ground" mean, precisely?

The amount of oil in the ground is not a reserve estimate. It is more commonly referred to as an "in-place" estimate. Rockman can correct me if I'm wrong of course.

I imagine that would be a good question for your EIA contact, considering they are the ones using it.

No need to wait on Rockman, anyone on this list who has been here for more than two weeks can answer that one. Estimates of oil in the ground are definitely referred to as "Reserves".

www.hubbertpeak.com/laherrere/PetroleumAfrica200704.pdf

Reserves

Proved 1P - at least 90% probability

Proved + Probable 2P - at least 50% probability

Proved + Probable +Possible 3P - at least 10 % probability

OPEC Share of World Oil Reserves

Bold mine but I wanted to point out that OPEC claims these are proved reserves meaning they have at least 90% probability of actually being there.

Now that that has been settled, back to the original question which you neglected to answer: Do you believe those OPEC reserve estimates?

Edit: I just noticed that OPEC has increased their estimate of their share of world oil reserves by about 2 percent. Their 2009 estimate was 79 point something now they say they have 81.33 percent of all the oil reserves in the world. The increase came from Venezuela who now has the highest estimate of reserves in the world, 296.5 billion barrels.

Ron P.

Some are. Others are not. They are referred to as resources.

http://www.spe.org/industry/docs/PRMS_guide_non_tech.pdf

Seems like everyone on this list longer than 2 weeks should be familiar with the referenced document, otherwise they might mistakenly believe that just because it is an estimate of oil in the ground, it is a reserve.

"Contingent resources are less certain than reserves."

Darn right there are. And they ain't reserves. But they can become reserves. Someday. Maybe. Under some conditions.

Sure you don't want Rockman to explain how the transition from resources to reserves happens? And what an in-place estimate actually is closer to, without, say, an economic overlay?

I don't know that OPEC even quotes reserve numbers, so how I can judge the quality of the estimate, of even what it is an estimate of? Isn't that part of the problem within this debate?

Oh don't be such an argumentative nit, they are always referred to as reserves. Contingent is a new word that you just brought into the debate in a vain attempt to try to show that you know what you are talking about. The question had nothing to do with contingent resources, the question was all about reserves. The question was ?? Do you take OPEC reserve estimates at face value? And you said:

You said oil in the ground is not a reserve estimate, and that is just flat wrong. But it gets worse, far, far worse. You wrote:

My God, can you not even read? The OPEC reserve estimate I quoted was a direct copy and paste from The Official OPEC Web Site. And I even posted the link so you could just click on it and read their quoted reserve numbers yourself.

And it is an estimate of their proven reserves! And no that is not a problem with this debate, we all know exactly what they claim.

Obviously Bruce, you are new around here. As of this morning you have been a member for four days. But you are sorely unqualified for the argument you are trying to make. Some here, at first, assumed you might be with the EIA. That is laughable.

Bruce, we have been debating OPEC reserves for almost six years on this list. Everyone has followed all the OPEC nations as they never subtract what they produce from their reserves. It is just like they have magic oil, that for every barrel produced another barrel automatically takes its place. But occasionally they do increase their reserves massively. They all did in the mid 80s, Iran and Iraq increased theirs last year and Venezuela massively increased their "proven" reserves very recently.

Everyone on this list is very aware of what is going on with OPEC reserves, or rather OPEC claimed reserves. We have been following this for years with a fine toothed comb.

Then you say: I don't know that OPEC even quotes reserve numbers,... Good God man, I am left speechless.

I am sure you have heard the quote: Better to keep your mouth shut and be thought...

Ron P.

I was prepared to respond until you began the "you must be a fool if..." routine.

I provided a previous SPE document designed for the likes of web "experts" which included the information showing that not everything is a "reserve". In combination with this document,

http://www.world-petroleum.org/index.php?/Reserves-Resources/petroleum-r...

it rapidly becomes apparent that your assumption of knowledge being garnered through close proximity to certain websites is invalid.

As to the rest of it, if you don't understand the uncertainty related to what OPEC may call "reserves" I cannot help you, and if you can't comprehend that OPEC only got dragged into the conversation because a prior poster doesn't know the difference between the EIA and IEA, I cannot help you with that either.

Good gravy, don't you see that this is what the debate is all about. Of course I understand the uncertainty related to what reserves OPEC clams they have. But OPEC says there is no uncertainty. That was the question. Those OPEC claims are all pure baloney but the EIA, the IEA, BP and just about everyone else in the world believes them. The whole damn world is counting on those reserves actually being there. Are they or are they not? That is the debate.

OPEC has been quoting their reserve numbers to the world for decades and swearing that they are valid. Yet you said: I don't know that OPEC even quotes reserve numbers, so... That statement was what blew me away.

NO, that is simply not the case. OPEC got dragged into the conversation because of this statement by you:

Since OPEC claims to possess over 81 percent of all the oil in the ground, there is just no way to keep OPEC out of any debate on reserves. You were asked if you took those OPEC reserves at face value. And apparently you didn't have a clue as to even why that question was asked you chose instead to dodge the question.

Really now, I was not looking for any help from you. ;-)

Ron P.

Of course I do. But if you can't even understand the difference between reserves and resources based on their technical definitions (let alone how they might be probabilistically calculated), and you can't do anything but point at someone elses numbers, the generation of which ranges from unknown to dice throws from Carnac the Magnificent, what is the point? Maybe they are resources. Maybe cumulatives. Maybe reserves. Maybe not. P2s or P3s? Maybe. Maybe not. Hell, they might have thrown in a few in-place estimates just for good measure, to keep everyone confused on purpose (as though that is necessary).

So asking, "What do you think of OPEC reserves?" is by nature a near nonsensical question, short of Ryder Scott getting involved, with the appropriate cooperation.

I agree there is no way to keep them out of the debate. As to their judgement on how much oil they have, well, they certainly have alot. But the western hemisphere is hardly lacking in resources.

http://pubs.usgs.gov/of/2007/1084/OF2007-1084v1.pdf

[EDIT] You know that this debate is not about the difference between reserves and resources. In fact that difference is being discussed right now on another special thread.

Long-Run Trends in the Price of Energy and of Energy Services The author of that special thread refers to the Green River Shale as "reserves". Virtually everyone else here at TOD believes that is nonsense.

Baloney! OPEC claims 1,193 billion barrels of PROVEN RESERVES! Not just resources but Proven Reserves that they can produce simply by sinking wells in any of those vast fields of oil they claim to be sitting on. Do you believe that or do you disbelieve that? That is NOT a nonsensical question.

Of course the Western Hemisphere is not lacking in reserves. What has that to do with whether OPEC is exaggerating their reserves or not? Even now, after all this discussion, you don't seem to have a clue as to what anyone is talking about. Look at the OPEC pie chart at my link. The EIA, the IEA, BP and just about everyone else in the world believes those numbers, or at least they pretend to believe them. All policy and all peak oil debates by cornucopians are based on the belief that those numbers are true.

So it is a simple question which this list has been discussing for almost six years: Are those numbers fact or are they just fiction made up in board meetings by OPEC nations? The vast majority of TOD list members believe they are fiction. And if you still think that is a nonsensical question, if you think we have been debating a nonsensical question for almost six years, then you don't know enough about the Peak Oil debate to even post on this list.

Here is one of the many special threads TOD has posted on that subject:

Middle East OPEC reserves revisited

That is a huge part of the peak oil debate. But when you were asked that question by Will Stewart you hadn't a clue as to what he was talking about or why he was asking the question.

One more point. If and when the world figures out that the majority of those vast OPEC claimed reserves are non-existent then that will be the shock felt around the world.

Ron P.

I don't know. To be honest, I don't know that I care either, or how much it even matters in the greater scheme of the oil resources available to the western hemisphere.

If and when is right.

"The amazing production of oil of the present era is a temporary and vanishing phenomenon which young men will live to see come to its natural end." J.P. Lesley, 1886.

FOR ALL

Got to the dog fight late...sorry...had to make a rig visit last night. Not much to add that hasn't already been clarified.

"It is more commonly referred to as an "in-place" estimate. Rockman can correct me if I'm wrong of course." Hadn't really thought about it in that context but for the most part we don't tend to use "estimate" when talking about any number. Everything we do is an estimate. Be it in place, recoverable, residual, etc. Obviously " resource" is always an estimate...even whe/if it will be developed. We might qualify some offered number as having some probability of being close to correct. But it's still an implied estimate.

Intellectually honest interpreters can have a wide difference in the in place reserves of a single well in just one reservoir. The calculation requires a number of assumptions in addition to the basic geologic interpretation. Now take it one step farther to recoverable reserves. There can be huge but honest disagreements at this next level. And then you can layer one more level of potential disagreement: production rate during the well's entire life. Now remember: I'm just talking about one reservoir penetrated by one well. Now multiply by that by many wells in a field and then by many fields in a trend and then by many trends in a country and then by all the countries in the world.

That should tell you something about how I view truly honest reserve estimates. Now let's talk about biased estimates. When I worked with public companies I was often in charge of liaison with third party reserve auditing companies. I would present interpretations that would max my company's reserve base. The third party would try to keep the numbers "real" in their estimation. A reserve auditing company is only as good as their reputation. Thus they are prejudiced to keep the numbers accurate or even a tad lower. Of course, too low and they could lose that client...IOW lose income. Essentially it becomes a theater of wills and technical capability. Make a long story short I was very good at getting my company's reserve numbers as high as possible. Never lied or presented false data. But I really was very good at squeezing every drop of blood out of a reserve report.

So when I see anyone's reserve numbers, be it the KSA, the USGS, ExxonMobil or even my VP of geology down the hall from me, I take it with a grain of salt. And an especially huge grain of salt if the basic data isn't supplied with the number. The KSA doesn't supply any support data to back up their numbers so they fall into the same category I slide everyone into: irrelevant. That's why I don't tend to join in debates about their numbers: there's no factual basis for a debate. Just inferences based upon the little public data available. Well thought out and seemingly logical inferences, but inferences none the less.

No, no, surely you did not mean to say "reserve numbers", you really meant "in-place numbers". ;-)

My outlook as well, but Rockman is so much better at expressing it than I (due to his extensive experience in this area).